ITEM 4. INFORMATION ON THE COMPANY

A. History and Development of the Company

We commenced our express delivery service business through Shanghai Zhongtongji Express Service Co., Ltd., or Shanghai Zhongtongji, in Shanghai, China in January 2009. Prior to 2014, we operated express delivery services in Shanghai, Anhui Province, Jiangsu Province and Zhejiang Province through Shanghai Zhongtongji, which authorized and cooperated with third-party business partners to operate ZTO-branded express delivery services elsewhere in China.

In January 2013, the shareholders who separately owned Shanghai Zhongtongji and 15 network partners located in the cities and provinces mentioned above, established ZTO Express, as the holding company to hold the businesses of Shanghai Zhongtongji and the 15 network partners.

In January 2014, ZTO Express acquired businesses and assets of Shanghai Zhongtongji and eight network partners that were wholly owned by some of the shareholders who formed ZTO Express.

In October 2015, ZTO Express and its wholly owned subsidiaries acquired express delivery businesses from 16 network partners and their respective shareholders in exchange for equity interest in ZTO Express (Cayman) Inc. and cash.

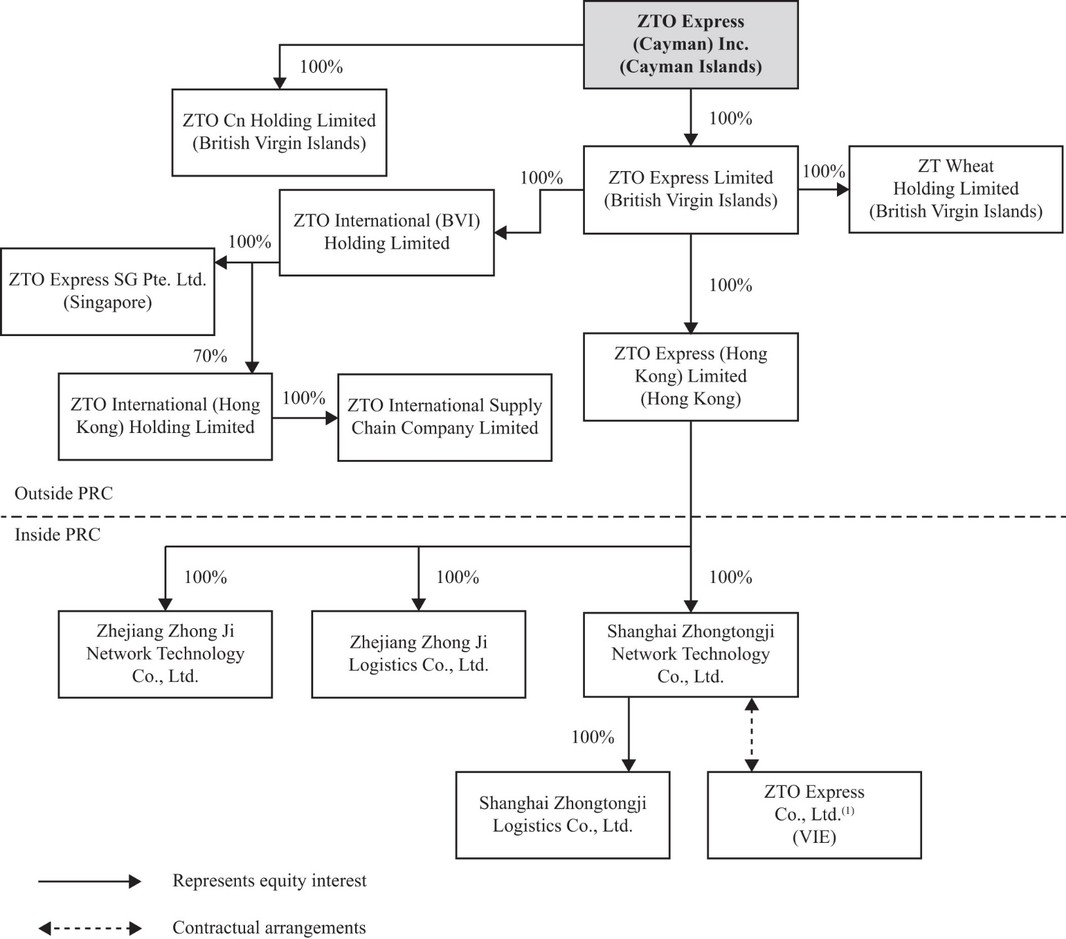

In April 2015, ZTO Express (Cayman) Inc. was incorporated under the laws of the Cayman Islands as our offshore holding company to facilitate financing and offshore listing. Upon its incorporation, ZTO Express (Cayman) Inc. issued 600,000,000 ordinary shares to the British Virgin Islands holding vehicles of the then shareholders of ZTO Express, in proportion to these shareholders’ then respective share percentage in ZTO Express. ZTO Express (Cayman) Inc. established ZTO Express Limited in British Virgin Islands as its wholly-owned subsidiary in April 2015. ZTO Express Limited subsequently established ZTO Express (Hong Kong) Limited as its wholly owned subsidiary in May 2015.

In July 2015, ZTO Express (Hong Kong) Limited established a wholly owned PRC subsidiary, Shanghai Zhongtongji Network. Due to the PRC legal restrictions on foreign ownership in companies that provide mail delivery services in China, we carry out our express delivery business through ZTO Express, a domestic PRC company, equity interests in which are held by PRC citizens and companies established in Shanghai China.

Zhongtongji Network entered into a series of contractual arrangements, including an exclusive call option agreement, an equity pledge agreement, a voting rights proxy agreement, as described in more detail below, irrevocable powers of attorney and an exclusive consulting and services agreement and its supplemental agreement, with ZTO Express and its shareholders, and obtained spousal consent letters by the spouses of six key shareholders of ZTO Express. These shareholders are Messrs. Meisong Lai, Jianfa Lai, Jilei Wang, Xiangliang Hu, Shunchang Zhang and Xuebing Shang, collectively holding 73.8% of equity interest in ZTO Express.

As a result of these contractual arrangements, we are able to direct the activities of, and are the primary beneficiary of, ZTO Express. ZTO Express is therefore the consolidated affiliated entity, or the VIE, which generally refers to an entity in which we do not have any equity interests but whose financial results are consolidated into our consolidated financial statements in accordance with U.S. GAAP because we have effective financial control over, and are the primary beneficiary of, that entity. We treat ZTO Express and its subsidiaries as the consolidated affiliated entities under U.S. GAAP and have consolidated their financial results in our consolidated financial statements in accordance with U.S. GAAP. However, those contractual arrangements may not be as effective in providing us with the ability to direct the operational activities as direct ownership.

On October 27, 2016, our ADSs commenced trading on the NYSE under the symbol “ZTO.” We raised from our initial public offering approximately $1.4 billion in net proceeds after deducting underwriting commissions and the offering expenses payable by us.

In May 2017, we announced a US$300 million share repurchase program and repurchased an aggregate of 9,759,888 ADSs at an average purchase price of US$14.12, including repurchase commissions, under this program as of May 21, 2018.

In May 2018, Alibaba and Cainiao Network entered into a strategic transaction with us. Pursuant to the transaction terms, investors led by Alibaba and Cainiao Network invested US$1.38 billion in our company in exchange for approximately 10% of our equity interest at that time and obtained certain shareholder rights in our company. The transaction was completed in June 2018.