Exhibit 99.11

Virtual Customer & Partner Q&A Thoma Bravo Acquisition

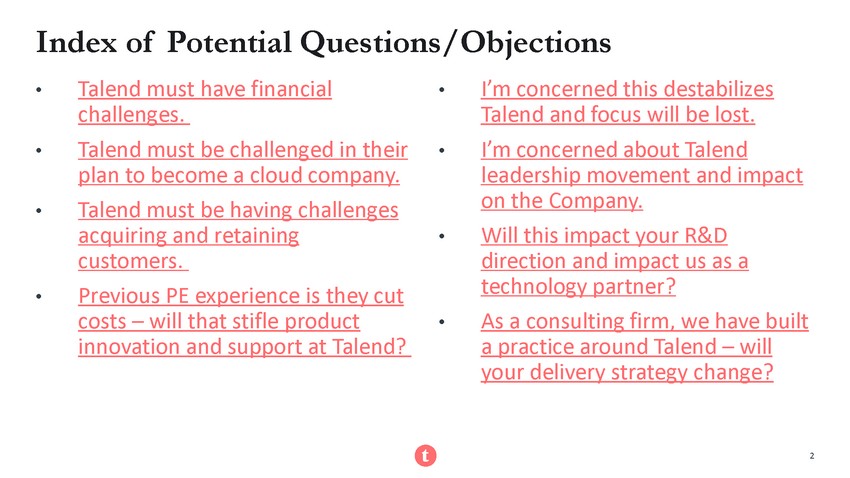

2 2 Index of Potential Questions/Objections • Talend must have financial challenges. • Talend must be challenged in their plan to become a cloud company. • Talend must be having challenges acquiring and retaining customers. • Previous PE experience is they cut costs – will that stifle product innovation and support at Talend? • I’m concerned this destabilizes Talend and focus will be lost. • I’m concerned about Talend leadership movement and impact on the C ompany . • Will this impact your R&D direction and impact us as a technology partner? • As a consulting firm, we have built a practice around Talend – will your delivery strategy change? 2

Question: Is the proposed acquisition a sign the Company is struggling financially?

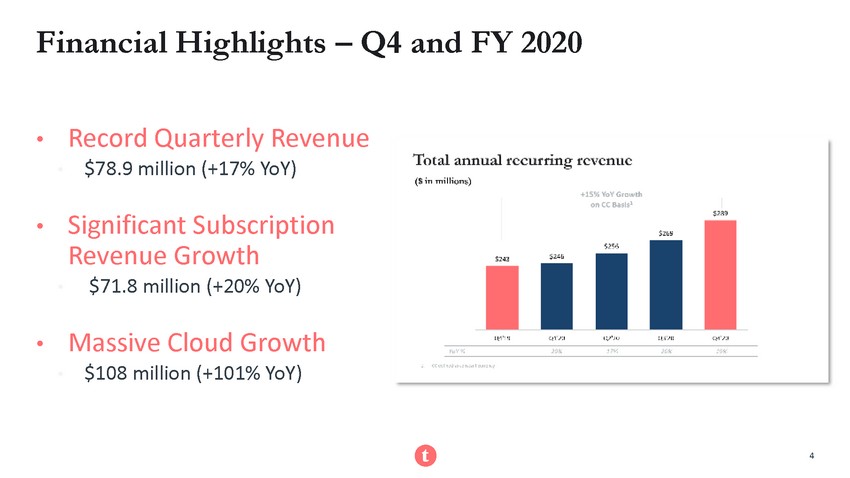

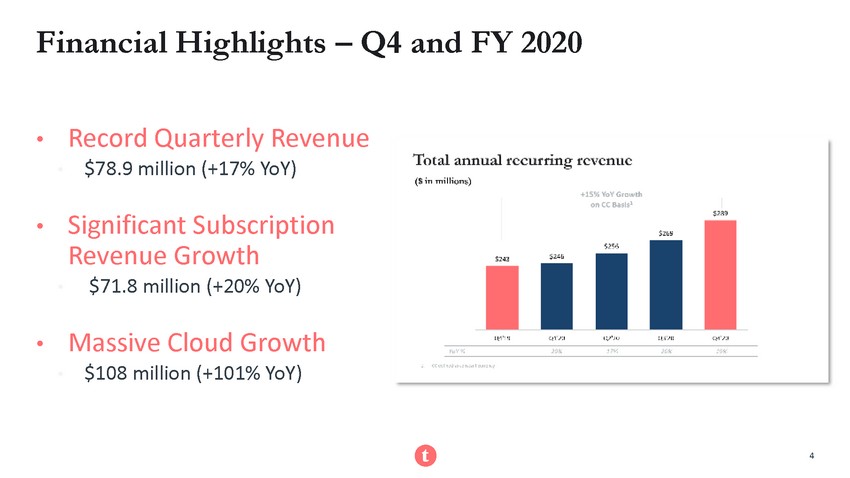

4 4 Financial Highlights – Q4 and FY 2020 • Record Quarterly Revenue • $78.9 million (+17% YoY) • Significant Subscription Revenue Growth • $71.8 million (+20% YoY) • Massive Cloud Growth • $108 million (+101% YoY) 4

Question: Is the proposed acquisition a sign the Company is struggling to transition to cloud ?

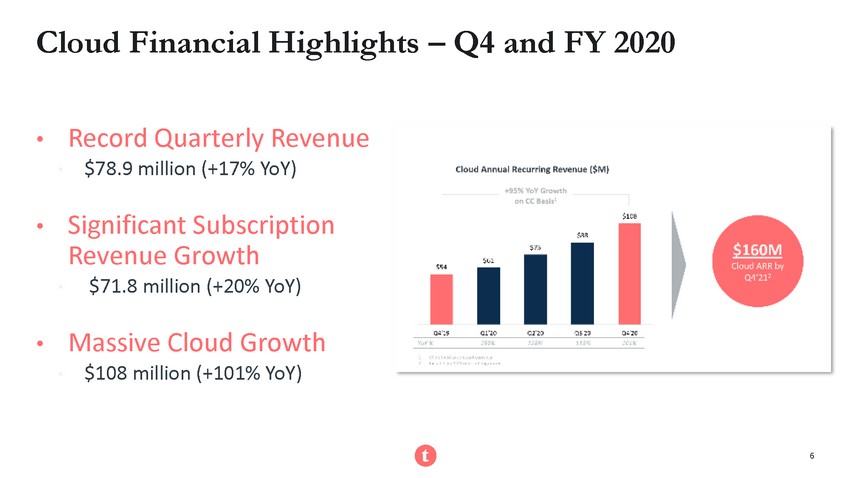

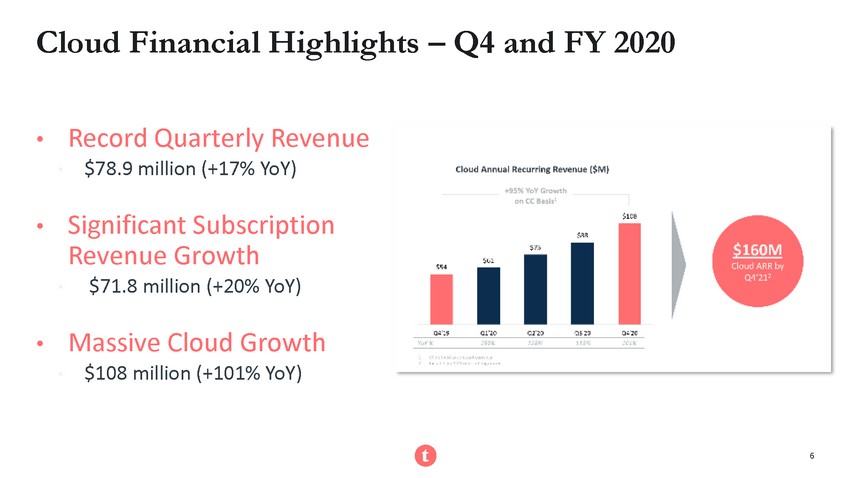

6 6 Cloud Financial Highlights – Q4 and FY 2020 • Record Quarterly Revenue • $78.9 million (+17% YoY) • Significant Subscription Revenue Growth • $71.8 million (+20% YoY) • Massive Cloud Growth • $108 million (+101% YoY) 6

Question: Is the proposed acquisition a sign that the Company is struggling to win and retain customers?

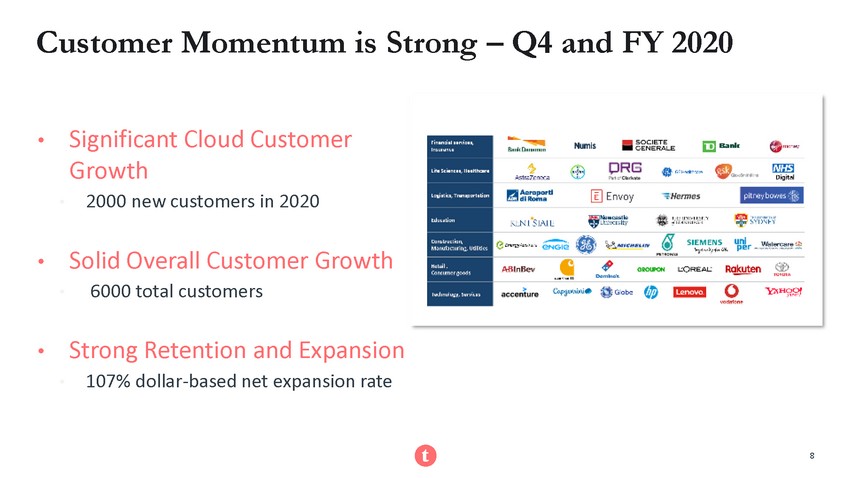

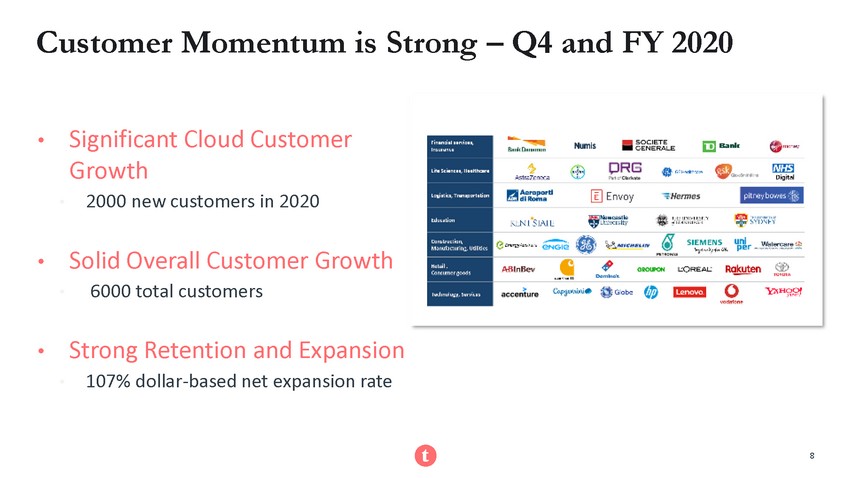

8 8 Customer Momentum is Strong – Q4 and FY 2020 • Significant Cloud Customer Growth • 2000 new customers in 2020 • Solid Overall Customer Growth • 6000 total customers • Strong Retention and Expansion • 107% dollar - based net expansion rate 8

Question: Some PE firms have a reputation for creating value by cutting expenses. Should I be concerned that Talend’s product and support will suffer as a result?

10 10 Intentional Strategy to Accelerate Business and Customer & Partner Value • Thoma Bravo shares our conviction that Talend is poised for tremendous long - term growth, and they have an impressive track record supporting growth - oriented companies like ours: » Provide access to additional capital, resources, and expertise to grow the business » Strong commitment to investing in product innovation and customer service » Deep software expertise (acquired 270 software and technology companies representing over $79 billion of value)

11 11 Intentional Strategy to Accelerate Business and Customer & Partner Value • Talend intends to use collaboration to separate from competition in a meaningful way and drive unique and strategic value for our customers and partners » Assuming the acquisition is successfully completed, w e intend to draw upon the best of Thoma Bravo to expand our capabilities in the cloud, enhance our customer - first approach, and deliver new innovations to drive intelligent data management and ensure corporate data health

Question: In my experience, a sale destabilizes companies. Should I be worried that Talend will lose focus or lose key employees?

13 13 Acquisition is an Intentional Strategy to Accelerate Business and Benefit all Stakeholders • Thoma Bravo shares our conviction that Talend is poised for tremendous long - term growth, and they have an impressive track record supporting growth - oriented companies like ours: » Provide access to additional capital, resources, and expertise to grow the business » Strong commitment to investing in product innovation and customer service » Deep software expertise (acquired 270 software and technology companies representing over $79 billion of value) • Assuming the transaction is completed, Talend will use collaboration to separate from competition in a meaningful way and drive unique and strategic value for our customers and partners » For Customers and Partners , we would have the flexibility to further invest in and accelerate our cloud transition, customer - first approach, and innovative solutions that serve their evolving needs » Employees will be happy because we would be able to double down on the key projects they are working on to propel Talend’s future. They also recognize there would be new opportunities for career development and advancement as part of a stronger, better - capitalized organization

Question: A sale destabilizes companies. Should I be concerned about exec attrition like I’ve seen at other companies?

15 15 Acquisition is the result of an intentional process to find the right partner • Result of an intentional strategy on the part of management and Talend’s Board to accelerate the business and drive unique and strategic value for our customers and partners » Talend executives are 100% behind this agreement » Helps accelerates our vision and ability to differentiate in the market » Provides access to additional capital, resources, and expertise • Thoma Bravo shares our conviction that Talend is poised for tremendous long - term growth, and they have an impressive track record supporting growth - oriented companies like ours: » Provide access to additional capital, resources, and expertise to grow the business » Strong commitment to investing in product innovation and customer service » Deep software expertise (acquired 270 software and technology companies representing over $79 billion of value)

Question: Will this impact your R&D direction and therefore reduce your value as a technology partner?

17 17 We’re very excited about our roadmap, and see this agreement as the opportunity to drive even more innovation and deepen our collaboration with partners • Talend’s technology partners are one of our most important assets and we cherish our strategic relationships with them • Over the near - term, it is business as usual for Talend, and we don't anticipate any changes to the roadmap • Assuming the acquisition is successfully completed, we believe we will have the opportunity to increase our focus on key strategic initiatives and collaborate more deeply with partners on joint market solutions • We intend to draw upon the best of Thoma Bravo for added expertise and resources to expand our capabilities in the cloud, extend and enhance our intelligent Data Fabric platform, and build from strength to strength on our core competencies such as data governance, quality, and trust

Question: As a consulting firm, we have built a practice around Talend – will your delivery strategy change?

19 19 Talend was, is, and remains first and foremost a software company • Our focus is to increase out partners’ abilities and capabilities to ensure successful customer projects • Talend has invested in our Academy approach as well as building out an accreditation and certification strategy – we will continue on this very successful path and continue to encourage our partners to get fully trained and enabled

20 20 Important Additional Information and Where to Find It In connection with the proposed acquisition of Talend S.A. (“Talend”) by Tahoe Bidco (Cayman), LLC, a limited liability company org anized under the laws of the Cayman Islands (“Parent”), Parent will commence, or will cause to be filed, a tender offer for all of the outstanding shares, American Depos ita ry Shares, and other outstanding equity interests of Talend. The tender offer has not commenced. This communication is for informational purposes only and is neither an offer to pur chase nor a solicitation of an offer to sell securities of Talend. It is also not a substitute for the tender offer materials that Parent will file with the Securities an d E xchange Commission (the “SEC”) upon commencement of the tender offer. At the time that the tender offer is commenced, Parent will file tender offer materials on Schedule TO with th e SEC, and Talend will file a Solicitation/Recommendation Statement on Schedule 14D - 9 with the SEC with respect to the tender offer. THE TENDER OFFER MATERIAL S (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT WILL CO NTA IN IMPORTANT INFORMATION THAT SHOULD BE READ CAREFULLY AND CONSIDERED BY TALEND’S SECURITY HOLDERS BEFORE ANY DECISION IS MADE WITH RESPEC T T O THE TENDER OFFER. Both the tender offer materials and the solicitation/recommendation statement will be made available to Talend’s investors and sec uri ty holders free of charge. A free copy of the tender offer materials and the solicitation/recommendation statement will also be made available to all of Talend’s investors and se cur ity holders by contacting Talend at ir@talend.com , or by visiting Talend’s website ( www.talend.com ). In addition, the tender offer materials and the solicitation/recommendation statement (and all other documents filed by Ta len d with the SEC) will be available at no charge on the SEC’s website ( www.sec.gov ) upon filing with the SEC. TALEND’S INVESTORS AND SECURITY HOLDERS ARE ADVISED TO READ THE TENDER OFFER MATERIALS AND THE SOLICITATION/RECOMMENDATION STATEMENT, AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIM E, AND ANY OTHER RELEVANT DOCUMENTS FILED BY PARENT OR TALEND WITH THE SEC WHEN THEY BECOME AVAILABLE BEFORE THEY MAKE ANY DECISION WITH RESPE CT TO THE TENDER OFFER. THESE MATERIALS WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TENDER OFFER, PARENT AND TALEND. Forward - Looking Statements This document contains certain statements that constitute forward - looking statements. These forward - looking statements include, but are not limited to, statements regarding the satisfaction of conditions to the completion of the proposed transaction and the expected completion of the proposed transact ion , the timing and benefits thereof, as well as other statements that are not historical fact. These forward - looking statements are based on currently available information, as well as Talend’s views and assumptions regarding future events as of the time such statements are being made. Such forward looking statements are subject to inherent risks and uncer tai nties. Accordingly, actual results may differ materially and adversely from those expressed or implied in such forward - looking statements. Such risks and uncertainties includ e, but are not limited to, the potential failure to satisfy conditions to the completion of the proposed transaction due to the failure to receive a sufficient number of tendere d s hares in the tender offer; the failure to obtain necessary regulatory or other approvals; the outcome of legal proceedings that may be instituted against Talend and/or others re lating to the transaction; the possibility that competing offers will be made, risks associated with acquisitions, such as the risk that transaction may be more difficult, t ime - consuming or costly than expected or that the expected benefits of the transaction will not occur; as well as those described in cautionary statements contained elsewhere her ein and in Talend’s periodic reports filed with the SEC including the statements set forth under “Risk Factors” set forth in Talend’s most recent annual report on Form 10 - K, and an y subsequent reports on Form 10 - Q or form 8 - K filed with the SEC, the Tender Offer Statement on Schedule TO (including the offer to purchase, the letter of transmittal and ot her documents relating to the tender offer) to be filed by Parent, and the Solicitation/Recommendation Statement on Schedule 14D - 9 to be filed by Talend. As a result of these and other risks, the proposed transaction may not be completed on the timeframe expected or at all. These forward - looking statements reflect Talend’s expectations as of the date of this report. The forward - looking statements included in this communication are made only as of the date hereof. Talend assumes no obligation and does not intend to updat e t hese forward - looking statements, except as required by law.