three months ended March 31, 2020. Additionally, we recognized unrealized losses of $2.3 million and $2.7 million on our investments in Finastra Group Holdings, Ltd. and ASP Chromaflo Technologies Corp., both of which were valued at March 31, 2020 based on active market prices.

Unrealized appreciation for the three months ended March 31, 2020 was primarily due to the sale of Commercial Barge in February 2020, for which we realized approximately $6.3 million of previously unrealized losses. In the table above, the presentation of gross unrealized appreciation and depreciation amounts for the three months ended March 31, 2020 has been updated consistent with the current year presentation which groups the funded and unfunded portion of revolvers together.

For the year ended December 31, 2020, net unrealized depreciation was largely driven by decreases in portfolio company valuations as compared to the prior year end. Most notably, we recognized unrealized depreciation of $16.1 million on our investment in Avanti 2nd lien secured bond, approximately $8.0 million on our investments in CPK, which went through a restructuring in November, and $4.1 million on our investment in Davidzon.

During the year ended December 31, 2020, unrealized appreciation was primarily due to the sales of Commercial Barge in February and TFC in November, for which we relieved approximately $6.3 million and $1.2 million, respectively, of unrealized losses on the positions as of December 31, 2019. In addition, we had unrealized appreciation due to increases in fair value of investments, including $3.2 million on investment in Crestwood, $2.4 million on our investment in Prestige, and $1.1 million on our investment in APTIM Corp.

For the year ended December 31, 2019, net unrealized depreciation was primarily driven by our investments in Avanti, Commercial Barge, Tru Taj and PFS, for which we recognized unrealized depreciation of $7.9 million, $4.7 million, $4.2 million and $2.1 million, respectively. The net unrealized depreciation for Avanti and Tru Taj are primarily driven by decreases in the fair value of the investment while net unrealized depreciation for Commercial Barge reflects both a decrease in the fair value of the investment and increase in the cost basis of the investment as a result of the accretion of discount.

During the year ended December 31, 2019, we recognized unrealized appreciation of $1.0 million and $0.4 million as a result of the sale of our investments in International Wire and SESAC, respectively. In addition, we recognized unrealized appreciation of $0.7 million, $0.6 million and $0.5 million as a result of increased fair value of our investments in Finastra Holdings Group, Ltd., Subcom, LLC, and Mitchell International, Inc., respectively. In the table above, the presentation of gross unrealized appreciation and depreciation amounts for the year ended December 31, 2019 has been updated consistent with the current year presentation which groups the funded and unfunded portion of revolvers together.

As discussed under “—Recent Developments”, we cannot predict the duration of the COVID-19 pandemic and the resulting impact to our individual portfolio companies or the broader market. It is likely that any recovery may be slow and/or volatile. The current unrealized depreciation on our portfolio may not be reversed in the short-term or at all and we may see further declines in fair value before the pandemic is over.

Liquidity and Capital Resources

This “—Liquidity and Capital Resources” discussion should be read in conjunction with the discussion of COVID-19 under “—Recent Developments—COVID 19”.

At March 31, 2021, we had approximately $26.6 million of cash and cash equivalents. At March 31, 2021, we had investments in 33 debt instruments across 29 companies, totaling approximately $135.5 million at fair value and 135 equity investments in 116 companies, totaling approximately $58.1 million at fair value.

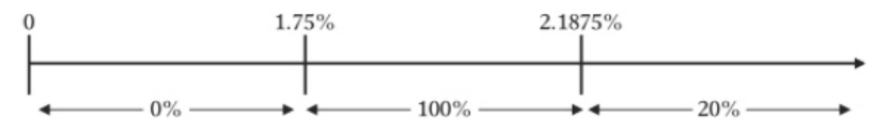

In the normal course of business, we may enter into investment agreements under which we commit to make an investment in a portfolio company at some future date or over a specified period of time. As of March 31, 2021, we had approximately $31.4 million in unfunded loan commitments, subject to our approval in certain instances, to provide debt financing to certain of our portfolio companies. We had sufficient cash and other liquid assets on our March 31, 2021 balance sheet to satisfy the unfunded commitments.

For the three months ended March 31, 2021, net cash used for operating activities was approximately $24.1 million, reflecting the purchases and repayments of investments offset by net investment income, including non-cash income related to accretion of discount and PIK income and proceeds from sales of investments and