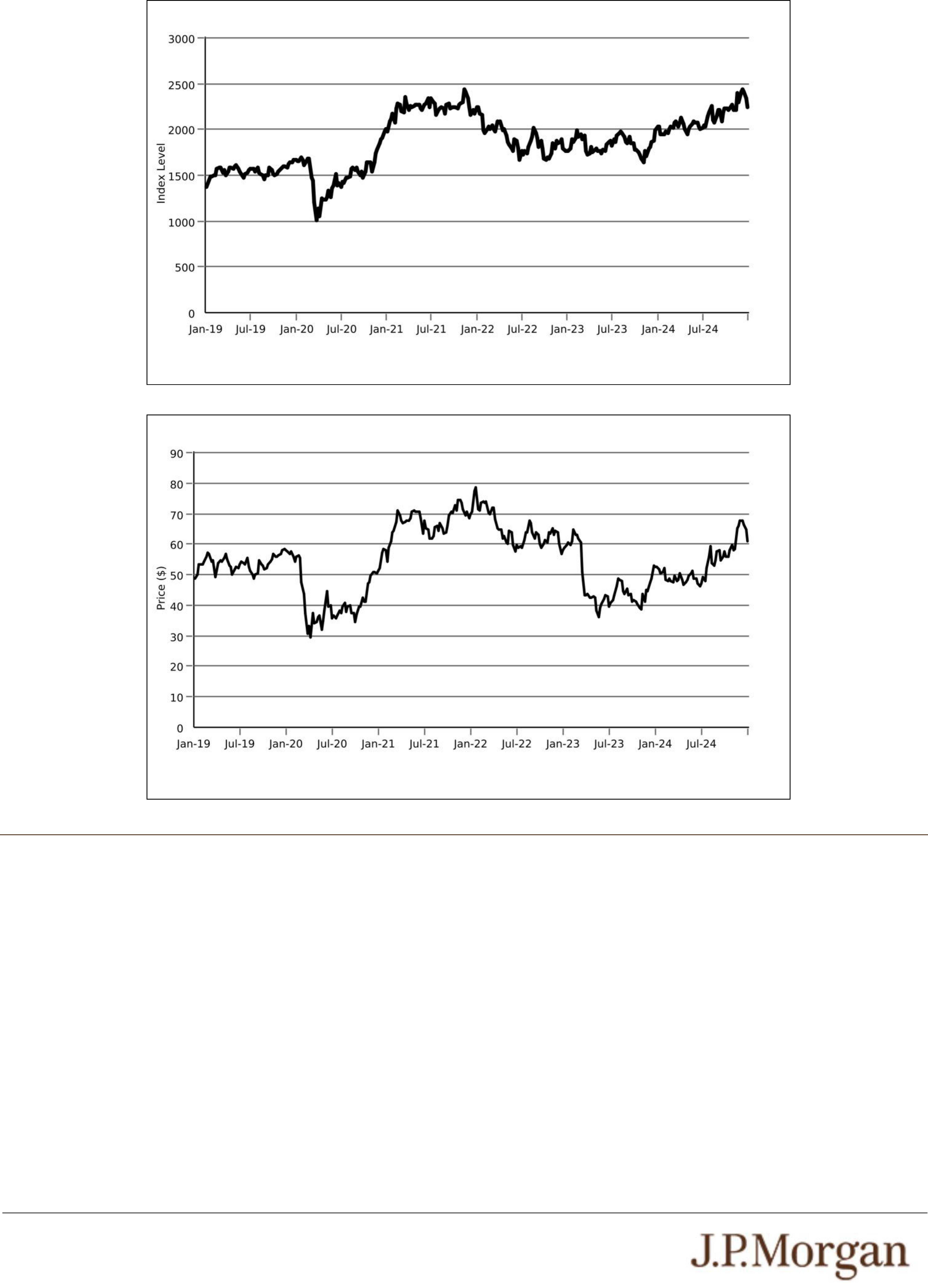

● THE PERFORMANCE AND MARKET VALUE OF THE FUND, PARTICULARLY DURING PERIODS OF MARKET VOLATILITY,

MAY NOT CORRELATE WITH THE PERFORMANCE OF THE FUND’S UNDERLYING INDEX AS WELL AS THE NET ASSET

VALUE PER SHARE —

The Fund does not fully replicate its Underlying Index (as defined under “The Underlyings” below) and may hold securities different

from those included in its Underlying Index. In addition, the performance of the Fund will reflect additional transaction costs and

fees that are not included in the calculation of its Underlying Index. All of these factors may lead to a lack of correlation between

the performance of the Fund and its Underlying Index. In addition, corporate actions with respect to the equity securities underlying

the Fund (such as mergers and spin-offs) may impact the variance between the performances of the Fund and its Underlying

Index. Finally, because the shares of the Fund are traded on a securities exchange and are subject to market supply and investor

demand, the market value of one share of the Fund may differ from the net asset value per share of the Fund.

During periods of market volatility, securities underlying the Fund may be unavailable in the secondary market, market participants

may be unable to calculate accurately the net asset value per share of the Fund and the liquidity of the Fund may be adversely

affected. This kind of market volatility may also disrupt the ability of market participants to create and redeem shares of the Fund.

Further, market volatility may adversely affect, sometimes materially, the prices at which market participants are willing to buy and

sell shares of the Fund. As a result, under these circumstances, the market value of shares of the Fund may vary substantially from

the net asset value per share of the Fund. For all of the foregoing reasons, the performance of the Fund may not correlate with the

performance of its Underlying Index as well as the net asset value per share of the Fund, which could materially and adversely

affect the value of the notes in the secondary market and/or reduce any payment on the notes.

● AN INVESTMENT IN THE NOTES IS SUBJECT TO RISKS ASSOCIATED WITH SMALL CAPITALIZATION STOCKS WITH

RESPECT TO THE RUSSELL 2000® INDEX —

Small capitalization companies may be less able to withstand adverse economic, market, trade and competitive conditions relative

to larger companies. Small capitalization companies are less likely to pay dividends on their stocks, and the presence of a dividend

payment could be a factor that limits downward stock price pressure under adverse market conditions.

● NON-U.S. SECURITIES RISK WITH RESPECT TO THE NASDAQ-100® TECHNOLOGY SECTOR INDEXSM —

The non-U.S. equity securities included in the Nasdaq-100® Technology Sector IndexSM have been issued by non-U.S. companies.

Investments in securities linked to the value of such non-U.S. equity securities involve risks associated with the home countries

and/or the securities markets in the home countries of the issuers of those non-U.S. equity securities. Also, with respect to equity

securities that are not listed in the U.S., there is generally less publicly available information about companies in some of these

jurisdictions than there is about U.S. companies that are subject to the reporting requirements of the SEC.

● RISKS ASSOCIATED WITH THE BANKING INDUSTRY WITH RESPECT TO THE FUND —

All or substantially all of the equity securities held by the Fund are issued by companies whose primary line of business is directly

associated with the banking industry. As a result, the value of the notes may be subject to greater volatility and be more adversely

affected by a single economic, political or regulatory occurrence affecting this industry than a different investment linked to

securities of a more broadly diversified group of issuers. The performance of bank stocks may be affected by extensive

governmental regulation, which may limit both the amounts and types of loans and other financial commitments they can make, the

interest rates and fees they can charge and the amount of capital they must maintain. Profitability is largely dependent on the

availability and cost of capital funds and can fluctuate significantly when interest rates change. Credit losses resulting from financial

difficulties of borrowers can negatively impact the banking companies. Banks may also be subject to severe price competition.

Competition is high among banking companies and failure to maintain or increase market share may result in lost market share.

These factors could affect the banking industry and could affect the value of the equity securities held by the Fund and the price of

the Fund during the term of the notes, which may adversely affect the value of your notes.

● RISKS ASSOCIATED WITH THE TECHNOLOGY SECTOR WITH RESPECT TO THE NASDAQ-100® TECHNOLOGY SECTOR

INDEXSM —

All or substantially all of the equity securities included in the Nasdaq-100® Technology Sector IndexSM are issued by companies

whose primary line of business is directly associated with the technology sector. As a result, the value of the notes may be subject

to greater volatility and be more adversely affected by a single economic, political or regulatory occurrence affecting this sector

than a different investment linked to securities of a more broadly diversified group of issuers. The value of stocks of technology

companies and companies that rely heavily on technology is particularly vulnerable to rapid changes in technology product cycles,

rapid product obsolescence, government regulation and competition, both domestically and internationally, including competition

from foreign competitors with lower production costs. Stocks of technology companies and companies that rely heavily on

technology, especially those of smaller, less-seasoned companies, tend to be more volatile than the overall market. Technology

companies are heavily dependent on patent and intellectual property rights, the loss or impairment of which may adversely affect

profitability. Additionally, companies in the technology sector may face dramatic and often unpredictable changes in growth rates

and competition for the services of qualified personnel. These factors could affect the technology sector and could affect the value

of the equity securities included in the Nasdaq-100® Technology Sector IndexSM and the level of the Nasdaq-100® Technology

Sector IndexSM during the term of the notes, which may adversely affect the value of your notes.

● YOU ARE EXPOSED TO THE RISK OF DECLINE IN THE VALUE OF EACH UNDERLYING —

Payments on the notes are not linked to a basket composed of the Underlyings and are contingent upon the performance of each

individual Underlying. Poor performance by any of the Underlyings over the term of the notes may negatively affect whether you

will receive a Contingent Interest Payment on any Interest Payment Date and your payment at maturity and will not be offset or

mitigated by positive performance by any other Underlying.

● YOUR PAYMENT AT MATURITY WILL BE DETERMINED BY THE LEAST PERFORMING UNDERLYING.

● THE BENEFIT PROVIDED BY THE TRIGGER VALUE MAY TERMINATE ON THE FINAL REVIEW DATE —

If the Final Value of any Underlying is less than its Trigger Value and the notes have not been redeemed early, the benefit provided

by the Trigger Value will terminate and you will be fully exposed to any depreciation of the Least Performing Underlying.