UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-23226)

Listed Funds Trust

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Gregory C. Bakken, President

Listed Funds Trust

c/o U.S. Bancorp Fund Services, LLC

777 East Wisconsin Avenue, 6th Floor

Milwaukee, WI 53202

(Name and address of agent for service)

(414) 516-3097

Registrant’s telephone number, including area code

Date of fiscal year end: December 31

Date of reporting period: December 31, 2023

Item 1. Reports to Stockholders.

| (a) |

Roundhill ETFs

Roundhill Video Games ETF (NERD)

Roundhill Sports Betting & iGaming ETF (BETZ)

Roundhill Ball Metaverse ETF (METV)

Roundhill Cannabis ETF (WEED)

Roundhill Magnificent Seven ETF (MAGS)

Roundhill S&P® Global Luxury ETF (LUXX)

Roundhill Alerian LNG ETF (LNGG)

ANNUAL REPORT

December 31, 2023

Roundhill ETFs

Table of Contents

Shareholder Letter (Unaudited) | 2 |

Performance Overview (Unaudited) | 11 |

Schedules of Investments and Total Return Swaps | 18 |

Statements of Assets and Liabilities | 31 |

Statements of Operations | 33 |

Statements of Changes in Net Assets | 35 |

Financial Highlights | 40 |

Notes to Financial Statements | 43 |

Report of Independent Registered Public Accounting Firm | 57 |

Board Consideration and Approval of Advisory and Sub-Advisory Agreements (Unaudited) | 59 |

Shareholder Expense Example (Unaudited) | 65 |

Trustees and Officers of the Trust (Unaudited) | 67 |

Supplemental Information (Unaudited) | 69 |

Privacy Policy (Unaudited) | 71 |

1

Roundhill Video Games ETF

Shareholder Letter

December 31, 2023 (Unaudited)

Dear Shareholders,

The Roundhill Video Games ETF (“NERD” or the “Fund”) seeks to track the total return performance, before fees and expenses, of the Nasdaq CTA Global Video Games Software Index (the “Index”). The Index is a rules-based index that tracks the performance of a group of globally-listed stocks that are involved in the video games industry. The Index, which was developed and is maintained by both Nasdaq and the Consumer Technology Association (the “CTA”), is a modified theme- adjusted free float market capitalization index designed to track the performance of the common stock (or corresponding depositary receipts) of exchange-listed companies engaged in video game publishing and/or video game development (the “Video Games Industry”). The companies are selected for inclusion in the Index based on a classification scheme developed by the CTA. Specifically, the companies are selected for inclusion in the Index based on (1) their classification within the Developer/ Publisher Sector developed by the CTA, which includes companies that design and execute the creation of video games (game developer companies) and companies that finance the development and distribution of video games (game publisher companies), and (2) the fact that they derive at least 50% of their revenue (at least 40% for companies already included in the Index) from such activities. Such companies also must not be classified by the CTA as a Social Casino Gaming company.

The following information pertains to the fiscal period of January 1, 2023 through December 31, 2023 (the “current fiscal period”).

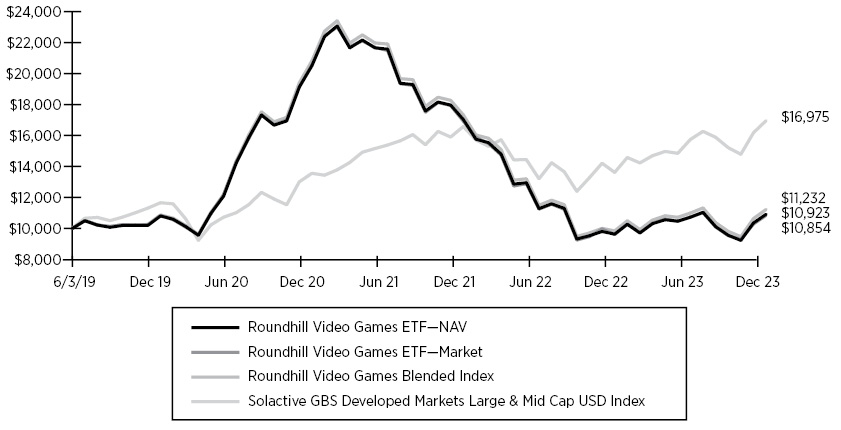

The Fund had positive performance during the current fiscal period. The market price and NAV for NERD increased by 12.92% and 13.35%, respectively, while the Fund’s Index increased by 14.10%. The Solactive GBS Developed Markets Large & Mid Cap USD Index increased by 24.55% over the same period.

For the current fiscal period, the largest positive contributors to returns were Nintendo Co Ltd., Roblox Corp., and Take-Two Interactive Software which added 4.69%, 3.79%, and 3.40% to the return of the Fund, respectively.

For the current fiscal period, the largest negative contributors to returns were NCSoft Corp, Team17 Group PLC, and Kakao Games Corp, which detracted 1.49%, 0.83%, and 0.83% from the return of the Fund, respectively.

Regards,

Will Hershey, CFA

Roundhill Financial Inc.

2

Roundhill Sports Betting & iGaming ETF

Shareholder Letter

December 31, 2023 (Unaudited)

Dear Shareholders,

The Roundhill Sports Betting & iGaming ETF (“BETZ” or the “Fund”) seeks to track the total return performance, before fees and expenses, of the Morningstar® Sports Betting & iGaming Select Index (the “Index”). The Index is a rules-based index that tracks the performance of a group of globally-listed stocks that are involved in sports and online betting. Effective upon the close of trading on September 29, 2023, the Fund’s underlying index transitioned to the Morningstar® Sports Betting & iGaming Select Index. The Index was developed by Morningstar, Inc. (the “Index Provider”) and is designed to provide pure exposure to sports and online betting themes. In order to achieve such exposure, the Index is comprised of common stock (or corresponding American Depositary Receipts (“ADRs”) or Global Depositary Receipts (“GDRs”)) of domestic and foreign sports and online betting (a/k/a iGaming) companies. The Index Provider defines sports betting and iGaming companies as follows (although the definitions may change over time): Sports Betting Companies – companies engaged, directly or indirectly, in analyzing sports events and wagering on the outcome, such as online bookmaking. iGaming Companies – companies engaged, directly or indirectly, in betting online in games of chance, such as poker, slots, blackjack, or the lottery.

The following information pertains to the fiscal period of January 1, 2023 through December 31, 2023 (the “current fiscal period”).

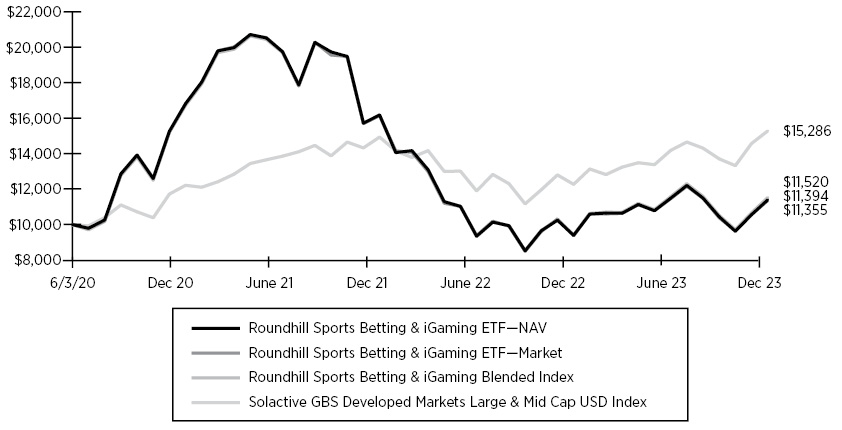

The Fund had positive performance during the current fiscal period. The market price and NAV for BETZ increased by 21.17% and 21.30%, respectively, while the Fund’s Index increased by 22.22%*. The Solactive GBS Developed Markets Large & Mid Cap USD Index increased by 24.55% over the same period.

For the current fiscal period, the largest positive contributors to returns were DraftKings Inc., Flutter Entertainment PLC, and Genius Sports LTD., which added 10.13%, 2.53%, and 2.01% to the return of the Fund, respectively.

For the current fiscal period, the largest negative contributors to returns were PENN Entertainment Inc., Entain PLC, and Tabcorp Holdings Ltd., which detracted 1.53%, 1.42%, and 1.33% from the return of the Fund, respectively.

Regards,

Will Hershey, CFA

Roundhill Financial Inc.

* | The Fund’s objective and strategies changed effective on October 2, 2023. Prior to October 2, the Fund tracked the performance, before fees and expenses, of the Roundhill Sports Betting & iGaming Index. Since October 2, 2023, the Fund tracks the performance, before fees and expenses, of the Morningstar® Sports Betting & iGaming Select Index. |

3

Roundhill Ball Metaverse ETF

Shareholder Letter

December 31, 2023 (Unaudited)

Dear Shareholders,

The Roundhill Ball Metaverse ETF (“METV” or the “Fund”) seeks to track the total return performance, before fees and expenses, of the Ball Metaverse Index (the “Index”). The Index is a rules-based index that tracks the performance of a group of globally- listed stocks that are involved in the metaverse. The “Metaverse” may be defined as a successor to the current internet that will be interoperable, persistent, synchronous, open to unlimited participants with a fully functioning economy, and an experience that spans the virtual and ‘real’ world. The Index includes companies involved in the following seven categories: (i) compute, (ii) networking, (iii) virtual platforms, (iv) interchange standards, (v) payments, (vi) content, assets, and identity services, and (vii) hardware.

The following information pertains to the fiscal period of January 1, 2023 through December 31, 2023 (the “current fiscal period”).

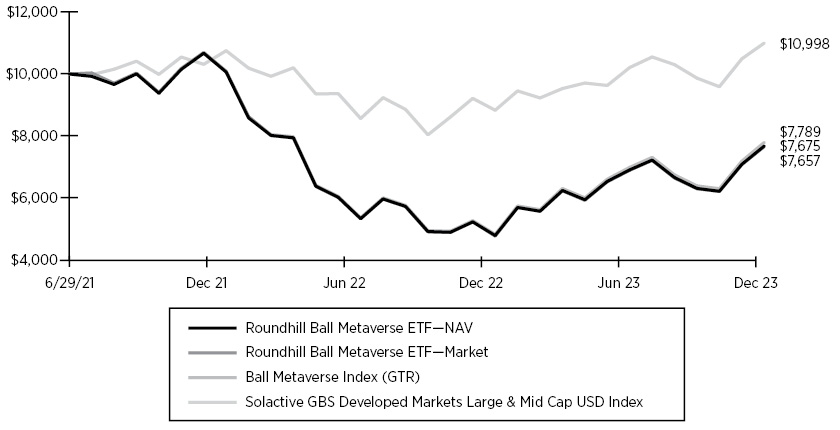

The Fund had positive performance during the current fiscal period. The market price and NAV for METV increased by 60.57% and 60.37%, respectively, while the Fund’s Index increased by 61.46%. The Solactive GBS Developed Markets Large & Mid Cap USD Index increased by 24.55% over the same period.

For the current fiscal period, the largest positive contributors to returns were NVIDIA Corp., Meta Platforms Inc., and Roblox Corp., which added 14.11%, 8.65%, and 6.28% to the return of the Fund, respectively.

For the current fiscal period, the largest negative contributors to returns were Lumen Technologies Inc., Planet Labs PBC, and Tencent Holdings Ltd., which detracted 1.05%, 0.31%, and 0.26% from the return of the Fund, respectively.

Regards,

Will Hershey, CFA

Roundhill Financial Inc.

4

Roundhill Cannabis ETF

Shareholder Letter

December 31, 2023 (Unaudited)

Dear Shareholders,

The Roundhill Cannabis ETF (“WEED” or the “Fund”) seeks to achieve its investment objective by investing primarily in exchange-listed equity securities and total return swaps intended to provide exposure to the cannabis and hemp ecosystem, this classification includes, but is not limited to: cannabis and hemp ecosystem encompasses businesses involved in the production, distribution and marketing of cannabis and hemp and products derived therefrom.

The following information pertains to the fiscal period of January 1, 2023 through December 31, 2023 (the “current fiscal period”).

The Fund had positive performance during the current fiscal period. The market price and NAV for WEED increased by 0.87% and 0.71%, respectively. The North American Cannabis Net Total Return Index decreased by -6.93% over the same period.

During the current fiscal period, the cannabis industry remained volatile due to a lack of meaningful regulatory reform and continued challenges regarding access to capital markets.

Regards,

Will Hershey, CFA

Roundhill Financial Inc.

5

Roundhill Magnificent Seven ETF

Shareholder Letter

December 31, 2023 (Unaudited)

Dear Shareholders,

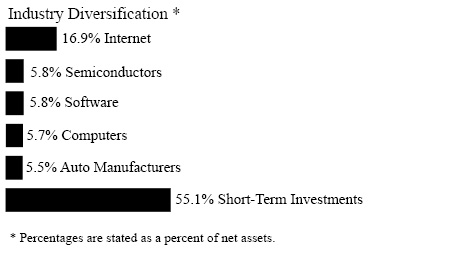

The Roundhill Magnificent Seven ETF (“MAGS” or the “Fund”) seeks to achieve its investment objective by seeking investment exposure to the largest companies (“Underlying Issuers”) in one or more of the following industries, each of which is defined by an independent industry classification scheme: Automotive Industry, Technology Hardware Industry, E-Commerce Discretionary Industry, Internet Media & Services Industry, Semiconductors Industry, and Software Industry (collectively, the “Technology Industries”). Effective upon the open of trading on November 9, 2023 (the “Effective Date”), the Fund’s ticker symbol changed from “BIGT” to “MAGS”. Additionally, the Fund’s name changed from “Roundhill BIG Tech ETF” to “Roundhill Magnificent Seven ETF”. As of October 2, 2023, the adviser has reconstituted MAGS to include exposure to Tesla and Nvidia to target the “Magnificent Seven”.

The following information pertains to the fiscal period from inception on April 10, 2023 through December 31, 2023 (the “current fiscal period”).

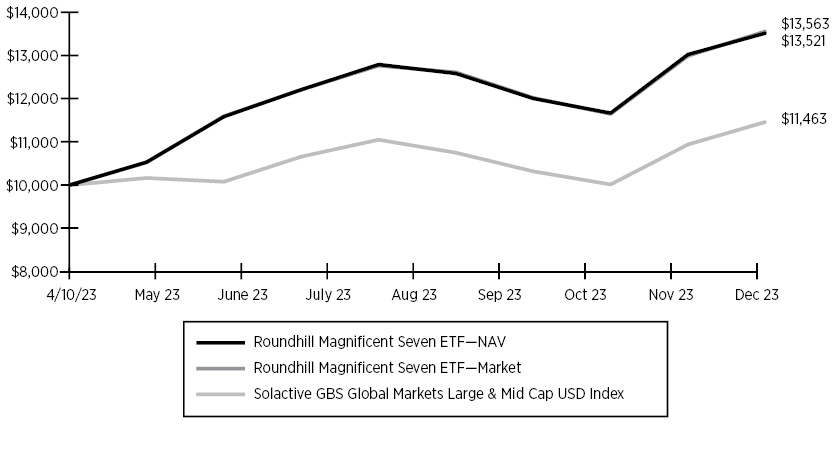

The Fund had positive performance during the current fiscal period. The market price and NAV for MAGS increased by 35.63% and 35.21%, respectively. The Solactive GBS Global Markets Large & Mid Cap USD Index increased by 14.63% over the same period.

During the current fiscal period, the Magnificent Seven stocks outperformed broader equity markets.

Regards,

Will Hershey, CFA

Roundhill Financial Inc.

6

Roundhill S&P® Global Luxury ETF

Shareholder Letter

December 31, 2023 (Unaudited)

Dear Shareholders,

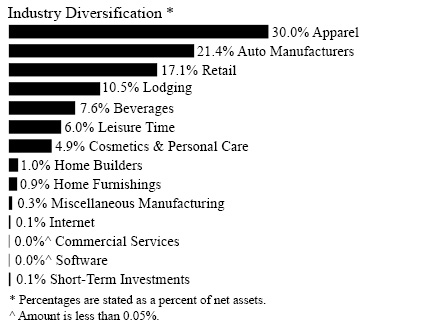

The Roundhill S&P® Global Luxury ETF (“LUXX” or the “Fund”) seeks to track the total return performance, before fees and expenses, of the S&P Global Luxury Index (the “Index”). The Index is a rules-based index that tracks the performance of a group of globally-listed stocks that are involved in the production, distribution, or provision of luxury goods and services. The Index is a subset of the S&P Global Broad Market Index (the “BMI Index”), which provides a broad measure of global equities markets and includes approximately 13,000 companies in more than 50 countries covering both developed and emerging markets, including U.S. companies.

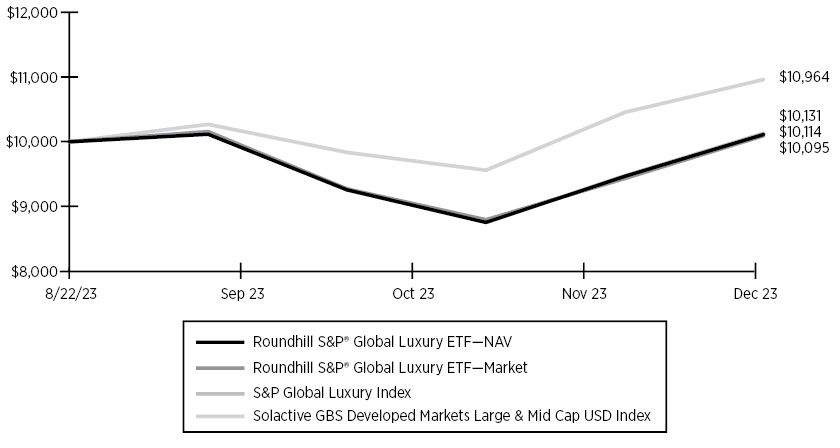

The following information pertains to the fiscal period from inception on August 22, 2023 through December 31, 2023 (the “current fiscal period”).

The Fund had positive performance during the current fiscal period. The market price and NAV for LUXX increased by 0.95% and 1.14%, respectively, while the Fund’s Index increased by 1.31%. The Solactive GBS Developed Markets Large & Mid Cap USD Index increased by 9.64% over the same period.

For the current fiscal period, the largest positive contributors to returns were Lululemon Athletica Inc., Royal Caribbean Cruises Ltd., and Hilton Worldwide Holdings Inc., which added 1.01%, 0.60%, and 0.57% to the return of the Fund, respectively.

For the current fiscal period, the largest negative contributors to returns were Kering, Pernod Ricard SA, and Shiseido Co. Ltd., which detracted 0.96%, 0.55%, and 0.52% from the return of the Fund, respectively.

Regards,

Will Hershey, CFA

Roundhill Financial Inc.

7

Roundhill Alerian LNG ETF

Shareholder Letter

December 31, 2023 (Unaudited)

Dear Shareholders,

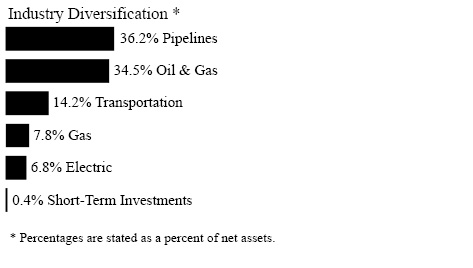

The Roundhill Alerian LNG ETF (“LNGG” or the “Fund”) seeks to track the total return performance, before fees and expenses, of the Alerian Liquefied Natural Gas Index (the “Index”). The Index is a rules-based index that tracks the performance of a group of globally-listed stocks that are principally engaged in or derive significant revenue from the liquefied natural gas industry (“LNG Industry”). The eligible universe of the Index consists of companies that are principally engaged in the following segments of the LNG Industry: Liquefaction, Liquefied Natural Gas Carriers, Regasification, and Diversified Liquefied Natural Gas.

The following information pertains to the fiscal period from inception on September 19, 2023 through December 31, 2023 (the “current fiscal period”).

The Fund had negative performance during the current fiscal period. The market price and NAV for LNGG decreased by -0.57% and -0.41%, respectively, while the Fund’s Index decreased by -0.09%. The Solactive GBS Global Markets Large & Mid Cap USD Index increased by 7.59% over the same period.

For the current fiscal period, the largest positive contributors to returns were Cheniere Energy Inc., New Fortress Energy Inc., and Tokyo Electric Power Company, which added 1.04%, 0.96%, and 0.60% to the return of the Fund, respectively.

For the current fiscal period, the largest negative contributors to returns were Woodside Energy Group Ltd., NextDecade Corp., and ENN Energy Holdings Ltd., which detracted 1.78%, 0.35%, and 0.34% from the return of the Fund, respectively.

Regards,

Will Hershey, CFA

Roundhill Financial Inc.

8

Roundhill ETFs

Shareholder Letter

December 31, 2023 (Unaudited) (Continued)

NERD Risks Esports gaming companies face intense competition, both domestically and internationally, may have limited product lines, markets, financial resources, or personnel, may have products that face rapid obsolescence, and are heavily dependent on the protection of patent and intellectual property rights. Such factors may adversely affect the profitability and value of video gaming companies. Investments made in small and mid-capitalization companies may be more volatile and less liquid due to limited resources or product lines and more sensitive to economic factors. For a complete list of risks see the prospectus.

BETZ Risks include those related to investments in the highly-competitive sports betting industry, including from illegal or unregulated companies. Expansion of sports betting (both regulated and unregulated), including the award of additional licenses or expansion or relocation of existing sports betting companies, and competition from other leisure and entertainment activities, could impact these companies’ finances. Small and mid-capitalization companies may be more volatile and less liquid due to limited resources or product lines and more sensitive to economic factors. For a complete list of risks see the prospectus.

METV Risks Metaverse Companies and other companies that rely heavily on technology are particularly vulnerable to research and development costs, substantial capital requirements, product and services obsolescence, government regulation, and domestic and international competition, including competition from foreign competitors with lower production costs. Stocks of such companies, especially smaller, less-seasoned companies, may be more volatile than the overall market. Metaverse Companies may face dramatic and unpredictable changes in growth rates. Metaverse Companies may be targets of hacking and theft of proprietary or consumer information or disruptions in service, which could have a material adverse effect on their businesses. For a complete list of risks see the prospectus.

WEED Risks Cannabis Companies may face litigation, formal or informal complaints, enforcement actions, and inquiries by various federal, state, or local governmental authorities. Litigation, complaints, and enforcement actions could consume considerable amounts of financial and other corporate resources, which could have a negative impact on sales, revenue, profitability, and growth prospects. Similarly, certain companies may not be able to obtain or maintain the necessary licenses, permits, authorizations, or accreditations, or may only be able to do so at great cost, to engage in medical marijuana research or to otherwise cultivate, possess or distribute marijuana. Small and mid-capitalization companies may be more volatile and less liquid due to limited resources or product lines and more sensitive to economic factors. For a complete list of risks see the prospectus.

LUXX: Luxury companies face intense competition, both domestically and internationally, may have products that face rapid obsolescence, and are heavily dependent on the protection of patent and intellectual property rights. Such factors may adversely affect the profitability and value of luxury goods companies. Investments made in small and mid-capitalization companies may be more volatile and less liquid due to limited resources or product lines and more sensitive to economic factors. Fund investments will be concentrated in an industry or group of industries, and the value of Fund shares may risk and fall more than diversified funds. Foreign investing involves social and political instability, market illiquidity, exchange-rate fluctuation, high volatility and limited regulation risks. Emerging markets may be more volatile and less liquid than more developed markets and therefore may involve greater risks. Depository Receipts involve risks similar to those associated investments in foreign securities, but may not provide a return that corresponds precisely with that of the underlying shares. The Fund is passively managed and attempts to mirror the composition and performance of the S&P® Global Luxury Index. The Fund’s returns may not match due to expenses incurred by the Fund or lack of precise correlation with the index. Please see the prospectus for details of these and other risks.

LNGG: Because the Fund’s assets will be concentrated in an industry or group of industries to the extent the Index concentrates in a particular industry or group of industries, the Fund is subject to loss due to adverse occurrences that may affect that industry or group of industries. Companies in the Oil and Gas Producers Industry (the Industry) are affected by worldwide energy prices and exploration and production costs. The Industry may have significant operations in areas at risk for natural disasters, social and political unrest, and environmental damage. These companies may also be at risk for increased government regulation and intervention, litigation, and negative publicity and public perception. Depositary receipts, including American depositary receipts, involve risks similar to those associated with investments in foreign securities, such as changes in political or economic conditions of other countries and changes in the exchange rates of foreign currencies. Non-Diversification Risk. Because the Fund is “non-diversified,” it may invest a greater percentage of its assets in the securities of a single issuer or a lesser number of issuers than if it was a diversified fund. As a result, the Fund may be more exposed to the risks associated with and developments affecting an individual issuer or a lesser number of issuers than a fund that invests more widely. This may increase the Fund’s volatility and cause the performance of a relatively small

9

Roundhill ETFs

Shareholder Letter

December 31, 2023 (Unaudited) (Continued)

number of issuers to have a greater impact on the Fund’s performance. Passive Management Risk. The Fund is passively managed and attempts to mirror the composition and performance of the Alerian Liquefied Natural Gas Index. The Fund’s returns may not match due to expenses incurred by the Fund or lack of precise correlation with the index.

MAGS: The Fund expects to have concentrated (i.e., invest more than 25% of its net assets) investment exposure in one or more of the Technology Industries at any given time, which may vary over time. Further, the Fund expects to obtain such investment exposure by transacting primarily with a limited number of financial intermediaries conducting business in the same industry or group of related industries. As a result, the Fund is more vulnerable to adverse market, economic, regulatory, political or other developments affecting those industries or groups of related industries than a fund that invests its assets in a more diversified manner. The value of stocks of information technology companies and companies that rely heavily on technology is particularly vulnerable to rapid changes in technology product cycles. Please see the summary and full prospectuses for a more complete description of these and other risks of the Fund.

10

Roundhill ETFs

Performance Overview

December 31, 2023 (Unaudited)

Hypothetical Growth of $10,000 Investment

(Since Commencement through 12/31/2023)

11

Roundhill ETFs

Performance Overview

December 31, 2023 (Unaudited) (Continued)

12

Roundhill ETFs

Performance Overview

December 31, 2023 (Unaudited) (Continued)

13

Roundhill ETFs

Performance Overview

December 31, 2023 (Unaudited) (Continued)

14

Roundhill ETFs

Performance Overview

December 31, 2023 (Unaudited) (Continued)

ANNUALIZED TOTAL RETURN | |||

Total Returns | 1 Year | 3 Years | Since |

Roundhill Video Games ETF—NAV | 13.35% | -18.96% | 1.95% |

Roundhill Video Games ETF—Market | 12.92% | -19.18% | 1.81% |

Roundhill Video Games Blended Index* | 14.10% | -18.61% | 2.57% |

Solactive GBS Developed Markets Large & Mid Cap USD Index | 24.55% | 7.75% | 12.25% |

1 | The Fund commenced operations on June 3, 2019. |

* | The Fund’s objective and strategies changed effective at the close on September 26, 2022. Prior to September 26, Fund performance reflects the investment objective of the Fund when it was the Roundhill BITKRAFT Esports & Digital Entertainment ETF and tracked the performance, before fees and expenses, of the Roundhill BITKRAFT Esports Index. Since September 27, 2022, the Fund tracks the performance, before fees and expenses, of the Nasdaq CTA Global Video Games Software Index. |

ANNUALIZED TOTAL RETURN | |||

Total Returns | 1 Year | 3 Years | Since |

Roundhill Sports Betting & iGaming ETF—NAV | 21.30% | -12.19% | 3.72% |

Roundhill Sports Betting & iGaming ETF—Market | 21.17% | -12.27% | 3.61% |

Roundhill Sports Betting & iGaming Blended Index* | 22.22% | -11.70% | 4.04% |

Solactive GBS Developed Markets Large & Mid Cap USD Index | 24.55% | 7.75% | 12.59% |

2 | The Fund commenced operations on June 3, 2020. |

* | The Fund’s objective and strategies changed effective on October 2, 2023. Prior to October 2, the Fund tracked the performance, before fees and expenses, of the Roundhill Sports Betting & iGaming Index. Since October 2, 2023, the Fund tracks the performance, before fees and expenses, of the Morningstar Sports Betting & iGaming Index. |

ANNUALIZED TOTAL RETURN | ||

Total Returns | 1 Year | Since |

Roundhill Ball Metaverse ETF—NAV | 60.37% | -10.02% |

Roundhill Ball Metaverse ETF—Market | 60.57% | -10.10% |

Ball Metaverse Index | 61.46% | -9.49% |

Solactive GBS Developed Markets Large & Mid Cap USD Index | 24.55% | 3.87% |

3 | The Fund commenced operations on June 29, 2021. |

15

Roundhill ETFs

Performance Overview

December 31, 2023 (Unaudited) (Continued)

ANNUALIZED TOTAL RETURN | ||

Total Returns | 1 Year | Since |

Roundhill Cannabis ETF—NAV | 0.71% | -42.20% |

Roundhill Cannabis ETF—Market | 0.87% | -42.16% |

North American Cannabis Net Total Return Index | -6.93% | -37.31% |

4 | The Fund commenced operations on April 19, 2022. |

CUMULATIVE TOTAL RETURN | |

Total Returns | Since Commencement5 |

Roundhill Magnificent Seven ETF—NAV | 35.21% |

Roundhill Magnificent Seven ETF—Market | 35.63% |

Solactive GBS Global Markets Large & Mid Cap USD Index | 14.63% |

5 | The Fund commenced operations on April 10, 2023. |

CUMULATIVE TOTAL RETURN | |

Total Returns | Since Commencement6 |

Roundhill S&P® Global Luxury ETF—NAV | 1.14% |

Roundhill S&P® Global Luxury ETF—Market | 0.95% |

S&P Global Luxury Index | 1.31% |

Solactive GBS Developed Markets Large & Mid Cap USD Index | 9.64% |

6 | The Fund commenced operations on August 22, 2023. |

CUMULATIVE TOTAL RETURN | |

Total Returns | Since Commencement7 |

Roundhill Alerian LNG ETF—NAV | -0.41% |

Roundhill Alerian LNG ETF—Market | -0.57% |

Alerian Liquefied Natural Gas Index | -0.09% |

Solactive GBS Global Markets Large & Mid Cap USD Index | 7.59% |

7 | The Fund commenced operations on September 19, 2023. |

The performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. For the most recent month-end performance, please call (855) 561-5728. You cannot invest directly in an index. Shares are bought and sold at market price, not net asset value (NAV), and are individually redeemed from the Funds. Market performance is determined

16

Roundhill ETFs

Performance Overview

December 31, 2023 (Unaudited) (Continued)

using the bid/ask midpoint at 4:00pm Eastern time when the NAV is typically calculated. Brokerage commissions will reduce returns. Returns shown include the reinvestment of all dividends and distribution. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In the absence of fee waivers and reimbursements, total returns would be reduced.

The Roundhill Video Games ETF is designed to offer retail and institutional investors exposure to the video game sector by providing investment results that closely correspond, before fees and expenses, to the performance of the Nasdaq CTA Global Video Games Software Index. The Nasdaq CTA Global Video Games Software Index is a modified theme-adjusted free float market capitalization index designed to track the performance of the common stock (or corresponding depositary receipts) of exchange-listed companies engaged in video game publishing and/or video game development. The companies are selected for inclusion in the Index based on a classification scheme developed by the Consumer Technology Association. The index excludes companies domiciled in China or Russia. An index is unmanaged and is not available for direct investment.

The Roundhill Sports Betting & iGaming ETF is designed to offer retail and institutional investors exposure to sports betting and gaming industries by providing investment results that closely correspond, before fees and expenses, to the performance of the Morningstar Sports Betting & iGaming Select Index. The Index is designed to provide pure exposure to sports and online betting themes. The Index defines sports betting and iGaming as companies engaged in, directly or indirectly, in analyzing sports events and wagering on the outcome, such as online bookmaking and/or in betting online in games of change, such as poker, slots, blackjack, or the lottery. An index is unmanaged and is not available for direct investment.

The Roundhill Ball Metaverse ETF is designed to offer retail and institutional investors exposure to the Metaverse by providing investment results that closely correspond, before fees and expenses, to the performance of the Ball Metaverse Index. The “Metaverse” may be defined as a successor to the current internet that will be interoperable, persistent, synchronous, open to unlimited participants with a fully functioning economy, and an experience that spans the virtual and ‘real’ world. An index is unmanaged and is not available for direct investment.

The Roundhill Cannabis ETF is designed to offer retail and institutional investors exposure to the cannabis and hemp ecosystem by providing investment results that reflect capital growth. The cannabis and hemp ecosystem encompasses businesses involved in the production, distribution and marketing of cannabis and hemp and products derived therefrom. The cannabis and hemp ecosystem spans a wide variety of sectors and industries including the agriculture, biotechnology, pharmaceuticals, real estate, retail, and finance sectors and industries.

The Roundhill Magnificent Seven ETF is designed to offer retail and institutional investors exposure to the largest companies in one or more technology industries by providing investment results that reflects capital growth. The technology industries encompass the automotive industry, technology hardware industry, e-commerce discretionary industry, internet media & services industry, semiconductors industry and software industry.

The Roundhill S&P® Global Luxury ETF is designed to offer retail and institutional investors exposure to luxury companies by providing investment results that closely correspond, before fees and expenses, to the performance of the S&P Global Luxury Index. Luxury companies are defined as those of any market capitalization engaged in the production, distribution, or provision of luxury goods and services. An index is unmanaged and is not available for direct investment.

The Roundhill Alerian LNG ETF is designed to offer retail and institutional investors exposure to the liquefied natural gas industry (“LNG Industry”) by providing investment results that closely correspond, before fees and expenses, to the performance of the Alerian Liquefied Natural Gas Index. The LNG Industry consists of companies that are primarily engaged in liquefaction, liquefied natural gas carriers, regasification, or diversified liquefied natural gas. An index is unmanaged and is not available for direct investment.

The Solactive GBS Developed Markets Large & Mid Cap USD and the Solactive GBS Global Markets Large & Mid Cap USD Index are part of the Solactive Global Benchmark Series which includes benchmark indices for developed and emerging market countries. The index intends to track the performance of the large and mid cap segment covering approximately the largest 85% of the free-float market capitalization in the Developed Markets and Global Markets, respectively. It is calculated as a Total Return index in USD and weighted by free-float market capitalization.

The North American Cannabis Net Total Return Index tracks the performance of a basket of North American publicly listed companies with significant business activities in the marijuana industry. A company is deemed to be eligible for inclusion in the index by the Index Provider if the company is a producer and/or supplier of marijuana and/or cannabis, biotechnology companies that are engaged in research and development of cannabinoids, companies that offer hydroponics supplies and equipment clearly aiming to increase efficiency in marijuana cultivation and companies mainly engaged in leasing property to cannabis growers. The index is calculated as a net total return index in US Dollar and adjusted quarterly.

17

Roundhill Video Games ETF

Schedule of Investments

December 31, 2023

Description | Shares | Value | ||||||

COMMON STOCKS — 99.6% | ||||||||

Computers — 1.7% | ||||||||

Keywords Studios PLC (b) | 16,773 | $ | 355,371 | |||||

Internet — 4.8% | ||||||||

NCSoft Corp. (b) | 2,078 | 388,042 | ||||||

Webzen, Inc. (b) | 23,167 | 294,107 | ||||||

Wemade Co., Ltd. (b) | 6,985 | 330,295 | ||||||

| 1,012,444 | ||||||||

Software — 73.2% (d) | ||||||||

AppLovin Corp. - Class A (a) | 15,703 | 625,765 | ||||||

Capcom Co., Ltd. (b) | 16,900 | 546,151 | ||||||

CD Projekt SA (b) | 12,638 | 369,603 | ||||||

COLOPL, Inc. (b) | 66,000 | 276,678 | ||||||

Com2uS Corp. (b) | 7,099 | 271,470 | ||||||

DeNA Co., Ltd. (b) | 28,500 | 278,369 | ||||||

Electronic Arts, Inc. | 14,048 | 1,921,907 | ||||||

Embracer Group AB (a)(b) | 148,816 | 403,941 | ||||||

Gree, Inc. (b) | 72,400 | 292,722 | ||||||

GungHo Online Entertainment, Inc. (b) | 21,400 | 356,945 | ||||||

IGG, Inc. (a)(b) | 613,000 | 254,352 | ||||||

International Games System Co., Ltd. (b) | 19,842 | 468,080 | ||||||

Kakao Games Corp. (a)(b) | 14,823 | 297,519 | ||||||

Koei Tecmo Holdings Co., Ltd. (b) | 25,800 | 294,363 | ||||||

Konami Group Corp. (b) | 8,900 | 466,085 | ||||||

Krafton, Inc. (a)(b) | 3,381 | 508,239 | ||||||

MIXI, Inc. (b) | 17,600 | 294,748 | ||||||

Modern Times Group AB - Class B (a)(b) | 34,696 | 296,597 | ||||||

Netmarble Corp. (a)(b)(f) | 8,142 | 367,304 | ||||||

Nexon Co., Ltd. (b) | 31,100 | 566,828 | ||||||

Paradox Interactive AB (b) | 13,868 | 310,170 | ||||||

Pearl Abyss Corp. (a)(b) | 9,725 | 292,603 | ||||||

ROBLOX Corp. - Class A (a)(e) | 34,405 | 1,572,997 | ||||||

Sega Sammy Holdings, Inc. (b) | 24,500 | 342,701 | ||||||

Square Enix Holdings Co., Ltd. (b) | 10,700 | 384,268 | ||||||

Stillfront Group AB (a)(b) | 232,324 | 280,554 | ||||||

Take-Two Interactive Software, Inc. (a)(e) | 9,592 | 1,543,832 | ||||||

Software (Continued) | ||||||||

Team17 Group PLC (a)(b) | 63,154 | 148,940 | ||||||

Ubisoft Entertainment SA (a)(b) | 11,674 | 298,021 | ||||||

Unity Software, Inc. (a)(e) | 22,536 | 921,497 | ||||||

| 15,253,249 | ||||||||

Toys/Games/Hobbies — 19.9% | ||||||||

Bandai Namco Holdings, Inc. (b) | 28,800 | 577,410 | ||||||

Nintendo Co., Ltd. (b) | 68,300 | 3,565,184 | ||||||

| 4,142,594 | ||||||||

TOTAL COMMON STOCKS (Cost $21,561,889) | 20,763,658 | |||||||

SHORT-TERM INVESTMENTS — 0.0% (g) | ||||||||

Money Market Fund — 0.0% (g) | ||||||||

First American Government Obligations Fund, Class X, 5.28% (c) | 3,300 | 3,300 | ||||||

TOTAL SHORT-TERM INVESTMENTS (Cost $3,300) | 3,300 | |||||||

INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING — 14.0% | ||||||||

Mount Vernon Liquid Assets Portfolio, LLC, 5.55% (c) | 2,919,764 | 2,919,764 | ||||||

TOTAL INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING (Cost $2,919,764) | 2,919,764 | |||||||

TOTAL INVESTMENTS (Cost $24,484,953) — 113.6% | 23,686,722 | |||||||

Other assets and liabilities, net — (13.6)% | (2,842,955 | ) | ||||||

NET ASSETS — 100.0% | $ | 20,843,767 | ||||||

PLC Public Limited Company

(a) | Non-income producing security. |

(b) | Foreign issued security, or represents a foreign issued security. |

(c) | The rate shown is the seven day yield at period end. |

(d) | To the extent the Fund invests more heavily in particular sectors of the economy, its performance will be especially sensitive to developments that significantly affect those sectors. |

(e) | All or a portion of this security is on loan as of December 31, 2023. The market value of securities out on loan is $2,775,323. |

(f) | Security exempt from registration pursuant to Rule 144a under the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration to qualified institutional investors. |

(g) | Amount is less than 0.05%. |

Percentages are stated as a percent of net assets.

The accompanying notes are an integral part of the financial statements.

18

Roundhill Video Games ETF

Schedule of Investments

December 31, 2023 (Continued)

COUNTRY | Percentage |

Japan | 39.5% |

United States | 31.6% |

Republic of Korea | 13.2% |

Sweden | 6.2% |

United Kingdom | 2.4% |

Taiwan | 2.3% |

Poland | 1.8% |

France | 1.4% |

Cayman Islands | 1.2% |

Total Country | 99.6% |

SHORT-TERM INVESTMENTS | 0.0%* |

INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING | 14.0% |

TOTAL INVESTMENTS | 113.6% |

Other assets and liabilities, net | -13.6% |

NET ASSETS | 100.0% |

* | Amount is less than 0.05%. |

The accompanying notes are an integral part of the financial statements.

19

Roundhill Sports Betting & iGaming ETF

Schedule of Investments

December 31, 2023

Description | Shares | Value | ||||||

COMMON STOCKS — 99.8% | ||||||||

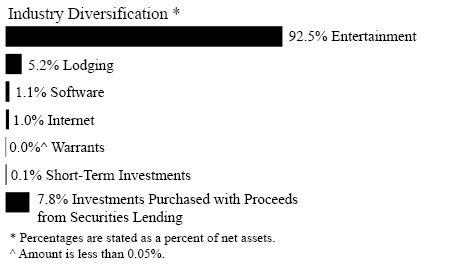

Entertainment — 92.5% (e) | ||||||||

888 Holdings PLC (a)(b) | 1,122,599 | $ | 1,367,400 | |||||

Bally’s Corp. (a)(f) | 86,716 | 1,208,821 | ||||||

Betsson AB - Class B (a)(b) | 422,722 | 4,551,103 | ||||||

Caesars Entertainment, Inc. (a)(f) | 66,987 | 3,140,351 | ||||||

Churchill Downs, Inc. (f) | 44,921 | 6,061,191 | ||||||

DraftKings, Inc. - Class A (a)(f) | 218,758 | 7,711,219 | ||||||

Entain PLC (b) | 544,579 | 6,901,999 | ||||||

Everi Holdings, Inc. (a) | 26,255 | 295,894 | ||||||

Evolution Gaming Group AB (b)(c) | 63,408 | 7,564,024 | ||||||

Flutter Entertainment PLC (a)(b) | 56,600 | 10,003,756 | ||||||

Genius Sports, Ltd. (a)(b) | 403,781 | 2,495,367 | ||||||

Intralot SA-Integrated Information Systems & Gaming Services (a)(b) | 86,666 | 101,097 | ||||||

Kambi Group PLC (a)(b) | 76,216 | 1,268,269 | ||||||

Kindred Group PLC - SDR (b) | 509,157 | 4,712,728 | ||||||

La Francaise des Jeux SAEM (b)(c) | 121,236 | 4,398,063 | ||||||

Light & Wonder, Inc. (a) | 29,263 | 2,402,785 | ||||||

NEOGAMES SA (a)(b) | 40,671 | 1,164,411 | ||||||

OPAP SA (b) | 147,415 | 2,502,893 | ||||||

Penn National Gaming, Inc. (a)(f) | 123,706 | 3,218,830 | ||||||

Playtech PLC (a)(b) | 820,024 | 4,689,495 | ||||||

PointsBet Holdings, Ltd. (a)(b) | 856,276 | 537,539 | ||||||

Rush Street Interactive, Inc. (a) | 356,323 | 1,599,890 | ||||||

Sportradar Holding AG - Class A (a)(b) | 429,647 | 4,747,599 | ||||||

Super Group SGHC, Ltd. (a)(b) | 713,134 | 2,260,635 | ||||||

Tabcorp Holdings, Ltd. (b) | 7,388,665 | 4,209,793 | ||||||

The Lottery Corp., Ltd. (b) | 697,031 | 2,302,002 | ||||||

Tokyotokeiba Co., Ltd. (b) | 48,100 | 1,513,147 | ||||||

| 92,930,301 | ||||||||

Internet — 1.0% | ||||||||

Gambling.com Group, Ltd. (a)(b) | 66,572 | 649,077 | ||||||

Jumbo Interactive, Ltd. (b) | 41,958 | 398,245 | ||||||

| 1,047,322 | ||||||||

Lodging — 5.2% | ||||||||

Boyd Gaming Corp. | 22,569 | 1,413,045 | ||||||

MGM Resorts International (a) | 85,683 | 3,828,316 | ||||||

| 5,241,361 | ||||||||

Software — 1.1% | ||||||||

Better Collective AS (a)(b)(f) | 43,625 | 1,110,337 | ||||||

TOTAL COMMON STOCKS (Cost $106,689,692) | 100,329,321 | |||||||

Warrants — 0.0% (h) | ||||||||

PointsBet Holdings, Ltd., Expiration: July 2024, Exercise Price: $10.00 (a)(b)(g) | 151,840 | — | ||||||

TOTAL WARRANTS (Cost $0) | — | |||||||

SHORT-TERM INVESTMENTS — 0.1% | ||||||||

Money Market Fund — 0.1% | ||||||||

First American Government Obligations Fund, Class X, 5.28% (d) | 161,521 | 161,521 | ||||||

TOTAL SHORT-TERM INVESTMENTS (Cost $161,521) | 161,521 | |||||||

INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING — 7.8% | ||||||||

Mount Vernon Liquid Assets Portfolio, LLC, 5.55% (d) | 7,809,974 | 7,809,974 | ||||||

TOTAL INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING (Cost $7,809,974) | 7,809,974 | |||||||

TOTAL INVESTMENTS (Cost $114,661,187) — 107.7% | 108,300,816 | |||||||

Other assets and liabilities, net — (7.7)% | (7,777,365 | ) | ||||||

NET ASSETS — 100.0% | $ | 100,523,451 | ||||||

PLC Public Limited Company

SDR Special Drawing Rights

(a) | Non-income producing security. |

(b) | Foreign issued security, or represents a foreign issued security. |

(c) | Security exempt from registration pursuant to Rule 144a under the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration to qualified institutional investors. |

(d) | The rate shown is the seven day yield at period end. |

(e) | To the extent the Fund invests more heavily in particular sectors of the economy, its performance will be especially sensitive to developments that significantly affect those sectors. |

(f) | All or a portion of this security is on loan as of December 31, 2023. The market value of securities out on loan is $7,470,104. |

The accompanying notes are an integral part of the financial statements.

20

Roundhill Sports Betting & iGaming ETF

Schedule of Investments

December 31, 2023 (Continued)

(g) | Value determined based on estimated fair value. The value of this security totals $0, which represents 0.00% of net assets. Classified as Level 3 in the fair value hierarchy. |

(h) | Amount is less than 0.05%. |

Percentages are stated as a percent of net assets.

COUNTRY | Percentage |

United States | 30.7% |

Sweden | 12.1% |

Isle of Man | 11.5% |

Ireland | 10.0% |

Australia | 7.4% |

Malta | 5.9% |

Guernsey | 4.7% |

Switzerland | 4.7% |

France | 4.4% |

Greece | 2.6% |

Japan | 1.5% |

Gibraltar | 1.4% |

Luxembourg | 1.2% |

Denmark | 1.1% |

Jersey | 0.6% |

Total Country | 99.8% |

WARRANTS | 0.0%* |

SHORT-TERM INVESTMENTS | 0.1% |

INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING | 7.8% |

TOTAL INVESTMENTS | 107.7% |

Other assets and liabilities, net | -7.7% |

NET ASSETS | 100.0% |

* | Amount is less than 0.05%. |

The accompanying notes are an integral part of the financial statements.

21

Roundhill Ball Metaverse ETF

Schedule of Investments

December 31, 2023

Description | Shares | Value | ||||||

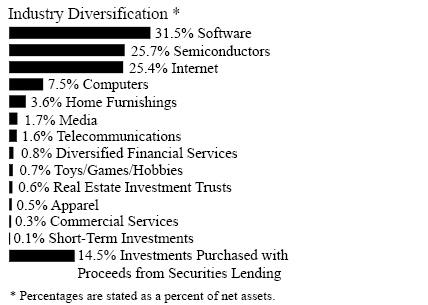

COMMON STOCKS — 99.3% | ||||||||

Apparel — 0.5% | ||||||||

NIKE, Inc. - Class B | 23,262 | $ | 2,525,555 | |||||

Commercial Services — 0.3% | ||||||||

Block, Inc. (a) | 8,737 | 675,807 | ||||||

PayPal Holdings, Inc. (a) | 10,146 | 623,066 | ||||||

| 1,298,873 | ||||||||

Computers — 7.5% | ||||||||

Apple, Inc. | 180,139 | 34,682,162 | ||||||

Diversified Financial Services — 0.8% | ||||||||

Coinbase Global, Inc. - Class A (a)(e) | 21,700 | 3,774,064 | ||||||

Home Furnishings — 3.6% | ||||||||

Sony Group Corp. (b) | 176,100 | 16,750,610 | ||||||

Internet — 25.4% (d) | ||||||||

Alibaba Group Holding, Ltd. (a)(b) | 761,900 | 7,376,483 | ||||||

Alphabet, Inc. - Class A (a) | 106,515 | 14,879,080 | ||||||

Amazon.com, Inc. (a) | 92,028 | 13,982,734 | ||||||

Baidu, Inc. - ADR (a)(b) | 96,751 | 11,522,077 | ||||||

Meta Platforms, Inc. - Class A (a) | 78,195 | 27,677,902 | ||||||

NAVER Corp. (b) | 37,025 | 6,439,630 | ||||||

Sea, Ltd. - ADR (a)(b) | 224,802 | 9,104,481 | ||||||

Snap, Inc. - Class A (a)(e) | 717,144 | 12,141,248 | ||||||

Tencent Holdings, Ltd. (b) | 387,500 | 14,569,927 | ||||||

| 117,693,562 | ||||||||

Media — 1.7% | ||||||||

The Walt Disney Co. | 86,302 | 7,792,208 | ||||||

Semiconductors — 25.7% (d) | ||||||||

Advanced Micro Devices, Inc. (a) | 61,582 | 9,077,803 | ||||||

Applied Materials, Inc. | 26,677 | 4,323,541 | ||||||

Arm Holdings PLC - ADR (a)(b)(e) | 127,558 | 9,585,346 | ||||||

ASML Holding NV (b) | 9,642 | 7,298,223 | ||||||

Broadcom, Inc. | 2,633 | 2,939,086 | ||||||

Intel Corp. | 92,920 | 4,669,230 | ||||||

Marvell Technology, Inc. | 49,740 | 2,999,819 | ||||||

NVIDIA Corp. | 49,716 | 24,620,358 | ||||||

QUALCOMM, Inc. | 118,558 | 17,147,044 | ||||||

Samsung Electronics Co., Ltd. (b) | 205,244 | 12,510,019 | ||||||

Skyworks Solutions, Inc. | 50,798 | 5,710,711 | ||||||

Taiwan Semiconductor Manufacturing Co., Ltd. - ADR (b) | 135,680 | 14,110,720 | ||||||

Texas Instruments, Inc. | 25,871 | 4,409,971 | ||||||

| 119,401,871 | ||||||||

Software — 31.5% (d) | ||||||||

Adobe, Inc. (a) | 7,802 | 4,654,673 | ||||||

Akamai Technologies, Inc. (a) | 47,242 | 5,591,091 | ||||||

Autodesk, Inc. (a) | 66,139 | 16,103,524 | ||||||

Bentley Systems, Inc. - Class B (e) | 48,351 | 2,522,955 | ||||||

Cloudflare, Inc. - Class A (a) | 69,643 | 5,798,476 | ||||||

Electronic Arts, Inc. | 50,715 | 6,938,319 | ||||||

Krafton, Inc. (a)(b) | 17,053 | 2,563,445 | ||||||

Matterport, Inc. - Class A (a)(e) | 3,221,465 | 8,665,741 | ||||||

Microsoft Corp. | 47,787 | 17,969,824 | ||||||

NetEase, Inc. - ADR (b) | 52,544 | 4,894,999 | ||||||

Planet Labs PBC (a)(e) | 1,159,281 | 2,863,424 | ||||||

PTC, Inc. (a)(e) | 14,467 | 2,531,146 | ||||||

ROBLOX Corp. - Class A (a)(e) | 859,455 | 39,294,283 | ||||||

Take-Two Interactive Software, Inc. (a) | 55,951 | 9,005,313 | ||||||

Unity Software, Inc. (a)(e) | 404,496 | 16,539,841 | ||||||

| 145,937,054 | ||||||||

Telecommunications — 1.6% | ||||||||

Lumen Technologies, Inc. (a)(e) | 3,955,942 | 7,239,374 | ||||||

Toys/Games/Hobbies — 0.7% | ||||||||

Nintendo Co., Ltd. (b) | 58,600 | 3,058,855 | ||||||

TOTAL COMMON STOCKS (Cost $480,112,620) | 460,154,188 | |||||||

REAL ESTATE INVESTMENT TRUSTS — 0.6% | ||||||||

Equinix, Inc. | 3,399 | 2,737,521 | ||||||

TOTAL REAL ESTATE INVESTMENT TRUSTS (Cost $2,693,868) | 2,737,521 | |||||||

The accompanying notes are an integral part of the financial statements.

22

Roundhill Ball Metaverse ETF

Schedule of Investments

December 31, 2023 (Continued)

Description | Shares | Value | ||||||

SHORT-TERM INVESTMENTS — 0.1% | ||||||||

Money Market Fund — 0.1% | ||||||||

First American Government Obligations Fund, Class X, 5.28% (c) | 589,045 | $ | 589,045 | |||||

TOTAL SHORT-TERM INVESTMENTS (Cost $589,045) | 589,045 | |||||||

INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING — 14.5% | ||||||||

Mount Vernon Liquid Assets Portfolio, LLC, 5.55% (c) | 67,458,659 | 67,458,659 | ||||||

TOTAL INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING (Cost $67,458,659) | 67,458,659 | |||||||

TOTAL INVESTMENTS (Cost $550,854,192) — 114.5% | 530,939,413 | |||||||

Other assets and liabilities, net — (14.5)% | (67,383,617 | ) | ||||||

NET ASSETS — 100.0% | $ | 463,555,796 | ||||||

ADR American Depositary Receipt

(a) | Non-income producing security. |

(b) | Foreign issued security, or represents a foreign issued security. |

(c) | The rate shown is the seven day yield at period end. |

(d) | To the extent the Fund invests more heavily in particular sectors of the economy, its performance will be especially sensitive to developments that significantly affect those sectors. |

(e) | All or a portion of this security is on loan as of December 31, 2023. The market value of securities out on loan is $63,762,835. |

Percentages are stated as a percent of net assets.

COUNTRY | Percentage |

United States | 73.5% |

Cayman Islands | 10.2% |

Republic of Korea | 4.6% |

Japan | 4.3% |

Taiwan | 3.0% |

United Kingdom | 2.1% |

Netherlands | 1.6% |

Total Country | 99.3% |

REAL ESTATE INVESTMENT TRUSTS | 0.6% |

SHORT-TERM INVESTMENTS | 0.1% |

INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING | 14.5% |

TOTAL INVESTMENTS | 114.5% |

Other assets and liabilities, net | -14.5% |

NET ASSETS | 100.0% |

The accompanying notes are an integral part of the financial statements.

23

Roundhill Cannabis ETF

Schedule of Investments

December 31, 2023

Description | Shares | Value | ||||||

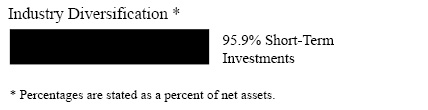

SHORT-TERM INVESTMENTS — 95.9% | ||||||||

Money Market Fund — 18.6% | ||||||||

First American Government Obligations Fund, Class X, 5.28% (a) | 587,260 | $ | 587,260 | |||||

Total Money Market Fund (Cost $587,260) | 587,260 | |||||||

U.S. Treasury Bills — 77.3% | ||||||||

5.42%, 01/02/2024 (b)(c) | 2,447,000 | 2,446,641 | ||||||

Total U.S. Treasury Bills (Cost $2,446,641) | 2,446,641 | |||||||

TOTAL SHORT-TERM INVESTMENTS (Cost $3,033,901) | 3,033,901 | |||||||

TOTAL INVESTMENTS (Cost $3,033,901) — 95.9% | 3,033,901 | |||||||

Other assets and liabilities, net — 4.1% | 130,935 | |||||||

NET ASSETS — 100.0% | $ | 3,164,836 | ||||||

(a) | The rate shown is the seven day yield at period end. |

(b) | The rate shown is the effective yield as of December 31, 2023. |

(c) | Held as collateral for total return swaps. |

Percentages are stated as a percent of net assets.

The accompanying notes are an integral part of the financial statements.

24

Roundhill Cannabis ETF

Schedule of Total Return Swaps

December 31, 2023

Long Total Return | Fund Pays/ | Counterparty | Payment | Financing Rate | Expiration | Upfront | Notional | Value/ | ||||||||||||||||||

Cresco Labs, Inc. Swap | Receives | Nomura Securities International, Inc. | Monthly | Overnight Bank Funding Rate Index + 1.50% | June 20, 2024 | $ | — | $ | 268,969 | $ | — | |||||||||||||||

Curaleaf Holdings, Inc. Swap | Receives | Nomura Securities International, Inc. | Monthly | Overnight Bank Funding Rate Index + 1.50% | June 20, 2024 | — | 1,094,397 | — | ||||||||||||||||||

Green Thumb Industries, Inc. Swap | Receives | Nomura Securities International, Inc. | Monthly | Overnight Bank Funding Rate Index + 1.50% | June 20, 2024 | — | 964,335 | — | ||||||||||||||||||

Trulieve Cannabis Corp. Swap | Receives | Nomura Securities International, Inc. | Monthly | Overnight Bank Funding Rate Index + 1.50% | June 20, 2024 | — | 376,334 | — | ||||||||||||||||||

Verano Holdings Corp. Swap | Receives | Nomura Securities International, Inc. | Monthly | Overnight Bank Funding Rate Index + 1.50% | June 20, 2024 | — | 465,974 | — | ||||||||||||||||||

| $ | — | $ | 3,170,009 | $ | — | |||||||||||||||||||||

The accompanying notes are an integral part of the financial statements.

25

Roundhill Magnificent Seven ETF

Schedule of Investments

December 31, 2023

Description | Shares | Value | ||||||

COMMON STOCKS — 39.7% | ||||||||

Auto Manufacturers — 5.5% | ||||||||

Tesla, Inc. (a) | 8,230 | $ | 2,044,990 | |||||

Computers — 5.7% | ||||||||

Apple, Inc. | 11,140 | 2,144,784 | ||||||

Internet — 16.9% | ||||||||

Alphabet, Inc. - Class A (a) | 15,329 | 2,141,308 | ||||||

Amazon.com, Inc. (a) | 13,511 | 2,052,861 | ||||||

Meta Platforms, Inc. - Class A (a) | 6,013 | 2,128,362 | ||||||

| 6,322,531 | ||||||||

Semiconductors — 5.8% | ||||||||

NVIDIA Corp. | 4,354 | 2,156,188 | ||||||

Software — 5.8% | ||||||||

Microsoft Corp. | 5,711 | 2,147,565 | ||||||

TOTAL COMMON STOCKS (Cost $14,323,905) | 14,816,058 | |||||||

SHORT-TERM INVESTMENTS — 55.1% | ||||||||

Money Market Fund — 13.7% | ||||||||

First American Government Obligations Fund, Class X, 5.28% (b) | 5,113,863 | 5,113,863 | ||||||

Total Money Market Fund (Cost $5,113,863) | 5,113,863 | |||||||

U.S. Treasury Bills — 41.4% | ||||||||

5.41%, 01/02/2024 (c)(d) | 15,472,000 | 15,469,735 | ||||||

Total U.S. Treasury Bills (Cost $15,469,735) | 15,469,735 | |||||||

TOTAL SHORT-TERM INVESTMENTS (Cost $20,583,598) | 20,583,598 | |||||||

TOTAL INVESTMENTS (Cost $34,907,503) — 94.8% | 35,399,656 | |||||||

Other assets and liabilities, net — 5.2% | 1,949,356 | |||||||

NET ASSETS — 100.0% | $ | 37,349,012 | ||||||

(a) | Non-income producing security. |

(b) | The rate shown is the seven day yield at period end. |

(c) | The rate shown is the effective yield as of December 31, 2023. |

(d) | Held as collateral for total return swaps. |

Percentages are stated as a percent of net assets.

The accompanying notes are an integral part of the financial statements.

26

Roundhill Magnificent Seven ETF

Schedule of Total Return Swaps

December 31, 2023

Long Total Return | Fund Pays/ | Counterparty | Payment | Financing Rate | Expiration | Upfront | Notional | Value/ | ||||||||||||||||||

Alphabet, Inc. - Class A Swap | Receives | Nomura Securities International, Inc. | At Maturity | Overnight Bank Funding Rate Index + 0.50% | April 2, 2024 | $ | — | $ | 3,056,485 | $ | 129,855 | |||||||||||||||

Amazon.com, Inc. Swap | Receives | Nomura Securities International, Inc. | At Maturity | Overnight Bank Funding Rate Index + 0.50% | April 2, 2024 | — | 3,032,547 | 218,303 | ||||||||||||||||||

Apple, Inc. Swap | Receives | Nomura Securities International, Inc. | At Maturity | Overnight Bank Funding Rate Index + 0.50% | April 2, 2024 | — | 3,141,785 | 50,459 | ||||||||||||||||||

Meta Platforms, Inc. - Class A Swap | Receives | Nomura Securities International, Inc. | At Maturity | Overnight Bank Funding Rate Index + 0.50% | April 2, 2024 | — | 2,866,809 | 300,610 | ||||||||||||||||||

Microsoft Corp. Swap | Receives | Nomura Securities International, Inc. | At Maturity | Overnight Bank Funding Rate Index + 0.50% | April 2, 2024 | — | 3,125,645 | 109,929 | ||||||||||||||||||

NVIDIA Corp. Swap | Receives | Nomura Securities International, Inc. | At Maturity | Overnight Bank Funding Rate Index + 0.50% | April 2, 2024 | — | 3,087,638 | 129,817 | ||||||||||||||||||

Tesla, Inc. Swap | Receives | Nomura Securities International, Inc. | At Maturity | Overnight Bank Funding Rate Index + 0.50% | April 2, 2024 | — | 3,038,891 | 12,479 | ||||||||||||||||||

| $ | — | $ | 21,349,800 | $ | 951,452 | |||||||||||||||||||||

The accompanying notes are an integral part of the financial statements.

27

Roundhill S&P® Global Luxury ETF

Schedule of Investments

December 31, 2023

Description | Shares | Value | ||||||

COMMON STOCKS — 99.8% | ||||||||

Apparel — 30.0% (e) | ||||||||

Burberry Group PLC (b) | 600 | $ | 10,831 | |||||

Canada Goose Holdings, Inc. (a)(b) | 85 | 1,015 | ||||||

Capri Holdings, Ltd. (a)(b) | 150 | 7,536 | ||||||

Christian Dior SE (b) | 5 | 3,908 | ||||||

Deckers Outdoor Corp. (a) | 30 | 20,053 | ||||||

Ermenegildo Zegna NV (b) | 80 | 926 | ||||||

Hermès International SCA (b) | 51 | 108,100 | ||||||

Kering SA (b) | 112 | 49,365 | ||||||

LVMH Moët Hennessy Louis Vuitton SE (b) | 112 | 90,762 | ||||||

Nike, Inc. - Class B | 500 | 54,285 | ||||||

Prada SpA (b) | 800 | 4,574 | ||||||

PVH Corp. | 75 | 9,159 | ||||||

Ralph Lauren Corp. | 50 | 7,210 | ||||||

Tapestry, Inc. | 270 | 9,939 | ||||||

Tod’s SpA (a)(b) | 20 | 754 | ||||||

| 378,417 | ||||||||

Auto Manufacturers — 21.4% | ||||||||

Aston Martin Lagonda Global Holdings PLC (a)(b)(d) | 610 | 1,754 | ||||||

Bayerische Motoren Werke AG (b) | 375 | 41,748 | ||||||

Dr. Ing. h.c. F. Porsche AG (b)(d) | 85 | 7,502 | ||||||

Ferrari NV (b) | 200 | 67,428 | ||||||

Li Auto, Inc. - Class A (a)(b) | 900 | 16,954 | ||||||

Lucid Group, Inc. (a) | 960 | 4,042 | ||||||

Mercedes-Benz Group AG (b) | 915 | 63,223 | ||||||

Rivian Automotive, Inc. - Class A (a) | 655 | 15,366 | ||||||

Tesla, Inc. (a) | 205 | 50,938 | ||||||

| 268,955 | ||||||||

Beverages — 7.6% | ||||||||

Diageo PLC (b) | 1,225 | 44,600 | ||||||

Pernod Ricard SA (b) | 240 | 42,352 | ||||||

Remy Cointreau SA (b) | 25 | 3,176 | ||||||

Treasury Wine Estates, Ltd. (b) | 845 | 6,216 | ||||||

| 96,344 | ||||||||

Commercial Services — 0.0% (f) | ||||||||

Seoul Auction Co., Ltd. (b) | 15 | 146 | ||||||

Cosmetics & Personal Care — 4.9% | ||||||||

Amorepacific Corp. (b) | 35 | 3,941 | ||||||

Inter Parfums, Inc. | 20 | 2,880 | ||||||

Shiseido Co., Ltd. (b) | 500 | 15,080 | ||||||

The Estee Lauder Cos., Inc. - Class A | 270 | 39,488 | ||||||

| 61,389 | ||||||||

Home Builders — 1.0% | ||||||||

Toll Brothers, Inc. | 120 | 12,335 | ||||||

Home Furnishings — 0.9% | ||||||||

Ethan Allen Interiors, Inc. | 25 | 798 | ||||||

Sleep Number Corp. (a) | 25 | 371 | ||||||

Tempur Sealy International, Inc. | 200 | 10,194 | ||||||

| 11,363 | ||||||||

Internet — 0.1% | ||||||||

Revolve Group, Inc. (a) | 50 | 829 | ||||||

The RealReal, Inc. (a) | 140 | 281 | ||||||

| 1,110 | ||||||||

Leisure Time — 6.0% | ||||||||

Beneteau SA (b) | 45 | 620 | ||||||

Carnival Corp. (a)(b) | 1,180 | 21,877 | ||||||

Norweigian Cruise Line Holdings, Ltd. (a)(b) | 500 | 10,020 | ||||||

Polaris, Inc. | 65 | 6,160 | ||||||

Royal Caribbean Cruises, Ltd. (a)(b) | 260 | 33,667 | ||||||

Sanlorenzo SpA (b) | 20 | 936 | ||||||

Topgolf Callaway Brands Corp. (a) | 165 | 2,366 | ||||||

| 75,646 | ||||||||

Lodging — 10.5% | ||||||||

Hilton Worldwide Holdings, Inc. | 205 | 37,328 | ||||||

Kangwon Land, Inc. (b) | 135 | 1,677 | ||||||

Las Vegas Sands Corp. | 385 | 18,946 | ||||||

Marriott International, Inc. - Class A | 200 | 45,102 | ||||||

Melco International Development, Ltd. (a)(b) | 1,000 | 701 | ||||||

Melco Resorts & Entertainment, Ltd. - ADR (a)(b) | 220 | 1,951 | ||||||

MGM China Holdings, Ltd. (a)(b) | 800 | 1,015 | ||||||

Paradise Co., Ltd. (a)(b) | 60 | 621 | ||||||

Resorttrust, Inc. (b) | 100 | 1,735 | ||||||

Sands China, Ltd. (a)(b) | 2,800 | 8,194 | ||||||

Shangri-La Asia, Ltd. (a)(b) | 2,000 | 1,373 | ||||||

SJM Holdings, Ltd. (a)(b) | 3,000 | 949 | ||||||

The Star Entertainment Group, Ltd. (a)(b) | 1,595 | 561 | ||||||

Wynn Macau, Ltd. (a)(b) | 1,600 | 1,318 | ||||||

Wynn Resorts, Ltd. | 120 | 10,933 | ||||||

| 132,404 | ||||||||

The accompanying notes are an integral part of the financial statements.

28

Roundhill S&P® Global Luxury ETF

Schedule of Investments

December 31, 2023 (Continued)

Description | Shares | Value | ||||||

Miscellaneous Manufacturing — 0.3% | ||||||||

Nikon Corp. (b) | 400 | $ | 3,961 | |||||

Retail — 17.1% | ||||||||

Brunello Cucinelli SpA (b) | 50 | 4,894 | ||||||

Chow Tai Fook Jewellery Group, Ltd. (b) | 3,000 | 4,464 | ||||||

Cie Financière Richemont SA (b) | 680 | 93,519 | ||||||

Hotel Shilla Co., Ltd. (b) | 40 | 2,031 | ||||||

HUGO BOSS AG (b) | 95 | 7,079 | ||||||

Luk Fook Holdings International, Ltd. (b) | 1,000 | 2,683 | ||||||

Lululemon Athletica, Inc. (a) | 90 | 46,016 | ||||||

Moncler SpA (b) | 325 | 19,997 | ||||||

Movado Group, Inc. | 20 | 603 | ||||||

Nordstrom, Inc. | 135 | 2,491 | ||||||

RH (a) | 20 | 5,830 | ||||||

Salvatore Ferragamo SpA (b) | 105 | 1,416 | ||||||

Shinsegae, Inc. (b) | 10 | 1,360 | ||||||

Signet Jewelers, Ltd. (b) | 55 | 5,899 | ||||||

Watches of Switzerland Group PLC (a)(b)(d) | 165 | 1,490 | ||||||

Williams-Sonoma, Inc. | 75 | 15,134 | ||||||

| 214,906 | ||||||||

Software — 0.0% (f) | ||||||||

Faraday Future Intelligent Electric, Inc. - Class A (a) | 18 | 4 | ||||||

TOTAL COMMON STOCKS (Cost $1,245,223) | 1,256,980 | |||||||

SHORT-TERM INVESTMENTS — 0.1% | ||||||||

Money Market Fund — 0.1% | ||||||||

First American Government Obligations Fund, Class X, 5.28% (c) | 1,592 | 1,592 | ||||||

TOTAL SHORT-TERM INVESTMENTS (Cost $1,592) | 1,592 | |||||||

TOTAL INVESTMENTS (Cost $1,246,815) — 99.9% | 1,258,572 | |||||||

Other assets and liabilities, net — 0.1% | 909 | |||||||

NET ASSETS — 100.0% | $ | 1,259,481 | ||||||

ADR American Depositary Receipt

PLC Public Limited Company

(a) | Non-income producing security. |

(b) | Foreign issued security, or represents a foreign issued security. |

(c) | The rate shown is the seven day yield at period end. |

(d) | Security exempt from registration pursuant to Rule 144a under the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration to qualified institutional investors. |

(e) | To the extent the Fund invests more heavily in particular sectors of the economy, its performance will be especially sensitive to developments that significantly affect those sectors. |

(f) | Amount is less than 0.05%. |

Percentages are stated as a percent of net assets.

COUNTRY | Percentage |

United States | 34.1% |

France | 23.7% |

Germany | 9.5% |

Switzerland | 7.4% |

Netherlands | 5.4% |

United Kingdom | 4.7% |

Cayman Islands | 2.7% |

Liberia | 2.7% |

Italy | 2.6% |

Panama | 1.7% |

Japan | 1.6% |

Bermuda | 1.6% |

Republic of Korea | 0.8% |

British Virgin Islands | 0.6% |

Australia | 0.5% |

Hong Kong | 0.1% |

Canada | 0.1% |

Total Country | 99.8% |

SHORT-TERM INVESTMENTS | 0.1% |

TOTAL INVESTMENTS | 99.9% |

Other assets and liabilities, net | 0.1% |

NET ASSETS | 100.0% |

The accompanying notes are an integral part of the financial statements.

29

Roundhill Alerian LNG ETF

Schedule of Investments

December 31, 2023

Description | Shares | Value | ||||||

COMMON STOCKS — 99.5% | ||||||||

Electric — 6.8% | ||||||||

Sempra | 190 | $ | 14,199 | |||||

Tokyo Electric Power Co. Holdings, Inc. (a)(b) | 6,800 | 35,621 | ||||||

| 49,820 | ||||||||

Gas — 7.8% | ||||||||

ENN Energy Holdings, Ltd. (b) | 5,300 | 39,028 | ||||||

Korea Gas Corp. (a)(b) | 934 | 17,913 | ||||||

| 56,941 | ||||||||

Oil & Gas — 34.5% (d) | ||||||||

Chevron Corp. | 98 | 14,618 | ||||||

Exxon Mobil Corp. | 141 | 14,097 | ||||||

Kunlun Energy Co., Ltd. (b) | 22,000 | 19,835 | ||||||

Santos, Ltd. (b) | 16,988 | 88,097 | ||||||

Shell PLC (b) | 439 | 14,451 | ||||||

Tellurian, Inc. (a) | 5,655 | 4,273 | ||||||

TotalEnergies SE (b) | 212 | 14,426 | ||||||

Woodside Energy Group, Ltd. (b) | 3,942 | 83,546 | ||||||

| 253,343 | ||||||||

Pipelines — 36.2% (d) | ||||||||

Cheniere Energy, Inc. | 595 | 101,572 | ||||||

Enbridge, Inc. (b) | 400 | 14,470 | ||||||

Excelerate Energy, Inc. - Class A | 760 | 11,750 | ||||||

Golar LNG, Ltd. (b) | 1,655 | 38,048 | ||||||

Kinder Morgan, Inc. | 586 | 10,337 | ||||||

Koninklijke Vopak NV (b) | 382 | 12,845 | ||||||

New Fortress Energy, Inc. | 929 | 35,051 | ||||||

NextDecade Corp. (a) | 4,802 | 22,906 | ||||||

Petronas Gas Bhd. (b) | 5,078 | 19,229 | ||||||

| 266,208 | ||||||||

Transportation — 14.2% | ||||||||

Cool Co., Ltd. (b) | 675 | 8,507 | ||||||

FLEX LNG, Ltd. (b) | 870 | 25,282 | ||||||

Korea Line Corp. (a)(b) | 922 | 1,543 | ||||||

Misc Bhd. (b) | 9,555 | 15,159 | ||||||

Mitsui O.S.K. Lines, Ltd. (b) | 500 | 16,020 | ||||||

Qatar Gas Transport Co., Ltd. (b) | 39,778 | 37,800 | ||||||

| 104,311 | ||||||||

TOTAL COMMON STOCKS (Cost $734,715) | 730,623 | |||||||

SHORT-TERM INVESTMENTS — 0.4% | ||||||||

Money Market Fund — 0.4% | ||||||||

First American Government Obligations Fund, Class X, 5.28% (c) | 3,204 | 3,204 | ||||||

TOTAL SHORT-TERM INVESTMENTS (Cost $3,204) | 3,204 | |||||||

TOTAL INVESTMENTS (Cost $737,919) — 99.9% | 733,827 | |||||||

Other assets and liabilities, net — 0.1% | 518 | |||||||

NET ASSETS — 100.0% | $ | 734,345 | ||||||

PLC Public Limited Company

(a) | Non-income producing security. |

(b) | Foreign issued security, or represents a foreign issued security. |

(c) | The rate shown is the seven day yield at period end. |

(d) | To the extent the Fund invests more heavily in particular sectors of the economy, its performance will be especially sensitive to developments that significantly affect those sectors. |

Percentages are stated as a percent of net assets.

COUNTRY | Percentage |

United States | 31.2% |

Australia | 23.4% |

Bermuda | 12.5% |

Japan | 7.0% |

Cayman Islands | 5.3% |

Qatar | 5.1% |

Malaysia | 4.7% |

Republic of Korea | 2.6% |

Canada | 2.0% |

United Kingdom | 2.0% |

France | 2.0% |

Netherlands | 1.7% |

Total Country | 99.5% |

SHORT-TERM INVESTMENTS | 0.4% |

TOTAL INVESTMENTS | 99.9% |

Other assets and liabilities, net | 0.1% |

NET ASSETS | 100.0% |

The accompanying notes are an integral part of the financial statements.

30

Roundhill ETFs

Statements of Assets and Liabilities

December 31, 2023

Roundhill Video | Roundhill | Roundhill Ball | Roundhill | |||||||||||||

Assets | ||||||||||||||||

Investments, at value (Cost $24,484,953, $114,661,187, $550,854,192 and $3,033,901, respectively)(1) | $ | 23,686,722 | $ | 108,300,816 | $ | 530,939,413 | $ | 3,033,901 | ||||||||

Cash | 5,640 | — | — | — | ||||||||||||

Receivable for investment securities sold | 31,271 | — | 35,564 | — | ||||||||||||

Dividends and interest receivable | 21,927 | 101,009 | 250,615 | 2,390 | ||||||||||||

Dividend tax reclaim receivable | 26,413 | — | — | — | ||||||||||||

Receivable for open swap contracts, net | — | — | — | 129,564 | ||||||||||||

Securities lending income receivable | 524 | 2,350 | 14,256 | — | ||||||||||||

Total Assets | 23,772,497 | 108,404,175 | 531,239,848 | 3,165,855 | ||||||||||||

Liabilities | ||||||||||||||||

Payable for collateral on securities loaned (Note 7) | 2,919,764 | 7,809,974 | 67,458,659 | — | ||||||||||||

Foreign currency payable to custodian, at value (Cost $0, $6,552, $0 and $0, respectively) | — | 6,596 | — | — | ||||||||||||

Payable to Adviser | 8,966 | 64,154 | 225,393 | 1,019 | ||||||||||||

Total Liabilities | 2,928,730 | 7,880,724 | 67,684,052 | 1,019 | ||||||||||||

Net Assets | $ | 20,843,767 | $ | 100,523,451 | $ | 463,555,796 | $ | 3,164,836 | ||||||||

| ||||||||||||||||

Net Assets Consists of: | ||||||||||||||||

Paid-in capital | $ | 62,604,188 | $ | 262,548,342 | $ | 798,302,071 | $ | 3,493,100 | ||||||||

Total distributable earnings (accumulated losses) | (41,760,421 | ) | (162,024,891 | ) | (334,746,275 | ) | (328,264 | ) | ||||||||

Net Assets | $ | 20,843,767 | $ | 100,523,451 | $ | 463,555,796 | $ | 3,164,836 | ||||||||

| ||||||||||||||||

Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | 1,325,000 | 5,775,000 | 40,175,000 | 105,000 | ||||||||||||

Net Asset Value, redemption price and offering price per share | $ | 15.73 | $ | 17.41 | $ | 11.54 | $ | 30.14 | ||||||||

(1) Includes loaned securities with a value of: | $ | 2,775,323 | $ | 7,470,104 | $ | 63,762,835 | $ | — | ||||||||

The accompanying notes are an integral part of the financial statements.

31

Roundhill ETFs

Statements of Assets and Liabilities

December 31, 2023 (Continued)

Roundhill | Roundhill | Roundhill | ||||||||||

Assets | ||||||||||||

Investments, at value (Cost $34,907,503, $1,246,815 and $737,919, respectively)(1) | $ | 35,399,656 | $ | 1,258,572 | $ | 733,827 | ||||||

Cash | — | 92 | — | |||||||||

Receivable for investment securities sold | 1,011,426 | — | 435 | |||||||||

Dividends and interest receivable | 7,879 | 1,276 | 487 | |||||||||

Receivable for fund shares sold | 1,667,370 | — | — | |||||||||

Unrealized appreciation on swap contracts | 951,452 | — | — | |||||||||

Securities lending income receivable | — | 16 | — | |||||||||

Total Assets | 39,037,783 | 1,259,956 | 734,749 | |||||||||

Liabilities | ||||||||||||

Payable for fund shares redeemed | 335,739 | — | — | |||||||||

Payable for investment securities purchased | 1,346,635 | — | — | |||||||||

Payable to Adviser | 6,397 | 475 | 404 | |||||||||

Total Liabilities | 1,688,771 | 475 | 404 | |||||||||

Net Assets | $ | 37,349,012 | $ | 1,259,481 | $ | 734,345 | ||||||

| ||||||||||||

Net Assets Consists of: | ||||||||||||

Paid-in capital | $ | 35,992,186 | $ | 1,249,626 | $ | 740,144 | ||||||

Total distributable earnings (accumulated losses) | 1,356,826 | 9,855 | (5,799 | ) | ||||||||

Net Assets | $ | 37,349,012 | $ | 1,259,481 | $ | 734,345 | ||||||

| ||||||||||||

Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | 1,120,000 | 50,000 | 30,000 | |||||||||

Net Asset Value, redemption price and offering price per share | $ | 33.35 | $ | 25.19 | $ | 24.48 | ||||||

| ||||||||||||

(1) Includes loaned securities with a value of: | $ | — | $ | — | $ | — | ||||||

The accompanying notes are an integral part of the financial statements.

32

Roundhill ETFs

Statements of Operations

For the Year or Period Ended December 31, 2023

Roundhill Video | Roundhill | Roundhill Ball | Roundhill | |||||||||||||

Investment Income | ||||||||||||||||

Dividend income (net of withholding taxes and issuance fees of $46,904, $54,437, $151,847 and $2,335, respectively) | $ | 285,717 | $ | 1,301,495 | $ | 3,241,028 | $ | — | ||||||||

Securities lending income, net | 7,759 | 94,076 | 162,973 | — | ||||||||||||

Interest income | 5,856 | 17,374 | 37,374 | 112,275 | ||||||||||||

Total investment income | 299,332 | 1,412,945 | 3,441,375 | 112,275 | ||||||||||||

| ||||||||||||||||

Expenses | ||||||||||||||||

Advisory fees | 118,919 | 875,903 | 2,607,603 | 10,778 | ||||||||||||

Tax expense | — | 185 | 185 | — | ||||||||||||

Total expenses before reimbursement | 118,919 | 876,088 | 2,607,788 | 10,778 | ||||||||||||

Less waivers and reimbursement by Adviser | — | — | — | (1,959 | ) | |||||||||||

Total net expenses | 118,919 | 876,088 | 2,607,788 | 8,819 | ||||||||||||

Net investment income | 180,413 | 536,857 | 833,587 | 103,456 | ||||||||||||

| ||||||||||||||||

Realized and Unrealized Gain (Loss) on Investments, Foreign Currency and Swap Contracts | ||||||||||||||||

Net realized gain (loss) from: | ||||||||||||||||

Investments | (541,097 | ) | (72,365,002 | ) | (30,489,944 | ) | 57 | |||||||||

Foreign currency transactions | (10,648 | ) | (355,520 | ) | (50,321 | ) | — | |||||||||

Swap contracts | — | — | — | 19,104 | ||||||||||||

Net realized gain (loss) on investments, foreign currency transactions and swap contracts | (551,745 | ) | (72,720,522 | ) | (30,540,265 | ) | 19,161 | |||||||||

Net change in unrealized appreciation/depreciation on: | ||||||||||||||||

Investments | 3,229,209 | 96,267,983 | 232,109,106 | — | ||||||||||||

Foreign currency translation | (1,016 | ) | 3,242 | (1,037 | ) | — | ||||||||||

Net change in unrealized appreciation/depreciation on investments and foreign currency translation | 3,228,193 | 96,271,225 | 232,108,069 | — | ||||||||||||

Net realized and unrealized gain (loss) on investments, foreign currency transactions and swap contracts | 2,676,448 | 23,550,703 | 201,567,804 | 19,161 | ||||||||||||

Net increase in net assets from operations | $ | 2,856,861 | $ | 24,087,560 | $ | 202,401,391 | $ | 122,617 | ||||||||

The accompanying notes are an integral part of the financial statements.

33

Roundhill ETFs

Statements of Operations

For the Year or Period Ended December 31, 2023 (Continued)

Roundhill | Roundhill | Roundhill | ||||||||||

Investment Income | ||||||||||||

Dividend income (net of withholding taxes and issuance fees of $0, $664 and $107, respectively) | $ | 3,236 | $ | 5,801 | $ | 3,406 | ||||||

Dividend tax reclaims | — | 679 | — | |||||||||

Securities lending income, net | — | 26 | — | |||||||||

Interest income | 157,423 | 106 | 93 | |||||||||

Total investment income | 160,659 | 6,612 | 3,499 | |||||||||

Expenses | ||||||||||||

Advisory fees | 14,517 | 1,903 | 1,234 | |||||||||

Tax expense | — | 185 | 185 | |||||||||

Total expenses | 14,517 | 2,088 | 1,419 | |||||||||

Net investment income | 146,142 | 4,524 | 2,080 | |||||||||

| ||||||||||||

Realized and Unrealized Gain (Loss) on Investments, Foreign Currency and Swap Contracts | ||||||||||||

Net realized gain (loss) from: | ||||||||||||

Investments | 119,404 | (2,118 | ) | (491 | ) | |||||||

Foreign currency transactions | — | (63 | ) | 483 | ||||||||

Net realized gain (loss) on investments and foreign currency transactions | 119,404 | (2,181 | ) | (8 | ) | |||||||

Net change in unrealized appreciation/depreciation on: | ||||||||||||

Investments | 492,153 | 11,757 | (4,092 | ) | ||||||||

Foreign currency translation | — | 40 | — | |||||||||

Swap contracts | 951,452 | — | — | |||||||||

Net change in unrealized appreciation/depreciation on investments, foreign currency translation and swap contracts | 1,443,605 | 11,797 | (4,092 | ) | ||||||||

Net realized and unrealized gain (loss) on investments, foreign currency transactions and swap contracts | 1,563,009 | 9,616 | (4,100 | ) | ||||||||

Net increase (decrease) in net assets from operations | $ | 1,709,151 | $ | 14,140 | $ | (2,020 | ) | |||||

(1) | The Fund commenced operations on April 10, 2023. |

(2) | The Fund commenced operations on August 22, 2023. |

(3) | The Fund commenced operations on September 19, 2023. |

The accompanying notes are an integral part of the financial statements.

34

Roundhill ETFs

Statements of Changes in Net Assets

Roundhill Video Games ETF | Roundhill Sports Betting & | |||||||||||||||

Year | Year | Year | Year | |||||||||||||

From Operations | ||||||||||||||||

Net investment income | $ | 180,413 | $ | 292,574 | $ | 536,857 | $ | 604,454 | ||||||||

Net realized loss on investments and foreign currency transactions | (551,745 | ) | (37,470,667 | ) | (72,720,522 | ) | (67,507,904 | ) | ||||||||

Net change in net unrealized appreciation/depreciation on investments and foreign currency translation | 3,228,193 | 13,822,197 | 96,271,225 | (41,816,932 | ) | |||||||||||

Net increase (decrease) in net assets resulting from operations | 2,856,861 | (23,355,896 | ) | 24,087,560 | (108,720,382 | ) | ||||||||||

| ||||||||||||||||

From Distributions | ||||||||||||||||

Distributable earnings | (222,207 | ) | (173,639 | ) | — | (309,837 | ) | |||||||||

Return of capital | — | — | — | (470,671 | ) | |||||||||||

Total distributions | (222,207 | ) | (173,639 | ) | — | (780,508 | ) | |||||||||

| ||||||||||||||||

From Capital Share Transactions | ||||||||||||||||

Proceeds from shares sold | 1,147,748 | 2,186,870 | 16,759,088 | 53,179,428 | ||||||||||||

Cost of shares redeemed | (8,200,183 | ) | (15,895,572 | ) | (58,354,018 | ) | (116,157,365 | ) | ||||||||

Transaction fees (Note 4) | 11,662 | 12,714 | 2,738 | — | ||||||||||||

Net decrease in net assets resulting from capital share transactions | (7,040,773 | ) | (13,695,988 | ) | (41,592,192 | ) | (62,977,937 | ) | ||||||||

| ||||||||||||||||

Total Decrease in Net Assets | (4,406,119 | ) | (37,225,523 | ) | (17,504,632 | ) | (172,478,827 | ) | ||||||||

| ||||||||||||||||

Net Assets | ||||||||||||||||

Beginning of year | 25,249,886 | 62,475,409 | 118,028,083 | 290,506,910 | ||||||||||||

End of year | $ | 20,843,767 | $ | 25,249,886 | $ | 100,523,451 | $ | 118,028,083 | ||||||||

Changes in Shares Outstanding | ||||||||||||||||

Shares outstanding, beginning of year | 1,800,000 | 2,500,000 | 8,225,000 | 11,675,000 | ||||||||||||

Shares sold | 75,000 | 100,000 | 975,000 | 2,950,000 | ||||||||||||

Shares redeemed | (550,000 | ) | (800,000 | ) | (3,425,000 | ) | (6,400,000 | ) | ||||||||

Shares outstanding, end of year | 1,325,000 | 1,800,000 | 5,775,000 | 8,225,000 | ||||||||||||

The accompanying notes are an integral part of the financial statements.

35

Roundhill ETFs

Statements of Changes in Net Assets

Roundhill Ball Metaverse ETF | Roundhill Cannabis ETF | |||||||||||||||

Year | Year | Year | Period | |||||||||||||