UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-23127)

GoodHaven Funds Trust

(Exact name of registrant as specified in charter)

374 Millburn Avenue, Suite 306

Millburn, New Jersey 07041

(Address of principal executive offices) (Zip code)

Larry Pitkowsky

374 Millburn Avenue, Suite 306

Millburn, New Jersey 07041

(Name and address of agent for service)

305-677-7650

Registrant's telephone number, including area code

Date of fiscal year end: November 30

Date of reporting period: November 30, 2024

Item 1. Reports to Stockholders.

| | |

| GoodHaven Fund | |

| GOODX |

| Annual Shareholder Report | November 30, 2024 |

This annual shareholder report contains important information about the GoodHaven Fund for the period of December 1, 2023, to November 30, 2024. You can find additional information about the Fund, including the most recent Shareholder letter, at https://www.goodhavenfunds.com/communications/. You can also request this information by contacting us at 1-855-654-6639.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| GoodHaven Fund | $128 | 1.10% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

The Fund’s investments having the most positive impact on portfolio performance for the twelve-month period ending November 30, 2024 were: Jefferies Financial Group, which rose amidst much better earnings and a strong outlook for core investment banking & trading future results. Berkshire Hathaway rose amidst solid operating earnings and the benefit of higher short-term interest rates on interest income. The largest detractor was Devon Energy which declined amidst weaker oil prices despite continued solid results and some general sector underperformance.

The Fund’s turnover rate of 6%, a measure of how frequently assets within a fund are bought and sold by the manager, remains at reasonably low levels and is consistent with the strategies, generally long-term in nature, of GoodHaven Capital Management LLC, the Fund’s investment advisor.

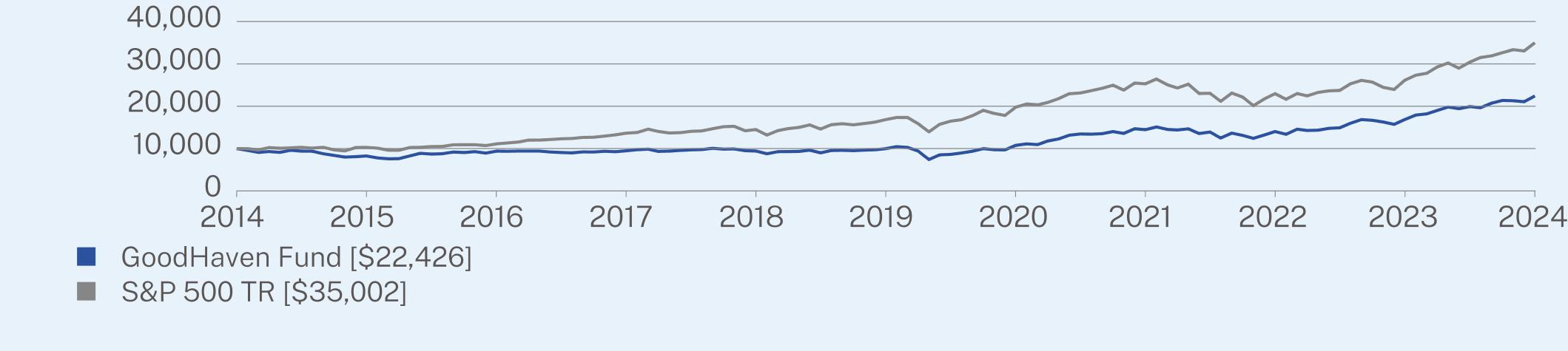

HOW DID THE FUND PERFORM OVER THE PAST 10 YEARS?*

The $10,000 chart reflects a hypothetical $10,000 investment in the Fund. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

GoodHaven Fund (without sales charge) | 32.97 | 17.60 | 8.41 |

S&P 500 TR | 33.89 | 15.77 | 13.35 |

Visit https://www.goodhavenfunds.com/performance/ for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| GoodHaven Fund | PAGE 1 | TSR-AR-38217G103 |

KEY FUND STATISTICS (as of November 30, 2024)

| |

Net Assets | $322,669,789 |

Number of Holdings | 33 |

Net Advisory Fee | $2,361,489 |

Portfolio Turnover | 6% |

Visit https://www.goodhavenfunds.com/performance/ for more recent performance information.

WHAT DID THE FUND INVEST IN? (% of net assets as of November 30, 2024)

| |

Top 10 Issuers | (%) |

United States Treasury Bills | 20.0% |

Berkshire Hathaway, Inc. | 12.8% |

Jefferies Financial Group, Inc. | 5.9% |

Builders FirstSource, Inc. | 5.7% |

Alphabet, Inc. - Class C | 5.6% |

Bank of America Corp. | 5.3% |

EXOR NV | 4.8% |

TerraVest Industries, Inc. | 4.0% |

KKR & Co., Inc. | 3.8% |

Lennar Corp. - Class B | 3.3% |

| |

Top Industries | (%) |

Diversified Holding Companies | 12.8% |

Oil & Gas Exploration & Production | 7.7% |

Investment Management | 6.9% |

Capital Markets | 5.9% |

Banks-Diversified | 5.9% |

General Building Materials | 5.7% |

Interactive Media & Services | 5.6% |

Property/Casualty Insurance | 5.4% |

Industrial Conglomerate | 4.8% |

Cash & Other | 39.3% |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.goodhavenfunds.com/.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your GoodHaven Fund documents not be householded, please contact GoodHaven Fund at 1-855-654-6639, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by GoodHaven Fund or your financial intermediary.

| GoodHaven Fund | PAGE 2 | TSR-AR-38217G103 |

100008251939794819421997010761144621402516865224261000010275111031364214498168341977325294229642614235002

Item 2. Code of Ethics.

The Registrant has adopted a code of ethics that applies to the Registrant’s principal executive officers and principal financial officer. The Registrant has not made any amendments to its code of ethics during the period covered by this report. The registrant has not granted any waivers from any provisions of the code of ethics during the period covered by this report.

A copy of the registrant’s Code of Ethics is filed herewith.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Trustees of the Trust has determined that there is at least one audit committee financial expert serving on its audit committee. Mr. Bruce Eatroff is an “audit committee financial expert” and is considered to be “independent” as each term is defined in Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

The registrant has engaged its principal accountant to perform audit services, audit-related services, tax services and other services during the past two fiscal years. “Audit services” refer to performing an audit of the registrant's annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years. “Audit-related services” refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit. “Tax services” refer to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning. There were no “Other services” provided by the principal accountant. The following table details the aggregate fees billed or expected to be billed for each of the last two fiscal years for audit fees, audit-related fees, tax fees and other fees by the principal accountant.

GoodHaven Fund

| | FYE 11/30/2024 | FYE 11/30/2023 |

| (a) Audit Fees | $19,000 | $19,000 |

| (b) Audit-Related Fees | N/A | N/A |

| (c) Tax Fees | $2,600 | $2,600 |

| (d) All Other Fees | N/A | N/A |

(e)(1) The audit committee has adopted pre-approval policies and procedures that require the audit committee to pre-approve all audit and non-audit services of the registrant, including services provided to any entity affiliated with the registrant.

(e)(2) The percentage of fees billed by Tait, Weller & Baker LLP applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows:

| | FYE 11/30/2024 | FYE 11/30/2023 |

| Audit-Related Fees | 0% | 0% |

| Tax Fees | 0% | 0% |

| All Other Fees | 0% | 0% |

(f) Not applicable

(g) The following table indicates the non-audit fees billed or expected to be billed by the registrant’s accountant for services to the registrant and to the registrant’s investment advisor (and any other controlling entity, etc.—not sub-advisor) for the last two years.

GoodHaven Fund

| Non-Audit Related Fees | FYE 11/30/2024 | FYE 11/30/2023 |

| Registrant | N/A | N/A |

| Registrant’s Investment Advisor | N/A | N/A |

(h) The audit committee of the board of trustees/directors has considered whether the provision of non-audit services that were rendered to the registrant's investment advisor is compatible with maintaining the principal accountant's independence and has concluded that the provision of such non-audit services by the accountant has not compromised the accountant’s independence.

(i) The registrant has not been identified by the U.S. Securities and Exchange Commission as having filed an annual report issued by a registered public accounting firm branch or office that is located in a foreign jurisdiction where the Public Company Accounting Oversight Board is unable to inspect or completely investigate because of a position taken by an authority in that jurisdiction.

(j) The registrant is not a foreign issuer.

Item 5. Audit Committee of Listed Registrants.

Not applicable to registrants who are not listed issuers (as defined in Rule 10A-3 under the Securities Exchange Act of 1934).

Item 6. Investments.

| (a) | Schedules of Investments are included within the financial statements filed under Item 7 of this Form. |

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

GoodHaven Funds Trust

Core Financial Statements

November 30, 2024

TABLE OF CONTENTS

GoodHaven Fund

Schedule of Investments

November 30, 2024

| | | | | | | |

COMMON STOCKS - 73.6%

| | | | | | |

Automobile Retailers - 1.0%

| | | | | | |

Asbury Automotive Group, Inc.(a) | | | 12,000 | | | $3,117,960 |

Banks-Diversified - 5.9%

| | | | | | |

Bank of America Corp. | | | 359,500 | | | 17,079,845 |

JPMorgan Chase & Co. | | | 8,000 | | | 1,997,760 |

| | | | | | 19,077,605 |

Capital Markets - 5.9%

| | | | | | |

Jefferies Financial Group, Inc. | | | 242,512 | | | 19,192,400 |

Diversified Holding Companies - 12.8%

| | | | | | |

Berkshire Hathaway, Inc. - Class B(a) | | | 85,800 | | | 41,443,116 |

General Building Materials - 5.7%

| | | | | | |

Builders FirstSource, Inc.(a) | | | 99,400 | | | 18,535,118 |

Government Agency - 0.2%

| | | | | | |

Federal National Mortgage Association(a) | | | 200,000 | | | 626,000 |

Home Builder - 3.3%

| | | | | | |

Lennar Corp. - Class B | | | 65,036 | | | 10,719,884 |

Industrial Conglomerate - 4.8%

| | | | | | |

EXOR NV | | | 156,362 | | | 15,474,270 |

Interactive Media & Services - 5.6%

| | | | | | |

Alphabet, Inc. - Class C | | | 106,200 | | | 18,106,038 |

Investment Management - 6.9%

| | | | | | |

Brookfield Asset Management Ltd. - Class A | | | 9,201 | | | 525,929 |

Brookfield Corp. | | | 154,548 | | | 9,487,702 |

Brookfield Wealth Solutions Ltd. | | | 252 | | | 15,470 |

KKR & Co., Inc. | | | 75,000 | | | 12,215,250 |

| | | | | | 22,244,351 |

Machinery, Equipment, and Supplies Merchant Wholesalers - 0.4%

| | | | | | |

Global Industrial Co. | | | 47,805 | | | 1,350,491 |

Mortgage Banking - 0.4%

| | | | | | |

Guild Holdings Co. - Class A | | | 85,011 | | | 1,147,649 |

Oil & Gas Equipment & Services - 4.0%

| | | | | | |

TerraVest Industries, Inc. | | | 158,300 | | | 12,948,478 |

Oil & Gas Exploration & Production - 6.5%

| | | | | | |

Devon Energy Corp. | | | 279,161 | | | 10,594,160 |

Vitesse Energy, Inc. | | | 369,254 | | | 10,368,652 |

| | | | | | 20,962,812 |

Oil & Gas Infrastructure - 0.9%

| | | | | | |

Hess Midstream LP - Class A | | | 75,667 | | | 2,867,779 |

| | | | | | | |

| | | | | | | |

Property/Casualty Insurance - 5.4%

| | | | | | |

Chubb Ltd. | | | 27,500 | | | $7,940,075 |

The Progressive Corp. | | | 35,000 | | | 9,410,800 |

| | | | | | 17,350,875 |

Real Estate - 1.2%

| | | | | | |

Camden Property Trust | | | 29,500 | | | 3,711,100 |

Specialty Retail - 1.0%

| | | | | | |

Academy Sports & Outdoors, Inc. | | | 68,150 | | | 3,356,387 |

Technology Distributors - 1.7%

| | | | | | |

Arrow Electronics, Inc.(a) | | | 44,500 | | | 5,347,120 |

TOTAL COMMON STOCKS

(Cost $109,580,292) | | | | | | 237,579,433 |

| | | Contracts | |

WARRANTS - 1.2%

| | | | | | |

Oil & Gas Exploration &

Production - 1.2%

| | | | | | |

Occidental Petroleum Corp., Expires 08/03/2027, Exercise

Price $22.00(a) | | | 128,522 | | | 3,678,299 |

TOTAL WARRANTS

(Cost $4,884,024) | | | | | | 3,678,299 |

| | | Shares | | | |

PREFERRED STOCKS - 1.0%

| | | | | | |

Government Agency - 1.0%

| | | | | | |

Federal National Mortgage Association

| | | | | | |

Series N, 5.50%, Perpetual | | | 31,037 | | | 509,007 |

Series R, 7.63%, Perpetual | | | 69,980 | | | 625,621 |

Series T, 8.25%, Perpetual | | | 216,881 | | | 2,201,342 |

TOTAL PREFERRED STOCKS

(Cost $820,675) | | | | | | 3,335,970 |

| | | Par | | | |

SHORT-TERM INVESTMENTS - 20.0%

|

U.S. Treasury Bills - 20.0%

| | | | | | |

5.20%, 12/05/2024(b) | | | $20,000,000 | | | 19,992,600 |

4.72%, 01/30/2025(b) | | | 10,000,000 | | | 9,927,131 |

4.53%, 02/13/2025(b) | | | 24,000,000 | | | 23,785,867 |

4.39%, 03/20/2025(b) | | | 11,000,000 | | | 10,857,019 |

TOTAL SHORT-TERM INVESTMENTS

| | | |

(Cost $64,547,892) | | | | | | 64,562,617 |

TOTAL INVESTMENTS - 95.8%

(Cost $179,832,883) | | | | | | $309,156,319 |

Money Market Deposit

Account - 4.3%(c) | | | | | | 13,718,295 |

Liabilities in Excess of Other

Assets - (0.1)% | | | | | | (204,825) |

TOTAL NET ASSETS - 100.0% | | | | | | $322,669,789 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

GoodHaven Fund

Schedule of Investments

November 30, 2024(Continued)

Percentages are stated as a percent of net assets.

(a)

| Non-income producing security. |

(b)

| The rate shown is the annualized effective yield as of November 30, 2024.

|

(c)

| The U.S. Bank Money Market Deposit Account (the “MMDA”) is a short-term vehicle in which the Fund holds cash balances. The MMDA will bear interest at a variable rate that is determined based on market conditions and is subject to change daily. The rate as of November 30, 2024 was 4.38%. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

GOODHAVEN FUND

Statement of Assets and Liabilities

November 30, 2024

| | | | |

ASSETS

| | | |

Investments in securities, at value (Cost $179,832,883) (Note 2) | | | $309,156,319 |

Cash equivalents | | | 13,718,295 |

Receivables:

| | | |

Dividends and interest | | | 44,421 |

Fund shares sold | | | 37,157 |

Total assets | | | 322,956,192 |

LIABILITIES

| | | |

Payables:

| | | |

Fund shares redeemed | | | 5,311 |

Management fees | | | 229,984 |

Support services fees | | | 51,108 |

Total liabilities | | | 286,403 |

NET ASSETS | | | $ 322,669,789 |

Components of net assets

| | | |

Paid-in capital | | | $186,332,846 |

Total distributable (accumulated) earnings (losses) | | | 136,336,943 |

Net assets | | | $ 322,669,789 |

Net Asset Value (unlimited shares authorized):

| | | |

Net assets | | | $322,669,789 |

Shares of beneficial interest issued and outstanding | | | 6,084,971 |

Net asset value, offering and redemption price per share | | | $53.03 |

| | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

GOODHAVEN FUND

Statement of Operations

For the Year Ended November 30, 2024

| | | | |

INVESTMENT INCOME

| | | |

Dividend income (net of $27,247 in foreign withholding taxes) | | | $2,519,023 |

Interest | | | 3,557,337 |

Total investment income | | | 6,076,360 |

EXPENSES

| | | |

Management fees | | | 2,361,489 |

Support services fees | | | 524,775 |

Total expenses | | | 2,886,264 |

Net investment income (loss) | | | 3,190,096 |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS & FOREIGN CURRENCY

| | | |

Net realized gain (loss) on transactions from investments & foreign currency | | | 3,985,433 |

Net change in unrealized appreciation/depreciation on investments & foreign currency | | | 65,880,519 |

Net realized and unrealized gain (loss) | | | 69,865,952 |

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | | | $ 73,056,048 |

| | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

GOODHAVEN FUND

STATEMENT OF CHANGES IN NET ASSETS

| | | | |

INCREASE (DECREASE) IN NET ASSETS FROM:

| | | | | | |

OPERATIONS

| | | | | | |

Net investment income (loss) | | | $3,190,096 | | | $1,723,072 |

Net realized gain (loss) on investments & foreign currency | | | 3,985,433 | | | 2,669,453 |

Change in unrealized appreciation/depreciation on investments & foreign currency | | | 65,880,519 | | | 19,318,718 |

Net increase (decrease) in net assets resulting from operations | | | 73,056,048 | | | 23,711,243 |

DISTRIBUTIONS TO SHAREHOLDERS

| | | | | | |

Net distributions to shareholders | | | (3,056,371) | | | (387,947) |

CAPITAL SHARE TRANSACTIONS

| | | | | | |

Net increase (decrease) in net assets derived from net change in outstanding shares1 | | | 49,648,518 | | | 72,681,696 |

Total increase (decrease) in net assets | | | 119,648,195 | | | 96,004,992 |

NET ASSETS

| | | | | | |

Beginning of year | | | 203,021,594 | | | 107,016,602 |

End of year | | | $ 322,669,789 | | | $203,021,594 |

1

| Summary of capital share transactions is as follows:

|

| | | | | | | |

Shares sold | | | 2,045,055 | | | $95,476,579 | | | 2,012,260 | | | $78,894,571 |

Shares issued on reinvestment of distributions | | | 68,245 | | | 2,762,562 | | | 10,125 | | | 328,138 |

Shares redeemed | | | (1,044,050) | | | (48,590,623) | | | (173,484) | | | (6,541,013) 2 |

Net increase (decrease) | | | 1,069,250 | | | $49,648,518 | | | 1,848,901 | | | $72,681,696 |

| | | | | | | | | | | | | |

2

| Net of redemption fees of $6,956.

|

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

GOODHAVEN FUND

Financial Highlights

For a capital share outstanding throughout each period

| | | | |

Net asset value at beginning of year | | | $ 40.48 | | | $ 33.79 | | | $ 34.89 | | | $ 26.08 | | | $ 24.48 |

INCOME (LOSS) FROM INVESTMENT OPERATIONS:

| | | | | | | | | | | | | | | |

Net investment income (loss)1 | | | 0.57 | | | 0.46 | | | 0.12 | | | 0.05 | | | 0.10 |

Net realized and unrealized gain (loss) on investments | | | 12.59 | | | 6.35 | | | (1.17) | | | 8.88 | | | 1.82 |

Total from investment operations | | | 13.16 | | | 6.81 | | | (1.05) | | | 8.93 | | | 1.92 |

LESS DISTRIBUTION:

| | | | | | | | | | | | | | | |

From net investment income | | | (0.37) | | | (0.12) | | | (0.05) | | | (0.12) | | | (0.32) |

From net realized gain | | | (0.24) | | | — | | | — | | | — | | | — |

Total distributions | | | (0.61) | | | (0.12) | | | (0.05) | | | (0.12) | | | (0.32) |

Paid-in capital from redemption fees | | | — | | | 0.002 | | | 0.002 | | | 0.002 | | | 0.002 |

Net asset value at end of year | | | $53.03 | | | $40.48 | | | $33.79 | | | $34.89 | | | $26.08 |

Total return | | | 32.97% | | | 20.25% | | | −3.02% | | | 34.39% | | | 7.93% |

SUPPLEMENTAL DATA/RATIOS:

|

Net assets at end of year (millions) | | | $322.7 | | | $203.0 | | | $107.0 | | | $107.0 | | | $84.0 |

Portfolio turnover rate | | | 6% | | | 14% | | | 17% | | | 13% | | | 32% |

Ratio of expenses to average net assets | | | 1.10% | | | 1.10% | | | 1.10% | | | 1.10% | | | 1.11% |

Ratio of net investment income (loss) to average net assets | | | 1.22% | | | 1.25% | | | 0.37% | | | 0.15% | | | 0.44% |

| | | | | | | | | | | | | | | | |

1

| Calculated using the average shares method.

|

2

| Does not round to $0.01 or $(0.01), as applicable.

|

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

GOODHAVEN FUND

NOTES TO THE FINANCIAL STATEMENTS

November 30, 2024

NOTE 1 – ORGANIZATION

The GoodHaven Funds Trust (the “Trust”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”) as a non-diversified, open-end investment management company. The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 “Financial Services – Investment Companies.” The Fund commenced operations on April 8, 2011.

The Fund’s investment objective is to seek long-term growth of capital.

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund. These policies are in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

A.

| Security Valuation. All equity securities, which may include Real Estate Investment Trusts (“REITs”), Business Development Companies (“BDCs”) and Master Limited Partnerships (“MLPs”), that are traded on U.S. national or foreign securities exchanges are valued at the last reported sale price on the exchange on which the security is principally traded or the exchange’s official closing price, if applicable. If, on a particular day, an exchange- traded security does not trade, then the mean between the most recent quoted bid and asked prices will be used. All equity securities, which may include REITs, BDCs and MLPs, that are not traded on a listed exchange are valued at the last sale price in the over-the-counter market. If a non- exchange traded security does not trade on a particular day, then the mean between the last quoted closing bid and asked price will be used.

|

Debt securities are valued by using the evaluated mean price supplied by an approved independent pricing service. The independent pricing service may use various valuation methodologies, including matrix pricing and other analytical pricing models as well as market transactions and dealer quotations. These models generally consider such factors as yields or prices of bonds of comparable quality, type of issue, coupon, maturity, ratings and general market conditions.

Exchange traded options are valued at the composite price, using the National Best Bid and Offer quotes (“NBBO”). NBBO consists of the highest bid price and lowest ask price across any of the exchanges on which an option is quoted, thus providing a view across the entire U.S. options marketplace. Composite option pricing calculates the mean of the highest bid price and lowest ask price across the exchanges where the option is traded. If a composite price is not available, then the closing price will be used.

Any securities or other assets for which market quotations are not readily available are valued at their fair value as determined in good faith by the Adviser as “valuation designee” of the Board of Trustees (the “Board”) pursuant to policies and procedures adopted pursuant to Rule 2a-5 under the 1940 Act. When a security is “fair valued,” consideration is given to the facts and circumstances relevant to the particular situation, including a review of various factors set forth in the pricing procedures adopted by the Board. Fair value pricing is an inherently subjective process, and no single standard exists for determining fair value. Different funds could reasonably arrive at different values for the same security. The use of fair value pricing by a fund may cause the net asset value of its shares to differ significantly from the net asset value that would be calculated without regard to such considerations.

As described above, the Fund utilizes various methods to measure the fair value of its investments on a recurring basis. U.S. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of inputs are:

Level 1 –

| Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access. |

Level 2 –

| Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

TABLE OF CONTENTS

GOODHAVEN FUND

NOTES TO THE FINANCIAL STATEMENTS

November 30, 2024(Continued)

Level 3 –

| Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The following is a summary of the inputs used to value the Fund’s investments as of November 30, 2024. See the Schedule of Investments for the industry and security type breakouts.

| | | | | | | | | | | | | |

Assets:

| | | | | | | | | | | | |

Common Stocks | | | $237,579,433 | | | $— | | | $ — | | | $237,579,433 |

Warrants | | | 3,678,299 | | | — | | | — | | | 3,678,299 |

Preferred Stocks | | | 3,335,970 | | | — | | | — | | | 3,335,970 |

Short-Term Investments | | | — | | | 64,562,617 | | | — | | | 64,562,617 |

Total Investments | | | $244,593,702 | | | $64,562,617 | | | $— | | | $309,156,319 |

| | | | | | | | | | | | | |

The Fund has adopted financial reporting rules and regulations that require enhanced disclosure regarding derivatives and hedging activity intending to improve financial reporting of derivative instruments by enabling investors to understand how and why an entity uses derivatives, how derivatives are accounted for, and how derivative instruments affect an entity’s results of operations and financial position.

The Fund may invest, at the time of purchase, up to 10% of the Fund’s net assets in options, which are a type of derivative and employ specialized trading techniques such as options trading to increase the Fund’s exposure to certain selected securities. The Fund may employ these techniques as hedging tools as well as speculatively to enhance returns. Other than when used for hedging, these techniques may be riskier than many investment strategies and may result in greater volatility for the Fund, particularly in periods of market declines. As a hedging tool, options may help cushion the impact of market declines, but may reduce the Fund’s participation in a market advance.

The Fund did not hold options contracts as of November 30, 2024:

Statement of Operations

The effect of derivative instruments on the Statement of Operations for the year ended November 30, 2024:

| | | | | | | | | | |

Equity Contracts:

Put Options Purchased

| | | Realized and Unrealized

Gain (Loss) on Investments & Foreign Currency | | | $(25,809) | | | $ — |

| | | | | | | | | | |

TABLE OF CONTENTS

GOODHAVEN FUND

NOTES TO THE FINANCIAL STATEMENTS

November 30, 2024(Continued)

B.

| Foreign Currency. Foreign currency amounts, other than the cost of investments, are translated into U.S. dollar values based upon the spot exchange rate prior to the close of regular trading. The cost of investments is translated at the rates of exchange prevailing on the dates the portfolio securities were acquired. The Fund includes foreign exchange gains and losses from dividends receivable and other foreign currency denominated payables and receivables in realized and unrealized gain (loss) on investments and foreign currency. The Fund does not isolate that portion of realized gain (loss) or unrealized gain (loss) on investments resulting from changes in foreign exchange rates on investments from fluctuations arising from changes in the market price of securities for financial reporting purposes. Fluctuations in foreign exchange rates on investments are thus included with net realized gain (loss) on investments and foreign currency and with net unrealized gain (loss) on investments and foreign currency. |

C.

| Federal Income Taxes. The Fund has elected to be taxed as a “regulated investment company” and intends to distribute substantially all taxable income to its shareholders and otherwise comply with the provisions of the Internal Revenue Code applicable to regulated investment companies. Therefore, no provision for federal income taxes or excise taxes has been made. |

In order to avoid imposition of the excise tax applicable to regulated investment companies, the Fund intends to declare each year as dividends in each calendar year at least 98.0% of its net investment income (earned during the calendar year) and at least 98.2% of its net realized capital gains (earned during the twelve months ended November 30) plus undistributed amounts, if any, from prior years.

Net investment losses incurred after December 31, and within the taxable year may be deferred and are deemed to arise on the first business day of the Fund’s next taxable year. As of November 30, 2024, the Fund did not have any capital loss carryovers.

As of November 30, 2024, the Fund did not have any tax positions that did not meet the “more likely-than-not” threshold of being sustained by the applicable tax authority. Generally, tax authorities can examine all the tax returns filed for the last three years. The Fund identifies their major tax jurisdictions as U.S. Federal and the State of Delaware. As of November 30, 2024, the Fund was not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially.

D.

| Reclassification of Capital Accounts. Accounting principles generally accepted in the United States of America require that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. For the year ended November 30, 2024, the following adjustments were made: |

E.

| Security Transactions and Investment Income. Investment securities transactions are accounted for on the trade date. Gains and losses realized on sales of securities are determined on a specific identification basis. Discounts/premiums on debt securities purchased are accreted/amortized over the life of the respective securities using the effective interest method. Dividend income is recorded on the ex-dividend date. Dividends from REITs and MLPs generally are comprised of ordinary income, capital gains and may include return of capital. Interest income is recorded on an accrual basis. Other non-cash dividends are recognized as investment income at the fair value of the property received. Withholding taxes on foreign dividends have been provided for in accordance with the Trust’s understanding of the applicable country’s tax rules and rates. |

F.

| Distributions to Shareholders. Distributions to shareholders from net investment income and net realized gains for the Fund normally are declared and paid on an annual basis. Distributions are recorded on the ex- dividend date. |

G.

| Use of Estimates. The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements, as well as the reported amounts of revenues and expenses during the period. Actual results could differ from those estimates. |

TABLE OF CONTENTS

GOODHAVEN FUND

NOTES TO THE FINANCIAL STATEMENTS

November 30, 2024(Continued)

H.

| Share Valuation. The net asset value (“NAV”) per share of the Fund is calculated by dividing the sum of the value of the securities held by the Fund, plus cash and other assets, minus all liabilities by the total number of shares outstanding for the Fund, rounded to the nearest cent. The Fund’s shares will not be priced on the days on which the New York Stock Exchange is closed for trading. The offering and redemption price per share for the Fund is equal to the Fund’s net asset value per share. Prior to November 1, 2023, the Fund charged a 2.00% redemption fee on shares held less than 60 days. |

I.

| Guarantees and Indemnifications. In the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote. |

J.

| Illiquid Securities. Pursuant to Rule 22e-4 under the 1940 Act, the Fund has adopted a Board approved Liquidity Risk management Program (“LRMP”) that requires, among other things, that the Fund limits its illiquid investments that are assets to no more than 15% of net assets. An illiquid investment is any security which may not reasonably be expected to be sold or disposed of in current market conditions in seven calendar days or less without the sale or disposition significantly changing the market value of the investment. |

K.

| Options Contracts. When the Fund purchases an option, an amount equal to the premium paid by the Fund is recorded as an investment and is subsequently adjusted to the current value of the option purchased. If an option expires on the stipulated expiration date or if the Fund enters into a closing sale transaction, a gain or loss is realized. If a call option is exercised, the cost of the security acquired is increased by the premium paid for the call. If a put option is exercised, a gain or loss is realized from the sale of the underlying security, and the proceeds from such sale are decreased by the premium originally paid. Written and purchased options are non-income producing securities. |

When the Fund writes an option, an amount equal to the premium received by the Fund is recorded as a liability and is subsequently adjusted to the current fair value of the option written. Premiums received from writing options that expire unexercised are treated by the Fund on the expiration date as realized gains from investments. The difference between the premium and the amount paid on effecting a closing purchase transaction, including brokerage commissions, is also treated as a realized gain, or, if the premium is less that the amount paid for the closing purchase transaction, as a realized loss. If a call option is exercised, the premium is added to the proceeds from the sale of the underlying security or currency in determining whether the Fund has realized a gain or loss. If a put option is exercised, the premium reduces the cost basis of the securities purchased by the Fund. The Fund as writer of an option bears the market risk of an unfavorable change in the price of the security underlying the written option.

The following table indicates the average volume when in use for the year ended November 30, 2024:

| | | | |

Average notional value of:

Options purchased | | | $— |

| | | | |

NOTE 3 – COMMITMENTS AND OTHER RELATED PARTY TRANSACTIONS

The Advisor provides the Fund with investment management services under an Investment Advisory Agreement (the “Advisory Agreement”). Under the Agreement, the Advisor provides all investment advice, office space and certain administrative services, and most of the personnel needed by the Fund. Under the Advisory Agreement, the Advisor is entitled to receive a monthly management fee calculated daily and payable monthly equal to 0.90% of the Fund’s average daily net assets. The amount of Management fees incurred by the Fund for the year ended November 30, 2024, is disclosed in the Statement of Operations.

The Fund has also entered into a Support Services Agreement (the “Support Agreement”) with the Advisor. Under this agreement, the Advisor is responsible for paying all of the Fund’s other normal day-to-day operational expenses,such as administrative, custody, transfer agency, fund accounting, legal and audit. The support services fee does not

TABLE OF CONTENTS

GOODHAVEN FUND

NOTES TO THE FINANCIAL STATEMENTS

November 30, 2024(Continued)

cover the following other expenses: (a) any charges associated with the execution of portfolio transactions, such as brokerage commissions, transaction charges or other transaction-related expenses (such as stamp taxes), (b) taxes, acquired fund fees and expenses, if any, imposed on the Fund, (c) interest, if any, on any Fund borrowings, or (d) extraordinary Fund legal expenses incurred outside of the normal operation of the Fund, such as legal fees, arbitration fees, or related expenses in connection with any actual or threatened arbitration, mediation, or litigation. Under the Support Agreement, the Advisor is entitled to receive a monthly fee calculated daily and payable monthly equal to 0.20% of the Fund’s average daily net assets. The amount of support services fees incurred by the Fund for the year ended November 30, 2024, is disclosed in the Statement of Operations.

U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services (“Fund Services”), acts as the Fund’s administrator, fund accountant and transfer agent. In those capacities Fund Services maintains the Fund’s books and records, calculates the Fund’s NAV, prepares various federal and state regulatory filings, coordinates the payment of fund expenses, reviews expense accruals and prepares materials supplied to the Board.

Quasar Distributors, LLC acts as the Fund’s principal underwriter in a continuous public offering of the Fund’s shares. U.S. Bank N.A. serves as custodian to the Fund. U.S. Bank N.A. is an affiliate of Fund Services.

NOTE 4 – PURCHASES AND SALES OF SECURITIES

Investment transactions (excluding short-term investments) for the year ended November 30, 2024, were as follows:

There were no purchases or sales/maturities of long-term U.S. Government securities for the year ended November 30, 2024.

NOTE 5 – DISTRIBUTIONS TO SHAREHOLDERS

The tax character of distributions paid during the years ended November 30, 2024 and November 30, 2023, was as follows:

| | | | |

Ordinary income | | | $1,837,705 | | | $387,947 |

Long-term capital gains | | | $1,218,666 | | | $— |

| | | | | | | |

As of the Fund’s prior fiscal year-ended November 30, 2024, the components of distributable earnings on a tax basis were as follows:

| | | | |

Cost of investments1 | | | $179,741,849 |

Gross tax unrealized appreciation | | | 134,166,567 |

Gross tax unrealized depreciation | | | (4,752,097) |

Net unrealized appreciation (depreciation) | | | 129,414,470 |

Undistributed ordinary income | | | 3,715,376 |

Undistributed long-term capital gain | | | 3,365,697 |

Total distributable earnings | | | 7,081,073 |

Other accumulated gain/(loss) | | | (158,600) |

Total accumulated gain/(loss) | | | $136,336,943 |

| | | | |

1

| At November 30, 2024 the difference in the basis for federal income tax purposes and financial reporting purposes is due to the partnership adjustment. |

TABLE OF CONTENTS

GOODHAVEN FUND

NOTES TO THE FINANCIAL STATEMENTS

November 30, 2024(Continued)

NOTE 6 – OTHER MATTERS

Significant market disruptions, such as those caused by the COVID-19 (commonly referred to as “coronavirus”) pandemic, war (e.g., Russia’s invasion of Ukraine, Israeli-Palestinian conflict), or other events, can adversely affect local and global markets and normal market operations. The COVID-19 pandemic caused significant economic disruption in recent years as countries worked to limit the negative health impacts of the virus. While the virus appears to be entering an endemic stage, significant outbreaks or new variants present a continued risk to the global economy. The ultimate economic fallout from these disruptions and the long- term impact on economies, markets, industries, and individual issuers, are not known. Continuing market volatility as a result of these or other events may have adverse effects on the Fund’s investments and lead to losses.

NOTE 7 – SUBSEQUENT EVENTS

In preparing these financial statements, the Fund has evaluated events and transactions for potential recognition or disclosure through the date the financial statement were issued. The Fund declared a distribution from net investment income and net realized gain on securities payable on December 13, 2024. The distribution amount for the Fund was as follows:

| | | | |

$3,296,332 ($0.53999486 per share) | | | $4,006,302 ($0.65630 per share) |

| | | | |

TABLE OF CONTENTS

GoodHaven Fund

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Directors of

GoodHaven Funds Trust

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of GoodHaven Fund (the “Fund”), a series of GoodHaven Funds Trust, including the schedule of investments, as of November 30, 2024, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, financial highlights for each of the five years in the period then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of November 30, 2024, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. We have served as the Fund’s auditor since 2011.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of November 30, 2024 by correspondence with the custodian. We believe that our audits provide a reasonable basis for our opinion.

TAIT, WELLER & BAKER LLP

Philadelphia, Pennsylvania

January 27, 2025

TABLE OF CONTENTS

GoodHaven Fund

APPROVAL OF INVESTMENT ADVISORY AGREEMENT (Unaudited)

At a meeting held on October 23, 2024 the Board of Trustees of the Trust (the “Board”) (which is comprised of four persons, one of whom is an “interested person”, as defined under the Investment Company Act of 1940) considered and approved an Investment Advisory Agreement (the “Advisory Agreement”) for the GoodHaven Fund (the “Fund”) between the GoodHaven Funds Trust (the “Trust”) and GoodHaven Capital Management, LLC (the “Adviser”). At the meeting, the Board received and reviewed substantial information regarding the Fund, the Adviser and the services to be provided by the Adviser to the Fund under the Advisory Agreement. This information formed the primary (but not exclusive) basis for the Board’s determinations. Below is a summary of the factors considered by the Board and the conclusions that formed the basis for the Board’s approval of the continuance of the Advisory Agreement:

Nature, Extent and Quality of Service. The Board, including the Independent Trustees, noted that the Adviser will continue to provide all investment research and analysis, portfolio management and execution decisions for the Fund. The Board reviewed the background information of the key investment personnel who will be responsible for servicing the Fund. The Board recognized that the managing member of the Adviser has over 25 years of experience in executive management positions with various advisory firms as well as a decades-long successful career as an analyst and portfolio manager. The Board considered that securities research involves a variety of activities, including, but not limited to, review of financial statements, analyst reports, interviews with executives, customers, and suppliers, review of analyst reports, retention of third-party research personnel where the Adviser believes additional value can be added, and other activities and their services are conducted in a professional and high-quality manner, consistent with industry practices. The Board discussed the Adviser’s risk management policies and procedures to manage and control the risks associated with providing investment advisory services to the Fund. The Board noted that the Adviser maintains controls in place to minimize risks associated with trading, allocations, trade reviews, conflicts of interest and other risks. The Adviser also has specific statutory guidelines with respect to portfolio concentration as well as internal guidelines designed to limit risks attributable to a single security. The Board concluded that the Adviser continues to provide a high quality of service to the Fund for the benefit of the Fund and its shareholders and that the nature, overall quality and extent of the advisory services provided by the Adviser to the Fund were satisfactory and reliable.

Performance. The Board reviewed the performance of the Fund and discussed the performance relative to its peer group, Morningstar category and index. The Board considered that for the one-, two-, five- and ten-year periods ended May 31, 2024, the Fund had annualized returns of 33.67%, 19.68%, 17.24% and 6.32%, respectively, as compared to the S&P 500 Index which had annualized returns of 28.17%, 14.82%, 15.77% and 12.66%, respectively, over the same periods. The Board also considered that, for the longer recent period from December 31, 2019 through May 31, 2024, the Fund was up 15.73% versus the S&P 500 Index which was up 13.54%. The Board stated that it remains confident in the Adviser and its strategies for the Fund and expects positive long-term performance. After further discussion, the Board concluded that current performance of the Fund was satisfactory.

Fees and Expenses. The Board discussed the current advisory fee paid by the Fund. The Board considered a comparison of the Fund’s contractual advisory fee structure to many funds within its peer group and noted that the Fund’s fee structure was fair and competitive. Additionally, the Independent Trustees recognized that the fee levels are appropriate, given the Fund’s size, history, performance and operations. After further discussion, the Board concluded that the proposed advisory fee with respect to the Fund was not unreasonable.

Economies of Scale. The Board considered the economies of scale and noted that the Fund has yet to achieve a sufficient amount of assets to warrant a discussion on economies of scale. Further, the Board noted that the Fund had set fees at inception anticipating scale benefits that have not yet occurred, causing the Adviser to bear early losses which it did not seek to recover from the Fund and benefitting shareholders despite the lack of scale. The Adviser agreed with the Board that it should consider breakpoints when asset levels for the Fund reach appropriate levels. After discussion, the Board agreed that based on the current size of the Fund, it does not appear that economies of scale have not been reached at this time; however, the matter would be revisited in the future should the size of the Fund increase materially.

Profitability. The Board reviewed the Adviser’s financial statements and allocation of expenses. The Board noted that the Adviser receives an advisory fee of 0.90% and a support servicing fee of 0.20% for a total fee of 1.10% from the Fund, which is a comparable fee to the Fund’s peer group. The Board reviewed a profitability analysis prepared by the Adviser based on current asset levels of the Fund. After discussion, the Board concluded that the Adviser’s current profitability was not excessive and, that the Adviser’s profitability with respect to the Fund is reasonable in light of the services provided to the Fund.

TABLE OF CONTENTS

GoodHaven Fund

APPROVAL OF INVESTMENT ADVISORY AGREEMENT (Unaudited)(Continued)

Conclusion. Having requested and received information from the Adviser as the Board believed to be reasonably necessary to evaluate the terms of the Investment Advisory Agreement, and after considering the Gartenberg factors with the assistance and advice of counsel, the Board concluded that the fee structure is fair not unreasonable and that approval of the Investment Advisory Agreement is in the best interests of the Fund and its shareholders.

TABLE OF CONTENTS

GOODHAVEN FUND

ADDITIONAL INFORMATION (Unaudited)

INFORMATION ABOUT PROXY VOTING

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling toll-free at (855) 654-6639 and on the Fund’s website at www.goodhavenfunds.com. Furthermore, you can obtain the description on the SEC’s website at www.sec.gov.

Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available without charge, upon request, by calling (855) 654-6639 or through the SEC’s website at www.sec.gov.

INFORMATION ABOUT THE PORTFOLIO HOLDINGS

The Fund files its complete schedule of portfolio holdings for the first and third quarters with the SEC on Form N-PORT. The Fund’s Form N-PORT may be reviewed and copied at the SEC’s Public Reference Room in Washington D.C. Information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330. The Fund’s Form N-PORT is available without charge, upon request, by calling (855) 654-6639. Furthermore, you can obtain the Form N-Q on the SEC’s website at www.sec.gov.

HOUSEHOLDING

In an effort to decrease costs, the Fund will reduce the number of duplicate Prospectuses and annual and semi-annual reports that you receive by sending only one copy of each to those addresses shown by two or more accounts. Please call the transfer agent toll free at (855) 654-6639 to request individual copies of these documents. The Fund will begin sending individual copies thirty days after receiving your request. This policy does not apply to account statements.

INFORMATION ABOUT THE FUND’S TRUSTEES

The Statement of Additional Information (“SAI”) includes additional information about the Fund’s Trustees and is available without charge, upon request, by calling (855) 654-6639. Furthermore, you can obtain the SAI on the SEC’s website at www.sec.gov or the Fund’s website at www.goodhavenfunds.com.

FEDERAL TAX INFORMATION

For the year ended November 30, 2024, certain dividends paid by the Fund may be subject to a maximum tax rate of 23.8%, as provided for by the Jobs and Growth Tax Relief Reconciliation Act of 2003 and the Tax Cuts and Jobs Act of 2017. The percentage of dividends declared from ordinary income designated as qualified dividend income was 97.25%. For corporate shareholders, the percent of ordinary income distributions qualifying for the corporate dividends received deduction for the year ended November 30, 2024 was 89.95%.

TABLE OF CONTENTS

GoodHaven Fund

Advisor

GOODHAVEN CAPITAL MANAGEMENT, LLC

374 Millburn Avenue, Suite 306

Millburn, New Jersey 07041

Distributor

QUASAR DISTRIBUTORS, LLC

Three Canal Plaza, Suite 100

Portland, Maine 04101

Custodian

U.S. BANK N.A.

Custody Operations

1555 North RiverCenter Drive, Suite 302

Milwaukee, Wisconsin 53212

Transfer Agent, Fund Accountant & Fund Administrator

U.S. BANCORP FUND SERVICES, LLC

615 East Michigan Street

Milwaukee, Wisconsin 53202

1-855-OK-GOODX

(1-855-654-6639)

Independent Registered Public Accounting Firm

TAIT WELLER

Two Liberty Place

50 South 16th Street, Suite 2900

Philadelphia, Pennsylvania 19102

Legal Counsel

BLANK ROME LLP

1271 Avenue of the Americas

New York, New York 10020

GoodHaven Fund

855-OK-GOODX (855-654-6639)

www.goodhavenfunds.com

Symbol – GOODX

CUSIP – 38217G103

| (b) | Financial Highlights are included within the financial statements filed under Item 7 of this Form. |

Item 8. Changes in and Disagreements with Accountants for Open-End Management Investment Companies.

There were no changes in or disagreements with accountants during the period covered by this report.

Item 9. Proxy Disclosure for Open-End Management Investment Companies.

There were no matters submitted to a vote of shareholders during the period covered by this report.

Item 10. Remuneration Paid to Directors, Officers, and Others of Open-End Management Investment Companies.

For the year ended November 30, 2024, trustee fees paid by the Trust were $33,863.

Item 11. Statement Regarding Basis for Approval of Investment Advisory Contract.

See Item 7(a)

Item 12. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 13. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 14. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable to open-end investment companies.

Item 15. Submission of Matters to a Vote of Security Holders.

There have been no material changes to the procedures by which shareholders may recommend nominees to the Registrant’s Board of Trustees.

Item 16. Controls and Procedures.

| (a) | The Registrant’s Principal Executive Officer and Principal Financial Officer have reviewed the Registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) as of a date within 90 days of the filing of this report, as required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934. Based on their review, such officers have concluded |

that the disclosure controls and procedures are effective in ensuring that information required to be disclosed in this report is appropriately recorded, processed, summarized and reported and made known to them by others within the Registrant and by the Registrant’s service provider.

| (b) | There were no changes in the Registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the period covered by this report that have materially affected, or are reasonably likely to materially affect, the Registrant's internal control over financial reporting. |

Item 17. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies

Not applicable to open-end investment companies.

Item 18. Recovery of Erroneously Awarded Compensation.

Not applicable.

Item 19. Exhibits.

(2) Any policy required by the listing standards adopted pursuant to Rule 10D-1 under the Exchange Act (17 CFR 240.10D-1) by the registered national securities exchange or registered national securities association upon which the registrant’s securities are listed. Not Applicable.

(3) A separate certification for each principal executive officer and principal financial officer of the registrant as required by Rule 30a-2(a) under the Investment Company Act of 1940 (17 CFR 270.30a-2(a)). Filed herewith.

(4) Any written solicitation to purchase securities under Rule 23c-1 under the Act sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable to open-end investment companies.

(5) Change in the registrant’s independent public accountant. Provide the information called for by Item 4 of Form 8-K under the Exchange Act (17 CFR 249.308). Unless otherwise specified by Item 4, or related to and necessary for a complete understanding of information not previously disclosed, the information should relate to events occurring during the reporting period. Not applicable to open-end investment companies.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | (Registrant) | GoodHaven Funds Trust | |

| | By (Signature and Title)* | /s/ Larry Pitkowsky | |

| | | Larry Pitkowsky, President and Principal Executive Officer | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| | By (Signature and Title)* | /s/ Larry Pitkowsky | |

| | | Larry Pitkowsky, President and Principal Executive Officer | |

| | By (Signature and Title)* | /s/ Lynn Iacona | |

| | | Lynn Iacona, Treasurer and Principal Financial Officer | |