Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23148

Guardian Variable Products Trust

(Exact name of registrant as specified in charter)

7 Hanover Square, New York, N.Y. 10004

(Address of principal executive offices) (Zip code)

Douglas Dubitsky

7 Hanover Square, New York, N.Y. 10004

(Name and address of agent for service)

Registrant’s telephone number, including area code: 212-598-8000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2016

Table of Contents

| Item 1. | Reports to Stockholders. |

The Report to Shareholders is attached herewith.

Table of Contents

Guardian Variable

Products Trust

2016

Annual Report

All Data as of December 31, 2016

Guardian Large Cap Fundamental Growth VIP Fund

| Not FDIC insured. May lose value. No bank guarantee. | www.guardianlife.com |

Table of Contents

Except as otherwise specifically stated, all information, including portfolio security positions, is as of December 31, 2016. The views expressed in the Fund Commentary are those of the Fund’s portfolio manager(s) as of the date of this report and are subject to change without notice. They do not necessarily represent the views of Park Avenue Institutional Advisers LLC or a sub-adviser. The Fund Commentary may contain some forward-looking statements providing expectations or forecasts of future events as of the date of this report; they do not necessarily relate to historical or current facts. There can be no guarantee that any forward-looking statement will be realized. We undertake no obligation to update forward-looking statements, whether as a result of new information, future events, or otherwise. Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. Fund holdings will vary. Information contained herein has been obtained from sources believed reliable, but is not guaranteed.

Table of Contents

GUARDIAN LARGE CAP FUNDAMENTAL GROWTH VIP FUND

The Statement of Additional Information provides further information about the investment team, including information regarding their compensation, other accounts they manage, and their ownership interests in the Fund. For information on how to receive a copy of the Statement of Additional Information, please see the back cover of the Prospectus or visit our website at http://prospectuses.guardianlife.com/VPT.

FUND COMMENTARY OF CLEARBRIDGE INVESTMENTS LLC, SUB-ADVISER

Highlights

| • | Guardian Large Cap Fundamental Growth VIP Fund (the “Fund”) returned 1.90%, outperforming its benchmark, the Russell 1000® Growth Index1 (the “Index”), for the four-month period ended December 31, 2016. The Fund’s outperformance relative to the Index was primarily due to stock selection in the health care sector. |

| • | The Index delivered a 1.38% return for the period. This performance was largely due to strength in the energy and industrials sectors. |

Market Overview

A decidedly positive reaction to the presidential election of Donald Trump lifted U.S. markets to gains for the reporting period as the Index advanced 1.38%.

We believe that equity markets are betting that Trump’s pro-growth policies will be successful in jump-starting a U.S. economy that has been mired in a tepid expansion since the financial crisis of 2008. This optimism was based on the then President-elect’s promises for tax cuts and reforms, increased fiscal spending and the likelihood of looser government regulation of corporations and corporate activity such as mergers and acquisitions. The U.S. Federal Reserve affirmed this more optimistic outlook for the economy by raising interest rates in December 2016 and upping its planned pace of tightening over the next year.

Financial, managed care and industrial companies are expected to be the biggest near-term beneficiaries under the Trump administration. Lower costs related to regulation and higher interest rates propelled financial companies to robust post-election gains. The potential repeal or reform of the Affordable Care Act boosted managed care providers. Energy was the top performing sector in the Index, boosted by the decision of the Organization of the Petroleum Exporting Countries (OPEC) to pare back production.

Portfolio Review

The Fund’s relative performance was primarily driven by stock selection in the health care sector, with

particular strength in managed care. Stock selection in the financials and consumer discretionary sectors and a lack of exposure to the real estate sector also contributed to relative performance. On the negative side, stock selection in the consumer staples sector, and an underweight to industrials detracted from the Fund’s relative performance.

Outlook

Beyond the election, OPEC’s decision to pare back production caused oil prices to rise 14% for the period, benefiting the energy sector. We are optimistic that the oil market will likely continue to recover as global supply and demand come into balance. In the technology sector, many companies are experiencing a slowdown in spending by corporate clients, with some of the largest cuts coming in the information security area. After a flurry of reactionary spending to high profile data breaches over the last 18 months, it appears that many companies are now rethinking their approach to security. This pause could last several more quarters, but we believe the long-term demand for security solutions remains strong.

Higher interest rates continued to prop up the U.S. dollar, which climbed to its highest levels against global currencies since 2002. A stronger dollar has been a headwind for the last several years and that could continue in the near term. The trajectory of dollar appreciation in 2017 could be influenced by tax policy, specifically border adjustments for imports.

We have positioned the Fund for a low growth environment and will need to gain more confidence in the prospects for improved growth before significantly changing this positioning. The substance of Trump’s promises is still largely unknown and the President’s success in getting his full agenda through Congress is far from assured. The first half of 2017 should engender further uncertainty as those proposals enter the policymaking stage. We will be closely evaluating this process and determining where it makes sense to reposition the Fund’s exposures to capture growth opportunities that we consider attractive.

| 1 | The Russell 1000® Growth Index (the “Index”) is an unmanaged market-capitalization-weighted index that measures the performance of those companies in the Russell 1000® Index (which consists of the 1,000 largest U.S. companies based on total market capitalization) with higher price-to-book ratios and higher forecasted growth values. Index results assume the reinvestment of dividends paid on the stocks constituting the Index. You may not invest in the Index, and, unlike the Fund, the Index does not incur fees or expenses. |

| 1 |

Table of Contents

GUARDIAN LARGE CAP FUNDAMENTAL GROWTH VIP FUND

Funds in the Guardian Variable Products Trust are sold by prospectus only. You should carefully consider the investment objectives, risks, charges and expenses of the Funds before making an investment decision. The prospectus contains this and other important information. Please read it carefully before investing or sending money. Please visit our website at http://prospectuses.guardianlife.com/VPT or to obtain a printed copy, call 800-221-3253.

As with all mutual funds, the value of an investment in the Fund could decline, and you could lose money. Diversification does not guarantee profit or protect against loss, and there can be no assurance that the Fund will achieve its investment objective. The Fund invests primarily in equity securities and therefore exposes you to the general risks of investing in stock markets. Investing in large-capitalization companies may involve risks such as having low growth rates, and slow responsiveness to competitive challenges or opportunities than in the case of smaller companies. Investments in growth companies may be highly volatile. Growth stocks may not realize their perceived growth potential and during certain periods the Fund may underperform other equity funds that employ a different style. International investing involves special risks, which include changes in currency rates, foreign taxation and differences in auditing standards and securities regulations, political uncertainty and greater volatility. Foreign securities are subject to political, regulatory, economic, and exchange-rate risks not present in domestic investments. Investing in a more limited number of issuers and sectors can be subject to greater market fluctuation. Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. Fund holdings will vary.

| 2 |

Table of Contents

GUARDIAN LARGE CAP FUNDAMENTAL GROWTH VIP FUND

Fund Characteristics (unaudited)

| Total Net Assets: $9,778,263 |

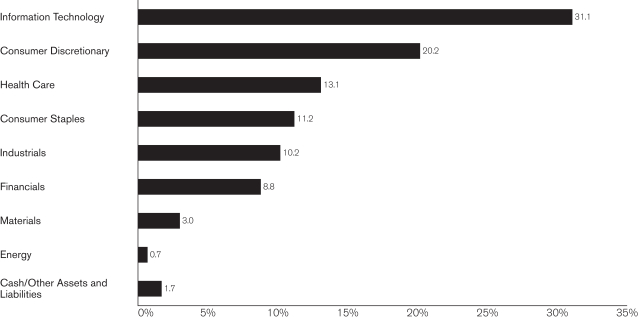

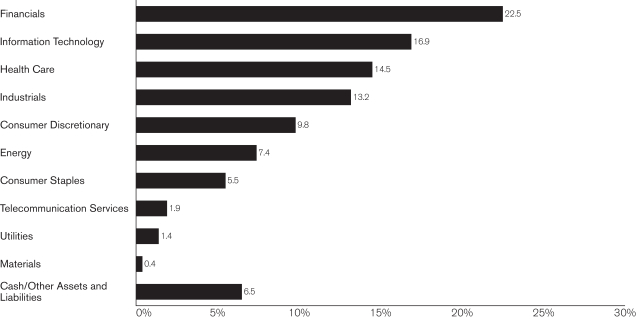

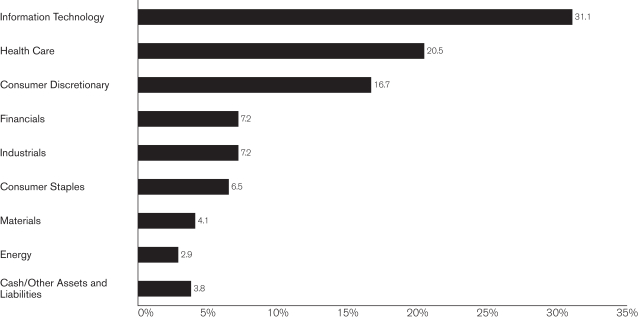

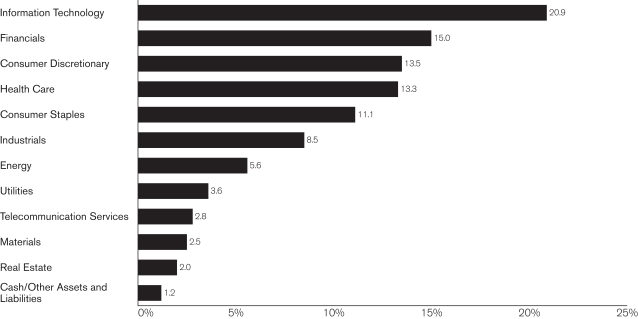

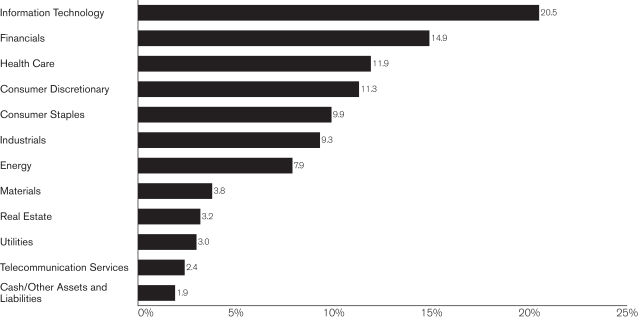

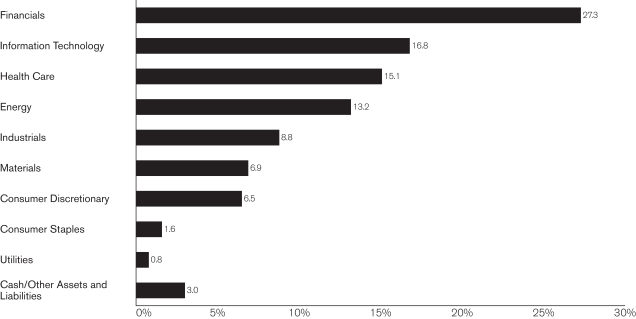

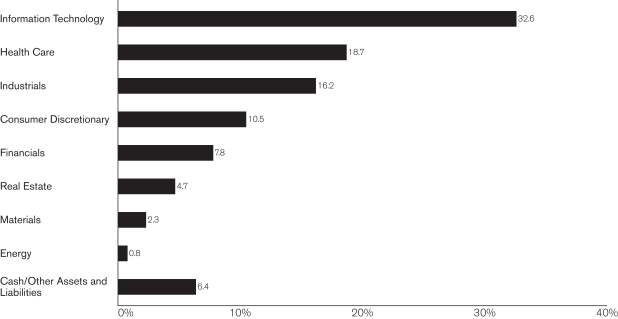

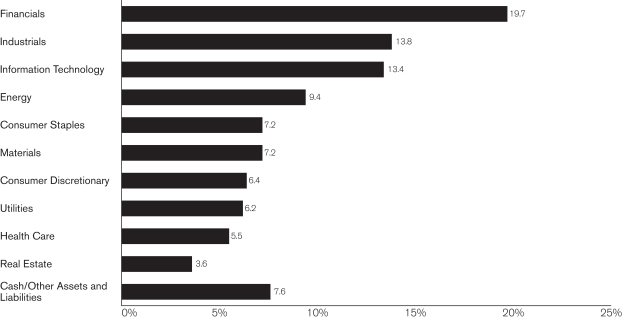

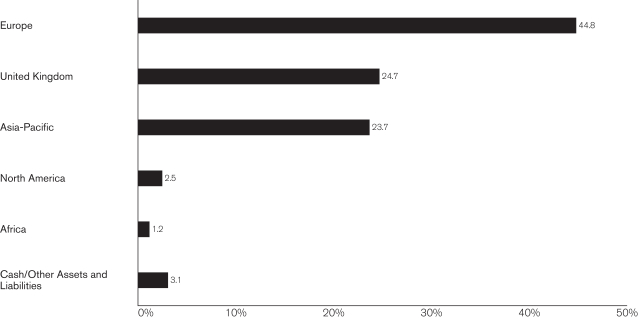

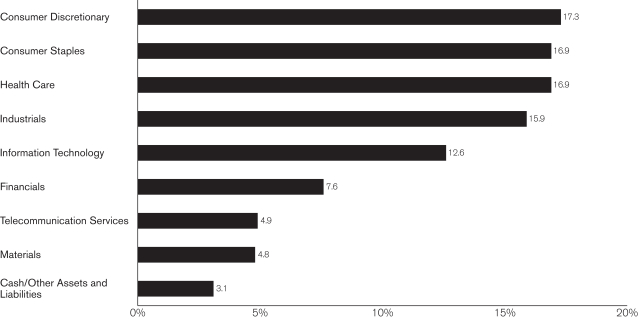

Sector Allocation1 As of December 31, 2016 |

|

Top Ten Holdings2 As of December 31, 2016 | ||||

| Holding | % of Total Net Assets | |||

| Amazon.com, Inc. | 4.60% | |||

| Microsoft Corp. | 3.44% | |||

| Alphabet, Inc., Class C | 3.08% | |||

| Schlumberger Ltd. | 2.94% | |||

| UnitedHealth Group, Inc. | 2.91% | |||

| Celgene Corp. | 2.86% | |||

| Visa, Inc., Class A | 2.85% | |||

| Comcast Corp., Class A | 2.85% | |||

| Akamai Technologies, Inc. | 2.78% | |||

| The Walt Disney Co. | 2.66% | |||

| Total | 30.97% | |||

| 1 | The Fund’s holdings are allocated to each sector based on the MSCI Global Industry Classification Standard (GICS®). Cash includes short-term investments and net other assets and liabilities. |

| 2 | Portfolio holdings are subject to change and should not be considered a recommendation to buy or sell individual securities. |

| 3 |

Table of Contents

GUARDIAN LARGE CAP FUNDAMENTAL GROWTH VIP FUND

Average Annual Total Returns As of December 31, 2016 | ||||||||||||||||||||

| Inception Date | 1 Year | 5 Year | 10 Year | Since Inception* | ||||||||||||||||

| Guardian Large Cap Fundamental Growth VIP Fund | 9/1/2016 | — | — | — | 1.90% | |||||||||||||||

| Russell 1000® Growth Index | — | — | — | 1.38% | ||||||||||||||||

| * | Since inception returns are not annualized and represent cumulative total returns. |

Performance quoted represents past performance and does not guarantee or predict future results. Investment return and principal value will fluctuate, so shares, when redeemed, may be worth more or less than their original cost. The Fund’s fees and expenses are detailed in the Financial Highlights section of this report. Fees and expenses are factored into the net asset value of Fund shares and any performance numbers we release. Total return figures include the effect of expense limitations in effect during the periods shown, if applicable; without such limitations, the performance shown would have been lower. Performance results assume the reinvestment of dividends and capital gains. The return figures shown do not reflect the deduction of taxes that a contract owner/policyholder may pay on redemption units. The actual total returns for owners of variable annuity contracts or variable life insurance policies that provide for investment in the Fund will be lower to reflect separate account and contract/policy charges. Current and month-end performance information, which may be lower or higher than that cited, is available by calling 800-221-3253 and is periodically updated on our website: http://guardianlife.com.

| 4 |

Table of Contents

UNDERSTANDING YOUR FUND’S EXPENSES (UNAUDITED)

By investing in the Fund, you incur two types of costs: (1) transaction costs, including, as applicable, sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including, as applicable, investment advisory fees and other Fund expenses. The example below is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from September 1, 2016 (commencement of operations), to December 31, 2016. The table below shows the Fund’s expenses in two ways:

Expenses based on actual return

This section of the table provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Expenses based on hypothetical 5% return for comparison purposes

This section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund with the cost of investing in other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore the second section is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If these transactional costs were included, your costs would have been higher. Charges and expenses at the insurance company separate account level are not reflected in the table.

Beginning 7/1/16 | Ending Account Value | Expenses Paid During Period 7/1/16-12/31/16 | Expense Ratio During Period 7/1/16-12/31/16 | |||||||||||

| Based on Actual Return* | $1,000.00 | $1,019.00 | $3.37 | 1.00% | ||||||||||

Based on Hypothetical Return (5% Return Before Expenses)** | $1,000.00 | $1,020.11 | $5.08 | 1.00% | ||||||||||

| * | Expenses are equal to the Fund’s annualized expense ratio as indicated, multiplied by the average account value over the period, multiplied by 122/366 (to reflect the period from September 1, 2016 (commencement of operations) through December 31, 2016). |

| ** | Expenses (hypothetical expenses if the Fund had been in existence from 7/1/2016) are equal to the Fund’s annualized expense ratio as indicated, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). |

| 5 |

Table of Contents

SCHEDULE OF INVESTMENTS — GUARDIAN LARGE CAP FUNDAMENTAL GROWTH VIP FUND

| December 31, 2016 | Shares | Value | ||||||

| Common Stocks – 96.2% | ||||||||

| Aerospace & Defense – 1.9% | ||||||||

Rockwell Collins, Inc. | 2,030 | $ | 188,303 | |||||

|

| |||||||

| 188,303 | ||||||||

| Air Freight & Logistics – 2.1% | ||||||||

United Parcel Service, Inc., Class B | 1,760 | 201,766 | ||||||

|

| |||||||

| 201,766 | ||||||||

| Beverages – 4.0% | ||||||||

Anheuser-Busch InBev S.A., ADR | 1,710 | 180,302 | ||||||

The Coca-Cola Co. | 5,060 | 209,788 | ||||||

|

| |||||||

| 390,090 | ||||||||

| Biotechnology – 8.2% | ||||||||

Alexion Pharmaceuticals, Inc.(1) | 1,480 | 181,078 | ||||||

Biogen, Inc.(1) | 750 | 212,685 | ||||||

Celgene Corp.(1) | 2,420 | 280,115 | ||||||

Regeneron Pharmaceuticals, Inc.(1) | 340 | 124,811 | ||||||

|

| |||||||

| 798,689 | ||||||||

| Capital Markets – 5.6% | ||||||||

BlackRock, Inc. | 600 | 228,324 | ||||||

Nasdaq, Inc. | 2,050 | 137,596 | ||||||

The Charles Schwab Corp. | 4,630 | 182,746 | ||||||

|

| |||||||

| 548,666 | ||||||||

| Chemicals – 4.1% | ||||||||

Ecolab, Inc. | 1,660 | 194,585 | ||||||

Monsanto Co. | 1,940 | 204,108 | ||||||

|

| |||||||

| 398,693 | ||||||||

| Communications Equipment – 1.4% | ||||||||

Palo Alto Networks, Inc.(1) | 1,070 | 133,803 | ||||||

|

| |||||||

| 133,803 | ||||||||

| Consumer Finance – 1.6% | ||||||||

American Express Co. | 2,130 | 157,790 | ||||||

|

| |||||||

| 157,790 | ||||||||

| Energy Equipment & Services – 2.9% | ||||||||

Schlumberger Ltd. | 3,420 | 287,109 | ||||||

|

| |||||||

| 287,109 | ||||||||

| Food & Staples Retailing – 2.5% | ||||||||

CVS Health Corp. | 3,050 | 240,675 | ||||||

|

| |||||||

| 240,675 | ||||||||

| Health Care Equipment & Supplies – 1.3% | ||||||||

DENTSPLY SIRONA, Inc. | 2,282 | 131,740 | ||||||

|

| |||||||

| 131,740 | ||||||||

| Health Care Providers & Services – 4.7% | ||||||||

Aetna, Inc. | 1,380 | 171,134 | ||||||

UnitedHealth Group, Inc. | 1,780 | 284,871 | ||||||

|

| |||||||

| 456,005 | ||||||||

| Hotels, Restaurants & Leisure – 2.5% | ||||||||

Chipotle Mexican Grill, Inc.(1) | 260 | 98,103 | ||||||

Yum China Holdings, Inc.(1) | 5,520 | 144,183 | ||||||

|

| |||||||

| 242,286 | ||||||||

| December 31, 2016 | Shares | Value | ||||||

| Industrial Conglomerates – 1.7% | ||||||||

General Electric Co. | 5,400 | $ | 170,640 | |||||

|

| |||||||

| 170,640 | ||||||||

| Internet & Direct Marketing Retail – 4.6% | ||||||||

Amazon.com, Inc.(1) | 600 | 449,922 | ||||||

|

| |||||||

| 449,922 | ||||||||

| Internet Software & Services – 11.0% | ||||||||

Akamai Technologies, Inc.(1) | 4,070 | 271,388 | ||||||

Alphabet, Inc., Class A(1) | 260 | 206,037 | ||||||

Alphabet, Inc., Class C(1) | 390 | 301,010 | ||||||

eBay, Inc.(1) | 2,960 | 87,882 | ||||||

Facebook, Inc., Class A(1) | 1,860 | 213,993 | ||||||

|

| |||||||

| 1,080,310 | ||||||||

| IT Services – 4.5% | ||||||||

PayPal Holdings, Inc.(1) | 4,060 | 160,248 | ||||||

Visa, Inc., Class A | 3,570 | 278,532 | ||||||

|

| |||||||

| 438,780 | ||||||||

| Life Sciences Tools & Services – 1.8% | ||||||||

Thermo Fisher Scientific, Inc. | 1,250 | 176,375 | ||||||

|

| |||||||

| 176,375 | ||||||||

| Media – 7.0% | ||||||||

Comcast Corp., Class A | 4,030 | 278,272 | ||||||

The Walt Disney Co. | 2,500 | 260,550 | ||||||

Twenty-First Century Fox, Inc., Class A | 5,380 | 150,855 | ||||||

|

| |||||||

| 689,677 | ||||||||

| Pharmaceuticals – 4.5% | ||||||||

Johnson & Johnson | 1,670 | 192,401 | ||||||

Zoetis, Inc. | 4,670 | 249,985 | ||||||

|

| |||||||

| 442,386 | ||||||||

| Semiconductors & Semiconductor Equipment – 3.2% | ||||||||

Texas Instruments, Inc. | 2,160 | 157,615 | ||||||

Xilinx, Inc. | 2,560 | 154,547 | ||||||

|

| |||||||

| 312,162 | ||||||||

| Software – 9.3% | ||||||||

Adobe Systems, Inc.(1) | 1,800 | 185,310 | ||||||

Fortinet, Inc.(1) | 2,900 | 87,348 | ||||||

Microsoft Corp. | 5,420 | 336,799 | ||||||

Red Hat, Inc.(1) | 2,340 | 163,098 | ||||||

VMware, Inc., Class A(1) | 1,700 | 133,841 | ||||||

|

| |||||||

| 906,396 | ||||||||

| Specialty Retail – 2.6% | ||||||||

The Home Depot, Inc. | 1,920 | 257,434 | ||||||

|

| |||||||

| 257,434 | ||||||||

| Technology Hardware, Storage & Peripherals – 1.7% | ||||||||

Apple, Inc. | 1,400 | 162,148 | ||||||

|

| |||||||

| 162,148 | ||||||||

| 6 | The accompanying notes are an integral part of these financial statements. |

Table of Contents

SCHEDULE OF INVESTMENTS — GUARDIAN LARGE CAP FUNDAMENTAL GROWTH VIP FUND

| December 31, 2016 | Shares | Value | ||||||

| Trading Companies & Distributors – 1.5% | ||||||||

WW Grainger, Inc. | 650 | $ | 150,962 | |||||

|

| |||||||

| 150,962 | ||||||||

| Total Common Stocks (Cost $9,291,006) | 9,412,807 | |||||||

| Principal Amount | Value | |||||||

| Short–Term Investment – 8.0% | ||||||||

| Repurchase Agreements – 8.0% | ||||||||

Fixed Income Clearing Corp., 0.03%, dated 12/30/2016, proceeds at maturity value of $780,003, due 1/3/2017(2) | $ | 780,000 | 780,000 | |||||

| Total Repurchase Agreements (Cost $780,000) | 780,000 | |||||||

| Total Investments – 104.2% (Cost $10,071,006) | 10,192,807 | |||||||

| Liabilities in excess of other assets – (4.2)% | (414,544 | ) | ||||||

| Total Net Assets – 100.0% | $ | 9,778,263 | ||||||

| (1) | Non-income-producing security. |

| (2) | The table below presents collateral for repurchase agreements. |

| Security | Coupon | Maturity Date | Principal Amount | Value | ||||||||||||

| U.S. Treasury Note | 3.625% | 2/15/2020 | $ | 740,000 | $ | 797,152 | ||||||||||

Legend:

ADR — American Depositary Receipt

The following is a summary of the inputs used as of December 31, 2016, in valuing the Fund’s investments. For more information on valuation inputs, please refer to Note 2a of the accompanying Notes to Financial Statements.

| Valuation Inputs | ||||||||||||||||

| Investments in Securities | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Common Stocks | $ | 9,412,807 | $ | — | $ | — | $ | 9,412,807 | ||||||||

| Repurchase Agreements | — | 780,000 | — | 780,000 | ||||||||||||

| Total | $ | 9,412,807 | $ | 780,000 | $ | — | $ | 10,192,807 | ||||||||

| The accompanying notes are an integral part of these financial statements. | 7 |

Table of Contents

FINANCIAL INFORMATION — GUARDIAN LARGE CAP FUNDAMENTAL GROWTH VIP FUND

For the Period Ended December 31, 20161 | ||||

Investment Income | ||||

Dividends | $ | 28,284 | ||

Interest | 342 | |||

Withholding taxes on foreign dividends | (430 | ) | ||

|

| |||

Total Investment Income | 28,196 | |||

|

| |||

Expenses | ||||

Investment advisory fees | 13,847 | |||

Professional fees | 27,709 | |||

Trustees’ fees | 19,311 | |||

Transfer agent fees | 8,823 | |||

Distribution fees | 5,583 | |||

Custodian and accounting fees | 3,434 | |||

Shareholder reports | 500 | |||

Administrative fees | 223 | |||

Other expenses | 2,782 | |||

|

| |||

Total Expenses | 82,212 | |||

Less: Fees waived | (59,879 | ) | ||

|

| |||

Total Expenses, Net | 22,333 | |||

|

| |||

Net Investment Income/(Loss) | 5,863 | |||

|

| |||

Realized Gain/(Loss) and Change in Unrealized Appreciation/(Depreciation) on Investments | ||||

Net realized gain/(loss) from investments | (2,227 | ) | ||

Net change in unrealized appreciation/(depreciation) on investments | 121,801 | |||

|

| |||

Net Gain on Investments | 119,574 | |||

|

| |||

Net Increase in Net Assets Resulting From Operations | $ | 125,437 | ||

|

| |||

| 1 | Commenced operations on September 1, 2016. |

| 8 | The accompanying notes are an integral part of these financial statements. |

Table of Contents

FINANCIAL INFORMATION — GUARDIAN LARGE CAP FUNDAMENTAL GROWTH VIP FUND

| For the Period Ended 12/31/161 | ||||

| ||||

Operations |

| |||

Net investment income/(loss) | $ | 5,863 | ||

Net realized gain/(loss) from investments | (2,227 | ) | ||

Net change in unrealized appreciation/(depreciation) on investments | 121,801 | |||

|

| |||

Net Increase in Net Assets Resulting from Operations | 125,437 | |||

|

| |||

Capital Share Transactions |

| |||

Proceeds from sales of shares | 9,652,826 | |||

|

| |||

Net Increase in Net Assets Resulting from Capital Share | 9,652,826 | |||

|

| |||

Net Increase in Net Assets | 9,778,263 | |||

|

| |||

Net Assets |

| |||

Beginning of period | — | |||

|

| |||

End of period | $ | 9,778,263 | ||

|

| |||

Accumulated Net Investment Income Included in Net Assets | $ | 5,863 | ||

|

| |||

Other Information: |

| |||

Shares | ||||

Sold | 959,939 | |||

|

| |||

Net Increase | 959,939 | |||

|

| |||

| 1 | Commenced operations on September 1, 2016. |

| The accompanying notes are an integral part of these financial statements. | 9 |

Table of Contents

FINANCIAL INFORMATION — GUARDIAN LARGE CAP FUNDAMENTAL GROWTH VIP FUND

The Financial Highlights table is intended to help you understand the Fund’s financial performance for the past five years (or, if shorter, the period since inception). Certain information reflects financial results for a single Fund share. The total returns in the table represent the rate that an investor would have earned (or lost) on an investment in the Fund.

| Per Share Operating Performance | ||||||||||||||||||||||||

Net Asset Value, | Net Investment Income2 | Net Realized and Unrealized Gain | Total Operations | Net Asset Value, End of Period | Total Return3,4 | |||||||||||||||||||

Period Ended 12/31/161 | $ | 10.00 | $ | 0.01 | $ | 0.18 | $ | 0.19 | $ | 10.19 | 1.90% | |||||||||||||

| 10 | The accompanying notes are an integral part of these financial statements. |

Table of Contents

FINANCIAL INFORMATION — GUARDIAN LARGE CAP FUNDAMENTAL GROWTH VIP FUND

| Ratios/Supplemental Data | ||||||||||||||||||||||

| Net Assets, End of Period (000s) | Net Ratio of Expenses to Average Net Assets3,5 | Gross Ratio of Expenses to Average Net Assets3 | Net Ratio of Net Investment Income to Average Net Assets3,5 | Gross Ratio of Net Investment Loss to Average Net Assets3 | Portfolio Turnover Rate3 | |||||||||||||||||

| $ | 9,778 | 1.00% | 3.08% | 0.26% | (1.82)% | 4% | ||||||||||||||||

| 1 | Commenced operations on September 1, 2016. |

| 2 | Calculated based on the average shares outstanding during the period. |

| 3 | Ratios for periods less than one year have been annualized, except for total return and portfolio turnover rate. Certain non-recurring fees (i.e., audit fees) are not annualized. |

| 4 | Total returns do not reflect the effects of charges deducted pursuant to the terms of The Guardian Insurance & Annuity Company, Inc.‘s variable contracts. Inclusion of such charges would reduce the total returns for all periods shown. |

| 5 | Net Ratio of Expenses to Average Net Assets and Net Ratio of Net Investment Income to Average Net Assets include the effect of fee waivers and expense limitations. |

| The accompanying notes are an integral part of these financial statements. | 11 |

Table of Contents

NOTES TO FINANCIAL STATEMENTS — GUARDIAN LARGE CAP FUNDAMENTAL GROWTH VIP FUND

1. Organization

Guardian Variable Products Trust (the “Trust”), a Delaware statutory trust organized on January 12, 2016, is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Trust currently offers eleven funds. Guardian Large Cap Fundamental Growth VIP Fund (the “Fund”) is a series of the Trust. The Fund is a diversified fund and commenced operations on September 1, 2016. The financial statements for the other remaining series of the Trust are presented in separate reports.

The Fund has authorized an unlimited number of shares of beneficial interest with no par value. Shares are bought and sold at closing net asset value (“NAV”). Shares of the Fund are only sold to certain separate accounts of The Guardian Insurance & Annuity Company, Inc. (“GIAC”) that fund certain variable annuity contracts and variable life insurance policies issued by GIAC. GIAC is a wholly owned subsidiary of The Guardian Life Insurance Company of America (“Guardian Life”).

The Fund seeks long-term growth of capital.

2. Significant Accounting Policies

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The Fund follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 Financial Services — Investment Companies. The following policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The preparation of financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

a. Investment Valuations Equity securities traded on an exchange other than NASDAQ Stock Market, LLC (“NASDAQ”) are valued at the last reported sale price on the principal exchange or market on which they are traded; or, if there were no sales that day, at the mean between the closing bid and ask prices. Securities traded on the NASDAQ are generally valued at the NASDAQ official closing price, which may not be the last sale price. If the NASDAQ official closing price is not available for a security, that security is generally valued at the mean between the

closing bid and ask prices. Repurchase agreements are carried at cost, which approximates fair value (see Note 5b). Foreign securities are valued in the currencies of the markets in which they trade and then converted to U.S. dollars by the application of foreign exchange rates at the close of the New York Stock Exchange (“NYSE”). Forward foreign currency contracts, if any, are valued at the mean between the bid and ask rates for the specified time interpolated from rates for proximate time periods. Securities for which market quotations are not readily available or for which market quotations may be considered unreliable are valued at their fair values as determined in accordance with guidelines and procedures adopted by the Board of Trustees.

Under the policies and procedures approved by the Board of Trustees, Park Avenue Institutional Advisers LLC (“Park Avenue”), the Fund’s investment adviser, has established a Fair Valuation Committee to assist the Board of Trustees with the oversight and monitoring of the valuation of the Fund’s investments. This includes monitoring the appropriateness of fair values based on results of ongoing valuation oversight, including but not limited to consideration of security specific events, market events and pricing vendor and broker-dealer due diligence. The Fair Valuation Committee oversees and carries out the policies for the valuation of investments held in the Fund. The Fair Valuation Committee is responsible for discussing and assessing the potential impacts to the fair values on an ongoing basis, and at least on a quarterly basis with the Board of Trustees.

Securities whose values have been materially affected by events occurring before the Fund’s valuation time but after the close of the securities’ principal exchange or market may be fair valued in accordance with guidelines and procedures adopted by the Board of Trustees. In addition, the values of the Fund’s investments in foreign securities are generally determined by a pricing service using pricing models designed to estimate likely changes in the values of those securities. Certain foreign equity instruments are valued by applying international fair value factors provided by approved pricing services. The factors seek to adjust the local closing price for movements of local markets post closing, but prior to the time the NAVs are calculated. Valuations reflected in this report are as of the report date. As a result, changes in valuation due to market events and/or issuer related events after the report date and prior to issuance of the report are not reflected herein.

| 12 |

Table of Contents

NOTES TO FINANCIAL STATEMENTS — GUARDIAN LARGE CAP FUNDAMENTAL GROWTH VIP FUND

Various inputs are used in determining the valuation of the Fund’s investments. These inputs are summarized in three broad levels listed below.

| • | Level 1 — unadjusted inputs using quoted prices in active markets for identical investments. |

| • | Level 2 — other significant observable inputs including but not limited to, quoted prices for similar investments, inputs other than quoted prices that are observable for investments (such as interest rates, prepayment speeds, credit risks, etc.) or other market corroborated inputs. |

| • | Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

Inputs may include price information, volatility statistics, specific and broad credit data, liquidity statistics, and other factors. A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. However, the determination of what constitutes “observable” requires significant judgment by the Trust. The Trust considers observable data to be that market data which is readily available, regularly distributed or updated, reliable and verifiable, and provided by independent sources that are actively involved in the relevant market. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. Changes in valuation techniques may result in transfers into or out of a financial instrument’s assigned level within the hierarchy.

The FASB requires reporting entities to make disclosures about purchases, sales, issuances and settlements of Level 3 securities on a gross basis.

The Fund’s policy is to recognize transfers between Level 1, Level 2 and Level 3 at the end of the reporting period. For the period ended December 31, 2016, there were no transfers among any levels.

In determining a financial instrument’s placement within the hierarchy, the Trust separates the Fund’s investment portfolio into two categories: investments and derivatives (e.g., futures). A summary of inputs used to value the Fund’s assets and liabilities carried at fair value as of December 31, 2016 is included in the Schedule of Investments.

Investments Investments whose values are based on quoted market prices in active markets, and are

therefore classified within Level 1, include active listed equities. Investments that trade in markets that are not considered to be active, but are valued based on quoted market prices, dealer quotations or alternative pricing sources supported by observable inputs are classified within Level 2. These include certain U.S. government and sovereign obligations, most government agency securities, investment-grade corporate bonds, certain mortgage products, state, municipal and provincial obligations, and certain foreign equity securities, including securities whose prices may have been affected by events occurring after the close of trading on their principal exchange or market and, as a result, whose values are determined by a pricing service as described above, or securities whose values are otherwise determined using fair valuation methods approved by the Fund’s Board of Trustees.

Investments classified within Level 3 have significant unobservable inputs, as they trade infrequently or not at all. Level 3 investments include, among others, private placement securities. When observable prices are not available for these securities, the Trust uses one or more valuation techniques for which sufficient and reliable data is available. The inputs used by the Trust in estimating the value of Level 3 investments include, for example, the original transaction price, recent transactions in the same or similar instruments, completed or pending third-party transactions in the underlying investment or comparable issuers, subsequent rounds of financing, recapitalizations, and other transactions across the capital structure. Level 3 investments may also be adjusted to reflect illiquidity and/or non-transferability, with the amount of such discount estimated by the Trust in the absence of market information. Assumptions used by the Trust due to the lack of observable inputs may significantly impact the resulting fair value and therefore the Fund’s results of operations. As of December 31, 2016, the Fund had no securities classified as Level 3.

Derivatives Exchange-traded derivatives, such as futures contracts, exchange-traded option contracts and certain swaps, are typically classified within Level 1 or Level 2 of the fair value hierarchy depending on whether or not they are deemed to be actively traded. Certain non-exchange-traded derivatives, such as generic forwards, certain swaps and options, have inputs which can generally be corroborated by market data and are therefore classified within Level 2. During the period ended December 31, 2016, the Fund did not hold any derivatives.

| 13 |

Table of Contents

NOTES TO FINANCIAL STATEMENTS — GUARDIAN LARGE CAP FUNDAMENTAL GROWTH VIP FUND

b. Securities Transactions Securities transactions are accounted for on the date securities are purchased or sold (trade date). Realized gains or losses on securities transactions are determined on the basis of specific identification.

c. Foreign Currency Translation The accounting records of the Fund are maintained in U.S. dollars. Investment securities and all other assets and liabilities of the Fund denominated in a foreign currency are generally translated into U.S. dollars at the exchange rates quoted at the close of the NYSE on each business day. The market value of investment securities and other assets and liabilities are translated at the exchange rate as of the valuation date. Purchases and sales of securities, income receipts, and expense payments are translated into U.S. dollars at the exchange rates in effect on the dates of the respective transactions. The Fund does not isolate the portion of the fluctuations on investments resulting from changes in foreign currency exchange rates from the fluctuations in market prices of investments held. Such fluctuations are included in the Change in net realized and unrealized gain or loss from investments on the Statement of Operations.

Reported realized foreign currency gains and losses arise from the disposition of foreign currency, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the Fund’s books on the transaction date and the U.S. dollar equivalent of the amounts actually received or paid. These reported realized foreign currency gains and losses, if any, are included in Net realized gain/(loss) on foreign currency transactions on the Statement of Operations. Unrealized foreign currency gains and losses arise from changes (due to changes in exchange rates) in the value of foreign currency and other assets and liabilities denominated in foreign currencies, which are held at period end, if any, and are included in Net change in unrealized appreciation/(depreciation) on translation of assets and liabilities in foreign currencies on the Statement of Operations.

d. Foreign Capital Gains Tax The Fund may be subject to foreign taxes on income, gains on investments or currency purchases/repatriation, a portion of which may be recoverable. The Fund will accrue such taxes and recoveries as applicable, based upon their current interpretation of tax rules and regulations that exist in the markets in which they invest.

e. Investment Income Dividend income net of foreign taxes withheld, if any, is generally recorded on the ex-dividend date. Interest income, which includes amortization/accretion of premium/discount, is determined using the interest income accrual method, and is accrued and recorded daily.

f. Allocation of Income and Expenses Many of the expenses of the Trust can be directly attributed to a specific series of the Trust. Expenses that cannot be directly attributed to a specific series of the Trust are generally apportioned among all the series in the Trust, based on relative net assets. In calculating net asset value per share for each series of the Trust, investment income, realized and unrealized gains and losses, and expenses other than class-specific expenses are allocated daily to each series based upon the proportion of net assets attributable to each series.

g. Distributions to Shareholders During the period ended December 31, 2016, the Fund elected to be treated as a disregarded entity (“DRE”) for U.S. federal income tax purposes. The Fund is not required to distribute taxable income and capital gains for U.S. federal income tax purposes. Therefore, no dividends and capital gains distributions were paid by the Fund in accordance with the current dividend and distribution policy (see Note 4).

3. Transactions with Affiliates

a. Investment Advisory Fee and Expense Limitation Under the terms of the advisory agreement, which, after its two year initial term, is reviewed and approved annually by the Board of Trustees, the Fund pays an investment advisory fee to Park Avenue. Park Avenue is a wholly-owned subsidiary of Guardian Life and receives an investment advisory fee at an annual rate of 0.62% up to $100 million, 0.57% up to $300 million, 0.52% up to $500 million, and 0.50% in excess of $500 million of the Fund’s average daily net assets. The fee is accrued daily and paid monthly.

Park Avenue has contractually agreed through April 30, 2018 to waive certain fees and/or reimburse certain expenses incurred by the Fund to the extent necessary to limit the Fund’s total annual operating expenses after fee waiver and/or expense reimbursement to 1.00% of the Fund’s average daily net assets (excluding, if applicable, any acquired fund fees and expenses, taxes, interest, transaction costs and brokerage commissions, litigation and extraordinary expenses). The limitation may not be increased or terminated prior to this time without action by the Board of Trustees, may be terminated

| 14 |

Table of Contents

NOTES TO FINANCIAL STATEMENTS — GUARDIAN LARGE CAP FUNDAMENTAL GROWTH VIP FUND

only upon approval of the Board of Trustees, and is subject to Park Avenue’s recoupment rights. For the period ended December 31, 2016, Park Avenue waived fees and/or paid Fund expenses in the amount of $59,879.

Park Avenue is entitled to recoupment of previously waived fees and reimbursed expenses from the Fund for three years from the date of the waiver or reimbursement, subject to the expense limitation in effect at the time of the waiver or reimbursement and at the time of the recoupment, if any. The amount available for potential future recapture by Park Avenue from the Fund under the Expense Limitation Agreement for the period ended December 31, 2016 is $59,879.

Park Avenue has entered into a Sub-Advisory Agreement with ClearBridge Investments LLC (“ClearBridge”). ClearBridge is responsible for providing day-to-day investment advisory services to the Fund, subject to the oversight of the Board of Trustees and Park Avenue. Sub-advisory fees are paid by Park Avenue and do not represent a separate or additional expense to the Fund.

b. Compensation of Trustees and Officers Trustees and officers who are interested persons of the Trust, as defined in the 1940 Act, receive no compensation from the Fund for acting as such. Trustees of the Trust who are not interested persons of the Trust receive compensation and reimbursement of expenses from the Trust.

c. Distribution Fees Park Avenue Securities LLC (“PAS”), a wholly owned subsidiary of Guardian Life, is the principal underwriter of Fund shares. The Trust has entered into a distribution and service agreement with PAS, which governs the sale and distribution of shares of the Fund. Under a distribution and service plan adopted by the Trust (“12b-1 plan”), PAS is compensated for services in such capacity, including its expenses in connection with the promotion and distribution of shares of the Fund, at an annual rate of 0.25% of the Fund’s average daily net assets. For the period ended December 31, 2016, the Fund paid distribution fees in the amount of $5,583 to PAS.

PAS has directed that certain payments under the 12b-1 plan be used to compensate GIAC for shareholder services provided to contract owners.

4. Federal Income Taxes

a. Distributions to Shareholders During the period ended December 31, 2016, the Fund elected to be treated as a DRE for U.S. federal income tax purposes. As a DRE, the Fund is not subject to an entity-level income tax; and any income, gains, losses, deductions, taxes, and credits of the Fund would instead be “passed through” directly to the separate accounts of GIAC that invest in the Fund and retain the same character for U.S. federal income tax purposes. In addition, the Fund is not required to distribute taxable income and capital gains for Federal income tax purposes. Therefore, no dividends and capital gains distributions were paid by the Fund.

5. Investments

a. Investment Purchases and Sales The cost of investments purchased and the proceeds from investments sold (excluding short-term investments) amounted to $9,588,540 and $295,307, respectively, for the period ended December 31, 2016. During the period ended December 31, 2016, there were no purchases or sales of U.S. government securities.

b. Repurchase Agreements The Fund may invest in repurchase agreements to maintain liquidity and earn income over periods of time as short as overnight. The collateral for repurchase agreements is either cash or fully negotiable U.S. government securities (including U.S. government agency securities). Repurchase agreements are fully collateralized (including the interest accrued thereon) and such collateral is marked to market daily while the agreements remain in force. If the value of the collateral falls below the repurchase price plus accrued interest, the Fund will typically require the seller to deposit additional collateral by the next business day. If the request for additional collateral is not met, or the seller defaults, the Fund maintains the right to sell the collateral (although it may be prevented or delayed from doing so in certain circumstances) and may be required to claim any resulting loss against the seller. Park Avenue monitors the creditworthiness of the seller with which the Fund enters into repurchase agreements.

6. Risk and Concentrations

Foreign securities investments involve special risks and considerations not typically associated with U.S. investments. These risks include, but are not limited

| 15 |

Table of Contents

NOTES TO FINANCIAL STATEMENTS — GUARDIAN LARGE CAP FUNDAMENTAL GROWTH VIP FUND

to, currency risk; adverse political, regulatory, social, and economic developments; and less reliable information about issuers. Moreover, securities of some foreign issuers may be less liquid and their prices more volatile than those of comparable U.S. issuers.

In its normal course of business, the Fund may invest a significant portion of its assets in companies within a limited number of industries or sectors. As a result, the Fund may be subject to greater risk of loss than that of a fund invested in a wider spectrum of industries or sectors because the stocks of many or all of the companies in the industry, group of industries, sector, or sectors may decline in value due to developments adversely affecting the industry, group of industries, sector, or sectors.

As of December 31, 2016, GIAC owns shares representing 100% of the Fund’s net assets.

7. Temporary Borrowings

Effective December 13, 2016, the Fund, with other funds managed by Park Avenue, is party to a $10 million committed revolving credit facility from State Street Bank and Trust Company for temporary borrowing purposes, including the meeting of redemption requests that otherwise might require the untimely disposition of securities. Interest is calculated based on the higher of the daily one-month LIBOR rate and the Federal Funds rate plus 1.25% at the time of borrowing. In addition to the interest charged on any borrowings by the Fund, each fund pays a commitment fee of 0.35% per annum on its share of the unused portion of the credit facility. The agreement is in place until December 12, 2017. The Fund did not utilize the credit facility during the period ended December 31, 2016.

8. Review for Subsequent Events

Management has evaluated subsequent events through the issuance of the Fund’s financial statements and determined that no material events have occurred that require disclosure.

9. Indemnifications

Under the Trust’s organizational documents and, in some cases, by contract, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund enters into contracts with its vendors and others that provide general indemnifications. The Fund’s maximum

exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

| 16 |

Table of Contents

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Trustees and Shareholders of the

Guardian Large Cap Fundamental Growth VIP Fund

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, as of December 31, 2016, and the related statements of operations and of changes in net assets and the financial highlights, for the period September 1, 2016 (commencement of operations) through December 31, 2016, present fairly, in all material respects, the financial position of the Guardian Large Cap Fundamental Growth VIP Fund (the “Fund”) as of December 31, 2016, and the results of its operations, the changes in its net assets, and the financial highlights for the period September 1, 2016 (commencement of operations) through December 31, 2016, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audit, which included confirmation of securities as of December 31, 2016 by correspondence with the custodian and brokers, provides a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

New York, NY

February 22, 2017

| 17 |

Table of Contents

SUPPLEMENTAL INFORMATION (UNAUDITED)

Approval of Investment Advisory and Sub-advisory Agreements

Section 15(c) of the Investment Company Act of 1940, as amended (the “1940 Act”), requires that a fund’s investment advisory and subadvisory agreements be approved initially by the fund’s board of trustees. Section 15(c) also requires that the continuation of these agreements, after an initial term of up to two years, be annually reviewed and approved by the board. Any such agreement must be approved by a vote of a majority of the trustees who are not parties to the agreement or “interested persons” (as defined in the 1940 Act) of a party to the agreement at an in-person meeting of the board called for the purpose of voting on such approval.

At a meeting of the Board of Trustees (the “Board”) of Guardian Variable Products Trust (the “Trust”) held on August 8-9, 2016, the Board considered and approved the proposed investment management agreement (the “Management Agreement”) between the Trust, on behalf of each series (the “Funds”), and Park Avenue Institutional Advisers LLC (the “Manager”). The Board also considered and approved the proposed subadvisory agreements (the “Subadvisory Agreements,” collectively with the Management Agreement, the “Agreements”) between the Manager and investment advisory firms engaged to serve as subadvisers to the various Funds, namely ClearBridge Investments LLC, Wellington Management Company LLP, Massachusetts Financial Services Company, Putnam Investment Management, LLC, Boston Partners Global Investors, Inc., AllianceBernstein L.P., Janus Capital Management LLC, Wells Capital Management Incorporated, J.P. Morgan Investment Management Inc., Lazard Asset Management LLC, and Lord, Abbett & Co. LLC. (the “Subadvisers”). The Trustees who are not parties to the Agreements or “interested persons” (as defined in the 1940 Act) of a party to the Agreements (the “Independent Trustees”) unanimously approved the Agreements for an initial term of two years.

The Board is responsible for overseeing the management of each Fund. In determining whether to approve the Agreements initially, the Trustees evaluated information and factors that they considered to be relevant and appropriate through the exercise of their own business judgment. The Trustees considered certain information and factors in light of advice furnished to them by legal counsel to the Trust and, in the case of the Independent Trustees, their independent legal counsel. In advance of the meeting held on August 8-9, 2016, the Trustees received

materials and information designed to assist their consideration of the Agreements, including written responses from the Manager and each Subadviser to a series of questions and formal requests for information encompassing a wide variety of topics. The Trustees also received materials and information regarding the legal standards applicable to their consideration of the Agreements and the process and criteria used by the Manager to identify and select the Subadvisers, including the engagement by the Manager of an independent third-party service provider to support the Manager’s due diligence process.

At the meeting held on August 8-9, 2016, representatives of the Manager and each Subadviser, along with other service providers, made presentations to the Board and responded to questions about their organizations, the services to be rendered, the fees to be charged and other aspects of the Agreements. During the course of their deliberations, the Independent Trustees met to discuss and evaluate the Agreements in executive session with their independent legal counsel, outside of the presence of the Trustees who are not Independent Trustees and representatives from Fund management, the Manager or any Subadviser.

In reaching its decisions to approve the Agreements, the Board took into account the materials and information described above as well as other materials and information provided to the Board and discussed with and among the Trustees. Individual Trustees may have given different weight to different factors and information with respect to each Agreement, and the Trustees did not identify any single factor or information that, in isolation, would be controlling in deciding to approve the Agreements. The discussion below is intended to summarize the broad factors that figured prominently in the Board’s decisions to approve the Agreements rather than to be all-inclusive. These broad factors included: (i) the nature, extent and quality of the services to be provided to the Funds by the Manager and the Subadvisers; (ii) the investment performance of accounts managed by each Subadviser with strategies similar to the applicable Fund; (iii) the fees to be charged and estimated profitability; (iv) the extent to which economies of scale may in the future exist for a Fund, and the extent to which a Fund may benefit from future economies of scale; and (v) any other benefits anticipated to be derived by the Manager or the Subadvisers (or their respective affiliates) from their relationships with the Funds.

| 18 |

Table of Contents

SUPPLEMENTAL INFORMATION (UNAUDITED)

Nature, Extent and Quality of Services

The Trustees considered information regarding the nature, extent and quality of services to be provided to the Funds by the Manager. The Trustees also considered, among other things, the terms of the Management Agreement and the range of investment advisory services to be provided by the Manager. In addition, the Trustees reviewed the range of non-investment advisory services to be provided by the Manager consistent with the terms of the Management Agreement, notably coordinating the preparation and filing of various regulatory documents, coordinating the preparation and assembly of Board meeting materials and assisting the Board with certain valuation matters.

The Trustees considered the Funds’ proposed operation in a “manager-of-managers” structure and reviewed the responsibilities that the Manager would have under this structure, including monitoring and evaluating the performance of the Subadvisers, monitoring the Subadvisers for adherence to the stated investment objectives, strategies, policies and restrictions of the Funds and supervising the Subadvisers with respect to the services that the Subadvisers would provide under the Subadvisory Agreements. The Trustees also considered the process used by the Manager, consistent with this structure, to identify and recommend subadvisers, and its ability to monitor and oversee subadvisers and recommend replacement subadvisers, when necessary, and provide other services under the Management Agreement. The Trustees reviewed information regarding the experience and background of the Manager’s key personnel and the Manager’s organizational structure and resources, including investment, legal and administrative capabilities of the Manager. In this regard, the Trustees recognized that the Funds may benefit from the Manager’s ability to use similar resources and capabilities of its affiliates in providing services to the Funds.

In addition, the Trustees considered information regarding the nature, extent and quality of services to be provided to the Funds by the Subadvisers. The Trustees also considered, among other things, the terms of the Subadvisory Agreements and the range of investment advisory services to be provided by the Subadvisers under the oversight of the Manager. In evaluating these investment advisory services, the Trustees considered, among other things, the Subadvisers’ investment philosophies, styles and/or processes and approach to managing risk. The

Trustees also considered information regarding funds or accounts managed by the Subadvisers with similar strategies as the applicable Fund, including performance and portfolio characteristics, when available. The Trustees received and evaluated information regarding the background, education, expertise and/or experience of the investment professionals that would serve as portfolio managers for the Funds and the capabilities, resources and reputations of the Subadvisers.

Based upon these considerations, the Trustees concluded, within the context of their full deliberations and in light of the Funds’ anticipated operations, that the nature, extent and quality of services to be provided to the Funds by the Manager and each Subadviser were appropriate.

Investment Performance

The Funds had not commenced operations prior to the meeting held on August 8-9, 2016. Accordingly, the Funds did not yet have an investment performance record. The Board considered historical performance information with respect to funds or accounts managed by the Subadvisers with similar investment strategies as the Funds, as well as each Subadviser’s historical performance records compared to relevant benchmarks and peer groups, when available. The Trustees concluded that the historical performance records available, viewed together with the other relevant factors and information considered by the Trustees, supported a decision to approve each Subadvisory Agreement. The Trustees also concluded that it was appropriate to revisit the Funds’ investment performance in connection with future reviews of the Subadvisory Agreements.

Costs and Profitability

The Trustees considered the proposed management fees to be paid by the Funds to the Manager under the Management Agreement and evaluated the reasonableness of these fees. The Trustees received and reviewed comparative information with respect to the proposed management fees, including the portion of the management fees proposed to be paid to each Subadviser as compared to the portion proposed to be retained by the Manager and the management fees paid by other funds offered as investment options underlying variable contracts within the applicable peer group based on data obtained from Morningstar, Inc., an independent provider of industry data, which showed that the Funds’ proposed management fees fell within the following quartiles: the second quartile

| 19 |

Table of Contents

SUPPLEMENTAL INFORMATION (UNAUDITED)

for Guardian Diversified Research VIP Fund, Guardian Integrated Research VIP Fund, Guardian International Growth VIP Fund, Guardian Large Cap Disciplined Growth VIP Fund, Guardian Large Cap Fundamental Growth VIP Fund, Guardian Mid Cap Relative Value VIP Fund, and Guardian Core Plus Fixed Income VIP Fund and the third quartile for Guardian Growth & Income VIP Fund, Guardian International Value VIP Fund, Guardian Large Cap Disciplined Value VIP Fund, and Guardian Mid Cap Traditional Growth VIP Fund.

The Trustees considered the proposed subadvisory fees to be paid under the Subadvisory Agreements and evaluated the reasonableness of those fees. The Trustees also considered that the fees to be paid to the Subadvisers would be paid by the Manager and not the Funds and that the Manager had negotiated the fees with the Subadvisers at arm’s-length.

The Trustees also considered the proposed breakpoint schedules relating to the management and subadvisory fees, if applicable, and the rationale for any variations in the asset levels at which breakpoints would be reached with respect to management and subadvisory fees for a Fund.

In addition, the Trustees received comparative information relating to each Fund’s anticipated operating expense ratios and the actual operating expense ratios of a peer group of funds. In this regard, the Trustees considered estimates of the Funds’ projected asset levels and the Manager’s commitment to initially limit each Fund’s operating expenses through an expense limitation agreement with the Trust. Although the Board recognized that the comparisons between the proposed management fees and anticipated operating expenses of the Funds and those of identified peer funds are imprecise, given different terms of agreements and variations in fund strategies, the Trustees found that the comparative information supported their consideration and approval of the proposed management fees and evaluation of the anticipated operating expenses.

The Trustees reviewed information regarding the Manager’s projected costs of sponsoring the Funds and projected profitability of the Funds to the Manager based on the anticipated assets and expenses of the Funds. The Trustees noted that the information, including with respect to revenues and expenses, contained estimates because the Funds had not yet commenced operations at the time of the Board meeting. Although the Trustees did not receive

specific projected cost and profitability information from certain Subadvisers, the Trustees primarily considered the projected cost and profitability of the Funds with respect to the Manager because the Manager would be responsible for payment of the subadvisory fees and had negotiated the fees with the Subadvisers at arm’s-length.

Based on the consideration of the information and factors summarized above, as well as other relevant information and factors, the Trustees concluded that the proposed management and subadvisory fees were reasonable in light of the nature, extent and quality of services expected to be rendered to the Funds by the Manager and the Subadvisers. The Trustees also concluded that the projected profitability of the Funds to the Manager was acceptable and the Trustees determined it was appropriate to revisit this information in connection with future reviews of the Agreements.

Economies of Scale

The Funds had not commenced operations prior to the Board meeting. As a result, no specific information was available concerning the possible effect that asset growth and economies of scale have on a Fund’s expenses. Accordingly, the Trustees considered the extent to which economies of scale may be shared as assets grow based on proposed management and subadvisory fee breakpoints, as applicable, that are designed to appropriately reduce fee rates as assets increase. The Trustees concluded that it was appropriate to revisit potential economies of scale in connection with future reviews of the Agreements or earlier, if appropriate, and that they were satisfied with the extent to which economies of scale would be shared for the benefit of shareholders based on anticipated asset levels.

Ancillary Benefits

The Trustees considered the potential benefits, other than management fees, that the Manager and/or its affiliates may receive because of the Manager’s relationship with the Funds. The Trustees acknowledged that the Funds were designed to serve as investment options under variable contracts issued by affiliates of the Manager that would receive fees under those contracts and that Park Avenue Securities LLC, an affiliate of the Manager and principal underwriter of the Funds, and participating insurance companies, including insurance companies affiliated with the Manager, would be entitled to receive fees from the Funds under a plan of distribution adopted

| 20 |

Table of Contents

SUPPLEMENTAL INFORMATION (UNAUDITED)

pursuant to Rule 12b-1 under the 1940 Act. The Trustees also considered that the Manager did not expect to receive any other direct or indirect benefits. In addition, the Trustees considered the potential benefits, other than subadvisory fees, that the Subadvisers and their affiliates may receive because of their relationships with the Funds, including the potential increased ability to use soft dollars consistent with Trust policies and other benefits from increases in assets under management. The Trustees concluded that benefits that may accrue to the Manager and its affiliates are reasonable and the benefits that may accrue to the Subadvisers and their affiliates are consistent with those expected for a subadviser to a mutual fund such as the applicable Fund.

Conclusion

Based on a comprehensive consideration and evaluation of all of the information and factors summarized above, among others, the Board as a whole, including the Independent Trustees, approved the Agreements.

| 21 |

Table of Contents

SUPPLEMENTAL INFORMATION (UNAUDITED)

Trustees and Officers Information Table

The following table provides information about the Trustees of the Trust.

| Name and Year of Birth | Term of Office, Position(s) Held and Length of Service* | Principal Occupation(s) During Past Five Years | Number of Funds in Fund Complex Overseen by Trustees**** | Other Directorships Held by Trustee | ||||

| Independent Trustees | ||||||||

Bruce W. Ferris† (born 1955) | Trustee | Retired (since 2015); President and CEO, Prudential Annuity Distributors (2013–2015); Director/Trustee, Advanced Series Trust, The Prudential Series Fund and Prudential’s Gibraltar Fund, Inc. (2013–2015); Senior Vice President, Prudential Annuities (2008–2015). | 11 | None | ||||

Theda R. Haber† (born 1954) | Trustee | Adjunct Assistant Professor of Law, UC Hastings College of Law (since 2013); Member of the Board of Directors, Fairholme Trust Company, LLC (since 2015); Attorney, Law Office of Theda R. Haber (since 2014); Visiting Professor of Law, UC Davis School of Law (since 2014); Consultant, Haber & Associates LLC (financial services industry), (since 2012); Advisory Council Chair, Vice Chair, and Member, Advisory Council on Employee Welfare and Pension Benefit Plans (ERISA Advisory Council), U.S. Department of Labor (2009–2011); Managing Director and General Counsel, BlackRock Institutional Trust Company, N.A. (2009–2011). | 11 | None | ||||

Marshall Lux† (born 1960) | Trustee | Senior Advisor, The Boston Consulting Group (since 2014); Senior Partner and Managing Director, The Boston Consulting Group (2009–2014) | 11 | None | ||||

Lisa K. Polsky† (born 1956) | Trustee | Senior Risk Advisor, AQR (investment management) (since 2016); Senior Risk Advisor, Ultra Capital (venture capital) (since 2016); Board Member and Chair of Risk Committee, DeutscheBank IHC (financial services) (since May 2016); Chief Risk Officer, CIT Group Inc. (financial services) (2010–2015); Board Member and Chair of Audit Committee, Piper Jaffray (investment bank) (2007–2016). | 11 | None | ||||

John Walters**† (born 1962) | Lead Independent Trustee | Board Member, Amerilife Holdings LLC (insurance distribution) (since 2015); Board Member, Stadion Money Management LLC (investment adviser) (since 2011); President and Chief Operating Officer, Hartford Life Insurance Company (2000–2010). | 11 | None | ||||

| 22 |

Table of Contents

SUPPLEMENTAL INFORMATION (UNAUDITED)

| Name and Year of Birth | Term of Office, Position(s) Held and Length of Service* | Principal Occupation(s) During Past Five Years | Number of Funds in Fund Complex Overseen by Trustees**** | Other Directorships Held by Trustee | ||||

| Interested Trustees | ||||||||

Douglas Dubitsky*** (born 1967) | Trustee | Vice President, Product Management, Retirement Solutions, The Guardian Life Insurance Company of America. | 11 | None | ||||

Marc Costantini*** (born 1969) | Chairman and Trustee | Executive Vice President and Chief Financial Officer, The Guardian Life Insurance Company of America (since 2014); Executive Vice President, Manulife Financial prior thereto (various positions from 1990–2014). | 11 | None | ||||

| * | Trustee since August 2016. Each Trustee serves until his or her successor is elected and qualified or until his or her resignation, death or removal. The business address of each Trustee is 7 Hanover Square, New York, New York 10004. |

| ** | John Walters was considered to be an “interested person” of the Trust, within the meaning of the 1940 Act, as of the date that the Board of Trustees approved the Advisory and Sub-advisory Agreements for the Fund as a result of his ownership of securities issued by a sub-adviser of a series of the Trust. At the time the Fund commenced operations, Mr. Walters was not considered to be an “interested person” of the Trust because he no longer owned these securities. |

| *** | Each of Douglas Dubitsky and Marc Costantini is considered to be an “interested person” of the Trust within the meaning of the 1940 Act because of their affiliation with The Guardian Life Insurance Company of America and/or its affiliates. |

| **** | As of the date of this report, the Trust consisted of 11 separate Funds. |

| † | Member of the Audit Committee of the Trust. |

The following table provides information about the Officers of the Trust.

| Name and Year of Birth | Position(s) Held and Length of Service* | Principal Occupation(s) During Past Five Years | ||

Douglas Dubitsky (born 1967) | President and Principal Executive Officer | Vice President, Product Management, Retirement Solutions, The Guardian Life Insurance Company of America. | ||

John H. Walter (born 1962) | Senior Vice President, Treasurer, and Principal Financial and Accounting Officer | Vice President, Chief Financial Officer, Equity Profit Center, The Guardian Life Insurance Company of America. | ||

Harris Oliner (born 1971) | Senior Vice President and Secretary | Senior Vice President, Corporate Secretary, The Guardian Life Insurance Company of America (since 2015); Senior Vice President, Deputy General Counsel, Corporate Secretary, Voya Financial, Inc. (2013–2014); Managing Director, Senior Counsel, Corporate Secretary, BlackRock, Inc. prior thereto. | ||

Richard T. Potter (born 1954) | Senior Vice President and Chief Legal Officer | Vice President and Equity Counsel, The Guardian Life Insurance Company of America. | ||

Michael Bessel (born 1962) | Chief Compliance Officer | Managing Director, Chief Compliance Officer, Investments, The Guardian Life Insurance Company of America (since 2011); Chief Compliance Officer, Credit Suisse Asset Management prior thereto. | ||

Charles Barresi, Jr. (born 1967) | Anti-Money Laundering Officer | Anti-Money Laundering Officer, Park Avenue Securities LLC. | ||

Kathleen M. Moynihan (born 1966) | Senior Counsel | Senior Counsel, The Guardian Life Insurance Company of America (since 2012); Counsel, The Guardian Life Insurance Company of America prior thereto. | ||

Maria Nydia Morrison (born 1958) | Fund Controller | Mutual Fund Controller, The Guardian Life Insurance Company of America (since 2015); Chief Financial Officer/Assistant Operating Officer, St. Francis De Assisi Montessori School (Plaridel, Bulacan), Inc. (Philippines) (2013–2015); Vice President, Bank of New York Mellon prior thereto. | ||

Kristina Fink (born 1976) | Assistant Secretary | Assistant Vice President, Assistant Corporate Secretary and Secretary Pro Tem, The Guardian Life Insurance Company of America (since 2014); Associate, Clifford Chance LLP prior thereto. | ||

Sonya L. Crosswell (born 1977) | Assistant Secretary | Assistant Vice President, Assistant Corporate Secretary and Secretary Pro Tem, The Guardian Life Insurance Company of America (since 2014); Vice President, Secretary and Assistant General Counsel, Carver Federal Savings Bank prior thereto. |

| * | Officer since August 2016. The Officers hold office until the next annual meeting of the Board and until their successors shall have been elected and qualified. The business address of each Officer is 7 Hanover Square, New York, New York 10004. |

| 23 |

Table of Contents

SUPPLEMENTAL INFORMATION (UNAUDITED)

The Statement of Additional Information (“SAI”) includes additional information about the Trust’s Trustees and Officers and is available, without charge, upon request by calling toll-free 800-221-3253.

Portfolio Holdings and Proxy Voting Procedures

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Form N-Q is available on the Securities and Exchange Commission’s website at http://www.sec.gov. The Fund’s Form N-Q may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330. This information is also available, without charge, upon request, by calling toll-free 800-221-3253.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is included in the SAI. The SAI and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 may be obtained (i) without charge, upon request, by calling toll-free 800-221-3253; and (ii) on the Securities and Exchange Commission’s website at http://www.sec.gov.

| 24 |

Table of Contents

This report is transmitted to shareholders only. It is not authorized for use as an offer of sale or a solicitation of an offer to buy shares of the Fund unless accompanied or preceded by the Fund’s current prospectus. Past performance results shown in this report should not be considered a representation of future performance. Investment returns and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Statements and other information herein are as dated and are subject to change.

The Guardian Life Insurance Company of America New York, NY 10004-4025

PUB8175

Table of Contents

Guardian Variable

Products Trust

2016

Annual Report

All Data as of December 31, 2016

Guardian Large Cap Disciplined Growth VIP Fund

| Not FDIC insured. May lose value. No bank guarantee. | www.guardianlife.com |

Table of Contents