UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN

PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ¨ Filed by a Party other than the Registrant x

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | | Definitive Proxy Statement |

| x | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to § 240.14a-12 |

GAS NATURAL INC.

(Name of Registrant as Specified in Its Charter)

Richard M. Osborne,

Darryl L. Knight,

Terence S. Profughi,

Joseph M. Gorman,

Martin W. Hathy, and

Lauren Tristano

The Committee to Re-Energize Gas Natural

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with proxy materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount previously paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

THE COMMITTEETO RE-ENERGIZE GAS NATURAL

June 16, 2016

Dear Fellow Gas Natural Shareholder:

It is time for change at Gas Natural and that change begins with the Board. You have an important decision to make that could significantly impact the value of your investment in Gas Natural. This is your opportunity to once again vote for the future of Gas Natural. The Committee to Re-Energize Gas Natural (the “Committee”), led by Richard M. Osborne, Sr., has nominated a slate of six highly-qualified director candidates to replace the current Board of Directors at the 2016 annual meeting of shareholders.

We strongly urge you to support our efforts to elect our nominees by signing, dating and returning the enclosed WHITE proxy card in the postage paid envelope provided. If you have already voted a proxy card furnished by Gas Natural, you have every right to change your votes by signing, dating and returning a later dated proxy card or by voting in person at the annual meeting.

OVERVIEW OF THE COMMITTEE’S CONCERNS

Notwithstanding the success of Gas Natural under Mr. Osborne’s stewardship since 2003, in 2014 the Board replaced Mr. Osborne as CEO with his son, Gregory, and then removed Mr. Osborne from the Board by not nominating him for re-election at the 2014 annual meeting of shareholders.

In the two short years since Mr. Osborne’s ouster:

| | • | | Gas Natural’s financial performance has suffered significantly; |

| | • | | Gas Natural’s common stock price has fallen from an all-time high (dividend and split adjusted) of about $12.00 per share to a closing price of $6.90 per share on May 24, 2016, the last trading day before our nomination became public; |

| | • | | Executive compensation has soared while Gas Natural has cut its dividend payment to shareholders by almost 45%; and |

| | • | | The Board has engaged in questionable corporate governance practices. |

SINCE OUSTING MR. OSBORNE IN 2014, THE COMPANY’S PERFORMANCE HAS SUFFERED ALONG WITH ITS STOCK PRICE

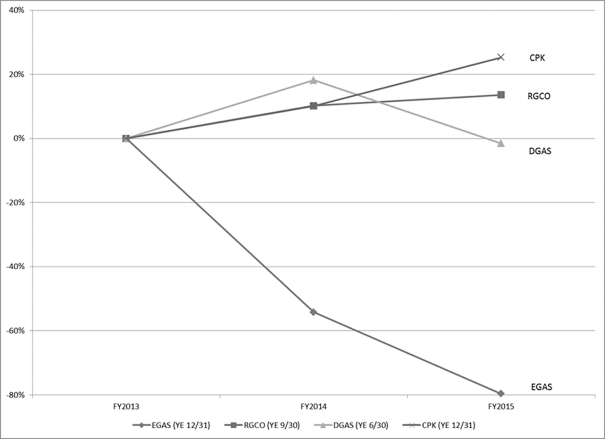

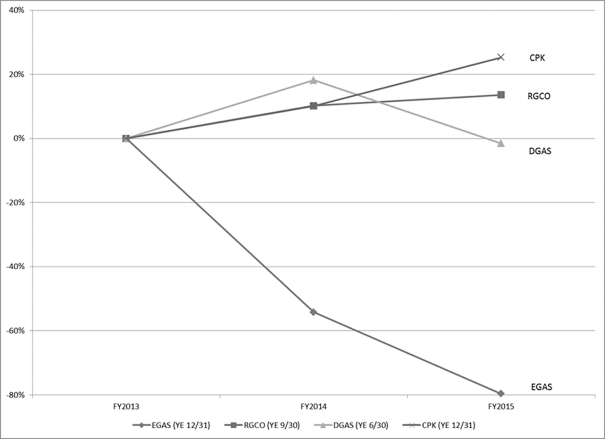

Gas Natural’s financial performance has suffered since Mr. Osborne last supervised the Company’s operations as Chairman and CEO. The following chart and graph illustrate the dramatic decline in the Company’s annual operating income since fiscal year 2013, Mr. Osborne’s last full fiscal year as the Company’s Chairman and CEO, as compared to some of its peers (dollars in millions).

| | | | | | | | | | | | | | | | |

| | | Fiscal Year

2013 | | | Fiscal Year

2014 | | | Fiscal Year

2015 | | | % Change

(2013-2015) | |

Gas Natural (YE 12/31) | | $ | 5.9 | | | $ | 2.7 | | | $ | 1.2 | | | | (80 | %) |

RGC Resources (YE 9/30) | | $ | 8.8 | | | $ | 9.7 | | | $ | 10.0 | | | | 14 | % |

Delta Natural Gas Company (YE 6/30) | | $ | 13.2 | | | $ | 15.6 | | | $ | 13.0 | | | | (2 | %) |

Chesapeake Utilities (YE 12/31) | | $ | 32.8 | | | $ | 36.1 | | | $ | 41.1 | | | | 25 | % |

Notwithstanding the fact that the same market conditions have affected these comparable companies, their performance improved, or at least remained stable, compared to Gas Natural over the same period. The market has punished Gas Natural’s stock price as a result.

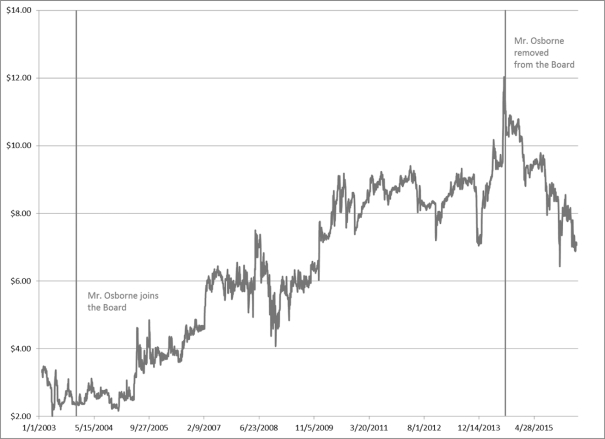

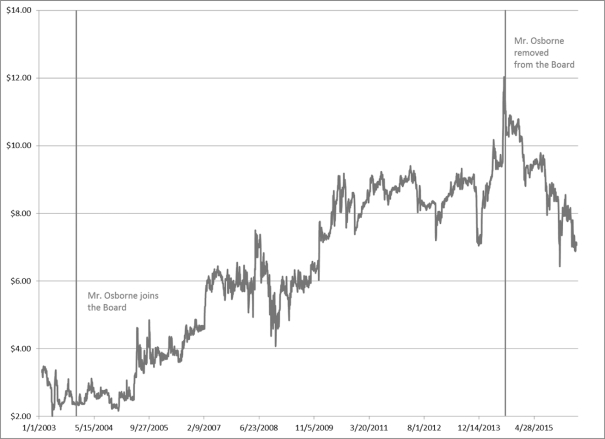

The following two graphs clearly demonstrate the effect Mr. Osborne’s stewardship had on the performance of the Company since he was first elected to the Board in 2003 and the disastrous performance of the Company since his ouster in 2014. Under Mr. Osborne’s stewardship, Gas Natural’s stock price increased from a low of about $2.40 in December 2003, to an all-time high in the summer of 2014 of about $12.00, adjusted for dividends and stock splits.

Source: Yahoo! Finance

Since reaching that all-time high, Gas Natural’s shares have declined in value to a closing price of $6.90 on May 24, 2016, the last trading day before our nomination became public, a near steady decline in value of almost 43% since Mr. Osborne’s ouster in 2014. By comparison, over the same time period, the stock price for both Delta Natural Gas Company and Chesapeake Utilities increased almost 40%, and the stock price for RGC Resources, Inc. increased almost 26%.

Source: Yahoo! Finance

EXECUTIVE COMPENSATION AND DIRECTOR FEES HAVE SOARED WHILE THE BOARD HAS CUT OUR DIVIDEND PAYMENT BY 45%

Since Mr. Osborne was removed from the Board of Directors in 2014, not only has the company’s performance suffered, but to make matters worse, the executive compensation at Gas Natural has soared. Gregory Osborne’s base salary soared $132,000, or almost 53%, from 2014 to 2015. Similarly, James Sprague’s base salary soared $156,000, or almost 80%, from 2014 to 2015. Other executives saw total compensation increase as well. Even more alarming is the fact that the Board increased executive compensation even though shareholder support (or lack thereof) for the Company’s say-on-pay proposal had declined to 66.9% of shares voted in 2014 from 89.2% of shares voted in 2013, Mr. Osborne’s last full year as the Company’s Chairman and CEO. This decline, in turn, prompted ISS to recommend a vote against the Company’s say-on-pay proposal in 2015, which only received support from 67.7% of shares voted. Meanwhile, the average support level for say-on-pay proposals in 2015 was 91% for the Russell 3000 Companies.

Similarly, prior to May 2013, director fees were $3,500 per meeting. In July 2013, at the only meeting Mr. Osborne ever missed (due to health reasons) in his entire tenure as a director of Gas Natural, the Board voted to increase director fees to $4,200 per meeting. After Mr. Osborne was removed from the Board in 2014, the Board again approved an increase in director fees, this time to $5,000 per month (as opposed to per meeting), and granted themselves $40,000 worth of stock, with total compensation for some directors exceeding $93,000. We believe these actions show blatant disregard for shareholders’ interests and demonstrate that current management is more interested in enriching themselves than improving company performance.

While the Board determined there was plenty of money available to ratchet up executive compensation and director fees, on April 21, 2016, the Company announced that it cut the dividend paid to shareholders to $0.30 per share annually, a 45% decline from the previous annual rate of $0.54 per share. While the Company claimed in that same announcement that executive management and the Board reduced their compensation (and the Company’s proxy materials disclose that director compensation was reduced to $4,000 per month), both are significantly higher than they were when Mr. Osborne last sat on the Board. This situation is tantamount to a retailer increasing prices and then announcing a sale.

THE BOARD HAS PRACTICED QUESTIONABLE CORPORATE GOVERNANCE

On August 4, 2014, the Board adopted an amendment to the Company’s Code of Regulations to increase the stock ownership percentage required to call a special meeting of the Company’s shareholders from 10% to 25%. By its own admission, the Board adopted this amendment in response to a shareholder’s attempt to call a special meeting to remove the then current Board. Ironically, that shareholder held less than 5% of the Company’s outstanding stock and was unable to get any other shareholder to act with it to call the special meeting even under the then existing regulations. Nonetheless, the Board acted to entrench itself and increase the stock ownership required to call a special meeting by 150%. Then, on July 23, 2015, Gas Natural announced that it had entered into indemnification agreements with each of its directors, which will serve to insulate them from liability for their actions.

The Company rationalized this change to the Code in part by citing to the fact that 25% is the statutory default under Ohio corporate law to call a special meeting. What they failed to mention is that the statute also allows the Board to lower the threshold, which the Board determined to do under Mr. Osborne’s stewardship. The Committee believes a lower threshold is more shareholder friendly than a higher threshold. In fact, independent corporate governance advocates like ISS recommend a threshold of 10%, the Company’s prior standard. Furthermore, the ISS voting guidelines provide that ISS will generally recommend a vote against or withhold from directors individually, committee members, or the entire board (except new nominees, who should be considered case-by-case) if the board amends the company’s bylaws or charter without shareholder approval in a manner that materially diminishes shareholders’ rights or that could adversely impact shareholders. The Committee believes the unilateral action of the Board, without seeking shareholder approval, to reduce the threshold, rather than the threshold itself, is the most problematic aspect of this Board action.

Furthermore, during his tenure as Chairman and CEO of Gas Natural, Mr. Osborne did not have an employment agreement. Immediately upon Mr. Osborne’s ouster in 2014, the Company entered into an employment agreement with Gregory Osborne that increased his base salary by 10% to $275,000, entitled him to annual equity grants, provided for certain other perquisites and provided for severance benefits upon his termination of employment in certain circumstances. The Company subsequently entered into employment agreements, also containing severance payments in certain circumstances, with Kevin J. Degenstein, Chief Operating Officer and Chief Compliance Officer, and Jed Henthorne, Corporate Controller.

Of particular note, the severance provisions in these employment agreements guarantee minimum severance payments to these executives if the executive is terminated without cause, and the definition of cause in their agreements does not include poor performance. Gregory Osborne’s agreement even provides for severance if the Company simply decides not to renew his agreement. In other words, unless Gregory Osborne voluntarily resigns from the Company, he will receive severance compensation in an amount equal to two times his annual base salary in effect at the time plus a cash lump sum payment equal to the pro-rated portion of his annual performance-based bonus in effect at the time. In short, Gregory Osborne will be paid at least $764,000 (based on his base compensation as reported in the Company’s proxy statement) if he leaves the Company for any reason other than he quits. Why would he ever quit?

The enclosed proxy statement provides a complete discussion of why we believe the current Board should be replaced in its entirety. If you have any lingering doubts after reading this letter, we encourage you to read the proxy statement for the complete discussion.

You have a choice to bring positive change that could significantly impact your investment in Gas Natural. Please sign, date and mail the enclosed WHITE proxy card today.

The Committee to Re-Energize Gas Natural

Richard M. Osborne, Sr.

IMPORTANT

Your vote is important, no matter how many Shares you own. We urge you to sign, date, and return the enclosed WHITE proxy card today to vote FOR the election of our Nominees.

| | • | | If your Shares are registered in your own name, please sign and date the enclosedWHITEproxy card and return it in the enclosed envelope today. |

| | • | | If your Shares are held in a brokerage account or bank, you are considered the beneficial owner of the Shares, and these proxy materials, together with aWHITE voting form, are being forwarded to you by your broker or bank. As a beneficial owner, you must instruct your broker, trustee or other representative how to vote.Your broker cannot vote your Shares on your behalf without your instructions. |

| | • | | Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or by the Internet. Please refer to the enclosed voting form for instructions on how to vote electronically. You may also vote by signing, dating and returning the enclosed voting form. |

Since only your latest dated proxy card will count, we urge you not to return any proxy card you receive from the Company. Even if you return the management proxy card marked “withhold” as a protest against the incumbent directors, it will revoke any proxy card you may have previously sent to us. Remember, you can vote for our six Nominees only on ourWHITEproxy card. So please make certain that the latest dated proxy card you return is theWHITEproxy card.

If you have any questions, require assistance in voting yourWHITEproxy card,

or need additional copies of the Participants’ proxy materials,

please contact Georgeson at the phone number or email listed below.

Georgeson LLC

1290 Avenue of the Americas, 9th Floor

New York, NY 10104

Call Toll-Free: (888) 219-8320

Or email ReEnergizeEgas@Georgeson.com

FOR IMMEDIATE RELEASE

June 16, 2016

THE COMMITTEE TO RE-ENERGIZE GAS NATURAL

ANNOUNCES MAILING OF PROXY STATEMENT

Mentor, Ohio, June 16, 2016 – The Committee to Re-Energize Gas Natural announced today that it has begun mailing its proxy statement in connection with the 2016 Annual Meeting of Shareholders of Gas Natural Inc. (NYSE: EGAS). In its proxy materials, the Committee proposes to elect six director candidates to replace the current Board of Directors.

The Committee, which was formed by Richard M. Osborne, Sr., the former Chairman and CEO of Gas Natural, also issued the following statement:

Since I departed from the Gas Natural Board in 2014, Gas Natural’s financial performance has suffered significantly and its dividend payment to shareholders was cut by almost 45%, yet executive compensation has soared. The Committee urges shareholders to review the Committee’s proxy statement for a complete discussion of the Committee’s concerns with the management of the Company. The Committee seeks the shareholders’ help to hold management and the current board responsible for the Company’s declining financial performance at the upcoming annual meeting.

Vote for the Committee’s highly-qualified director candidates on the WHITE proxy card.

If you have any questions, require assistance in voting your WHITE proxy card, or need additional copies of the Committee’s proxy materials, please contact the Committee’s proxy solicitor, Georgeson LLC, at its toll-free number (888) 219-8320 or at ReEnergizeEgas@Georgeson.com. You may also download copies of the Committee’s proxy materials, as well as review related information, at www.ReEnergizeEgas.com.

Investor Contact:

Bill Fiske

Georgeson LLC

(212) 440-9128