Mandatory Exchangeable Trust

NOTES TO FINANCIAL STATEMENTS

As of and for the six months ended June 30, 2016

(Unaudited)

The Mandatory Exchangeable Trust ("Trust") was established on May 20, 2016 and is registered as a non-diversified, closed-end investment company under the Investment Company Act of 1940, as amended (the "Act"). The Trust commenced operations on June 10, 2016. In June 2016, the Trust sold Mandatory Exchangeable Trust Securities (“Trust Securities") to qualified institutional buyers in reliance on Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”). The Trust Securities have not been registered for offering under the Act. The Trust used the net offering proceeds to purchase a portfolio comprised of U.S. Treasury Securities and to pay the purchase price for a forward purchase contract (the “Contract”) for shares of American Depository Shares (“ADSs”) of Alibaba Group Holding Limited ("Alibaba"), with an existing ADS holder of Alibaba, West Raptor Holdings, LLC (the “Shareholder”), an indirect subsidiary of SoftBank Group Corp., a company incorporated under the laws of Japan. Under the terms of the Contract, at the Shareholder’s discretion, the Trust will exchange each Trust Security for either (i) a certain number of ADSs of Alibaba, or (ii) cash equal to the value of the Alibaba ADSs on the Exchange Date, June 1, 2019. The Trust will thereafter terminate.

The Trust has entered into an Administration Agreement with U.S. Bank National Association (the "Administrator") to provide administrative services to the Trust.

| 2. | Significant Accounting Policies |

A. Basis of Accounting

The accompanying financial statements of the Trust have been prepared on an accrual basis in conformity with U.S. generally accepted accounting principles (U.S. GAAP).

B. Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amount of assets and liabilities, recognition of distribution income and disclosure of contingent assets and liabilities at the date of the financial statements. Actual results could differ from those estimates.

C. Investment Valuation

The Trust will use the following valuation methods to determine either current market value for investments for which market quotations are available, or if not available, the fair value, as determined in good faith pursuant to such policies and procedures approved by the Trust’s Board of Trustees (“Board of Trustees”) from time to time. The valuation of the portfolio securities of the Trust currently includes the following processes:

| (i) | the U.S. Treasury Securities held by the Trust will be valued at the mean between the last current bid and asked prices or, if quotations are not available, as determined in good faith by the Board of Trustees, |

| (ii) | short-term investments having an original maturity of 60 days or less will be valued at cost with accrued interest or discount earned included in interest receivable, and |

| (iii) | the Contract will be valued using a market based approach on the basis of the bid price received by the Trust for the Contract, or any portion of the Contract covering not less than 1,000 shares, from an independent valuation firm unaffiliated with the Trust to be named by the Board of Trustees who is in the business of making bids on financial instruments similar to the Contract and with comparable terms, or if such a bid quotation is not available, as determined in good faith by the Board of Trustees. |

In order to determine the Contract fair value at June 30, 2016 the Trust engaged an independent valuation firm with expertise in valuing this type of Contract. The independent valuation firm developed the fair value of the Contract using a discounted cash flow analysis in conjunction with a Monte Carlo model that simulated potential future payouts under the Contract.

D. Security Transactions and Investment Income

Securities transactions are accounted for as of the date the securities are purchased and sold (trade date). Interest income is recorded as earned and includes accrual of discount. Unrealized gains and losses are accounted for on the specific identification method. Amortized cost valuation represents cost, adjusted for a proportional increase or decrease in value due to the discount or premium until maturity.

E. Forward Purchase Contract

On June 10, 2016, the Trust entered into the Contract, which is a derivative instrument, with the Shareholder and paid to the Shareholder $5,400,894,000 in connection therewith. Pursuant to this Contract, the Shareholder is obligated to deliver to the Trust a specified number of Alibaba ADS on June 1, 2019 (the "Exchange Date") so as to permit the holders of the Trust Securities to exchange on the Exchange Date each of their shares of Trust Securities.

At June 30, 2016, the Contract had the following value:

Forward Contract | Exchange Date | Cost of Contract | Contract Fair Value | Net Unrealized Appreciation |

| Shareholder – West Raptor Holdings, LLC | 06/01/2019 | $5,400,894,000 | $6,287,160,000 | $886,266,000 |

The cost and value of the Contract are included in investments, at fair value in the Statement of Assets and Liabilities. The net change in unrealized appreciation in the Statement of Operations is included in the net unrealized appreciation on investments in the Statement of Assets and Liabilities.

The Shareholder’s obligation under the Contract is collateralized by Alibaba ADS which are being held in the custody of the Trust’s Custodian, U.S. Bank National Association. At June 30, 2016, the Custodian held 66,000,000 shares of Alibaba ADS with an aggregate value of $5,248,980,000.

Trust Securities holders are entitled to receive distributions from the maturity of U.S. Treasury Securities of $1.4375 per quarter (except for the first distribution on September 1, 2016 of $1.2938), payable quarterly which commenced September 1, 2016.

The Trust is not an association taxable as a corporation for Federal or State income tax purposes; accordingly, no provision is required for such taxes. Specifically, the Trust is a grantor trust under the U.S. federal and State income tax laws and as such, Trust Securities holders will be treated as if each holder owns directly its proportionate share of the assets held by the Trust.

As of June 30, 2016, gross unrealized appreciation and depreciation of investments, based on cost for Federal income tax purposes, aggregated $889,299,220 and $0, respectively. The aggregate cost of investments for Federal income tax purposes was $6,516,619,437 at June 30, 2016.

| 5. | Fair Value Measurements |

Under generally accepted accounting principles for fair value measurements, a three-tier hierarchy to prioritize the assumptions, referred to as inputs, is used in valuation techniques to measure fair value. The three-tier hierarchy of inputs is summarized in the three broad levels listed below.

Level 1: Quoted prices (unadjusted) in active markets that are accessible at the measurement date for identical assets or liabilities.

Level 2: Valuations that are based on other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment spreads, credit risk, etc.)

Level 3: Valuations based on significant unobservable inputs that are not corroborated by market data.

In cases where the inputs used to measure fair value fall in different levels of the fair value hierarchy, the level disclosed is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used to value the Fund’s investments as of June 30, 2016:

| | | | | | Fair Value Measurements at June 30, 2012 Using | |

| | | | | | Quoted Prices in | | | | | | Significant | |

| | | | | | Active Markets for | | | Significant Other | | | Unobservable | |

| | | Fair Value at | | | Identical Assets | | | Observable Inputs | | | Inputs | |

| Description | | June 30, 2016 | | | (Level 1) | | | (Level 2) | | | (Level 3) | |

| Other | | | | | | | | | | | | |

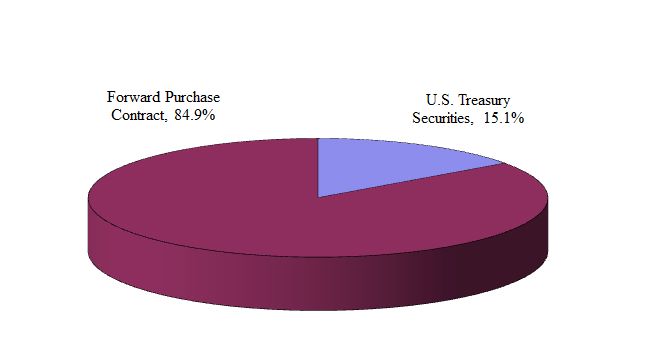

| U.S. Treasury Securities | | $ | 1,118,758,657 | | | $ | 1,118,758,657 | | | $ | - | | | $ | - | |

| Total Other | | | 1,118,758,657 | | | | 1,118,758,657 | | | | - | | | | - | |

| Derivative Instruments | | | | | | | | | | | | | | | | |

| Forward Purchase Contract | | | 6,287,160,000 | | | | - | | | | - | | | | 6,287,160,000 | |

| Total Derivative Instruments | | | 6,287,160,000 | | | | - | | �� | | - | | | | 6,287,160,000 | |

| Total | | $ | 7,405,918,657 | | | $ | 1,118,758,657 | | | $ | - | | | $ | 6,287,160,000 | |

| | | | | | | | | | | | | | | | | |

During the period from June 10, 2016 through June 30, 2016, there were no transfers between Level 1, Level 2 and Level 3.

| | Fair Value Measurements Using Significant Unobservable Inputs (Level 3) for Investments for the period ended June 30, 2016 |

| Fair Value Beginning Balance | | $ | - | |

| Increase in Unrealized Gains Included in Net Increase in Net Assets Applicable to Trust Security Holders | | | 886,266,000 | |

| Net Purchases, Issuances and Settlements | | | 5,400,894,000 | |

| Transfers Out of Level 3 | | | - | |

| Fair Value Ending Balance | | $ | 6,287,160,000 | |

The following table is a summary of quantitative information about significant unobservable valuation inputs for Level 3 fair value measurement for investments held as of June 30, 2016.

| Type of Asset | | Fair Value as of June 30, 2016 | | Valuation Technique | Unobservable Input |

| Forward Purchase Contract | | $ | 6,287,160,000 | | Income Approach Pricing Model | Stock price of underlying asset. Returns of the S&P 500 Index |

| 6. | Investment Transactions |

For the period from June 10, 2016 through June 30, 2016, the Trust purchased U.S. Treasury Securities (at cost) and the Contract (at cost) in the amount of $1,115,291,925 and $5,400,894,000, respectively. The Trust did not sell any securities during the period ended June 30, 2016.

| 7. | Capital Share Transactions |

During the period from June 10, 2016 through June 30, 2016, the Trust sold 66,000,000 Trust Securities to qualified institutional buyers in reliance on Rule 144A under the Securities Act and received net proceeds of $6,517,500,000 ($6,600,000,000 net of selling commissions of $82,500,000). As of June 30, 2016, there were 66,000,000 Trust Securities issued and outstanding.

The Trust has performed an evaluation of subsequent events through the date the financial statements were available to be issued. No subsequent events or transactions had occurred that would have materially impacted the financial statements as presented.

Mandatory Exchangeable Trust

ADDITIONAL INFORMATION

June 30, 2016

(Unaudited)

Trustee Compensation

The Trust does not compensate any of its trustees who are interested persons. For the period ended June 30, 2016, the aggregate compensation paid by the Trust to the independent trustees was $84,000. The Trust did not pay any special compensation to any of its trustees. The Trust’s Statement of Additional Information includes additional information about the trustees and is available on the SEC’s Web site at www.sec.gov.

Form N-Q

The Trust will file its complete schedule of portfolio holdings for the first and third quarters of each fiscal year with the SEC on Form N-Q. The Trust’s Form N-Q and Form N-2 will be available on or before their respective filing dates without charge by visiting the SEC’s Web site at www.sec.gov. In addition, you may review and copy the Trust’s Form N-Q at the SEC’s Public Reference Room in Washington D.C. You may obtain information on the operation of the Public Reference Room by calling (800) SEC-0330.