Exhibit 99.3

Talend to be Acquired by Thoma Bravo March 10, 2021

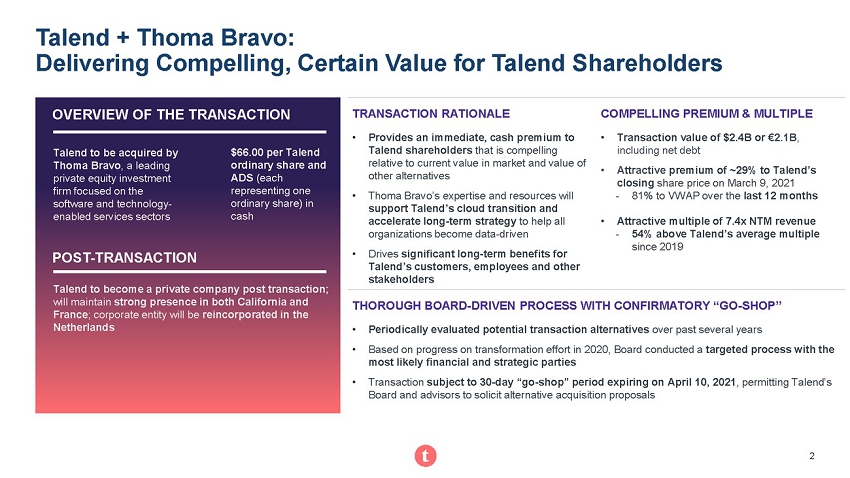

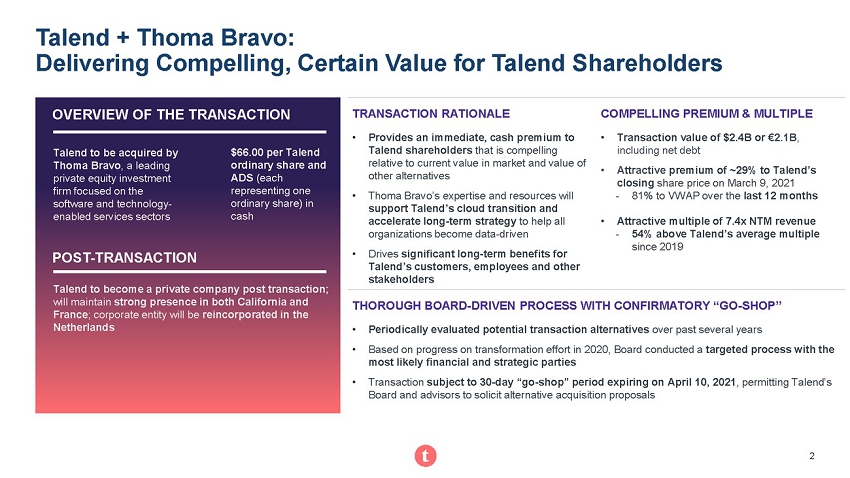

2 2 Talend + Thoma Bravo: Delivering Compelling, Certain Value for Talend Shareholders TRANSACTION RATIONALE • Provides an immediate, cash premium to Talend shareholders that is compelling relative to current value in market and value of other alternatives • Thoma Bravo’s expertise and resources will support Talend’s cloud transition and accelerate long - term strategy to help all organizations become data - driven • Drives significant long - term benefits for Talend’s customers, employees and other stakeholders COMPELLING PREMIUM & MULTIPLE • Transaction value of $2.4B or € 2.1B , including net debt • Attractive premium of ~29% to Talend’s closing share price on March 9, 2021 - 81% to VWAP over the last 12 months • Attractive multiple of 7.4x NTM revenue - 54% above Talend ’s average multiple since 2019 THOROUGH BOARD - DRIVEN PROCESS WITH CONFIRMATORY “GO - SHOP” • Periodically evaluated potential transaction alternatives over past several years • Based on progress on transformation effort in 2020, Board conducted a targeted process with the most likely financial and strategic parties • Transaction subject to 30 - day “go - shop” period expiring on April 9, 2021 , permitting Talend’s Board and advisors to solicit alternative acquisition proposals Talend to be acquired by Thoma Bravo , a leading private equity investment firm focused on the software and technology - enabled services sectors OVERVIEW OF THE TRANSACTION Talend to become a private company post transaction; will maintain strong presence in both California and France ; corporate entity will be reincorporated in the Netherlands $66.00 per Talend ordinary share and ADS (each representing one ordinary share) in cash POST - TRANSACTION 2

3 3 Thoma Bravo: the Right Partner for Talend’s Next Chapter $[ ] per Talend ordinary share and ADS (each representing one ordinary share) in cash A leader in data integration and data integrity Over 6,000 customers across the globe have chosen Talend to find clarity in their data and drive their transition to the cloud 1,300+ employees worldwide Transaction Value: $2.4B or €2.1B Fourth Quarter 2020 Financial Results: • Total revenue of $78.9M , up 17% year - over - year • Annual Recurring Revenue (“ARR”) of $288.7M , up 19% y/y or 15% on a constant currency basis • Cloud ARR of $108.5 million , up 101% y/y or 95% on a constant currency basis A leading private equity investment firm focused on the software and technology - enabled services sectors $73 billion in assets under management as of September 30, 2020 More than 270 software and technology companies acquired representing over $79 billion of value over last 40+ years 40+ portfolio companies and 60 fully realized investments Some examples of companies that the firm has successfully worked with include 3

4 4 Transaction Represents a Highly Attractive Value and Multiple Relative to Talend’s Historical Trading 4 Talend ADS Trading Price (USD) Talend EV / NTM Revenue Multiple (1) - $20.00 $40.00 $60.00 $80.00 Jan-19 Apr-19 Aug-19 Dec-19 Mar-20 Jul-20 Nov-20 Mar-21 Trading Price Offer Price 1.0x 3.0x 5.0x 7.0x 9.0x Jan-19 Apr-19 Aug-19 Dec-19 Mar-20 Jul-20 Nov-20 Mar-21 EV / NTM Revenue Multiple Offer Multiple ▪ Top - quartile multiple of comparable transactions (2) since 2014 ▪ Top - quartile multiple paid by a financial sponsor ▪ Highest multiple paid adjusted for growth and profitability (“Rule of 40”) Offer Multiple: 7.4x Offer Price: $66.00 Premium to: 3/9/2021 29% 30 - day VWAP 29% 90 - day VWAP 50% LTM VWAP 81% Premium to Multiple: 3/9/2021 32% 90 - day Average 51% LTM Average 68% Avg. since 2019 54%

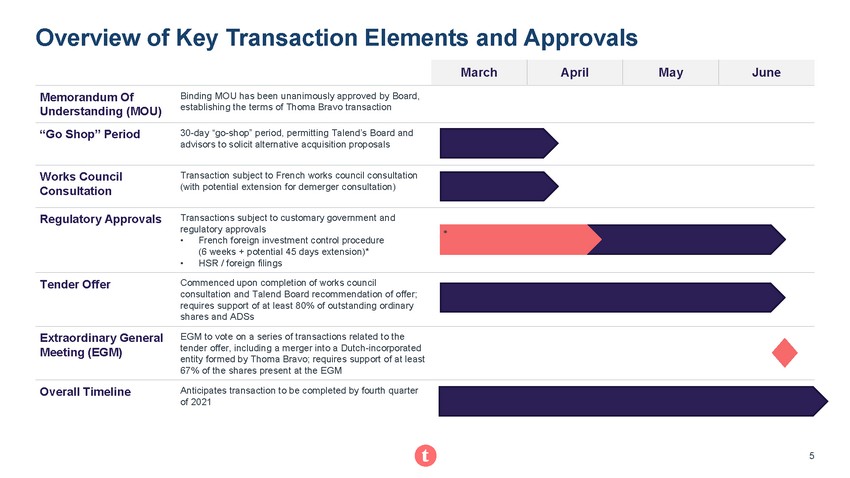

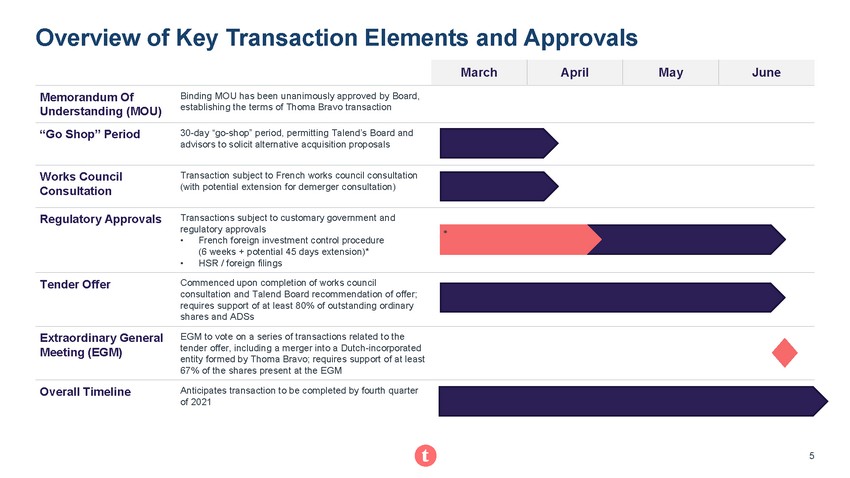

5 5 Memorandum Of Understanding (MOU) Binding MOU has been unanimously approved by Board, establishing the terms of Thoma Bravo transaction “Go Shop” Period 30 - day “go - shop” period, permitting Talend’s Board and advisors to solicit alternative acquisition proposals Works Council Consultation Transaction subject to French works council consultation (with potential extension for demerger consultation) Regulatory Approvals Transactions subject to customary government and regulatory approvals • French foreign investment control procedure (6 weeks + potential 45 days extension)* • HSR / foreign filings Tender Offer Commenced upon completion of works council consultation and Talend Board recommendation of offer; requires support of at least 80% of outstanding ordinary shares and ADSs Extraordinary General Meeting (EGM) EGM to vote on a series of transactions related to the tender offer, including a merger into a Dutch - incorporated entity formed by Thoma Bravo; requires support of at least 67% of the shares present at the EGM Overall Timeline Anticipates transaction to be completed by fourth quarter of 2021 Overview of Key Transaction Elements and Approvals March April May June * 5

6 6 Important Additional Information and Where to Find It In connection with the proposed acquisition of Talend S.A. (“Talend”) by Tahoe Bidco (Cayman), LLC, a limited liability compa ny organized under the laws of the Cayman Islands (“Parent”), Parent will commence, or will cause to be filed, a tender offer for all of the outstanding shares, Am erican Depositary Shares, and other outstanding equity interests of Talend. The tender offer has not commenced. This communication is for informational purposes onl y and is neither an offer to purchase nor a solicitation of an offer to sell securities of Talend. It is also not a substitute for the tender offer materi als that Parent will file with the Securities and Exchange Commission (the “SEC”) upon commencement of the tender offer. At the time that the tender offer is commenced, Parent wi ll file tender offer materials on Schedule TO with the SEC, and Talend will file a Solicitation/Recommendation Statement on Schedule 14D - 9 with the SEC with respe ct to the tender offer. THE TENDER OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT WILL CONTAIN IMPORTANT INFORMATION THAT SHOULD BE READ CAREFULLY AND CONSIDERED BY TALEND’S SECURITY HOLDERS BEFORE ANY DECISION IS MADE WITH RESPECT TO THE TENDER OFFER. Both the tender offer materials and the solicitation/recommendation statement will be made available to Talend’s investors and securit y h olders free of charge. A free copy of the tender offer materials and the solicitation/recommendation statement will also be made available to all of Talend’s inves tor s and security holders by contacting Talend at ir@talend.com, or by visiting Talend’s website (www.talend.com). In addition, the tender offer materials and the so lic itation/recommendation statement (and all other documents filed by Talend with the SEC) will be available at no charge on the SEC’s website (www.sec.gov) upon fili ng with the SEC. TALEND’S INVESTORS AND SECURITY HOLDERS ARE ADVISED TO READ THE TENDER OFFER MATERIALS AND THE SOLICITATION/RECOMMENDATION STATEMENT, AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, AND ANY OTHER RELEVANT DOCUMENTS FILED BY PARENT OR TALEND WITH THE SEC WHEN THEY BECOME AVAILABLE BEFORE THEY MAKE ANY DECISION WITH RESPECT TO THE TENDER OFFER. THESE MATERIALS WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TENDER OFFER, PARENT AND TALEND. Forward - Looking Statements This document contains certain statements that constitute forward - looking statements. These forward - looking statements include, but are not limited to, statements regarding the satisfaction of conditions to the completion of the proposed transaction and the expected completion of the pro pos ed transaction, the timing and benefits thereof, as well as other statements that are not historical fact. These forward - looking statements are based on curren tly available information, as well as Talend’s views and assumptions regarding future events as of the time such statements are being made. Such forward looking st ate ments are subject to inherent risks and uncertainties. Accordingly, actual results may differ materially and adversely from those expressed or implied in s uch forward - looking statements. Such risks and uncertainties include, but are not limited to, the potential failure to satisfy conditions to the completion of the propo sed transaction due to the failure to receive a sufficient number of tendered shares in the tender offer; the failure to obtain necessary regulatory or other approvals; the out come of legal proceedings that may be instituted against Talend and/or others relating to the transaction; the possibility that competing offers will be made, risk s a ssociated with acquisitions, such as the risk that transaction may be more difficult, time - consuming or costly than expected or that the expected benefits of the transaction will not occur; as well as those described in cautionary statements contained elsewhere herein and in Talend’s periodic reports filed with the SEC including t he statements set forth under “Risk Factors” set forth in Talend’s most recent annual report on Form 10 - K, and any subsequent reports on Form 10 - Q or form 8 - K filed with the SEC, the Tender Offer Statement on Schedule TO (including the offer to purchase, the letter of transmittal and other documents relating to the tend er offer) to be filed by Parent, and the Solicitation/Recommendation Statement on Schedule 14D - 9 to be filed by Talend. As a result of these and other risks, the propose d transaction may not be completed on the timeframe expected or at all. These forward - looking statements reflect Talend’s expectations as of the date of this report. The forward - looking statements included in this communication are made only as of the date hereof. Talend assumes no obligation and does not inte nd to update these forward - looking statements, except as required by law. 6