As filed with the Securities and Exchange Commission on October 5, 2016

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REGISTRATION STATEMENT

Under Schedule B of

THE SECURITIES ACT OF 1933

Japan International Cooperation Agency

(Issuer)

Japan

(Guarantor)

(Names of Registrants)

Nibancho Center Building 5-25

Niban-cho

Chiyoda-ku

Tokyo 102-8012, Japan

(Address of Principal Executive Office of Japan International Cooperation Agency)

Names and addresses of Duly Authorized Representatives:

| | |

| For the Issuer: | | For the Guarantor: |

Ryosuke Nakata Chief Representative JICA USA Office 1776 I Street, N.W., Suite 895 Washington, D.C. 20006 | | Genichi Osawa Ministry of Finance Consulate General of Japan in New York 299 Park Avenue, 18th Floor New York, New York 10171 |

Copies to:

| | |

Kenji Hosokawa Morrison & Foerster LLP Shin-Marunouchi Building 29th Floor 5-1, Marunouchi 1-chome Chiyoda-ku, Tokyo 100-6529 Japan | | Kenji Taneda Skadden, Arps, Slate, Meagher & Flom LLP Izumi Garden Tower, 21st Floor 1-6-1 Roppongi Minato-ku, Tokyo 106-6021 Japan |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

CALCULATION OF REGISTRATION FEE

| | | | | | | | |

|

Title of Each Class of Securities to be

Registered | | Amount being

Registered(1)(2) | | Proposed

Maximum Offering

Price Per Unit(3) | | Proposed

Maximum Aggregate

Offering Price(3) | | Amount of

Registration Fee |

Debt Securities | | $125,000,000 | | 100% | | $125,000,000 | | $14,488 |

Guarantee of Japan | | — | | — | | — | | — |

|

|

| (1) | In the case of debt securities issued at an original issue discount, such greater principal amount as will result in an aggregate public offering price of such registered amount and, in the case of debt securities denominated in a currency other than U.S. dollars, such principal amount in such currency as will result in an aggregate public offering price of such registered amount when converted into U.S. dollars at the exchange rate in effect on the date such debt securities are initially offered to the public. |

| (2) | Offers and sales of debt securities outside the United States are being made pursuant to Regulation S under the Securities Act of 1933, as amended, and are not covered by this registration statement. |

| (3) | Estimated solely for the purpose of determining the registration fee. |

The registrants hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrants shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. Japan International Cooperation Agency may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted

Subject to Completion, Dated October 5, 2016

P R O S P E C T U S

$●

Japan International Cooperation Agency

(An incorporated administrative agency)

●% Guaranteed Bonds Due ●, ●

Unconditionally and Irrevocably Guaranteed

as to Payment of Principal and Interest by

Japan

Japan International Cooperation Agency (“JICA”) will pay interest semi-annually in arrears in equal payments on the $● ●% guaranteed bonds due ● (the “bonds”) on ● and ● of each year, commencing ●, 2017. The bonds will mature on ●. JICA may redeem all, but not less than all, of the bonds in the event of certain tax law changes. The redemption terms are described in this prospectus dated ●, 2016 under “Description of the Bonds and Guarantee—Redemption” (this “Prospectus”). The bonds will be issued only in registered form in denominations of $200,000 and integral multiples of $2,000 in excess thereof. See “Description of the Bonds and Guarantee”.

Application will be made for the listing and quotation of the bonds on the Singapore Exchange Securities Trading Limited (the “SGX-ST”). The SGX-ST assumes no responsibility for the correctness of any of the statements made or opinions or reports contained in this Prospectus. Admission of the bonds to the official list of the SGX-ST is not to be taken as an indication of the merits of JICA, Japan, the bonds or the guarantee.

Neither the United States Securities and Exchange Commission (the “Commission”) nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this Prospectus. Any representation to the contrary is a criminal offense.

Prospective investors should consider carefully the factors described under the section headed “Risk Factors” in this Prospectus.

| | | | | | | | |

| | | Per Bond | | | Total | |

Price to Public(1) | | ● | % | | | $ | ● | |

Underwriting Commissions | | ● | % | | | $ | ● | |

Proceeds, before expenses, to JICA(1)(2) | | ● | % | | | $ | ● | |

| (1) | Plus accrued interest, if any, from ●, 2016, if settlement occurs after that date. |

The underwriters are offering the bonds subject to various conditions. The underwriters expect to deliver the bonds through the book-entry facilities of The Depository Trust Company (“DTC”), Euroclear Bank S.A./N.V. (“Euroclear”) and Clearstream Banking S.A. (“Clearstream”), against payment on or about ●, 2016.

| | | | |

| Barclays | | BofA Merrill Lynch | | Daiwa Capital Markets Europe |

The date of this Prospectus is ●, 2016.

Table of Contents

ii

The debt securities have not been and will not be registered under the Financial Instruments and Exchange Act of Japan (Act No. 25 of 1948, as amended) and the debt securities are subject to the Act on Special Measures Concerning Taxation of Japan (Act No. 26 of 1957, as amended). The debt securities may not be offered or sold in Japan or to, or for the benefit of, residents of Japan or Japanese corporations, except pursuant to an exemption from the registration requirements of, and otherwise in compliance with, the Financial Instruments and Exchange Act of Japan and any other applicable laws, regulations and ministerial guidelines of Japan (see “Underwriting” below). The debt securities are not, as part of the initial distribution at any time, to be offered or sold to, or for the benefit of, any person other than a beneficial owner that is, (i) for Japanese tax purposes, neither (x) an individual resident of Japan or a Japanese corporation, nor (y) an individual non-resident of Japan or a non-Japanese corporation that in either case is a person having a special relationship with JICA (that is, in general terms, a person who directly or indirectly controls or is directly or indirectly controlled by, or is under direct or indirect common control with, JICA) as described in Article 6, Paragraph (4) of the Act on Special Measures Concerning Taxation of Japan (a “Specially-Related Party of JICA”) or (ii) a Japanese financial institution, designated in Article 6, Paragraph (9) of the Act on Special Measures Concerning Taxation of Japan. BY SUBSCRIBING FOR THE DEBT SECURITIES, AN INVESTOR WILL BE DEEMED TO HAVE REPRESENTED IT IS A PERSON WHO FALLS INTO THE CATEGORY OF (i) OR (ii) ABOVE.

In addition, interest payments on the debt securities will generally be subject to Japanese withholding tax unless it is established that debt securities are held by or for the account of a beneficial owner that is (i) for Japanese tax purposes, neither (x) an individual resident of Japan or a Japanese corporation, nor (y) an individual non-resident of Japan or a non-Japanese corporation that in either case is a Specially-Related Party of JICA, (ii) a designated Japanese financial institution described in Article 6, Paragraph (9) of the Act on Special Measures Concerning Taxation of Japan which complies with the requirement for tax exemption under that paragraph, or (iii) a public corporation, a financial institution or a financial instruments business operator, etc. described in Article 3-3, Paragraph (6) of the Act on Special Measures Concerning Taxation of Japan which complies with the requirement for tax exemption under that paragraph.

You should rely only on the information contained in this Prospectus. We have not authorized anyone to provide you with different information. We are not making an offer of these securities in any jurisdiction where the offer is not permitted. You should not assume that the information contained in this Prospectus is accurate as of any date other than the date on the front page of this Prospectus.

In this Prospectus, “we”, “our”, “us” and “JICA” refer to Japan International Cooperation Agency.

The spot buying rate for U.S. dollars quoted on the Tokyo foreign exchange market on ●, 2016, as reported by the Bank of Japan at 5:00 p.m., Tokyo time, was ¥● = $1.00, and the noon buying rate on ●, 2016 for cable transfers in New York City payable in yen, as reported by the Federal Reserve Bank of New York, was $1.00 = ¥●.

References in this Prospectus to Japanese fiscal years (“JFYs”) are to 12-month periods commencing in each case on April 1 of the year indicated and ending on March 31 of the following year. References to years not specified as being JFYs are to calendar years. References to business years in the audited financial statements of JICA contained in this Prospectus are to the fiscal years of JICA. References to “¥”or “yen” are to Japanese yen and references to “$” are to U.S. dollars.

The distribution of this Prospectus and the offering of the bonds in certain jurisdictions may be restricted by law. In particular, in the case of offers in the European Economic Area, or EEA, the bonds may not be offered or sold, directly or indirectly, except in circumstances that will result in compliance with Directive 2003/71/EC of

iii

the European Parliament and of the Council of 4 November 2003 (and amendments thereto, including Directive 2010/73/EU) and any relevant implementing measure in the Relevant Member State (as defined below) (the “Prospectus Directive”) and any other applicable laws and regulations. Persons in whose possession this Prospectus come should inform themselves about and observe any such restrictions. This Prospectus does not constitute, and may not be used in connection with, an offer or solicitation by anyone in any jurisdiction in which such offer or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to do so or to any person to whom it is unlawful to make such offer or solicitation. See “Underwriting”.

This Prospectus has been prepared on the basis that all offers of bonds in any Member State of the EEA which has implemented the Prospective Directive (a “Relevant Member State”) will be made pursuant to an exemption under the Prospectus Directive, as implemented in that Relevant Member State, from the requirement to produce and publish a prospectus for offers of the bonds. Accordingly, any person making or intending to make any offer in that Relevant Member State of the bonds which are the subject of the placement referred to in this Prospectus may only do so in circumstances in which no obligation arises for JICA or the Underwriters to produce and publish a prospectus pursuant to Article 3 of the Prospectus Directive, or supplement a prospectus pursuant to Article 16 of the Prospective Directive, in relation to such offer. Neither JICA, Japan nor the underwriters have authorized, nor do they authorize, the making of any offer of the bonds in circumstances in which an obligation arises for JICA or the underwriters to publish a prospectus or supplement a prospectus for such offer. JICA and Japan have not authorized and do not authorize the making of any offer of the bonds through any financial intermediary, other than offers made by the underwriters resulting in sales constituting the final placement of the bonds contemplated in this Prospectus.

IN THE UNITED KINGDOM, THIS PROSPECTUS IS FOR DISTRIBUTION ONLY TO PERSONS WHO (I) HAVE PROFESSIONAL EXPERIENCE IN MATTERS RELATING TO INVESTMENTS WHO FALL WITHIN ARTICLE 19(5) OF THE FINANCIAL SERVICES AND MARKETS ACT 2000 (FINANCIAL PROMOTION) ORDER 2005, AS AMENDED (THE “ORDER”) OR (II) ARE PERSONS WHO FALL WITHIN ARTICLE 49(2)(A)-(D) OF THE ORDER (ALL SUCH PERSONS TOGETHER BEING REFERRED TO AS “RELEVANT PERSONS”). IN THE UNITED KINGDOM THIS PROSPECTUS AND ANY OF ITS CONTENTS ARE DIRECTED ONLY AT RELEVANT PERSONS AND MUST NOT BE ACTED ON OR RELIED ON BY PERSONS WHO ARE NOT RELEVANT PERSONS. IN THE UNITED KINGDOM, ANY INVESTMENT OR INVESTMENT ACTIVITY TO WHICH THIS PROSPECTUS RELATES IS AVAILABLE ONLY TO RELEVANT PERSONS AND WILL BE ENGAGED IN ONLY WITH RELEVANT PERSONS.

IN CONNECTION WITH THE ISSUE OF THE BONDS, BARCLAYS BANK PLC (THE “STABILIZING MANAGER”) (OR ANY PERSONS ACTING ON BEHALF OF THE STABILIZING MANAGER) MAY OVER- ALLOT THE BONDS OR EFFECT TRANSACTIONS WITH A VIEW TO SUPPORTING THE MARKET PRICE OF THE BONDS AT A LEVEL HIGHER THAN THAT WHICH MAY OTHERWISE PREVAIL. HOWEVER, THERE IS NO ASSURANCE THAT THE STABILIZING MANAGER (OR PERSONS ACTING ON BEHALF OF THE STABILIZING MANAGER) WILL UNDERTAKE STABILIZATION ACTION. ANY STABILIZATION ACTION MAY BEGIN ON OR AFTER THE DATE ON WHICH ADEQUATE PUBLIC DISCLOSURE OF THE TERMS OF THE OFFER OF THE BONDS IS MADE AND, IF BEGUN, MAY BE ENDED AT ANY TIME, BUT IT MUST END NO LATER THAN THE EARLIER OF 30 DAYS AFTER THE ISSUE DATE OF THE BONDS AND 60 DAYS AFTER THE DATE OF THE ALLOTMENT OF THE BONDS. ANY STABILIZATION ACTION OR OVER-ALLOTMENT MUST BE CONDUCTED BY THE RELEVANT STABILIZING MANAGER (OR PERSONS ACTING ON BEHALF OF THE RELEVANT STABILIZING MANAGER) IN ACCORDANCE WITH ALL APPLICABLE LAWS AND RULES.

iv

PRESENTATION OF FINANCIAL INFORMATION

The fiscal year end of JICA is March 31. JICA’s financial statements have been prepared in accordance with accounting principles for incorporated administrative agencies generally accepted in Japan, which may differ in certain respects from accounting principles for business enterprises generally accepted in Japan.

JICA’s operations are separated into two categories for accounting purposes pursuant to Article 17 of the Act of the Incorporated Administrative Agency—Japan International Cooperation Agency (the “JICA Act”): (i) a Finance and Investment Account, which is funded through capital contributions and borrowings from the Japanese government, bonds issued to investors and interest and revenues generated by JICA from loans disbursed and (ii) a General Account, which is largely funded by management grants from the Japanese government.

The following financial statements are contained in this Prospectus: (i) the annual audited balance sheets as at March 31, 2015 and 2016, the related audited statements of income, cash flows and administrative service operations costs for each of the fiscal years ended March 31, 2015 and 2016, and the significant accounting policies, notes and detailed statements relating thereto, all in respect of the General Account of JICA and (ii) the annual audited balance sheets as at March 31, 2015 and 2016, the related audited statements of income, cash flows and administrative service operations costs for each of the fiscal years ended March 31, 2015 and 2016, and the significant accounting policies, notes and detailed statements relating thereto, all in respect of the Finance and Investment Account of JICA.

v

FOREIGN EXCHANGE CONSIDERATIONS

For an investor that is not resident in the United States or does not conduct business or activities in the United States, an investment in the bonds, which are denominated in, and all payments in respect of which are to be made in, U.S. dollars entails significant risks not associated with a similar investment in a security denominated in the investor’s home currency (i.e., the currency of the country in which the investor is resident or the currency in which the investor conducts its business or activities). These include the possibility of:

| | • | | significant changes in rates of exchange between the home currency and the U.S. dollar; and |

| | • | | the imposition or modification of foreign exchange controls with respect to the U.S. dollar. |

We have no control over a number of factors affecting this type of bond, including economic, financial and political events that are important in determining the existence, magnitude and longevity of these risks and their results. In recent years, rates of exchange for certain currencies, including the U.S. dollar, have been volatile and this volatility may be expected to continue in the future. Fluctuations in any particular exchange rate that have occurred in the past are not necessarily indicative of fluctuations in the rate that may occur during the term of the bonds. Depreciations of the U.S. dollar against the investor’s home currency could result in a decrease in the investor’s effective yield of the bonds below the coupon rate, and in certain circumstances, could result in a loss to such purchaser on a home currency basis.

The description of foreign currency risks does not describe all the risks of an investment in securities denominated in a currency other than your home currency. Prospective investors should consult their own financial and legal advisors as to the risks involved in an investment in such bonds.

vi

SUMMARY

The following summary does not purport to be complete and is qualified in its entirety by, and is subject to, the more detailed information and financial statements and the notes thereto contained elsewhere in this Prospectus. For a discussion of certain factors that should be considered by prospective investors in connection with an investment in the Bonds, see “Risk Factors”.

JAPAN INTERNATIONAL COOPERATION AGENCY

JICA is an incorporated administrative agency established in October 2003 pursuant to the Act on General Rules for Incorporated Administrative Agencies and the Act of the Incorporated Administrative Agency—Japan International Cooperation Agency. JICA’s main objective is to contribute to the promotion of international cooperation as well as the sound development of the Japanese and global economy by supporting the socioeconomic development, recovery or economic stability of developing regions. Following an overhaul in October 2008 (see “Japan International Cooperation Agency—History”), JICA is currently the sole implementing agency for all major Japanese Official Development Assistance (“ODA”) schemes, which are separated into three categories: Technical Cooperation, Grant Aid and Finance and Investment. See “Japan International Cooperation Agency—Operations”. JICA is entirely owned by the Japanese government and is subject to control and supervision by the Minister for Foreign Affairs of Japan and the Minister of Finance of Japan.

THE BONDS

Issuer | Japan International Cooperation Agency |

Issue Date | The issue date is ●, 2016. |

Securities Offered | $● principal amount of ●% Guaranteed Bonds Due ● |

Guarantee | Payments of principal of and interest on the bonds are unconditionally and irrevocably guaranteed by Japan. |

Maturity Date

Interest Payment Dates | semi-annually on ● and ● of each year, commencing ●, 2017. |

Interest Rate | The bonds will bear interest at a rate of ●% per annum, accruing from ●, 2016. We will pay interest on the bonds semi-annually in arrears in equal payments. Whenever it is necessary to compute any amount of interest in respect of the bonds, that interest will be calculated on the basis of a 360-day year of twelve 30-day months. |

Ranking | The bonds constitute our direct, unconditional, unsubordinated and unsecured obligations and shall at all times rank pari passu and without any preference among themselves. Our payment obligations under the bonds shall, save for such exceptions as may be provided by applicable legislation, at all times rank at least equally with all of our other present and future unsecured and unsubordinated obligations. |

1

Additional Amounts | If certain taxes, as described under “Description of the Bonds and Guarantee”, are payable on the bonds, we will, subject to certain exceptions, pay such additional amounts on the bonds as will result, after deduction or withholding of such taxes, in the payment of the amounts that would have been payable on the bonds if no such deduction or withholding had been required. For further detail on the payment of these additional amounts, see “Description of the Bonds and Guarantee—Additional Amounts”. |

Redemption | We may redeem all, but not less than all, of the bonds in the event of certain changes relating to Japanese taxation at 100% of the principal amount thereof plus accrued interest thereon and any additional amounts we are required to pay, as described under “Description of the Bonds and Guarantee—Redemption”. |

Markets | We are offering the bonds for sale only in those jurisdictions other than Japan (subject to certain exceptions) where it is legal to make such offers. See “Underwriting” for a description of applicable selling restrictions. |

Listing | Application will be made for the listing and quotation of the bonds on the SGX-ST. The bonds will be traded on the SGX-ST in a minimum board lot size of $200,000 for so long as such bonds are listed on the SGX-ST and the rules of the SGX-ST so provide. |

Form and Settlement | The bonds will be in registered form, without interest coupons attached. Bonds held outside the United States, referred to as the international bonds, will be represented by beneficial interests in the international global bond, which will be registered in the name of the nominee of the common depositary for, and in respect of interests held through, Euroclear and Clearstream. Bonds held within the United States, referred to as the DTC bonds, will be represented by beneficial interests in one or more DTC global bonds, which will be registered in the name of Cede & Co., as the nominee of DTC. Except as described in this Prospectus, beneficial interests in the global bonds will be represented through book-entry accounts of financial institutions acting on behalf of beneficial owners as direct and indirect participants in DTC, Euroclear and Clearstream, and owners of beneficial interests in the global bonds will not be entitled to have bonds registered in their names, will not receive or be entitled to receive bonds in definitive form and will not be considered holders of bonds under the fiscal agency agreement relating to the bonds. The bonds will be sold only in denominations of $200,000 and integral multiples of $2,000 in excess thereof. For further information on book-entry procedures, see “Description of the Bonds and Guarantee—Form, Denominations and Registration”. |

| | Investors electing to hold their bonds through DTC will follow the settlement practices applicable to U.S. corporate debt obligations. The securities custody accounts of investors will be credited with their holdings against payment in same-day funds on the settlement date. |

2

| | Investors electing to hold their bonds through Euroclear or Clearstream accounts will follow the settlement procedures applicable to conventional eurobonds in registered form. Bonds will be credited to the securities custody accounts of Euroclear holders and of Clearstream holders against payment in same-day funds on the settlement date. For information on secondary market trading, see “Global Clearance and Settlement—Secondary Market Trading”. |

Fiscal Agent, Principal Paying Agent and Transfer Agent | The Bank of Tokyo-Mitsubishi UFJ, Ltd., London Branch, also acting through MUFG Union Bank, N.A. |

Common code | ● (DTC global bond); ● (international global bond). |

ISIN | ● (DTC global bond); ● (international global bond). |

3

RISK FACTORS

JICA believes that the following factors may affect its ability to fulfill its obligations under the bonds. All of these factors are contingencies which may or may not occur and JICA is not in a position to express a view on the likelihood of any such contingency occurring. Factors which JICA believes may be material for the purpose of assessing the market risks associated with the bonds are also described below.

JICA believes that the factors described below represent the principal risks inherent in investing in the bonds, but JICA may be unable to pay interest, principal or other amounts on or in connection with the bonds for other reasons, and JICA does not represent that the statements below regarding the risks of holding the bonds are exhaustive. Prospective investors should also read the detailed information set out elsewhere in this Prospectus and reach their own views prior to making any investment decision.

Risks Relating to the Japanese Economy in General

Prospective investors in the bonds should be aware of the challenges faced by the Japanese economy in general. Japan’s economy continues to face challenges due to prolonged deflation, uncertainty about the economic prospects of China and other emerging countries and the general deceleration of the world economy.

Although the Japanese government and the Bank of Japan are pursuing expansionary monetary and fiscal measures in an effort to counter deflation and have proposed structural reforms to complement such stimulus measures, including the Bank of Japan’s introduction of a negative interest rate policy in February 2016 and its announcement of a strengthened framework for quantitative and qualitative monetary easing in September 2016, the full effects of such reform efforts remain unclear. In addition, an increase in the consumption tax rate from 5% to 8% in April 2014 is thought to have contributed to Japan’s entering a recession in the third quarter of 2014. Since then and through the second quarter of 2016, real gross domestic product has fluctuated moderately on a quarter-over-quarter basis. Moreover, the Japanese government decided to delay a scheduled further increase in the consumption tax to 10% from October 2015 to October 2019, and the effect of such delay and the increase itself on the Japanese economy and government finances is uncertain. Further challenges for the Japanese economy include an increased dependence on liquefied natural gas (LNG) and other energy imports as a result of the nuclear accident at the Fukushima Daiichi Nuclear Plant and suspension of operations at other nuclear power plants, volatile exchange rates and, over the long term, demographic challenges, such as an aging workforce and population decrease, and high levels of public debt and associated debt servicing payments. Further slowdowns in overseas economies and sharp fluctuations in the financial and capital markets also pose downside risks to the Japanese economy.

Risks Relating to JICA

Risks relating to policies of the Japanese government

As a government-affiliated financial institution established to implement the ODA policies of the Japanese government, JICA’s business and financial condition may be adversely affected by the policies of the Japanese government.

In particular, JICA has undergone significant transformations in its history, first through the re-establishment of JICA from a special public institution into an incorporated administrative agency in October 2003 pursuant to the Act of the Incorporated Administrative Agency—Japan International Cooperation Agency (the “JICA Act”) and then through various changes following the enactment of the Act for Partial Amendments to the Act of the Incorporated Administrative Agency—Japan International Cooperation Agency, which amended the JICA Act. Pursuant to such amendment, inter alia, Finance and Investment operations previously managed by Japan Bank for International Cooperation, a government-affiliated financial institution of Japan, and a portion of Grant Aid (see “Japan International Cooperation Agency—Operations”) provided by the Ministry of Foreign Affairs of Japan (“MOFA”) were succeeded by JICA. Any further reforms to the operational scope and

4

organizational structure of JICA, whether through amendment of the laws and regulations underpinning JICA’s existence or otherwise, may have a material effect on the operations of JICA.

Risks Relating to the Market Risk of Bonds Generally

Interest rate risk

Investment in the bonds involves the risk that subsequent changes in market interest rates may adversely affect the value of the bonds.

Exchange rate risk

Prospective investors in the bonds should be aware that an investment in the bonds may involve exchange rate risks. The bonds may be denominated in a currency other than the currency of the investor’s home jurisdiction and/or in a currency other than the currency in which an investor wishes to receive funds. Exchange rates between currencies are determined by factors of supply and demand in the international currency markets which are influenced by macroeconomic factors, speculation and central bank and government intervention (including the imposition of currency controls and restrictions). Fluctuations in exchange rates may affect the value of the bonds. See “Foreign Exchange Considerations”.

The secondary market generally

The bonds may have no established trading market when issued, and one may never develop. If a market does develop, it may not be sufficiently liquid. Therefore, investors may not be able to sell their bonds easily or at prices that will provide them with a yield comparable to similar investments that have a developed secondary market. Although application will be made to the SGX-ST for the listing and quotation of the bonds on the SGX-ST, there is also no assurance that an active trading market will develop. Illiquidity may have a severely adverse effect on the market value of the bonds.

Risks Relating to the Bonds

The bonds may not be suitable for all investors

Each potential investor in the bonds must determine the suitability of that investment in light of its own circumstances. In particular, each potential investor should:

| | • | | have sufficient knowledge and experience to make a meaningful evaluation of the bonds and the guarantee, the merits and risks of investing in the bonds and the information contained in this Prospectus; |

| | • | | have access to, and knowledge of, appropriate analytical tools to evaluate, in the context of its particular financial situation, an investment in the bonds and the impact such investment will have on its overall investment portfolio; |

| | • | | have sufficient financial resources and liquidity to bear all of the risks pertaining to an investment in the bonds; |

| | • | | thoroughly understand the terms and conditions of the bonds as summarized in “Description of the Bonds and Guarantee” and be familiar with the behavior of any relevant markets; and |

| | • | | be able to evaluate (either alone or with the help of a financial adviser) possible scenarios for economic, interest rate and other factors including those set forth in this “Risk Factors” section that may affect its investment and its ability to bear the applicable risks. |

5

Limited liquidity

The fact that the bonds may be listed does not necessarily assure liquidity. No assurance can be given that there will be a market for the bonds. If the bonds are not traded on any stock exchange, pricing information for such bonds may be more difficult to obtain, and the liquidity and market prices of such bonds may be adversely affected. The liquidity of the bonds may also be affected by restrictions on offers and sales of the bonds in some jurisdictions. The underwriters may from time to time make a market in the bonds but are under no obligation to do so and, if a market does develop, it may not continue until the maturity of all the bonds.

Bonds subject to optional redemption by JICA

Redemption of the bonds in circumstances of changes in applicable laws or treaties may limit their market value. During any period when JICA may elect to redeem the bonds, the market value of the bonds generally will not rise substantially above the price at which they can be redeemed.

Legal investment considerations may restrict certain investments

The investment activities of certain investors are subject to investment laws and regulations, or review or regulation by certain authorities. Each potential investor should consult its own legal advisers to determine whether, and to what extent (i) the bonds are legal investments for it, (ii) the bonds can be used as collateral for various types of borrowing and (iii) other restrictions may apply to its purchase or pledge of the bonds. In addition, financial institutions should consult their own legal advisers or the appropriate regulators to determine the appropriate treatment of the bonds under any applicable risk-based capital or similar rules.

Credit rating of the bonds may not reflect all risks and may be downgraded

It is expected that the bonds will be assigned a credit rating by a credit rating agency. The rating assigned to the bonds may not reflect the potential impact of all risks related to structure, market, additional factors discussed above, and other factors that may affect the value of the bonds. A downgrade or potential downgrade in the rating or the assignment of new rating that is lower than the existing rating could reduce the number of potential investors in the bonds and adversely affect the price and liquidity of the bonds. A credit rating is based upon information furnished by JICA or obtained by the rating agency from its own sources and is subject to revisions, suspension or withdrawal by the rating agency at any time. A credit rating is not a recommendation to buy, sell or hold securities. Any adverse change in an applicable credit rating could affect the trading price for the bonds.

6

JAPAN INTERNATIONAL COOPERATION AGENCY

Overview

JICA is an incorporated administrative agency established in October 2003 pursuant to the Act on General Rules for Incorporated Administrative Agencies and the Act of the Incorporated Administrative Agency—Japan International Cooperation Agency (the “JICA Act”). JICA’s main objective is to contribute to the promotion of international cooperation as well as the sound development of the Japanese and global economy by supporting the socioeconomic development, recovery or economic stability of developing regions. Following an overhaul in October 2008 (see “—History”), JICA is currently the sole implementing agency for all major Japanese Official Development Assistance (“ODA”) schemes, which are separated into three categories—Technical Cooperation, Grant Aid and Finance and Investment (see “—Operations”).

JICA is entirely owned by the Japanese government and is subject to control and supervision by the Minister for Foreign Affairs of Japan and the Minister of Finance of Japan. As of March 31, 2016, government investment by Japan contributed to ¥7,862 billion of net assets on the balance sheet of JICA’s Finance and Investment Account and the capital ratio, calculated as total net assets divided by total assets, was 80.04%.

History

JICA’s origins can be traced back to January 1954, with the establishment of the Federation of Japan Overseas Associations. In subsequent years, the Society for Economic Cooperation in Asia, Japan Emigration Promotion, Co., Ltd., Overseas Technical Cooperation Agency, Japan Emigration Service and Japan Overseas Cooperation Volunteers were established, each with the objective of fostering international cooperation. JICA was originally established in May 1974 as a special public institution (“Former JICA”) with the promulgation of the Act of Japan International Cooperation Agency. In December 2001, a reorganization and rationalization plan for special public institutions was announced by the Japanese government. Included in this reform plan was a measure transforming JICA into an incorporated administrative agency. This was put into effect by the JICA Act, and Former JICA was re-established as an incorporated administrative agency in October 2003.

Separately, in December 1960, the Overseas Economic Cooperation Fund Law was promulgated pursuant to which the Overseas Economic Cooperation Fund was established to take over management of the Southeast Asia Development Cooperation Fund from the Export-Import Bank of Japan (“JEXIM”). In April 1999, the Japan Bank for International Cooperation Law was promulgated, and the Japan Bank for International Cooperation (“JBIC”) was established, which succeeded the operations of the Overseas Economic Cooperation Fund and JEXIM.

JICA, in its current form, was established in October 2008 following the enactment in November 2006 of the Act for Partial Amendments to the Act of the Incorporated Administrative Agency—Japan International Cooperation Agency. Pursuant to such Act, the operations of Former JICA, Finance and Investment previously managed by JBIC and a portion of Grant Aid provided by the Ministry of Foreign Affairs of Japan (“MOFA”) were succeeded by JICA. MOFA remains responsible for directly providing Grant Aid in conjunction with the execution of diplomatic policies.

Strategy

In accordance with Article 30, Paragraph 1 of the Act on General Rules for Incorporated Administrative Agencies, JICA established a mid-term plan for achieving its mid-term objectives during a period commencing from the year ended March 31, 2013.

Taking into consideration the circumstances surrounding development assistance set out in its mid-term objectives, JICA follows its vision of “Inclusive and Dynamic Development” in effectively conducting projects in accordance with the initiatives and policies of the Japanese government regarding ODA. Since its launch as a renewed organization in October 2008, JICA has become the sole implementing agency for all major Japanese

7

ODA schemes—Technical Cooperation, Grant Aid and Finance and Investment. This structure enables JICA to provide optimum cooperation to the developing areas facing various development issues through organic combinations of different schemes, taking into account the characteristics of each scheme.

JICA’s key mission statements and strategies can be summarized as follows:

Mission Statements

Addressing the global agenda.

The advance of globalization brings positive effects, sparking economic development and providing people with new opportunities. It also has its negative side, though, including such effects as uneven wealth distribution and cross-border issues of climate change, infectious diseases, terrorism, and expanding economic crises. These effects pose a threat to the stability and prosperity of Japan—which depends on resources from around the world—and the rest of the international community. The threat is particularly dire for developing countries. JICA seeks to make full use of Japan’s experience and technologies as it works in concert with international society to address the various globalization-related issues developing countries face in a comprehensive manner.

Reducing poverty through equitable growth

Impoverished people in developing countries are particularly susceptible to the effects of economic crisis, conflict, and disaster and are constantly exposed to the risk of even deeper poverty. Moreover, growing wealth gaps are a destabilizing factor in societies. Helping people to escape poverty and lead healthy, civilized lives is a vital task not only for the growth of developing countries, but also for the stability of the international community. To reduce poverty, employment opportunities must be expanded through equitable growth that gives proper consideration to impoverished members of society, and public services like education and healthcare must be enhanced. JICA aims to provide support for human resources development, capacity building, policy and institutional improvements, and provision of social and economic infrastructure, thereby pursuing sustained poverty reduction through equitable growth.

Improving governance

A state’s capacity for governance refers to its status as a society that can take the resources available to it and direct, apportion and manage them efficiently and in ways that reflect the will of the people. Improving governance is of vital importance to the stable economic growth of developing countries. However, these states often have underdeveloped legal and judicial systems and administrative organs, which present obstacles to efforts to reduce poverty through economic growth. JICA offers support aimed at improving the fundamental systems needed by a state, as well as systems for effectively providing public services based on the needs of people, and at fostering the institutions and human resources needed to manage those systems appropriately.

Achieving human security

The advance of globalization causes an increase in various cross-border dangers and exposes many people in developing countries to civil strife, disasters, poverty and other humanitarian threats. The concept of human security places individual human beings at its core, seeking to defend them from fear and want: fear of things like conflict, terrorism, disaster, environmental destruction and infectious disease, and want in the face of poverty and in social services and infrastructure. By building up people’s abilities to address these issues themselves, this approach aims to build societies in which they can live with dignity. In order to defend the weakest members of society from these various threats, JICA supports efforts to bolster social and institutional capacity and to increase people’s ability to deal with threats themselves.

8

Strategies

Integrated assistance

JICA undertakes the integrated management of three modalities of assistance—Technical Cooperation, Grant Aid and Finance and Investment—to offer comprehensive support that organically combines such elements as policy and institutional improvements in developing countries; human resources development and capacity building; and improvements in infrastructure. JICA also makes use of diverse approaches and takes advantage of the expanded scale of its operations to tackle issues that go beyond borders and affect entire regions or that span multiple sectors. Through such integrated assistance, JICA pursues international cooperation with even more development impact in terms of both its quality and scale.

Seamless assistance

JICA brings together a wide variety of aid approaches to provide seamless assistance that spans everything from prevention of armed conflict and natural disasters to emergency aid following a conflict or disaster, assistance for prompt recovery, and mid- to long-term development assistance. Among developing countries are states at various stages of development, from the least developed countries where most of the population lives in poverty to middle-income countries that are on the growth track but are still wrestling with the problems of wealth gaps in society. JICA seeks to provide assistance in ways that best match the level of development in each recipient nation, taking a long-term perspective and offering seamless assistance to ensure sustainable development into the future.

Promoting development partnerships

JICA aims to be a good partner for developing countries, accurately grasping their changing needs through a focus on the field and promoting their own self-help efforts swiftly and effectively through a focus on results. JICA also promotes public-private partnerships, pooling the experience, technologies and resources of local governments, universities, nongovernmental organizations and other actors. Furthermore, to fulfill its responsibilities as one of the largest donor organizations in the world with more than 40 years of experience, JICA strives to strengthen partnerships with international organizations and other donor institutions, leading the creation of a broad framework for development assistance in a global community that is seeing growing numbers of players in the international cooperation field and increasingly diverse forms of aid to developing countries.

Enhancing research and knowledge-sharing

In the face of the advance of globalization and the rise of new international cooperation actors, global trends in the issues affecting developing countries are undergoing sweeping change. Through the establishment of the JICA Research Institute, JICA puts its wisdom gained in the field to work, building broad networks of academics from Japan and elsewhere around the world to create new knowledge value in the field of international development assistance not just for Japan but also for the entire world. To play a leading role in guiding the newest development trends, JICA aims to enhance its research and knowledge-sharing capacities. JICA also actively carries out surveys and research grounded in actual assistance projects, focusing on the subjects in both regional and issue-based contexts.

Operations

Since its launch as a renewed organization in October 2008, JICA has become the sole implementing agency for all major Japanese ODA schemes: Technical Cooperation, Grant Aid and Finance and Investment.

9

Background to ODA in Japan

Various organizations and groups, including governments, international organizations, non-governmental organizations (“NGOs”) and private companies, carry out economic cooperation to support socioeconomic development in developing countries. The financial and technical assistance that governments provide to developing countries as part of this economic cooperation are called ODA.

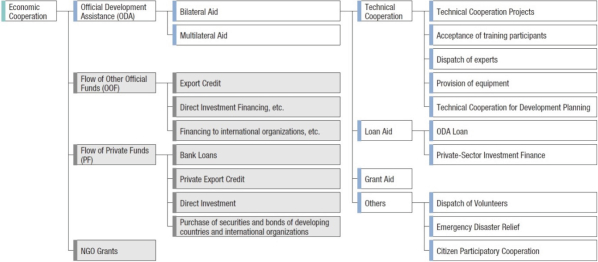

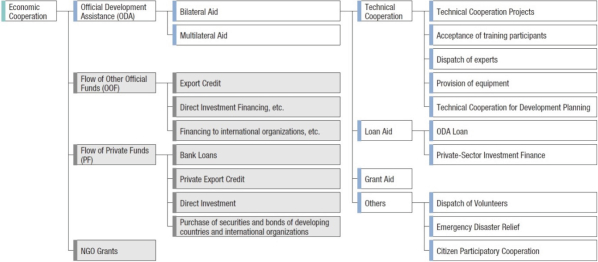

ODA is broadly classified into two types: bilateral aid and multilateral aid. Multilateral aid consists of financing and financial contributions to international organizations, while bilateral aid is provided in three forms: Technical Cooperation, Grant Aid and Finance and Investment. In addition, other schemes of bilateral aid include the dispatch of volunteers.

In recent years, developed countries in Europe and North America have expanded ODA as a means of strengthening the efforts to address global issues such as climate change and poverty reduction. Furthermore, new donor countries including the People’s Republic of China and the Republic of Korea have emerged. Japan, conversely, has decreased its ODA budget as a result of its severe financial circumstances.

In view of this international situation as well as the flow of domestic administrative reforms, the Japanese government has undertaken reforms that strategize ODA policies and strengthen implementation systems with the objective of further raising the quality of its ODA. With the aim of integrating ODA implementation organizations as part of these reforms, Overseas Economic Cooperation Operations of JBIC and Grant Aid Operations of MOFA (excluding those which MOFA continues to directly implement for the necessity of diplomatic policy) were transferred to JICA as of October 1, 2008, thereby creating a “New JICA”. See “—History”. Through this integration, the three schemes of assistance have become organically linked under a single organization, which better enables JICA to provide effective and efficient assistance.

JICA’s ODA

The principal schemes of ODA carried on by JICA are outlined below. JICA’s operations are separated into two categories for accounting purposes pursuant to Article 17 of the JICA Act: (a) a Finance and Investment Account, which is funded through capital contributions and borrowings from the Japanese government, bonds issued to investors and interest and revenues generated by JICA and (b) a General Account, which is largely funded by management grants from the Japanese government. JICA’s Technical Cooperation and Grant Aid activities are carried on through its General Account. JICA’s Finance and Investment activities are carried on through its Finance and Investment Account.

10

Technical Cooperation

Technical Cooperation draws on Japan’s technology, knowhow and experience to nurture the human resources who will promote socioeconomic development in developing countries. Moreover, through collaboration with partner countries in jointly planning a cooperation plan suited to local situations, Technical Cooperation supports the development and improvement of technologies that are appropriate for the actual circumstances of these countries, while also contributing to raising their overall technology levels and setting up new institutional frameworks and organizations. These enable partner countries to develop problem-solving capacities and achieve economic growth.

Total Technical Cooperation expenditures (excluding management expenses) for the fiscal year ended March 31, 2016 were ¥191.7 billion.

The following table provides breakdowns of JICA’s Technical Cooperation operations in terms of expenditures (excluding management expenses) by geographical region and sector for JFY 2015:

Technical Cooperation

| | | | |

| | | For the year ended

March 31, 2016 | |

| | | (%) | |

Distribution by Region | | | | |

Asia | | | 38 | |

Africa | | | 22 | |

Middle East | | | 5 | |

North and Latin America | | | 9 | |

Europe | | | 2 | |

Others | | | 24 | |

| | | | |

Total | | | 100 | |

| | | | |

| |

Distribution by Sector | | | | |

Public Works and Utilities | | | 19 | |

Agriculture, Forestry and Fisheries | | | 13 | |

Planning and Administration | | | 13 | |

Human Resources | | | 11 | |

Health and medical care | | | 6 | |

Others | | | 38 | |

| | | | |

Total | | | 100 | |

| | | | |

Technical Cooperation includes acceptance of training participants, dispatch of experts, provision of equipment and implementation of studies aimed at supporting policymaking and planning of public works projects.

Grant Aid

Grant Aid, which is an assistance method that provides necessary funds to promote socioeconomic development, is financial cooperation with developing countries with no obligation for repayment. Particularly in developing countries with low income levels, Grant Aid is broadly implemented for building hospitals, bridges and other socioeconomic infrastructure, as well as for promoting education, HIV/AIDS programs, children’s healthcare and environmental activities, which directly support the improvement of living standards.

11

Assistance is given to development projects that are essential in developing countries’ nation building, including: construction of hospitals or schools and increasing access to safe water supply to satisfy basic human needs; improvement of irrigation systems to promote development of communities and agricultural productivity; construction of roads and bridges to build socio-economic foundations; building facilities to promote environmental conservation; and developing human resources. In recent years, assistance has also been provided for peacebuilding, developing business environments, disaster prevention and reconstruction after disasters, and measures to cope with climate change. Where necessary, technical guidance for operation and maintenance (soft components) is also provided, so that the facilities and other systems financed by Grant Aid are sustainably managed.

Total new agreements under JICA’s Grand Aid operations for the fiscal year ended March 31, 2016 were ¥111.7 billion.

The following table provides breakdowns of JICA’s Grant Aid operations in terms of total agreement amount by geographical region and sector for JFY 2015:

Grant Aid

| | | | |

| | | For the year ended

March 31, 2016 | |

| | | (%) | |

Distribution by Region | | | | |

Asia | | | 50 | |

Africa | | | 33 | |

Middle East | | | 3 | |

North and Latin America | | | 4 | |

Others | | | 10 | |

| | | | |

Total | | | 100 | |

| | | | |

| |

Distribution by Sector | | | | |

Public Works and Utilities | | | 50 | |

Agriculture, Forestry and Fisheries | | | 11 | |

Planning and Administration | | | 6 | |

Human Resources | | | 10 | |

Health and Medical Services | | | 10 | |

Others | | | 13 | |

| | | | |

Total | | | 100 | |

| | | | |

Finance and Investment

Finance and Investment supports the efforts of developing countries to advance by providing these nations with the capital necessary for development under long-term and substantially lower interest rates than commercial rates. The primary types of Finance and Investment are ODA Loans and Private Sector Investment Finance (“PSIF”):

| | • | | ODA Loans promote efficient use of the borrowed funds and appropriate supervision of the relevant projects, bolstering the developing countries’ ownership in the development process. ODA Loans are divided into Project-type Loans (including Project Loans, which account for the largest portion of ODA Loans, and finance projects such as roads, power plants, irrigation, water supply and sewerage facilities) and Non-Project Loans (including Program Loans, which support the implementation of national strategies and poverty reduction strategies and Commodity Loans, which provide settlement |

12

| | funds for urgent and essential imports of materials). In addition, JICA developed sovereign based lending denominated in U.S. dollars to developing countries from JFY 2016. As of March 31, 2016, the total amount of ODA Loans outstanding was ¥11,783 billion as measured by aggregate loans receivable from all borrowing countries and organizations. |

| | • | | Private Sector Investment Finance aims to stimulate economic activity and improve the living standards of people in developing countries through equity investments and loans for projects undertaken in developing countries by the private sector. As of March 31, 2016, the total amount of Private Sector Investment Finance outstanding was ¥43 billion as measured by aggregate loans receivable from all borrowing countries and organizations. |

ODA Loans in particular enable the provision of finance in larger amounts compared with Technical Cooperation or Grant Aid. Thus, this form of aid has been well utilized for building large-scale basic infrastructure in developing countries.

JICA applies preferential terms for certain sectors and fields, namely: global environmental problems and climate change, health and medical care and services, disaster prevention and reduction, and human resource development.

Unlike Technical Cooperation or Grant Aid, Finance and Investment requires full repayment by the recipient country, which encourages the beneficiary country to focus closely on the importance and priority of projects and to make efforts to allocate and utilize the funds as efficiently as possible. In addition, as an ODA Loan is financial assistance with a repayment obligation, this method of assistance places a relatively small fiscal burden on the Japanese government and represents a sustainable instrument for ODA.

Total new Finance and Investment commitments for the fiscal year ended March 31, 2016 were ¥2,261 billion.

The following table provides breakdowns of JICA’s Finance and Investment operations in terms of commitment amount by geographical region and sector for JFY 2015:

Finance and Investment

(ODA Loans and PSIF)

| | | | |

| | | For the year ended

March 31, 2016 | |

| | | (%) | |

Distribution by Region | | | | |

Asia | | | 65 | |

Africa | | | 8 | |

Middle East | | | 9 | |

Europe | | | 8 | |

Others | | | 10 | |

| | | | |

Total | | | 100 | |

| | | | |

Distribution by Sector | | | | |

Transportation | | | 44 | |

Electric Power and Gas | | | 18 | |

Social Services | | | 18 | |

Program Loans | | | 6 | |

Others | | | 14 | |

| | | | |

Total | | | 100 | |

| | | | |

13

Scale of Japan’s and JICA’s ODA Programs in Recent Years

In the year ended March 31, 2015, Japan’s total ODA disbursements amounted to U.S.$15,641.64 million (¥1,655.63 billion). Of this total, Grant Aid accounted for U.S.$2,402.72 million (¥254.32 billion), Technical Cooperation U.S.$2,610.62 million (¥276.33 billion) and Finance and Investment U.S.$7,381.14 million (¥781.28 billion).

Of JICA’s disbursements in the year ended March 31, 2015, Technical Cooperation implemented by JICA amounted to ¥176.4 billion, a decrease of 0.5% from the previous fiscal year. Turning to Grant Aid, which JICA began implementing from October 2008, JICA implemented 159 projects amounting to approximately ¥111.2 billion (grant agreement amount). Finance and Investment disbursement amount totaled ¥827.3 billion and was provided to 52 countries and two organizations, and PSIF disbursement amount totaled ¥600 million and was provided to four organizations.

The table below sets forth trends in the scale of JICA’s programs for Technical Cooperation, Finance and Investment Commitments and Grant Aid for the past ten years:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the year ended March 31, | |

| | | 2007 | | | 2008 | | | 2009 | | | 2010 | | | 2011 | | | 2012 | | | 2013 | | | 2014 | | | 2015 | | | 2016 | |

| | | (in billions of yen) | |

Technical Cooperation Disbursements for the Past Ten Years | | ¥ | 151.2 | | | ¥ | 146.1 | | | ¥ | 150.8 | | | ¥ | 176.0 | | | ¥ | 168.8 | | | ¥ | 188.9 | | | ¥ | 167.8 | | | ¥ | 177.3 | | | ¥ | 176.4 | | | ¥ | 191.7 | |

Finance and Investment Commitment Amounts for the Past Ten Years. | | | 763.7 | | | | 901.2 | | | | 929.4 | | | | 967.6 | | | | 538.9 | | | | 949.4 | | | | 1,226.7 | | | | 985.8 | | | | 1,015.9 | | | | 2,260.9 | |

Scale of Grant Aid for the Past Ten Years | | | 110.4 | | | | 96.4 | | | | 111.1 | | | | 136.8 | | | | 118.1 | | | | 111.0 | | | | 141.6 | | | | 115.8 | | | | 111.2 | | | | 111.7 | |

JICA’s Path for Development Activities

JICA will develop and implement specific programs and projects based upon the Development Cooperation Charter, which was endorsed by the Japanese government in February 2015. Specifically JICA will focus upon: (i) quality growth and mitigating disparities; (ii) promoting peacebuilding and the sharing of universal values; (iii) strengthening its operational engagement on global issues and the international aid agenda; (iv) expanding and deepening strategic partnerships; and (v) supporting an active role for women and their empowerment in developing countries.

JICA’s Development Cooperation Achievements

In carrying out development activities in line with the Development Cooperation Charter, JICA draws on its track record of accomplishments achieved through the provision of ODA Loans. During the ten year period from JFY 2005 to JFY 2014, JICA provided ODA Loans for construction and other infrastructure projects that have contributed to the following achievements, as determined in ex-post evaluations of the relevant projects:

| | • | | Safe drinking water. Provided access to safe drinking water to approximately 42.89 million people in developing countries; |

| | • | | Flood control systems. Protected approximately 32.81 million people in developing countries from natural disaster risk; |

| | • | | Airport facilities. Met the air transportation needs of approximately 109.21 million people in developing countries on an annual basis; |

14

| | • | | Railroad facilities. Met the rail transportation needs of approximately 1.90 billion people in developing countries on an annual basis; |

| | • | | Roads. Built approximately 8,807 km of new roads and repaired approximately 23,702 km of existing roads in developing countries, contributing to traffic volumes of approximately 3.45 million vehicles per day; |

| | • | | Ports. Constructed port facilities in developing countries with capacity to handle approximately 620.47 million tons of freight per year; |

| | • | | Power plants. Met power generation needs in developing countries through the supply of 109,313GWh of electricity per year (equivalent to the electricity consumption needs of approximately 41.27 million people based on worldwide averages in 2015); and |

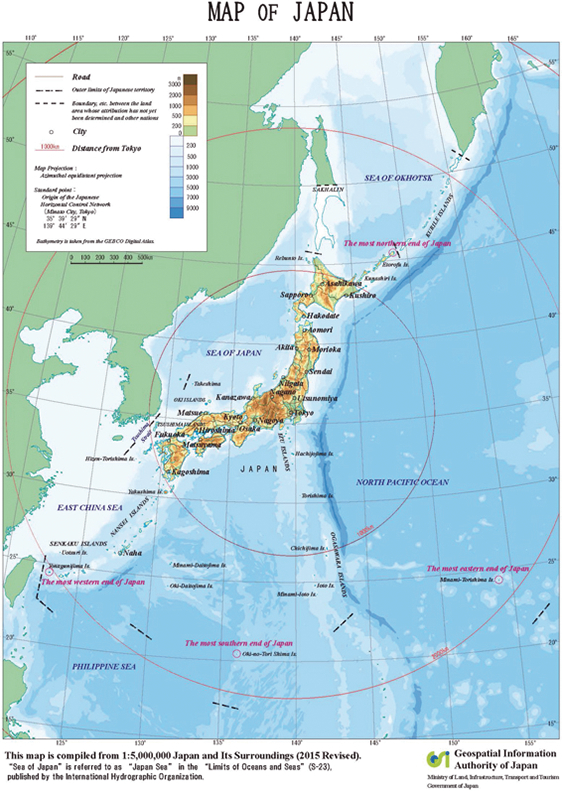

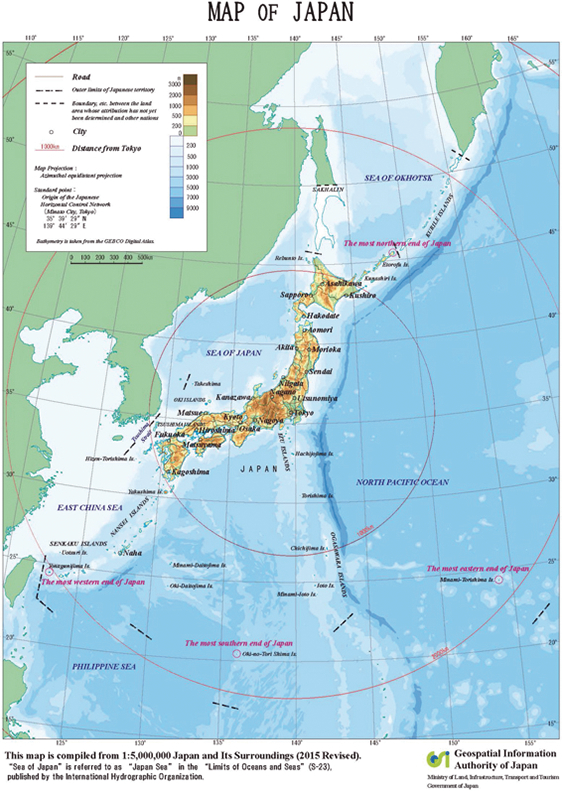

| | • | | Forestation. Supported forestation efforts in developing countries on the scale of approximately 2.79 million ha (or 12.75 times the land area of Tokyo Metropolis). |

Key Regional Initiatives

Southeast Asia and the Pacific

JICA provides cooperation that focuses on regional capacity development to support the extensive socioeconomic transformation and diversity in development needs, in line with the Development Cooperation Charter announced in February 2015. In particular, JICA extends support for the development of soft and hard infrastructure and the narrowing of the development gap within the Southeast Asian region and in individual countries to achieve sustainable economic growth. JICA also cooperates in various fields such as disaster risk reduction, maritime safety, the rule of law, health, women’s empowerment, and peacebuilding utilizing Japanese knowledge, technology, and experience.

As the importance of countries in the Pacific region in economic growth increases, JICA aims to continue to provide aid in order to accelerate growth in the Pacific region.

East Asia and Central Asia

In East Asia, JICA supports regional stability and growth that is sound and sustained, providing cooperative assistance that strengthens economic relationships that are both reciprocal and mutually beneficial. JICA’s cooperation in parts of the region extends to challenges faced by Japan as well, such as measures against cross-border pollution, infectious diseases and food safety-related issues. In other parts of the region, JICA has focused on the promotion of sustainable development in the industrial sector and enhancement of governance, inclusive growth by increasing employment at small and medium-sized businesses, and enhancement of urban centers through technical cooperation.

In Central Asia and the Caucasus, JICA provides assistance to promote intra-regional cooperation and the promotion of democracy and market economies. Cooperation priorities include programs for improving electric-power and transportation infrastructure in Central Asia and programs to enhance market economies by activating the private sector.

South Asia

In South Asia, JICA concentrates on promoting quality growth and reducing poverty through the building of infrastructure such as transportation systems, electricity, water supply and sewerage services, by strengthening political systems and by promoting cooperation with Japanese private companies. JICA also provides peacebuilding and reconstruction aid to contribute to the peace and stability of countries and areas in the South

15

Asian region. Further, JICA provides support following natural disasters in cooperation with international organizations and other partners, as well as providing support for measures on climate change and for protecting the environment.

Latin America and the Caribbean

In Central America and the Caribbean, JICA supports economic infrastructure improvement and human resource development in order for each country to achieve growth. JICA is focused on building a sustainable and resilient society by addressing global issues such as the promotion of a shift toward renewable energy and energy efficiency as well as projects intended to mainstream the concept of disaster risk reduction. JICA is extending support to improve the quality of public services, health care and education. In addition, JICA is providing support through cooperation with both regional organizations, including Sistema de la Integración Centroamericana (“SICA”), and international organizations, such as the Inter-American Development Bank, through which it has expanded its assistance in the area of energy saving and renewable energy projects.

In South America, JICA is providing support for improving lagging infrastructure development and creating an investment environment. Furthermore, JICA is assisting countries in enhancing their administrative capability as a foundation to facilitate private economic activities and ensure public security, as well as in improving the urban environment. JICA is also addressing such global issues by, for example, providing emergency disaster relief and enhancing disaster response capabilities.

Africa

The Sixth Tokyo International Conference on African Development (“TICAD VI”) was held in August 2016 in Nairobi, Kenya. Discussions at the summit culminated in the adoption of the Nairobi Declaration, which identifies three priority areas for addressing newly emerging challenges in Africa’s development: “promoting structural economic transformation through economic diversification and industrialization”, “promoting resilient health systems for quality of life” and “promoting social stability for shared prosperity”. During TICAD VI, JICA committed to continuing its contributions to development in Africa by supporting Africa’s initiatives based on the Nairobi Declaration. JICA also affirmed the importance of “Agenda 2063”, which is the African Union’s long-term development vision for the upcoming decade, as a key initiative to guide JICA’s and the international community’s efforts to confront newly emerging development challenges in Africa.

Middle East and Europe

The Middle East and Europe, including approximately 30 countries in Central Eastern Europe, the Middle East and North Africa, is a strategically important region for Japan for securing energy resources and trade routes, and therefore peace and stability in these regions is vital. JICA provides flexible assistance in accordance with the needs and individuality of the region, based on four key strategies: “promoting human security and peacebuilding”, “promoting quality growth”, “contributing to environmental issues beyond national borders” and “cooperating with emerging donors”.

Issue specific initiatives

Millennium Development Goals and Sustainable Development Goals

During the Millennium Summit held in September 2000 in which 189 countries participated, the United Nations (“UN”) Millennium Declaration (the “Declaration”) was adopted, and it set the goals to be achieved by the international community in the 21st century. The Declaration served to clarify the direction and role of the UN on issues of peace and security, development and poverty, the environment, human rights and protecting the vulnerable.

The Millennium Development Goals (the “MDGs”) were then established as a common framework by integrating the Declaration and the international development goals adopted by major international conferences

16

and summits in the 1990s. The MDGs consist of eight goals that were to be achieved by 2015, and which consisted of the following: (a) eradicate extreme poverty and hunger, (b) achieve universal primary education, (c) promote gender equality and empower women, (d) reduce child mortality, (e) improve maternal health, (f) combat HIV/AIDS, malaria and other diseases, (g) ensure environmental sustainability and (h) develop a global partnership for development.

The Sustainable Development Goals (“SDGs”) were adopted at the UN Sustainable Development Summit in September 2015. The SDGs aim to promote efforts to resolve or ameliorate issues that have not been resolved under the MDGs and to set universal goals and targets for new and emerging issues. JICA will continue to contribute to the establishment of a new development framework in developing countries by building on and extrapolating from its past support.

For information on JICA’s track record of achievements in furtherance of development cooperation goals that are broadly consistent with the MDGs, see “—JICA’s Path for Development Activities—JICA’s Development Cooperation Achievements”. In addition, the following are some examples of JICA’s operations geared towards achieving the goals set out in the MDGs:

Infrastructure and Peace Building

The Infrastructure and Peace Building Department of JICA is involved in a wide variety of projects including developing national infrastructure such as urban and regional development planning, transportation, information and communication technology. JICA also extends cooperation for strengthening organizations and training people for the maintenance and operation of these infrastructure systems.

Human Resource Development

Starting in JFY 2014, JICA has implemented dynamic programs that bring together its initiatives and advance “visible” outcomes, and promote mutual learning that transcended national borders and sectors. JICA continues to assist with people-centered development in the fields of education, social security and health. Under the principle of human security, JICA will focus on people and accelerate the efforts that bring together a diverse range of fields and national activities to tackle issues that directly affect people.

Global Environment

JICA works with the international community to support developing countries, in various ways, in improving the global environment, protecting people’s lives, and achieving healthier lives. The Global Environment Department of JICA’s responsibilities cover a wide scope, including environmental conservation and management, water and sanitation issues, and disaster risk reduction.

Rural Development

JICA has viewed rural development as an important area since it began international cooperation. Traditionally, JICA had provided assistance in the area of canal irrigation and rice cultivation in South East Asia. However, in recent years, the focus has shifted towards African nations which has led to new business developments in agriculture. JICA provides cooperation to address the issues of agricultural, maritime and rural development aiming to ensure a stable food supply to people in both rural and urban communities, thereby driving economic development at national and regional levels. In recent years, JICA has concentrated on providing support for regional development under the initiatives of Smallholder Horticulture Empowerment and Promotion and for increased food production with the Coalition for African Rice Development.

17

Industrial Development and Public Policy

The Industrial Development and Public Policy Department of JICA comprises the private sector development, energy and mining and governance groups. In recent years, the private sector has gained more importance in developing market and economic growth in developing countries. JICA assists developing countries in strengthening their private sectors and also strives to strengthen governance through cooperation in establishing legal and judicial frameworks. Through these activities, JICA promotes sustainable growth as well as democratic and fair societies in developing countries.

Partnership for Quality Infrastructure

At the occasion of the 21st International Conference on the Future of Asia held in May 2015, in order to promote infrastructure investment in Asia both in terms of quantity and quality, Prime Minister of Japan Shinzo Abe announced the Partnership for Quality Infrastructure. Under this Partnership, the Government of Japan promotes “quality infrastructure investment” in collaboration with other countries and international organizations. To this end, Japan, in collaboration with the strengthened Asian Development Bank (“ADB”), will provide approximately U.S.$110 billion for quality infrastructure development in Asia over a five-year period. Following the announcement, JICA and ADB signed a Memorandum of Understanding (the “MOU”) providing a framework for the partnership between the two organizations. There are two main provisions specified in the MOU:

1. Establishment of a trust fund for supporting public-private and other private sector infrastructure projects. By the end of JFY 2016, JICA will make an equity contribution out of its PSIF to a trust fund established by ADB. This fund will be used to finance quality infrastructure projects structured under public-private partnerships or on a fully-private basis in conjunction with private sector financing from ADB. With a target of providing up to U.S.$1.5 billion in financing over five years, this initiative is expected to facilitate further development of large-scale private infrastructure projects in Asia.

2. Co-financing framework for supporting the governments of developing countries to promote public infrastructure. To promote quality public infrastructure in Asia, JICA and ADB will provide sovereign loans to the governments of developing countries with a goal of reaching U.S.$10 billion through co-financing between the two agencies over five years. Long-term assistance plans will be formulated by JICA and ADB for target countries and, based on these plans, the two agencies will provide technical assistance required for project preparation and implementation, while leveraging the comparative advantages of each institution.

Budget

The following table sets forth summary budget information in terms of budgeted expenses for the three main arms of operations of JICA for JFY 2015 and JFY 2016:

Budget for Three Main Arms of Operations

| | | | | | | | |

| | | For the year ended | | | For the year ending | |

| | | March 31, 2016 | | | March 31, 2017 | |

| | | (in billions of yen) | |

Finance and Investment | | ¥ | 988.5 | | | ¥ | 1,052.5 | |

Technical Cooperation | | | 147.9 | | | | 150.7 | |

Grand Aid | | | 160.5 | | | | 162.9 | |

| | | | | | | | |

Total | | ¥ | 1,296.9 | | | ¥ | 1,366.1 | |

18

Funding

Finance and Investment operations are funded in accordance with the government of Japan’s ODA commitments and carried out in line with policies implemented by the Japanese Cabinet, and JICA is authorized by statute to borrow from the Japanese government on a long-term basis or issue bonds in order to fund these operations. Over the past three fiscal years, the amount of available funding for JICA’s Finance and Investment operations under JICA’s funding plan has increased, as shown in the following table:

Finance and Investment Account Funding Plan

| | | | | | | | | | | | |

| | | JFY2014 | | | JFY2015 | | | JFY2016 | |

| | | (in billions of yen) | |

Contribution from the government | | ¥ | 48.5 | | | ¥ | 48.3 | | | ¥ | 44.4 | |

Fiscal Investment and Loan Program (FILP)(1) | | | 482.0 | | | | 436.6 | | | | 468.0 | |

Borrowing from FILP | | | 422.0 | | | | 376.6 | | | | 393.0 | |

Government-guaranteed bonds | | | 60.0 | | | | 60.0 | | | | 75.0 | |

FILP Agency Bonds(2) | | | 80.0 | | | | 60.0 | | | | 60.0 | |

Others | | | 378.0 | | | | 443.6 | | | | 480.1 | |

| | | | | | | | | | | | |

Total | | ¥ | 988.5 | | | ¥ | 988.5 | | | ¥ | 1,052.5 | |

| | | | | | | | | | | | |

Notes:

| (1) | See “Japan—Fiscal Investment and Loan Program”. |

| (2) | Refers to non-government-guaranteed domestic bonds issued pursuant to FILP. |

Funding Track Record

Pursuant to JICA’s authority to issue bonds to fund its Finance and Investment operations, JICA has developed a track record of issuing bonds in both domestic and international markets.

Since December 2008, JICA has issued 38 non-government-guaranteed bonds in domestic markets, totaling ¥485 billion. The following table provides JICA’s issuance record of non-government-guaranteed bonds since December 2015:

| | | | | | | | |

Bond | | Issue Date | | Amount | | Coupon | | Term |

| | | | | (in billions of yen) | | (%) | | (years) |

33rd | | December 2015 | | ¥10 | | 1.130 | | 20 |

34th | | February 2016 | | 10 | | 0.245 | | 10 |

35th | | June 2016 | | 10 | | 0.080 | | 10 |

36th | | June 2016 | | 10 | | 0.313 | | 20 |

37th | | September 2016 | | 20 | | 0.100 | | 10 |

38th | | September 2016 | | 15 | | 0.590 | | 30 |

JICA issued its first government-guaranteed Euro-dollar bonds in November 2014 as follows:

| | | | | | | | |

Bond | | Issue Date | | Amount | | Coupon | | Term |

| | | | | (in millions of dollars) | | (%) | | (years) |

1st | | November 2014 | | $500 | | 1.875 | | 5 |

Guidelines for Environmental and Social Considerations

Although JICA’s various projects aim for social and economic development, there is the risk that such initiatives may involve a risk of negative impact on the environment including air, water, soil, or ecosystem as

19

well as negative impact on society such as involuntary resettlement or infringement of rights of indigenous peoples. In order to achieve sustainable development, any project’s impact on the environment and society must be assessed and any means and costs to avoid, minimize or compensate for such impact is integrated into the project itself. This internalization of environmental and social cost into the development cost is the gist of Environmental and Social Considerations (“ESC”). JICA has set out Guidelines for ESC which set forth JICA’s responsibilities and required procedures, together with obligations of partner countries and project proponents, in order to put ESC into practice.

JICA’s partners, including host countries, borrowers and project proponents bear the primary responsibility for ESC. JICA’s role is to examine ESC undertaken by project proponents in their development projects and to provide necessary support to ensure that the appropriate ESC are put into practice and that any adverse impact is avoided or minimized to an acceptable level.

Risk Management