UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN

PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ¨ Filed by a Party other than the Registrant x

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | | Definitive Proxy Statement |

| x | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to § 240.14a-12 |

GAS NATURAL INC.

(Name of Registrant as Specified in Its Charter)

Richard M. Osborne,

Darryl L. Knight,

Terence S. Profughi,

Joseph M. Gorman,

Martin W. Hathy, and

Lauren Tristano

The Committee to Re-Energize Gas Natural

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with proxy materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount previously paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

The Committee to Re-Energize Gas Natural July 5, 2016 The Committee to Re-Energize Gas Natural made the following presentation to Institutional Shareholder Services, Inc., on July 5, 2016.

Gas Natural Overview Operates local natural gas distribution companies in Maine, Montana, North Carolina, and Ohio Reports results in three business segments Natural Gas Marketing and Production Corporate and other (acquisitions, equity transactions, discontinued operations)

About the Committee Led by Richard M. Osborne, Sr., former Chairman and Chief Executive Officer of Gas Natural Composed of six director candidates nominated to replace current Board Richard M. Osborne, Sr. Darryl L. Knight Terence S. Profughi Joseph Michael Gorman (Mike) Martin W. Hathy Lauren Tristano Experienced in forming, operating and supervising complicated operating companies, including in the utilities industry

Underperforming & Overcompensated Gas Natural’s financial metrics have plummeted since Mr. Osborne was ousted in 2014 while management enriches itself at the expense of shareholders. Operating income has plummeted 80%. Stock prices have dropped almost 43% and dividends have been cut by 45%; by contrast, Mr. Osborne delivered almost a 475% total return to shareholders from 2003 to 2014. Management and director compensation has skyrocketed. The Board has unilaterally amended the Company’s Code of Regulations. The Board has given management severance agreements and itself indemnification agreements.

Our Action Plan Our nominees would use the detailed financial and operational information available to them as directors to pursue the following objectives: Reinstate the Company’s dividend to $0.54 annually as soon as possible, though we may first need to improve the Company’s financial performance which has suffered under current management. Amend the Company’s Code of Regulations to restore all shareholder rights eliminated by the current Board. Terminate all employment agreements with the executive officers of the Company (in a way to minimize any financial impact on the Company). Increase customer growth, in part by hiring additional field representatives to service customers. Improve gross margins by cutting expenses, including executive compensation. Rationalize the Company’s capital structure to avoid borrowing from shareholders at above market interest rates. Provide management with strategic, operational and financial oversight necessary to establish a strategic vision for the Company’s business.

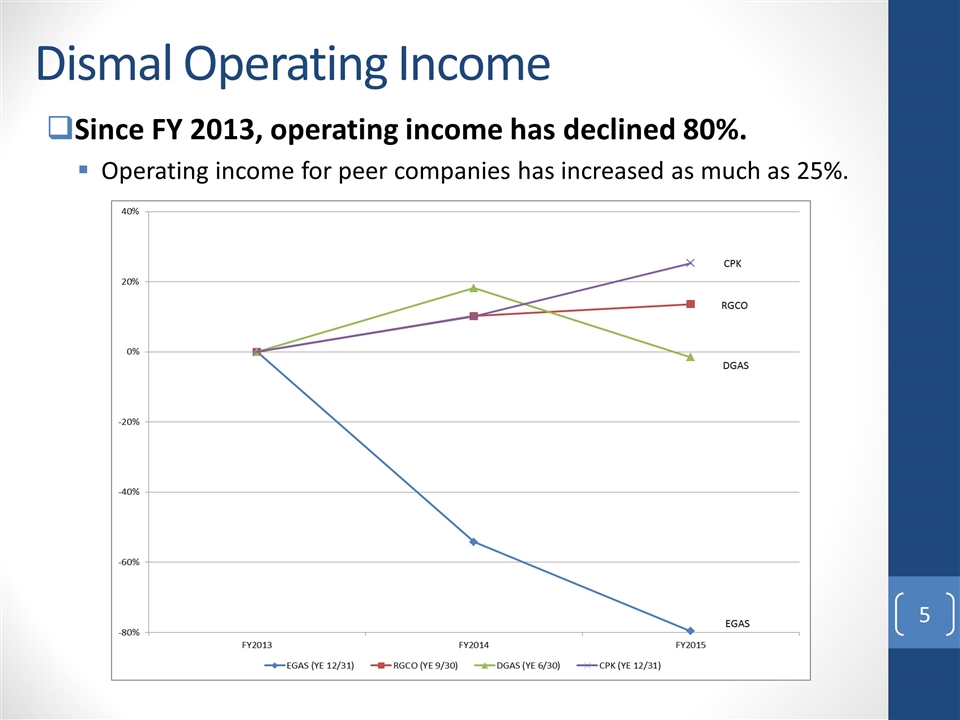

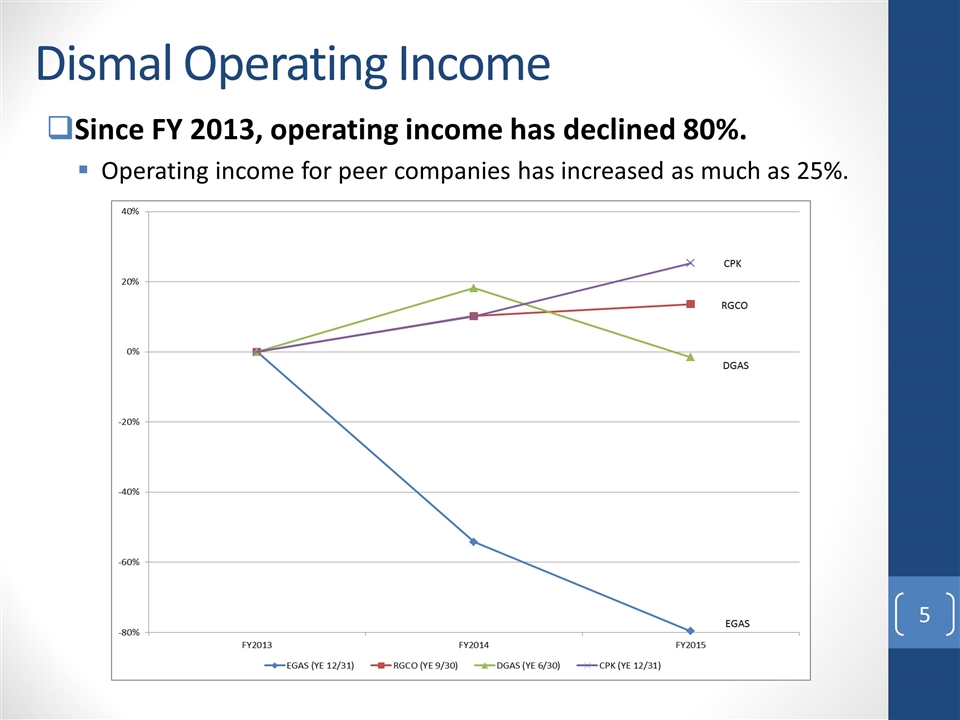

Dismal Operating Income Since FY 2013, operating income has declined 80%. Operating income for peer companies has increased as much as 25%.

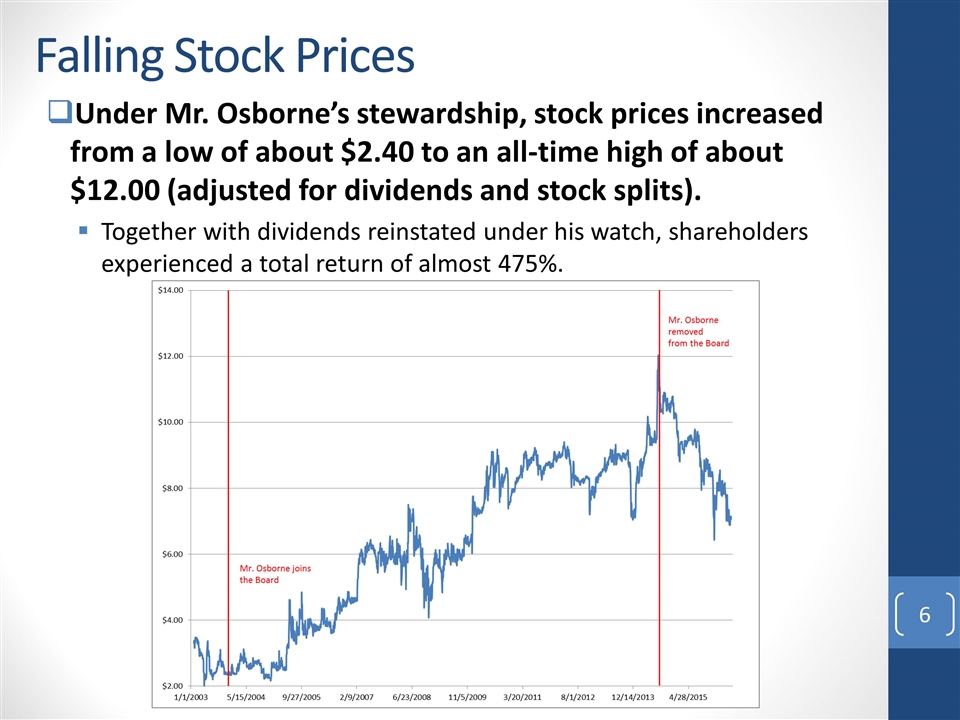

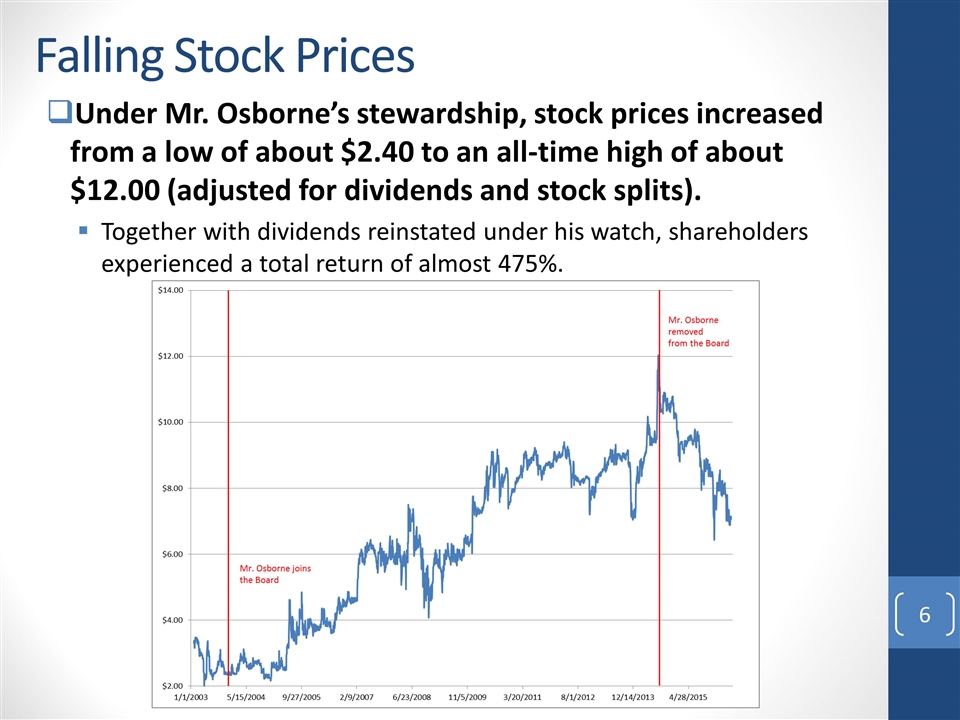

Falling Stock Prices Under Mr. Osborne’s stewardship, stock prices increased from a low of about $2.40 to an all-time high of about $12.00 (adjusted for dividends and stock splits). Together with dividends reinstated under his watch, shareholders experienced a total return of almost 475%.

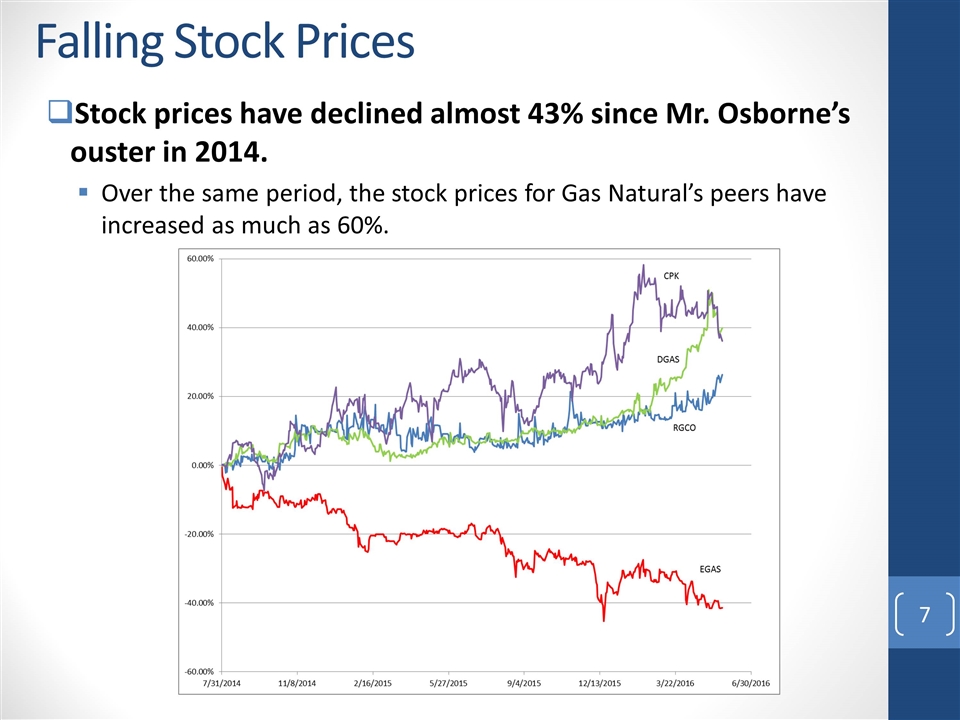

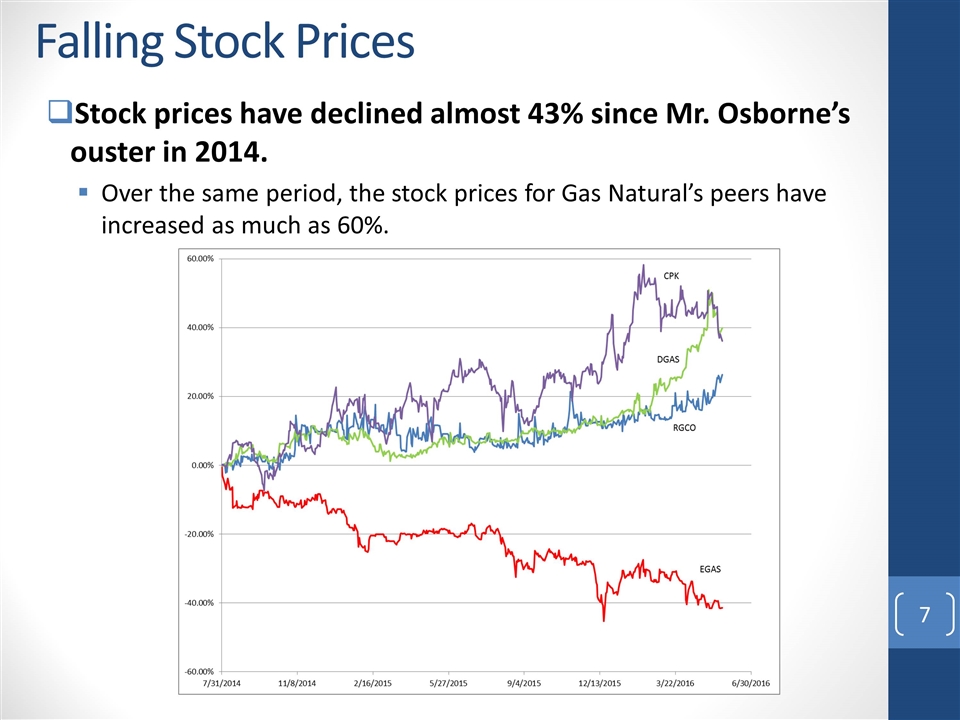

Falling Stock Prices Stock prices have declined almost 43% since Mr. Osborne’s ouster in 2014. Over the same period, the stock prices for Gas Natural’s peers have increased as much as 60%.

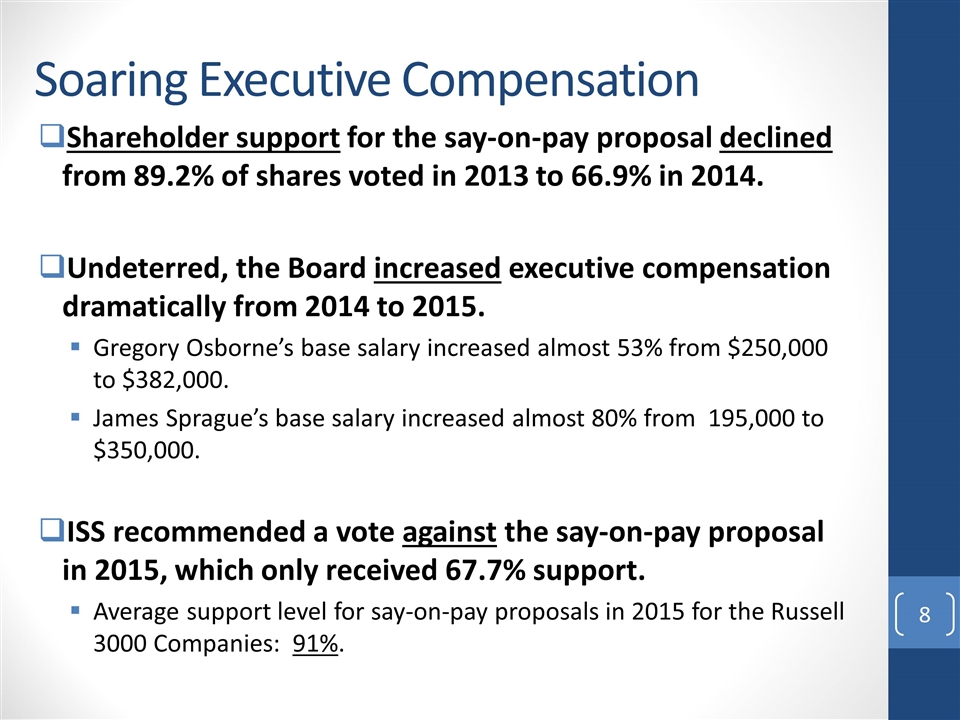

Shareholder support for the say-on-pay proposal declined from 89.2% of shares voted in 2013 to 66.9% in 2014. Undeterred, the Board increased executive compensation dramatically from 2014 to 2015. Gregory Osborne’s base salary increased almost 53% from $250,000 to $382,000. James Sprague’s base salary increased almost 80% from 195,000 to $350,000. ISS recommended a vote against the say-on-pay proposal in 2015, which only received 67.7% support. Average support level for say-on-pay proposals in 2015 for the Russell 3000 Companies: 91%. Soaring Executive Compensation

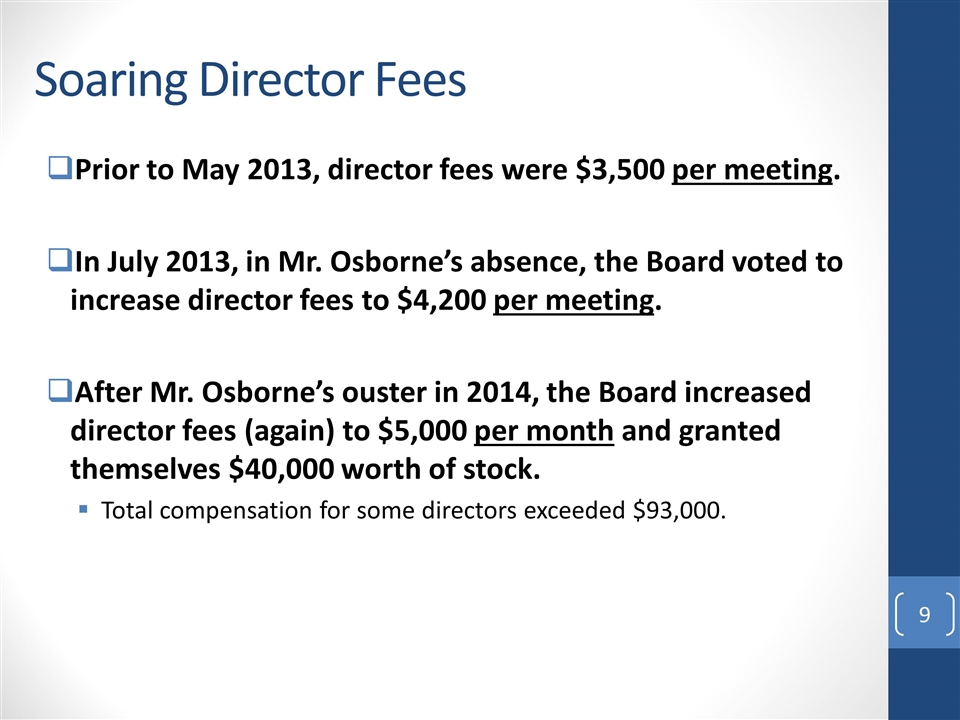

Soaring Director Fees Prior to May 2013, director fees were $3,500 per meeting. In July 2013, in Mr. Osborne’s absence, the Board voted to increase director fees to $4,200 per meeting. After Mr. Osborne’s ouster in 2014, the Board increased director fees (again) to $5,000 per month and granted themselves $40,000 worth of stock. Total compensation for some directors exceeded $93,000.

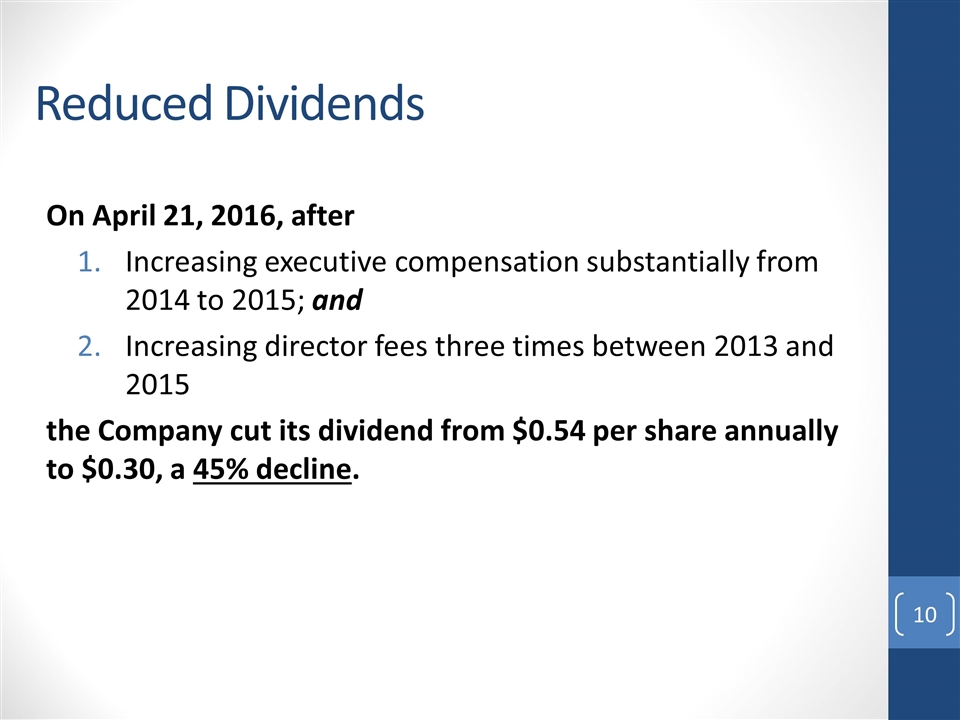

Reduced Dividends On April 21, 2016, after Increasing executive compensation substantially from 2014 to 2015; and Increasing director fees three times between 2013 and 2015 the Company cut its dividend from $0.54 per share annually to $0.30, a 45% decline.

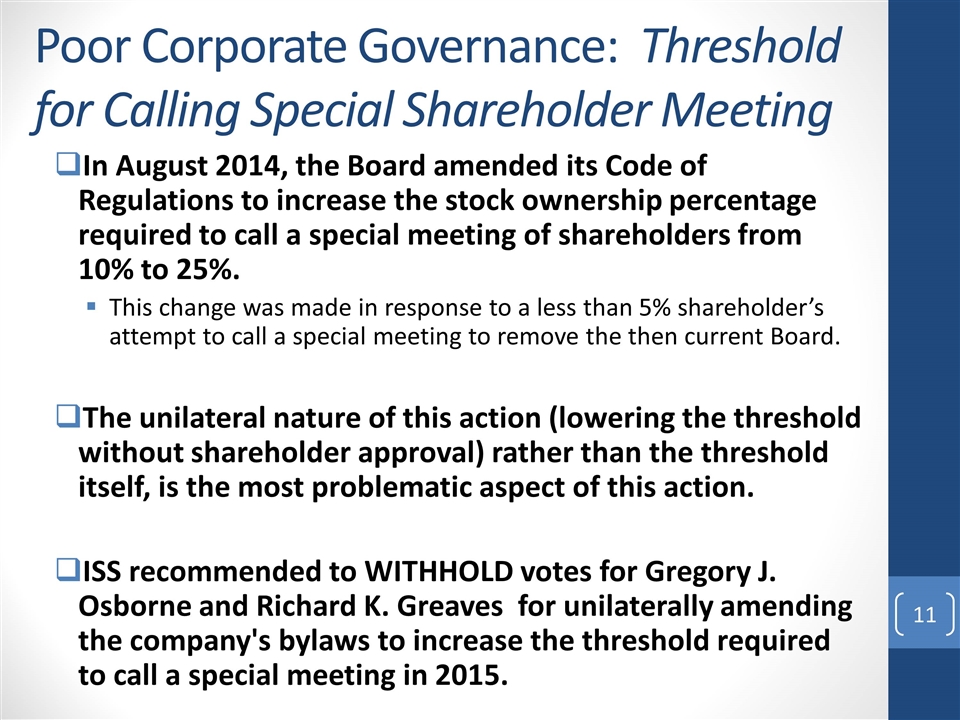

Poor Corporate Governance: Threshold for Calling Special Shareholder Meeting In August 2014, the Board amended its Code of Regulations to increase the stock ownership percentage required to call a special meeting of shareholders from 10% to 25%. This change was made in response to a less than 5% shareholder’s attempt to call a special meeting to remove the then current Board. The unilateral nature of this action (lowering the threshold without shareholder approval) rather than the threshold itself, is the most problematic aspect of this action. ISS recommended to WITHHOLD votes for Gregory J. Osborne and Richard K. Greaves for unilaterally amending the company's bylaws to increase the threshold required to call a special meeting in 2015.

Poor Corporate Governance: Employment Agreements Richard Osborne did not have an employment agreement during his tenure as CEO of Gas Natural. After Mr. Osborne’s ouster in 2014, the Company entered into an employment agreement with Gregory Osborne. Increased base salary 10% (subsequently increased another 40%). Entitled him to annual equity grants. Provided for severance benefits upon termination of employment. Also includes if Gas Natural simply does not renew his contract. The Company subsequently entered into employment agreements with remaining executives containing similar severance provisions. James E. Sprague, Vice President and Chief Financial Officer Kevin J. Degenstein, Chief Operating Officer and Chief Compliance Officer Jed Henthorne, Corporate Controller Vincent A. Parisi, Vice President and General Counsel

Poor Corporate Governance: Indemnification Agreements In July 2015, the Company entered into indemnification agreements with each of its directors. These agreements insulate the directors from liability for their actions.

The Company’s Mischaracterizations: Related Party Transactions The Company repeatedly attacks Mr. Osborne regarding the commercial relationships between the Company and Mr. Osborne’s entities. All were approved by a disinterested committee, and in some cases by shareholders. The Board’s own minutes state that “the board members agree that these transactions have been negotiated at arms-length and are beneficial…[and] essential to the Company and must continue.” Ironically, while originally expressing concern over the negative public perception over these arrangements, the Board is now the chief proponent of this misperception. The Company has retained favorable related-party contracts with Mr. Osborne despite their repeated rhetoric about seeking to terminate such agreements. Also despite the rhetoric, new related-party transactions continue, including multiple short-term loans the Company has taken out with NIL Funding, an affiliate of the Company’s largest shareholder and two of the Company’s current directors.

The Company’s Mischaracterizations: PUCO Order–Related Party Transactions The Board states that commercial arrangements between the Company and Mr. Osborne’s entities have “raised the concern of the Public Utilities Commission of Ohio.” The Company filed a complaint with the PUCO challenging a transportation service agreement between it and one of Mr. Osborne’s entities, Orwell-Trumbull Pipeline (OTP). The PUCO refused to terminate the contract, stating it is “in the best interests” of the Company and its customers to “maintain a working relationship” with OTP. The PUCO acknowledged the contract was negotiated at arm’s length, but, in order to protect consumers, reformed those terms that had become uneconomical to the Company since it was executed.

The Company’s Mischaracterizations: PUCO Order – Investigative Audit The Board repeatedly stresses that the investigative audit only identifies issues that took place when Mr. Osborne was Chairman and CEO. The audit was conducted after Mr. Osborne departed in 2014. The PUCO order never states that Mr. Osborne is personally culpable for the issues identified by the audit. Current directors Gregory Osborne and Richard Greaves and current CFO James Sprague were also directors of Gas Natural during the time covered by the audit. Three of the Company’s current executive officers, Gregory Osborne, Kevin J. Degenstein and Jed D. Henthorne, were also officers of Gas Natural during the time covered by the audit.

Biographies of Director Nominees Richard M. Osborne, Sr. Many years of experience owning and managing companies in energy and utility related industries. Past Positions Joined Gas Natural’s board as a director in 2003 and served as chairman of the board of the Company from 2005 to May 2014 and chief executive officer of the Company from November 2007 to May 2014. From 2010 to 2014, chairman of each of Northeast Ohio Natural Gas Corporation and Orwell Natural Gas Company, natural gas distribution companies acquired by Gas Natural in January 2010. From 2006 to February 2009 , director of Corning Natural Gas Corporation, a publicly-held public utility company in Corning, New York. From September 2008 to January 2009, director of PVF Capital Corp., a publicly-held holding company for Park View Federal Savings Bank in Solon, Ohio. Present Positions President and chief executive officer of OsAir, Inc., a company Mr. Osborne founded in 1963, which operates as a property developer and manufacturer of industrial gases for pipeline delivery. Since 1998, chairman of the board, chief executive officer and a director of John D. Oil and Gas Company, an oil and gas exploration company in Mentor, Ohio.

Biographies of Director Nominees Darryl L. Knight Years of industry experience and background managing companies in the energy and utility related industries. Present Position Since September 2014, President of Ohio Rural Natural Gas Co-Op, a natural gas distribution cooperative located in Mentor, Ohio. Past Positions From October 2012 through September 2014, President & General Manager of Frontier Natural Gas, a natural gas distribution company serving over 3,000 customers located in Elkin, NC. President of Independence Oil from December 2012 until November 2013 when it was sold to Blue Ridge Energies. Corporate Director of Purchasing for Gas Natural Inc. from February 2009 through October 2012. Vice President of Energy West Resources, a non-regulated division of Energy West Inc. located in Great Falls MT from May 2008 through February 2009.

Biographies of Director Nominees Terence S. Profughi Years of experience owning, acquiring and managing companies in energy and utility related industries. Present Position Since 1979, Chairman of Chagrin Venture Ltd. Inc., a holding company for investments in real estate and manufacturing companies ranging from the heat treating to commercial food equipment. Past Positions Chairman and CEO of Hi TecMetal Group, Inc., a specialist in the fields of brazing, heat treating and welding, from 1983 to 2016. Director of the Council of Smaller Enterprises (COSE) from 1985 to 1994. Director of First County Bank from 1997 to 2002.

Biographies of Director Nominees Joseph Michael Gorman (Mike) Background of business development for companies in highly regulated industries. Present Position Since 2006, President of Gorbec Pharmaceuticals, Inc., a contract developer and manufacturer of prescription pharmaceutical products. Past Positions Owner of domestic and international companies in the highly regulated field of pharmaceutical manufacturing.

Biographies of Director Nominees Martin W. Hathy Years of experience owning and managing industrial companies. Present Position Currently retired. Past Positions Co-owner and President of Lake Erie Iron and Metal Company and its subsidiaries Welder’s Supply, Great Lakes Propane and Great Lakes Oxygen, which provided supplies and industrial gases to the welding industry, prior their acquisition by AirGas, Inc. in 2009. Continued to provide services to AirGas until subsequent retirement in 2010.

Biographies of Director Nominees Lauren Tristano Diverse background and public service experience. Present Position Since February, 2016, Executive Liaison for Mr. Osborne and the various companies he owns and manages. Member of Junior League of Chicago, Chicago Cares. Board member of Holy Name Cathedral. Past Positions From 2010 to 2016, registered nurse in emergency rooms and neonatal intensive care units throughout Chicago. Managed funeral home and livery service. Board member of Metropolitan Club of Chicago. Board member of Key Bank Club in Cleveland.