Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 1 29 July 2022 ASX RELEASE Company Announcements Platform Quarterly Activities Report and Appendix 4C Sezzle Inc. (ASX:SZL) (Sezzle or Company) // Purpose-driven installment payment platform, Sezzle, is pleased to provide the market with an update on key financial metrics for the second quarter ended 30 June 2022 (2Q22).1 • Underlying Merchant Sales (UMS) for 2Q22 increased 1.9% YoY to US$419.1M (A$617.3M2). • 2Q22 Total Income grew 6.8% YoY to US$29.3M, representing 7.0% of UMS. Merchant Fee Income represented over 80% of Total Income. • As a percentage of UMS, the provision for uncollectible accounts receivable declined to 1.9% in 2Q22 from 3.4% in 2Q21. • Transaction expense as a percentage of UMS improved 20bps QoQ to 2.4%. • Active3 Merchants rose 19.0% YoY to 47,9004. • Active Consumers stood at 3.4 million at quarter end (+18.2% YoY). o The top 10% of Sezzle users (as measured by UMS) remained highly engaged, transacting 46x on average over the trailing twelve-month period ended 30 June 2022. o Repeat usage improved for the 42nd consecutive month to 93.5%. o The omnichannel opportunity continued to grow, as in-store UMS for 2Q22 rose 262.8% YoY and almost 9.0% of UMS for the quarter. o Over 4.6 million consumers have downloaded the Sezzle app as of 30 June 2022. • Sezzle Canada continued its strong performance in 2Q22, as UMS improved 52.9% YoY, Active Consumers increased 68.2% YoY, and Active Merchants rose 58.0% YoY. • In June 2022, the Company launched Sezzle Premium, a subscription service (monthly and annual options) providing consumers a number of additional features and 1 2Q22 results are unaudited. 2 A$ to US$ exchange rate of $0.6789 as of 30 June 2022. 3 Active defined as having transacted in the last twelve months. 4 Rounded to nearest hundred.

Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 2 benefits relative to the Company’s core pay in four product. As of 27 July 2022, total subscriptions exceed 47,000. • The Company has taken several actions representing over US$40.0 million in expected annualized revenue and cost savings to improve free cash flow and accelerate its path to profitability: 1) offboarded or renegotiated rates with merchants, 2) improved virtual card network revenue share, 3) workforce reduction, 4) scaled back efforts in Europe and Brazil, 5) ceased payment processing in India, 6) reduced third-party spend and 7) launched its Sezzle Premium subscription product. • On 12 July 2022, Sezzle and Zip Co Limited (ASX:ZIP) mutually agreed to terminate the proposed merger. As part of the mutual termination, Sezzle received US$11.0 million from Zip to cover Sezzle’s legal, accounting, and other costs associated with the transaction. “’In the last few months, we have launched US$40.0 million worth of revenue and cost savings initiatives, as we move towards profitability and positive free cash flow generation, and we believe the results of those actions are starting to show,” stated Sezzle’s Executive Chairman and CEO Charlie Youakim. “We expect to see the full benefit of these initiatives on a run-rate basis by year end, and coupled with additional actions we are taking, we anticipate achieving positive monthly net operating income (excluding stock-based compensation and non-recurring charges) by year end. We recognize these initiatives may be at the expense of growth, but believe it is the prudent move for Sezzle at this time.” Key Activity During the Quarter: • UMS and Total Income. UMS reached US$419.1 million during the quarter, up 1.9% YoY, with in-store up 262.8% YoY. According to Mastercard SpendingPulse, U.S. e-commerce retail sales declined in the low-single digits YoY for the months of April and May before rising 1.1% YoY in June. In-store sales continue to outperform as shoppers are returning, as U.S. retail in-store sales rose 10.0%, 13.7%, and 11.7%, for the months of April, May, and June, respectively, according to Mastercard SpendingPulse1. Sezzle had a record quarter for in-store as a percentage of UMS, representing approximately 9.0%. 1 Mastercard SpendingPulse findings are based on aggregate sales activity in the Mastercard payments network, coupled with survey-based estimates for certain other payment forms, such as cash and check.

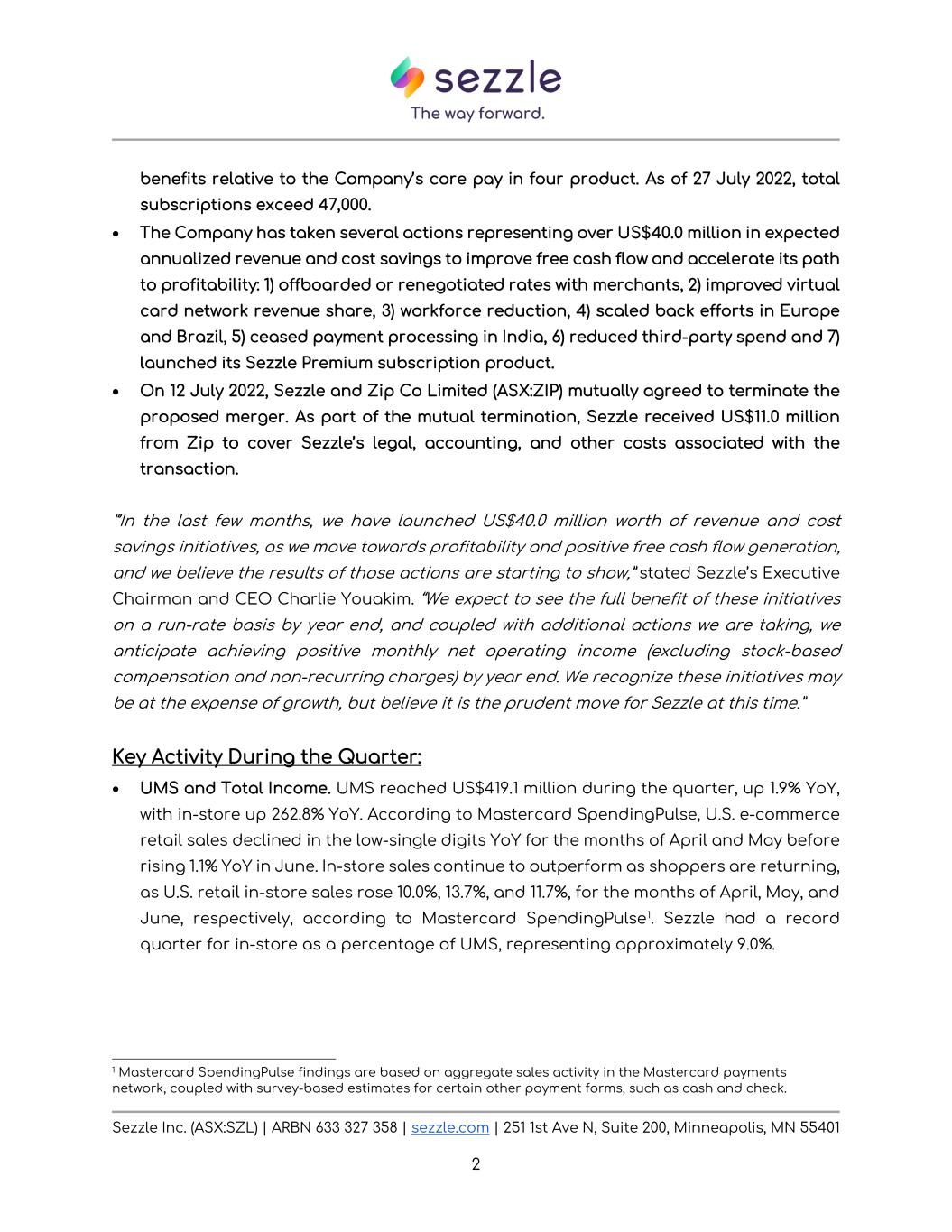

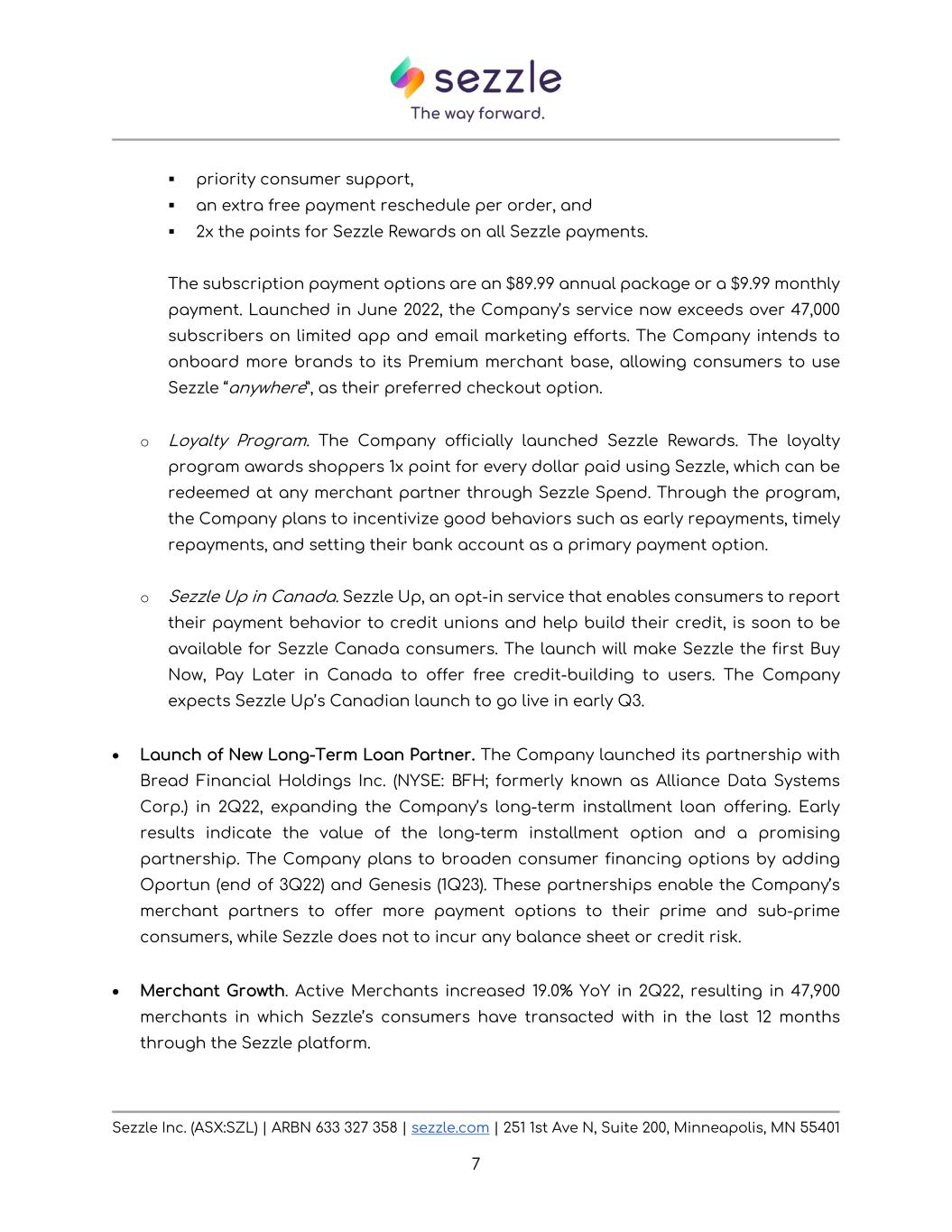

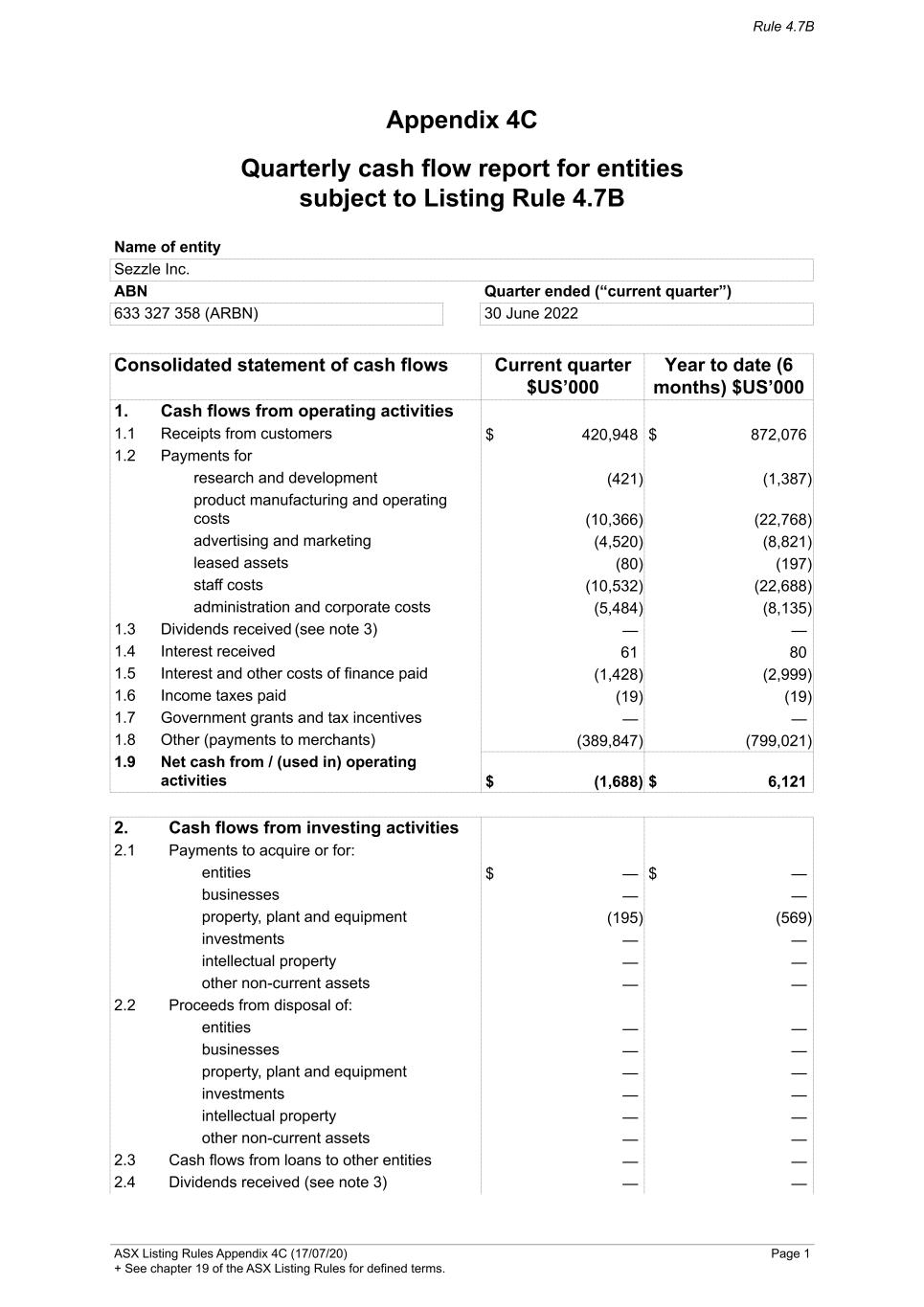

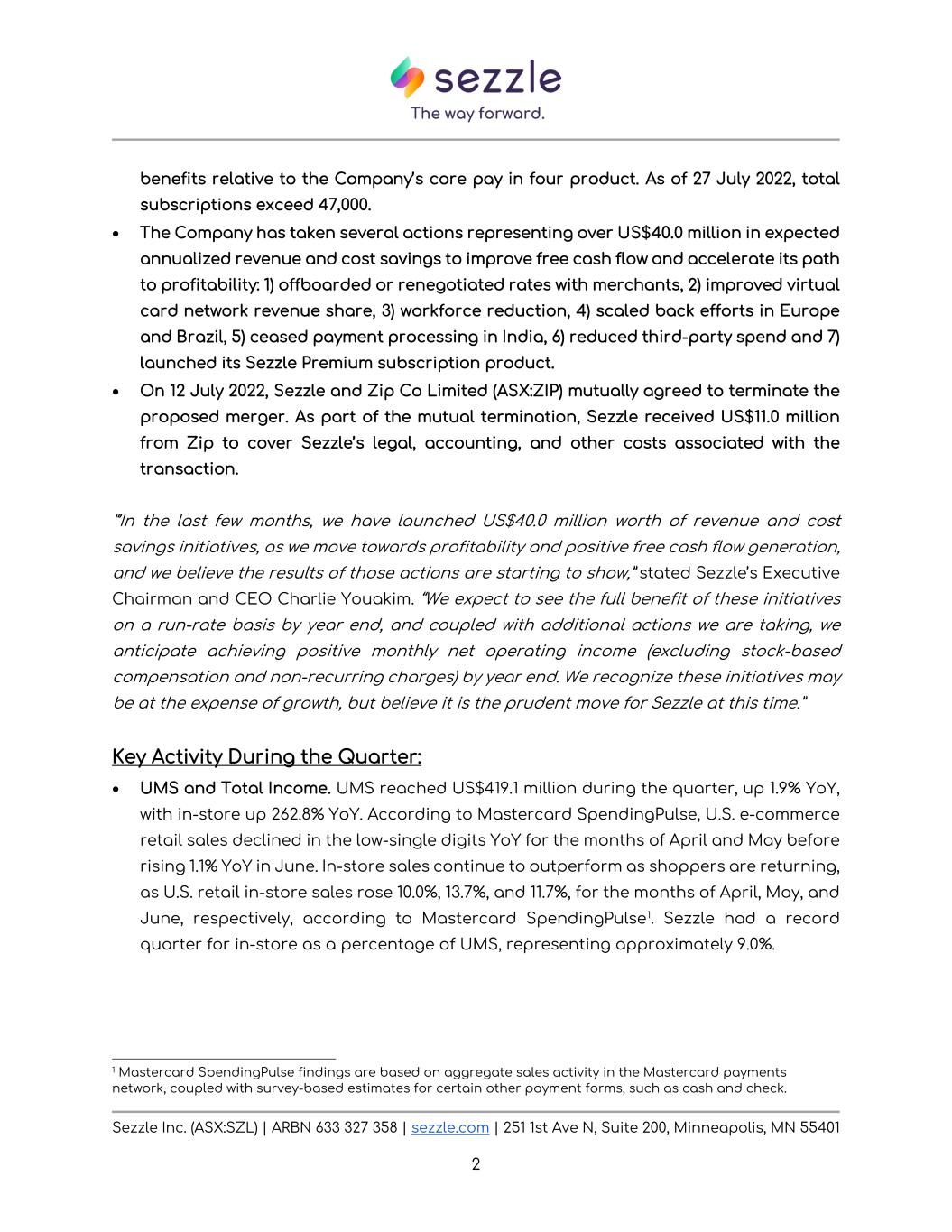

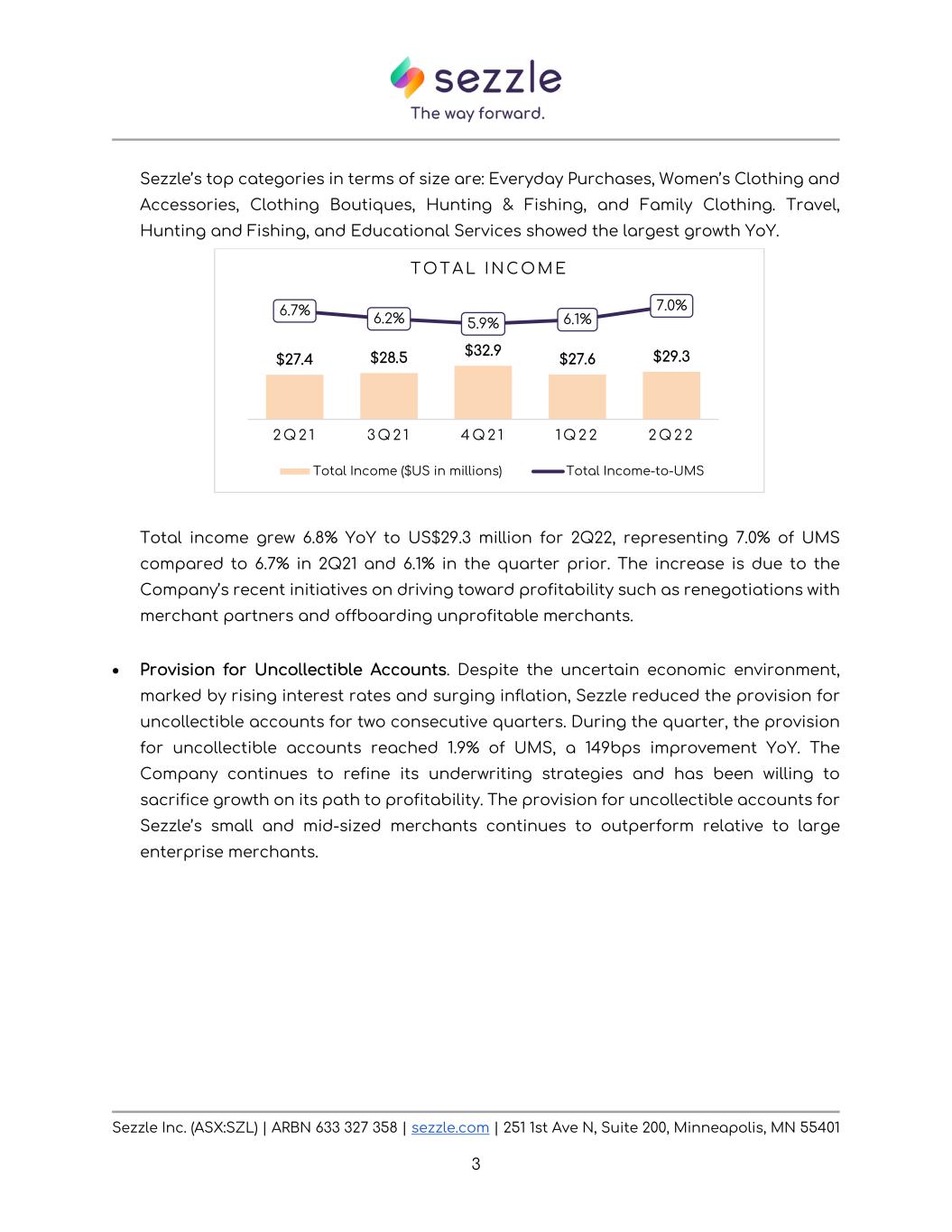

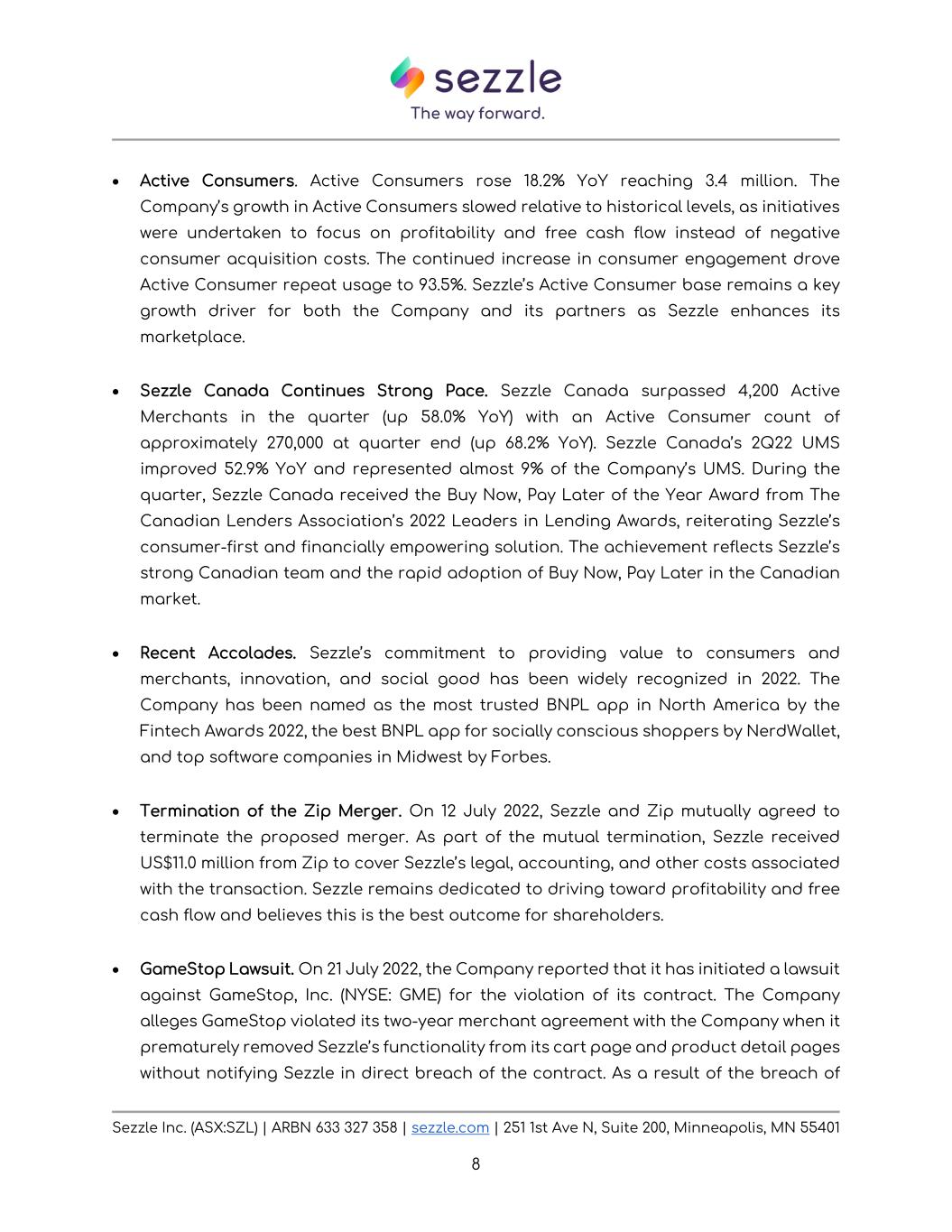

Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 3 Sezzle’s top categories in terms of size are: Everyday Purchases, Women’s Clothing and Accessories, Clothing Boutiques, Hunting & Fishing, and Family Clothing. Travel, Hunting and Fishing, and Educational Services showed the largest growth YoY. Total income grew 6.8% YoY to US$29.3 million for 2Q22, representing 7.0% of UMS compared to 6.7% in 2Q21 and 6.1% in the quarter prior. The increase is due to the Company’s recent initiatives on driving toward profitability such as renegotiations with merchant partners and offboarding unprofitable merchants. • Provision for Uncollectible Accounts. Despite the uncertain economic environment, marked by rising interest rates and surging inflation, Sezzle reduced the provision for uncollectible accounts for two consecutive quarters. During the quarter, the provision for uncollectible accounts reached 1.9% of UMS, a 149bps improvement YoY. The Company continues to refine its underwriting strategies and has been willing to sacrifice growth on its path to profitability. The provision for uncollectible accounts for Sezzle’s small and mid-sized merchants continues to outperform relative to large enterprise merchants. $27.4 $28.5 $32.9 $27.6 $29.3 6.7% 6.2% 5.9% 6.1% 7.0% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% $0 $10 $20 $30 $40 $50 $60 $70 $80 2 Q 2 1 3 Q 2 1 4 Q 2 1 1 Q 2 2 2 Q 2 2 T O T A L I N C O M E Total Income ($US in millions) Total Income-to-UMS

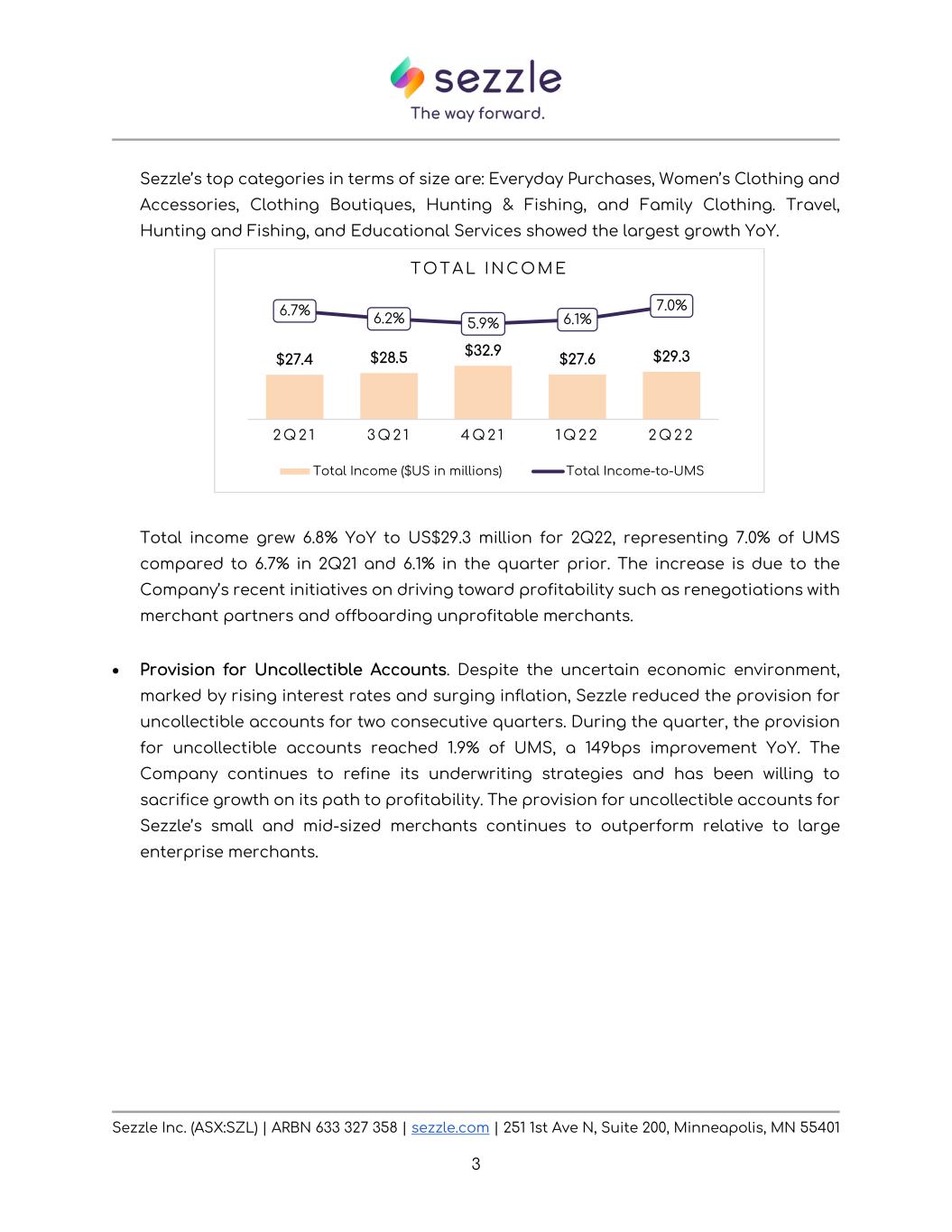

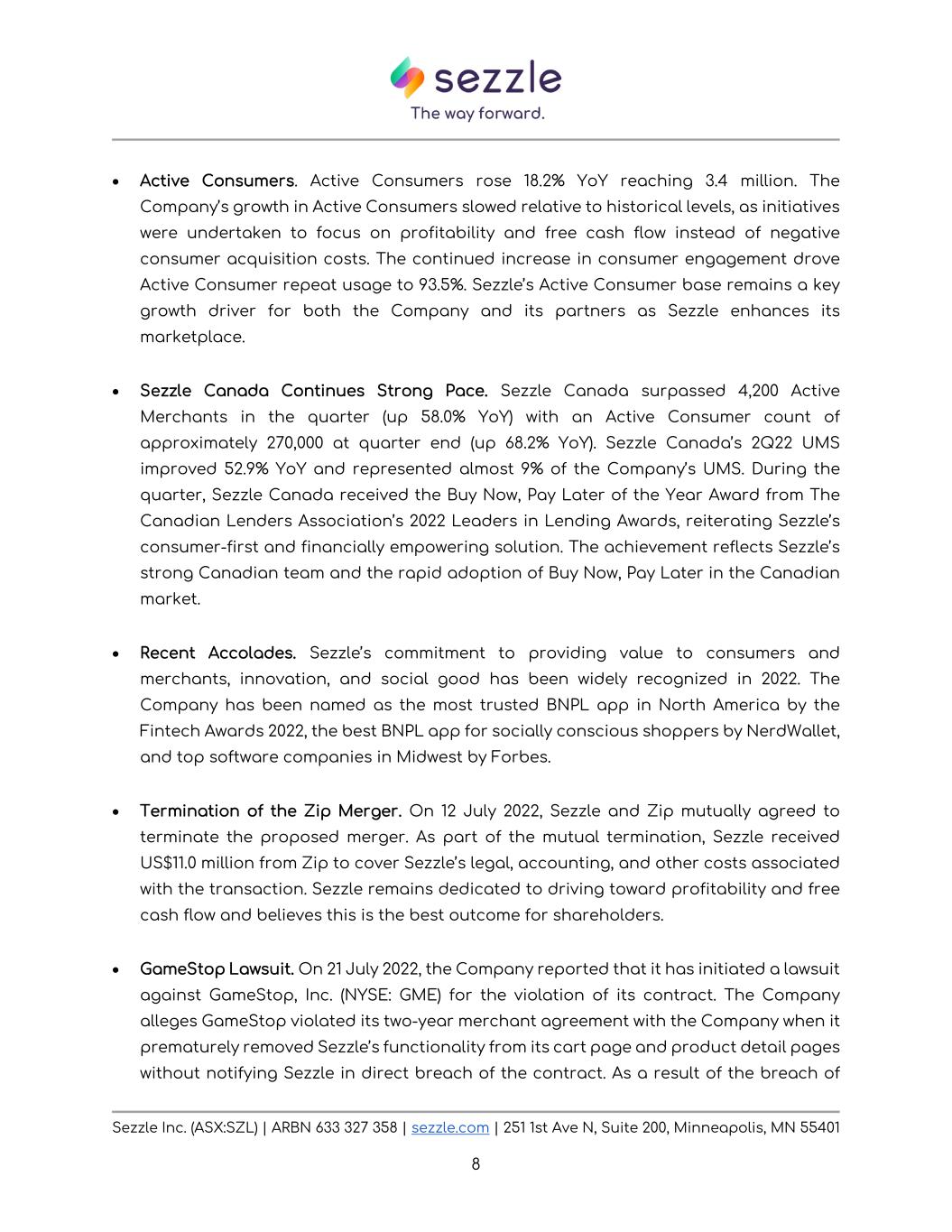

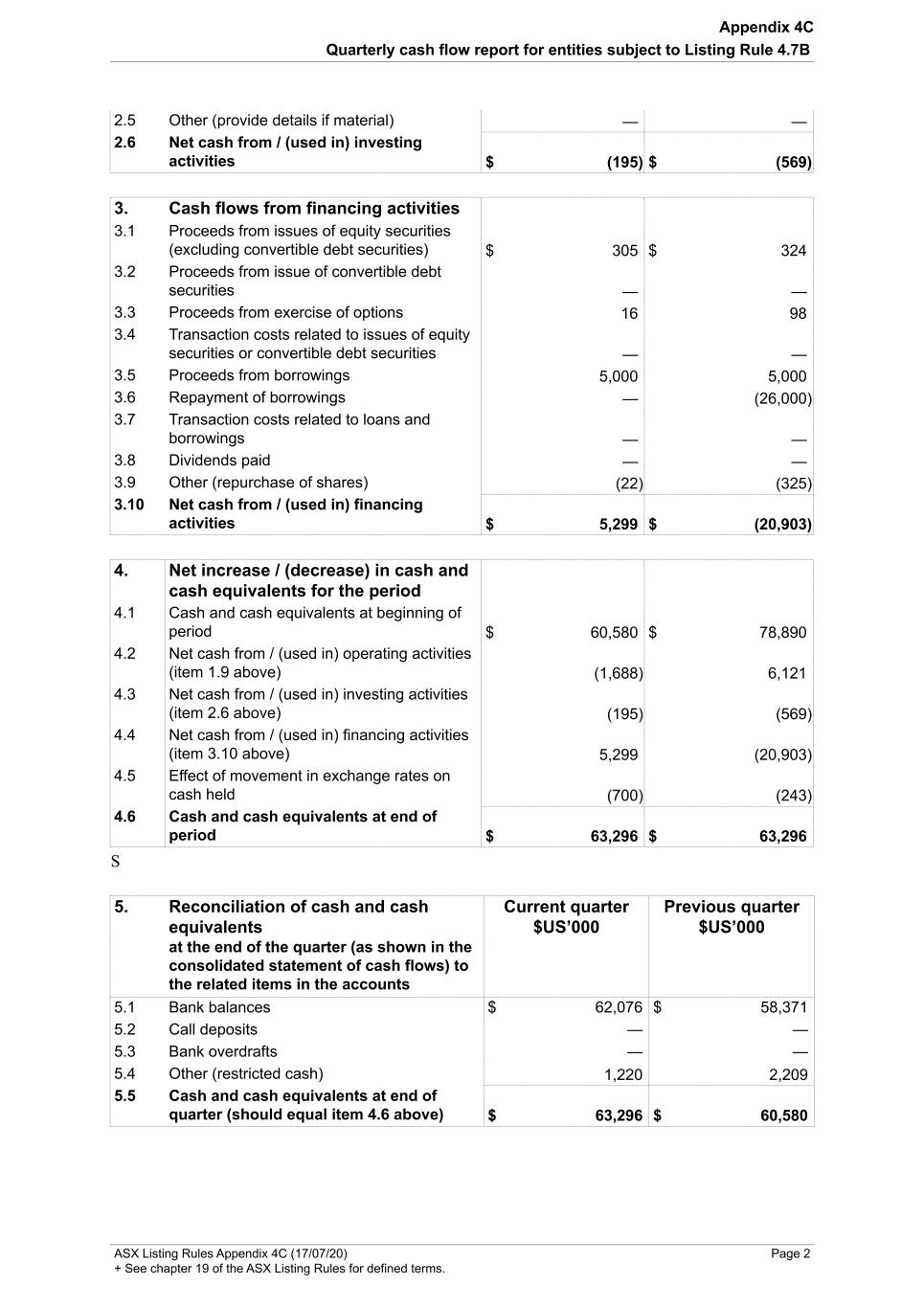

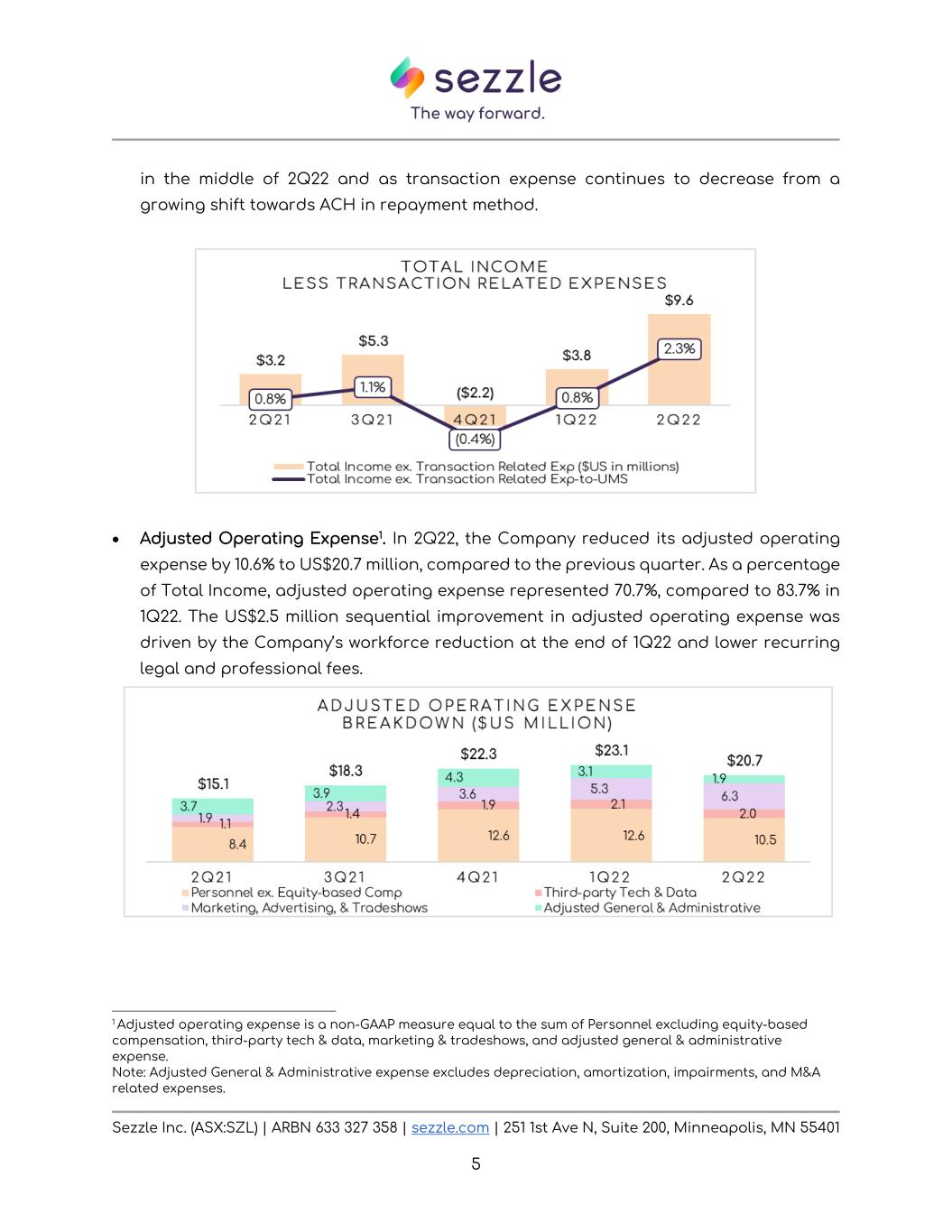

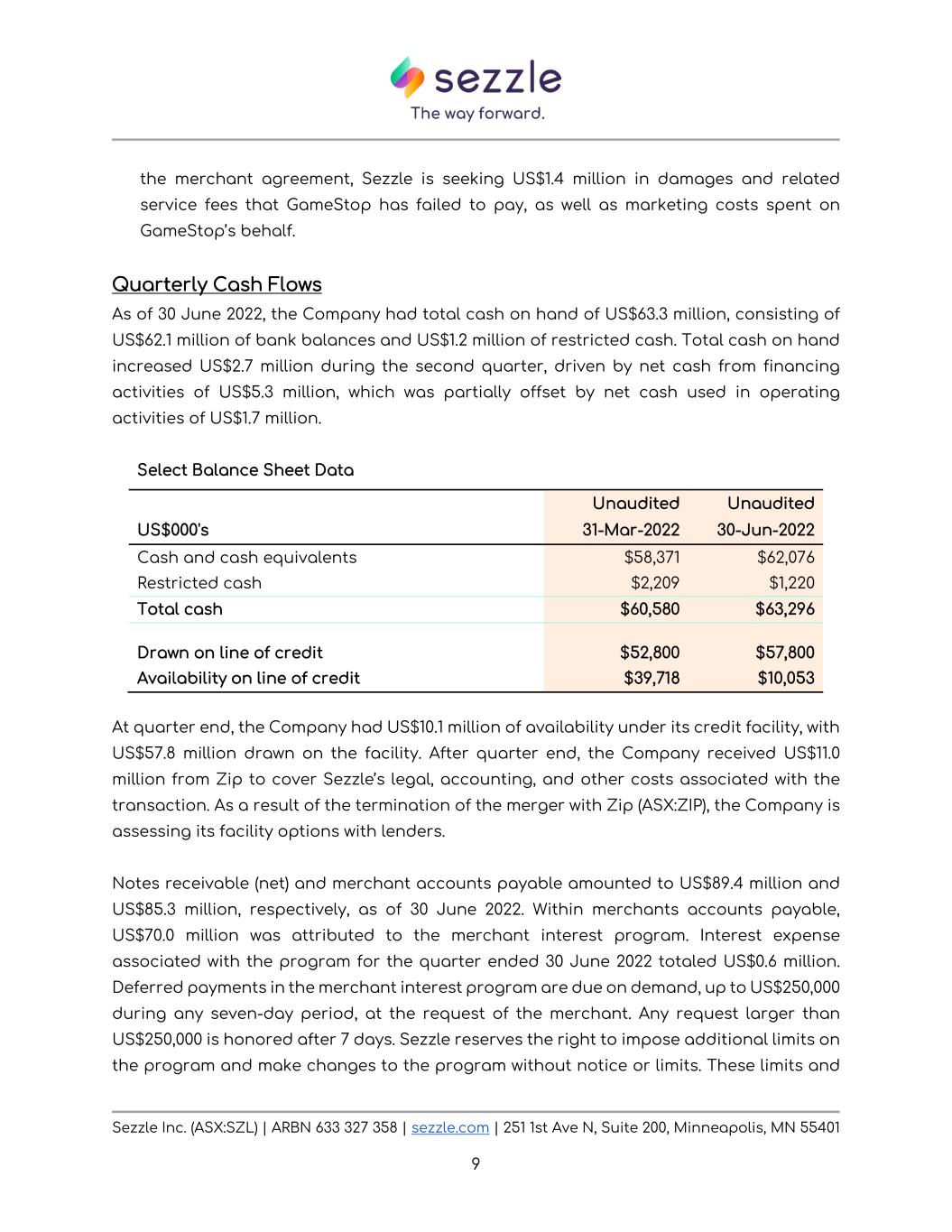

Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 4 • Transaction Expense. Transaction expense1 for 2Q22 declined compared to 1Q22, approaching a level consistent with 1Q21 as a percentage of UMS. Transaction expense decreased as a percentage of UMS driven by an increase in Automated Clearing House (ACH) expense as a percentage of the Company’s payment mix. The shift toward ACH is attributable to Company initiatives, as the cost of processing ACH is lower compared to card (debit or credit). As a risk mitigation measure, Sezzle requires all consumers to pay the first installment by card. • Total Income less Transaction Related Costs2. Sezzle delivered a record quarter for Total Income less Transaction Related Costs of US$9.6 million. The Company anticipates this to improve further in 3Q22 as contract re-negotiation efforts occurred 1 Comprises processing fees paid to third parties to process debit, credit, and ACH payments received from consumers, merchant affiliate program and partnership fees, and consumer communication costs 2 Transaction Related Costs is a non-GAAP financial measure equal to the sum of Transaction Expense, Provision for Uncollectible Accounts, and Net Interest Expense. $13.8 $10.5 $19.7 $10.5 $7.9 3.4% 2.3% 3.5% 2.3% 1.9% -0.4% 0.1% 0.6% 1.1% 1.6% 2.1% 2.6% 3.1% 3.6% $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 2 Q 2 1 3 Q 2 1 4 Q 2 1 1 Q 2 2 2 Q 2 2 P R O V I S I O N F O R U N C O L L EC T I B L E A C C O U N T S Provision for Uncollectible Accounts ($US in milllions) Provision-to-UMS

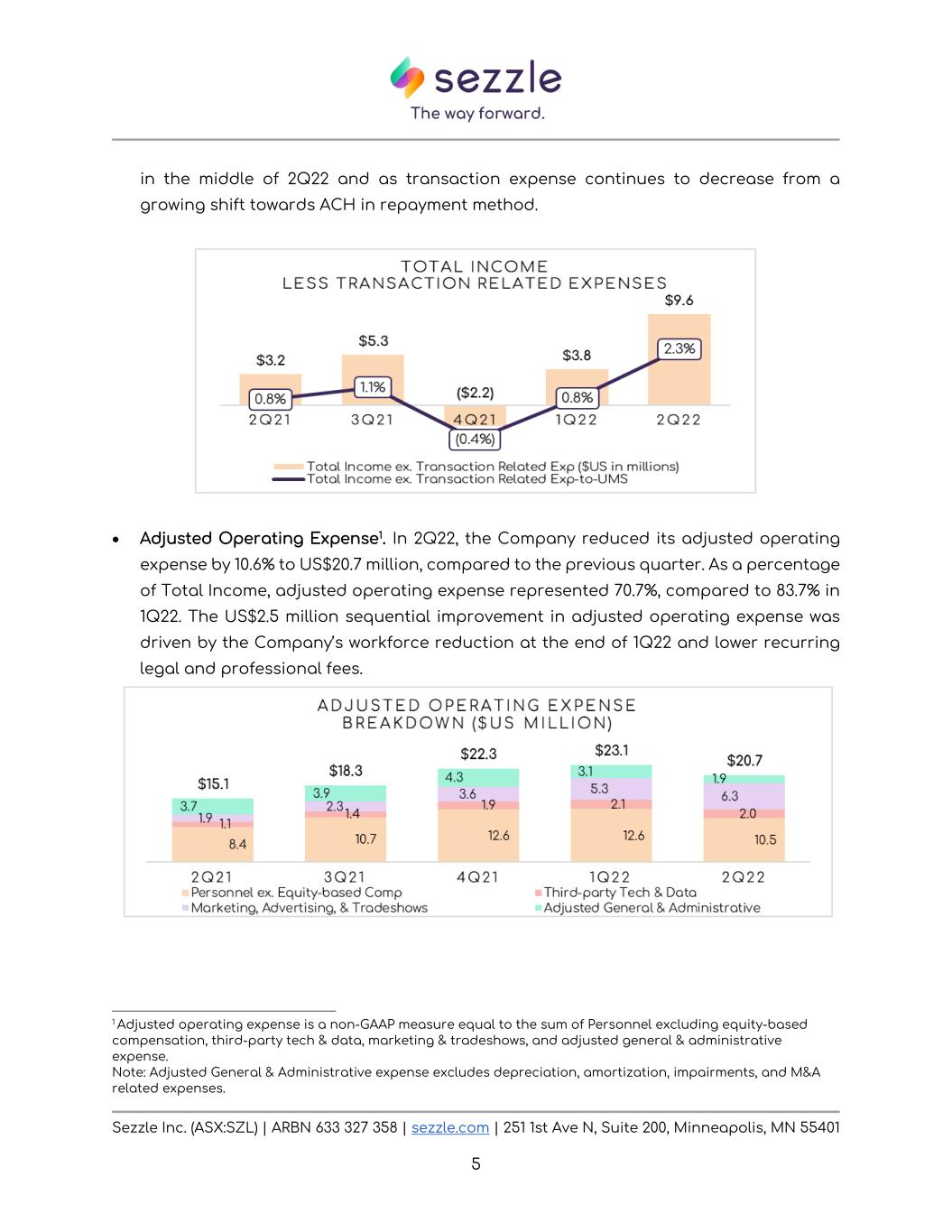

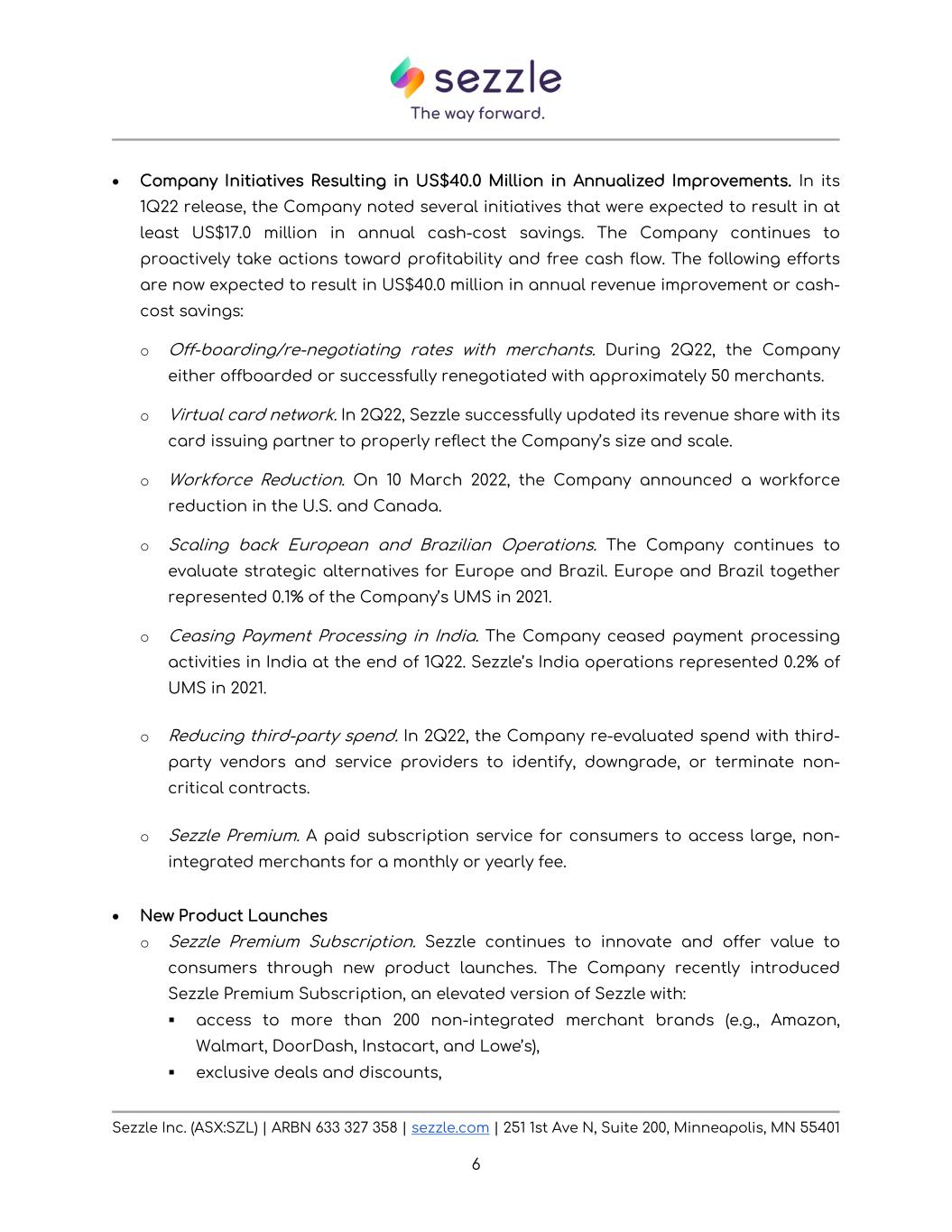

Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 5 in the middle of 2Q22 and as transaction expense continues to decrease from a growing shift towards ACH in repayment method. • Adjusted Operating Expense1. In 2Q22, the Company reduced its adjusted operating expense by 10.6% to US$20.7 million, compared to the previous quarter. As a percentage of Total Income, adjusted operating expense represented 70.7%, compared to 83.7% in 1Q22. The US$2.5 million sequential improvement in adjusted operating expense was driven by the Company’s workforce reduction at the end of 1Q22 and lower recurring legal and professional fees. 1 1 Adjusted operating expense is a non-GAAP measure equal to the sum of Personnel excluding equity-based compensation, third-party tech & data, marketing & tradeshows, and adjusted general & administrative expense. Note: Adjusted General & Administrative expense excludes depreciation, amortization, impairments, and M&A related expenses.

Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 6 • Company Initiatives Resulting in US$40.0 Million in Annualized Improvements. In its 1Q22 release, the Company noted several initiatives that were expected to result in at least US$17.0 million in annual cash-cost savings. The Company continues to proactively take actions toward profitability and free cash flow. The following efforts are now expected to result in US$40.0 million in annual revenue improvement or cash- cost savings: o Off-boarding/re-negotiating rates with merchants. During 2Q22, the Company either offboarded or successfully renegotiated with approximately 50 merchants. o Virtual card network. In 2Q22, Sezzle successfully updated its revenue share with its card issuing partner to properly reflect the Company’s size and scale. o Workforce Reduction. On 10 March 2022, the Company announced a workforce reduction in the U.S. and Canada. o Scaling back European and Brazilian Operations. The Company continues to evaluate strategic alternatives for Europe and Brazil. Europe and Brazil together represented 0.1% of the Company’s UMS in 2021. o Ceasing Payment Processing in India. The Company ceased payment processing activities in India at the end of 1Q22. Sezzle’s India operations represented 0.2% of UMS in 2021. o Reducing third-party spend. In 2Q22, the Company re-evaluated spend with third- party vendors and service providers to identify, downgrade, or terminate non- critical contracts. o Sezzle Premium. A paid subscription service for consumers to access large, non- integrated merchants for a monthly or yearly fee. • New Product Launches o Sezzle Premium Subscription. Sezzle continues to innovate and offer value to consumers through new product launches. The Company recently introduced Sezzle Premium Subscription, an elevated version of Sezzle with: access to more than 200 non-integrated merchant brands (e.g., Amazon, Walmart, DoorDash, Instacart, and Lowe’s), exclusive deals and discounts,

Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 7 priority consumer support, an extra free payment reschedule per order, and 2x the points for Sezzle Rewards on all Sezzle payments. The subscription payment options are an $89.99 annual package or a $9.99 monthly payment. Launched in June 2022, the Company’s service now exceeds over 47,000 subscribers on limited app and email marketing efforts. The Company intends to onboard more brands to its Premium merchant base, allowing consumers to use Sezzle “anywhere”, as their preferred checkout option. o Loyalty Program. The Company officially launched Sezzle Rewards. The loyalty program awards shoppers 1x point for every dollar paid using Sezzle, which can be redeemed at any merchant partner through Sezzle Spend. Through the program, the Company plans to incentivize good behaviors such as early repayments, timely repayments, and setting their bank account as a primary payment option. o Sezzle Up in Canada. Sezzle Up, an opt-in service that enables consumers to report their payment behavior to credit unions and help build their credit, is soon to be available for Sezzle Canada consumers. The launch will make Sezzle the first Buy Now, Pay Later in Canada to offer free credit-building to users. The Company expects Sezzle Up’s Canadian launch to go live in early Q3. • Launch of New Long-Term Loan Partner. The Company launched its partnership with Bread Financial Holdings Inc. (NYSE: BFH; formerly known as Alliance Data Systems Corp.) in 2Q22, expanding the Company’s long-term installment loan offering. Early results indicate the value of the long-term installment option and a promising partnership. The Company plans to broaden consumer financing options by adding Oportun (end of 3Q22) and Genesis (1Q23). These partnerships enable the Company’s merchant partners to offer more payment options to their prime and sub-prime consumers, while Sezzle does not to incur any balance sheet or credit risk. • Merchant Growth. Active Merchants increased 19.0% YoY in 2Q22, resulting in 47,900 merchants in which Sezzle’s consumers have transacted with in the last 12 months through the Sezzle platform.

Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 8 • Active Consumers. Active Consumers rose 18.2% YoY reaching 3.4 million. The Company’s growth in Active Consumers slowed relative to historical levels, as initiatives were undertaken to focus on profitability and free cash flow instead of negative consumer acquisition costs. The continued increase in consumer engagement drove Active Consumer repeat usage to 93.5%. Sezzle’s Active Consumer base remains a key growth driver for both the Company and its partners as Sezzle enhances its marketplace. • Sezzle Canada Continues Strong Pace. Sezzle Canada surpassed 4,200 Active Merchants in the quarter (up 58.0% YoY) with an Active Consumer count of approximately 270,000 at quarter end (up 68.2% YoY). Sezzle Canada’s 2Q22 UMS improved 52.9% YoY and represented almost 9% of the Company’s UMS. During the quarter, Sezzle Canada received the Buy Now, Pay Later of the Year Award from The Canadian Lenders Association’s 2022 Leaders in Lending Awards, reiterating Sezzle’s consumer-first and financially empowering solution. The achievement reflects Sezzle’s strong Canadian team and the rapid adoption of Buy Now, Pay Later in the Canadian market. • Recent Accolades. Sezzle’s commitment to providing value to consumers and merchants, innovation, and social good has been widely recognized in 2022. The Company has been named as the most trusted BNPL app in North America by the Fintech Awards 2022, the best BNPL app for socially conscious shoppers by NerdWallet, and top software companies in Midwest by Forbes. • Termination of the Zip Merger. On 12 July 2022, Sezzle and Zip mutually agreed to terminate the proposed merger. As part of the mutual termination, Sezzle received US$11.0 million from Zip to cover Sezzle’s legal, accounting, and other costs associated with the transaction. Sezzle remains dedicated to driving toward profitability and free cash flow and believes this is the best outcome for shareholders. • GameStop Lawsuit. On 21 July 2022, the Company reported that it has initiated a lawsuit against GameStop, Inc. (NYSE: GME) for the violation of its contract. The Company alleges GameStop violated its two-year merchant agreement with the Company when it prematurely removed Sezzle’s functionality from its cart page and product detail pages without notifying Sezzle in direct breach of the contract. As a result of the breach of

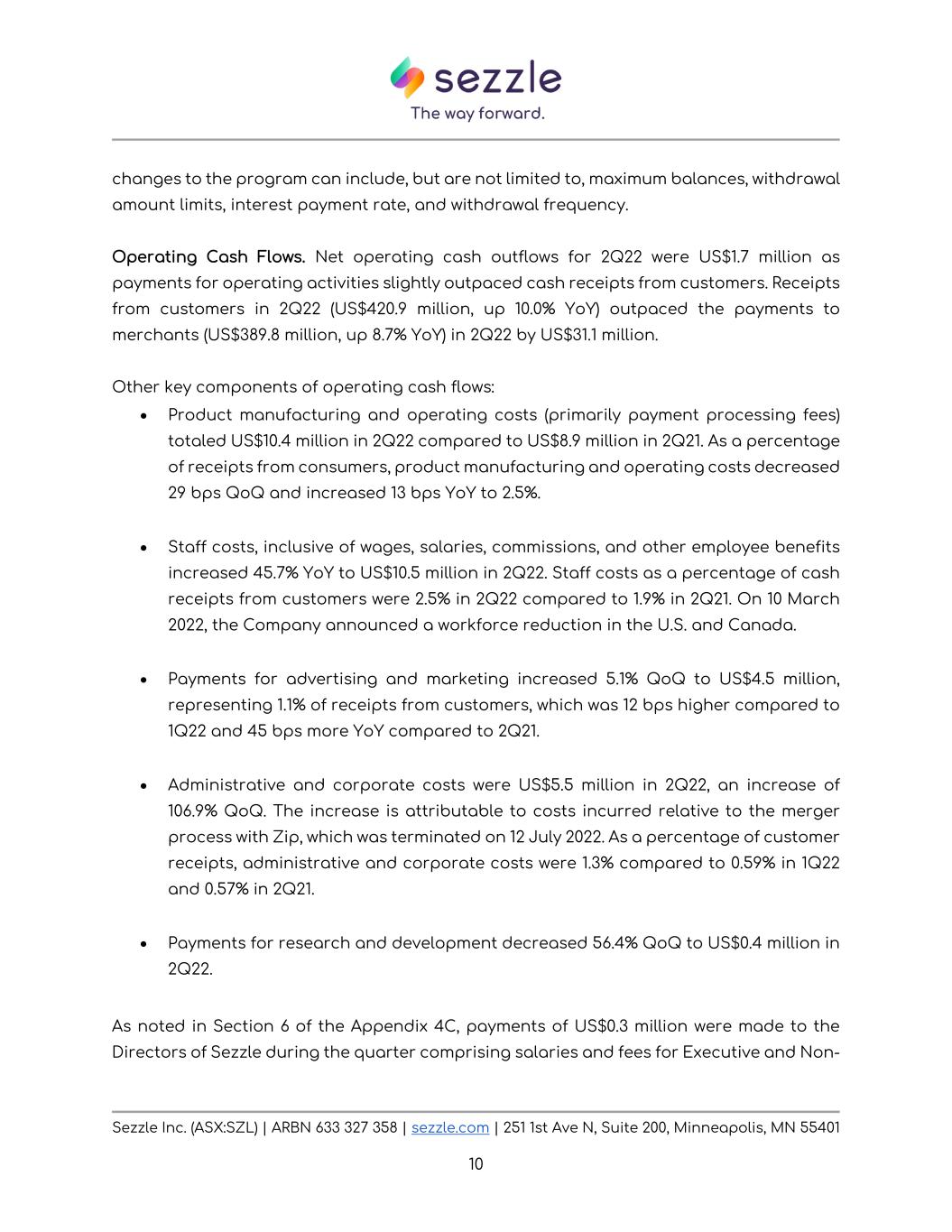

Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 9 the merchant agreement, Sezzle is seeking US$1.4 million in damages and related service fees that GameStop has failed to pay, as well as marketing costs spent on GameStop’s behalf. Quarterly Cash Flows As of 30 June 2022, the Company had total cash on hand of US$63.3 million, consisting of US$62.1 million of bank balances and US$1.2 million of restricted cash. Total cash on hand increased US$2.7 million during the second quarter, driven by net cash from financing activities of US$5.3 million, which was partially offset by net cash used in operating activities of US$1.7 million. Select Balance Sheet Data Unaudited Unaudited US$000's 31-Mar-2022 30-Jun-2022 Cash and cash equivalents $58,371 $62,076 Restricted cash $2,209 $1,220 Total cash $60,580 $63,296 Drawn on line of credit $52,800 $57,800 Availability on line of credit $39,718 $10,053 At quarter end, the Company had US$10.1 million of availability under its credit facility, with US$57.8 million drawn on the facility. After quarter end, the Company received US$11.0 million from Zip to cover Sezzle’s legal, accounting, and other costs associated with the transaction. As a result of the termination of the merger with Zip (ASX:ZIP), the Company is assessing its facility options with lenders. Notes receivable (net) and merchant accounts payable amounted to US$89.4 million and US$85.3 million, respectively, as of 30 June 2022. Within merchants accounts payable, US$70.0 million was attributed to the merchant interest program. Interest expense associated with the program for the quarter ended 30 June 2022 totaled US$0.6 million. Deferred payments in the merchant interest program are due on demand, up to US$250,000 during any seven-day period, at the request of the merchant. Any request larger than US$250,000 is honored after 7 days. Sezzle reserves the right to impose additional limits on the program and make changes to the program without notice or limits. These limits and

Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 10 changes to the program can include, but are not limited to, maximum balances, withdrawal amount limits, interest payment rate, and withdrawal frequency. Operating Cash Flows. Net operating cash outflows for 2Q22 were US$1.7 million as payments for operating activities slightly outpaced cash receipts from customers. Receipts from customers in 2Q22 (US$420.9 million, up 10.0% YoY) outpaced the payments to merchants (US$389.8 million, up 8.7% YoY) in 2Q22 by US$31.1 million. Other key components of operating cash flows: • Product manufacturing and operating costs (primarily payment processing fees) totaled US$10.4 million in 2Q22 compared to US$8.9 million in 2Q21. As a percentage of receipts from consumers, product manufacturing and operating costs decreased 29 bps QoQ and increased 13 bps YoY to 2.5%. • Staff costs, inclusive of wages, salaries, commissions, and other employee benefits increased 45.7% YoY to US$10.5 million in 2Q22. Staff costs as a percentage of cash receipts from customers were 2.5% in 2Q22 compared to 1.9% in 2Q21. On 10 March 2022, the Company announced a workforce reduction in the U.S. and Canada. • Payments for advertising and marketing increased 5.1% QoQ to US$4.5 million, representing 1.1% of receipts from customers, which was 12 bps higher compared to 1Q22 and 45 bps more YoY compared to 2Q21. • Administrative and corporate costs were US$5.5 million in 2Q22, an increase of 106.9% QoQ. The increase is attributable to costs incurred relative to the merger process with Zip, which was terminated on 12 July 2022. As a percentage of customer receipts, administrative and corporate costs were 1.3% compared to 0.59% in 1Q22 and 0.57% in 2Q21. • Payments for research and development decreased 56.4% QoQ to US$0.4 million in 2Q22. As noted in Section 6 of the Appendix 4C, payments of US$0.3 million were made to the Directors of Sezzle during the quarter comprising salaries and fees for Executive and Non-

Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 11 executive Directors. No other payments were made to any related parties or their associates of Sezzle. U.S. Filings In accordance with the provisions of the U.S. Securities Act, Sezzle is a reporting company for U.S. Securities and Exchange Commission (SEC) purposes. As such, the Company will be filing its quarterly Form 10-Q for the period ended 30 June 2022 by 15 Augst 2022 (U.S. time) with a copy of the Form 10-Q to be lodged on the ASX platform at a similar time by 16 August 2022 (Australian time). Quarterly Earnings Conference Call The management team will host a conference call to discuss the quarterly earnings with investors on 29 July 2022, at 10:30 am (Sydney). Participants can register for the conference call by navigating to: https://s1.c-conf.com/diamondpass/10024010-sdmffs22.html Please note that registered participants will receive their dial in number upon registration. Investors are encouraged to submit any questions in advance of the call by emailing them to: Investorrelations@sezzle.com. This Quarterly Activities Report and accompanying Appendix 4C have been approved by the Company’s Executive Chairman and CEO, Charlie Youakim, on behalf of the Sezzle Inc. Board. Contact Information For more information about this announcement: Lee Brading, CFA Investor Relations +651 240 6001 InvestorRelations@sezzle.com Justin Clyne Company Secretary +61 407 123 143 jclyne@clynecorporate.com.au Erin Foran Media Enquiries +651 403-2184 erin.foran@sezzle.com About Sezzle Inc.

Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 12 Sezzle is a fintech company on a mission to financially empower the next generation. Sezzle’s payment platform increases the purchasing power for millions of consumers by offering interest-free installment plans at online stores and select in-store locations. Sezzle’s transparent, inclusive, and seamless payment option allows consumers to take control over their spending, be more responsible, and gain access to financial freedom. For more information visit sezzle.com. Sezzle’s CDIs are issued in reliance on the exemption from registration contained in Regulation S of the US Securities Act of 1933 (Securities Act) for offers of securities which are made outside the US. Accordingly, the CDIs have not been, and will not be, registered under the Securities Act or the laws of any state or other jurisdiction in the US. As a result of relying on the Regulation S exemption, the CDIs are ‘restricted securities’ under Rule 144 of the Securities Act. This means that you are unable to sell the CDIs into the US or to a US person who is not a QIB for the foreseeable future, unless the re-sale of the CDIs is registered under the Securities Act or another exemption is available. To enforce the above transfer restrictions, all CDIs issued bear a FOR Financial Product designation on the ASX. This designation restricts any CDIs from being sold on ASX to US persons excluding QIBs. However, you are still able to freely transfer your CDIs on ASX to any person other than a US person who is not a QIB. In addition, hedging transactions with regard to the CDIs may only be conducted in accordance with the Securities Act. Cautionary Note Regarding Forward-Looking Statements This report contains certain forward-looking statements within the meaning of the federal securities laws with respect to: (i) the proposed acquisition of Sezzle by Zip (the “Proposed Transaction”) including, but not limited to, statements regarding the expected benefits of the Proposed Transaction and the anticipated timing, completion and effects of the Proposed Transaction, (ii) strategies, objectives and the products, (iii) markets of Sezzle and Zip, (iv) future operations, (v) financial position, (vi) estimated revenues and losses, (vii) prospects and (viii) plans and objectives of management. These forward-looking statements generally are identified by the words “believe,” “predict,” “target,” “contemplate,” “potential,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “could,” “will be,” “will continue,” “will likely result,” or similar expressions. Forward-looking statements are predictions, projections and other statements about future events or trends that are based on current expectations and assumptions. These statements are based on various assumptions, whether or not identified in this document, and on the current expectations of Sezzle and are not predictions of actual performance, and, as a result, are subject to risks and uncertainties. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Forward looking statements involve inherent known and unknown risks, uncertainties and contingencies, both general and specific, many of which are beyond Sezzle’s control, and there is a risk that such predictions, forecasts, projections, and other forward-looking statements will not be achieved. Actual results may be materially different from those expressed or implied in

Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 13 forward-looking statements and any projections and assumptions upon which these statements are based. These forward-looking statements are subject to a number of risks and uncertainties, including those set out in this report but not limited to: (i) the risk that the Proposed Transaction may not be completed in a timely manner or at all, (ii) the failure to satisfy the conditions to the consummation of the Proposed Transaction, including the adoption of the merger agreement by the stockholders of Sezzle or Zip and the receipt of certain U.S. and foreign governmental and regulatory approvals, (iii) the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement, (iv) Sezzle’s and Zip’s ability to increase its merchant network, its base of consumers and underlying merchant sales; (v) Sezzle’s and Zip’s ability to effectively manage growth, sustain its growth rate and maintain its market share; (vi) the impact of Sezzle’s and Zip’s exposure to consumer bad debts and insolvency of merchants; (vii) the impact of key vendors or merchants failing to comply with legal or regulatory requirements or to provide various services that are important to Sezzle’s and Zip’s operations; (viii) the impact of the nature of the integration, support and presentation of Sezzle’s and Zip’s platform by its merchants; (ix) the impact of exchange rate fluctuations in the international markets in which Sezzle and Zip operate; (x) Sezzle’s and Zip’s ability to protect its intellectual property rights; (xi) Sezzle’s ability to achieve its public benefit purpose and maintain its B Corporation certification; (xii) the effect of the announcement or pendency of the Proposed Transaction on Sezzle’s and Zip’s business relationships, operating results, and business generally and the responses of merchants and business partners to the announcement, (xii) risks that the Proposed Transaction disrupts current plans and operations of Sezzle or Zip (xiii) potential difficulties in retaining Sezzle and Zip customers and employees as a result of the Proposed Transaction, (xiv) risks related to diverting the attention of the management of Sezzle and Zip from each party’s respective ongoing business operations, (xv) Sezzle and Zip’s estimates of its financial performance, including requirements for additional capital and its ability to raise sufficient funds to meet its needs in the future; (xvi) changes in general economic or political conditions; (xvii) changes in the markets in which Sezzle and Zip competes, including with respect to its competitive landscape, technology evolution or regulatory changes; (xviii) the impact of the Buy-Now Pay-Later (“BNPL”) industry becoming subject to increased regulatory scrutiny; (xix) the impact of the costs of complying with various laws and regulations applicable to the BNPL industry in the United States and the international markets in which Sezzle and Zip operate; (xx) the impact of macro-economic conditions on consumer spending; (xxi) slowdowns in securities trading or shifting demand for security trading product; (xxii) the impact of natural disasters or health epidemics, including the ongoing COVID-19 pandemic; (xxiii) legislative or regulatory changes; (xxiv) the impact of operating in a highly competitive industry; (xxv) reliance on third party service providers; (xxvi) the impact of a potential loss of Sezzle’s or Zip’s key partners and merchant relationships; (xxvii) competition in retaining key employees; (xxviii) Sezzle’s and Zip’s reliance on new products and establishment and maintenance of its brand; (xxix) risks related to data security and privacy, including the impact of any data security breaches, cyberattacks, employee or other internal misconduct, malware, phishing or ransomware, physical security breaches, natural disasters, or similar disruptions; (xxx) changes to accounting principles and guidelines; (xxxi) the risk that Sezzle may not be able to launch its partnership with the Bread Financial Holdings Inc.; (xxxii) the impact of Sezzle’s workforce reductions in the U.S.

Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 14 and Canada and of scaling back operations in Europes; (xxxiii) the impact of Sezzle ceasing payment processing activities in India; (xxxiv) the risk that Sezzle will not be able to spin off its Brazilian operations or the impact that the spin off will have on Sezzle; (xxxv) potential litigation relating to the Proposed Transaction that could be instituted against Sezzle, Zip or their respective directors and officers, including the effects of any outcomes related thereto; (xxxvi) the outcome of any legal proceedings that may be instituted against Zip or against Sezzle related to the merger agreement or the Proposed Transaction (which may result in significant costs of defense, indemnification and liability), (xxxvii) the price of Sezzle’s or Zip’s securities may be volatile due to a variety of factors; (xxxix) the ability to implement business plans, forecasts, and other expectations after the completion of the Proposed Transaction, and identify and realize additional opportunities; (xxxx) unexpected costs, charges or expenses resulting from the Proposed Transaction; (xxxxi) the possibility that competing offers or acquisition proposals for Sezzle or Zip will be made, which could result in termination of the merger agreement, (xxxxii) the risk that Zip is unable to consummate the financings contemplated by the merger agreement on acceptable terms or at all, (xxxxiii) the risk that Zip shareholders do not approve the Proposed Transaction, if their approval is required, and (xxxxiv) Zip’s ability to realize the synergies contemplated by the Proposed Transaction and integrate the business of Sezzle. The risks and uncertainties may be amplified by the COVID-19 pandemic (and related variants), which has caused significant economic uncertainty. The extent to which the COVID-19 pandemic (and related variants) impacts Sezzle’s or Zip’s businesses, operations, and financial results, including the duration and magnitude of such effects, will depend on numerous factors, which are unpredictable, including, but not limited to, the duration and spread of the outbreak, its severity, the actions to contain the virus or treat its impact, and how quickly and to what extent normal economic and operating conditions can resume. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties that affect the businesses of Zip and Sezzle described in the “Risk Factors” section of Sezzle’s Annal Report on Form 10-K filed with the SEC, Zip’s Form F-4 to be filed with the SEC and other documents filed by either Zip or Sezzle from time to time with the ASX, the Australian Securities & Investments Commission (“ASIC”) and/or the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward- looking statements. If any of these risks materialize or our assumptions prove incorrect, actual events and results could differ materially from those contained in the forward- looking statements. There may be additional risks that Sezzle presently does not know or that Sezzle currently believes are immaterial that could also cause actual events and results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Sezzle’s expectations, plans or forecasts of future events and views as of the date of this document. These forward-looking statements should not be relied upon as representing Sezzle’s assessment as of any date subsequent to the date of this document. Accordingly, undue reliance should not be placed upon the forward-looking statements. Readers are cautioned not to put undue reliance on forward- looking statements, and Sezzle assumes no obligation to, and does not intend to, update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise, unless required by law. Sezzle does not give any assurance that either

Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 15 Zip or Sezzle, or the combined company, will achieve the results or other matters set forth in the forward-looking statements. Additional Information and Where to Find It This communication is being made in respect of the proposed merger transaction involving the Company and Zip. In connection with the proposed acquisition by Zip of the Company, Zip will file with: (a) the SEC a registration statement on Form F-4, (b) to the extent required by ASIC, a prospectus in Australia with the ASIC in relation to the offer of ordinary shares of Zip, and (c) with the ASX, the Notice of Zip Extraordinary General Meeting in connection with the Zip stockholder approval. The registration statement will include a document that serves as a prospectus of Zip and a proxy statement of the Company (the “proxy statement/prospectus”), and each party will file other documents regarding the Proposed Transaction with the SEC, ASIC and the ASX. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, PROXY STATEMENT/PROSPECTUS, AUSTRALIAN PROSPECTUS (IF ANY), NOTICE OF ZIP EXTRAORDINARY GENERAL MEETING, INCLUDING ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION WHEN THEY BECOME AVAILABLE, BECAUSE THEY DO AND THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE PROPOSED TRANSACTION. A definitive proxy statement/prospectus and Australian prospectus (if any) will be mailed to the Company’s security holders when it becomes available. Investors and security holders will be able to obtain the registration statement, the proxy statement/prospectus, the Australian prospectus (if any) and all other relevant documents filed or that will be filed free of charge from the SEC’s website at www.sec.gov or at the ASX’s website at www2.asx.com/au. The documents filed by the Zip or the Company with the SEC and the ASX may also be obtained free of charge at the Zip’s or Company’s website at https://investors.sezzle.com/ and https://zip.com/investors. Participants in the Solicitation Zip, the Company and their respective directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from the Company’s security holders with respect to the Proposed Transaction. Information about Zip’s directors and executive officers is available in Zip’s Annual Report to Stockholders for the fiscal year ended June 30, 2021 filed with the ASX on September 28, 2021. Information concerning the ownership of the Company’s securities by the Company’s directors and executive officers is included in the Company’s Annual Report on Form 10-K filed with the SEC on March 30, 2022. Other information regarding persons who may, under the rules of the SEC, be deemed the participants in the proxy solicitation of the Company’s stockholders in connection with the Proposed Transaction and a description of their direct and indirect interests, by security holdings or otherwise, will be included in the proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the Proposed Transaction (if and when they become available). Security holders, potential investors and other readers should read the proxy statement/prospectus carefully when it

Sezzle Inc. (ASX:SZL) | ARBN 633 327 358 | sezzle.com | 251 1st Ave N, Suite 200, Minneapolis, MN 55401 16 becomes available before making any voting or investment decisions. You may obtain free copies of these documents from Zip or the Company as indicated above. No Offer or Solicitation This report shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended, or pursuant to another available exemption.

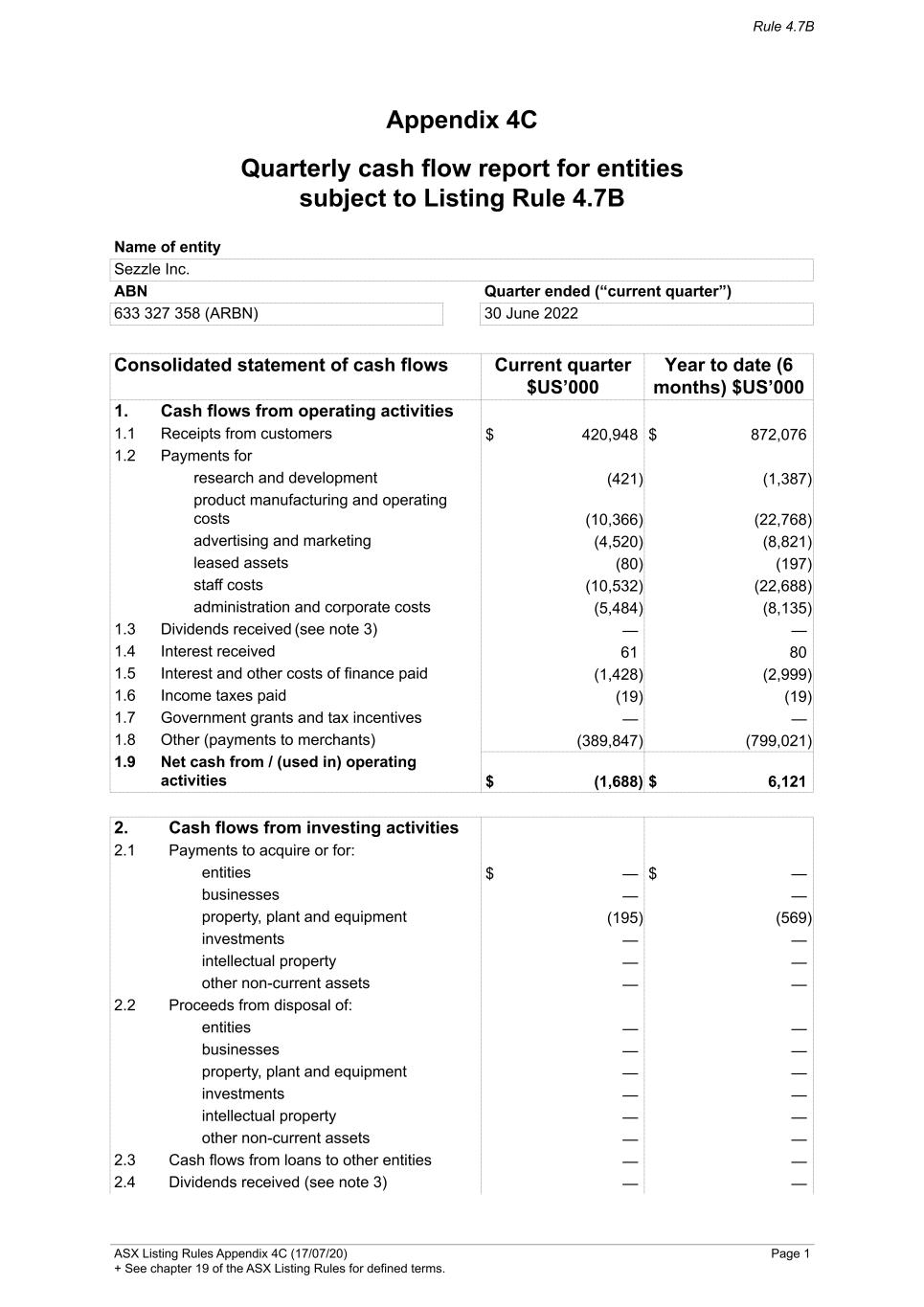

Appendix 4C Quarterly cash flow report for entities subject to Listing Rule 4.7B Name of entity Sezzle Inc. ABN Quarter ended (“current quarter”) 633 327 358 (ARBN) 30 June 2022 Consolidated statement of cash flows Current quarter $US’000 Year to date (6 months) $US’000 1. Cash flows from operating activities $ 420,948 $ 872,076 1.1 Receipts from customers 1.2 Payments for (421) (1,387) research and development product manufacturing and operating costs (10,366) (22,768) advertising and marketing (4,520) (8,821) leased assets (80) (197) staff costs (10,532) (22,688) administration and corporate costs (5,484) (8,135) 1.3 Dividends received (see note 3) — — 1.4 Interest received 61 80 1.5 Interest and other costs of finance paid (1,428) (2,999) 1.6 Income taxes paid (19) (19) 1.7 Government grants and tax incentives — — 1.8 Other (payments to merchants) (389,847) (799,021) 1.9 Net cash from / (used in) operating activities $ (1,688) $ 6,121 2. Cash flows from investing activities $ — $ — 2.1 Payments to acquire or for: entities businesses — — property, plant and equipment (195) (569) investments — — intellectual property — — other non-current assets — — 2.2 Proceeds from disposal of: — — entities businesses — — property, plant and equipment — — investments — — intellectual property — — other non-current assets — — 2.3 Cash flows from loans to other entities — — 2.4 Dividends received (see note 3) — — Rule 4.7B ASX Listing Rules Appendix 4C (17/07/20) Page 1 + See chapter 19 of the ASX Listing Rules for defined terms.

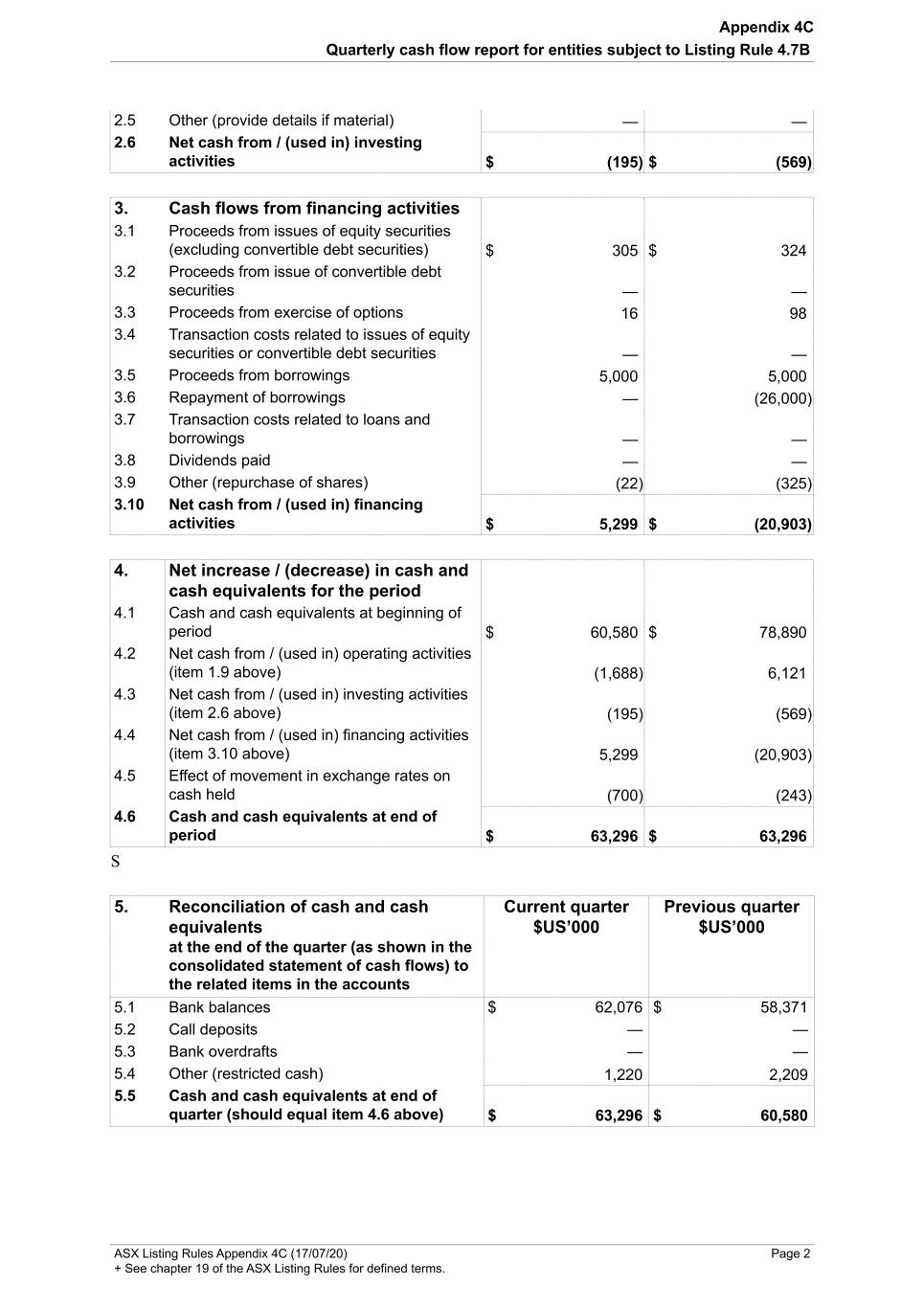

2.5 Other (provide details if material) — — 2.6 Net cash from / (used in) investing activities $ (195) $ (569) 3. Cash flows from financing activities $ 305 $ 324 3.1 Proceeds from issues of equity securities (excluding convertible debt securities) 3.2 Proceeds from issue of convertible debt securities — — 3.3 Proceeds from exercise of options 16 98 3.4 Transaction costs related to issues of equity securities or convertible debt securities — — 3.5 Proceeds from borrowings 5,000 5,000 3.6 Repayment of borrowings — (26,000) 3.7 Transaction costs related to loans and borrowings — — 3.8 Dividends paid — — 3.9 Other (repurchase of shares) (22) (325) 3.10 Net cash from / (used in) financing activities $ 5,299 $ (20,903) 4. Net increase / (decrease) in cash and cash equivalents for the period $ 60,580 $ 78,890 4.1 Cash and cash equivalents at beginning of period 4.2 Net cash from / (used in) operating activities (item 1.9 above) (1,688) 6,121 4.3 Net cash from / (used in) investing activities (item 2.6 above) (195) (569) 4.4 Net cash from / (used in) financing activities (item 3.10 above) 5,299 (20,903) 4.5 Effect of movement in exchange rates on cash held (700) (243) 4.6 Cash and cash equivalents at end of period $ 63,296 $ 63,296 S 5. Reconciliation of cash and cash equivalents at the end of the quarter (as shown in the consolidated statement of cash flows) to the related items in the accounts Current quarter $US’000 Previous quarter $US’000 5.1 Bank balances $ 62,076 $ 58,371 5.2 Call deposits — — 5.3 Bank overdrafts — — 5.4 Other (restricted cash) 1,220 2,209 5.5 Cash and cash equivalents at end of quarter (should equal item 4.6 above) $ 63,296 $ 60,580 Appendix 4C Quarterly cash flow report for entities subject to Listing Rule 4.7B ASX Listing Rules Appendix 4C (17/07/20) Page 2 + See chapter 19 of the ASX Listing Rules for defined terms.

6. Payments to related parties of the entity and their associates Current quarter $US'000 6.1 Aggregate amount of payments to related parties and their associates included in item 1 $ 271 6.2 Aggregate amount of payments to related parties and their associates included in item 2 — Note: if any amounts are shown in items 6.1 or 6.2, your quarterly activity report must include a description of, and an explanation for, such payments. 7. Financing facilities Note: the term “facility’ includes all forms of financing arrangements available to the entity. Add notes as necessary for an understanding of the sources of finance available to the entity. Total facility amount at quarter end $US’000 Amount drawn at quarter end $US’000 7.1 Loan facilities $ 250,000 $ 57,800 7.2 Credit standby arrangements — — 7.3 Other (please specify) — — 7.4 Total financing facilities $ 250,000 $ 57,800 7.5 Unused financing facilities available at quarter end $ 10,053 7.6 Include in the box below a description of each facility above, including the lender, interest rate, maturity date and whether it is secured or unsecured. If any additional financing facilities have been entered into or are proposed to be entered into after quarter end, include a note providing details of those facilities as well. Loan facilities consist of a revolving line of credit with three members, Goldman Sachs Bank USA, Bastion Consumer Funding II LLC, and Bastion Funding IV LLC, for a credit facility of up to US$250 million, with a committed amount of US$125 million. Borrowings on the line of credit carry a weighted average interest rate of 6.70% as of 30 June 2022. The line of credit is secured by consumer receivables and offers an available borrowing base of US$67.9 million, of which US$57.8 million is drawn as of 30 June 2022. Appendix 4C Quarterly cash flow report for entities subject to Listing Rule 4.7B ASX Listing Rules Appendix 4C (17/07/20) Page 3 + See chapter 19 of the ASX Listing Rules for defined terms.

8. Estimated cash available for future operating activities $US’000 8.1 Net cash from / (used in) operating activities (item 1.9) $ (1,688) 8.2 Cash and cash equivalents at quarter end (item 4.6) 63,296 8.3 Unused finance facilities available at quarter end (item 7.5) 10,053 8.4 Total available funding (item 8.2 + item 8.3) $ 73,349 8.5 Estimated quarters of funding available (item 8.4 divided by item 8.1) 43.5 Note: if the entity has reported positive net operating cash flows in item 1.9, answer item 8.5 as “N/A”. Otherwise, a figure for the estimated quarters of funding available must be included in item 8.5. 8.6 If item 8.5 is less than 2 quarters, please provide answers to the following questions: 8.6.1 Does the entity expect that it will continue to have the current level of net operating cash flows for the time being and, if not, why not? Answer: N/A 8.6.2 Has the entity taken any steps, or does it propose to take any steps, to raise further cash to fund its operations and, if so, what are those steps and how likely does it believe that they will be successful? Answer: N/A 8.6.3 Does the entity expect to be able to continue its operations and to meet its business objectives and, if so, on what basis? Answer: N/A Note: where item 8.5 is less than 2 quarters, all of questions 8.6.1, 8.6.2 and 8.6.3 above must be answered. Compliance statement 1 This statement has been prepared in accordance with accounting standards and policies which comply with Listing Rule 19.11A. 2 This statement gives a true and fair view of the matters disclosed. Date: 29 July 2022 Authorised by: The Company's CEO and Executive Chairman (Name of body or officer authorising release – see note 4) Notes 1. This quarterly cash flow report and the accompanying activity report provide a basis for informing the market about the entity’s activities for the past quarter, how they have been financed and the effect this has had on its cash position. An entity that wishes to disclose additional information over and above the minimum required under the Listing Rules is encouraged to do so. 2. If this quarterly cash flow report has been prepared in accordance with Australian Accounting Standards, the definitions in, and provisions of, AASB 107: Statement of Cash Flows apply to this report. If this quarterly cash flow report has been prepared in accordance with other accounting standards agreed by ASX pursuant to Listing Rule 19.11A, the corresponding equivalent standard applies to this report. 3. Dividends received may be classified either as cash flows from operating activities or cash flows from investing activities, depending on the accounting policy of the entity. 4. If this report has been authorised for release to the market by your board of directors, you can insert here: “By the board”. If it has been authorised for release to the market by a committee of your board of directors, you can insert here: Appendix 4C Quarterly cash flow report for entities subject to Listing Rule 4.7B ASX Listing Rules Appendix 4C (17/07/20) Page 4 + See chapter 19 of the ASX Listing Rules for defined terms.

“By the [name of board committee – eg Audit and Risk Committee]”. If it has been authorised for release to the market by a disclosure committee, you can insert here: “By the Disclosure Committee”. 5. If this report has been authorised for release to the market by your board of directors and you wish to hold yourself out as complying with recommendation 4.2 of the ASX Corporate Governance Council’s Corporate Governance Principles and Recommendations, the board should have received a declaration from its CEO and CFO that, in their opinion, the financial records of the entity have been properly maintained, that this report complies with the appropriate accounting standards and gives a true and fair view of the cash flows of the entity, and that their opinion has been formed on the basis of a sound system of risk management and internal control which is operating effectively. Appendix 4C Quarterly cash flow report for entities subject to Listing Rule 4.7B ASX Listing Rules Appendix 4C (17/07/20) Page 5 + See chapter 19 of the ASX Listing Rules for defined terms.