Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| | |

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material under §240.14a-12

|

| | | | |

| WILDHORSE RESOURCE DEVELOPMENT CORPORATION |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

Table of Contents

WILDHORSE RESOURCE DEVELOPMENT CORPORATION

9805 Katy Freeway, Suite 400

Houston, Texas 77024

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 17, 2018

NOTICE IS HEREBY GIVEN that the 2018 Annual Meeting of Stockholders of WildHorse Resource Development Corporation will be held at 9805 Katy Freeway, Suite 400, Houston, Texas 77024 on Thursday, May 17, 2018, at 9:00 a.m. local time. The holders of shares of common stock, par value $0.01 per share ("common stock"), and shares of preferred stock, par value $0.01 per share, designated as "Series A Perpetual Convertible Preferred Stock" ("Preferred Stock"), of WildHorse Resource Development Corporation will, voting together as a single class, be asked to consider the following proposals:

- 1.

- To elect nine members of the board of directors named in this proxy statement to hold office until our 2019 Annual Meeting of Stockholders or until their respective successors are duly elected and qualified; and

- 3.

- To ratify the appointment, by the Audit Committee of the board of directors, of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018.

The holders of the Preferred Stock will, voting as a separate class, also be asked:

- 2.

- To elect two additional members of the board of directors named in this proxy statement to hold office until our 2019 Annual Meeting of Stockholders or until their respective successors are duly elected and qualified.

Holders of common stock and Preferred Stock may be asked to transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof.

These matters are more fully described in the accompanying proxy materials. Only holders of common stock and Preferred Stock at the close of business on March 21, 2018, the record date, are entitled to receive notice of and to vote at the Annual Meeting.

Pursuant to rules adopted by the Securities and Exchange Commission, we have elected to provide access to our proxy solicitation materials primarily via the Internet, rather than mailing paper copies of these materials to each stockholder. Beginning on April 2, 2018, we will mail to each stockholder of record a Notice of Internet Availability of Proxy Materials with instructions on how to access the proxy materials, vote or request paper copies.

| | |

| | By Order of the Board of Directors, |

|

|

|

| | Kyle N. Roane

Executive Vice President, General Counsel and Corporate Secretary |

Houston, Texas

April 2, 2018

Table of Contents

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 17, 2018

This Notice of Annual Meeting and Proxy Statement, along with our 2017 Annual Report on Form 10-K, are available free of charge at http://www.proxyvote.com.

YOUR VOTE IS IMPORTANT

Your vote is important. We urge you to review the accompanying Proxy Statement carefully and to vote as soon as possible so that your shares will be represented at the meeting.

Table of Contents

TABLE OF CONTENTS

| | | | |

INFORMATION ABOUT THE PROXY PROCESS AND VOTING | | | 1 | |

CERTAIN MATTERS RELATING TO PROXY MATERIALS AND ANNUAL REPORT | | | 8 | |

PROPOSAL 1—ELECTION OF DIRECTORS | | | 10 | |

PROPOSAL 2—ELECTION OF DIRECTORS | | | 12 | |

DIRECTORS | | | 13 | |

CORPORATE GOVERNANCE MATTERS | | | 17 | |

DIRECTOR COMPENSATION IN 2017 | | | 22 | |

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS | | | 24 | |

EXECUTIVE OFFICERS | | | 28 | |

EXECUTIVE COMPENSATION | | | 30 | |

EQUITY COMPENSATION PLAN INFORMATION TABLE | | | 46 | |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | | | 47 | |

PROPOSAL 3—RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | | 51 | |

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS | | | 53 | |

Table of Contents

WILDHORSE RESOURCE DEVELOPMENT CORPORATION

9805 Katy Freeway, Suite 400

Houston, Texas 77024

PROXY STATEMENT

2018 ANNUAL MEETING OF STOCKHOLDERS

We have furnished this proxy statement to you because the Board of Directors (the "Board") of WildHorse Resource Development Corporation, a Delaware corporation (referred to herein as the "Company," "WildHorse," "we," "us" or "our"), is soliciting your proxy to vote at our 2018 Annual Meeting of Stockholders (the "Annual Meeting") to be held on Thursday, May 17, 2018, at 9:00 a.m. local time, at 9805 Katy Freeway, Suite 400, Houston, Texas 77024. By granting a proxy, you authorize the persons named in the proxy to represent you and vote your shares at the Annual Meeting or any adjournment or postponement of the Annual Meeting. If you attend the Annual Meeting, you may vote in person.

We provide access to our proxy materials to our stockholders on the Internet. Accordingly, beginning on April 2, 2018, the Company is sending a Notice of Internet Availability of Proxy Materials (the "Notice of Availability") to stockholders. Stockholders will have the ability to access the proxy materials, including this proxy statement and voting instructions, on the website referred to in the Notice of Availability or request a printed set of the proxy materials to be sent to them by following the instructions in the Notice of Availability.

Unless the context indicates or otherwise requires, when we refer to (i) "stockholders" within these proxy materials, we are referring to record holders of our common stock, par value $0.01 per share ("common stock"), and record holders of our preferred stock, par value $0.01 per share, designated as "Series A Perpetual Convertible Preferred Stock" ("Preferred Stock"), and (ii) "shares," we are referring collectively to shares of our common stock and Preferred Stock.

INFORMATION ABOUT THE PROXY PROCESS AND VOTING

Why am I receiving these materials?

We have furnished this proxy statement to you because the Board is soliciting your proxy to vote at the Annual Meeting, including at any adjournments or postponements of the Annual Meeting.

Am I entitled to vote at the Annual Meeting?

Only stockholders of record at the close of business on March 21, 2018, the record date for the Annual Meeting (the "Record Date"), are entitled to receive notice of and to vote at the Annual Meeting. Each record holder of common stock will have one vote for each share of common stock on each matter that is properly brought before the Annual Meeting and on which holders of common stock are entitled to vote. There were 101,281,482 shares of common stock outstanding at the close of business on the Record Date.

Each record holder of Preferred Stock will have a number of votes equal to the largest number of whole shares of common stock into which such shares are convertible on the Record Date on each

1

Table of Contents

matter that is properly brought before the Annual Meeting and on which holders of Preferred Stock are entitled to vote. At the close of business on the Record Date, there were 435,000 shares of Preferred Stock outstanding, which, as of such date were convertible into 32,402,059 shares of common stock. There is no cumulative voting for holders of either common stock or Preferred Stock.

If, on the Record Date, your shares were registered directly in your name with the transfer agent for our shares, EQ Shareowner Services (formerly known as Wells Fargo Shareowner Services), then you are a stockholder of record. As a stockholder of record, you may vote in person at the Annual Meeting or vote by proxy. If you attend the Annual Meeting in person, you may be asked to present valid picture identification, such as a driver's license or passport, to be admitted.

Beneficial Owner: Shares Registered in the Name of a Broker, Bank or Other Agent

If, on the Record Date, your shares were held in an account at a broker, bank, dealer or other similar organization, then you are the beneficial owner of shares held in "street name," and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the Annual Meeting. If you attend the Annual Meeting in person, you may be asked to present valid picture identification, such as a driver's license or passport, and you must present proof of your ownership, such as a current brokerage or bank account statement reflecting ownership as of the Record Date, to be admitted. However, since you are not the stockholder of record, you may not vote your shares in person at the Annual Meeting unless you request and obtain a valid proxy card executed in your favor from your broker, bank, dealer or other holder of record.

Why did I receive a notice in the mail regarding Internet availability of proxy materials instead of a full set of proxy materials?

As permitted under the rules of the Securities and Exchange Commission (the "SEC"), we are making our proxy materials available to our stockholders electronically via the Internet, rather than mailing paper copies of these materials to each stockholder. Beginning on April 2, 2018, the Company is sending the Notice of Availability to its stockholders of record as of the Record Date. You will not receive a printed copy of the proxy materials unless you request one. Instead, the Notice of Availability includes (i) instructions on how to access the Company's proxy materials and vote via the Internet, (ii) the date, time and location of the Annual Meeting, (iii) a description of the matters intended to be acted upon at the Annual Meeting, (iv) a list of the materials being made available electronically, (v) instructions on how a stockholder can request paper copies of the Company's proxy materials, (vi) any control/identification numbers that a stockholder needs to access the proxy materials, and (vii) information about attending the Annual Meeting and voting in person.

Can I vote my shares by filling out and returning the Notice of Availability?

No. The Notice of Availability only identifies the items to be voted on at the Annual Meeting. You cannot vote by marking the Notice of Availability and returning it. The Notice of Availability provides instructions on how to cast your vote. For additional information, please see "—What are the different methods that I can use to vote my shares?" below.

2

Table of Contents

What am I being asked to vote on?

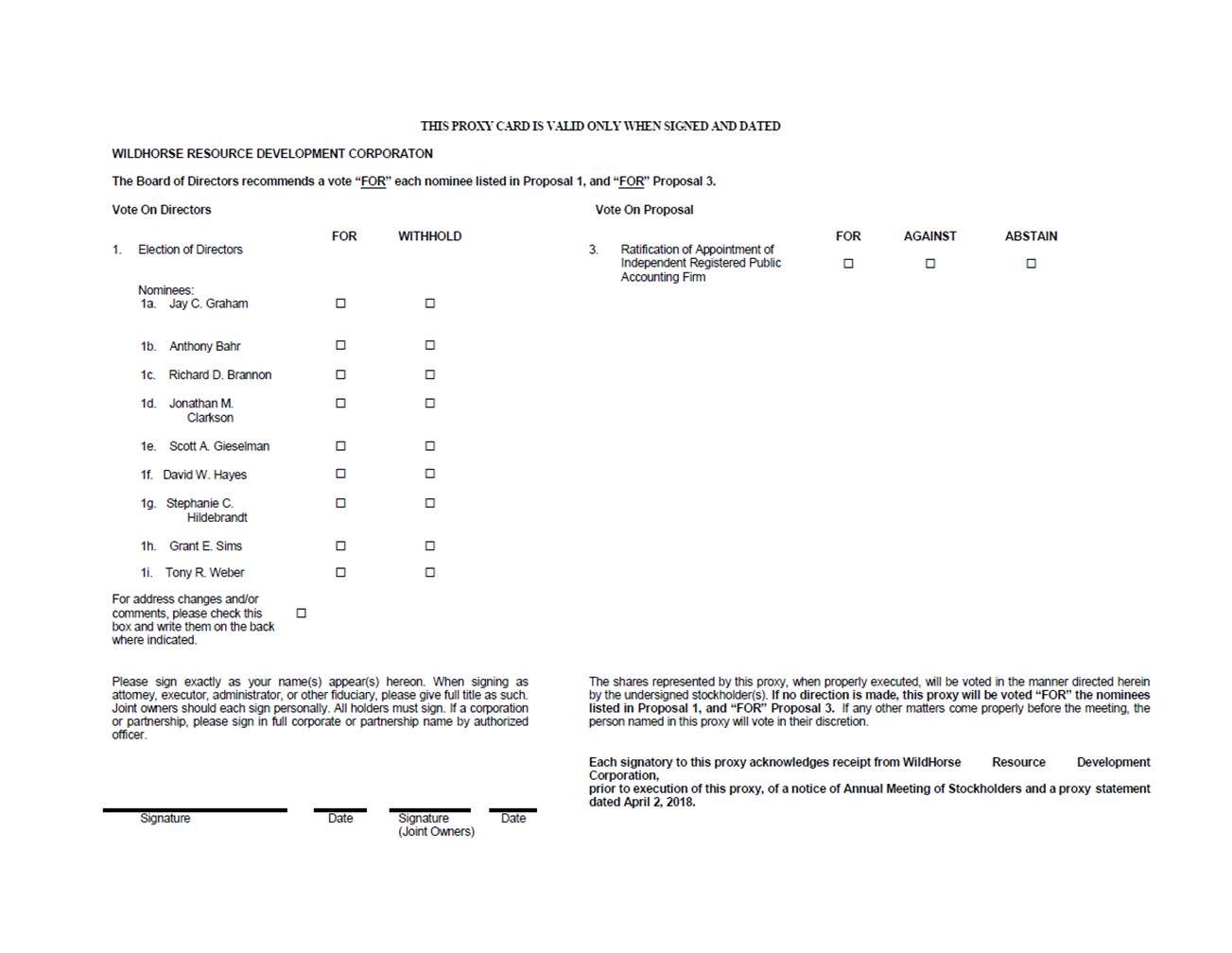

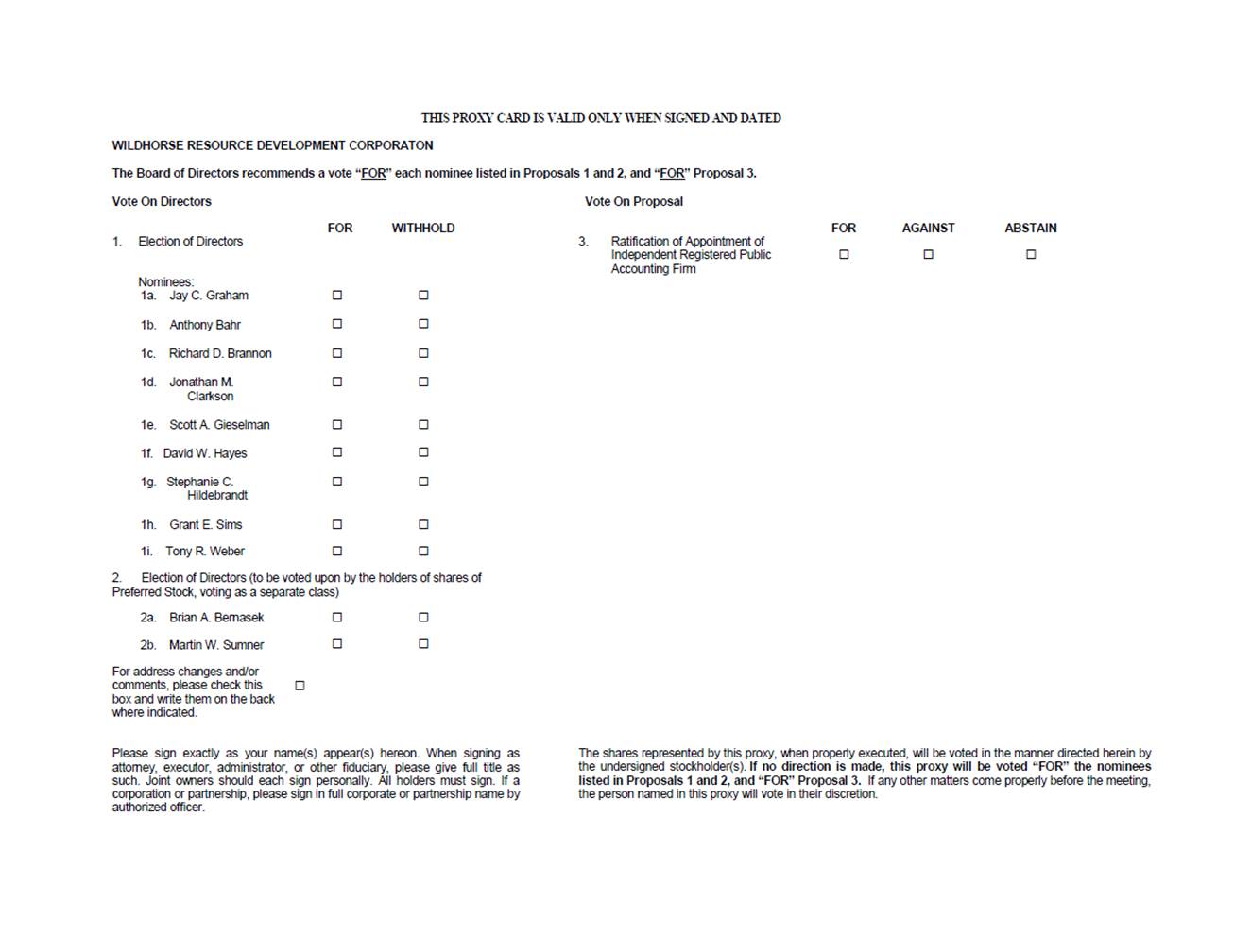

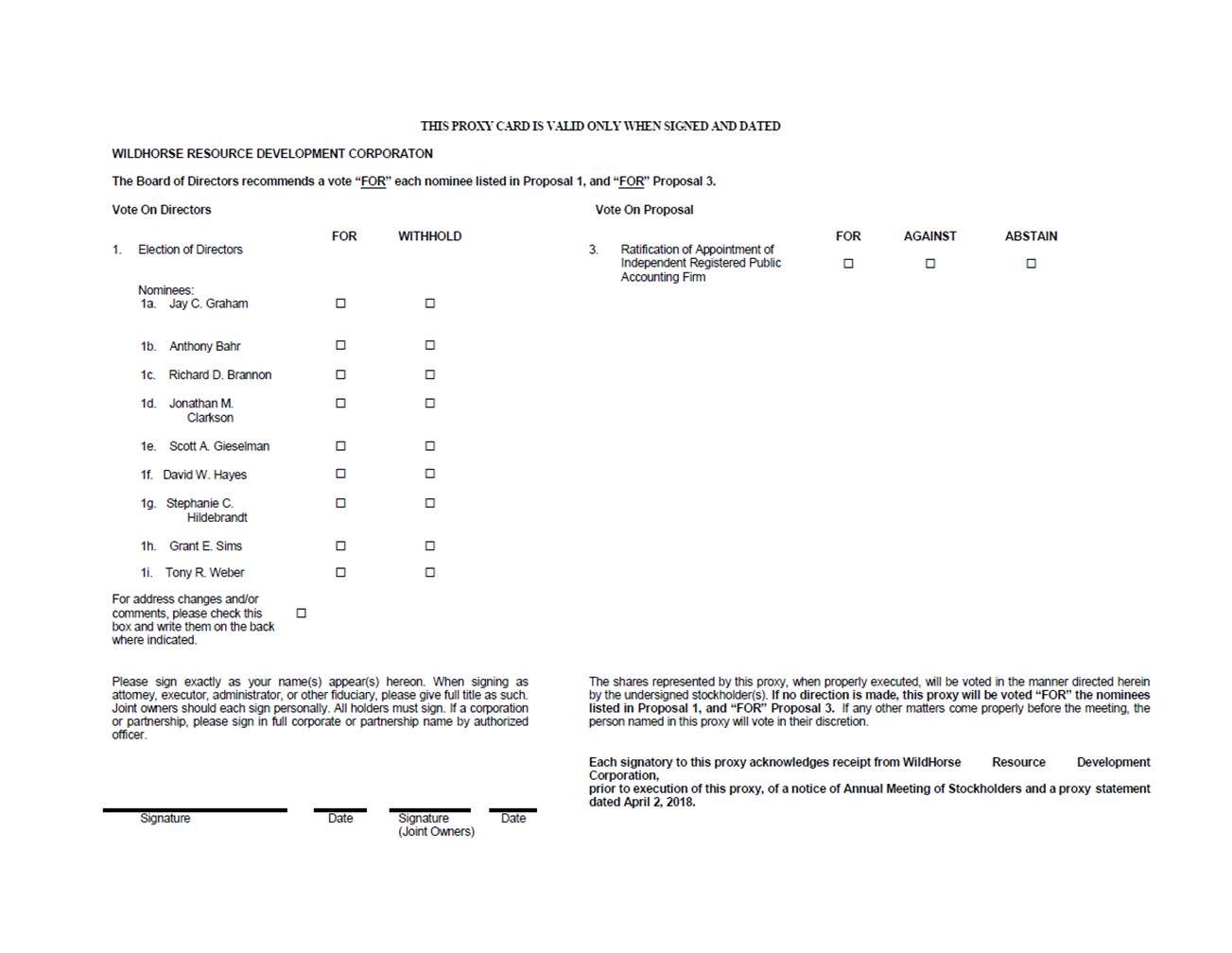

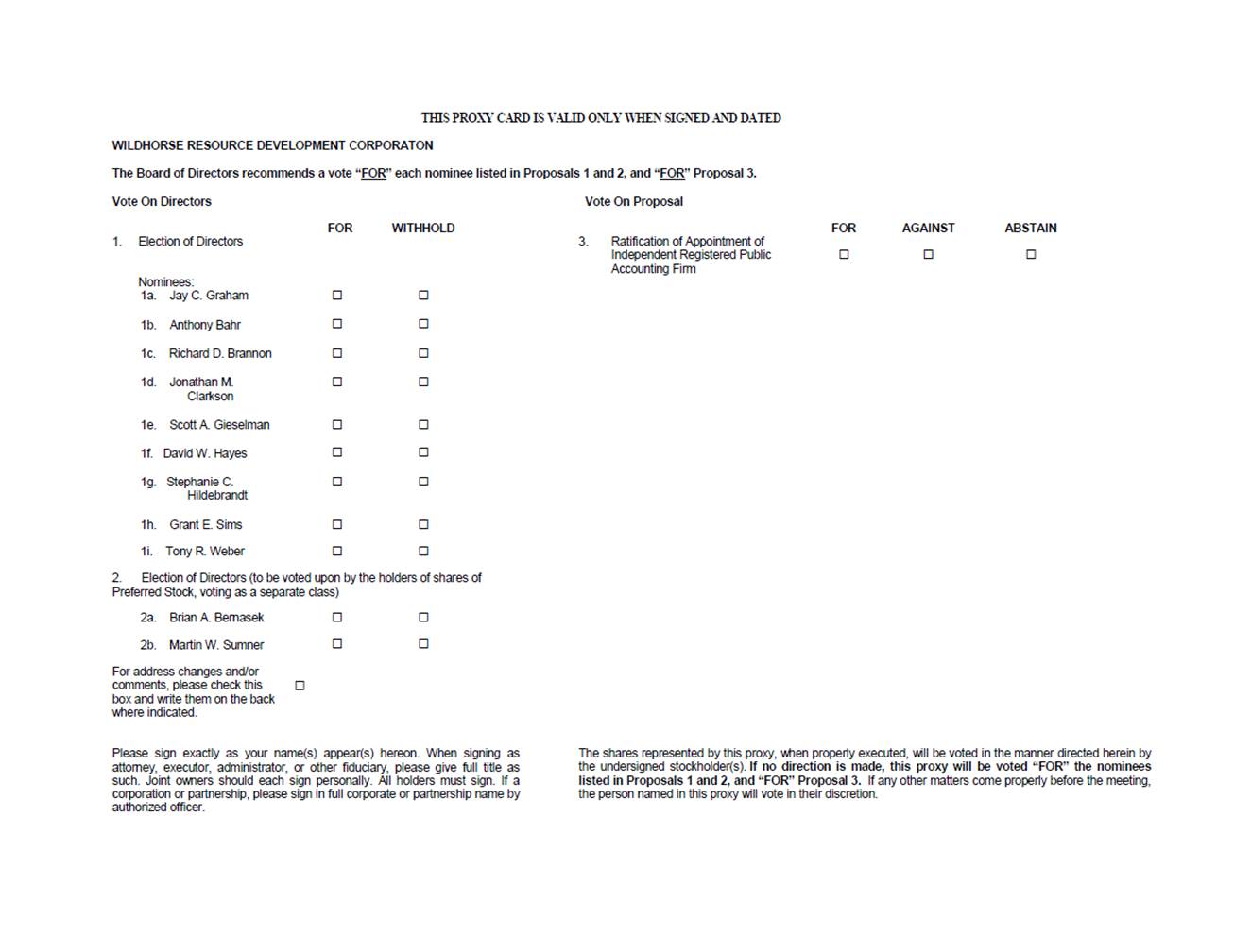

The holders of the common stock and Preferred Stock, voting together as a single class, are being asked to vote on two proposals:

- •

- Proposal 1—the election of nine members of the Board named in this proxy statement to hold office until our 2019 Annual Meeting of Stockholders or until their respective successors are duly elected and qualified; and

- •

- Proposal 3—the ratification of the appointment, by the Audit Committee of the Board, of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018.

The holders of the Preferred Stock, voting as a separate class, are also being asked to vote on a separate proposal:

- •

- Proposal 2—the election of two additional members of the Board named in this proxy statement to hold office until our 2019 Annual Meeting of Stockholders or until their respective successors are duly elected and qualified.

In addition, you are entitled to vote on any other matters that may properly come before the Annual Meeting or any adjournment or postponement thereof.

Why are the holders of common stock being asked to vote on the election of only nine directors?

A total of eleven director nominees will be voted upon at the Annual Meeting. The holders of common stock and Preferred Stock, voting together as a single class, are being asked to vote on nine of the eleven director nominees to hold office until our 2019 Annual Meeting of Stockholders or until their respective successors are duly elected and qualified: Jay C. Graham, Anthony Bahr, Richard D. Brannon, Jonathan M. Clarkson, Scott A. Gieselman, David W. Hayes, Stephanie C. Hildebrandt, Grant E. Sims and Tony R. Weber.

The holders of Preferred Stock, voting as a separate class, are also entitled to elect two additional directors. Our outstanding shares of Preferred Stock were issued to certain entities affiliated with The Carlyle Group, L.P. (the "Carlyle Investor") under a Preferred Stock Purchase Agreement, dated May 10, 2017 (the "Preferred Stock Purchase Agreement"). The Preferred Stock Certificate of Designations dated June 30, 2017 (the "Certificate of Designations") provides that the Carlyle Investor is entitled to the exclusive right, voting separately as a class, to nominate and elect (i) two directors to our Board for so long as the Carlyle Investor or its affiliates hold Preferred Stock and shares of our common stock, including shares of common stock issuable upon the conversion of Preferred Stock, representing at least 10% of our outstanding common stock on an as-converted basis and (ii) one director to our Board for so long as the Carlyle Investor or its affiliates hold Preferred Stock and shares of our common stock, including shares of common stock issuable upon the conversion of Preferred Stock, representing 5% or more of our outstanding common stock on an as-converted basis. The holders of Preferred Stock as a separate class designate director nominees for election, whom the board of directors shall include in its slate of nominees for election, and only holders of the Preferred Stock have the right to vote for such nominees. Because the Carlyle Investor or its affiliates hold at least 10% of our outstanding common stock on an as-converted basis, the holders of Preferred Stock, voting separately as a class, are being asked to vote on two additional director nominees to hold office until our 2019 Annual Meeting of Stockholders or until their respective successors are duly elected and qualified: Brian A. Bernasek and Martin W. Sumner.

3

Table of Contents

How does the Board recommend that I vote my shares?

A proxy that is properly completed and returned will be voted at the Annual Meeting in accordance with the instructions on the proxy. If you properly complete and return a proxy, but do not indicate any contrary voting instructions, your shares will be voted in accordance with the Board's recommendations. The Board's recommendations can be found with the description of each proposal in this proxy statement. In summary, the Board recommends a vote:

- •

- Proposal 1—FOR the election of each of the nine director nominees to be elected by the holders of common stock and Preferred Stock, voting together as a single class;

- •

- Proposal 2—FOR the election of each of the two additional director nominees to be elected by the holders of Preferred Stock, voting separately as a class; and

- •

- Proposal 3—FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018 by the holders of common stock and Preferred Stock, voting together as a single class.

If any other business properly comes before the stockholders for a vote at the Annual Meeting, your shares will be voted at the discretion of the holders of the proxy. The Board knows of no matters, other than those previously stated herein, to be presented for consideration at the Annual Meeting.

What are the different methods that I can use to vote my shares?

As a record holder, you may vote your shares or submit a proxy to have your shares voted by one of the following methods:

- •

- By Internet. You may submit a proxy electronically via the Internet, using the website listed on the Notice of Availability. Please have the Notice of Availability in hand when you log onto the website. Internet voting facilities will close and no longer be available on the date and time specified on the Notice of Availability. We provide Internet proxy voting to allow you to vote your shares online, with procedures designed to verify the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet service providers and telephone companies.

- •

- By Telephone. You may submit a proxy by telephone using the toll-free number listed on the Notice of Availability. Please have the Notice of Availability in hand when you call. Telephone voting facilities will close and no longer be available on the date and time specified on the Notice of Availability.

- •

- By Mail. You may request a hard copy of the proxy card by following the instructions on the Notice of Availability. You may submit a proxy by mail by completing, signing, dating and returning your proxy card in the provided pre-addressed envelope. If you vote by mail and your proxy card is returned unsigned, then your vote cannot be counted. The completed and signed proxy card must be received by the date specified on the Notice of Availability.

- •

- In Person. You may vote in person at the Annual Meeting by completing a ballot; however, attending the meeting without completing a ballot will not count as a vote.

Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure your vote is counted. Even if you have submitted a proxy before the Annual Meeting, you may still attend the Annual Meeting and vote in person. In such case, your previously submitted proxy will be disregarded.

4

Table of Contents

If your shares are held in street name, you will receive instructions from the holder of record that you must follow in order for your shares to be voted. Internet and/or telephone voting will also be offered to stockholders owning shares through most banks and brokers.

Can I change my vote after submitting my proxy?

Yes. You may revoke your proxy in writing at any time before it is exercised at the Annual Meeting.

If you are the record holder of your shares, you may revoke your proxy in any one of three ways:

- •

- You may submit another properly completed proxy with a later date.

- •

- You may send a written notice that you are revoking your proxy to our Corporate Secretary at P.O. Box 79588, Houston, Texas 77279.

- •

- You may attend the Annual Meeting and vote in person. Simply attending the Annual Meeting will not, by itself, revoke your proxy.

If your shares are held in street name, you should follow the instructions provided by your broker, bank, dealer or other agent.

How are votes counted and how many votes are required to approve each proposal?

For Proposal 1, directors will be elected by a plurality of all votes cast by holders of the common stock and Preferred Stock, voting together a single class. You may vote "FOR" a nominee to the Board or you may "WITHHOLD" your vote for any nominee you specify. The nine nominees who receive the highest number of "FOR" votes will be elected as directors. For Proposal 2, directors will be elected by a majority of the then-outstanding shares of Preferred Stock, voting separately as a single class. For Proposal 3, you may vote "FOR," "AGAINST" or "ABSTAIN." Proposal 3 requires the affirmative "FOR" vote of a majority of voting power of the outstanding shares of common stock and Preferred Stock, voting together as a single class, present in person or represented by proxy at the Annual Meeting and entitled to vote thereon.

With respect to Proposals 1 and 3, each vote by a share of Preferred Stock will have a number of votes equal to the largest number of whole shares of common stock into which such shares are convertible on the Record Date.

If one of the voting options is not adopted by the required vote of the stockholders, the Board will evaluate the votes cast for each of the voting options and will deem the voting option receiving the greatest number of votes to be the voting option approved by the stockholders.

With respect to Proposal 1 to elect nine directors, withheld votes and broker non-votes will not have any effect on the outcome of these director elections. With respect to Proposal 2 to elect two directors, abstentions will have the effect of a vote against the proposal and broker non-votes will not have any direct effect on the outcome of these director elections. With respect to Proposal 3 to ratify the appointment of our independent registered accounting firm, abstentions will be included in the number of shares voting and abstentions will have the effect of a vote against the proposal. In addition, with respect to Proposal 3, brokers may, in their discretion, vote the shares they hold for stockholders of record if the broker does not receive instructions from the stockholder of record, as discussed in greater detail below.

Will my shares be voted if I don't provide my proxy and don't attend the Annual Meeting?

If you are a stockholder of record and you do not vote in person at the Annual Meeting or vote by proxy, then your shares will not be voted.

5

Table of Contents

If you hold your shares in street name, your broker will ask you how you want your shares to be voted. If you give the broker instructions, your shares will be voted as you direct. If you do not give instructions, one of two things can happen, depending on the type of proposal. For certain "routine" matters, even if you do not give your broker instructions on how to vote your shares, the broker may vote your shares in its discretion. This is a broker discretionary vote. The ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018 (Proposal 3) is considered routine under applicable rules. For matters not considered "routine," if you do not give your broker instructions on how to vote your shares, the broker will return the proxy card without voting on that proposal. This is a broker non-vote. The proposals to elect directors (Proposals 1 and 2) are not considered routine. As a result, no broker may vote your shares on the election of directors without your specific instructions.

Who counts the votes?

We have engaged Broadridge Financial Solutions, Inc., as our independent agent, to receive and tabulate votes at the Annual Meeting. Broadridge will separately tabulate "For" or "Withhold," or "For," "Against" or "Abstain" votes, abstentions and broker non-votes, as applicable. Broadridge has also been retained to be our election inspector to certify the results, determine the existence of a quorum and the validity of proxies, and perform any other acts required under the Delaware General Corporation Law.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if the holders of a majority in voting power of the shares of common stock and Preferred Stock outstanding and entitled to vote are present in person or represented by proxy at the Annual Meeting, with respect to Proposals 1 and 3. The voting power of the shares of Preferred Stock will be calculated based on the number of votes equal to the largest number of whole shares of common stock into which such shares are convertible on the Record Date. With respect to Proposal 2, a quorum will be present if the holders of a majority in voting power of the shares of Preferred Stock outstanding and entitled to vote are present in person or represented by proxy at the Annual Meeting,

Your shares will be counted towards the quorum if you submit a valid proxy vote or vote at the Annual Meeting. Your shares will be counted towards the quorum if you submit a valid proxy (or one is submitted on your behalf by your broker or bank) or if you vote in person at the meeting. In addition, shares present in person or by proxy, but not voting; shares for which we receive signed proxies, but for which holders have abstained from voting; and shares represented by proxies returned by a bank, broker, or other nominee holding shares will each be counted as present for purposes of determining the presence of a quorum. If there is no quorum, either the chairperson of the Annual Meeting or a majority in voting power of the stockholders entitled to vote at the Annual Meeting, present in person or represented by proxy, may adjourn the Annual Meeting to another time or place.

Natural Gas Partners ("NGP") or its affiliates (through WHR Holdings, LLC ("WildHorse Holdings"), Esquisto Holdings, LLC ("Esquisto Holdings"), WHE AcqCo Holdings, LLC ("WHE Holdings") and NGP XI US Holdings, L.P. ("NGP XI")) (collectively, the "Sponsor Group") beneficially own approximately 53.5% of the voting power entitled to vote at the Annual Meeting, as of the Record Date. Accordingly, the Sponsor Group has the requisite voting power to constitute a quorum at the Annual Meeting with respect to Proposals 1 and 3. The Carlyle Investor beneficially owns all of the Preferred Stock, which is 24.2% of the voting power to vote at the Annual Meeting with respect to Proposals 1 and 3 and all of the voting power with respect to Proposal 2, as of the Record Date. Accordingly, the Carlyle Investor's presence at the Annual Meeting, with in person or represented by proxy, will constitute a quorum with respect to Proposal 2 described in this proxy statement.

6

Table of Contents

Who is paying for this proxy solicitation?

We will bear all costs incurred in the solicitation of proxies, including the preparation, printing and mailing of the Notice of Availability, Notice of Annual Meeting and Proxy Statement and the related materials. In addition to solicitation by mail, our directors, officers and employees may solicit proxies in person or by telephone, e-mail, facsimile or other means, without additional compensation. We may also reimburse brokers, banks, dealers and other agents for the cost of forwarding proxy materials to beneficial owners.

How can I find out the results of the voting at the Annual Meeting?

Voting results will be announced by the filing of a Current Report on Form 8-K within four business days after the Annual Meeting. If final voting results are unavailable at that time, we will file an amended Current Report on Form 8-K within four business days of the day the final results are available.

When are stockholder proposals due for next year's annual meeting?

To be considered for inclusion in next year's proxy materials, your proposal must be submitted in writing by Monday, December 3, 2018, to our Corporate Secretary at P.O. Box 79588, Houston, Texas 77279; provided that if the date of the annual meeting is more than 30 days before or after May 17, 2019, the deadline will be a reasonable time before we begin to print and send our proxy materials for next year's annual meeting, and we will announce that date in such event. Your proposal must also comply with the requirements set forth in Rule 14a-8 and the SEC's related guidance. If you wish to submit a proposal that is not to be included in our proxy materials for next year's annual meeting or to nominate a director, your proposal must be received by the Corporate Secretary at P.O. Box 79588, Houston, Texas, 77279 between Thursday, January 17, 2019 and Saturday, February 16, 2019; provided that if the date of that annual meeting is more than 30 days before or more than 60 days after May 17, 2019, your proposal must be received by the Corporate Secretary not earlier than the 120th day before such annual meeting date and not later than the 90th day before such annual meeting date or, if later, the 10th day following the day on which public announcement of the annual meeting date is first made. You are also advised to review our amended and restated bylaws (our "bylaws"), which contain additional requirements about advance notice of stockholder proposals and director nominations.

What are the implications of being an "emerging growth company"?

We are an "emerging growth company" as that term is used in the Jumpstart Our Business Startups Act of 2012 and, as such, have elected to comply with certain reduced public company reporting and other requirements. These reduced requirements include reduced disclosures about the Company's executive compensation arrangements. We will remain an emerging growth company until the earlier of (1) the last day of the fiscal year (a) following the fifth anniversary of the completion of our initial public offering, or (b) in which we have total annual gross revenue of at least $1.07 billion or (c) in which we are deemed to be a large accelerated filer, which means the market value of our common stock that is held by non-affiliates exceeds $700 million as of the prior June 30th, and (2) the date on which we have issued more than $1.07 billion in non-convertible debt during the prior three-year period.

7

Table of Contents

CERTAIN MATTERS RELATING TO PROXY MATERIALS AND ANNUAL REPORT

Householding of Proxy Materials

The SEC has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements, annual reports and a Notice of Internet Availability of Proxy Materials with respect to two or more stockholders sharing the same address by delivering a single proxy statement addressed to those stockholders. This process, which is commonly referred to as "householding," potentially means extra convenience for stockholders and cost savings for companies.

Brokers with account holders who are WildHorse stockholders may be "householding" our proxy materials. One annual report, proxy statement and Notice of Internet Availability of Proxy Materials may be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker that it will be "householding" communications to your address, "householding" will continue until you are notified otherwise or until you notify your broker or the Company that you no longer wish to participate in "householding."

If, at any time, you no longer wish to participate in "householding" and would prefer to receive a separate annual report, proxy statement or Notice of Internet Availability of Proxy Materials, you may (1) notify your broker, (2) direct your written request to: P.O. Box 79588, Houston, Texas 77279 or (3) contact our Investor Relations department by telephone at (713) 255-9327. Stockholders who currently receive multiple copies of the proxy materials at their address and would like to request "householding" of their communications should contact their broker if their shares are held in "street name" or the Company if they are stockholder of record. In addition, the Company will promptly deliver, upon written or oral request to the address or telephone number above, a separate copy of the annual report, proxy statement and Notice of Internet Availability of Proxy Materials to a stockholder at a shared address to which a single copy of the documents was delivered.

Other Matters

As of the date of this proxy statement, the Board does not intend to present any matters other than those described herein at the Annual Meeting and is unaware of any matters to be presented by other parties. If other matters are properly brought before the meeting for action by the stockholders, proxies will be voted in accordance with the recommendation of the Board or, in the absence of such a recommendation, in accordance with the judgment of the proxy holder.

Incorporation by Reference

Neither the compensation committee report nor the audit committee report shall be deemed soliciting material or filed with the SEC and neither of them shall be deemed incorporated by reference into any prior or future filings made by us under the Securities Act of 1933, as amended (the "Securities Act"), or the Securities Exchange Act of 1934, as amended (the "Exchange Act"), except to the extent that we specifically incorporate such information by reference. In addition, this document includes several website addresses. These website addresses are intended to provide inactive, textual references only. The information on these websites is not part of this document.

Availability of Annual Reports on Form 10-K

We have filed our Annual Report on Form 10-K for the fiscal year ended December 31, 2017 with the SEC. It is available free of charge at the SEC's website at www.sec.gov. Upon written request, we will provide, without charge, a copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2017 to any of our stockholders of record, or to any stockholder who owns our common stock listed in the name of a broker, bank or dealer as nominee, at the close of business on March 21,

8

Table of Contents

2018. Any request for a copy of our Annual Report on Form 10-K should be mailed to our Corporate Secretary at P.O. Box 79588, Houston, Texas 77279, or by calling (713) 568-4910.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on May 17, 2018. You are requested to cast your proxy as instructed in the Notice of Internet Availability of Proxy Materials whether or not you expect to attend the meeting in person. You may request paper copies of the proxy materials free of charge by following the instructions on the Notice of Internet Availability of Proxy Materials. If you request a paper proxy, please complete, date, and sign the enclosed form of proxy card and return it promptly in the envelope provided. By submitting your proxy promptly, you can help us avoid the expense of follow-up mailings to ensure a quorum so that the meeting can be held. We encourage you to vote via the Internet.

9

Table of Contents

PROPOSAL 1—ELECTION OF DIRECTORS

The Board currently consists of eleven members.

At each annual meeting, our stockholders will elect our directors. Our executive officers and key employees serve at the discretion of the Board. Directors elected by holders of our common stock and Preferred Stock may be removed, either with or without cause, by the affirmative vote of the holders of a majority of our common stock and Preferred Stock, with shares of Preferred Stock voting on an as-converted basis, so long as at least 50% of the voting power of all our shares of common stock is owned by the Sponsor Group. At any other time, directors elected by holders of our common stock and Preferred Stock may be removed for cause only by the affirmative vote of at least 75% of the voting power of our common stock and Preferred Stock, with shares of Preferred Stock voting on an as-converted basis. Directors elected by our Preferred Stock may be removed, either with or without cause, by the affirmative vote of the holders of a majority of our Preferred Stock.

Further, in connection with the closing of our initial public offering, we entered into a stockholders' agreement (the "Stockholders' Agreement") with the Sponsor Group. Among other things, the Stockholders' Agreement provides the right to designate nominees to the Board as follows:

- •

- so long as the Sponsor Group beneficially own greater than 50% of the Company's common stock in the aggregate, WildHorse Holdings and Esquisto Holdings can each nominate up to three nominees to the Board;

- •

- so long as the Sponsor Group and their affiliates beneficially own greater than 35% of the Company's common stock but less than 50% of the Company's common stock in the aggregate, WildHorse Holdings and Esquisto Holdings can each nominate two nominees to the Board;

- •

- so long as the Sponsor Group and their affiliates beneficially own greater than 15% of the Company's common stock but less than 35% of the Company's common stock in the aggregate, WildHorse Holdings and Esquisto Holdings can each nominate one nominee to the Board and can nominate a third nominee by agreement between them;

- •

- so long as the Sponsor Group and their affiliates beneficially own greater than 5% but less than 15% of the Company's common stock in the aggregate, WildHorse Holdings and Esquisto Holdings can each nominate one nominee to the Board; and

- •

- once the Sponsor Group and their affiliates beneficially own less 5% of the Company's common stock in the aggregate, WildHorse Holdings and Esquisto Holdings will not have any board designation rights.

The Stockholders Agreement also requires us and the stockholders party thereto to take all necessary actions, to the fullest extent permitted by applicable law (including with respect to any fiduciary duties under Delaware law), including voting their shares of our common stock, to cause the election of the nominees designated by WildHorse Holdings and Esquisto Holdings. In addition, the Stockholders' Agreement provides that for so long as the Sponsor Group and their affiliates beneficially own at least 15% of the outstanding shares of the Company's common stock in the aggregate, WildHorse Holdings and Esquisto Holdings will have the right to cause any committee of the Board to include in its membership at least one director designated by WildHorse Holdings or Esquisto Holdings, except to the extent that such membership would violate applicable securities laws or stock exchange rules. The rights granted to WildHorse Holdings and Esquisto Holdings to designate directors are additive to and not intended to limit in any way the rights that the Sponsor Group or any of their affiliates may have to nominate, elect or remove the Company's directors under the amended and restated certificate of incorporation (the "certificate of incorporation"), bylaws or the Delaware General Corporation Law ("DGCL"). WildHorse Holdings has nominated Jay C. Graham,

10

Table of Contents

Scott A. Gieselman and Tony R. Weber and Esquisto Holdings has nominated Anthony Bahr, David W. Hayes and Richard D. Brannon.

The Board, upon the directive of the Sponsor Group pursuant to the terms of our certificate of incorporation and bylaws, has nominated the following individuals for election as directors of the Company to serve until our 2019 Annual Meeting of Stockholders or until their respective successors are duly elected and qualified:

Jay C. Graham

Anthony Bahr

Richard D. Brannon

Jonathan M. Clarkson

Scott A. Gieselman

David W. Hayes

Stephanie C. Hildebrandt

Grant E. Sims

Tony R. Weber

Each of the nine director nominees directly above receiving a plurality of the votes by holders of our common stock and Preferred Stock, voting together as a single class, at the Annual Meeting will be elected. The Board recommends that you vote "FOR" the election of each of the nominees listed above.

Unless otherwise instructed, the proxyholders will vote the proxies received by them for the nine nominees named above. The Board has no reason to believe that any of its nominees will be unable or unwilling to serve if elected. If a nominee becomes unable or unwilling to accept nomination or election, either the number of the Company's directors will be reduced or the proxyholders will vote for the election of a substitute nominee that the Board recommends.

THE BOARD UNANIMOUSLY RECOMMENDS THAT THE HOLDERS OF COMMON STOCK AND PREFERRED STOCK, VOTING TOGETHER AS A SINGLE CLASS, VOTE FOR THE ELECTION OF EACH OF THE NINE NOMINEES DIRECTLY ABOVE.

11

Table of Contents

PROPOSAL 2—ELECTION OF DIRECTORS

The Board currently consists of eleven members.

At each annual meeting, our stockholders will elect our directors. Our executive officers and key employees serve at the discretion of the Board. Directors elected by holders of our common stock and Preferred Stock may be removed, either with or without cause, by the affirmative vote of the holders of a majority of our common stock and Preferred Stock, with shares of Preferred Stock voting on an as-converted basis, so long as at least 50% of the voting power of all our shares of common stock is owned by the Sponsor Group. At any other time, directors elected by holders of our common stock and Preferred Stock may be removed for cause only by the affirmative vote of at least 75% of the voting power of our common stock and Preferred Stock, with shares of Preferred Stock voting on an as-converted basis. Directors elected by our Preferred Stock may be removed, either with or without cause, by the affirmative vote of the holders of a majority of our Preferred Stock.

The Carlyle Investor, as the sole holder of Preferred Stock, pursuant to the Certificate of Designations, is also entitled to, voting separately as a class, nominate and elect (i) two directors to our board of directors for so long as the Carlyle Investor or its affiliates hold Preferred Stock and shares of our common stock, including shares of common stock issuable upon the conversion of Preferred Stock, representing at least 10% of our outstanding common stock on an as-converted basis and (ii) one board seat for so long as the Carlyle Investor or its affiliates hold Preferred Stock and shares of our common stock, including shares of common stock issuable upon the conversion of Preferred Stock, representing 5% or more of our outstanding common stock on an as-converted basis. The Carlyle Investor beneficially owns all of the Preferred Stock, which is 24.2% of the voting power to vote at the Annual Meeting with respect to Proposals 1 and 3 and all of the voting power with respect to Proposal 2, as of the Record Date. The Carlyle Investor has nominated Brian A. Bernasek and Martin W. Sumner and will vote its shares of Preferred Stock separately as a class, on the their election at the Annual Meeting.

The Board, upon the directive of the Carlyle Investor, pursuant to the terms of our certificate of incorporation, bylaws and the Certificate of Designations, has nominated the following individuals for election as directors of the Company to serve until our 2019 Annual Meeting of Stockholders or until their respective successors are duly elected and qualified:

Brian A. Bernasek

Martin W. Sumner

Both of the director nominees directly above receiving votes by a majority of the holders of our then outstanding Preferred Stock, voting together as a single class, will be elected. The Board recommends that you vote "FOR" the election of both of the nominees listed above.

Unless otherwise instructed, the proxyholders will vote the proxies received by them for the two nominees named above. The Board has no reason to believe that any of its nominees will be unable or unwilling to serve if elected. If a nominee becomes unable or unwilling to accept nomination or election, either the number of the Company's directors will be reduced or the proxyholders will vote for the election of a substitute nominee that the Board recommends.

THE BOARD UNANIMOUSLY RECOMMENDS THAT THE HOLDERS OF PREFERRED STOCK, VOTING SEPARATELY AS A CLASS, VOTE FOR THE ELECTION OF EACH OF THE TWO NOMINEES DIRECTLY ABOVE.

12

Table of Contents

DIRECTORS

After the Annual Meeting, assuming the stockholders elect the nominees of the Board as set forth in "Proposal 1—Election of Directors" and "Proposal 2—Election of Directors" above, the members of the Board will be:

| | | | |

Name | | Age | | Position |

|---|

| Jay C. Graham | | 47 | | Chief Executive Officer and Chairman |

| Anthony Bahr | | 48 | | President and Director |

| Brian A. Bernasek | | 45 | | Director |

| Richard D. Brannon | | 59 | | Director |

| Jonathan M. Clarkson | | 68 | | Director |

| Scott A. Gieselman | | 54 | | Director |

| David W. Hayes | | 43 | | Director |

| Stephanie C. Hildebrandt | | 53 | | Director |

| Grant E. Sims | | 62 | | Director |

| Martin W. Sumner | | 44 | | Director |

| Tony R. Weber | | 55 | | Director |

Set forth below is biographical information for the nominees. The following includes certain information regarding our directors' individual experience, qualifications, attributes and skills that led the Board to conclude that they should serve as directors.

Jay C. Graham has served as our Chief Executive Officer and as Chairman of our board of directors since September 2016. Previously, Mr. Graham served as Chief Executive Officer and as a member of the board of directors of Memorial Resource Development Corp. ("MRD") from January 2016 until it was acquired by Range Resources Corporation in September 2016. Previously, Mr. Graham served as Co-CEO and Co-Founder of WildHorse from June 2013 to January 2016 and President of WildHorse Resources Management Company ("WHRM") since its formation in October 2012 to January 2016. Prior to MRD's initial public offering in June 2014, Mr. Graham served as President of WildHorse Resources, LLC, one of the predecessors of MRD, from August 2007 to June 2014. From 1993 to 2007, Mr. Graham held a variety of positions of increasing responsibility with Halliburton, Devon Energy and Anadarko Petroleum Corporation. Further, Mr. Graham currently serves on the Petroleum Industry Board and the College of Engineering Advisory Council at Texas A&M University, is a co-founder and advisor of the Texas A&M Petroleum Ventures Program educational collaboration between the Mays Business School and Department of Petroleum Engineering and is also a member of the Petroleum Engineering Academy of Distinguished Graduates.

The board of directors believes that Mr. Graham's degree and experience in petroleum engineering, as well as his history of operating oil and natural gas companies, bring valuable strategic, managerial and leadership skills to the board of directors and us.

Anthony Bahr has served as our President and a member of our board of directors since our formation in August 2016. Previously, Mr. Bahr was a Co-Founder and served as the Co-CEO of WildHorse since WildHorse's formation in June 2013 and Chief Executive Officer of WHRM since its formation in October 2012. Additionally, Mr. Bahr was a Co-Founder and served as Chief Executive Officer of WildHorse Resources, LLC, one of the predecessors of MRD, since its formation in 2007. Prior to 2007, Mr. Bahr held various management and engineering roles with Hilcorp Energy, Devon Energy, Ocean Energy, Berry Petroleum and Unocal Corporation. Further, Mr. Bahr currently serves on the Dean's Council of the Mays Business School at Texas A&M University, is a co-founder and advisor of the Texas A&M Petroleum Ventures Program educational collaboration between the Mays Business School and Department of Petroleum Engineering and is also a member of the Petroleum

13

Table of Contents

Engineering Academy of Distinguished Graduates. Mr. Bahr is a registered petroleum engineer in California.

The board of directors believes that Mr. Bahr's degree and experience in petroleum engineering, as well as his history of operating oil and natural gas companies, bring valuable strategic, managerial and analytical skills to the board of directors and us.

Brian A. Bernasek has served as a member of our board of directors since June 2017. Mr. Bernasek is a Managing Director of The Carlyle Group and head of the firm's Global Industrial and Transportation team. Prior to joining Carlyle in 2000, Mr. Bernasek held positions in New York with Investcorp International, a private equity firm, and Morgan Stanley & Co., in its Investment Banking Division. Mr. Bernasek is a graduate of the University of Notre Dame and received his M.B.A. from the Harvard Business School. He is currently also a member of the Board of Directors of Accudyne Industries, Atotech BV, Novolex Holdings, Inc., and Signode Industrial Group. He previously served on the Board of Directors of Allison Transmission, Inc. (NYSE: ALSN), HD Supply, Inc. (NYSE:HDS) and The Hertz Corporation (NYSE:HTZ), among others.

The board of directors believes that Mr. Bernasek's considerable financial and private equity experience, as well as his experience on the boards of several companies bring important and valuable skills to the board of directors and us.

Richard D. Brannon has served as a member of our board of directors since September 2016. From June 2014 through December 12, 2016, Mr. Brannon was Chairman and CEO of Esquisto Resources II, LLC and, since 2007, President of certain CH4 Energy entities, all companies focused on horizontal development of oil & gas reserves in the Eagle Ford formation. Mr. Brannon serves on the Board of Directors of the general partner of Energy Transfer Equity, L.P., and is currently Chairman of the Audit Committee, and previously served on the boards of Sunoco LP, Regency Energy Partners LP, OEC Compression Corporation and Cornerstone Natural Gas, Inc. Mr. Brannon has over 35 years in the energy business starting his career in 1981 with TXO Production Corp. Further, Mr. Brannon is a Certified Registered Professional Engineer in the State of Texas.

The board of directors believes that Mr. Brannon's extensive experience in the energy industry, including his past experiences as an executive with various energy companies, brings important and valuable skills to the board of directors and us.

Jonathan M. Clarkson has served as a member of our board of directors since December 2016. From 2011 until April 2017, Mr. Clarkson served on the board of directors and as a member of the audit committee of Memorial Production Partners GP LLC ("MEMP GP"). From May 2012 until January 2016, Mr. Clarkson served as Chief Financial Officer for Matrix Oil Corporation. Mr. Clarkson served as Chairman of the Houston Region of Texas Capital Bank from May 2009 until his retirement in December 2011. From 2003 to May 2009, he served as President and CEO of the Houston Region of Texas Capital Bank. From May 2001 to October 2002, Mr. Clarkson served as President, Chief Financial Officer and a director of Mission Resources Corp., an independent oil and gas exploration and production company. From 1999 through 2001, Mr. Clarkson served as President and Chief Operating Officer of Bargo Energy Company, a private company engaged in the acquisition and exploitation of onshore oil and natural gas properties, which merged with Mission Resources in May 2001. From 1987 to 1999, Mr. Clarkson served as Executive Vice President and Chief Financial Officer for Ocean Energy Corp. and its predecessor company United Meridian Corporation. From October 2006 until December 2009, Mr. Clarkson served on the board of directors, was chairman of the audit committee, and was a member of the compensation committee of Edge Petroleum Corp., an oil and gas exploration and production company. Mr. Clarkson currently serves on the board of directors, is chairman of the audit committee, and is a member of the corporate governance committee, of Parker Drilling Company. This service began in January 2012. Since September 2010, Mr. Clarkson has served

14

Table of Contents

on the advisory board of Rivington Capital Advisors, LLC, an investment banking firm focused on upstream energy sector investments.

The board of directors believes that Mr. Clarkson's over 40 years of experience in the oil and gas industry, his service in multiple Chief Financial Officer positions with both private and public companies and his experience as Audit Chair for three public companies bring extensive financial expertise and proven leadership to the board of directors and us.

Scott A. Gieselman has served as a member of our board of directors since September 2016. Mr. Gieselman has served as a Partner for NGP since April 2007. Prior to joining NGP, Mr. Gieselman worked in various positions in the investment banking energy group of Goldman, Sachs & Co., where he became a partner in 2002. Mr. Gieselman served as a member of the board of directors of Rice Energy, Inc. from January 2014 until it was acquired by EQT Corporation in November 2017 and was a member of the board of directors of MRD from its formation until it was acquired by Range Resources Corporation in September 2016. In addition, Mr. Gieselman served as a member of the board of directors of MEMP GP from December 2011 until March 2016.

The board of directors believes that Mr. Gieselman's considerable financial and energy investment banking experience, as well as his experience on the boards of several energy companies bring important and valuable skills to the board of directors and us.

David W. Hayes has served as a member of our board of directors since September 2016. Mr. Hayes has served as a Partner for NGP since 2008. Prior to joining NGP, Mr. Hayes was a member of Merrill Lynch's Energy Investment Banking group in Houston, Texas, where he focused on mergers and acquisitions and financing in the exploration and production and natural gas pipeline industries. Mr. Hayes previously served on the board of directors of the general partner of Eagle Rock Energy Partners, L.P. from June 2011 until its sale to Vanguard Natural Resources LLC in October 2015 and the board of directors for the general partner of PennTex Midstream Partners, LP ("PennTex") from June 2015 until NGP sold its interest in PennTex in November 2016.

The board of directors believes that Mr. Hayes's considerable financial and energy investment banking experience, as well as his experience on the boards of several energy companies bring important and valuable skills to the board of directors and us.

Stephanie Hildebrandt has served as a member of our board of directors since December 2017. Ms. Hildebrandt is Senior Vice President, General Counsel and Secretary of Archrock, Inc. She also serves as Senior Vice President, General Counsel and Director of Archrock GP LLC, the managing general partner of Archrock Partners, L.P. Prior to joining Archrock in August 2017, Ms. Hildebrandt was a partner in the Houston office of global law firm Norton Rose Fulbright, with a practice focused on corporate governance, energy transactions and mergers and acquisitions. Previously, she was Senior Vice President, General Counsel and Secretary of Enterprise Products Partners L.P., a publicly traded pipeline partnership and a provider of midstream energy services, from 2010 to 2014, and held various other roles at Enterprise from 2004, including Vice President, Deputy General Counsel and Assistant Secretary. Ms. Hildebrandt was an attorney for El Paso Corporation / GulfTerra Energy Partners from 2001 until GulfTerra's merger with Enterprise in 2004 and an attorney for Texaco, Inc. from 1989 to 2001. Currently she serves as a Director for Rice Midstream Management LLC, the general partner of Rice Midstream Partners LP and as a member of the conflicts committee. Ms. Hildebrandt served as a Director of TRC Companies, Inc. from December 2014 until its acquisition in June 2017. She currently serves as a member of the Advisory Council of the Kay Bailey Hutchison Center for Energy, Law & Business at the University of Texas.

The board of directors believes that Ms. Hildebrandt's extensive experience in the legal and energy industry, including her leadership roles in several midstream companies bring substantial leadership skill and experience to the board of directors and us.

15

Table of Contents

Grant E. Sims has served as a member of our board of directors since February 2017. Mr. Sims has served as a director and Chief Executive Officer of the general partner of Genesis Energy Partners, L.P. (NYSE: GEL) since August 2006 and Chairman of the Board of the general partner since October 2012. He served as a director of Texas Capital Bancshares, Inc. (NASDAQ: TCBI) from April 2012 until January 2015. Mr. Sims had been a private investor since 1999. He was affiliated with Leviathan Gas Pipeline Partners, L.P. from 1992 to 1999, serving as the Chief Executive Officer and a director beginning in 1993 until he left to pursue personal interests, including investments. Leviathan (subsequently known as El Paso Energy Partners, L.P. and then GulfTerra Energy Partners, L.P.) was an NYSE-listed MLP that merged with Enterprise Products Partners, L.P. on September 30, 2004. Mr. Sims provides leadership skills, executive management experience and significant knowledge of our business environment.

The board of directors believes that Mr. Sims' extensive experience in the energy industry, including his service in multiple Chief Executive Officer positions focused on midstream energy sector companies bring substantial leadership skill and experience to the board of directors and us.

Martin W. Sumner has served as a member of our board of directors since June 2017. Mr. Sumner is a Managing Director of The Carlyle Group where he focuses on investment opportunities in the industrial and transportation sectors. Mr. Sumner has been at The Carlyle Group since 2003 and has led or been a key contributor to the firm's energy and chemical related investments. Prior to joining Carlyle, he held positions with Thayer Capital Partners, a private equity firm and the strategy consulting group of Mercer Management Consulting. Mr. Sumner received his M.B.A. from Stanford University, where he was an Arjay Miller Scholar and a B.S. in Economics, magna cum laude, from the Wharton School of the University of Pennsylvania. He is currently also a member of the Board of Directors of Atotech BV and AxleTech International. He previously served on the Board of Directors of Axalta Coating Systems (NYSE: AXTA) and Centennial Resource Production, among others.

The board of directors believes that Mr. Sumner's extensive corporate finance and private equity experience bring substantial leadership skill and experience to the board of directors and us.

Tony R. Weber has served as a member of our board of directors since September 2016. Mr. Weber currently serves as Managing Partner and Chairman of the Executive Committee for NGP. Prior to joining NGP in December 2003, Mr. Weber was the Chief Financial Officer of Merit Energy Company from April 1998 to December 2003. Prior to that, he was Senior Vice President and Manager of Union Bank of California's Energy Division in Dallas, Texas from 1987 to 1998. Mr. Weber served as Chairman of the board of directors of MRD from its formation in January 2014 until MRD was acquired by Range Resources Corporation in September 2016. In addition, Mr. Weber served as a member of the board of directors of MEMP GP from December 2011 to March 2016. Further, in his role at NGP, Mr. Weber serves on numerous private company boards as well as industry groups, IPAA Capital Markets Committee and Dallas Wildcat Committee. He currently serves on the Dean's Council of the Mays Business School at Texas A&M University and was a founding member of the Mays Business Fellows Program.

The board of directors believes that Mr. Weber's extensive corporate finance, banking and private equity experience bring substantial leadership skill and experience to the board of directors and us.

16

Table of Contents

CORPORATE GOVERNANCE MATTERS

Code of Conduct

The Board has adopted a code of business conduct and ethics (the "Code of Conduct") that applies to all directors, officers and employees, including our principal executive officer, principal financial officer and principal accounting officer. The Code of Conduct is available in the Corporate Governance section of our website at www.wildhorserd.com. The purpose of the Code of Conduct is to promote honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; to promote full, fair, accurate, timely and understandable disclosure in periodic reports required to be filed by us; and to promote compliance with all applicable rules and regulations that apply to us and our officers. Any waiver of this code may be made only by our board of directors and will be promptly disclosed as required by applicable U.S. federal securities laws and the corporate governance rules of the NYSE. The Code of Conduct is available in the Investor Relations section under the Corporate Governance tab of our website at www.wildhorserd.com.

The Board has also adopted a financial code of ethics applicable to our Chief Executive Officer, President, Chief Financial Officer, Controller, Treasurer and other senior financial officers. Any waiver of this code may be made only by our board of directors and will be promptly disclosed as required by applicable U.S. federal securities laws and the corporate governance rules of the NYSE. The financial code of ethics is available in the Investor Relations section under the Corporate Governance tab of our website at www.wildhorserd.com.

Corporate Governance Guidelines

The Board has adopted corporate governance guidelines ("Corporate Governance Guidelines") in accordance with the corporate governance rules of the NYSE. The Corporate Governance Guidelines are available in the Investor Relations section under the Corporate Governance tab of our website at www.wildhorserd.com.

Board Composition

We have eleven directors. Assuming that the Sponsor Group continues to control more than 50% of our common stock, we intend to continue to avail ourselves of the "controlled company" exception under the New York Stock Exchange rules, which eliminates the requirements that we (i) have a majority of independent directors, (ii) maintain a compensation committee or (iii) maintain an independent nominating function. We are required, however, to have an audit committee comprised entirely of independent directors within the permitted "phase-in" period under the New York Stock Exchange rules, upon which we are relying. We do not expect such reliance to impact the audit committee's ability to act independently and to satisfy its applicable legal requirements.

As a result of the size of the Sponsor Group's ownership of our common stock, that group is able to control matters requiring stockholder approval, including the election of nine of the eleven directors, changes to our organizational documents and significant corporate transactions.

If at any time we cease to be a "controlled company" under the New York Stock Exchange rules, the Board will take all action necessary to comply with the New York Stock Exchange rules, including appointing a majority of independent directors to the Board, appointing a compensation committee composed entirely of independent directors and a nominating and corporate governance committee composed entirely of independent directors or a nominating process in which nominees for election to the Board are selected by, or recommended for the Board's selection by, a majority of the independent directors, subject to a permitted "phase-in" period. We will cease to qualify as a "controlled company" once the Sponsor Group ceases to control a majority of our voting stock.

17

Table of Contents

Our Board consists of a single class of directors each serving one year terms. After the Sponsor Group no longer collectively beneficially owns or controls more than 50% of the voting power of our outstanding common stock, our board of directors will be divided into three classes of directors, with each class as equal in number as possible, serving staggered three-year terms, and such directors will be removable only for "cause."

In evaluating director candidates, the Board will assess whether a candidate possesses the integrity, judgment, knowledge, experience, skill and expertise that are likely to enhance the ability of the Board to manage and direct our affairs and business, including, when applicable, to enhance the ability of committees of the Board to fulfill their duties. The Board will consider individuals identified by stockholders on the same basis as nominees from other sources. We have no minimum qualifications for director candidates. In general, however, the Board will review and evaluate both incumbent and potential new directors in an effort to achieve diversity of background, skills and experience among our directors and in light of the following criteria:

- •

- experience in business, government, education, technology or public interests;

- •

- high-level managerial experience in large organizations;

- •

- breadth of knowledge regarding our business or industry;

- •

- specific skills, experience or expertise related to an area of importance to us, such as energy production, consumption, distribution or transportation, government, policy, finance or law;

- •

- moral character and integrity;

- •

- commitment to our stockholders' interests;

- •

- ability to provide insights and practical wisdom based on experience and expertise;

- •

- ability to read and understand financial statements; and

- •

- ability to devote the time necessary to carry out the duties of a director, including attendance at meetings and consultation on company matters.

Although we do not have a policy in regard to the consideration of diversity in identifying director nominees, the Board seeks nominees with distinct professional backgrounds, experience and perspectives so that the Board as a whole has the range of skills and viewpoints necessary to fulfill its responsibilities.

Director Independence

The Board has determined that, under the New York Stock Exchange listing standards, Messrs. Brannon, Clarkson, Gieselman, Hayes, Sims and Weber and Ms. Hildebrandt are independent directors. In addition, the Board has determined that, the New York Stock Exchange listing standards and taking into account any applicable committee standards and rules under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), Messrs. Clarkson and Sims and Ms. Hildebrandt are independent directors under the heightened independence requirements for service on an audit committee. The Board considered Mr. Sims' position as Chief Executive Officer of one of our purchasers of hydrocarbons and other liquids, Genesis Energy, L.P. ("Genesis"), and determined that the relationship between Genesis and WildHorse does not affect Mr. Sims' independence. The Board considered the employment by WildHorse of Mr. Brannon's son, Richard D. Brannon, Jr., and determined that the relationship between Mr. Brannon's son and WildHorse does not affect Mr. Brannon's independence. For additional information regarding the relationships of Messrs. Sims and Brannon, see the discussion below under the heading "Certain Relationships and Related Party Transactions."

18

Table of Contents

Leadership Structure of the Board

Our bylaws and corporate governance guidelines provide the Board with flexibility to combine or separate the positions of Chairman of the Board and Chief Executive Officer and/or to implement a lead director in accordance with its determination that utilizing one or the other structure would be in the best interests of our company. Mr. Graham serves as Chairman of the Board and facilitates communications between members of the Board and works with management in the preparation of the agenda for each Board meeting. All of our directors are encouraged to make suggestions for Board agenda items or pre-meeting materials.

The Board has concluded that our current leadership structure is appropriate at this time. However, the Board will continue to periodically review our leadership structure and may make such changes in the future as it deems appropriate.

Role of Board in Risk Oversight Process

Risk assessment and oversight are an integral part of our governance and management processes. The Board encourages management to promote a culture that incorporates risk management into our corporate strategy and day-to-day business operations. Management discusses strategic and operational risks at regular management meetings, and conducts specific strategic planning and review sessions during the year that include a focused discussion and analysis of the risks facing us. Throughout the year, senior management reviews these risks with the Board at regular Board meetings as part of management presentations that focus on particular business functions, operations or strategies, and presents the steps taken by management to mitigate or eliminate such risks.

The Board does not have a standing risk management committee, but rather administers this oversight function directly through the Board as a whole. The Board is responsible for monitoring and assessing strategic risk exposure, and the Audit Committee assists the Board in fulfilling its oversight responsibilities by overseeing our major financial risk exposures and the steps our management has taken to monitor and control these exposures. The Audit Committee also monitors compliance with legal and regulatory requirements and considers and approves or disapproves any related-person transactions. The full Board oversees the performance of an annual compensation risk assessment.

Committees of the Board of Directors

The Board has established an Audit Committee and may establish such other committees as the Board shall determine from time to time. The Audit Committee composition and responsibilities are described below.

Messrs. Clarkson and Sims and Ms. Hildebrandt serve as the members of the Audit Committee. The Board has determined that Mr. Clarkson is an "audit committee financial expert" as defined by the SEC. Messrs. Clarkson and Sims and Ms. Hildebrandt each meet the criteria for independence of Audit Committee members set forth in Rule 10A-3(b)(1) under the Exchange Act and the independence standards established by the New York Stock Exchange. Mr. Clarkson serves as the Chairman of the Audit Committee.

The duties of the Audit Committee are set forth in its charter, which is available in the Corporate Governance section of our website at http://www.wildhorserd.com. The principal duties of the Audit Committee are to assist the Board in fulfilling its responsibility to oversee management regarding:

- •

- systems of internal control over financial reporting and disclosure controls and procedures;

- •

- the integrity of the financial statements;

19

Table of Contents

- •

- the qualifications, engagement, compensation, independence and performance of the independent auditors and our internal audit function;

- •

- compliance with legal and regulatory requirements;

- •

- review of material related party transactions; and

- •

- compliance with and adequacy of the Code of Conduct and review and, if appropriate, approve any requests for written waivers sought with respect to any executive officer or director under, the Code of Conduct.

Meetings of the Board of Directors, Board and Committee Member Attendance and Annual Meeting Attendance

During 2017, the Board and the Audit Committee met eight and four times respectively, either in person or by telephone. Each currently serving director attended at least 75% of the aggregate of the total number of meetings of the board of directors in 2017 (held during the periods for which he or she served as a director) and the total number of meetings held by each committee on which he or she served in 2017 (during the period that he or she served). Under our corporate governance guidelines, we encourage all of our directors and nominees for director to attend the Annual Meeting; however, attendance is not mandatory. Four of our nine directors at that time, attended our 2017 Annual Meeting of Stockholders.

In connection with each of the quarterly board of directors meetings, the non-management directors meet in executive session without any members of management present. If the board of directors convenes a special meeting, the non-management directors may meet in executive session if the circumstances warrant. Mr. Clarkson presides at each board executive session of non-management directors.

Stockholders' and Other Interested Parties' Communications with the Board of Directors

Should stockholders and other interested parties wish to communicate with the Board or any specified individual directors, such correspondence should be sent to the attention of the Corporate Secretary at P.O. Box 79588, Houston, Texas 77279. The mailing envelope must contain a clear notation indicating that the enclosed letter is a "WRD Stockholder-Board Communication" or "WRD Stockholder-Director Communication." All such letters must identify the author as a stockholder and clearly state whether the intended recipients are all members of the Board or just certain specified individual directors. The Company's General Counsel will review each communication received from stockholders and other interested parties and will forward the communication, as expeditiously as reasonably practicable, to the addressees if: (i) the communication complies with the requirements of any applicable policy adopted by the Board relating to the subject matter of the communication and (ii) the communication falls within the scope of matters generally considered by the Board. If the subject matter of a communication relates to matters that have been delegated by the Board to a committee or to an executive officer of the Company, then the Company's General Counsel may forward the communication to the executive officer or chairman of the committee to which the matter has been delegated. If requested, any questions or comments will be kept confidential to the extent reasonably possible. The acceptance and forwarding of communications to the members of the Board or an executive officer does not imply or create any fiduciary duty of the Board members or executive officer to the person submitting the communications.

Compensation Committee Interlocks and Insider Participation

During 2017, none of our executive officers served on the board of directors or compensation committee of a company that had an executive officer that served on the Board. During 2017, no

20

Table of Contents

member of the Board was an executive officer of a company in which one of our executive officers served as a member of the board of directors or compensation committee of that company.

Compensation Committee Report

As permitted under the New York Stock Exchange "controlled company" exception, we do not have a compensation committee. The Board has reviewed and discussed the "Compensation Discussion and Analysis" section of this proxy statement with management. Based on its review and discussion with management, the Board approved that the"Compensation Discussion and Analysis" section be included in this proxy statement.

| | |

| | Jay C. Graham,Chairman of the Board

Anthony Bahr

Brian A. Bernasek

Richard D. Brannon

Jonathan M. Clarkson

Scott A. Gieselman

David W. Hayes

Stephanie C. Hildebrandt

Grant E. Sims

Martin W. Sumner

Tony R. Weber

|

21

Table of Contents

DIRECTOR COMPENSATION IN 2017

Our officers or employees and officers or employees of NGP or Carlyle who also serve as our directors do not receive additional compensation for their service as a director. Our directors who are not our officers or employees and our directors who are not officers or employees of NGP or Carlyle receive compensation as "non-employee directors." The following table presents information regarding compensation paid to the non-employee directors during the year ended December 31, 2017.

| | | | | | | | | | | | | |

Name | | Fees Earned or

Paid in Cash ($) | | Restricted

Stock Awards ($)(2) | | All Other

Compensation ($) | | Total ($) | |

|---|

Richard D. Brannon | | $ | 150,000 | | $ | —(3 | ) | $ | — | | $ | 150,000 | |

Jonathan M. Clarkson(1) | | | 195,000 | | | — (3 | ) | | — | | | 195,000 | |

Stephanie C. Hildebrandt | | | — | | | — | | | — | | | — | |

Grant E. Sims | | | 175,000 | | | 142,200 | | | — | | | 317,200 | |

- (1)

- Mr. Clarkson serves as chairman of the Audit Committee.

- (2)