Earnings Overview Verra Mobility Q1 Earnings Presentation For the Quarter Ended March 31, 2022 Exhibit 99.2

Forward-looking statements This presentation includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “forecast,” “intend,” “seek,” “target,” “anticipate,” “believe,” “expect,” “estimate,” “plan,” “outlook,” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Such forward-looking statements include projected financial information. Such forward-looking statements with respect to revenues, earnings, performance, strategies, prospects and other aspects of the business of Verra Mobility Corporation and its subsidiaries (collectively, “Verra Mobility” or the “Company”) are based on current expectations and judgements of the Company as of the date of this release. The Company disclaims any intent or obligation to update forward-looking statements hereafter. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such forward-looking statements, including but not limited to (1) the impacts on our operations and business resulting from our delayed 2021 Form 10-K filing (2) the disruption to our business and results of operations as a result of the COVID-19 pandemic; (3) the impact of the COVID-19 pandemic on our revenues from key customers in the rental car industry and from photo enforcement programs; (4) customer concentration in our Commercial Services and Government Solutions segments; (5) decreases in the prevalence of automated photo enforcement or the use of tolling; (6) risks and uncertainties related to our government contracts, including but not limited to administrative hurdles, legislative changes, termination rights, audits and investigations; (7) decreased interest in outsourcing from our customers; (8) our ability to properly perform under our contracts and otherwise satisfy our customers; (9) our ability to compete in a highly competitive and rapidly evolving market; (10) our ability to keep up with technological developments and changing customer preferences; (11) the success of our new products and changes to existing products and services; (12) our ability to successfully integrate our recent or future acquisitions; (13) failures in or breaches of our networks or systems, including as a result of cyber-attacks; and (14) other risks and uncertainties indicated from time to time in documents filed or to be filed with the Securities and Exchange Commission (the “SEC”) by Verra Mobility. These risks, uncertainties and other factors are further described under "Risk Factors," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and elsewhere in the documents filed with the SEC from time to time. You are cautioned not to place undue reliance upon any forward-looking statements, including the projections, which speak only as of the date made. Verra Mobility does not undertake any commitment to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. Non-GAAP Financial Information This presentation uses certain non-GAAP financial information, including earnings before interest, taxes, depreciation and amortization (“EBITDA”) and adjusted EBITDA, which further excludes certain non-cash expenses and other transactions that management believes are not indicative of Verra Mobility’s ongoing operating performance. Verra Mobility believes that these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to Verra Mobility’s financial condition and results of operations. These financial measures are not recognized measures under GAAP and they are not intended to be and should not be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. EBITDA, adjusted EBITDA and adjusted EBITDA margin are non-GAAP financial measures as defined by SEC rules. This non-GAAP financial information may be determined or calculated differently by other companies. A reconciliation of Verra Mobility’s non-GAAP financial information to GAAP financial information is provided in the Appendix hereto and in Verra Mobility’s Form 8-K, filed with the SEC, with the earnings press release for the period indicated.

Providing mission critical operational services to solve the complex challenges of our customers Key Highlights Attractive macro trends driving strong growth in Commercial Services Q1 2022 results represent 17% revenue growth over Q1 2019 Strong top-line performance across all business segments Commercial Services – 61% Y-o-Y growth Government Solutions – 66% Y-o-Y service revenue growth; 28% of which is organic growth Parking Solutions – delivering results in line with expectations and poised for low double-digit growth for the year Solid contract bookings in Parking Solutions and Government Solutions for new awards as well as a contract renewal for a top 10 metro customer Hertz tolls and violations contract renewal Renewed the Hertz tolls and violations contract for a 5-year term Financial Guidance Expect to generate revenue and Adj. EBITDA at the high end of the guidance range Share Repurchase Program Board of directors has approved a stock repurchase program, which authorizes the Company to repurchase up to $125 million of its shares over the next twelve months Executive summary Q1 2022 Total Revenue $170 million Q1 2022 Adjusted EBITDA 1 $75 million 1 Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. For a reconciliation of these non-GAAP financial measures, see the appendix. Q1 2022 Cash Flow from Operations $31 million

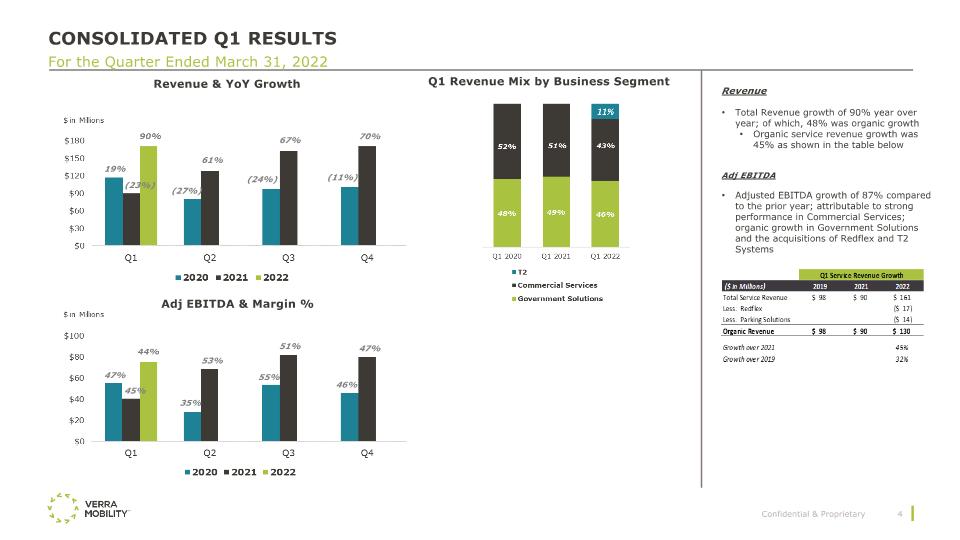

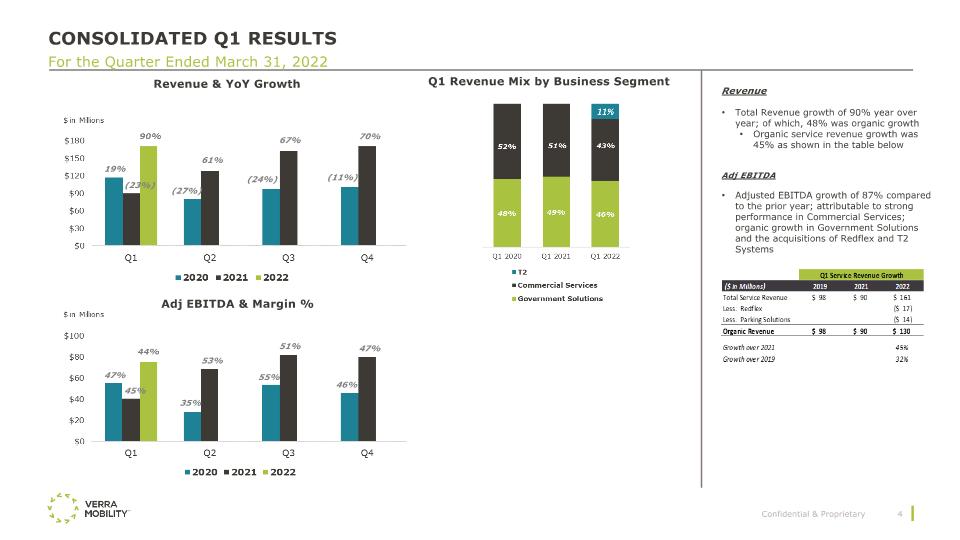

Consolidated Q1 Results For the Quarter Ended March 31, 2022 Revenue & YoY Growth Adj EBITDA & Margin % Revenue Total Revenue growth of 90% year over year; of which, 48% was organic growth Organic service revenue growth was 45% as shown in the table below Adj EBITDA Adjusted EBITDA growth of 87% compared to the prior year; attributable to strong performance in Commercial Services; organic growth in Government Solutions and the acquisitions of Redflex and T2 Systems (23%) (24%) 67% (27%) (11%) 61% 70% 19% 46% 47% 51% 55% 35% 53% 47% 45% Q1 Revenue Mix by Business Segment

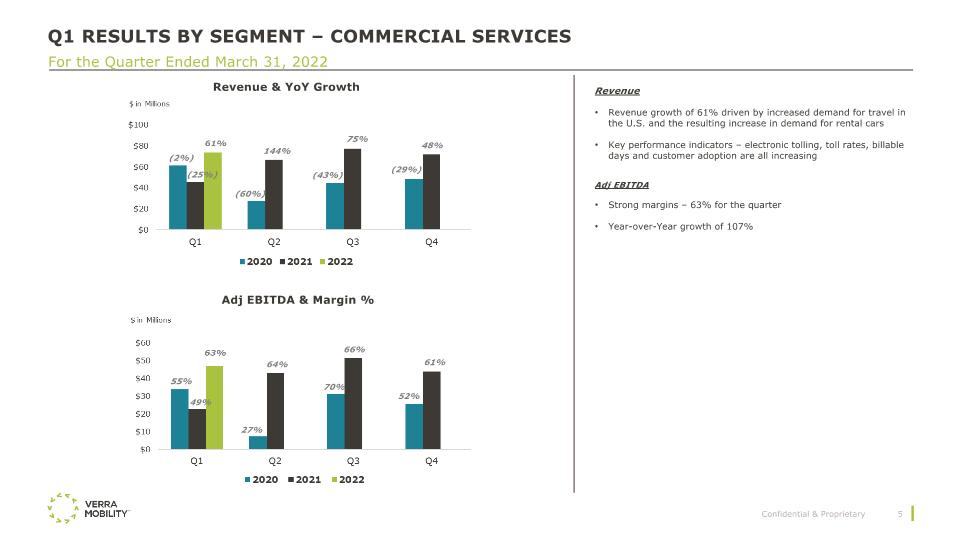

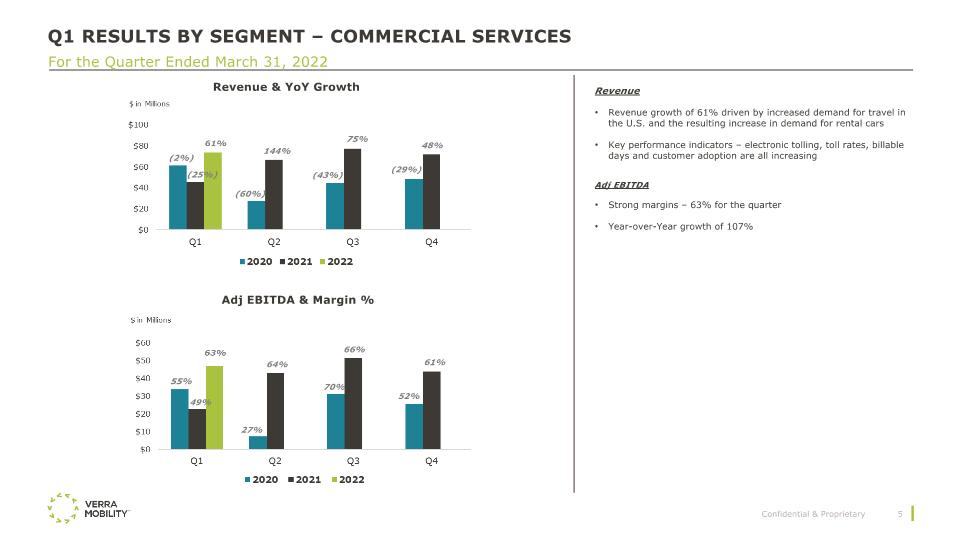

Q1 Results by segment – commercial services For the Quarter Ended March 31, 2022 Revenue & YoY Growth Adj EBITDA & Margin % Revenue Revenue growth of 61% driven by increased demand for travel in the U.S. and the resulting increase in demand for rental cars Key performance indicators – electronic tolling, toll rates, billable days and customer adoption are all increasing Adj EBITDA Strong margins – 63% for the quarter Year-over-Year growth of 107% (25%) (2%) (60%) (43%) (29%) 55% 27% 52% 70% 63% 54% 61% 144% 75% 48% 49% 64% 66% 61%

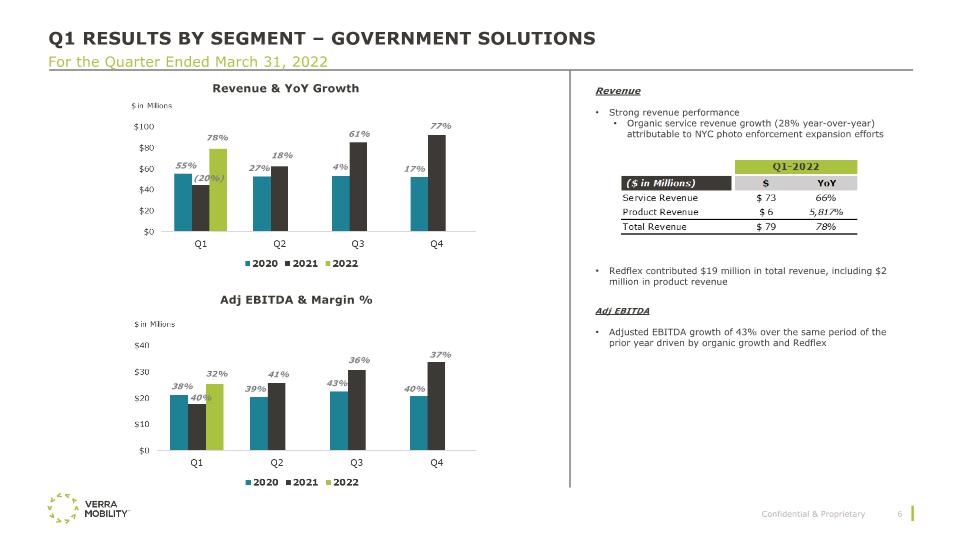

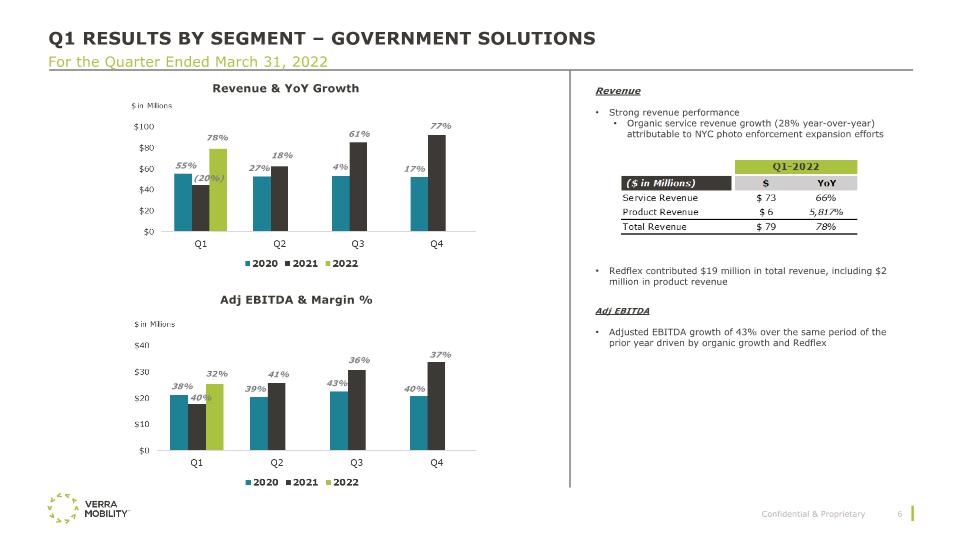

Q1 Results by segment – Government solutions For the Quarter Ended March 31, 2022 Revenue & YoY Growth Adj EBITDA & Margin % Revenue Strong revenue performance Organic service revenue growth (28% year-over-year) attributable to NYC photo enforcement expansion efforts Redflex contributed $19 million in total revenue, including $2 million in product revenue Adj EBITDA Adjusted EBITDA growth of 43% over the same period of the prior year driven by organic growth and Redflex (20%) 55% 4% 17% 27% 38% 40% 36% 39% 43% 40% 37% 38% 40% 38% 18% 61% 77% 41%

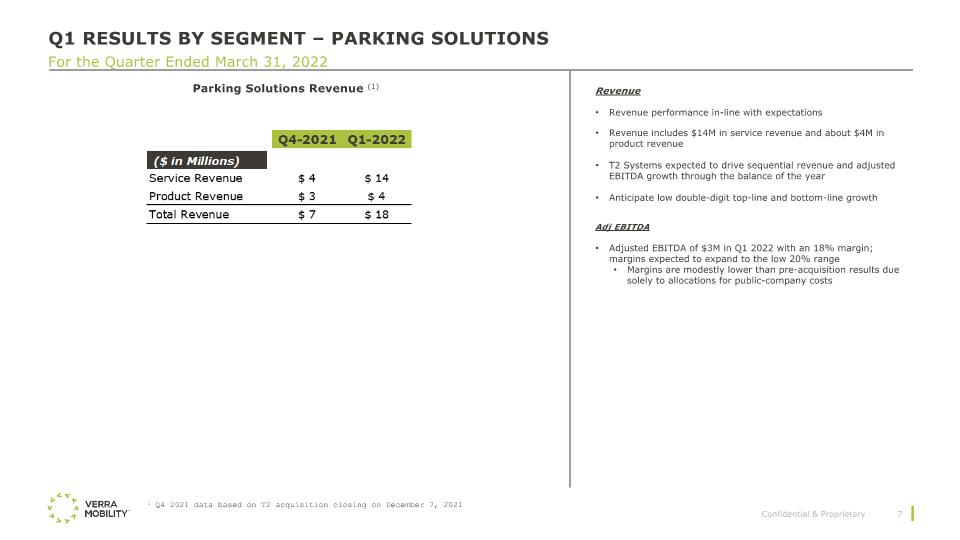

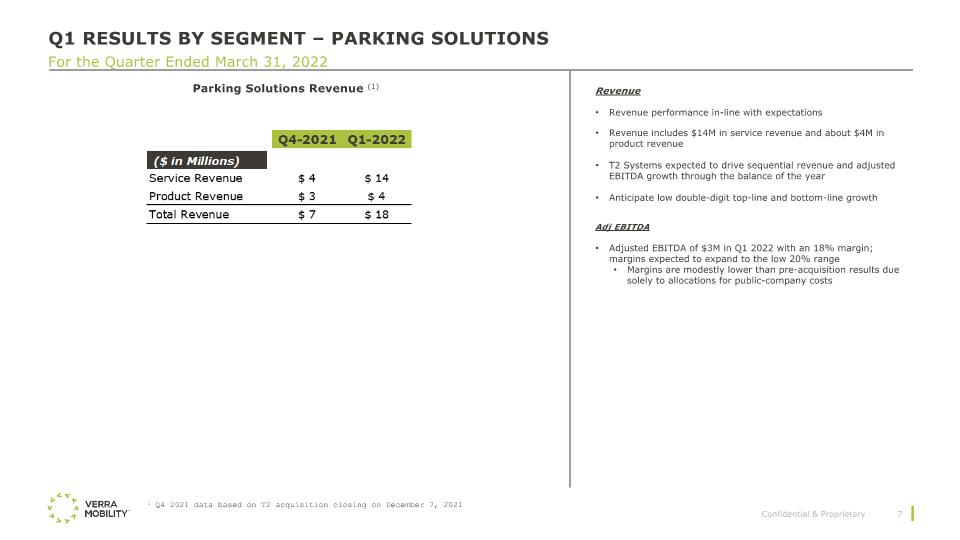

Q1 Results by segment – PARKING solutions For the Quarter Ended March 31, 2022 Revenue Revenue performance in-line with expectations Revenue includes $14M in service revenue and about $4M in product revenue T2 Systems expected to drive sequential revenue and adjusted EBITDA growth through the balance of the year Anticipate low double-digit top-line and bottom-line growth Adj EBITDA Adjusted EBITDA of $3M in Q1 2022 with an 18% margin; margins expected to expand to the low 20% range Margins are modestly lower than pre-acquisition results due solely to allocations for public-company costs 38% 40% 38% Parking Solutions Revenue (1) 1 Q4 2021 data based on T2 acquisition closing on December 7, 2021

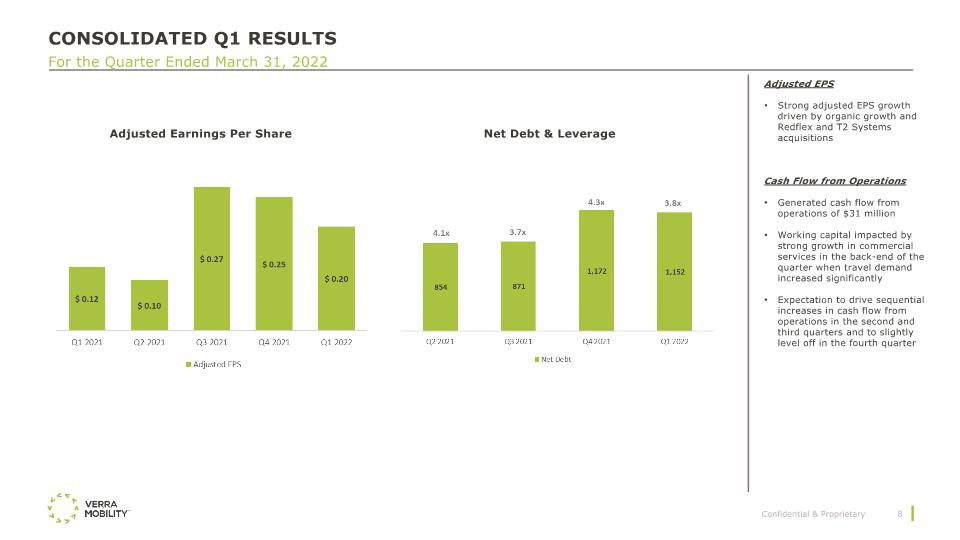

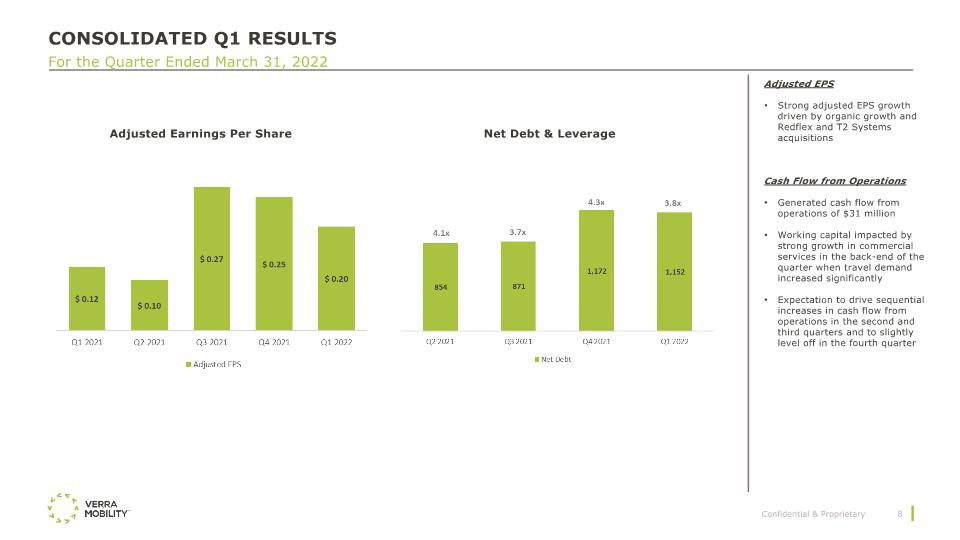

Consolidated Q1 Results For the Quarter Ended March 31, 2022 Adjusted Earnings Per Share Net Debt & Leverage Adjusted EPS Strong adjusted EPS growth driven by organic growth and Redflex and T2 Systems acquisitions Cash Flow from Operations Generated cash flow from operations of $31 million Working capital impacted by strong growth in commercial services in the back-end of the quarter when travel demand increased significantly Expectation to drive sequential increases in cash flow from operations in the second and third quarters and to slightly level off in the fourth quarter

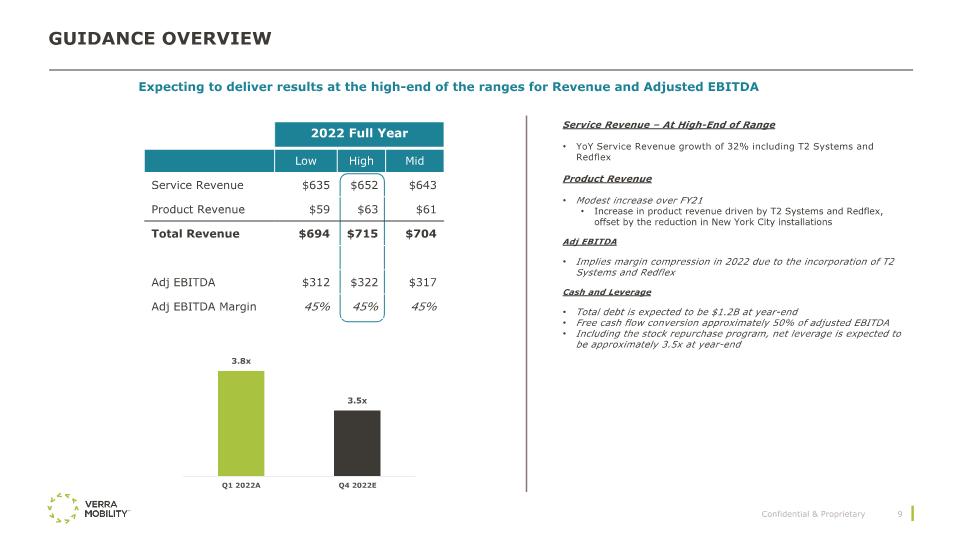

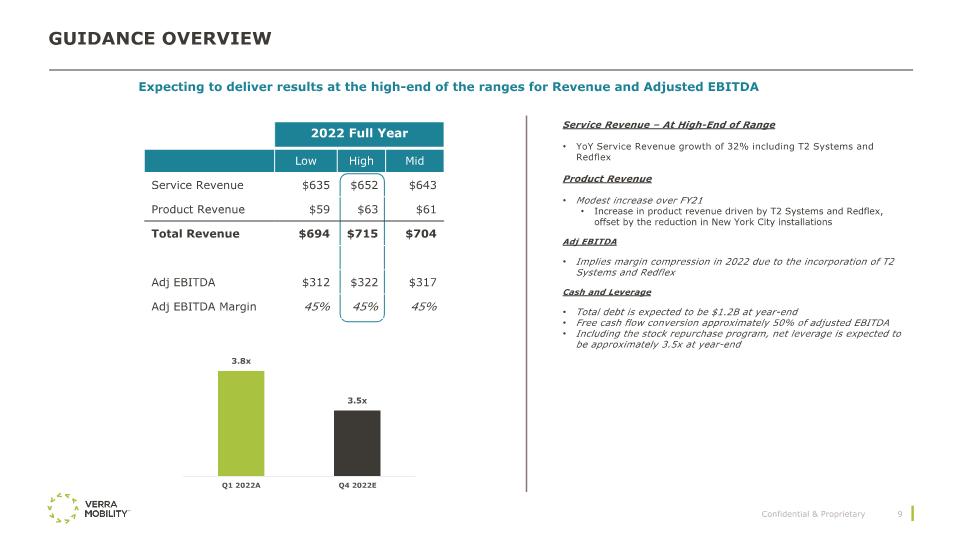

2022 Full Year Low High Mid Service Revenue $635 $652 $643 Product Revenue $59 $63 $61 Total Revenue $694 $715 $704 Adj EBITDA $312 $322 $317 Adj EBITDA Margin 45% 45% 45% Guidance Overview Service Revenue – At High-End of Range YoY Service Revenue growth of 32% including T2 Systems and Redflex Product Revenue Modest increase over FY21 Increase in product revenue driven by T2 Systems and Redflex, offset by the reduction in New York City installations Adj EBITDA Implies margin compression in 2022 due to the incorporation of T2 Systems and Redflex Cash and Leverage Total debt is expected to be $1.2B at year-end Free cash flow conversion approximately 50% of adjusted EBITDA Including the stock repurchase program, net leverage is expected to be approximately 3.5x at year-end Expecting to deliver results at the high-end of the ranges for Revenue and Adjusted EBITDA

APPENDIX

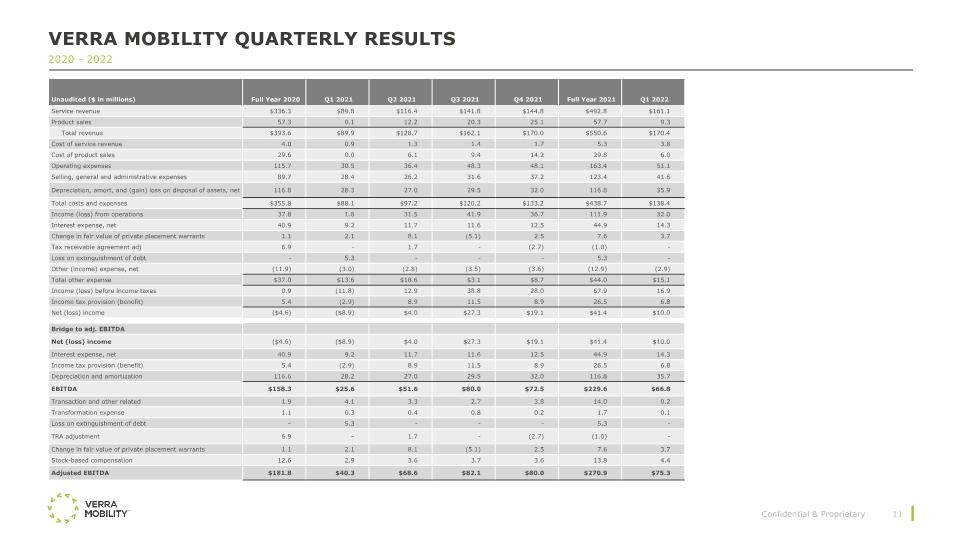

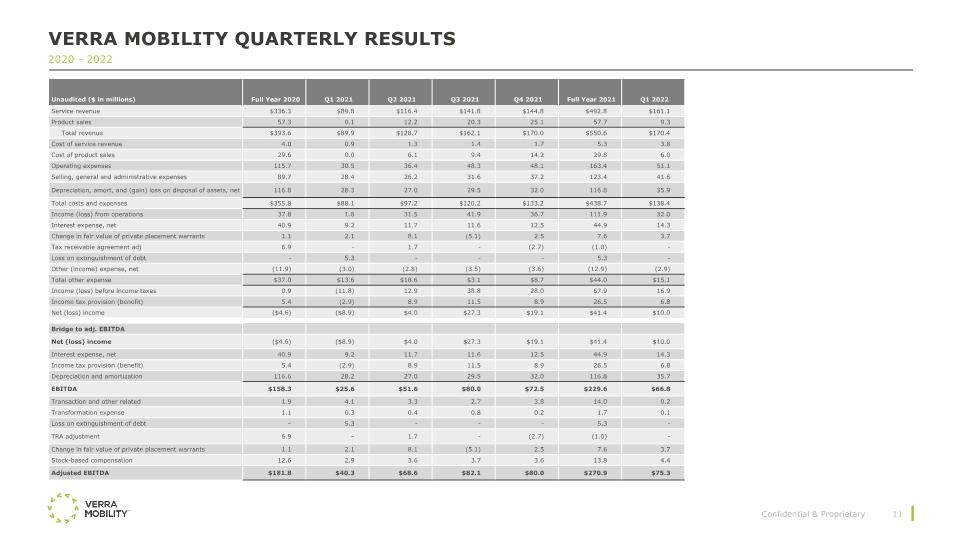

Verra Mobility Quarterly Results 2020 - 2022 Unaudited ($ in millions) Full Year 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Full Year 2021 Q1 2022 Service revenue $336.3 $89.8 $116.4 $141.8 $144.8 $492.8 $161.1 Product sales 57.3 0.1 12.2 20.3 25.1 57.7 9.3 Total revenue $393.6 $89.9 $128.7 $162.1 $170.0 $550.6 $170.4 Cost of service revenue 4.0 0.9 1.3 1.4 1.7 5.3 3.8 Cost of product sales 29.6 0.0 6.1 9.4 14.2 29.8 6.0 Operating expenses 115.7 30.5 36.4 48.3 48.1 163.4 51.1 Selling, general and administrative expenses 89.7 28.4 26.2 31.6 37.2 123.4 41.6 Depreciation, amort, and (gain) loss on disposal of assets, net 116.8 28.3 27.0 29.5 32.0 116.8 35.9 Total costs and expenses $355.8 $88.1 $97.2 $120.2 $133.2 $438.7 $138.4 Income (loss) from operations 37.8 1.8 31.5 41.9 36.7 111.9 32.0 Interest expense, net 40.9 9.2 11.7 11.6 12.5 44.9 14.3 Change in fair value of private placement warrants 1.1 2.1 8.1 (5.1) 2.5 7.6 3.7 Tax receivable agreement adj 6.9 - 1.7 - (2.7) (1.0) - Loss on extinguishment of debt - 5.3 - - - 5.3 - Other (income) expense, net (11.9) (3.0) (2.8) (3.5) (3.6) (12.9) (2.9) Total other expense $37.0 $13.6 $18.6 $3.1 $8.7 $44.0 $15.1 Income (loss) before income taxes 0.9 (11.8) 12.9 38.8 28.0 67.9 16.9 Income tax provision (benefit) 5.4 (2.9) 8.9 11.5 8.9 26.5 6.8 Net (loss) income ($4.6) ($8.9) $4.0 $27.3 $19.1 $41.4 $10.0 Bridge to adj. EBITDA Net (loss) income ($4.6) ($8.9) $4.0 $27.3 $19.1 $41.4 $10.0 Interest expense, net 40.9 9.2 11.7 11.6 12.5 44.9 14.3 Income tax provision (benefit) 5.4 (2.9) 8.9 11.5 8.9 26.5 6.8 Depreciation and amortization 116.6 28.2 27.0 29.5 32.0 116.8 35.7 EBITDA $158.3 $25.6 $51.6 $80.0 $72.5 $229.6 $66.8 Transaction and other related 1.9 4.1 3.3 2.7 3.8 14.0 0.2 Transformation expense 1.1 0.3 0.4 0.8 0.2 1.7 0.1 Loss on extinguishment of debt – 5.3 - - - 5.3 - TRA adjustment 6.9 – 1.7 - (2.7) (1.0) - Change in fair value of private placement warrants 1.1 2.1 8.1 (5.1) 2.5 7.6 3.7 Stock-based compensation 12.6 2.9 3.6 3.7 3.6 13.8 4.4 Adjusted EBITDA $181.8 $40.3 $68.6 $82.1 $80.0 $270.9 $75.3

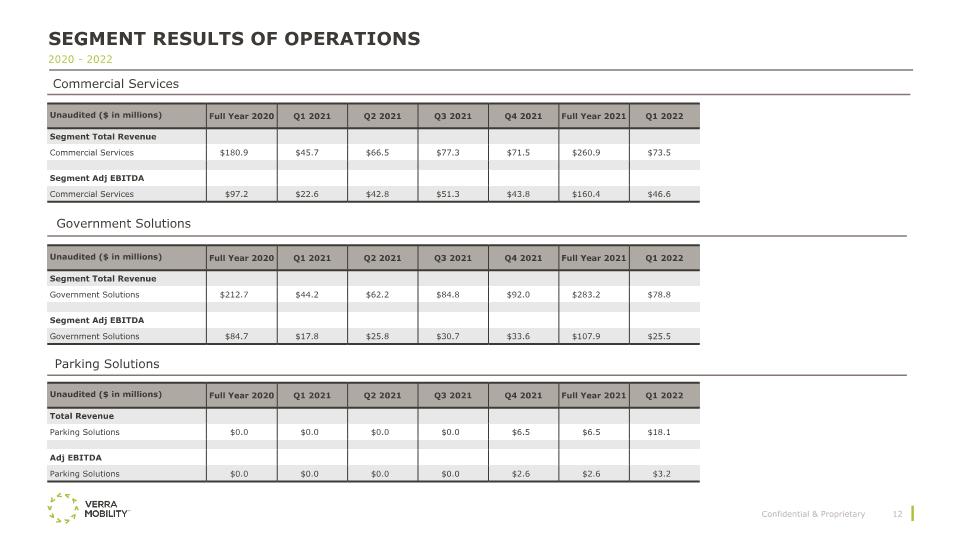

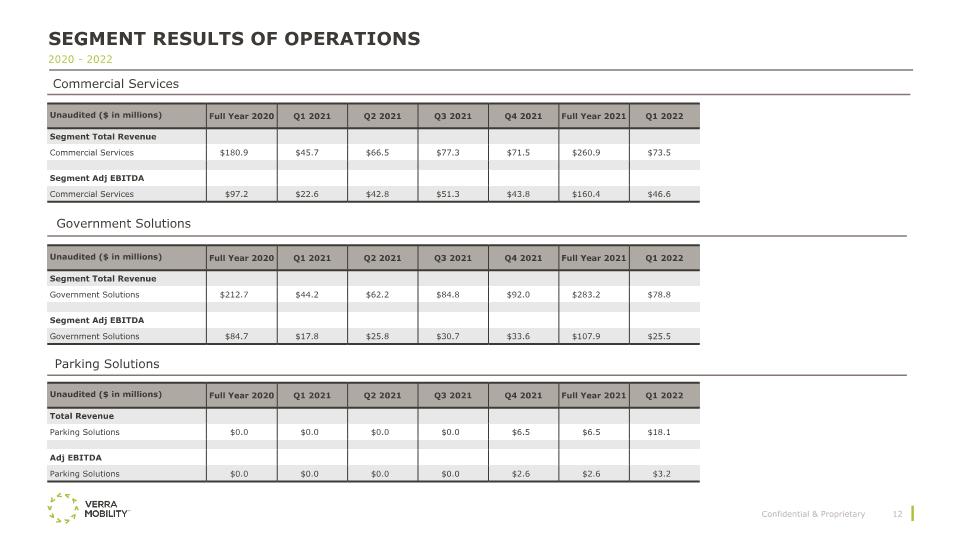

Segment Results of Operations 2020 - 2022 Commercial Services Parking Solutions Government Solutions Unaudited ($ in millions) Full Year 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Full Year 2021 Q1 2022 Segment Total Revenue Commercial Services $180.9 $45.7 $66.5 $77.3 $71.5 $260.9 $73.5 Segment Adj EBITDA Commercial Services $97.2 $22.6 $42.8 $51.3 $43.8 $160.4 $46.6 Unaudited ($ in millions) Full Year 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Full Year 2021 Q1 2022 Segment Total Revenue Government Solutions $212.7 $44.2 $62.2 $84.8 $92.0 $283.2 $78.8 Segment Adj EBITDA Government Solutions $84.7 $17.8 $25.8 $30.7 $33.6 $107.9 $25.5 Unaudited ($ in millions) Full Year 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Full Year 2021 Q1 2022 Total Revenue Parking Solutions $0.0 $0.0 $0.0 $0.0 $6.5 $6.5 $18.1 Adj EBITDA Parking Solutions $0.0 $0.0 $0.0 $0.0 $2.6 $2.6 $3.2

Thank You http://ir.verramobility.com/