****

What Campbell Can Learn from Third Point

The Wall Street Journal

By Aaron Back

October 31, 2018

Campbell Soup Co. could stand to learn a thing or two from its critics.

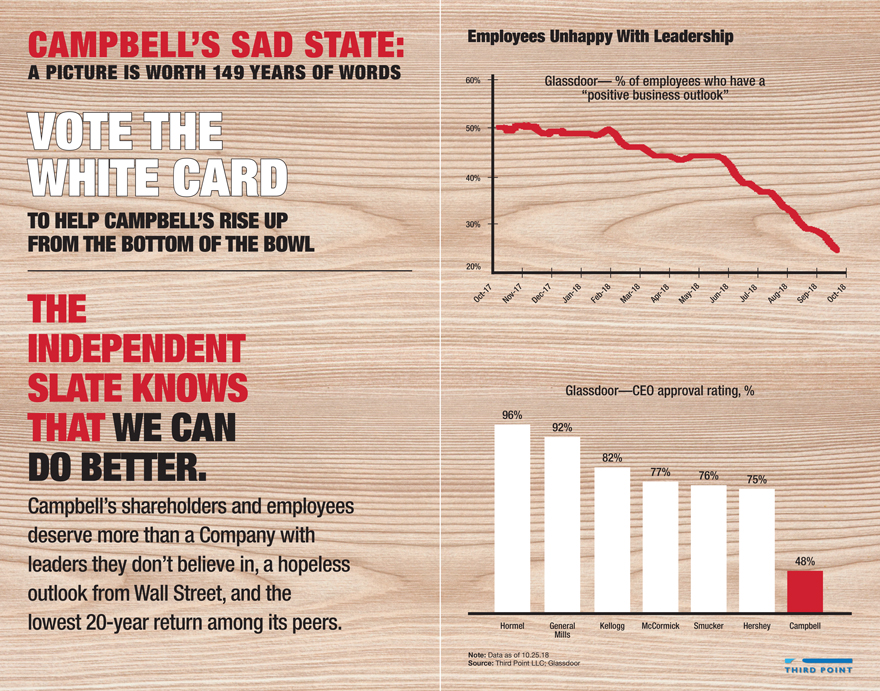

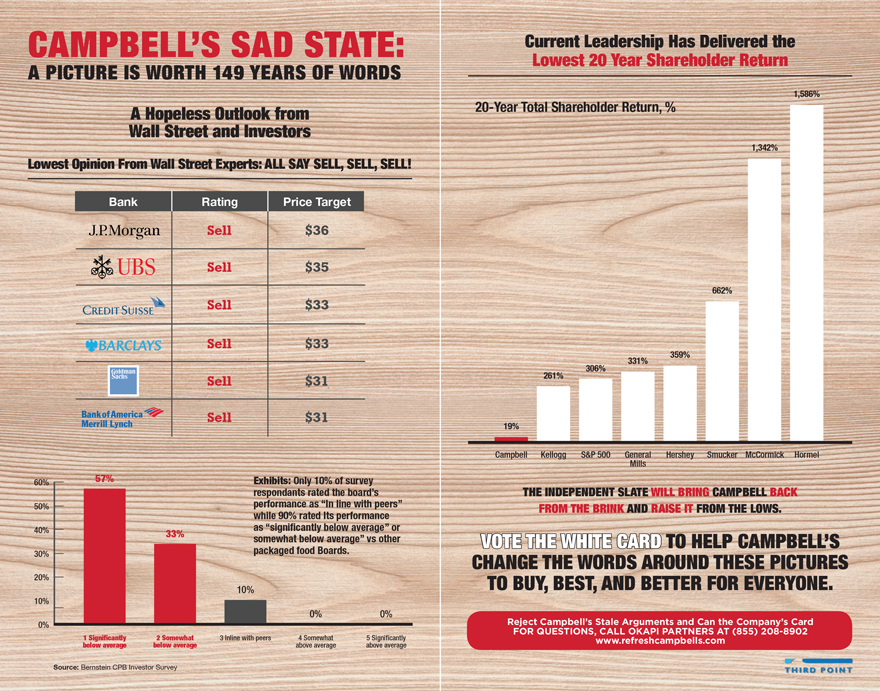

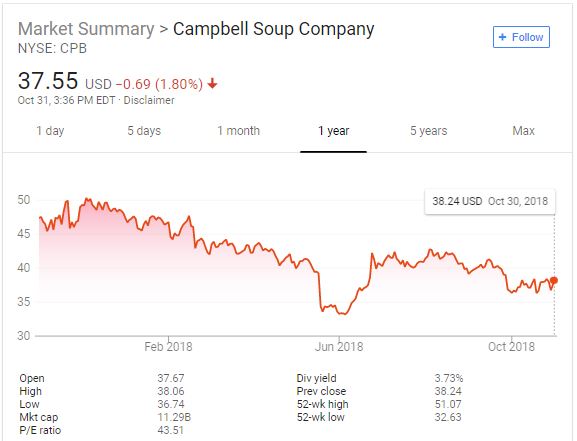

Dan Loeb’s activist hedge fund, Third Point, is seeking to replace Campbell’s entire board of directors in a November shareholder vote. It has made a case that Campbell’s board has done a poor job, which wasn’t too hard considering that the stock is down 30% over the last two years.

The more difficult case to make has been that the directors Third Point prefers could do a better one, especially since there appears to be no buyer out there for the whole company.

Third Point’s argument got a bit stronger on Tuesday as itreleased a plan to turn Campbell around. The company dismissed it in a statement as a mere copy of its own strategic plan unveiled in August, saying it relies on the same cost savings and synergies with recently acquired snack business Snyder’s-Lance.

This isn’t quite fair. Compared with Campbell’s plan, Third Point puts greater emphasis on stabilizing the core soup business by improving old recipes and removing unappealing ingredients like monosodium glutamate. It cites the precedent of Conagra’s successful renovation of old brands, which is rapidly becoming an industry model.

Campbell, by contrast, has focused most of its innovation away from its core. On Monday, it unveiled a new line of “Well Yes!” branded soups, in packages made for sipping soup on the go, with novel flavors like “sweet corn and roasted poblano.” Third Point is likely right that it would be better to update the company’s old classics and stop them from decaying.

Third Point also calls for a rethink of Campbell’splanned divestitures. This includes the international snack business, which has real potential, and smoothie and carrot maker Bolthouse Farms, which is troubled but likely couldn’t be sold for anything but a fire-sale price.

Finally, Third Point envisions a possible split between the grocery and snacks businesses, the merits of which are debatable, but which at least shows more willingness to countenance bold changes than Campbell has displayed so far.

Especially powerful is what Third Point has left unsaid—the possibility that Campbell’s dividend may need to be cut tofund new investments. This isn’t proposed anywhere in the plan, but is hinted at in Third Point’s strong language that Campbell is being run “for the benefit of corporate insiders and billionaire heirs.”

Family insiders opposed to Third Point own around 41% of the company and benefited from the $426 million of dividends it has paid out over the last four quarters.

This high ownership means Third Point faces steep odds in trying to replace the board. Even so, it would be in the own long-term interest of family members to at least listen to criticism from outsiders.

----