UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

811-23159

(Investment Company Act file number)

Griffin Institutional Access Credit Fund

(Exact name of registrant as specified in charter)

Griffin Capital Plaza

1520 E. Grand Avenue

El Segundo, CA 90245

(Address of principal executive offices) (Zip code)

ALPS Fund Services, Inc.

1290 Broadway, Suite 1100

Denver, CO 80203

(Name and address of agent for service)

Copy to:

Terrence O. Davis, Esq.

Greenberg Traurig, LLP

3333 Piedmont Road, NE, Suite 2500

Atlanta, GA 30305

Registrant's telephone number, including area code: 310.469.6100

Date of fiscal year end: December 31

Date of reporting period: January 1 - June 30, 2018

Item 1. Reports to Stockholders.

Table of Contents

| Shareholder Letter | 1 |

| Portfolio Update | 7 |

| Schedule of Investments | 9 |

| Statement of Assets and Liabilities | 18 |

| Statement of Operations | 20 |

| Statements of Changes in Net Assets | 21 |

| Statement of Cash Flows | 23 |

| Financial Highlights | 24 |

| Notes to Financial Statements | 29 |

| Additional Information | 41 |

| GRIFFIN INSTITUTIONAL ACCESS CREDIT FUND | 1 |

| SEMI-ANNUAL REPORT 2018 | |

Dear Fellow Shareholders,

We are pleased to present the semi-annual report for Griffin Institutional Access® Credit Fund (the “Fund”). We appreciate the support of our shareholders as well as our broker-dealer partners and will remain true to our stated investment objective of generating a return comprised of both current income and capital appreciation with low volatility and low correlation1 to the broader markets.

The Fund’s sub-adviser—BCSF Advisors, LP, an affiliate of Bain Capital Credit, LP— has continued to construct a well-diversified portfolio consisting primarily of floating rate, senior secured bank loans. The portfolio composition is ultimately determined through both fundamental quantitative and qualitative analysis to determine the optimal mix of securities across global markets with the potential to deliver the best risk-adjusted returns for investors During the first half of 2018, the Fund was granted exemptive relief which has allowed shareholders to gain exposure to the full breadth and expertise of the Bain Capital Credit Platform, including direct origination opportunities, as well as senior direct lending and non-performing loan (NPL) investments sourced from financial institutions in Europe.

Since its inception on April 3, 2017, the Fund delivered a total cumulative return of 5.95%, outperforming the S&P/ LSTA Leveraged Loan Index2 by 84 basis points.3 As of June 30, 2018, the Fund was diversified across 295 individual securities and 32 industries.4

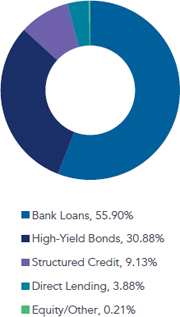

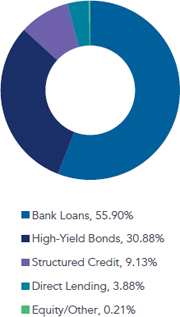

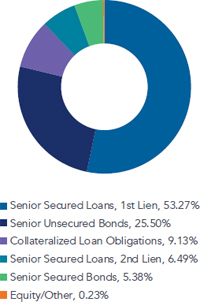

GRIFFIN INSTITUTIONAL ACCESS CREDIT FUND HOLDINGS

(Based on market value of invested assets as of June 30, 2018)

| Floating Rate Assets4: 66.97% | Fixed Rate Assets4: 33.03% |

| | |

| | |

| Sector Analysis4 | Asset Type4 |

| | |

|  |

| 2 | GRIFFIN INSTITUTIONAL ACCESS CREDIT FUND |

| | SEMI-ANNUAL REPORT 2018 |

Investment Performance

Performance in the first half of 2018 was driven primarily by exposure to first and second lien loans and, to a lesser extent, collateralized loan obligation (CLO) debt and equity. High-yield bonds detracted from year-to-date performance as the sector experienced heightened price volatility. From an industry standpoint, four industries contributed the majority of the Fund’s returns: Healthcare; Airlines, Aerospace & Defense; Software/Entertainment Services; and Metals & Mining. In addition, several company specific events within these industries occurred in the first half of the year that benefited the portfolio.

In terms of positioning, we continue to favor bank loans over high-yield bonds due to our desire to be senior in the capital structure and maintain a floating-rate exposure. That being said, we were able to allocate to some attractive opportunities in the bond space due to selling pressure that occurred in the period. During the first half of the year, we began building a bar-belled CLO position – buying CLO equity and AAA-rated tranches, while limiting exposure to mezzanine tranches. Together, we believe floating-rate AAA CLO debt and CLO equity combine to create an attractive low-duration, high-yield asset blend with positive convexity, which compares favorably to high-yield bonds today.

On the private side, we were able to invest in several senior direct deals during the first half of the year. Due to the illiquidity of direct loans, we tend to be patient when allocating to the asset class. Fortunately, Bain Capital Credit’s broad platform and deep sourcing networks can allow the Fund to assess a plethora of opportunities across asset type, industry, and geography. We will continue to approach this market with caution, looking for opportunities that still yield premium over liquid markets and are accretive to the portfolio on a risk-adjusted basis.

Outside of the traditional credit asset classes, Bain Capital Credit, LP as a firm continues to focus on European non-performing loans (NPLs) given the size of the opportunity, high barriers to entry, and the attractive return potential. Within NPLs, assuming certain conditions are met, we intend to target portfolios of loans backed by hard collateral (e.g. real estate, small-to-medium sized enterprises, etc.) in an effort to minimize our downside and drive value. We continue to develop our pipeline for NPL investments and we expect the NPL exposure in the Fund to increase gradually in the coming quarters.

Market Overview and Outlook

Market volatility returned in earnest in the first half of 2018, caused by investor angst over inflation fears, a hawkish Federal Reserve, and intensifying global trade talks. In June, the Fed raised rates for the second time in 2018 and alluded to another two hikes before year end.

| GRIFFIN INSTITUTIONAL ACCESS CREDIT FUND | 3 |

| SEMI-ANNUAL REPORT 2018 | |

Though the 10-year Treasury did increase above 3% in April for the first time since 2014, its yield settled in at 2.85% at the end of June. Ultimately, the Treasury yield curve flattened during the first six months of the year5 – typically a bearish signal. Despite the volatility, risky assets eked out positive returns. Prices in both high-yield bonds and bank loans declined, but both asset classes earned positive, coupon-driven returns in the first half of 2018. Higher-quality, longer-duration credits (e.g. BB-rated high-yield bonds) sold off due to interest rate volatility and continued outflows from the high-yield asset class. Bank loan prices fell modestly as spreads widened ahead of a busy issuance calendar in the second half of 2018. Robust CLO formation and refinancings continued to provide a strong bid for bank loans as CLO managers looked to take advantage of tight liability spreads. Despite the volatility, default rates remain low. Trailing twelve-month default rates for both loans and bonds declined to approximately 2.0% at the end of June, including a rather large default in iHeartCommunications, Inc. in February 2018.6

We are one more quarter into what is now a nine-year economic expansion, just one year shy of the longest in U.S. history. Broadly, we feel good about market fundamentals and the macro backdrop, but expect volatility will reappear at some point in 2018. In addition, credit valuations remain near historical peaks in most markets. Another market trend we are watching closely is the continued degradation of loan documentation and creditor rights. Collateral leakage, pro-forma add-backs, and other debtor- or sponsor-friendly activities are clear late-cycle indicators. While it is difficult to avoid these situations entirely, Bain Capital Credit’s large industry research team works to dissect and interpret covenant language, collateral packages, and sponsor tendencies, all of which are extremely important in today’s market. For these reasons, we are positioned conservatively today and are selectively rotating into what we believe are attractive opportunities as they arise.

We are pleased with the development of the portfolio and our performance year-to date. We believe that our ability to actively manage across credit sectors and markets will allow us to provide value to our shareholders in the form of strong risk-adjusted returns. The portfolio management team continues to leverage the breadth of Bain Capital Credit’s global platform to uncover investment opportunities in line with the stated investment objective of the Fund.

Thank you for your investment in and support of Griffin Institutional Access Credit Fund.

Sincerely,

Randy I. Anderson, Ph.D., CRE

President

Griffin Capital Asset Management Company, LLC

Griffin Institutional Access Credit Fund (the “Fund”) is a closed-end interval fund. Limited liquidity is provided to shareholders only through the Fund’s quarterly repurchase offers for no less than 5% of the Fund’s shares outstanding at net asset value. The Fund is only suitable for investors who can bear the risks associated with the limited liquidity of the Fund and should be viewed as a long-term investment.

| 4 | GRIFFIN INSTITUTIONAL ACCESS CREDIT FUND |

| | SEMI-ANNUAL REPORT 2018 |

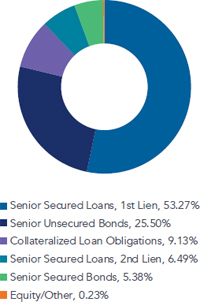

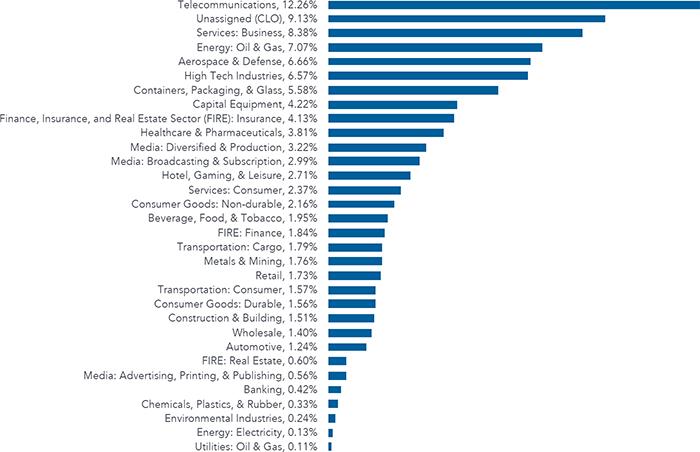

Industry Diversification4, 7

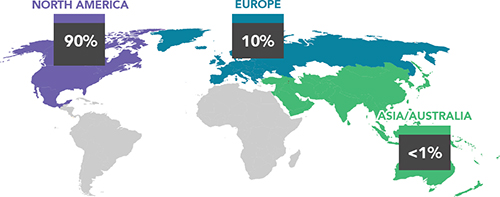

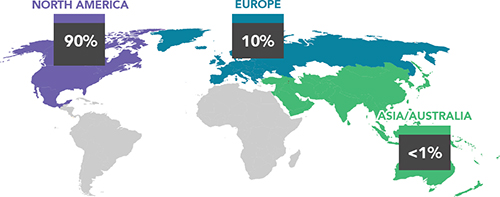

Geography4

| GRIFFIN INSTITUTIONAL ACCESS CREDIT FUND | 5 |

| SEMI-ANNUAL REPORT 2018 | |

FUND SUB-ADVISER (UNAUDITED)

BCSF Advisors, LP Griffin Institutional Access Credit Fund is sub-advised by BCSF Advisors, LP, an SEC-registered investment adviser and affiliate of Bain Capital Credit, LP. |  |

Bain Capital Credit, LP provides ongoing research, opinions and recommendations regarding the Fund’s investment portfolio. Bain Capital Credit was formed in 1998 as the credit investing arm of Bain Capital, one of the world’s premier alternative investment firms, with approximately $95 billion in assets under management.8 Bain Capital Credit invests across the full spectrum of credit strategies, including leveraged loans, high-yield bonds, distressed debt, direct lending, structured products, non-performing loans and equities. With offices in Boston, Chicago, New York, London, Dublin, Madrid, Hong Kong, Guangzhou, Mumbai, Melbourne and Sydney, Bain Capital Credit has a global footprint with approximately $39.5 billion9 in assets under management.

END NOTES

| 1. | Correlation is a statistical measure of how two securities move in relation to each other. A correlation ranges from -1 to 1. A positive correlation of 1 implies that as one security moves, either up or down, the other security will move in lockstep, in the same direction. A negative correlation of -1 indicates that the securities will move in the opposite direction. If the correlation is 0, the movements of the securities are said to have no correlation; they are completely random. |

| 2. | The S&P/LSTA Leveraged Loan Index is a daily total return index that uses mark-to-market pricing to calculate market value change. The LSTA tracks, on a real-time basis, the current outstanding balance and spread over the London Interbank Offered Rate (LIBOR) for fully funded term loans. The facilities included in the LSTA represent a broad cross section of leveraged loans syndicated in the United States, including dollar-denominated loans to overseas issuers. You cannot invest directly in an index. Index performance does not represent actual Fund or portfolio performance. A fund or portfolio may differ significantly from the securities included in the index. Index performance assumes reinvestment of dividends but does not reflect any management fees, transaction costs or other expenses that would be incurred by a fund or portfolio, or brokerage commissions on transactions in fund shares. Such fees, expenses, and commissions could reduce returns. |

| 3. | One basis point is equal to 1/100th of 1%, or 0.01%. |

| 4. | Based on market value of invested assets as of June 30, 2018. Holdings are subject to change without notice. |

| 6. | Source: JP Morgan Default Monitor as of June 30, 2018. |

| 7. | Based on Moody’s 35 Industry Categories (“Moody’s 35”). |

| 8. | Firm-level AUM for Bain Capital is estimated and is presented as of March 31, 2018. |

| 9. | AUM estimated as of July 1, 2018. Bain Capital Credit’s assets under management includes its subsidiaries and credit vehicles managed by its AIFM affiliate. |

DISCLOSURES (UNAUDITED)

Performance data quoted represents past performance. Past performance is no guarantee of future results. Investment returns and principal value of Griffin Institutional Access Credit Fund (the “Fund”) will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. The most recent performance is available at www.griffincapital.com or by calling 888.926.2688. Performance reflects management fees and other expenses. Performance uses the Class I share (NASDAQ: CRDIX) of Griffin Institutional Access Credit Fund. Investors of the Class I share do not pay a front-end sales charge/load.

Investors in the Fund should understand that the net asset value (“NAV”) of the Fund will fluctuate, which may result in a loss of the principal amount invested. The Fund is a closed-end interval fund, the shares have no history of public trading, nor is it intended at this time that the shares will be listed on a public exchange. No secondary market is expected to develop for the Fund’s shares, liquidity for the Fund’s shares will be provided only through quarterly repurchase offers for no less than 5% and no more than 25% of the Fund’s shares at NAV, and there is no guarantee that an investor will be able to sell all the shares that the investor desires to sell in the repurchase offer. Due to these restrictions, an investor should consider an investment in the Fund to be of limited liquidity. The Fund is suitable only for investors who can bear the risks associated with the limited liquidity of the Fund and should be viewed as a long-term investment. Investing in the Fund is speculative and involves a high degree of risk, including the risks associated with leverage.

Diversification does not assure a profit or protect against loss in a declining market.

By investing in the Fund, a shareholder will not be deemed to be an investor in any underlying fund and will not have the ability to exercise any rights attributable to an investor in any such underlying fund related to their investment.

This semi-annual report may contain certain forward-looking statements. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue,” or other similar words. Because such statements include risks, uncertainties and contingencies, actual results may differ materially from the expectations, intentions, beliefs, plans or predictions of the future expressed or implied by such forward-looking statements. These risks, uncertainties and contingencies include, but are not limited to: uncertainties relating to changes in general economic and real estate conditions; uncertainties relating to the implementation of our investment strategy; uncertainties relating to capital proceeds; and other risk factors as outlined in our prospectus, annual report and semi-annual report filed with the Securities and Exchange Commission (the “SEC”). This is neither an offer nor a solicitation to purchase securities.

The views and information discussed in this commentary are as of the date of publication, are subject to change, and may not reflect the writer’s current views. The views expressed represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the fund(s) or any securities or any sectors mentioned herein. The subject matter contained herein has been derived from several sources believed to be reliable and accurate at the time of compilation. Griffin Capital Securities, LLC does not accept any liability for losses either direct or consequential caused by the use of this information.

Distribution Policy Risk

The Fund’s distribution policy is to make quarterly distributions to shareholders. All or a portion of a distribution may consist solely of a return of capital (i.e. from your original investment) and not a return of net profit. Shareholders should not assume that the source of a distribution from the Fund is net profit. Shareholders should note that return of capital will reduce the tax basis of their shares and potentially increase the taxable gain, if any, upon disposition of their shares. Sources of distributions to shareholders for tax reporting purposes will depend upon the Fund’s investment experience during the remainder of its fiscal year and may be subject to changes based on tax regulations. Pursuant to Section 852 of the Internal Revenue Code, the taxability of distributions will be reported on Form 1099-DIV.

The Fund distribution rate is the amount, expressed as a percentage, a Fund investor would receive in distributions if the most recent Fund distribution stayed consistent going forward. It is calculated by annualizing the most recent Fund distribution yield. The percentage represents a single distribution from the Fund and does not represent the total return of the Fund.

ALPS Distributors, Inc. is the distributor of Griffin Institutional Access Credit Fund. Griffin Capital and ALPS Distributors, Inc. are not affiliated.

| Griffin Institutional Access Credit Fund | Portfolio Update |

June 30, 2018 (Unaudited)

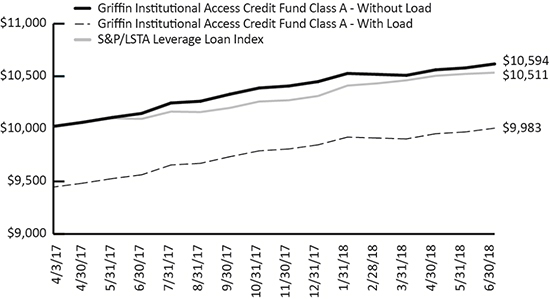

Performance (for the period ended June 30, 2018)

| | 6 Month | 1 Year | Since Inception | Inception | Total Expense Ratio |

| Griffin Institutional Access Credit Fund - A - Without Load | 1.49% | 4.65% | 4.76% | 4/3/17 | 2.60% |

| Griffin Institutional Access Credit Fund - A - With Load* | -4.33% | -1.36% | -0.14% | 4/3/17 | |

| Griffin Institutional Access Credit Fund - C - Without Load | 1.49% | 4.65% | 4.75% | 4/3/17 | 3.35% |

| Griffin Institutional Access Credit Fund - C - With Load** | 0.51% | 3.66% | 3.95% | 4/3/17 | |

| Griffin Institutional Access Credit Fund - I - NAV | 1.50% | 4.66% | 4.77% | 4/3/17 | 2.35% |

| Griffin Institutional Access Credit Fund - L - Without Load | 1.48% | N/A | 3.35% | 9/5/17 | 2.85% |

| Griffin Institutional Access Credit Fund - L - With Load*** | -2.82% | N/A | -1.05% | 9/5/17 | |

| Griffin Institutional Access Credit Fund - F - NAV | 1.52% | N/A | 2.95% | 9/25/17 | 1.85% |

| S&P/LSTA Leveraged Loan Index | 2.16% | N/A | 3.36% | 4/3/17 | |

| * | Adjusted for initial maximum sales charge of 5.75%. |

| ** | Adjusted for contingent deferred sales charge of 1.00%. |

| *** | Adjusted for initial maximum sales charge of 4.25% |

The S&P/LSTA Leveraged Loan Index is a capitalization-weighted syndicated loan index based upon market weightings, spreads and interest payments. The S&P/LSTA Leveraged Loan Index covers the U.S. market back to 1997 and currently calculates on a daily basis.

Indexes are not actively managed and do not reflect deduction for fees, expenses or taxes. An investor cannot invest directly into an index.

The returns shown above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or redemption of Fund shares.

The performance data quoted above represents past performance. Past performance is not a guarantee of future results. Investment return and value of the Fund shares will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Fund performance current to the most recent month-end is available by calling 1-888-926-2688 or by visiting www.griffincapital.com.

Class A shares are offered subject to a maximum sales charge of 5.75% of the offering price and Class L shares are offered subject to a maximum sales charge of 4.25% of the offering price. Class C, Class I and Class F shares are offered at net asset value per share. Class C shares may be subject to a 1.00% contingent deferred sales charge on shares redeemed during the first 365 days after their purchase. The Fund’s investment adviser has contractually agreed to waive its fees and to pay or absorb the ordinary annual operating expenses of the Fund (including offering expenses, but excluding taxes, interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses), to the extent that they exceed 2.60%, 3.35%, 2.35%, 2.85 and 1.85% per annum of the Fund’s average daily net assets attributable to Class A, Class C, Class I, Class L and Class F, respectively. The Expense Limitation Agreement will remain in effect at least until August 31, 2019, unless and until the Board approves its modification or termination. Without the waiver the expenses would be 5.15%, 6.25%, 5.62%, 4.17% and 3.27% for Class A, Class C, Class I, Class L and Class F, respectively per the Fund’s most recent prospectus. In addition to the Expense Limitation Agreement described above, the Adviser voluntarily has absorbed all of the operating expenses of the Fund since the commencement of the Fund’s operations. The Adviser will continue to bear such expenses on a going forward basis in its discretion and is under no obligation to continue to do so for any specified period of time. In the absence of the election by the Adviser to bear all of the Fund’s operating expenses, the performance of the Fund would have been reduced. Please review the Fund’s Prospectus for more details regarding the Fund’s fees and expenses. No assurances can be given that the Fund will pay a dividend in the future; or, if any such dividend is paid, the amount or rate of the dividend.

| Semi-Annual Report | June 30, 2018 | 7 |

| Griffin Institutional Access Credit Fund | Portfolio Update |

June 30, 2018 (Unaudited)

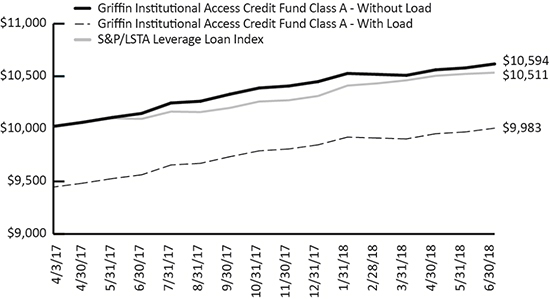

Performance of $10,000 Initial Investment (for the period ended June 30, 2018)

The graph shown above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. All returns reflect reinvested dividends, but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Industry Diversification (as a % of Net Assets)

| Telecommunications | 11.47% |

| Unassigned | 8.28% |

| Services: Business | 7.60% |

| Energy: Oil & Gas | 6.41% |

| Aerospace & Defense | 6.04% |

| High Tech Industries | 5.99% |

| Containers, Packaging, & Glass | 4.98% |

| Capital Equipment | 3.83% |

| FIRE: Insurance | 3.74% |

| Healthcare & Pharmaceuticals | 3.45% |

| Hotel, Gaming, & Leisure | 3.00% |

| Media: Diversified & Production | 2.92% |

| Media: Broadcasting & Subscription | 2.71% |

| Services: Consumer | 2.15% |

| Consumer goods: non-durable | 1.96% |

| Beverage, Food, & Tobacco | 1.77% |

| FIRE: Finance | 1.67% |

| Transportation: Cargo | 1.63% |

| Metals & Mining | 1.59% |

| Retail | 1.57% |

| Transportation: Consumer | 1.43% |

| Consumer goods: durable | 1.42% |

| Construction & Building | 1.37% |

| Wholesale | 1.27% |

| Automotive | 1.12% |

| FIRE: Real Estate | 0.54% |

| Media: Advertising, Printing & Publishing | 0.51% |

| Banking | 0.38% |

| Chemicals, Plastics, & Rubber | 0.30% |

| Environmental Industries | 0.21% |

| Energy: Electricity | 0.11% |

| Utilities: Oil & Gas | 0.10% |

| Cash, Cash Equivalents, & Other Net Assets | 8.48% |

| TOTAL | 100.00% |

Portfolio Composition (as a % of Net Assets)

| Bank Loans | 54.47% |

| Corporate Bonds | 28.56% |

| Collateralized Loan Obligations | 8.28% |

| Common Stocks | 0.20% |

| Warrants | 0.01% |

| Other Assets in Excess of Liabilities | 8.48% |

| TOTALS | 100.00% |

| 8 | 1.888.926.2688 | www.griffincapital.com |

| Griffin Institutional Access Credit Fund | Schedule of Investments |

June 30, 2018 (Unaudited)

| Description | | Currency | | Rate | | Maturity

Date | | Principal

Amount | | Value

(Note 2) | |

| BANK LOANS (54.47%)(a) | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| 1011778 B.C. Unlimited Liability Company, First Lien Term B-3 Loan | | USD | | 1M US L + 2.25% | | 02/16/24 | | 95,939 | | $ | 95,533 | |

| Accudyne Industries Borrower S.C.A. / Accudyne Industries LLC, First Lien Initial Term Loan | | USD | | 1M US L + 3.25% | | 08/18/24 | | 155,562 | | | 155,546 | |

| Acosta, Inc., First Lien Tranche B-1 Loan | | USD | | 1M US L + 3.25% | | 09/26/21 | | 106,574 | | | 81,890 | |

| Advantage Sales & Marketing, Inc., First Lien Initial Term Loan | | USD | | 1M US L + 3.25% | | 07/23/21 | | 371,144 | | | 353,283 | |

| A-L Parent LLC, First Lien Initial Term Loan(b) | | USD | | 1M US L + 3.25% | | 12/01/23 | | 400,952 | | | 402,456 | |

| Albertson's Companies LLC, First Lien Last Out Term Loan(b) | | USD | | L + 3.00% | | 06/01/23 | | 433,928 | | | 431,909 | |

| Alliant Holdings Intermediate LLC, First Lien 2018 Initial Term Loan | | USD | | 1M US L + 3.00% | | 05/09/25 | | 559,141 | | | 556,313 | |

| Ancestry.com Operations, Inc., First Lien Term Loan | | USD | | 1M US L + 3.25% | | 10/19/23 | | 782,378 | | | 782,051 | |

| AqGen Ascensus, Inc., Delayed Draw Term Loan | | USD | | 3M US L + 3.50% | | 12/05/22 | | 240,667 | | | 239,463 | |

| AqGen Ascensus, Inc., First Lien Incremental Delayed Draw Term Loan(c) | | USD | | 3M US L + 3.50% | | 12/05/22 | | 247,704 | | | 248,013 | |

| AqGen Ascensus, Inc., First Lien Initial Incremental Term Loan | | USD | | 1M US L + 3.50% | | 12/05/22 | | 411,808 | | | 412,322 | |

| Aristocrat Leisure, Ltd., First Lien Term B-3 Loan | | USD | | 3M US L + 1.75% | | 10/19/24 | | 169,787 | | | 168,970 | |

| Ascena Retail Group, Inc., First Lien Tranche B Term Loan | | USD | | 1M US L + 4.50% | | 08/21/22 | | 287,544 | | | 257,640 | |

| Ascend Performance Materials Operations LLC, First Lien Term B Loan | | USD | | 3M US L + 5.25% | | 08/12/22 | | 226,442 | | | 227,857 | |

| ASP MCS Acquisition Corp., First Lien Initial Term Loan | | USD | | 3M US L + 4.75% | | 05/20/24 | | 424,482 | | | 419,176 | |

| Asurion LLC, First Lien Amendment No. 14 Replacement B-4 Term Loan | | USD | | 1M US L + 2.75% | | 08/04/22 | | 480,533 | | | 480,292 | |

| Asurion LLC, First Lien Replacement B-6 Term Loan | | USD | | 1M US L + 2.75% | | 11/03/23 | | 198,750 | | | 198,770 | |

| Asurion LLC, Second Lien Replacement B-2 Term Loan | | USD | | 1M US L + 6.00% | | 08/04/25 | | 1,085,308 | | | 1,097,010 | |

| Autodata, Inc., First Lien Initial Term Loan | | USD | | 1M US L + 3.25% | | 12/13/24 | | 498,750 | | | 497,503 | |

| Autodata, Inc., Second Lien Initial Term Loan | | USD | | 1M US L + 7.25% | | 12/12/25 | | 190,967 | | | 193,474 | |

| AVSC Holding Corp., First Lien Initial Term Loan | | USD | | 1M US L + 3.25% | | 03/03/25 | | 96,838 | | | 95,990 | |

| Baring Private Equity Asia VI Holding, Ltd., First Lien Initial Dollar Term Loan | | USD | | 1M US L + 3.00% | | 10/26/22 | | 85,603 | | | 85,496 | |

| BCP Renaissance Parent LLC, First Lien Initial Term Loan | | USD | | 3M US L + 3.50% | | 10/31/24 | | 87,088 | | | 87,160 | |

| BioClinica Holding I LP, First Lien Initial Term Loan | | USD | | 3M US L + 4.25% | | 10/20/23 | | 504,908 | | | 482,187 | |

| BlackBrush Oil & Gas LP, First Lien Closing Date Loan | | USD | | 3M US L + 8.00% | | 02/09/24 | | 2,151,724 | | | 2,119,449 | |

| BWay Holding Company, First Lien Initial Term Loan | | USD | | 3M US L + 3.25% | | 04/03/24 | | 780,017 | | | 781,723 | |

| Caelus Energy Alaska O3 LLC, Second Lien Loan | | USD | | 3M US L + 7.50% | | 04/15/20 | | 53,937 | | | 50,342 | |

| Camelot U.S. Acquisition 1 Co., First Lien New Term Loan | | USD | | 1M US L + 3.25% | | 10/03/23 | | 249,372 | | | 249,112 | |

| CB Poly Investments LLC, First Lien Closing Date Term Loan | | USD | | 1M US L + 3.75% | | 08/16/23 | | 1,049,551 | | | 1,060,047 | |

| CenturyLink, Inc., First Lien Initial Term B Loan | | USD | | 1M US L + 2.75% | | 01/31/25 | | 723,868 | | | 710,165 | |

| Checkout Holding Corp., First Lien Term B Loan | | USD | | 1M US L + 3.50% | | 04/09/21 | | 500,000 | | | 317,000 | |

| CMI Marketing, Inc., First Lien Revolving Credit Loan(c)(d) | | USD | | 3M US L + 5.00% | | 05/24/23 | | 120,000 | | | 118,800 | |

| CMI Marketing, Inc., First Lien Term Loan(d) | | USD | | 3M US L + 5.00% | | 05/24/24 | | 880,000 | | | 871,200 | |

| Comet Bidco, Ltd., First Lien Facility B Loan | | GBP | | 1M GBP L + 5.25% | | 09/30/24 | | 469,565 | | | 607,831 | |

| Comet Bidco, Ltd., First Lien Facility B2 Loan | | USD | | 3M US L + 5.00% | | 09/30/24 | | 364,375 | | | 353,142 | |

| Commercial Barge Line Company, First Lien Initial Term Loan(b) | | USD | | 1M US L + 8.75% | | 11/12/20 | | 627,237 | | | 439,153 | |

| Commercial Vehicle Group, Inc., First Lien Initial Term Loan | | USD | | 1M US L + 6.00% | | 04/12/23 | | 243,750 | | | 245,578 | |

See Notes to Financial Statements.

| Semi-Annual Report | June 30, 2018 | 9 |

| Griffin Institutional Access Credit Fund | Schedule of Investments |

June 30, 2018 (Unaudited)

| Description | | Currency | | Rate | | Maturity

Date | | Principal

Amount | | Value

(Note 2) | |

| Communications Sales & Leasing, Inc., First Lien Shortfall Term Loan | | USD | | 1M US L + 3.00% | | 10/24/22 | | 294,840 | | $ | 282,492 | |

| Compass Bidco B.V., First Lien Facility B2 Loan(b) | | EUR | | EUR L + 4.50% | | 05/09/25 | | 671,493 | | | 780,249 | |

| Compass Power Generation LLC, First Lien Term Loan | | USD | | 1M US L + 3.75% | | 12/20/24 | | 146,171 | | | 147,216 | |

| Concentra, Inc., First Lien Tranche B-1 Term Loan | | USD | | 1M US L + 2.75% | | 06/01/22 | | 150,567 | | | 150,818 | |

| Concentra, Inc., Second Lien Initial Term Loan | | USD | | 1M US L + 6.50% | | 06/01/23 | | 953,029 | | | 967,325 | |

| CPG International LLC, First Lien New Term Loan(b) | | USD | | 3M US L + 3.75% | | 05/05/24 | | 581,891 | | | 582,982 | |

| CVS Holdings I LP, Second Lien Initial Term Loan | | USD | | 1M US L + 6.75% | | 02/06/26 | | 112,634 | | | 112,423 | |

| Cyxtera DC Holdings, Inc., Second Lien Initial Term Loan | | USD | | 3M US L + 7.25% | | 05/01/25 | | 500,000 | | | 496,625 | |

| DAE Aviation Holdings, Inc., First Lien Initial Term Loan | | USD | | 1M US L + 3.75% | | 07/07/22 | | 654,565 | | | 656,856 | |

| Deck Chassis Acquisition, Inc., Second Lien Initial Term Loan | | USD | | 1M US L + 6.00% | | 06/15/23 | | 374,252 | | | 378,462 | |

| Deep Gulf Energy II LLC, 2018 Term Loan(b)(d)(e) | | USD | | 3M US L + 16.10% | | 09/30/19 | | 106,517 | | | 102,256 | |

| DXP Enterprises, Inc., First Lien Term Loan(b) | | USD | | L + 4.75% | | 08/29/23 | | 53,321 | | | 53,654 | |

| Emerald Expositions Holding, Inc., First Lien Initial Term Loan | | USD | | 1M US L + 2.75% | | 05/22/24 | | 479,699 | | | 479,100 | |

| Epicor Software Corp., First Lien Term B Loan | | USD | | 1M US L + 3.25% | | 06/01/22 | | 206,611 | | | 206,482 | |

| EXC Holdings III Corp., First Lien Initial Euro Term Loan | | EUR | | 3M EUR L + 3.50%, 0.00% Floor | | 12/02/24 | | 22,711 | | | 26,555 | |

| EXC Holdings III Corp., First Lien Initial USD Term Loan | | USD | | 3M US L + 3.50% | | 12/02/24 | | 157,298 | | | 159,068 | |

| EXC Holdings III Corp., Second Lien Initial Term Loan | | USD | | 6M US L + 7.50% | | 12/01/25 | | 143,183 | | | 146,583 | |

| Exclusive Bidco, First Lien Term Loan(b) | | EUR | | EUR L + 4.00% | | 06/06/25 | | 303,237 | | | 350,800 | |

| Eyemart Express LLC, First Lien Term Loan | | USD | | 1M US L + 3.00% | | 08/04/24 | | 249,372 | | | 250,853 | |

| EZE Software Group LLC, First Lien Term B-2 Loan | | USD | | 1M US L + 3.00% | | 04/06/20 | | 494,827 | | | 497,095 | |

| Filtration Group Corp., First Lien Initial Euro Term Loan | | EUR | | 3M EUR L + 3.50%, 0.00% Floor | | 03/29/25 | | 239,293 | | | 279,447 | |

| Financière Dry Mix Solutions S.A.S., First Lien Facility B Loan | | EUR | | 3M EUR L + 3.50%, 0.00% Floor | | 03/15/24 | | 199,319 | | | 232,219 | |

| First Data Corp., First Lien 2024A New Dollar Term Loan | | USD | | 1M US L + 2.00% | | 04/26/24 | | 500,000 | | | 497,688 | |

| Flex Acquisition Company, Inc., First Lien Initial Term Loan(b) | | USD | | 3M US L + 3.00% | | 12/29/23 | | 627,241 | | | 626,177 | |

| Frontier Communications Corp., First Lien Term B-1 Loan(b) | | USD | | 1M US L + 3.75% | | 06/15/24 | | 714,865 | | | 711,961 | |

| Gamma Infrastructure III B.V., First Lien Facility B Loan | | EUR | | 6M EUR L + 3.50%, 0.00% Floor | | 01/09/25 | | 186,957 | | | 218,329 | |

| Genworth Holdings, Inc., First Lien Initial Loan | | USD | | 1M US L + 4.50% | | 03/07/23 | | 49,686 | | | 50,742 | |

| Getty Images, Inc., First Lien Initial Term Loan | | USD | | 1M US L + 3.50% | | 10/18/19 | | 715,337 | | | 692,791 | |

| GTT Communications B.V., First Lien Closing Date EMEA Term Loan | | EUR | | 3M EUR L + 3.25%, 0.00% Floor | | 05/31/25 | | 425,353 | | | 493,468 | |

| Hargray Communications Group, Inc., First Lien Initial Term Loan | | USD | | 1M US L + 3.00% | | 05/16/24 | | 247,500 | | | 247,191 | |

| H-Food Holdings LLC, First Lien Initial Term Loan | | USD | | 1M US L + 3.00% | | 05/23/25 | | 491,581 | | | 487,996 | |

| Horizon Telcom, Inc. Delay Draw Term Loan(c)(d) | | USD | | L + 4.50% | | 06/15/23 | | 86,897 | | | 85,810 | |

| Horizon Telcom, Inc. First Lien Term Loan(d) | | USD | | L + 4.50% | | 06/15/23 | | 695,172 | | | 686,483 | |

| Horizon Telcom, Inc. Revolver(c)(d) | | USD | | L + 4.50% | | 06/15/23 | | 57,931 | | | 57,207 | |

| Hub International, Ltd., First Lien Initial Term Loan | | USD | | 3M US L + 3.00% | | 04/25/25 | | 687,712 | | | 684,105 | |

| Intelsat Jackson Holdings S.A., First Lien Tranche B-4 Term Loan | | USD | | 1M US L + 4.50% | | 01/02/24 | | 177,721 | | | 185,496 | |

| Intelsat Jackson Holdings S.A., First Lien Tranche B-5 Term Loan | | USD | | 6M US L + 6.63% | | 01/02/24 | | 289,875 | | | 299,876 | |

| IRB Holding Corp., First Lien Term B Loan | | USD | | 1M US L + 3.25% | | 02/05/25 | | 296,866 | | | 297,682 | |

| Jaguar Holding Company I LLC, First Lien 2018 Term Loan | | USD | | 1M US L + 2.50% | | 08/18/22 | | 985,989 | | | 981,264 | |

| Jazz Acquisition, Inc., First Lien Term Loan | | USD | | 3M US L + 3.50% | | 06/19/21 | | 1,295,102 | | | 1,270,819 | |

See Notes to Financial Statements.

| 10 | 1.888.926.2688 | www.griffincapital.com |

| Griffin Institutional Access Credit Fund | Schedule of Investments |

June 30, 2018 (Unaudited)

| Description | | Currency | | Rate | | Maturity

Date | | Principal

Amount | | Value

(Note 2) | |

| KBR, Inc., First Lien Term B Loan | | USD | | 1M US L + 3.75% | | 04/25/25 | | 750,000 | | $ | 752,344 | |

| Keane Group Holdings LLC, First Lien Initial Term Loan | | USD | | 1M US L + 3.75% | | 05/25/25 | | 162,267 | | | 162,876 | |

| KeyW Corp., First Lien Initial Term Loan | | USD | | 1M US L + 4.50% | | 05/08/24 | | 783,034 | | | 788,907 | |

| KeyW Corp., Second Lien Term Loan Loan | | USD | | 1M US L + 8.75% | | 05/08/25 | | 500,000 | | | 502,500 | |

| K-Mac Holdings Corp., Second Lien Initial Term Loan | | USD | | 1M US L + 6.75% | | 03/16/26 | | 93,023 | | | 93,372 | |

| Kronos Acquisition Intermediate, Inc., First Lien Initial Loan | | USD | | 1M US L + 4.00% | | 05/15/23 | | 983,049 | | | 980,386 | |

| Kronos, Inc., First Lien Incremental Term Loan | | USD | | 3M US L + 3.00% | | 11/01/23 | | 825,880 | | | 825,786 | |

| Lakeland Tours LLC, Delayed Draw Term Loan | | USD | | 3M US L + 4.00% | | 12/16/24 | | 9,330 | | | 9,446 | |

| Lakeland Tours LLC, First Lien Initial Term Loan | | USD | | 3M US L + 4.00% | | 12/16/24 | | 112,984 | | | 114,396 | |

| LOGIX Holding Company LLC, First Lien Initial Term Loan | | USD | | 1M US L + 5.75% | | 12/22/24 | | 343,800 | | | 345,949 | |

| Masergy Holdings, Inc., First Lien 2017 Replacement Term Loan | | USD | | 3M US L + 3.25% | | 12/15/23 | | 960,458 | | | 962,059 | |

| Masergy Holdings, Inc., Second Lien Initial Loan | | USD | | 3M US L + 7.50% | | 12/16/24 | | 462,778 | | | 465,477 | |

| Mavenir Systems, Inc., First Lien Initial Term Loan | | USD | | 1M US L + 6.00% | | 05/08/25 | | 244,243 | | | 243,327 | |

| Mavis Tire Express Services Corp., First Lien Closing Date Term Loan | | USD | | 1M US L + 3.25% | | 03/20/25 | | 214,940 | | | 214,134 | |

| Mavis Tire Express Services Corp., First Lien Delayed Draw Term Loan, Tranche 1(c) | | USD | | 3M US L + 1.00% | | 03/20/25 | | 32,594 | | | 32,472 | |

| Mavis Tire Express Services Corp., First Lien Delayed Draw Term Loan, Tranche 2 | | USD | | 1M US L + 3.25% | | 03/20/25 | | 1,897 | | | 1,890 | |

| MH Sub I LLC, First Lien Amendment No. 2 Initial Term Loan | | USD | | 1M US L + 3.75% | | 09/13/24 | | 652,882 | | | 653,562 | |

| MH Sub I LLC, Second Lien Amendment No. 2 Initial Term Loan | | USD | | 1M US L + 7.50% | | 09/15/25 | | 491,828 | | | 495,516 | |

| Microchip Technology, Inc., First Lien Initial Term Loan | | USD | | 1M US L + 2.00% | | 05/29/25 | | 338,664 | | | 339,511 | |

| Midas Intermediate Holdco II LLC, First Lien 2017 Refinancing Term Loan(b) | | USD | | L + 2.75% | | 08/18/21 | | 315,362 | | | 303,536 | |

| Moran Foods LLC, First Lien Term Loan | | USD | | 1M US L + 6.00% | | 12/05/23 | | 149,266 | | | 117,920 | |

| MRO Holdings, Inc., First Lien Initial Term Loan | | USD | | 3M US L + 5.25% | | 10/25/23 | | 724,585 | | | 730,020 | |

| Murray Energy Corp. | | USD | | 3M US L + 7.25% | | 04/16/20 | | 1,332,571 | | | 1,262,611 | |

| National CineMedia LLC, First Lien Initial Term Loan(b) | | USD | | L + 3.00% | | 06/20/25 | | 70,940 | | | 71,029 | |

| National Vision, Inc., First Lien New Term Loan | | USD | | 1M US L + 2.75% | | 11/20/24 | | 699,998 | | | 699,998 | |

| Netsmart Technologies, Inc., First Lien Term C-1 Loan Retired 07/02/2018 Loan | | USD | | 1M US L + 4.50% | | 04/19/23 | | 280,667 | | | 281,895 | |

| New Milani Group LLC, First Lien Term Loan(d) | | USD | | 3M US L + 4.25% | | 06/06/24 | | 800,000 | | | 792,000 | |

| NPC International, Inc., Second Lien Initial Term Loan | | USD | | 1M US L + 7.50% | | 04/18/25 | | 250,000 | | | 253,750 | |

| OEConnection LLC, Second Lien Term Loan Loan | | USD | | 1M US L + 8.00% | | 11/22/25 | | 167,079 | | | 167,079 | |

| Optiv, Inc., First Lien Initial Term Loan | | USD | | 1M US L + 3.25% | | 02/01/24 | | 89,362 | | | 87,268 | |

| Oxbow Carbon LLC, First Lien Tranche B Term Loan | | USD | | 1M US L + 3.75% | | 01/04/23 | | 49,584 | | | 50,142 | |

| Oxbow Carbon LLC, Second Lien Term Loan Loan | | USD | | 1M US L + 7.50% | | 01/04/24 | | 453,306 | | | 460,105 | |

| Packaging Coordinators Midco, Inc., First Lien Initial Term Loan | | USD | | 3M US L + 4.00% | | 06/30/23 | | 674,676 | | | 678,892 | |

| Packaging Coordinators Midco, Inc., Second Lien Initial Term Loan | | USD | | 3M US L + 8.75% | | 07/01/24 | | 512,500 | | | 512,500 | |

| Paladin Brands Holding, Inc., First Lien Loan | | USD | | 3M US L + 5.50% | | 08/15/22 | | 785,927 | | | 790,839 | |

| Parexel International Corp., First Lien Initial Term Loan | | USD | | 1M US L + 2.75% | | 09/27/24 | | 732,801 | | | 729,748 | |

| Park Place Technologies LLC, Second Lien Initial Loan | | USD | | 1M US L + 8.00% | | 03/29/26 | | 276,817 | | | 277,509 | |

| Pearl Intermediate Parent LLC, First Lien Delayed Draw Term Loan, Tranche 1(b) | | USD | | 3M US L + 2.75% | | 02/14/25 | | 31,205 | | | 30,919 | |

| Pearl Intermediate Parent LLC, First Lien Delayed Draw Term Loan, Tranche 2(c) | | USD | | 3M US L + 1.00% | | 02/14/25 | | 17,111 | | | 16,954 | |

| Pearl Intermediate Parent LLC, First Lien Initial Term Loan(b) | | USD | | 1M US L + 2.75% | | 02/14/25 | | 164,275 | | | 162,496 | |

See Notes to Financial Statements.

| Semi-Annual Report | June 30, 2018 | 11 |

| Griffin Institutional Access Credit Fund | Schedule of Investments |

June 30, 2018 (Unaudited)

| Description | | Currency | | Rate | | Maturity

Date | | Principal

Amount | | Value

(Note 2) | |

| Petco Animal Supplies, Inc., First Lien Term Loan | | USD | | 3M US L + 3.25% | | 01/26/23 | | 72,020 | | $ | 52,178 | |

| Pisces Midco, Inc., First Lien Initial Term Loan | | USD | | 3M US L + 3.75% | | 04/12/25 | | 278,847 | | | 278,934 | |

| Polycom, Inc., First Lien Initial Term Loan Retired 07/02/2018 Loan | | USD | | 1M US L + 5.25% | | 09/27/23 | | 427,878 | | | 428,680 | |

| Pre-Paid Legal Services, Inc., First Lien Initial Term Loan | | USD | | 1M US L + 3.25% | | 05/01/25 | | 88,323 | | | 88,958 | |

| Press Ganey Holdings, Inc., 2018 First Lien Replacement Term Loans Loan | | USD | | 1M US L + 2.75% | | 10/23/23 | | 549,540 | | | 548,739 | |

| Prime Security Services Borrower LLC, First Lien 2016-2 Refinancing Term B-1 Loan | | USD | | 1M US L + 2.75% | | 05/02/22 | | 64,770 | | | 64,563 | |

| Project Alpha Intermediate Holding, Inc., First Lien Term Loan | | USD | | 3M US L + 3.50% | | 04/26/24 | | 219,483 | | | 218,523 | |

| Pulsant Acquisitions Ltd., Facility B Term Loan(d) | | GBP | | 3M GBP L + 5.25% | | 05/18/23 | | 710,227 | | | 927,950 | |

| Quest Software US Holdings, Inc., First Lien Initial Term Loan | | USD | | 3M US L + 4.25% | | 05/16/25 | | 432,753 | | | 432,572 | |

| Quidditch Acquisition, Inc., First Lien Term B Loan | | USD | | 1M US L + 7.00% | | 03/21/25 | | 410,874 | | | 414,983 | |

| Rackspace Hosting, Inc., First Lien Term B Loan | | USD | | 3M US L + 3.00% | | 11/03/23 | | 522,798 | | | 517,430 | |

| Research Now Group, Inc., First Lien Initial Term Loan | | USD | | 3M US L + 5.50% | | 12/20/24 | | 335,235 | | | 330,206 | |

| RP Crown Parent LLC, First Lien Initial Term Loan | | USD | | 1M US L + 2.75% | | 10/12/23 | | 267,810 | | | 266,918 | |

| Safe Fleet Holdings LLC, Second Lien Initial Term Loan | | USD | | 1M US L + 6.75% | | 02/02/26 | | 667,223 | | | 668,057 | |

| Sapphire Bidco B.V., First Lien Facility B Loan | | EUR | | 3M EUR L + 3.25%, 0.00% Floor | | 05/05/25 | | 90,073 | | | 103,741 | |

| Scientific Games International, Inc., First Lien Initial Term B-5 Loan, Tranche 1 | | USD | | 2M US L + 2.75% | | 08/14/24 | | 150,009 | | | 149,616 | |

| Scientific Games International, Inc., First Lien Initial Term B-5 Loan, Tranche 2 | | USD | | 1M US L + 2.75% | | 08/14/24 | | 35,672 | | | 35,578 | |

| Sedgwick Claims Management Services, Inc., First Lien Initial Term Loan | | USD | | 1M US L + 2.75% | | 03/01/21 | | 618,222 | | | 615,827 | |

| Sequa Mezzanine Holdings LLC, First Lien Initial Term Loan | | USD | | 1M US L + 5.00% | | 11/28/21 | | 757,682 | | | 759,812 | |

| Severin Acquisition LLC, First Lien Term Loan(b) | | USD | | L + 3.25% | | 06/12/25 | | 135,990 | | | 135,426 | |

| SIG Combibloc Holdings S.C.A., First Lien Repriced Euro Term Loan | | EUR | | 1M EUR L + 3.25%, 0.00% Floor | | 03/11/22 | | 95,126 | | | 110,658 | |

| Silk Bidco AS, First Lien Facility B Loan | | EUR | | 6M EUR L + 4.00%, 0.00% Floor | | 02/24/25 | | 126,480 | | | 146,919 | |

| SolarWinds Holdings, Inc., First Lien 2018 Refinancing Term Loan | | USD | | 1M US L + 3.00% | | 02/05/24 | | 941,821 | | | 944,044 | |

| SonicWall US Holdings Inc., First Lien Initial Term Loan | | USD | | 3M US L + 3.50% | | 05/16/25 | | 141,628 | | | 141,274 | |

| Sophia LP, First Lien Term B Loan | | USD | | 3M US L + 3.25% | | 09/30/22 | | 979,258 | | | 978,951 | |

| SRS Distribution, Inc., First Lien Initial Term Loan | | USD | | 3M US L + 3.25% | | 05/23/25 | | 596,769 | | | 591,995 | |

| Sterling Midco Holdings, Inc., First Lien Initial Term Loan | | USD | | 1M US L + 3.50% | | 06/19/24 | | 15,802 | | | 15,743 | |

| STG-Fairway Acquisitions, Inc., First Lien Term Loan | | USD | | 1M US L + 5.25% | | 06/30/22 | | 636,363 | | | 636,363 | |

| Syneos Health, Inc., First Lien Replacement Term B Loan | | USD | | 1M US L + 2.00% | | 08/01/24 | | 149,857 | | | 149,442 | |

| Syniverse Holdings, Inc., First Lien Tranche C Term Loan | | USD | | 1M US L + 5.00% | | 03/09/23 | | 73,792 | | | 73,838 | |

| Tacala Investment Corp., Second Lien Initial Term Loan | | USD | | 1M US L + 7.00% | | 01/30/26 | | 340,426 | | | 344,043 | |

| TDC A/S, First Lien Facility B1 Loan(b) | | EUR | | EUR L + 3.50% | | 06/11/25 | | 1,042,126 | | | 1,205,334 | |

| Tecostar Holdings, Inc., First Lien 2017 Term Loan, Tranche 1 | | USD | | 1M US L + 3.50% | | 05/01/24 | | 1,117,862 | | | 1,122,753 | |

| Tecostar Holdings, Inc., First Lien 2017 Term Loan, Tranche 2 | | USD | | 3M US L + 2.50% | | 05/01/24 | | 5,779 | | | 5,804 | |

| Tempo Acquisition LLC, First Lien Initial Term Loan | | USD | | 1M US L + 3.00% | | 05/01/24 | | 593,275 | | | 591,976 | |

| Terminator Bidco AS, Facility B2 Term Loan(d) | | USD | | 3M US L + 5.00% | | 05/22/22 | | 1,000,000 | | | 977,500 | |

| Titan Acquisition, Ltd., First Lien Initial Term Loan | | USD | | 1M US L + 3.00% | | 03/28/25 | | 402,510 | | | 397,590 | |

| TMK Hawk Parent, Corp., First Lien Initial Term Loan | | USD | | 1M US L + 3.50% | | 08/28/24 | | 206,928 | | | 206,756 | |

| TNS, Inc., First Lien Initial Term Loan | | USD | | 1M US L + 4.00% | | 08/14/22 | | 247,212 | | | 248,757 | |

See Notes to Financial Statements.

| 12 | 1.888.926.2688 | www.griffincapital.com |

| Griffin Institutional Access Credit Fund | Schedule of Investments |

June 30, 2018 (Unaudited)

| Description | | Currency | | Rate | | Maturity

Date | | Principal

Amount | | Value

(Note 2) | |

| Transdigm, Inc., First Lien 2018 New Tranche F Term Loan | | USD | | 1M US L + 2.50% | | 06/09/23 | | | 126,242 | | $ | 125,868 | |

| Transdigm, Inc., First Lien New Tranche G Term Loan(b) | | USD | | 1M US L + 2.50% | | 08/22/24 | | | 563,517 | | | 560,950 | |

| Travelport Finance S.à r.l., First Lien Initial Term Loan | | USD | | 3M US L + 2.50% | | 03/17/25 | | | 210,250 | | | 209,790 | |

| Traverse Midstream Partners LLC, First Lien Advance Loan | | USD | | 3M US L + 4.00% | | 09/27/24 | | | 46,471 | | | 46,569 | |

| TRC Companies, Inc., First Lien Initial Term Loan | | USD | | 1M US L + 3.50% | | 06/21/24 | | | 323,743 | | | 322,934 | |

| Turbocombustor Technology, Inc., First Lien Initial Term Loan | | USD | | 1M US L + 4.50% | | 12/02/20 | | | 681,643 | | | 652,674 | |

| U.S. Anesthesia Partners, Inc., First Lien Initial Term Loan | | USD | | 1M US L + 3.00% | | 06/23/24 | | | 1,190,596 | | | 1,189,108 | |

| Ultra Resources, Inc., First Lien Loan | | USD | | 1M US L + 3.00% | | 04/12/24 | | | 250,000 | | | 231,125 | |

| Unitymedia Hessen GmbH & Co. KG, First Lien Facility C Loan | | EUR | | 3M EUR L + 2.75%, 0.00% Floor | | 01/15/27 | | | 246,269 | | | 285,975 | |

| Virgin Media Bristol LLC, First Lien K Facility Loan | | USD | | 1M US L + 2.50% | | 01/15/26 | | | 137,770 | | | 136,952 | |

| Weld North Education LLC, First Lien Initial Term Loan | | USD | | 3M US L + 4.25% | | 02/15/25 | | | 123,448 | | | 124,065 | |

| Wheels Up Partners LLC, First Lien Class A Notes Loan | | USD | | 3M US L + 6.50% | | 03/01/24 | | | 353,333 | | | 352,450 | |

| William Morris Endeavor Entertainment LLC, First Lien Term B-1 Loan | | USD | | 2M US L + 2.75% | | 05/18/25 | | | 1,016,157 | | | 1,006,630 | |

| Windstream Services LLC, First Lien 2016 Tranche B-6 Term Loan(b) | | USD | | 1M US L + 4.00% | | 03/29/21 | | | 728,272 | | | 692,314 | |

| Wink Holdco, Inc., First Lien Initial Term Loan | | USD | | 1M US L + 3.00% | | 12/02/24 | | | 249,373 | | | 248,750 | |

| WireCo WorldGroup, Inc., First Lien Initial Term Loan | | USD | | 1M US L + 5.00% | | 09/29/23 | | | 331,557 | | | 334,211 | |

| WP CPP Holdings LLC, First Lien Initial Term Loan | | USD | | 3M US L + 3.75% | | 04/30/25 | | | 309,901 | | | 311,490 | |

| | | | | | | | | | | | | | |

| TOTAL BANK LOANS | | | | | | | | | | | | | |

| (Cost $71,311,169) | | | | | | | | | | | | 71,109,897 | |

| | | | | | | | | | | | | | |

| CORPORATE BONDS (28.38%)(f) | | | | | | | | | | | | | |

| 1011778 BC ULC (New Red Finance, Inc.)(g) | | USD | | 5.00% | | 10/15/25 | | | 383,000 | | | 364,310 | |

| Acadia Healthcare Co., Inc. | | USD | | 5.63% | | 02/15/23 | | | 284,000 | | | 287,550 | |

| AECOM | | USD | | 5.13% | | 03/15/27 | | | 650,000 | | | 614,250 | |

| Aptim Corp.(g) | | USD | | 7.75% | | 06/15/25 | | | 481,000 | | | 392,015 | |

| Ardagh Packaging Finance PLC / Ardagh Holdings USA, Inc.(g) | | USD | | 6.00% | | 02/15/25 | | | 1,000,000 | | | 976,249 | |

| Ashtead Capital, Inc.(g) | | USD | | 4.13% | | 08/15/25 | | | 269,000 | | | 252,188 | |

| Avolon Holdings Funding, Ltd.(g) | | USD | | 5.50% | | 01/15/23 | | | 76,000 | | | 76,000 | |

| BBA US Holdings, Inc.(g) | | USD | | 5.38% | | 05/01/26 | | | 57,000 | | | 57,357 | |

| Beacon Roofing Supply, Inc.(g) | | USD | | 4.88% | | 11/01/25 | | | 250,000 | | | 232,500 | |

| BWAY Holding Co.(g) | | USD | | 7.25% | | 04/15/25 | | | 375,000 | | | 366,563 | |

| BWX Technologies, Inc.(g) | | USD | | 5.38% | | 07/15/26 | | | 323,000 | | | 327,845 | |

| California Resources Corp.(g) | | USD | | 8.00% | | 12/15/22 | | | 125,000 | | | 114,063 | |

| CB Escrow Corp.(g) | | USD | | 8.00% | | 10/15/25 | | | 314,000 | | | 294,375 | |

| CBS Radio, Inc.(g) | | USD | | 7.25% | | 11/01/24 | | | 306,000 | | | 292,995 | |

| CCO Holdings LLC / CCO Holdings Capital Corp.(g) | | USD | | 5.00% | | 02/01/28 | | | 596,000 | | | 548,320 | |

| CDK Global, Inc. | | USD | | 4.88% | | 06/01/27 | | | 291,000 | | | 280,451 | |

| CDK Global, Inc. | | USD | | 5.88% | | 06/15/26 | | | 116,000 | | | 118,755 | |

| Cequel Communications Holdings I LLC / Cequel Capital Corp.(g) | | USD | | 7.50% | | 04/01/28 | | | 379,000 | | | 385,519 | |

| Chaparral Energy, Inc.(g) | | USD | | 8.75% | | 07/15/23 | | | 291,000 | | | 293,728 | |

| Compass Minerals International, Inc.(g) | | USD | | 4.88% | | 07/15/24 | | | 177,000 | | | 166,876 | |

| Comstock Resources, Inc. | | USD | | 10.00% Cash or 12.25% PIK | | 03/15/20 | | | 250,000 | | | 262,500 | |

| Core & Main LP(g) | | USD | | 6.13% | | 08/15/25 | | | 250,000 | | | 238,125 | |

| CPG Merger Sub LLC(g) | | USD | | 8.00% | | 10/01/21 | | | 563,000 | | | 571,445 | |

See Notes to Financial Statements.

| Semi-Annual Report | June 30, 2018 | 13 |

| Griffin Institutional Access Credit Fund | Schedule of Investments |

June 30, 2018 (Unaudited)

| Description | | Currency | | Rate | | Maturity

Date | | | Principal

Amount | | | Value

(Note 2) | |

| CSC Holdings LLC(g) | | USD | | 5.38% | | 02/01/28 | | | 328,000 | | $ | 304,220 | |

| Extraction Oil & Gas, Inc.(g) | | USD | | 5.63% | | 02/01/26 | | | 496,000 | | | 475,570 | |

| Gates Global LLC / Gates Global Co.(g) | | USD | | 6.00% | | 07/15/22 | | | 299,000 | | | 303,485 | |

| Genworth Holdings, Inc. | | USD | | 4.80% | | 02/15/24 | | | 229,000 | | | 199,803 | |

| Genworth Holdings, Inc. | | USD | | 4.90% | | 08/15/23 | | | 182,000 | | | 160,160 | |

| GTT Communications, Inc.(g) | | USD | | 7.88% | | 12/31/24 | | | 750,000 | | | 746,250 | |

| Gulfport Energy Corp. | | USD | | 6.38% | | 01/15/26 | | | 636,000 | | | 612,149 | |

| HCA, Inc. | | USD | | 5.38% | | 02/01/25 | | | 797,000 | | | 786,798 | |

| Intelsat Jackson Holdings SA(g) | | USD | | 9.50% | | 09/30/22 | | | 729,000 | | | 845,640 | |

| Intrepid Aviation Group Holdings LLC / Intrepid Finance Co.(g) | | USD | | 6.88% | | 02/15/19 | | | 695,000 | | | 695,869 | |

| Intrum AB(g) | | EUR | | 3.13% | | 07/15/24 | | | 195,000 | | | 214,090 | |

| IRB Holding Corp.(g) | | USD | | 6.75% | | 02/15/26 | | | 324,000 | | | 310,230 | |

| Iron Mountain, Inc.(g) | | USD | | 5.25% | | 03/15/28 | | | 274,000 | | | 254,930 | |

| Jones Energy Holdings LLC / Jones Energy Finance Corp. | | USD | | 6.75% | | 04/01/22 | | | 125,000 | | | 78,125 | |

| KAR Auction Services, Inc.(g) | | USD | | 5.13% | | 06/01/25 | | | 103,000 | | | 98,623 | |

| Kronos Acquisition Holdings, Inc.(g) | | USD | | 9.00% | | 08/15/23 | | | 553,000 | | | 499,083 | |

| Level 3 Financing, Inc. | | USD | | 5.38% | | 01/15/24 | | | 660,000 | | | 648,450 | |

| Live Nation Entertainment, Inc.(g) | | USD | | 4.88% | | 11/01/24 | | | 358,000 | | | 347,260 | |

| Mattel, Inc.(g) | | USD | | 6.75% | | 12/31/25 | | | 375,000 | | | 366,094 | |

| Matterhorn Merger Sub LLC / Matterhorn Finance Sub, Inc.(g) | | USD | | 8.50% | | 06/01/26 | | | 679,000 | | | 656,932 | |

| MEDNAX, Inc.(g) | | USD | | 5.25% | | 12/01/23 | | | 500,000 | | | 491,250 | |

| Midas Intermediate Holdco II LLC / Midas Intermediate Holdco II Finance, Inc.(g) | | USD | | 7.88% | | 10/01/22 | | | 500,000 | | | 485,000 | |

| Multi-Color Corp.(g) | | USD | | 4.88% | | 11/01/25 | | | 610,000 | | | 569,588 | |

| Murray Energy Corp.(g) | | USD | | 11.25% | | 04/15/21 | | | 512,000 | | | 304,640 | |

| Nabors Industries, Inc.(g) | | USD | | 5.75% | | 02/01/25 | | | 122,000 | | | 115,595 | |

| National CineMedia LLC | | USD | | 5.75% | | 08/15/26 | | | 802,000 | | | 735,834 | |

| Netflix, Inc.(g) | | USD | | 5.88% | | 11/15/28 | | | 465,000 | | | 471,836 | |

| New Enterprise Stone & Lime Co., Inc.(g) | | USD | | 6.25% | | 03/15/26 | | | 242,000 | | | 245,025 | |

| Park Aerospace Holdings, Ltd.(g) | | USD | | 5.50% | | 02/15/24 | | | 1,000,000 | | | 989,790 | |

| Parsley Energy LLC / Parsley Finance Corp.(g) | | USD | | 5.38% | | 01/15/25 | | | 760,000 | | | 758,099 | |

| Pioneer Holdings LLC / Pioneer Finance Corp.(g) | | USD | | 9.00% | | 11/01/22 | | | 434,000 | | | 449,190 | |

| Pisces Midco Inc Pgem 8 04/15/26(g) | | USD | | 8.00% | | 04/15/26 | | | 114,000 | | | 110,215 | |

| Post Holdings, Inc.(g) | | USD | | 5.00% | | 08/15/26 | | | 250,000 | | | 233,750 | |

| Post Holdings, Inc.(g) | | USD | | 5.75% | | 03/01/27 | | | 121,000 | | | 117,068 | |

| Prime Security Services Borrower LLC / Prime Finance, Inc.(g) | | USD | | 9.25% | | 05/15/23 | | | 1,115,000 | | | 1,193,049 | |

| PVH Corp.(g) | | EUR | | 3.13% | | 12/15/27 | | | 242,000 | | | 279,642 | |

| QEP Resources, Inc. | | USD | | 5.63% | | 03/01/26 | | | 353,000 | | | 338,439 | |

| Radiate Holdco LLC / Radiate Finance, Inc.(g) | | USD | | 6.63% | | 02/15/25 | | | 177,000 | | | 162,398 | |

| Radiate Holdco LLC / Radiate Finance, Inc.(g) | | USD | | 6.88% | | 02/15/23 | | | 59,000 | | | 56,935 | |

| Radisson Hotel Holdings AB(g) | | EUR | | 6.88% | | 07/15/23 | | | 619,000 | | | 719,059 | |

| Range Resources Corp. | | USD | | 5.00% | | 03/15/23 | | | 500,000 | | | 488,250 | |

| RBS Global, Inc. / Rexnord LLC(g) | | USD | | 4.88% | | 12/15/25 | | | 220,000 | | | 207,900 | |

| Resolute Energy Corp. | | USD | | 8.50% | | 05/01/20 | | | 354,000 | | | 354,000 | |

| Sabre GLBL, Inc.(g) | | USD | | 5.25% | | 11/15/23 | | | 250,000 | | | 252,808 | |

| Sabre GLBL, Inc.(g) | | USD | | 5.38% | | 04/15/23 | | | 250,000 | | | 253,750 | |

| Sally Holdings LLC / Sally Capital, Inc. | | USD | | 5.63% | | 12/01/25 | | | 250,000 | | | 231,875 | |

| SBA Communications Corp. | | USD | | 4.88% | | 09/01/24 | | | 298,000 | | | 285,793 | |

| Scientific Games International, Inc.(g) | | EUR | | 3.38% | | 02/15/26 | | | 127,000 | | | 141,508 | |

| Scientific Games International, Inc.(g) | | USD | | 5.00% | | 10/15/25 | | | 70,000 | | | 66,850 | |

| Sirius XM Radio, Inc.(g) | | USD | | 3.88% | | 08/01/22 | | | 76,000 | | | 73,720 | |

See Notes to Financial Statements.

| 14 | 1.888.926.2688 | www.griffincapital.com |

| Griffin Institutional Access Credit Fund | Schedule of Investments |

June 30, 2018 (Unaudited)

| Description | | Currency | | Rate | | Maturity

Date | | | Principal

Amount | | | Value

(Note 2) | |

| Sirius XM Radio, Inc.(g) | | USD | | 5.00% | | 08/01/27 | | | 625,000 | | $ | 585,937 | |

| SM Energy Co. | | USD | | 5.00% | | 01/15/24 | | | 95,000 | | | 90,369 | |

| SM Energy Co. | | USD | | 5.63% | | 06/01/25 | | | 625,000 | | | 606,250 | |

| Sophia LP / Sophia Finance, Inc.(g) | | USD | | 9.00% | | 09/30/23 | | | 250,000 | | | 263,719 | |

| Sprint Corp. | | USD | | 7.88% | | 09/15/23 | | | 365,000 | | | 379,372 | |

| SPX FLOW, Inc.(g) | | USD | | 5.88% | | 08/15/26 | | | 250,000 | | | 248,750 | |

| SRC Energy, Inc.(g) | | USD | | 6.25% | | 12/01/25 | | | 481,000 | | | 482,804 | |

| SRS Distribution, Inc.(g) | | USD | | 8.25% | | 07/01/26 | | | 252,000 | | | 250,740 | |

| Summit Materials LLC / Summit Materials Finance Corp.(g) | | USD | | 5.13% | | 06/01/25 | | | 119,000 | | | 112,158 | |

| Tesla, Inc.(g) | | USD | | 5.30% | | 08/15/25 | | | 375,000 | | | 335,156 | |

| Titan Acquisition Ltd. / Titan Co-Borrower LLC(g) | | USD | | 7.75% | | 04/15/26 | | | 536,000 | | | 501,160 | |

| T-Mobile USA, Inc. | | USD | | 6.38% | | 03/01/25 | | | 1,125,000 | | | 1,169,999 | |

| T-Mobile USA, Inc. | | USD | | 6.50% | | 01/15/26 | | | 250,000 | | | 258,050 | |

| Travelport Corporate Finance PLC(g) | | USD | | 6.00% | | 03/15/26 | | | 316,000 | | | 319,160 | |

| TriMas Corp.(g) | | USD | | 4.88% | | 10/15/25 | | | 184,000 | | | 175,145 | |

| Ultra Resources, Inc.(g) | | USD | | 7.13% | | 04/15/25 | | | 237,000 | | | 167,678 | |

| United Continental Holdings, Inc. | | USD | | 5.00% | | 02/01/24 | | | 682,000 | | | 659,835 | |

| ViaSat, Inc.(g) | | USD | | 5.63% | | 09/15/25 | | | 220,000 | | | 207,900 | |

| W/S Packaging Holdings, Inc.(g) | | USD | | 9.00% | | 04/15/23 | | | 500,000 | | | 507,500 | |

| Wabash National Corp.(g) | | USD | | 5.50% | | 10/01/25 | | | 250,000 | | | 240,625 | |

| Wildhorse Resource Development Corp.(g) | | USD | | 6.88% | | 02/01/25 | | | 201,000 | | | 206,025 | |

| Wind Tre SpA(g) | | USD | | 5.00% | | 01/20/26 | | | 375,000 | | | 299,141 | |

| WMG Acquisition Corp.(g) | | USD | | 5.50% | | 04/15/26 | | | 164,000 | | | 162,975 | |

| XPO Logistics, Inc.(g) | | USD | | 6.50% | | 06/15/22 | | | 500,000 | | | 514,375 | |

| Zayo Group LLC / Zayo Capital, Inc.(g) | | USD | | 5.75% | | 01/15/27 | | | 500,000 | | | 492,500 | |

| Zayo Group LLC / Zayo Capital, Inc. | | USD | | 6.38% | | 05/15/25 | | | 500,000 | | | 511,250 | |

| TOTAL CORPORATE BONDS | | | | | | | | | | | | | |

| (Cost $38,231,751) | | | | | | | | | | | | 37,049,169 | |

| | | | | | | | | | | | | | |

| CONVERTIBLE CORPORATE BONDS (0.18%) | | | | | | | | | | | | | |

| Whiting Petroleum Corp. | | USD | | 1.25% | | 04/01/20 | | | 245,000 | | | 234,448 | |

| TOTAL CONVERTIBLE CORPORATE BONDS | | | | | | | | | | | | | |

| (Cost $231,141) | | | | | | | | | | | | 234,448 | |

| | | | | | | | | | | | | | |

| COLLATERALIZED LOAN OBLIGATIONS (8.28%) | | | | | | | | | | | | | |

| DEBT (2.38%) | | | | | | | | | | | | | |

| Atrium, Series 2017-12A(a)(g) | | USD | | 3M US L + 0.83% | | 04/22/27 | | | 300,000 | | | 299,540 | |

| Carlyle Global Market Strategies, Ltd., Series 2014- 3RA(a)(g) | | USD | | 3M US L + 1.05% | | 07/27/31 | | | 500,000 | | | 500,491 | |

| Dryden, Ltd., Series 2017-53A(a)(g) | | USD | | 3M US L + 1.12% | | 01/15/31 | | | 250,000 | | | 250,475 | |

| Dryden, Ltd., Series 2018-58A(a)(b)(g) | | USD | | L + 0.50% | | 07/17/31 | | | 12,500 | | | 10,348 | |

| Dryden, Ltd., Series 2018-58A(a)(b)(g) | | USD | | L + 1.00% | | 07/17/31 | | | 500,000 | | | 500,000 | |

| Madison Park Funding, Ltd., Series 2018-30A(a)(g) | | USD | | 3M US L + 0.75% | | 04/15/29 | | | 300,000 | | | 297,080 | |

| Magnetite, Ltd., Series 2018-15A(a)(g) | | USD | | 3M US L + 1.01% | | 07/25/31 | | | 250,000 | | | 250,000 | |

| Sound Point CLO, Ltd., Series 2017-3A(a)(g) | | USD | | 3M US L + 6.50% | | 10/20/30 | | | 500,000 | | | 514,079 | |

| THL Credit Wind River, Series 2014-1A(a)(g) | | USD | | 3M US L + 1.05% | | 07/18/31 | | | 500,000 | | | 500,465 | |

| | | | | | | | | | | | | 3,122,478 | |

| EQUITY (5.90%)(h) | | | | | | | | | | | | | |

| CARLYLE US CLO 2017-5, Ltd., Series 2017-5A(g) | | USD | | 17.13% | | 01/20/30 | | | 700,000 | | | 718,845 | |

| CIFC Funding 2018-II, Ltd., Series 2018-2A(g) | | USD | | 18.00% | | 04/20/31 | | | 300,000 | | | 266,722 | |

| CIFC Funding, Ltd., Series 2018-1A(g) | | USD | | 14.98% | | 04/18/31 | | | 200,000 | | | 202,514 | |

| Dryden, Ltd., Series 2014-31X(d)(g)(i) | | USD | | 0.00% | | 04/18/26 | | | 600,000 | | | 23,536 | |

| Dryden, Ltd., Series 2018-64A(g) | | USD | | 19.05% | | 04/18/31 | | | 900,000 | | | 784,606 | |

See Notes to Financial Statements.

| Semi-Annual Report | June 30, 2018 | 15 |

| Griffin Institutional Access Credit Fund | Schedule of Investments |

June 30, 2018 (Unaudited)

| Description | | Currency | | Rate | | Maturity

Date | | | Principal

Amount | | | Value

(Note 2) | |

| Madison Park Funding, Ltd., Series 2017-26A(g) | | USD | | 15.21% | | 07/29/47 | | | 500,000 | | $ | 380,882 | |

| Midocean Credit CLO, Ltd., Series 2018-8A(g) | | USD | | 33.68% | | 02/20/31 | | | 300,000 | | | 272,722 | |

| Octagon Investment Partners 37, Ltd., Series 2018- 2A(g)(j) | | USD | | TBD | | 07/25/30 | | | 1,000,000 | | | 910,000 | |

| OZLM XIX, Ltd., Series 2017-19A(g) | | USD | | 16.60% | | 11/22/30 | | | 1,100,000 | | | 951,177 | |

| Sound Point CLO, Ltd., Series 2018-2A(g) | | USD | | 17.64% | | 07/26/31 | | | 500,000 | | | 453,623 | |

| Sound Point CLO, Ltd., Series 2017-3A(g) | | USD | | 17.85% | | 10/20/30 | | | 600,000 | | | 621,092 | |

| Venture CDO, Ltd., Series 2017-30A(g) | | USD | | 18.03% | | 01/15/31 | | | 600,000 | | | 540,029 | |

| Venture CDO, Ltd., Series 2017-28A(g) | | USD | | 19.53% | | 10/20/29 | | | 200,000 | | | 179,909 | |

| Vibrant CIO VIII, Ltd., Series 2018-8A(g) | | USD | | 15.84% | | 01/20/31 | | | 500,000 | | | 492,674 | |

| Voya, Ltd., Series 2017-1A(g) | | USD | | 10.70% | | 04/17/30 | | | 505,000 | | | 383,770 | |

| Voya, Ltd., Series 2018-1A(g) | | USD | | 16.58% | | 04/19/31 | | | 500,000 | | | 501,420 | |

| | | | | | | | | | | | | 7,683,521 | |

| TOTAL COLLATERALIZED LOAN OBLIGATIONS | | | | | | | | | | | | | |

| (Cost $10,702,968) | | | | | | | | | | | | 10,805,999 | |

| | | | | | | | | | Shares | | | | |

| COMMON STOCKS (0.20%) | | | | | | | | | | | | | |

| Toshiba Corp.(k) | | JPY | | | | | | | 85,720 | | | 257,822 | |

| TOTAL COMMON STOCKS | | | | | | | | | | | | | |

| (Cost $249,264) | | | | | | | | | | | | 257,822 | |

| | | | | | | Expiration

Date | | | Shares | | | Value

(Note 2) | |

| WARRANTS (0.01%) | | | | | | | | | | | | | |

| Deep Gulf Energy II, LLC(d)(k)(l) | | USD | | | | 12/31/25 | | | 33 | | | 19,472 | |

| | | | | | | | | | | | | | |

| TOTAL WARRANTS | | | | | | | | | | | | | |

| (Cost $-) | | | | | | | | | | | | 19,472 | |

| | | | | | | | | | | | | | |

| TOTAL INVESTMENTS (91.52%) | | | | | | | | | | | | | |

| (Cost $120,726,293) | | | | | | | | | | | $ | 119,476,807 | |

| | | | | | | | | | | | | | |

| Other Assets In Excess Of Liabilities (8.48%) | | | | | | | | | | | | 11,066,549 | |

| NET ASSETS (100.00%) | | | | | | | | | | | $ | 130,543,356 | |

Libor Rates:

1M US L - 1 Month US LIBOR as of June 30, 2018 was 2.09%

2M US L - 2 Month US LIBOR as of June 30, 2018 was 2.17%

3M US L - 3 Month US LIBOR as of June 30, 2018 was 2.34%

6M US L - 6 Month US LIBOR as of June 30, 2018 was 2.50%

3M EUR L - 3 Month EURIBOR as of June 30, 2018 was -0.36%

6M EUR L - 6 Month EURIBOR as of June 30, 2018 was -0.32%

1M GBP L - 1 Month GBP LIBOR as of June 30, 2018 was 0.50%

3M GBP L - 3 Month GBP LIBOR as of June 30, 2018 was 0.67%

| (a) | Floating or variable rate security. The reference rate is described above. The rate in effect as of June 30, 2018 is based on the reference rate plus the displayed spread as of the security's last reset date. |

| (b) | All or a portion of this position has not settled as of June 30, 2018. The interest rate shown represents the stated spread over the applicable London Interbank Offered Rate ("LIBOR" or "L") or Euro Interbank Offered Rate (“EURIBOR” or “EUR L”); the Fund will not accrue interest until the settlement date, at which point LIBOR will be established. If the position is partially settled, the reference rate and floor shown is applicable to the settled portion. |

See Notes to Financial Statements.

| 16 | 1.888.926.2688 | www.griffincapital.com |

| Griffin Institutional Access Credit Fund | Schedule of Investments |

June 30, 2018 (Unaudited)

| (c) | A portion of this position or the entire position was not funded as of June 30, 2018. The Fund had approximately $562,237 in unfunded commitments pursuant to Delayed Draw Term Loan facility and unused Revolver capacity. The Schedule of Investments records each of these investments as fully funded and accordingly, a corresponding payable for investments purchased has also been recorded which represents the actual unfunded amount on the balance sheet date. |

| (d) | This investment is classified as a level 3 asset, and such classification was a result of unavailable quoted prices from an active market or the unavailability of other significant observable inputs. |

| (e) | 43.71% of the total coupon was PIK and 56.29% was cash. |

| (g) | Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in the ordinary course of business in transactions exempt from registration, normally to qualified institutional buyers. As of June 30, 2018, the aggregate market value of those securities was $37,696,861, representing 28.88% of net assets. |

| (h) | CLO subordinated notes, income notes, and M notes are considered CLO equity positions. CLO equity positions are entitled to recurring distributions which are generally equal to the remaining cash flow of payments made by underlying securities less contractual payments to debt holders and fund expenses. The effective yield is estimated based upon the current projection of the amount and timing of these recurring distributions in addition to the estimated amount of terminal principal payment. Effective yields for the Fund's CLO equity positions are updated at least once a year, either on the anniversary of the formation of a CLO investment that the Fund holds in its portfolio or on a transaction such as a partial sale, add-on purchase, refinancing or reset. The estimated yield and investment cost may ultimately not be realized. |

| (i) | Securities were purchased pursuant to Regulation S under the Securities Act of 1933, which exempts securities offered and sold outside of the United States from registration. Such securities cannot be sold in the United States without either an effective registration statement filed pursuant to the Securities Act of 1933, or pursuant to an exemption from registration. These securities have been deemed liquid under guidelines approved by the Fund's Board of Trustees. As of June 30, 2018 the aggregate market value of those securities was $23,536 representing 0.02% of net assets. |

| (j) | Position is fully unsettled and therefore estimated yield has not been calculated. |

| (k) | Non-income producing security. |

| (l) | Security is wholly owned by a single member special purpose vehicle. |

Common Abbreviations:

EURIBOR - Euro InterBank Offered Rate

LIBOR - London Interbank Offered Rate

LLC - Limited Liability Company

LP - Limited Partnerships

PIK - Payment in Kind

OUTSTANDING FORWARD FOREIGN CURRENCY CONTRACTS

| Counterparty | | Buy/Sale

Currency | | Contracted

Amount* | | | Purchase/Sale

Contract | | Settlement

Date | | Current

Value(USD) | | | Unrealized

Appreciation/

(Depreciation) | |

| BNY Mellon | | USD/GBP | | | 1,180,000 | | | Sale | | 07/20/2018 | | $ | 1,558,553 | | | $ | 628 | |

| FXC | | USD/JPY | | | 28,520,000 | | | Sale | | 07/20/2018 | | | 257,899 | | | | 1,384 | |

| | | | | | | | | | | | | | | | | $ | 2,012 | |

| | | | | | | | | | | | | | | | | | | |

| BNY Mellon | | USD/EUR | | | 2,520,000 | | | Sale | | 07/20/2018 | | $ | 2,946,606 | | | $ | (20,760 | ) |

| | | | | | | | | | | | | | | | | $ | (20,760 | ) |

| * | The contracted amount is stated in the foreign currency in which the security is denominated. |

See Notes to Financial Statements.

| Semi-Annual Report | June 30, 2018 | 17 |

| Griffin Institutional Access Credit Fund | Statement of Assets and Liabilities |

June 30, 2018 (Unaudited)

| ASSETS | | | |

| Investments, at value (Cost $120,726,293) | | $ | 119,476,807 | |

| Cash | | | 15,072,090 | |

| Foreign currency, at value (Cost $634,534) | | | 634,565 | |

| Unrealized appreciation on forward foreign currency contracts | | | 2,012 | |

| Receivable for investments sold | | | 4,130,100 | |

| Receivable for shares sold | | | 1,877,720 | |

| Dividends and interest receivable | | | 855,166 | |

| Receivable due from Adviser (Note 4) | | | 301,143 | |

| Prepaid expenses and other assets | | | 68,232 | |

| Total Assets | | | 142,417,835 | |

| LIABILITIES | | | | |

| Payable for investments purchased | | | 9,619,992 | |

| Shareholder servicing fees payable (Note 4) | | | 11,945 | |

| Unrealized depreciation on forward foreign currency contracts | | | 20,760 | |

| Investment advisory fees payable (Note 4) | | | 189,822 | |

| Administration fees payable (Note 4) | | | 42,121 | |

| Transfer agency fees payable (Note 4) | | | 46,218 | |

| Distribution fees payable (Note 4) | | | 12,340 | |

| Payable for distributions | | | 1,823,229 | |

| Chief compliance officer fees payable (Note 4) | | | 6,026 | |

| Trustees' fees payable (Note 4) | | | 10,438 | |

| Legal fees payable | | | 37,106 | |

| Audit and tax fees payable | | | 30,857 | |

| Custody fees payable | | | 17,164 | |

| Accrued expenses and other liabilities | | | 6,461 | |

| Total Liabilities | | | 11,874,479 | |

| NET ASSETS | | $ | 130,543,356 | |

| NET ASSETS CONSIST OF | | | | |

| Paid-in capital | | $ | 131,764,565 | |

| Accumulated net investment loss | | | (34,619 | ) |

| Accumulated net realized gain | | | 41,011 | |

| Net unrealized depreciation | | | (1,227,601 | ) |

| NET ASSETS | | $ | 130,543,356 | |

See Notes to Financial Statements.

| 18 | 1.888.926.2688 | www.griffincapital.com |

| Griffin Institutional Access Credit Fund | Statement of Assets and Liabilities |

June 30, 2018 (Unaudited)

| PRICING OF SHARES | | | |

| Class A: | | | | |

| Net asset value | | $ | 24.92 | |

| Net assets | | $ | 20,427,253 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 819,641 | |

| Maximum offering price per share ((NAV/0.9425), based on maximum sales charge of 5.75% of the offering price) | | $ | 26.44 | |

| Class C: | | | | |

| Net asset value and offering | | $ | 24.92 | |

| Net assets | | $ | 10,235,097 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 410,652 | |

| Class I: | | | | |

| Net asset value and offering | | $ | 24.92 | |

| Net assets | | $ | 69,142,238 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 2,774,023 | |

| Class L: | | | | |

| Net asset value | | $ | 24.92 | |

| Net assets | | $ | 657,351 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 26,377 | |

| Maximum offering price per share ((NAV/0.9575), based on maximum sales charge of 4.25% of the offering price) | | $ | 26.03 | |

| Class F: | | | | |

| Net asset value and offering | | $ | 24.93 | |

| Net assets | | $ | 30,081,417 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 1,206,711 | |

See Notes to Financial Statements.

| Semi-Annual Report | June 30, 2018 | 19 |

| Griffin Institutional Access Credit Fund | Statement of Operations |

| | | For the Six

Months Ended

June 30, 2018

(Unaudited) | |

| INVESTMENT INCOME | | | | |

| Interest (net of foreign withholding tax of $3,223) | | $ | 3,262,424 | |

| Total Investment Income | | | 3,262,424 | |

| | | | | |

| EXPENSES | | | | |

| Investment advisory fees (Note 4) | | | 1,031,585 | |

| Administrative fees (Note 4) | | | 122,258 | |

| Transfer Agency fees (Note 4) | | | 90,236 | |

| Shareholder servicing fees: | | | | |

| Class A | | | 23,499 | |

| Class C | | | 10,129 | |

| Class L | | | 4 | |

| Distribution fees: | | | | |

| Class C | | | 30,388 | |

| Class L | | | 676 | |

| Legal fees | | | 67,739 | |

| Audit and tax fees | | | 65,019 | |

| Reports to shareholders and printing fees | | | 29,275 | |

| State registration fees | | | 20,109 | |

| Insurance fees | | | 26,151 | |

| Custody fees | | | 15,662 | |

| Chief compliance officer fees (Note 4) | | | 62,572 | |

| Offering cost (Note 2) | | | 83,178 | |

| Trustees' fees (Note 4) | | | 43,316 | |

| Other expenses | | | 7,891 | |

| Total Expenses | | | 1,729,687 | |

| Less: Fees waived/expenses reimbursed by Adviser (Note 4) | | | (1,729,687 | ) |

| Net Expenses | | | – | |

| Net Investment Income | | | 3,262,424 | |

| Net realized loss on investments | | | (152,094 | ) |

| Net realized gain on forward foreign currency transactions | | | 206,344 | |

| Net realized loss on foreign currency translation | | | (12,665 | ) |

| Net realized gain | | | 41,585 | |

| Net change in unrealized appreciation/(depreciation) on investments | | | (1,663,471 | ) |

| Net change in unrealized appreciation/(depreciation) on forward foreign currency transactions | | | (6,047 | ) |

| Net change in unrealized appreciation/(depreciation) on translation of assets and liabilities denominated in foreign currencies | | | 44,526 | |

| Net change in unrealized depreciation | | | (1,624,992 | ) |

| NET REALIZED AND UNREALIZED LOSS ON INVESTMENTS | | | (1,583,407 | ) |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 1,679,017 | |

See Notes to Financial Statements.

| 20 | 1.888.926.2688 | www.griffincapital.com |

| Griffin Institutional Access Credit Fund | Statement of Changes in Net Assets |

| | | For the Six

Months Ended

June 30, 2018

(Unaudited) | | | For the Period

April 3, 2017

(Commencement

of Operations) to

December 31, 2017 | |

| OPERATIONS: | | | | | | |

| Net investment income | | $ | 3,262,424 | | | $ | 1,567,613 | |

| Net realized gain on investments | | | 41,585 | | | | 37,736 | |

| Net change in unrealized appreciation/(depreciation) on investments | | | (1,624,992 | ) | | | 397,391 | |

| Net Increase in Net Assets Resulting from Operations | | | 1,679,017 | | | | 2,002,740 | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| Class A | | | | | | | | |

| From net investment income | | | (523,275 | ) | | | (195,865 | ) |

| Class C | | | | | | | | |

| From net investment income | | | (246,192 | ) | | | (104,149 | ) |

| Class I | | | | | | | | |

| From net investment income | | | (1,610,452 | ) | | | (729,549 | ) |

| Class L(a) | | | | | | | | |

| From net investment income | | | (16,297 | ) | | | (7,568 | ) |

| Class F(b) | | | | | | | | |

| From net investment income | | | (974,494 | ) | | | (436,978 | ) |

| Total Distributions to Shareholders | | | (3,370,710 | ) | | | (1,474,109 | ) |

| BENEFICIAL INTEREST TRANSACTIONS, IN DOLLARS: | | | | | | | | |

| Class A | | | | | | | | |

| Shares sold | | | 6,664,136 | | | | 14,979,001 | |

| Distributions reinvested | | | 232,157 | | | | 100,857 | |

| Shares redeemed | | | (733,317 | ) | | | (36,689 | ) |

| Transferred out | | | (49,799 | ) | | | (507,511 | ) |

| Class C | | | | | | | | |

| Shares sold | | | 3,602,793 | | | | 7,102,320 | |

| Distributions reinvested | | | 141,205 | | | | 61,626 | |

| Shares redeemed | | | (61,927 | ) | | | – | |

| Transferred out | | | – | | | | (506,599 | ) |

| Class I | | | | | | | | |