UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-23127)

GoodHaven Funds Trust

(Exact name of registrant as specified in charter)

374 Millburn Avenue, Suite 306

Millburn, New Jersey 07041

(Address of principal executive offices) (Zip code)

Larry Pitkowsky

374 Millburn Avenue, Suite 306

Millburn, New Jersey 07041

(Name and address of agent for service)

305-677-7650

Registrant's telephone number, including area code

Date of fiscal year end: November 30

Date of reporting period: November 30, 2022

Item 1. Report to Stockholders.

Annual Report

November 30, 2022

GoodHaven Fund

Ticker: GOODX

GoodHaven Capital Management, LLC

GoodHaven Fund

Table of Contents

| Shareholder Letter | | | 1 |

| MOI Global Interview | | | 10 |

| Portfolio Management Discussion and Analysis | | | 20 |

| Sector Allocation | | | 24 |

| Historical Performance | | | 25 |

| Schedule of Investments | | | 26 |

| Statement of Assets and Liabilities | | | 29 |

| Statement of Operations | | | 30 |

| Statements of Changes in Net Assets | | | 31 |

| Financial Highlights | | | 32 |

| Notes to Financial Statements | | | 33 |

| Report of Independent Registered Public Accounting Firm | | | 42 |

| Expense Example | | | 43 |

| Approval of Investment Advisory Agreement | | | 45 |

| Statement Regarding Liquidity Risk Management Program | | | 48 |

| Trustees and Executive Officers | | | 49 |

| Additional Information | | | 51 |

| Privacy Notice | | | 53 |

GoodHaven Fund

| PERFORMANCE as of November 30, 2022 |

| | | | | | | Since |

| | | 2 Years | 3 Years | 5 Years | 10 Years | Incept. 1 |

| | 1 Year | Annualized | Annualized | Annualized | Annualized | Annualized |

| | Ended | as of | as of | as of | as of | as of |

| | 11/30/22 | 11/30/22 | 11/30/22 | 11/30/22 | 11/30/22 | 11/30/22 |

| GOODX | -3.02% | 14.16% | 12.04% | 8.14% | 4.86% | 5.81% |

S&P 500 Index 2 | -9.21% | 7.75% | 10.91% | 10.98% | 13.34% | 12.31% |

| Wilshire 5000 | | | | | | |

| Total Market Index | -13.60% | 3.52% | 8.17% | 8.07% | 10.56% | 9.48% |

| HFRI Fundamental | | | | | | |

Growth Index 3 | -15.91% | -1.00% | 4.88% | 3.14% | 4.63% | 3.04% |

| HFRI Fundamental | | | | | | |

Value Index 3 | -5.41% | 6.25% | 7.78% | 5.53% | 6.75% | 5.65% |

CS Hedge Fund Index 3 | 2.89% | 6.49% | 5.69% | 4.41% | 4.38% | 3.85% |

1 | The Fund commenced operations on April 8, 2011. |

2 | with dividends reinvested |

3 | Hedge Fund Index performance figures are supplied on a month end basis and are provided for illustrative purposes as a broad equity alternative asset class only. Accordingly, “since inception” hedge fund index performance figures reflect a start date of 3/31/11 and an end date of 11/30/22. Source: Bloomberg Terminal |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by calling (855) OK-GOODX or (855) 654-6639. The Fund imposes a 2.00% redemption fee on shares redeemed within 60 days of purchase. Performance data for an individual shareholder will be reduced by redemption fees that apply, if any. Redemption fees are paid directly into the Fund and do not reduce overall performance of the Fund. The annualized gross expense ratio of the GoodHaven Fund is 1.10%.

“Bad companies are destroyed by crisis, good companies survive them, great companies are improved by them.”

— Andy Grove

January 5, 2023

2022 was a year many investors would like to forget. A recent Financial Times (FT) headline captures the mood “Global stocks set to post worst year since 2008 financial crisis.”

Our un-hedged portfolio fared much better than the averages, for our fiscal year we were down 3.02% versus the S&P’s decline of 9.21%. Our opinion of our performance this fiscal year is “decent.” Our view of our holdings’ recent underlying business results is strong and we expect strong long-term portfolio returns from recent price levels.

GoodHaven Fund

This also marks the end of year three for GoodHaven 2.0. The last three years have captured a lifetime of economic, geopolitical and societal surprises, challenges, tragedies, and yes plenty of opportunities. This period saw: low interest rates, soaring interest rates, modest inflation, high inflation, modest energy prices, strong energy prices, a tragic pandemic, a shocking war, a global partial economic shutdown, a capital markets crisis’ and collapse, massive fiscal and monetary stimulus, soaring stock markets, sector crashes of market areas previously the most popular—and more.

Our report card covering this period – from 12/01/19 - 11/30/22 was an increase of 40.66% versus the S&P’s up 36.35%. By the way, we have also not had to pay a capital gains dividend distribution during this period. We are pleased, but not satisfied, with those longer-term results and to have achieved them with a portfolio that we think has less risk than the market.

While we have regained much relative ground versus the S&P 500 for our historic returns, more work remains. We strive for strong, long-term returns on a relative and absolute basis through our concentrated portfolio ownership of high-quality businesses with an outsized return potential, all purchased with a significant margin of safety.

The macro backdrop continues to be one of very high inflation and much higher short term interest rates—the Federal Reserve’s primary tool to fight high inflation. Recently, pockets of economic slowdown were evident in certain industries. A return to more normal interest rates after a prolonged period of very low interest is something we had previously written about, should not be shocking and while impactful to all asset values (and especially more speculative investments) is not an existential problem.

We’ve previously written about how difficult it is to consistently predict short-term macro-economic trends, market moves, recessions and how easy it is to sound clever by being overly negative in one’s outlook. Charlie Munger said it well recently via The Australian Financial Review article on July 12, 2022:

| “The business partner of Berkshire Hathaway chairman Warren Buffett, Munger’s investment philosophy is to look beyond the short-term economic fluctuations and target excellent businesses for long-term ownership. “I don’t pay much attention to macroeconomic trends,” he says. “Like the weather, I just ignore the weather. I just try to invest whatever capital I have as best I can and take the results as they fall. I just seize whatever opportunities I can and I hope I get my share. I’m just trying to invest my own money and Berkshire’s money sensibly. All these people that are blabbering on television don’t think the way that I do.” Inflation and aggressive central bank interest rate rises are the top concern of many global investors, but the 98-year-old is not overly concerned. “I’m always aware of it, but it doesn’t stop me from operating,” Munger says. “I’m 98 ½ years of age, and I’ve seen a lot of inflation. I intend to live through inflation. I’ve lived through a lot of it already in my long life. It doesn’t discourage.” | |

GoodHaven Fund

We do not think active trading and market timing work well either as a big picture strategy. To quote a recent UBS report: “Since 1960, a strategy that waited for a 10% correction before buying the S&P 500, and then sold at a new all-time high, would have underperformed a buy-and-hold strategy by 80 times.”1

We are contrarians by nature. Prior experience and a study of the history of markets shows how often the crowd is wrong at the extremes (in either direction) about markets, and sometimes companies. Markets are also forward looking, and market inflection points often occur ahead of actual underlying economic progress. While being a contrarian by itself is not an investment strategy for us, it’s hard not to be startled and then be optimistic by some of the recent sentiment—well summarized below and in the subsequent chart/graph:

| By Sagarika Jaisinghani (Bloomberg October 2022) — Investors are flocking to cash and shunning almost every other asset class as they turn the most pessimistic since the global financial crisis, according to Bank of America Corp. strategists. Cash had inflows of $30.3 billion, while global equity funds saw outflows of $7.8 billion in the week through Sept. 21, the bank said in a note, citing EPFR Global data. Bond funds lost $6.9 billion, while $400 million left gold, the data showed. Investor sentiment is “unquestionably” the worst it’s been since the crisis of 2008, with losses in government bonds being the highest since 1920, strategists led by Michael Hartnett wrote in the note. They see cash, commodities and volatility continuing to outperform bonds and stocks, with Bank of America’s custom bull and bear indicator returning to the maximum level of bearishness. | |

Chart 1: Relative positioning in stocks vs bonds now lowest since 2009

Net % of FMS overweight equities – bonds

Source: BofA Global Fund Manager Survey

__________

1 | Vincent Heaney, UBS Strategist and thanks to our friend Ali Kay of KIDS Capital |

GoodHaven Fund

TABLE OF TOP 5 CONTRIBUTORS & DETRACTORS ($’s) FOR THE FISCAL YEAR

Contributors (11/30/21 – 11/30/22) | Detractors (11/30/21 – 11/30/22) |

| Berkshire Hathaway Inc. – Class B | Alphabet Inc. – Class C |

| Devon Energy Corp. | KKR & Co. Inc. |

| Progressive Corp. | Meta Platforms Inc. |

| Goldman Sachs Group Inc. | Global Industrial Company |

| Hess Midstream LP – Class A | Lennar Corp. – Class B |

Alphabet was our biggest dollar detractor by far, after having been a top gainer in many prior periods. As a top holding in our portfolio, its price movement will often impact overall performance in either direction. In our last letter we said:

“We’ve owned Alphabet for many years and for almost all of that time have been expecting growth to moderate. We’ve been happily proven wrong so far but that expectation remains. As many companies in the tech/venture capital world retrench and possibly reduce their spending on digital advertising, we would not be surprised to see this negatively impact Alphabet’s growth.”

Slower growth at Alphabet is now here. In Q3 2022 revenues (f/x neutral) were up 11% (YOY) while operating earnings declined. Similar to some of their tech peers, Alphabet was over-earning during the COVID recovery and recent growth trends have normalized. Although it is important for Alphabet to continue to invest in attractive growth opportunities like YouTube and Google Cloud and defend its existing moats, it must also right size its costs to align with the current operating environment. While management has partially recognized this, more needs to be done. A recent and thoughtful public letter to Alphabet’s management and Board from TCI’s Chris Hohn is worth reading:

https://www.tcifund.com/files/corporateengageement/alphabet/15th%20November%202022.pdf

We think Alphabet’s core business remains strong, very profitable and with many years of growth ahead of it - if we had secular worries about the long-term it would not be a large holding. The cost challenges are within their control to address. While trading in and out of a great business to try and add to long-term returns by avoiding all drawdowns sounds appealing it’s usually detrimental to long-term returns. By the way, the fact that our second biggest holding was down about 28% during the period (while the overall portfolio was down 3%) tells you a bit more about the performance of the rest of the portfolio. Alphabet currently trades at a forward 2024 P/E of 15x and 14x net cash.2

Our next biggest detractor was our successful holding in KKR. While KKR navigates a changing climate of higher interest rates and the to be expected periodic mark-to-market declines in some of its holdings, we continue to like the long-term

__________

2 | After this letter was finished but before the annual report was issued, Alphabet announced layoffs of approximately 12,000 jobs |

GoodHaven Fund

outlook and added to our KKR holdings during the period. KKR recently reported total AUM of $496 billion, doubling in two years, with perpetual capital making up 38% of total AUM, and dry powder of $113 billion that they can deploy during market dislocations. The pace of AUM growth has slowed from its peak but the company raised $13 billion in the most recent quarter and $84 billion in the last twelve months. Distributable earnings, which includes realized performance fees, were approximately $4.50 per share in the last twelve months The current valuation implies a high single digit multiple to its core asset management business, which is a significant discount to its peers that are more balance sheet light. KKR continues to have high insider ownership and is also aligned with their clients as the company continues to reinvest alongside them in their own funds. We also don’t think the recent trend by large investors of allocating more investments to “alternative investments” as an asset class is done and the runway for growth is significant over the next few years from insurance companies and high net worth clients. We also note that New York State/City’s pension plans’ recent move to potentially increase alternative allocations from 25% to 35% was just approved.3

While we don’t think either Alphabet or KKR experienced any noticeable decline in underlying business value during the period the same cannot be said for our final detractor, our recently purchased Meta Platforms (formerly Facebook Inc). Here our thesis has so far been wrong. While we kept Meta as a smaller holding by design, the competitive landscape and management’s spending decisions remain concerns. Meta has been undergoing a significant product investment across its platforms towards more live video that will increase engagement and better compete with TikTok. However, this has come at the expense of lower monetization in the near-term. TikTok has emerged as a strong competitor, but our research indicates that Meta remains an important way for advertisers to reach a wide audience and an attractive platform for content creators. We will continue to monitor the situation closely though the recent stock price and expectations do not appear to price in the optionality of a meaningful improvement despite Meta’s past track record of profitable market share growth and more recent internal efforts to reduce expenses and improve efficiencies.

Our biggest gainer in the period was our largest holding Berkshire Hathaway. Berkshire’s underlying businesses are progressing well. Recently Vice-Chairman (and likely CEO successor) Greg Abel purchased approximately $68 million dollars of Berkshire shares in the open market with good old-fashioned cash of his own (as vs. options). Although this was not a huge shock given he recently sold his minority stake in Berkshire’s energy subsidiary back to Berkshire for a much bigger dollar amount, the structure of the transaction(s) does speak to Berkshire’s unique “ownership” culture. As a reminder, we increased our Berkshire holdings at the height of the COVID (financial) crisis. Berkshire’s insurance/reinsurance divisions are still its largest segment. The Property and Casualty (P&C) industry broadly, including the

__________

3 | “NY Raises Cap on Pensions Private Equity, Hedge Fund Assets” Bloomberg 12/27/22 |

GoodHaven Fund

reinsurance sector, faced serious uncertainty then. Many felt P&C companies would somehow be forced to provide much broader coverage for COVID business related claims, even where policy language seemed to exclude COVID type claims. We concluded otherwise and allocated more capital to Berkshire and the industry under this cloud of uncertainty. Our companies in the sector have subsequently navigated these issues well, and fairly. The courts have mostly upheld policy language as intended. This was a material uncertainty then that is clearer now. The recent trend in reinsurance is for much higher rates – quoting a recent FT headline “Reinsurance costs rise up to 200% as Ukraine war and extreme weather bite.” Reinsurance is a big business at Berkshire and even bigger now post the Alleghany purchase – this trend bodes well.

Our next biggest gainer was Devon Energy. The company has executed well over the past year managing its core acreage portfolio in the Delaware Basin and has accelerated cash distributions via its unique fixed and variable dividend strategy. We have now received approximately $7.14/Share in dividends since Devon instituted their thoughtful capital return framework back in early 2021.4

Our final gainer of note was Progressive Corporation. Our thesis here continues to evolve well with the auto insurance sector, Progressive’s biggest exposure, broadly in need of higher premium rates to offset higher losses. Progressive appears ahead of the pack in implementing such increases and is poised to grow as others play catch up.

Our biggest addition to the portfolio lately was to (over the summer of 2022) materially increase our holdings in Exor.

Here is a review of Exor from a recent interview I did:

| “Exor is the Agnelli family holding company run by John Elkann, the grandson of the patriarch, Giovanni Agnelli. The company is well-known for some of its historic large underlying investments, including Fiat Chrysler (now called Stellantis). It is a significant shareholder of Stellantis, Ferrari and CNH, the tractor company. We are not by nature super focused on looking for things trading at discounts to NAV. | |

| | |

| We are first looking for situations where we think intrinsic value is moving forward and where there are strong underlying businesses run by good people. We’re not looking for subpar businesses that might be cheap on a sum-of-the-parts basis. Here, we get to potentially have our cake and eat it too, because Mr. Elkann has articulated a very interesting go-forward strategy. The company is clearly focused. | |

| | |

| It has just closed the sale of PartnerRe for greater than $8 billion. Cash will be one of the largest positions in the NAV, similar to their Ferrari equity stake, and Exor is doing more in sectors such as healthcare and luxury. Mr. Elkann is | |

__________

4 | Dividends received from March 2021-December 2022 https://investors.devonenergy.com/investors/stock-information/dividend-history/default.aspx |

GoodHaven Fund

| clearly looking to own high-quality, great companies. He’s articulated it well in his writings, and the topper is you’ve got in excess of a 40% discount to stated NAV with all of that quality and a long-term record of growing NAV at close to 20% between 2009 and 2021—much greater than the benchmark.” | |

Other additions to the portfolio recently, include RH (discussed previously), Goldman Sachs, and a new position in Academy Sports and Outdoor – both of these positions are working out reasonably well so far.

We’d call your attention to STORE Capital which during the period entered into an agreement to be taken over at a material premium to its then stock price. This is our second holding (Alleghany was the first) this year to enter into an agreement to be purchased. We thank recently appointed CEO Mary Fedewa for her leadership. We expect this transaction to close in early 2023 and may sell shares earlier if better uses for the capital appear.

In the past, we have long observed that underlying business and consumer purchase and expenditure decisions move much more gradually and slowly (and logically) than the volatility exhibited by stock and bond prices. We have always strived to use this disconnect to our advantage. However, we note that in recent periods, actual consumer and business decisions as well as spending patterns are much more volatile than in past years. We don’t think this alters what or how we do things but it is something we think more about.

Along those lines we remind all that as we’ve written for a few years now about the structural makeup of financial markets today; with so much trading day to day dominated by non-fundamental investment strategies, this continues to create enormous price volatility and periodic market dislocations. We have strived to use this dynamic to our long-term advantage, but we are well aware that at some point this makeup of markets is far from ideal.

In closing we’d call your attention to our recently redesigned website (and logo) goodhavenfunds.com. We hope this allows us to convey the firm’s approach, views and philosophy in a clear way to current and prospective investors. While US equity fund investors withdrew $205 billion from funds in 2022 our assets have seen slight inflows and we thank our long-term owners and welcome some new owners.5 Finally, attached after this letter is an interview I recently gave to the thoughtful investor community MOI Global (moiglobal.com). While many of you know the story of GoodHaven and pre-GoodHaven, we thought you might enjoy the interview.

I thank all fellow shareholders for their continued confidence as GoodHaven 2.0 continues to unfold. I also thank our Fund Board of Trustees and our long-time partner and investor Markel for their support and wise counsel.

__________

5 | Tania Mitra Citywire December 15, 2022 “Mutual Fund Outflows Top $800 billion for 2022” |

GoodHaven Fund

While the letters are often shorter these days, we strive to write less and say more in our correspondences to you.

Stay healthy and safe.

Larry Pitkowsky

Mutual fund investing involves risk. Principal loss is possible. The Fund is non-diversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund. Therefore, the Fund is more exposed to individual stock volatility than a diversified fund. The Fund invests in midcap and smaller capitalization companies, which involve additional risks such as limited liquidity and greater volatility. The Fund may invest in foreign securities which involve political, economic and currency risks, greater volatility and differences in accounting methods. These risks are enhanced in emerging markets. The Fund may invest in REITs, which are subject to additional risks associated with direct ownership of real property including decline in value, economic conditions, operating expenses, and property taxes. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investments in lower-rated, non-rated and distressed securities present a greater risk of loss to principal and interest than higher-rated securities.

The opinions expressed are those of Larry Pitkowsky through the end of the period for this report, are subject to change, and are not intended to be a forecast of future events, a guarantee of future results, nor investment advice. This material may include statements that constitute “forward-looking statements” under the U.S. securities laws. Forward-looking statements include, among other things, projections, estimates, and information about possible or future results related to the Fund, market or regulatory developments. The views expressed herein are not guarantees of future performance or economic results and involve certain risks, uncertainties and assumptions that could cause actual outcomes and results to differ materially from the views expressed herein. The views expressed herein are subject to change at any time based upon economic, market, or other conditions and GoodHaven undertakes no obligation to update the views expressed herein. While we have gathered this information from sources believed to be reliable, GoodHaven cannot guarantee the accuracy of the information provided. Any discussions of specific securities or sectors should not be considered a recommendation to buy or sell those securities. The views expressed herein (including any forward-looking statement) may not be relied upon as investment advice or as an indication of the Fund’s trading intent. Information included herein is not an indication of the Fund’s future portfolio composition.

Fund holdings and sector allocations are subject to change and are not a recommendation to buy or sell any security. Please see the Schedule of Investments for a complete list of Fund holdings.

It is not possible to invest directly in an index. Must be preceded or accompanied by a prospectus.

Margin of safety is a principle of investing in which an investor only purchases securities when their market price is significantly below their intrinsic value.

The MSCI World Growth Index captures large and mid cap securities exhibiting overall growth style characteristics across 23 Developed Markets (DM) countries. The growth investment style characteristics for index construction are defined using five variables: long-term forward EPS growth rate, short-term forward EPS growth rate, current internal growth rate and long-term historical EPS growth trend and long-term historical sales per share growth trend.

GoodHaven Fund

The MSCI World Value Index captures large and mid cap securities exhibiting overall value style characteristics across 23 Developed Markets (DM) countries. The value investment style characteristics for index construction are defined using three variables: book value to price, 12-month forward earnings to price and dividend yield.

The S&P 500 Index is a capitalization weighted index of 500 large capitalization stocks which is designed to measure broad domestic securities markets.

The Wilshire 5000 Total Market Index (full-cap) measures the performance of all U.S. equity securities with readily available price data. Over 5,000 capitalization weighted security returns are used to adjust the index.

HFRI Fundamental Growth strategies employ analytical techniques in which the investment thesis is predicated on assessment of the valuation characteristics on the underlying companies which are expected to have prospects for earnings growth and capital appreciation exceeding those of the broader equity market. Investment theses are focused on characteristics of the firm’s financial statements in both an absolute sense and relative to other similar securities and more broadly, market indicators. Strategies employ investment processes designed to identify attractive opportunities in securities of companies which are experiencing or expected to experience abnormally high levels of growth compared with relevant benchmarks growth in earnings, profitability, sales or market share.

HFRI Fundamental Value Index strategies employ investment processes designed to identify attractive opportunities in securities of companies which trade a valuation metrics by which the manager determines them to be inexpensive and undervalued when compared with relevant benchmarks. Investment theses are focused on characteristics of the firm’s financial statements in both an absolute sense and relative to other similar securities and more broadly, market indicators. Relative to Fundamental Growth strategies, in which earnings growth and capital appreciation is expected as a function of expanding market share & revenue increases, Fundamental Value strategies typically focus on equities which currently generate high cash flow, but trade at discounted valuation multiples, possibly as a result of limited anticipated growth prospects or generally out of favor conditions, which may be specific to sector or specific holding.

CS Hedge Fund Index is an asset-weighted hedge fund index derived from the TASS database of more than 5000 funds. The index consists of funds with a minimum of US $10 million under management and a current audited financial statement. Funds are separated into primary subcategories based on investment style. The index in all cases represents at least 85% of the assets under management in the universe. The index is rebalanced monthly, and funds are reselected on a quarterly basis. Index NAVs are updated on the 15th of each month.

References to other mutual funds should not be interpreted as an offer of these securities. Please see the Schedule of Investments for a full list of fund holdings.

The GoodHaven Fund is distributed by Quasar Distributors, LLC

GoodHaven Fund

We had the pleasure of speaking with Larry Pitkowsky, managing partner and portfolio manager of GoodHaven Capital Management. The conversation took place at the end of August 2022.

In the following wide-ranging interview, John speaks with Larry about his path in investing, the investment strategy of GoodHaven, the types of businesses Larry has found particularly rewarding from an investment perspective, his thoughts on portfolio concentration and risk management, and three ideas that illustrate GoodHaven’s investment approach.

John Mihaljevic, MOI Global: It is a great pleasure to welcome to the conversation Larry Pitkowsky, co-founder of GoodHaven Capital Management.

Larry, I look forward to talking about your investment approach, philosophy, and perhaps a few ideas as well. At the outset, would you mind sharing a bit about your path in investing and the genesis of GoodHaven?

Larry Pitkowsky: Thank you for having me, John. Some people love to talk about their life story, and while I don’t, I’m more than happy to do it for you and for the benefit of the MOI folks.

I was an undergraduate student getting a degree in accounting with no real passion for accounting. I developed an interest in the financial markets. I wasn’t exactly sure what to do with it, though it was clear I found it much more interesting than a traditional path into the accounting field.

I decided to become a stockbroker, which I enjoyed a lot. I was able to build up a business and continue to explore what the world and the financial markets held. In the meantime, I self-taught myself security analysis. Along the way, I had a brokerage business. It was a mishmash of all kinds of things. I was very fortunate in that I had as part of the clientele some legendary value investors who were a bit older than me. Somewhere along the way, it dawned on me that I was making suggestions on some arcane ideas to them that they were finding interesting. Instead of suggesting ideas to them, maybe I should try and build an asset management business in some fashion.

I moved around to a firm where I could build a small asset management business while still making a living doing all of my normal brokerage things. I started to build that; then, at some point, I joined Fairholme Capital right after it had started. There, I took with me the asset management business I had built. Along with Keith and Bruce, we built a nice business. We did a very good job for clients and shareholders in the time we were all together – 1999 through 2008, when Keith and I became less involved day to day.

Then the two of us decided we would like to build our own firm and launched GoodHaven with the backing of Tom Gayner and Markel in the spring of 2011. We were very fortunate that when we had the idea to launch GoodHaven, Tom said,

GoodHaven Fund

“Come on down to Hondos in Richmond, Virginia. We’ll have a steak, and we’ll talk about it.” We did, and we’re forever grateful that Markel became our minority partner, and anchor client.

I think we did a very nice job for a while. We had some very solid years with a bit of an uneven period there in the middle. In mid-2019, all of the key people – myself, Keith, Tom Gayner, Dan Gertner, and the team at Markel – were open to making some changes in the structure of GoodHaven. We figured out how to do that in a way that everybody was comfortable with. As 2019 ended, Keith retired from day-to-day activity and remains a supportive minority partner. Around that period, Markel increased the assets we managed for it. I became the majority controlling partner and sole portfolio manager at the very end of 2019. That began what I call GoodHaven 2.0. More recently, in the beginning of 2022, our longtime senior analyst Artie Kwok became a managing director and a minority partner.

I think it’s been an interesting path. I’m very fortunate to have the opportunity that is in front of us. I believe everything that has happened before has provided the opportunity for what is to come as we continue to build GoodHaven 2.0.

MOI: Thank you so much for providing that background. I believe many of our members have been aware of your path and GoodHaven for quite some time. Tom Gayner and Markel are part of the community, so philosophically, there’s a lot of overlap here.

Pitkowsky: Can I do a quick advertisement for Markel?

MOI: Sure.

Pitkowsky: For anybody out there who has a large, profitable, private business that is looking for a home, you should call Tom because our experience through all these different moments with him and the Markel team has been nothing but spectacular. I think that as good as they look from the outside they are better once you get to know them. If anybody thinks they have a large business that Markel Ventures might be a good home for in some fashion, I encourage them to give Tom a call.

MOI: Terrific. I’d love to talk a bit about some of the key principles that will guide GoodHaven 2.0 going forward. How do you see the firm evolving over time?

Pitkowsky: If somebody were to stop me on the street and say, “Could you tell me in a few simple words, without industry jargon, what the heck it is you’re trying to do for clients?” I would say, “We’re in the generating-strong-returns-for-clients-without-taking-a-lot-of-risk business.” You can create a 50-page PowerPoint around that, but that’s the business we’re in. By the way, I think that’s the business most people who are sitting in my shoes are in, or maybe should be.

I joked in a recent letter that somebody once asked how to describe myself to their clients. It was a financial adviser who was going to give us some money. I said, “Smart, honest, and very good-looking.” He said, “No, Larry, I meant what box are you in? Are you SMID? Mid- cap value? Large-cap value or whatever?” I offer that

GoodHaven Fund

little backdrop because I think it’s been very important here at GoodHaven 2.0 to step away from some of the industry jargon and remember what we’re trying to accomplish for clients and ourselves and how and with what risk mentality.

I also think it’s been important – and I’ve tried to write about it the last couple of years – to remember what value investing is and what it is not. Value investing, in my opinion, is the search for investments where you have a large margin of safety between your purchase price and the intrinsic value. It is making sure you remember the markets are there to serve you, not to guide you, to focus on the fundamentals, to be long-term oriented, and then to come back to point number one, which is to invest with a margin of safety. It also is completely consistent with value investing to invest in high-quality companies that earn good returns on capital and are growing and well-managed.

What value investing does not have to be is having a draconian and negative view of the world. It does not necessarily mean you have to buy the cheapest statistical securities available, regardless of their quality. It does not mean you have to have a macro view of everything going on in the world. Those are not necessarily what the tenets of value investing are about.

In a couple of recent letters, I attached a letter I wrote back in 1998 to my then-fledgling clientele talking about owning high-quality companies but with a margin of safety that earn good returns. At GoodHaven 2.0, which started right as the pandemic hit in early 2020, we used that awful moment for our society and the market collapse in that period to try and upgrade the portfolio a bit, keeping some of those things in mind.

MOI: Would you mind expanding on your investment philosophy a little? What are the types of businesses you have historically found most rewarding for your investors?

Pitkowsky: When I’m looking for something for the portfolio, the first thing is whether it is a business that we have an ability to picture what it will look like three, four, five, or seven years down the road. Do we feel we have some understanding of where the business and the industry are headed? That right away rules out a lot of things that you don’t have a view on or shouldn’t really have a view on. I think it’s an enormous mistake in life to have an opinion about everything, especially when you’re investing.

(1) Do we have a view of where the business is headed in the future? (2) Is it a business that earns above-average returns on capital employed and on equity? (3) Is it run by a management team that we feel is treating the shareholders reasonably well?

Then the question is whether you have a view that’s a bit different from everybody else’s. Most of the time, to get an above-average return or performance, it’s nice to find something you have a view on or an insight into that differs somewhat from the market’s. That’s the opportunity.

GoodHaven Fund

Then, you have to say, “That’s all great, but what is the stock market giving me as an entry price?” A lot of the time, it’s not giving you a price that you feel provides you with a margin of safety or will allow you to earn an above-average return, so you stick that on the shelf and say, “That’s an interesting company.” I might say, “Let’s keep an eye on it; who knows?”

That is the type of mindset we’re looking at for the bigger holdings and for most of the portfolio. We will also do an occasional true special situation, arbitrage and liquidations, distressed debt, a workout of some sort where those all of those quality things don’t align but there’s an attractive return we think we’re going to earn with a margin of safety due to some idiosyncratic situation.

What we’re trying to avoid is what I would call – with my undue sophistication – the stuff in the middle. We’re trying not to put together a portfolio of somewhat statistically cheap, not- great businesses run by not-great people but where the entry price in relation to earnings and free cash flow looks good. We’d rather not have it. We’d rather be patient and put together a portfolio of above-average businesses run by above-average people but still with a material margin of safety or something that’s truly a special situation. We’re trying to avoid all this stuff in the middle. In the last couple of years, we’ve been able to do that.

By the way, the GoodHaven Fund put out its semiannual report very recently. Though I’m not super obsessed with short-term numbers, for the last six months, a year, two years, and since we did the reorganization, we’re ahead of the S&P, in some of those periods by a material amount. We’ve still got work to do to improve our since-inception numbers, but we’ve regained a lot of ground and will continue to stay at it.

MOI: Maybe it would be instructive to discuss a couple of ideas that illustrate the approach, if you don’t mind. Anything you’d care to talk about today?

Pitkowsky: Before I do that, John, I want to add in a couple of other tenets or process things that I consider very important. One, when I look at the portfolio today, we’re trying to have our cake and eat it, too. The portfolio is trading at a much lower PE multiple than the S&P with much better growth characteristics. We do try and concentrate.

Concentration is important to us. In the public fund, the top 10 holdings are above 60% of the portfolio. We are wired for concentration. The way I see it, you either are or aren’t. The price volatility that comes with concentration does not bother us. I’m much more comfortable knowing a lot about a smaller number of things and trying to make great ideas work.

We have tried to renew our focus on some other things at GoodHaven 2.0. As Peter Lynch said, it’s a huge mistake to “water the weeds and cut the flowers.” There are a lot of bad sayings on Wall Street, but “you can’t go broke taking a profit” is one of the worst. Lots of people do not get the long-term result from a good business they find because they sell it along the way. We’ve done some of that in the past. I was there in the room, but I’m trying to remind us that we’ve got to be very careful about

GoodHaven Fund

doing that. A lot of times, being patient over long periods of time – as long as the business continues to deliver – is how you make exceptional returns.

The business of constructing a portfolio is not an IQ contest. There’s a lot more art than science involved. Everybody gets news right away. Even things like expert networks are very widely disseminated, and financial statements are immediately disseminated. The decision-making, how you read the tea leaves, how you find an occasional insight about where the puck is going in a certain industry of business, how you put that into practice , and how you construct the portfolio size-wise – these are very important things.

Idea-wise, it’s interesting. First, we’ve had some material exposure in and around the housing market for a while. In the fall and winter of 2018, we made some of our first purchases in Miami-based Lennar (NYSE: LEN), the second-largest public homebuilder. What we saw then was a business we thought was becoming better, so to speak. We thought there was going to be an eventual plan to become a more asset-light company, to focus on having less owned land, more option land, trying to improve the returns on capital and on equity, and bring down the leverage (Lennar had additional debt from the acquisition of CalAtlantic). We also thought there was a potential tailwind as single-family housing in the United States was underbuilt. We also thought the management team was the best in the business – Stuart Miller as a founder and Chairman, Rick Beckwitt, and Jon Jaffe as co- Presidents.

We made it a reasonable-sized holding. We focused on the Lennar B shares, which are ironically super-voting shares. They have a ten-for-one vote, and yet they consistently traded at around a 20% to the A shares because they’re not quite as liquid. That worked very well. We wrote to clients and shareholders over a year ago and we said something like, “It’s the summer of 2021, and the single-family housing market in the United States is rocking and rolling, but we’re telling you now, one of these days, it’s going to slow. When it happens, that is not the time to reassess how we feel about having Lennar as an important holding. That time is now, while there’s euphoria and the headlines are great. We’re telling you we’re willing to own it through the cycle.”

By the way, I don’t have some special love for the housing sector. If you were to go read my friend Roger Lowenstein’s wonderful book The End of Wall Street, he retold a story I told him about our suspicions –which proved founded – about the speculation in the housing market before the Great Financial Crisis. It’s not like it’s an industry I have some predilection to love, but I think it has changed. In the case of Lennar today, if you were to say to yourself, “Let’s assume deliveries, average selling prices all come down in the high single digits next year from where they’ve been recently. Let’s assume gross margins go back down to the mid-20s from the high 20s. What might the company earn?” Well, it might earn $12.00 instead of $16.00 bucks a share this year.

At the end of the day, everything depends on what the stock price is. Lennar B shares are trading at $62.00. Even if you’ve got a material slowdown – which is

GoodHaven Fund

obviously happening, as we said it would a year ago – the stock still looks very attractive from here. The company has done better than we ever thought as far as its move to a more land-light strategy which has the benefit of providing downside protection in a weaker environment. Optioned land is now over 60% of the total supply of homesites versus half of that at the end of 2019. Lennar has repurchased stock opportunistically, and it’s going to spin off by around year-end some non-core assets, which should improve the return on equity and capital even further.

This has been a winner for us. I think it is emblematic of the types of things we look for and is as interesting today as it was then.

Another idea that is interesting today is Exor (Italy: EXO), the Agnelli family holding company run by John Elkann, the grandson of the patriarch, Giovanni Agnelli. The company is well-known for some of its historic large underlying investments, including Fiat Chrysler (now called Stellantis). It owns a big part of that and a big part of Ferrari and CNH, the tractor company.

We are not by nature super focused on looking for things trading at discounts to NAV. We are first looking for situations where we think intrinsic value is moving forward and where there are strong underlying businesses run by good people. We’re not looking for subpar businesses that might be cheap on a sum-of-the-parts basis.

Here, we get to potentially have our cake and eat it, too, because Mr. Elkann has articulated a very interesting go-forward strategy. The company is clearly focused. It has just closed the sale of PartnerRe, so it has an enormous amount of cash. Cash might now be as big of a part of NAV as the Ferrari stake is, and Exor is doing more in sectors such as healthcare and luxury. Mr. Elkann is clearly looking to own high-quality, great companies. He’s articulated it well in his writings, and the topper is you’ve got in excess of a 40% discount to stated NAV with all of that quality and a long-term record of growing NAV at close to 20% between 2009 and 2021 – much greater than the benchmark.

We like all of the qualitative attributes. Mr. Elkann has proven himself over the last couple of decades, we like where he’s headed with the business and capital, and it’s cheap in a very material way.

Lastly, over the last couple of months, we bought some shares in Goldman Sachs (NYSE: GS). We’ve had some wonderful experience in this sector. We’ve been a large owner of Jefferies for quite a while, and I’m an enormous fan of Rich Handler and what he’s done and continues to do. It’s a top holding for us.

We have an understanding of the industry – besides having been in the industry – and we decided to add Goldman recently. For many years, the return on equity at Goldman has been somewhat lackluster. David Solomon and management recently articulated that their goal is to get return on equity and return on tangible equity to between 14% and 16% and 15% and 17% in the not-so-distant future. They are focused on expanding the wealth management platform and have made a lot of investments in the consumer bank. We’ll see how that goes. Now, they’re also

GoodHaven Fund

focused on expanding the asset management business. They’ve laid out a path to improve the return on equity. We were able to buy shares at what we think looks like probably a little less than what tangible book value will be at the end of the year.

It’s obviously a dominant, strong banking and trading franchise which has been going through a period of lower profitability than you’ve had over the last couple of years, which is perfectly normal. Nobody was expecting that to continue. Also, being a bank holding company – which Goldman is – means there’s an enormous amount of regulatory scrutiny; there are stress tests and different kinds of examinations. We find that somewhat comforting even though it may be a very time-consuming thing for management because we feel a lot of looking under the hood helps to offset some of the outlier risk issues that exist in running any kind of a leveraged financial institution. Those are the ideas.

MOI: Let’s follow up on those. Housing is a very interesting sector that I think investors have found rewarding over time. I’m curious how you decide to own Lennar versus another homebuilder. What is the process for choosing among the available companies there?

Pitkowsky: We’ve kept an eye on all of them. It’s fair to say the company that has been the most aggressive and more focused on returns on equity and returns on capital and having less land has been NVR. I think it ended up with a premium multiple because of it. We looked at the rest of the landscape and did some digging.

Of all the wonderful historic investment books, Phil Fisher’s writings were always amongst my favorite. It’s still fun after all these years to go out there, talk to people in different industries, and do a little scuttlebutt, as Mr. Fisher called it. We felt the management at Lennar was exceptional. We thought where they were focused geographically made sense, and the price was also super attractive. The company had taken on additional debt from the acquisition of Calatlantic, the pro forma company became one of the largest homebuilders in the country.

What’s the opportunity set in front of you? We looked at it and asked “Do we have a bit of an edge in understanding the people in the company? Do we like how they’re situated? What are they saying about improving the underlying returns?” We thought it was the setup we were most comfortable with, and we’re very happy with that decision.

There are some other well-run companies in the sector, but we’ve been very happy. We’ve also had the chance to buy the Lennar B shares, which consistently traded at mid-teens to 20% discount to the A shares. They have the same economics and more votes. It was just an opportunity that was available to us because we’re not moving around $50 billion of capital at the moment.

MOI: With regard to Exor, how do you see the mix of the portfolio evolving over time? Is there capital available now that needs to be deployed following the PartnerRe sale?

GoodHaven Fund

Pitkowsky: Sure, an enormous amount – almost $9 billion of capital. Again, the proceeds from PartnerRe are around the same as the Ferrari stake. Those are the two biggest investments. Then you have Stellantis and CNH.

Exor has got an enormous amount of capital to deploy and an enormous discount from underlying NAV. It has been doing things. It acquired 10% of Institut Mérieux and 45% of Lifenet Healthcare. It made an investment in Christian Louboutin. It also has a venture arm which is investing in growth companies at a smaller scale. There’s enormous optionality.

I think it’s important to realize that Mr. Elkann is not like some people running holding company structures, tracking stocks, or being super obsessed with the NAV discount every moment of every day. He has been opportunistic and repurchased shares when the discount is wider. He’s aware of it. He obviously gets it. He’s John Elkann, but he’s not waking up every day saying, “My God, if I don’t get that discount lower, I’m going to be distraught .”

You have to be comfortable with his being opportunistic and well aware of it, but he’s also much more focused on continuing to find great businesses run by great people with great brands that Exor can grow over time. We’re comfortable with that strategy. He’s articulated it very clearly for anybody who wants to read, but the optionality is there, and a discount is there.

By the way, Stellantis – the old Fiat Chrysler which merged with Peugeot, call it the third- biggest underlying piece – is potentially in and of itself unbelievably cheap. Reasonable people might debate whether Ferrari is undervalued or not, but I would not bet against Ferrari at all. Stellantis in and of itself is very cheap, so you have a discount upon a discount.

MOI: Finally, on Goldman Sachs, my question would be around the culture. To what extent do you feel there’s still a partnership culture in place at Goldman?

Pitkowsky: If I might digress for a moment, our looking for and finding some more financials to do has been interesting. In the spring of 2021, we said to people we had some exposure to so-called financial companies in a couple of different ways. We had a bunch of property casualty insurance companies, including Alleghany, which now is about to be taken over by Berkshire. We commend, by the way, the job Jeff Kirby did as chairman of the board in helping to create value over time for owners.

We said, “If interest rates should ever go up and spreads in certain trading areas should ever improve –because both of those things had been somewhat lackluster when we wrote this in the spring-summer of 2021 – there’s a bunch of financial companies for which it would be better, and it’s definitely better for certain aspects of property and casualty insurance where you have a big interest income line as a large part of the income statement.” Goldman then had the trading banking bonanza that happened in the last couple of years.

From what we can tell – and we try and poke around as much as we can – it seems to still be a collaborative and focused culture that continues to evolve given

GoodHaven Fund

the size of the organization. We think management has articulated a path forward to try to have an earnings stream that’s a little less volatile, and I think that is part of the reason for slightly more of a focus on the asset management and the wealth management part of the business, maybe the consumer bank to some extent. We will see how it evolves.

We have observed closely how good a job Rich Handler has done at continuing the culture at Jefferies and it’s important. So far, Mr. Solomon appears to have been doing a very solid job and has put forward some goals, but I think when you pay an attractive price, we’re looking for things where it’s “Heads, I win a lot; tails, it works out okay.” Given the price we paid for Goldman, should it remain able to grow the business over time and improve those returns on equity and tangible equity, we’re going to do great. If it can’t quite get there given the price we paid, we’ll do okay.

MOI: You talked about portfolio concentration, which I think resonates with a lot of our members because there’s such a strong case to be made for allocating more to your best ideas. Could you talk a little more about how you view risk within the portfolio and whether you have any guidelines or rules of thumb around exposure to various sectors or anything you would highlight on that portfolio and risk management front?

Pitkowsky: Artie and I talk about this all the time; we’re really operating in a parimutuel system. Those of us who are value investors wake up every day looking for a three-to-two horse that’s going off at 15-to-one odds. Then, when you occasionally find that horse, that is, something you truly feel is mispriced or misunderstood, you want to make it count sizing-wise.

Having said that, I’m especially careful about having things bigger in size be things that I’m totally comfortable can withstand unusual economic environments. Right after GoodHaven 2.0 began in 2020, the economy was partially closing, the markets were cascading, and liquidity was drying up everywhere. I looked around and said, “There are things to do. We have some cash, but this could go on for a long time. This is unprecedented. This is not normal.” In the new investments we made – and we made a lot of them – I was trying to make sure they could live through a treacherous environment for a while. That’s how we think about big holdings.

As for concentration, we have a public fund and separate accounts that live by different guidelines and rules, but in the public fund, we can have two 25% positions at cost. Then, we have a certain other regulations as far as what we would call the top bucket half of the portfolio.. If you look at the separate accounts, they don’t necessarily abide by those same constraints. If you look at the portfolio today, in the public fund, we have two positions, one mid-teens and one is low-teens, and then we have a few others hovering around the 5% or 6% range.

To be comfortable with concentration, first I have to answer the question whether I think something does have the balance sheet and the financial structure to withstand unusual things because unusual things don’t announce when they’re

GoodHaven Fund

coming. Secondly, you must be comfortable with portfolio volatility. Lots of people say they’re comfortable with portfolio volatility, but when they do have portfolio volatility – which is inevitable – if you have your top ten holdings in more than 60% of the portfolio, you’re going to have idiosyncratic portfolio volatility even if everything fundamentally is going wonderfully. For a lot of people, it doesn’t jive with their temperament.

Temperaments are a hugely important thing. We’re all wired how we’re wired. I happen to be very comfortable with these levels of concentration. I try and articulate to clients and shareholders where we’re going with concentration and what we’re comfortable with because I would never want anybody who was not comfortable with it, but it makes perfect sense to me that great ideas are rare and to achieve a different result from the market, you have to do something different. I think that’s one of the things that sets us apart.

MOI: Thank you, Larry. Before you go, is there anything else you’d like to add to this conversation?

Pitkowsky: One thing we didn’t cover when we talked about what value investing is and isn’t is that the distinction between growth and value investing often gets mislabeled. Obviously, whether a business or an asset grows is a component of a company’s underlying value.

When you think to yourself, “I believe I’m buying something with a margin of safety, and I’m giving some consideration to how I think it’s going to grow,” what you really have to do is ask yourself, “How likely do I think that is, and why do I feel comfortable with thinking this business is going to grow and not be disintermediated or interrupted in some material way?” In my view, to separate, to say that value investing can’t involve a growing high- quality business is a huge mistake.

Larry Pitkowsky co-founded GoodHaven Capital Management in late 2010 with Keith Trauner, created and began managing the affiliated GoodHaven Fund in April 2011. Larry currently serves as the sole managing partner and portfolio manager.

Prior to forming GoodHaven, he was a consultant to Fairholme Capital Management for approximately two years, and from 1999 through 2008, he held a variety of roles at Fairholme and its affiliates, including analyst and portfolio manager. In addition, for most of the period from 2002 through 2007, he was a portfolio manager of FCM’s affiliated Fairholme Fund.

Larry was also vice-president of Fairholme Funds, Inc., the parent company of the Fairholme Fund, from March 2008 through January 2009. Larry has more than thirty years of experience in securities research and portfolio management across a wide range of companies and industries. Larry has been quoted in a variety of business media, including Forbes, Fortune, The New York Times, and Reuters.

GoodHaven Fund

| PORTFOLIO MANAGEMENT DISCUSSION AND ANALYSIS |

The Net Asset Value (“NAV”) of the GoodHaven Fund was $33.79 at November 30, 2022, based on 3,166,820.346 shares outstanding. This compares to the Fund’s NAV of $33.50 at May 31, 2022 and NAV of $34.89 at November 30, 2021 and an NAV of $20.00 at inception on April 8, 2011. Although the Fund did not pay a capital gains distribution in 2022, it did pay an income distribution of $0.1226 per share which reduced per share NAV on the ex-dividend date (December 09, 2022). Shareholders should be aware that the Fund has paid capital gains and income distributions in prior years that reduced NAV by the amount of a distribution on the ex-dividend date. Please note that except where otherwise indicated, discussions in this MD&A relate to the period ended November 30, 2022.

In late November 2019, the Fund’s shareholders approved a new investment advisory agreement for the Fund in conjunction with a reorganization of the advisor which was subsequently completed. Details of this reorganization have been previously disclosed in a proxy filing dated October 25, 2019. As a result of the reorganization Larry Pitkowsky became the Fund’s sole portfolio manager, Chairman of the Board of Trustees, and the controlling owner of the advisor. Keith Trauner is now a minority partner of the advisor and no longer a portfolio manager of the Fund.

The performance data quoted above represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, maybe worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by calling (855) OK-GOODX or (855) 654-6639.

During the recent annual period, the Fund declined though it materially outperformed the S&P 500. While value strategies in general have experienced better relative performance lately, the Fund has benefited in recent periods from an improved investment and security selection process, and strong business results from its investments.

While the Fund’s record since inception is still colored by a material divergence between mid-2014 and the end of 2015, we continue to believe that the investment manager’s strategy is sound and risk averse and note that the recent reorganization appears to have improved the investment process, decision making, and recent performance. Since shortly after our reorganization at the end of 2019 the Fund has outperformed the S&P 500 and the Wilshire 5000. The portfolio manager continues to be among the largest individual owners of Fund shares and continues to have significant personal assets at risk, aligning with the interests of shareholders.

The portfolio manager believes that short-term performance figures are less meaningful than comparison of longer periods and that a long-term investment strategy should be properly judged over a period of years rather than weeks or months. Moreover, as we have noted, value investing has been out of favor for an extended period of years. Please note that the S&P 500 Index is an unmanaged index

GoodHaven Fund

| PORTFOLIO MANAGEMENT DISCUSSION AND ANALYSIS (Continued) |

incurring no fees, expenses, or taxes and is shown solely for the purpose of comparing the Fund’s portfolio to an unmanaged and diversified index of large companies. There are other indexes whose performance may diverge materially from that of the S&P 500. Below is a table of the Fund’s top ten holdings and categories as of November 30, 2022:

Top 10 Holdings 1 | | % | | Top 10 Categories 2 | | % | |

| Berkshire Hathaway Inc. – Class B | | | 14.9 | | Diversified Holding Companies | | | 14.9 | |

| Alphabet Inc. – Class C | | | 10.1 | | Interactive Media & Services | | | 11.6 | |

| Jefferies Financial Group | | | 8.6 | | Capital Markets | | | 10.9 | |

| Builders FirstSource | | | 5.9 | | Cash & Equivalents | | | 7.5 | |

| STORE Capital Corp. | | | 5.5 | | General Building Materials | | | 5.9 | |

| Devon Energy | | | 5.4 | | Real Estate | | | 5.5 | |

| Exor | | | 5.0 | | Oil & Gas E&P | | | 5.4 | |

| Progressive Corp. | | | 4.3 | | Investment Management | | | 5.3 | |

| Lennar Corp. – Class B | | | 4.1 | | Industrial Conglomerate | | | 5.0 | |

| KKR & Co. Inc. | | | 3.6 | | Banks-Diversified | | | 4.5 | |

| Total | | | 67.4 | | Total | | | 76.5 | |

1 | Top ten holdings excludes cash, money market funds and Government and Agency Obligations. |

2 | Where applicable, includes money market funds and short-term Government and Agency Obligations. |

Fund holdings and/or sector allocations are subject to change at any time and are not recommendations to buy or sell any security.

The Fund experienced moderate inflows in the 2022 period. Since the inception of the Fund, there have been periods where there were large new shareholder subscriptions and periods with significant net withdrawals. We believe this was primarily caused by shareholders who were attracted by the potential performance of a concentrated value fund but found it difficult to handle the volatility in results as well as certain structural industry issues impacting many active funds.

Material swings in shareholder subscriptions and redemptions have made management of the portfolio more difficult. During the most recent fiscal year, the portfolio manager was able to undertake actions to avoid creating taxable capital gains during 2022 without materially affecting portfolio values. Although the Fund has a net gain on its overall portfolio, it retains a modest loss-carry forward that is available to offset a portion of the current unrealized profit in the Fund. The Fund’s investments are stated as of November 30, 2022, and the amounts and rankings of the Fund’s holdings today may vary significantly from the data disclosed above and the managers may have taken actions that would result in material changes to the portfolio.

The Fund’s investments having the most positive impact on portfolio performance for the twelve month period ending November 30, 2022 were: Berkshire Hathaway rose amidst solid operating results and a recent more aggressive deployment of cash

GoodHaven Fund

| PORTFOLIO MANAGEMENT DISCUSSION AND ANALYSIS (Continued) |

reserves including the now completed acquisition of Alleghany. Devon Energy, which rose as earnings and cash flow benefitted from higher oil prices and strong operating results and a continued focus on returning capital to shareholders. The Fund’s investments having the most negative impact on the portfolio for the period ended November 30, 2022 were: Alphabet, which fell as earnings declined and top line growth slowed and as investors have recently rotated away from large technology holdings in favor of other sectors. KKR declined as higher interest rates and volatility capital markets impacted both the value of their holdings and the pace of AUM growth.

The Fund’s turnover rate of 17%, a measure of how frequently assets within a fund are bought and sold by the manager, remains at reasonably low levels and is consistent with the strategies, generally long-term in nature, of GoodHaven Capital Management LLC, the Fund’s investment advisor. Turnover rates remain low and have been modestly influenced by the need to meet shareholder redemptions rather than a change in the portfolio strategy of the Fund. Importantly, there may be times when turnover rates rise, however, we do not anticipate rapid turnover of the portfolio under normal circumstances.

The portfolio manager believes that a liquidity position is an important part of portfolio management. Since inception, the Fund has continued to have liquidity available both in cash holdings as well as short-term fixed income investments to potentially make opportunistic purchases and meet redemptions. In addition, in order to ensure that we have sufficient resources to behave opportunistically, the Fund has sold or reduced certain investments and has held some modest hedges from time to time. Over time, and as previously communicated, we expect the Fund’s level of cash to vary significantly and has lately sometimes been materially lower than in recent years. In addition, and as previously communicated, the portfolio is now more concentrated in its holdings than in the past—consistent with its prospectus—which could increase volatility materially. The manager of the Fund does not believe that a decline in a security price necessarily means that the security is a less attractive investment. The opposite may be the case in that price declines may represent significant investment opportunities. Finally, the Fund periodically invests in special-situations which may entail a greater level of risk and potential for loss. The portfolio manager’s letter to shareholders contains additional discussion about performance.

Generally, we do not expect significant realized capital gain or loss from any particular short-term, non-U.S. investments when viewed over an extended period. Certain large multi-national businesses in the portfolio may be exposed to non-U.S. rules and regulations as well as volatility in currency values.

The COVID-19 global pandemic, and a potential resurgence of it or of continued new variants of the virus, is still a material economic, market and portfolio risk and after a period of improving domestic health statistics, certain international health statistics are again now worsening providing a material amount of economic and market uncertainty and risk.

GoodHaven Fund

| PORTFOLIO MANAGEMENT DISCUSSION AND ANALYSIS (Continued) |

In addition, the recent elevated level of inflation has lead the Federal Reserve to tighten monetary policies materially which could lead to continued declines in financial markets and may lead to a recession domestically.

The Fund is subject to certain risks as disclosed in the Prospectus and Statement of Additional Information, both of which may be obtained from the Fund’s website at www.goodhavenfunds.com or by calling 1-855-654-6639. Some of these risks include, but are not limited to, adverse market conditions that negatively affect the price of securities owned by the Fund, a high level of cash, which may result in underperformance during periods of robust price appreciation, adverse movements in foreign currency relationships as a number of the Fund’s holdings have earnings resulting from operations outside the United States, and the fact that the Fund is non-diversified, meaning that its holdings are more concentrated than a diversified Fund and that adverse price movements in a particular security may affect the Fund’s Net Asset Value more negatively than would occur in a more diversified fund.

As of November 30, 2022, the members, officers, and employees of GoodHaven Capital Management, LLC, the investment advisor to the GoodHaven Fund, owned approximately 124,075 shares of the Fund. It is management’s intention to disclose such holdings (in the aggregate) in this section of the Fund’s Annual and Semi-Annual reports on an ongoing basis.

GoodHaven Fund

| ASSET/SECTOR ALLOCATION at November 30, 2022 (Unaudited) |

| Asset/Sector | | % of Net Assets |

| | | | |

| Diversified Holding Companies | | | 14.9 | % |

| U.S. Government Securities | | | 11.8 | % |

| Interactive Media & Services | | | 11.6 | % |

| Capital Markets | | | 10.9 | % |

| General Building Materials | | | 5.9 | % |

| Real Estate | | | 5.5 | % |

| Oil & Gas Exploration & Production | | | 5.4 | % |

| Investment Management | | | 5.3 | % |

| Industrial Conglomerate | | | 5.0 | % |

| Banks-Diversified | | | 4.5 | % |

| Property/Casualty Insurance | | | 4.3 | % |

| Specialty Retail | | | 4.2 | % |

| Home Builder | | | 4.1 | % |

| Oil & Gas Equipment & Services | | | 2.8 | % |

| Oil & Gas Infrastructure | | | 2.2 | % |

| Electronic Gaming & Multimedia | | | 1.2 | % |

| Machinery, Equipment, and Supplies Merchant Wholesalers | | | 1.1 | % |

| Metals & Mining | | | 1.0 | % |

| Internet & Direct Marketing Retail | | | 1.0 | % |

| Mortgage Banking | | | 0.9 | % |

| Government Agency | | | 0.7 | % |

| Miscellaneous Securities | | | 0.0 | %1 |

| Cash and Equivalents | | | -4.3 | %2,3 |

| Total | | | 100.0 | % |

Equities are classified by sector. Debt is classified by asset type.

1 | Does not round to 0.1% or (0.1)%, as applicable. |

2 | Represents liabilities in excess of cash and other assets. |

3 | The negative Cash and Equivalents percentage is a result of a Treasury Bill purchased on 11/30/22 pending settlement on 12/1/22. On 12/1/22, Cash and Equivalents was approximately 1.7%. |

GoodHaven Fund

| HISTORICAL PERFORMANCE (Unaudited) |

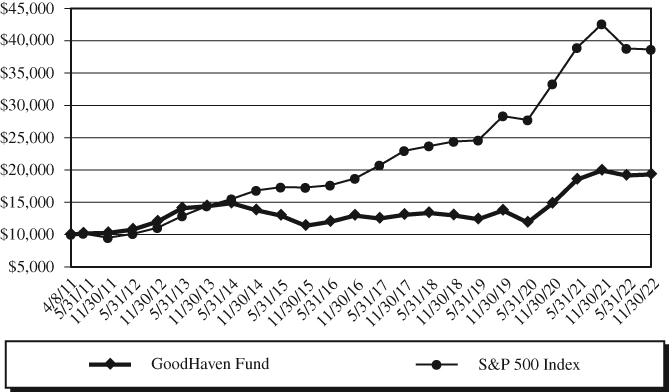

Value of $10,000 vs. S&P 500 Index

Average Annual Total Returns

Periods Ended November 30, 2022

| | | | | | Annualized | Value of |

| | One | Three | Five | Ten | Since Inception | $10,000 |

| | Year | Year | Year | Year | (4/8/2011) | (11/30/2022) |

| GoodHaven Fund | -3.02% | 12.04% | 8.14% | 4.86% | 5.81% | $19,314 |

| S&P 500 Index | -9.21% | 10.91% | 10.98% | 13.34% | 12.31% | $38,659 |

This chart illustrates the performance of a hypothetical $10,000 investment made on April 8, 2011 (the Fund’s inception) and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The chart assumes reinvestment of capital gains, dividends, and return of capital, if applicable, for the Fund and dividends for an index, but does not reflect redemption fees of 2.00% on shares held less than 60 days.

GoodHaven Fund

| SCHEDULE OF INVESTMENTS at November 30, 2022 |

| Shares | | COMMON STOCKS – 91.8% | | Value | |

| | | | | | |

| | | Banks-Diversified – 4.5% | | | |

| | 99,000 | | Bank of America Corp. | | $ | 3,747,150 | |

| | 8,000 | | JPMorgan Chase & Co. | | | 1,105,440 | |

| | | | | | | 4,852,590 | |

| | | | | | | | |

| | | | Capital Markets – 10.9% | | | | |

| | 242,512 | | Jefferies Financial Group Inc. | | | 9,213,031 | |

| | 6,300 | | The Goldman Sachs Group Inc. | | | 2,432,745 | |

| | | | | | | 11,645,776 | |

| | | | | | | | |

| | | | Diversified Holding Companies – 14.9% | | | | |

| | 50,200 | | Berkshire Hathaway Inc. – Class B 1 | | | 15,993,720 | |

| | | | | | | | |

| | | | Electronic Gaming & Multimedia – 1.2% | | | | |

| | 18,000 | | Activision Blizzard, Inc. | | | 1,331,100 | |

| | | | | | | | |

| | | | General Building Materials – 5.9% | | | | |

| | 99,400 | | Builders FirstSource, Inc. 1 | | | 6,354,642 | |

| | | | | | | | |

| | | | Home Builder – 4.1% | | | | |

| | 59,684 | | Lennar Corporation – Class B | | | 4,333,655 | |

| | | | | | | | |

| | | | Industrial Conglomerate – 5.0% | | | | |

| | 68,226 | | Exor NV | | | 5,330,400 | |

| | | | | | | | |

| | | | Interactive Media & Services – 11.6% | | | | |

| | 106,200 | | Alphabet Inc. – Class C 1 | | | 10,773,990 | |

| | 13,800 | | Meta Platforms, Inc. – Class A 1 | | | 1,629,780 | |

| | | | | | | 12,403,770 | |

| | | | | | | | |

| | | | Internet & Direct Marketing Retail – 1.0% | | | | |

| | 12,000 | | Alibaba Group Holding Ltd. 1 | | | 1,050,720 | |

| | | | | | | | |

| | | | Investment Management – 5.3% | | | | |

| | 36,555 | | Brookfield Asset Management, Inc. – Class A | | | 1,723,569 | |

| | 252 | | Brookfield Asset Management | | | | |

| | | | Reinsurance Partners Ltd. 1 | | | 11,937 | |

| | 75,000 | | KKR & Co, Inc. | | | 3,894,000 | |

| | | | | | | 5,629,506 | |

| | | | | | | | |

| | | | Machinery, Equipment, and Supplies | | | | |

| | | | Merchant Wholesalers – 1.1% | | | | |

| | 47,805 | | Global Industrial Co. | | | 1,176,481 | |

The accompanying notes are an integral part of these financial statements.

GoodHaven Fund

| SCHEDULE OF INVESTMENTS at November 30, 2022 (Continued) |

| Shares | | COMMON STOCKS – 91.8% (Continued) | | Value | |

| | | | | | |

| | | Metals & Mining – 1.0% | | | |

| | 68,650 | | Barrick Gold Corp. | | $ | 1,120,368 | |

| | | | | | | | |

| | | | Mortgage Banking – 0.9% | | | | |

| | 85,011 | | Guild Holdings Co. – Class A | | | 991,228 | |

| | | | | | | | |

| | | | Oil & Gas Equipment & Services – 2.8% | | | | |

| | 158,300 | | TerraVest Industries, Inc. | | | 2,984,417 | |

| | | | | | | | |

| | | | Oil & Gas Exploration & Production – 5.4% | | | | |

| | 84,161 | | Devon Energy Corp. | | | 5,766,712 | |

| | | | | | | | |

| | | | Oil & Gas Infrastructure – 2.2% | | | | |

| | 75,667 | | Hess Midstream LP – Class A | | | 2,363,080 | |

| | | | | | | | |

| | | | Property/Casualty Insurance – 4.3% | | | | |

| | 35,000 | | The Progressive Corp. | | | 4,625,250 | |

| | | | | | | | |

| | | | Real Estate – 5.5% | | | | |

| | 183,000 | | STORE Capital Corp. – REIT | | | 5,837,700 | |

| | | | | | | | |

| | | | Specialty Retail – 4.2% | | | | |

| | 42,000 | | Academy Sports & Outdoors, Inc. | | | 2,120,160 | |

| | 8,100 | | RH 1 | | | 2,323,323 | |

| | | | | | | 4,443,483 | |

| | | | TOTAL COMMON STOCKS | | | | |

| | | | (Cost $53,869,044) | | | 98,234,598 | |

| | | | | | | | |

| | | | PREFERRED STOCKS – 0.7% | | | | |

| | | | Government Agency – 0.7% | | | | |

| | 31,037 | | Federal National Mortgage Association, | | | | |

| | | | 5.500% 1,2 | | | 116,699 | |

| | 7,750 | | Federal National Mortgage Association, | | | | |

| | | | Series E, 5.100% 1,2 | | | 29,101 | |

| | 69,980 | | Federal National Mortgage Association, | | | | |

| | | | Series R, 7.625% 1,2 | | | 135,061 | |

| | 216,881 | | Federal National Mortgage Association, | | | | |

| | | | Series T, 8.250% 1,2 | | | 438,100 | |

| | | | | | | 718,961 | |

| | | | TOTAL PREFERRED STOCKS | | | | |

| | | | (Cost $929,908) | | | 718,961 | |

The accompanying notes are an integral part of these financial statements.

GoodHaven Fund

| SCHEDULE OF INVESTMENTS at November 30, 2022 (Continued) |

| Shares | | SHORT-TERM INVESTMENTS – 1.1% | | Value | |

| | | | | | |

| | | Money Market Funds – 1.1% | | | |

| | 1,199,961 | | U.S. Bank Money Market | | | |

| | | | Deposit Account, 3.50% | | $ | 1,199,961 | |

| | | | TOTAL SHORT-TERM INVESTMENTS | | | | |

| | | | (Cost $1,199,961) | | | 1,199,961 | |

| | | | | | | | |

| Principal | | | | | | |

| Amount | | U.S. GOVERNMENT SECURITIES – 11.8% | | | | |