1 EARNINGS PRESENTATION 4Q 2022 February 24, 2023

2 CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS This presentation may contain forward-looking statements within the meaning of the federal securities laws, including statements relating to (i) our strategy, outlook and growth prospects, (ii) our operational and financial targets and (iii) general economic trends and trends in our industry and markets. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions. Forward-looking statements involve known and unknown risks, uncertainties, assumptions and contingencies, many of which are beyond the Company’s control, and may cause the Company’s actual results to differ significantly from those expressed in any forward-looking statement. Factors that might cause such a difference include, without limitation, our ability to grow our business by raising capital for our funds and the companies that we manage; whether run rate metrics presented herein are reflective of actual annual data; our position as an owner, operator and investment manager of digital infrastructure and our ability to manage any related conflicts of interest; adverse changes in general economic and political conditions, including those resulting from supply chain difficulties, inflation, interest rate increases, a potential economic slowdown or a recession; our ability to deconsolidate our Operating segment; our exposure to business risks in Europe, Asia and other foreign markets; our ability to obtain and maintain financing arrangements, including securitizations, on favorable or comparable terms or at all; the ability of our managed companies to attract and retain key customers and to provide reliable services without disruption; the reliance of our managed companies on third-party suppliers for power, network connectivity and certain other services; our ability to increase assets under management ("AUM") and expand our existing and new investment strategies; our ability to integrate and maintain consistent standards and controls, including our ability to manage our acquisitions in the digital infrastructure and investment management industries effectively; our business and investment strategy, including the ability of the businesses in which we have significant investments to execute their business strategies; performance of our investments relative to our expectations and the impact on our actual return on invested equity, as well as the cash provided by these investments and available for distribution; our ability to deploy capital into new investments consistent with our investment management strategies; the availability of, and competition for, attractive investment opportunities and the earnings profile of such new investments; our ability to achieve any of the anticipated benefits of certain joint ventures, including any ability for such ventures to create and/or distribute new investment products; our expected hold period for our assets and the impact of any changes in our expectations on the carrying value of such assets; the general volatility of the securities markets in which we participate; the market value of our assets; interest rate mismatches between our assets and any borrowings used to fund such assets; effects of hedging instruments on our assets; the impact of economic conditions on third parties on which we rely; the impact of any security incident or deficiency affecting our systems or network or the system and network of any of our managed companies or service providers; any litigation and contractual claims against us and our affiliates, including potential settlement and litigation of such claims; our levels of leverage; the impact of legislative, regulatory and competitive changes, including those related to privacy and data protection; the impact of our transition from a real estate investment trust ("REIT") to a taxable C corporation for tax purposes, and the related liability for corporate and other taxes; whether we will be able to utilize existing tax attributes to offset taxable income to the extent contemplated; our ability to maintain our exemption from registration as an investment company under the Investment Company Act of 1940, as amended (the “1940 Act”); changes in our board of directors or management team, and availability of qualified personnel; our ability to make or maintain distributions to our stockholders; and our understanding of and ability to successfully navigate the competitive landscape in which we and our managed companies operate and other risks and uncertainties, including those detailed in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021 and Quarterly Reports on Form 10-Q for the fiscal quarters ended March 31, 2022, June 30, 2022 and September 30, 2022, each under the heading “Risk Factors,” as such factors may be updated from time to time in the Company’s subsequent periodic filings with the U.S. Securities and Exchange Commission (“SEC”). All forward-looking statements reflect the Company’s good faith beliefs, assumptions and expectations, but they are not guarantees of future performance. Additional information about these and other factors can be found in the Company’s reports filed from time to time with the SEC. The Company cautions investors not to unduly rely on any forward-looking statements. The forward-looking statements speak only as of the date of this presentation. The Company is under no duty to update any of these forward-looking statements after the date of this presentation, nor to conform prior statements to actual results or revised expectations, and the Company does not intend to do so. This presentation is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities of the Company. This information is not intended to be indicative of future results. Actual performance of the Company may vary materially. The appendices herein contain important information that is material to an understanding of this presentation and you should read this presentation only with and in context of the appendices.

3 AGENDA BUSINESS UPDATESE CT IO N 1 FINANCIAL RESULTSSE CT IO N 2 SE CT IO N 3 EXECUTING THE DIGITAL PLAYBOOK

4 1 BUSINESS UPDATE

5 2022 – DELIVERED GROWTH IN A DYNAMIC MACRO ENVIRONMENT DigitalBridge continued to be the Partner of Choice to top operating management teams and institutional investors allocating capital to this durable, growing asset class CAPITAL FORMATION 1 2 3 PORTFOLIO PERFORMED Established Asset Management Platform as Strategic Growth Driver “Full Stack” Profile CORPORATE STRATEGY Exceeded Fundraising Target Significant Embedded Earnings Growth Strong Leasing Drove Solid Outcomes

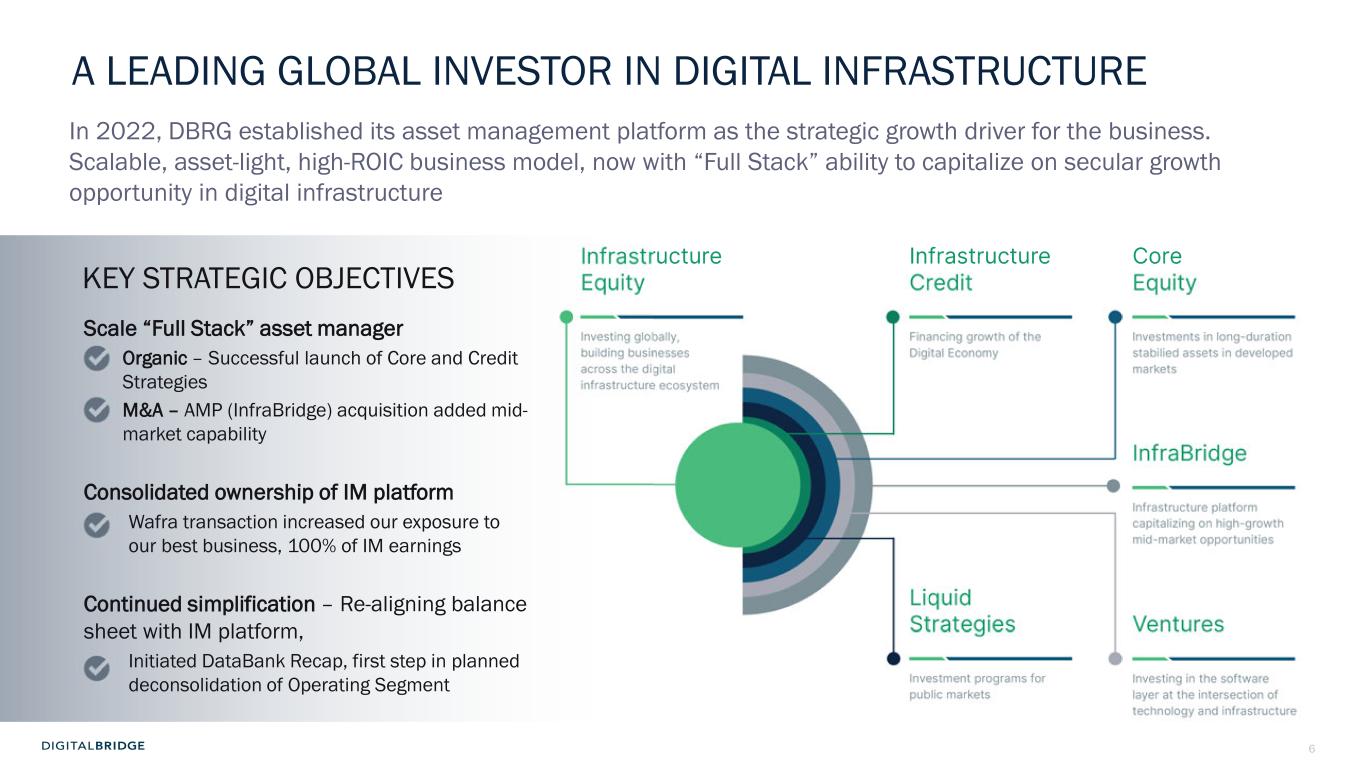

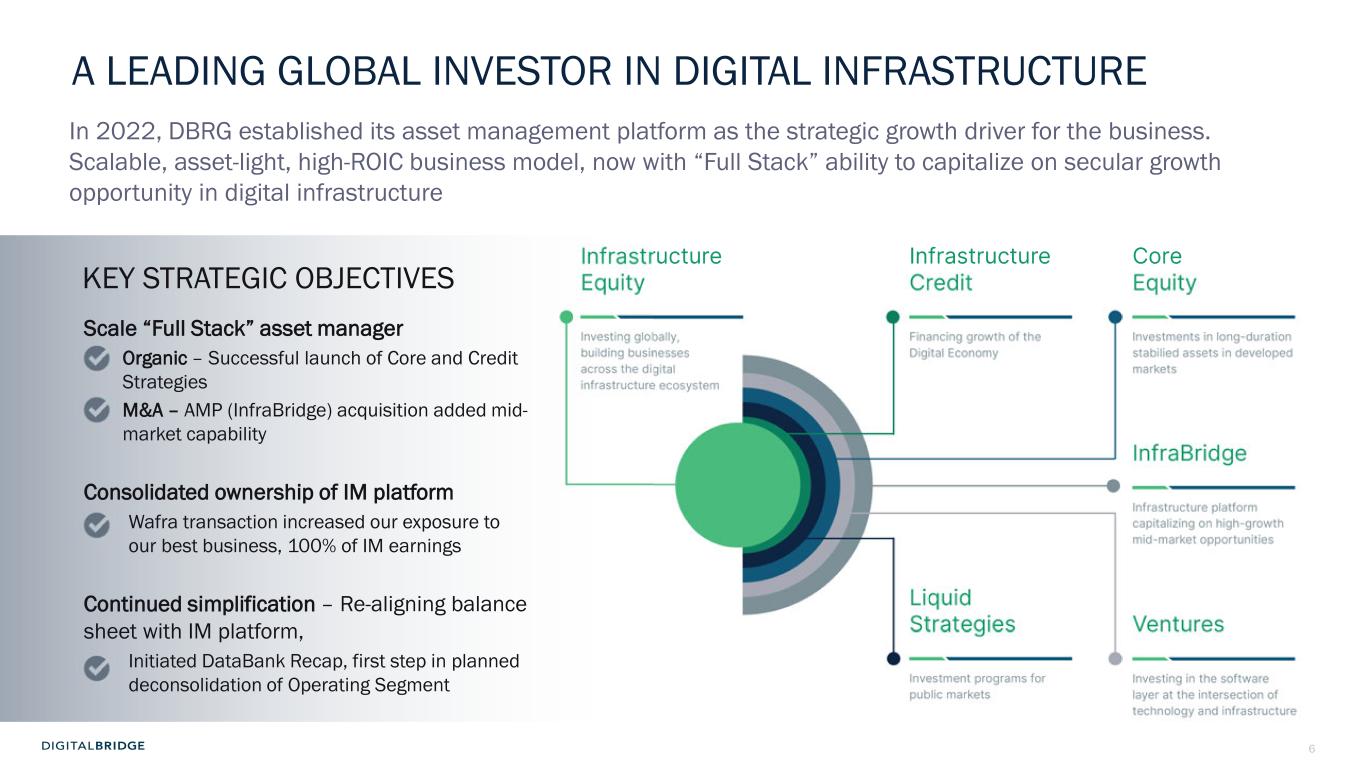

6 Scale “Full Stack” asset manager Organic – Successful launch of Core and Credit Strategies M&A – AMP (InfraBridge) acquisition added mid- market capability Consolidated ownership of IM platform Wafra transaction increased our exposure to our best business, 100% of IM earnings Continued simplification – Re-aligning balance sheet with IM platform, Initiated DataBank Recap, first step in planned deconsolidation of Operating Segment A LEADING GLOBAL INVESTOR IN DIGITAL INFRASTRUCTURE In 2022, DBRG established its asset management platform as the strategic growth driver for the business. Scalable, asset-light, high-ROIC business model, now with “Full Stack” ability to capitalize on secular growth opportunity in digital infrastructure KEY STRATEGIC OBJECTIVES

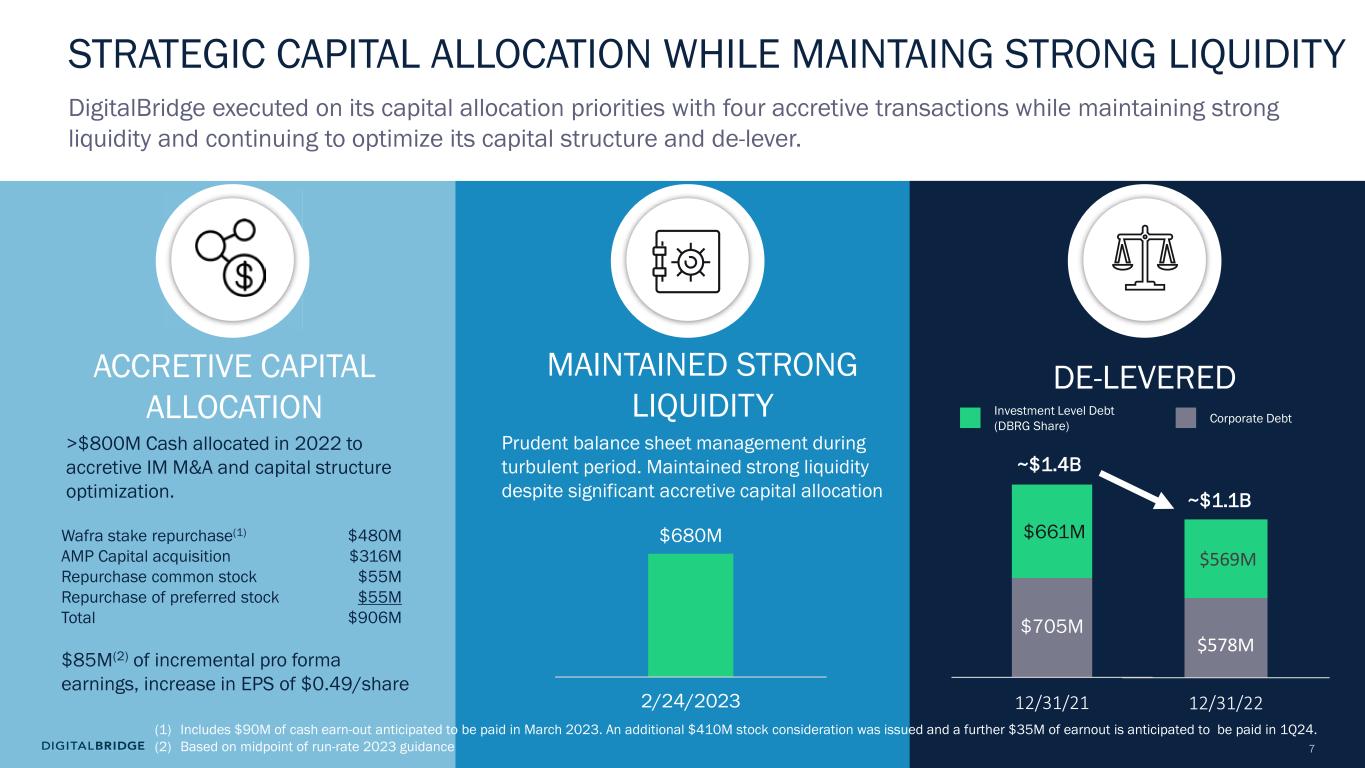

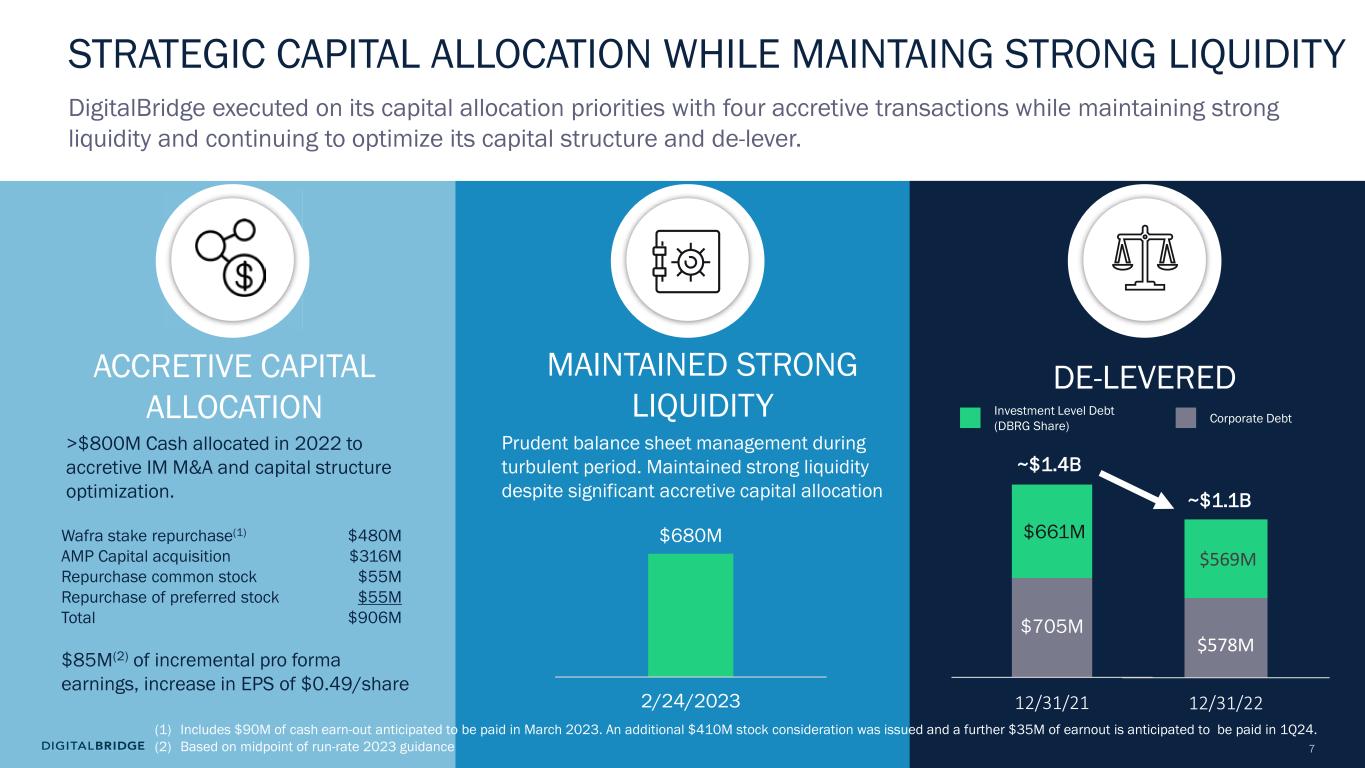

7 $578M $569M 12/31/22 STRATEGIC CAPITAL ALLOCATION WHILE MAINTAING STRONG LIQUIDITY DigitalBridge executed on its capital allocation priorities with four accretive transactions while maintaining strong liquidity and continuing to optimize its capital structure and de-lever. Prudent balance sheet management during turbulent period. Maintained strong liquidity despite significant accretive capital allocation ACCRETIVE CAPITAL ALLOCATION MAINTAINED STRONG LIQUIDITY Wafra stake repurchase(1) AMP Capital acquisition Repurchase common stock Repurchase of preferred stock Total $480M $316M $55M $55M $906M DE-LEVERED $705M $661M 12/31/21 ~$1.4B ~$1.1B Investment Level Debt (DBRG Share) Corporate Debt >$800M Cash allocated in 2022 to accretive IM M&A and capital structure optimization. $85M(2) of incremental pro forma earnings, increase in EPS of $0.49/share (1) Includes $90M of cash earn-out anticipated to be paid in March 2023. An additional $410M stock consideration was issued and a further $35M of earnout is anticipated to be paid in 1Q24. (2) Based on midpoint of run-rate 2023 guidance $680M 2/24/2023

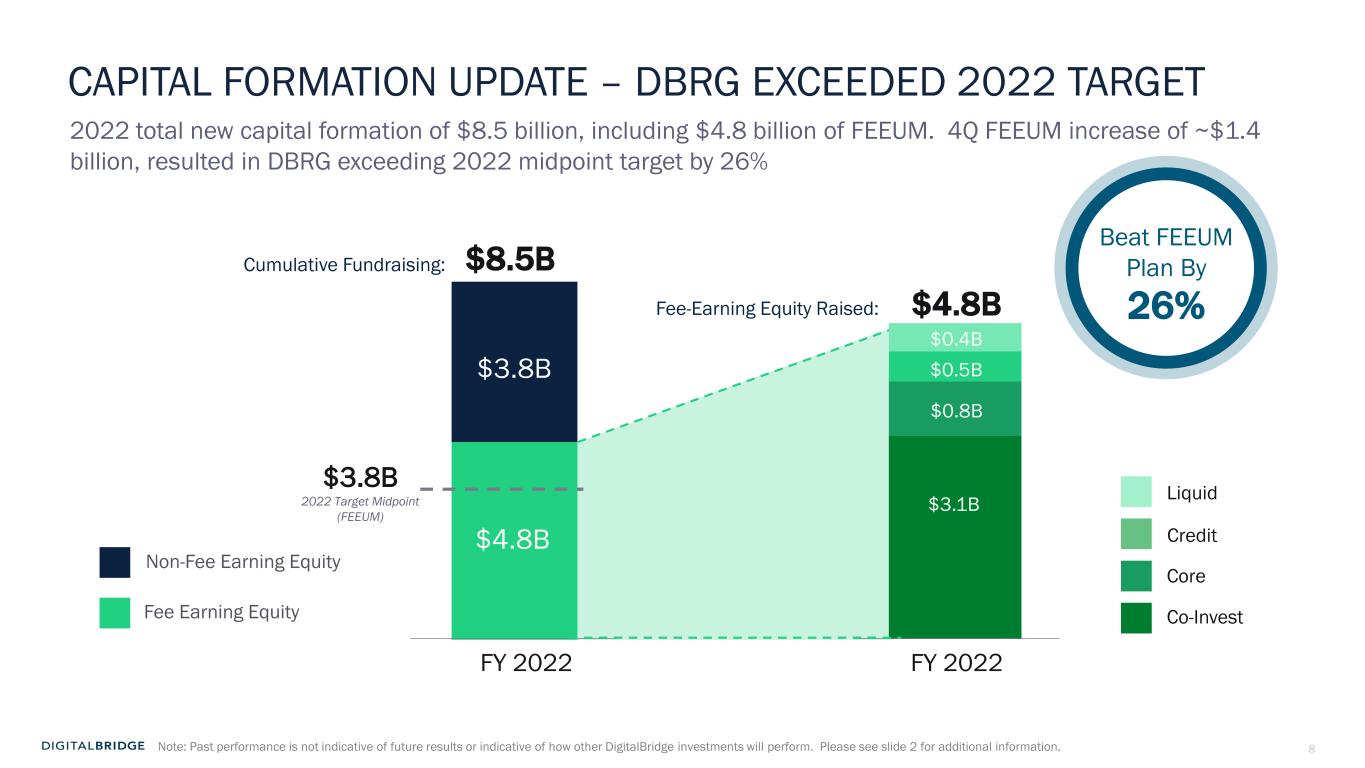

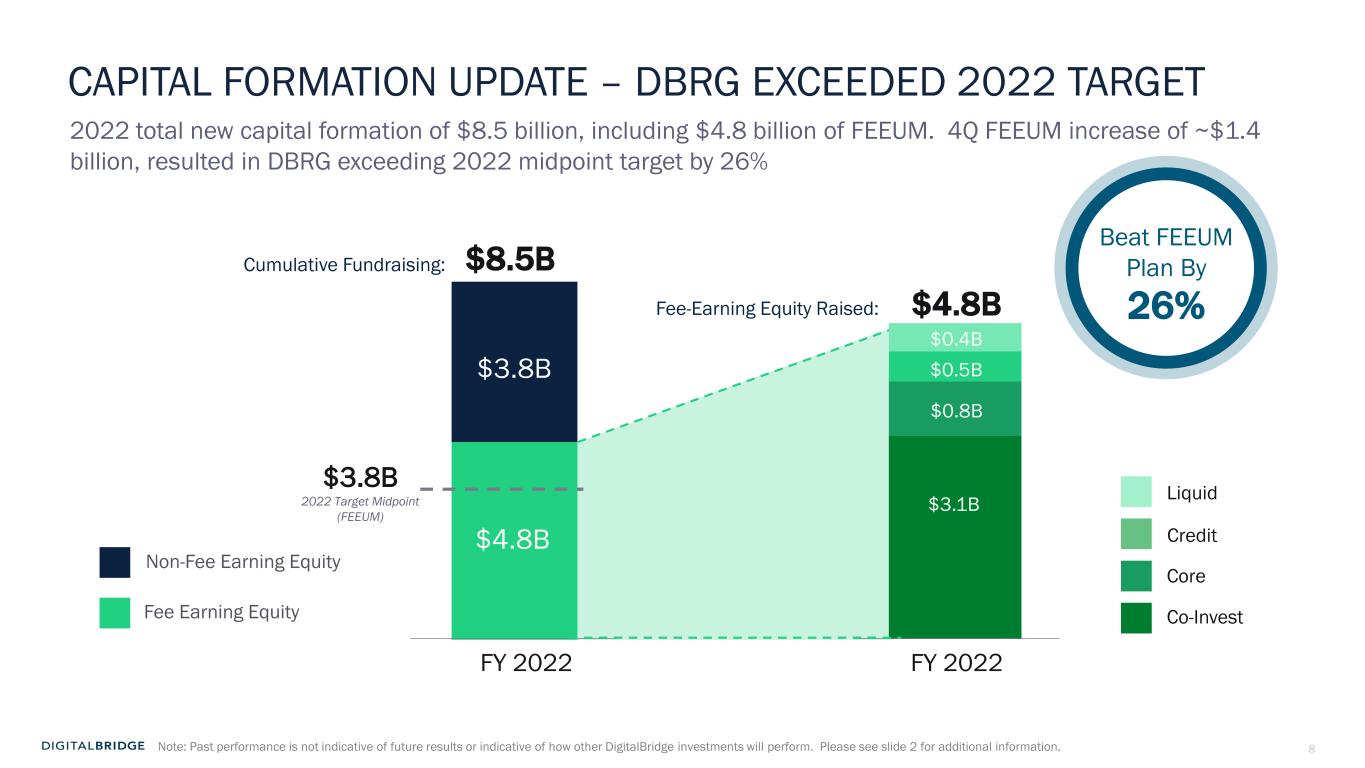

8 CAPITAL FORMATION UPDATE – DBRG EXCEEDED 2022 TARGET 2022 total new capital formation of $8.5 billion, including $4.8 billion of FEEUM. 4Q FEEUM increase of ~$1.4 billion, resulted in DBRG exceeding 2022 midpoint target by 26% Non-Fee Earning Equity Fee Earning Equity FY 2022 $3.8B 2022 Target Midpoint (FEEUM) $8.5B $4.8B $3.8B Cumulative Fundraising: FY 2022 $4.8B Liquid Credit Core Co-Invest $0.4B $0.5B $0.8B Fee-Earning Equity Raised: $3.1B Beat FEEUM Plan By 26% Note: Past performance is not indicative of future results or indicative of how other DigitalBridge investments will perform. Please see slide 2 for additional information.

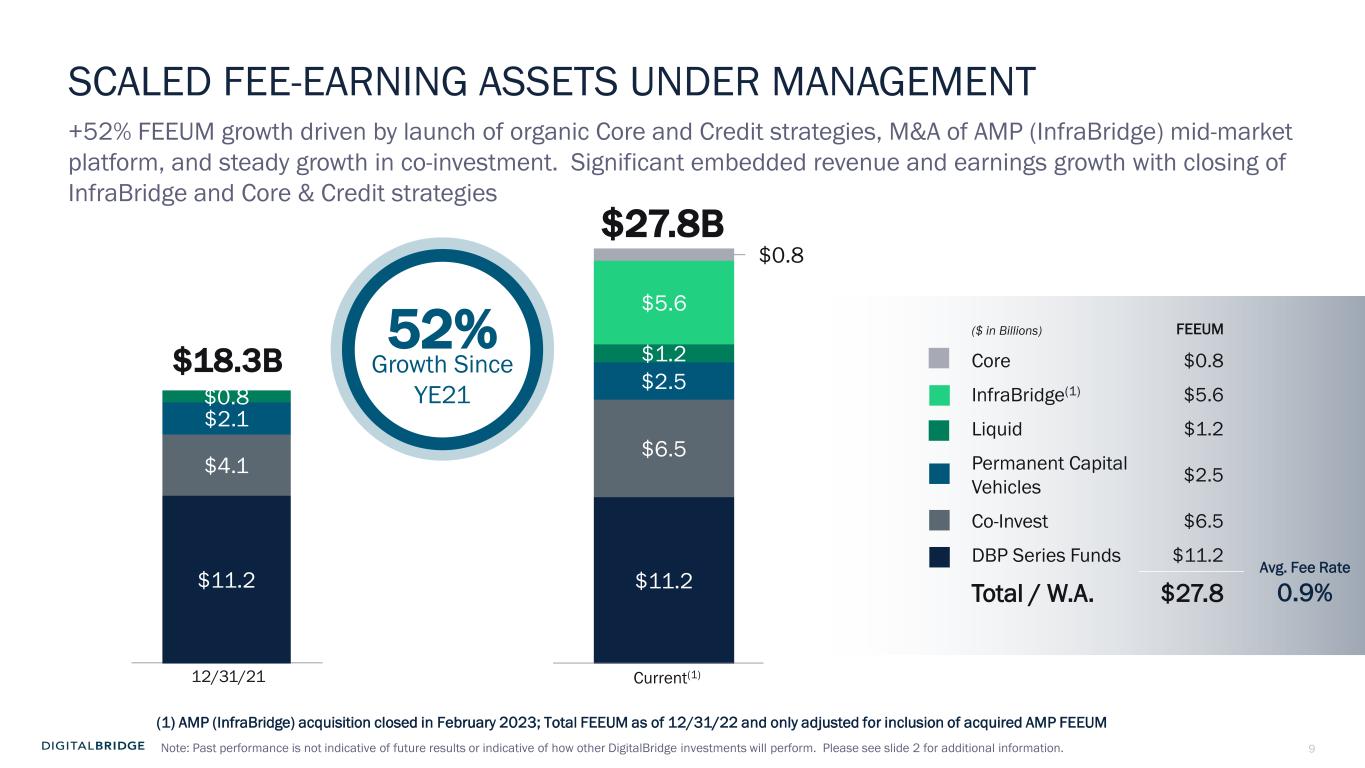

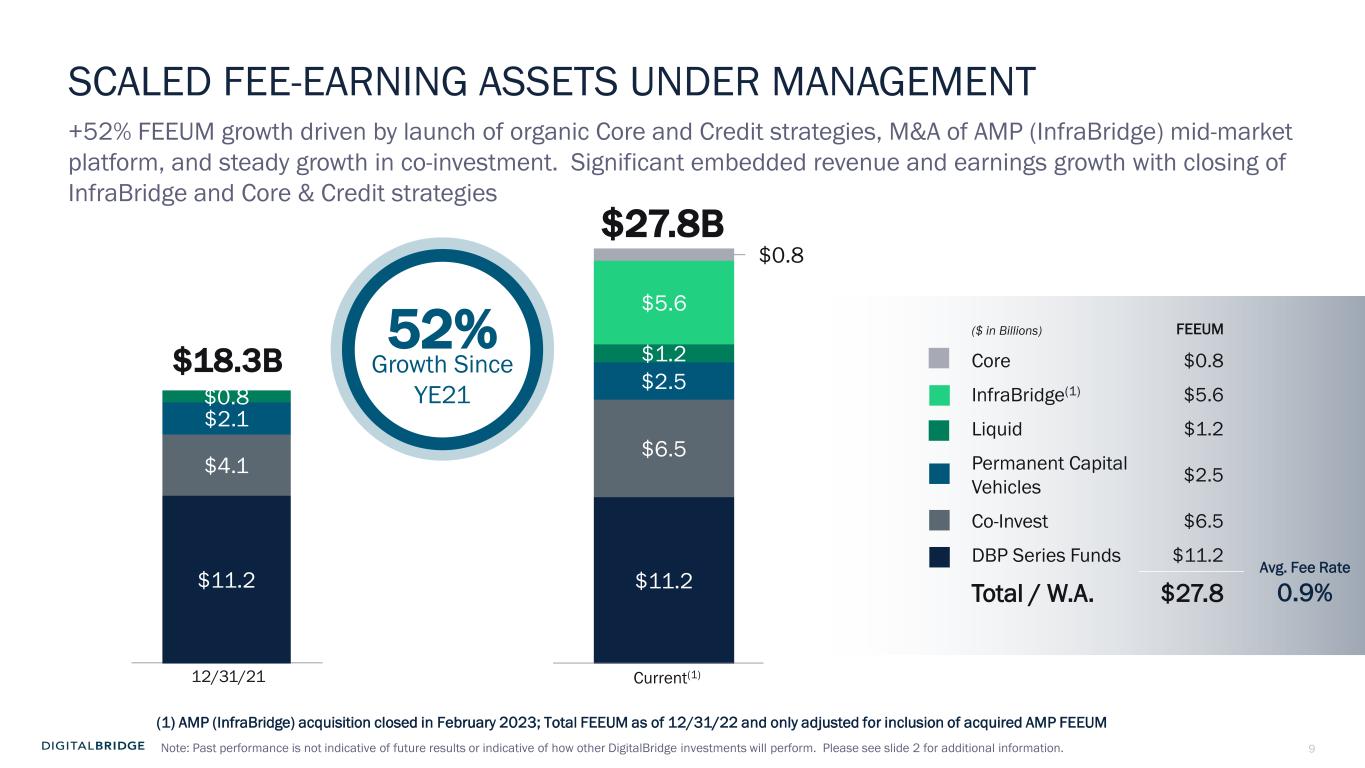

9 $11.2 $6.5 $2.5 $1.2 $5.6 $0.8 Current(1) $27.8B (1) AMP (InfraBridge) acquisition closed in February 2023; Total FEEUM as of 12/31/22 and only adjusted for inclusion of acquired AMP FEEUM $11.2 $4.1 $2.1 $0.8 12/31/21 $18.3B ($ in Billions) FEEUM Core $0.8 InfraBridge(1) $5.6 Liquid $1.2 Permanent Capital Vehicles $2.5 Co-Invest $6.5 DBP Series Funds $11.2 Total / W.A. $27.8 SCALED FEE-EARNING ASSETS UNDER MANAGEMENT +52% FEEUM growth driven by launch of organic Core and Credit strategies, M&A of AMP (InfraBridge) mid-market platform, and steady growth in co-investment. Significant embedded revenue and earnings growth with closing of InfraBridge and Core & Credit strategies 52% Growth Since YE21 Avg. Fee Rate 0.9% Note: Past performance is not indicative of future results or indicative of how other DigitalBridge investments will perform. Please see slide 2 for additional information.

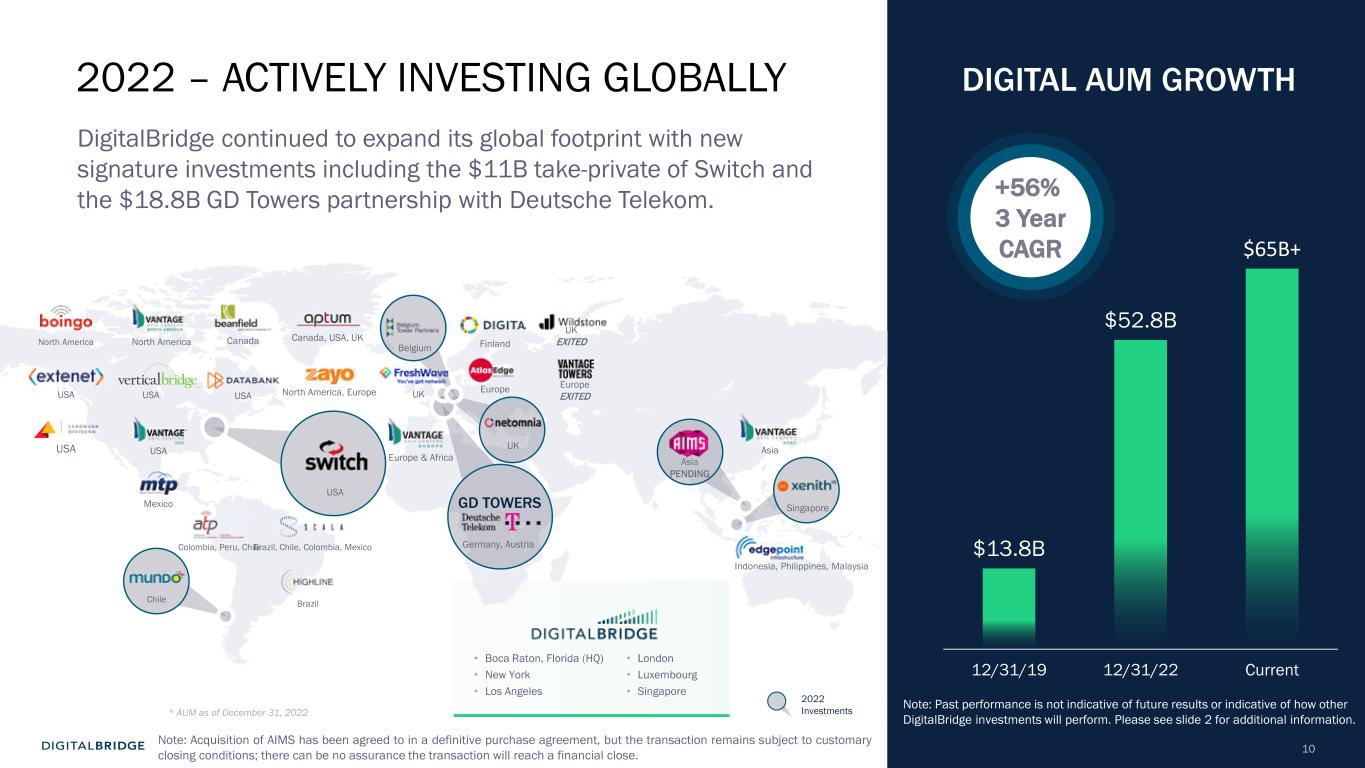

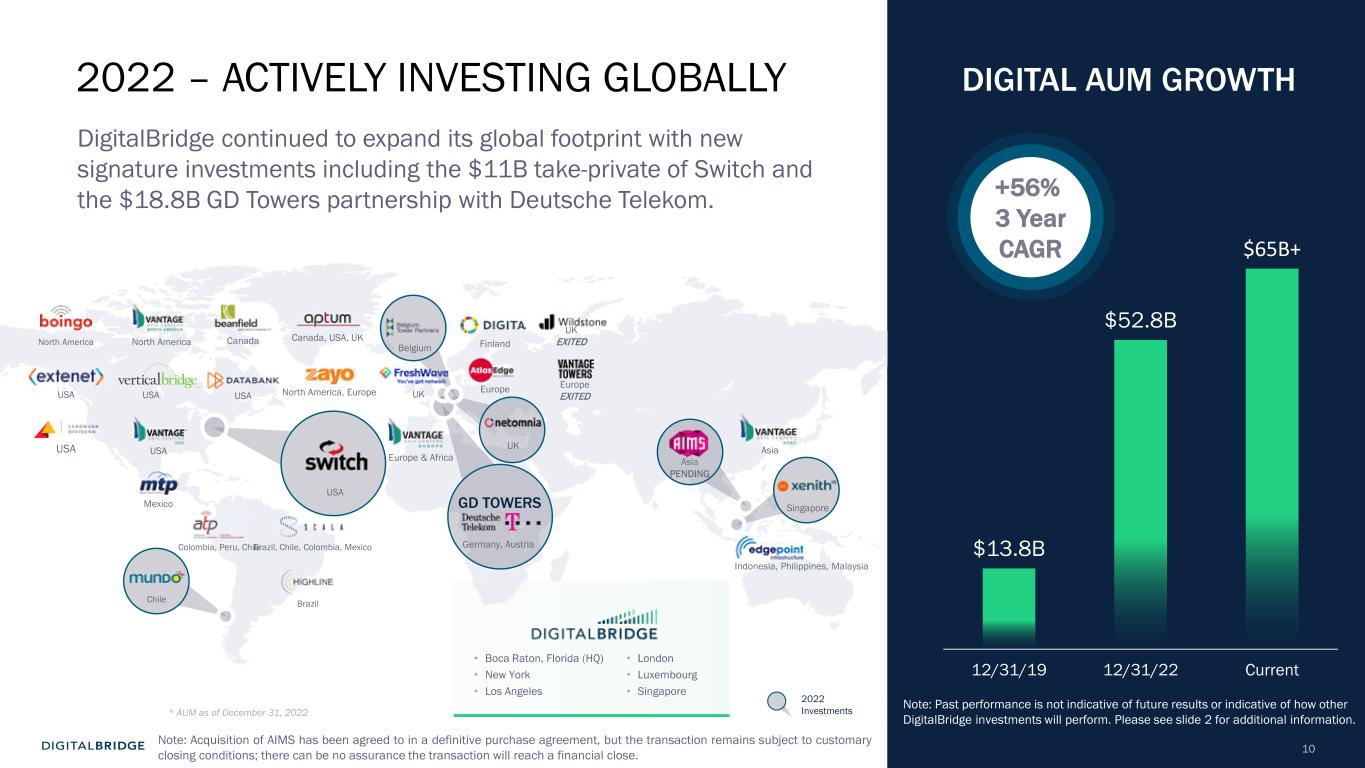

10 Note: Acquisition of AIMS has been agreed to in a definitive purchase agreement, but the transaction remains subject to customary closing conditions; there can be no assurance the transaction will reach a financial close. 2022 – ACTIVELY INVESTING GLOBALLY DigitalBridge continued to expand its global footprint with new signature investments including the $11B take-private of Switch and the $18.8B GD Towers partnership with Deutsche Telekom. * AUM as of December 31, 2022 • Boca Raton, Florida (HQ) • New York • Los Angeles • London • Luxembourg • Singapore 2022 Investments Colombia, Peru, Chile Canada, USA, UK UKUSAUSA USA Brazil Brazil, Chile, Colombia, Mexico Europe & Africa North America Europe USA Mexico North America Canada Finland North America, Europe USA Indonesia, Philippines, Malaysia Asia UK EXITED Europe EXITED Asia PENDING USA UK GD TOWERS Germany, Austria Chile Singapore Belgium $13.8B $52.8B $65B+ 12/31/19 12/31/22 Current +56% 3 Year CAGR DIGITAL AUM GROWTH Note: Past performance is not indicative of future results or indicative of how other DigitalBridge investments will perform. Please see slide 2 for additional information.

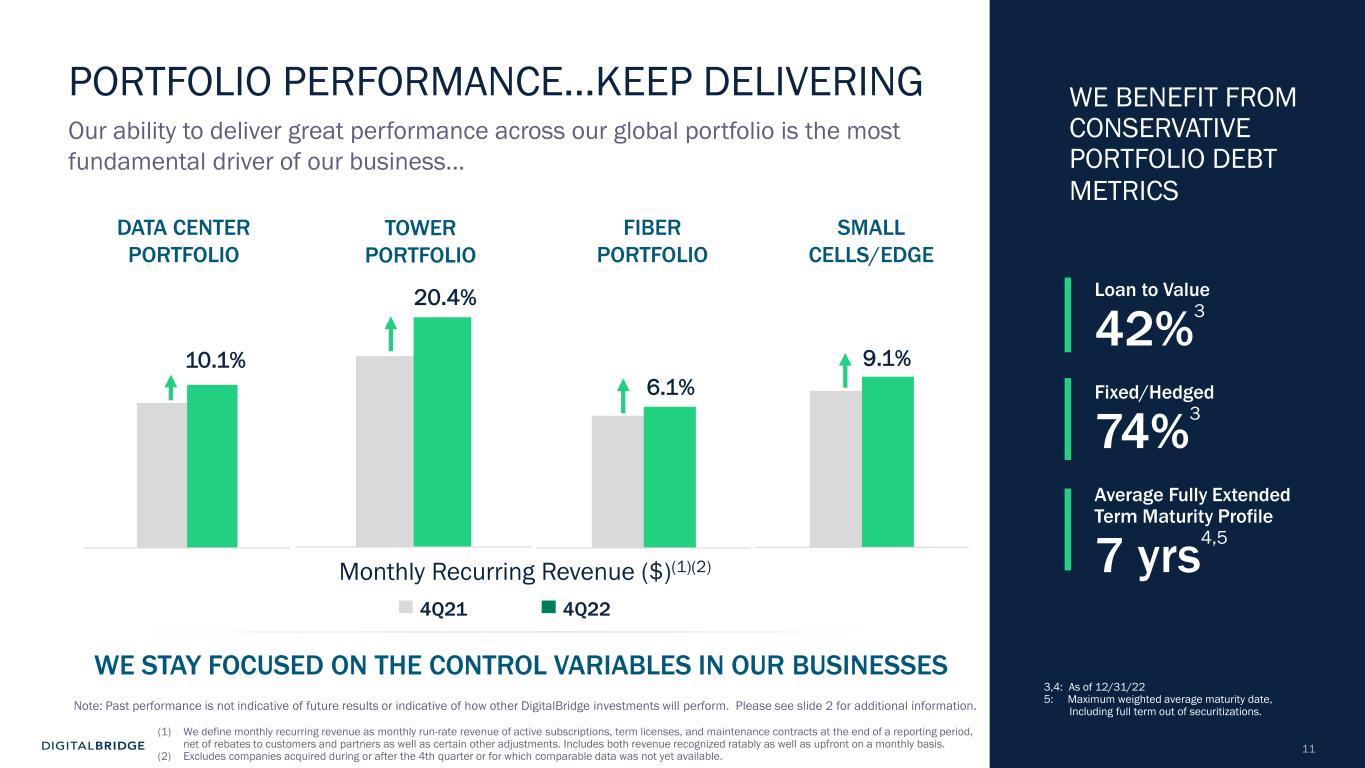

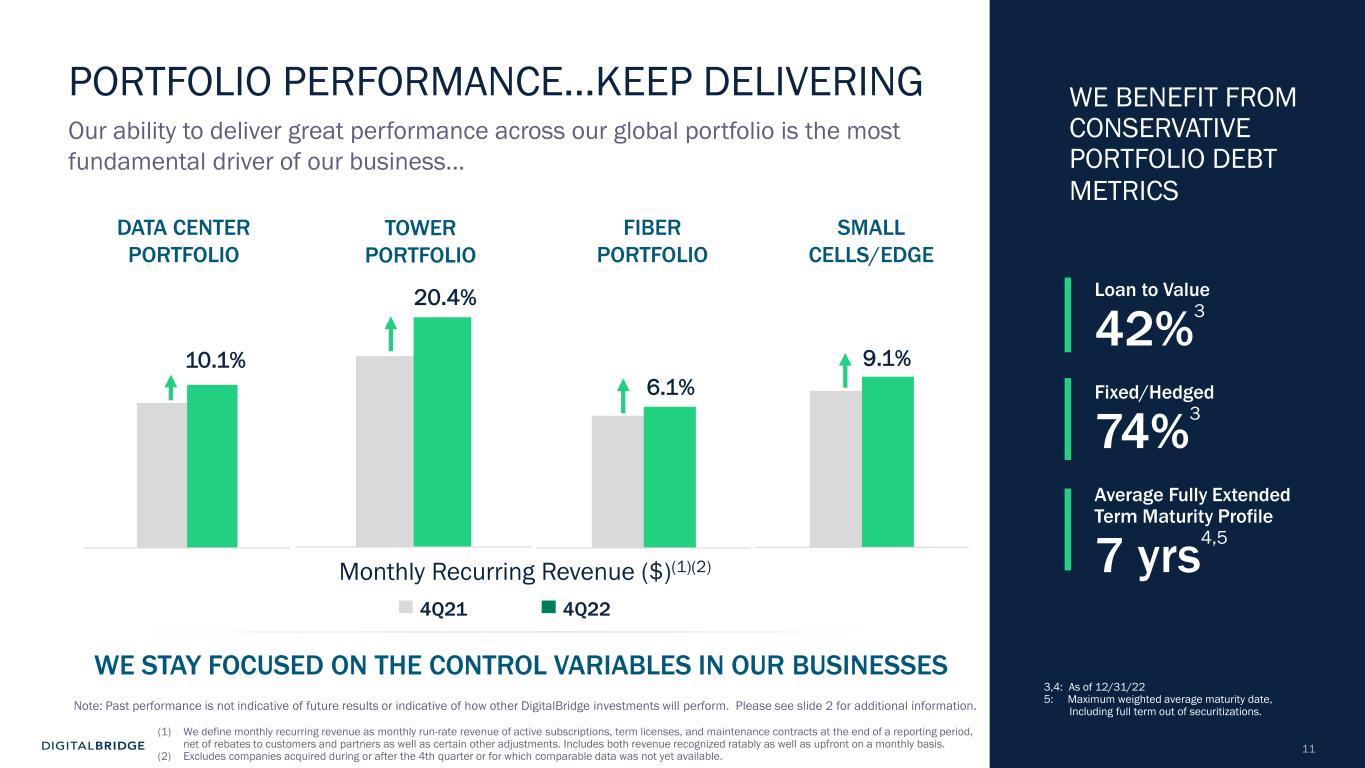

11 PORTFOLIO PERFORMANCE…KEEP DELIVERING Our ability to deliver great performance across our global portfolio is the most fundamental driver of our business… WE BENEFIT FROM CONSERVATIVE PORTFOLIO DEBT METRICS WE STAY FOCUSED ON THE CONTROL VARIABLES IN OUR BUSINESSES (1) We define monthly recurring revenue as monthly run-rate revenue of active subscriptions, term licenses, and maintenance contracts at the end of a reporting period, net of rebates to customers and partners as well as certain other adjustments. Includes both revenue recognized ratably as well as upfront on a monthly basis. (2) Excludes companies acquired during or after the 4th quarter or for which comparable data was not yet available. 4Q224Q21 TOWER PORTFOLIO SMALL CELLS/EDGE FIBER PORTFOLIO DATA CENTER PORTFOLIO 10.1% 6.1% 9.1% 20.4% Monthly Recurring Revenue ($)(1)(2) Loan to Value 42%3 Fixed/Hedged 74%3 Average Fully Extended Term Maturity Profile 7 yrs4,5 3,4: As of 12/31/22 5: Maximum weighted average maturity date, Including full term out of securitizations.Note: Past performance is not indicative of future results or indicative of how other DigitalBridge investments will perform. Please see slide 2 for additional information.

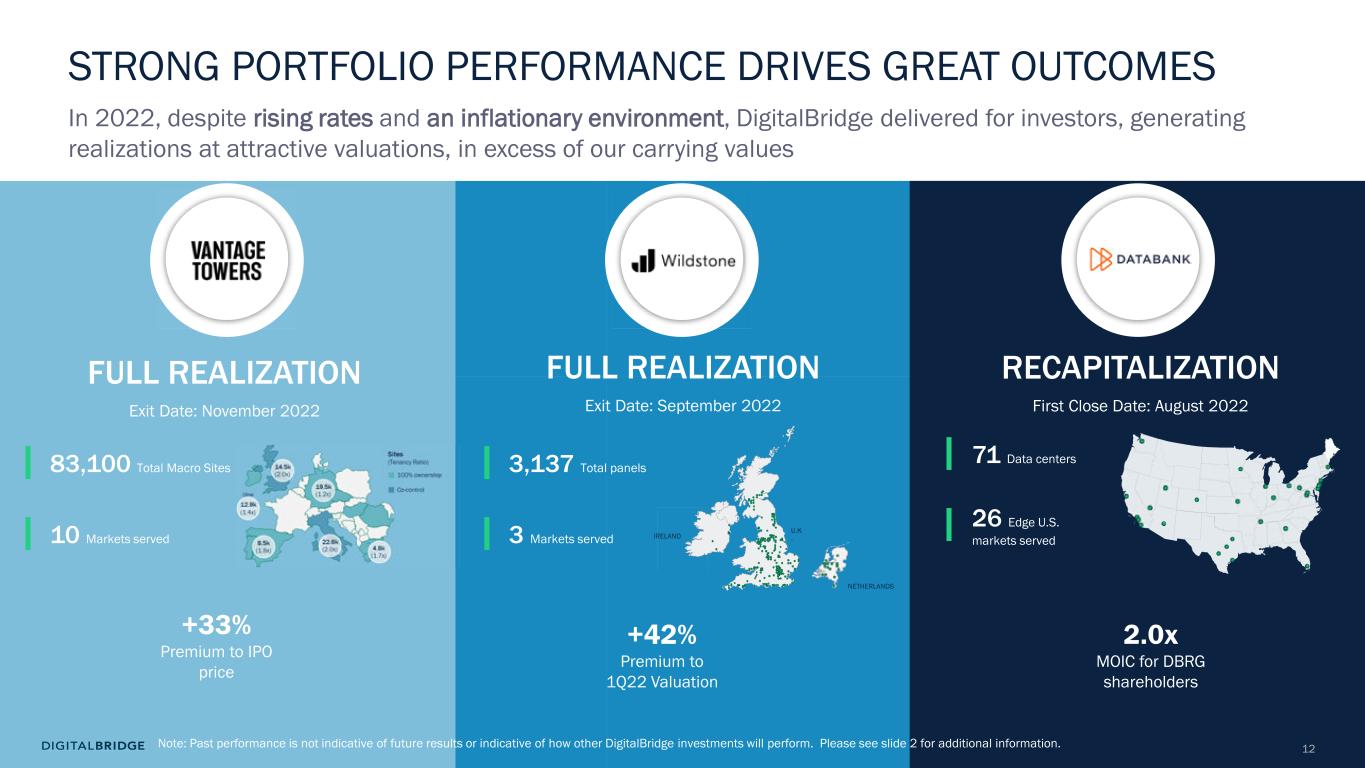

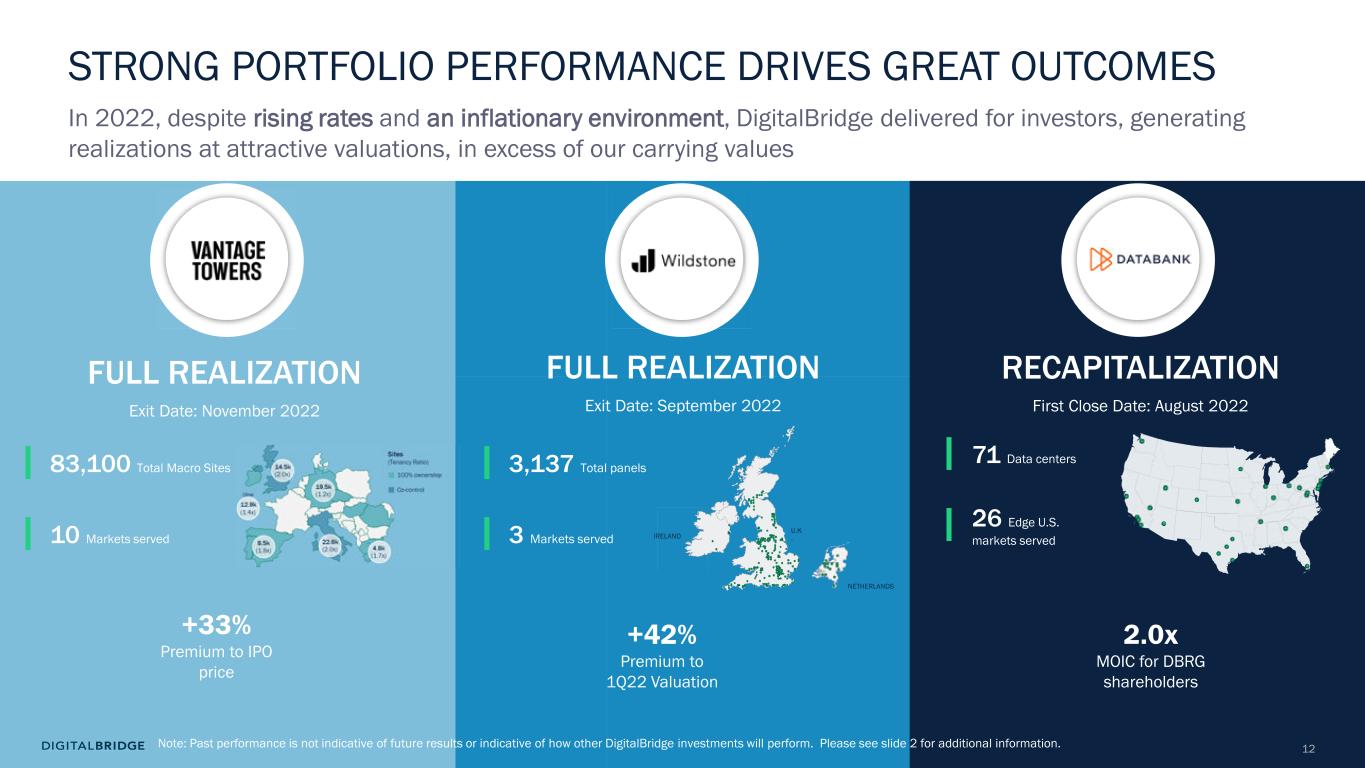

12 71 Data centers 26 Edge U.S. markets served FULL REALIZATION Exit Date: November 2022 3,137 Total panels 3 Markets served U.K .IRELAND NETHERLANDS 83,100 Total Macro Sites 10 Markets served FULL REALIZATION Exit Date: September 2022 RECAPITALIZATION First Close Date: August 2022 STRONG PORTFOLIO PERFORMANCE DRIVES GREAT OUTCOMES In 2022, despite rising rates and an inflationary environment, DigitalBridge delivered for investors, generating realizations at attractive valuations, in excess of our carrying values 2.0x MOIC for DBRG shareholders +33% Premium to IPO price +42% Premium to 1Q22 Valuation Note: Past performance is not indicative of future results or indicative of how other DigitalBridge investments will perform. Please see slide 2 for additional information.

13 2 FINANCIAL RESULTS

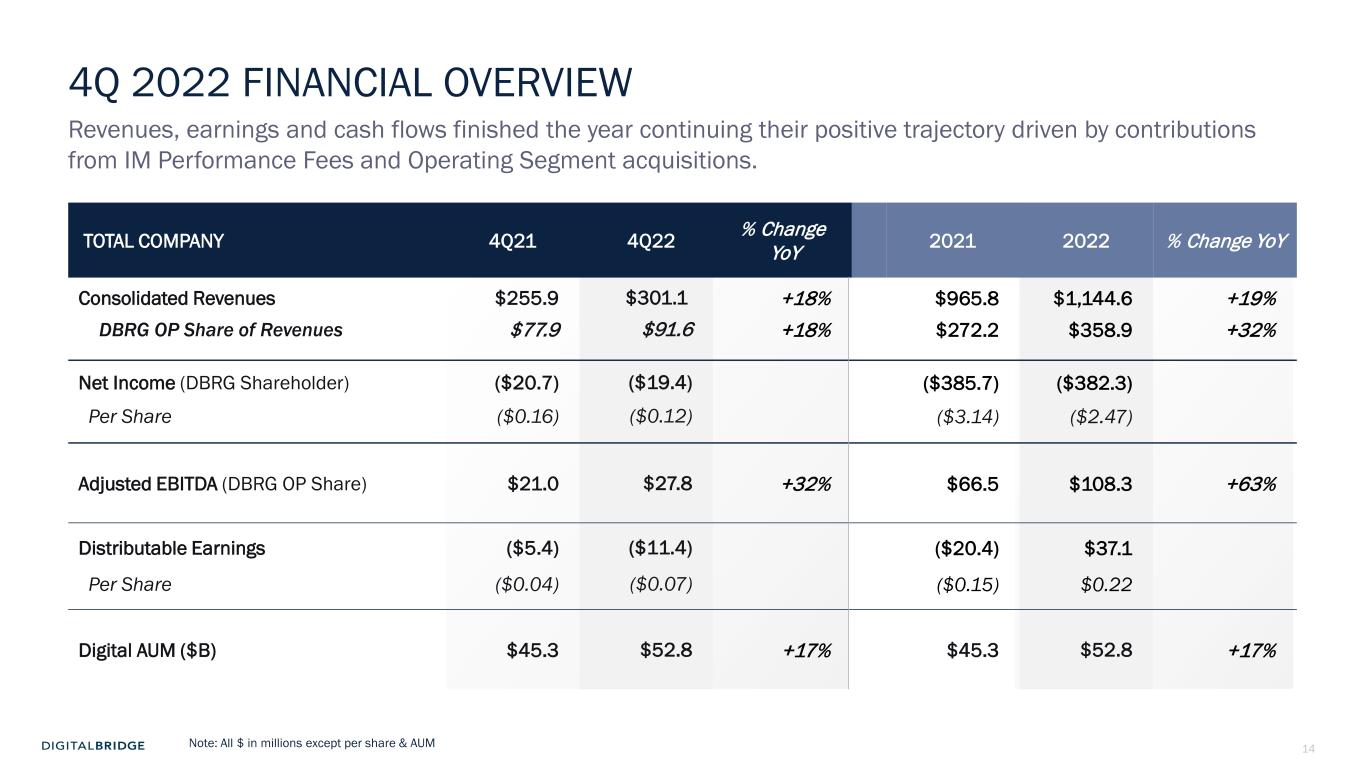

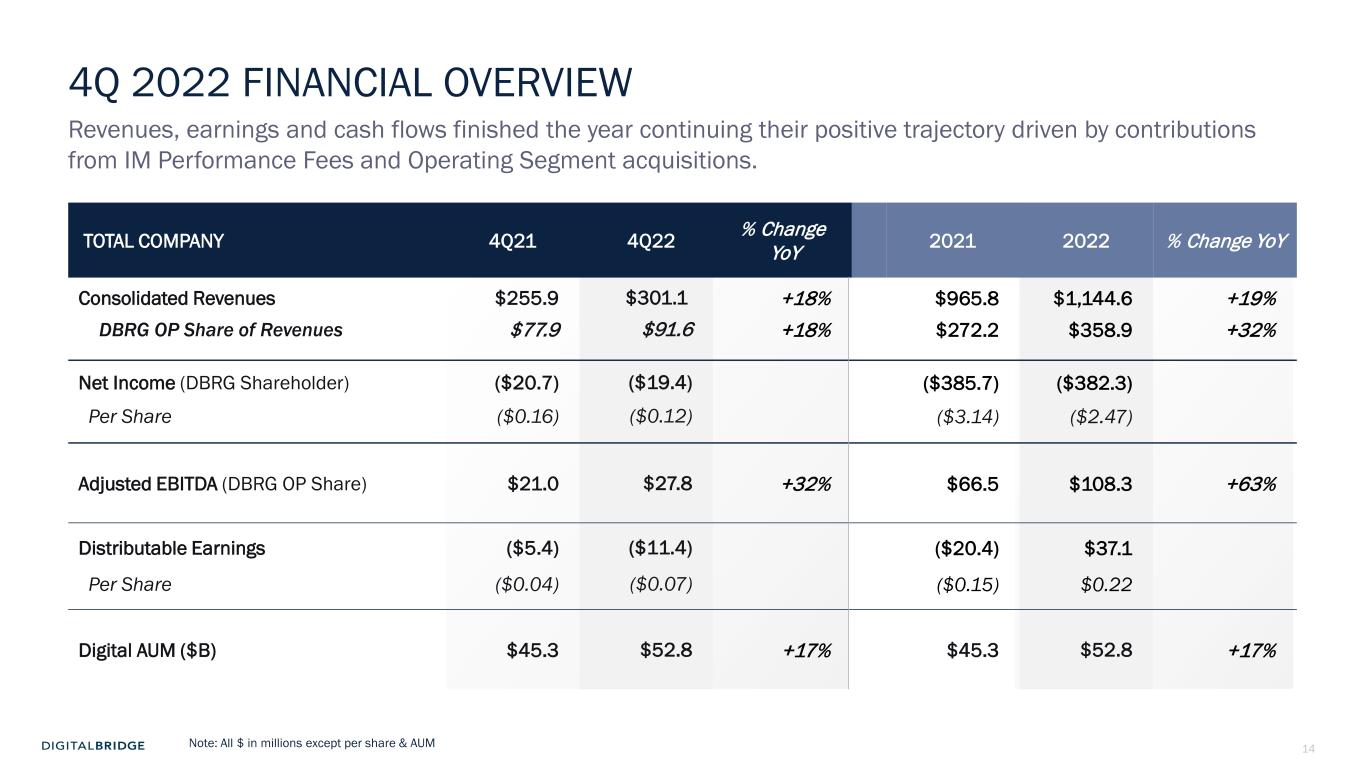

14 4Q 2022 FINANCIAL OVERVIEW Note: All $ in millions except per share & AUM TOTAL COMPANY 4Q21 4Q22 % Change YoY 2021 2022 % Change YoY Consolidated Revenues $255.9 $301.1 +18% $965.8 $1,144.6 +19% DBRG OP Share of Revenues $77.9 $91.6 +18% $272.2 $358.9 +32% Net Income (DBRG Shareholder) ($20.7) ($19.4) ($385.7) ($382.3) Per Share ($0.16) ($0.12) ($3.14) ($2.47) Adjusted EBITDA (DBRG OP Share) $21.0 $27.8 +32% $66.5 $108.3 +63% Distributable Earnings ($5.4) ($11.4) ($20.4) $37.1 Per Share ($0.04) ($0.07) ($0.15) $0.22 Digital AUM ($B) $45.3 $52.8 +17% $45.3 $52.8 +17% Revenues, earnings and cash flows finished the year continuing their positive trajectory driven by contributions from IM Performance Fees and Operating Segment acquisitions.

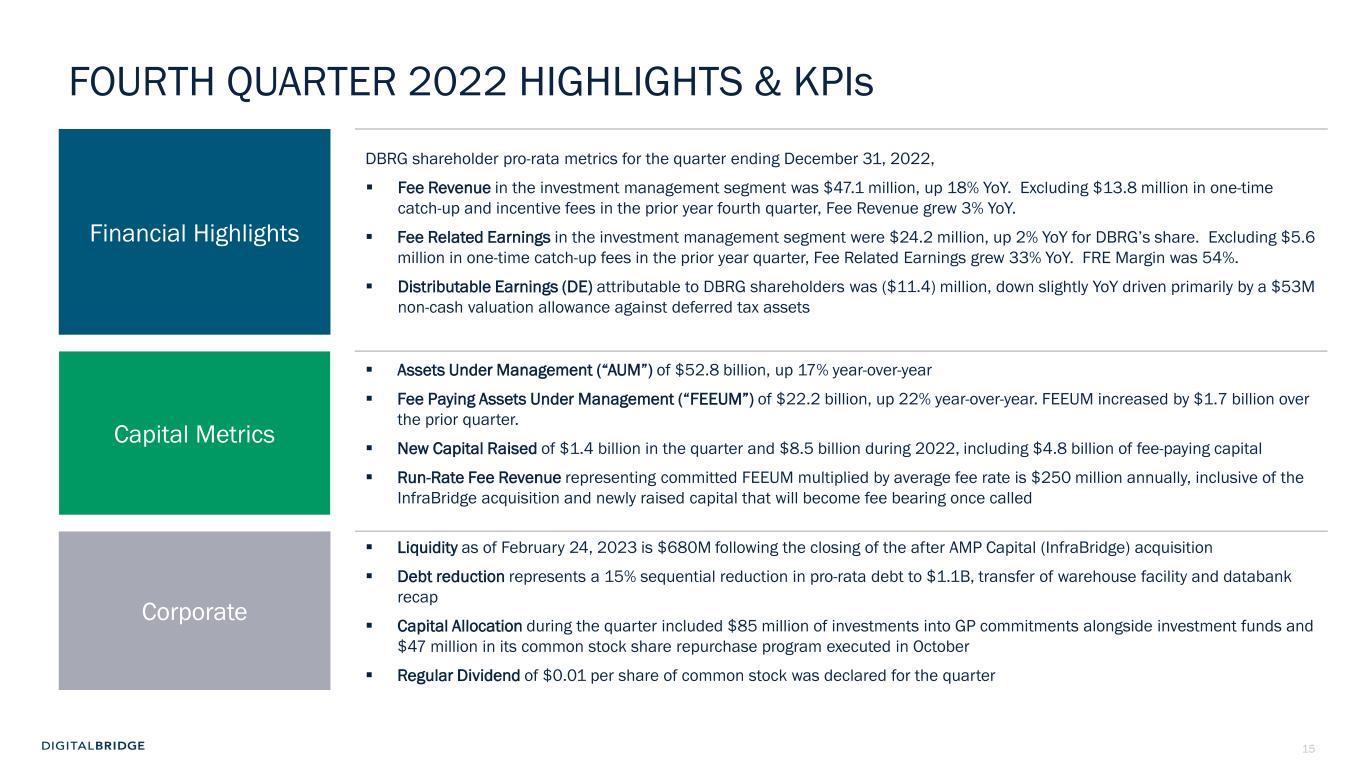

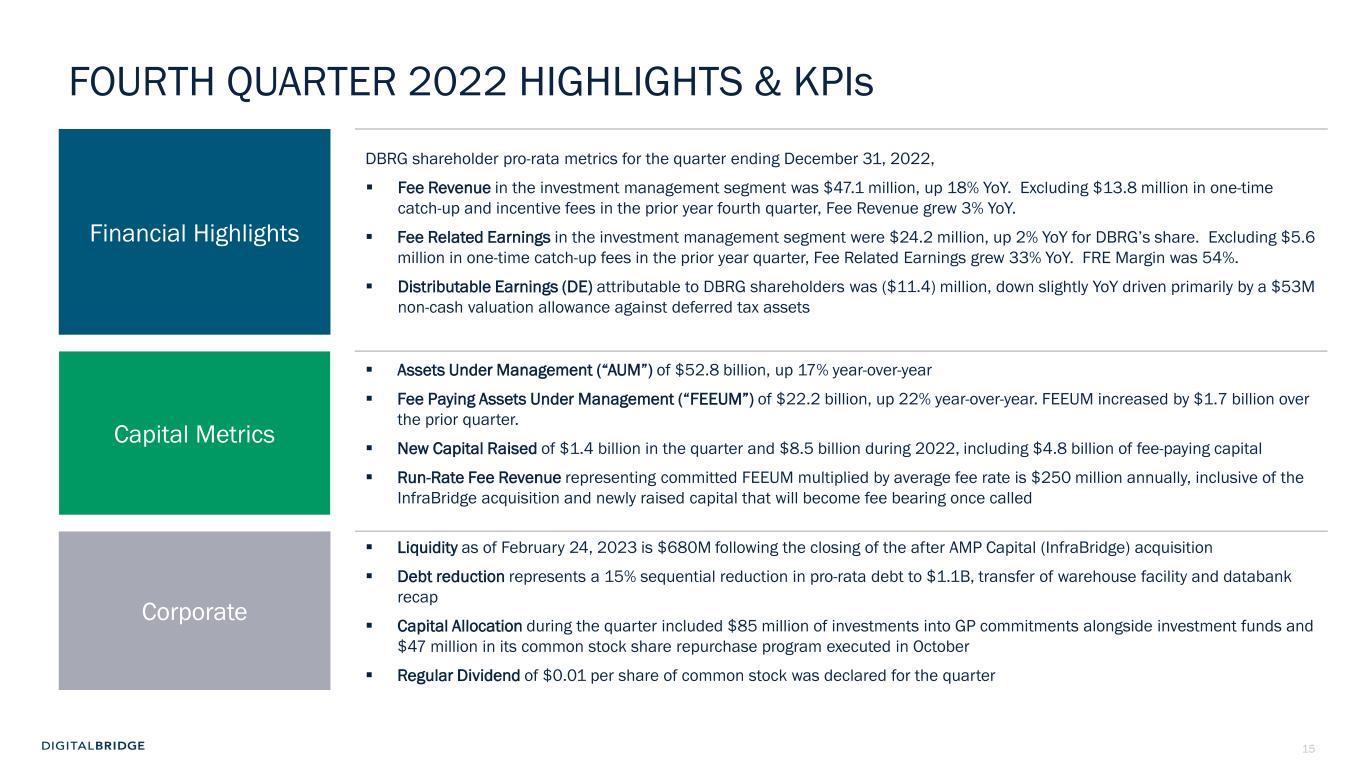

15 FOURTH QUARTER 2022 HIGHLIGHTS & KPIs Financial Highlights DBRG shareholder pro-rata metrics for the quarter ending December 31, 2022, Fee Revenue in the investment management segment was $47.1 million, up 18% YoY. Excluding $13.8 million in one-time catch-up and incentive fees in the prior year fourth quarter, Fee Revenue grew 3% YoY. Fee Related Earnings in the investment management segment were $24.2 million, up 2% YoY for DBRG’s share. Excluding $5.6 million in one-time catch-up fees in the prior year quarter, Fee Related Earnings grew 33% YoY. FRE Margin was 54%. Distributable Earnings (DE) attributable to DBRG shareholders was ($11.4) million, down slightly YoY driven primarily by a $53M non-cash valuation allowance against deferred tax assets Capital Metrics Assets Under Management (“AUM”) of $52.8 billion, up 17% year-over-year Fee Paying Assets Under Management (“FEEUM”) of $22.2 billion, up 22% year-over-year. FEEUM increased by $1.7 billion over the prior quarter. New Capital Raised of $1.4 billion in the quarter and $8.5 billion during 2022, including $4.8 billion of fee-paying capital Run-Rate Fee Revenue representing committed FEEUM multiplied by average fee rate is $250 million annually, inclusive of the InfraBridge acquisition and newly raised capital that will become fee bearing once called Corporate Liquidity as of February 24, 2023 is $680M following the closing of the after AMP Capital (InfraBridge) acquisition Debt reduction represents a 15% sequential reduction in pro-rata debt to $1.1B, transfer of warehouse facility and databank recap Capital Allocation during the quarter included $85 million of investments into GP commitments alongside investment funds and $47 million in its common stock share repurchase program executed in October Regular Dividend of $0.01 per share of common stock was declared for the quarter

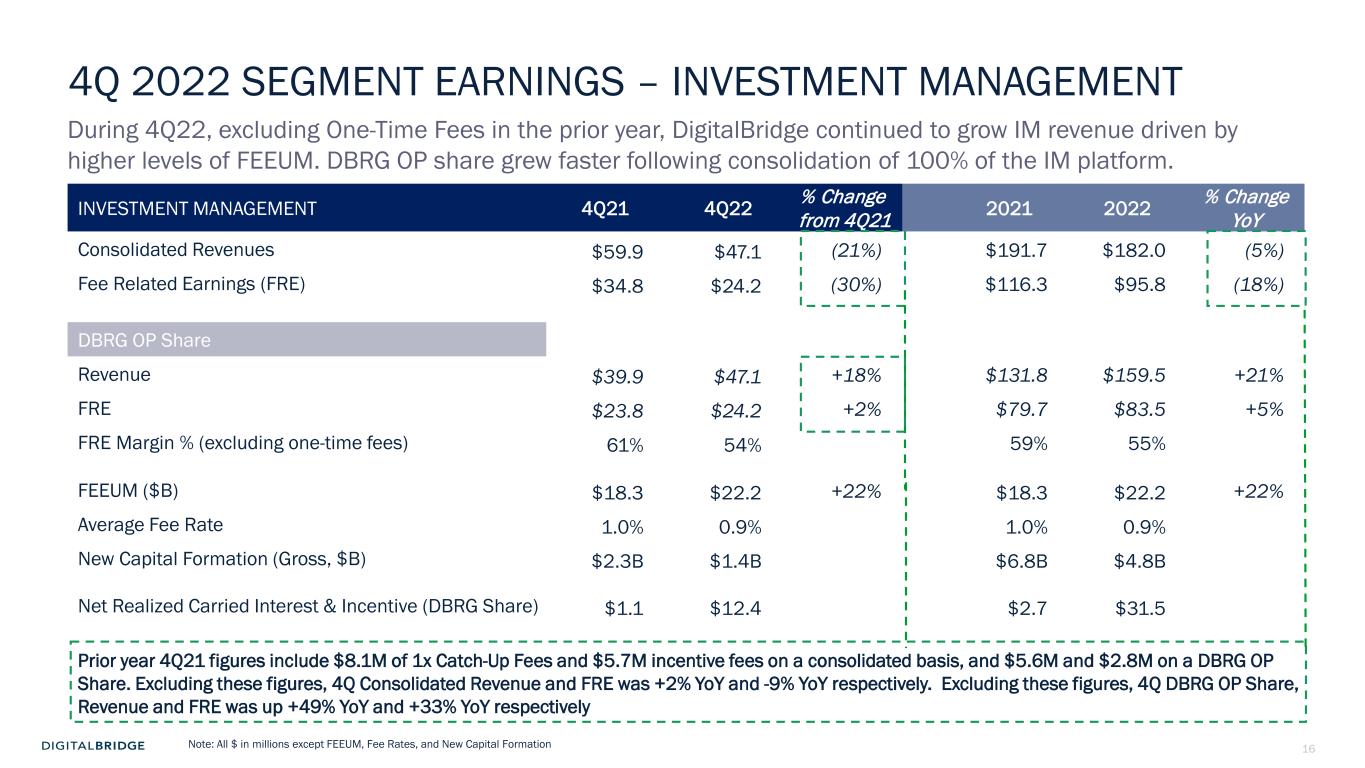

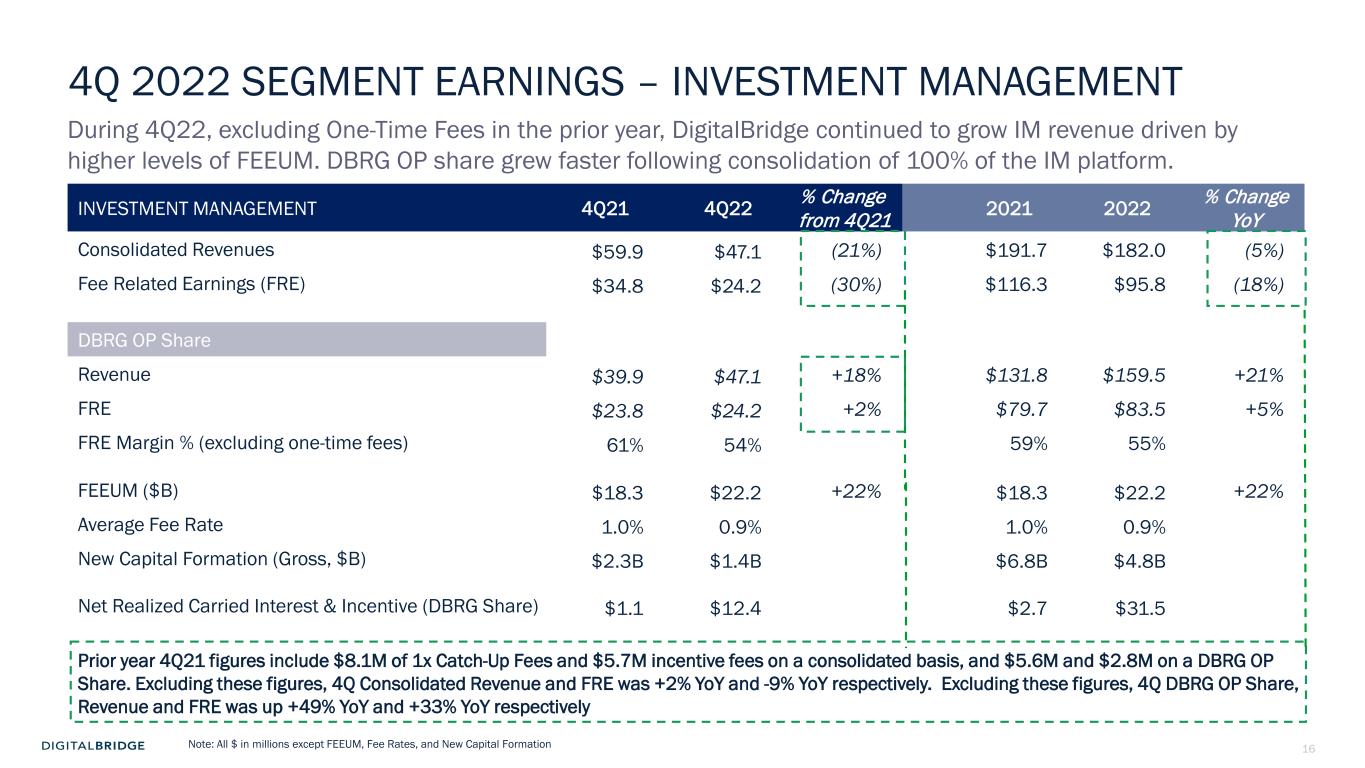

16 INVESTMENT MANAGEMENT 4Q21 4Q22 % Change from 4Q21 2021 2022 % Change YoY Consolidated Revenues $59.9 $47.1 (21%) $191.7 $182.0 (5%) Fee Related Earnings (FRE) $34.8 $24.2 (30%) $116.3 $95.8 (18%) DBRG OP Share Revenue $39.9 $47.1 +18% $131.8 $159.5 +21% FRE $23.8 $24.2 +2% $79.7 $83.5 +5% FRE Margin % (excluding one-time fees) 61% 54% 59% 55% FEEUM ($B) $18.3 $22.2 +22% $18.3 $22.2 +22% Average Fee Rate 1.0% 0.9% 1.0% 0.9% New Capital Formation (Gross, $B) $2.3B $1.4B $6.8B $4.8B Net Realized Carried Interest & Incentive (DBRG Share) $1.1 $12.4 $2.7 $31.5 During 4Q22, excluding One-Time Fees in the prior year, DigitalBridge continued to grow IM revenue driven by higher levels of FEEUM. DBRG OP share grew faster following consolidation of 100% of the IM platform. 4Q 2022 SEGMENT EARNINGS – INVESTMENT MANAGEMENT Note: All $ in millions except FEEUM, Fee Rates, and New Capital Formation Prior year 4Q21 figures include $8.1M of 1x Catch-Up Fees and $5.7M incentive fees on a consolidated basis, and $5.6M and $2.8M on a DBRG OP Share. Excluding these figures, 4Q Consolidated Revenue and FRE was +2% YoY and -9% YoY respectively. Excluding these figures, 4Q DBRG OP Share, Revenue and FRE was up +49% YoY and +33% YoY respectively

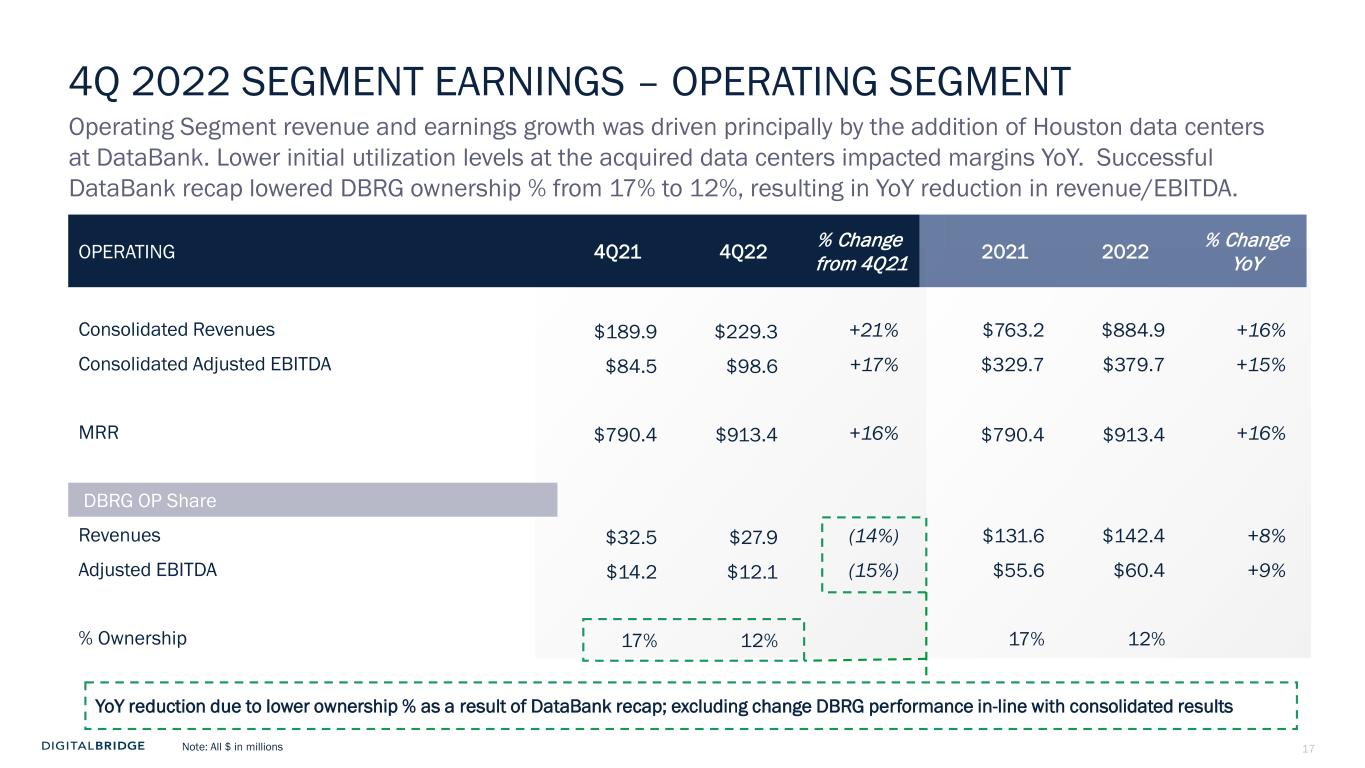

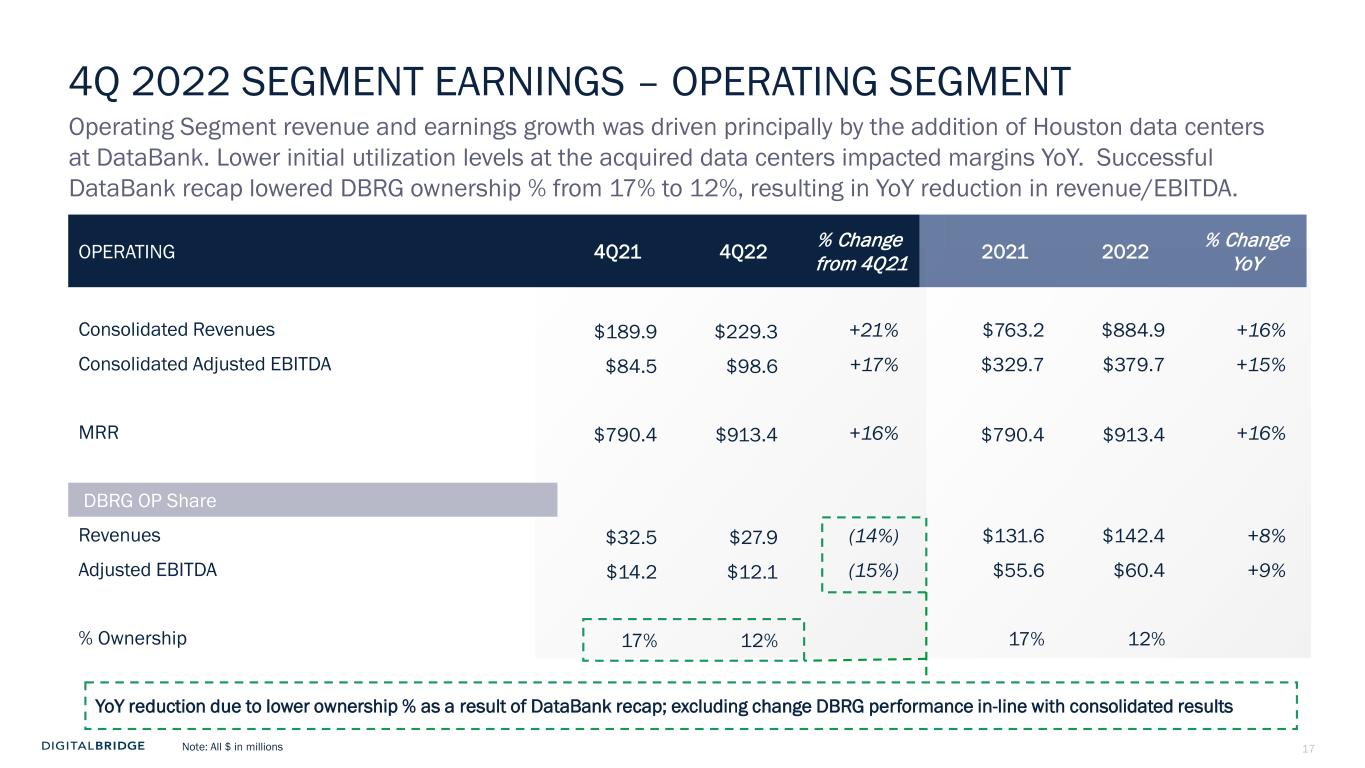

17 4Q 2022 SEGMENT EARNINGS – OPERATING SEGMENT Note: All $ in millions Operating Segment revenue and earnings growth was driven principally by the addition of Houston data centers at DataBank. Lower initial utilization levels at the acquired data centers impacted margins YoY. Successful DataBank recap lowered DBRG ownership % from 17% to 12%, resulting in YoY reduction in revenue/EBITDA. OPERATING 4Q21 4Q22 % Change from 4Q21 2021 2022 % Change YoY Consolidated Revenues $189.9 $229.3 +21% $763.2 $884.9 +16% Consolidated Adjusted EBITDA $84.5 $98.6 +17% $329.7 $379.7 +15% MRR $790.4 $913.4 +16% $790.4 $913.4 +16% DBRG OP Share Revenues $32.5 $27.9 (14%) $131.6 $142.4 +8% Adjusted EBITDA $14.2 $12.1 (15%) $55.6 $60.4 +9% % Ownership 17% 12% 17% 12% YoY reduction due to lower ownership % as a result of DataBank recap; excluding change DBRG performance in-line with consolidated results

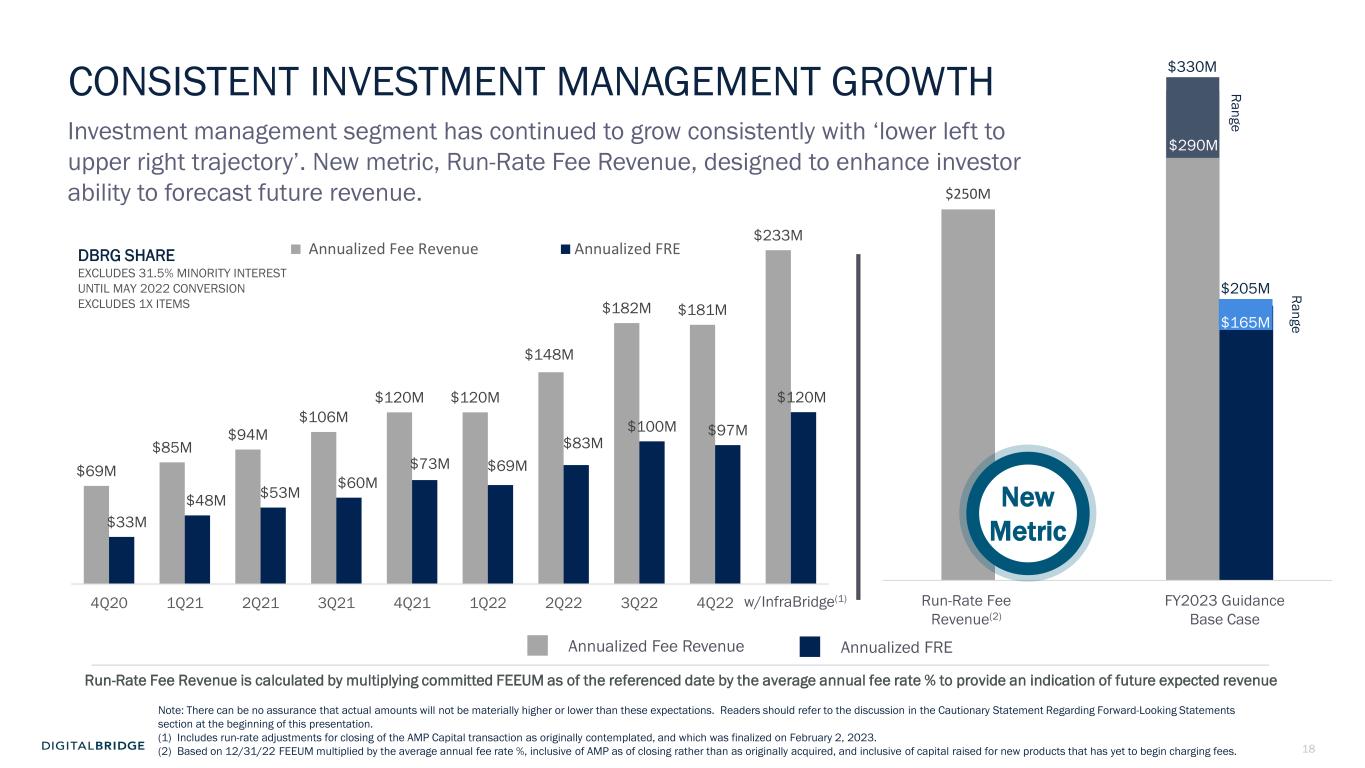

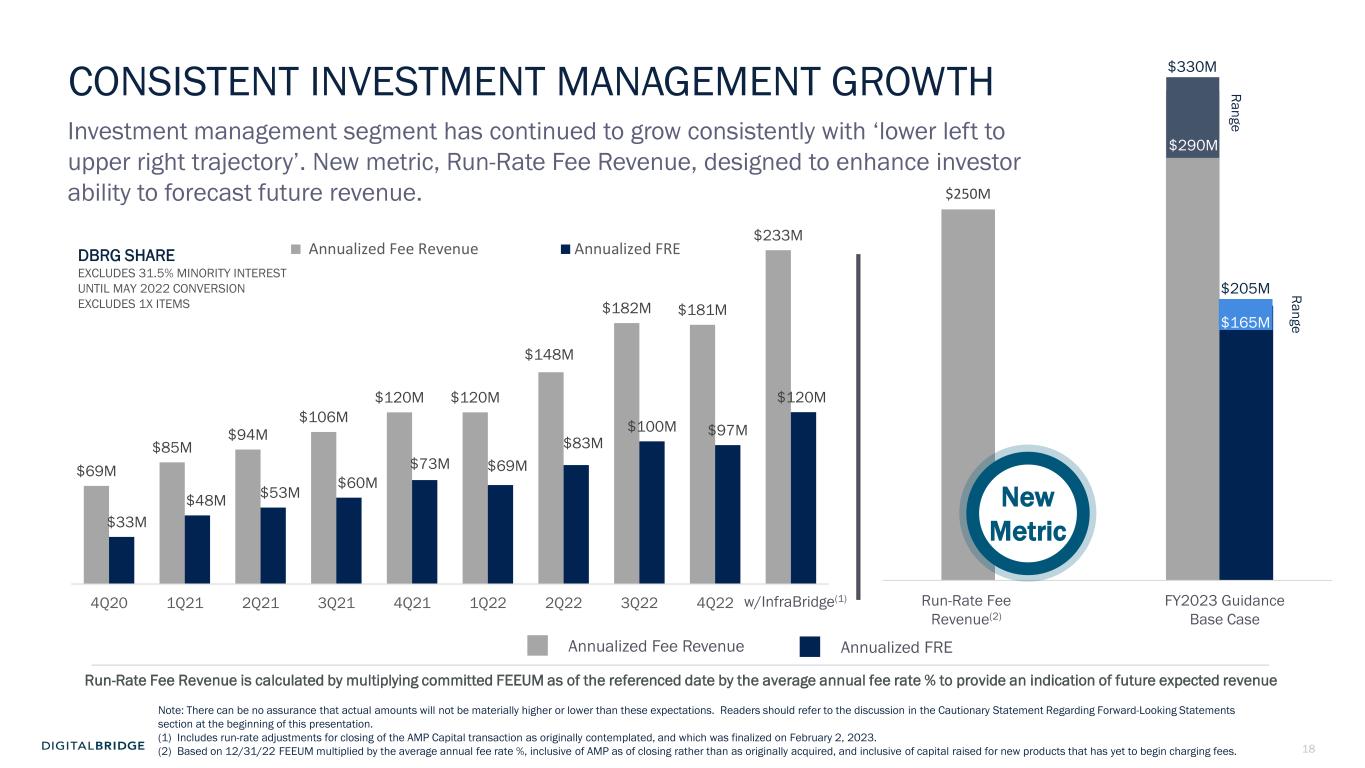

18 CONSISTENT INVESTMENT MANAGEMENT GROWTH Investment Management continue to grow consistently with ‘lower left to upper right trajectory’ Note: There can be no assurance that actual amounts will not be materially higher or lower than these expectations. Readers should refer to the discussion in the Cautionary Statement Regarding Forward-Looking Statements section at the beginning of this presentation. (1) Includes run-rate adjustments for closing of the AMP Capital transaction as originally contemplated, and which was finalized on February 2, 2023. (2) Based on 12/31/22 FEEUM multiplied by the average annual fee rate %, inclusive of AMP as of closing rather than as originally acquired, and inclusive of capital raised for new products that has yet to begin charging fees. $69M $85M $94M $106M $120M $120M $148M $182M $181M $233M $33M $48M $53M $60M $73M $69M $83M $100M $97M $120M 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 Annualized Fee Revenue Annualized FRE Run-Rate Fee Revenue is calculated by multiplying committed FEEUM as of the referenced date by the average annual fee rate % to provide an indication of future expected revenue DBRG SHARE EXCLUDES 31.5% MINORITY INTEREST UNTIL MAY 2022 CONVERSION EXCLUDES 1X ITEMS $250M $0M Run-Rate Fee Revenue(2) FY2023 Guidance Base Case t management segm nt has continued o grow consistently with ‘lower left upper right trajectory’. New metric, Run-Rate Fee Revenue, designed to enhance investor ability to forecast future revenue. New Metric w/InfraBridge(1) $330M $290M $205M $165M Range Range Annualized Fee Revenue Annualized FRE

19 2023 2025 Base Case W/M&A or Deployment1 Base Case Run Rate Investment Mgmt Fee Revenue $290 - 330M $315 - 400M $430 - 480M Run Rate Investment Mgmt FRE (earnings) $165 - 205M $180 - 250M $250 - 300M Ending FEEUM (Implied) $33 - 36B $35 - 41B $47 - 51B Operating Revenue (DBRG Share)1 $90 - 100M NA NA Operating EBITDA (DBRG Share)1 $45 - 55M NA NA Corporate Overhead, Net $(45 - 55)M $(40 - 50)M $(35 - 45)M EBITDA $155 - 215M $130 - 210M $205 - 265M Distributable Earnings (DE) ($, Per Share) $45 - 105M / $0.26 - 0.60 $60 - 140M / $0.34 - 0.78 $140 - 200M / $0.75 - 1.07 Future Firepower (cash & VFN) $500 - 600M $450 - 550M $1,000 - $1,100 GUIDANCE UPDATE – 2023 & 2025 DigitalBridge is outlining its 2023 and 2025 targets for Investment Management and providing indicative guidance on run-rate earnings for the first time. By 2025, Operating Segment results expected to be deconsolidated and contribute net earnings via equity method income. To D ec on so lid at e Updating 2023 and 2025 targets for Investment Management 1 Assumes deployment of $250-350 million into M&A (complementary asset management platforms), with $150-250 million of firepower derived from incremental Operating Segment monetizations, consistent with deconsolidation initiative. Digital M&A executed at 10-15x multiple of FRE for businesses with 50% FRE margin, which further assume 15% margin improvement. Alternative scenario includes preferred stock paydown, which would not impact revenue/EBITDA, but would have a commensurate impact on DE. Note: There can be no assurance that actual amounts will not be materially higher or lower than these expectations. Readers should refer to the discussion in the Cautionary Statement Regarding Forward- Looking Statements section at the beginning of this presentation. The Company undertakes no obligation to provide updated projections on a quarterly or other basis.

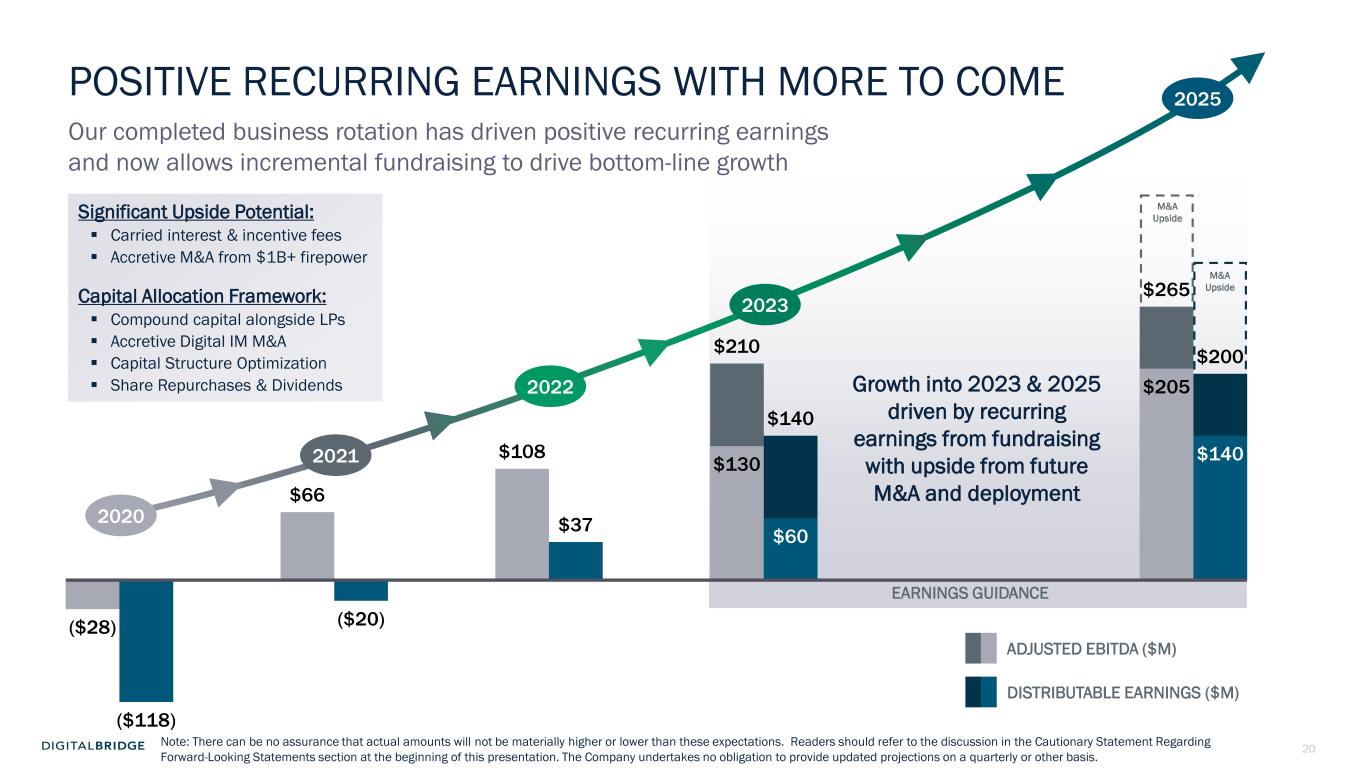

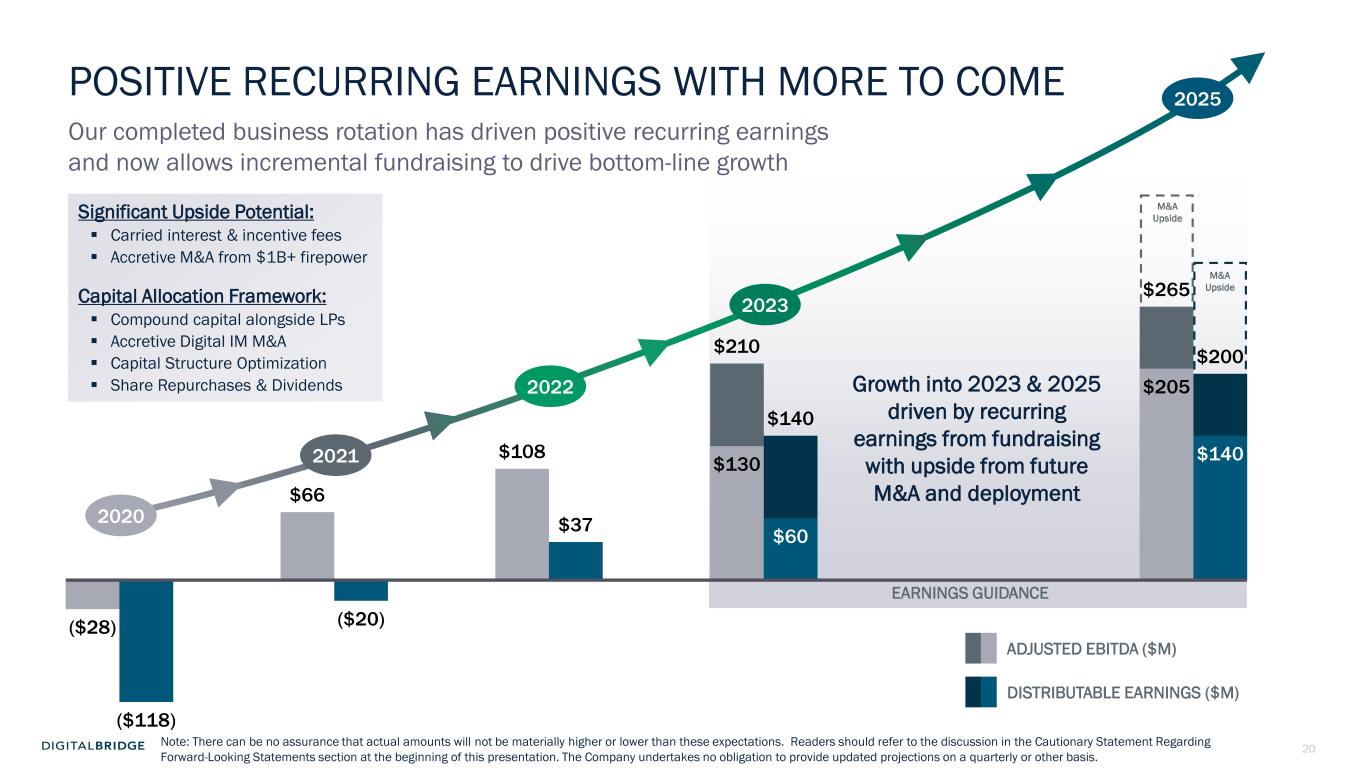

20 ($28) $66 $108 $210 $265 ($118) ($20) $37 $140 $200 $130 $205 $60 $140 POSITIVE RECURRING EARNINGS WITH MORE TO COME Our completed business rotation has driven positive recurring earnings and now allows incremental fundraising to drive bottom-line growth 2020 2021 2022 2023 2025 Growth into 2023 & 2025 driven by recurring earnings from fundraising with upside from future M&A and deployment EARNINGS GUIDANCE ADJUSTED EBITDA ($M) DISTRIBUTABLE EARNINGS ($M) Note: There can be no assurance that actual amounts will not be materially higher or lower than these expectations. Readers should refer to the discussion in the Cautionary Statement Regarding Forward-Looking Statements section at the beginning of this presentation. The Company undertakes no obligation to provide updated projections on a quarterly or other basis. Significant Upside Potential: Carried interest & incentive fees Accretive M&A from $1B+ firepower Capital Allocation Framework: Compound capital alongside LPs Accretive Digital IM M&A Capital Structure Optimization Share Repurchases & Dividends M&A Upside M&A Upside

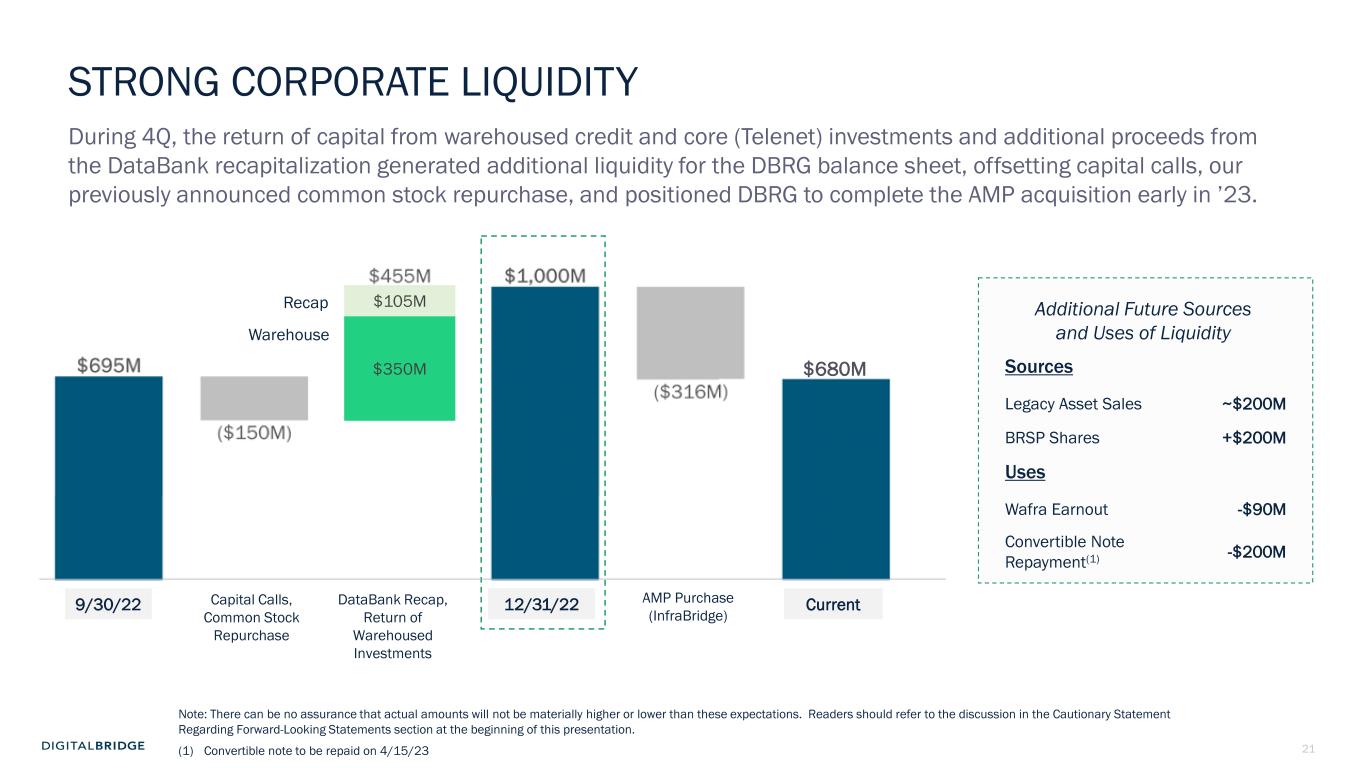

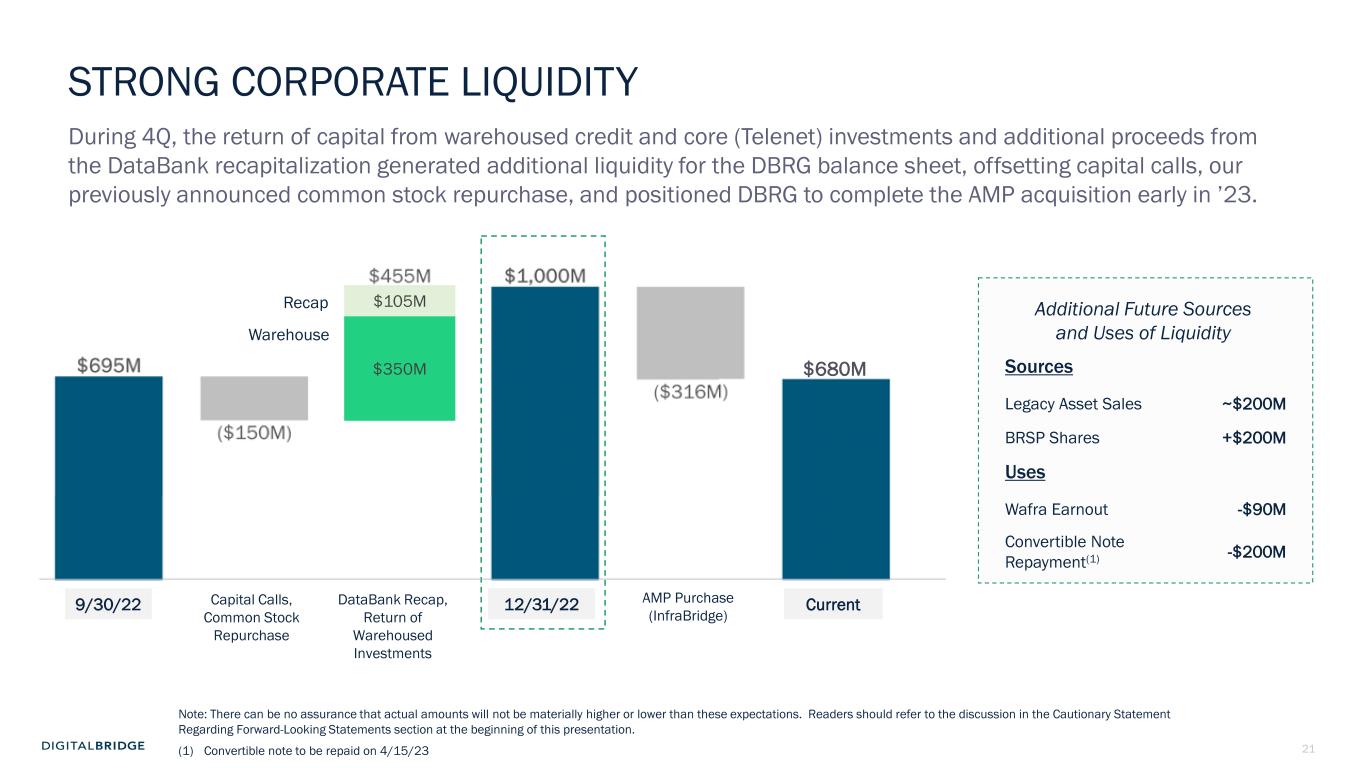

21 STRONG CORPORATE LIQUIDITY During 4Q, the return of capital from warehoused credit and core (Telenet) investments and additional proceeds from the DataBank recapitalization generated additional liquidity for the DBRG balance sheet, offsetting capital calls, our previously announced common stock repurchase, and positioned DBRG to complete the AMP acquisition early in ’23. 9/30/22 Capital Calls, Common Stock Repurchase 12/31/22 AMP Purchase (InfraBridge) DataBank Recap, Return of Warehoused Investments Current (1) Convertible note to be repaid on 4/15/23 Note: There can be no assurance that actual amounts will not be materially higher or lower than these expectations. Readers should refer to the discussion in the Cautionary Statement Regarding Forward-Looking Statements section at the beginning of this presentation. Sources Legacy Asset Sales ~$200M BRSP Shares +$200M Uses Wafra Earnout -$90M Convertible Note Repayment(1) -$200M Additional Future Sources and Uses of Liquidity $350M $105M Recap Warehouse $680M

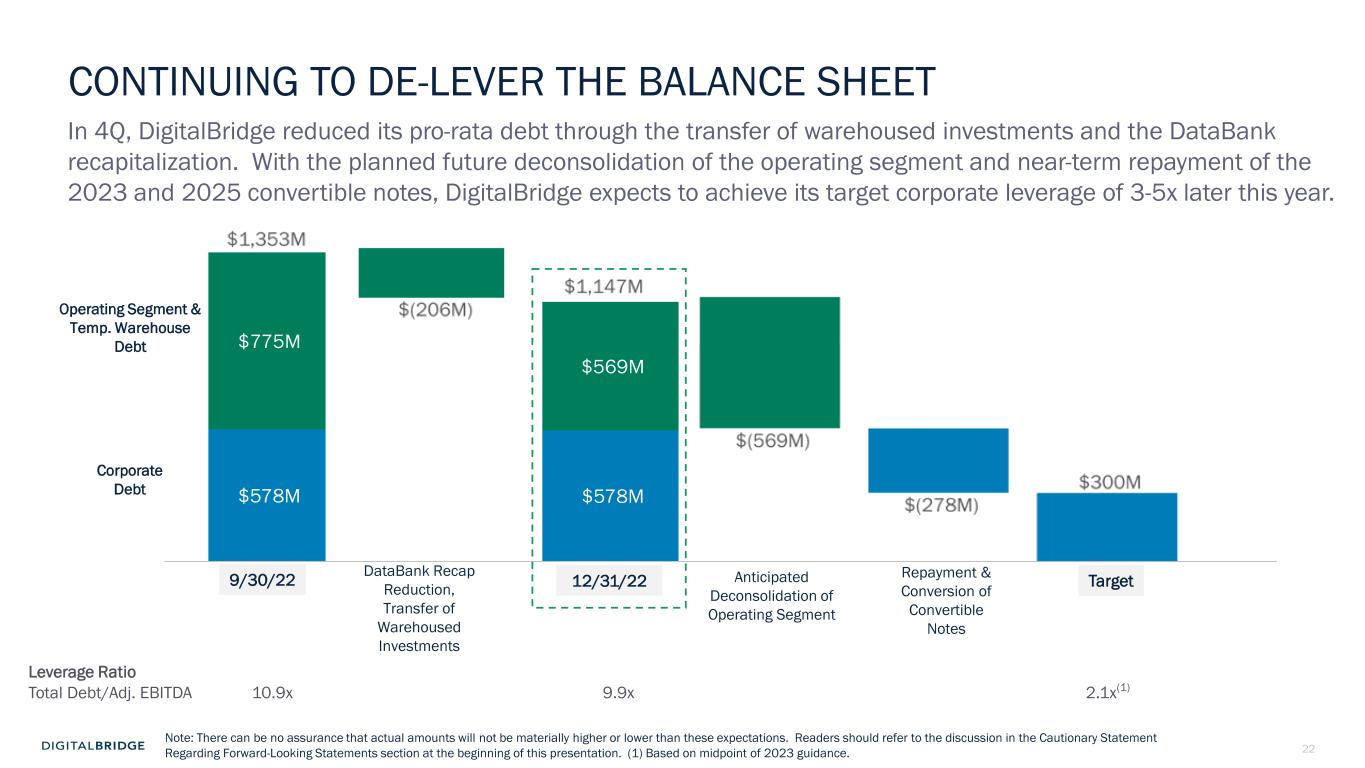

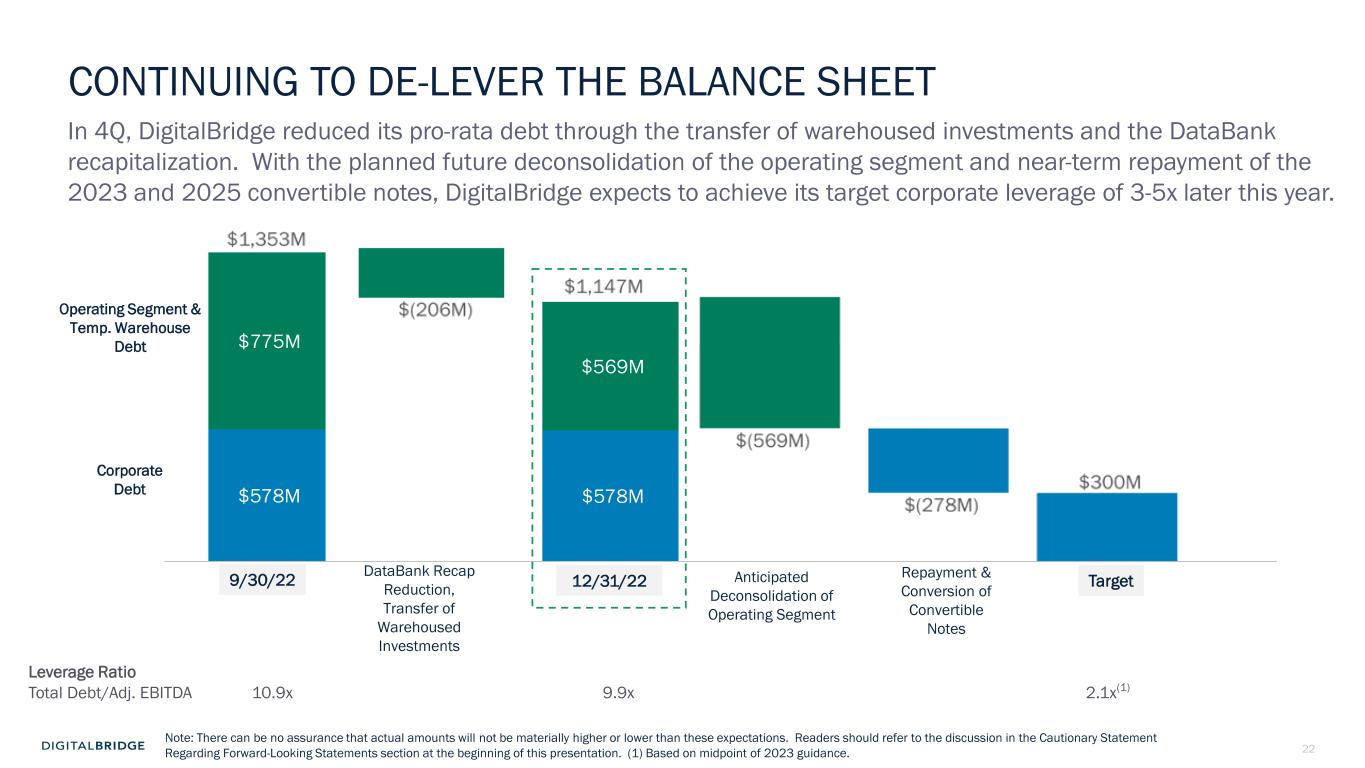

22 $578M $775M $578M $569M Leverage Ratio Total Debt/Adj. EBITDA 10.9x 9.9x 2.1x(1) CONTINUING TO DE-LEVER THE BALANCE SHEET In 4Q, DigitalBridge reduced its pro-rata debt through the transfer of warehoused investments and the DataBank recapitalization. With the planned future deconsolidation of the operating segment and near-term repayment of the 2023 and 2025 convertible notes, DigitalBridge expects to achieve its target corporate leverage of 3-5x later this year. 9/30/22 DataBank Recap Reduction, Transfer of Warehoused Investments 12/31/22 Target Operating Segment & Temp. Warehouse Debt Corporate Debt Note: There can be no assurance that actual amounts will not be materially higher or lower than these expectations. Readers should refer to the discussion in the Cautionary Statement Regarding Forward-Looking Statements section at the beginning of this presentation. (1) Based on midpoint of 2023 guidance. Anticipated Deconsolidation of Operating Segment Repayment & Conversion of Convertible Notes

23 3 EXECUTING THE DIGITAL PLAYBOOK

24 OUR MISSION IN 2023: THE 3 THINGS THAT MATTER Our focus today remains clear – continue to deliver resilient performance through a turbulent macro environment FUNDRAISE Form Capital Around Great Companies and Strategies 1 2 3 DRIVE PORTCO PERFORMANCE Strong Asset Management Through The Cycle SIMPLIFY Simplify Our Business and Build Strong Liquidity

25 February 2023 2023E 2025E FUNDRAISING – OUR 2023 KPI Reiterate our commitment to delivering our near and medium-term targets. Expect to update and introduce new 2027 targets at Investor Day 2023 We continue to see strong interest in the digital infrastructure asset class by investors attracted to the unique combination of growth and durability, underpinned by historical under-allocation to the sector…offsetting widely known ‘denominator effect’ $50B+ $ billions Incremental $8B+ in FEEUM expected to drive high- margin fee revenue $72M+ $28B 2023 PLAN Launch next DBP series Finish Core & Credit Continue to Grow Co-Invest $36B+ Sources of Capital Formation $8B+ $72M+ REVENUE $8B+ FEEUM @ 90 bps Avg. Fee Rate Illustrative Note: There can be no assurance that actual amounts will not be materially higher or lower than these expectations. Readers should refer to the discussion in the Cautionary Statement Regarding Forward-Looking Statements section at the beginning of this presentation. Ending FEEUM

26 Unlock incremental capital to fuel growth/optimize capital structure Public markets understate intrinsic value of operating assets, which we estimate are worth >$700M in net equity at realized prices. DBRG expects $200M+ in additional proceeds from further stake sales Significantly Reduced Complexity Consolidation of financial statements distorts presentation of true DBRG shareholder income, capital structure, and cash flows. Unnecessary complexity has tangible cost burden and complicates financial analysis, ‘what does DBRG own?’ Accelerate ‘Pure-Play’ Corporate Profile Lean, Profitable Asset Manager serving secular growth markets Balance sheet data center holdings expected to be deconsolidated, recharacterized as ‘Principal Investments’ DBRG TO ADVANCE SIMPLIFICATION OF CORPORATE PROFILE DigitalBridge to evaluate further simplification of corporate profile and structure with focus on alternative paths for Operating Segment

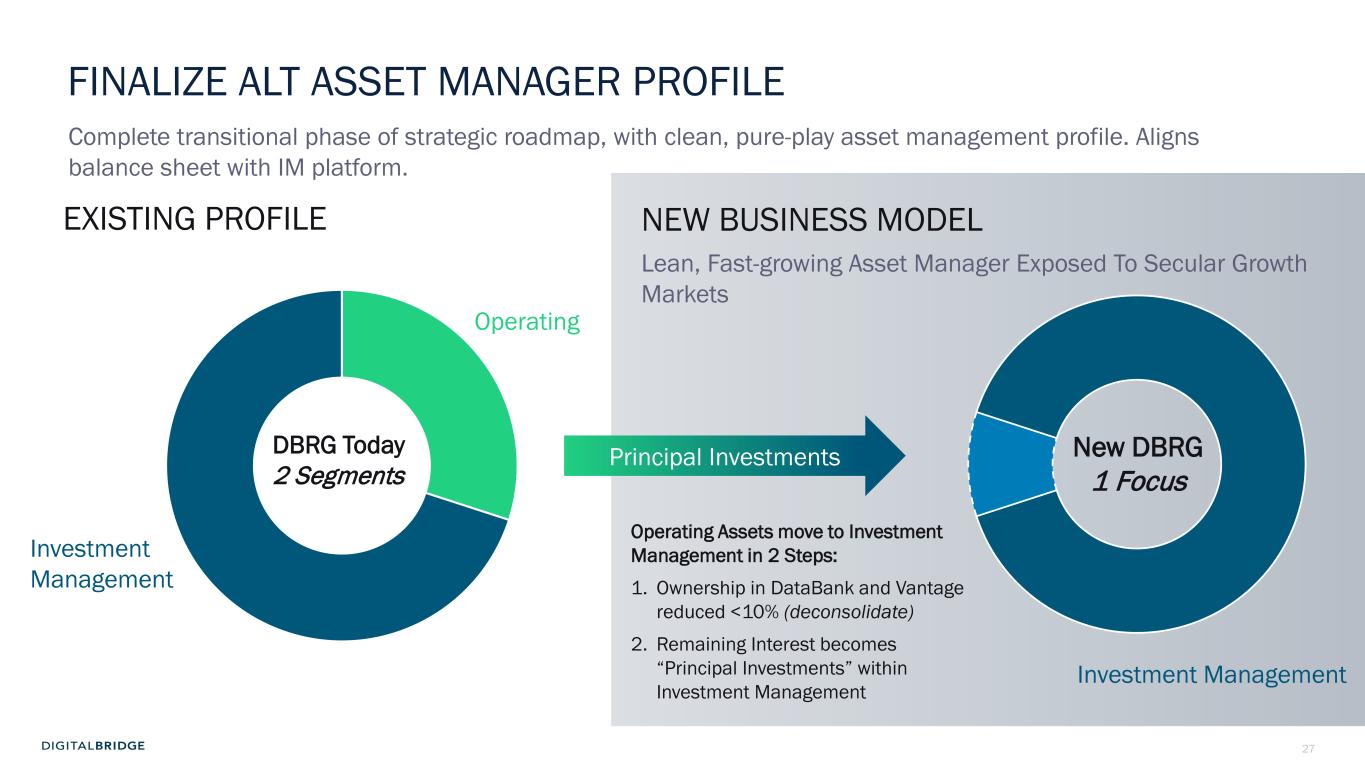

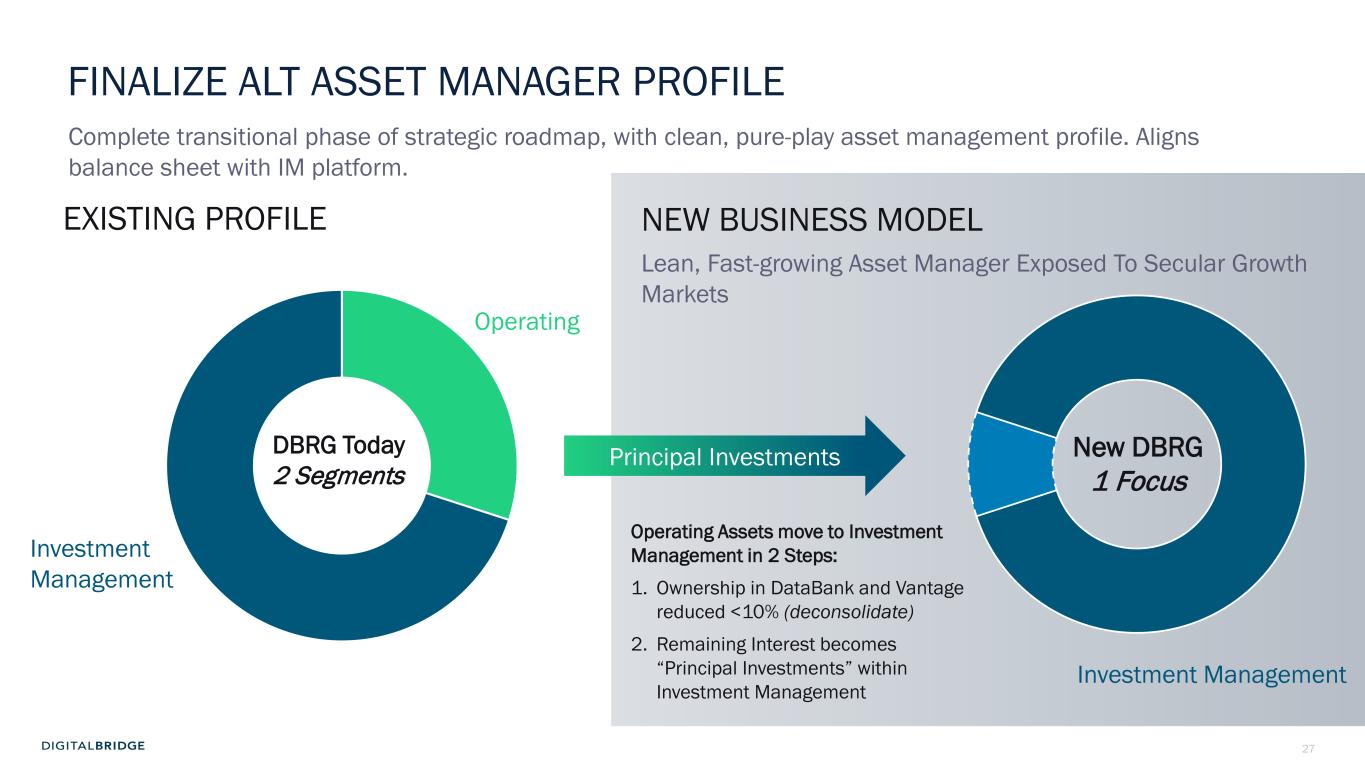

27 FINALIZE ALT ASSET MANAGER PROFILE Complete transitional phase of strategic roadmap, with clean, pure-play asset management profile. Aligns balance sheet with IM platform. Operating Investment Management Investment Management Operating Assets move to Investment Management in 2 Steps: 1. Ownership in DataBank and Vantage reduced <10% (deconsolidate) 2. Remaining Interest becomes “Principal Investments” within Investment Management NEW BUSINESS MODEL Lean, Fast-growing Asset Manager Exposed To Secular Growth Markets DBRG Today 2 Segments Principal Investments New DBRG 1 Focus EXISTING PROFILE

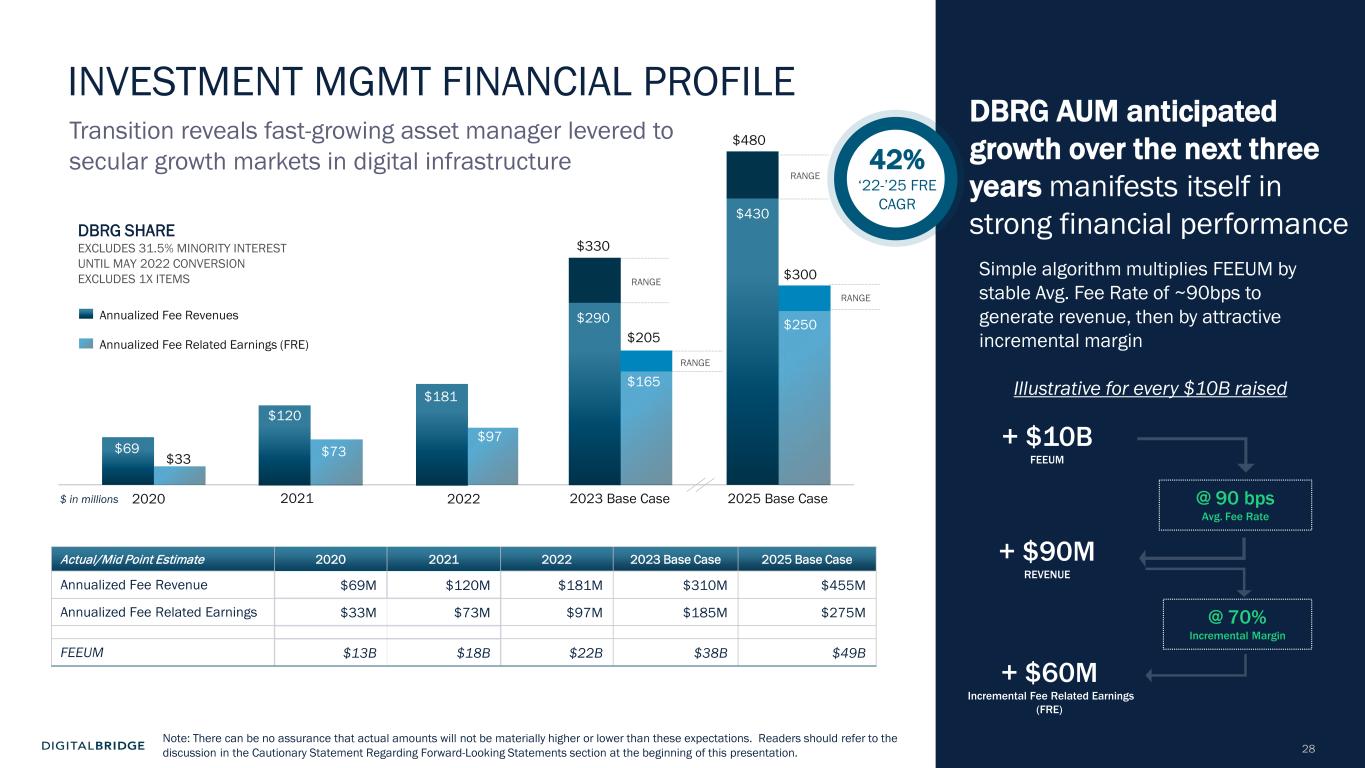

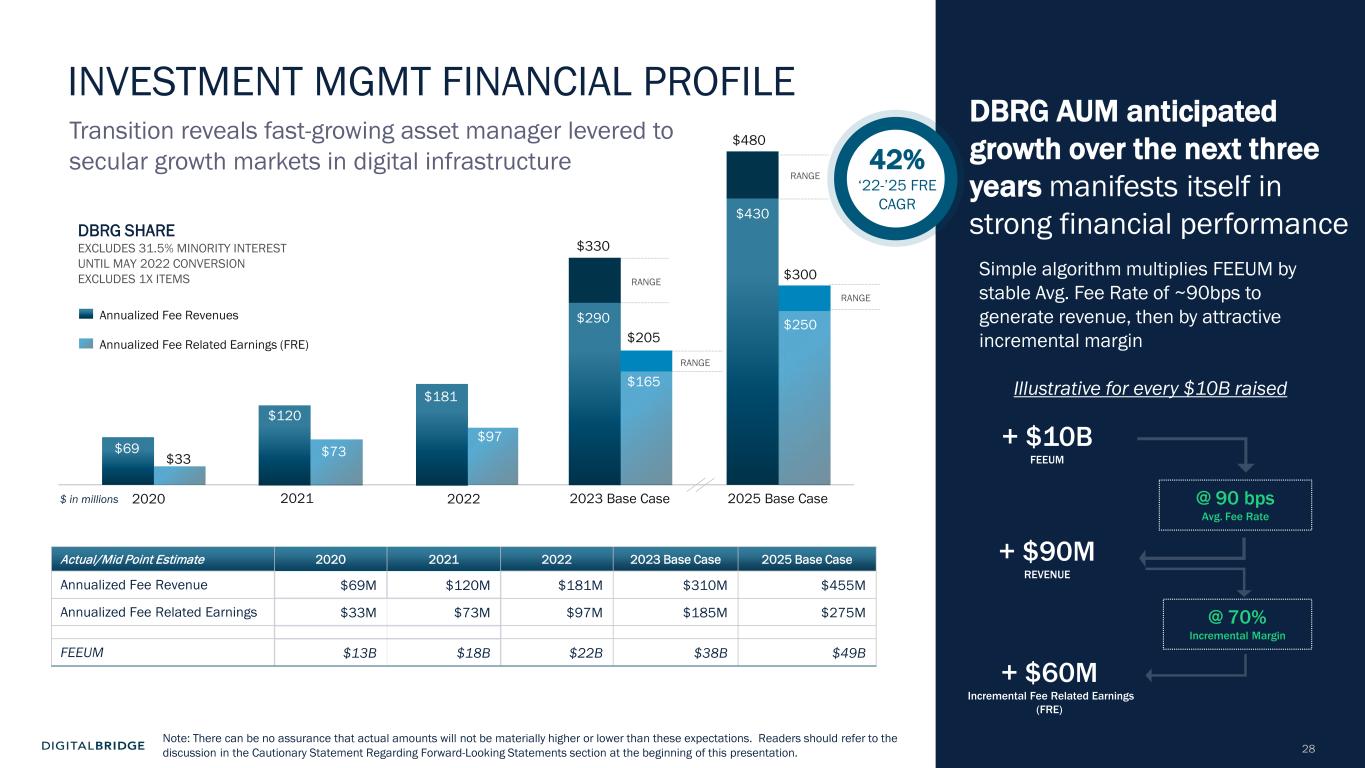

28 DBRG AUM anticipated growth over the next three years manifests itself in strong financial performance $115 2025 Base Case2021 2022 2023 Base Case $120 $73 $181 $97 $290 $330 $430 $480 $300 RANGE RANGE RANGE Annualized Fee Revenues Annualized Fee Related Earnings (FRE) $205 $250 $165 2020 $69 $33 RANGE + $90M REVENUE + $60M Incremental Fee Related Earnings (FRE) + $10B FEEUM @ 90 bps Avg. Fee Rate @ 70% Incremental Margin Simple algorithm multiplies FEEUM by stable Avg. Fee Rate of ~90bps to generate revenue, then by attractive incremental margin Illustrative for every $10B raised INVESTMENT MGMT FINANCIAL PROFILE Actual/Mid Point Estimate 2020 2021 2022 2023 Base Case 2025 Base Case Annualized Fee Revenue $69M $120M $181M $310M $455M Annualized Fee Related Earnings $33M $73M $97M $185M $275M FEEUM $13B $18B $22B $38B $49B $ in millions 42% ‘22-’25 FRE CAGR Transition reveals fast-growing asset manager levered to secular growth markets in digital infrastructure DBRG SHARE EXCLUDES 31.5% MINORITY INTEREST UNTIL MAY 2022 CONVERSION EXCLUDES 1X ITEMS Note: There can be no assurance that actual amounts will not be materially higher or lower than these expectations. Readers should refer to the discussion in the Cautionary Statement Regarding Forward-Looking Statements section at the beginning of this presentation.

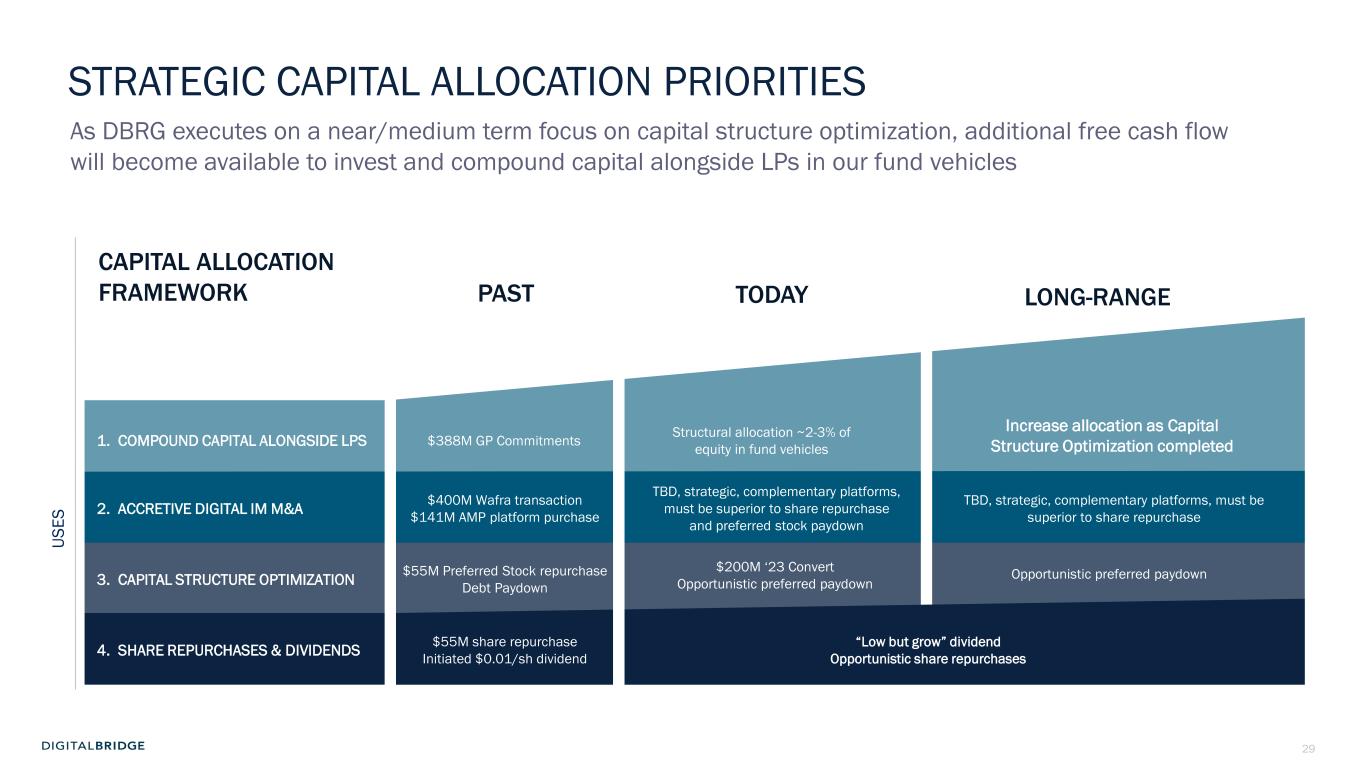

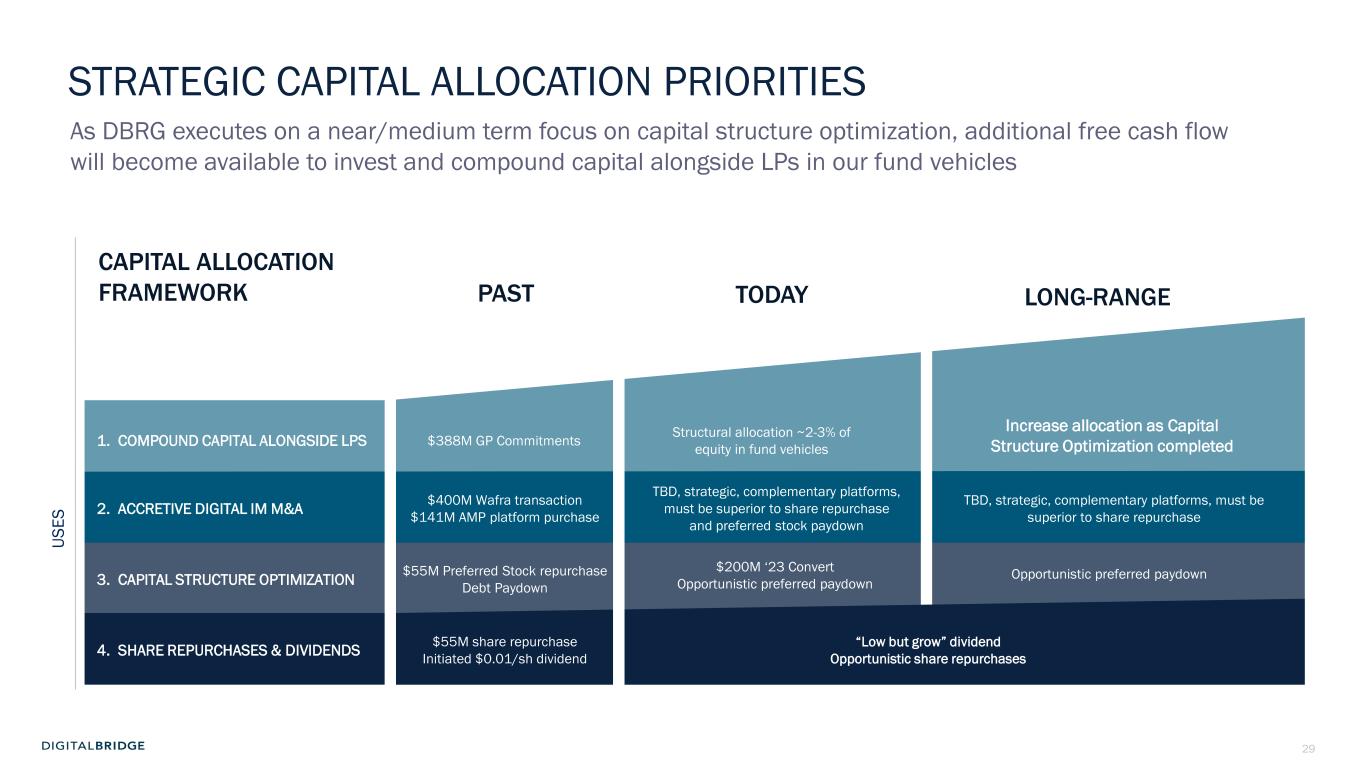

29 STRATEGIC CAPITAL ALLOCATION PRIORITIES As DBRG executes on a near/medium term focus on capital structure optimization, additional free cash flow will become available to invest and compound capital alongside LPs in our fund vehicles 1. COMPOUND CAPITAL ALONGSIDE LPS 2. ACCRETIVE DIGITAL IM M&A 3. CAPITAL STRUCTURE OPTIMIZATION $388M GP Commitments $400M Wafra transaction $141M AMP platform purchase $55M Preferred Stock repurchase Debt Paydown Structural allocation ~2-3% of equity in fund vehicles TBD, strategic, complementary platforms, must be superior to share repurchase and preferred stock paydown $200M ‘23 Convert Opportunistic preferred paydown TBD, strategic, complementary platforms, must be superior to share repurchase Increase allocation as Capital Structure Optimization completed MEDIUM/LONG TERMNEAR/MEDIUM TERMCAPITAL ALLOCATION FRAMEWORK 4. SHARE REPURCHASES & DIVIDENDS $55M share repurchase Initiated $0.01/sh dividend “Low but grow” dividend Opportunistic share repurchases US ES LONG-RANGETODAY PAST Opportunistic preferred paydown

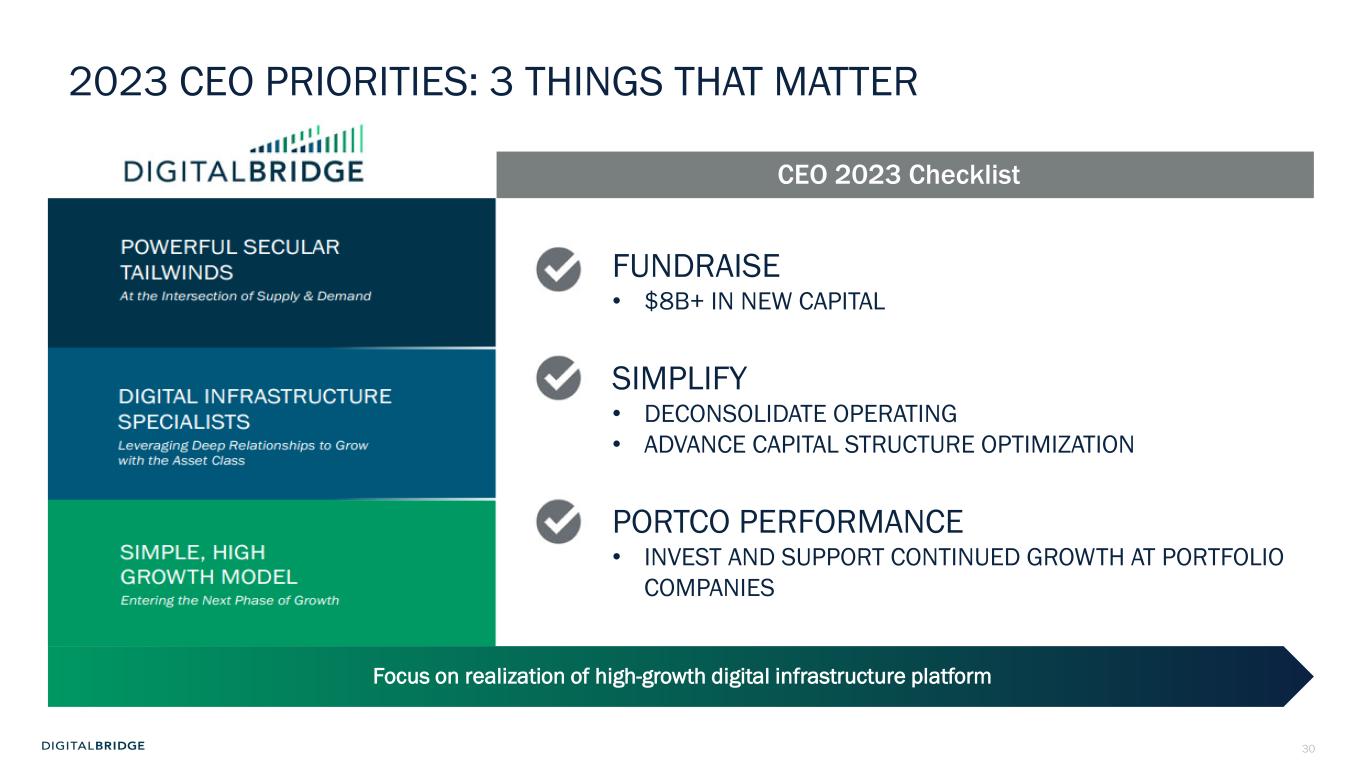

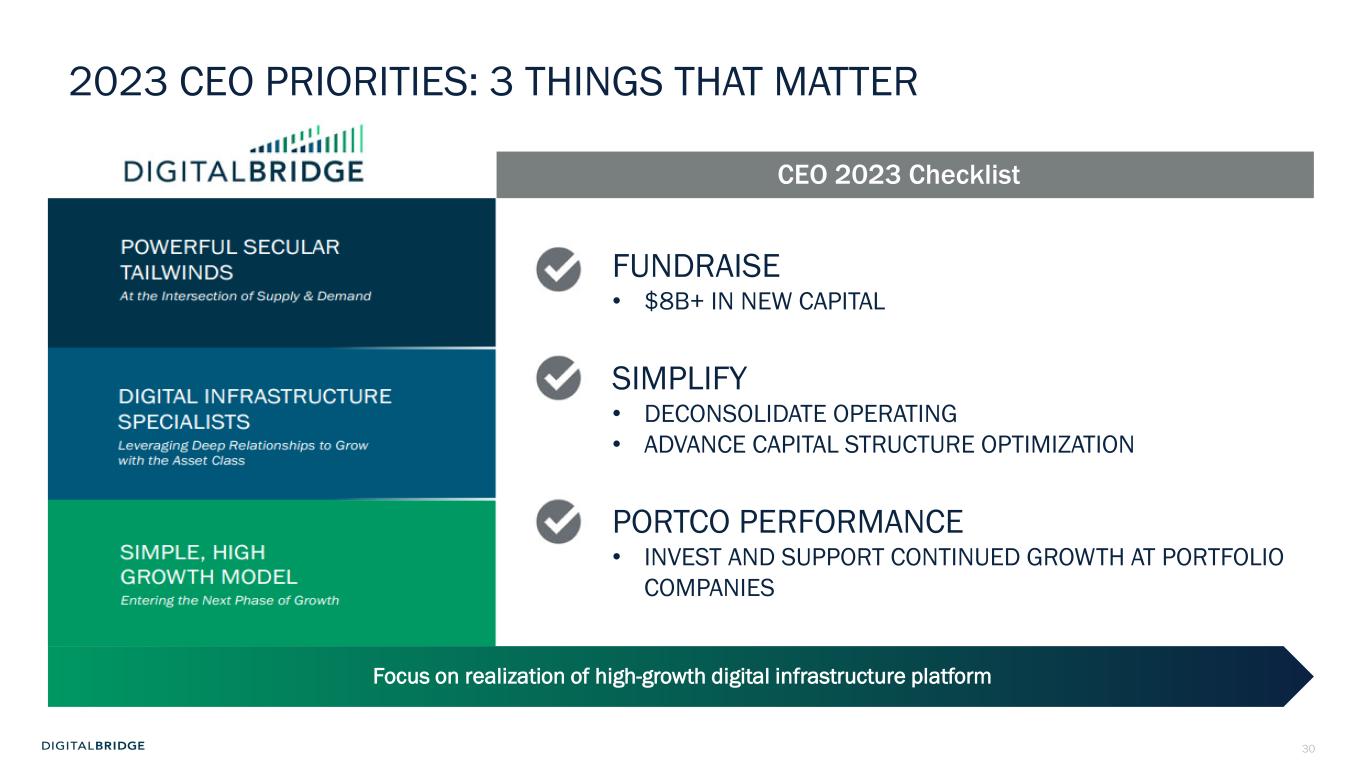

30 2023 CEO PRIORITIES: 3 THINGS THAT MATTER CEO 2023 Checklist Secular Tailwinds Around Connectivity – Big Growing TAM The Leading Management Team 25+ years Investing and Operating Digital Assets Converged Vision with Exposure to Entire Digital Ecosystem Focus on realization of high-growth digital infrastructure platform FUNDRAISE • $8B+ IN NEW CAPITAL SIMPLIFY • DECONSOLIDATE OPERATING • ADVANCE CAPITAL STRUCTURE OPTIMIZATION PORTCO PERFORMANCE • INVEST AND SUPPORT CONTINUED GROWTH AT PORTFOLIO COMPANIES

31 4 Q&A SESSION

32 5 APPENDIX

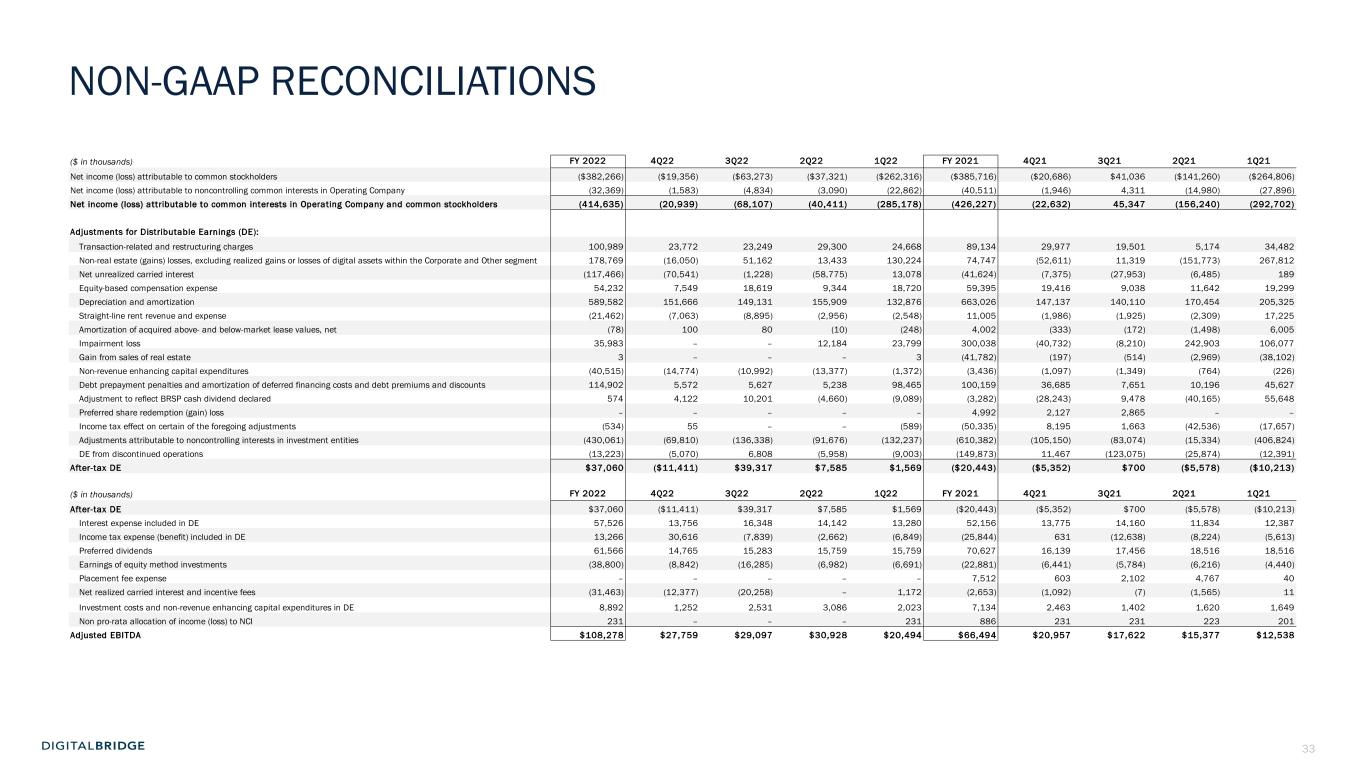

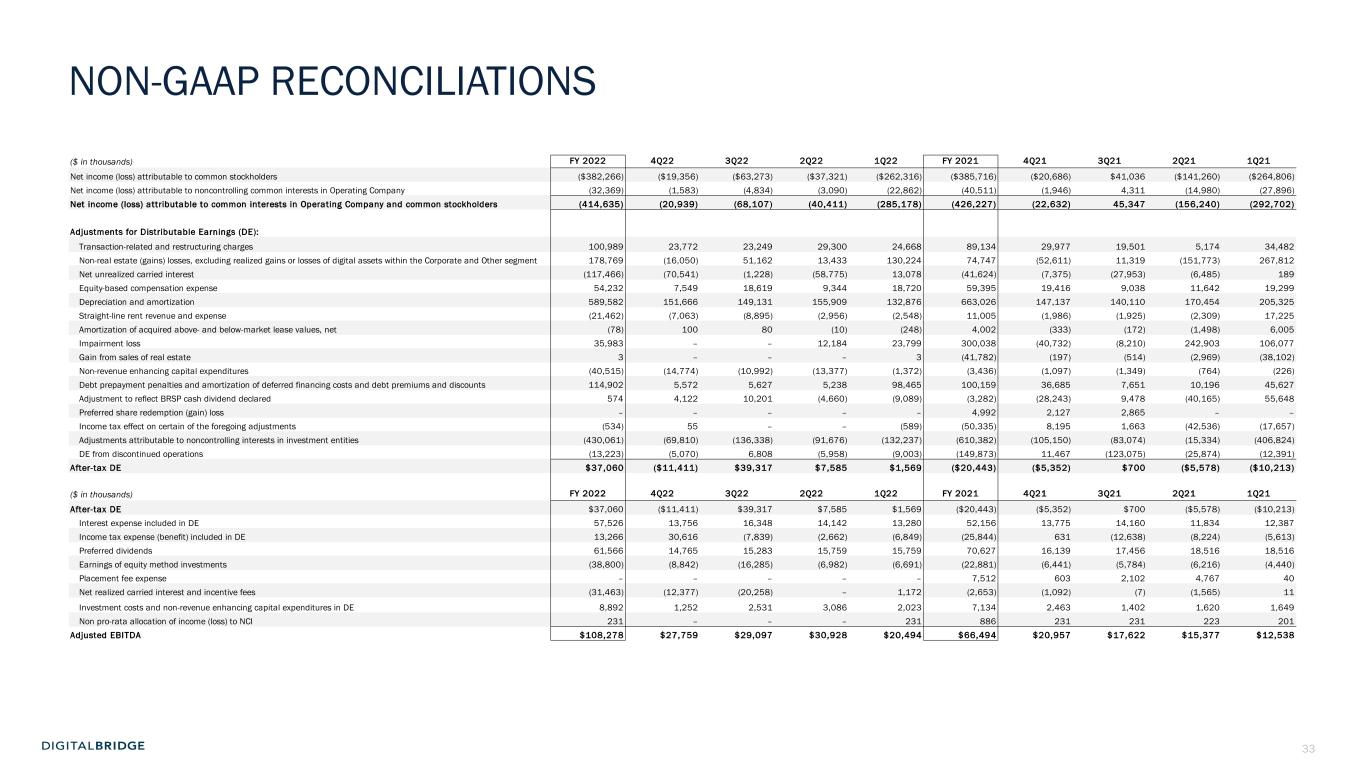

33 NON-GAAP RECONCILIATIONS ($ in thousands) FY 2022 4Q22 3Q22 2Q22 1Q22 FY 2021 4Q21 3Q21 2Q21 1Q21 Net income (loss) attributable to common stockholders ($382,266) ($19,356) ($63,273) ($37,321) ($262,316) ($385,716) ($20,686) $41,036 ($141,260) ($264,806) Net income (loss) attributable to noncontrolling common interests in Operating Company (32,369) (1,583) (4,834) (3,090) (22,862) (40,511) (1,946) 4,311 (14,980) (27,896) Net income (loss) attributable to common interests in Operating Company and common stockholders (414,635) (20,939) (68,107) (40,411) (285,178) (426,227) (22,632) 45,347 (156,240) (292,702) Adjustments for Distributable Earnings (DE): Transaction-related and restructuring charges 100,989 23,772 23,249 29,300 24,668 89,134 29,977 19,501 5,174 34,482 Non-real estate (gains) losses, excluding realized gains or losses of digital assets within the Corporate and Other segment 178,769 (16,050) 51,162 13,433 130,224 74,747 (52,611) 11,319 (151,773) 267,812 Net unrealized carried interest (117,466) (70,541) (1,228) (58,775) 13,078 (41,624) (7,375) (27,953) (6,485) 189 Equity-based compensation expense 54,232 7,549 18,619 9,344 18,720 59,395 19,416 9,038 11,642 19,299 Depreciation and amortization 589,582 151,666 149,131 155,909 132,876 663,026 147,137 140,110 170,454 205,325 Straight-line rent revenue and expense (21,462) (7,063) (8,895) (2,956) (2,548) 11,005 (1,986) (1,925) (2,309) 17,225 Amortization of acquired above- and below-market lease values, net (78) 100 80 (10) (248) 4,002 (333) (172) (1,498) 6,005 Impairment loss 35,983 – – 12,184 23,799 300,038 (40,732) (8,210) 242,903 106,077 Gain from sales of real estate 3 – – – 3 (41,782) (197) (514) (2,969) (38,102) Non-revenue enhancing capital expenditures (40,515) (14,774) (10,992) (13,377) (1,372) (3,436) (1,097) (1,349) (764) (226) Debt prepayment penalties and amortization of deferred financing costs and debt premiums and discounts 114,902 5,572 5,627 5,238 98,465 100,159 36,685 7,651 10,196 45,627 Adjustment to reflect BRSP cash dividend declared 574 4,122 10,201 (4,660) (9,089) (3,282) (28,243) 9,478 (40,165) 55,648 Preferred share redemption (gain) loss – – – – – 4,992 2,127 2,865 – – Income tax effect on certain of the foregoing adjustments (534) 55 – – (589) (50,335) 8,195 1,663 (42,536) (17,657) Adjustments attributable to noncontrolling interests in investment entities (430,061) (69,810) (136,338) (91,676) (132,237) (610,382) (105,150) (83,074) (15,334) (406,824) DE from discontinued operations (13,223) (5,070) 6,808 (5,958) (9,003) (149,873) 11,467 (123,075) (25,874) (12,391) After-tax DE $37,060 ($11,411) $39,317 $7,585 $1,569 ($20,443) ($5,352) $700 ($5,578) ($10,213) ($ in thousands) FY 2022 4Q22 3Q22 2Q22 1Q22 FY 2021 4Q21 3Q21 2Q21 1Q21 After-tax DE $37,060 ($11,411) $39,317 $7,585 $1,569 ($20,443) ($5,352) $700 ($5,578) ($10,213) Interest expense included in DE 57,526 13,756 16,348 14,142 13,280 52,156 13,775 14,160 11,834 12,387 Income tax expense (benefit) included in DE 13,266 30,616 (7,839) (2,662) (6,849) (25,844) 631 (12,638) (8,224) (5,613) Preferred dividends 61,566 14,765 15,283 15,759 15,759 70,627 16,139 17,456 18,516 18,516 Earnings of equity method investments (38,800) (8,842) (16,285) (6,982) (6,691) (22,881) (6,441) (5,784) (6,216) (4,440) Placement fee expense – – – – – 7,512 603 2,102 4,767 40 Net realized carried interest and incentive fees (31,463) (12,377) (20,258) – 1,172 (2,653) (1,092) (7) (1,565) 11 Investment costs and non-revenue enhancing capital expenditures in DE 8,892 1,252 2,531 3,086 2,023 7,134 2,463 1,402 1,620 1,649 Non pro-rata allocation of income (loss) to NCI 231 – – – 231 886 231 231 223 201 Adjusted EBITDA $108,278 $27,759 $29,097 $30,928 $20,494 $66,494 $20,957 $17,622 $15,377 $12,538

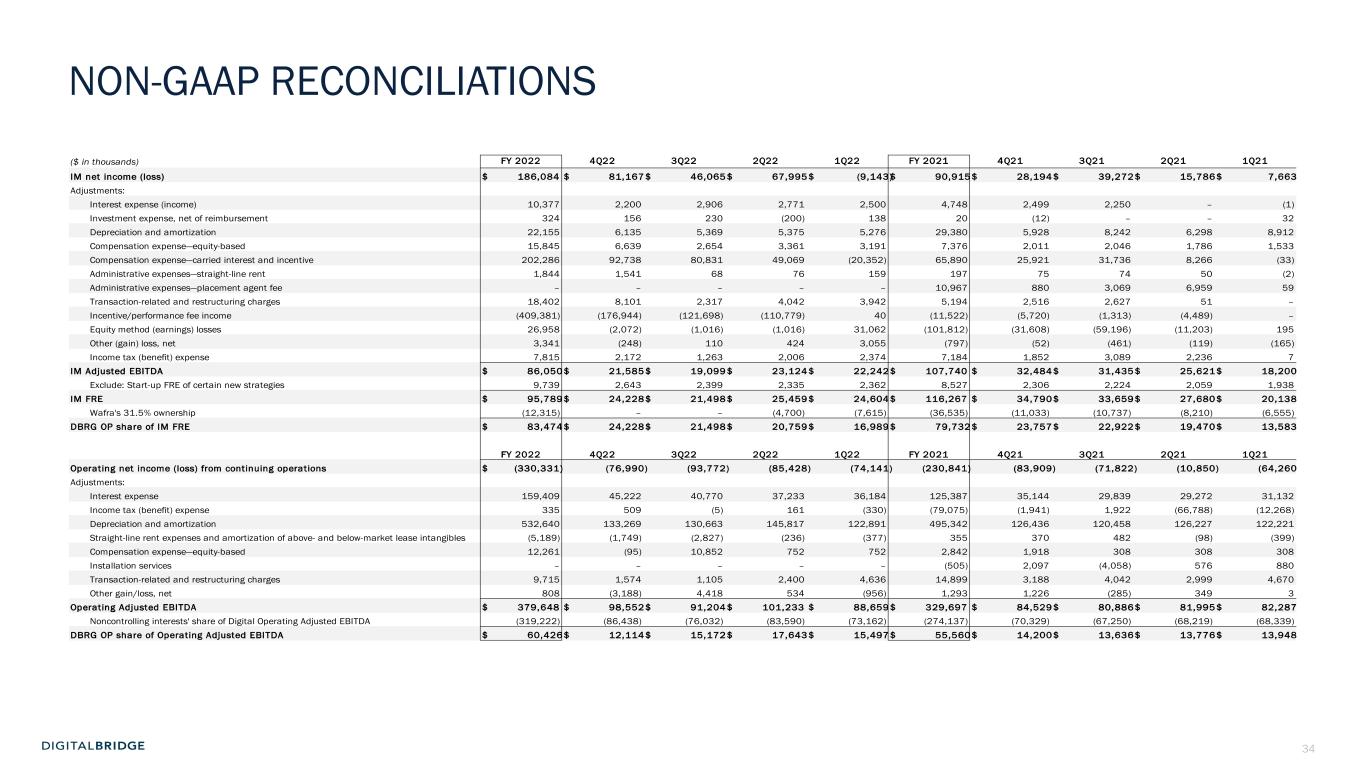

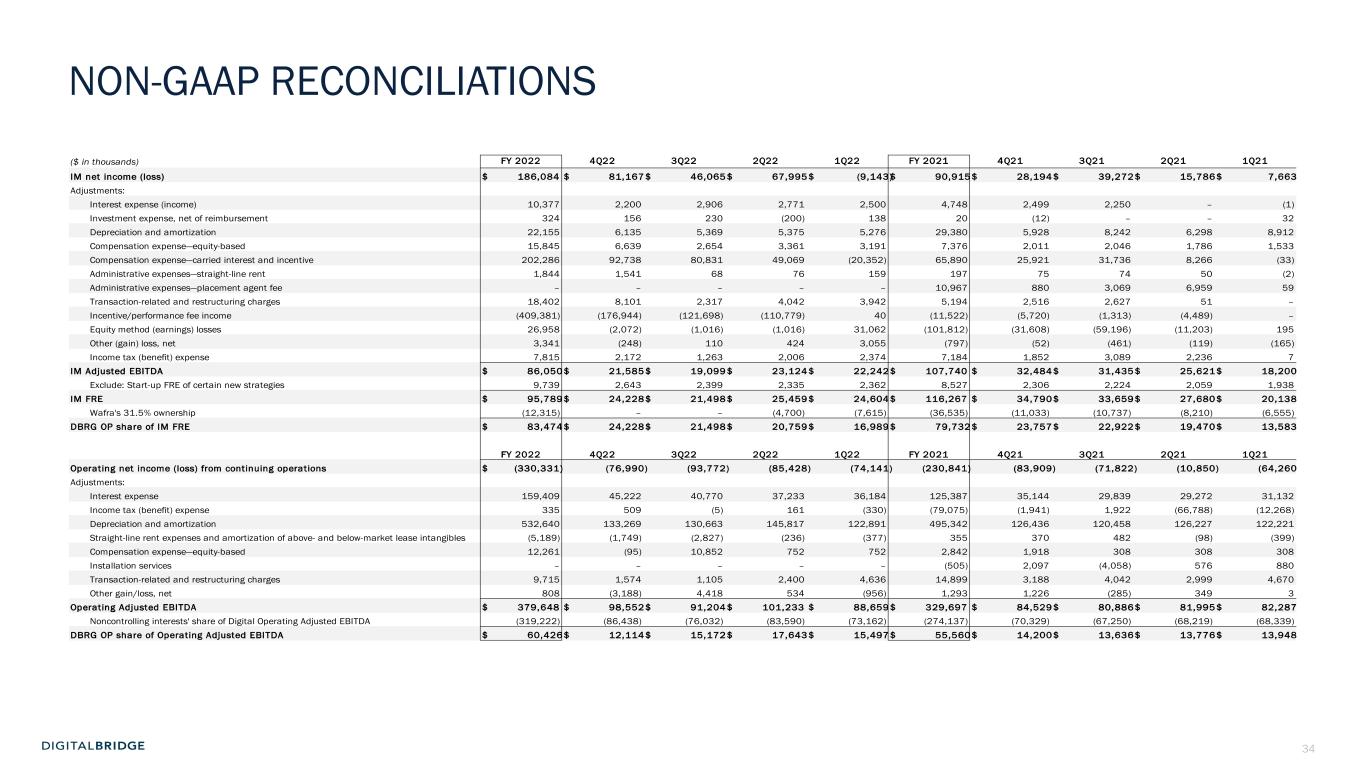

34 NON-GAAP RECONCILIATIONS ($ in thousands) FY 2022 4Q22 3Q22 2Q22 1Q22 FY 2021 4Q21 3Q21 2Q21 1Q21 IM net income (loss) $ 186,084 $ 81,167 $ 46,065 $ 67,995 $ (9,143)$ 90,915 $ 28,194 $ 39,272 $ 15,786 $ 7,663 Adjustments: Interest expense (income) 10,377 2,200 2,906 2,771 2,500 4,748 2,499 2,250 – (1) Investment expense, net of reimbursement 324 156 230 (200) 138 20 (12) – – 32 Depreciation and amortization 22,155 6,135 5,369 5,375 5,276 29,380 5,928 8,242 6,298 8,912 Compensation expense—equity-based 15,845 6,639 2,654 3,361 3,191 7,376 2,011 2,046 1,786 1,533 Compensation expense—carried interest and incentive 202,286 92,738 80,831 49,069 (20,352) 65,890 25,921 31,736 8,266 (33) Administrative expenses—straight-line rent 1,844 1,541 68 76 159 197 75 74 50 (2) Administrative expenses—placement agent fee – – – – – 10,967 880 3,069 6,959 59 Transaction-related and restructuring charges 18,402 8,101 2,317 4,042 3,942 5,194 2,516 2,627 51 – Incentive/performance fee income (409,381) (176,944) (121,698) (110,779) 40 (11,522) (5,720) (1,313) (4,489) – Equity method (earnings) losses 26,958 (2,072) (1,016) (1,016) 31,062 (101,812) (31,608) (59,196) (11,203) 195 Other (gain) loss, net 3,341 (248) 110 424 3,055 (797) (52) (461) (119) (165) Income tax (benefit) expense 7,815 2,172 1,263 2,006 2,374 7,184 1,852 3,089 2,236 7 IM Adjusted EBITDA $ 86,050 $ 21,585 $ 19,099 $ 23,124 $ 22,242 $ 107,740 $ 32,484 $ 31,435 $ 25,621 $ 18,200 Exclude: Start-up FRE of certain new strategies 9,739 2,643 2,399 2,335 2,362 8,527 2,306 2,224 2,059 1,938 IM FRE $ 95,789 $ 24,228 $ 21,498 $ 25,459 $ 24,604 $ 116,267 $ 34,790 $ 33,659 $ 27,680 $ 20,138 Wafra's 31.5% ownership (12,315) – – (4,700) (7,615) (36,535) (11,033) (10,737) (8,210) (6,555) DBRG OP share of IM FRE $ 83,474 $ 24,228 $ 21,498 $ 20,759 $ 16,989 $ 79,732 $ 23,757 $ 22,922 $ 19,470 $ 13,583 FY 2022 4Q22 3Q22 2Q22 1Q22 FY 2021 4Q21 3Q21 2Q21 1Q21 Operating net income (loss) from continuing operations $ (330,331) (76,990) (93,772) (85,428) (74,141) (230,841) (83,909) (71,822) (10,850) (64,260 Adjustments: Interest expense 159,409 45,222 40,770 37,233 36,184 125,387 35,144 29,839 29,272 31,132 Income tax (benefit) expense 335 509 (5) 161 (330) (79,075) (1,941) 1,922 (66,788) (12,268) Depreciation and amortization 532,640 133,269 130,663 145,817 122,891 495,342 126,436 120,458 126,227 122,221 Straight-line rent expenses and amortization of above- and below-market lease intangibles (5,189) (1,749) (2,827) (236) (377) 355 370 482 (98) (399) Compensation expense—equity-based 12,261 (95) 10,852 752 752 2,842 1,918 308 308 308 Installation services – – – – – (505) 2,097 (4,058) 576 880 Transaction-related and restructuring charges 9,715 1,574 1,105 2,400 4,636 14,899 3,188 4,042 2,999 4,670 Other gain/loss, net 808 (3,188) 4,418 534 (956) 1,293 1,226 (285) 349 3 Operating Adjusted EBITDA $ 379,648 $ 98,552 $ 91,204 $ 101,233 $ 88,659 $ 329,697 $ 84,529 $ 80,886 $ 81,995 $ 82,287 Noncontrolling interests' share of Digital Operating Adjusted EBITDA (319,222) (86,438) (76,032) (83,590) (73,162) (274,137) (70,329) (67,250) (68,219) (68,339) DBRG OP share of Operating Adjusted EBITDA $ 60,426 $ 12,114 $ 15,172 $ 17,643 $ 15,497 $ 55,560 $ 14,200 $ 13,636 $ 13,776 $ 13,948

35 IMPORTANT NOTE REGARDING NON-GAAP FINANCIAL MEASURES This presentation includes certain “non-GAAP” supplemental measures that are not defined by generally accepted accounting principles, or GAAP, including the financial metrics defined below, of which the calculations may from methodologies utilized by other companies for similar performance measurements, and accordingly, may not be comparable to those of other companies. This presentation includes forward-looking guidance for certain non-GAAP financial measures, including Adjusted EBITDA, FRE, Run-rate Investment Management Fee Revenue and Run-Rate Investment Management Fee Related Earnings. These measures will differ from net income, determined in accordance with GAAP, in ways similar to those described in the reconciliations of historical Adjusted EBITDA and FRE to net income. We do not provide guidance for net income, determined in accordance with GAAP, or a reconciliation of guidance for these measures to the most directly comparable GAAP measure because the Company is not able to predict with reasonable certainty the amount or nature of all items that will be included in net income. Adjusted Earnings before Interest, Taxes, Depreciation and Amortization (Adjusted EBITDA): Adjusted EBITDA represents DE adjusted to exclude the following items: interest expense as included in DE, income tax expense or benefit as included in DE, preferred stock dividends, equity method earnings, placement fee expense, our share of realized carried interest and incentive fees net of associated compensation expense, certain investment costs for capital raising that are not reimbursable by our sponsored funds, and capital expenditures as deducted in DE. Adjusted EBITDA is presented on a reportable segment basis and for the Company in total. We believe that Adjusted EBITDA is a meaningful supplemental measure of performance because it presents the Company’s operating performance independent of its capital structure, leverage and non-cash items, which allows for better comparability against entities with different capital structures and income tax rates. However, because Adjusted EBITDA is calculated before recurring cash charges including interest expense and taxes and does not deduct capital expenditures or other recurring cash requirements, its usefulness as a performance measure may be limited. Assets Under Management (“AUM”): Assets owned by the Company’s balance sheet and assets for which the Company and its affiliates provide investment management services, including assets for which the Company may or may not charge management fees and/or performance allocations. Balance sheet AUM is based on the undepreciated carrying value of digital investments and the impaired carrying value of non digital investments as of the report date. Investment management AUM is based on the cost basis of managed investments as reported by each underlying vehicle as of the report date. AUM further includes uncalled capital commitments but excludes DBRG OP’s share of non wholly-owned real estate investment management platform’s AUM. The Company's calculations of AUM may differ from the calculations of other asset managers, and as a result, this measure may not be comparable to similar measures presented by other asset managers. DigitalBridge Operating Company, LLC (“DBRG OP”): The operating partnership through which the Company conducts all of its activities and holds substantially all of its assets and liabilities. DBRG OP share excludes noncontrolling interests in investment entities. Digital Investment Management Fee Related Earnings (Digital IM FRE): Digital IM FRE is calculated as recurring fee income and other income inclusive of cost reimbursements (related to administrative expenses), and net of compensation expense (excluding equity-based compensation, carried interest and incentive compensation) and administrative expense (excluding placement fees and straight-line rent). Digital IM FRE is used to assess the extent to which direct base compensation and operating expenses are covered by recurring fee revenues in the digital investment management business. We believe that Digital IM FRE is a useful supplemental performance measure because it may provide additional insight into the profitability of the overall digital investment management business. Digital IM FRE is measured as Adjusted EBITDA for the Digital IM segment, adjusted to reflect the Company’s Digital IM segment as a stabilized business by excluding FRE associated with new investment strategies that have 1) not yet held a first close raising FEEUM; or 2) not yet achieved break-even Adjusted EBITDA only for investment products that may be terminated solely at the Company’s discretion, collectively referred to as “Start-up FRE.” The Company evaluates new investment strategies on a regular basis and excludes Start-Up FRE from Digital IM FRE until such time a new strategy is determined to form part of the Company’s core investment management business. Digital Operating Earnings before Interest, Taxes, Depreciation and Amortization for Real Estate (EBITDAre) and Adjusted EBITDA: The Company calculates EBITDAre in accordance with the standards established by the National Association of Real Estate Investment Trusts, which defines EBITDAre as net income or loss calculated in accordance with GAAP, excluding interest, taxes, depreciation and amortization, gains or losses from the sale of depreciated property, and impairment of depreciated property. The Company calculates Adjusted EBITDA by adjusting EBITDAre for the effects of straight-line rental income/expense adjustments and amortization of acquired above- and below-market lease adjustments to rental income, revenues and corresponding costs related to the delivery of installation services, equity-based compensation expense, restructuring and transaction related costs, the impact of other impairment charges, gains or losses from sales of undepreciated land, gains or losses from foreign currency remeasurements, and gains or losses on early extinguishment of debt and hedging instruments. The Company uses EBITDAre and Adjusted EBITDA as supplemental measures of our performance because they eliminate depreciation, amortization, and the impact of the capital structure from its operating results. EBITDAre represents a widely known supplemental measure of performance, EBITDA, but for real estate entities, which we believe is particularly helpful for generalist investors in REITs. EBITDAre depicts the operating performance of a real estate business independent of its capital structure, leverage and non-cash items, which allows for comparability across real estate entities with different capital structure, tax rates and depreciation or amortization policies. Additionally, exclusion of gains on disposition and impairment of depreciated real estate, similar to FFO, also provides a reflection of ongoing operating performance and allows for period-over-period comparability. However, because EBITDAre and Adjusted EBITDA are calculated before recurring cash charges including interest expense and taxes and are not adjusted for capital expenditures or other recurring cash requirements, their utilization as a cash flow measurement is limited. Distributable Earnings (DE): DE is an after-tax measure that differs from GAAP net income or loss from continuing operations as a result of the following adjustments, including adjustment for our share of similar items recognized by our equity method investments: transaction-related and restructuring charges; realized and unrealized gains and losses, except realized gains and losses from digital assets in Corporate and Other; depreciation, amortization and impairment charges; debt prepayment penalties, and amortization of deferred financing costs, debt premiums and debt discounts; our share of unrealized carried interest, net of associated compensation expense; equity-based compensation expense; equity method earnings from BRSP which is replaced with dividends declared by BRSP; effect of straight-line lease income and expense; impairment of equity investments directly attributable to decrease in value of depreciable real estate held by the investee; non-revenue enhancing capital expenditures; income tax effect on certain of the foregoing adjustments. Income taxes included in DE reflect the benefit of deductions arising from certain expenses that are excluded from the calculation of DE, such as equity-based compensation, as these deductions do decrease actual income tax paid or payable by the Company in any one period. There are no differences in the Company’s measurement of DE and AFFO. Therefore, previously reported AFFO is the equivalent to DE and prior period information has not been recast. DE is presented on a reportable segment basis and for the Company in total. We believe that DE is a meaningful supplemental measure as it reflects the ongoing operating performance of our core business by generally excluding items that are non-core operational in nature and allows for better comparability of operating results period-over-period and to other companies in similar lines of business. Fee Related Earnings Margin (FRE Margin): FRE Margin is calculated by dividing Digital IM FRE by management fee revenues, excluding one-time catch-up fees and/or incentives fees Fee-Earning Equity Under Management (“FEEUM”): Equity for which the Company and its affiliates provides investment management services and derives management fees and/or performance allocations. FEEUM generally represents the basis used to derive fees, which may be based on invested equity, stockholders’ equity, or fair value pursuant to the terms of each underlying investment management agreement. The Company's calculations of FEEUM may differ materially from the calculations of other asset managers, and as a result, this measure may not be comparable to similar measures presented by other asset managers. Monthly Recurring Revenue (“MRR”): The Company defines MRR as revenue from ongoing services that is generally fixed in price and contracted for longer than 30 days. Run-rate Investment Management Fee Related Earnings: Calculated as Run-rate Investment Management Fee Revenues less compensation expense (excluding equity-based compensation, carried interest and incentive compensation) and administrative expense (excluding placement fees and straight-line rent, net of any cost reimbursements) calculated on annualized basis at the end of the time period being presented. Run-rate Investment Management Fee Revenue: Calculated as FEEUM , inclusive of uncalled contractual commitments expected to be called within their commitment periods by investment vehicles that charge fees on invested capital once called, multiplied by the blended average fee rate as of the most recent reporting period. The Company’s calculations of Run-rate Investment Management Fee Revenues may not be achieved if all uncalled commitments are not called In evaluating the information presented throughout this presentation see definitions and reconciliations of non-GAAP financial measures to GAAP measures. For purposes of comparability, historical data in this presentation may include certain adjustments from prior reported data at the historical period.

36