Exhibit 99.3

The enclosed materials require your immediate attention. If you are in doubt as to how to deal with the enclosed materials or the matters referred to in such materials, please consult your financial, tax or other professional advisor for assistance.

NOTICE OF SPECIAL MEETING

to be held at 8:00 a.m. (Vancouver time)

on January 21, 2025

at Suite 3500 – 1133 Melville Street, Vancouver, British Columbia V6E 4E5

MANAGEMENT INFORMATION CIRCULAR

dated December 9, 2024

CONCERNING A TRANSACTION INVOLVING

ORLA MINING LTD.

and

GOLDCORP CANADA LTD.

(a subsidiary of Newmont Corporation)

If you have any questions with respect to the Special Meeting or require assistance with voting, please contact Orla Mining Ltd.’s proxy solicitation agent:

Laurel Hill Advisory Group

North American Toll-Free Number: 1-877-452-7184

Outside North America: 1-416-304-0211

| What’s Inside | |

| | |

| LETTER TO SHAREHOLDERS | 1 |

| MANAGEMENT INFORMATION CIRCULAR | 1 |

| SUMMARY | 6 |

| SOLICITATION OF PROXIES AND VOTING INSTRUCTIONS | 13 |

| Summary of Matters to be Voted on at the Meeting | 13 |

| Solicitation of Proxies | 13 |

| Appointment and Revocation of Proxies | 13 |

| Voting of Proxies | 14 |

| Registered Shareholders | 14 |

| Non-Registered Holders | 15 |

| Voting at the Meeting | 16 |

| Record Date | 16 |

| Quorum | 16 |

| VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF | 17 |

| Voting Shares | 17 |

| Principal Shareholders | 17 |

| THE MUSSELWHITE MINE | 17 |

| Musselwhite Mine Technical Report | 18 |

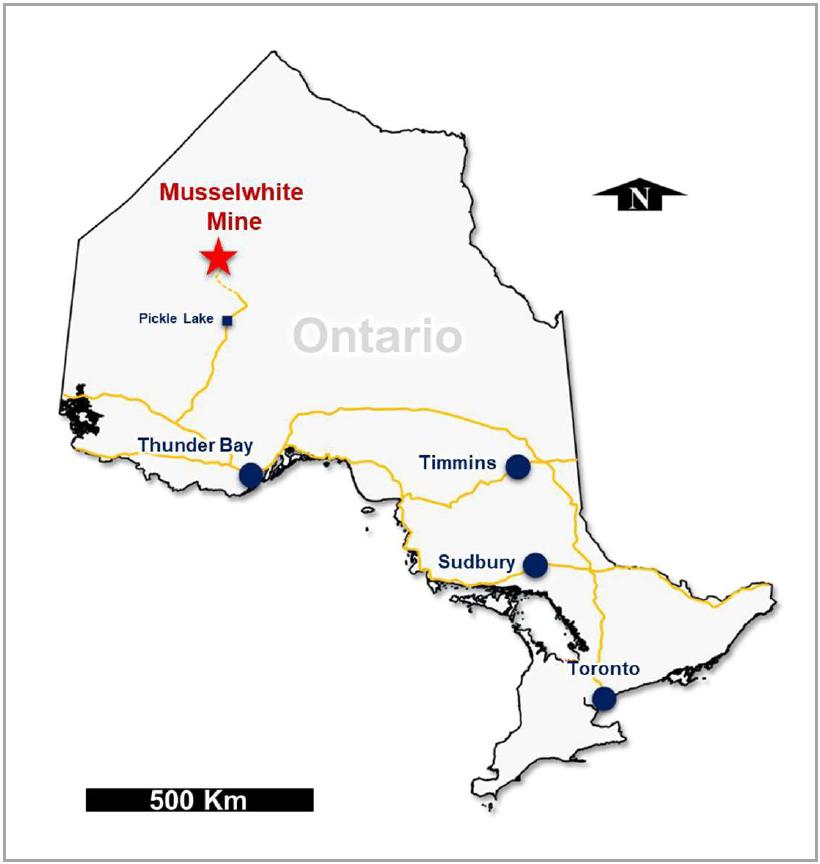

| Property Description and Location | 18 |

| Accessibility, Climate, Local Resources, Infrastructure, and Physiography | 19 |

| History | 19 |

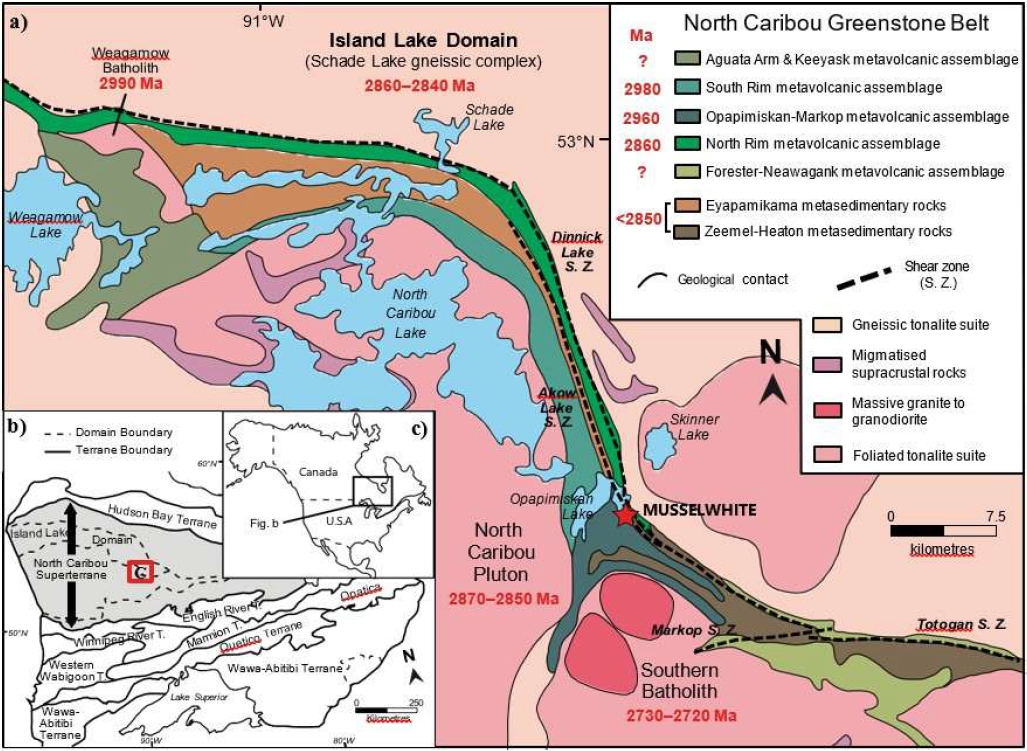

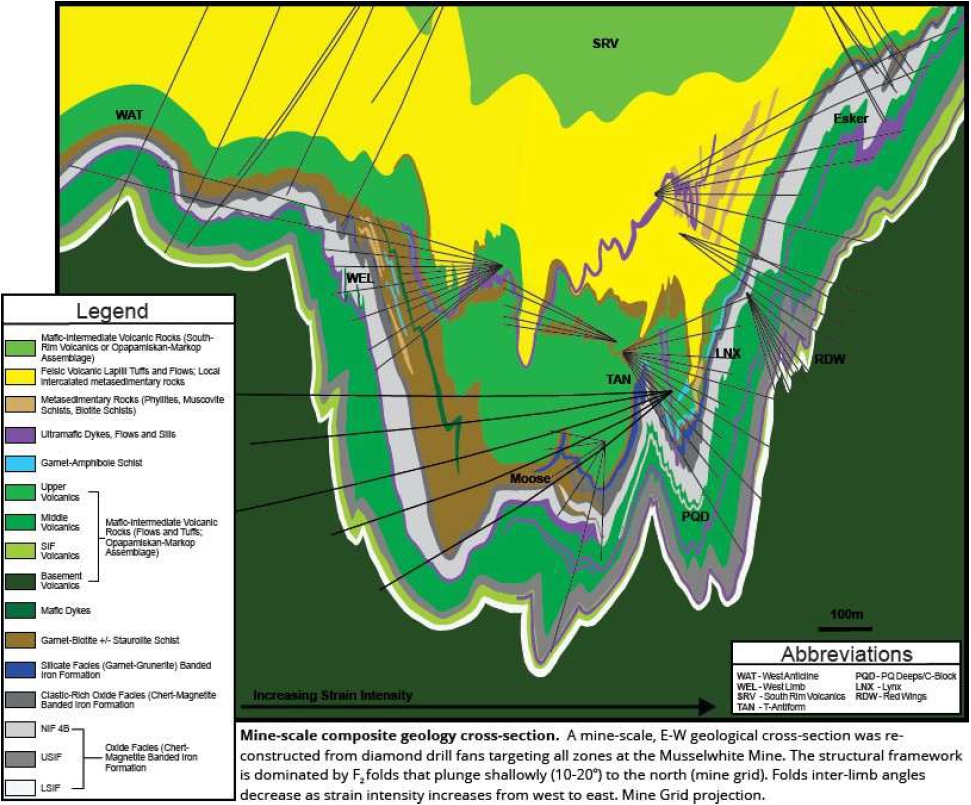

| Geological Setting and Mineralization | 21 |

| Exploration Work and Drilling | 23 |

| Data Verification, Sampling Preparation, Analysis, and Security | 26 |

| Mineral Processing and Metallurgical Testing | 26 |

| Mineral Resources Estimate | 26 |

| Mineral Reserve Estimation | 27 |

| Mining Methods | 28 |

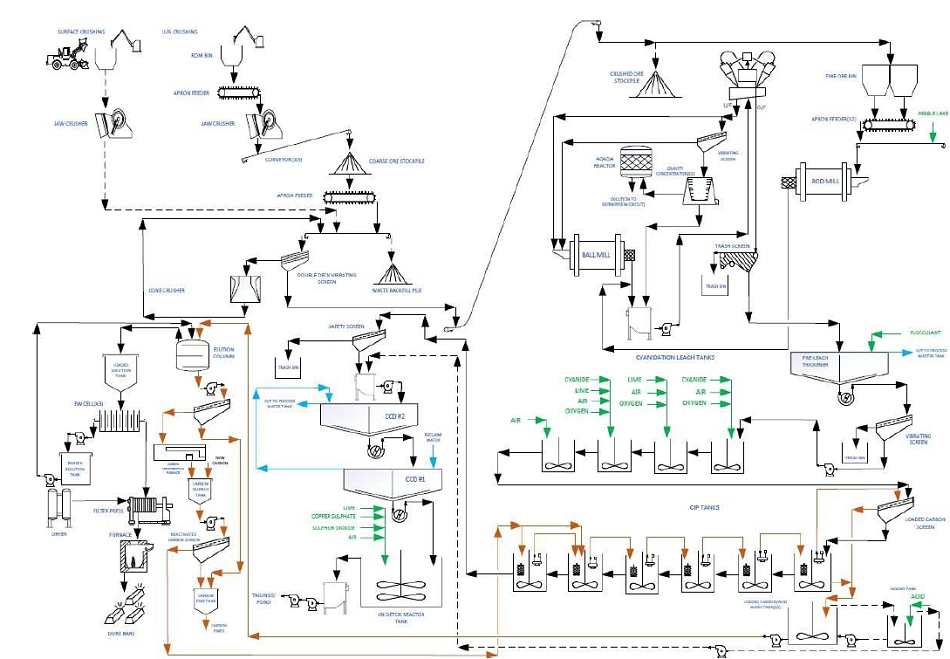

| Recovery Methods | 31 |

| Project Infrastructure | 31 |

| Environmental Studies, Permitting and Social or Community Impact | 32 |

| Capital and Operating Costs | 34 |

| Economic Analysis | 37 |

| Adjacent Properties | 39 |

| Interpretation and Conclusions | 40 |

| Opportunities | 42 |

| | TSX: OLA |

| | NYSE AMERICAN: ORLA |

| Risk Evaluation | 43 |

| Recommendations | 45 |

| Selected Unaudited Pro Forma Combined Financial Information | 49 |

| PARTICULARS OF MATTERS TO BE ACTED UPON AT THE MEETING | 50 |

| The Transaction | 50 |

| Background to the Transaction | 50 |

| Reasons For and Benefits of the Transaction | 53 |

| The Share Purchase Agreement | 55 |

| Formal Valuation | 60 |

| Source of Funds and Expenses for the Proposed Transaction | 63 |

| The Transaction under MI 61-101 | 63 |

| Voting Support Agreements | 64 |

| Recommendation of the Board | 65 |

| The Concurrent Private Placement | 65 |

| Terms of the Subscription Letter | 66 |

| Control Person Issuance | 67 |

| The Concurrent Private Placement Under MI 61-101 | 67 |

| Recommendation of the Board | 68 |

| INTEREST OF CERTAIN PERSONS OR COMPANIES IN MATTERS TO BE ACTED UPON | 68 |

| SECURITIES LAW MATTERS | 68 |

| Compliance with MI 61-101 Requirements | 68 |

| Prior Valuations | 69 |

| Prior Offers | 69 |

| Auditor | 69 |

| Other | 69 |

| INFORMATION RELATING TO GCL | 69 |

| INFORMATION RELATING TO THE COMPANY | 69 |

| Trading Price and Volume | 70 |

| Holdings of Directors and Officers | 71 |

| Material Changes in the Affairs of the Company | 72 |

| Arrangements Between the Company and Security Holders | 72 |

| Previous Purchases and Sales | 72 |

| Dividends | 72 |

| RISK FACTORS | 73 |

| Risks Relating to the Transaction | 73 |

| Risks Relating to the Acquisition of the Musselwhite Mine | 75 |

| OTHER BUSINESS | 81 |

| ADDITIONAL INFORMATION | 81 |

| | TSX: OLA |

| | NYSE AMERICAN: ORLA |

| APPROVAL OF DIRECTORS | 81 |

| SCHEDULE A SHAREHOLDERS RESOLUTIONS | A-1 |

| SCHEDULE B FINANCIAL STATEMENTS | B-1 |

| SCHEDULE C FORMAL VALUATION | C-1 |

| SCHEDULE D CONSENT OF DAVIDSON & COMPANY LLP | D-1 |

| | TSX: OLA |

| | NYSE AMERICAN: ORLA |

LETTER TO SHAREHOLDERS

December 9, 2024

Dear Fellow Shareholders,

On behalf of the Board of Directors (the “Board”) of Orla Mining Ltd. (“Orla” or the “Company”), we invite you to attend a special meeting (the “Meeting”) of the holders of common shares of Orla (the “Common Shares”), which will be held on January 21, 2025 at 8:00 a.m. (Vancouver time) at 1133 Melville St #3500, Vancouver, BC V6E 4E5.

THE TRANSACTION

The Company, 1511583 B.C. Ltd., a wholly-owned subsidiary of the Company (the “Purchaser”), and Goldcorp Canada Ltd. (“GCL”), a subsidiary of Newmont Corporation (“Newmont”), have entered into a share purchase agreement dated November 17, 2024 (the “Agreement”), pursuant to which the Purchaser will acquire all of the issued and outstanding shares (the “Purchased Shares”) of Musselwhite Mine Ltd., a newly formed wholly-owned subsidiary of GCL, which will hold the associated right and title to the property and assets related to the gold mining complex known as the “Musselwhite Mine” (“Musselwhite”) located in the Province of Ontario, Canada (the “Transaction”). In consideration for the Purchased Shares, the Purchaser has agreed to pay:

| a. | US$810,000,000 in cash, representing the base purchase price (the “Base Purchase Price”), on the closing date of the Transaction (the “Closing Date”); |

| b. | US$20,000,000 (the “First Deferred Amount”) in cash, by no later than ten (10) business days following the first anniversary of the Closing Date, unless the average spot gold price is equal to or less than US$2,900/oz during the period commencing on the Closing Date and ending on first anniversary thereof, in which case the First Deferred Amount will be reduced to US$0; and |

| c. | US$20,000,000 (the “Second Deferred Amount”) in cash, by no later than ten (10) business days following the second anniversary of the Closing Date, unless the average spot gold price is equal to or less than US$3,000/oz during the period commencing on the first anniversary of the Closing Date and ending on second anniversary thereof, in which case the Second Deferred Amount will be reduced to US$0. |

The Company has arranged the following financing commitments in order to fund the Base Purchase Price of the Transaction:

| · | Credit Facility: US$150,000,000 available under the Company’s existing revolving credit facility and a new US$100,000,000 term loan with a syndicate of lenders comprised of the Bank of Nova Scotia, Bank of Montreal, Canadian Imperial Bank of Commerce and ING Capital LLC. |

| · | Concurrent Private Placement: Pursuant to a subscription letter (the “Subscription Letter”) executed by each of Fairfax Financial Holdings Limited (“Fairfax”), Pierre Lassonde, and Trinity Capital Partners Corporation (“Trinity”) (collectively, and together with their affiliates, the “Subscribers”), the Subscribers have committed to subscribe for senior unsecured convertible notes of the Company in the aggregate principal amount of US$200,000,000 (the “Notes”). |

| · | Gold Prepay Facility: Pursuant to commitment letters (the “Gold Prepay Letters”) with each of the Bank of Montreal, Canadian Imperial Bank of Commerce and ING Capital Markets LLC (together, the “Gold Prepay Lenders”), the Gold Prepay Lenders have committed, subject to the terms and conditions therein, to provide a gold prepay to the Company in the amount of US$360,000,000. |

The Transaction will have significant benefits to Orla and its shareholders, including:

| · | Acquisition of a high-quality, long-life, producing gold mine: Musselwhite is an established operation with nearly 6 Moz of gold produced over the past 28 years, 1.5 Moz of gold reserves with additional mineral resources, as well as identified upside potential supporting opportunities for significant mine life extension. The mineralization at Musselwhite is hosted in a banded iron formation (BIF) that remains open along a known strike extent, at least one kilometre beyond the current reserves. The total mining and exploration lease covers over 65,000 hectares. |

| · | Strategic entry into Canada establishing an enhanced North American presence: Strengthened portfolio diversification with entry into Ontario, Canada – a tier one mining jurisdiction. Located in a mining-friendly region with a strong work force and robust stakeholder support, the operation benefits from a stable operating environment that further enhances its long-term value. The combination of quality assets in Ontario, Canada, Nevada, United States, and Zacatecas, Mexico creates a premier North America focused gold company. |

| · | Immediately increases annual gold production by 140% to over 300,000 ounces at competitive costs: Pro forma annual gold production of over 300,000 ounces at combined all-in sustaining cost1 of US$1,080/oz2. Through the development of South Railroad in Nevada, the Company has a pathway to annual production of 500,000 ounces at industry leading costs. |

| · | No upfront equity dilution with significant support from cornerstone shareholders: Attractive transaction financing package including bank-provided debt and a gold prepay, as well as a placement of the Notes led by Fairfax, Pierre Lassonde and Trinity, allows shareholders to retain exposure to Orla's increasing net asset value with no upfront equity dilution. |

| · | Accretive to key metrics: The Transaction is expected to be significantly accretive to operating and free cash flow, gold production and gold reserves and resources, all on a per share basis. |

| · | Strengthened cash flow generation to support growth pipeline: Musselwhite is expected to generate over US$150,000,000 in average annual cash flow over the next 6 years. The combined cash flows of Camino Rojo and Musselwhite will allow the Company to self-fund continued investment in its growth pipeline. This includes Musselwhite's growth development, the South Railroad Project, development of the Camino Rojo sulphides project, and exploration in all three countries. The Company has a robust cash position of approximately US$150,000,000 as of December 9, 2024. |

| · | Musselwhite is well suited to Orla's technical capabilities: Orla's experienced management team boasts in-depth experience developing and operating underground mines, including many in Canada, and is supplemented by the board of directors’ operating history with the asset. |

| · | Increased leverage to strong gold price environment: Production uplift from Musselwhite increases exposure to the current record gold price environment. |

At the Meeting, the shareholders of the Company will be asked to consider and, if deemed advisable, pass an ordinary resolution to approve the Transaction (the “Acquisition Resolution”). As Newmont is a "related party" of Orla under Multinational Instrument 61-101 – Protection of Minority Security Holders in Special Transactions ("MI 61-101"), the Common Shares held by Newmont or its affiliates will be excluded from the vote

1 Non-GAAP measure. Excludes exploration and project growth spending. Refer to the “Non-GAAP Measures” section of the enclosed Circular (as defined below).

2 Based on combined 2024 guidance Orla (Midpoint of 130-140koz and "low end" of US$800-900/oz AISC) and Musselwhite life of mine (“LoM”) averages as per the Technical Report (as defined below) (202 koz and US$1,269/oz AISC).

on the Transaction Resolution in accordance with MI 61-101. In addition, the Common Shares held by Fairfax and Mr. Lassonde will be excluded from the Acquisition Resolution pursuant to section 604(a)(ii) of the TSX Company Manual.

The board of directors of the Company (the “Board”) (excluding Scott Langley, Newmont’s representative on the Board), after careful consideration of the Formal Valuation (as defined and discussed in the enclosed Circular (as defined below)) and such other matters as it considered relevant, as more particularly described under the heading “Reasons for and Benefits of the Transaction” contained in the Circular, including, among other things, (i) the terms and conditions of the Agreement and related transaction documents; (ii) the benefits and risks associated with the Transaction; (iii) the impact of the Transaction on other stakeholders of the Company; and (iv) consultations with management and their legal and financial advisors, determined it advisable and in the best interests of the Company to: (A) approve the Company’s execution of the Agreement and related transaction documents and the performance of its obligations thereunder; and (B) recommend that the shareholders vote in favour of the Acquisition Resolution and the Financing Resolution (as defined below) at the Meeting.

THE CONCURRENT PRIVATE PLACEMENT

To fund a portion of the purchase price of the Transaction, the Company entered into the Subscription Letter with Pierre Lassonde, Trinity, and Fairfax whereby such Subscribers have agreed to subscribe for the Notes in the aggregate principal amount of US$200,000,000 together with common share purchase warrants (the “Concurrent Private Placement”), all as more particularly described in the Circular. Under the rules of the Toronto Stock Exchange (the “TSX”), as the Concurrent Private Placement will result in more than 10% of the issued and outstanding Common Shares being made issuable to "insiders" (as defined in the TSX Company Manual) of the Company, of which Fairfax and Mr. Lassonde are, and create the potential for Fairfax to become a control person of the Company, the Concurrent Private Placement is subject to the approval of the shareholders of the Company, excluding Fairfax, Mr. Lassonde and Newmont, and their respective joint actors, if any.

Accordingly, at the Meeting the shareholders will be asked to consider and, if deemed advisable, pass an ordinary resolution to approve the Concurrent Private Placement and the potential creation of a new control person of the Company (together, the “Financing Resolution”). Shareholder approval of both the Acquisition Resolution and the Financing Resolution is a condition precedent to the completion of the Transaction.

THE MEETING

The enclosed management information circular (the “Circular”) provides important information on the matters to be considered at the Meeting, including information about the Transaction and the Concurrent Private Placement, which you will be asked to approve.

The directors and officers of the Company, along with certain key Shareholders, namely Pierre Lassonde, Fairfax, Trinity, and Agnico Eagle Mines Limited (collectively with Newmont, the “Supporting Shareholders”), have entered into voting support agreements (“Voting Agreements”) with the Company, the Purchaser and GCL and under which they have agreed, among other things, to vote in favour of the Transaction and the Concurrent Private Placement. Newmont has also agreed to vote in favour of the Concurrent Private Placement pursuant to the Agreement. Irrespective of the Voting Agreements and the Agreement, the votes of Fairfax, Mr. Lassonde and Newmont will be excluded from calculating approval of the resolutions. Collectively, the Supporting Shareholders represent (i) in aggregate approximately 52% of the Common Shares and (ii) 19.05% of the Common Shares eligible to vote on the Acquisition Resolution approving the Transaction and the Financing Resolution approving the Concurrent Private Placement, respectively (excluding the Common Shares held by Newmont, Fairfax and Mr. Lassonde, and their respective joint actors, if any).

Your participation at the Meeting is important to us, regardless of the number of Common Shares that you own. We encourage you to read the Circular and to exercise your right to vote on the items for consideration at the Meeting. If you are unable to attend the Meeting, we encourage you to complete and return your form of proxy or voting instruction form in accordance with the instructions in the Circular to ensure that your votes are counted.

SHAREHOLDER QUESTIONS

Shareholders who have questions or need assistance with voting their Common Shares should contact Laurel Hill Advisory Group Company by telephone at by telephone at 1-877-452-7184 (toll-free in North America) or 416-304-0211 (collect outside North America) or by email at assistance@laurelhill.com.

THANK YOU

On behalf of the Board, thank you for your continued support and engagement and we look forward to your participation at the Meeting.

Sincerely,

“Charles Jeannes”

Chairman of the Board of Directors

ORLA MINING LTD.

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

NOTICE is hereby given that the special meeting (the “Meeting”) of the holders of common shares (“Shareholders”) of Orla Mining Ltd. (the “Company”) will be held on January 21, 2025 at 8:00 a.m. (Vancouver time) at 1133 Melville St #3500, Vancouver, BC V6E 4E5, for the following purposes:

| (a) | to consider, and if deemed advisable, to pass, with or without variation, an ordinary resolution (the “Acquisition Resolution”), the full extent of which is set forth in Schedule “A” to the management information circular attached hereto (the “Circular”), authorizing and approving the Company’s acquisition of all the issued and outstanding shares of Musselwhite Mine Ltd., a wholly owned subsidiary of Goldcorp Canada Ltd., which will hold the assets and liabilities of the gold mining complex known as the “Musselwhite Mine” located in the Province of Ontario, including any property and assets related to such mine, and enter into any further agreements and take any further actions as required to complete the transaction as contemplated in the share purchase agreement dated November 17, 2024; |

| (b) | to consider and, if thought advisable, to pass, with or without variation, an ordinary resolution (the “Financing Resolution”), the full extent of which is set forth in Schedule “A” to the Circular attached hereto, approving the issuance of a respective portion of senior unsecured convertible notes of the Company (“Notes”) in the aggregate principal amount of US$200,000,000, together with the issuance of the common shares of the Company (“Common Shares”) upon conversion thereof, and the issuance of common share purchase warrants of the Company (“Warrants”), together with the issuance of the Common Shares upon conversion thereof, to each of Pierre Lassonde and Fairfax Financial Holdings Limited (“Fairfax”), or a respective affiliate thereof (the “Concurrent Private Placement”); and |

| (c) | to transact such other business as may properly come before the Meeting or any adjournment or postponement thereof. |

The record date is December 9, 2024 (the “Record Date”) for determining Shareholders who are entitled to receive notice of and to vote at the Meeting. Only registered shareholders of the Company (“Registered Shareholders”), as of the Record Date, are entitled to receive this notice of the Meeting (“Notice of Meeting”) and to attend and vote at the Meeting.

Each Registered Shareholder whose name is entered on the central securities register of the Company at the close of business on the Record Date is entitled to one vote for each Common Share registered in his, her or its name. In order to become effective, each of the Acquisition Resolution and the Financing Resolution must be approved by a simple majority (50%) of votes cast on such resolution by holders of Common Shares present in person or represented by proxy at the Meeting, other than votes attached to Common Shares required to be excluded from such resolution pursuant to Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions and the rules of the Toronto Stock Exchange.

Registered Shareholders are requested to read, complete, sign, date and return the applicable enclosed form of proxy in accordance with the instructions set out therein and in the Circular. In order to be valid for use at the Meeting, proxies must be received by our transfer agent, Computershare Investor Services Inc., by 8:00 a.m. (Vancouver time) on January 17, 2025 or at least 48 hours (excluding Saturdays, Sundays and holidays) prior to the time of the Meeting in the event of any adjournment or postponement thereof. The deadline for the deposit of proxies may be extended or waived by the Chair of Meeting at his discretion without notice.

If your Common Shares are not registered in your name but are held through a broker, investment dealer, bank, trust, company, custodian, nominee or other intermediary (a “Non-Registered Shareholder”) and you have not objected to your Intermediary disclosing certain ownership information to the Company, you can expect to receive a voting instruction form (“VIF”). Please complete and return the request for voting instructions in

accordance with the instructions provided. Failure to do so may result in such securities not being voted at the Meeting.

A Shareholder who wishes to appoint a person other than the management nominees identified on the applicable form(s) of proxy or VIF, as applicable, to represent him, her or it at the Meeting may do so by inserting such person’s name in the blank space provided in the applicable form(s) of proxy or VIF, as applicable, and following the instructions for submitting such form of proxy or VIF, as applicable. If you wish that a person other than the management nominees identified on the form of proxy or VIF attend and participate at the Meeting as your proxy and vote your Common Shares, including if you are not a Registered Shareholder and wish to appoint yourself as proxyholder to attend, participate and vote at the Meeting, you MUST submit your form of proxy (or proxies) or VIF, as applicable, in accordance with the instructions set out in the Circular.

Non-Registered Shareholders should carefully follow the instructions of their intermediaries to ensure that their Common Shares are voted at the Meeting in accordance with such Shareholder’s instructions.

Dated December 9, 2024.

By Order of the Board of Directors

| | Jason Simpson

President, Chief Executive Officer and Director |

MANAGEMENT INFORMATION CIRCULAR

This management information circular (the “Circular”) is furnished in connection with the solicitation by management (“Management”) of Orla Mining Ltd. (the “Company” or “Orla”) of proxies to be used at the Company’s special meeting of the holders (“Shareholders”) of common shares of the Company (the “Common Shares”) to be held on January 21, 2025 (the “Meeting”) or at any adjournment or postponement thereof at the time and place and for the following purposes:

| (a) | to consider, and if deemed advisable, to pass, with or without variation, an ordinary resolution, the full extent of which is set forth in Schedule “A” hereto (the “Acquisition Resolution”), authorizing and approving the Company’s acquisition of all the issued and outstanding shares of Musselwhite Mine Ltd., a wholly owned subsidiary of Goldcorp Canada Ltd. (“GCL”), which will hold the assets and liabilities of the gold mining complex known as the “Musselwhite Mine” located in the Province of Ontario, including any property and assets related to such mines, and enter into any further agreements and take any further actions as required to complete the transaction as contemplated in the share purchase agreement dated November 17, 2024 (collectively, the “Transaction”); |

| (b) | to consider and, if thought advisable, to pass, with or without variation, an ordinary resolution (the “Financing Resolution” and, together with the Acquisition Resolution, the “Shareholders Resolutions”), the full extent of which is set forth in Schedule “A” to the Circular attached hereto, approving the issuance of a respective portion of senior unsecured convertible notes of the Company (“Notes”) in the aggregate principal amount of US$200,000,000, together with the issuance of the common shares of the Company (“Common Shares”) upon conversion thereof, and the issuance of common share purchase warrants of the Company (“Warrants”), together with the issuance of the Common Shares upon conversion thereof, to each of Pierre Lassonde and Fairfax Financial Holdings Limited (“Fairfax”), or a respective affiliate thereof (the “Concurrent Private Placement”); and |

| (c) | to transact such other business as may properly come before the Meeting or any adjournment or postponement thereof. |

The Meeting will be held will be held in person on January 21, 2025 at 8:00 a.m. (Vancouver time) at 1133 Melville St #3500, Vancouver, BC V6E 4E5.

No person has been authorized to give any information or make any representation in connection with the matters set out in this Circular or the accompanying notice of special meeting (the “Notice of Meeting”), other than those contained in this Circular and, if given or made, any such information or representation must not be relied upon as having been authorized.

Only registered Shareholders (“Registered Shareholders”) and duly appointed proxyholders will be able to vote at and attend Meeting.

Registered Shareholders are requested to read, complete, sign, date and return the applicable enclosed form of proxy in accordance with the instructions set out therein and in the Circular. In order to be valid for use at the Meeting, proxies must be received by our transfer agent, Computershare Investor Services Inc. (“Computershare”), by 8:00 a.m. (Vancouver time) on January 17, 2025 or at least 48 hours (excluding Saturdays, Sundays and holidays) prior to the time of the Meeting in the event of any adjournment or postponement thereof. The deadline for the deposit of proxies may be extended or waived by the Chair of Meeting at his discretion without notice.

If your Common Shares are not registered in your name but are held through a broker, investment dealer, bank, trust, company, custodian, nominee or other intermediary (a “Non-Registered Shareholder”), please consult the section entitled “Non-Registered Holders” hereto for instructions as to the procedure for voting your Common Shares.

Reporting Currencies and Accounting Principles

This Circular contains references to Canadian dollars (“C$”) and United States dollars (“US$”, or “US dollars”). All dollar amounts referenced, unless otherwise indicated, are expressed in United States dollars.

The most recent audited condensed consolidated financial statements of the Company and the unaudited pro forma condensed combined financial statements set forth in Schedule “B” to this Circular are reported in United States dollars and are prepared in accordance with International Financial Reporting Standards (“IFRS”), which differ from United States generally accepted accounting principles ("U.S. GAAP") in certain material respects, and thus they may not be comparable to financial statements of United States companies.

Conversely, the Musselwhite Mine financial statements and other financial information concerning Musselwhite Mine included in this Circular have been prepared in accordance with U.S. GAAP, which differs from IFRS in certain material respects, and thus are not directly comparable to financial statements prepared in accordance with IFRS.

Currency Exchange Rate Information

The high, low, average and closing rates for the US dollars in terms of Canadian dollars for each of the financial periods indicated below, as quoted by the Bank of Canada, were as follows:

| | Nine Months Ended September 30, 2024 | Six Months Ended June 30, 2024 | Year ended December 31, 2023 |

| | (expressed in Canadian dollars) |

| High | 1.3858 | 1.3807 | 1.3875 |

| Low | 1.3316 | 1.3128 | 1.3128 |

| Average | 1.3604 | 1.3457 | 1.3497 |

| Closing | 1.3499 | 1.3520 | 1.3544 |

Cautionary Note Regarding Forward-Looking Statements

This Circular contains certain “forward-looking information” and “forward-looking statements” within the meaning of Canadian securities legislation and within the meaning of Section 27A of the United States Securities Act of 1933, as amended, Section 21E of the United States Exchange Act of 1934, as amended, the United States Private Securities Litigation Reform Act of 1995, or in releases made by the United States Securities and Exchange Commission, all as may be amended from time to time, including, without limitation, statements regarding: the potential benefits to be derived from the Transaction, including accretion to operating and free cash flow, production, reserves and resources, as well as potential benefits to Shareholders; the closing of the Transaction, including receipt of all necessary shareholder and regulatory approvals, and the timing thereof; the Company’s production following completion of the Transaction, including its ability to reach 500 thousand ounces gold production per annum; projected net present value, production, revenue, costs, taxes, sensitivities, and cash flows from Musselwhite Mine; potential exploration, additional value, operational improvements, and mine life extension at Musselwhite Mine; the timing of production at the South Railroad Project; the Company’s ability to self fund its growth pipeline; mineral resource and reserve estimates; and the Company’s goals and strategies. Forward-looking statements are statements that are not historical facts which address events, results, outcomes or developments that the Company expects to occur. Forward-looking statements are based on the beliefs, estimates and opinions of Management on the date the statements are made, and they involve a number of risks and uncertainties. Certain material assumptions regarding such forward-looking statements were made, including without limitation, assumptions regarding: the Company following completion of the Transaction; completion of the Transaction, including receipt of required shareholder approvals, the future price of gold and silver; anticipated costs and the Company’s ability to fund its programs; the Company’s ability to carry on exploration, development, and mining activities; tonnage of ore to be mined and processed; ore grades and recoveries; decommissioning and reclamation estimates; currency exchange rates remaining as estimated; prices for energy inputs, labour, materials, supplies and services remaining as estimated; the

Company’s ability to secure and to meet obligations under property agreements, including the layback agreement with Fresnillo plc; that all conditions of the Company’s credit facility will be met; the timing and results of drilling programs; mineral reserve and mineral resource estimates and the assumptions on which they are based; the discovery of mineral resources and mineral reserves on the Company’s mineral properties; the obtaining of a subsequent agreement with Fresnillo to access the sulphide mineral resource at the Camino Rojo Project and develop the entire Camino Rojo Project mineral resources estimate; that political and legal developments will be consistent with current expectations; the timely receipt of required approvals and permits, including those approvals and permits required for successful project permitting, construction, and operation of projects; the timing of cash flows; the costs of operating and exploration expenditures; the Company’s ability to operate in a safe, efficient, and effective manner; the Company’s ability to obtain financing as and when required and on reasonable terms; that the Company’s activities will be in accordance with the Company’s public statements and stated goals; and that there will be no material adverse change or disruptions affecting the Company, its properties or Musselwhite Mine.

Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements involve significant known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated. These risks include, but are not limited to: the failure to obtain shareholder approvals in connection with the Transaction; uncertainty and variations in the estimation of mineral resources and mineral reserves; the Company’s dependence on the Camino Rojo oxide mine; risks related to the Company’s indebtedness; risks related to exploration, development, and operation activities; foreign country and political risks, including risks relating to foreign operations; risks related to the Cerro Quema Project; delays in obtaining or failure to obtain governmental permits, or non-compliance with permits; environmental and other regulatory requirements; delays in or failures to enter into a subsequent agreement with Fresnillo with respect to accessing certain additional portions of the mineral resource at the Camino Rojo Project and to obtain the necessary regulatory approvals related thereto; the mineral resource estimations for the Camino Rojo Project being only estimates and relying on certain assumptions; loss of, delays in, or failure to get access from surface rights owners; uncertainties related to title to mineral properties; water rights; risks related to natural disasters, terrorist acts, health crises, and other disruptions and dislocations; financing risks and access to additional capital; risks related to guidance estimates and uncertainties inherent in the preparation of feasibility studies; uncertainty in estimates of production, capital, and operating costs and potential production and cost overruns; the fluctuating price of gold and silver; unknown labilities in connection with acquisitions; global financial conditions; uninsured risks; climate change risks; competition from other companies and individuals; conflicts of interest; risks related to compliance with anti-corruption laws; volatility in the market price of the Company’s securities; assessments by taxation authorities in multiple jurisdictions; foreign currency fluctuations; the Company’s limited operating history; litigation risks; the Company’s ability to identify, complete, and successfully integrate acquisitions; intervention by non-governmental organizations; outside contractor risks; risks related to historical data; the Company not having paid a dividend; risks related to the Company’s foreign subsidiaries; risks related to the Company’s accounting policies and internal controls; the Company’s ability to satisfy the requirements of Sarbanes-Oxley Act of 2002; enforcement of civil liabilities; the Company’s status as a passive foreign investment company for U.S. federal income tax purposes; information and cyber security; the Company’s significant Shareholders; gold industry concentration; shareholder activism; other risks associated with executing the Company’s objectives and strategies; as well as those risk factors discussed in this Circular, the Company’s most recently filed management’s discussion and analysis, and its annual information form dated March 19, 2024, which are available on www.sedarplus.ca and www.sec.gov. Except as required by the securities disclosure laws and regulations applicable to the Company, the Company undertakes no obligation to update these forward-looking statements if Management’s beliefs, estimates or opinions, or other factors, should change.

Cautionary Note to U.S. Readers

This Circular has been prepared in accordance with Canadian standards for the reporting of mineral resource and mineral reserve estimates, which differ from the previous and current standards of the United States securities laws. In particular, and without limiting the generality of the foregoing, the terms “mineral reserve”, “proven mineral reserve”, “probable mineral reserve”, “inferred mineral resources,”, “indicated mineral

resources,” “measured mineral resources” and “mineral resources” used or referenced herein and the documents incorporated by reference herein, as applicable, are Canadian mineral disclosure terms as defined in accordance with Canadian National Instrument 43-101 — Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) — CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the “CIM Definition Standards”). For United States reporting purposes, the United States Securities and Exchange Commission (the “SEC”) has adopted amendments to its disclosure rules (the “SEC Modernization Rules”) to modernize the mining property disclosure requirements for issuers whose securities are registered with the SEC under the Exchange Act, which became effective February 25, 2019. The SEC Modernization Rules more closely align the SEC’s disclosure requirements and policies for mining properties with current industry and global regulatory practices and standards, including NI 43-101, and replace the historical property disclosure requirements for mining registrants that were included in SEC Industry Guide 7. Issuers were required to comply with the SEC Modernization Rules in their first fiscal year beginning on or after January 1, 2021. As a foreign private issuer that is eligible to file reports with the SEC pursuant to the multi-jurisdictional disclosure system, the Company is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101 and the CIM Definition Standards. Accordingly, mineral reserve and mineral resource information contained or incorporated by reference herein may not be comparable to similar information disclosed by United States companies subject to the United States federal securities laws and the rules and regulations thereunder. As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources.” In addition, the SEC has amended its definitions of “proven mineral reserves” and “probable mineral reserves” to be “substantially similar” to the corresponding CIM Definition Standards that are required under NI 43-101. While the SEC will now recognize “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources”, U.S. investors should not assume that all or any part of the mineralization in these categories will be converted into a higher category of mineral resources or into mineral reserves without further work and analysis. Mineralization described using these terms has a greater amount of uncertainty as to its existence and feasibility than mineralization that has been characterized as reserves. Accordingly, U.S. investors are cautioned not to assume that all or any measured mineral resources, indicated mineral resources, or inferred mineral resources that the Company reports are or will be economically or legally mineable without further work and analysis. Further, “inferred mineral resources” have a greater amount of uncertainty and as to whether they can be mined legally or economically. Therefore, U.S. investors are also cautioned not to assume that all or any part of inferred mineral resources will be upgraded to a higher category without further work and analysis. Under Canadian securities laws, estimates of “inferred mineral resources” may not form the basis of feasibility or pre-feasibility studies, except in rare cases.

While the above terms are “substantially similar” to CIM Definitions, there are differences in the definitions under the SEC Modernization Rules and the CIM Definition Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as “proven mineral reserves”, “probable mineral reserves”, “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules or under the prior standards of SEC Industry Guide 7.

Non-GAAP Measures

The Company has included certain performance measures in this Circular which are not specified, defined, or determined under generally accepted accounting principles (in the Company’s case, IFRS). These are common performance measures in the gold mining industry, but because they do not have any mandated standardized definitions, they may not be comparable to similar measures presented by other issuers. Accordingly, the Company uses such measures to provide additional information, and you should not consider them in isolation or as a substitute for measures of performance prepared in accordance with generally accepted accounting principles.

All-In Sustaining Cost

The Company has provided AISC performance measures that reflect all the expenditures that are required to produce an ounce of gold from operations. While there is no standardized meaning of the measure across the industry, the Company's definition conforms to the AISC definition as set out by the World Gold Council in its guidance dated November 14, 2018. Orla believes that this measure is useful to market participants in assessing operating performance and the Company's ability to generate cash flow from operating activities.

Cash Costs

The Company calculated total cash costs as the sum of operating costs, royalty costs, production taxes, refining and shipping costs, net of by-product silver credits. Cash costs per ounce is calculated by taking total cash costs and dividing such amount by payable gold ounces. While there is no standardized meaning of the measure across the industry, the Company believes that this measure is useful to external users in assessing operating performance.

SUMMARY

The following information is a summary of the contents of this Circular. This summary is provided for convenience only and the information contained in this summary should be read in conjunction with, and is qualified in its entirety by, the more detailed information and financial data and statements contained elsewhere in this Circular or incorporated by reference herein. All defined terms used herein are as defined elsewhere in the Circular. The full text of the Share Purchase Agreement is available under the Company’s profile on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov.

Date and Place of the Meeting

The Meeting will be held on January 21, 2025 at 8:00 a.m. (Vancouver Time) in person at Suite 3500 –1133 Melville Street, Vancouver, British Columbia V6E 4E5.

Purpose of the Meeting

The purpose of the Meeting is to consider the proposed Transaction and related matters and, if deemed advisable, pass, with or without variation, resolutions to approve all matters relating to the Transaction including the Acquisition Resolution and the Financing Resolution, as more particularly disclosed in this Circular.

Parties

The Company is a reporting issuer in all the provinces and territories of Canada, and the outstanding Common Shares of the Company are listed on the TSX under the symbol "OLA" and the NYSE American under the symbol “ORLA”. See the section entitled "Information Relating to the Company".

GCL is a private company incorporated under the federal laws of Canada and a wholly-owned subsidiary of Goldcorp Inc. which, in turn, is a wholly owned subsidiary of Newmont. GCL owns a 100% interest in the Musselwhite Mine. See the section entitled “Information Relating to GCL".

Interests of Certain Persons in the Acquisition

Scott Langley, a director of the Company, is also an officer of Newmont which may constitute a disclosable interest within the meaning of Section 120(1) of the CBCA and, accordingly pursuant to Section 120(5) of the CBCA, Mr. Langley has disclosed his interest in the Transaction and abstained from participating in any discussions and voting on all resolutions of the Board concerning the Transaction.

Overview of Transaction

On November 17, 2024, the Company, together with the Purchaser, entered into the Share Purchase Agreement to acquire Musselwhite Mine in Ontario from GCL for upfront cash consideration of US$810,000,000 and gold- price linked contingent consideration of US$40,000,000, to be paid, if payable, on the first and second anniversary of the Closing Date subject to the specified threshold gold price at such times.

The cash consideration will be financed through a combination of the Company’s existing undrawn debt capacity, new indebtedness, a gold pre-pay facility, and convertible notes offering led by the Company’s existing cornerstone investors. There is no upfront equity dilution associated with the Transaction.

See the section entitled "The Transaction".

Business of the Meeting

At the Meeting, Shareholders will be asked to (a) approve the Transaction, and (b) approve the Concurrent Private Placement, by voting in favour of the Acquisition Resolution and the Financing Resolution, respectively. See Schedule “A” hereto, for the full text of the Shareholders Resolutions.

Shareholder approval of the Transaction and the Concurrent Private Placement are conditions precedent to the completion of the Transaction. The resolutions set out in paragraphs (a) to (b) above are interdependent and therefore, in the event either of these resolutions are not passed at the Meeting, the Transaction will not be completed, and the Share Purchase Agreement will be terminated.

See the section entitled “Particulars of Matters to be Acted Upon at the Meeting”.

Reasons for the Transaction

In reaching its conclusion to approve the Transaction and related matters, and unanimously (with Mr. Langley abstaining) recommending that Shareholders vote in favour of the Shareholders Resolutions, the Board considered, among other things, the following factors:

| · | Acquisition of a high-quality, long-life, producing gold mine: Musselwhite Mine is an established operation with nearly 6 Moz of gold produced over the past 28 years, 1.5 Moz of gold reserves with additional mineral resources, as well as identified upside potential supporting opportunities for significant mine life extension. The mineralization at Musselwhite Mine is hosted in a banded iron formation (BIF) that remains open along a known strike extent, at least one kilometre beyond the current reserves. The total mining and exploration lease covers over 65,000 hectares. |

| · | Strategic entry into Canada establishing an enhanced North American presence: Strengthened portfolio diversification with entry into Ontario, Canada – a tier one mining jurisdiction. Located in a mining-friendly region with a strong work force and robust stakeholder support, the operation benefits from a stable operating environment that further enhances its long-term value. The combination of quality assets in Ontario, Canada, Nevada, United States, and Zacatecas, Mexico creates a premier North America focused gold company. |

| · | Immediately increases annual gold production by 140% to over 300,000 ounces at competitive costs: Pro forma annual gold production of over 300,000 ounces at combined AISC3 of US$1,080/oz4. Through the development of South Railroad in Nevada, the Company has a pathway to annual production of 500,000 ounces at industry leading costs. |

| · | No upfront equity dilution with significant support from cornerstone shareholders: Attractive transaction financing package including bank-provided debt and a gold prepay, as well as a placement of the Notes led by Fairfax, Pierre Lassonde and Trinity Capital Partners Corporation (“Trinity”), allows shareholders to retain exposure to the Company's increasing net asset value with no upfront equity dilution. |

| · | Accretive to key metrics: The Transaction is expected to be significantly accretive to operating and free cash flow, gold production and gold reserves and resources, all on a per share basis. |

| · | Strengthened cash flow generation to support growth pipeline: Musselwhite Mine is expected to generate over US$150,000,000 in average annual cash flow over the next 6 years. The combined cash flows of Camino Rojo and Musselwhite Mine will allow the Company to self-fund continued investment in its growth pipeline. This includes Musselwhite Mine's growth development, the South Railroad Project, development of the Camino Rojo sulphides project, and exploration in all three countries. The Company has a robust cash position of approximately US$150,000,000 as of December 9, 2024. |

3 Non-GAAP measure. Excludes exploration and project growth spending. Refer to the “Non-GAAP Measures” section of this Circular.

4 Based on combined 2024 guidance Orla (Midpoint of 130-140koz and "low end" of US$800-900/oz AISC) and Musselwhite Mine LoM averages as per the Technical Report (as defined below) (202 koz and US$1,269/oz AISC).

| · | Musselwhite is well suited to Orla's technical capabilities: The Company's experienced management team boasts in-depth experience developing and operating underground mines, including many in Canada, and is supplemented by the Board's operating history with the asset. |

| · | Increased leverage to strong gold price environment: Production uplift from Musselwhite Mine increases exposure to the current record gold price environment. |

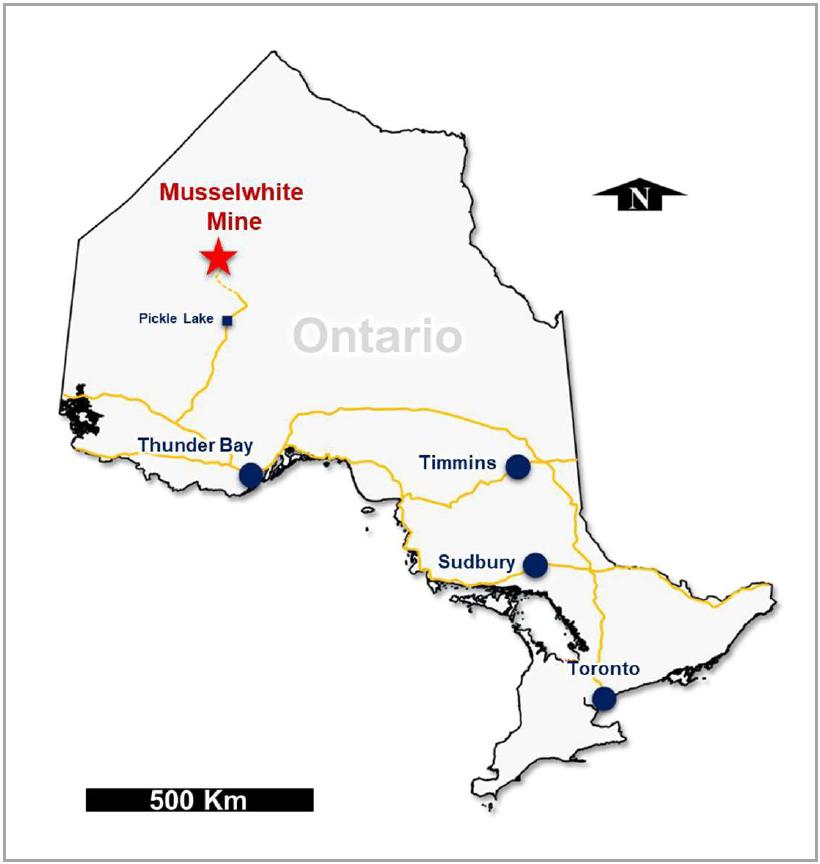

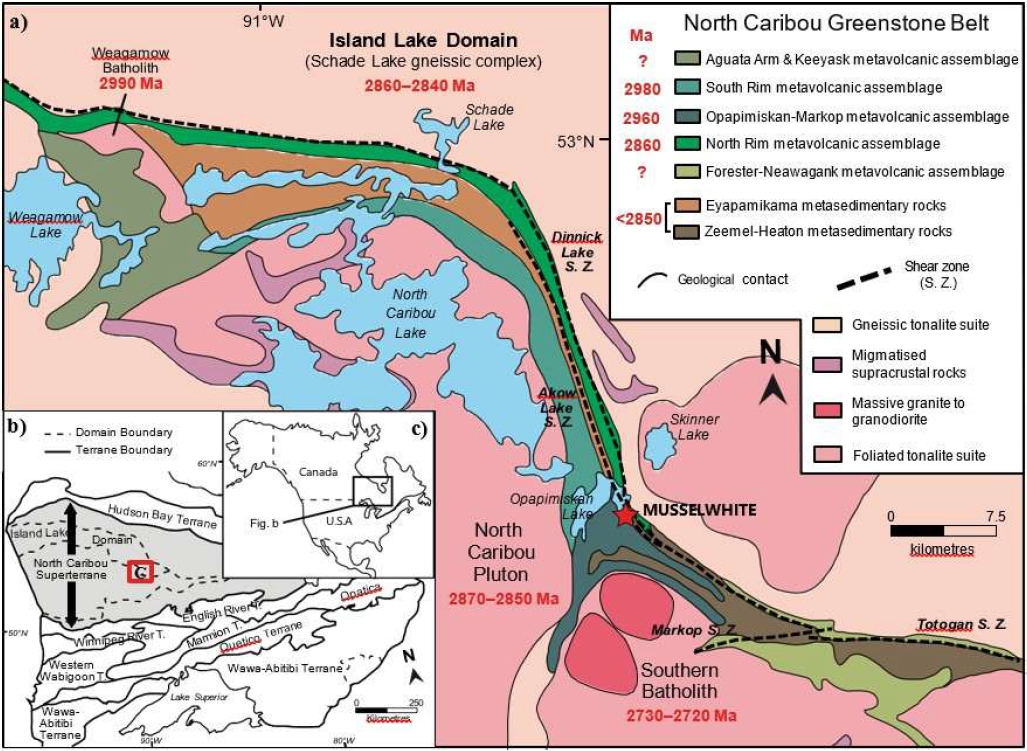

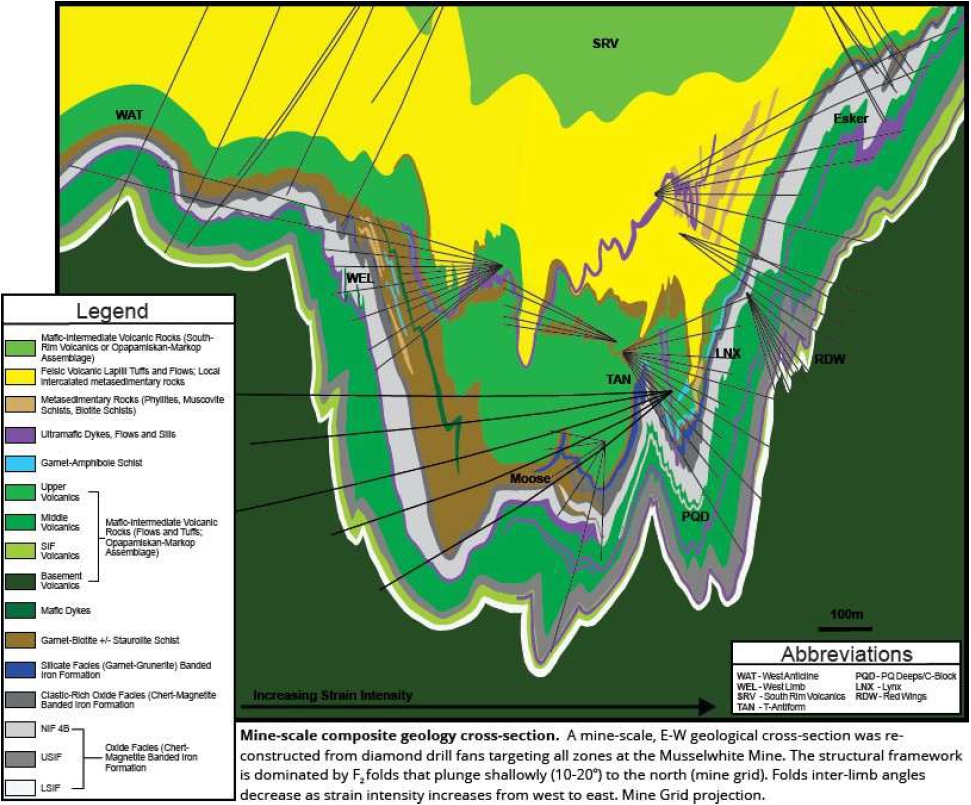

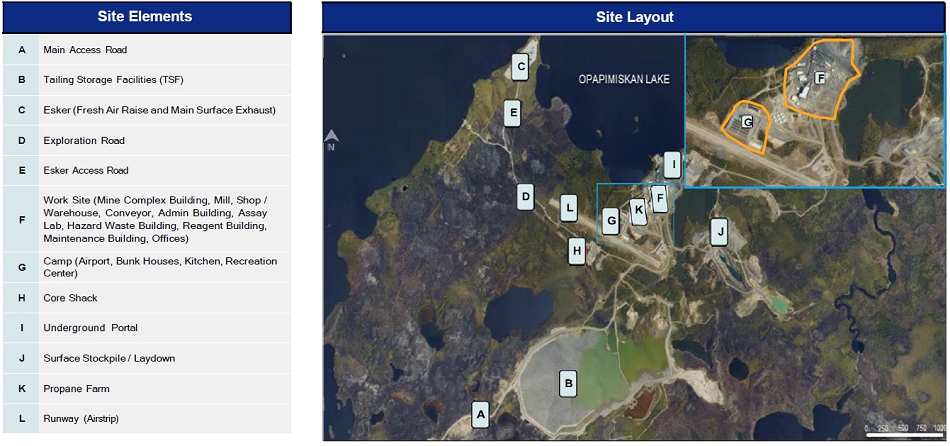

The Musselwhite Mine

The Musselwhite Mine property is located in the Patricia Mining District in north-western Ontario, on traditional territory of North Caribou Lake First Nation, in the Kenora District of Ontario, Canada. The Musselwhite Mine is comprised of 940 exploration claims and 338 mining leases, 100% owned by GCL, issued under the Ontario Mining Act. Musselwhite is a producing, underground gold mine that has been in operation for over 25 years, having produced close to 6,000,000 ounces of gold to date, with a long history of resource growth and conversion.

Current as of December 31, 2023, proven gold reserves contained 707,000 ounces (3,250,000 tonnes at grade of 6.76 g/t Au) and probable gold reserves contained 766,000 ounces (4,100,000 tonnes at grade of 5.81 g/t Au) within a measured and indicated resource5 of 1,800,000 ounces (9,520,000 tonnes at 5.78 g/t Au) and an inferred resource of 190,000 ounces (1,200,000 tonnes at 4.96 g/t Au).

The Company commissioned an independent NI 43-101 technical report for Musselwhite Mine in connection with the Transaction. Based only on the current reserves, Musselwhite Mine has a seven-year mine life (2024- 2030) with average annual gold production of 202 koz at US$1,269/oz AISC6.

See section entitled “The Musselwhite Mine – Technical Report”.

Selected Unaudited Pro Forma Combined Financial Information

| | | Nine months ended

September 30, 2024 | | | Year ended

December 31, 2023 | |

| | | US$ 000’s | | | US$ 000’s | |

| Income statement information: | | | | | | | | |

| Revenue | | $ | 608,533 | | | $ | 584,357 | |

| Net income (loss) | | | 80,969 | | | | (368,891 | )7 |

| Earnings (loss) per share | | $ | 0.25 | | | $ | (1.18 | ) |

5 Inclusive of mineral reserves.

6 Non-GAAP measure. Excludes exploration and project growth spending. Refer to the “Non-GAAP Measures” section of this Circular.

7 This loss includes (a) $72.7 million impairment of the Cerro Quema project in December 2023, and (b) an impairment charge of $292.9 million on goodwill at Musselwhite. Had the Transaction occurred, the impairment charge at Musselwhite Mine would have been included in the computations for consideration given and net assets acquired and would not have been recognized.

| | | As at

September 30, 2024 | |

| | | US$000’s | |

| Balance sheet information: | | | | |

| Current assets | | $ | 181,613 | |

| Mineral properties | | | 1,489,642 | |

| Other long-term assets | | | 8,026 | |

| Total assets | | $ | 1,679,281 | |

| | | | | |

| Current liabilities | | $ | 423,473 | |

| Long term liabilities | | | 760,951 | |

| Equity | | | 494,857 | |

| Total liabilities and equity | | $ | 1,679,281 | |

This summary unaudited pro forma combined financial information is not intended to be indicative of the results that would actually have occurred, or the results expected in future periods, had the events reflected herein occurred on the dates indicated. Actual amounts recorded upon consummation of the Transaction could differ materially from the pro forma information presented above.

See section entitled “The Musselwhite Mine – Selected Unaudited Pro Forma Combined Financial Information” and Schedule “B” to this Circular.

The Transaction

Pursuant to the Share Purchase Agreement, the Company, through the Purchaser, will acquire a 100% interest in the Musselwhite Mine through the purchase from GCL, or an affiliate thereof, of all the issued and outstanding shares of Musselwhite Mine Ltd.

In consideration for the Purchased Shares, the Purchaser has agreed to pay:

| a. | US$810,000,000 in cash, representing the Base Purchase Price, on the Closing Date; |

| b. | US$20,000,000 in cash, by no later than ten (10) business days following the first anniversary of the Closing Date, unless the average spot gold price is equal to or less than US$2,900/oz during the period commencing on the Closing Date and ending on first anniversary thereof, in which case the First Deferred Amount will be reduced to US$0; and |

| c. | US$20,000,000 in cash no later than ten (10) business days following the second anniversary of the Closing Date, unless the average spot gold price is equal to or less than US$3,000/oz during the period commencing on the first anniversary of the Closing Date and ending on second anniversary thereof, in which case the Second Deferred Amount will be reduced to US$0. |

See the section entitled "The Share Purchase Agreement – Consideration".

The Company has arranged the following financing commitments in order to fund the Base Purchase Price of the Transaction:

| · | Credit Facility: US$150,000,000 available under the Company’s existing revolving credit facility and a new US$100,000,000 term loan with a syndicate of lenders comprised of the Bank of Nova Scotia, Bank of Montreal, Canadian Imperial Bank of Commerce and ING Capital LLC. |

| · | Concurrent Private Placement: Pursuant to the Subscription Letter executed by each of Fairfax, Pierre Lassonde, and Trinity, the Subscribers have committed on behalf of themselves and their affiliates to subscribe for Notes in the aggregate principal amount of US$200,000,000. |

| · | Gold Prepay Facility: Pursuant to the Gold Prepay Letters with each of the Bank of Montreal, Canadian Imperial Bank of Commerce and ING Capital Markets LLC, the Gold Prepay Lenders have committed, subject to the terms and conditions therein, to provide a gold prepay to the Company in the amount of US$360,000,000 as set forth in the Gold Prepay Letters. |

See the sections entitled "Source of Funds and Expenses for the Proposed Transaction" and “The Concurrent Private Placement”.

See the section entitled "The Transaction".

Formal Valuation

Pursuant to the Davidson Engagement Letter dated October 31, 2024, the Board retained Davidson to prepare the Formal Valuation in connection with the Transaction and to provide the Formal Valuation as to the fair market value of the Musselwhite Mine in accordance with MI 61-101. The Board concluded that Davidson is qualified and independent for the purposes of MI 61-101.

Davidson delivered to the Board the results of the Formal Valuation opining that, as of the date of the Share Purchase Agreement, subject to the assumptions, limitations and qualifications set forth therein, the fair market value of Musselwhite Mine is between US$910,000,000 and US$940,000,000.

See the section entitled “The Transaction – Formal Valuation” and Schedule “C” of this Circular.

The Concurrent Private Placement

In connection with the Transaction, the Company has entered into the Subscription Letter with Fairfax, Pierre Lassonde, and Trinity for a non-brokered private placement of Notes in an aggregate principal amount of US$200,000,000. The Notes will have the following terms:

| · | Interest Rate: 4.5% per annum, payable in cash. |

| · | Maturity: Five years from the date of issuance. |

| · | Conversion Right: The Notes may be converted in full or in part at any time prior to the maturity date, by the holder thereof, into Common Shares. |

| · | Conversion Price: The initial conversion price for the Notes will be C$7.90 (approximately US$5.64) per Share. The Conversion Price represents a premium of 37% relative to the five-day volume-weighted average price of the Common Shares on the TSX as of market close on November 15, 2024, the last trading day prior to the execution of the Subscription Letter, and will be subject to standard anti- dilution adjustments. For the purposes of conversion, the Conversion Price will be converted into U.S dollars using a fixed exchange rate of $1.40 Canadian dollars per US dollar ($0.714 USD/CAD). |

| · | Redemption Right: After the 18-month anniversary of the issuance, the Company may redeem the Notes, provided that the 20-day volume weighted average price of the Common Shares is not less than 130% of the Conversion Price. Upon redemption, the Notes will convert into Common Shares at the Conversion Price. |

| · | Warrants: On closing, each holder of the Notes will receive, for each Common Share issuable upon conversion thereof, 0.66 Warrants. The Warrants shall have an exercise price of C$11.50 per Common Share and shall expire on the fifth anniversary of the closing of the Concurrent Private Placement. |

The Concurrent Private Placement is expected to close concurrently with and is conditional on the closing of the Transaction.

In aggregate, 58,835,441 Common Shares are issuable pursuant to the Concurrent Private placement, reflecting the sum of 35,443,037 Common Shares issuable upon conversion of all Notes and 23,392,404 Common Shares issuable upon the exercise of all Warrants, and representing approximately 18.3% of the issued and outstanding Common Shares as of the Record Date.

The Concurrent Private Placement is also subject to approval of the TSX and NYSE American. Pursuant to section 604(a)(ii) and 607(g)(ii) of the TSX Company Manual, the TSX requires shareholder approval to be obtained for private placements to “insiders” (as defined in the TSX Company Manual) for listed securities, options or other entitlements to listed securities greater than 10% of the number of securities of the issuer, on a non-diluted basis, prior to the date of closing of the private placement. As the Concurrent Private Placement will result in more than 10% of the issued and outstanding Common Shares being made issuable to insiders of the Company, the Concurrent Private Placement is subject to the approval by an ordinary resolution of the Shareholders, excluding the votes attached to the Common Shares owned or controlled by Newmont, Fairfax and Mr. Lassonde and their respective joint actors, if any.

See the sections entitled “The Concurrent Private Placement”.

Control Person Issuance

Upon consummation of the Concurrent Private Placement Fairfax will receive sufficient Notes and Warrants to, upon conversion and exercise thereof, materially effect control of the Company. As such, the issuance of Notes to Fairfax forms part of the Financing Resolution and is, according to section 604(a)(i) of the TSX Company Manual, subject to an ordinary resolution of the Shareholders, excluding Common Shares owned or controlled by Fairfax, and its respective joint actors, if any, pursuant to the TSX Company Manual. See sections entitled “Control Person Issuance” and “The Concurrent Private Placement Under MI 61-101”.

MI 61-101

Newmont, as a holder of more than 10% of the voting rights attached to the outstanding Common Shares, is a "related party" of the Company under MI 61-101 and, therefore, the Transaction is a “related party transaction”, which requires among other things that (i) the Transaction receive majority approval of the Shareholders, excluding all Common Shares held by Newmont or any of its affiliates, and (ii) the Company obtain a formal valuation relating to assets acquired pursuant to the Transaction. In addition to the requirements of MI 61-101, minority shareholder approval of the Transaction is required pursuant to sections 501(c) and 604(a)(ii) of the TSX Company Manual. See the section entitled "The Transaction Under MI 61-101".

Fairfax and Mr. Lassonde also hold more than 10% of the voting rights attached to the outstanding Common Shares and are, therefore, "related parties" of the Company as defined under MI 61-101. As such, the issuance of the Convertible Notes and Warrants to Fairfax and Mr. Lassonde is a "related party transaction" within the meaning MI 61-101. However, as neither the fair market value of the securities acquired, nor the consideration for the securities paid, insofar as it involves Fairfax and Mr. Lassonde, exceeds 25% of the Company's market capitalization, the issuance of securities is exempt from the formal valuation requirements of Section 5.4 of MI 61-101 pursuant to Subsection 5.5(a) of MI 61-101 and exempt from the minority approval requirements of Section 5.6 of MI 61-101 pursuant to Subsection 5.7(1)(a) of MI 61-101. See the sections entitled “The Concurrent Private Placement Under MI 61-101”.

Voting Support Agreements

The directors and officers of the Company, along with certain key Shareholders, namely Pierre Lassonde, Fairfax, Trinity, and Agnico Eagle (collectively with Newmont, the “Supporting Shareholders”), have entered into voting support agreements (“Voting Agreements”) with the Company, the Purchaser and GCL and under which they have agreed, among other things, to vote in favour of the Transaction and the Concurrent Private Placement.

Newmont has also agreed to vote in favour of the Concurrent Private Placement pursuant to the Share Purchase Agreement. Irrespective of the Voting Agreements and the Share Purchase Agreement, the votes of Fairfax, Mr. Lassonde and Newmont will be excluded from calculating approval of the Shareholders Resolutions. Collectively, the Supporting Shareholders represent (i) in aggregate approximately 52% of the Common Shares and (ii) 19.05% of the Common Shares eligible to vote on the Acquisition Resolution approving the Transaction and the Financing Resolution approving the Concurrent Private Placement, respectively (excluding the Common Shares held by Newmont, Fairfax and Mr. Lassonde, and their respective joint actors, if any).

Recommendation of the Board

The Board (with Mr. Langley abstaining), having considered all factors it has deemed to be necessary to be considered, unanimously recommends the approval of the Shareholders Resolutions to be presented to the Shareholders at the Meeting. See the section entitled “Particulars of Matters to be Acted Upon at the Meeting – Recommendation of the Board”.

Risk Factors

The Company is subject to a number of risk factors related to the Transaction, the Financings, the Musselwhite Mine, and other related matters, as set out in this Circular. Shareholders should carefully consider these risk factors. See the section entitled “Risk Factors”.

SOLICITATION OF PROXIES AND VOTING INSTRUCTIONS

SUMMARY OF MATTERS TO BE VOTED ON AT THE MEETING

No: | | Description: | | Board’s Recommendation: | | Further Information: |

| 1. | | Approval of the transaction to acquire the Musselwhite Mine (as defined below) along with all related property and assets. | | FOR | | Page 50 |

| | | | | | | |

| 2. | | Approval of a private placement to certain insiders of the Company and such issuances thereunder as to materially affect control of the Company. | | FOR | | Page 65 |

SOLICITATION OF PROXIES

It is anticipated that the solicitations will be made primarily by mail in relation to the delivery of the Circular. Proxies may also be solicited personally or by telephone by directors, officers or employees of the Company at nominal cost. The cost of the solicitation will be borne by the Company. The Company has also retained Laurel Hill Advisory Group Company (“Laurel Hill”), as its proxy solicitation agent, to assist in the solicitation of proxies with respect to the matters to be considered at the Meeting. For these services, Laurel Hill will receive C$60,000 advisory fee, in addition to a fee for retail shareholder calls and certain out-of-pocket expenses.

The Company has arranged for Intermediaries (as defined below) to forward the Meeting Materials (as defined below) to Non-Registered Shareholders and the Company will reimburse the Intermediaries for their reasonable fees and disbursements in that regard.

This solicitation of proxies and voting instruction forms involves securities of a Company located in Canada and is being effected in accordance with the applicable corporate and securities laws of Canada. The proxy solicitation rules under the United States Securities Exchange Act of 1934, as amended (the “Exchange Act”), are not applicable to the Company or this solicitation. Shareholders should be aware that disclosure and proxy solicitation requirements under the applicable securities laws of Canada and the Toronto Stock Exchange (“TSX”) differ from the disclosure and proxy solicitation requirements under United States securities laws.

APPOINTMENT AND REVOCATION OF PROXIES

The person(s) designated by Management in the enclosed form of proxy are directors and/or officers of the Company (the “Management Proxyholders”). Each Shareholder has the right to appoint as proxyholder a person (who need not be a Shareholder) other than Management Proxyholders to represent the Shareholder at the Meeting or at any adjournment or postponement thereof. Such right may be exercised by striking out the names of the person(s) printed in the accompanying form of proxy and inserting the name of the person in the blank space provided in the enclosed form of proxy or by completing another suitable form of proxy and, in either case, delivering the completed and executed form of proxy as provided below.

If you are a Non-Registered Shareholder and wish to vote at the Meeting, you have to insert your own name in the blank space provided on the voting instruction form or form of proxy sent to you by your Intermediary and follow the applicable instructions provided by your Intermediary.

A Registered Shareholder who has submitted a proxy may revoke it at any time prior to the exercise thereof at the Meeting or any adjournment or postponement thereof.

In addition to revocation in any other manner permitted by law, a proxy may be revoked by:

| (a) | executing a proxy bearing a later date or by executing a valid notice of revocation, either of the foregoing to be executed by the Registered Shareholder or such holders’ authorized attorney in writing, or, if such a holder is a corporation, under its corporate seal by an officer or duly authorized attorney, and by delivering the proxy bearing a later date to Computershare at 100 University Avenue, 8th Floor, Toronto, Ontario, M5J 2Y1 or to the address of the registered office of the Company at 1010 - 1075 West Georgia St. Vancouver, BC V6E 3C9, at any time up to and including the last business day that precedes the day of the Meeting or, if the Meeting is adjourned, the last business day that precedes any reconvening thereof, or to the chair of the Meeting on the day of the Meeting or any reconvening thereof, or in any other manner provided by law; or |

| (b) | personally attending the Meeting and voting the Common Shares. |

Upon such deposit, the proxy is revoked. A revocation of a proxy will not affect a matter on which a vote is taken before the revocation.

If you are a Non-Registered Shareholder, please contact your Intermediary or Laurel Hill. Any change or revocation of voting instructions by a Non-Registered Shareholder can take several days or longer to complete and, accordingly, any such action should be completed well in advance of the deadline given in the proxy or voting instruction form by the Intermediary or its service company to ensure it is effective.

VOTING OF PROXIES

On any ballot that may be called for, the Common Shares represented by a properly executed proxy given in favour of the Management Proxyholders will be voted or withheld from voting in accordance with the instructions given on the ballot. If the Shareholder specifies a choice with respect to any matter to be acted upon, the Common Shares will be voted accordingly.

In the absence of any direction in the instrument of proxy, such Common Shares will be voted in favour of the matters set forth in the accompanying Notice of Meeting. The enclosed form of proxy confers discretionary authority upon the persons named therein with respect to amendments or variations to matters identified in the accompanying Notice of Meeting, and with respect to other matters which may properly come before the Meeting or any adjournment or postponement thereof. At the date of this Circular, Management is not aware of any such amendment, variation or other matter to come before the Meeting. However, if any amendments or variations to matters identified in the accompanying Notice of Meeting or any other matters which are not now known to Management should properly come before the Meeting or any adjournment or postponement thereof, the Common Shares represented by properly executed proxies given in favour of the Management Proxyholders will be voted on such matters pursuant to such discretionary authority.

REGISTERED SHAREHOLDERS

In the case of Registered Shareholders, the completed, signed and dated form of proxy should be sent in the addressed envelope enclosed to Computershare Investor Services Inc., Attn: Proxy Department, 100 University Avenue, 8th Floor, Toronto, Ontario M5J 2Yl, or via fax to 1-866-249-7775 (toll free North America) or 1-416-263- 9524 (International). Alternatively, Registered Shareholders may vote by telephone by calling 1-866-732-8683 (toll free) or online via www.investorvote.com. To be effective, a proxy must be received not later than 8:00 a.m. (Vancouver time) on January 17, 2025, or at least 48 hours (excluding Saturdays and holidays), before the time for holding the Meeting or any adjournment thereof.

A Registered Shareholder who has given a proxy may revoke it by depositing an instrument in writing, including another proxy bearing a later date, signed by the Registered Shareholder or by the Registered Shareholder’s attorney, who is authorized in writing, or by transmitting, by telephonic or electronic means, a revocation signed by electronic signature by the Registered Shareholder or by the Registered Shareholder’s attorney, who is

authorized in writing, to the head office of the Company at any time up to and including the last business day preceding the day of the Meeting, or in the case of any adjournment or postponement of the Meeting, the last business day preceding the day of the adjournment or postponement, or by attending the Meeting in-person and complying with the instructions as provided thereat. A Registered Shareholder may also revoke a proxy in any other manner permitted by law. Only Registered Shareholders have the right to revoke a proxy. A Non- Registered Shareholder who wishes to change its vote must arrange for its Intermediary to revoke its proxy on its behalf.

NON-REGISTERED HOLDERS

Only Registered Shareholders (or duly appointed proxyholders) are permitted to vote at the Meeting. However, in many cases, Shareholders are “non-registered” Shareholders because the Common Shares they own are not registered in their names, but are instead registered in the name of the brokerage firm, bank or trust company through which they purchased the Common Shares. More particularly, a person is not a Registered Shareholder in respect of Common Shares which are held on behalf of that person, but which are registered either: (a) in the name of an intermediary (an “Intermediary”) that the Non-Registered Shareholder deals with in respect of the Common Shares (Intermediaries include, among others, banks, trust companies, securities dealers or brokers and trustees or administrators of self-administered RRSPs, RRIFs, RESPs and similar plans); or (b) in the name of a clearing agency (such as The Canadian Depository for Securities Limited) of which the Intermediary is a participant. Non-Registered Shareholders do not appear on the list of Shareholders maintained by the transfer agent.

Non-Registered Shareholders who have not objected to their Intermediary disclosing certain ownership information about themselves to the Company are referred to as Non-Objecting Beneficial Owners (“NOBOs”). Those Non-Registered Shareholders who have objected to their Intermediary disclosing ownership information about themselves to the Company are referred to as Objecting Beneficial Owners.

In accordance with applicable securities law requirements, the Company will have distributed copies of the Notice of Meeting, this Circular, the form of proxy or voting instruction form and the supplemental mailing list request card (collectively, the “Meeting Materials”) to the clearing agencies and Intermediaries for distribution to Non-Registered Shareholders. The Company intends to pay for Intermediaries to deliver the Meeting Materials to Non-Registered Shareholders.

Intermediaries are required to forward the Meeting Materials to Non-Registered Shareholders unless a Non- Registered Shareholder has waived the right to receive them. Very often, Intermediaries will use service companies to forward the Meeting Materials to Non-Registered Shareholders. The majority of Intermediaries now delegate responsibility for obtaining instructions from Non-Registered Shareholders to Broadridge Financial Solutions, Inc. (“Broadridge”). Broadridge typically mails a voting instruction form to Non-Registered Shareholders and asks Non-Registered Shareholders to return the VIF to Broadridge. The Company may utilize Broadridgeʼs QuickVote TM system to assist eligible NOBOs with voting their Common Shares over the

telephone.

Generally, Non-Registered Shareholders who have not waived the right to receive the Meeting Materials will either:

| (a) | be given a form of proxy which has already been signed by the Intermediary (typically by a facsimile, stamped signature), which is restricted as to the number of Common Shares beneficially owned by the Non-Registered Shareholder but which is otherwise not completed. Because the Intermediary has already signed the form of proxy, this form of proxy is not required to be signed by the Non-Registered Shareholder when submitting the proxy. If the Non-Registered Shareholder does not wish to attend and vote at the Meeting in person (or have another person attend and vote on the holder’s behalf), the Non-Registered Shareholder must complete the form of proxy and deposit it with the Company’s registrar and transfer agent, Computershare, as provided above; or |

| (b) | be given a voting instruction form which is not signed by the Intermediary, and which, when properly completed and signed by the Non-Registered Shareholder and returned to the Intermediary or its service company, will constitute voting instructions (often called a “proxy authorization form”), which the Intermediary must follow. Typically, the proxy authorization form will consist of a one-page pre- printed form. Sometimes, instead of the one-page pre-printed form, the proxy authorization form will consist of a regular printed proxy form accompanied by a page of instructions, which contains a removable label containing a barcode and other information. In order for the form of proxy to validly constitute a proxy authorization form, the Non-Registered Shareholder must remove the label from the instructions and affix it to the form of proxy, properly complete and sign the form of proxy and return it to the Intermediary or its service company in accordance with the instructions of the Intermediary or its service company. If the Non-Registered Shareholder does not wish to attend and vote at the Meeting in person (or have another person attend and vote on the holder’s behalf), the voting instruction form must be completed, signed and returned in accordance with the directions on the form. |

In either case, the purpose of this procedure is to permit a Non-Registered Shareholder to direct the voting of the Common Shares which they beneficially own. In addition, an Intermediary subject to the New York Stock Exchange rules and who has not received specific voting instructions from the Non-Registered Shareholder will not be able to vote the Common Shares on all or, as applicable, any matters at the Meeting. Non-Registered Shareholders should carefully follow the instructions of their Intermediary, including those regarding when and where the proxy or proxy authorization form is to be delivered. Only Registered Shareholders have the right to revoke a proxy. A Non-Registered Shareholder who wishes to change its vote must arrange for its Intermediary to revoke its proxy on its behalf.

VOTING AT THE MEETING

The Company will hold its Meeting in-person at 1133 Melville St #3500, Vancouver, BC V6E 4E5. In order to streamline the Meeting process, the Company encourages Shareholders to vote in advance of the Meeting using the voting instruction form or the form of proxy mailed to them with the Meeting Materials. Only Registered Shareholders and duly appointed proxyholders will be able attend and/or vote in-person at the Meeting.

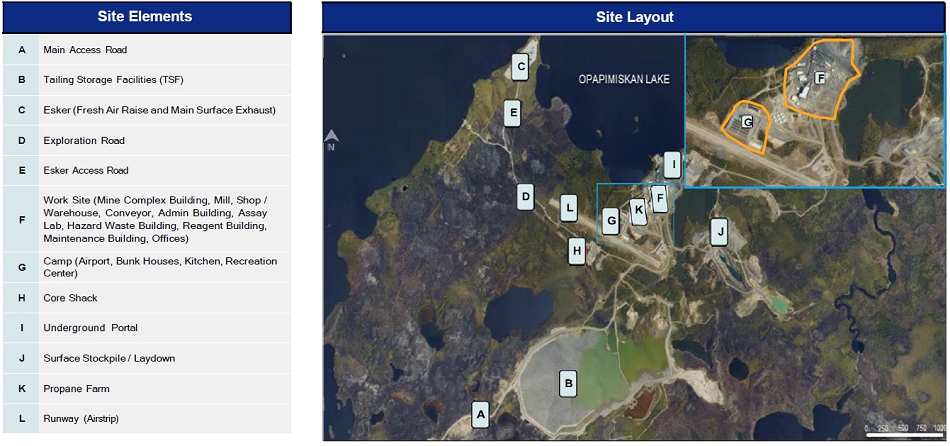

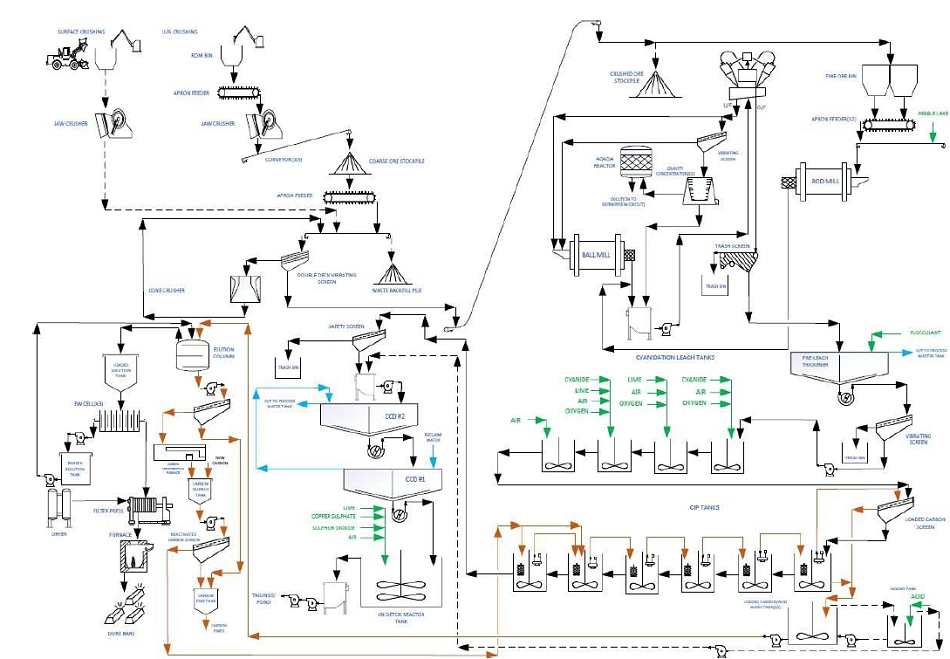

Registered Shareholders and duly appointed proxyholders who participate in the Meeting may ask questions in accordance with the instructions provided at the Meeting. Questions will generally only be addressed during a question period at the end of the Meeting, however, questions regarding procedural matters or directly related to a specific motion may be addressed during the Meeting.