UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23137

SIERRA TOTAL RETURN FUND

(exact name of registrant as specified in charter)

280 Park Ave, 6th Floor East

New York, NY 10017

(Address of principal executive offices) (Zip code)

Seth Taube

Chief Executive Officer

280 Park Ave, 6th Floor East

New York, NY 10017

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 759-0777

Date of fiscal year end: June 30

Date of reporting period: July 1, 2016 – June 30, 2017

Item 1. Reports to Stockholders.

TABLE OF CONTENTS

| Shareholder Letter | 1 |

| Manager Commentary | 2 |

| Schedule of Investments | 4 |

| Statement of Assets and Liabilities | 6 |

| Statement of Operations | 7 |

| Statements of Changes in Net Assets | 8 |

| Financial Highlights | 9 |

| Notes to Financial Statements | 10 |

| Report of Independent Registered Public Accounting Firm | 18 |

| Additional Information | 19 |

| Trustees & Officers | 20 |

| Sierra Total Return Fund | Shareholder Letter |

June 30, 2017 (Unaudited)

Dear Fellow Shareholders:

We are pleased to provide Sierra Total Return Fund’s (the “Fund”) annual report for the period ended June 30, 2017.

With the launch of this exciting new Fund beginning with our first investments in June, we are optimistic about the growth and earnings potential that this credit focused investment opportunity provides for shareholders.

The Fund began investing in June with the view that it needed to position its shareholders’ capital in investments that provide current income, the opportunity for capital appreciation and increased returns if interest rates rise. To that end, we have successfully begun deploying capital into floating rate investments within our core strategies.

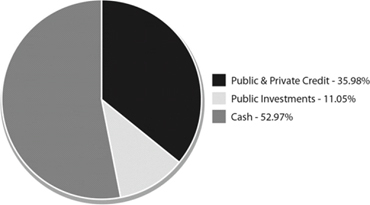

The Fund’s investments remain focused on four core strategies. We have begun creating a diversified portfolio of secured loans to middle market companies and dividend paying common and preferred stocks. As of June 30, 2017, the following presents our portfolio by our core strategies (as a percentage of total investments):

STRATEGY DIVERSIFICATION (unaudited)

Our Fund’s portfolio manager and the rest of our investment team are dedicated to portfolio optimization and diversification across all sectors by industry, investment type and income characteristics. We have strategically positioned capital in secured floating rate loans that have the opportunity to deliver increased income if market rates rise.

I am happy to share with you that the Fund’s Sponsor, Medley, has made its initial strategic equity investment in the Fund, aligning its interests with shareholders.

As we look to the year ahead, we believe that the benefits of continued economic growth bode well for income securities and investments in the middle market. We are excited about the future and look forward to your continued interest and support.

Sincerely,

Seth Taube, CEO and Chairman of the Board of Trustees

Sierra Total Return Fund

Past performance is not a guarantee of future results. Fund holdings and sector allocations are subject to change and are not a recommendation to buy or sell any security. Diversification does not assure a profit or protect against loss in a declining market. ALPS Distributors, Inc. is the distributor of Sierra Total Return Fund. Investing involves risk; Principal loss is possible. The Fund offers the following share classes: Class A – SRNAX, Class L – SRNLX, Class T – SRNTX, Class I – SRNIX. For more information on the differences in share classes, refer to the applicable prospectus, which can be found at: www.sierratotalreturnfund.com

| Annual Report | June 30, 2017 | 1 |

| Sierra Total Return Fund | Manager Commentary |

June 30, 2017 (Unaudited)

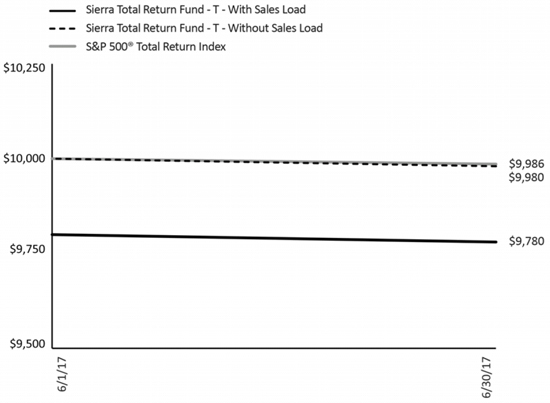

Performance (for the period ended June 30, 2017)

| | Since Inception | Inception |

| Sierra Total Return Fund ‐ Class T – Without Load | ‐0.20% | 6/1/17 |

| Sierra Total Return Fund ‐ Class T – With Load | ‐2.20% | 6/1/17 |

S&P 500® Total Return Index | ‐0.14% | 6/1/17 |

Past performance is not predictive of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares when redeemed, may be worth more or less than the original cost. Total return is calculated assuming reinvestment of all dividends and distributions. Performance figures for periods less than one year are not annualized. Class T shares are subject to a maximum sales load of 2.00% of the amount invested in Class T shares. For performance information current to the most recent month-end, please call toll-free 1-888-292-3172.

The S&P 500® Total Return Index is an unmanaged index of 500 common stocks chosen for market size, liquidity and industry group representation. It is a market-value weighted index. The index is not actively managed and does not reflect any deduction for fees, expenses or taxes.

Indexes are not actively managed and do not reflect deduction for fees, expenses or taxes. An investor cannot invest directly into an index.

The Expense Support Agreement will remain in effect at least until July 25, 2018. Following this term, the Adviser may elect, in its sole discretion, to offer to continue the Expense Support Agreement for successive quarterly periods. Any such continuance must be approved by a majority of the Fund’s board of trustees (the “Board”), including a majority of the trustees that are not “interested persons” of the Fund, as such term is defined under the Investment Company Act of 1940, as amended. The Board may terminate the Expense Support Agreement at any time, and there can be no assurance that STRF Advisors LLC will renew the Expense Support Agreement after the period noted above. Without the waiver the expenses would be 96.26% for Class T shares. Please review the Fund’s Prospectus for more details regarding the Fund’s fees and expenses. No assurances can be given that the Fund will pay a dividend in the future; or, if any such dividend is paid, the amount or rate of the dividend.

Comparison of the Change in Value of a $10,000 Investment

The graph shown above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. All returns reflect reinvested dividends, but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| 2 | www.sierratotalreturnfund.com |

| Sierra Total Return Fund | Manager Commentary |

June 30, 2017 (Unaudited)

| Top Ten Holdings* | Percent of

Net Assets** |

| Imagine! Print Solutions, LLC | 7.07% |

| MND Holdings III Corp. | 4.75% |

| Brand Energy & Infrastructure Services, Inc. | 3.61% |

| Keystone Acquisition Corp. | 3.58% |

| ConvergeOne Holdings Corp. | 3.54% |

| GMAC Capital Trust I | 2.50% |

| PrivateBancorp, Inc. | 2.44% |

| Touch Tunes Interactive Networks, Inc. | 2.40% |

| KNB Holdings Corp. | 2.39% |

| New Media Holdings II LLC | 2.37% |

| Top Ten Holdings | 34.65% |

| Asset Type Allocation | Percent of

Net Assets** |

| Senior Secured First Lien Term Loans | 36.87% |

| Preferred Stocks | 10.76% |

| Corporate Bonds | 9.71% |

| Common Stocks | 4.27% |

| Senior Secured Second Lien Term Loans | 2.35% |

| Cash, Cash Equivalents, & Other Net Assets | 36.04% |

| Total Net Assets | 100.00% |

| * | Excludes short term investments. |

| ** | Holdings are subject to change. |

| Annual Report | June 30, 2017 | 3 |

| Sierra Total Return Fund | Schedule of Investments |

June 30, 2017

| Description | | Shares | | | Fair Value | |

| COMMON STOCKS ‐ 4.27% | | | | | | |

| BANKING, FINANCE, INSURANCE & REAL ESTATE ‐ 4.27% | | | | | | |

| Ares Capital Corp. | | | 1,100 | | | $ | 18,018 | |

| Blackstone Mortgage Trust, Inc., Class A | | | 600 | | | | 18,960 | |

| Eagle Point Credit Co., Inc. | | | 900 | | | | 18,612 | |

| FS Investment Corp. | | | 2,000 | | | | 18,300 | |

| PennantPark Investment Corp. | | | 2,100 | | | | 15,519 | |

| | | | | | | | | |

TOTAL COMMON STOCKS (Cost $89,922) | | | | | | $ | 89,409 | |

| | | | | | | | | |

| PREFERRED STOCKS ‐ 10.76% | | | | | | | | |

| BANKING, FINANCE, INSURANCE & REAL ESTATE ‐ 10.76% | | | | | | | | |

| Apollo Commercial Real Estate Finance, Inc., Series C, 8.000% | | | 1,000 | | | $ | 25,404 | |

Chimera Investment Corp., Series B, 8.000%(a) | | | 1,000 | | | | 25,590 | |

Invesco Mortgage Capital, Inc., Series B, 7.750%(a) | | | 1,000 | | | | 25,310 | |

| New York Mortgage Trust, Inc., Series C, 7.875% | | | 2,000 | | | | 49,620 | |

| Oxford Lane Capital Corp., 8.125% | | | 1,000 | | | | 25,070 | |

PennyMac Mortgage Investment Trust, Series B, 8.000%(a)(b) | | | 2,000 | | | | 49,660 | |

Resource Capital Corp., 8.625%(a) | | | 1,000 | | | | 24,750 | |

| | | | | | | | | |

TOTAL PREFERRED STOCKS (Cost $226,173) | | | | | | $ | 225,404 | |

| Description | Interest Rate | Maturity | | Par Amount | | | Fair Value | |

| SENIOR SECURED FIRST LIEN TERM LOANS ‐ 36.87% | | | | | | | |

| AUTOMOTIVE ‐ 2.36% | | | | | | | | |

Rough Country, LLC(c) | 1M‐L+4.50%, 1.00%, Floor | 05/25/2023 | | $ | 50,000 | | | $ | 49,500 | |

| BANKING, FINANCE, INSURANCE & REAL ESTATE ‐ 2.39% | | | | | | | | | |

Freedom Mortgage Corp.(c)(d) | 6M‐L+5.50%, 1.00%, Floor | 02/23/2022 | | $ | 50,000 | | | | 50,000 | |

| CHEMICALS, PLASTICS & RUBBER ‐ 2.37% | | | | | | | | | |

KMG Chemicals, Inc.(c) | 2M‐L+4.25%, 1.00%, Floor | 06/15/2024 | | $ | 50,000 | | | | 49,750 | |

| CONSTRUCTION & BUILDING ‐ 3.61% | | | | | | | | | | |

| Brand Energy & Infrastructure Services, Inc. | 2M‐L+4.25%, 1.00%, Floor | 06/21/2024 | | $ | 75,000 | | | | 75,750 | |

| CONSUMER GOODS: DURABLE ‐ 7.14% | | | | | | | | | | |

KNB Holdings Corp.(c)(d) | 6M‐L+5.50%, 1.00%, Floor | 04/26/2024 | | $ | 50,000 | | | | 50,125 | |

MND Holdings III Corp.(c)(d) | 3M‐L+4.50%, 1.00%, Floor | 06/19/2024 | | $ | 100,000 | | | | 99,500 | |

| HEALTHCARE & PHARMACEUTICALS ‐ 3.58% | | | | | | | | | |

Keystone Acquisition Corp.(c)(d) | 3M‐L+5.25%, 1.00%, Floor | 05/01/2024 | | $ | 75,000 | | | | 75,000 | |

| HIGH TECH INDUSTRIES ‐ 2.38% | | | | | | | | | | |

Switch, Ltd.(c) | 1M‐L+2.75%, 1.00%, Floor | 06/27/2024 | | $ | 50,000 | | | | 49,875 | |

| MEDIA ‐ 2.37% | | | | | | | | | | |

New Media Holdings II LLC(c)(d) | 1M‐L+6.25%, 1.00%, Floor | 06/04/2020 | | $ | 50,000 | | | | 49,688 | |

| MEDIA: ADVERTISING, PRINTING & PUBLISHING ‐ 4.73% | | | | | | | | | |

Imagine! Print Solutions, LLC(c)(d) | 3M‐L+4.75%, 1.00%, Floor | 06/21/2022 | | $ | 100,000 | | | | 98,999 | |

| MEDIA: DIVERSIFIED & PRODUCTION ‐ 2.40% | | | | | | | | | |

TouchTunes Interactive Networks, Inc.(c)(d) | 3M‐L+4.75%, 1.00%, Floor | 05/28/2021 | | $ | 50,000 | | | | 50,313 | |

| TELECOMMUNICATIONS ‐ 3.54% | | | | | | | | | | |

ConvergeOne Holdings Corp.(c)(d) | 3M‐L+4.75%, 1.00%, Floor | 06/20/2024 | | $ | 75,000 | | | | 74,250 | |

| | | | | | | | | | | |

TOTAL SENIOR SECURED FIRST LIEN TERM LOANS (Cost $771,691) | | | | | | $ | 772,750 | |

See Notes to Financial Statements.

| 4 | www.sierratotalreturnfund.com |

| Sierra Total Return Fund | Schedule of Investments |

June 30, 2017

| Description | Interest Rate | Maturity | | Par Amount | | | Fair Value | |

| SENIOR SECURED SECOND LIEN TERM LOANS ‐ 2.35% | | | | | | | |

| MEDIA: ADVERTISING, PRINTING & PUBLISHING ‐ 2.35% | | | | | | | |

Imagine! Print Solutions, LLC(c) | 3M‐L+8.75%, 1.00%, Floor | 06/21/2023 | | $ | 50,000 | | | $ | 49,250 | |

| | | | | | | | | | | |

TOTAL SENIOR SECURED SECOND LIEN TERM LOANS (Cost $49,252) | | | | | | $ | 49,250 | |

| | | | | | | | | | | |

| CORPORATE BONDS ‐ 9.71% | | | | | | | | | | |

| BANKING, FINANCE, INSURANCE & REAL ESTATE ‐ 9.71% | | | | | | | | | |

| Arbor Realty Trust, Inc. | 7.38% | 05/15/2021 | | $ | 1,000 | | | $ | 25,450 | |

GMAC Capital Trust I, Series 2(a) | 6.97% | 02/15/2040 | | $ | 2,000 | | | | 52,400 | |

| JMP Group LLC | 8.00% | 01/15/2023 | | $ | 1,000 | | | | 25,450 | |

| Popular Capital Trust I | 6.70% | 11/01/2033 | | $ | 2,000 | | | | 49,000 | |

| PrivateBancorp, Inc. | 7.13% | 10/30/2042 | | $ | 2,000 | | | | 51,200 | |

| | | | | | | | | | | |

TOTAL CORPORATE BONDS (Cost $202,373) | | | | | | | | $ | 203,500 | |

| | | | | | | | | | | |

TOTAL INVESTMENTS ‐ 63.96% (Cost $1,339,411) | | | | | | | | 1,340,313 | |

US BANK MONEY MARKET CORP. TRUST ‐ 72.01% | 0.20% | | | $ | 1,509,093 | | | | 1,509,093 | |

| LIABILITIES IN EXCESS OF OTHER ASSETS ‐ (35.97)% | | | | | | | | (753,860 | ) |

| NET ASSETS ‐ 100.00% | | | | | | | $ | 2,095,546 | |

(a) | Floating or variable rate security. Interest rate disclosed is that which was in effect at June 30, 2017. |

(b) | Non-income producing security. |

(c) | Fair Value estimated using Fair Valuation Policies and Procedures adopted by the Board of Trustees. The aggregate fair value of these securities is $746,250 which represents 35.61% of net assets of the Fund. |

(d) | All or a portion of these positions have not settled as of June 30, 2017. The interest rate shown represents the stated spread over the London Interbank Offered Rate ("LIBOR" or "L") or the applicable LIBOR floor; the Fund will not accrue interest until the settlement date, at which point LIBOR will be established. See LIBOR rates as of June 30, 2017 below. |

LIBOR rates:

1M - 1 Month LIBOR, 1.22%

2M - 2 Month LIBOR, 1.25%

3M - 3 Month LIBOR, 1.30%

6M - 6 Month LIBOR, 1.45%

All of the Fund's investments are made in companies which are domiciled in the United States of America.

See Notes to Financial Statements.

| Annual Report | June 30, 2017 | 5 |

| Sierra Total Return Fund | Statement of Assets and Liabilities |

June 30, 2017

| ASSETS: | | | |

| Investments, at fair value (Cost $1,339,411) | | $ | 1,340,313 | |

| Cash and cash equivalents | | | 1,509,093 | |

| Dividend receivable | | | 3,719 | |

| Interest receivable | | | 139 | |

| Offering costs | | | 1,209,794 | |

| Prepaid expenses and other assets | | | 376 | |

| Total Assets | | | 4,063,434 | |

| | | | | |

| LIABILITIES: | | | | |

| Payable for investment securities purchased | | | 647,388 | |

| Distributions fees payable | | | 1,250 | |

| Shareholder fees payable | | | 417 | |

| Management fees payable | | | 4,684 | |

| Due to Adviser | | | 1,015,382 | |

| Accrued fund accounting and administration fees payable | | | 55,797 | |

| Accrued chief compliance officer fee payable | | | 6,444 | |

| Other payables and accrued expenses | | | 236,526 | |

| Total Liabilities | | | 1,967,888 | |

| Net Assets | | $ | 2,095,546 | |

| | | | | |

| COMPOSITION OF NET ASSETS | | | | |

| Paid‐in capital | | $ | 2,093,876 | |

| Accumulated net investment income | | | 471 | |

| Accumulated net realized gain | | | 297 | |

| Net unrealized appreciation | | | 902 | |

| Net Assets | | $ | 2,095,546 | |

| | | | | |

| PRICING OF SHARES: | | | | |

| Class T Shares | | | | |

| Net Assets | | $ | 2,095,546 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common share authorized) (Note 8) | | | 84,000 | |

| Net Asset Value and redemption price per share | | $ | 24.95 | |

| Maximum Offering Price per Share (Including Maximum Sales Load of 2.00%) | | $ | 25.46 | |

See Notes to Financial Statements.

| 6 | www.sierratotalreturnfund.com |

| Sierra Total Return Fund | Statement of Operations |

For the Period June 1, 2017 (Commencement of Operations) to June 30, 2017

| INVESTMENT INCOME: | | | |

| Dividends | | $ | 4,012 | |

| Interest | | | 312 | |

| Total Investment Income | | | 4,324 | |

| | | | | |

| EXPENSES: | | | | |

| Management fees | | | 4,684 | |

| Fund accounting and administration fees | | | 55,797 | |

| Distribution fees | | | 1,250 | |

| Shareholder servicing fees | | | 417 | |

| Organizational costs | | | 238,077 | |

| Offering costs | | | 104,416 | |

| Insurance expenses | | | 4,559 | |

| Legal and audit fees | | | 112,275 | |

| Custodian fees | | | 2,463 | |

| Chief compliance officer fee | | | 6,444 | |

| Trustees' fees and expenses | | | 13,500 | |

| Printing expenses | | | 2,400 | |

| Transfer agent fees | | | 6,153 | |

| Other expenses | | | 13,999 | |

| Total expenses before expenses support reimbursement (Note 3) | | | 566,434 | |

| Net expenses support reimbursement (Note 3) | | | (556,460 | ) |

| Net expenses | | | 9,974 | |

| Net Investment Loss | | | (5,650 | ) |

| | | | | |

| REALIZED AND UNREALIZED GAIN ON INVESTMENTS: | | | | |

| Net realized gain on: | | | | |

| Distributions from real estate investment trusts | | | 166 | |

| Distributions from other investment companies | | | 128 | |

| Net realized gain: | | | 294 | |

| Change in unrealized appreciation on: | | | | |

| Investment securities | | | 902 | |

| Net Realized and Unrealized Gain on Investments | | | 1,196 | |

| | | | | |

| Net Decrease in Net Assets | | $ | (4,454 | ) |

See Notes to Financial Statements.

| Annual Report | June 30, 2017 | 7 |

| Sierra Total Return Fund | Statement of Changes in Net Assets |

For the Period June 1, 2017 (Commencement of Operations) to June 30, 2017

| FROM OPERATIONS: | | | |

| Net investment loss | | $ | (5,650 | ) |

| Net realized gain distributions from real estate investment trusts | | | 166 | |

| Net realized gain distributions from other investment companies | | | 128 | |

| Change in unrealized appreciation | | | 902 | |

| Net Decrease in Net Assets from Operations | | | (4,454 | ) |

| | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | |

| Class T Shares | | | | |

| Proceeds from sale of shares of beneficial interest | | | 2,000,000 | |

| Net Increase from Capital Share Transactions | | | 2,000,000 | |

| Net Increase in Net Assets | | | 1,995,546 | |

| | | | | |

| NET ASSETS: | | | | |

| Beginning of period | | | 100,000 | |

End of period(a) | | $ | 2,095,546 | |

(a) Including accumulated net investment income of: | | $ | 471 | |

| | | | | |

| OTHER INFORMATION: | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | |

| Class T Shares | | | | |

| Issued | | | 80,000 | |

| Net increase in capital shares | | | 80,000 | |

See Notes to Financial Statements.

| 8 | www.sierratotalreturnfund.com |

| Sierra Total Return Fund | Financial Highlights |

For the Period June 1, 2017 (Commencement of Operations) to June 30, 2017

| For a share outstanding throughout the period presented | | | |

| OPERATING PERFORMANCE: | | | |

| Net asset value ‐ beginning of period | | $ | 25.00 | |

| INCOME/(LOSS) FROM INVESTMENT OPERATIONS: | | | | |

Net investment loss(a) | | | (0.07 | ) |

| Net realized and unrealized gain on investments | | | 0.02 | |

| Total Loss from Investment Operations | | | (0.05 | ) |

| | | | | |

| Net asset value ‐ end of period | | $ | 24.95 | |

| | | | | |

Total Investment Return ‐ Net Asset Value(b) | | | (0.20 | %)(c) |

| | | | | |

| RATIOS AND SUPPLEMENTAL DATA: | | | | |

| Net assets end of period | | $ | 2,095,546 | |

| Ratio of expenses to average net assets excluding reimbursement | | | 96.26 | %(d) |

| Ratio of expenses to average net assets including reimbursement | | | 5.98 | (d) |

| Ratio of net investment loss to average net assets | | | (3.39 | %)(d) |

| Portfolio turnover rate | | | 0 | %(c) |

(a) | Calculated using daily average shares outstanding. |

(b) | Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been reimbursed during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns shown exclude applicable sales charges. |

(d) | Expenses and net investment loss amounts used to calculate the ratios above include amounts allocated to investors of Class T Shares. An individual investor's results may vary based on a variety of factors including differing fee arrangements and the timing of capital transactions. These ratios to average net assets' have been annualized except certain non-recurring expenses, such as organization/offering costs which have not been annualized. |

See Notes to Financial Statements.

| Annual Report | June 30, 2017 | 9 |

| Sierra Total Return Fund | Notes to Financial Statements |

June 30, 2017

Sierra Total Return Fund (the “Fund”) is a Delaware statutory trust registered under the Investment Act of 1940, as amended (“1940 Act”), as a continuously offered, non‐diversified, closed‐end management investment company that operates as an interval fund. In order to operate as an interval fund, the Fund has adopted a fundamental policy to make repurchase offers for 5.00% of its outstanding shares at the net asset value (“NAV”) during each calendar quarter of each year. The Fund commenced investment operations on June 1, 2017.

The Fund currently offers Class T Shares. Class T Shares are offered at NAV plus a maximum sales load of 2.00% of the amount invested in Class T shares. Class T shares are subject to (i) a monthly shareholder services fee that will accrue at an annual rate of up to 0.25% of the average daily net assets of the Fund attributable to Class T shares; (ii) a distribution fee that will accrue at an annual rate equal to 0.75% of the average daily net assets of the Fund attributable to Class T shares; and (iii) an early withdrawal charge equal to 1.00% of the original purchase price of Class T shares repurchased by the Fund, through a quarterly repurchase offer request, during the 365 days following such shareholder’s initial purchase. Class T shares are subject to a total sales charge cap, which consists of the upfront sales load, early withdrawal charges and the ongoing distribution fee of 6.25% under FINRA Rule 2341.

The Fund’s investment adviser is STRF Advisors, LLC (the “Adviser”). The Adviser is registered with the U.S. Securities and Exchange Commission (“SEC”) as a registered investment adviser under the Investment Advisers Act of 1940, as amended. The Adviser’s registration became effective on May 12, 2016.

The investment objective of the Fund is to seek a total return through a combination of current income and long‐term capital appreciation by investing in a portfolio of debt securities and equities. The Fund expects to pursue its investment objectives by investing its assets in the debt and equities of fixed‐income and fixed‐income related securities, including real estate securities. The Fund may invest without limitation in fixed‐income and fixed‐income related securities of any industry, sector, or minimum market cap. In addition, the Fund may invest across domestic and foreign markets.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

Basis of Presentation

The Fund is considered an investment company under U.S. generally accepted accounting principles (“GAAP”) and follows the accounting and reporting guidance in the Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 946 ‐ Financial Services, Investment Companies. The accompanying financial statements have been prepared on the accrual basis of accounting in conformity with GAAP. All financial information is presented in U.S. Dollars, the functional currency of the Fund.

Organizational and Offering Costs

All costs incurred by the Fund in connection with its organization were expensed as incurred. The Adviser paid these organizational expenses on behalf of the Fund and the Fund has recorded a corresponding payable to the Adviser for the reimbursement of these expenses. Organization costs consist of costs incurred to establish the Fund and enable it legally to do business. Examples of these costs are incorporation fees, legal fees, and audit fees relating to the initial registration statement and the seed audit. Expenses that have been advanced by the Adviser are subject to recoupment under the Expense Support Agreement as described in Note 3.

Offering costs incurred by the Fund were treated as deferred charges until operations commenced on June 1, 2017 and thereafter were amortized over a twelve month period using the straight line method. Examples of these costs are legal fees pertaining to the Fund’s shares offered for sale, costs of printing prospectuses and SEC and state notice fees. As of June 30, 2017, the Fund has $1,209,794 of deferred offering expenses on the Statement of Assets and Liabilities which will be amortized over the next 11 months. The Fund has expensed $104,416, which is included in the Statement of Operations for the period ended June 30, 2017.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions related to the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of income and expenses during the period. Actual results could differ from those estimates.

Cash and Cash Equivalents

The Fund considers cash equivalents to be highly liquid investments or investments with original maturities of three months or less. Cash and cash equivalents include deposits in a money market demand deposit account. The Fund deposits its cash in a financial institution that, at times, may be in excess of the Federal Deposit Insurance Corporation insurance limits. There are no restrictions on cash. As of June 30, 2017, the Fund had a balance of $1,509,093 in money market demand deposit accounts.

| 10 | www.sierratotalreturnfund.com |

| Sierra Total Return Fund | Notes to Financial Statements |

June 30, 2017

Recent Accounting Pronouncements and Regulatory Developments

On October 13, 2016, the SEC amended Regulation S‐X, which will require standardized, enhanced disclosure about derivatives in investment company financial statements, as well as other amendments. The compliance date for the amendments to Regulation S‐X is August 1, 2017. As of June 30, 2017, Management is evaluating the impact to the financial statements and disclosures.

In March 2016, the FASB issued ASU 2016‐08, Revenue from Contracts with Customers (Topic 606): Principal versus Agent Considerations (Reporting Revenue Gross versus Net), which clarified the implementation guidance on principal versus agent considerations. In April 2016, the FASB issued ASU 2016‐10, Revenue from Contracts with Customers (Topic 606): Identifying Performance Obligations and Licensing, which clarified the implementation guidance regarding performance obligations and licensing arrangements. The new standard will become effective for the Fund on January 1, 2018, with early application permitted to the effective date of January 1, 2017. The Fund is evaluating the effect that the above referenced guidance will have on its consolidated financial statements and related disclosures. The Fund has not yet selected a transition method nor has it determined the effect of the standard on its ongoing financial reporting. The guidance does not apply to revenue associated with financial instruments, including loans and notes that are accounted for under other U.S. GAAP. As a result, the Fund does not expect the new revenue recognition guidance to have a material impact on the elements of its consolidated statements of operations, most closely associated with financial instruments, including realized gains, fees, interest and dividend income. The Fund plans to adopt the revenue recognition guidance effective July 1, 2018. The Fund’s implementation efforts include the identification of revenue within the scope of the guidance, as well as the evaluation of revenue contracts and related accounting policies. While the Fund has not yet identified any material changes in the timing of revenue recognition, the Fund’s review is ongoing, and it continues to evaluate the presentation of certain contract costs.

Loan Participations and Assignments

The Fund may invest in loan participations and assignments. The Fund considers loan participations and assignments to be investments in debt securities. Loan participations typically will result in the Fund having a contractual relationship only with the lender, not with the borrower. The Fund will have the right to receive payments of principal, interest and any fees to which it is entitled only from the lender selling the participation and only upon receipt by the lender of the payments from the borrower. Under a loan participation, the Fund generally will have no right to enforce compliance by the borrower with the terms of the loan agreement relating to the loan, nor any rights of set‐off against the borrower, and the Fund may not benefit directly from any collateral supporting the loan in which it has purchased the participation. As a result, the Fund will assume the credit risk of both the borrower and the lender that is selling the participation. In the event of the insolvency of the lender selling a participation, the Fund may be treated as a general creditor of the lender and may not benefit from any set‐off between the lender and the borrower. When the Fund purchases assignments of loans from lenders, the Fund will acquire direct rights against the borrower on the loan, except that under certain circumstances such rights may be more limited than those held by the assigning lender.

Fair Value Measurements

The Fund applies fair value accounting to all of its financial instruments in accordance with the 1940 Act and ASC Topic 820 ‐ Fair Value Measurements and Disclosures (“ASC 820”). ASC 820 defines fair value, establishes a framework used to measure fair value and requires disclosures for fair value measurements. In accordance with ASC 820, the Fund has categorized its financial instruments carried at fair value, based on the priority of the valuation technique, into a three‐level fair value hierarchy. Fair value is a market‐based measure considered from the perspective of the market participant who holds the financial instrument rather than an entity specific measure. Therefore, when market assumptions are not readily available, the Fund’s own assumptions are set to reflect those that management believes market participants would use in pricing the financial instrument at the measurement date.

Various inputs are used in determining the value of the Fund’s investments as of the reporting period end. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

Level 1 — Valuations based on quoted prices in active markets for identical assets or liabilities at the measurement date.

Level 2 — Valuations based on inputs other than quoted prices in active markets included in Level 1, which are either directly or indirectly observable at the measurement date. This category includes quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets or liabilities in non‐active markets including actionable bids from third parties for privately held assets or liabilities, and observable inputs other than quoted prices such as yield curves and forward currency rates that are entered directly into valuation models to determine the value of derivatives or other assets or liabilities.

Level 3 — Valuations based on inputs that are unobservable and where there is little, if any, market activity at the measurement date. The inputs for the determination of fair value may require significant management judgment or estimation and are based upon management’s assessment of the assumptions that market participants would use in pricing the assets or liabilities. These investments include debt and equity investments in private companies or assets valued using the Market or Income Approach and may involve pricing models whose inputs require significant judgment or estimation because of the absence of any meaningful current market data for identical or similar investments. The inputs in these valuations may include, but are not limited to, capitalization and discount rates, beta and Earnings Before Interest, Taxes, Depreciation and Amortization ("EBITDA") multiples. The information may also include pricing information or broker quotes which include a disclaimer that the broker would not be held to such a price in an actual transaction. The non‐binding nature of consensus pricing and/or quotes accompanied by disclaimer would result in classification as Level 3 information, assuming no additional corroborating evidence.

| Annual Report | June 30, 2017 | 11 |

| Sierra Total Return Fund | Notes to Financial Statements |

June 30, 2017

Investments for which market quotations are readily available are valued at such market quotations, which are generally obtained from an independent pricing service or multiple broker‐dealers or market makers. The Fund weighs the use of third‐party broker quotations, if any, in determining fair value based on management's understanding of the level of actual transactions used by the broker to develop the quote and whether the quote was an indicative price or binding offer. However, debt investments with remaining maturities within 60 days that are not credit impaired are valued at cost plus accreted discount, or minus amortized premium, which approximates fair value. Investments for which market quotations are not readily available are valued at fair value as determined by the Fund’s board of trustees based upon input from management and third party valuation firms. Because these investments are illiquid and because there may not be any directly comparable companies whose financial instruments have observable market values, these loans are valued using a fundamental valuation methodology, consistent with traditional asset pricing standards, that is objective and consistently applied across all loans and through time.

Investments in investment companies are generally determined utilizing the NAV supplied by, or on behalf of, management of each investment company, which is net of management and incentive fees or allocations charged by the investment company and is in accordance with the "practical expedient", as defined by ASC 820. NAVs received by, or on behalf of, management of each investment company are based on the fair value of the investment company's underlying investments in accordance with policies established by management of each investment company, as described in each of their financial statements and offering memorandum.

The methodologies utilized by the Fund in estimating the fair value of its investments categorized as Level 3 generally fall into the following two categories:

| • | The “Market Approach” uses prices and other relevant information generated by market transactions involving identical or comparable assets, liabilities, or a group of assets and liabilities, such as a business. |

| • | The “Income Approach” converts future amounts (for example, cash flows or income and expenses) to a single current (that is, discounted) amount. When the Income Approach is used, the fair value measurement reflects current market expectations about those future amounts. |

The Fund uses third‐party valuation firms to assist the board of trustees in the valuation of its portfolio investments. The valuation reports generated by the third‐party valuation firms consider the evaluation of financing and sale transactions with third parties, expected cash flows and market based information, including comparable transactions, performance multiples, and movement in yields of debt instruments, among other factors. Based on market data obtained from the third‐party valuation firms, the Fund uses a combined market yield analysis and an enterprise model of valuation. In applying the market yield analysis, the value of the Fund’s loans is determined based upon inputs such as the coupon rate, current market yield, interest rate spreads of similar securities, the stated value of the loan, and the length to maturity. In applying the enterprise model, the Fund uses a waterfall analysis which takes into account the specific capital structure of the borrower and the related seniority of the instruments within the borrower’s capital structure into consideration. To estimate the enterprise value of the portfolio company, the Fund weighs some or all of the traditional market valuation methods and factors based on the individual circumstances of the portfolio company in order to estimate the enterprise value. The methodologies for performing investments may be based on, among other things: valuations of comparable public companies, recent sales of private and public comparable companies, discounting the forecasted cash flows of the portfolio company, third party valuations of the portfolio company, considering offers from third parties to buy the Fund, estimating the value to potential strategic buyers and considering the value of recent investments in the equity securities of the portfolio company. For non‐performing investments, the Fund may estimate the liquidation or collateral value of the portfolio company’s assets and liabilities using an expected recovery model. The Fund may estimate the fair value of warrants based on a model such as the Black‐Scholes model or simulation models or a combination thereof.

The methodologies and information that the Fund utilizes when applying the Market Approach for performing investments include, among other things:

| • | valuations of comparable public companies (“Guideline Comparable Approach”); |

| • | recent sales of private and public comparable companies (“Guideline Comparable Approach”); |

| • | recent acquisition prices of the Fund, debt securities or equity securities (“Acquisition Price Approach”); |

| • | external valuations of the portfolio company, offers from third parties to buy the Fund (“Estimated Sales Proceeds Approach”); |

| 12 | www.sierratotalreturnfund.com |

| Sierra Total Return Fund | Notes to Financial Statements |

June 30, 2017

| • | subsequent sales made by the Fund of its investments (“Expected Sales Proceeds Approach”); and |

| • | estimating the value to potential buyers. |

The methodologies and information that the Fund utilizes when applying the Income Approach for performing investments include:

| • | discounting the forecasted cash flows of the portfolio company or securities (“Discounted Cash Flow” or “DCF” Approach); and |

| • | Black‐Scholes model or simulation models or a combination thereof (Income Approach – Option Model) with respect to the valuation of warrants. |

The Fund undertakes a multi‐step valuation process each quarter when valuing investments for which market quotations are not readily available, as described below:

| • | the Fund’s quarterly valuation process begins with each portfolio investment being initially valued by the valuation professionals; |

| • | conclusions are then documented and discussed with senior management; and |

| • | an independent valuation firm engaged by the Fund’s board of trustees prepares an independent valuation report for approximately one‐third of the portfolio investments each quarter on a rotating quarterly basis on non‐fiscal year‐end quarters, such that each of these investments will be valued by an independent valuation firm at least twice per annum when combined with the fiscal year‐end review of all the investments by independent valuation firms. |

In addition, all of the Fund’s investments are subject to the following valuation process:

| • | management reviews preliminary valuations and conducts its own independent assessment; |

| • | the audit committee of the Fund’s board of trustees reviews the preliminary valuations of senior management and independent valuation firms; and |

| • | the Fund’s board of trustees discusses valuations and determines the fair value of each investment in the Fund’s portfolio in good faith based on the input of the Adviser, the respective independent valuation firms and the audit committee. |

Due to the inherent uncertainty of determining the fair value of investments that do not have a readily available market value, the fair value of the Fund’s investments may differ significantly from the values that would have been used had a readily available market value existed for such investments, and the differences could be material.

The following is a summary of the inputs used in valuing the Fund’s investments as of June 30, 2017:

| | | Valuation Inputs | | | | |

| Investments in Securities at Fair Value | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 89,409 | | | $ | – | | | $ | – | | | $ | 89,409 | |

| Preferred Stocks | | | 225,404 | | | | – | | | | – | | | | 225,404 | |

| Senior Secured First Lien Term Loans | | | – | | | | 75,750 | | | | 697,000 | | | | 772,750 | |

| Senior Secured Second Lien Term Loans | | | – | | | | – | | | | 49,250 | | | | 49,250 | |

| Corporate Bonds | | | 203,500 | | | | – | | | | – | | | | 203,500 | |

| Total | | $ | 518,313 | | | $ | 75,750 | | | $ | 746,250 | | | $ | 1,340,313 | |

There were no transfers between Levels 1, 2 and 3 during the period ended June 30, 2017. It is the Fund’s policy to recognize transfers between levels at the end of the reporting period.

| Annual Report | June 30, 2017 | 13 |

| Sierra Total Return Fund | Notes to Financial Statements |

June 30, 2017

The following is a reconciliation of assets in which Level 3 inputs were used in determining value:

| Asset Type | | Balance as of June 1, 2017 | | | Realized Gain/ (Loss) | | | Change in Unrealized Appreciation/ (Deperciation) | | | Purchases | | | Sales Proceeds | | | Balance as of June 30, 2017 | | | Net change in unrealized appreciation/(depreciation) included in the Statements of Operations attributable to Level 3 investments held at June 30, 2017 | |

Senior Secured First

Lien Term Notes | | $ | – | | | $ | – | | | $ | (440 | ) | | $ | 697,438 | | | $ | – | | | $ | 697,000 | | | $ | (440 | ) |

Senior Secured Second

Lien Term Notes | | | – | | | | – | | | | (2 | ) | | | 49,252 | | | | – | | | | 49,250 | | | | (2 | ) |

| | | $ | – | | | $ | – | | | $ | (442 | ) | | $ | 746,690 | | | $ | – | | | $ | 746,250 | | | $ | (442 | ) |

Significant unobservable valuation inputs for material Level 3 investments as of June 30, 2017 are as follows:

| | | Fair Value at 6/30/2017 | | Valuation Technique | Unobservable Input | | Range | |

| Senior Secured First Lien Term Loans | | $ | 697,000 | | Transaction Data | Recent Arms length transactions | | | N/A | |

| Senior Secured Second Lien Term Loans | | $ | 49,250 | | Transaction Data | Recent Arms length transactions | | | N/A | |

| | | $ | 746,250 | | | | | | | |

A change to the unobservable input may result in a significant change to the value of the investment as follows:

| Unobservable Input | Impact to Value if Input Increases | Impact to Value if Input Decreases |

| Recent Arms length transactions | N/A | N/A |

Security Transactions and Investment Income

Investment security transactions are accounted for on a trade date basis. Cost is determined and gains and losses are based upon the specific identification method for both financial statement and federal income tax purposes. Dividend income is recorded on the ex‐dividend date and interest income is recorded on the accrual basis. Purchase discounts and premiums on securities are accreted and amortized over the life of the respective securities.

Federal and Other Taxes

The Fund has elected to be treated as a registered investment company ("RIC") under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”), and intends to operate in a manner so as to qualify each year for the tax treatment applicable to RICs. In order to qualify as a RIC, among other things, each year the Fund is required to meet certain source of income and asset diversification requirements and timely distribute to its shareholders at least 90% of the sum of its investment company taxable income ("ICTI"), as defined by the Code, and net tax‐ exempt interest income (which is the excess of the Fund’s gross tax‐exempt interest income over certain disallowed deductions) for each taxable year in order to be eligible for tax treatment under Subchapter M of the Code. Depending on the level of ICTI earned in a tax year, the Fund may choose to carry forward ICTI in excess of current year dividend distributions into the next tax year. Any such carryover ICTI must be distributed before the end of that next tax year through a dividend declared prior to filing the final tax return related to the year which generated such ICTI. The Fund intends to qualify as a RIC, and, if so qualified, will not be liable for federal income taxes to the extent earnings are distributed to shareholders on a timely basis.

The Fund accounts for income taxes in conformity with ASC Topic 740 ‐ Income Taxes (“ASC 740”). ASC 740 provides guidelines for how uncertain tax positions should be recognized, measured, presented and disclosed in financial statements. ASC 740 requires the evaluation of tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether the tax positions are “more‐likely‐than‐not” to be sustained by the applicable tax authority. Tax positions deemed to meet the “more‐likely‐than‐not” threshold would be recorded as a tax benefit or expense. For the period ended June 30, 2017, there were no interest or penalties due to uncertain income tax positions.

No provision for income taxes is included in the accompanying financial statements, as the Fund intends to distribute to shareholders all taxable investment income and realized gains and otherwise comply with Subchapter M of the Code applicable to RICs.

As of June 30, 2017, the Fund did not have a liability for any unrecognized tax benefits. The Fund files U.S. federal, state and local tax returns as required. The Fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations which is generally three years after the filing of the tax return for federal purposes and four years for most state returns. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes.

| 14 | www.sierratotalreturnfund.com |

| Sierra Total Return Fund | Notes to Financial Statements |

Distributions to Shareholders

Distributions from investment income, if any, are declared and paid quarterly. Distributions from net realized capital gains, if any, are declared and paid annually and are recorded on the ex‐dividend date. The character of income and gains to be distributed is determined in accordance with income tax regulations, which may differ from GAAP. The Fund did not pay any distributions during the period ending June 30, 2017.

Fair Value of Other Financial Instruments

The carrying amounts of certain of the Fund’s financial instruments, including cash and cash equivalents and accounts payable and accrued expenses, approximate fair value due to their short‐term nature.

Indemnification

The Fund expects to indemnify its officers and trustees for certain liabilities that may arise from the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties which provide general indemnities. The Fund has had no material claims or payments pursuant to such agreements. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, the Fund expects the risk of loss due to these warranties and indemnities to be remote.

3. MANAGEMENT FEES AND OTHER RELATED PARTY TRANSACTIONS

Management Fee

The Fund’s management fee is calculated and payable monthly in arrears at the annual rate of 1.50% of the Fund’s average daily total assets during such period. No management fees were incurred until the Fund commenced operations. For the period ended June 30, 2017, the Fund incurred $4,684 of management fees.

Incentive Fee

The Fund’s incentive fee is calculated and payable quarterly in arrears in an amount equal to 15% of the Fund’s “pre‐incentive fee net investment income” for the immediately preceding quarter, and is subject to a hurdle rate, expressed as a rate of return on the Fund’s “adjusted capital,” equal to 1.50% per quarter, subject to a “catch‐up” feature, which allows the Adviser to recover foregone incentive fees that were previously limited by the hurdle rate. Any incentive fees will be accrued and tracked on a daily basis. For this purpose, “pre‐incentive fee net investment income” means interest income, dividend income and any other income accrued during the calendar quarter, minus the Fund’s operating expenses for the quarter (including the management fee, expenses reimbursed to the Adviser and any interest expenses and distributions paid on any issued and outstanding preferred shares, but excluding the incentive fee). Pre‐incentive fee net investment income includes, in the case of investments with a deferred interest feature (such as original issue discount, debt instruments with paid‐in‐kind interest and zero coupon securities), accrued income that the Fund has not yet received in cash. Pre‐incentive fee net investment income does not include any realized capital gains, realized capital losses or unrealized capital appreciation or depreciation. “Adjusted capital” means the cumulative gross proceeds received by the Fund from the sale of shares (including pursuant to the Fund’s distribution reinvestment plan), reduced by amounts paid in connection with purchases of shares pursuant to the Fund’s fundamental policy to make repurchase offers. No incentive fees were collected during the period ended June 30, 2017.

Expense Support Agreement

The Fund entered into an Expense Support and Reimbursement Agreement, (the “Expense Support Agreement”), with the Adviser.

The Adviser has agreed to reimburse the Fund for expenses the Fund incurs for the purpose of limiting the Fund’s payment of certain operating expenses (exclusive of any taxes, interest, brokerage commissions, acquired fund fees and expenses, incentive fees, shareholder services expenses, annual dealer manager fees, distribution fees and extraordinary expenses, such as litigation or reorganization costs, but inclusive of organizational costs and offering costs) in any fiscal year to 2.66% per annum of the Fund’s average daily gross assets attributable to each of Class A, Class T, Class I, Class S, and Class L shares (the “Operational Expense Limit”). The Adviser will be eligible to recoup expense support payments it previously made, both during the term of the Expense Support Agreement and upon its termination by the Board, within the three years following the period in which the expenses occurred, and the Adviser will recoup an amount from the Fund to the extent the amount recouped does not cause the Fund’s average daily gross assets with respect to the respective Class A, Class T, Class I, Class S, and Class L shares in the period of recoupment to exceed the lesser of the Operational Expense Limit in effect at the time the Expense Support Payment was made in that period or the Operational Expense Limit in effect at such time the Adviser seeks recoupment. The initial term of the Expense Support Agreement was for twelve months, beginning as of the effective date of the Fund’s registration statement, November 9, 2016. The Adviser and the Fund have agreed to extend the term of the Expense Support Agreement through July 25, 2018. The Board of Trustees may terminate the Expense Support Agreement at any time, and there can be no assurance that the Adviser will renew the Expense Support Agreement after July 25, 2018 noted above. As of June 30, 2017, the amount of recoverable by the Adviser under the Expense Support Agreement was $556,460 which is available to be recouped by the Adviser until June 30, 2020.

| Annual Report | June 30, 2017 | 15 |

| Sierra Total Return Fund | Notes to Financial Statements |

June 30, 2017

Administration

The Fund entered into an administration agreement (“Administration Agreement”) with Medley Capital LLC, (“Medley”), an affiliate of the Adviser, whereby Medley provides administrative services necessary to conduct the Fund’s day‐to‐day operations. Such services will include providing office facilities and equipment, clerical, bookkeeping, accounting and recordkeeping services, legal services, and all such other services as deemed necessary by the Fund. The Fund will reimburse Medley for any such costs and expenses which have been paid by Medley on behalf of the Fund as set forth in the Administration Agreement. The Fund incurred $55,797 of administrative expenses from Medley for the period ended June 30, 2017, $55,797 of which was payable as of June 30, 2017.

Sub‐Administration

Medley entered into a sub‐administration agreement with ALPS Fund Services, Inc. (“ALPS”) to serve as sub‐administrator and fund accounting agent for the Fund. ALPS will provide certain administrative and bookkeeping services to Medley for the benefit of the Fund.

Distributor and Transfer Agent

ALPS Distributor, Inc., (the “Distributor”) an affiliate of ALPS, serves as the Fund’s principal underwriter within the meaning of the 1940 Act, and acts as the distributor of the Fund’s shares on a best efforts basis, subject to various conditions. The Distributor acts as the Fund’s principal underwriter in a continuous public offering of the Fund’s shares. During the period ended June 30, 2017, no fees were retained by the Distributor.

The Board has adopted, on behalf of the Fund, a Shareholder Services Plan under which the Fund may compensate financial industry professionals for providing ongoing services in respect of clients with whom they have distributed shares of the Fund. Under the Shareholder Servicing Plan, the Fund’s Class T shares are subject to a shareholder services fee at an annual rate of 0.25% of the average daily net assets attributable to Class T shares. For the period ended June 30, 2017, the Fund incurred shareholder services fees of $417. Class T shares are subject to distribution fee that accrues at an annual rate equal to 0.75% of the Fund’s average daily net assets attributable to Class T shares and is payable on a quarterly basis. For the period ended June 30, 2017, the Fund accrued $1,250 in distribution fees.

DST Systems, Inc. ("DST"), the parent company of ALPS, serves as the transfer agent to the Fund. Under the Transfer Agency Agreement, DST is responsible for maintaining all shareholder records of the Fund.

Trustees

Each trustee who is not an “interested person” of the Fund or the Adviser as defined in Section 2(a)(19) of the 1940 Act (the “Independent Trustees”) receives an annual fee of $2,500. Independent Trustees also receive $2,000 ($500 for each telephonic board or committee meeting) plus reimbursement of reasonable out‐of‐pocket expenses incurred in connection with attending each in‐person board or committee meeting. None of the interested trustees receive compensation from the Fund. The Fund incurred $13,500 of trustees fees for the period ended June 30, 2017.

4. INVESTMENT TRANSACTIONS

The cost of purchases and proceeds from the sale of securities, other than short‐term securities, for the period ended June 30, 2017 amounted to $1,339,411 and $0, respectively.

5. TAX BASIS INFORMATION

For the period ended June 30, 2017, the following reclassifications, which had no impact on results of operations or net assets, were recorded to reflect tax character.

| | Decrease

Paid-in capital | | | Increase

Accumulated

net investment

income | | | Increase

Accumulated

net realized loss

on investments | |

| | $ | (6,124 | ) | | $ | 6,121 | | | $ | 3 | |

| 16 | www.sierratotalreturnfund.com |

| Sierra Total Return Fund | Notes to Financial Statements |

As of June 30, 2017, the components of accumulated earnings/(deficit) on a tax basis were as follows:

| Accumulated net investment income | | $ | 832 | |

| Accumulated net realized gain | | | 294 | |

| Net unrealized appreciation | | | 905 | |

| Other cumulative effect of timing differences | | | (361 | ) |

| Total | | $ | 1,670 | |

The following information is computed on a tax basis for each item as of June 30, 2017: | | | | |

| Cost of investments for income tax purposes (excluding money market investments) | | $ | 1,339,408 | |

| Gross appreciation (excess of value over tax cost) | | $ | 3,864 | |

| Gross depreciation (excess of tax cost over value) | | | (2,959 | ) |

| Net unrealized appreciation | | $ | 905 | |

The difference between book basis and tax basis distributable earnings and unrealized appreciation/(depreciation) is primarily attributable to the tax treatment of organizational costs and certain other investments.

There were no distributions paid during the period ended June 30, 2017.

6. REPURCHASE OFFERS

Once each quarter, pursuant to Rule 23c‐3 under the 1940 Act, the Fund intends to offer to repurchase at NAV no less than 5% of its outstanding shares as of the close of regular business hours on the New York Stock Exchange on the Repurchase Pricing Date pursuant to a fundamental policy. There can be no assurance that the Fund will be able to repurchase all shares that each shareholder has tendered, even if all the shares in a shareholder's account are tendered. If shareholders tender for repurchase more than the repurchase offer amount for a given repurchase offer, the Fund will repurchase the shares on a pro rata basis. However, the Fund may accept all shares tendered for repurchase by shareholders who own less than one hundred shares and who tender all of their shares, before prorating other amounts tendered. During the period ended June 30, 2017, the Fund made no quarterly repurchase offers.

7. BENEFICIAL OWNERSHIP

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of the fund, under Section 2(a)(9) of the 1940 Act. As of June 30, 2017, the Adviser is the beneficial owner of more than 25% of the voting securities and controls the Fund. Control Investments are defined by the 1940 Act as investments in companies in which the Company owns more than 25% of the voting securities or maintains greater than 50% of the board representation.

8. CAPITAL TRANSACTIONS

On August 10, 2016, the Adviser purchased 10,000 Class T shares for an aggregate purchase price of $100,000. On November 4, 2016, the Board approved a reverse split of beneficial interests in the Class T shares that resulted in a NAV of $25.00 per Class T share. As a result, the number of Class T shares owned by the Adviser was reduced from 10,000 to 4,000, effective as of November 4, 2016. On June 1, 2017, an affiliate of the Adviser purchased 80,000 Class T shares of beneficial interest for an aggregate purchase price of $2,000,000.

9. SUBSEQUENT EVENTS

Subsequent events after the date of the Statement of Assets and Liabilities have been evaluated through the date the financial statements were issued.

The Fund has filed and declared effective by the SEC, on July 25, 2017, a registration statement on Form N‐2 pursuant to which it has registered, and may issue Class A, Class T, Class I, Class L, and Class S shares in accordance with the terms of the exemptive order received from the SEC on June 6, 2017.

| Annual Report | June 30, 2017 | 17 |

Report of Independent Registered Public Accounting Firm

The Board of Trustees and Shareholders of

Sierra Total Return Fund

We have audited the accompanying statement of assets and liabilities of Sierra Total Return Fund (the “Fund”), including the schedule of investments, as of June 30, 2017, and the related statements of operations and changes in net assets and the financial highlights for the period from June 1, 2017 (commencement of operations) to June 30, 2017. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Fund’s internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of June 30, 2017, by correspondence with the custodian, brokers, directly with designees of the portfolio companies and debt agents, as applicable, or by other appropriate auditing procedures where replies were not received. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Sierra Total Return Fund at June 30, 2017, the results of its operations and the changes in its net assets and the financial highlights for the period from June 1, 2017 (commencement of operations) to June 30, 2017 in conformity with U.S. generally accepted accounting principles.

New York, NY

August 28, 2017

| 18 | www.sierratotalreturnfund.com |

| Sierra Total Return Fund | Additional Information |

1. PROXY VOTING POLICIES AND VOTING RECORD

The Board has adopted the Adviser’s Proxy Voting Policies and Procedures (“Policies”) on behalf of the Fund, which delegate the responsibility for voting proxies to the Adviser, subject to the Board’s continuing oversight. A description of, or a copy of, the Policies is available without charge, upon request, by calling the Fund toll‐free at 1‐888‐292‐3178, or on the SEC’s website at http://www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12‐month period ended June 30, 2017 is available without charge upon request by calling toll‐free 1‐888‐292‐3178, or on the SEC’s website at http://www.sec.gov.

2. QUARTERLY PORTFOLIO HOLDINGS

The Fund files a complete listing of portfolio holdings for the Fund with the SEC as of the first and third quarters of each fiscal year on Form N‐Q. The filings are available upon request by calling 1‐888‐292‐3178. Furthermore, you may obtain a copy of the filing on the SEC’s website at http://www.sec.gov. The Fund’s Form N‐Q may also be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C., and information on the operation of the Public Reference Room may be obtained by calling 1‐800‐SEC‐0330.

3. APPROVAL OF THE INVESTMENT MANAGEMENT AGREEMENT

The Board determined at a meeting held on August 18, 2016 to approve the Investment Management Agreement. In its consideration of the approval of the Investment Management Agreement, the Board considered information it had received relating to, among other things:

| • | the nature, quality and extent of the advisory and other services to be provided to the Fund by the Adviser; |

| • | the investment performance of individuals affiliated with the Fund and the Adviser; |

| • | comparative data with respect to advisory fees or similar expenses paid by other non‐traded closed‐end funds with similar investment objectives; |

| • | the Fund’s projected operating expenses and expense ratio compared to non‐traded closed‐end funds with similar investment objectives; |

| • | any existing and potential sources of indirect income to the Adviser from its relationships with the Fund and the profitability of those relationships; |

| • | information about the services to be performed and the personnel performing such services under the Investment Management Agreement; |

| • | the organizational capability and financial condition of the Adviser and its affiliates; |

| • | the Adviser’s practices regarding the selection and compensation of brokers that may execute portfolio transactions for the Fund and the brokers’ provision of brokerage and research services to the Adviser; and |

| • | the possibility of obtaining similar services from other third‐party service providers or through an internally managed structure. |

Based on the information reviewed and related discussions, the Board concluded that fees payable to the Adviser pursuant to the Investment Management Agreement were reasonable in relation to the services to be provided. The Board did not assign relative weights to the above factors or the other factors considered by it. In addition, the Board did not reach any specific conclusion on each factor considered, but conducted an overall analysis of these factors.

| Annual Report | June 30, 2017 | 19 |

| Sierra Total Return Fund | Trustees & Officers |

June 30, 2017

INDEPENDENT TRUSTEES

Name, Address(1)

and Age | Position/Term

of Office(2) | Principal Occupation

During the Past Five Years | Number of

Portfolios in

Fund Complex

Overseen

by Trustee | Other

Directorships

held by Trustee

During Last

5 Years |

Jonathan Gregory Coules

Age: 47 | Trustee since

2016 | Jonathan Gregory Coules has served on the Board of Trustees since its inception in 2016. Mr. Coules has also served as the President and Founder of JG Coules Advisors, a retained search firm which specializes in placements of senior level hedge fund, asset management and family office professionals, since its inception in March 2012. He also has experience as a retained strategic advisor, helping investment managers consider growth strategies, crisis management and related personnel decisions. Mr. Coules was previously a Managing Director at Hunter Advisors, a global retained search firm, where he focused on the Hedge Fund and Asset Management practice and led the Family Office practice, from 2008 to 2011, and a portfolio manager at Brencourt Advisors, a multi‐billion dollar, multi‐strategy hedge fund, from 2007 to 2008. Mr. Coules was also a portfolio manager at Metropolitan Capital Advisors, an event‐driven hedge fund from 2004 to 2007. Mr. Coules is also a member of the Visiting Committee of the University of Chicago Law School, a founding Advisory Board member of The Family Office Association and a Senior Advisor to a major private family foundation focused on projects in the United States and Israel. Mr. Coules began his investment career as a research analyst at Morgan Stanley, where in 2002 he led the Broadcasting, Printing and Publishing team to a #1 ranking in Institutional Investor Magazine. Mr. Coules received a BA from the University of Chicago, an MBA from Harvard Business School and a JD from the University of Chicago Law School. | 1 | N/A |

John Hathway Dyett Age: 47 | Trustee since 2016 | John Hathway Dyett has served on the Board of Trustees since its inception in 2016. Mr. Dyett has also served as the Co‐CEO of Salem Partners Wealth Management, LLC since 2004 and the Co‐CEO of Salem Partners, LLC, an investment banking firm, since 1997. Mr. Dyett also serves on the Board of Directors of Femasys, Inc. and as an advisor to Akashi Therapeutics. Mr. Dyett was previously a banker with Gerard Klauer Mattison & Co., Inc. and Needham and Co., Inc. Mr. Dyett also serves on the Board of Trustees of Middlesex School in Concord. Mr. Dyett received a BA from Harvard University. | 1 | 1 |

Anthony E. Gellert Age: 48 | Trustee since 2016 | Anthony E. Gellert has served on the Board of Trustees since its inception in 2016. Mr. Gellert has also served as Managing Member of the General Partner and Chief Financial Officer of Livingston Capital Fund, a hedge fund and public securities firm, since February 2001 and Managing Member of Livingston Capital Ventures, an angel investing fund, since July 2015. He previously served as a junior investment banker at Lazard Frères and Wertheim Schroder & Co. Mr. Gellert also serves as the Treasurer of the Harvard Business School Alumni Angels of Greater New York, a non‐profit angel organization affiliated with The Harvard Business School Club of New York. Mr. Gellert received a BA from Harvard University and an MBA from Harvard Business School. | 1 | N/A |

| 20 | www.sierratotalreturnfund.com |

| Sierra Total Return Fund | Trustees & Officers |

INTERESTED TRUSTEES AND OFFICERS

Name, Address(1)

and Year of Birth | Position/Term

Of Office(2) | Principal Occupation

During the Past Five Years | Number of Portfolios in Fund Complex Overseen by Trustee | Other Directorships held by Trustee During Last 5 Years |

Seth Taube (3) Age: 47 | Trustee, Chairman of the Board and Chief Executive officer since 2016 | Seth Taube has served as Chief Executive Officer and Chairman of the Board of Trustees of the Fund since its inception in 2016. He also co‐ founded Medley in 2006 and has served as Medley’s Co‐Chief Executive Officer since then and as Co‐Chairman of the Board of Directors of Medley Management Inc. since its formation. He has also served as Chief Executive Officer and Chairman of the Board of Directors of Sierra Income Corporation since its inception in 2012 and on the Board of Directors of Medley Capital Corporation since its inception in 2011. Mr. Taube previously worked with Tiger Management and held positions with Morgan Stanley & Co. in the Investment Banking and Institutional Equity Divisions. Mr. Taube received a BA from Harvard University, an M. Litt. in Economics from St. Andrew’s University in Great Britain, where he was a Rotary Foundation Fellow, and an MBA from the Wharton School at the University of Pennsylvania. | 1 | 3 |

Brook Taube(3) Age: 47 | Trustee since 2016 | Brook Taube has served on the Board of Trustees of the Fund since its inception in 2016. He also co‐founded Medley in 2006 and has served as Medley’s Co‐Chief Executive Officer since then and as Co‐Chairman of the Board of Directors of Medley Management Inc. since its formation. He has also served as Chief Executive Officer and Chairman of the Board of Directors of Medley Capital Corporation since 2011 and has served on the Board of Directors of Sierra Income Corporation since its inception in 2012. Mr. Taube began his career at Bankers Trust in leveraged finance in 1992. Mr. Taube received a BA from Harvard University. | 1 | 3 |

Jeffrey Tonkel Age: 46 | President since 2016 | Jeffrey Tonkel has served as President of the Fund since its inception in 2016. He joined Medley in 2011 and has served as President and as a member of the Board of Directors of Medley Management Inc. since its formation. He has also served as President of Sierra Income Corporation since July 2013 and as a member of the Board of Directors of Medley Capital Corporation since February 2014. Prior to joining Medley, Mr. Tonkel was a Managing Director with JPMorgan from January 2010 to November 2011, where he was Chief Financial Officer of a global financing and markets business. Prior to JPMorgan, Mr. Tonkel was a Managing Director, Principal Investments, with Friedman Billings Ramsey, where he focused on merchant banking and corporate development investments. Mr. Tonkel began his investment career with Summit Partners. Mr. Tonkel received a BA from Harvard University and an MBA from Harvard Business School. | N/A | 2 |

| Annual Report | June 30, 2017 | 21 |

| Sierra Total Return Fund | Trustees & Officers |

June 30, 2017

Name, Address(1) and Year of Birth | Position/Term Of Office(2) | Principal Occupation During the Past Five Years | Number of Portfolios in Fund Complex Overseen by Trustee | Other Directorships held by Trustee During Last 5 Years |

Christopher M. Mathieu

Age: 52 | Chief Financial Officer, Treasurer and Secretary since 2016 | Christopher M. Mathieu has served as the Chief Financial Officer, Treasurer and Secretary of the Fund since November 2016. He also has served as Managing Director of Medley Management Inc. since September 2016 and Chief Financial Officer, Treasurer and Secretary of Sierra Income Corporation since November 2016. Mr. Mathieu was previously a Senior Vice President, Chief Financial Officer and Treasurer of Horizon Technology Finance Corporation from 2010 until 2016. He also served as Senior Vice President and Chief Financial Officer of Horizon Technology Finance, LLC and Horizon Technology Finance Management LLC from 2003 until 2016. Before joining Horizon, Mr. Mathieu was a Vice president at GATX Ventures, Inc. from 2000 until 2003. From 1996 until 2000, Mr. Mathieu was a Vice President at Transamerica Technology Finance. Prior to Transamerica, Mr. Mathieu was a Vice President at Financing for Science International, Inc. Mr. Mathieu began his career with KPMG Peat Marwick from 1987 until 1993 where he audited financial service and middle market sectors including banks and commercial finance companies. Mr. Mathieu is a Certified Public Accountant in Connecticut and received a BS in Business Administration and Accounting from Western New England College. | N/A | N/A |

John D. Fredericks

Age: 53 | Chief Compliance Officer since 2016 | John D. Fredericks has served as Chief Compliance Officer of the Fund since its inception in 2016. He has served as Medley’s General Counsel since June 2013. Mr. Fredericks has also served as the Chief Compliance Officer of Medley Capital Corporation and Sierra Income Corporation since February 2014. Prior to joining Medley, Mr. Fredericks was a partner with Winston & Strawn, LLP from February 2003 to May 2013, where he was a member of the firm’s restructuring and insolvency and corporate lending groups. Before joining Winston & Strawn, LLP, from 2000 to 2003, Mr. Fredericks was a partner with Murphy Sheneman Julian & Rogers and, from 1993 to 2000, an associate at Murphy, Weir & Butler. Mr. Fredericks was admitted to the California State Bar in 1993. Mr. Fredericks received a B.A. from the University of California Santa Cruz and a JD from University of San Francisco. | N/A | N/A |

(1) | The address of each Trustee and Officer is c/o Sierra Total Return Fund, 280 Park Ave, 6th Floor East, New York, NY 10017. |

(2) | The term of office for each Trustee and Officer listed above will continue indefinitely. |

(3) | Seth Taube and Brook Taube are brothers. |

| 22 | www.sierratotalreturnfund.com |

This Page Intentionally Left Blank

Must be accompanied or preceded by a Prospectus.

ALPS Distributors, Inc. is the Distributor for the Sierra Total Return Fund.

Item 2. Code of Ethics.

| (a) | As of the end of the period covered by this report, the registrant has adopted a code of ethics that applies to the registrant's principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party. |

| (c) | During the period covered by this report, there have not been any amendments to the provisions of the code of ethics referred to in Item 2(a) of this report. |

| (d) | During the period covered by this report, the registrant had not granted any waivers, including an implicit waiver, from the provisions of the code of ethics referred to in Item 2(a) of this report. |

| (f) | The registrant’s Code of Ethics is attached as an Exhibit herewith. |

Item 3. Audit Committee Financial Expert.

| (a)(1)(ii) | The Board of Trustees of the registrant has determined that the registrant has at least one audit committee financial expert serving on its audit committee. |

| (a)(2) | The Board of Trustees of the registrant has designated Mr. John Hathaway Dyett as the registrant’s audit committee financial expert. Mr. Dyett is “independent” as defined in paragraph (a)(2) of Item 3 to Form N-CSR. |

Item 4. Principal Accountant Fees and Services.