UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23149

Thrivent Core Funds

(Exact name of registrant as specified in charter)

625 Fourth Avenue South

Minneapolis, Minnesota 55415

(Address of principal executive offices) (Zip code)

Michael W. Kremenak, Secretary and Chief Legal Officer

625 Fourth Avenue South

Minneapolis, Minnesota 55415

(Name and address of agent for service)

Registrant’s telephone number, including area code: (612) 844-4198

Date of fiscal year end: October 31

Date of reporting period: April 30, 2018

| Item 1. | Report to Stockholders |

SEMIANNUAL REPORT

APRIL 30, 2018

THRIVENT CORE FUNDS

TABLEOF CONTENTS

THRIVENT CORE EMERGING MARKETS DEBT FUND

Kent L. White, CFA, and Cortney L. Swensen, CFA , Portfolio Co-Managers

The Fund seeks to maximize total return while providing high current income and capital appreciation. The Fund’s investment objective may be changed without shareholder approval.

Under normal circumstances, the Fund invests at least 80% of its net assets (plus the amount of any borrowing for investments purposes) in sovereign and corporate debt securities of issuers in emerging market countries. An “emerging market” country is any country determined by Thrivent Asset Management, LLC to have an emerging market economy, considering factors such as the country’s credit rating, its political and economic stability and the development of its financial and capital markets. These emerging market countries include every nation in the world except the U.S., Canada, Israel, Japan, Australia, New Zealand, Hong Kong, Singapore and all nations typically considered part of Western Europe. At times, the Fund may have a significant amount of its assets invested in a particular country or geographic region. The Fund primarily invests in the emerging market sovereign debt of countries covered by the Bloomberg Barclays EM USD Aggregate Index (the Fund’s benchmark index), but will also invest in the sovereign debt, quasi-sovereign debt and corporate bonds of emerging market countries outside of the benchmark where the Adviser finds attractive opportunities. The Fund may invest in investment-grade and high yield (i.e., “junk bond”) securities, which may include the lowest-rated bonds, including those in default. The Fund may invest in derivatives or other investments whose return is based on the return of an emerging market security, including exchange-traded funds (“ETFs”).

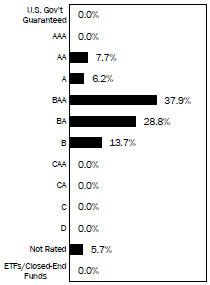

Bond Quality Ratings Distributions

| | | | |

Major Market Sectors (% of Net Assets) | |

Foreign Government | | | 95.5 | % |

Energy | | | 2.1 | % |

| | | | |

| Top 10 Countries | |

| (% of Net Assets) | |

Indonesia | | | 10.2 | % |

Turkey | | | 8.9 | % |

Argentina | | | 8.9 | % |

Mexico | | | 7.7 | % |

Russia | | | 6.9 | % |

Saudi Arabia | | | 5.2 | % |

Colombia | | | 4.5 | % |

South Africa | | | 4.3 | % |

Brazil | | | 4.2 | % |

Qatar | | | 4.2 | % |

| Investments in securities in these countries represent 65.0% of the total net assets of the Fund. | |

| | |

Bond quality ratings are obtained from Moody’s Investors Service, Inc. (“Moody’s”) and Standard & Poor’s Ratings Services (“S&P”). Ratings from S&P, when used, are converted into their equivalent Moody’s ratings. If Moody’s and S&P have assigned different ratings to a security, the lowest rating for the security is used. Not rated may include cash. Investments in derivatives and short-term investments are not reflected in the table.

Quoted Bond Quality Ratings Distributions, Major Market Sectors and Top 10 Countries are subject to change.

The lists of Major Market Sectors and Top 10 Countries exclude short-term investments and collateral held for securities loaned. Bond Quality Ratings Distributions exclude collateral held for securities loaned.

2

THRIVENT CORE INTERNATIONAL EQUITY FUND

Noah J. Monsen, CFA and Brian W. Bomgren, CQF, Portfolio Co-Managers

The Fund seeks long-term capital appreciation. The Fund’s investment objective may be changed without shareholder approval.

Under normal circumstances, the Fund invests at least 80% of its net assets (plus the amount of any borrowing for investments purposes) in equity securities. At least 65% of the Fund’s net assets will be invested in equity securities of issuers in international developed market countries. Developed market countries are countries covered by the MSCI EAFE + Canada Index, an international developed markets equity index (the Fund’s benchmark index). The Fund will primarily invest in the common stocks of mid- and large-capitalization companies represented in its benchmark, but may also invest in small capitalization companies. The Fund may invest in securities denominated in various currencies. The Fund may invest in derivatives or other investments whose return is based on the return of developed market equity securities, such as equity index futures.

| | | | |

Portfolio Composition (% of Portfolio) | |

Common Stock | | | 99.5% | |

Short-Term Investments | | | 0.3% | |

Preferred Stock | | | 0.2% | |

| | | | | |

Total | | | 100.0% | |

| | | | |

| Major Market Sectors | |

| (% of Net Assets) | |

Industrials | | | 17.7 | % |

Materials | | | 15.3 | % |

Financials | | | 14.8 | % |

Consumer Discretionary | | | 14.3 | % |

Consumer Staples | | | 8.5 | % |

Health Care | | | 6.8 | % |

Energy | | | 6.2 | % |

Information Technology | | | 5.9 | % |

Telecommunications Services | | | 5.6 | % |

Utilities | | | 2.5 | % |

| | | | |

| Top 10 Countries | |

| (% of Net Assets) | |

Japan | | | 25.7 | % |

United Kingdom | | | 17.8 | % |

France | | | 7.3 | % |

Germany | | | 6.9 | % |

Switzerland | | | 6.1 | % |

Canada | | | 5.5 | % |

Australia | | | 5.6 | % |

Netherlands | | | 5.5 | % |

Sweden | | | 5.0 | % |

Denmark | | | 3.6 | % |

Investments in securities in these countries represent 89.0% of the total net assets of the Fund. | |

Quoted Portfolio Composition, Major Market Sectors and Top 10 Countries are subject to change.

The lists of Major Market Sectors and Top 10 Countries exclude short-term investments and collateral held for securities loaned. The Portfolio Composition chart excludes collateral held for securities loaned.

3

THRIVENT CORE LOW VOLATILITY EQUITY FUND

Noah J. Monsen, CFA and Brian W. Bomgren, CQF, Portfolio Co-Managers

The Fund seeks to provide long-term capital appreciation with lower volatility relative to the domestic equity market. The Fund’s investment objective may be changed without shareholder approval.

Under normal circumstances, the Fund invests at least 80% of its net assets (plus the amount of any borrowing for investments purposes) in equity securities. The Adviser focuses mainly on the common stocks of domestic companies of any market capitalization, including small- and mid-cap sized companies. In seeking to achieve the Fund’s investment objective, the Adviser employs investment management techniques to identify securities that exhibit low volatility returns. Volatility refers to the variation in security and market prices over time. Over a full market cycle, the Fund seeks to produce returns similar to the MSCI USA Minimum Volatility (USD) Index (the Fund’s benchmark index).

| | | | |

| Portfolio Composition | |

| (% of Portfolio) | |

Common Stock | | | 99.9% | |

Short-Term Investments | | | 0.1% | |

| | | | | |

Total | | | 100.0% | |

| | | | |

| Major Market Sectors | |

| (% of Net Assets) | |

Information Technology | | | 21.0 | % |

Financials | | | 15.7 | % |

Health Care | | | 14.9 | % |

Industrials | | | 13.6 | % |

Consumer Staples | | | 12.6 | % |

Consumer Discretionary | | | 7.9 | % |

Utilities | | | 6.8 | % |

Real Estate | | | 2.1 | % |

Telecommunications Services | | | 2.1 | % |

Materials | | | 1.8 | % |

| | | | |

| Top 10 Holdings | |

| (% of Net Assets) | |

Intuit, Inc. | | | 2.2 | % |

Public Service Enterprise Group, Inc. | | | 2.2 | % |

NextEra Energy, Inc. | | | 2.1 | % |

McDonald’s Corporation | | | 2.1 | % |

Allstate Corporation | | | 2.1 | % |

Eli Lilly and Company | | | 2.1 | % |

UnitedHealth Group, Inc. | | | 2.1 | % |

Home Depot, Inc. | | | 2.1 | % |

Verizon Communications, Inc. | | | 2.1 | % |

Aflac, Inc. | | | 2.1 | % |

These securities represent 21.2% of the total net assets of the Fund. | |

Quoted Portfolio Composition, Major Market Sectors and Top 10 Holdings are subject to change.

The lists of Major Market Sectors and Top 10 Holdings exclude short-term investments and collateral held for securities loaned. The Portfolio Composition chart excludes collateral held for securities loaned.

4

THRIVENT CORE SHORT-TERM RESERVE FUND

William D. Stouten, Portfolio Manager

The Fund seeks a high level of current income consistent with liquidity and the preservation of capital.

The Fund invests primarily in investment-grade, fixed-income securities. Although the value of the Fund’s shares will fluctuate, Thrivent Asset Management seeks to manage the magnitude of fluctuation by limiting the Fund’s weighted-average-maturity to 90 days or less. Weighted-average-maturity measures the price sensitivity of a fixed-income security to changes in interest rates. Allowable investments consist primarily of U.S. dollar-denominated debt securities that may include, but are not limited to, obligations of U.S., state, and local governments, their agencies and instrumentalities; mortgage- and asset-backed securities; corporate debt securities; time deposits, repurchase agreements; and other securities that have debt-like characteristics. The Fund may also invest in other investment companies that have exposure to fixed income securities.

| | | | |

| Portfolio Composition | |

| (% of Portfolio) | |

Short-Term Investments | | | 100.0% | |

| | | | | |

Total | | | 100.0% | |

| | | | |

| Major Market Sectors | |

| (% of Net Assets) | |

Financials | | | 41.3 | % |

Consumer Non-Cyclical | | | 13.3 | % |

Foreign | | | 8.9 | % |

Asset-Backed Securities | | | 7.9 | % |

Utilities | | | 5.4 | % |

Energy | | | 5.1 | % |

Consumer Cyclical | | | 4.8 | % |

Communications Services | | | 4.6 | % |

Capital Goods | | | 3.4 | % |

Technology | | | 1.7 | % |

| | | | |

| Top 10 Holdings | |

| (% of Net Assets) | |

Macquarie Bank, Ltd. | | | 1.0 | % |

PepsiCo, Inc. | | | 0.9 | % |

Pfizer, Inc. | | | 0.9 | % |

National Australia Bank, Ltd. | | | 0.8 | % |

American Honda Finance Corporation | | | 0.7 | % |

Erste Abwicklungsanstalt | | | 0.7 | % |

Kells Funding, LLC | | | 0.7 | % |

KFW | | | 0.7 | % |

Ford Credit Auto Lease Trust | | | 0.6 | % |

Cisco Systems, Inc. | | | 0.6 | % |

| |

These securities represent 7.6% of the total net assets of the Fund. | |

Quoted Portfolio Composition, Major Market Sectors and Top 10 Holdings are subject to change.

5

SHAREHOLDER EXPENSE EXAMPLE

(unaudited)

As a shareholder of the Fund, you incur ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Trust and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from November 1, 2017 through April 30, 2018.

Actual Expenses

In the table below, the first line provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid during Period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes

In the table below, the second line provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical example that appears in the shareholder reports of the other funds.

| | | | | | | | | | | | | | | | |

| | | Beginning Account Value

11/1/2017 | | | Ending Account Value

4/30/2018 | | | Expenses Paid During

Period

11/1/2017 -

4/30/2018* | | | Annualized

Expense Ratio | |

Thrivent Core Emerging Markets Debt Fund | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 972 | | | $ | 0.29 | | | | 0.06 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,024 | | | $ | 0.30 | | | | 0.06 | % |

Thrivent Core International Equity Fund | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 1,026 | | | $ | 0.47 | | | | 0.10 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,024 | | | $ | 0.50 | | | | 0.10 | % |

Thrivent Core Low Volatility Equity Fund | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 990 | | | $ | 0.20 | | | | 0.12 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,024 | | | $ | 0.60 | | | | 0.12 | % |

Thrivent Core Short-Term Reserve Fund | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 1,008 | | | $ | 0.05 | | | | 0.01 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,025 | | | $ | 0.05 | | | | 0.01 | % |

| * | Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period. Core International Equity Fund and Core Low Volatility Equity Fund expenses are equal to the fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 168/365 and 62/365, respectively, to reflect the inception date short period. |

| ** | Assuming 5% annualized total return before expenses. |

6

EMERGING MARKETS DEBT FUND

Schedule of Investments as of April 30, 2018

(unaudited)

| | | | | | |

Principal Amount | | Long-Term Fixed Income (97.6%) | | Value | |

Argentina (8.9%) | | | | |

| | Argentina Government International Bond | | | | |

$3,250,000 | | 7.125%, 6/28/2117a | | $ | 2,887,625 | |

6,375,000 | | 6.875%, 4/22/2021 | | | 6,690,562 | |

3,865,000 | | 5.625%, 1/26/2022 | | | 3,897,852 | |

2,000,000 | | 4.625%, 1/11/2023 | | | 1,909,000 | |

11,702,000 | | 7.500%, 4/22/2026 | | | 12,263,696 | |

5,000,000 | | 6.875%, 1/26/2027 | | | 4,975,000 | |

4,000,000 | | 5.875%, 1/11/2028 | | | 3,664,000 | |

7,973,407 | | 8.280%, 12/31/2033 | | | 8,551,479 | |

2,103,057 | | 8.280%, 12/31/2033 | | | 2,202,952 | |

7,963,066 | | 2.500%, 12/31/2038b | | | 5,195,901 | |

3,671,000 | | 7.625%, 4/22/2046 | | | 3,542,515 | |

1,500,000 | | 6.875%, 1/11/2048 | | | 1,332,750 | |

| | | | | | |

| | Total | | | 57,113,332 | |

| | | | | | |

| |

Bahrain (3.0%) | | | | |

| | Bahrain Government International Bond | | | | |

2,000,000 | | 5.875%, 1/26/2021a | | | 2,009,376 | |

2,500,000 | | 6.125%, 7/5/2022a | | | 2,510,250 | |

4,000,000 | | 6.125%, 8/1/2023a | | | 3,990,000 | |

2,000,000 | | 6.875%, 10/5/2025a | | | 1,992,500 | |

3,500,000 | | 7.000%, 1/26/2026a | | | 3,468,955 | |

1,000,000 | | 7.000%, 10/12/2028a | | | 953,464 | |

2,500,000 | | 6.750%, 9/20/2029a | | | 2,304,000 | |

3,000,000 | | 7.500%, 9/20/2047a | | | 2,709,984 | |

| | | | | | |

| | Total | | | 19,938,529 | |

| | | | | | |

| |

Brazil (4.2%) | | | | |

| | Brazil Government International Bond | | | | |

4,800,000 | | 2.625%, 1/5/2023 | | | 4,516,800 | |

6,911,000 | | 6.000%, 4/7/2026 | | | 7,470,791 | |

2,000,000 | | 8.250%, 1/20/2034 | | | 2,473,020 | |

5,005,000 | | 7.125%, 1/20/2037 | | | 5,705,700 | |

5,500,000 | | 5.000%, 1/27/2045 | | | 4,757,500 | |

2,000,000 | | 5.625%, 2/21/2047 | | | 1,882,000 | |

| | | | | | |

| | Total | | | 26,805,811 | |

| | | | | | |

| |

Cayman Islands (1.9%) | | | | |

| | Dubai DOF Sukuk, Ltd. | | | | |

2,000,000 | | 3.875%, 1/30/2023 | | | 1,988,148 | |

| | KSA Sukuk, Ltd. | | | | |

4,000,000 | | 2.894%, 4/20/2022a | | | 3,854,320 | |

2,500,000 | | 3.628%, 4/20/2027a | | | 2,366,015 | |

| | RAK Capital | | | | |

2,000,000 | | 3.094%, 3/31/2025 | | | 1,883,760 | |

| | Sharjah Sukuk, Ltd. | | | | |

2,000,000 | | 3.839%, 1/27/2021 | | | 2,010,000 | |

| | | | | | |

| | Total | | | 12,102,243 | |

| | | | | | |

| |

Colombia (4.5%) | | | | |

| | Colombia Government International Bond | | | | |

3,870,000 | | 4.375%, 7/12/2021 | | | 3,966,750 | |

5,000,000 | | 2.625%, 3/15/2023 | | | 4,730,000 | |

910,000 | | 4.000%, 2/26/2024 | | | 907,725 | |

3,875,000 | | 3.875%, 4/25/2027 | | | 3,739,375 | |

4,000,000 | | 7.375%, 9/18/2037 | | | 5,070,000 | |

2,000,000 | | 6.125%, 1/18/2041 | | | 2,260,000 | |

7,705,000 | | 5.625%, 2/26/2044 | | | 8,259,760 | |

| | | | | | |

| | Total | | | 28,933,610 | |

| | | | | | |

| | | | | | |

Principal Amount | | Long-Term Fixed Income (97.6%) | | Value | |

Croatia (2.7%) | | | | |

| | Croatia Government International Bond | | | | |

| $2,650,000 | | 6.750%, 11/5/2019a | | $ | 2,782,500 | |

| 4,000,000 | | 6.625%, 7/14/2020a | | | 4,264,000 | |

| 4,500,000 | | 6.375%, 3/24/2021a | | | 4,828,500 | |

| 2,000,000 | | 5.500%, 4/4/2023a | | | 2,121,020 | |

| 3,021,000 | | 6.000%, 1/26/2024a | | | 3,292,213 | |

| | | | | | |

| | Total | | | 17,288,233 | |

| | | | | | |

| |

Dominican Republic (3.0%) | | | | |

| | Dominican Republic Government International Bond | | | | |

| 2,000,000 | | 7.500%, 5/6/2021a | | | 2,113,000 | |

| 1,500,000 | | 6.600%, 1/28/2024a | | | 1,597,500 | |

| 3,500,000 | | 5.500%, 1/27/2025a | | | 3,512,250 | |

| 3,000,000 | | 6.875%, 1/29/2026a | | | 3,250,500 | |

| 2,000,000 | | 5.950%, 1/25/2027a | | | 2,045,000 | |

| 4,000,000 | | 7.450%, 4/30/2044a | | | 4,380,000 | |

| 2,000,000 | | 6.850%, 1/27/2045a | | | 2,065,000 | |

| 1,000,000 | | 6.500%, 2/15/2048a | | | 993,500 | |

| | | | | | |

| | Total | | | 19,956,750 | |

| | | | | | |

| |

Hungary (2.5%) | | | | |

| | Hungary Government International Bond | | | | |

| 3,000,000 | | 6.250%, 1/29/2020 | | | 3,150,000 | |

| 2,500,000 | | 6.375%, 3/29/2021 | | | 2,693,750 | |

| 5,950,000 | | 5.750%, 11/22/2023 | | | 6,491,450 | |

| 2,000,000 | | 5.375%, 3/25/2024 | | | 2,150,000 | |

| 1,500,000 | | 7.625%, 3/29/2041 | | | 2,111,070 | |

| | | | | | |

| | Total | | | 16,596,270 | |

| | | | | | |

| |

Indonesia (10.2%) | | | | |

| | Indonesia Government International Bond | | | | |

| 5,750,000 | | 4.875%, 5/5/2021a | | | 5,956,327 | |

| 4,650,000 | | 3.750%, 4/25/2022a | | | 4,634,376 | |

| 2,500,000 | | 3.375%, 4/15/2023a | | | 2,428,210 | |

| 6,197,000 | | 5.875%, 1/15/2024a | | | 6,732,185 | |

| 575,000 | | 4.125%, 1/15/2025a | | | 573,756 | |

| 6,100,000 | | 4.750%, 1/8/2026a | | | 6,290,546 | |

| 3,000,000 | | 4.100%, 4/24/2028 | | | 2,943,558 | |

| 5,000,000 | | 8.500%, 10/12/2035a | | | 7,003,810 | |

| 2,000,000 | | 6.625%, 2/17/2037a | | | 2,383,932 | |

| 2,000,000 | | 7.750%, 1/17/2038a | | | 2,662,974 | |

| 3,226,000 | | 6.750%, 1/15/2044a | | | 4,001,405 | |

| 1,700,000 | | 5.125%, 1/15/2045a | | | 1,721,937 | |

| 4,000,000 | | 5.950%, 1/8/2046a | | | 4,533,728 | |

| 1,200,000 | | 5.250%, 1/8/2047a | | | 1,239,271 | |

| 1,500,000 | | 4.350%, 1/11/2048 | | | 1,394,521 | |

| | Perusahaan Penerbit SBSN Indonesia III | | | | |

| 3,000,000 | | 3.400%, 3/29/2021a | | | 2,972,400 | |

| 2,500,000 | | 4.350%, 9/10/2024a | | | 2,518,000 | |

| 3,500,000 | | 4.150%, 3/29/2027a | | | 3,408,125 | |

| 2,000,000 | | 4.400%, 3/1/2028a | | | 1,977,600 | |

| | | | | | |

| | Total | | | 65,376,661 | |

| | | | | | |

The accompanying Notes to Financial Statements are an integral part of this schedule.

EMERGING MARKETS DEBT FUND

Schedule of Investments as of April 30, 2018

(unaudited)

| | | | | | |

Principal Amount | | Long-Term Fixed Income (97.6%) | | Value | |

Kuwait (1.2%) | | | | |

| | Kuwait Government International Bond | | | | |

$3,500,000 | | 2.750%, 3/20/2022a | | $ | 3,390,625 | |

5,000,000 | | 3.500%, 3/20/2027a | | | 4,809,790 | |

| | | | | | |

| | Total | | | 8,200,415 | |

| | | | | | |

Mexico (7.7%) | | | | |

| | Mexico Government International Bond | | | | |

5,590,000 | | 5.750%, 10/12/2110 | | | 5,506,150 | |

5,220,000 | | 4.000%, 10/2/2023 | | | 5,272,200 | |

1,215,000 | | 3.600%, 1/30/2025 | | | 1,182,195 | |

3,000,000 | | 4.125%, 1/21/2026 | | | 2,988,000 | |

5,781,000 | | 4.150%, 3/28/2027 | | | 5,691,395 | |

3,085,000 | | 3.750%, 1/11/2028 | | | 2,906,070 | |

1,000,000 | | 6.750%, 9/27/2034 | | | 1,213,740 | |

5,878,000 | | 6.050%, 1/11/2040 | | | 6,459,922 | |

6,000,000 | | 5.550%, 1/21/2045 | | | 6,376,800 | |

5,250,000 | | 4.600%, 1/23/2046 | | | 4,811,625 | |

| | Petroleos Mexicanos | | | | |

2,850,000 | | 6.375%, 2/4/2021 | | | 2,999,625 | |

2,500,000 | | 6.500%, 3/13/2027 | | | 2,582,500 | |

| | | | | | |

| | Total | | | 47,990,222 | |

| | | | | | |

| |

Netherlands (1.2%) | | | | |

| | Petrobras Global Finance BV | | | | |

674,000 | | 8.375%, 5/23/2021 | | | 759,177 | |

3,000,000 | | 5.299%, 1/27/2025a | | | 2,948,250 | |

3,500,000 | | 7.375%, 1/17/2027 | | | 3,753,750 | |

| | | | | | |

| | Total | | | 7,461,177 | |

| | | | | | |

| |

Oman (2.6%) | | | | |

| | Oman Government International Bond | | | | |

3,000,000 | | 3.625%, 6/15/2021a | | | 2,902,500 | |

3,000,000 | | 4.125%, 1/17/2023a | | | 2,853,300 | |

5,000,000 | | 4.750%, 6/15/2026a | | | 4,656,500 | |

2,000,000 | | 5.375%, 3/8/2027a | | | 1,904,648 | |

3,000,000 | | 5.625%, 1/17/2028a | | | 2,864,916 | |

2,000,000 | | 6.750%, 1/17/2048a | | | 1,882,796 | |

| | | | | | |

| | Total | | | 17,064,660 | |

| | | | | | |

| |

Panama (3.0%) | | | | |

| | Panama Government International Bond | | | | |

1,000,000 | | 4.500%, 4/16/2050 | | | 965,700 | |

2,000,000 | | 9.375%, 1/16/2023 | | | 2,515,000 | |

3,000,000 | | 3.750%, 3/16/2025 | | | 2,977,500 | |

1,500,000 | | 8.875%, 9/30/2027 | | | 2,043,750 | |

1,688,000 | | 9.375%, 4/1/2029 | | | 2,401,180 | |

5,079,000 | | 6.700%, 1/26/2036 | | | 6,272,565 | |

1,500,000 | | 4.500%, 5/15/2047 | | | 1,462,500 | |

| | | | | | |

| | Total | | | 18,638,195 | |

| | | | | | |

| |

Peru (1.8%) | | | | |

| | Peru Government International Bond | | | | |

2,650,000 | | 5.625%, 11/18/2050 | | | 3,095,200 | |

1,000,000 | | 7.350%, 7/21/2025 | | | 1,228,000 | |

5,000,000 | | 8.750%, 11/21/2033 | | | 7,362,500 | |

| | | | | | |

| | Total | | | 11,685,700 | |

| | | | | | |

| | | | | | |

Principal Amount | | Long-Term Fixed Income (97.6%) | | Value | |

Philippines (2.7%) | | | | |

| | Philippines Government International Bond | | | | |

$2,000,000 | | 4.000%, 1/15/2021 | | $ | 2,044,500 | |

5,025,000 | | 7.750%, 1/14/2031 | | | 6,755,756 | |

2,625,000 | | 6.375%, 10/23/2034 | | | 3,293,073 | |

1,000,000 | | 5.000%, 1/13/2037 | | | 1,096,909 | |

3,720,000 | | 3.950%, 1/20/2040 | | | 3,619,638 | |

| | | | | | |

| | Total | | | 16,809,876 | |

| | | | | | |

| |

Poland (1.2%) | | | | |

| | Poland Government International Bond | | | | |

4,000,000 | | 5.000%, 3/23/2022 | | | 4,244,160 | |

3,000,000 | | 4.000%, 1/22/2024 | | | 3,072,198 | |

| | | | | | |

| | Total | | | 7,316,358 | |

| | | | | | |

| |

Qatar (4.2%) | | | | |

| | Qatar Government International Bond | | | | |

2,000,000 | | 5.250%, 1/20/2020a | | | 2,061,200 | |

6,000,000 | | 4.500%, 1/20/2022a | | | 6,150,000 | |

5,000,000 | | 3.250%, 6/2/2026a | | | 4,673,000 | |

1,000,000 | | 4.500%, 4/23/2028a | | | 998,104 | |

2,000,000 | | 9.750%, 6/15/2030a | | | 2,932,560 | |

2,000,000 | | 5.750%, 1/20/2042a | | | 2,196,000 | |

1,250,000 | | 4.625%, 6/2/2046a | | | 1,175,000 | |

4,000,000 | | 5.103%, 4/23/2048a | | | 3,964,600 | |

| | SoQ Sukuk A QSC | | | | |

2,500,000 | | 3.241%, 1/18/2023 | | | 2,430,665 | |

| | | | | | |

| | Total | | | 26,581,129 | |

| | | | | | |

| |

Russia (6.9%) | | | | |

| | Russia Government International Bond | | | | |

9,100,000 | | 5.000%, 4/29/2020a | | | 9,304,695 | |

2,000,000 | | 4.500%, 4/4/2022a | | | 2,029,064 | |

600,000 | | 4.875%, 9/16/2023a | | | 621,000 | |

7,600,000 | | 4.750%, 5/27/2026 | | | 7,720,156 | |

4,000,000 | | 4.250%, 6/23/2027a | | | 3,903,768 | |

2,000,000 | | 12.750%, 6/24/2028a | | | 3,232,352 | |

1,000,000 | | 4.375%, 3/21/2029a | | | 968,516 | |

1,335,000 | | 7.500%, 3/31/2030a | | | 1,489,246 | |

6,600,000 | | 5.625%, 4/4/2042a | | | 6,916,800 | |

8,000,000 | | 5.250%, 6/23/2047a | | | 7,751,392 | |

| | | | | | |

| | Total | | | 43,936,989 | |

| | | | | | |

| |

Saudi Arabia (5.2%) | | | | |

| | Saudi Arabia Government International Bond | | | | |

2,500,000 | | 2.375%, 10/26/2021a | | | 2,396,150 | |

3,000,000 | | 2.875%, 3/4/2023a | | | 2,861,754 | |

2,000,000 | | 4.000%, 4/17/2025a | | | 1,971,476 | |

5,000,000 | | 3.250%, 10/26/2026a | | | 4,614,920 | |

6,000,000 | | 3.625%, 3/4/2028a | | | 5,612,580 | |

5,000,000 | | 4.500%, 4/17/2030a | | | 4,932,000 | |

5,250,000 | | 4.500%, 10/26/2046a | | | 4,744,079 | |

4,000,000 | | 4.625%, 10/4/2047a | | | 3,660,000 | |

3,000,000 | | 5.000%, 4/17/2049a | | | 2,876,970 | |

| | | | | | |

| | Total | | | 33,669,929 | |

| | | | | | |

The accompanying Notes to Financial Statements are an integral part of this schedule.

EMERGING MARKETS DEBT FUND

Schedule of Investments as of April 30, 2018

(unaudited)

| | | | | | |

Principal Amount | | Long-Term Fixed Income (97.6%) | | Value | |

South Africa (4.3%) | | | | |

| | South Africa Government International Bond | | | | |

$3,500,000 | | 5.500%, 3/9/2020 | | $ | 3,621,926 | |

4,125,000 | | 5.875%, 5/30/2022 | | | 4,395,749 | |

2,000,000 | | 4.665%, 1/17/2024 | | | 1,990,440 | |

2,500,000 | | 5.875%, 9/16/2025 | | | 2,623,645 | |

4,100,000 | | 4.875%, 4/14/2026 | | | 4,026,872 | |

1,500,000 | | 4.850%, 9/27/2027 | | | 1,452,834 | |

4,000,000 | | 4.300%, 10/12/2028 | | | 3,672,176 | |

500,000 | | 6.250%, 3/8/2041 | | | 521,528 | |

5,200,000 | | 5.650%, 9/27/2047 | | | 4,982,640 | |

| | | | | | |

| | Total | | | 27,287,810 | |

| | | | | | |

| |

Sri Lanka (1.5%) | | | | |

| | Sri Lanka Government International Bond | | | | |

1,500,000 | | 6.250%, 10/4/2020a | | | 1,548,729 | |

1,500,000 | | 5.750%, 1/18/2022a | | | 1,511,117 | |

1,500,000 | | 5.875%, 7/25/2022a | | | 1,512,242 | |

1,000,000 | | 5.750%, 4/18/2023a | | | 993,676 | |

2,000,000 | | 6.850%, 11/3/2025a | | | 2,042,712 | |

1,500,000 | | 6.200%, 5/11/2027a | | | 1,447,233 | |

1,000,000 | | 6.750%, 4/18/2028a | | | 995,110 | |

| | | | | | |

| | Total | | | 10,050,819 | |

| | | | | | |

| |

Turkey (8.9%) | | | | |

| | Turkey Government International Bond | | | | |

1,500,000 | | 7.500%, 11/7/2019 | | | 1,580,895 | |

4,750,000 | | 7.000%, 6/5/2020 | | | 5,016,019 | |

2,500,000 | | 5.625%, 3/30/2021 | | | 2,578,230 | |

4,000,000 | | 5.125%, 3/25/2022 | | | 4,044,200 | |

8,000,000 | | 5.750%, 3/22/2024 | | | 8,110,160 | |

1,250,000 | | 7.375%, 2/5/2025 | | | 1,369,915 | |

3,000,000 | | 4.250%, 4/14/2026 | | | 2,709,996 | |

2,042,000 | | 4.875%, 10/9/2026 | | | 1,907,228 | |

4,300,000 | | 6.000%, 3/25/2027 | | | 4,315,738 | |

1,000,000 | | 6.125%, 10/24/2028 | | | 997,500 | |

2,500,000 | | 8.000%, 2/14/2034 | | | 2,871,265 | |

6,839,000 | | 6.875%, 3/17/2036 | | | 7,023,735 | |

5,935,000 | | 6.750%, 5/30/2040 | | | 5,963,666 | |

6,500,000 | | 6.625%, 2/17/2045 | | | 6,337,500 | |

3,000,000 | | 5.750%, 5/11/2047 | | | 2,619,726 | |

| | | | | | |

| | Total | | | 57,445,773 | |

| | | | | | |

| |

United Arab Emirates (2.4%) | | | | |

| | Abu Dhabi Government International Bond | | | | |

3,000,000 | | 2.500%, 10/11/2022a | | | 2,868,180 | |

3,000,000 | | 3.125%, 5/3/2026a | | | 2,828,328 | |

5,500,000 | | 3.125%, 10/11/2027a | | | 5,093,132 | |

4,000,000 | | 4.125%, 10/11/2047a | | | 3,652,848 | |

| | Dubai Government International Bond | | | | |

1,000,000 | | 7.750%, 10/5/2020 | | | 1,098,580 | |

| | | | | | |

| | Total | | | 15,541,068 | |

| | | | | | |

| | | | | | |

Principal Amount | | Long-Term Fixed Income (97.6%) | | Value | |

Uruguay (1.9%) | | | | |

| | Uruguay Government International Bond | | | | |

$1,071,287 | | 4.975%, 4/20/2055 | | $ | 1,031,114 | |

7,000,000 | | 5.100%, 6/18/2050 | | | 6,877,500 | |

1,000,000 | | 4.500%, 8/14/2024 | | | 1,028,150 | |

2,500,000 | | 4.375%, 10/27/2027 | | | 2,518,750 | |

| | | | | | |

| | Total | | | 11,455,514 | |

| | | | | | |

| | Total Long-Term Fixed Income

(cost $655,008,156) | | | 625,247,073 | |

| | | | | | |

Shares or Principal Amount | | Short-Term Investments (0.8%) | |

| | Thrivent Core Short-Term Reserve Fund | | | | |

531,751 | | 2.120% | | | 5,317,511 | |

| | | | | | |

| | Total Short-Term Investments

(cost $5,317,511) | | | 5,317,511 | |

| | | | | | |

| | Total Investments

(cost $660,325,667) 98.4% | | $ | 630,564,584 | |

| | | | | | |

| | Other Assets and Liabilities, Net 1.6% | | | 10,495,938 | |

| | | | | | |

| | Total Net Assets 100.0% | | $ | 641,060,522 | |

| | | | | | |

| a | Denotes securities sold under Rule 144A of the Securities Act of 1933, which exempts them from registration. These securities may be resold to other dealers in the program or to other qualified institutional buyers. As of April 30, 2018, the value of these investments was $274,073,912 or 42.8% of total net assets. |

| b | Denotes step coupon securities. Step coupon securities pay an initial coupon rate for the first period and then different coupon rates for following periods. The rate shown is as of April 30, 2018. |

Unrealized Appreciation (Depreciation)

Gross unrealized appreciation and depreciation of investments of the portfolio as a whole (including derivatives), based on cost for federal income tax purposes, were as follows:

| | | | |

Gross unrealized appreciation | | $ | 10,873 | |

Gross unrealized depreciation | | | (29,771,956 | ) |

| | | | |

Net unrealized appreciation (depreciation) | | $ | (29,761,083 | ) |

| |

Cost for federal income tax purposes | | $ | 660,325,667 | |

The accompanying Notes to Financial Statements are an integral part of this schedule.

EMERGING MARKETS DEBT FUND

Schedule of Investments as of April 30, 2018

(unaudited)

Fair Valuation Measurements

The following table is a summary of the inputs used, as of April 30, 2018, in valuing Emerging Markets Debt Fund’s assets carried at fair value.

| | | | | | | | | | | | | | | | |

Investments in Securities | | Total | | | Level 1 | | | Level 2 | | | Level 3 | |

Long-Term Fixed Income | | | | | | | | | | | | | | | | |

Energy | | | 13,043,302 | | | | – | | | | 13,043,302 | | | | – | |

Foreign Government | | | 612,203,771 | | | | – | | | | 612,203,771 | | | | – | |

| | | | | | | | | | | | | | | | |

Subtotal Investments in Securities | | $ | 625,247,073 | | | $ | – | | | $ | 625,247,073 | | | $ | – | |

| | | | | | | | | | | | | | | | |

| | | | |

Other Investments * | | Total | | | | | | | | | | |

Short-Term Investments | | | 5,317,511 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Subtotal Other Investments | | $ | 5,317,511 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Total Investments at Value | | $ | 630,564,584 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| * | Certain investments are measured at fair value using a net asset value per share that is not publicly available (practical expedient). According to disclosure requirements of Accounting Standards Codification (ASC) 820, Fair Value Measurement, securities valued using the practical expedient are not classified in the fair value hierarchy. The fair value amounts presented in this table are intended to permit reconciliation of the fair value hierarchy to the amounts presented in the Statement of Assets and Liabilities. |

There were no significant transfers between Levels during the period ended April 30, 2018. Transfers between Levels are identified as of the end of the period.

Investment in Affiliates

Affiliated issuers, as defined under the Investment Company Act of 1940, include those in which the Fund’s holdings of an issuer represent 5% or more of the outstanding voting securities of an issuer, any affiliated mutual fund, or a company which is under common ownership or control with the Fund. The Fund owns shares of Thrivent Cash Management Trust for the purpose of securities lending and Thrivent Core Short-Term Reserve Fund primarily to serve as a cash sweep vehicle for the Fund. Thrivent Cash Management Trust and Thrivent Core Funds are established solely for investment by Thrivent entities.

A summary of transactions (in thousands) for the fiscal year to date, in Emerging Markets Debt Fund, is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | |

Fund | | Value

10/31/2017 | | | Gross

Purchases | | | Gross

Sales | | | Shares Held at

4/30/2018 | | | Value

4/30/2018 | | | % of Net

Assets

4/30/2018 | |

Affiliated Short-Term Investments | | | | | | | | | | | | | | | | | | | | | | | | |

Core Short-Term Reserve, 2.120% | | $ | 3,193 | | | $ | 140,293 | | | $ | 138,168 | | | | 532 | | | $ | 5,318 | | | | 0.8 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Affiliated Short-Term Investments | | | 3,193 | | | | | | | | | | | | | | | | 5,318 | | | | 0.8 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Collateral Held for Securities Loaned | | | | | | | | | | | | | | | | | | | | | | | | |

Cash Management Trust- Collateral Investment | | | – | | | | 2,118 | | | | 2,118 | | | | – | | | | – | | | | – | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Value | | $ | 3,193 | | | | | | | | | | | | | | | $ | 5,318 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Fund | | Net Realized

Gain/(Loss) | | | Change in

Unrealized

Appreciation/

(Depreciation) | | | Distributions of

Realized Capital

Gains | | | Income Earned

11/1/2017

- 4/30/2018 | |

Affiliated Short-Term Investments | | | | | | | | | | | | | | | | |

Core Short-Term Reserve, 2.120% | | $ | – | | | $ | – | | | $ | 0 | | | $ | 50 | |

| | | | | | | | | | | | | | | | |

Total Income from Affiliated Investments | | | | | | | | | | | | | | $ | 50 | |

| | | | | | | | | | | | | | | | |

Collateral Held for Securities Loaned | | | | | | | | | | | | | | | | |

Cash Management Trust- Collateral Investment | | | – | | | | – | | | | – | | | | 1 | |

| | | | | | | | | | | | | | | | |

Total Affiliated Income from Securities Loaned, Net | | | | | | | | | | | | | | $ | 1 | |

| | | | | | | | | | | | | | | | |

Total | | $ | – | | | $ | – | | | $ | 0 | | | | | |

| | | | | | | | | | | | | | | | |

The accompanying Notes to Financial Statements are an integral part of this schedule.

INTERNATIONAL EQUITY FUND

Schedule of Investments as of April 30, 2018

(unaudited)

| | | | | | |

Shares | | Common Stock (99.1%) | | Value | |

Australia (5.6%) | | | | |

35,377 | | ASX, Ltd. | | $ | 1,555,267 | |

321,042 | | Australia & New Zealand Banking Group, Ltd. | | | 6,453,632 | |

725,325 | | BHP Billiton, Ltd. | | | 16,921,236 | |

48,280 | | Carsales.com, Ltd. | | | 518,205 | |

294,632 | | DEXUS Property Group | | | 2,095,284 | |

1,032,321 | | FlexiGroup, Ltd. | | | 1,596,185 | |

473,067 | | GWA Group, Ltd. | | | 1,365,814 | |

37,778 | | Macquarie Group, Ltd. | | | 3,076,565 | |

3,800,328 | | Medibank Private, Ltd. | | | 8,352,176 | |

143,994 | | Monadelphous Group, Ltd. | | | 1,741,568 | |

27,946 | | Rio Tinto, Ltd. | | | 1,663,178 | |

295,507 | | Sandfire Resources NL | | | 1,748,912 | |

| | | | | | |

| | Total | | | 47,088,022 | |

| | | | | | |

| |

Austria (1.2%) | | | | |

150,831 | | OMV AG | | | 9,341,718 | |

16,856 | | Verbund AG | | | 522,016 | |

| | | | | | |

| | Total | | | 9,863,734 | |

| | | | | | |

| |

Belgium (1.0%) | | | | |

63,154 | | Solvay SA | | | 8,782,841 | |

| | | | | | |

| | Total | | | 8,782,841 | |

| | | | | | |

| |

Canada (5.5%) | | | | |

40,632 | | Artis Real Estate Investment Trust | | | 423,741 | |

41,024 | | Canfor Corporationa | | | 942,247 | |

53,447 | | CGI Group, Inc.a | | | 3,097,050 | |

383,581 | | CI Financial Corporation | | | 8,072,245 | |

137,128 | | Empire Company, Ltd. | | | 2,651,885 | |

102,302 | | Genworth MI Canada, Inc.b | | | 3,306,619 | |

26,236 | | Hudbay Minerals, Inc. | | | 183,291 | |

6,526 | | Linamar Corporation | | | 365,704 | |

177,618 | | Lundin Mining Corporation | | | 1,175,866 | |

195,260 | | Magna International, Inc. | | | 11,520,340 | |

116,480 | | Methanex Corporation | | | 7,035,392 | |

118,285 | | National Bank of Canada | | | 5,617,835 | |

49,049 | | Power Corporation of Canada | | | 1,165,532 | |

150,382 | | Transcontinental, Inc. | | | 3,167,046 | |

| | | | | | |

| | Total | | | 48,724,793 | |

| | | | | | |

| |

Denmark (3.6%) | | | | |

51,550 | | Danske Bank AS | | | 1,794,050 | |

517,712 | | Novo Nordisk AS | | | 24,346,932 | |

18,250 | | Rockwool International AS | | | 5,502,134 | |

| | | | | | |

| | Total | | | 31,643,116 | |

| | | | | | |

| |

Finland (1.8%) | | | | |

427,050 | | UPM-Kymmene Oyj | | | 15,237,812 | |

| | | | | | |

| | Total | | | 15,237,812 | |

| | | | | | |

| |

France (7.3%) | | | | |

17,612 | | BNP Paribas SA | | | 1,359,633 | |

110,645 | | Capgemini SA | | | 15,220,955 | |

14,269 | | Cie Generale des Etablissements Michelin | | | 2,006,546 | |

272,984 | | CNP Assurancesa | | | 6,992,132 | |

8,174 | | Gaztransport Et Technigaz SA | | | 506,754 | |

20,962 | | Ipsos SA | | | 798,043 | |

5,464 | | LNA Sante | | | 352,047 | |

2,882 | | Nexity SA | | | 180,212 | |

394,976 | | Peugeot SA | | | 9,725,714 | |

52,199 | | Schneider Electric SEa | | | 4,731,544 | |

| | | | | | |

Shares | | Common Stock (99.1%) | | Value | |

France (7.3%) - continued | | | | |

151,097 | | Total SA | | $ | 9,496,697 | |

103,558 | | Vinci SAb | | | 10,354,097 | |

| | | | | | |

| | Total | | | 61,724,374 | |

| | | | | | |

| |

Germany (6.7%) | | | | |

272,536 | | BASF SE | | | 28,355,551 | |

214,424 | | Evonik Industries AG | | | 7,618,514 | |

86,615 | | Freenet AG | | | 2,749,492 | |

68,863 | | Hannover Rueckversicherung SE | | | 9,671,495 | |

14,815 | | Henkel AG & Company KGaA | | | 1,763,629 | |

66,827 | | Hugo Boss AG | | | 6,264,741 | |

57,310 | | ProSiebenSat.1 Media AG | | | 2,079,093 | |

| | | | | | |

| | Total | | | 58,502,515 | |

| | | | | | |

| |

Hong Kong (1.3%) | | | | |

535,000 | | Hang Lung Properties, Ltd. | | | 1,266,117 | |

884,000 | | Hysan Development Company, Ltd. | | | 5,145,033 | |

276,000 | | Road King Infrastructure, Ltd. | | | 523,273 | |

225,000 | | Sun Hung Kai Properties, Ltd. | | | 3,623,500 | |

84,000 | | Swire Pacific, Ltd. | | | 830,030 | |

| | | | | | |

| | Total | | | 11,387,953 | |

| | | | | | |

| |

Ireland (0.4%) | | | | |

56,040 | | Seagate Technology plc | | | 3,244,156 | |

| | | | | | |

| | Total | | | 3,244,156 | |

| | | | | | |

| |

Israel (0.1%) | | | | |

67,112 | | Plus500, Ltd. | | | 1,304,133 | |

| | | | | | |

| | Total | | | 1,304,133 | |

| | | | | | |

| |

Italy (0.6%) | | | | |

55,677 | | Anima Holding SPAc | | | 399,479 | |

709,554 | | Banco BPM SPAa | | | 2,573,794 | |

229,505 | | Finecobank Banca Fineco SPA | | | 2,732,891 | |

10,409 | | Societa Iniziative Autostradali e Servizi SPA | | | 220,494 | |

| | | | | | |

| | Total | | | 5,926,658 | |

| | | | | | |

| |

Japan (25.7%) | | | | |

27,500 | | AOKI Holdings, Inc. | | | 421,935 | |

12,900 | | Aozora Bank, Ltd. | | | 520,407 | |

68,500 | | Arcs Company, Ltd. | | | 1,876,478 | |

33,900 | | Asahi Glass Company, Ltd. | | | 1,406,891 | |

773,700 | | Astellas Pharmaceutical, Inc. | | | 11,316,317 | |

42,800 | | Autobacs Seven Company, Ltd. | | | 807,950 | |

161,400 | | Bridgestone Corporation | | | 6,746,938 | |

81,900 | | Canon, Inc. | | | 2,817,294 | |

2,300 | | Central Glass Company, Ltd. | | | 54,493 | |

34,900 | | Chiyoda Company, Ltd. | | | 838,872 | |

34,300 | | Dai Nippon Printing Company, Ltd. | | | 738,556 | |

343,600 | | Daicel Corporation | | | 3,964,546 | |

55,500 | | DCM Holdings Company, Ltd. | | | 552,234 | |

538,300 | | Honda Motor Company, Ltd. | | | 18,509,962 | |

59,900 | | Inaba Denki Sangyo Company, Ltd. | | | 2,569,145 | |

336,400 | | Japan Tobacco, Inc. | | | 9,042,836 | |

66,200 | | JSR Corporation | | | 1,247,080 | |

128,000 | | Kaneka Corporation | | | 1,264,802 | |

43,000 | | KDDI Corporation | | | 1,154,275 | |

820,700 | | Konica Minolta Holdings, Inc. | | | 7,044,735 | |

306,500 | | Kuraray Company, Ltd. | | | 5,104,501 | |

91,400 | | Kyocera Corporation | | | 5,839,838 | |

174,800 | | Kyoei Steel, Ltd. | | | 3,639,932 | |

52,300 | | KYORIN Holdings, Inc. | | | 1,022,713 | |

The accompanying Notes to Financial Statements are an integral part of this schedule.

INTERNATIONAL EQUITY FUND

Schedule of Investments as of April 30, 2018

(unaudited)

| | | | | | |

Shares | | Common Stock (99.1%) | | Value | |

Japan (25.7%) - continued | | | | |

63,200 | | Lawson, Inc. | | $ | 4,175,061 | |

12,600 | | Ministop Company, Ltd. | | | 261,411 | |

92,000 | | Mitsuboshi Belting, Ltd. | | | 1,049,386 | |

2,397,900 | | Mizuho Financial Group, Inc. | | | 4,338,369 | |

79,000 | | NEC Networks & System Integration Corporation | | | 2,066,989 | |

47,600 | | NHK Spring Company, Ltd. | | | 526,011 | |

52,900 | | Nippon Kayaku Company, Ltd. | | | 661,925 | |

600 | | Nippon Shokubai Company, Ltd. | | | 40,770 | |

114,800 | | Nippon Telegraph & Telephone Corporation | | | 5,447,855 | |

1,648,000 | | Nissan Motor Company, Ltd. | | | 17,337,735 | |

152,000 | | Nitto Kogyo Corporation | | | 2,609,295 | |

888,200 | | NTT DOCOMO, Inc. | | | 22,945,768 | |

457,200 | | Osaka Gas Company, Ltd. | | | 9,845,332 | |

24,200 | | Plenus Company, Ltd.b | | | 417,116 | |

30,100 | | Ryoyo Electro Corporation | | | 498,382 | |

65,100 | | Sangetsu Company, Ltd. | | | 1,343,503 | |

176,000 | | Sankyo Company, Ltd. | | | 6,170,061 | |

8,400 | | Sanyo Special Steel Company, Ltd. | | | 213,722 | |

35,900 | | Senshu Ikeda Holdings, Inc. | | | 141,574 | |

22,100 | | Seven & I Holdings Company, Ltd. | | | 973,744 | |

37,500 | | SHIMAMURA Company, Ltd. | | | 4,363,999 | |

442,100 | | Shinko Electric Industries Company, Ltd. | | | 3,439,443 | |

65,400 | | ShinMaywa Industries, Ltd. | | | 732,970 | |

27,400 | | Sony Financial Holdings, Inc. | | | 499,882 | |

520,000 | | Sumitomo Electric Industries, Ltd. | | | 7,960,719 | |

136,600 | | Sumitomo Rubber Industries, Ltd. | | | 2,439,359 | |

22,300 | | Taikisha, Ltd. | | | 777,668 | |

22,500 | | Taiyo Holdings Company, Ltd. | | | 956,130 | |

12,800 | | Takara Standard Company, Ltd. | | | 217,519 | |

104,900 | | Toagosei Company, Ltd. | | | 1,237,949 | |

331,900 | | Tokyo Gas Company, Ltd. | | | 8,906,646 | |

60,700 | | Toppan Forms Company, Ltd. | | | 678,031 | |

528,000 | | Toppan Printing Company, Ltd. | | | 4,415,228 | |

257,700 | | Toyoda Gosei Company, Ltd. | | | 6,506,668 | |

238,000 | | Tsubakimoto Chain Company | | | 2,062,353 | |

213,400 | | TV Asahi Holdings Corporation | | | 5,004,575 | |

26,500 | | Yamato Kogyo Company, Ltd. | | | 781,185 | |

8,600 | | Yokohama Rubber Company, Ltd. | | | 202,496 | |

28,200 | | Yuasa Trading Company, Ltd. | | | 901,358 | |

| | | | | | |

| | Total | | | 221,650,917 | |

| | | | | | |

| |

Netherlands (5.5%) | | | | |

68,231 | | Euronext NVc | | | 4,891,077 | |

51,017 | | ForFarmers BV | | | 715,702 | |

551,867 | | RELX NV | | | 11,742,137 | |

465,703 | | Unilever NV | | | 26,698,056 | |

50,275 | | Wolters Kluwer NV | | | 2,720,367 | |

| | | | | | |

| | Total | | | 46,767,339 | |

| | | | | | |

| |

Norway (2.2%) | | | | |

293,967 | | DnB ASA | | | 5,497,580 | |

604,549 | | Telenor ASA | | | 13,381,029 | |

9,099 | | TGS Nopec Geophysical Company ASA | | | 286,927 | |

| | | | | | |

| | Total | | | 19,165,536 | |

| | | | | | |

| |

Portugal (0.1%) | | | | |

71,534 | | Navigator Company SA | | | 417,384 | |

| | | | | | |

| | Total | | | 417,384 | |

| | | | | | |

| | | | | | |

Shares | | Common Stock (99.1%) | | Value | |

Singapore (0.1%) | | | | |

641,600 | | Wing Tai Holdings, Ltd. | | $ | 983,041 | |

| | | | | | |

| | Total | | | 983,041 | |

| | | | | | |

| |

Spain (1.5%) | | | | |

31,502 | | Amadeus IT Holding SA | | | 2,298,377 | |

1,620,878 | | Banco de Sabadell SA | | | 3,171,874 | |

144,414 | | Bankinter SA | | | 1,509,289 | |

112,510 | | CaixaBank SA | | | 547,121 | |

82,711 | | Enagas SA | | | 2,404,073 | |

169,395 | | Mediaset Espana Comunicacion SAb | | | 1,621,137 | |

| | | | | | |

| | Total | | | 11,551,871 | |

| | | | | | |

| |

Sweden (5.0%) | | | | |

469,742 | | Atlas Copco AB, Class A | | | 18,369,891 | |

302,994 | | Atlas Copco AB, Class B | | | 10,739,167 | |

154,666 | | Granges AB | | | 2,163,569 | |

49,055 | | JM AB | | | 970,521 | |

25,776 | | Loomis AB | | | 938,680 | |

45,406 | | Nobina ABc | | | 297,980 | |

91,963 | | Sandvik AB | | | 1,568,009 | |

403,435 | | SKF AB | | | 8,167,470 | |

| | | | | | |

| | Total | | | 43,215,287 | |

| | | | | | |

| |

Switzerland (6.1%) | | | | |

130,984 | | Adecco SA | | | 8,674,441 | |

40,667 | | Ferguson plc | | | 3,112,962 | |

242,546 | | Novartis AG | | | 18,669,813 | |

49,447 | | Pargesa Holding SA | | | 4,627,730 | |

10,200 | | Roche Holding AG | | | 2,266,312 | |

41,486 | | Schindler Holding AG, Participation Certificate | | | 8,566,305 | |

557 | | SGS SA | | | 1,352,757 | |

47,778 | | TE Connectivity, Ltd. | | | 4,383,631 | |

| | | | | | |

| | Total | | | 51,653,951 | |

| | | | | | |

| |

United Kingdom (17.8%) | | | | |

216,592 | | Barclays plc | | | 617,530 | |

137,184 | | Berkeley Group Holdings plc | | | 7,680,158 | |

611,345 | | BHP Billiton plc | | | 13,035,444 | |

2,662,944 | | BP plc | | | 19,780,383 | |

1,097,008 | | Direct Line Insurance Group plc | | | 5,636,779 | |

19,603 | | Hargreaves Lansdown plc | | | 480,601 | |

2,325,175 | | HSBC Holdings plc | | | 23,149,552 | |

204,778 | | Inchcape plc | | | 2,045,820 | |

80,142 | | Jupiter Fund Management plc | | | 501,185 | |

1,947,106 | | KCOM Group plc | | | 2,680,598 | |

237,477 | | Mondi plc | | | 6,610,711 | |

183,830 | | National Express Group plc | | | 992,022 | |

37,180 | | Next plc | | | 2,685,762 | |

56,037 | | Northgate plc | | | 286,368 | |

719,979 | | Old Mutual plc | | | 2,480,394 | |

434,189 | | PageGroup plc | | | 3,204,601 | |

338,812 | | RELX plc | | | 7,241,477 | |

11,083 | | Rio Tinto plc | | | 604,093 | |

51,557 | | Royal Dutch Shell plc, Class A | | | 1,793,742 | |

327,634 | | Royal Dutch Shell plc, Class B | | | 11,696,237 | |

1,191,184 | | Royal Mail plc | | | 9,499,706 | |

61,745 | | Schroders plc | | | 2,793,397 | |

114,297 | | Smiths Group plc | | | 2,504,409 | |

24,289 | | Spirax-Sarco Engineering plc | | | 1,925,398 | |

409,825 | | Unilever plc | | | 22,988,077 | |

| | | | | | |

| | Total | | | 152,914,444 | |

| | | | | | |

The accompanying Notes to Financial Statements are an integral part of this schedule.

INTERNATIONAL EQUITY FUND

Schedule of Investments as of April 30, 2018

(unaudited)

| | | | | | |

Shares | | Common Stock (99.1%) | | Value | |

United States (<0.1%) | | | | |

17,783 | | Kulicke and Soffa Industries, Inc.a | | $ | 407,053 | |

| | | | | | |

| | Total | | | 407,053 | |

| | | | | | |

| | Total Common Stock

(cost $841,861,460) | | | 852,156,930 | |

| | | | | | |

| | |

Shares | | Preferred Stock (0.2%) | | | |

Germany (0.2%) | | | | |

13,201 | | Henkel AG & Company KGaA, 1.620% | | | 1,677,644 | |

| | | | | | |

| | Total | | | 1,677,644 | |

| | | | | | |

| | Total Preferred Stock

(cost $1,774,643) | | | 1,677,644 | |

| | | | | | |

| | |

Shares | | Collateral Held for Securities Loaned

(1.8%) | | | |

15,455,901 | | Thrivent Cash Management Trust | | | 15,455,901 | |

| | | | | | |

| | Total Collateral Held for Securities Loaned

(cost $15,455,901) | | | 15,455,901 | |

| | | | | | |

| | |

Shares or Principal Amount | | Short-Term Investments (0.3%) | | | |

| | Thrivent Core Short-Term Reserve Fund

| | | | |

280,225 | | 2.120% | | | 2,802,251 | |

| | | | | | |

| | Total Short-Term Investments

(cost $2,802,251) | | | 2,802,251 | |

| | | | | | |

| | Total Investments

(cost $861,894,255) 101.4% | | $ | 872,092,726 | |

| | | | | | |

| | Other Assets and Liabilities, Net (1.4%) | | | (12,184,039) | |

| | | | | | |

| | Total Net Assets 100.0% | | $ | 859,908,687 | |

| | | | | | |

| a | Non-income producing security. |

| b | All or a portion of the security is on loan. |

| c | Denotes securities sold under Rule 144A of the Securities Act of 1933, which exempts them from registration. These securities may be resold to other dealers in the program or to other qualified institutional buyers. As of April 30, 2018, the value of these investments was $5,588,536 or 0.6% of total net assets. |

The following table presents the total amount of securities loaned with continuous maturity, by type, offset by the gross payable upon return of collateral for securities loaned by Thrivent Core International Equity Fund as of April 30, 2018:

Securities Lending Transactions

| | | | |

Common Stock | | $ | 14,631,079 | |

| | | | |

Total lending | | $ | 14,631,079 | |

Gross amount payable upon return of collateral for securities loaned | | $ | 15,455,901 | |

| | | | |

Net amounts due to counterparty | | $ | 824,822 | |

| | | | |

Unrealized Appreciation (Depreciation)

Gross unrealized appreciation and depreciation of investments of the portfolio as a whole (including derivatives), based on cost for federal income tax purposes, were as follows:

| | | | |

Gross unrealized appreciation | | $ | 35,513,986 | |

Gross unrealized depreciation | | | (25,315,515 | ) |

| | | | |

Net unrealized appreciation (depreciation) | | $ | 10,198,471 | |

| |

Cost for federal income tax purposes | | $ | 861,894,255 | |

The accompanying Notes to Financial Statements are an integral part of this schedule.

INTERNATIONAL EQUITY FUND

Schedule of Investments as of April 30, 2018

(unaudited)

Fair Valuation Measurements

The following table is a summary of the inputs used, as of April 30, 2018, in valuing Core International Equity Fund’s assets carried at fair value.

| | | | | | | | | | | | | | | | |

Investments in Securities | | Total | | | Level 1 | | | Level 2 | | | Level 3 | |

Common Stock | | | | | | | | | | | | | | | | |

Consumer Discretionary | | | 123,071,091 | | | | 11,520,340 | | | | 111,550,751 | | | | – | |

Consumer Staples | | | 71,146,879 | | | | – | | | | 71,146,879 | | | | – | |

Energy | | | 52,902,458 | | | | – | | | | 52,902,458 | | | | – | |

Financials | | | 127,428,004 | | | | – | | | | 127,428,004 | | | | – | |

Health Care | | | 57,974,134 | | | | – | | | | 57,974,134 | | | | – | |

Industrials | | | 152,222,570 | | | | – | | | | 152,222,570 | | | | – | |

Information Technology | | | 50,876,108 | | | | 8,034,840 | | | | 42,841,268 | | | | – | |

Materials | | | 131,608,583 | | | | 7,035,392 | | | | 124,573,191 | | | | – | |

Real Estate | | | 14,890,019 | | | | – | | | | 14,890,019 | | | | – | |

Telecommunications Services | | | 48,359,017 | | | | – | | | | 48,359,017 | | | | – | |

Utilities | | | 21,678,067 | | | | – | | | | 21,678,067 | | | | – | |

Preferred Stock | | | | | | | | | | | | | | | | |

Consumer Staples | | | 1,677,644 | | | | – | | | | 1,677,644 | | | | – | |

| | | | | | | | | | | | | | | | |

Subtotal Investments in Securities | | $ | 853,834,574 | | | $ | 26,590,572 | | | $ | 827,244,002 | | | $ | – | |

| | | | | | | | | | | | | | | | |

| | | | |

Other Investments * | | Total | | | | | | | | | | |

Short-Term Investments | | | 2,802,251 | | | | | | | | | | | | | |

Collateral Held for Securities Loaned | | | 15,455,901 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Subtotal Other Investments | | $ | 18,258,152 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Total Investments at Value | | $ | 872,092,726 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| * | Certain investments are measured at fair value using a net asset value per share that is not publicly available (practical expedient). According to disclosure requirements of Accounting Standards Codification (ASC) 820, Fair Value Measurement, securities valued using the practical expedient are not classified in the fair value hierarchy. The fair value amounts presented in this table are intended to permit reconciliation of the fair value hierarchy to the amounts presented in the Statement of Assets and Liabilities. |

There were no significant transfers between Levels during the period ended April 30, 2018. Transfers between Levels are identified as of the end of the period.

Investment in Affiliates

Affiliated issuers, as defined under the Investment Company Act of 1940, include those in which the Fund’s holdings of an issuer represent 5% or more of the outstanding voting securities of an issuer, any affiliated mutual fund, or a company which is under common ownership or control with the Fund. The Fund owns shares of Thrivent Cash Management Trust for the purpose of securities lending and Thrivent Core Short-Term Reserve Fund primarily to serve as a cash sweep vehicle for the Fund. Thrivent Cash Management Trust and Thrivent Core Funds are established solely for investment by Thrivent entities.

A summary of transactions (in thousands) for the fiscal year to date, in International Equity Fund, is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | |

Fund | | Value

11/14/2017 | | | Gross

Purchases | | | Gross

Sales | | | Shares Held at

4/30/2018 | | | Value

4/30/2018 | | | % of Net

Assets

4/30/2018 | |

Affiliated Short-Term Investments | | | | | | | | | | | | | | | | | | | | | | | | |

Core Short-Term Reserve, 2.120% | | $ | – | | | $ | 214,400 | | | $ | 211,598 | | | | 280 | | | $ | 2,802 | | | | 0.3 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Affiliated Short-Term Investments | | | – | | | | | | | | | | | | | | | | 2,802 | | | | 0.3 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Collateral Held for Securities Loaned | | | | | | | | | | | | | | | | | | | | | | | | |

Cash Management Trust- Collateral Investment | | | – | | | | 60,331 | | | | 44,875 | | | | 15,456 | | | | 15,456 | | | | 1.8 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Collateral Held for Securities Loaned | | | – | | | | | | | | | | | | | | | | 15,456 | | | | 1.8 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Value | | $ | – | | | | | | | | | | | | | | | $ | 18,258 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Portfolio | | Net Realized

Gain/(Loss) | | | Change in

Unrealized

Appreciation/

(Depreciation) | | | Distributions of

Realized Capital

Gains | | | Income Earned

11/14/2017

- 4/30/2018 | |

Affiliated Short-Term Investments | | | | | | | | | | | | | | | | |

Core Short-Term Reserve, 2.120% | | $ | – | | | $ | – | | | $ | 0 | | | $ | 39 | |

| | | | | | | | | | | | | | | | |

Total Income from Affiliated Investments | | | | | | | | | | | | | | $ | 39 | |

| | | | | | | | | | | | | | | | |

Collateral Held for Securities Loaned | | | | | | | | | | | | | | | | |

Cash Management Trust- Collateral Investment | | | – | | | | – | | | | – | | | | 108 | |

| | | | | | | | | | | | | | | | |

Total Affiliated Income from Securities Loaned, Net | | | | | | | | | | | | | | $ | 108 | |

| | | | | | | | | | | | | | | | |

Total Value | | $ | – | | | $ | – | | | $ | 0 | | | | | |

| | | | | | | | | | | | | | | | |

The accompanying Notes to Financial Statements are an integral part of this schedule.

14

LOW VOLATILITY EQUITY FUND

Schedule of Investments as of April 30, 2018

(unaudited)

| | | | | | |

Shares | | Common Stock (99.9%) | | Value | |

Consumer Discretionary (7.9%) | | | | |

816 | | Booking Holdings, Inc.a | | $ | 1,777,248 | |

267,053 | | Comcast Corporation | | | 8,382,794 | |

92,380 | | Home Depot, Inc. | | | 17,071,824 | |

97,812 | | Liberty SiriusXM Groupa | | | 4,085,607 | |

208,215 | | LKQ Corporationa | | | 6,458,829 | |

30,151 | | Lowe’s Companies, Inc. | | | 2,485,347 | |

104,060 | | McDonald’s Corporation | | | 17,423,807 | |

39,563 | | Starbucks Corporation | | | 2,277,642 | |

48,619 | | Walt Disney Company | | | 4,877,944 | |

| | | | | | |

| | Total | | | 64,841,042 | |

| | | | | | |

| |

Consumer Staples (12.6%) | | | | |

260,790 | | Altria Group, Inc. | | | 14,632,927 | |

74,605 | | Archer-Daniels-Midland Company | | | 3,385,575 | |

48,886 | | Church & Dwight Company, Inc. | | | 2,258,533 | |

379,842 | | Coca-Cola Company | | | 16,412,973 | |

231,966 | | Conagra Brands, Inc. | | | 8,598,980 | |

3,225 | | Estee Lauder Companies, Inc. | | | 477,590 | |

410,755 | | Mondelez International, Inc. | | | 16,224,823 | |

160,767 | | PepsiCo, Inc. | | | 16,227,821 | |

235,071 | | Sysco Corporation | | | 14,701,340 | |

143,281 | | Tyson Foods, Inc. | | | 10,043,998 | |

| | | | | | |

| | Total | | | 102,964,560 | |

| | | | | | |

| |

Energy (1.4%) | | | | |

79,069 | | Exxon Mobil Corporation | | | 6,147,615 | |

68,366 | | Occidental Petroleum Corporation | | | 5,281,957 | |

| | | | | | |

| | Total | | | 11,429,572 | |

| | | | | | |

| |

Financials (15.7%) | | | | |

369,286 | | Aflac, Inc. | | | 16,828,363 | |

177,882 | | Allstate Corporation | | | 17,400,417 | |

15,734 | | American Express Company | | | 1,553,732 | |

50,489 | | American Financial Group, Inc. | | | 5,716,365 | |

121,569 | | Arthur J. Gallagher & Company | | | 8,508,614 | |

79,227 | | Berkshire Hathaway, Inc.a | | | 15,348,647 | |

155,846 | | Brown & Brown, Inc. | | | 4,243,687 | |

48,078 | | Cincinnati Financial Corporation | | | 3,381,807 | |

193,021 | | Loews Corporation | | | 10,125,882 | |

9,384 | | Markel Corporationa | | | 10,604,295 | |

139,499 | | Marsh & McLennan Companies, Inc. | | | 11,369,168 | |

142,826 | | Progressive Corporation | | | 8,610,980 | |

301,945 | | U.S. Bancorp | | | 15,233,125 | |

| | | | | | |

| | Total | | | 128,925,082 | |

| | | | | | |

| |

Health Care (14.9%) | | | | |

52,314 | | Abbott Laboratories | | | 3,041,013 | |

1,720 | | Amgen, Inc. | | | 300,105 | |

158,118 | | Boston Scientific Corporationa | | | 4,541,149 | |

60,757 | | CIGNA Corporation | | | 10,439,268 | |

108,355 | | Danaher Corporation | | | 10,870,174 | |

44,382 | | Edwards Lifesciences Corporationa | | | 5,652,491 | |

213,121 | | Eli Lilly and Company | | | 17,277,719 | |

49,049 | | Hill-Rom Holdings, Inc. | | | 4,209,876 | |

47,800 | | IDEXX Laboratories, Inc.a | | | 9,296,622 | |

130,076 | | Johnson & Johnson | | | 16,453,313 | |

452,065 | | Pfizer, Inc. | | | 16,550,100 | |

26,530 | | Quest Diagnostics, Inc. | | | 2,684,836 | |

72,569 | | UnitedHealth Group, Inc. | | | 17,155,312 | |

44,529 | | Zoetis, Inc. | | | 3,717,281 | |

| | | | | | |

| | Total | | | 122,189,259 | |

| | | | | | |

| | | | | | |

Shares | | Common Stock (99.9%) | | Value | |

Industrials (13.6%) | | | | |

40,786 | | 3M Company | | $ | 7,928,391 | |

115,638 | | AMETEK, Inc. | | | 8,071,532 | |

62,319 | | Emerson Electric Company | | | 4,138,605 | |

46,241 | | General Dynamics Corporation | | | 9,308,776 | |

2,941 | | Harris Corporation | | | 460,031 | |

108,110 | | Honeywell International, Inc. | | | 15,641,355 | |

11,812 | | Hubbell, Inc. | | | 1,226,794 | |

37,291 | | Illinois Tool Works, Inc. | | | 5,296,068 | |

47,091 | | Lockheed Martin Corporation | | | 15,108,677 | |

18,311 | | Northrop Grumman Corporation | | | 5,896,874 | |

22,012 | | Raytheon Company | | | 4,511,139 | |

88,773 | | Republic Services, Inc. | | | 5,741,838 | |

181,918 | | Waste Connections, Inc. | | | 13,152,671 | |

190,163 | | Waste Management, Inc. | | | 15,458,350 | |

| | | | | | |

| | Total | | | 111,941,101 | |

| | | | | | |

| |

Information Technology (21.0%) | | | | |

142,246 | | Automatic Data Processing, Inc. | | | 16,796,408 | |

68,353 | | Broadridge Financial Solutions, Inc. | | | 7,328,125 | |

213,276 | | CA, Inc. | | | 7,422,005 | |

40,918 | | CDW Corporation | | | 2,917,044 | |

144,536 | | Cisco Systems, Inc. | | | 6,401,499 | |

28,607 | | F5 Networks, Inc.a | | | 4,665,516 | |

58,331 | | Facebook, Inc.a | | | 10,032,932 | |

171,601 | | Fidelity National Information Services, Inc. | | | 16,296,947 | |

231,445 | | Fiserv, Inc.a | | | 16,400,193 | |

98,386 | | Intuit, Inc. | | | 18,180,749 | |

93,408 | | MasterCard, Inc. | | | 16,651,844 | |

79,743 | | Microsoft Corporation | | | 7,457,565 | |

356,379 | | Oracle Corporation | | | 16,275,829 | |

104,150 | | Synopsys, Inc.a | | | 8,905,867 | |

131,171 | | Visa, Inc. | | | 16,642,976 | |

| | | | | | |

| | Total | | | 172,375,499 | |

| | | | | | |

| |

Materials (1.8%) | | | | |

369,152 | | Newmont Mining Corporation | | | 14,503,982 | |

| | | | | | |

| | Total | | | 14,503,982 | |

| | | | | | |

| |

Real Estate (2.1%) | | | | |

23,519 | | American Tower Corporation | | | 3,207,051 | |

264,098 | | Brixmor Property Group, Inc. | | | 3,932,419 | |

37,758 | | Douglas Emmett, Inc. | | | 1,407,240 | |

146,418 | | First Industrial Realty Trust, Inc. | | | 4,555,064 | |

104,512 | | Liberty Property Trust | | | 4,370,692 | |

| | | | | | |

| | Total | | | 17,472,466 | |

| | | | | | |

| |

Telecommunications Services (2.1%) | | | | |

343,877 | | Verizon Communications, Inc. | | | 16,970,330 | |

| | | | | | |

| | Total | | | 16,970,330 | |

| | | | | | |

| |

Utilities (6.8%) | | | | |

58,294 | | Atmos Energy Corporation | | | 5,065,165 | |

217,314 | | Exelon Corporation | | | 8,623,019 | |

45,081 | | MDU Resources Group, Inc. | | | 1,269,932 | |

107,202 | | NextEra Energy, Inc. | | | 17,571,480 | |

338,978 | | Public Service Enterprise Group, Inc. | | | 17,677,703 | |

116,959 | | UGI Corporation | | | 5,659,646 | |

| | | | | | |

| | Total | | | 55,866,945 | |

| | | | | | |

| | Total Common Stock (cost $825,497,601) | | | 819,479,838 | |

| | | | | | |

The accompanying Notes to Financial Statements are an integral part of this schedule.

LOW VOLATILITY EQUITY FUND

Schedule of Investments as of April 30, 2018

(unaudited)

| | | | | | |

Shares or Principal Amount | | Short-Term Investments (0.1%) | | Value | |

| | Thrivent Core Short-Term Reserve Fund | | | | |

41,404 | | 2.120% | | $ | 414,037 | |

| | | | | | |

| | Total Short-Term Investments (cost $414,037) | | | 414,037 | |

| | | | | | |

| | Total Investments (cost $825,911,638) 100.0% | | $ | 819,893,875 | |

| | | | | | |

| | Other Assets and Liabilities, Net <0.1% | | | 395,311 | |

| | | | | | |

| | Total Net Assets 100.0% | | $ | 820,289,186 | |

| | | | | | |

| a | Non-income producing security. |

Unrealized Appreciation (Depreciation)

Gross unrealized appreciation and depreciation of investments of the portfolio as a whole (including derivatives), based on cost for federal income tax purposes, were as follows:

| | | | |

Gross unrealized appreciation | | $ | 17,921,636 | |

Gross unrealized depreciation | | | (23,939,399 | ) |

| | | | |

Net unrealized appreciation (depreciation) | | ($ | 6,017,763 | ) |

| |

Cost for federal income tax purposes | | $ | 825,911,638 | |

The accompanying Notes to Financial Statements are an integral part of this schedule.

LOW VOLATILITY EQUITY FUND

Schedule of Investments as of April 30, 2018

(unaudited)

Fair Valuation Measurements

The following table is a summary of the inputs used, as of April 30, 2018, in valuing Core Low Volatility Equity Fund’s assets carried at fair value.

| | | | | | | | | | | | | | | | |

Investments in Securities | | Total | | | Level 1 | | | Level 2 | | | Level 3 | |

Common Stock | | | | | | | | | | | | | | | | |

Consumer Discretionary | | | 64,841,042 | | | | 64,841,042 | | | | – | | | | – | |

Consumer Staples | | | 102,964,560 | | | | 102,964,560 | | | | – | | | | – | |

Energy | | | 11,429,572 | | | | 11,429,572 | | | | – | | | | – | |

Financials | | | 128,925,082 | | | | 128,925,082 | | | | – | | | | – | |

Health Care | | | 122,189,259 | | | | 122,189,259 | | | | – | | | | – | |

Industrials | | | 111,941,101 | | | | 111,941,101 | | | | – | | | | – | |

Information Technology | | | 172,375,499 | | | | 172,375,499 | | | | – | | | | – | |

Materials | | | 14,503,982 | | | | 14,503,982 | | | | – | | | | – | |

Real Estate | | | 17,472,466 | | | | 17,472,466 | | | | – | | | | – | |

Telecommunications Services | | | 16,970,330 | | | | 16,970,330 | | | | – | | | | – | |

Utilities | | | 55,866,945 | | | | 55,866,945 | | | | – | | | | – | |

| | | | | | | | | | | | | | | | |

Subtotal Investments in Securities | | $ | 819,479,838 | | | $ | 819,479,838 | | | $ | – | | | $ | – | |

| | | | | | | | | | | | | | | | |

| | | | |

Other Investments * | | Total | | | | | | | | | | |

Short-Term Investments | | | 414,037 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Subtotal Other Investments | | $ | 414,037 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Total Investments at Value | | $ | 819,893,875 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| * | Certain investments are measured at fair value using a net asset value per share that is not publicly available (practical expedient). According to disclosure requirements of Accounting Standards Codification (ASC) 820, Fair Value Measurement, securities valued using the practical expedient are not classified in the fair value hierarchy. The fair value amounts presented in this table are intended to permit reconciliation of the fair value hierarchy to the amounts presented in the Statement of Assets and Liabilities. |

There were no significant transfers between Levels during the period ended April 30, 2018. Transfers between Levels are identified as of the end of the period.

Investment in Affiliates

Affiliated issuers, as defined under the Investment Company Act of 1940, include those in which the Fund’s holdings of an issuer represent 5% or more of the outstanding voting securities of an issuer, any affiliated mutual fund, or a company which is under common ownership or control with the Fund. The Fund owns shares of Thrivent Core Short-Term Reserve Fund primarily to serve as a cash sweep vehicle for the Fund. Thrivent Core Funds are established solely for investment by Thrivent entities.

A summary of transactions (in thousands) for the fiscal year to date, in Core Low Volatility Equity Fund, is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | |

Fund | | Value

2/28/2018 | | | Gross

Purchases | | | Gross

Sales | | | Shares Held at

4/30/2018 | | | Value

4/30/2018 | | | % of Net

Assets

4/30/2018 | |

Affiliated Short-Term Investments | | | | | | | | | | | | | | | | | | | | | | | | |

Core Short-Term Reserve, 2.120% | | $ | – | | | $ | 45,213 | | | $ | 44,799 | | | | 41 | | | $ | 414 | | | | 0.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Affiliated Short-Term Investments | | | – | | | | | | | | | | | | | | | | 414 | | | | 0.1 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Value | | $ | – | | | | | | | | | | | | | | | $ | 414 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Fund | | Net Realized

Gain/(Loss) | | | Change in

Unrealized

Appreciation/

(Depreciation) | | | Distributions of

Realized Capital

Gains | | | Income Earned

2/28/2018

- 4/30/2018 | |

Affiliated Short-Term Investments | | | | | | | | | | | | | | | | |

Core Short-Term Reserve, 2.120% | | $ | – | | | $ | – | | | $ | – | | | $ | 9 | |

| | | | | | | | | | | | | | | | |

Total Income from Affiliated Investments | | | | | | | | | | | | | | $ | 9 | |

| | | | | | | | | | | | | | | | |

Total | | $ | – | | | $ | – | | | $ | – | | | | | |

| | | | | | | | | | | | | | | | |

The accompanying Notes to Financial Statements are an integral part of this schedule.

SHORT-TERM RESERVE FUND

Schedule of Investments as of April 30, 2018

(unaudited)

| | | | | | |

Principal Amount | | Asset-Backed Securities (7.9%)a | | Value | |

| | Ally Auto Receivables Trust | | | | |

$3,226,584 | | 1.400%, 12/17/2018, Ser. 2017-5 | | $ | 3,226,592 | |

8,116,691 | | 1.750%, 2/15/2019, Ser. 2017-1A | | | 8,116,774 | |

| | ARI Fleet Lease Trust | | | | |

25,996,313 | | 1.950%, 3/15/2019, Ser. 2018-Ab | | | 25,971,471 | |

| | Ascentium Equipment Receivables, LLC | | | | |

7,909,036 | | 1.450%, 11/13/2018, Ser. 2017-2Ab | | | 7,899,623 | |

30,000,000 | | 2.500%, 5/10/2019, Ser. 2018-1Ab | | | 30,000,000 | |

| | Bank of the West Auto Trust | | | | |

47,760 | | 1.350%, 10/15/2018, Ser. 2017-1b | | | 47,760 | |

| | BMW Vehicle Lease Trust | | | | |

1,834,134 | | 1.350%, 10/22/2018, Ser. 2017-2 | | | 1,834,131 | |

| | Canadian Pacer Auto Receivables Trust | | | | |

30,000,000 | | 2.300%, 4/19/2019, Ser. 2018-1Ab | | | 30,000,000 | |

| | CarMax Auto Owner Trust | | | | |

3,699,280 | | 1.350%, 11/15/2018, Ser. 2017-4 | | | 3,699,252 | |

22,000,000 | | 2.300%, 5/15/2019, Ser. 2018-2 | | | 22,000,000 | |

| | CCG Receivables Trust | | | | |

8,394,935 | | 1.850%, 2/14/2019, Ser. 2018-1b | | | 8,395,100 | |

| | Daimler Trucks Retail Trust | | | | |

17,413,086 | | 2.200%, 4/15/2019, Ser. 2018-1b | | | 17,413,397 | |

| | DLL Securitization Trust | | | | |

5,856,816 | | 1.500%, 11/15/2018, Ser. 2017-Ab | | | 5,854,640 | |

| | Enterprise Fleet Financing, LLC | | | | |

7,674,457 | | 1.500%, 10/22/2018, Ser. 2017-3b | | | 7,674,530 | |

21,436,416 | | 2.150%, 3/20/2019, Ser. 2018-1b | | | 21,437,010 | |

| | Foursight Capital Automobile Receivables Trust | | | | |

8,777,063 | | 2.200%, 3/15/2019, Ser. 2018-1b | | | 8,777,209 | |

| | GM Financial Consumer Automobile Receivables Trust | | | | |

378,660 | | 1.390%, 10/16/2018, Ser. 2017-3Ab | |

| 378,661

|

|

8,848,788 | | 1.700%, 1/16/2019, Ser. 2018-1 | | | 8,848,856 | |

30,000,000 | | 2.300%, 4/16/2019, Ser. 2018-2 | | | 30,000,000 | |

| | Great America Leasing Receivables | | | | |

11,124,309 | | 1.850%, 2/15/2019, Ser. 2018-1b | | | 11,124,529 | |

| | Honda Auto Receivables Owner Trust | | | | |

7,268,729 | | 1.430%, 12/21/2018, Ser. 2017-4 | | | 7,268,752 | |

| | | | | | |

Principal Amount | | Asset-Backed Securities (7.9%)a | | Value | |

| | Hyundai Auto Lease Securitization Trust | | | | |

$5,837,724 | | 1.420%, 11/15/2018, Ser. 2017-Cb | | $ | 5,837,740 | |

7,101,112 | | 1.950%, 3/15/2019, Ser. 2018-Ab | | | 7,101,229 | |

| | John Deere Owner Trust | | | | |

22,063,676 | | 1.950%, 3/15/2019, Ser. 2018-A | | | 22,064,179 | |

| | Kubota Credit Owner Trust | | | | |

23,500,000 | | 2.370%, 5/15/2019, Ser. 2018-1Ab,c | | | 23,500,000 | |

| | Mercedes-Benz Auto Lease Trust | | | | |

18,863,782 | | 1.750%, 2/15/2019, Ser. 2018-A | | | 18,863,989 | |

| | MMAF Equipment Finance LLC | | | | |

5,833,745 | | 1.500%, 12/14/2018, Ser. 2017-Bb | | | 5,831,148 | |

| | Santander Retail Auto Lease Trust | | | | |

6,752,324 | | 1.500%, 11/20/2018, Ser. 2017-Ab | | | 6,746,958 | |

| | Securitized Term Auto Receivables Trust | | | | |

25,000,000 | | 2.400%, 4/25/2019, Ser. 2018-1Ab,c | | | 25,000,000 | |

| | Volvo Financial Equipment, LLC | | | | |

15,464,146 | | 1.850%, 2/15/2019, Ser. 2018-1Ab | | | 15,464,401 | |

| | Wheels SPV 2, LLC | | | | |

711,194 | | 1.400%, 7/20/2018, Ser. 2017-1Ab | | | 711,195 | |

| | World Omni Auto Receivables Trust | | | | |

14,988,466 | | 1.750%, 2/15/2019, Ser. 2018-A | | | 14,988,619 | |

9,000,000 | | 2.250%, 4/15/2019, Ser. 2018-B | | | 9,000,203 | |