0001667919 us-gaap:StandardPoors500IndexMember 2021-12-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

First Trust Exchange-Traded Fund VIII

(Exact name of registrant as specified in charter)

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Address of principal executive offices) (Zip code)

W. Scott Jardine, Esq.

First Trust Portfolios L.P.

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Name and address of agent for service)

Registrant's telephone number, including area code:

Date of reporting period:

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Shareholders.

(a) Following is a copy of the annual reports transmitted to shareholders pursuant to Rule 30e-1 under the Act.

First Trust Income Opportunities ETF

FCEF | NASDAQ, INC.

ANNUAL SHAREHOLDER REPORT | August 31, 2024

This annual shareholder report contains important information about the First Trust Income Opportunities ETF (the “Fund”) for the year of September 1, 2023 to August 31, 2024 (the “Period”). You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/FCEF. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| First Trust Income Opportunities ETF | $94(1) | 0.85%(1) |

(1) | Excludes any Acquired Fund Fees and Expenses of underlying investment companies in which the Fund invests. |

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE?

The Fund returned 21.94% for the 12 months ended August 31, 2024. The Fund outperformed its blended benchmark, which consists of the following two indexes: 60% of the First Trust Equity Closed-End Fund Total Return Index, and 40% of the First Trust Taxable Fixed Income Closed-End Fund Total Return Index. The blended benchmark returned 21.00% for the same Period.

This outperformance was a result of several factors including the security selection within the portfolio, sector selection as well as the Fund’s ability to actively manage positions on a continuous basis. Strength across the board in closed-end funds allowed the Fund to move out of previously established defensive positions and into funds which had the best potential for growth in the current market environment.

The Fund posted strong performance during the Period on anticipation that the Federal Reserve would begin to lower interest rates in an effort to encourage growth in a slowing economy. Strong general equity market performance also played a role in the Fund posting a double-digit total return for the Period.

In the closed-end fund space, wide discounts and the proactive move by many Fund sponsors to raise distribution levels encouraged retail investors to revisit the closed-end fund space as an investment option within their portfolios. As investor sentiment turned, we witnessed buyers return to the space. In the past, the Fund witnessed fund sponsors raising distributions in the equity-based funds to coincide with total returns funds were generating, however, the use of a total return-like distribution policy has not been common within the fixed income funds.

Driving fund sponsors to push distribution rates higher was an activist hedge fund. The hedge fund had been accumulating large share positions in a multitude of outstanding closed-end funds which it used to press sponsors to initiate policies which would work to reduce discounts. In some instances, this shareholder sought Board of Director seats, initiated proxy contests and worked to take over fund mandates. While these types of shareholders have existed in the closed-end fund space for a number of years, the engagement that we witnessed over the last year was unprecedented.

During the fiscal year, the Fund continued to make a conscious effort to continue to pay an attractive distribution to shareholders, one that consists predominately of income from the underlying funds.

The Fund will continue to utilize a total return approach to investing that has worked so well through the years. While big “yields” in the closed-end fund space can be enticing to investors, the ability of the Fund to deliver that yield through a portfolio that delivers a total return above and beyond the payout is where the Fund will focus.

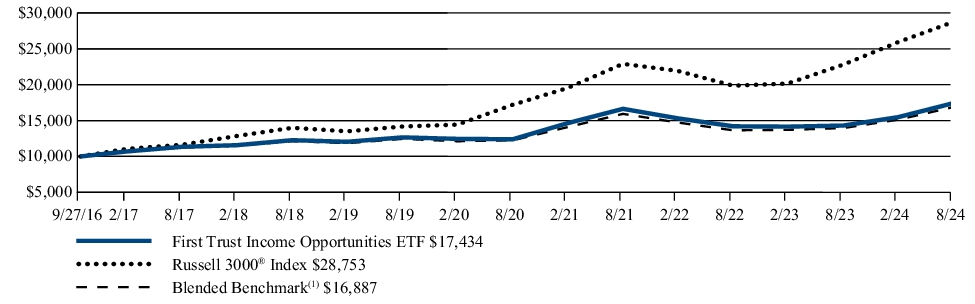

FUND PERFORMANCE (September 27, 2016 to August 31, 2024)

The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods.

Investment Performance of $10,000

| Average Annual Total Returns (as of August 31, 2024) | 1 Year | 5 Year | Since

Inception

(9/27/16) |

| First Trust Income Opportunities ETF | 21.94% | 6.62% | 7.27% |

| Russell 3000® Index | 26.14% | 15.19% | 14.25% |

| Blended Benchmark(1) | 21.00% | 6.28% | 6.83% |

| (1) | A blended benchmark (the “Blended Benchmark”) comprised 60% of the First Trust Equity Closed-End Fund Total Return Index, a cap-weighted index (based on NAV) designed to provide a broad representation of the equity based closed-end fund universe, and 40% of the First Trust Taxable Fixed Income Closed-End Fund Total Return Index, a cap-weighted index (based on NAV) designed to provide a broad representation of the taxable fixed income closed-end fund universe, has been selected as a secondary benchmark to provide a more direct correlation to the Fund's underlying portfolio. The Blended Benchmark returns are calculated by using the monthly return of the two indices during each period shown above. At the beginning of each month the two indices are rebalanced to a 60-40 ratio to account for divergence from that ratio that occurred during the course of each month. The monthly returns are then compounded for each period shown above, giving the performance for the Blended Benchmark for each period shown above. |

Visit www.ftportfolios.com/etf/FCEF for more recent performance information.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

KEY FUND STATISTICS (As of August 31, 2024)

| Fund net assets | $38,496,587 |

| Total number of portfolio holdings | 54 |

| Total advisory fee paid | $259,088 |

| Portfolio turnover rate | 14% |

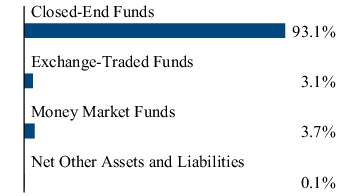

WHAT DID THE FUND INVEST IN? (As of August 31, 2024)

The tables below show the investment makeup of the Fund, representing the percentage of total investments and percentage of net assets, respectively, of the Fund.

| Eaton Vance Tax-Advantaged Global Dividend Income Fund | 4.0% |

| Morgan Stanley Institutional Liquidity Funds - Treasury Portfolio - Institutional Class | 3.7% |

| abrdn Healthcare Opportunities Fund | 3.5% |

| abrdn Healthcare Investors | 3.5% |

| abrdn Global Infrastructure Income Fund | 3.3% |

| Source Capital, Inc. | 3.3% |

| Eaton Vance Tax-Advantaged Dividend Income Fund | 3.3% |

| John Hancock Tax-Advantaged Dividend Income Fund | 3.3% |

| Invesco Variable Rate Investment Grade ETF | 3.2% |

| Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund | 3.1% |

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

Visit www.ftportfolios.com/fund-documents/etf/FCEF to view additional information about the Fund such as the prospectus, financial information, Fund holdings and proxy voting information. You may also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

First Trust Flexible Municipal

High Income ETF

MFLX | NASDAQ, INC.

ANNUAL SHAREHOLDER REPORT | August 31, 2024

This annual shareholder report contains important information about the First Trust Flexible Municipal High Income ETF (the “Fund”) for the year of September 1, 2023 to August 31, 2024 (the “Period”). You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/MFLX. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| First Trust Flexible Municipal High Income ETF | $79(1) | 0.75%(1) |

(1) | Excludes any Acquired Fund Fees and Expenses of underlying investment companies in which the Fund invests. |

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE?

The Fund returned 9.97% for the 12 months ended August 31, 2024. The Fund outperformed its benchmark, the Bloomberg Municipal Long Bond (22+) Index, which returned 8.34% for the same Period.

The following key Fund factors impacted Fund performance relative to the benchmark during the Period:

Credit Rating: The Fund’s selection and allocation of NR (“not-rated”) bonds was the primary contributor to Fund outperformance relative to the benchmark while the selection and allocation of BBB rated bonds was a secondary contributor. The Fund’s selection of A rated bonds was the primary detractor to Fund performance relative to the benchmark.

Yield Curve Positioning/Duration: Relative to the benchmark, the Fund’s selection of bonds in the 18+ years to maturity range and the allocation of levered closed-end funds were the primary contributors for Fund outperformance. The Fund’s allocation to bonds in the 16-18 years to maturity range was a secondary contributor. The Fund’s allocation to bonds in cash and the 10-12 years to maturity range were the primary detractors to Fund performance. Examining effective duration, the Fund’s selection of bonds with an effective duration of 7-10 years and the allocation and selection of the levered closed-end funds were the leading contributors to Fund performance while the Fund’s allocation and selection of bonds with an effective duration of 0-1 years and allocation in cash were the main detractors to Fund performance.

Interest Rate Hedge: The use of Treasury futures to hedge interest rate risk was a modest positive contributor to Fund performance.

Sector/Industry: The allocation of closed-end funds, as well as Health Care bonds and the selection of bonds in the Special Tax sectors were the leading contributors to Fund outperformance. Conversely, the Fund’s allocation to cash and selection to Utilities sectors were detractors to Fund performance.

U.S. Treasury Rate Trends: The 10-Year and 30-Year U.S. Treasury yields decreased by approximately 21 basis points (“bps”) and 1 bp, respectively, to 3.90% and 4.20%.

Industry Fund Flows: According to data collected by Investment Company Institute, fund outflows totaled approximately $4.76 billion; however, for the six months ended August 31, 2024, fund flows turned positive at $8.89 billion.

New Issue Supply: According to the Securities Industry and Financial Markets Assocation, primary market supply stood at $467.8 billion. New issue supply is up 34% year-to-date in 2024 as compared to the prior year.

Municipal Credit Yields: According to Municipal Market Data, AAA yield curve data, 10-Year and 30-Year municipal yields decreased 22 bps and 28 bps, respectively, to 2.71% and 3.60%.

Municipal Credit Spreads: Credit spreads for high yield, BBB, and A rated bonds all compressed.

During the Period, the Fund purchased odd lot positions which had a positive impact on performance of 0.058%.

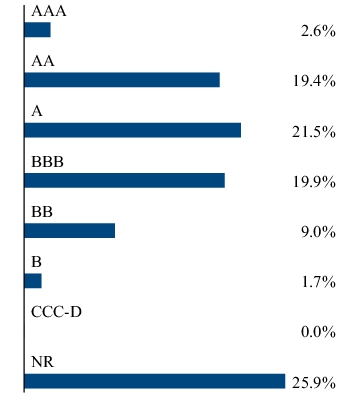

FUND PERFORMANCE (September 27, 2016 to August 31, 2024)

The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods.

Investment Performance of $10,000

| Average Annual Total Returns (as of August 31, 2024) | 1 Year | 5 Year | Since

Inception

(9/27/16) |

| First Trust Flexible Municipal High Income ETF | 9.97% | 1.26% | 1.85% |

| Bloomberg Municipal Long Bond (22+) Index | 8.34% | 0.53% | 1.98% |

| Blended Benchmark(1) | 9.20% | 1.96% | 3.00% |

| Bloomberg Municipal Bond Index | 6.09% | 1.02% | 1.94% |

| (1) | The Blended Benchmark returns are a 50/50 split between the Bloomberg Municipal High Yield Bond Index and the Bloomberg Municipal Bond Index. |

Visit www.ftportfolios.com/etf/MFLX for more recent performance information.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Performance in municipal bond investment strategies can be impacted from the benefits of purchasing odd lot positions. The impact of these investments can be particularly meaningful when funds have limited assets under management and may not be a sustainable source of performance as a fund grows in size.

KEY FUND STATISTICS (As of August 31, 2024)

| Fund net assets | $15,634,548 |

| Total number of portfolio holdings | 71 |

| Total advisory fee paid | $112,116 |

| Portfolio turnover rate | 51% |

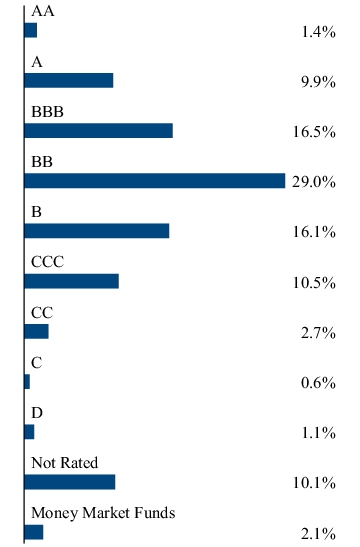

WHAT DID THE FUND INVEST IN? (As of August 31, 2024)

The tables below show the investment makeup of the Fund, representing the percentage of net assets and percentage of total investments, respectively, of the Fund.

| Municipal Bonds | 90.5% |

| Closed-End Funds | 8.1% |

| Net Other Assets and Liabilities | 1.4% |

| Total | 100.0% |

(1) This represents the municipal and closed-end fund holdings in the Fund. The ratings for the Municipal Bond portion of the Fund are by S&P Global Ratings, Moody’s Investors Service, Inc., Fitch Ratings, or a comparably rated NRSRO. For situations in which a security is rated by more than one NRSRO and the ratings are not equivalent, the highest ratings are used. The ratings for the CEF portion of the Fund are provided by Morningstar. A credit rating is an assessment provided by a nationally recognized statistical rating organization (NRSRO) of the creditworthiness of an issuer with respect to debt obligations except for those debt obligations that are only privately rated. Ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). Investment grade is defined as those issuers that have a long-term credit rating of BBB- or higher. “NR” indicates no rating. The credit ratings shown relate to the creditworthiness of the issuers of the underlying securities in the Fund, and not to the Fund or its shares. Credit ratings are subject to change.

Any amount shown as 0.0% represents less than 0.1%.

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

Visit www.ftportfolios.com/fund-documents/etf/MFLX to view additional information about the Fund such as the prospectus, financial information, Fund holdings and proxy voting information. You may also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

First Trust Low Duration

Strategic Focus ETF

LDSF | NASDAQ, INC.

ANNUAL SHAREHOLDER REPORT | August 31, 2024

This annual shareholder report contains important information about the First Trust Low Duration Strategic Focus ETF (the “Fund”) for the year of September 1, 2023 to August 31, 2024 (the “Period”). You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/LDSF. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| First Trust Low Duration Strategic Focus ETF | $21(1) | 0.20%(1) |

(1) | Excludes any Acquired Fund Fees and Expenses of underlying investment companies in which the Fund invests. |

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE?

The Fund returned 7.46% for the 12 months ended August 31, 2024. The Fund outperformed its primary benchmark, the Bloomberg 1-5 Year Government/Credit Index, which returned 6.67% for the same Period. The Fund underperformed the secondary blended benchmark (80% Bloomberg 1-5 Year Government/Credit Index and 20% ICE BofA US High Yield Constrained Index), which returned 7.82% for the same Period.

The outperformance relative to the primary benchmark and the underperformance relative to the secondary benchmark were driven by the Fund’s allocation to credit spread sensitive assets through investments such as investment grade corporate bonds, mortgage-backed securities (“MBS”), high-yield bonds and senior loans, as these assets outperformed. The primary benchmark has no allocation to high-yield bonds, in contrast to 20% in the secondary benchmark. Neither benchmark had an allocation to MBS during the Period.

High yield corporate bond spreads narrowed from 387 to 318 basis points and the ICE BofA US High Yield Constrained Index returned 12.47%, as ‘risk’ assets benefitted from continued economic and corporate profit growth and market enthusiasm surrounding Artificial Intelligence-related growth companies provided a tailwind to returns. Meanwhile, the Federal Reserve (the “Fed”) made their last rate hike in July of 2023 and remained on hold throughout the Period before declining inflation and signs of labor market deterioration caused them to signal that rate cuts are expected in 2024, causing the market to price in lower yields and providing greater confidence the Fed would engineer a soft landing.

The Fund’s largest allocations were to MBS and short-duration investment-grade corporate bonds through the First Trust Low Duration Opportunities ETF and the First Trust Limited Duration Investment Grade Corporate ETF. These ETFs individually represented between 35% and 40% of the Fund and contributed positively to performance relative to the primary benchmark but were modest drags on returns relative to the blended benchmark given the blended benchmark’s exposure to high yield bonds, as both funds returned 7.66% on a market price basis, over the Period.

The best performing holding was the First Trust Tactical High Yield ETF which the Fund held at 10% over the entire Period and returned 11.20% on a market price basis, and which benefited from tightening credit spreads, declining interest rates and elevated levels of income. This allocation to high yield resulted in roughly a 10% overweight to the primary benchmark and a 10% underweight to the secondary blended benchmark.

The top detractor from relative performance was the First Trust Enhanced Short Maturity ETF which returned 5.68% on a market price basis, in line with a modest spread over the target range of the Federal Funds target rate, which was between 5.25% and 5.50% for the entire Period, however it underperformed both benchmarks. The declining rate environment, in which the 2-Year U.S. Treasury fell from 4.86% to 3.91% and the 10-Year U.S. Treasury declined from 4.11% to 3.90%, provided a greater benefit to total returns of fixed income securities with longer duration.

FUND PERFORMANCE (January 3, 2019 to August 31, 2024)

The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods.

Investment Performance of $10,000

| Average Annual Total Returns (as of August 31, 2024) | 1 Year | 5 Year | Since

Inception

(1/3/19) |

| First Trust Low Duration Strategic Focus ETF | 7.46% | 1.57% | 2.19% |

| Bloomberg 1-5 Year Government/Credit Index | 6.67% | 1.32% | 1.93% |

| Blended Benchmark(1) | 7.82% | 1.96% | 2.72% |

| Bloomberg US Aggregate Bond Index | 7.30% | -0.04% | 1.39% |

| (1) | The Blended Benchmark consists of the following two indexes: 80% of the Bloomberg 1-5 Year Government/Credit Index which measures the performance of U.S. dollar-denominated U.S. Treasury bonds, government related bonds and investment grade U.S. corporate bonds that have a maturity between one and five years; and 20% of the ICE BofA US High Yield Constrained Index which tracks the performance of U.S. dollar denominated below investment grade corporate debt publicly issued in the U.S. domestic market but caps issuer exposure at 2%. |

Visit www.ftportfolios.com/etf/LDSF for more recent performance information.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

KEY FUND STATISTICS (As of August 31, 2024)

| Fund net assets | $153,152,294 |

| Total number of portfolio holdings | 8 |

| Total advisory fee paid | $257,182 |

| Portfolio turnover rate | 15% |

WHAT DID THE FUND INVEST IN? (As of August 31, 2024)

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| Exchange-Traded Funds | 100.0% |

| Money Market Funds | 0.0% |

| Net Other Assets and Liabilities | 0.0% |

| Total | 100.0% |

Any amount shown as 0.0% represents less than 0.1%.

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

Visit www.ftportfolios.com/fund-documents/etf/LDSF to view additional information about the Fund such as the prospectus, financial information, Fund holdings and proxy voting information. You may also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

First Trust Active Factor Large Cap ETF

AFLG | NYSE ARCA, INC.

ANNUAL SHAREHOLDER REPORT | August 31, 2024

This annual shareholder report contains important information about the First Trust Active Factor Large Cap ETF (the “Fund”) for the year of September 1, 2023 to August 31, 2024 (the “Period”). You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/AFLG. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

This report describes changes to the Fund that occurred during the Period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| First Trust Active Factor Large Cap ETF | $64 | 0.55% |

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE?

The Fund returned 31.10% for the 12 months ended August 31, 2024. The Fund outperformed its benchmark, the S&P 500® Index, which returned 27.14% for the same Period.

This outperformance was largely attributable to strong performance from the momentum and quality factors. Both quality and momentum were overweight the Technology sector, which was the best performing sector. In addition, both selection and industry effects added to performance. By contrast, the value and small size factors subtracted from the Fund’s returns as the largest stocks in the benchmark continued to outpace the broader market during the Period.

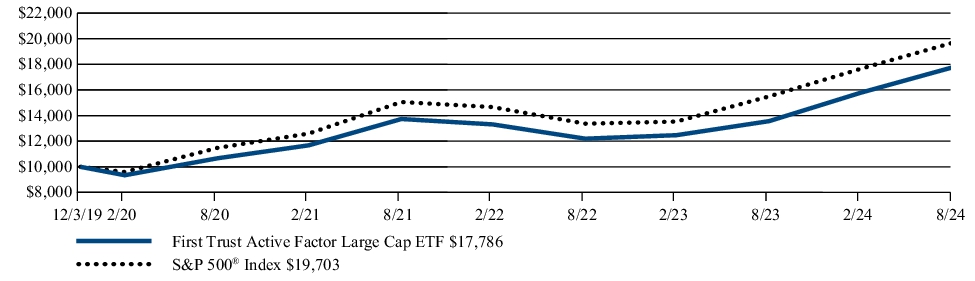

FUND PERFORMANCE (December 3, 2019 to August 31, 2024)

The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods.

Investment Performance of $10,000

| Average Annual Total Returns (as of August 31, 2024) | 1 Year | Since

Inception

(12/3/19) |

| First Trust Active Factor Large Cap ETF | 31.10% | 12.90% |

| S&P 500® Index | 27.14% | 15.37% |

Visit www.ftportfolios.com/etf/AFLG for more recent performance information.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

KEY FUND STATISTICS (As of August 31, 2024)

| Fund net assets | $18,324,103 |

| Total number of portfolio holdings | 253 |

| Total advisory fee paid | $40,712 |

| Portfolio turnover rate | 48% |

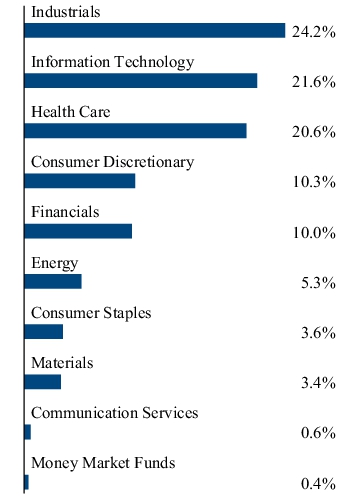

WHAT DID THE FUND INVEST IN? (As of August 31, 2024)

The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund.

| Apple, Inc. | 7.5% |

| Microsoft Corp. | 4.9% |

| NVIDIA Corp. | 4.7% |

| Alphabet, Inc., Class A | 2.0% |

| Berkshire Hathaway, Inc., Class B | 1.7% |

| Amazon.com, Inc. | 1.7% |

| Meta Platforms, Inc., Class A | 1.5% |

| Broadcom, Inc. | 1.3% |

| Hartford Financial Services Group (The), Inc. | 1.1% |

| Universal Health Services, Inc., Class B | 1.1% |

HOW HAS THE FUND MATERIALLY CHANGED?

This is a summary of certain changes to the Fund since September 1, 2023. For more complete information, you may review the Fund’s prospectus and any applicable supplements at www.ftportfolios.com/fund-documents/etf/AFLG or upon request at 1-800-621-1675 or info@ftportfolios.com.

The Fund may have significant investments in various jurisdictions or investment sectors from time to time, making the Fund subject to the risks of such jurisdictions or investment sectors.

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

Visit www.ftportfolios.com/fund-documents/etf/AFLG to view additional information about the Fund such as the prospectus, financial information, Fund holdings and proxy voting information. You may also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

First Trust Active Factor Mid Cap ETF

AFMC | NYSE ARCA, INC.

ANNUAL SHAREHOLDER REPORT | August 31, 2024

This annual shareholder report contains important information about the First Trust Active Factor Mid Cap ETF (the “Fund”) for the year of September 1, 2023 to August 31, 2024 (the “Period”). You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/AFMC. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

This report describes changes to the Fund that occurred during the Period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| First Trust Active Factor Mid Cap ETF | $74 | 0.65% |

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE?

The Fund returned 26.81% for the 12 months ended August 31, 2024. The Fund outperformed its benchmark, the S&P MidCap 400® Index, which returned 18.75% for the same Period.

This outperformance was largely attributable to strong performance from the momentum and quality factors. The momentum factor benefited from the Artificial Intelligence trade. Additionally, quality stocks with better balance sheets and higher profitability outpaced peers as interest rates remained higher than expected. The strong performance was also aided by positive selection and industry effects. By contrast, the value factor subtracted from the Fund’s returns during the Period.

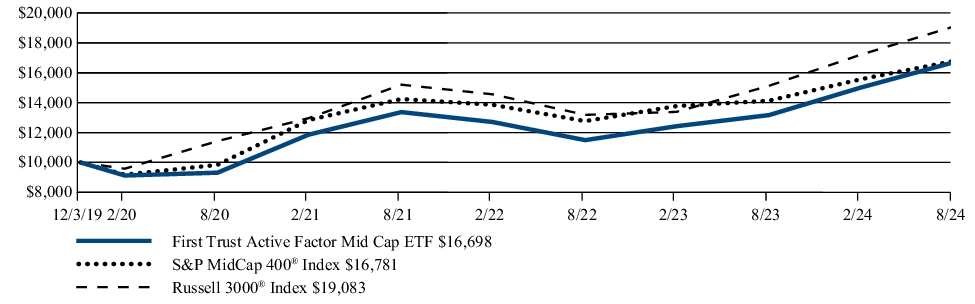

FUND PERFORMANCE (December 3, 2019 to August 31, 2024)

The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods.

Investment Performance of $10,000

| Average Annual Total Returns (as of August 31, 2024) | 1 Year | Since

Inception

(12/3/19) |

| First Trust Active Factor Mid Cap ETF | 26.81% | 11.41% |

| S&P MidCap 400® Index | 18.75% | 11.53% |

| Russell 3000® Index | 26.14% | 14.60% |

Visit www.ftportfolios.com/etf/AFMC for more recent performance information.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

KEY FUND STATISTICS (As of August 31, 2024)

| Fund net assets | $14,228,486 |

| Total number of portfolio holdings | 247 |

| Total advisory fee paid | $62,842 |

| Portfolio turnover rate | 60% |

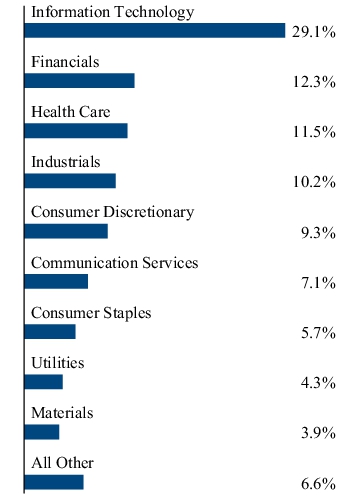

WHAT DID THE FUND INVEST IN? (As of August 31, 2024)

The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund.

| United Therapeutics Corp. | 1.6% |

| Sprouts Farmers Market, Inc. | 1.5% |

| Toll Brothers, Inc. | 1.5% |

| Tenet Healthcare Corp. | 1.3% |

| KB Home | 1.2% |

| MGIC Investment Corp. | 1.2% |

| Old Republic International Corp. | 1.2% |

| GoDaddy, Inc., Class A | 1.1% |

| EMCOR Group, Inc. | 1.1% |

| Vistra Corp. | 1.0% |

HOW HAS THE FUND MATERIALLY CHANGED?

This is a summary of certain changes to the Fund since September 1, 2023. For more complete information, you may review the Fund’s prospectus and any applicable supplements at www.ftportfolios.com/fund-documents/etf/AFMC or upon request at 1-800-621-1675 or info@ftportfolios.com.

The Fund may have significant investments in various jurisdictions or investment sectors from time to time, making the Fund subject to the risks of such jurisdictions or investment sectors.

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

Visit www.ftportfolios.com/fund-documents/etf/AFMC to view additional information about the Fund such as the prospectus, financial information, Fund holdings and proxy voting information. You may also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

First Trust Active Factor Small Cap ETF

AFSM | NYSE ARCA, INC.

ANNUAL SHAREHOLDER REPORT | August 31, 2024

This annual shareholder report contains important information about the First Trust Active Factor Small Cap ETF (the “Fund”) for the year of September 1, 2023 to August 31, 2024 (the “Period”). You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/AFSM. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

This report describes changes to the Fund that occurred during the Period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| First Trust Active Factor Small Cap ETF | $84 | 0.75% |

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE?

The Fund returned 22.72% for the 12 months ended August 31, 2024. The Fund outperformed its benchmark, the Russell 2000® Index, which returned 18.47% for the same Period.

This outperformance was largely attributable to strong performance from the momentum and quality factors. The momentum factor benefited from the Artificial Intelligence trade. Stocks with better balance sheets and higher profitability outpaced peers as interest rates remained higher than expected. In addition, selection effect added to performance. By contrast, the value factor and sector exposures, primarily from an underweight to the Technology and Financials sectors, subtracted from the Fund’s performance.

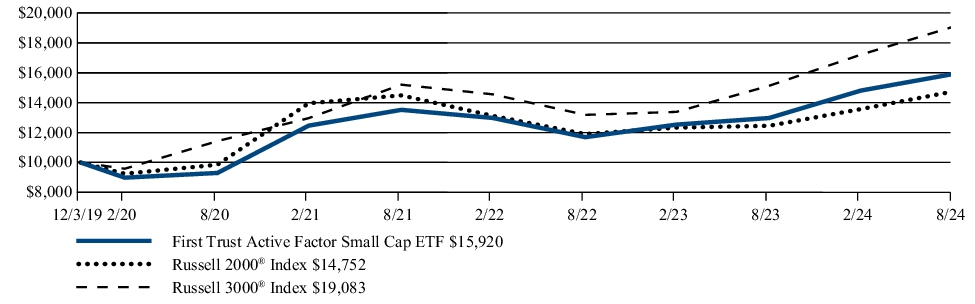

FUND PERFORMANCE (December 3, 2019 to August 31, 2024)

The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods.

Investment Performance of $10,000

| Average Annual Total Returns (as of August 31, 2024) | 1 Year | Since

Inception

(12/3/19) |

| First Trust Active Factor Small Cap ETF | 22.72% | 10.29% |

| Russell 2000® Index | 18.47% | 8.54% |

| Russell 3000® Index | 26.14% | 14.60% |

Visit www.ftportfolios.com/etf/AFSM for more recent performance information.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

KEY FUND STATISTICS (As of August 31, 2024)

| Fund net assets | $15,282,901 |

| Total number of portfolio holdings | 307 |

| Total advisory fee paid | $53,780 |

| Portfolio turnover rate | 79% |

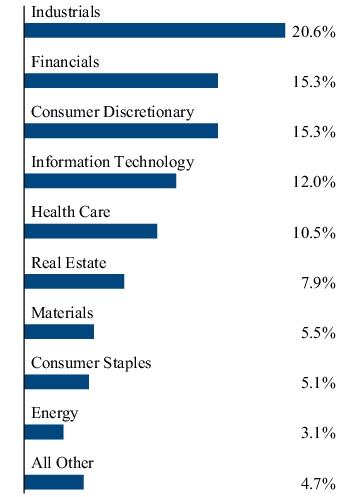

WHAT DID THE FUND INVEST IN? (As of August 31, 2024)

The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund.

| National HealthCare Corp. | 1.3% |

| Mueller Industries, Inc. | 1.1% |

| Alkermes PLC | 1.0% |

| InterDigital, Inc. | 0.9% |

| Abercrombie & Fitch Co., Class A | 0.9% |

| SkyWest, Inc. | 0.9% |

| Daktronics, Inc. | 0.9% |

| Catalyst Pharmaceuticals, Inc. | 0.9% |

| M/I Homes, Inc. | 0.8% |

| Preferred Bank | 0.8% |

HOW HAS THE FUND MATERIALLY CHANGED?

This is a summary of certain changes to the Fund since September 1, 2023. For more complete information, you may review the Fund’s prospectus and any applicable supplements at www.ftportfolios.com/fund-documents/etf/AFSM or upon request at 1-800-621-1675 or info@ftportfolios.com.

The Fund may have significant investments in various jurisdictions or investment sectors from time to time, making the Fund subject to the risks of such jurisdictions or investment sectors.

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

Visit www.ftportfolios.com/fund-documents/etf/AFSM to view additional information about the Fund such as the prospectus, financial information, Fund holdings and proxy voting information. You may also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

First Trust Innovation Leaders ETF

ILDR | NYSE ARCA, INC.

ANNUAL SHAREHOLDER REPORT | August 31, 2024

This annual shareholder report contains important information about the First Trust Innovation Leaders ETF (the “Fund”) for the year of September 1, 2023 to August 31, 2024 (the “Period”). You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/ILDR. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| First Trust Innovation Leaders ETF | $86 | 0.75% |

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE?

The Fund returned 29.64% for the 12 months ended August 31, 2024. The Fund underperformed its benchmark, the Russell 3000® Growth Index, which returned 30.10% for the same Period.

This underperformance was driven by negative selection effect and mostly offset by favorable allocation.

Key Drivers of Negative Selection Effect:

Health Care stocks were the largest detriment to the Fund’s performance for the Period as stock selection within the Health Care sector drove 367 basis points (bps) of underperformance.

The Fund did not have exposure to Eli Lilly and Company which had an average benchmark weight of 2.33% for the Period and returned 74.37% as its leading weight loss drugs gained approval from the Food and Drug Administration and went to market.

High contribution to negative selection effect for the Period arose from Coherus Biosciences, Inc., down 65.85%, Replimune Group, Inc., down 50.20%, Fulgent Genetics, Inc., down 37.85% and Inmode Ltd., down 37.54%.

NVIDIA Corp. contributed to negative performance despite the Fund having an average exposure of 6.03% to the stock for the Period. NVIDIA Corp. was up 141.93% on the strength of Artificial Intelligence-related demand for its Graphics Processing Units. However, the benchmark had an average weight of 7.04% to NVIDIA for the Period which generated relative underperformance for the Fund.

Key Drivers of Positive Allocation Effect:

Within the Consumer Discretionary sector holdings, the Fund held few stocks and, predominately, Amazon.com, Inc. This provided favorable allocation as the Fund’s average discretionary weight was only 5.68% for the Period compared with 14.71% in the benchmark. As consumers exhibited spending exhaustion driven by inflation ravaged incomes, the sector did not keep pace with the broader market for the Period.

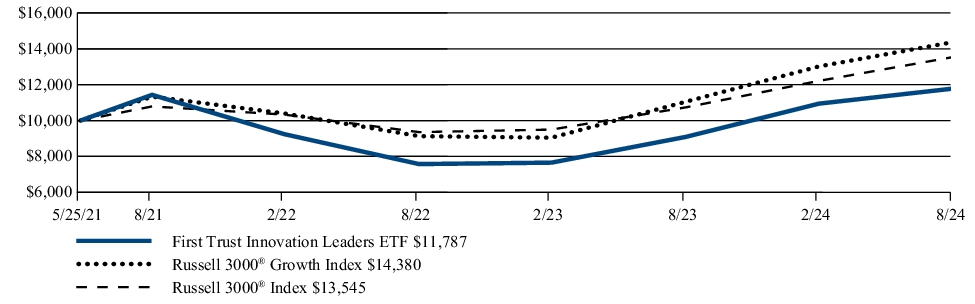

FUND PERFORMANCE (May 25, 2021 to August 31, 2024)

The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods.

Investment Performance of $10,000

| Average Annual Total Returns (as of August 31, 2024) | 1 Year | Since

Inception

(5/25/21) |

| First Trust Innovation Leaders ETF | 29.64% | 5.16% |

| Russell 3000® Growth Index | 30.10% | 11.76% |

| Russell 3000® Index | 26.14% | 9.73% |

Visit www.ftportfolios.com/etf/ILDR for more recent performance information.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

KEY FUND STATISTICS (As of August 31, 2024)

| Fund net assets | $40,147,388 |

| Total number of portfolio holdings | 63 |

| Total advisory fee paid | $191,103 |

| Portfolio turnover rate | 43% |

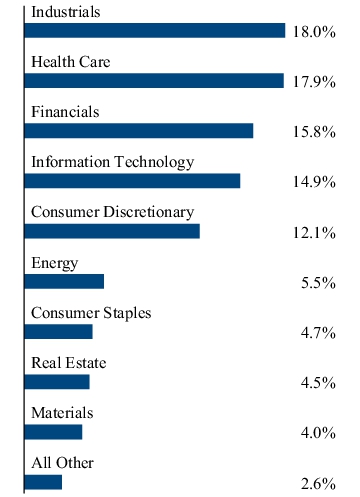

WHAT DID THE FUND INVEST IN? (As of August 31, 2024)

The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund.

| NVIDIA Corp. | 7.7% |

| Oracle Corp. | 6.0% |

| Amazon.com, Inc. | 5.3% |

| Microsoft Corp. | 5.3% |

| Alphabet, Inc., Class C | 3.9% |

| ServiceNow, Inc. | 3.6% |

| Meta Platforms, Inc., Class A | 3.5% |

| Uber Technologies, Inc. | 3.3% |

| Broadcom, Inc. | 3.0% |

| Siemens AG | 2.3% |

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

Visit www.ftportfolios.com/fund-documents/etf/ILDR to view additional information about the Fund such as the prospectus, financial information, Fund holdings and proxy voting information. You may also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

First Trust Expanded Technology ETF

XPND | NYSE ARCA, INC.

ANNUAL SHAREHOLDER REPORT | August 31, 2024

This annual shareholder report contains important information about the First Trust Expanded Technology ETF (the “Fund”) for the year of September 1, 2023 to August 31, 2024 (the “Period”). You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/XPND. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

This report describes changes to the Fund that occurred during the Period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| First Trust Expanded Technology ETF | $74 | 0.65% |

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE?

The Fund returned 29.18% for the 12 months ended August 31, 2024. The Fund underperformed its benchmark, the S&P 500® Information Technology Index, which returned 38.73% for the same Period.

This underperformance was largely attributable to the Fund’s weighting methodology designed to minimize single stock risk and to the Fund’s exposure to industries outside of the benchmark. The Semiconductor stock NVIDIA Corp. (NVDA) represented over 15% of the benchmark and returned 141.93% over the Period, accounting for over 40% of the benchmark’s net contribution. The Fund caps the weight of individual names to a 4.50% max at the time of rebalance, which caused the Fund to be structurally underweight the technology market’s undisputed winner. The effect of the Fund’s underweight in NVDA accounted for a significant portion of the underperformance. The Financials sector and the Communication Services sector, which combined represented about 30% of the Fund, could not keep pace with the Information Technology sector. Of the five industries held by the Fund within these two sectors, only the Interactive Media & Services industry outperformed the benchmark.

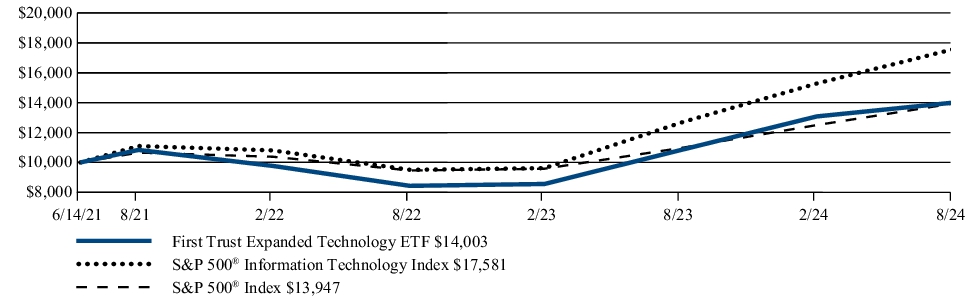

FUND PERFORMANCE (June 14, 2021 to August 31, 2024)

The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods.

Investment Performance of $10,000

| Average Annual Total Returns (as of August 31, 2024) | 1 Year | Since

Inception

(6/14/21) |

| First Trust Expanded Technology ETF | 29.18% | 11.04% |

| S&P 500® Information Technology Index | 38.73% | 19.19% |

| S&P 500® Index | 27.14% | 10.91% |

Visit www.ftportfolios.com/etf/XPND for more recent performance information.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

KEY FUND STATISTICS (As of August 31, 2024)

| Fund net assets | $21,065,698 |

| Total number of portfolio holdings | 51 |

| Total advisory fee paid | $94,936 |

| Portfolio turnover rate | 61% |

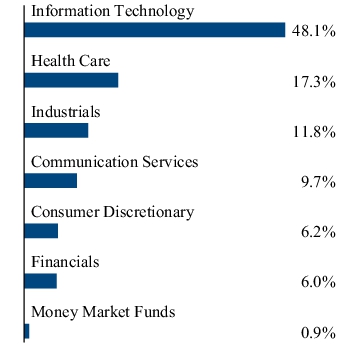

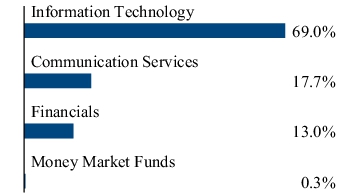

WHAT DID THE FUND INVEST IN? (As of August 31, 2024)

The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund.

| Broadcom, Inc. | 5.1% |

| Oracle Corp. | 5.0% |

| Apple, Inc. | 5.0% |

| T-Mobile US, Inc. | 4.7% |

| Meta Platforms, Inc., Class A | 4.7% |

| NVIDIA Corp. | 4.6% |

| Mastercard, Inc., Class A | 4.5% |

| Visa, Inc., Class A | 4.2% |

| Microsoft Corp. | 4.2% |

| International Business Machines Corp. | 4.2% |

HOW HAS THE FUND MATERIALLY CHANGED?

This is a summary of certain changes to the Fund since September 1, 2023. For more complete information, you may review the Fund’s prospectus and any applicable supplements at www.ftportfolios.com/fund-documents/etf/XPND or upon request at 1-800-621-1675 or info@ftportfolios.com.

The Fund may have significant investments in various jurisdictions or investment sectors from time to time, making the Fund subject to the risks of such jurisdictions or investment sectors.

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

Visit www.ftportfolios.com/fund-documents/etf/XPND to view additional information about the Fund such as the prospectus, financial information, Fund holdings and proxy voting information. You may also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

First Trust Multi-Strategy Alternative ETF

LALT | NYSE ARCA, INC.

ANNUAL SHAREHOLDER REPORT | August 31, 2024

This annual shareholder report contains important information about the First Trust Multi-Strategy Alternative ETF (the “Fund”) for the year of September 1, 2023 to August 31, 2024 (the “Period”). You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/LALT. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

This report describes changes to the Fund that occurred during the Period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| First Trust Multi-Strategy Alternative ETF | $21(1) | 0.20%(1) |

(1) | Excludes any Acquired Fund Fees and Expenses of underlying investment companies in which the Fund invests. |

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE?

The Fund returned 5.49% for the 12 months ended August 31, 2024. The Fund underperformed its benchmark, the Credit Suisse AllHedge Index, which returned 7.01% the same Period.

The overall economic backdrop over the Period was one of solid economic growth and declining inflation. Broad based economic indicators highlighting these trends were:

Average Quarterly Gross Domestic Product Growth in the prior four calendar quarters (Third Quarter 2023 – Second Quarter 2024) was 3.2%;

Year-over-year Consumer Price Index continued to decline, falling from 3.7% as of August 31, 2023 to 2.5% as of August 31, 2024;

Year-over-year increase in real wages, as measured by the U.S. Bureau of Labor Statistics, increased by 0.9%.

U.S. equities, as measured by the S&P 500® Index, dipped in September and October 2023 and then proceeded to rally strongly, ending the Period up 27.14%. A boost to equities during the Period was the market’s increasing confidence that the Federal Reserve (the “Fed”) would lower the Federal Funds target rate in the final four months of 2024 and then throughout 2025. Two-year Treasury rates, in anticipation of the lower Federal Funds target rate, declined by -0.98%, while the Ten-Year Treasury rate, which helps set 30-year mortgage rates, declined by -0.20%.

In response to the macro-economic environment, the Fund increased its holdings of equity long-short exchange-traded funds (“ETFs”). As of August 31, 2024, the Fund held 21.66% in the First Trust Long/Short Equity ETF (“FTLS”), up 11.71% from August 31, 2023. This was beneficial to the Fund as FTLS had the second highest total return of the ETFs held during the Period and contributed more than any other ETF to the Fund’s total return. The top performing ETF held by the Fund, and the second largest contributor to Fund’s total return, was the iShares Gold Trust ETF (“IAU”), which rallied strongly during the second half of the Period as market participants began anticipating that the Fed would likely lower short-term borrowing rates in the second half of 2024. IAU was up 29.08%, 23.51% in the second half of the Period. IAU’s weight within the Fund’s portfolio was increased during the Period, rising from 4.95% to 8.53% as of August 31, 2024. Also increasing in weight during the Period was the Fund’s allocation to the First Trust TCW Unconstrained Plus Bond ETF which returned 8.35% over the Period. The Fund’s weight was increased to 12.50% (up 2.50%) as of the end of the first quarter of the calendar year.

During the Period, the commodity allocation in the First Trust Global Tactical Commodity Strategy Fund (“FTGC”) and the merger arbitrage allocation in the First Trust Merger Arbitrage ETF (“MARB”) were reduced. FTGC’s allocation was reduced from 10.50% to 4.78% and MARB’s allocation was reduced from 11.96% to 5.10%. FTGC was the worst performing allocation during the Period, despite outperforming its benchmark by 1.82%. Commodities were down during the Period as declining inflation rates reduced the attractiveness of commodities to investors seeking inflation hedges. MARB’s total returns for the Period were positive but below the levels available from a risk-free cash allocation.

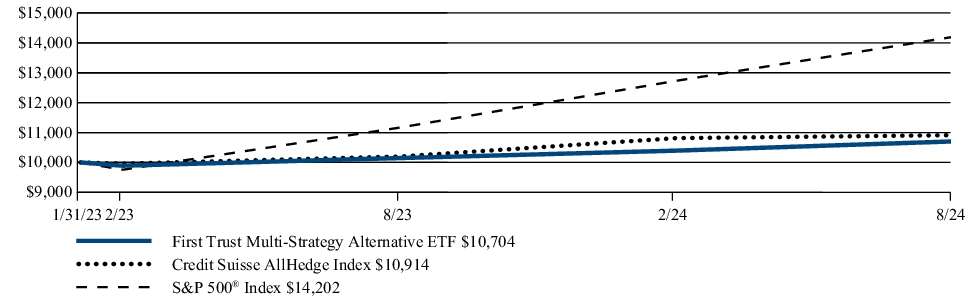

FUND PERFORMANCE (January 31, 2023 to August 31, 2024)

The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods.

Investment Performance of $10,000

| Average Annual Total Returns (as of August 31, 2024) | 1 Year | Since

Inception

(1/31/23) |

| First Trust Multi-Strategy Alternative ETF | 5.49% | 4.40% |

| Credit Suisse AllHedge Index | 7.01% | 5.69% |

| S&P 500® Index | 27.14% | 24.85% |

Visit www.ftportfolios.com/etf/LALT for more recent performance information.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

KEY FUND STATISTICS (As of August 31, 2024)

| Fund net assets | $10,416,857 |

| Total number of portfolio holdings | 8 |

| Total advisory fee paid | $10,093 |

| Portfolio turnover rate | 21% |

WHAT DID THE FUND INVEST IN? (As of August 31, 2024)

The tables below show the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| Exchange-Traded Funds | 99.9% |

| Net Other Assets and Liabilities | 0.1% |

| Total | 100.0% |

HOW HAS THE FUND MATERIALLY CHANGED?

This is a summary of certain changes to the Fund since September 1, 2023. For more complete information, you may review the Fund’s prospectus and any applicable supplements at www.ftportfolios.com/fund-documents/etf/LALT or upon request at 1-800-621-1675 or info@ftportfolios.com.

During the fiscal year ended August 31, 2024, the Fund’s principal investment strategies were revised to allow the Fund to invest in exchange-traded products with exposure to credit default swaps. The Fund’s principal investment strategies and principal risks were revised accordingly.

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

Visit www.ftportfolios.com/fund-documents/etf/LALT to view additional information about the Fund such as the prospectus, financial information, Fund holdings and proxy voting information. You may also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

FT Vest U.S. Equity Buffer ETF - January

FJAN | CBOE BZX EXCHANGE, INC.

ANNUAL SHAREHOLDER REPORT | August 31, 2024

This annual shareholder report contains important information about the FT Vest U.S. Equity Buffer ETF - January (the “Fund”) for the year of September 1, 2023 to August 31, 2024 (the “Period”). You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/FJAN. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

This report describes changes to the Fund that occurred during the Period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| FT Vest U.S. Equity Buffer ETF - January | $93 | 0.85% |

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE?

The Fund returned 17.84% for the twelve months ended August 31, 2024. The Fund underperformed its benchmark, the S&P 500® Index, which returned 27.14% for the same Period.

This underperformance was due to the following:

| Fund NAV Performance Attributed to*: | | |

| Changes in Reference Asset | 13.90 | % |

| Changes in other Variables | 4.79 | % |

| Fees and Expenses | -0.85 | % |

The Fund holds a combination of FLexible EXchange® Options (“FLEX Options”) designed to target the Fund’s objective.

* The Fund’s performance is impacted by changes in the values of the FLEX Options to which it is exposed. We attribute (allocate) the impact on the Fund’s performance into three components. The first of the three components is the impact on the Fund’s performance due to changes in the Fund’s Reference Asset. The second component is the aggregate impact on the Fund’s performance due to changes in other variables that impact FLEX Options prices - these include changes in a) the Reference Asset’s dividends, b) interest rates, c) implied volatility, and d) time to option expiration. The third component is from the Fund’s fees and expenses incurred during the Period.

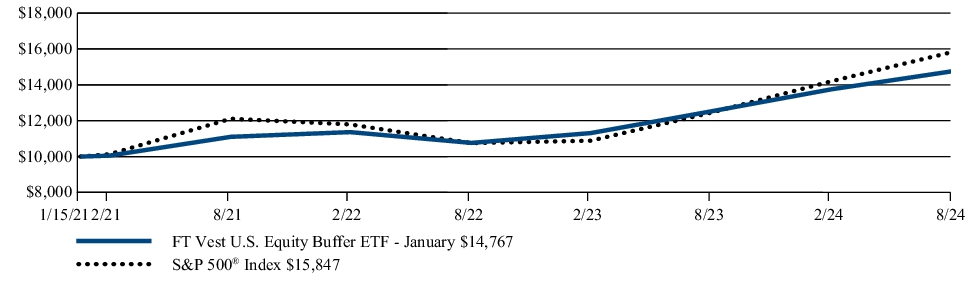

FUND PERFORMANCE (January 15, 2021 to August 31, 2024)

The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods.

Investment Performance of $10,000

| Average Annual Total Returns (as of August 31, 2024) | 1 Year | Since

Inception

(1/15/21) |

| FT Vest U.S. Equity Buffer ETF - January | 17.84% | 11.35% |

| S&P 500® Index | 27.14% | 13.54% |

Visit www.ftportfolios.com/etf/FJAN for more recent performance information.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

KEY FUND STATISTICS (As of August 31, 2024)

| Fund net assets | $742,339,869 |

| Total number of portfolio holdings | 5 |

| Total advisory fee paid | $5,001,784 |

| Portfolio turnover rate | 0% |

WHAT DID THE FUND INVEST IN? (As of August 31, 2024)

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| Money Market Funds | 0.6% |

| Purchased Options | 104.9% |

| Written Options | (5.4%) |

| Net Other Assets and Liabilities | (0.1%) |

| Total | 100.0% |

HOW HAS THE FUND MATERIALLY CHANGED?

This is a summary of certain changes to the Fund since September 1, 2023. For more complete information, you may review the Fund’s prospectus and any applicable supplements at www.ftportfolios.com/fund-documents/etf/FJAN or upon request at 1-800-621-1675 or info@ftportfolios.com.

During the fiscal year ended August 31, 2024, the Fund’s predetermined upside cap on Underlying ETF returns was reset based upon prevailing market conditions at the start of the new Target Outcome Period.

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

Visit www.ftportfolios.com/fund-documents/etf/FJAN to view additional information about the Fund such as the prospectus, financial information, Fund holdings and proxy voting information. You may also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

OTHER INFORMATION

The Fund is not sponsored, endorsed, sold or promoted by SPDR® S&P 500® ETF Trust, PDR Services, LLC, or Standard & Poor’s® (together with their affiliates hereinafter referred to as the “Corporations”). The Corporations have not passed on the legality or suitability of, or the accuracy or adequacy of, descriptions and disclosures relating to the Fund or the FLEX Options. The Corporations make no representations or warranties, express or implied, regarding the advisability of investing in the Fund or the FLEX Options or results to be obtained by the Fund or the FLEX Options, shareholders or any other person or entity from use of the SPDR® S&P 500® ETF Trust. The Corporations have no liability in connection with the management, administration, marketing or trading of the Fund or the FLEX Options.

FT Vest U.S. Equity

Deep Buffer ETF - January

DJAN | CBOE BZX EXCHANGE, INC.

ANNUAL SHAREHOLDER REPORT | August 31, 2024

This annual shareholder report contains important information about the FT Vest U.S. Equity Deep Buffer ETF - January (the “Fund”) for the year of September 1, 2023 to August 31, 2024 (the “Period”). You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/DJAN. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

This report describes changes to the Fund that occurred during the Period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| FT Vest U.S. Equity Deep Buffer ETF - January | $91 | 0.85% |

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE?

The Fund returned 14.16% for the twelve months ended August 31, 2024. The Fund underperformed its benchmark, the S&P 500® Index, which returned 27.14% for the same Period.

This underperformance was due to the following:

| Fund NAV Performance Attributed to*: | | |

| Changes in Reference Asset | 10.49 | % |

| Changes in other Variables | 4.52 | % |

| Fees and Expenses | -0.85 | % |

The Fund holds a combination of FLexible EXchange® Options (“FLEX Options”) designed to target the Fund’s objective.

* The Fund’s performance is impacted by changes in the values of the FLEX Options to which it is exposed. We attribute (allocate) the impact on the Fund’s performance into three components. The first of the three components is the impact on the Fund’s performance due to changes in the Fund’s Reference Asset. The second component is the aggregate impact on the Fund’s performance due to changes in other variables that impact FLEX Options prices - these include changes in a) the Reference Asset’s dividends, b) interest rates, c) implied volatility, and d) time to option expiration. The third component is from the Fund’s fees and expenses incurred during the Period.

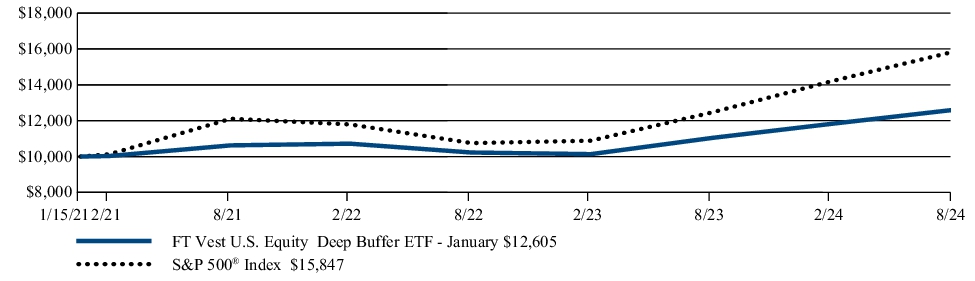

FUND PERFORMANCE (January 15, 2021 to August 31, 2024)

The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods.

Investment Performance of $10,000

| Average Annual Total Returns (as of August 31, 2024) | 1 Year | Since

Inception

(1/15/21) |

| FT Vest U.S. Equity Deep Buffer ETF - January | 14.16% | 6.59% |

| S&P 500® Index | 27.14% | 13.54% |

Visit www.ftportfolios.com/etf/DJAN for more recent performance information.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

KEY FUND STATISTICS (As of August 31, 2024)

| Fund net assets | $245,331,379 |

| Total number of portfolio holdings | 5 |

| Total advisory fee paid | $1,991,100 |

| Portfolio turnover rate | 0% |

WHAT DID THE FUND INVEST IN? (As of August 31, 2024)

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| Money Market Funds | 0.6% |

| Purchased Options | 106.0% |

| Written Options | (6.5%) |

| Net Other Assets and Liabilities | (0.1%) |

| Total | 100.0% |

HOW HAS THE FUND MATERIALLY CHANGED?

This is a summary of certain changes to the Fund since September 1, 2023. For more complete information, you may review the Fund’s prospectus and any applicable supplements at www.ftportfolios.com/fund-documents/etf/DJAN or upon request at 1-800-621-1675 or info@ftportfolios.com.

During the fiscal year ended August 31, 2024, the Fund’s predetermined upside cap on Underlying ETF returns was reset based upon prevailing market conditions at the start of the new Target Outcome Period.

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

Visit www.ftportfolios.com/fund-documents/etf/DJAN to view additional information about the Fund such as the prospectus, financial information, Fund holdings and proxy voting information. You may also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

OTHER INFORMATION

The Fund is not sponsored, endorsed, sold or promoted by SPDR® S&P 500® ETF Trust, PDR Services, LLC, or Standard & Poor’s® (together with their affiliates hereinafter referred to as the “Corporations”). The Corporations have not passed on the legality or suitability of, or the accuracy or adequacy of, descriptions and disclosures relating to the Fund or the FLEX Options. The Corporations make no representations or warranties, express or implied, regarding the advisability of investing in the Fund or the FLEX Options or results to be obtained by the Fund or the FLEX Options, shareholders or any other person or entity from use of the SPDR® S&P 500® ETF Trust. The Corporations have no liability in connection with the management, administration, marketing or trading of the Fund or the FLEX Options.

FT Vest U.S. Equity Buffer ETF - February

FFEB | CBOE BZX EXCHANGE, INC.

ANNUAL SHAREHOLDER REPORT | August 31, 2024

This annual shareholder report contains important information about the FT Vest U.S. Equity Buffer ETF - February (the “Fund”) for the year of September 1, 2023 to August 31, 2024 (the “Period”). You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/FFEB. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

This report describes changes to the Fund that occurred during the Period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| FT Vest U.S. Equity Buffer ETF - February | $93 | 0.85% |

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE?

The Fund returned 19.11% for the twelve months ended August 31, 2024. The Fund underperformed its benchmark, the S&P 500® Index, which returned 27.14% for the same Period.

This underperformance was due to the following:

| Fund NAV Performance Attributed to*: | | |

| Changes in Reference Asset | 15.37 | % |

| Changes in other Variables | 4.59 | % |

| Fees and Expenses | -0.85 | % |

The Fund holds a combination of FLexible EXchange® Options (“FLEX Options”) designed to target the Fund’s objective.

* The Fund’s performance is impacted by changes in the values of the FLEX Options to which it is exposed. We attribute (allocate) the impact on the Fund’s performance into three components. The first of the three components is the impact on the Fund’s performance due to changes in the Fund’s Reference Asset. The second component is the aggregate impact on the Fund’s performance due to changes in other variables that impact FLEX Options prices - these include changes in a) the Reference Asset’s dividends, b) interest rates, c) implied volatility, and d) time to option expiration. The third component is from the Fund’s fees and expenses incurred during the Period.

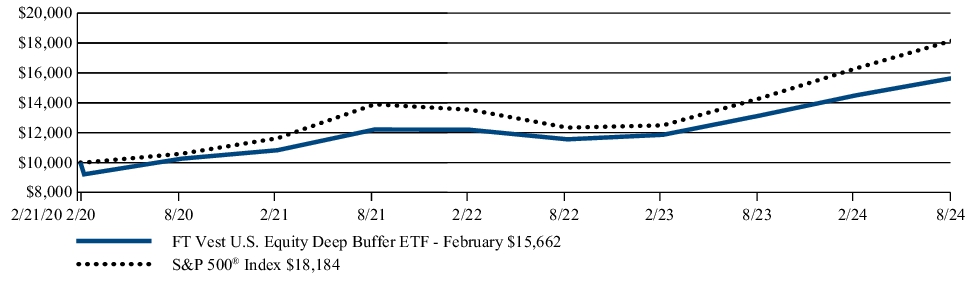

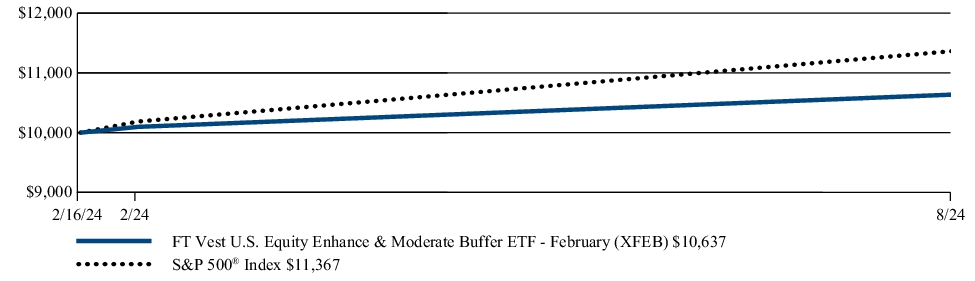

FUND PERFORMANCE (February 21, 2020 to August 31, 2024)

The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods.

Investment Performance of $10,000

| Average Annual Total Returns (as of August 31, 2024) | 1 Year | Since

Inception

(2/21/20) |

| FT Vest U.S. Equity Buffer ETF - February | 19.11% | 10.42% |

| S&P 500® Index | 27.14% | 14.13% |

Visit www.ftportfolios.com/etf/FFEB for more recent performance information.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

KEY FUND STATISTICS (As of August 31, 2024)

| Fund net assets | $926,256,152 |

| Total number of portfolio holdings | 5 |

| Total advisory fee paid | $5,697,944 |

| Portfolio turnover rate | 0% |

WHAT DID THE FUND INVEST IN? (As of August 31, 2024)

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| Money Market Funds | 0.7% |

| Purchased Options | 102.8% |

| Written Options | (3.4%) |

| Net Other Assets and Liabilities | (0.1%) |

| Total | 100.0% |

HOW HAS THE FUND MATERIALLY CHANGED?

This is a summary of certain changes to the Fund since September 1, 2023. For more complete information, you may review the Fund’s prospectus and any applicable supplements at www.ftportfolios.com/fund-documents/etf/FFEB or upon request at 1-800-621-1675 or info@ftportfolios.com.

During the fiscal year ended August 31, 2024, the Fund’s predetermined upside cap on Underlying ETF returns was reset based upon prevailing market conditions at the start of the new Target Outcome Period.

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

Visit www.ftportfolios.com/fund-documents/etf/FFEB to view additional information about the Fund such as the prospectus, financial information, Fund holdings and proxy voting information. You may also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

OTHER INFORMATION

The Fund is not sponsored, endorsed, sold or promoted by SPDR® S&P 500® ETF Trust, PDR Services, LLC, or Standard & Poor’s® (together with their affiliates hereinafter referred to as the “Corporations”). The Corporations have not passed on the legality or suitability of, or the accuracy or adequacy of, descriptions and disclosures relating to the Fund or the FLEX Options. The Corporations make no representations or warranties, express or implied, regarding the advisability of investing in the Fund or the FLEX Options or results to be obtained by the Fund or the FLEX Options, shareholders or any other person or entity from use of the SPDR® S&P 500® ETF Trust. The Corporations have no liability in connection with the management, administration, marketing or trading of the Fund or the FLEX Options.

FT Vest U.S. Equity

Deep Buffer ETF - February

DFEB | CBOE BZX EXCHANGE, INC.

ANNUAL SHAREHOLDER REPORT | August 31, 2024

This annual shareholder report contains important information about the FT Vest U.S. Equity Deep Buffer ETF - February (the “Fund”) for the year of September 1, 2023 to August 31, 2024 (the “Period”). You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/DFEB. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

This report describes changes to the Fund that occurred during the Period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| FT Vest U.S. Equity Deep Buffer ETF - February | $91 | 0.85% |

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE?

The Fund returned 15.24% for the twelve months ended August 31, 2024. The Fund underperformed its benchmark, the S&P 500® Index, which returned 27.14% for the same Period.

This underperformance was due to the following:

| Fund NAV Performance Attributed to*: | | |

| Changes in Reference Asset | 12.01 | % |

| Changes in other Variables | 4.08 | % |

| Fees and Expenses | -0.85 | % |

The Fund holds a combination of FLexible EXchange® Options (“FLEX Options”) designed to target the Fund’s objective.

* The Fund’s performance is impacted by changes in the values of the FLEX Options to which it is exposed. We attribute (allocate) the impact on the Fund’s performance into three components. The first of the three components is the impact on the Fund’s performance due to changes in the Fund’s Reference Asset. The second component is the aggregate impact on the Fund’s performance due to changes in other variables that impact FLEX Options prices - these include changes in a) the Reference Asset’s dividends, b) interest rates, c) implied volatility, and d) time to option expiration. The third component is from the Fund’s fees and expenses incurred during the Period.

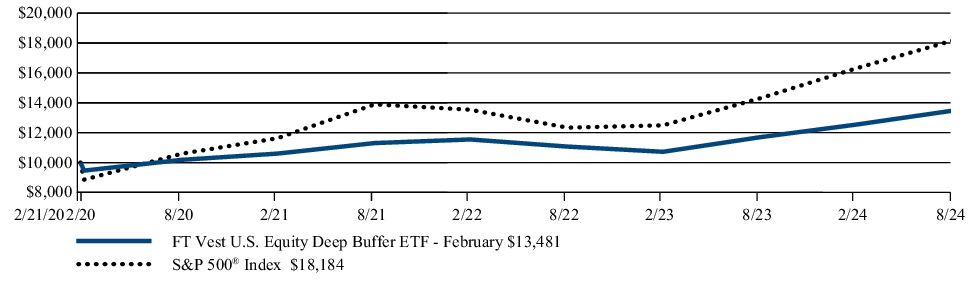

FUND PERFORMANCE (February 21, 2020 to August 31, 2024)

The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods.

Investment Performance of $10,000

| Average Annual Total Returns (as of August 31, 2024) | 1 Year | Since

Inception

(2/21/20) |

| FT Vest U.S. Equity Deep Buffer ETF - February | 15.24% | 6.82% |

| S&P 500® Index | 27.14% | 14.13% |

Visit www.ftportfolios.com/etf/DFEB for more recent performance information.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

KEY FUND STATISTICS (As of August 31, 2024)

| Fund net assets | $262,627,031 |

| Total number of portfolio holdings | 5 |

| Total advisory fee paid | $2,080,212 |

| Portfolio turnover rate | 0% |

WHAT DID THE FUND INVEST IN? (As of August 31, 2024)

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| Money Market Funds | 0.7% |

| Purchased Options | 103.4% |

| Written Options | (4.0%) |

| Net Other Assets and Liabilities | (0.1%) |

| Total | 100.0% |

HOW HAS THE FUND MATERIALLY CHANGED?

This is a summary of certain changes to the Fund since September 1, 2023. For more complete information, you may review the Fund’s prospectus and any applicable supplements at www.ftportfolios.com/fund-documents/etf/DFEB or upon request at 1-800-621-1675 or info@ftportfolios.com.

During the fiscal year ended August 31, 2024, the Fund’s predetermined upside cap on Underlying ETF returns was reset based upon prevailing market conditions at the start of the new Target Outcome Period.

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

Visit www.ftportfolios.com/fund-documents/etf/DFEB to view additional information about the Fund such as the prospectus, financial information, Fund holdings and proxy voting information. You may also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

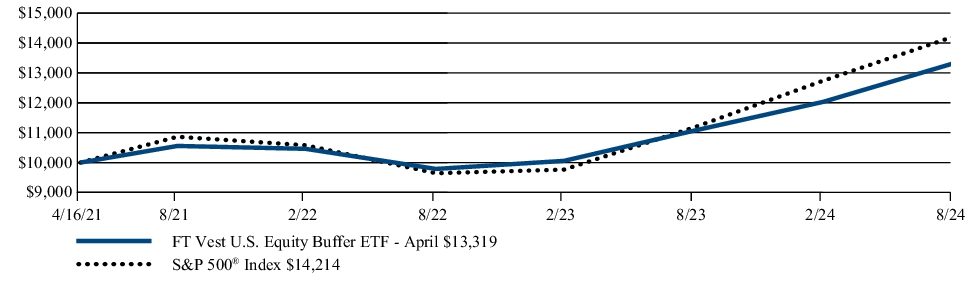

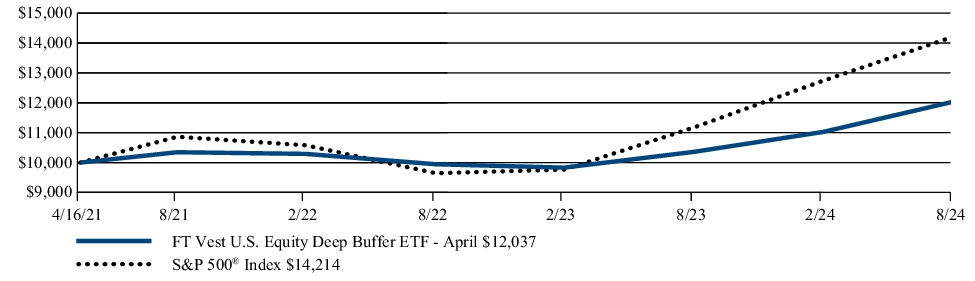

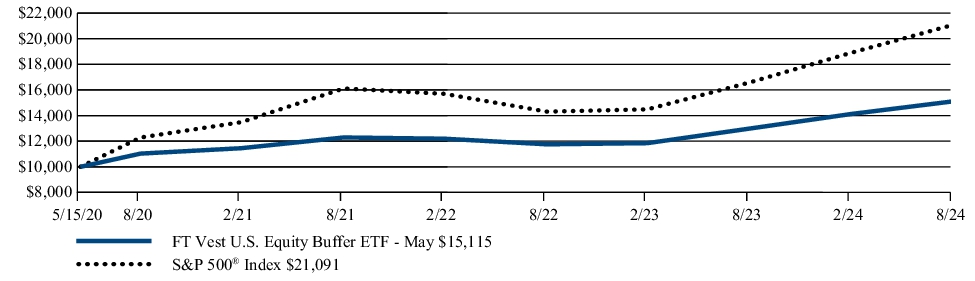

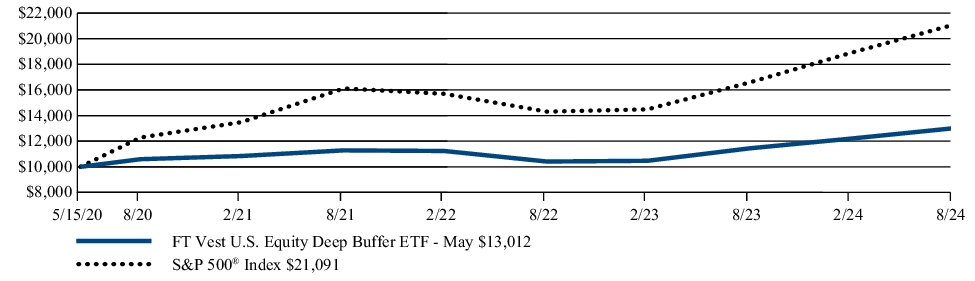

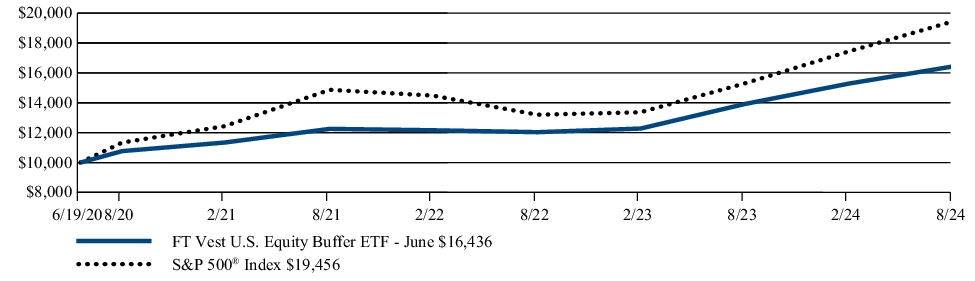

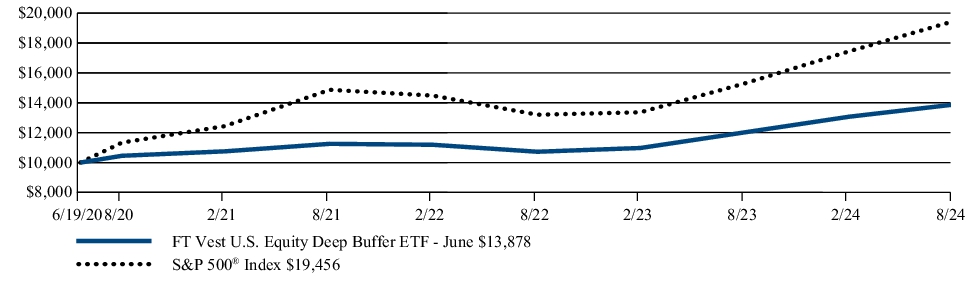

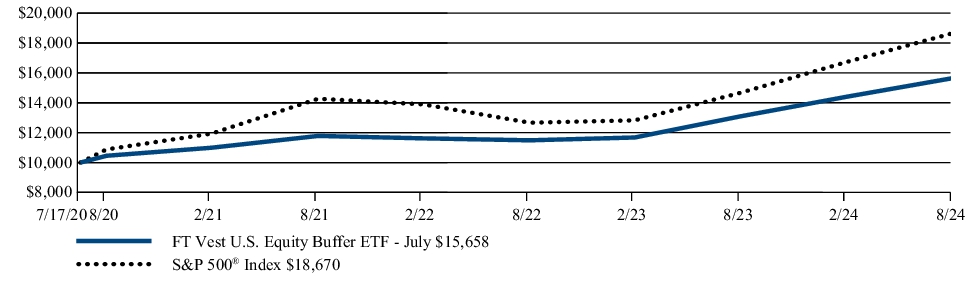

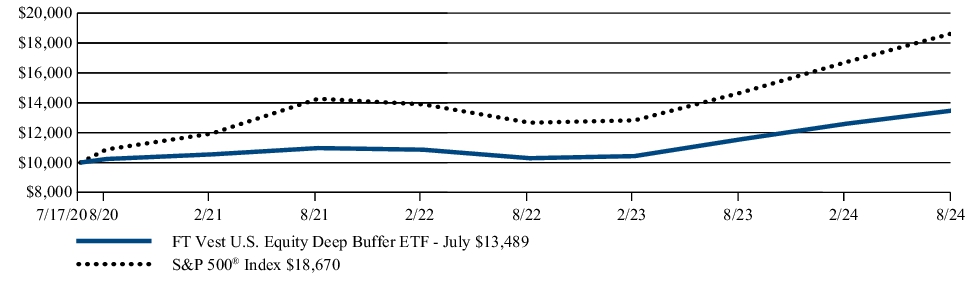

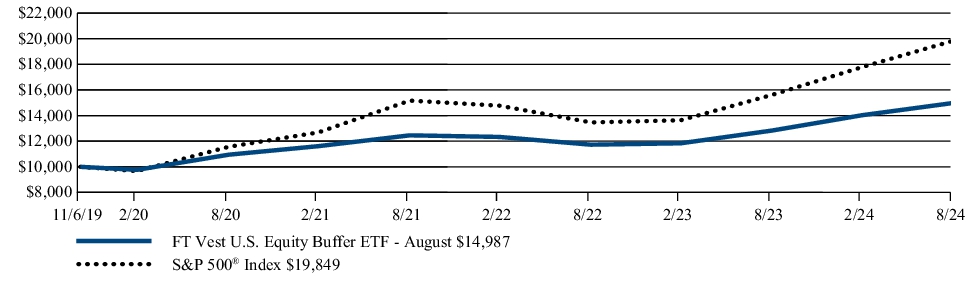

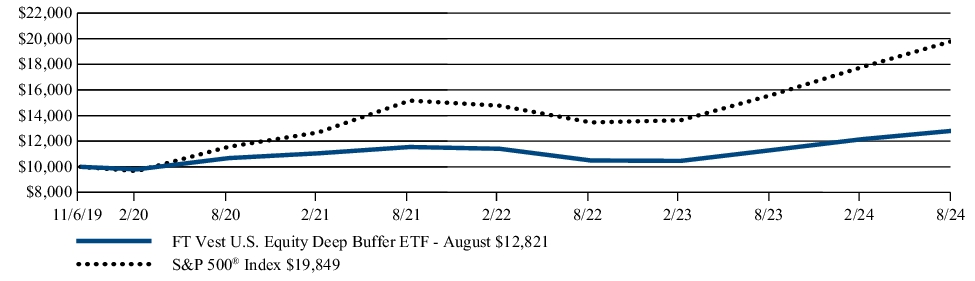

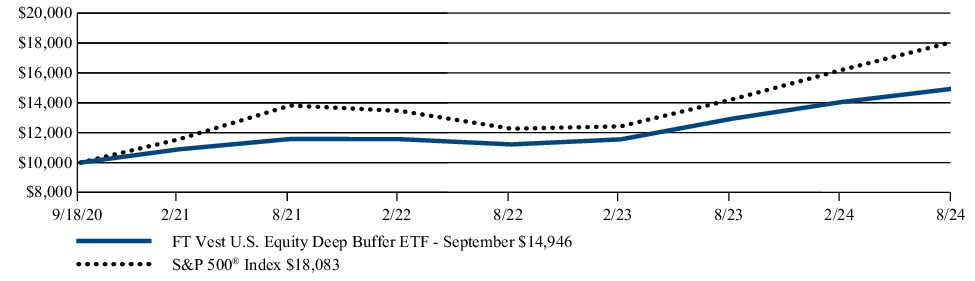

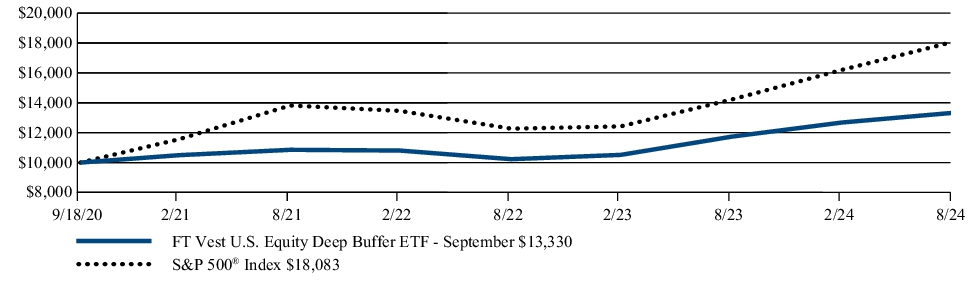

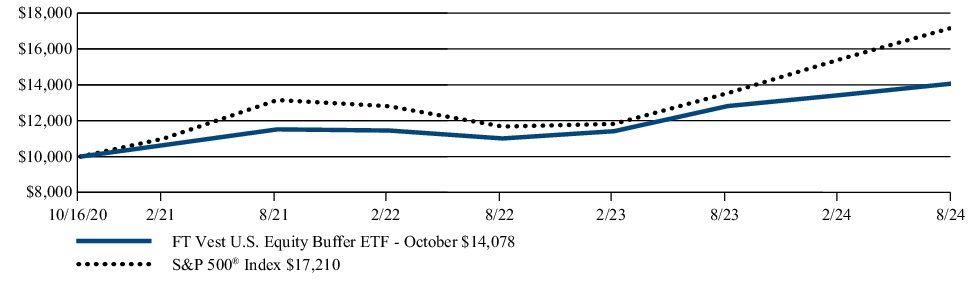

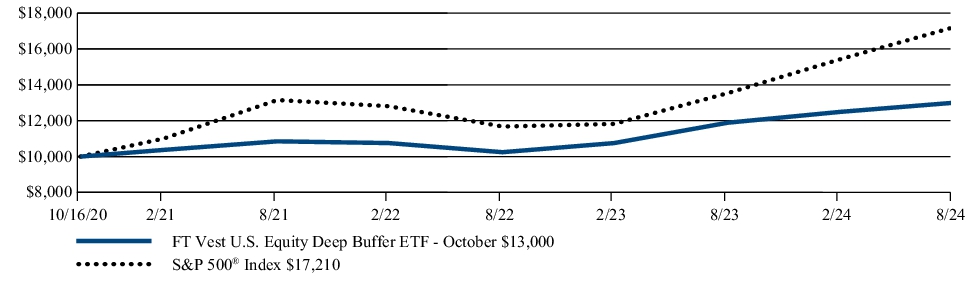

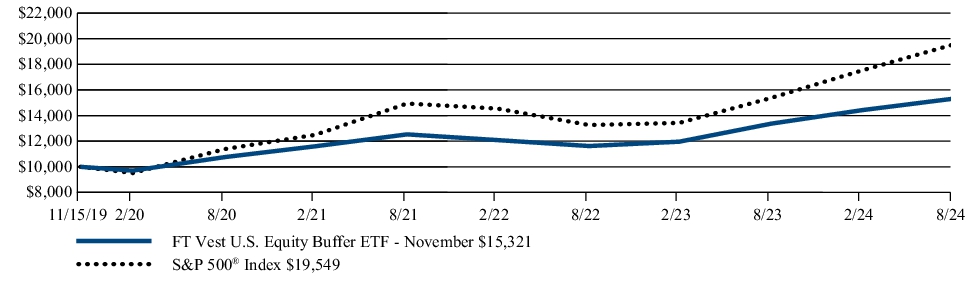

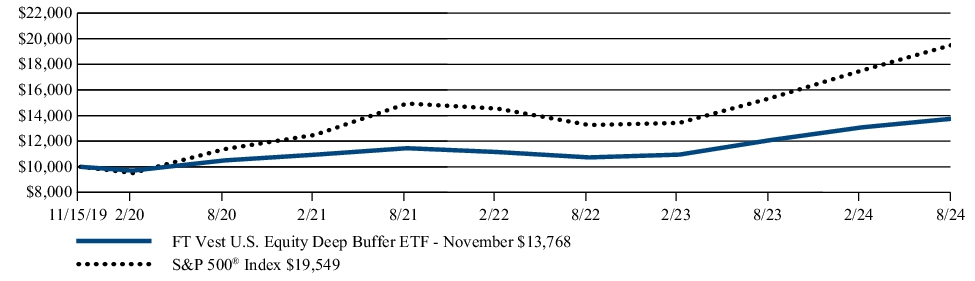

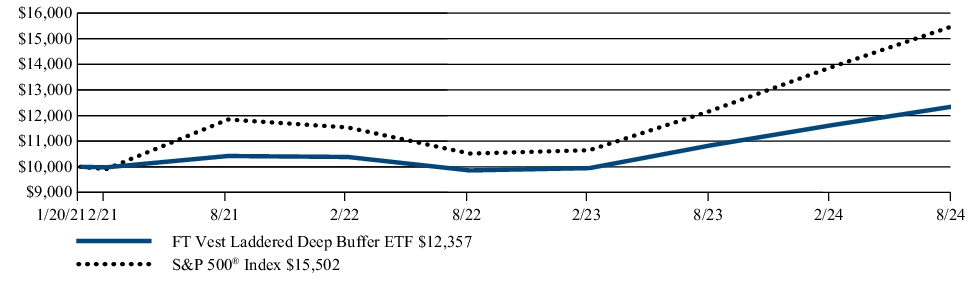

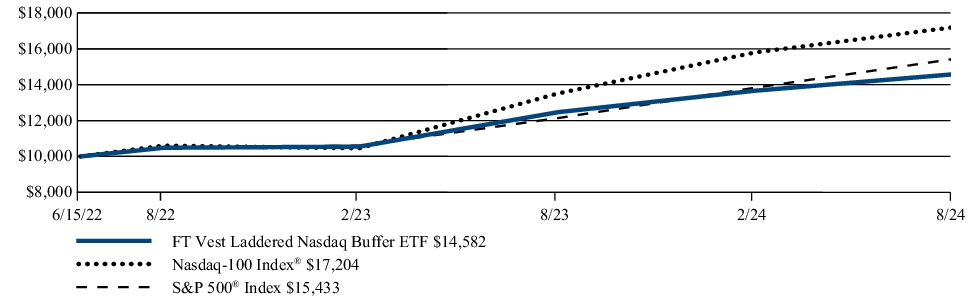

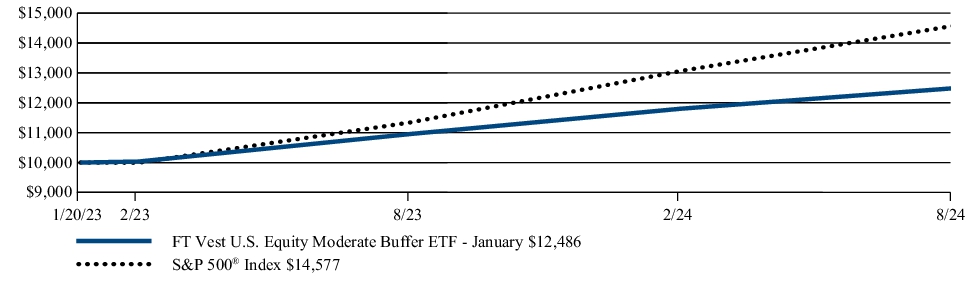

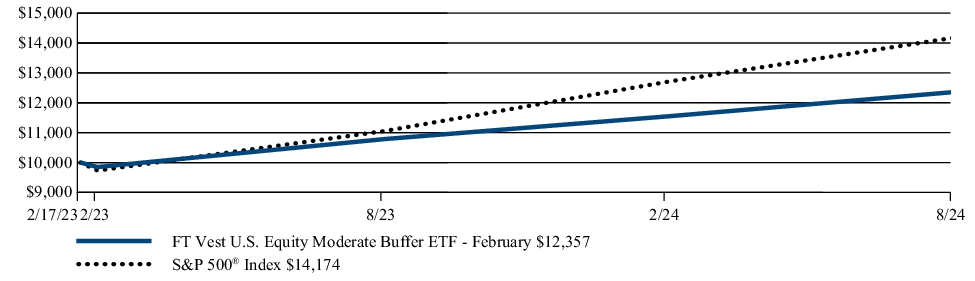

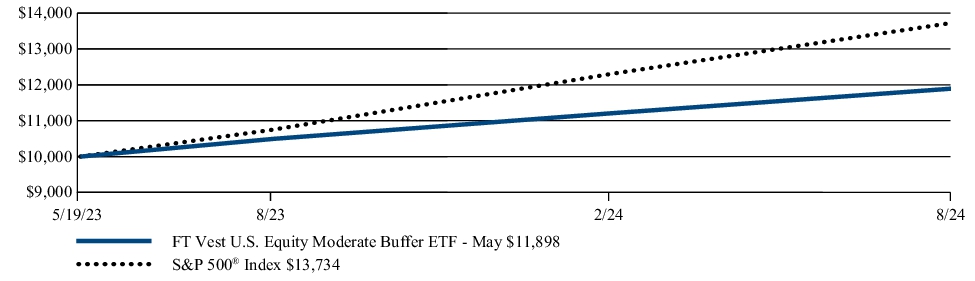

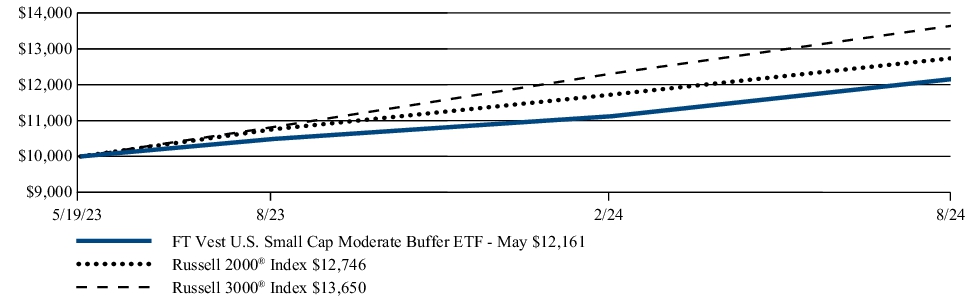

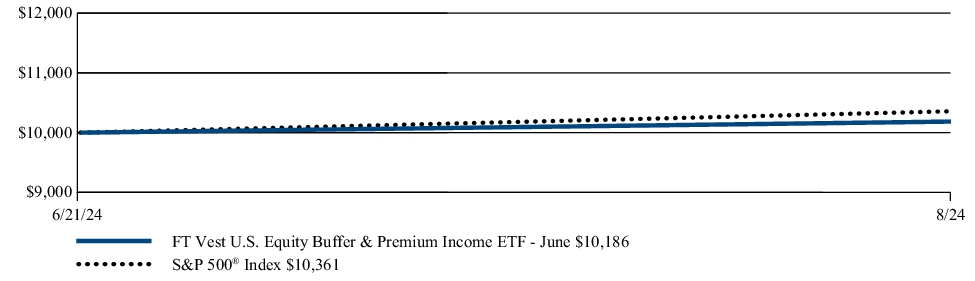

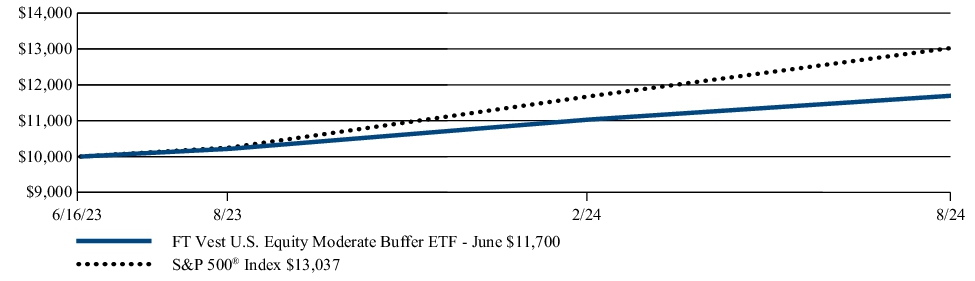

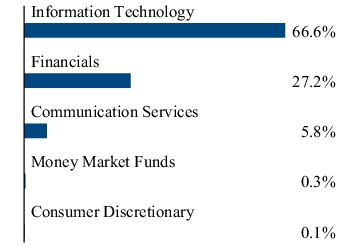

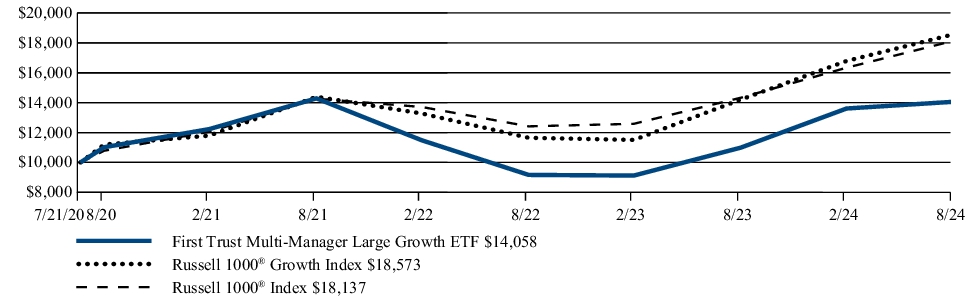

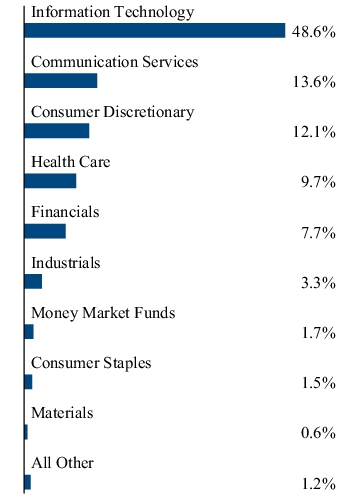

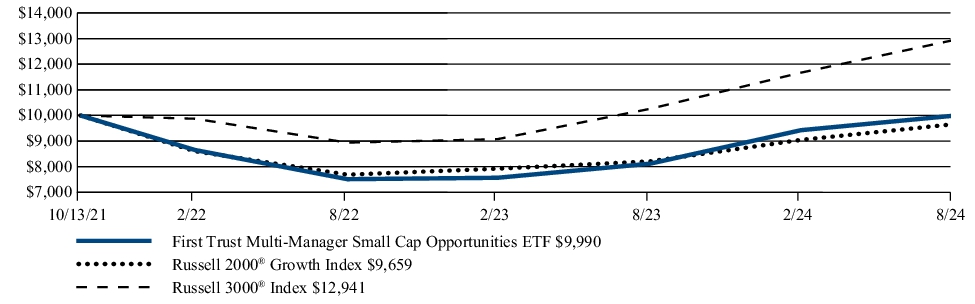

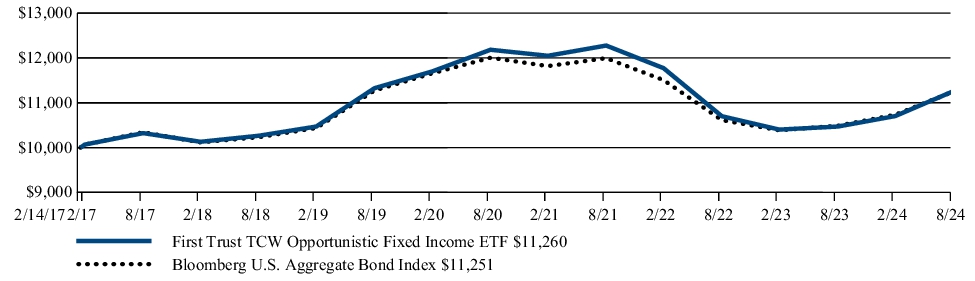

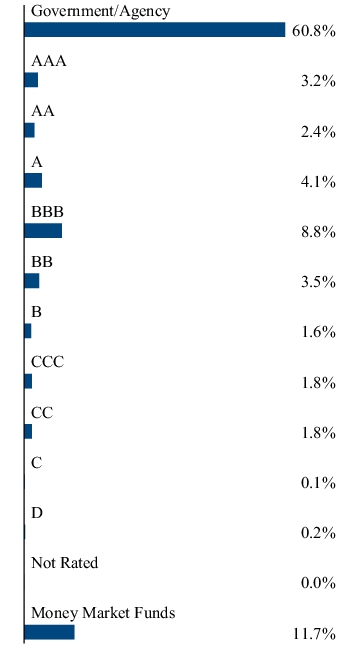

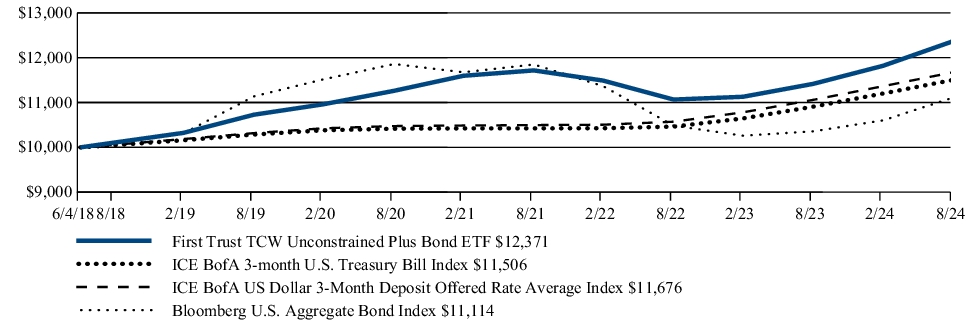

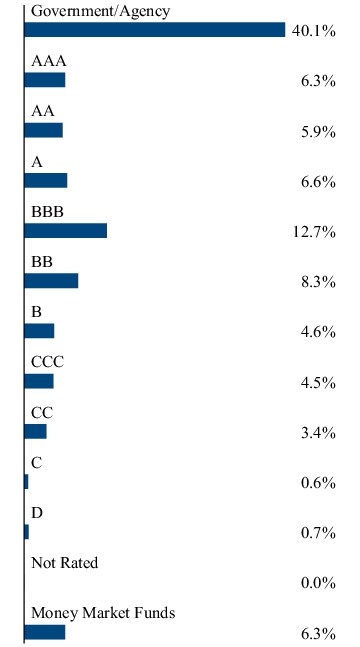

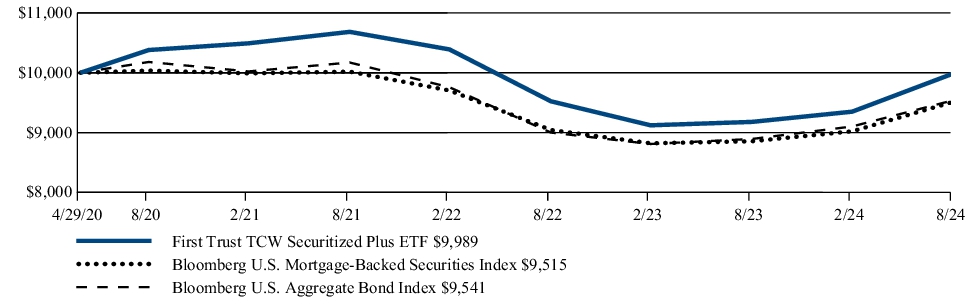

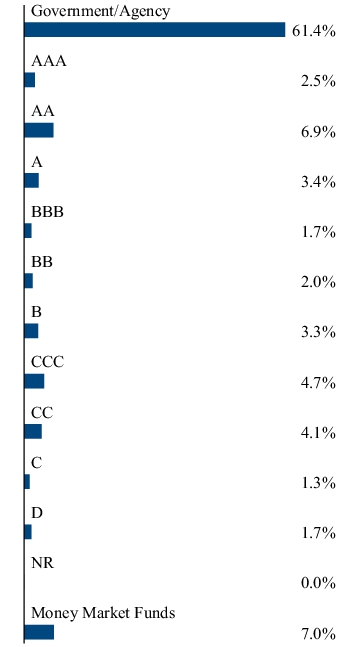

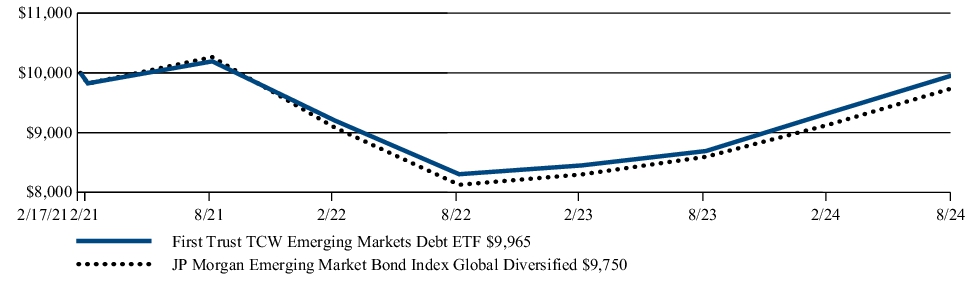

OTHER INFORMATION