Investor Overview Verra Mobility Q1 Investor Presentation For the Quarter Ended March 31, 2022 Exhibit 99.3

Forward-looking statements This presentation includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “forecast,” “intend,” “seek,” “target,” “anticipate,” “believe,” “expect,” “estimate,” “plan,” “outlook,” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Such forward-looking statements include projected financial information. Such forward-looking statements with respect to revenues, earnings, performance, strategies, prospects and other aspects of the business of Verra Mobility Corporation and its subsidiaries (collectively, “Verra Mobility” or the “Company”) are based on current expectations and judgements of the Company as of the date of this release. The Company disclaims any intent or obligation to update forward-looking statements hereafter. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such forward-looking statements, including but not limited to (1) the impacts on our operations and business resulting from our delayed 2021 Form 10-K filing (2) the disruption to our business and results of operations as a result of the COVID-19 pandemic; (3) the impact of the COVID-19 pandemic on our revenues from key customers in the rental car industry and from photo enforcement programs; (4) customer concentration in our Commercial Services and Government Solutions segments; (5) decreases in the prevalence of automated photo enforcement or the use of tolling; (6) risks and uncertainties related to our government contracts, including but not limited to administrative hurdles, legislative changes, termination rights, audits and investigations; (7) decreased interest in outsourcing from our customers; (8) our ability to properly perform under our contracts and otherwise satisfy our customers; (9) our ability to compete in a highly competitive and rapidly evolving market; (10) our ability to keep up with technological developments and changing customer preferences; (11) the success of our new products and changes to existing products and services; (12) our ability to successfully integrate our recent or future acquisitions; (13) failures in or breaches of our networks or systems, including as a result of cyber-attacks; and (14) other risks and uncertainties indicated from time to time in documents filed or to be filed with the Securities and Exchange Commission (the “SEC”) by Verra Mobility. These risks, uncertainties and other factors are further described under "Risk Factors," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and elsewhere in the documents filed with the SEC from time to time. You are cautioned not to place undue reliance upon any forward-looking statements, including the projections, which speak only as of the date made. Verra Mobility does not undertake any commitment to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. Use of Non-GAAP Financial Measures �This presentation includes non-GAAP financial measures, including earnings before interest, taxes, depreciation and amortization (“EBITDA”), Pro Forma Adjusted EBITDA, Free Cash Flow, Free Cash Flow Margin and Pro Forma Adjusted Revenue. Pro Forma Adjusted EBITDA is defined as EBITDA adjusted as described in this presentation for historical costs and estimated cost savings and synergies. Free Cash Flow is defined as EBITDA minus capital expenditures, and Free Cash Flow Margin is defined as Free Cash Flow divided by total revenue. Pro Forma Adjusted Revenue adjusts total revenue for non-cash amortization of contract incentive and certain pre-acquisition results. These non-GAAP financial measures may be determined or calculated differently by other companies. As a result, they may not be comparable to similarly titled performance measures presented by other companies. Reconciliations of these non-GAAP measurements to the most directly comparable GAAP financial measurements have been provided elsewhere in this presentation. Verra Mobility uses these non-GAAP financial metrics to measure its performance from period to period both at the consolidated level as well as within its operating segments, to evaluate and fund incentive compensation programs and to compare its results to those of its competitors. In addition, the Company also believes that these non-GAAP measures provide useful information to investors regarding financial and business trends related to the Company’s results of operations and that when non-GAAP financial information is viewed with GAAP financial information, investors are provided with a more meaningful understanding of the Company’s ongoing operating performance. These non-GAAP measures have certain limitations as analytical tools and should not be used as substitutes for net income, cash flows from operations, earnings per share or other consolidated income or cash flow data prepared in accordance with GAAP.

Verra mobility Who We Are SAFE. SMART. CONNECTED.�Leading provider of smart mobility solutions that address mission critical mobility needs for cities, fleets, and universities Building safer cities by installing, maintaining and managing leading technology that positively impacts driver behavior and enhances road safety. Enabling smarter roadways �by providing the integrated technology to help rental car companies and large fleet operators manage tolls, violations, and vehicle title and registrations. Developing more connected systems �by seamlessly connecting people, technology and data across the smart mobility ecosystem. Enriching lives by making transportation Safer & Easier

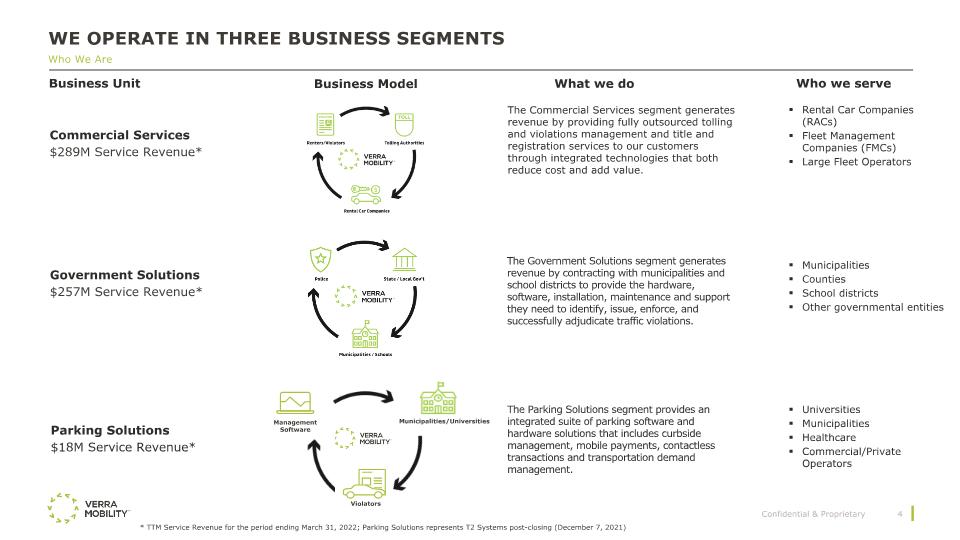

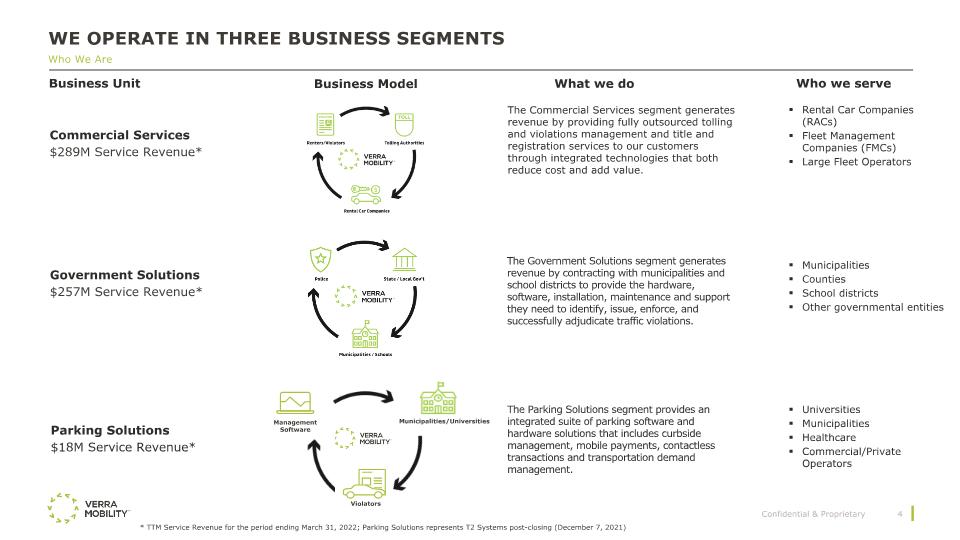

We operate in three business segments Who We Are * TTM Service Revenue for the period ending March 31, 2022; Parking Solutions represents T2 Systems post-closing (December 7, 2021) Business Unit Commercial Services $289M Service Revenue* Government Solutions $257M Service Revenue* Parking Solutions $18M Service Revenue* What we do Who we serve Business Model The Commercial Services segment generates revenue by providing fully outsourced tolling and violations management and title and registration services to our customers through integrated technologies that both reduce cost and add value. The Government Solutions segment generates revenue by contracting with municipalities and school districts to provide the hardware, software, installation, maintenance and support they need to identify, issue, enforce, and successfully adjudicate traffic violations. Rental Car Companies (RACs) Fleet Management Companies (FMCs) Large Fleet Operators Municipalities Counties School districts Other governmental entities Universities Municipalities Healthcare Commercial/Private Operators The Parking Solutions segment provides an integrated suite of parking software and hardware solutions that includes curbside management, mobile payments, contactless transactions and transportation demand management. Violators Management Software Municipalities/Universities

Commercial services Providing tolling, violation management and title/registration services Toll Management Violations Title and Registration Rental fleet toll collection and management, reducing in-house administrative burdens while providing convenience to the driver – daily or flat fee Commercial fleet toll collection and management driving value for customers Manage toll, parking and photo enforcement violations for rental car and commercial fleets, reducing violation-related expenses and late fees European toll and violation collection and management for issuing authorities for administrative fees Rental car and commercial fleet title and registration for data management and services fee $289M Service Revenue* United States & a portion of Canada United States & Europe United States * TTM Service Revenue for the period ending March 31, 2022

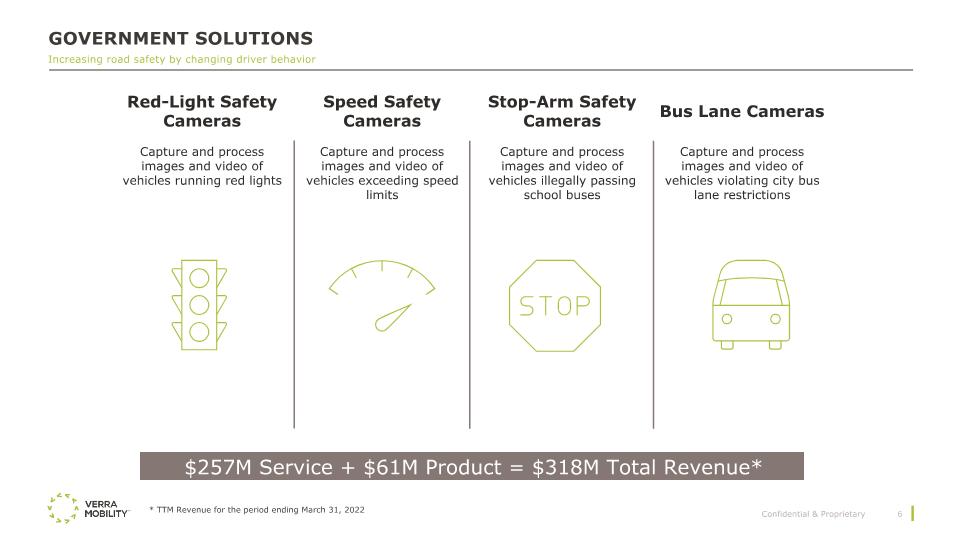

Government solutions Increasing road safety by changing driver behavior Red-Light Safety Cameras Speed Safety Cameras Stop-Arm Safety Cameras Bus Lane Cameras Capture and process images and video of vehicles running red lights Capture and process images and video of vehicles exceeding speed limits Capture and process images and video of vehicles illegally passing school buses Capture and process images and video of vehicles violating city bus lane restrictions $257M Service + $61M Product = $318M Total Revenue* * TTM Revenue for the period ending March 31, 2022

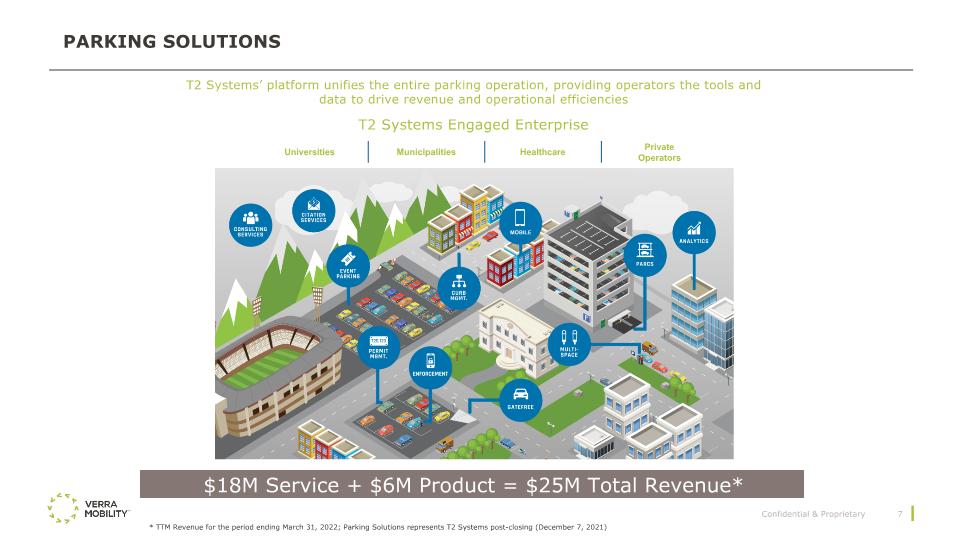

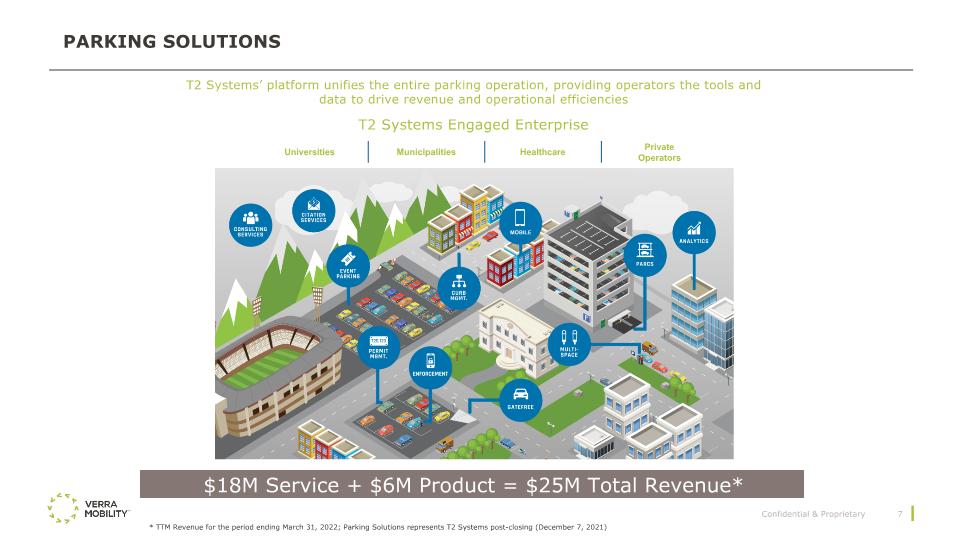

Parking solutions Universities Municipalities Healthcare Private Operators T2 Systems’ platform unifies the entire parking operation, providing operators the tools and data to drive revenue and operational efficiencies T2 Systems Engaged Enterprise MOBILE $18M Service + $6M Product = $25M Total Revenue* * TTM Revenue for the period ending March 31, 2022; Parking Solutions represents T2 Systems post-closing (December 7, 2021)

Why invest in verra mobility? Leadership, business model and strong financial performance A market leader with highly differentiated platforms Leading provider of road safety cameras in the U.S. Leading provider of toll and violation management to rental car and fleet management companies in U.S. Contracted, reoccurring revenue business model Contracts with the three largest U.S. rental car companies Large install base = reoccurring revenue Proven financial performance Solid financial results with robust margins Historically strong free cash flow conversion CAGR for service revenue from 2017-2021 = 21% Demonstrated commitment to opportunistically return cash to shareholders Platform for future growth Connected Fleet, shared economy and smart mobility addressable market growth M&A

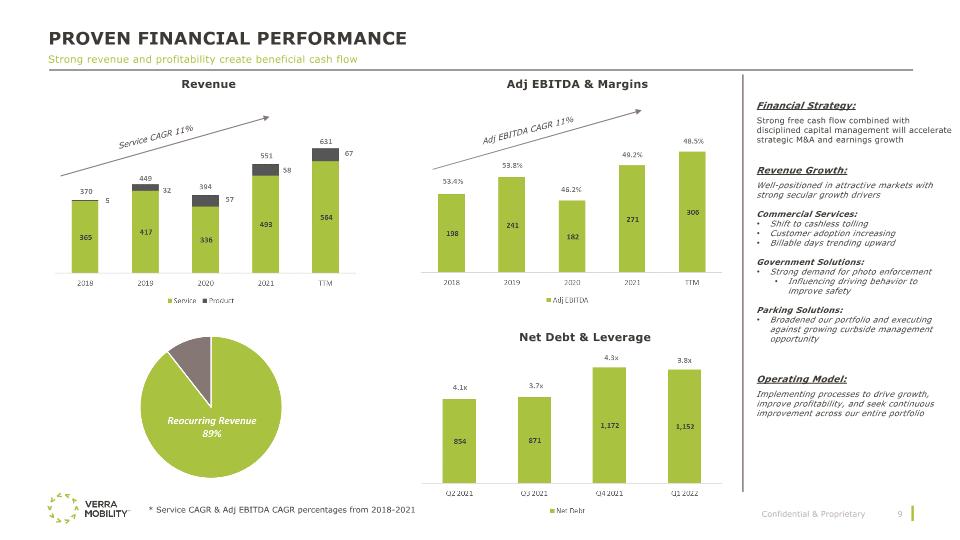

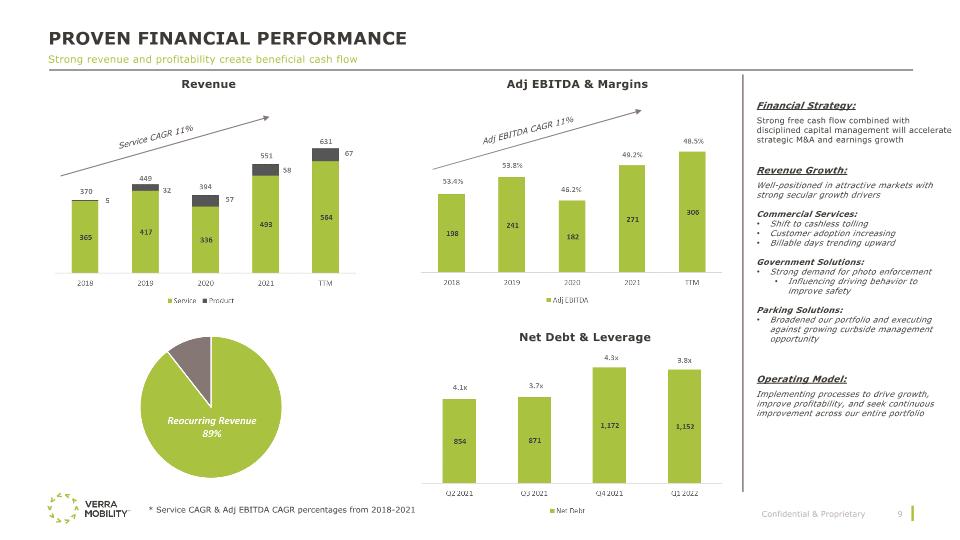

Service CAGR 11% Proven financial performance Strong revenue and profitability create beneficial cash flow Revenue Adj EBITDA & Margins Net Debt & Leverage Financial Strategy: Strong free cash flow combined with disciplined capital management will accelerate strategic M&A and earnings growth Revenue Growth: Well-positioned in attractive markets with strong secular growth drivers Commercial Services: Shift to cashless tolling Customer adoption increasing Billable days trending upward Government Solutions: Strong demand for photo enforcement Influencing driving behavior to improve safety Parking Solutions: Broadened our portfolio and executing against growing curbside management opportunity Operating Model: Implementing processes to drive growth, improve profitability, and seek continuous improvement across our entire portfolio Adj EBITDA CAGR 11% * Service CAGR & Adj EBITDA CAGR percentages from 2018-2021

Emphasis on Innovation and Diversifying Strategic Client Relationships Solving our client’s most complex problems through deep industry knowledge and differentiated solutions Accelerating future growth through M&A and innovation Building meaningful relationships with customers based on trust & founded on partnership

Long-Term Value Creation Through Strategic M&A A disciplined approach to M&A to deliver shareholder value Strategic Fit Aligned with secular growth drivers Connected to Verra Mobility’s growth strategy Find opportunities where the combined assets can create unique value Compounding Returns Over Time Financial Discipline Integration Focus Seek returns above the cost of capital required for the deal Cash flow focused (DCF modeling) Margin of Safety – high probability view on synergies Seamless execution across the organization Ensure cultural fit and change management discipline Establish processes for short & long-term execution & accountability

APPENDIX

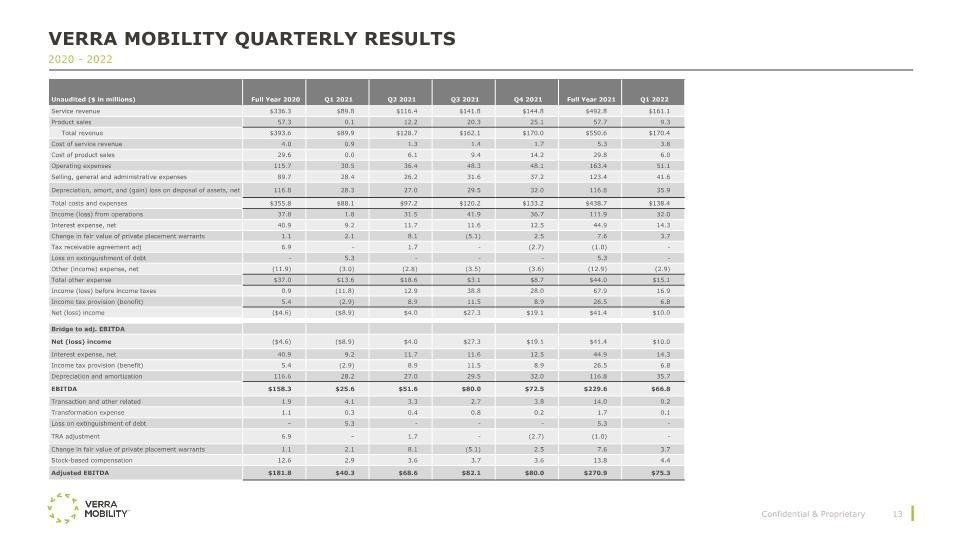

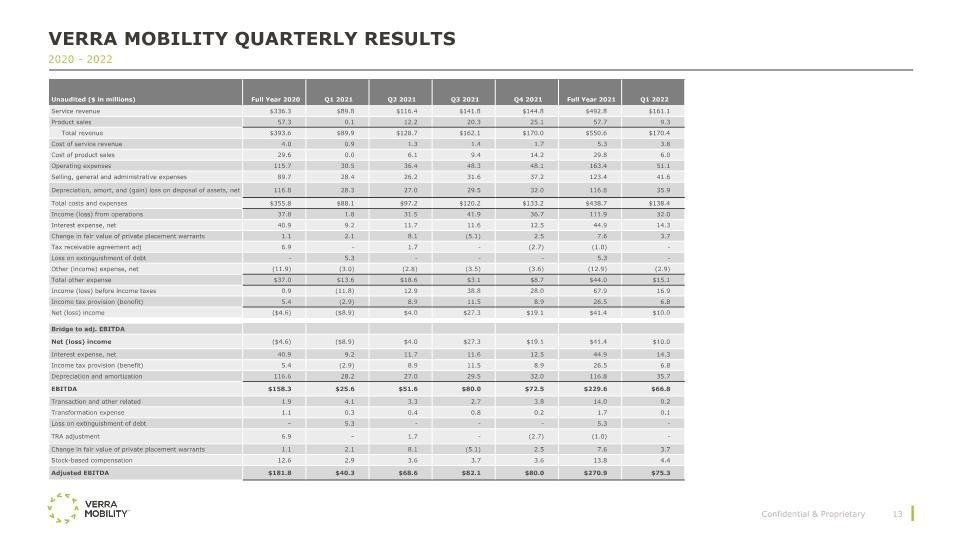

Verra Mobility Quarterly Results 2020 - 2022 Unaudited ($ in millions) Full Year 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Full Year 2021 Q1 2022 Service revenue $336.3 $89.8 $116.4 $141.8 $144.8 $492.8 $161.1 Product sales 57.3 0.1 12.2 20.3 25.1 57.7 9.3 Total revenue $393.6 $89.9 $128.7 $162.1 $170.0 $550.6 $170.4 Cost of service revenue 4.0 0.9 1.3 1.4 1.7 5.3 3.8 Cost of product sales 29.6 0.0 6.1 9.4 14.2 29.8 6.0 Operating expenses 115.7 30.5 36.4 48.3 48.1 163.4 51.1 Selling, general and administrative expenses 89.7 28.4 26.2 31.6 37.2 123.4 41.6 Depreciation, amort, and (gain) loss on disposal of assets, net 116.8 28.3 27.0 29.5 32.0 116.8 35.9 Total costs and expenses $355.8 $88.1 $97.2 $120.2 $133.2 $438.7 $138.4 Income (loss) from operations 37.8 1.8 31.5 41.9 36.7 111.9 32.0 Interest expense, net 40.9 9.2 11.7 11.6 12.5 44.9 14.3 Change in fair value of private placement warrants 1.1 2.1 8.1 (5.1) 2.5 7.6 3.7 Tax receivable agreement adj 6.9 - 1.7 - (2.7) (1.0) - Loss on extinguishment of debt - 5.3 - - - 5.3 - Other (income) expense, net (11.9) (3.0) (2.8) (3.5) (3.6) (12.9) (2.9) Total other expense $37.0 $13.6 $18.6 $3.1 $8.7 $44.0 $15.1 Income (loss) before income taxes 0.9 (11.8) 12.9 38.8 28.0 67.9 16.9 Income tax provision (benefit) 5.4 (2.9) 8.9 11.5 8.9 26.5 6.8 Net (loss) income ($4.6) ($8.9) $4.0 $27.3 $19.1 $41.4 $10.0 Bridge to adj. EBITDA Net (loss) income ($4.6) ($8.9) $4.0 $27.3 $19.1 $41.4 $10.0 Interest expense, net 40.9 9.2 11.7 11.6 12.5 44.9 14.3 Income tax provision (benefit) 5.4 (2.9) 8.9 11.5 8.9 26.5 6.8 Depreciation and amortization 116.6 28.2 27.0 29.5 32.0 116.8 35.7 EBITDA $158.3 $25.6 $51.6 $80.0 $72.5 $229.6 $66.8 Transaction and other related 1.9 4.1 3.3 2.7 3.8 14.0 0.2 Transformation expense 1.1 0.3 0.4 0.8 0.2 1.7 0.1 Loss on extinguishment of debt – 5.3 - - - 5.3 - TRA adjustment 6.9 – 1.7 - (2.7) (1.0) - Change in fair value of private placement warrants 1.1 2.1 8.1 (5.1) 2.5 7.6 3.7 Stock-based compensation 12.6 2.9 3.6 3.7 3.6 13.8 4.4 Adjusted EBITDA $181.8 $40.3 $68.6 $82.1 $80.0 $270.9 $75.3

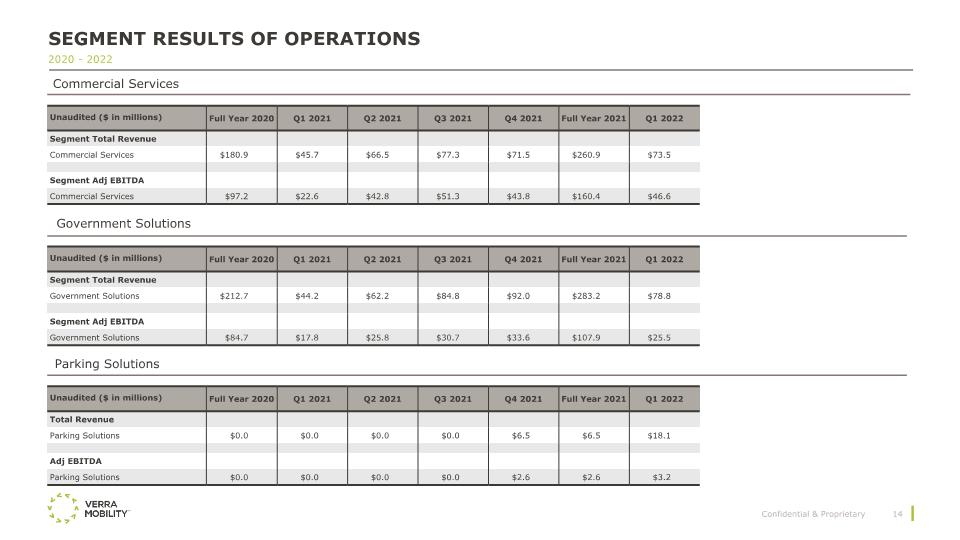

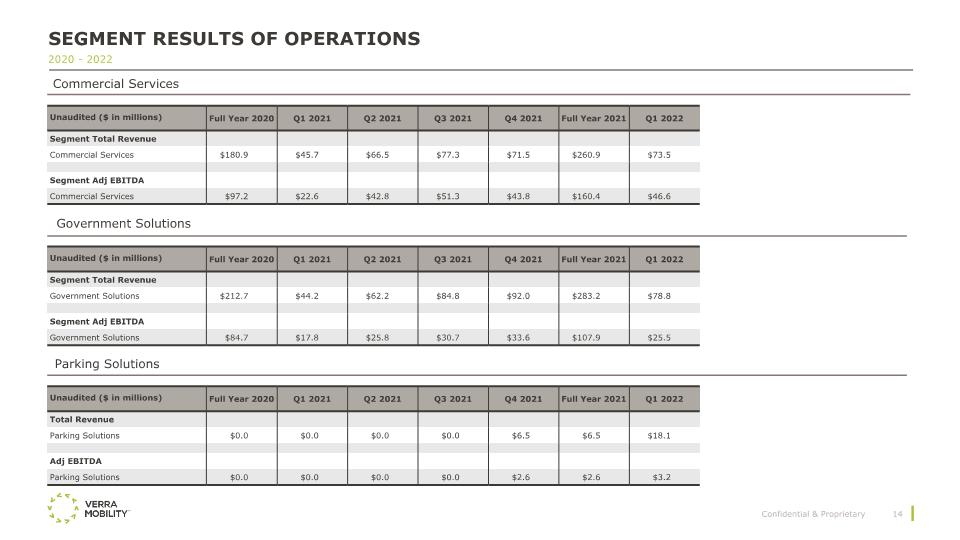

Segment Results of Operations 2020 - 2022 Commercial Services Parking Solutions Unaudited ($ in millions) Full Year 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Full Year 2021 Q1 2022 Segment Total Revenue Commercial Services $180.9 $45.7 $66.5 $77.3 $71.5 $260.9 $73.5 Segment Adj EBITDA Commercial Services $97.2 $22.6 $42.8 $51.3 $43.8 $160.4 $46.6 Unaudited ($ in millions) Full Year 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Full Year 2021 Q1 2022 Segment Total Revenue Government Solutions $212.7 $44.2 $62.2 $84.8 $92.0 $283.2 $78.8 Segment Adj EBITDA Government Solutions $84.7 $17.8 $25.8 $30.7 $33.6 $107.9 $25.5 Unaudited ($ in millions) Full Year 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Full Year 2021 Q1 2022 Total Revenue Parking Solutions $0.0 $0.0 $0.0 $0.0 $6.5 $6.5 $18.1 Adj EBITDA Parking Solutions $0.0 $0.0 $0.0 $0.0 $2.6 $2.6 $3.2 Government Solutions

Thank You http://ir.verramobility.com/