UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23148

Guardian Variable Products Trust

(Exact name of registrant as specified in charter)

10 Hudson Yards New York , N.Y. 10001

(Address of principal executive offices) (Zip code)

Dominique Baede

President

Guardian Variable Products Trust

10 Hudson Yards

New York, N.Y. 10001

(Name and address of agent for service)

Registrant’s telephone number, including area code: 212-598-8000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2020

| Item 1. | Reports to Stockholders. |

(a) A copy of the report transmitted to stockholders pursuant to Rule 30e-1 is filed herewith.

Guardian Variable

Products Trust

2020

Annual Report

All Data as of December 31, 2020

Guardian Large Cap Fundamental Growth VIP Fund

| | |

| Not FDIC insured. May lose value. No bank guarantee. | | www.guardianlife.com |

TABLE OF CONTENTS

Guardian Large Cap Fundamental Growth VIP Fund

Except as otherwise specifically stated, all information, including portfolio security positions, is as of December 31, 2020. The views expressed in the Fund Commentary are those of the Fund’s sub-adviser as of the date of this report and are subject to change without notice. They do not necessarily represent the views of Park Avenue Institutional Advisers LLC. The Fund Commentary may contain some forward-looking statements providing expectations or forecasts of future events as of the date of this report; they do not necessarily relate to historical or current facts. There can be no guarantee that any forward-looking statement will be realized. We undertake no obligation to update forward-looking statements, whether as a result of new information, future events, or otherwise. Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. Fund holdings will vary. Information contained herein has been obtained from sources believed reliable, but is not guaranteed.

GUARDIAN LARGE CAP FUNDAMENTAL GROWTH VIP FUND

FUND COMMENTARY OF CLEARBRIDGE INVESTMENTS LLC, SUB-ADVISER (UNAUDITED)

Highlights

| • | | Guardian Large Cap Fundamental Growth VIP Fund (the “Fund”) returned 30.73%, underperforming its benchmark, the Russell 1000® Growth Index1 (the “Index”), for the 12 months ended December 31, 2020. The Fund’s underperformance relative to the Index was primarily due to stock selection in the information technology (“IT”), consumer discretionary and communication services sectors. |

| • | | The Index delivered a 38.49% return for the period, topping its 36.39% return in 2019 and marking the best year for the Index since the initial recovery from the global financial crisis in 2009. This performance was largely due to the continued trade momentum that was accelerated by the dramatic shift to a work-from-home environment due to the COVID-19 pandemic. This shift led to continued strength in the consumer discretionary and IT sectors, which returned 62.70% and 52.89% for the period, respectively, far outpacing all other sectors due to strength in mega-cap stocks. Communication services was the only other sector that came close to matching the Index’s overall return. |

Market Overview

The U.S. equity market shrugged off a global coronavirus pandemic, COVID-19, that severely reduced economic activity for a significant portion of the reporting period yet managed to finish with strong gains. The large cap Standard & Poor’s 500® Index2 (the “S&P 500 Index”) advanced 18.40% for the 12-month period, due in large part to unprecedented levels of fiscal and monetary stimulus from the U.S. Federal Reserve (the “Fed”) and Congress. Growth stocks outperformed value stocks by historically wide margins with the Index

trouncing the Russell 1000® Value Index3 by 35.69 percentage points for the year, after beating it by 9.85 percentage points in 2019. The COVID-19 pandemic sparked the S&P 500 Index’s 30% decline in 22 trading days late in the first quarter, the fastest drop of that magnitude in history. Cyclical stocks and companies with weak balance sheets led the decline. Oil prices collapsed from $61 dollars to below $0 in early April. Consumer staples and large companies with strong balance sheets outperformed, but many groups that historically have been defensive in a recession, such as aerospace and entertainment, were not because COVID-19 threatened their profits. Large-cap technology, especially collaboration software and e-commerce, which historically suffered in recessions due to their high betas, thrived because COVID-19 accelerated their businesses. Swift action by the Fed and enormous fiscal stimulus packages totaling more than $4 trillion helped the market to recover. The S&P 500 Index rose 44% in the 53 trading days between March 23 and June 8, leading to its best quarter in 22 years. Mega cap IT soared, resulting in the highest concentration of the five largest stocks in the benchmark historically. The rebound continued in the third quarter. By September, improving economic data flipped the market leadership away from IT towards cyclicals. Resolution of the U.S. presidential election, with Joe Biden winning the White House, as well as positive COVID-19 vaccine trials and emergency use approval of two vaccines late in the year continued a rally in cyclical and more value-oriented names, solidifying a broadening of the market.

Portfolio Review

Stock selection in the IT, consumer discretionary and communication services sectors were the primary detractors from performance relative to the Index.

| 1 | The Russell 1000® Growth Index (the “Index”) is an unmanaged market-capitalization-weighted index that measures the performance of those companies in the Russell 1000® Index (which consists of the 1.000 largest U.S. companies based on total market capitalization) with higher price-to-book ratios and higher forecasted growth values. Index results assume the reinvestment of dividends paid on the stocks constituting the Index. You may not invest in the Index, and, unlike the Fund, the Index does not incur fees or expenses. Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Russell Investment Group. |

| 2 | The Standard & Poor’s 500® Index (the “S&P 500 Index”) is an unmanaged market-capitalization-weighted index generally considered to be representative of U.S. equity market activity. The S&P 500 Index consists of 500 stocks representing leading industries of the U.S. economy. Index results assume the reinvestment of dividends paid on the stocks constituting the Index. You may not invest in the S&P 500 Index, and, unlike the Fund, the S&P 500 Index does not incur fees or expenses. |

| 3 | The Russell 1000® Value Index is an unmanaged market-capitalization-weighted index that measures the performance of those companies in the Russell 1000® Index (which consists of the 1,000 largest U.S. companies based on total market capitalization) with lower price-to-book ratios and lower forecasted growth values. Index results assume the reinvestment of dividends paid on the stocks constituting the Russell 1000® Value Index. You may not invest in the Russell 1000® Value Index, and, unlike the Fund, the Russell 1000® Value Index does not incur fees and expenses. Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Russell Investment Group. |

GUARDIAN LARGE CAP FUNDAMENTAL GROWTH VIP FUND

Stock selection in the financials sector, an underweight to the IT sector and overweights to the industrials and energy sectors also negatively contributed to relative results. On the positive side, stock selection in the industrials and health care sectors and an overweight to the consumer discretionary sector were the primary contributors to relative returns.

Outlook

For some time, the Fund has been positioned for an environment of low economic growth. That was certainly the case for much of 2020 as the economy suffered through a sharp but brief recession. As we enter the new year, the economy is still down 10 million jobs from its pre-COVID-19 peak and a recent surge in infections has caused jobless claims to move higher again. There is uncertainty as to whether the economy is

hitting a rough patch or headed for a double dip recession. We think the former scenario is more likely as the successful distribution of COVID-19 vaccines, combined with new fiscal stimulus and continued monetary accommodation, could lead to reasonable gross domestic product (“GDP”) growth in 2021. GDP growth and inflation have historically been correlated so inflation is a factor we have been examining closely. We believe the level of inflation and the slope of the yield curve will be key determinants of whether growth stocks outperform in 2021. We’re not seeing it yet, but we believe that when inflation picks up and the yield curve steepens, that should cause a further broadening out in the market and less of a premium on the very narrow universe of growth stocks that have performed so well the last several years.

GUARDIAN LARGE CAP FUNDAMENTAL GROWTH VIP FUND

Fund Characteristics (unaudited)

| | |

| Total Net Assets: $339,889,767 | | |

|

| |

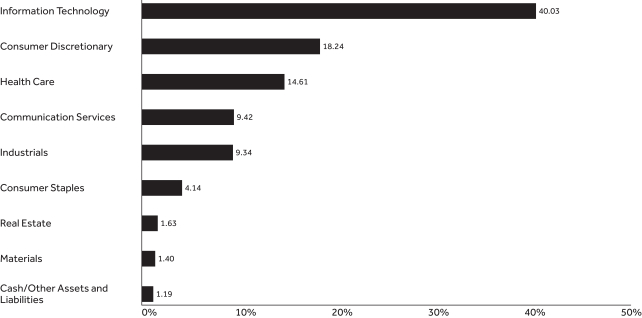

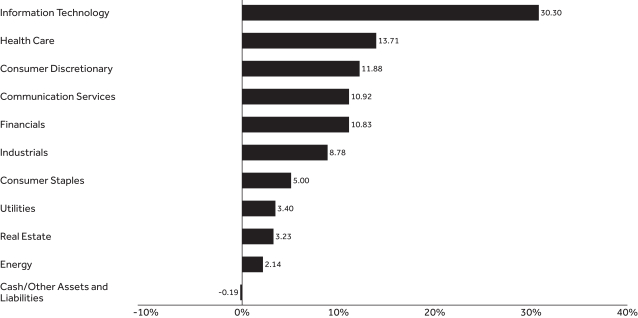

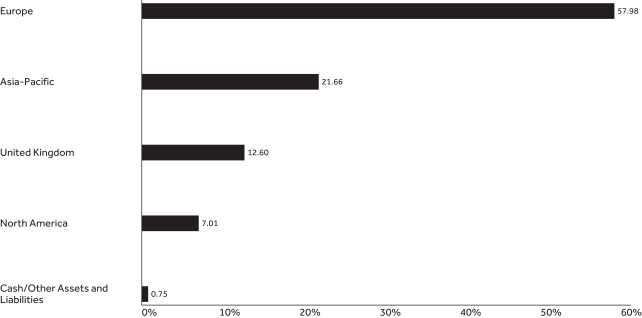

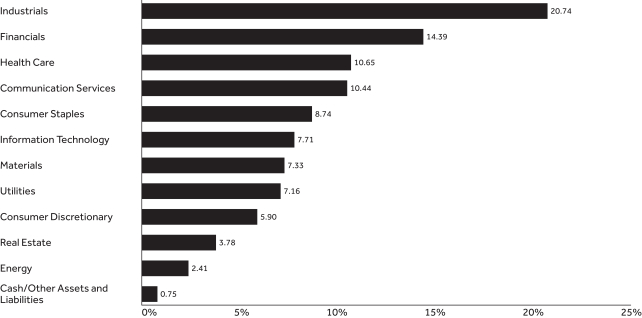

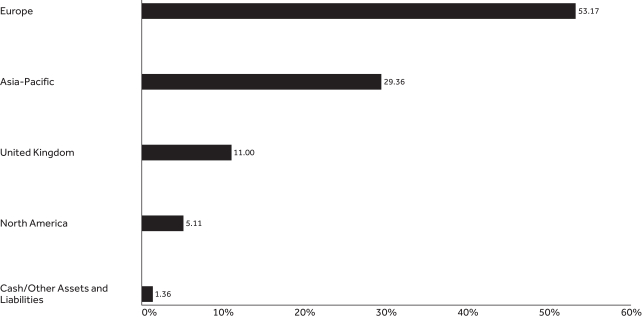

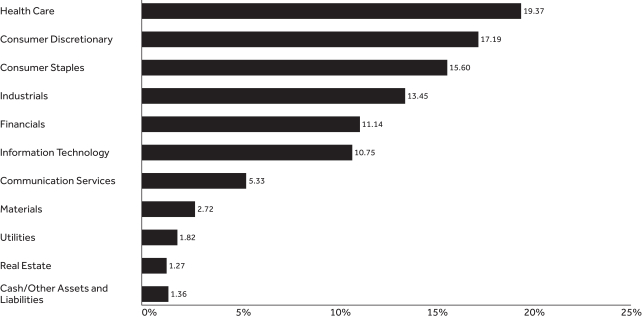

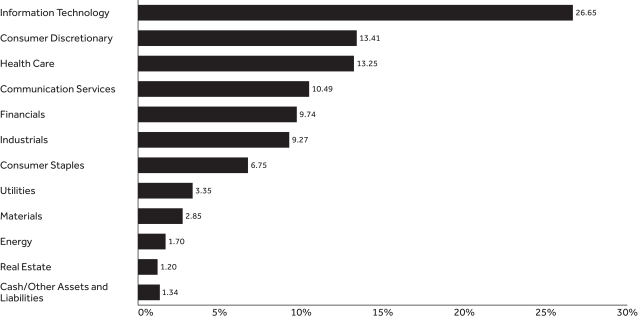

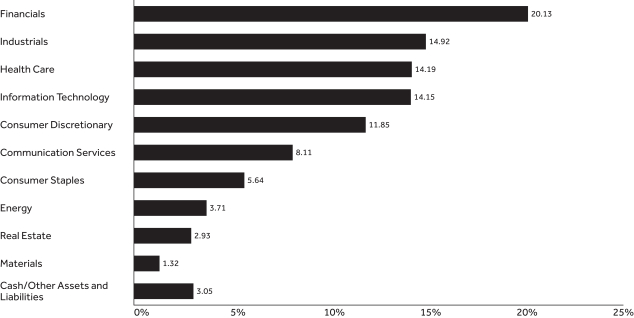

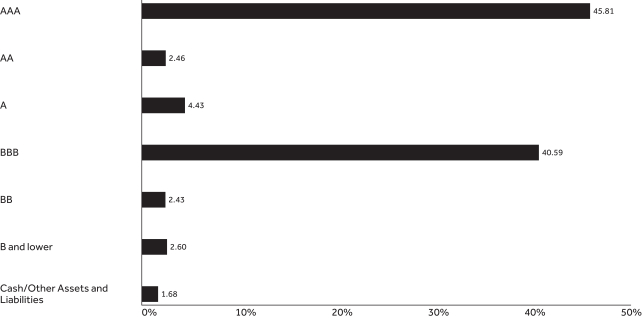

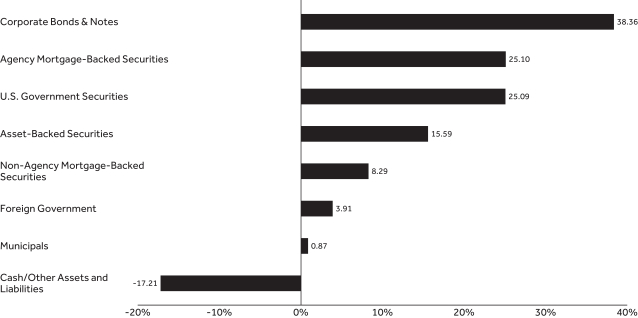

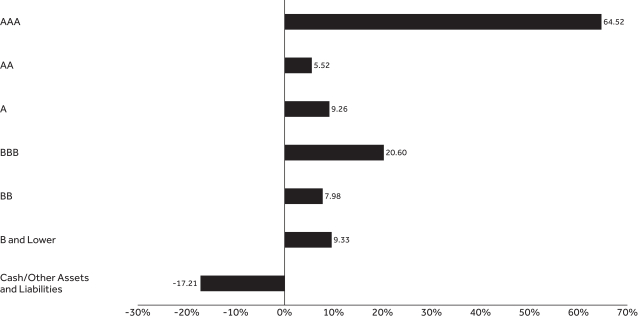

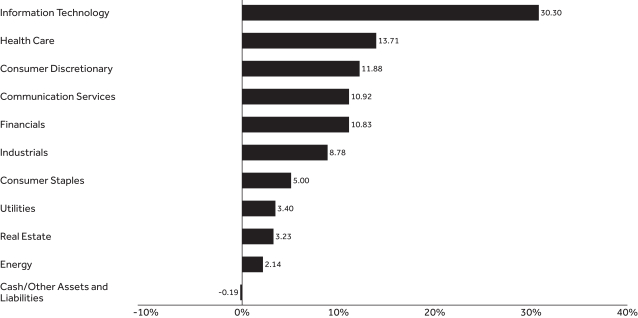

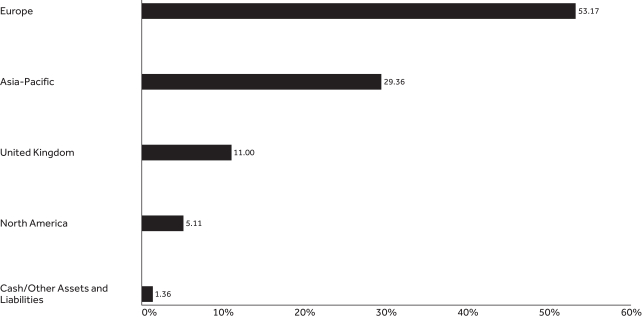

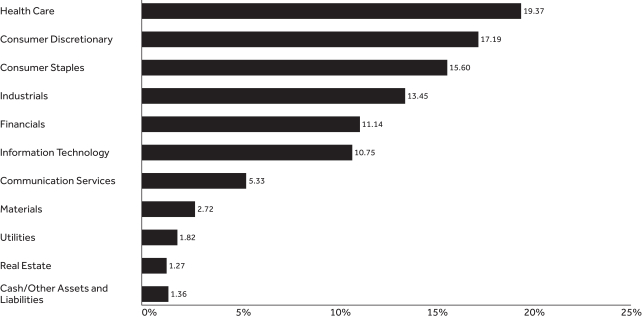

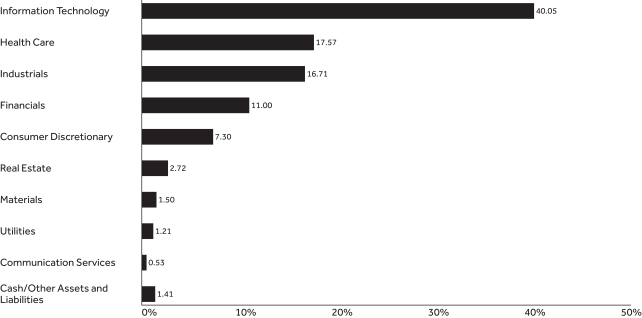

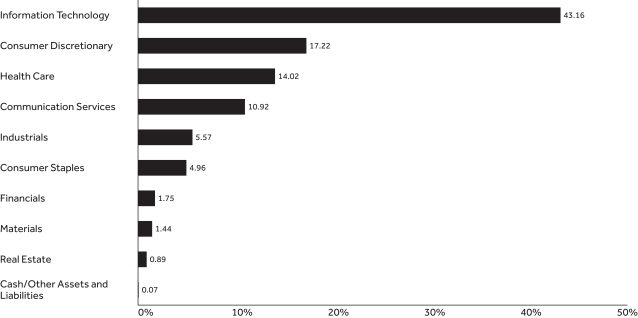

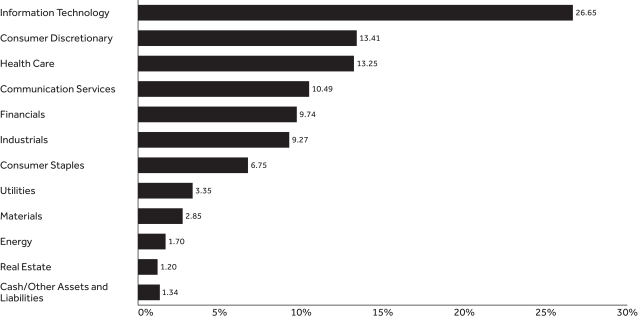

Sector Allocation1 As of December 31, 2020 |

|

| | | | |

| | |

Top Ten Holdings2 As of December 31, 2020 | | | |

| | |

| Holding | | % of Total

Net Assets | |

| Amazon.com, Inc. | | | 9.08% | |

| Facebook, Inc., Class A | | | 5.68% | |

| Apple, Inc. | | | 5.27% | |

| Microsoft Corp. | | | 4.86% | |

| Visa, Inc., Class A | | | 4.72% | |

| UnitedHealth Group, Inc. | | | 3.37% | |

| Adobe, Inc. | | | 3.28% | |

| QUALCOMM, Inc. | | | 2.87% | |

| Thermo Fisher Scientific, Inc. | | | 2.77% | |

| salesforce.com, Inc. | | | 2.62% | |

| Total | | | 44.52% | |

| 1 | The Fund’s holdings are allocated to each sector based on the MSCI Global Industry Classification Standard (GICS®). Cash includes short-term investments and net other assets and liabilities. |

| 2 | Portfolio holdings are subject to change and should not be considered a recommendation to buy or sell individual securities. |

GUARDIAN LARGE CAP FUNDAMENTAL GROWTH VIP FUND

Fund Performance (unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Average Annual Total Returns As of December 31, 2020 | | | | | | | | | | | | | | | |

| | | | | | |

| | | Inception Date | | | 1 Year | | | 5 Year | | | 10 Year | | | Since Inception | |

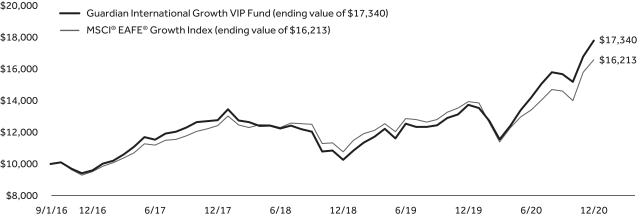

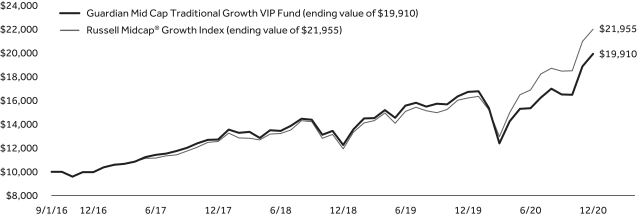

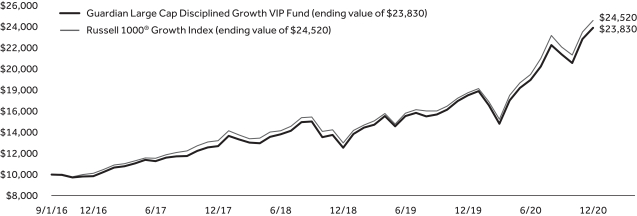

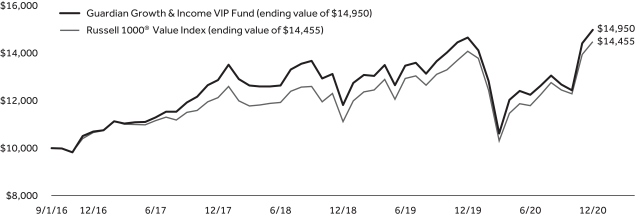

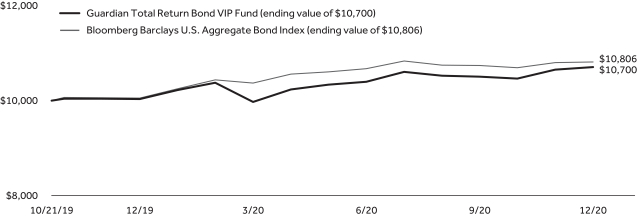

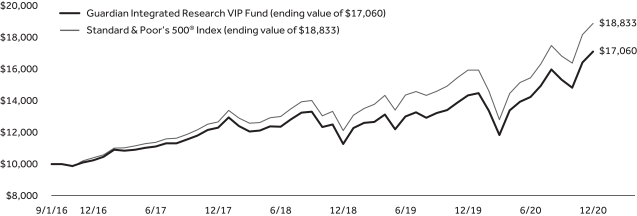

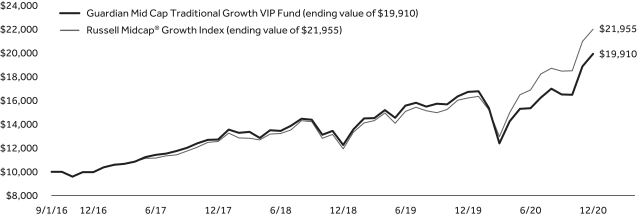

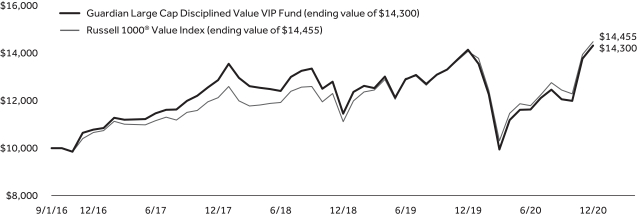

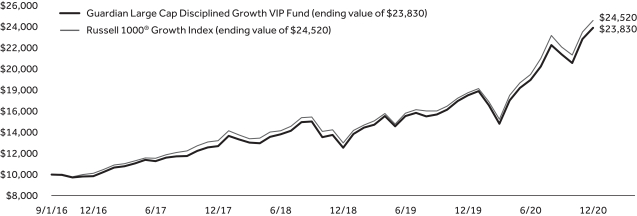

| Guardian Large Cap Fundamental Growth VIP Fund | | | 9/1/2016 | | | | 30.73% | | | | — | | | | — | | | | 19.41% | |

| Russell 1000® Growth Index | | | | | | | 38.49% | | | | — | | | | — | | | | 23.01% | |

|

| |

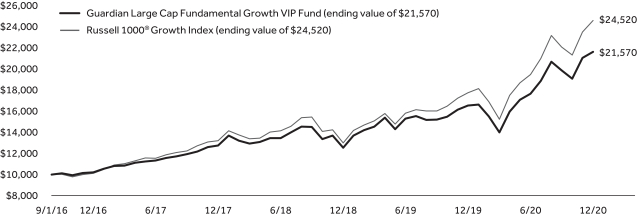

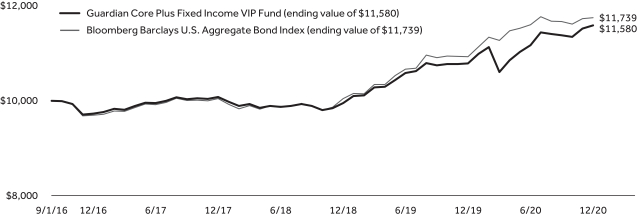

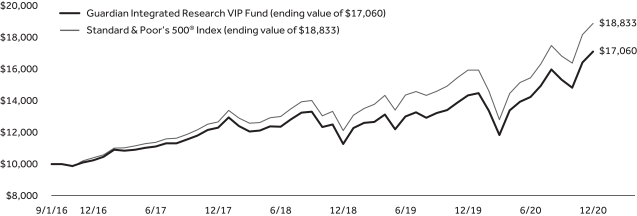

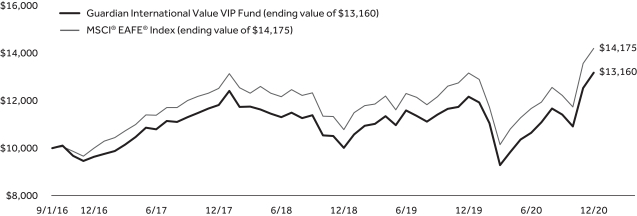

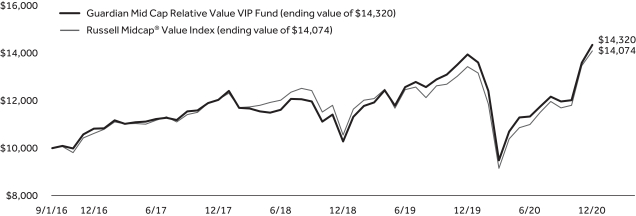

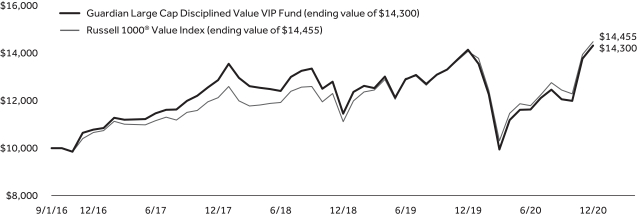

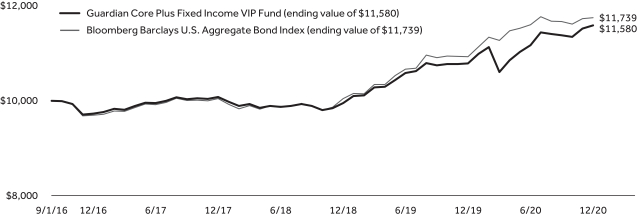

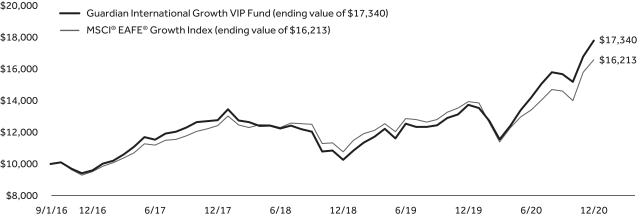

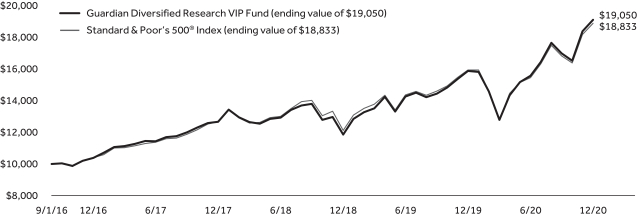

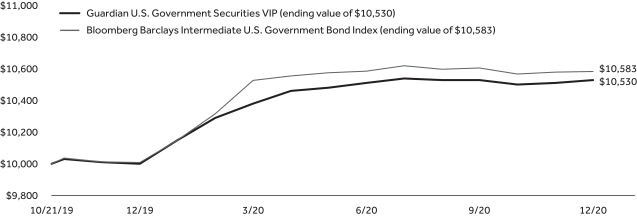

Results of a Hypothetical $10,000 Investment As of December 31, 2020 |

|

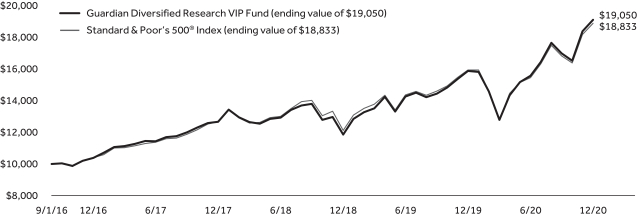

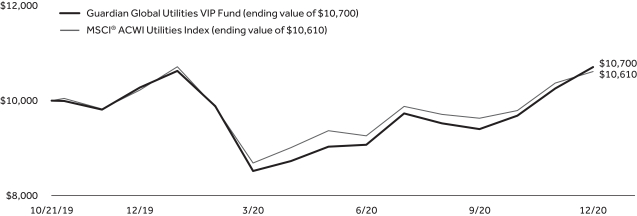

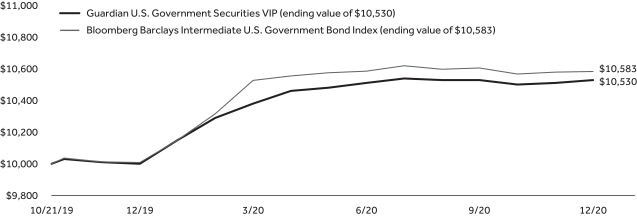

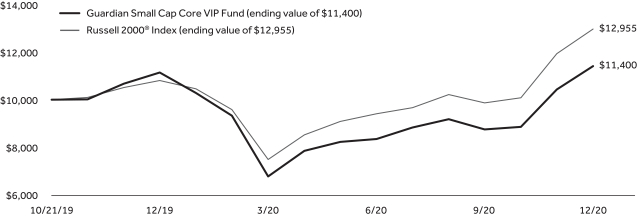

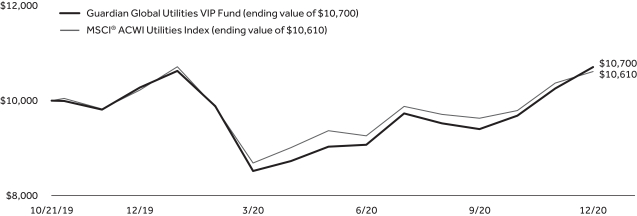

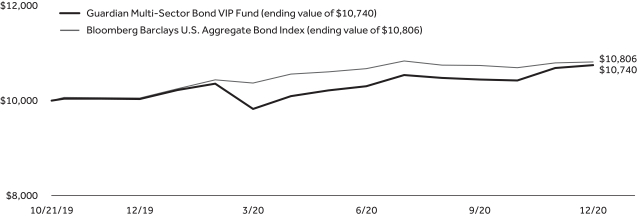

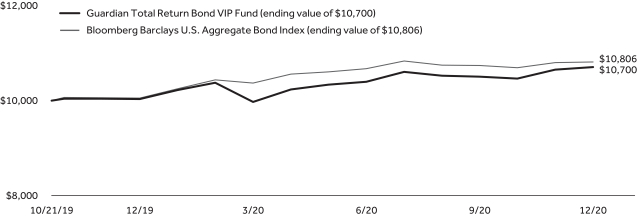

The chart above shows the performance of a hypothetical $10,000 investment made on inception date in Guardian Large Cap Fundamental Growth VIP Fund and the Russell 1000® Growth Index. Index returns do not include the fees and expenses of the Fund, but do include reinvestment of dividends, if any.

Performance quoted represents past performance and does not guarantee or predict future results. Investment return and principal value will fluctuate, so shares, when redeemed, may be worth more or less than their original cost. The Fund’s fees and expenses are detailed in the Financial Highlights section of this report. Fees and expenses are factored into the net asset value of Fund shares and any performance numbers we release. Total return figures include the effect of expense limitations in effect during the periods shown, if applicable; without such limitations, the performance shown would have been lower. Performance results assume the reinvestment of dividends and capital gains. The return figures shown do not reflect the deduction of taxes that a contract owner/policyholder may pay on redemption units. The actual total returns for owners of variable annuity contracts or variable life insurance policies that provide for investment in the Fund will be lower to reflect separate account and contract/policy charges. Current and month-end performance information, which may be lower or higher than that cited, is available by calling 1-888-GUARDIAN (1-888-482-7342) and is periodically updated on our website: http://guardianlife.com.

UNDERSTANDING YOUR FUND’S EXPENSES (UNAUDITED)

By investing in the Fund, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including, as applicable, investment advisory fees, distribution and/or service (12b-1) fees and other Fund expenses. The example below is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2020 to December 31, 2020. The table below shows the Fund’s expenses in two ways:

Expenses based on actual return

This section of the table provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Expenses based on hypothetical 5% return for comparison purposes

This section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund with the cost of investing in other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore the second section is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If these transactional costs were included, your costs would have been higher. Charges and expenses at the insurance company separate account level are not reflected in the table.

| | | | | | | | | | | | | | |

| | | | | |

| | | Beginning

Account Value

7/1/20 | | Ending Account Value

12/31/20 | | | Expenses Paid During Period* 7/1/20-12/31/20 | | | Expense Ratio During Period 7/1/20-12/31/20 | |

| Based on Actual Return | | $1,000.00 | | | $1,224.90 | | | | $5.54 | | | | 0.99% | |

| Based on Hypothetical Return (5% Return Before Expenses) | | $1,000.00 | | | $1,020.16 | | | | $5.03 | | | | 0.99% | |

| * | Expenses are equal to the Fund’s annualized expense ratio as indicated, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). |

SCHEDULE OF INVESTMENTS — GUARDIAN LARGE CAP FUNDAMENTAL GROWTH VIP FUND

| | | | | | | | |

| December 31, 2020 | | Shares | | | Value | |

| Common Stocks – 98.8% | |

| |

| Aerospace & Defense – 1.4% | |

| | | |

Raytheon Technologies Corp. | | | 67,500 | | | $ | 4,826,925 | |

| | | | | | | | | |

| | |

| | | | | 4,826,925 | |

| Air Freight & Logistics – 2.4% | |

| | | |

United Parcel Service, Inc., Class B | | | 48,796 | | | | 8,217,246 | |

| | | | | | | | | |

| | |

| | | | | 8,217,246 | |

| Auto Components – 1.6% | |

| | | |

Aptiv PLC | | | 40,244 | | | | 5,243,391 | |

| | | | | | | | | |

| | |

| | | | | 5,243,391 | |

| Beverages – 2.5% | |

| | | |

Anheuser-Busch InBev S.A., ADR | | | 47,888 | | | | 3,347,850 | |

| | | |

Monster Beverage Corp.(1) | | | 55,850 | | | | 5,165,008 | |

| | | | | | | | | |

| | |

| | | | | 8,512,858 | |

| Biotechnology – 4.7% | |

| | | |

Alexion Pharmaceuticals, Inc.(1) | | | 36,148 | | | | 5,647,764 | |

| | | |

Amgen, Inc. | | | 31,470 | | | | 7,235,582 | |

| | | |

BioMarin Pharmaceutical, Inc.(1) | | | 35,581 | | | | 3,120,098 | |

| | | | | | | | | |

| | |

| | | | | 16,003,444 | |

| Chemicals – 1.4% | |

| | | |

Ecolab, Inc. | | | 22,011 | | | | 4,762,300 | |

| | | | | | | | | |

| | |

| | | | | 4,762,300 | |

| Entertainment – 2.0% | |

| | | |

The Walt Disney Co.(1) | | | 37,399 | | | | 6,775,951 | |

| | | | | | | | | |

| | |

| | | | | 6,775,951 | |

| Equity Real Estate Investment – 1.6% | |

| | | |

Equinix, Inc. REIT | | | 7,747 | | | | 5,532,752 | |

| | | | | | | | | |

| | |

| | | | | 5,532,752 | |

| Food & Staples Retailing – 1.6% | |

| | | |

Costco Wholesale Corp. | | | 14,779 | | | | 5,568,432 | |

| | | | | | | | | |

| | |

| | | | | 5,568,432 | |

| Health Care Equipment & Supplies – 1.2% | |

| | | |

Alcon, Inc.(1) | | | 63,460 | | | | 4,187,091 | |

| | | | | | | | | |

| | |

| | | | | 4,187,091 | |

| Health Care Providers & Services – 3.4% | |

| | | |

UnitedHealth Group, Inc. | | | 32,697 | | | | 11,466,184 | |

| | | | | | | | | |

| | |

| | | | | 11,466,184 | |

| Interactive Media & Services – 5.7% | |

| | | |

Facebook, Inc., Class A(1) | | | 70,683 | | | | 19,307,768 | |

| | | | | | | | | |

| | |

| | | | | 19,307,768 | |

| Internet & Direct Marketing Retail – 11.8% | |

| | | |

Alibaba Group Holding Ltd., ADR(1) | | | 19,956 | | | | 4,644,360 | |

| | | |

Amazon.com, Inc.(1) | | | 9,473 | | | | 30,852,898 | |

| | | |

Booking Holdings, Inc.(1) | | | 2,097 | | | | 4,670,585 | |

| | | | | | | | | |

| | |

| | | | | 40,167,843 | |

| IT Services – 7.9% | |

| | | |

Akamai Technologies, Inc.(1) | | | 48,349 | | | | 5,076,162 | |

| | | |

Fidelity National Information Services, Inc. | | | 39,327 | | | | 5,563,197 | |

| | | |

Visa, Inc., Class A | | | 73,417 | | | | 16,058,500 | |

| | | | | | | | | |

| | |

| | | | | 26,697,859 | |

| | | | | | | | |

| December 31, 2020 | | Shares | | | Value | |

| Life Sciences Tools & Services – 2.8% | |

| | | |

Thermo Fisher Scientific, Inc. | | | 20,222 | | | $ | 9,419,003 | |

| | | | | | | | | |

| | |

| | | | | 9,419,003 | |

| Media – 1.7% | |

| | | |

Comcast Corp., Class A | | | 112,952 | | | | 5,918,685 | |

| | | | | | | | | |

| | |

| | | | | 5,918,685 | |

| Pharmaceuticals – 2.5% | |

| | | |

Zoetis, Inc. | | | 51,831 | | | | 8,578,030 | |

| | | | | | | | | |

| | |

| | | | | 8,578,030 | |

| Professional Services – 1.7% | |

| | | |

IHS Markit Ltd. | | | 64,897 | | | | 5,829,697 | |

| | | | | | | | | |

| | |

| | | | | 5,829,697 | |

| Road & Rail – 2.0% | |

| | | |

Uber Technologies, Inc.(1) | | | 133,792 | | | | 6,823,392 | |

| | | | | | | | | |

| | |

| | | | | 6,823,392 | |

| Semiconductors & Semiconductor Equipment – 9.0% | |

| | | |

ASML Holding N.V. | | | 7,310 | | | | 3,565,233 | |

| | | |

NVIDIA Corp. | | | 16,883 | | | | 8,816,303 | |

| | | |

NXP Semiconductors N.V. | | | 25,270 | | | | 4,018,183 | |

| | | |

QUALCOMM, Inc. | | | 64,021 | | | | 9,752,959 | |

| | | |

Texas Instruments, Inc. | | | 27,572 | | | | 4,525,392 | |

| | | | | | | | | |

| | |

| | | | | 30,678,070 | |

| Software – 17.9% | |

| | | |

Adobe, Inc.(1) | | | 22,260 | | | | 11,132,671 | |

| | | |

Atlassian Corp. PLC, Class A(1) | | | 8,860 | | | | 2,072,088 | |

| | | |

Microsoft Corp. | | | 74,214 | | | | 16,506,678 | |

| | | |

Nutanix, Inc., Class A(1) | | | 77,562 | | | | 2,471,901 | |

| | | |

Palo Alto Networks, Inc.(1) | | | 20,834 | | | | 7,404,195 | |

| | | |

salesforce.com, Inc.(1) | | | 40,030 | | | | 8,907,876 | |

| | | |

Splunk, Inc.(1) | | | 37,411 | | | | 6,355,755 | |

| | | |

VMware, Inc., Class A(1) | | | 29,360 | | | | 4,118,034 | |

| | | |

Workday, Inc., Class A(1) | | | 7,620 | | | | 1,825,828 | |

| | | | | | | | | |

| | |

| | | | | 60,795,026 | |

| Specialty Retail – 4.9% | |

| | | |

Advance Auto Parts, Inc. | | | 28,940 | | | | 4,558,340 | |

| | | |

The Home Depot, Inc. | | | 22,603 | | | | 6,003,809 | |

| | | |

Ulta Beauty, Inc.(1) | | | 20,933 | | | | 6,011,120 | |

| | | | | | | | | |

| | |

| | | | | 16,573,269 | |

| Technology Hardware, Storage & Peripherals – 5.3% | |

| | | |

Apple, Inc. | | | 134,904 | | | | 17,900,412 | |

| | | | | | | | | |

| | |

| | | | | 17,900,412 | |

| Trading Companies & Distributors – 1.8% | |

| | | |

WW Grainger, Inc. | | | 14,829 | | | | 6,055,274 | |

| | | | | | | | | |

| | |

| | | | | 6,055,274 | |

| | |

Total Common Stocks

(Cost $217,989,053) | | | | 335,840,902 | |

| | | | |

| 6 | | | | The accompanying notes are an integral part of these financial statements. |

SCHEDULE OF INVESTMENTS — GUARDIAN LARGE CAP FUNDAMENTAL GROWTH VIP FUND

| | | | | | | | |

| December 31, 2020 | | Principal

Amount | | | Value | |

| Short–Term Investment – 1.3% | |

| |

| Repurchase Agreements – 1.3% | |

| | | |

Fixed Income Clearing Corp., 0.00%, dated 12/31/2020, proceeds at maturity value of $4,414,276, due 1/4/2021(2) | | $ | 4,414,276 | | | $ | 4,414,276 | |

| | |

Total Repurchase Agreements

(Cost $4,414,276) | | | | 4,414,276 | |

| | |

Total Investments – 100.1%

(Cost $222,403,329) | | | | 340,255,178 | |

| | |

| Liabilities in excess of other assets – (0.1)% | | | | (365,411 | ) |

| | |

| Total Net Assets – 100.0% | | | $ | 339,889,767 | |

| (1) | Non–income–producing security. |

| (2) | The table below presents collateral for repurchase agreements. |

| | | | | | | | | | | | | | | | |

| Security | | Coupon | | | Maturity

Date | | | Principal

Amount | | | Value | |

| U.S. Treasury Note | | | 0.125% | | | | 12/31/2022 | | | $ | 4,502,600 | | | $ | 4,502,600 | |

Legend:

ADR — American Depositary Receipt

REIT — Real Estate Investment Trust

The following is a summary of the inputs used as of December 31, 2020 in valuing the Fund’s investments. For more information on valuation inputs, please refer to Note 2a of the accompanying Notes to Financial Statements.

| | | | | | | | | | | | | | | | |

| | | Valuation Inputs | | | | |

| Investments in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 335,840,902 | | | $ | — | | | $ | — | | | $ | 335,840,902 | |

| Repurchase Agreements | | | — | | | | 4,414,276 | | | | — | | | | 4,414,276 | |

| Total | | $ | 335,840,902 | | | $ | 4,414,276 | | | $ | — | | | $ | 340,255,178 | |

| | | | |

| The accompanying notes are an integral part of these financial statements. | | | | 7 |

FINANCIAL INFORMATION — GUARDIAN LARGE CAP FUNDAMENTAL GROWTH VIP FUND

| | | | |

Statement of Assets and Liabilities As of December 31, 2020 | | | |

Assets | | | | |

| | |

Investments, at value | | $ | 340,255,178 | |

| | |

Foreign tax reclaims receivable | | | 35,502 | |

| | |

Dividends/interest receivable | | | 30,899 | |

| | |

Reimbursement receivable from adviser | | | 9,848 | |

| | |

Prepaid expenses | | | 18,584 | |

| | | | | |

| | |

Total Assets | | | 340,350,011 | |

| | | | | |

| | |

Liabilities | | | | |

| | |

Investment advisory fees payable | | | 182,659 | |

| | |

Payable for fund shares redeemed | | | 88,784 | |

| | |

Distribution fees payable | | | 71,179 | |

| | |

Accrued audit fees | | | 27,999 | |

| | |

Accrued custodian and accounting fees | | | 21,076 | |

| | |

Accrued trustees’ and officers’ fees | | | 1,480 | |

| | |

Accrued expenses and other liabilities | | | 67,067 | |

| | | | | |

| | |

Total Liabilities | | | 460,244 | |

| | | | | |

| | |

Total Net Assets | | $ | 339,889,767 | |

| | | | | |

| | |

Net Assets Consist of: | | | | |

| | |

Paid-in capital | | $ | 174,237,201 | |

| | |

Distributable earnings | | | 165,652,566 | |

| | | | | |

| | |

Total Net Assets | | $ | 339,889,767 | |

| | | | | |

| | |

Investments, at Cost | | $ | 222,403,329 | |

| | | | | |

| | |

Pricing of Shares | | | | |

| | |

Shares of Beneficial Interest Outstanding with

No Par Value | | | 15,759,729 | |

| | |

Net Asset Value Per Share | | | $21.57 | |

| | | | | |

| | | | |

Statement of Operations For the Year Ended December 31, 2020 | | | |

Investment Income | | | | |

| | |

Dividends | | $ | 2,710,730 | |

| | |

Interest | | | 1,181 | |

| | |

Withholding taxes on foreign dividends | | | (17,149 | ) |

| | | | | |

| | |

Total Investment Income | | | 2,694,762 | |

| | | | | |

| | |

Expenses | | | | |

| | |

Investment advisory fees | | | 1,901,249 | |

| | |

Distribution fees | | | 818,591 | |

| | |

Trustees’ and officers’ fees | | | 106,466 | |

| | |

Professional fees | | | 100,695 | |

| | |

Administrative fees | | | 51,730 | |

| | |

Custodian and accounting fees | | | 40,835 | |

| | |

Shareholder reports | | | 21,937 | |

| | |

Transfer agent fees | | | 20,248 | |

| | |

Other expenses | | | 22,610 | |

| | | | | |

| | |

Total Expenses | | | 3,084,361 | |

| | |

Expenses recouped by adviser | | | 180,157 | |

| | | | | |

| | |

Total Expenses | | | 3,264,518 | |

| | | | | |

| | |

Net Investment Income/(Loss) | | | (569,756 | ) |

| | | | | |

| | |

Realized Gain/(Loss) and Change in Unrealized Appreciation/(Depreciation) on Investments | | | | |

| | |

Net realized gain/(loss) from investments | | | 29,777,248 | |

| | |

Net change in unrealized appreciation/(depreciation) on investments | | | 60,199,277 | |

| | | | | |

| | |

Net Gain on Investments | | | 89,976,525 | |

| | | | | |

| | |

Net Increase in Net Assets Resulting From Operations | | $ | 89,406,769 | |

| | | | | |

| | | | | |

| | | | |

| 8 | | | | The accompanying notes are an integral part of these financial statements. |

FINANCIAL INFORMATION — GUARDIAN LARGE CAP FUNDAMENTAL GROWTH VIP FUND

| | | | | | | | |

Statements of Changes in Net Assets | | | | | | |

| | | |

| | | For the

Year Ended

12/31/20 | | | For the

Year Ended

12/31/19 | |

| | | | |

Operations | | | | | | | | |

| | | |

Net investment income/(loss) | | $ | (569,756 | ) | | $ | 24,341 | |

| | | |

Net realized gain/(loss) from investments | | | 29,777,248 | | | | 10,072,295 | |

| | | |

Net change in unrealized appreciation/(depreciation) on investments | | | 60,199,277 | | | | 64,386,434 | |

| | | | | | | | | |

| | | |

Net Increase in Net Assets Resulting from Operations | | | 89,406,769 | | | | 74,483,070 | |

| | | | | | | | | |

| | | |

Capital Share Transactions | | | | | | | | |

| | | |

Proceeds from sales of shares | | | 1,002,424 | | | | 100,269,388 | 1 |

| | | |

Cost of shares redeemed | | | (100,440,034 | ) | | | (48,096,100 | ) |

| | | | | | | | | |

| | | |

Net Increase/(Decrease) in Net Assets Resulting from Capital Share Transactions | | | (99,437,610 | ) | | | 52,173,288 | |

| | | | | | | | | |

| | | |

Net Increase/(Decrease) in Net Assets | | | (10,030,841 | ) | | | 126,656,358 | |

| | | | | | | | | |

| | | |

Net Assets | | | | | | | | |

| | | |

Beginning of year | | | 349,920,608 | | | | 223,264,250 | |

| | | | | | | | | |

| | | |

End of year | | $ | 339,889,767 | | | $ | 349,920,608 | |

| | | | | | | | | |

| | | |

Other Information: | | | | | | | | |

| | | |

Shares | | | | | | | | |

| | | |

Sold | | | 58,494 | | | | 6,537,264 | |

| | | |

Redeemed | | | (5,503,667 | ) | | | (3,176,006 | ) |

| | | | | | | | | |

| | | |

Net Increase/(Decrease) | | | (5,445,173 | ) | | | 3,361,258 | |

| | | | | | | | | |

| | | | | | | | | |

| 1 | Includes in-kind subscriptions of $90,000,216. The cost basis of the contributed securities is equal to the market value of the securities on the date of the subscription. |

| | | | |

| The accompanying notes are an integral part of these financial statements. | | | | 9 |

FINANCIAL INFORMATION — GUARDIAN LARGE CAP FUNDAMENTAL GROWTH VIP FUND

The Financial Highlights table is intended to help you understand the Fund’s financial performance for the past five years (or, if shorter, the period since inception). Certain information reflects financial results for a single Fund share. The total returns in the table represent the rate that an investor would have earned (or lost) on an investment in the Fund.

| | | | | | | | | | | | | | | | | | | | | | | | |

Financial Highlights | | | | | | | | | | | | | | | | | | |

| | | Per Share Operating Performance | | | | |

| | | Net Asset Value,

Beginning of

Period | | | Net Investment

Income/ (Loss)(1) | | |

Net Realized

and Unrealized

Gain/(Loss) | | | Total

Operations | | | Net Asset

Value, End of

Period | | | Total

Return(2) | |

| | | | | | | |

Year Ended 12/31/20 | | $ | 16.50 | | | $ | (0.03 | ) | | $ | 5.10 | | | $ | 5.07 | | | $ | 21.57 | | | | 30.73% | |

| | | | | | | |

Year Ended 12/31/19 | | | 12.51 | | | | 0.00 | (4) | | | 3.99 | | | | 3.99 | | | | 16.50 | | | | 31.89% | |

| | | | | | | |

Year Ended 12/31/18 | | | 12.74 | | | | 0.03 | | | | (0.26 | ) | | | (0.23 | ) | | | 12.51 | | | | (1.81)% | |

| | | | | | | |

Year Ended 12/31/17 | | | 10.19 | | | | 0.01 | | | | 2.54 | | | | 2.55 | | | | 12.74 | | | | 25.02% | |

| | | | | | | |

Period Ended 12/31/16(5) | | | 10.00 | | | | 0.01 | | | | 0.18 | | | | 0.19 | | | | 10.19 | | | | 1.90% | (6) |

| | | | |

| 10 | | | | The accompanying notes are an integral part of these financial statements. |

FINANCIAL INFORMATION — GUARDIAN LARGE CAP FUNDAMENTAL GROWTH VIP FUND

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | |

Net Assets, End

of Period (000s) | | | Net Ratio of

Expenses to

Average

Net Assets(3) | | | Gross Ratio of

Expenses to

Average Net

Assets | | | Net Ratio of Net

Investment Income/(Loss)

to Average

Net Assets(3) | | | Gross Ratio of Net

Investment Income/(Loss)

to Average

Net Assets | | | Portfolio

Turnover Rate | |

| | | | | |

| $ | 339,890 | | | | 1.00% | | | | 1.00% | | | | (0.18)% | | | | (0.18)% | | | | 20% | |

| | | | | |

| | 349,921 | | | | 1.00% | | | | 1.00% | | | | 0.01% | | | | 0.01% | | | | 44% | |

| | | | | |

| | 223,264 | | | | 1.00% | | | | 1.02% | | | | 0.26% | | | | 0.24% | | | | 33% | |

| | | | | |

| | 11,946 | | | | 1.00% | | | | 1.95% | | | | 0.09% | | | | (0.86)% | | | | 51% | |

| | | | | |

| | 9,778 | | | | 1.00% | (6) | | | 3.08% | (6) | | | 0.26% | (6) | | | (1.82)% | (6) | | | 4% | (6) |

| (1) | Calculated based on the average shares outstanding during the period. |

| (2) | Total returns do not reflect the effects of charges deducted pursuant to the terms of The Guardian Insurance & Annuity Company, Inc.’s variable contracts. Inclusion of such charges would reduce the total returns for all periods shown. |

| (3) | Net Ratio of Expenses to Average Net Assets and Net Ratio of Net Investment Income/(Loss) to Average Net Assets include the effect of fee waivers, expense limitations, and recoupments. |

| (4) | Rounds to $0.00 per share. |

| (5) | Commenced operations on September 1, 2016. |

| (6) | Ratios for periods less than one year have been annualized, except for total return and portfolio turnover rate. For the period ended December 31, 2016, certain non-recurring fees (i.e., audit fees) are not annualized. |

| | | | |

| The accompanying notes are an integral part of these financial statements. | | | | 11 |

NOTES TO FINANCIAL STATEMENTS — GUARDIAN LARGE CAP FUNDAMENTAL GROWTH VIP FUND

December 31, 2020

1. Organization

Guardian Variable Products Trust (the “Trust”), a Delaware statutory trust organized on January 12, 2016, is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Trust currently has twenty-four series. Guardian Large Cap Fundamental Growth VIP Fund (the “Fund”) is a series of the Trust. The Fund is a diversified fund and commenced operations on September 1, 2016. The financial statements for other series of the Trust are presented in separate reports.

The Trust has authorized an unlimited number of shares of beneficial interest with no par value. Shares are bought and sold at closing net asset value (“NAV”). Shares of the Fund are only sold to certain separate accounts of The Guardian Insurance & Annuity Company, Inc. (“GIAC”) that fund certain variable annuity contracts and variable life insurance policies issued by GIAC. GIAC is a wholly-owned subsidiary of The Guardian Life Insurance Company of America (“Guardian Life”).

The Fund seeks long-term growth of capital.

2. Significant Accounting Policies

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The Fund follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 Financial Services – Investment Companies. The following policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The preparation of financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

a. Investment Valuations Equity securities traded on an exchange other than NASDAQ Stock Market, LLC (“NASDAQ”) are valued at the last reported sale price on the principal exchange or market on which they are traded; or, if there were no sales that day, at the mean between the closing bid and ask prices. Securities traded on the NASDAQ are generally valued at the NASDAQ official closing price, which may not be the last sale price. If the NASDAQ official closing price is not available

for a security, that security is generally valued at the mean between the closing bid and ask prices. Repurchase agreements are carried at cost, which approximates fair value (see Note 5d). Foreign securities are valued in the currencies of the markets in which they trade and then converted to U.S. dollars by the application of foreign exchange rates at the close of the New York Stock Exchange (“NYSE”). Forward foreign currency contracts, if any, are valued at the mean between the bid and ask rates for the specified time interpolated from rates for proximate time periods. Securities for which market quotations are not readily available or for which market quotations may be considered unreliable are valued at their fair values as determined in accordance with policies and procedures adopted by the Board of Trustees.

Under the policies and procedures approved by the Board of Trustees, Park Avenue Institutional Advisers LLC (“Park Avenue”), the Fund’s investment adviser, has established a Fair Valuation Committee to assist the Board of Trustees with the oversight and monitoring of the valuation of the Fund’s investments. This includes monitoring the appropriateness of fair values based on results of ongoing valuation oversight, including but not limited to consideration of security specific events, market events, and pricing vendor and broker-dealer due diligence. The Fair Valuation Committee oversees and carries out the policies for the valuation of investments held in the Fund. The Fair Valuation Committee is responsible for discussing and assessing the potential impacts to the fair values on an ongoing basis, and at least on a quarterly basis with the Board of Trustees.

Securities whose values have been materially affected by events occurring before the Fund’s valuation time but after the close of the securities’ principal exchange or market may be fair valued in accordance with policies and procedures adopted by the Board of Trustees. In addition, the values of the Fund’s investments in foreign securities are generally determined by a pricing service using pricing models designed to estimate likely changes in the values of those securities. Certain foreign equity instruments are valued by applying international fair value factors provided by approved pricing services. The factors seek to adjust the local closing price for movements of local markets post closing, but prior to the time the NAVs are calculated. Valuations reflected in this report are as of the report date. As a result, changes in valuation due to market events and/or issuer related events after the report date and prior to issuance of the report are not reflected herein.

NOTES TO FINANCIAL STATEMENTS — GUARDIAN LARGE CAP FUNDAMENTAL GROWTH VIP FUND

Various inputs are used in determining the valuation of the Fund’s investments. These inputs are summarized in three broad levels listed below.

| • | | Level 1 – unadjusted inputs using quoted prices in active markets for identical investments. |

| • | | Level 2 – other significant observable inputs, including, but not limited to, quoted prices for similar investments, inputs other than quoted prices that are observable for investments (such as interest rates, prepayment speeds, credit risks, etc.) or other market corroborated inputs. |

| • | | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

Inputs may include price information, volatility statistics, specific and broad credit data, liquidity statistics, and other factors. A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input; both individually and in aggregate, that is significant to the fair value measurement. However, the determination of what constitutes “observable” requires significant judgment by the Trust. The Trust considers observable data to be that market data which is readily available, regularly distributed or updated, reliable and verifiable, and provided by independent sources that are actively involved in the relevant market. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. Changes in valuation techniques may result in transfers into or out of a financial instrument’s assigned level within the hierarchy.

The FASB requires reporting entities to make disclosures about purchases, sales, issuances and settlements of Level 3 securities on a gross basis. For the year ended December 31, 2020, there were no transfers into or out of Level 3 of the fair value hierarchy.

In determining a financial instrument’s placement within the hierarchy, the Trust separates the Fund’s investment portfolio into two categories: investments and derivatives (e.g., futures). A summary of inputs used to value the Fund’s assets and liabilities carried at fair value as of December 31, 2020 is included in the Schedule of Investments.

Investments Investments whose values are based on quoted market prices in active markets, and are therefore classified within Level 1, include active listed equities. Investments that trade in markets that are not considered to be active, but are valued based on quoted market prices, dealer quotations or alternative pricing

sources supported by observable inputs are classified within Level 2. These include certain U.S. government and sovereign obligations, most government agency securities, investment-grade corporate bonds, certain mortgage products, state, municipal and provincial obligations, and certain foreign equity securities, including securities whose prices may have been affected by events occurring after the close of trading on their principal exchange or market and, as a result, whose values are determined by a pricing service as described above, or securities whose values are otherwise determined using fair valuation methods approved by the Fund’s Board of Trustees.

Investments classified within Level 3 have significant unobservable inputs, as they trade infrequently or not at all. Level 3 investments include, among others, private placement securities. When observable prices are not available for these securities, the Trust uses one or more valuation techniques for which sufficient and reliable data is available. The inputs used by the Trust in estimating the value of Level 3 investments include, for example, the original transaction price, recent transactions in the same or similar instruments, completed or pending third-party transactions in the underlying investment or comparable issuers, subsequent rounds of financing, recapitalizations, and other transactions across the capital structure. Level 3 investments may also be adjusted to reflect illiquidity and/or non-transferability, with the amount of such discount estimated by the Trust in the absence of market information. Assumptions used by the Trust due to the lack of observable inputs may significantly impact the resulting fair value and therefore the Fund’s results of operations. As of December 31, 2020, the Fund had no securities classified as Level 3.

Derivatives Exchange-traded derivatives, such as futures contracts, exchange-traded option contracts and certain swaps, are typically classified within Level 1 or Level 2 of the fair value hierarchy depending on whether or not they are deemed to be actively traded. Certain non-exchange-traded derivatives, such as generic forwards, certain swaps and options, have inputs which can generally be corroborated by market data and are therefore classified within Level 2. During the year ended December 31, 2020, the Fund did not hold any derivatives.

b. Securities Transactions Securities transactions are accounted for on the date securities are purchased or sold (trade date). Realized gains or losses on securities transactions are determined on the basis of specific identification.

NOTES TO FINANCIAL STATEMENTS — GUARDIAN LARGE CAP FUNDAMENTAL GROWTH VIP FUND

c. Foreign Currency Translation The accounting records of the Fund are maintained in U.S. dollars. Investment securities and all other assets and liabilities of the Fund denominated in a foreign currency are generally translated into U.S. dollars at the exchange rates quoted at the close of the NYSE on each business day. The market value of investment securities and other assets and liabilities are translated at the exchange rate as of the valuation date. Purchases and sales of securities, income receipts, and expense payments are translated into U.S. dollars at the exchange rates in effect on the dates of the respective transactions. The Fund does not isolate the portion of the fluctuations on investments resulting from changes in foreign currency exchange rates from the fluctuations in market prices of investments held. Such fluctuations are included in the Net change in net realized and unrealized gain/(loss) from investments on the Statement of Operations.

Reported realized foreign currency gains and losses arise from the disposition of foreign currency, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the Fund’s books on the transaction date and the U.S. dollar equivalent of the amounts actually received or paid. These reported realized foreign currency gains and losses, if any, are included in Net realized gain/(loss) from foreign currency transactions on the Statement of Operations. Unrealized foreign currency gains and losses arise from changes (due to changes in exchange rates) in the value of foreign currency and other assets and liabilities denominated in foreign currencies, which are held at period end, if any, and are included in Net change in unrealized appreciation/(depreciation) on translation of assets and liabilities in foreign currencies on the Statement of Operations.

d. Foreign Capital Gains Tax The Fund may be subject to foreign taxes on income, gains on investments or currency purchases/repatriation, a portion of which may be recoverable. The Fund will accrue such taxes and recoveries as applicable, based upon their current interpretation of tax rules and regulations that exist in the markets in which they invest.

e. Investment Income Dividend income net of foreign taxes withheld, if any, is generally recorded on the ex-dividend date. Interest income, which includes amortization/accretion of premium/discount, is determined using the interest income accrual method, and is accrued and recorded daily.

f. Allocation of Income and Expenses Many of the expenses of the Trust can be directly attributed to a specific series of the Trust. Expenses that cannot be directly attributed to a specific series of the Trust are generally apportioned among all the series in the Trust, based on relative net assets. In calculating net asset value per share for each series of the Trust, investment income, realized and unrealized gains and losses, and expenses other than series-specific expenses are allocated daily to each series based upon the proportion of net assets attributable to each series.

3. Transactions with Affiliates

a. Investment Advisory Fee and Expense Limitation Under the terms of the advisory agreement, which, after its two year initial term, is reviewed and approved annually by the Board of Trustees, the Fund pays an investment advisory fee to Park Avenue. Park Avenue is a wholly-owned subsidiary of Guardian Life and receives an investment advisory fee at an annual rate of 0.62% up to $100 million, 0.57% up to $300 million, 0.52% up to $500 million, and 0.50% in excess of $500 million of the Fund’s average daily net assets. The fee is accrued daily and paid monthly.

Park Avenue has contractually agreed through April 30, 2021 to waive certain fees and/or reimburse certain expenses incurred by the Fund to the extent necessary to limit the Fund’s total annual operating expenses after fee waiver and/or expense reimbursement to 1.01% of the Fund’s average daily net assets (excluding, if applicable, any acquired fund fees and expenses, taxes, interest, transaction costs and brokerage commissions, litigation and extraordinary expenses). The limitation may not be increased or terminated prior to this time without action by the Board of Trustees, may be terminated only upon approval of the Board of Trustees, and is subject to Park Avenue’s recoupment rights.

Park Avenue may be entitled to recoupment of previously waived fees and reimbursed expenses from the Fund for three years from the date of the waiver or reimbursement, subject to the expense limitation in effect at the time of the waiver or reimbursement and at the time of the recoupment, if any. Amounts waived or reimbursed by Park Avenue pursuant to any expense limitation after April 9, 2018 are not subject to Park Avenue’s recoupment rights. During the year ended December 31, 2020, Park Avenue recouped previously waived or reimbursed expenses in the amount of $180,157. No further amounts are available for potential future recoupment by Park Avenue under the Expense Limitation Agreement.

NOTES TO FINANCIAL STATEMENTS — GUARDIAN LARGE CAP FUNDAMENTAL GROWTH VIP FUND

Park Avenue has entered into a Sub-Advisory Agreement with ClearBridge Investments LLC (“ClearBridge”). ClearBridge is responsible for providing day-to-day investment advisory services to the Fund, subject to the supervision of Park Avenue and the oversight of the Board of Trustees. Sub-advisory fees are paid by Park Avenue and do not represent a separate or additional expense to the Fund.

b. Compensation of Trustees and Officers Trustees and officers who are interested persons of the Trust, as defined in the 1940 Act, receive no compensation from the Fund, except for the Chief Compliance Officer of the Trust. Trustees of the Trust who are not interested persons of the Trust, and the Chief Compliance Officer, receive compensation and reimbursement of expenses from the Trust.

c. Distribution Fees Park Avenue Securities LLC (“PAS”), a wholly-owned subsidiary of Guardian Life, is the principal underwriter of Fund shares. The Trust has entered into a distribution and service agreement with PAS, which governs the sale and distribution of shares of the Fund. Under a distribution and service plan adopted by the Trust (“12b-1 plan”), PAS is compensated for services in such capacity, including its expenses in connection with the promotion and distribution of shares of the Fund, at an annual rate of 0.25% of the Fund’s average daily net assets. For the year ended December 31, 2020, the Fund paid distribution fees in the amount of $818,591 to PAS.

PAS has directed that certain payments under the 12b-1 plan be used to compensate GIAC for shareholder services provided to contract owners.

4. Federal Income Taxes

a. Distributions to Shareholders For federal income tax purposes, the Fund is treated as a disregarded entity (“DRE”). As a DRE, the Fund is not subject to an entity-level income tax; and any income, gains, losses, deductions, taxes, and credits of the Fund would instead be “passed through” directly to the separate accounts of GIAC that invest in the Fund and retain the same character for U.S. federal income tax purposes. In addition, the Fund is not required to distribute taxable income and capital gains for U.S. federal income tax purposes. Therefore, no dividends and capital gains distributions were paid by the Fund.

5. Investments

a. Investment Purchases and Sales The cost of investments purchased and the proceeds from investments sold (excluding short-term investments)

amounted to $64,978,346 and $165,381,701, respectively, for the year ended December 31, 2020. During the year ended December 31, 2020, there were no purchases or sales of U.S. government securities.

b. Foreign Securities Foreign securities investments involve special risks and considerations not typically associated with U.S. investments. These risks include, but are not limited to, currency risk; adverse political, regulatory, social, and economic developments; and less reliable information about issuers. Moreover, securities of some foreign issuers may be less liquid and their prices more volatile than those of comparable U.S. issuers.

c. Industry or Sector Concentration In its normal course of business, the Fund may invest a significant portion of its assets in companies within a limited number of industries or sectors. As a result, the Fund may be subject to a greater risk of loss than that of a fund invested in a wider spectrum of industries or sectors because the stocks of many or all of the companies in the industry, group of industries, sector, or sectors may decline in value due to developments adversely affecting the industry, group of industries, sector, or sectors.

d. Repurchase Agreements The Fund may invest in repurchase agreements to maintain liquidity and earn income over periods of time as short as overnight. The collateral for repurchase agreements is either cash or fully negotiable U.S. government securities (including U.S. government agency securities). Repurchase agreements are fully collateralized (including the interest accrued thereon) and such collateral is marked to market daily while the agreements remain in force. If the value of the collateral falls below the repurchase price plus accrued interest, the Fund will typically require the seller to deposit additional collateral by the next business day. If the request for additional collateral is not met, or the seller defaults, the Fund maintains the right to sell the collateral (although it may be prevented or delayed from doing so in certain circumstances) and may be required to claim any resulting loss against the seller. Park Avenue monitors the creditworthiness of the seller with which the Fund enters into repurchase agreements.

6. Temporary Borrowings

The Fund, with other funds managed by Park Avenue, is party to a $10 million committed revolving credit facility from State Street Bank and Trust Company for temporary borrowing purposes, including the meeting of redemption requests that otherwise might require

NOTES TO FINANCIAL STATEMENTS — GUARDIAN LARGE CAP FUNDAMENTAL GROWTH VIP FUND

the untimely disposition of securities. Interest is calculated based on the higher of the daily one-month LIBOR rate and the Federal Funds rate plus 1.25% at the time of borrowing. In addition to the interest charged on any borrowings by the Fund, each fund pays a commitment fee of 0.30% per annum on its share of the unused portion of the credit facility. The agreement is in place until January 8, 2021 and has been extended until January 7, 2022. The Fund did not utilize the credit facility during the year ended December 31, 2020.

7. Indemnifications

Under the Trust’s organizational documents and, in some cases, by contract, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund enters into contracts with its vendors and others that provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

8. Additional Information

The outbreak of COVID-19 has materially reduced consumer demand and economic output, disrupting supply chains, resulting in market closures, travel restrictions and quarantines, strained healthcare systems, and adversely impacting local and global economies, including those in which the Funds invest. A Fund’s operations may be interrupted as a result, which may contribute to the negative impact on investment performance. As with other serious economic disruptions, governmental authorities and regulators are responding to this crisis with significant fiscal and monetary policy changes, including by providing direct capital infusions into companies, introducing new monetary programs and considerably lowering interest rates, which, in some cases resulted in negative interest rates. These actions, including their possible unexpected or sudden reversal or potential ineffectiveness, could further increase volatility in securities and other financial markets, reduce market liquidity, heighten investor uncertainty, and lead to sustained economic downturn or a global recession, domestic and foreign political and social instability, damage to diplomatic and international trade relations. As a result, the value of a Fund’s shares may fall, sometimes sharply and for extended periods, causing investors to lose money.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Trustees of Guardian Variable Products Trust and Shareholders of

Guardian Large Cap Fundamental Growth VIP Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Guardian Large Cap Fundamental Growth VIP Fund (one of the funds constituting Guardian Variable Products Trust, referred to hereafter as the “Fund”) as of December 31, 2020, the related statement of operations for the year ended December 31, 2020, the statement of changes in net assets for each of the two years in the period ended December 31, 2020, including the related notes, and the financial highlights for each of the periods indicated therein (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of December 31, 2020, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period ended December 31, 2020 and the financial highlights for each of the periods indicated therein in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of December 31, 2020 by correspondence with the custodian. We believe that our audits provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

New York, New York

February 22, 2021

We have served as the auditor of one or more investment companies in Guardian Variable Products Trust since 2016.

SUPPLEMENTAL INFORMATION (UNAUDITED)

Liquidity Risk Management Program

In compliance with Rule 22e-4 under the Investment Company Act of 1940, as amended (the “Liquidity Rule”), Guardian Variable Products Trust (the “Trust”) has adopted and implemented a written liquidity risk management program (the “Program”) for each series of the Trust (each, a “Fund”), which is reasonably designed to assess and manage each Fund’s liquidity risk. The Fund’s “liquidity risk” is the risk that the Fund could not meet requests to redeem shares issued by the Fund without significant dilution of the remaining investors’ interests in the Fund.

The Board of Trustees of the Trust (the “Board”) approved the designation of Park Avenue Institutional Advisers LLC (the “Administrator” or “PAIA”) as Program administrator. The Administrator established a Liquidity Risk Management Committee, which is comprised of certain officers of the Trust and PAIA, that assists the Administrator in the implementation and day-to-day administration of the Program and in carrying out the Administrator’s liquidity risk management responsibilities.

In accordance with the Program, each Fund’s liquidity risk is assessed no less frequently than monthly taking into consideration a variety of factors, including, as applicable, the Fund’s investment strategy and liquidity of portfolio investments, cash flow projections, and holdings of cash and cash equivalents, as well as borrowing arrangements and other funding sources. Certain factors are considered under both normal and reasonably foreseeable stressed conditions.

Each Fund portfolio investment is classified into one of four liquidity categories (including “highly liquid investments” and “illiquid investments,” discussed below) based on a determination of the number of days it is reasonably expected to take to convert the

investment to cash, or sell or dispose of the investment, in current market conditions without significantly changing the investment’s market value. The Liquidity Rule limits the Fund’s investments in illiquid investments by prohibiting the Fund from acquiring any illiquid investment if, immediately after the acquisition, the Fund would have invested more than 15% of its net assets in illiquid investments that are assets. The Program includes provisions reasonably designed to comply with this investment limitation. In addition, the Program includes provisions reasonably designed to comply with the Liquidity Rule’s requirements relating to highly liquid investment minimums, which is a minimum amount of Fund net assets to be invested in highly liquid investments that are assets, as applicable. The Fund was not required to adopt a highly liquid investment minimum during the year.

At a meeting of the Board held on March 24-25, 2020, the Board received a report (the “Report”) prepared by the Administrator addressing the Program’s operation and assessing the adequacy and effectiveness of its implementation for the period from the Program’s implementation date through December 31, 2019. The Report noted that the Administrator believes the Program operated effectively and continues to be reasonably designed to effectively assess and manage each Fund’s liquidity risk and that the Program has been adequately and effectively implemented since its inception. The Report also notes that there were no material changes to the Program during reporting year and that there were no recommended changes as a result of the annual assessment.

There can be no assurance that the Program will achieve its objectives under all circumstances. Please refer to the Fund’s prospectus for more information regarding the Fund’s exposure to liquidity risk and other risks to which an investment in the Fund may be subject.

SUPPLEMENTAL INFORMATION (UNAUDITED)

Trustees and Officers Information Table

The following table provides information about the Trustees of the Trust.

| | | | | | | | |

| | | | | |

Name and

Year of Birth | | Term of Office,

Position(s) Held

and Length of

Service1 | | Principal

Occupation(s)

During Past Five Years | | Number of

Funds

in Fund

Complex

Overseen

by Trustees2 | | Other Directorships

Held by Trustee |

| Independent Trustees | | | | | | |

| | | | | |

Bruce W. Ferris3 (born 1955) | | Trustee | | Retired (since 2015); President and CEO, Prudential Annuities Distributors, Inc. (2013– 2015); Director/Trustee, Advanced Series Trust, The Prudential Series Fund and Prudential’s Gibraltar Fund, Inc. (2013–2015); Senior Vice President, Prudential Annuities (2008–2015). | | 24 | | None. |

| | | | | |

Theda R. Haber3 (born 1954) | | Trustee | | Adjunct Assistant Professor of Law, UC Hastings College of Law (since 2013); Member of the Board of Directors, Fairholme Trust Company, LLC (2015–2019); Attorney, Law Office of Theda R. Haber (since 2014); Visiting Professor of Law, UC Davis School of Law (since 2014); Consultant, Haber & Associates LLC (financial services industry) (2012–2017); Advisory Council Chair, Vice Chair, and Member, Advisory Council on Employee Welfare and Pension Benefit Plans (ERISA Advisory Council), U.S. Department of Labor (2009–2011); Managing Director and General Counsel, BlackRock Institutional Trust Company, N.A. (2009–2011); Deputy Global General Counsel, Barclays Global Investors (2006–2009); Managing Director, Barclays Global Investors (1998–2006). | | 24 | | None. |

| | | | | |

Marshall Lux3 (born 1960) | | Trustee | | Senior Advisor, The Boston Consulting Group (since 2014); Board Member, Mphasis (public global IT company) (since 2018); Senior Partner and Managing Director, The Boston Consulting Group (2009–2014). | | 24 | | None. |

| | | | | |

Lisa K. Polsky3 (born 1956) | | Trustee | | Board Member, MFA Financial, Inc. (real estate investment trust) (since 2020); Advisor, SMBC Americas (financial services) (since 2020); Senior Risk Advisor, AQR Capital (investment management) (2016–2019); Senior Risk Advisor, Ultra Capital (venture capital) (2016–2019); Board Member, DB USA Corporation (Deutsche Bank Intermediate Holding Company) (financial services) (since 2016); Chief Risk Officer, CIT Group Inc. (financial services) (2010–2015); Board Member and Chair of Audit Committee, Piper Jaffray (investment bank) (2007–2016). | | 24 | | None. |

| | | | | |

John Walters3 (born 1962) | | Lead Independent Trustee | | Board Member, Amerilife Holdings LLC (insurance distribution) (2015–2020); Member, Board of Governors, University of North Carolina, Chapel Hill (2013–2019); Board Member, Stadion Money Management LLC (investment adviser) (2011–2019); President and Chief Operating Officer, Hartford Life Insurance Company (2000–2010). | | 24 | | Trustee, USAA Mutual Funds Trust, (registered investment company offering 47 individual funds) (since 2019). |

SUPPLEMENTAL INFORMATION (UNAUDITED)

| | | | | | | | |

| | | | | |

Name and

Year of Birth | | Term of Office,

Position(s) Held

and Length of

Service1 | | Principal

Occupation(s)

During Past Five Years | | Number of

Funds

in Fund

Complex

Overseen

by Trustees2 | | Other Directorships

Held by Trustee |

| Interested Trustees | | | | | | | | |

| | | | | |

Dominique Baede4 (born 1970) | | Trustee (Since January 2020) | | Vice President, Head of Product, Life Annuity and Inforce, The Guardian Life Insurance Company of America (since 2019); Managing Director, Product Management Group, AXA Equitable (insurance company) prior thereto. | | 24 | | None. |

| | | | | |

Michael Ferik4 (born 1972) | | Chairman and Trustee (Since December 2019) | | Executive Vice President, Individual Markets, The Guardian Life Insurance Company of America (since 2020); Executive Vice President and Chief Financial Officer, The Guardian Life Insurance Company of America (2017–2019); Executive Vice President, Individual Markets, The Guardian Life Insurance Company of America prior thereto. | | 24 | | None. |

| 1 | Except as otherwise noted, each Trustee began service in such capacity in 2016 and serves until his or her successor is elected and qualified or until his or her resignation, death or removal. The business address of each Trustee is 10 Hudson Yards, New York, New York 10001. |

| 2 | The Trust currently consists of 24 separate Funds. |

| 3 | Member of the Audit Committee of the Board. |

| 4 | Each of Dominique Baede and Michael Ferik is considered to be an “interested person” of the Trust within the meaning of the 1940 Act because of their affiliation with The Guardian Life Insurance Company of America and/or its affiliates. |

| | | | |

| | | |

Name and

Year of Birth | | Position(s) Held and

Length of Service5 | | Principal Occupation(s)

During Past Five Years |

| Officers | | | | |

| | | |

Dominique Baede (born 1970) | | President and Principal Executive Officer (Since January 2020) | | Vice President, Head of Product, Life Annuity and Inforce, The Guardian Life Insurance Company of America (since 2019); Managing Director, Product Management Group, AXA Equitable (insurance company) prior thereto. |

| | | |

John H. Walter (born 1962) | | Senior Vice President, Treasurer, and Principal Financial and Accounting Officer | | Vice President, Director of Finance, Corporate Finance, The Guardian Life Insurance Company of America. |

| | | |

Harris Oliner (born 1971) | | Senior Vice President and Secretary | | Senior Vice President, Corporate Secretary, The Guardian Life Insurance Company of America (since 2015); Senior Vice President, Deputy General Counsel, Corporate Secretary, Voya Financial, Inc. prior thereto. |

| | | |

Richard T. Potter (born 1954) | | Senior Vice President and Chief Legal Officer | | Vice President and Equity Counsel, The Guardian Life Insurance Company of America. |

| | | |

Philip Stack (born 1964) | | Chief Compliance Officer (Since September 2017) | | Second Vice President, Mutual Fund Chief Compliance Officer, The Guardian Life Insurance Company of America (since 2017); Executive Director, Chief Compliance Officer, Morgan Stanley (2015–2017); Vice President, Morgan Stanley prior thereto. |

| | | |

Brian Hagan (born 1984) | | Anti-Money Laundering Officer (Since March 2019) | | Assistant Vice President (since 2019), Anti-Money Laundering Compliance, The Guardian Life Insurance Company of America/Park Avenue Securities LLC; Vice President, Head of Financial Intelligence Unit, Brown Brothers Harriman & Co. (2014–2019); Assistant Vice President, AML Compliance Manager, JPMorgan Chase & Co. (2011–2014). |

| | | |

Kathleen M. Moynihan (born 1966) | | Senior Counsel | | Second Vice President, Counsel (since 2019), The Guardian Life Insurance Company of America; Senior Counsel prior thereto. |

SUPPLEMENTAL INFORMATION (UNAUDITED)

| | | | |

| | | |

Name and

Year of Birth | | Position(s) Held and

Length of Service5 | | Principal Occupation(s)

During Past Five Years |

| Officers | | | | |

| | | |

Maria Nydia Morrison (born 1958) | | Fund Controller | | Mutual Fund Controller, The Guardian Life Insurance Company of America (since 2015); Chief Financial Officer/Assistant Operating Officer, St. Francis De Assisi Montessori School (Plaridel, Bulacan), Inc. (Philippines) prior thereto. |

| | | |

Sonya L. Crosswell (born 1977) | | Assistant Secretary | | Second Vice President, Associate Corporate Secretary, The Guardian Life Insurance Company of America (since 2020); Assistant Vice President, Assistant Corporate Secretary and Secretary Pro Tem, The Guardian Life Insurance Company of America prior thereto. |

| 5 | Unless otherwise indicated, the Officers each began service in such capacity in 2016 and hold office for an indefinite term or until their successors shall have been elected and qualified. The business address of each Officer is 10 Hudson Yards, New York, New York 10001. |

SUPPLEMENTAL INFORMATION (UNAUDITED)

The Statement of Additional Information (“SAI”) includes additional information about the Trust’s Trustees and Officers and is available, without charge, upon request by calling toll-free 1-888-GUARDIAN (1-888-482-7342) or by visiting our website at http://guardianvpt.onlineprospectus.net/GuardianVPT/Prospectuses.

Portfolio Holdings and Proxy Voting Procedures

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the Securities and Exchange Commission’s website at https://www.sec.gov. The Fund’s Form N-PORT information is also available, without charge, upon request, by calling toll-free 1-888-GUARDIAN (1-888-482-7342) or by visiting our website at http://guardianvpt.onlineprospectus.net/

GuardianVPT/Prospectuses.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is included in the SAI. The SAI and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 may be obtained (i) without charge, upon request, by calling toll-free 1-888-GUARDIAN (1-888-482-7342) or by visiting our website at http://guardianvpt.onlineprospectus.net/

GuardianVPT/Prospectuses; and (ii) on the Securities and Exchange Commission’s website at https://www.sec.gov.

This report is transmitted to shareholders only. It is not authorized for use as an offer of sale or a solicitation of an offer to buy shares of the Fund unless accompanied or preceded by the Fund’s current prospectus. Past performance results shown in this report should not be considered a representation of future performance. Investment returns and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Statements and other information herein are as dated and are subject to change.

The Guardian Life Insurance Company of America New York, NY 10001-2159

PUB8175

Guardian Variable

Products Trust

2020

Annual Report

All Data as of December 31, 2020

Guardian Core Plus Fixed Income VIP Fund

| | |

| Not FDIC insured. May lose value. No bank guarantee. | | www.guardianlife.com |

TABLE OF CONTENTS

Guardian Core Plus Fixed Income VIP Fund

Except as otherwise specifically stated, all information, including portfolio security positions, is as of December 31, 2020. The views expressed in the Fund Commentary are those of the Fund’s sub-adviser as of the date of this report and are subject to change without notice. They do not necessarily represent the views of Park Avenue Institutional Advisers LLC. The Fund Commentary may contain some forward-looking statements providing expectations or forecasts of future events as of the date of this report; they do not necessarily relate to historical or current facts. There can be no guarantee that any forward-looking statement will be realized. We undertake no obligation to update forward-looking statements, whether as a result of new information, future events, or otherwise. Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. Fund holdings will vary. Information contained herein has been obtained from sources believed reliable, but is not guaranteed.

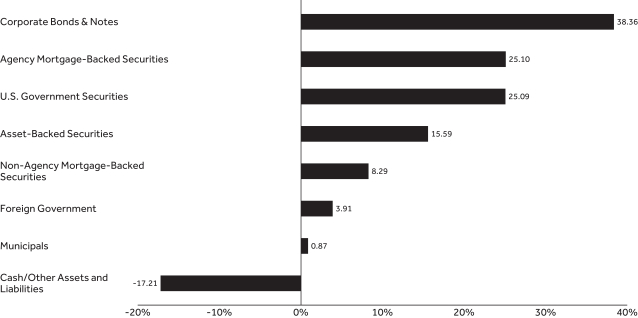

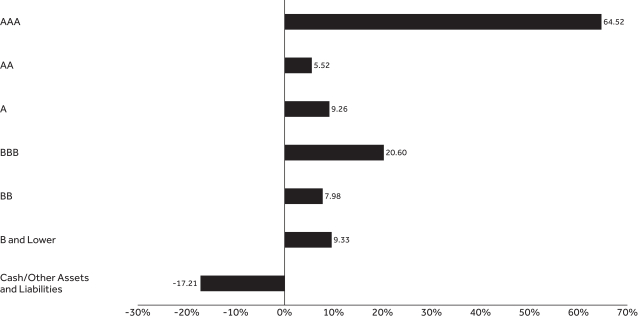

GUARDIAN CORE PLUS FIXED INCOME VIP FUND

FUND COMMENTARY OF

LORD, ABBETT & CO. LLC, SUB-ADVISER (UNAUDITED)

Highlights

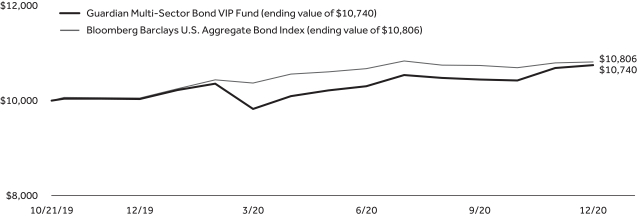

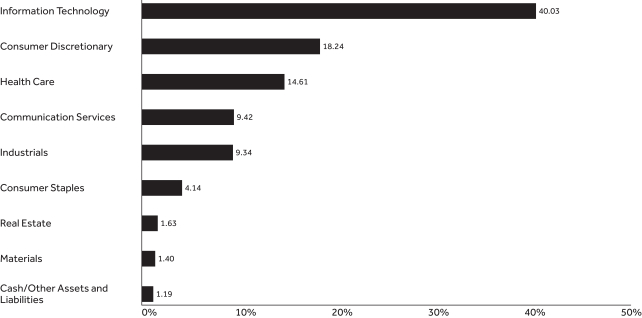

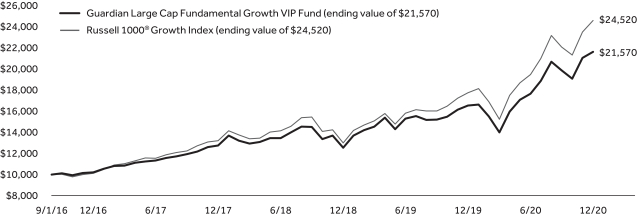

| • | | Guardian Core Plus Fixed Income VIP Fund (the “Fund”) returned 7.42%, underperforming its benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index1 (the “Index”), for the 12 months ended December 31, 2020. |

| • | | The Index returned 7.51% for the same period. |

Market Overview

The trailing twelve-month period was characterized by several market-moving events. After trade tensions continued to ebb and flow in the final months of 2019, U.S. President Donald Trump signed a “phase one” trade deal with China on the 15th of January 2020 and markets priced in a likelihood of two more interest rate cuts in 2020. The tide turned abruptly in February and March 2020, as the outbreak of the COVID-19 pandemic and the expected economic damage resulting from a sudden slowdown in corporate spending, individual spending, consumer confidence, and thus recessionary and deflationary pressures, triggered a severe sell-off. As the COVID-19 pandemic fueled fears of slowing global growth, oil prices fell precipitously, with the primary U.S. oil contract closing in negative territory for the first time in history, although it has since rebounded. During the month of March, the S&P 500® Index2 experienced its fastest bear market since 1987 and the longest U.S. economic expansion in history ended at 128 months.

The U.S. Federal Reserve (the “Fed”) responded to the COVID-19 outbreak with a breadth of policy measures which lifted investors’ confidence in the markets. The Fed launched a $700 billion quantitative easing program, decreased the reserve requirements to zero for thousands of banks, and cut the federal funds rate to the current target range of 0-0.25%. Next, the Fed announced additional stimulus programs, including open-ended asset purchases, purchases of corporate debt, and a commitment to a new small business lending program. Additionally, the central bank announced $2.3 trillion of additional credit support by expanding the Primary Market Corporate Credit Facility (PMCCF), the Secondary Market Corporate Credit Facility (SMCCF),

and the Term Asset-Backed Securities Loan Facility (TALF). Most notably, the expanded measures included the purchase of select fallen angels (fixed income securities that were once rated investment grade but have had a credit rating downgrade to junk bond status).