PS-1 | Structured Investments

Callable Contingent Interest Notes Linked to the Least Performing of the

Russell 2000

®

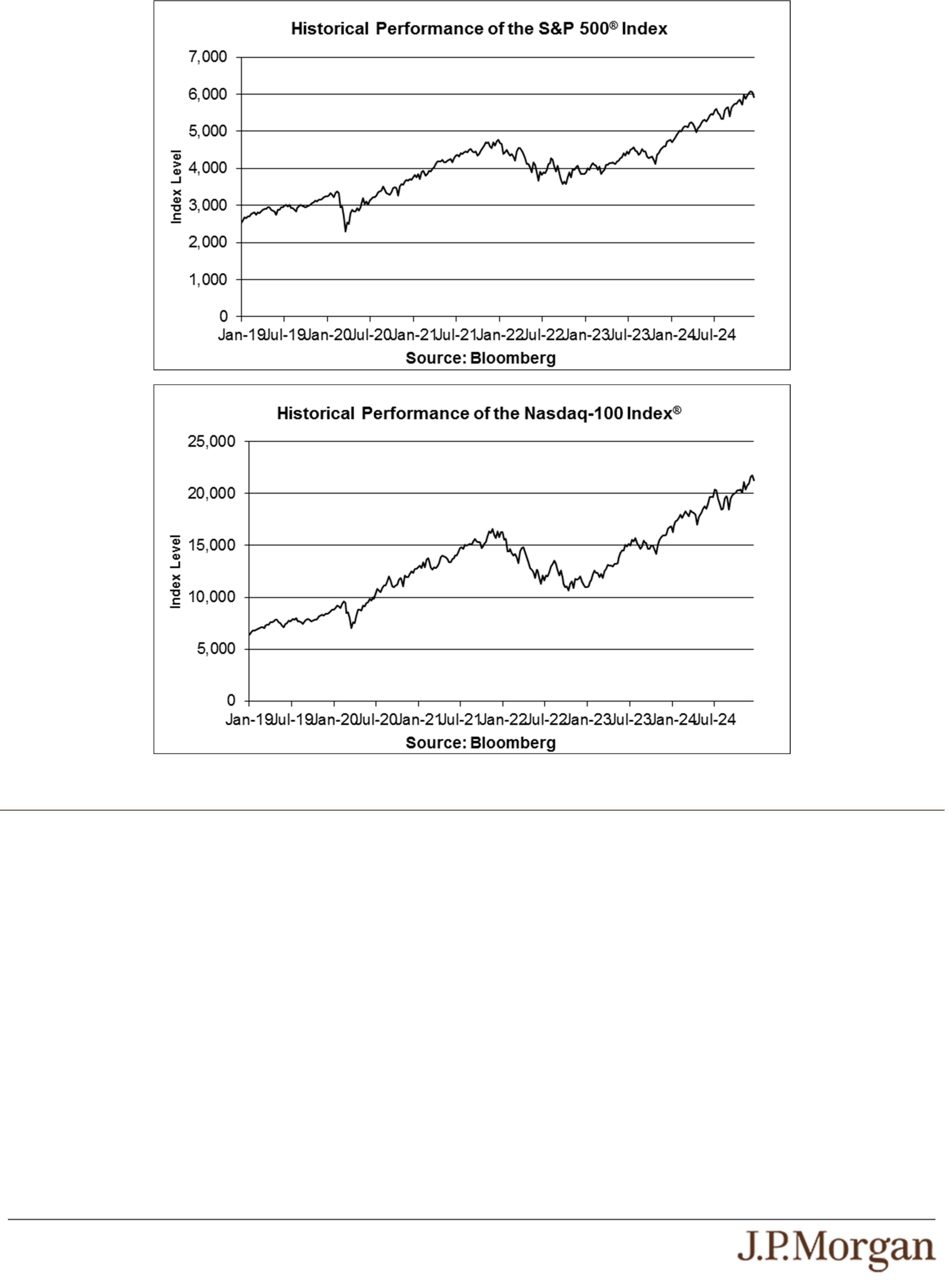

Index, the S&P 500

®

Index and the Nasdaq-100 Index

®

Key Terms

Issuer: JPMorgan Chase Financial Company LLC, a direct,

wholly owned finance subsidiary of JPMorgan Chase & Co.

Guarantor: JPMorgan Chase & Co.

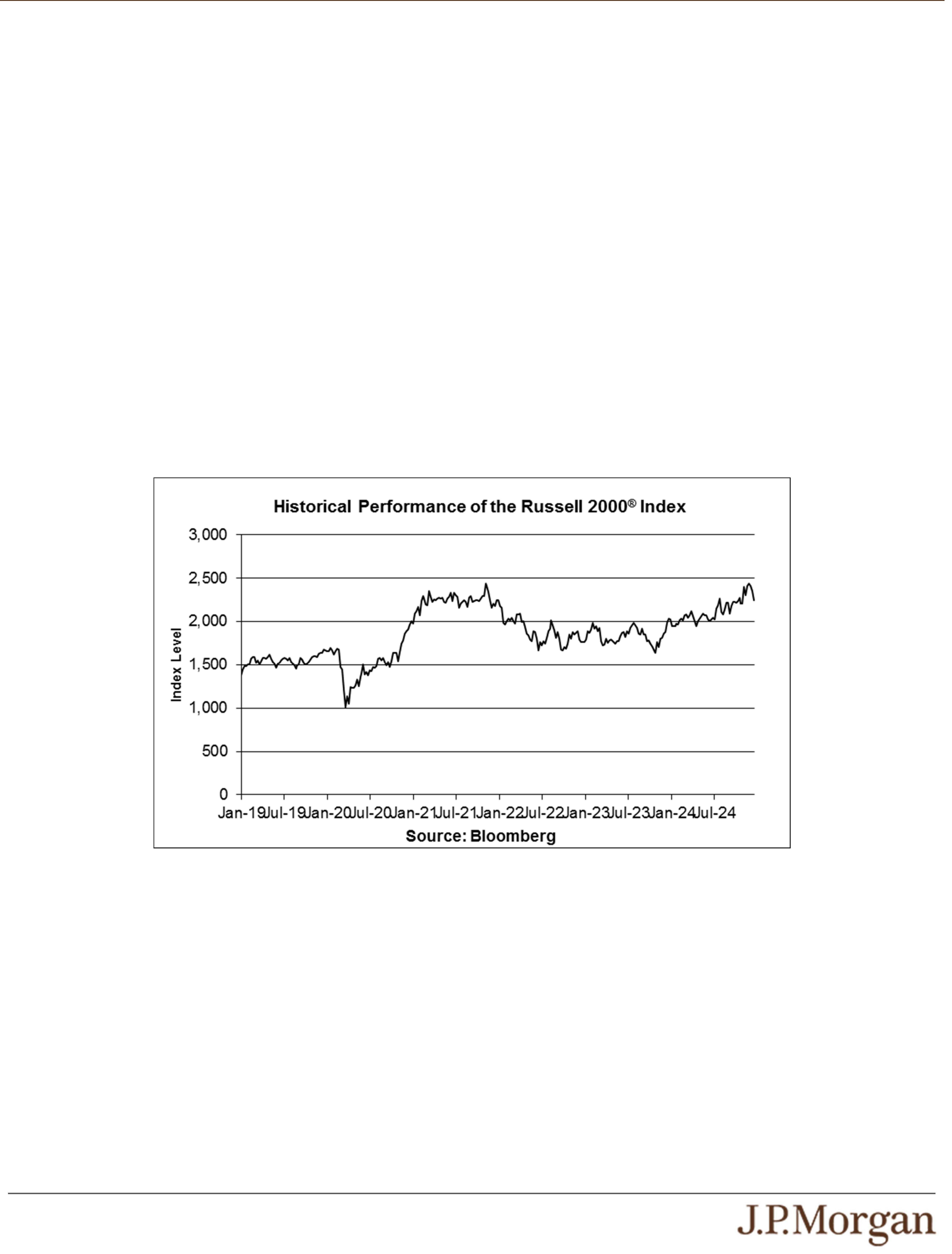

Indices: The Russell 2000

®

Index (Bloomberg ticker: RTY), the

S&P 500

®

Index (Bloomberg ticker: SPX) and the Nasdaq-100

Index

®

(Bloomberg ticker: NDX)

Contingent Interest Payments: If the notes have not been

previously redeemed early and the closing level of each Index

on any Review Date is greater than or equal to its Interest

Barrier, you will receive on the applicable Interest Payment

Date for each $1,000 principal amount note a Contingent

Interest Payment equal to $8.75 (equivalent to a Contingent

Interest Rate of 10.50% per annum, payable at a rate of 0.875%

per month).

If the closing level of any Index on any Review Date is less than

its Interest Barrier, no Contingent Interest Payment will be made

with respect to that Review Date.

Contingent Interest Rate: 10.50% per annum, payable at a

rate of 0.875% per month

Interest Barrier: With respect to each Index, 70.00% of its

Initial Value, which is 1,569.659 for the Russell 2000

®

Index,

4,151.595 for the S&P 500

®

Index and 14,902.405 for the

Nasdaq-100 Index

®

Trigger Value:

With respect to each Index, 67.00% of its Initial

Value, which is 1,502.3879 for the Russell 2000

®

Index,

3,973.6695 for the S&P 500

®

Index and 14,263.7305 for the

Nasdaq-100 Index

®

Pricing Date: December 20, 2024

Original Issue Date (Settlement Date): On or about December

26, 2024

Review Dates*: January 21, 2025, February 20, 2025, March

20, 2025, April 21, 2025, May 20, 2025, June 20, 2025, July 21,

2025, August 20, 2025, September 22, 2025, October 20, 2025,

November 20, 2025, December 22, 2025, January 20, 2026,

February 20, 2026, March 20, 2026, April 20, 2026, May 20,

2026 and June 22, 2026 (final Review Date)

Interest Payment Dates*: January 24, 2025, February 25,

2025, March 25, 2025, April 24, 2025, May 23, 2025, June 25,

2025, July 24, 2025, August 25, 2025, September 25, 2025,

October 23, 2025, November 25, 2025, December 26, 2025,

January 23, 2026, February 25, 2026, March 25, 2026, April 23,

2026, May 26, 2026 and the Maturity Date

Maturity Date*: June 25, 2026

* Subject to postponement in the event of a market disruption event

and as described under “General Terms of Notes — Postponement

of a Determination Date — Notes Linked to Multiple Underlyings”

and “General Terms of Notes — Postponement of a Payment Date”

in the accompanying product supplement

Early Redemption:

We, at our election, may redeem the notes early, in whole but

not in part, on any of the Interest Payment Dates (other than the

first through fifth and final Interest Payment Dates) at a price,

for each $1,000 principal amount note, equal to (a) $1,000 plus

(b) the Contingent Interest Payment, if any, applicable to the

immediately preceding Review Date. If we intend to redeem

your notes early, we will deliver notice to The Depository Trust

Company, or DTC, at least three business days before the

applicable Interest Payment Date on which the notes are

redeemed early.

Payment at Maturity:

If the notes have not been redeemed early and (i) the Final

Value of each Index is greater than or equal to its Initial Value

or (ii) a Trigger Event has not occurred, you will receive a cash

payment at maturity, for each $1,000 principal amount note,

equal to (a) $1,000 plus (b) the Contingent Interest Payment, if

any, applicable to the final Review Date.

If the notes have not been redeemed early and (i) the Final

Value of any Index is less than its Initial Value and (ii) a Trigger

Event has occurred, your payment at maturity per $1,000

principal amount note, in addition to any Contingent Interest

Payment, will be calculated as follows:

$1,000 + ($1,000 × Least Performing Index Return)

If the notes have not been redeemed early and (i) the Final

Value of any Index is less than its Initial Value and (ii) a Trigger

Event has occurred, you will lose some or all of your principal

amount at maturity.

Trigger Event: A Trigger Event occurs if, on any day during the

Monitoring Period, the closing level of any Index is less than its

Trigger Value.

Monitoring Period: The period from but excluding the Pricing

Date to and including the final Review Date

Least Performing Index: The Index with the Least Performing

Index Return

Least Performing Index Return: The lowest of the Index

Returns of the Indices

Index Return:

With respect to each Index,

(Final Value – Initial Value)

Initial Value

Initial Value: With respect to each Index, the closing level of

that Index on the Pricing Date, which was 2,242.370 for the

Russell 2000

®

Index, 5,930.85 for the S&P 500

®

Index and

21,289.15 for the Nasdaq-100 Index

®

Final Value: With respect to each Index, the closing level of

that Index on the final Review Date