UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE QUARTERLY PERIOD ENDED JUNE 30, 2017

OR

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

Commission File Number: 333-213043

Blackstone Real Estate Income Trust, Inc.

(Exact name of Registrant as specified in its charter)

| |

Maryland | 81-0696966 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

345 Park Avenue

New York, New York 10154

(Address of principal executive offices) (Zip Code)

(212) 583-5000

(Registrant’s telephone number, including area code)

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | | Accelerated filer | ☐ |

Non-accelerated filer | ☒ | (Do not check if a smaller reporting company) | Smaller reporting company | ☐ |

| | | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. Yes ☒ No ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act. Yes ☐ No ☒

As of August 11, 2017, there were 88,132,022 outstanding shares of Class S common stock, 20,584,019 outstanding shares of Class I common stock, 635,802 outstanding shares of Class D common stock, and 1,117,944 outstanding shares of Class T common stock.

TABLE OF CONTENTS

PART I. | FINANCIAL INFORMATION | 1 |

| | |

ITEM 1. | FINANCIAL STATEMENTS | 1 |

| | |

| Consolidated Financial Statements (Unaudited): | |

| | |

| Consolidated Balance Sheets as of June 30, 2017 and December 31, 2016 | 1 |

| | |

| Consolidated Statements of Operations for the Three and Six Months Ended June 30, 2017 and for the Three Months ended June 30, 2016 and the Period March 2, 2016 (date of initial capitalization) through June 30, 2016 | 2 |

| | |

| Consolidated Statement of Changes in Equity for the Six Months Ended June 30, 2017 | 3 |

| | |

| Consolidated Statements of Cash Flows for the Six Months Ended June 30, 2017 and for The Period March 2, 2016 (date of initial capitalization) through June 30, 2016 | 4 |

| | |

| Notes to Consolidated Financial Statements | 6 |

| | |

ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 22 |

| | |

ITEM 3. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 34 |

| | |

ITEM 4. | CONTROLS AND PROCEDURES | 35 |

| | |

PART II. | OTHER INFORMATION | 36 |

| | |

ITEM 1. | LEGAL PROCEEDINGS | 36 |

| | |

ITEM 1A. | RISK FACTORS | 36 |

| | |

ITEM 2. | UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS | 36 |

| | |

ITEM 3. | DEFAULTS UPON SENIOR SECURITIES | 37 |

| | |

ITEM 4. | MINE SAFETY DISCLOSURES | 37 |

| | |

ITEM 5. | OTHER INFORMATION | 37 |

| | |

ITEM 6. | EXHIBITS | 37 |

| | |

SIGNATURES | 38 |

PART I. FINANCIAL INFORMATION

ITEM 1. | FINANCIAL STATEMENTS |

Blackstone Real Estate Income Trust, Inc.

Consolidated Balance Sheets (Unaudited)

(in thousands, except share and per share data)

| | June 30, | | | December 31, | |

| | 2017 | | | 2016 | |

Assets | | | | | | | | |

Investments in real estate, net | | $ | 1,430,515 | | | $ | — | |

Investments in real estate-related securities | | | 291,549 | | | | — | |

Cash and cash equivalents | | | 31,296 | | | | 200 | |

Restricted cash | | | 92,861 | | | | — | |

Intangible assets, net | | | 77,596 | | | | — | |

Other assets | | | 10,781 | | | | — | |

Total assets | | $ | 1,934,598 | | | $ | 200 | |

Liabilities and Equity | | | | | | | | |

Mortgage notes, term loan, and revolving credit facility, net | | $ | 717,072 | | | $ | — | |

Repurchase agreements | | | 169,583 | | | | — | |

Affiliate line of credit | | | 43,708 | | | | — | |

Subscriptions received in advance | | | 88,657 | | | | — | |

Due to affiliates | | | 68,492 | | | | 86 | |

Accounts payable, accrued expenses, and other liabilities | | | 46,636 | | | | 29 | |

Total liabilities | | $ | 1,134,148 | | | $ | 115 | |

| | | | | | | | |

Commitments and contingencies | | | — | | | | — | |

| | | | | | | | |

Equity | | | | | | | | |

Preferred stock, $0.01 par value per share, 100,000,000 shares authorized; none issued and outstanding as of June 30, 2017 and December 31, 2016 | | | — | | | | — | |

Common stock — Class S shares, $0.01 par value per share, 500,000,000 shares authorized; 71,382,151 and no shares issued and outstanding as of June 30, 2017 and December 31, 2016, respectively | | | 714 | | | | — | |

Common stock — Class T shares, $0.01 par value per share, 500,000,000 shares authorized; 13,460 and no shares issued and outstanding as of June 30, 2017 and December 31, 2016, respectively | | | — | | | | — | |

Common stock — Class D shares, $0.01 par value per share, 500,000,000 shares authorized; 216,570 and no shares issued and outstanding as of June 30, 2017 and December 31, 2016, respectively | | | 2 | | | | — | |

Common stock — Class I shares, $0.01 par value per share, 500,000,000 shares authorized; 17,318,240 and 20,000 shares issued and outstanding as of June 30, 2017 and December 31, 2016, respectively | | | 173 | | | | — | |

Additional paid-in capital | | | 827,914 | | | | 200 | |

Accumulated deficit and cumulative distributions | | | (28,353 | ) | | | (115 | ) |

Total equity | | | 800,450 | | | | 85 | |

Total liabilities and equity | | $ | 1,934,598 | | | $ | 200 | |

See accompanying notes to consolidated financial statements.

1

Blackstone Real Estate Income Trust, Inc.

Consolidated Statements of Operations (Unaudited)

(in thousands, except share and per share data)

| Three Months Ended June 30, | | | Six Months Ended June 30, | | | For the Period March 2, 2016 (date of initial capitalization) through June 30, | |

| 2017 | | | 2016 | | | 2017 | | | 2016 | |

Revenues | | | | | | | | | | | | | | | |

Rental revenue | $ | 21,230 | | | $ | — | | | $ | 22,128 | | | $ | — | |

Tenant reimbursement income | | 2,206 | | | | — | | | | 2,273 | | | | — | |

Hotel revenue | | 3,748 | | | | — | | | | 5,174 | | | | — | |

Other revenue | | 1,155 | | | | — | | | | 1,208 | | | | — | |

Total revenues | | 28,339 | | | | — | | | | 30,783 | | | | — | |

Expenses | | | | | | | | | | | | | | | |

Rental property operating | | 9,389 | | | | — | | | | 9,694 | | | | — | |

Hotel operating | | 2,109 | | | | — | | | | 2,949 | | | | — | |

General and administrative | | 1,567 | | | | — | | | | 4,253 | | | | — | |

Performance participation allocation | | 5,241 | | | | — | | | | 5,241 | | | | — | |

Depreciation and amortization | | 23,696 | | | | — | | | | 24,786 | | | | — | |

Total expenses | | 42,002 | | | | — | | | | 46,923 | | | | — | |

Other income (expense) | | | | | | | | | | | | | | | |

Income from real estate-related securities | | 2,543 | | | | — | | | | 3,409 | | | | — | |

Interest income | | 117 | | | | — | | | | 382 | | | | — | |

Interest expense | | (5,541 | ) | | | — | | | | (5,547 | ) | | | — | |

Other expenses | | (28 | ) | | | | | | | (28 | ) | | | | |

Total other (expense) income | | (2,909 | ) | | | — | | | | (1,784 | ) | | | — | |

Net loss before income tax | | (16,572 | ) | | | — | | | | (17,924 | ) | | | — | |

Income tax expense | | (129 | ) | | | — | | | | (44 | ) | | | — | |

Net loss | $ | (16,701 | ) | | $ | — | | | $ | (17,968 | ) | | $ | — | |

Net loss per share of common stock — basic and diluted | $ | (0.22 | ) | | $ | — | | | $ | (0.31 | ) | | $ | — | |

Weighted-average shares of common stock outstanding, basic and diluted | | 76,595,994 | | | | 20,000 | | | | 57,060,077 | | | | 20,000 | |

See accompanying notes to consolidated financial statements.

2

Blackstone Real Estate Income Trust, Inc.

Consolidated Statement of Changes in Equity (Unaudited)

(in thousands)

| | Par Value | | | | | | | Accumulated | | | | | |

| | Common | | | Common | | | Common | | | Common | | | Additional | | | Deficit and | | | | | |

| | Stock | | | Stock | | | Stock | | | Stock | | | Paid-In | | | Cumulative | | | Total | |

| | Class S | | | Class T | | | Class D | | | Class I | | | Capital | | | Distributions | | | Equity | |

Balance at December 31, 2016 | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 200 | | | $ | (115 | ) | | $ | 85 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Common stock issued | | | 711 | | | | — | | | | 2 | | | | 172 | | | | 893,765 | | | | — | | | | 894,650 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Distribution reinvestment | | | 3 | | | | — | | | | — | | | | 1 | | | | 4,266 | | | | — | | | | 4,270 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Offering costs | | | — | | | | — | | | | — | | | | — | | | | (70,369 | ) | | | — | | | | (70,369 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Amortization of restricted stock grant | | | — | | | | — | | | | — | | | | — | | | | 52 | | | | — | | | | 52 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net loss | | | — | | | | — | | | | — | | | | — | | | | — | | | | (17,968 | ) | | | (17,968 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Distributions declared on common stock | | | — | | | | — | | | | — | | | | — | | | | — | | | | (10,270 | ) | | | (10,270 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance at June 30, 2017 | | $ | 714 | | | $ | — | | | $ | 2 | | | $ | 173 | | | $ | 827,914 | | | $ | (28,353 | ) | | $ | 800,450 | |

See accompanying notes to consolidated financial statements.

3

Blackstone Real Estate Income Trust, Inc.

Consolidated Statements of Cash Flows (Unaudited)

(in thousands)

| | Six Months Ended June 30, 2017 | | | For the Period March 2, 2016 (date of initial capitalization) through June 30, 2016 | |

Cash flows from operating activities: | | | | | | | | |

Net loss | | $ | (17,968 | ) | | | — | |

Adjustments to reconcile net loss to net cash provided by operating activities: | | | | | | | | |

Depreciation and amortization | | | 24,786 | | | | — | |

Unrealized gain on changes in fair value of real estate-related securities | | | (1,635 | ) | | | — | |

Realized loss on settlement of real estate-related securities | | | 177 | | | | | |

Straight-line rent adjustment | | | (567 | ) | | | — | |

Amortization of above- and below-market lease intangibles | | | (365 | ) | | | — | |

Amortization of below-market and prepaid ground lease intangible | | | 77 | | | | | |

Amortization of deferred financing costs | | | 269 | | | | — | |

Amortization of restricted stock grant | | | 52 | | | | — | |

Bad debt expense | | | 154 | | | | | |

Change in assets and liabilities: | | | | | | | | |

(Increase) / decrease in other assets | | | (6,277 | ) | | | — | |

Increase / (decrease) in due to affiliates | | | 7,634 | | | | — | |

Increase / (decrease) in accounts payable, accrued expenses, and other liabilities | | | 13,147 | | | | — | |

Net cash provided by operating activities | | | 19,484 | | | | — | |

Cash flows from investing activities: | | | | | | | | |

Acquisitions of real estate | | | (1,509,640 | ) | | | — | |

Capital improvements to real estate | | | (461 | ) | | | — | |

Pre-acquisition costs | | | (1,123 | ) | | | — | |

Purchase of real estate-related securities | | | (300,040 | ) | | | — | |

Proceeds from settlement of real estate-related securities | | | 16,596 | | | | — | |

Net cash used in investing activities | | | (1,794,668 | ) | | | — | |

Cash flows from financing activities: | | | | | | | | |

Proceeds from issuance of common stock | | | 894,650 | | | | — | |

Offering costs paid | | | (10,102 | ) | | | — | |

Subscriptions received in advance | | | 88,657 | | | | — | |

Borrowings from mortgage notes, term loan, and revolving credit facility | | | 723,304 | | | | — | |

Borrowings under repurchase agreements | | | 182,154 | | | | — | |

Settlement of repurchase agreements | | | (12,571 | ) | | | — | |

Borrowings from affiliate line of credit | | | 178,208 | | | | — | |

Repayments on affiliate line of credit | | | (134,500 | ) | | | — | |

Payment of deferred financing costs | | | (8,742 | ) | | | — | |

Distributions | | | (1,917 | ) | | | — | |

Net cash provided by financing activities | | | 1,899,141 | | | | — | |

Net change in cash and cash equivalents and restricted cash | | | 123,957 | | | | — | |

| | | | | | | | |

Cash and cash equivalents and restricted cash, beginning of period | | $ | 200 | | | $ | 200 | |

Cash and cash equivalents and restricted cash, end of period | | $ | 124,157 | | | $ | 200 | |

| | | | | | | | |

Reconciliation of cash and cash equivalents and restricted cash to the consolidated balance sheet: | | | | | | | | |

Cash and cash equivalents | | $ | 31,296 | | | $ | 200 | |

Restricted cash | | | 92,861 | | | | — | |

Total cash and cash equivalents and restricted cash | | $ | 124,157 | | | $ | 200 | |

| | | | | | | | |

Non-cash investing and financing activities: | | | | | | | | |

Assumption of other liabilities in conjunction with acquisitions of real estate | | $ | 10,459 | | | | — | |

Accrued capital expenditures and acquisition related costs | | $ | 1,003 | | | | — | |

Accrued pre-acquisition costs | | $ | 585 | | | | — | |

4

Accrued distributions | | $ | 4,083 | | | | — | |

Accrued stockholder servicing fee due to affiliate | | $ | 53,385 | | | | — | |

Accrued offering costs due to affiliate | | $ | 6,882 | | | | — | |

Distribution reinvestment | | $ | 4,270 | | | | — | |

Payable for real-estate related securities | | $ | 6,647 | | | | — | |

Accrued deferred financing costs | | $ | 142 | | | | — | |

See accompanying notes to consolidated financial statements.

5

Blackstone Real Estate Income Trust, Inc.

Notes to Consolidated Financial Statements

(Unaudited)

1. Organization and Business Purpose

Blackstone Real Estate Income Trust, Inc. (the “Company”) was formed on November 16, 2015 as a Maryland corporation and intends to qualify as a real estate investment trust (“REIT”) for U.S. federal income tax purposes commencing with the taxable year ending December 31, 2017. The Company was organized to invest primarily in stabilized income-oriented commercial real estate in the United States and to a lesser extent, invest in real estate-related securities. The Company is the sole general partner of BREIT Operating Partnership, L.P., a Delaware limited partnership (“BREIT OP”). BREIT Special Limited Partner L.L.C. (the “Special Limited Partner”), a wholly-owned subsidiary of The Blackstone Group L.P. (together with its affiliates, “Blackstone”), owns a special limited partner interest in BREIT OP. Substantially all of the Company’s business is conducted through BREIT OP. The Company and BREIT OP are externally managed by BX REIT Advisors L.L.C. (the “Adviser”), an affiliate of Blackstone.

The Company has registered with the Securities and Exchange Commission (the “SEC”) an offering of up to $5.0 billion in shares of common stock, consisting of up to $4.0 billion in shares in its primary offering and up to $1.0 billion in shares pursuant to its distribution reinvestment plan (the “Offering”). The Company intends to sell any combination of four classes of shares of its common stock, with a dollar value up to the maximum aggregate amount of the Offering. The share classes have different upfront selling commissions, dealer manager fees and ongoing stockholder servicing fees. As of January 1, 2017, the Company had satisfied the minimum offering requirement and the Company’s board of directors authorized the release of proceeds from escrow. As of June 30, 2017, the Company issued and sold 88,930,421 shares of the Company’s common stock (consisting of 71,382,151 Class S shares, 17,318,240 Class I shares, 216,570 Class D shares, and 13,460 Class T shares). The Company intends to continue selling shares on a monthly basis.

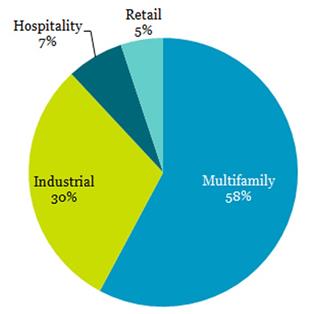

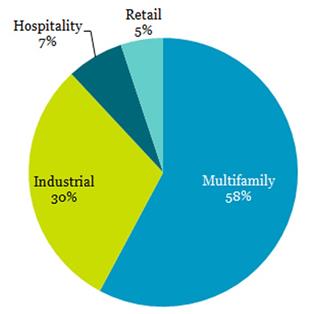

As of June 30, 2017, the Company owned ten investments in real estate and had twelve positions in commercial mortgage-backed securities (“CMBS”). The Company currently operates in five reportable segments: Multifamily, Industrial, Hotel, and Retail Properties, and investments in Real Estate-Related Securities. Financial results by segment are reported in Note 14 — Segment Reporting.

2. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying unaudited consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) for interim financial information and the instructions to Form 10-Q and Rule 10-01 of Regulation S-X. All intercompany transactions have been eliminated in consolidation. The consolidated financial statements, including the notes thereto, are unaudited and exclude some of the disclosures required in audited financial statements. Management believes it has made all necessary adjustments, consisting of only normal recurring items, so that the consolidated financial statements are presented fairly and that estimates made in preparing its consolidated financial statements are reasonable and prudent. The accompanying unaudited consolidated interim financial statements should be read in conjunction with the audited consolidated financial statements included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2016 filed with the SEC.

The preparation of the financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the balance sheet. Actual results could differ from those estimates.

Cash and Cash Equivalents

Cash and cash equivalents represent cash held in banks, cash on hand, and liquid investments with original maturities of three months or less. The Company may have bank balances in excess of federally insured amounts; however, the Company deposits its cash and cash equivalents with high credit-quality institutions to minimize credit risk.

Restricted Cash

Restricted cash primarily consists of cash received for subscriptions prior to the date in which the subscriptions are effective. The Company’s restricted cash is held primarily in a bank account controlled by the Company’s transfer agent but in the name of the Company. The amount of $88.7 million as of June 30, 2017 represents proceeds from subscriptions received in advance and is classified as restricted cash.

6

Investments in Real Estate

In accordance with the guidance for business combinations, the Company determines whether the acquisition of a property qualifies as a business combination, which requires that the assets acquired and liabilities assumed constitute a business. If the property acquired is not a business, the Company accounts for the transaction as an asset acquisition. The Company has early adopted Accounting Standards Update 2017-01 — Clarifying the Definition of a Business (“ASU 2017-01”). ASU 2017-01 states that when substantially all of the fair value of the gross assets to be acquired is concentrated in a single identifiable asset or group of similar identifiable assets, the asset or set of assets is not a business. All property acquisitions to date have been accounted for as asset acquisitions.

Whether the acquisition of a property acquired is considered a business combination or asset acquisition, the Company recognizes the identifiable assets acquired, the liabilities assumed, and any non-controlling interest in the acquired entity. In addition, for transactions that are business combinations, the Company evaluates the existence of goodwill or a gain from a bargain purchase. The Company expenses acquisition-related costs associated with business combinations as they are incurred. The Company capitalizes acquisition-related costs associated with asset acquisitions.

Upon acquisition of a property, the Company assesses the fair value of acquired tangible and intangible assets (including land, buildings, tenant improvements, “above-market” and “below-market” leases, acquired in-place leases, other identified intangible assets and assumed liabilities) and allocates the purchase price to the acquired assets and assumed liabilities. The Company assesses and considers fair value based on estimated cash flow projections that utilize discount and/or capitalization rates that it deems appropriate, as well as other available market information. Estimates of future cash flows are based on a number of factors including the historical operating results, known and anticipated trends, and market and economic conditions.

The fair value of the tangible assets of an acquired property considers the value of the property as if it were vacant. The Company also considers an allocation of purchase price of other acquired intangibles, including acquired in-place leases that may have a customer relationship intangible value, including (but not limited to) the nature and extent of the existing relationship with the tenants, the tenants’ credit quality and expectations of lease renewals. Based on its acquisitions to date, the Company’s allocation to customer relationship intangible assets has not been material.

The Company records acquired above-market and below-market leases at their fair values (using a discount rate which reflects the risks associated with the leases acquired) equal to the difference between (1) the contractual amounts to be paid pursuant to each in-place lease and (2) management’s estimate of fair market lease rates for each corresponding in-place lease, measured over a period equal to the remaining term of the lease for above-market leases and the initial term plus the term of any below-market fixed rate renewal options for below-market leases. Other intangible assets acquired include amounts for in-place lease values that are based on the Company’s evaluation of the specific characteristics of each tenant’s lease. Factors to be considered include estimates of carrying costs during hypothetical expected lease-up periods considering current market conditions, and costs to execute similar leases. In estimating carrying costs, the Company includes real estate taxes, insurance and other operating expenses and estimates of lost rentals at market rates during the expected lease-up periods, depending on local market conditions. In estimating costs to execute similar leases, the Company considers leasing commissions, legal and other related expenses.

The amortization of acquired above-market and below-market leases is recorded as an adjustment to rental revenue on the consolidated statements of operations. The amortization of in-place leases is recorded as an adjustment to depreciation and amortization expense on the consolidated statements of operations. The amortization of below-market and pre-paid ground leases are recorded as an adjustment to hotel or rental property operating expenses, as applicable, on the consolidated statements of operations.

The cost of buildings and improvements includes the purchase price of the Company’s properties and any acquisition-related costs, along with any subsequent improvements to such properties. The Company’s investments in real estate are stated at cost and are generally depreciated on a straight-line basis over the estimated useful lives of the assets as follows:

Description | | Depreciable Life |

Building | | 30 - 40 years |

Building- and land-improvements | | 10 years |

Furniture, fixtures and equipment | | 1 - 7 years |

Lease intangibles | | Over lease term |

Significant improvements to properties are capitalized. When assets are sold or retired, their costs and related accumulated depreciation are removed from the accounts with the resulting gains or losses reflected in net income or loss for the period.

Repairs and maintenance are expensed to operations as incurred and are included in property and hotel operating expenses on the Company’s consolidated statements of operations.

7

The Company’s management reviews its real estate properties for impairment each quarter or when there is an event or change in circumstances that indicates an impaired value. If the carrying amount of the real estate investment is no longer recoverable and exceeds the fair value such investment, an impairment loss is recognized. The impairment loss is recognized based on the excess of the carrying amount of the asset over its fair value. The evaluation of anticipated future cash flows is highly subjective and is based in part on assumptions regarding future occupancy, rental rates and capital requirements that could differ materially from actual results. Since cash flows on real estate properties considered to be “long-lived assets to be held and used” are considered on an undiscounted basis to determine whether an asset has been impaired, the Company’s strategy of holding properties over the long term directly decreases the likelihood of recording an impairment loss. If the Company’s strategy changes or market conditions otherwise dictate an earlier sale date, an impairment loss may be recognized and such loss could be material to the Company’s results. If the Company determines that an impairment has occurred, the affected assets must be reduced to their fair value, less cost to sell. During the period presented, no such impairment occurred.

Deferred Charges

The Company’s deferred charges include financing and leasing costs. Deferred financing costs include legal, structuring, and other loan costs incurred by the Company for its financing agreements. Deferred financing costs related to the Company’s mortgage notes and term loan are recorded as an offset to the related liability and amortized over the term of the financing instrument. Deferred financing costs related to the Company’s revolving credit facility and affiliate line of credit are recorded as a component of other assets and amortized over the term of the financing agreement. Deferred leasing costs incurred in connection with new leases, which consist primarily of brokerage and legal fees, are recorded as a component of other assets and amortized over the life of the related lease.

Investments in Real Estate-Related Securities

The Company has elected to classify its investment in real estate-related securities as trading securities and carry such investments at estimated fair value. As such, the resulting gains and losses are recorded as a component of income from real estate-related securities on the consolidated statements of operations.

Fair Value Measurement

Under normal market conditions, the fair value of an investment is the amount that would be received to sell an asset or transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price). Additionally, there is a hierarchal framework that prioritizes and ranks the level of market price observability used in measuring investments at fair value. Market price observability is impacted by a number of factors, including the type of investment and the characteristics specific to the investment and the state of the market place, including the existence and transparency of transactions between market participants. Investments with readily available active quoted prices or for which fair value can be measured from actively quoted prices generally will have a higher degree of market price observability and a lesser degree of judgment used in measuring fair value.

Investments measured and reported at fair value are classified and disclosed in one of the following levels within the fair value hierarchy:

Level 1 — quoted prices are available in active markets for identical investments as of the measurement date. The Company does not adjust the quoted price for these investments.

Level 2 — quoted prices are available in markets that are not active or model inputs are based on inputs that are either directly or indirectly observable as of the measurement date.

Level 3 — pricing inputs are unobservable and include instances where there is minimal, if any, market activity for the investment. These inputs require significant judgment or estimation by management or third parties when determining fair value and generally represent anything that does not meet the criteria of Levels 1 and 2. Due to the inherent uncertainty of these estimates, these values may differ materially from the values that would have been used had a ready market for these investments existed.

As of June 30, 2017, the Company’s $291.5 million of investments in real estate-related securities were classified as Level 2.

Valuation

The Company’s investments in real estate-related securities are reported at estimated fair value.

8

As of June 30, 2017, the Company’s investments in real estate-related securities consisted of CMBS, which are fixed income securities. The Company generally values its CMBS by utilizing third-party pricing service providers and broker-dealer quotations on the basis of last available bid price.

In determining the value of a particular investment, pricing service providers may use broker-dealer quotations, reported trades or valuation estimates from their internal pricing models to determine the reported price. The pricing service providers’ internal models use observable inputs such as issuer details, interest rates, yield curves, prepayment speeds, credit risks/spreads, default rates and quoted prices for similar assets.

The fair value of the Company’s mortgage notes, term loan, and revolving credit facility, repurchase agreements, and affiliate line of credit all approximate their carrying value.

Revenue Recognition

The Company’s sources of revenue and the related revenue recognition policies are as follows:

Rental revenue — primarily consists of base rent arising from tenant leases at the Company’s industrial, multifamily, and retail properties. Rental revenue is recognized on a straight-line basis over the life of the lease, including any rent steps or abatement provisions. The Company begins to recognize revenue upon the acquisition of the related property or when a tenant takes possession of leased space.

Tenant reimbursement income — consists primarily of amounts due from tenants for costs related to common area maintenance, real estate taxes, and other recoverable costs included in lease agreements. The Company recognizes the reimbursement of such costs incurred as tenant reimbursement income.

Hotel revenue — consists of income from the Company’s hotel properties. Hotel revenue consists primarily of room revenue and food and beverage revenue. Room revenue is recognized when the related room is occupied and other hotel revenue is recognized when the service is rendered.

Income Taxes

The Company intends to make an election to be taxed as a REIT under Sections 856 through 860 of the Internal Revenue Code of 1986, as amended, or the Internal Revenue Code, commencing with its taxable year ending December 31, 2017. If the Company qualifies for taxation as a REIT, the Company generally will not be subject to federal corporate income tax to the extent it distributes 90% of its taxable income to its stockholders. REITs are subject to a number of other organization and operational requirements. Even if the Company qualifies for taxation as a REIT, it may be subject to certain state and local taxes on its income and property, and federal income and excise taxes on its undistributed income.

The Company leases its hotel investments to wholly-owned taxable REIT subsidiaries (“TRSs”). The TRSs are subject to taxation at the federal, state and local levels, as applicable. Revenues related to the hotels’ operations such as room revenue, food and beverage revenue and other revenue are recorded in the TRS along with corresponding expenses. The Company accounts for applicable income taxes by utilizing the asset and liability method. As such, the Company records deferred tax assets and liabilities for the future tax consequences resulting from the difference between the carrying value of existing assets and liabilities and their respective tax basis. As of June 30, 2017, the Company recorded a deferred tax asset of $317 thousand due to its hotel investments and recorded such amount as a tax benefit within income tax expense on the consolidated statements of operations.

Organization and Offering Costs

Organization costs are expensed as incurred and recorded as a component of general and administrative on the Company’s consolidated statement of operations and offering costs are charged to equity as such amounts are incurred.

The Adviser has agreed to advance certain organization and offering costs on behalf of the Company interest free (including legal, accounting, and other expenses attributable to the Company’s organization, but excluding upfront selling commissions, dealer manager fees and stockholder servicing fees) through December 31, 2017, the day before the first anniversary of the date as of which escrow for the Offering was released. The Company will reimburse the Adviser for all such advanced expenses ratably over a 60 month period following December 31, 2017.

As of June 30, 2017, the Adviser and its affiliates had incurred organization and offering costs on the Company’s behalf of $8.7 million, consisting of offering costs of $6.9 million and organization costs of $1.8 million. These organization and offering costs were

9

recorded as a component of due to affiliates in the accompanying consolidated balance sheet as of June 30, 2017. Such costs became the Company’s liability on January 1, 2017, the date as of which the proceeds from the Offering were released from escrow.

Blackstone Advisory Partners L.P. (the “Dealer Manager”), a registered broker-dealer affiliated with the Adviser, serves as the dealer manager for the Offering. The Dealer Manager is entitled to receive selling commissions and dealer manager fees based on the transaction price of each applicable class of shares sold in the Offering. The Dealer Manager is also entitled to receive a stockholder servicing fee of 0.85%, 0.85% and 0.25% per annum of the aggregate net asset value (“NAV”) of the Company’s outstanding Class S shares, Class T shares, and Class D shares, respectively.

The following table details the selling commissions, dealer manager fees, and stockholder servicing fees for each applicable share class:

| | Class S | | | Class T | | | Class D | | | Class I |

Selling commissions and dealer manager fees (% of transaction price) | | up to 3.5% | | | up to 3.5% | | | — | | | — |

Stockholder servicing fee (% of NAV) | | | 0.85% | | | | 0.85% | | | | 0.25% | | | — |

There is no stockholder servicing fee with respect to Class I shares. The Dealer Manager has entered into agreements with the selected dealers distributing the Company’s shares in the Offering, which provide, among other things, for the re-allowance of the full amount of the selling commissions and dealer manager fees received and all or a portion of the stockholder servicing fees to such selected dealers. The Company will cease paying the stockholder servicing fee with respect to any Class S share, Class T share or Class D share held in a stockholder’s account at the end of the month in which the total selling commissions, dealer manager fees and stockholder servicing fees paid with respect to the shares held by such stockholder within such account would exceed, in the aggregate, 8.75% (or, in the case of Class T shares sold through certain participating broker-dealers, a lower limit as set forth in any applicable agreement between the Dealer Manager and a participating broker-dealer) of the gross proceeds from the sale of such shares (including the gross proceeds of any shares issued under the Company’s distribution reinvestment plan with respect thereto). The Company will accrue the full cost of the stockholder servicing fee as an offering cost at the time each Class S, Class T, and Class D share is sold during the Offering. As of June 30, 2017, the Company had accrued $53.4 million of stockholder servicing fees related to Class S shares, Class D shares and Class T shares sold and recorded such amount as a component of due to affiliate on the Company’s consolidated balance sheets.

Earnings Per Share

Basic net loss per share of common stock is determined by dividing net loss attributable to common stockholders by the weighted average number of common shares outstanding during the period. All classes of common stock are allocated net income/(loss) at the same rate per share.

The restricted stock grants of Class I shares held by our directors and issued on January 1, 2017 are considered to be participating securities because they contain non-forfeitable rights to distributions. The impact of these restricted stock grants on basic and diluted earnings per common share (“EPS”) has been calculated using the two-class method whereby earnings are allocated to the restricted stock grants based on dividends declared and the restricted stocks’ participation rights in undistributed earnings. As of June 30, 2017, the effects of the two-class method on basic and diluted EPS were not material to the consolidated financial statements.

Recent Accounting Pronouncements

In May 2014, the Financial Accounting Standards Board (“FASB”) issued ASU 2014-09 “Revenue from Contracts with Customers (Topic 606).” Beginning January 1, 2018, companies will be required to recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services and also includes additional disclosure requirements. The new standard can be adopted either retrospectively to prior reporting periods presented or as a cumulative effect adjustment as of the date of adoption. The Company is taking inventory of its revenue streams and performing a detailed review of the related contracts to determine the impact of this standard on the Company’s consolidated financial statements. The majority of the Company’s revenue is derived from tenant leases at multifamily, industrial and retail properties. As such the Company does not expect the adoption of ASU 2014-09 to have a material impact on its consolidated financial statements. However, upon adoption of the new leasing standard, ASU 2014-09 will impact the presentation of certain lease and non-lease components of revenue. See below for a further description of the expected impact the new leasing standard will have on the Company. The Company is currently assessing the expected impact ASU 2014-09 will have on its performance obligations related to the revenue components at the Company’s hotel properties.

In February 2016, the FASB issued ASU 2016-02, “Leases,” which will require organizations that lease assets to recognize the assets and liabilities for the rights and obligations created by those leases on their balance sheet. Additional disclosure regarding a

10

company’s leasing activities will also be expanded under the new guidance. For public entities, ASU 2016-02 is effective for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years, and requires a modified retrospective transition. The Company is currently evaluating the potential impact of this pronouncement on its consolidated financial statements from both a lessor and lessee standpoint. Under the new leasing standard lessor accounting remains substantially the same as current GAAP. However, the classification of certain lease and non-lease components, such as tenant reimbursement income for real estate taxes and insurance, will change but will not impact total revenue. The new lease standard will have a significant impact on lessee accounting. As such, the Company will be required to recognize a right of use asset on its consolidated balance sheet along with a lease liability equal to the present value of the remaining minimum lease payments for the Company’s ground leases.

3. Investments in Real Estate

Investments in real estate, net consisted of the following ($ in thousands):

| | June 30, 2017 | |

Building and building improvements | | $ | 1,225,356 | |

Land and land improvements | | | 194,741 | |

Furniture, fixtures and equipment | | | 19,771 | |

Total | | | 1,439,868 | |

Accumulated depreciation | | | (9,353 | ) |

Investments in real estate, net | | $ | 1,430,515 | |

During the six months ended June 30, 2017, the Company acquired wholly-owned interests in 10 real estate investments, which were comprised of 39 industrial, 13 multifamily, two hotel, and one retail property. As of December 31, 2016, the Company had not commenced its principal operations and had not acquired any real estate investment properties.

The following table provides further details of the properties acquired during the six months ended June 30, 2017 ($ in thousands):

Property Name | | Number of Properties | | Location | | Sector | | Acquisition Date | | Purchase Price(1) | |

Hyatt Place UC Davis(2) | | 1 | | Davis, CA | | Hotel | | Jan. 2017 | | $ | 32,687 | |

Sonora Canyon | | 1 | | Mesa, AZ | | Multifamily | | Feb. 2017 | | | 40,983 | |

Stockton | | 1 | | Stockton, CA | | Industrial | | Feb. 2017 | | | 32,751 | |

Bakers Centre | | 1 | | Philadelphia, PA | | Retail | | Mar. 2017 | | | 54,223 | |

TA Multifamily Portfolio | | 6 | | Various(3) | | Multifamily | | Apr. 2017 | | | 432,593 | |

HS Industrial Portfolio | | 38 | | Various(4) | | Industrial | | Apr. 2017 | | | 405,930 | |

Emory Point(2) | | 1 | | Atlanta, GA | | Multifamily(5) | | May 2017 | | | 201,578 | |

Nevada West | | 3 | | Las Vegas, NV | | Multifamily | | May 2017 | | | 170,965 | |

Hyatt Place San Jose Downtown | | 1 | | San Jose, CA | | Hotel | | June 2017 | | | 65,321 | |

Mountain Gate & Trails | | 2 | | Las Vegas, NV | | Multifamily | | June 2017 | | | 83,572 | |

| | | | | | | | | | $ | 1,520,603 | |

(1) | Purchase price is inclusive of acquisition related costs. |

(2) | The Hyatt Place UC Davis and Emory Point are subject to a ground lease. The Emory Point ground lease was prepaid by the seller and is recorded as an intangible asset on the Company’s consolidated balance sheet. |

(3) | The TA Multifamily Portfolio consists of a 32-floor property in downtown Orlando (“55 West”) and five garden style properties located in the suburbs of Palm Beach Gardens, Orlando, Chicago, Dallas and Kansas City. |

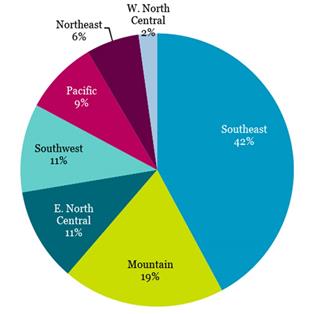

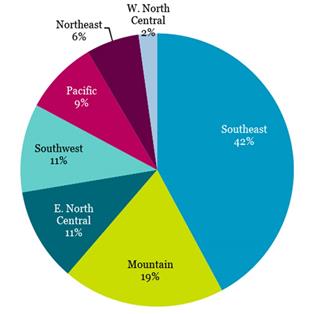

(4) | The HS Industrial Portfolio consists of 38 industrial properties located in six submarkets, with the following concentration based on square footage: Atlanta (38%), Chicago (23%), Houston (17%), Harrisburg (10%), Dallas (10%) and Orlando (2%). |

(5) | Emory Point also includes 124,000 square feet of walkable retail space. |

11

The following table summarizes the purchase price allocation for the properties acquired during the six months ended June 30, 2017 ($ in thousands):

| | TA Multifamily Portfolio | | | HS Industrial Portfolio | | | Emory Point | | | Nevada West | | | All Other | | | Total | |

Building and building improvements | | $ | 337,889 | | | $ | 345,391 | | | $ | 171,709 | | | $ | 145,305 | | | $ | 224,576 | | | $ | 1,224,870 | |

Land and land improvements | | | 68,456 | | | | 45,081 | | | | — | | | | 17,409 | | | | 63,746 | | | | 194,692 | |

Furniture, fixtures and equipment | | | 4,651 | | | | — | | | | 3,040 | | | | 2,833 | | | | 8,823 | | | | 19,347 | |

In-place lease intangibles | | | 21,880 | | | | 20,793 | | | | 11,207 | | | | 5,418 | | | | 10,163 | | | | 69,461 | |

Below-market ground lease intangibles | | | — | | | | — | | | | — | | | | — | | | | 4,683 | | | | 4,683 | |

Above-market lease intangibles | | | 24 | | | | 2,726 | | | | 84 | | | | — | | | | 150 | | | | 2,984 | |

Below-market lease intangibles | | | (307 | ) | | | (8,061 | ) | | | (576 | ) | | | — | | | | (2,604 | ) | | | (11,548 | ) |

Prepaid ground lease rent | | | — | | | | — | | | | 16,114 | | | | — | | | | — | | | | 16,114 | |

Total purchase price | | $ | 432,593 | | | $ | 405,930 | | | $ | 201,578 | | | $ | 170,965 | | | $ | 309,537 | | | $ | 1,520,603 | |

The weighted-average amortization periods for the acquired in-place lease intangibles, below-market ground lease intangibles, above-market lease intangibles, below-market lease intangibles, and prepaid ground lease rent of the properties acquired during the six months ended June 30, 2017 were 3, 52, 6, 7, and 71 years, respectively.

4. Intangibles

The gross carrying amount and accumulated amortization of the Company’s intangible assets and liabilities consisted of the following ($ in thousands):

| | June 30, 2017 | |

Intangible assets: | | | | |

In-place lease intangibles | | $ | 69,461 | |

Below-market ground lease intangibles | | | 4,683 | |

Above-market lease intangibles | | | 2,984 | |

Prepaid ground lease rent | | | 16,114 | |

Total intangible assets | | | 93,242 | |

Accumulated amortization: | | | | |

In-place lease amortization | | | (15,432 | ) |

Below-market ground lease amortization | | | (40 | ) |

Above-market lease amortization | | | (137 | ) |

Prepaid ground lease rent amortization | | | (37 | ) |

Total accumulated amortization | | | (15,646 | ) |

Intangible assets, net | | $ | 77,596 | |

Intangible liabilities: | | | | |

Below-market lease intangibles | | $ | 11,548 | |

Accumulated amortization | | | (502 | ) |

Intangible liabilities, net | | $ | 11,046 | |

The estimated future amortization on the Company’s intangibles for each of the next five years and thereafter as of June 30, 2017 is as follows ($ in thousands):

| | In-place Lease Intangibles | | | Below-market Ground Lease Intangibles | | | Above-market Lease Intangibles | | | Pre-paid Ground Lease Intangibles | | | Below-market Lease Intangibles | |

2017 (remaining) | | $ | 28,356 | | | $ | 45 | | | $ | 339 | | | $ | 112 | | | $ | (1,120 | ) |

2018 | | | 7,933 | | | | 89 | | | | 647 | | | | 224 | | | | (2,198 | ) |

2019 | | | 5,283 | | | | 89 | | | | 433 | | | | 224 | | | | (1,930 | ) |

2020 | | | 4,431 | | | | 89 | | | | 410 | | | | 224 | | | | (1,751 | ) |

2021 | | | 3,484 | | | | 89 | | | | 378 | | | | 224 | | | | (1,514 | ) |

Thereafter | | | 4,542 | | | | 4,242 | | | | 640 | | | | 15,069 | | | | (2,533 | ) |

| | $ | 54,029 | | | $ | 4,643 | | | $ | 2,847 | | | $ | 16,077 | | | $ | (11,046 | ) |

12

5. Investments in Real Estate-Related Securities

The following table details the Company’s investments in CMBS as of June 30, 2017 ($ in thousands):

| Number of Investments | | | Credit Rating(1) | | Collateral | | Weighted Average Coupon(2) | | Face Amount | | | Cost Basis | | | Fair Value | |

| | 4 | | | BBB | | Office, Industrial, Hospitality | | L+2.15% | | $ | 114,659 | | | $ | 114,659 | | | $ | 115,307 | |

| | 5 | | | BB | | Office, Hospitality, Multifamily | | L+3.29% | | | 150,899 | | | | 150,942 | | | | 151,800 | |

| | 3 | | | B | | Office, Multifamily | | L+3.79% | | | 24,313 | | | | 24,313 | | | | 24,442 | |

| | 12 | | | | | | | | | $ | 289,871 | | | $ | 289,914 | | | $ | 291,549 | |

| (1) | BBB represents credit ratings of BBB+, BBB, and BBB-, BB represents credit ratings of BB+, BB, and BB-, and B represents credit ratings of B+, B, and B-. |

| (2) | The term “L” refers to the three-month U.S. dollar-denominated London Interbank Offer Rate. As of June 30, 2017, three-month U.S. dollar-denominated LIBOR was equal to 1.3%. |

As of June 30, 2017, the Company’s investments in real estate-related securities included five CMBS with a total cost basis of $122.3 million collateralized by properties owned by Blackstone-advised investment vehicles and three CMBS with a total cost basis of $63.5 million collateralized by a loan originated by a Blackstone-advised investment vehicle. Such CMBS were purchased in fully or over-subscribed offerings. Each investment in such CMBS by Blackstone and its affiliates (including the Company) represented no more than a 49% participation in any individual tranche. The Company acquired its minority participation interests from third-party investment banks on market terms negotiated by the majority third-party investors. Blackstone and its affiliates (including the Company) will forgo all non-economic rights (including voting rights) in such CMBS as long as the Blackstone-advised investment vehicles either own the properties collateralizing, or have an interest in a different part of the capital structure related to such CMBS. For both the three and six months ended June 30, 2017, the Company recorded interest income of $1.2 million related to its investments in such CMBS.

As described in Note 2, the Company classifies its investments in real estate-related securities as trading and records these investment in real estate related securities at fair value on its consolidated balance sheets. During the three and six months ended June 30, 2017, the Company recorded an unrealized gain of $900 thousand and $1.6 million, respectively, as a component of income from real estate-related securities on its consolidated statements of operations. During the three and six months ended June 30, 2017, one of the Company’s CMBS investments was repaid and the Company recorded a realized loss of $177 thousand as a component of income from real estate-related securities on its consolidated statements of operations. The Company did not sell any securities during the three and six months ended June 30, 2017.

13

6. Mortgage Notes, Term Loan, and Revolving Credit Facility

The following is a summary of the mortgage notes, term loan, and revolving credit facility secured by the Company’s properties as of June 30, 2017 ($ in thousands):

Property | | Interest Rate(1) | | | Maturity Dates | | Principal Balance | | | Amortization Period | | Prepayment Provisions(2) |

TA Multifamily (excluding 55 West) | | | 3.76% | | | 6/1/2024 | | $ | 211,249 | | | Interest Only | | Yield Maintenance |

Industrial Properties - Term Loan | | L+2.10% | | | 6/1/2022 | | | 146,000 | | | Interest Only | | Spread Maintenance |

Industrial Properties - Revolving Credit Facility | | L+2.10% | | | 6/1/2022 | | | 146,000 | | | Interest Only | | None |

Emory Point | | | 3.66% | | | 5/5/2024 | | | 130,000 | | | Interest Only(4) | | Yield Maintenance |

55 West (part of TA Multifamily Portfolio) | | L+2.18% | | | 5/9/2022(3) | | | 63,600 | | | Interest Only | | Spread Maintenance |

Sonora Canyon | | | 3.76% | | | 6/1/2024 | | | 26,455 | | | Interest Only | | Yield Maintenance |

Total principal balance | | | | | | | | | 723,304 | | | | | |

Deferred financing costs | | | | | | | | | (6,232) | | | | | |

Mortgage notes, term loan, and revolving credit facility | | | | | | | | $ | 717,072 | | | | | |

| (1) | The term “L” refers to the one-month U.S. dollar-denominated London Interbank Offer Rate. As of June 30, 2017, one-month U.S. dollar-denominated LIBOR was equal to 1.2%. |

| (2) | Yield and spread maintenance provisions require the borrower to pay a premium to the lender in an amount that would allow the lender to attain the yield or spread assuming the borrower had made all payments until maturity. |

| (3) | The 55 West mortgage has an initial maturity date of May 9, 2019 and the Company, at its sole discretion, has three one-year extension options. |

| (4) | Interest only payments required for the first 60 months of the mortgage and principal and interest payments required for the final 24 months. |

The following table presents the future principal payment due under the Company’s mortgage notes, term loan, and revolving credit facility as of June 30, 2017 ($ in thousands):

| | | | |

Year | | Amount | |

2017 (remaining) | | $ | — | |

2018 | | — | |

2019 | | — | |

2020 | | — | |

2021 | | — | |

Thereafter | | | 723,304 | |

Total | | $ | 723,304 | |

14

7. Repurchase Agreements

The Company has entered into master repurchase agreements with Citigroup Global Markets Inc. (the “Citi MRA”) and Royal Bank of Canada (the “RBC MRA”), to provide the Company with additional financing capacity secured by its real estate-related securities. The terms of the Citi MRA and the RBC MRA provide the lenders the ability to determine the size and terms of the financing provided based upon the particular collateral pledged by the Company from time-to-time.

The following table is a summary of our repurchase agreements as of June 30, 2017 ($ in thousands):

Facility | | Security Interests | | Interest Rate(1) | | Maturity Dates(2) | | Outstanding Balance | | | Prepayment Provisions |

Citi MRA | | CMBS | | L+1.30% - L+1.60% | | 7/17/17 - 8/30/2017 | | | 153,567 | | | None |

RBC MRA | | CMBS | | L+1.25% | | 7/28/2017 | | | 16,016 | | | None |

| | | | | | | | $ | 169,583 | | | |

| (1) | The term “L” refers to the three-month U.S. dollar-denominated London Interbank Offer Rate. As of June 30, 2017, three-month U.S. dollar-denominated LIBOR was equal to 1.3% |

| (2) | Subsequent to quarter end, the Company rolled its repurchase agreement contracts expiring in July 2017 into new three-month contracts with a maturity date of October 2017. |

8. Affiliate Line of Credit

On January 23, 2017, the Company entered into an unsecured, uncommitted line of credit (the “Line of Credit”) up to a maximum amount of $250 million with Blackstone Holdings Finance Co. L.L.C. (“Lender”), an affiliate of Blackstone. The Line of Credit expires on January 23, 2018, and may be extended for up to twelve months, subject to Lender approval. The interest rate is the then-current rate offered by a third-party lender, or, if no such rate is available, LIBOR plus 2.25%. Interest under the Line of Credit is determined based on a one-month U.S. dollar-denominated London Interbank Offer Rate, which was 1.2% as of June 30, 2017. Each advance under the Line of Credit is repayable on the earliest of (i) the expiration of the Line of Credit, (ii) Lender’s demand and (iii) the date on which the Adviser no longer acts as the Company’s investment adviser, provided that the Company will have 180 days to make such repayment in the cases of clauses (i) and (ii) and 45 days to make such repayment in the case of clause (iii). To the extent the Company has not repaid all loans and other obligations under the Line of Credit when repayment is required, the Company is obligated to apply the net cash proceeds from the Offering and any sale or other disposition of assets to the repayment of such loans and other obligations; provided that the Company will be permitted to (x) make payments to fulfill any repurchase requests pursuant to the Company’s share repurchase plan, (y) use funds to close any acquisition of property that the Company committed to prior to receiving a demand notice and (z) make quarterly distributions to the Company’s stockholders at per share levels consistent with the immediately preceding fiscal quarter and as otherwise required for the Company to maintain its REIT status. As of June 30, 2017, the Company had $43.7 million in borrowings outstanding under the Line of Credit.

9. Other Assets and Other Liabilities

The following table summarizes the components of other assets ($ in thousands):

| | June 30, 2017 | | | December 31, 2016 | |

Deferred financing costs | | | 2,383 | | | | — | |

Prepaid expenses | | | 2,243 | | | | — | |

Pre-acquisition costs | | | 1,709 | | | | — | |

Accounts receivable | | | 1,398 | | | | — | |

Deferred rent receivable | | | 567 | | | | — | |

Other | | | 2,481 | | | | — | |

Total | | $ | 10,781 | | | $ | — | |

15

The following table summarizes the components of accounts payable, accrued expenses, and other liabilities ($ in thousands):

| | June 30, 2017 | | | December 31, 2016 | |

Intangible liabilities, net | | $ | 11,046 | | | $ | — | |

Real estate taxes payable | | | 9,150 | | | | — | |

Payable for real estate-related securities | | | 6,648 | | | | — | |

Accounts payable and accrued expenses | | | 5,645 | | | | — | |

Distribution payable | | | 4,083 | | | | — | |

Tenant security deposits | | | 3,506 | | | | — | |

Prepaid rental income | | | 3,306 | | | | — | |

Accrued interest expense | | | 2,645 | | | | — | |

Other | | | 607 | | | | 29 | |

Total | | $ | 46,636 | | | $ | 29 | |

10. Equity

Authorized Capital

The Company is authorized to issue preferred stock and four classes of common stock consisting of Class S shares, Class T shares, Class D shares, and Class I shares. The Company’s board of directors has the ability to establish the preferences and rights of each class or series of preferred stock, without stockholder approval, and as such, it may afford the holders of any series or class of preferred stock preferences, powers and rights senior to the rights of holders of common stock. The differences among the common share classes relate to upfront selling commissions, dealer manager fees and ongoing stockholder servicing fees. See Note 2 for a further description of such items. Other than the differences in upfront selling commissions, dealer manager fees and ongoing stockholder servicing fees, each class of common stock is subject to the same economic and voting rights.

As of June 30, 2017, the Company had authority to issue 2,100,000,000 shares, consisting of the following:

Classification | | Number of Shares (in thousands) | | | Par Value | |

Preferred Stock | | | 100,000 | | | $ | 0.01 | |

Class S Shares | | | 500,000 | | | $ | 0.01 | |

Class T Shares | | | 500,000 | | | $ | 0.01 | |

Class D Shares | | | 500,000 | | | $ | 0.01 | |

Class I Shares | | | 500,000 | | | $ | 0.01 | |

Total | | | 2,100,000 | | | | | |

Common Stock

As of June 30, 2017, the Company had sold 88.9 million shares of its common stock in the Offering for aggregate net proceeds of $890.3 million. The following table details the movement in the Company’s outstanding shares of common stock (in thousands):

| | Six Months Ended June 30, 2017 | |

| | Class T | | | Class S | | | Class D | | | Class I | | | Total | |

Beginning balance | | | — | | | | — | | | | — | | | | 20 | | | | 20 | |

Common stock issued | | | 13 | | | | 71,060 | | | | 216 | | | | 17,192 | | | | 88,481 | |

Distribution reinvestment | | | — | | | | 322 | | | | 1 | | | | 99 | | | | 422 | |

Directors’ restricted stock grant(1) | | | — | | | | — | | | | — | | | | 7 | | | | 7 | |

Ending balance | | | 13 | | | | 71,382 | | | | 217 | | | | 17,318 | | | | 88,930 | |

(1) | The directors’ restricted stock grant represents 25% of the annual compensation paid to the independent directors. The grant is amortized over the service period of such grant. |

Distributions

The Company generally intends to distribute substantially all of its taxable income, which does not necessarily equal net income as calculated in accordance with GAAP, to its stockholders each year to comply with the REIT provisions of the Internal Revenue Code.

16

Beginning March 2017, the Company declared a monthly distribution to stockholders of record as of the last day of each applicable month.

The following table details the aggregate distributions declared for each applicable class of common stock for the six months ended June 30, 2017 ($ in thousands, except share and per share data):

| | Class S | | | Class I | | | Class D | | | Class T | |

Aggregate distributions declared per share of common stock | | $ | 0.1732 | | | $ | 0.1732 | | | $ | 0.0958 | | | $ | 0.0517 | |

Stockholder servicing fee per share of common stock | | | (0.0377 | ) | | | — | | | | (0.0042 | ) | | | (0.0071 | ) |

Net distributions declared per share of common stock | | $ | 0.1355 | | | $ | 0.1732 | | | $ | 0.0916 | | | $ | 0.0446 | |

11. Related Party Transactions

Management Fee and Performance Participation Allocation

On August 7, 2017, the Company renewed the advisory agreement among the Company, BREIT OP and the Adviser for an additional one-year period ending August 31, 2018. The Adviser is entitled to an annual management fee equal to 1.25% of the Company’s NAV, payable monthly as compensation for the services it provides to the Company. The management fee can be paid, at the Adviser’s election, in cash, shares of common stock, or BREIT OP units. The Adviser agreed to waive its management fee through June 30, 2017.

Additionally, the Special Limited Partner holds a performance participation interest in BREIT OP that entitles it to receive an allocation of BREIT OP’s total return to its capital account. Total return is defined as distributions paid or accrued plus the change in NAV. Under the BREIT OP agreement, the annual total return will be allocated solely to the Special Limited Partner after the other unit holders have received a total return of 5% (after recouping any loss carryforward amount) and such allocation will continue until the allocation between the Special Limited Partner and all other unit holders is equal to 12.5% and 87.5%, respectively. Thereafter, the Special Limited Partner will receive an allocation of 12.5% of the annual total return. The annual distribution of the performance participation interest will be paid in cash or Class I units of BREIT OP, at the election of the Special Limited Partner. As of June 30, 2017, the Company had accrued $5.2 million of performance participation allocation on the consolidated statement of operations.

Due to Affiliate

The following table details the components of due to affiliates ($ in thousands):

| | June 30, 2017 | | | December 31, 2016 | |

Accrued stockholder servicing fee | | $ | 53,385 | | | $ | — | |

Advanced organization and offering costs | | | 8,720 | | | | — | |

Performance participation allocation | | | 5,241 | | | | — | |

Accrued affiliate service provider expenses | | | 990 | | | | — | |

Advanced expenses | | | 156 | | | | 86 | |

Total | | $ | 68,492 | | | $ | 86 | |

Accrued stockholder servicing fee

As described in Note 2, the Company accrues the full amount of the future stockholder servicing fees payable to the Dealer Manager for Class S, Class T, and Class D shares up to the 8.75% of gross proceeds limit at the time such shares are sold. As of June 30, 2017, the Company accrued $53.4 million of stockholder servicing fees payable to the Dealer Manager related to the Class S, Class T, and Class D shares sold. The Dealer Manager has entered into agreements with the selected dealers distributing the Company’s shares in the Offering, which provide, among other things, for the re-allowance of the full amount of the selling commissions and dealer manager fees received and all or a portion of the stockholder servicing fees to such selected dealers.

Advanced organization and offering costs

The Adviser advanced $8.7 million of organization and offering costs (excluding upfront selling commissions, dealer manager fees and stockholder servicing fees) on behalf of the Company through June 30, 2017. Such amounts will be reimbursed to the Adviser on a pro-rata basis over 60 months beginning January 1, 2018.

17

Accrued affiliate service provider expenses

The Company has engaged and expects to continue to engage BRE Hotels and Resorts, a portfolio company controlled (but not owned) by a Blackstone-advised fund, to provide day-to-day operational and management services (including revenue management, accounting, legal and contract management, expense management, and capital expenditure projects and transaction support services) for the Company’s hotel properties. The Company currently estimates the cost for such services to be approximately $200 per key per annum (which will be reviewed periodically and adjusted if appropriate), plus actual costs allocated for transaction support services. During the three and six months ended June 30, 2017, the Company incurred $10 thousand and $15 thousand, respectively, of expenses due to BRE Hotels and Resorts for services incurred in connection with its investments and such amount is included in hotel operating expenses on its consolidated statements of operations.

The Company has engaged and expects to continue to engage LivCor, LLC (“LivCor”), a portfolio company owned by a Blackstone-advised fund, to provide day-to-day operational and management services (including leasing, construction management, revenue management, accounting, legal and contract management, expense management, and capital expenditure projects and transaction support services) for the Company’s multifamily properties. The Company currently estimates the cost for such services to be approximately $300 per unit per annum (which will be reviewed periodically and adjusted if appropriate), plus actual costs allocated for transaction support services. During both the three and six months ended June 30, 2017, the Company incurred $70 thousand of expenses due to LivCor for services incurred in connection with its investments and such amount is included in rental property operating expenses on its consolidated statements of operations. Additionally, the Company capitalized $485 thousand to investments in real estate for transaction support services provided by LivCor.

The Company has engaged and expects to continue to engage Equity Office Management, L.L.C. (“EOM”), a portfolio company owned by Blackstone-advised funds, to provide day-to-day operational and management services (including property management services, leasing, construction management, accounting, legal and contract management, expense management, and capital expenditure projects and transaction support services) for the Company’s office and industrial properties. The Company currently estimates the cost for such services to be approximately 3% of gross revenue for property management services, 1% of gross rents from new and renewal leases for leasing services and 4% of total project costs for construction management services, plus a per square foot amount for corporate services and actual costs allocated for transaction support services. During the three and six months ended June 30, 2017, the Company incurred $461 thousand and $471 thousand, respectively, of expenses due to EOM for services incurred in connection with its investments, and such amount is included in rental property operating expenses on its consolidated statements of operations. Additionally, the Company capitalized $20 thousand to investments in real estate for transaction support services provided by EOM.

The Company has engaged and expects to continue to engage ShopCore Properties TRS Management LLC (“ShopCore”), a portfolio company owned by a Blackstone-advised fund, to provide day-to-day operational and management services (including property management services, leasing, construction management, revenue management, accounting, legal and contract management, expense management, and capital expenditure projects and transaction support services) for the Company’s retail properties. The Company currently estimates the cost of such services to be approximately 3% of gross revenue for property management services, 1% of gross rents from new and renewal leases for leasing services and 4% of total project costs for construction management services, plus a per square foot amount for corporate services and actual costs allocated for transaction support services. During both the three and six months ended June 30, 2017, the Company incurred $70 thousand of expenses due to ShopCore for services incurred in connection with its investments and such amount is included in rental property operating expenses on its consolidated statements of operations.

The Company expects to set up a management incentive plan for each transaction for which the Company engages BRE Hotels and Resorts, LivCor, EOM, or ShopCore for certain senior executives of the applicable portfolio company. Neither Blackstone nor the Adviser receives any fees or incentive payments from agreements between the Company and such portfolio companies or their management teams. During the six months ended June 30, 2017, the Company has not paid or accrued any incentive fees to its affiliated service providers under such agreements.

Advanced expenses

The Adviser had advanced $156 thousand and $86 thousand of expenses on the Company’s behalf for general corporate services provided by unaffiliated third parties as of June 30, 2017 and December 31, 2016, respectively.

Other

Blackstone partnered with a leading national title agency to create Lexington National Land Services (“LNLS”), a title agent company. LNLS acts as an agent for one or more underwriters in issuing title policies in connection with investments by the Company, Blackstone, and third parties. LNLS will not perform services in non-regulated states for the Company, unless in the context of a portfolio transaction that includes properties in rate-regulated states, as part of a syndicate of title insurance companies

18

where the rate is negotiated by other insurers or their agents, when a third party is paying all or a material portion of the premium or in other scenarios where LNLS is not negotiating the premium. LNLS earns fees, which would have otherwise been paid to third parties, by providing title agency services and facilitating placement of title insurance with underwriters. Blackstone receives distributions from LNLS in connection with investments by the Company based on its equity interest in LNLS. During the six months ended June 30, 2017, the Company paid LNLS $160 thousand for title services related to two investments. Such costs were capitalized as part of the Company’s cost basis in the investment and are classified as part of investments in real estate, net on its consolidated balance sheet.

12. Commitments and Contingencies

As of June 30, 2017 and December 31, 2016, the Company was not subject to any material litigation nor is the Company aware of any material litigation threatened against it.

The Hyatt Place UC Davis is subject to a ground lease that expires in 2070. Pursuant to the ground lease, the Company will pay the landlord annual rent equal to the greater of (a) minimum base rent of $130 thousand (subject to certain periodic adjustments) or (b) 5% of room revenue reduced by a utility rebate equal to actual utility charges paid capped at 2% of room revenue.

The 55 West parking garage is subject to a ground lease that expires in 2085. Pursuant to the ground lease, the Company will pay the landlord annual rent equal to a fixed payment of $50 thousand and a variable payment which is the product of the prior year variable rate adjusted by the Consumer Price Index during the previous year. At the time the Company acquired the ground lease, the variable rent payment component was equal to $59 thousand.

The following table details the Company’s contractual obligations and commitments with payments due subsequent to June 30, 2017 ($ in thousands):

Year | | Future Commitments | |

2017 (remaining) | | $ | 119 | |

2018 | | | 239 | |

2019 | | | 239 | |

2020 | | | 239 | |

2021 | | | 239 | |

Thereafter | | | 13,233 | |

Total | | $ | 14,308 | |

13. Five Year Minimum Rental Payments

The following table presents the future minimum rents the Company expects to receive for its industrial and retail properties ($ in thousands). Leases at the Company’s multifamily investments are short term, generally 12 months or less, and are therefore not included.

Year | | Future Minimum Rents | |

2017 (remaining) | | $ | 17,041 | |

2018 | | | 31,925 | |

2019 | | | 26,790 | |

2020 | | | 24,131 | |

2021 | | | 20,424 | |

Thereafter | | | 55,234 | |

Total | | $ | 175,545 | |

19

14. Segment Reporting

The Company operates in five reportable segments: Multifamily properties, Industrial properties, Hotel properties, Retail properties, and Real Estate-Related Securities. The Company allocates resources and evaluates results based on the performance of each segment individually. The Company believes that Segment Net Operating Income is the key performance metric that captures the unique operating characteristics of each segment.

The following table sets forth the total assets by segment as of June 30, 2017 ($ in thousands):

| | Multifamily | | | Industrial | | | Hotel | | | Retail | | | Real Estate- Related Securities | | | Other (Corporate) | | | Total | |

Total assets | | $ | 932,689 | | | $ | 456,639 | | | $ | 102,225 | | | $ | 56,780 | | | $ | 292,074 | | | $ | 94,191 | | | $ | 1,934,598 | |

The following table sets forth the financial results by segment for the three months ended June 30, 2017 ($ in thousands):

| | Multifamily | | | Industrial | | | Hotel | | | Retail | | | Real Estate- Related Securities | | | Total | |

Revenues: | | | | | | | | | | | | | | | | | | | | | | | | |

Rental revenue | | $ | 14,036 | | | $ | 6,260 | | | $ | — | | | $ | 934 | | | $ | — | | | $ | 21,230 | |

Tenant reimbursement income | | | 482 | | | | 1,626 | | | | — | | | | 98 | | | | — | | | | 2,206 | |

Hotel revenue | | | — | | | | — | | | | 3,748 | | | | — | | | | — | | | | 3,748 | |

Other revenue | | | 1,149 | | | | — | | | | — | | | | 6 | | | | — | | | | 1,155 | |

Total revenues | | | 15,667 | | | | 7,886 | | | | 3,748 | | | | 1,038 | | | | — | | | | 28,339 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Expenses: | | | | | | | | | | | | | | | | | | | | | | | | |

Rental property operating | | | 6,667 | | | | 2,549 | | | | — | | | | 173 | | | | — | | | | 9,389 | |

Hotel operating | | | — | | | | — | | | | 2,109 | | | | — | | | | — | | | | 2,109 | |

Total expenses | | | 6,667 | | | | 2,549 | | | | 2,109 | | | | 173 | | | | — | | | | 11,498 | |

Income from real estate-related securities | | | — | | | | — | | | | — | | | | — | | | | 2,543 | | | | 2,543 | |

Segment net operating income | | $ | 9,000 | | | $ | 5,337 | | | $ | 1,639 | | | $ | 865 | | | $ | 2,543 | | | $ | 19,384 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Depreciation and amortization | | $ | 18,240 | | | $ | 4,217 | | | $ | 763 | | | $ | 476 | | | $ | — | | | $ | 23,696 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Other income (expense): | | | | | | | | | | | | | | | | | | | | | | | | |

General and administrative | | | | | | | | | | | | | | | | | | | | | | | (1,567 | ) |

Interest income | | | | | | | | | | | | | | | | | | | | | | | 117 | |

Interest expense | | | | | | | | | | | | | | | | | | | | | | | (5,541 | ) |

Performance participation allocation | | | | | | | | | | | | | | | | | | | | | | | (5,241 | ) |

Other expenses | | | | | | | | | | | | | | | | | | | | | | | (28 | ) |

Income tax expense | | | | | | | | | | | | | | | | | | | | | | | (129 | ) |

Net loss | | | | | | | | | | | | | | | | | | | | | | $ | (16,701 | ) |

20

The following table sets for the financial results by segment for the six months ended June 30, 2017 ($ in thousands):

| | Multifamily | | | Industrial | | | Hotel | | | Retail | | | Real Estate- Related Securities | | | Total | |

Revenues: | | | | | | | | | | | | | | | | | | | | | | | | |

Rental revenue | | $ | 14,556 | | | $ | 6,619 | | | $ | — | | | $ | 953 | | | $ | — | | | $ | 22,128 | |

Tenant reimbursement income | | | 508 | | | | 1,667 | | | | — | | | | 98 | | | | — | | | | 2,273 | |

Hotel revenue | | | — | | | | — | | | | 5,174 | | | | — | | | | — | | | | 5,174 | |

Other revenue | | | 1,202 | | | | — | | | | — | | | | 6 | | | | — | | | | 1,208 | |

Total revenues | | | 16,266 | | | | 8,286 | | | | 5,174 | | | | 1,057 | | | | — | | | | 30,783 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Expenses: | | | | | | | | | | | | | | | | | | | | | | | | |