U.S. SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of December, 2013

Commission File No.:001-04192

MFC Industrial Ltd.

(Translation of Registrant's name into English)

Suite #1620 - 400 Burrard Street, Vancouver, British Columbia, Canada V6C 3A6

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Indicate by check mark whether the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):¨

Note:Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark whether the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):¨

Note:Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

If "Yes" is marked, indicate below the file number assigned to the Registrant in connection with Rule 12g3-2(b):¨

SIGNATURES

Pursuant to the requirements of theSecurities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

MFC INDUSTRIAL LTD.

| By: | | /s/ Michael Smith |

| | Michael Smith |

| | Chairman, President and |

| | Chief Executive Officer |

Date: December 2, 2013

| NEWS RELEASE |

| |

| Corporate | Investors |

| MFC Industrial Ltd. | Cameron Associates |

| Rene Randall | Kevin McGrath |

| 1 (604) 683 8286 ex 224 | 1 (212) 245 4577 |

| rrandall@bmgmt.com | kevin@cameronassoc.com |

MFC FILES PROXY CIRCULAR AND EXPOSES KELLOGG GROUP’S UNLAWFUL TAKEOVER STRATEGY

VOTE YOURWHITE PROXY TO STOP THE KELLOGG GROUP FROM OBTAINING CONTROL OF MFC’S BOARD WITHOUT PAYING YOU A CONTROL PREMIUM

NEW YORK (December 2, 2013) . . . MFC Industrial Ltd. ("MFC" or the "Company") (NYSE: MIL) today advised shareholders that it has filed its management proxy circular (the “Circular”) for the annual and special meeting (the “Meeting”) of shareholders of MFC scheduled for December 27, 2013.

The Circular exposes the Kellogg Group’s attempt to execute an unlawful takeover of MFC, its breaches of applicable Canadian and United States securities laws and details the Kellogg Group’s attempts to put its interests ahead of the interests of other shareholders. MFC believes that shareholders should be of wary of the Kellogg Group’s intentions for the reasons as set forth in the Circular.

Mr. Michael J. Smith, Chief Executive Officer, commented: “The evidence overwhelmingly suggests that the Kellogg Group wants control of MFC without paying a premium for control. The MFC board has serious concerns about the actions and motives of the Kellogg Group as set forth in the Circular.”

MFC urges shareholders to carefully review MFC’s letter to shareholders and the Circular and promptly vote only theirWHITE proxy well in advance of the proxy voting deadline of December 24, 2013 at 4:00 p.m. (Hong Kong time).

MFC’s letter to shareholders and Circular will be filed on SEDAR and EDGAR and posted to MFC’s website at www.mfcindustrial.com/investor_relations.

The board of directors and management of MFC unanimously recommends that shareholders vote only theWHITE proxyFOR Dr. Shuming Zhao and Ravin Prakash as class II directors of MFC andFOR the advance notice policy. |

Regardless of the number of shares you own, we ask for your support by casting your vote today by completing and returning ONLY the WHITE proxy.If you have any questions or need assistance in casting your vote or completing your WHITE proxy, please call Mackenzie Partners Inc. within North America toll free at 1-800-322-2885, collect at (212) 929-5500, or by email at proxy@mackenziepartners.com.

PAGE 1/1

MANAGEMENT PROXY CIRCULAR

for the Annual General and Special Meeting of Shareholders

of

MFC INDUSTRIAL LTD.

to be held on December 27, 2013

THE BOARD OF MFCUNANIMOUSLY RECOMMENDSTHAT YOU VOTE:

| þ | | FOR THEMFC DIRECTOR NOMINEESPROPOSED IN THE CIRCULAR |

| | |

| þ | | FOR APPROVING THE MFC ADVANCE NOTICE POLICY |

THE FUTURE OF MFC AND YOUR INVESTMENT WILL BE DETERMINED BY THE OUTCOME OF THIS VOTE. DO NOT ALLOW THE KELLOGG GROUP TOADVANCE ITS HIDDEN AGENDA OF TAKING CONTROL OF THE MFC BOARD AND YOUR INVESTMENT.

YourWHITE proxy or VIF must be received by Corporate Election Services by 4:00 p.m. (Hong Kong time) on December 24, 2013, as further described in this Circular.

YOUR VOTE IS EXTREMELY IMPORTANT

PLEASE SUBMIT YOURWHITE PROXY OR VIF TODAY |

IF YOU HAVE QUESTIONS OR NEED ASSISTANCE VOTING YOUR SHARES, CONTACT OUR PROXY SOLICIATION AGENT MACKENZIE PARTNERS, INC. AT:

North America toll free: 1-800-322-2885

Outside of North America (collect): (212) 929-5500

Email: proxy@mackenziepartners.com

November 29, 2013

If you have any questions about the information contained in this document or require assistance in completing yourWHITE proxy or VIF, please contact our proxy solicitation agent:

North American toll free number: 1-800-322-2885

Outside of North America (collect): (212) 929-5500

Email: proxy@mackenziepartners.com

The MFC board of directorsunanimously recommends that youVOTE yourWHITE proxy or VIF:

| þ | | FOR the election of theMFC director nominees proposed in the Circular |

| | |

| þ | | FOR the approval of the MFC Advance Notice Policy |

The detailed reasons for the board's recommendations are discussed in the accompanying Management Proxy Circular which you are urged to read carefully.

YOUR VOTE IS EXTREMELY IMPORTANT

PLEASE SUBMIT YOURWHITE PROXY OR VIF TODAY |

In order to be counted at the Meeting, yourWHITE proxy or VIF must be received by Corporate Election Services by 4:00 p.m. (Hong Kong time) on Tuesday, December 24, 2013, or in the case of any adjournment(s) or postponement(s) of the Meeting, not less than 48 hours, excluding Saturdays, Sundays and holidays, prior to the time fixed for the re-convened Meeting. The time limit for the deposit of proxies may be waived by the chair of the Meeting at his or her discretion without notice. See the instructions under "Voting Information" on page 15 of our Circular for further details.

These materials are important and require your immediate attention. They require shareholders of MFC Industrial Ltd. to make important decisions. If you are in doubt as to how to make such decisions, please contact your financial, legal or other professional advisors. If you have any questions or require more information with regard to voting your shares, please contact MacKenzie Partners, Inc. within North America toll free at 1-800-322-2885, call collect at (212) 929-5500, or email atproxy@mackenziepartners.com.

Dear fellow shareholder,

MFC Industrial Ltd. ("MFC") faces a proxy contest at its 2013 annual shareholder's meeting (the "Meeting") that has serious consequences for MFC's future. This proxy contest is about stopping an unlawful takeover of MFC by Peter R. Kellogg, IAT Reinsurance Company Ltd., and certain of their affiliates (the "Kellogg Group"), a dissident group that is attempting to put its interests above those of all other shareholders. The Kellogg Group wants control of your company without paying you a "control premium". For now, the Board has halted the Kellogg Group's unlawful takeover of MFC, but it needs your help to ensure that MFC is able to successfully defend itself.

At the Meeting, MFC is asking shareholders to vote for the election of its two (2) class II director nominees, Dr. Shuming Zhao and Ravin Prakash, both of whom are current directors of MFC. The Board has fixed the number of directors at six (6) and, accordingly, shareholders only need to elect two (2) class II directors at the Meeting.

Your board believes that the Kellogg Group's purpose in proposing its own nominees at the Meeting is the final step in a scheme designed to take control of MFC. Shareholders should be wary of the Kellogg Group's intentions as it seems to be intending to raid MFC's substantial assets for its own purposes.

Reasons to Support MFC and its Nominees

- We have a demonstrated record of generating superior returns for shareholders. This includes a total return on our shares of over 500% over the past 10 fiscal years and a compound annual growth rate of 20.1% over the same period. MFC's book value, which we view value as a key indicator of our overall financial performance, increased by 307% from $180.6 million to $735.3 million between December 31, 2002 and September 30, 2013, and our total assets also increased by 356% from $282.7 million to about $1.3 billion over the same period.

- We have demonstrated a successful record of identifying and executing accretive transactions to build shareholder value. In 2012, this included a successful expansion of our commodities platform into natural gas, and the acquisition of a controlling interest in 2 global commodities supply chain businesses. In 2013, we announced that MFC entered into an agreement with an established oil and gas company whereby they have committed to spending a minimum of $50 million to drill a total of 12 net wells over three years on certain of our undeveloped lands.

Reasons to Oppose the Kellogg Proposals

Kellogg's unlawful takeover has violated securities laws in order to avoid paying you a control premium

- The Kellogg Group has committed numerous, egregious and ongoing violations of Canadian and United States securities laws. Since at least 1999, the Kellogg Group has been an "insider" under Canadian securities laws by acquiring more than 10% of MFC's shares, but it left MFC shareholders and the markets in the dark regarding its subsequent acquisitions and intentions in violation of "insider", "early warning" and "takeover bid" laws. Additionally, the Kellogg Group has unlawfully acquired MFC shares while being prohibited from doing so under Canadian "early warning" requirements.

Page 2

- The Kellogg Group, which describes itself as "not shareholder activists", has, for some time, been conducting a unlawful takeover of MFC by purchasing MFC shares when it was prohibited from doing so without informing shareholders as required by applicable law.

- Under Canadian takeover bid rules, absent an exemption, a person acquiring 20% or more of an issuer's outstanding shares must make a formal takeover bid to all shareholders. It now appears that the Kellogg Group surpassed this 20% threshold in 2000 and has thereafter made numerous acquisitions to increase its ownership to 33% without making a formal takeover bid to all shareholders. In most cases, shareholders receive a significant premium to the current share price in exchange for handing over control of their company, but the Kellogg Group has failed to pay shareholders anything for its control position.

- MFC believes that the Kellogg Group may likely have triggered MFC's 2003 shareholder rights plan (the "2003 Rights Plan") between 2003 and 2006, but due to the Kellogg Group's failure to disclose the details of its acquisitions, MFC shareholders did not know and could not have known that the 2003 Rights Plan might have been triggered, and as a result, were effectively deprived of their rights under the plan. The Kellogg Group may have unfairly deprived MFC shareholders their rights under the 2003 Rights Plan to purchase MFC shares at a 50% discount to the market price, representing an economic loss to other shareholders potentially in excess of hundreds of millions of dollars and unfairly maintained its share position in MFC which, assuming shareholders exercised their rights in full, would have been diluted to about only 3% of the outstanding MFC shares.

- The Kellogg Proposals would have effected ade facto change of control of MFC without paying a control premium and without giving other shareholders a chance to sell their shares into a bid. As compared to the Kellogg Group's 33% ownership interest in MFC, the Kellogg Proposals seeks the appointment of approximately 75% of the Board.

The Kellogg Group's proxy contest is selfishly motivated and unrelated to MFC's "strategic direction"

In its November 25, 2013 news release, the Kellogg Group made abstract references to its ostensible concerns regarding the "strategic direction" of MFC. These concerns are specious and self-serving and only came about after MFC adopted a shareholder rights plan and took other steps to protect itself against the Kellogg Group's unlawful accumulation of shares. If the Kellogg Group's concerns were legitimate, why would the Kellogg Group purchase an additional 1,606,241 MFC shares between April and October, 2013 for approximately $13.1 million? Interestingly, these purchases increased the Kellogg Group's holdings to 33% of the MFC shares, which is coincidentally the threshold necessary to defeat any transaction requiring special majority approval.

The Kellogg Group may well be facing a liquidity crunch resulting from its tax scheme that was rejected by the IRS, and appears to be after MFC's assets. The Kellogg Group launched this proxy contest only after: (i) it paid in excess of $186 million to the IRS for back taxes and interest in June - October 2011; (ii) MFC rejected the Kellogg Group's request for a loan from MFC of $50 million in the third quarter of 2011; and (iii) the Kellogg Group's alternate dispute resolution was delayed indefinitely in November 2013.

If the Kellogg Proposals are successful, MFC believes the Kellogg Group nominees would dismiss MFC's existing legal actions against Mr. Kellogg for his blatant breaches of securities laws and the resulting damage it has caused MFC and its shareholders.

Page 3

The Kellogg Group lacks knowledge of MFC, its business and strategies

The Kellogg Group nominees have little or no relevant operational expertise running a commodities business, lack, for the most part, the international experience necessary to successfully run MFC's operations, and have little or no relevant public company experience.

The Kellogg Group has no strategic plan for MFC, and has not been transparent in its intentions for MFC's future.

The Kellogg proposals are dangerous

The Kellogg Proposals could be a change of control triggering an event of default under MFC's existing bank lines and arrangements with lenders, and could also trigger change of control provisions in MFC's other contracts with third parties and employment agreements with management.

The remaining directors whom the Kellogg Group is not seeking to replace are considering their positions in light of the proxy contest and, in the event that the Kellogg Group is successful, they may not wish to remain in their positions as directors of MFC. Should those directors decide to depart, MFC would have no continuity of directors going forward.

If the Kellogg Group nominees go in a direction incompatible with MFC's current strategy, management and other key employees may not wish to remain in their current positions and may instead wish to explore alternative opportunities, which could have a material adverse impact on MFC's business and operations.

The MFC Board has a clear strategy to build long-term value for your investment in MFC, and has created tremendous shareholder value in the past. MFC has outperformed its peers, even during period of troubled financial markets. There is no valid reason for a timely and costly proxy contest. Vote theWHITE proxy today to stop the Kellogg Group from unlawfully taking control of MFC and raiding its assets.

Regardless of the number of shares you own, we ask for your support by casting vote today by completing and returning ONLY the WHITE proxy. If you have any questions or need assistance in casting your vote or completing your WHITE proxy, please call Mackenzie Partners, Inc. within North America toll free at 1-800-322-2885, collect at (212) 929-5500, or by email at proxy@mackenziepartners.com.

Yours Truly,

"Michael J. Smith"

Michael J. Smith

Chairman of the Board of Directors

NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS

TO: THE HOLDERS OF COMMON SHARES OF MFC INDUSTRIAL LTD.

NOTICE IS HEREBY GIVEN that the annual general and special meeting (the "Meeting") of shareholders of MFC Industrial Ltd. ("MFC") will be held at the Renaissance Hong Kong Harbour View Hotel, 1 Harbour Road, Wanchai, Hong KongSAR, Chinaon Friday, December 27, 2013 at 4:00 p.m. (Hong Kong time) for the following purposes:

| 1. | | to receive and consider MFC's financial statements for the financial year ended December 31, 2012; |

| |

| 2. | | to elect Dr. Shuming Zhao and Ravin Prakash as Class II directors of MFC; |

| |

| 3. | | to appoint MFC's auditors for the ensuing year and authorize MFC's board to fix the remuneration of the auditors; |

| |

| 4. | | to consider and, if thought fit, to pass an ordinary resolution affirming, ratifying and approving MFC's advance notice policy (the "Advance Notice Policy") in the form set out at Schedule "A" to the Management Proxy Circular (the "Circular") accompanying this notice of meeting, as more particularly set forth in the Circular; and |

| |

| 5. | | to transact such other business as may properly come before the Meeting and any adjournment(s) or postponement(s) thereof. |

Accompanying this notice of meeting is the Circular, aWHITE form of proxy and a supplemental mailing list form. A copy of the Advance Notice Policy will also be available for inspection by shareholders at MFC's records office during normal business hours. The accompanying Circular provides additional information relating to the matters to be dealt with at the Meeting and forms part of this notice of meeting.

The board of directors of MFC has fixed the close of business (New York time) on November 25, 2013 as the record date for determining shareholders who are entitled to receive notice of the Meeting and to attend and vote at the Meeting and any adjournment(s) or postponement(s) thereof.

Registered shareholders (shareholders of record) who are unable to attend the Meeting in person are requested to complete, sign and date the enclosedWHITE form of proxy and return theWHITE form of proxy in the enclosed return envelope provided for that purpose. If you receive more than oneWHITE form of proxy because you own common shares registered in different names or at different addresses, eachWHITE form of proxy should be completed and returned.

AWHITE form of proxy will not be valid unless it is deposited, by mail, courier or hand, to the attention of: Corporate Election Services, PO Box 3230, Pittsburgh, Pennsylvania 15230, USA, by 4:00 p.m. (Hong Kong time) on December 24, 2013, or in the case of any adjournment(s) or postponement(s) of the Meeting, not less than 48 hours, excluding Saturdays, Sundays and holidays, prior to the time fixed for the re-convened Meeting. You may also provide your voting instructions by telephone by calling toll free 1-888-693-VOTE (8683), by facsimile at 1-412-299-9191, or through the Internet atwww.cesvote.com. The time limit for the deposit of proxies may be waived by the chair of the Meeting at his or her discretion without notice.

| | BY ORDER OF THE BOARD OF DIRECTORS |

| |

| /s/ Michael J. Smith |

| Michael J. Smith |

| Chairman of the Board of Directors |

29 November, 2013

Vancouver, British Columbia

TABLE OF CONTENTS

| MANAGEMENT PROXY CIRCULAR | 1 |

| Forward-Looking Information | 2 |

| REASONS FOR THIS SOLICITATION | 3 |

| REASONS TO SUPPORT MFC AND ITS NOMINEES | 5 |

| REASONS TO OPPOSE THE KELLOGG GROUP NOMINEES | 8 |

| VOTING INFORMATION | 15 |

| Solicitation of Proxies | 15 |

| Record Date | 15 |

| Appointment of Proxyholders | 15 |

| Revocability of Proxy | 16 |

| Voting of MFC Shares and Proxies and Exercise of Discretion by Designated Persons | 16 |

| NON-REGISTERED HOLDERS | 17 |

| VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF | 18 |

| ELECTION OF DIRECTORS | 18 |

| Corporate Cease Trade Orders | 20 |

| Bankruptcies | 21 |

| Penalties or Sanctions | 21 |

| APPOINTMENT AND REMUNERATION OF AUDITORS | 21 |

| STATEMENT OF EXECUTIVE COMPENSATION | 21 |

| General | 21 |

| Compensation Discussion and Analysis | 22 |

| Risk Management | 23 |

| Compensation Governance | 23 |

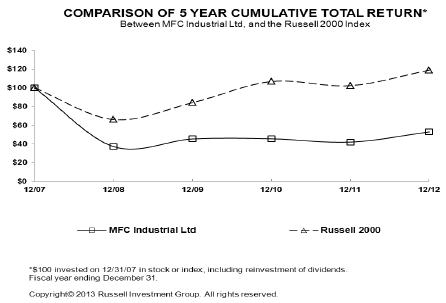

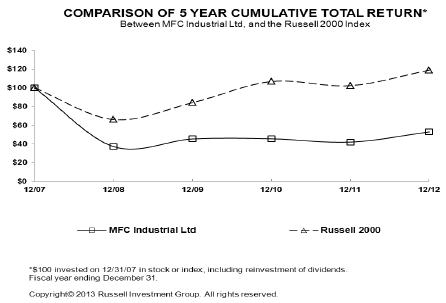

| Performance Graph | 24 |

| Option-Based Awards | 24 |

| Summary Compensation Table | 25 |

| Incentive Plan Awards | 26 |

| Pension Plan Benefits | 27 |

| Termination and Change of Control Benefits | 27 |

| Director Compensation | 28 |

| Incentive Plan Compensation for Directors | 28 |

| SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS | 29 |

| CORPORATE GOVERNANCE DISCLOSURE | 30 |

| INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS | 37 |

| INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS | 37 |

| MANAGEMENT CONTRACTS | 37 |

| AUDIT COMMITTEE DISCLOSURE | 38 |

| PARTICULARS OF MATTERS TO BE ACTED UPON | 38 |

| INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON | 39 |

| REGISTRAR AND TRANSFER AGENT | 39 |

| OTHER BUSINESS | 40 |

| ADDITIONAL INFORMATION AND AVAILABILITY OF DOCUMENTS | 40 |

| SCHEDULE "A" ADVANCE NOTICE POLICY | A-1 |

| SCHEDULE "B" FORMER AND SUCCESSOR AUDITORS | B-1 |

| SCHEDULE "C" AUDIT COMMITTEE DISCLOSURE | C 1 |

(i)

MANAGEMENT PROXY CIRCULAR

The information in this Circular is given as of November 29, 2013, except as otherwise stated.

This management proxy circular (the "Circular") is being furnished to holders of common shares in the capital of MFC Industrial Ltd. ("MFC", "we", "us", or "our") in connection with the solicitation ofWHITE proxies by the board of directors (the "Board") of MFC for use at the annual general and special meeting of shareholders to be held on December 27, 2013 (the "Meeting") at the Renaissance Hong Kong Harbour View Hotel, 1 Harbour Road, Wanchai, Hong KongSAR, Chinaat 4:00 p.m. (Hong Kong time), and any adjournment(s) or postponement(s) thereof, for the purposes set forth in the accompanying notice of meeting (the "Notice of Meeting"). No person has been authorized by MFC to give any information or make any representations in connection with any matter to be considered at the Meeting other than those contained in this Circular.

In this document, "you" and "your" refer to the shareholders of MFC. Unless otherwise noted, references in this document to "$" and "dollars" are to United States dollars, all references to "C$" are to Canadian dollars and all references to "€" are to the European Union Euro.

THE BOARDUNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTEFOR THE MFC

DIRECTOR NOMINEES PROPOSED IN THIS CIRCULAR ANDFOR THE ADOPTION OF THE

ADVANCE NOTICE POLICY. SUPPORT MFC BY VOTING YOURWHITE PROXY OR VIF TODAY. |

Your vote is very important to the future of your investment in MFC. The Board is concerned that the Kellogg Group (as defined below) is seeking to take control of MFC's Board forno consideration and no articulated business plan. The Board believes that this proxy contest reflects the Kellogg Group's underlying, short-term, opportunistic motivation to seizede factocontrol of MFC at the expense of its other shareholders. Whether or not you plan to attend the Meeting, we ask that you complete and return yourWHITE proxy or VIF promptly and discard any material that you receive from anyone other than from the management of MFC.

In order to be counted at the Meeting, yourWHITE proxy or VIF must be received by Corporate Election Services by 4:00 p.m. (Hong Kong time) on Tuesday, December 24, 2013, or in the case of any adjournment(s) or postponement(s) of the Meeting, not less than 48 hours, excluding Saturdays, Sundays and holidays, prior to the time fixed for the re-convened Meeting. The time limit for the deposit of proxies may be waived by the chair of the Meeting at his or her discretion without notice. See the instructions under "Voting Information" on page 15 of our Circular for further details.

AWHITE form of proxy will not be valid unless it is deposited, by mail, courier or hand, to the attention of: Corporate Election Services, PO Box 3230, Pittsburgh, Pennsylvania 15230, USA, by 4:00 p.m. (Hong Kong time) on December 24, 2013, or in the case of any adjournment(s) or postponement(s) of the Meeting, not less than 48 hours, excluding Saturdays, Sundays and holidays, prior to the time fixed for the re-convened Meeting. You may also provide your voting instructions by telephone by calling toll free 1-888-693-VOTE (8683), by facsimile at 1-412-299-9191, or through the Internet atwww.cesvote.com. The time limit for the deposit of proxies may be waived by the chair of the Meeting at his or her discretion without notice.

If you have questions or need assistance voting your shares, contact our proxy solicitation agent MacKenzie Partners, Inc. by telephone at North America toll free 1-800-322-2885, or outside of North America (collect) at (212) 929-5500, or by email at proxy@mackenziepartners.com.

For assistance, please call MacKenzie Partners North America toll free at 1-800-322-2885 or collect at (212) 929-5500

PROTECT YOUR INVESTMENT – VOTE ONLY YOURWHITE PROXY OR VIF TODAY

1

Forward-Looking Information

Certain statements in this Circular are forward-looking statements, which reflect MFC's expectations regarding its future growth, results of operations, future corporate governance and performance and business prospects and opportunities. These forward-looking statements consist of statements that are not purely historical and include statements regarding MFC's proposed projects or its beliefs, plans, expectations or intentions regarding the future. While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect MFC's current judgment regarding the direction of its business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. No assurance can be given that any of the events anticipated by the forward-looking statements will occur or, if they do occur, what benefits MFC will obtain from them.

These forward-looking statements reflect MFC's current views and are based on certain assumptions and speak only as of the date hereof. These assumptions, which include MFC's current expectations, estimates and assumptions about its business and the markets MFC operates in, the global economic environment, interest rates, commodities prices, exchange rates, proceedings and other types of claims and litigation involving MFC, unexpected change of control consequences, MFC's ability to identify, complete and finance additional acquisitions and sources of supply for its global commodity supply chain business, MFC's ability to manage its assets and operating costs, MFC's ability to maintain key personnel, MFC's ability to implement its business strategies and pursue business opportunities and financing alternatives after a state of uncertainty related to the Meeting, MFC's ability to pass certain resolutions at the Meeting, the costs involved with solicitation of proxies leading up to the Meeting and the voting results at the Meeting, may prove to be incorrect. No forward-looking statement is a guarantee of future results.

A number of risks and uncertainties could cause MFC's actual results to differ materially from those expressed or implied by the forward-looking statements, including those described herein and in MFC's interim reports filed by MFC with the U.S. Securities and Exchange Commission (the "SEC") and Canadian securities regulators and its 2012 annual report on Form 20-F. Such forward-looking statements should therefore be construed in light of such factors. Shareholders are cautioned not to place undue reliance on these forward-looking statements. Other than in accordance with MFC's legal or regulatory obligations, MFC is not under any obligation and MFC expressly disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Additional information about these and other assumptions, risks and uncertainties are set out in MFC's interim reports and annual report on Form 20-F for the year ended December 31, 2012 filed with the SEC and Canadian securities regulators.

Notice to Shareholders in the United States

The solicitation of proxies involves securities of an issuer located in Canada and is being effected in accordance with the relevant corporate and securities laws of Canada. The proxy solicitation rules under the United StatesSecurities Exchange Act of 1934, as amended, are not applicable to MFC or this solicitation, and this solicitation has been prepared in accordance with the disclosure requirements of the securities laws of the provinces of Canada. Shareholders should be aware that disclosure requirements under the securities laws of the provinces of Canada differ from the disclosure requirements under United States securities laws.

The enforcement by shareholders of civil liabilities under United States federal securities laws may be affected adversely by the fact that MFC is existing under theBusiness Corporations Act (British Columbia), as amended (the "BCBCA"), certain of its directors and its executive officers are residents of Canada and other jurisdictions outside of the United States and a substantial portion of its assets and the assets of such persons are located outside the United States. Shareholders may not be able to sue a foreign company or its officers or directors in a foreign court for violations of United States federal securities laws. It may be difficult to compel a foreign company and its officers and directors to subject themselves to a judgment by a United States court.

For assistance, please call MacKenzie Partners North America toll free at 1-800-322-2885 or collect at (212) 929-5500

PROTECT YOUR INVESTMENT – VOTE ONLY YOURWHITE PROXY OR VIF TODAY

2

REASONS FOR THIS SOLICITATION

This proxy contest is about stopping a takeover of MFC's Board by Peter R. Kellogg, IAT Reinsurance Company Ltd. ("IAT") and certain of their affiliates (collectively, the "Kellogg Group"), a dissident group that is attempting to put its interests above those of all other shareholders. The Kellogg Group wants to complete its takeover of your company without paying you a "control premium". The Board has, for now, paused the Kellogg Group's unlawful takeover of MFC. Now, the Board needs your help to ensure that MFC is able to successfully defend itself and all of its shareholders.

At the Meeting, MFC is asking shareholders to vote for the election of two (2) Class II directors. MFC's nominees are Dr. Shuming Zhao and Ravin Prakash, both currently Class II directors of MFC. The Board has fixed the number of directors at six (6) and, accordingly, shareholders only need to elect two (2) Class II directors at the Meeting.

The Kellogg Group is trying to capture MFC's value for itself, at your expense. The Kellogg Proposals (as defined below) would let the Kellogg Group complete ade factotake-over of MFC without paying a "control premium" or otherwise affording shareholders the rights they are entitled to under securities laws. By doing so, the Kellogg Group is taking money directly from your pockets to line its own.

Your Board believes that the Kellogg Proposals are another step in a scheme ultimately designed to unlawfully and improperly take control of MFC's Board. Shareholders should be wary of the Kellogg Group's intentions as it may be intending to raid MFC's substantial assets for its own purposes. Shareholders should consider the following:

- The Kellogg Group has committed numerous, egregious and ongoing violations of Canadian and United States securities laws. Since at least 1999, the Kellogg Group has been an "insider" under Canadian securities laws by acquiring more than 10% of MFC's shares, but it left MFC shareholders and the markets in the dark regarding its subsequent acquisitions and intentions in violation of "insider", "early warning" and "takeover bid" laws.Additionally, the Kellogg Group has unlawfully acquired MFC shares while being prohibited from doing so under Canadian "early warning" requirements. See "Reasons to Oppose the Kellogg Group Nominees" beginning at page 8 below.

- The existing Board has a clear strategy to build long-term value for your investment in MFC and has created tremendous shareholder value in the past, includingachieving a compound annual growth rate on the MFC shares of 20.1% between December 31, 2002 and December 31, 2012. MFC's existing Board and management have generated strong returns and achieved impressive growth, while maintaining a strong balance sheet and financial discipline. There is no valid reason for a costly and disruptive proxy contest.

- In its November 25, 2013 news release, the Kellogg Group made abstract, specious and self-serving references to its ostensible concerns regarding the "strategic direction" of MFC.Why would the Kellogg Group purchase an additional 1,606,241 MFC shares between April 2013 and October 2013 for approximately $13.1 million if its concerns were genuine? Interestingly, these purchases increased the Kellogg Group's holdings to 33% of theMFC shares, which is coincidentally the threshold necessary to defeat any transaction requiring special majority approval.

- The Kellogg Group, which describes itself as "not shareholder activists", has, for some time, been conducting an unlawful takeover of MFC by purchasing MFC shares when it was prohibited from doing so and without informing shareholders as required by applicable law. On November 25, 2013, it provided notice of its intention to propose an increase of MFC's Board to eleven (11) directors and elect eight (8) directors at the Meeting (the "Kellogg Proposals").

- If the Kellogg Proposals are successful, the Kellogg Group will complete ade factochange of control of MFC without paying a control premium and without giving other shareholders a chance to sell their shares into a bid.As compared to the Kellogg Group's 33% ownership interest in MFC, the Kellogg Group sought the appointment of approximately 75% of the Board through the Kellogg Proposals.

- The Kellogg Group launched this proxy contest only after: (i) it paid in excess of $186 million to the IRS in or around June to November 2011; (ii) MFC declined the Kellogg Group's request for a loan from MFC of $50 million in the third quarter of 2011; and (iii) the Kellogg Group's alternative dispute resolution meeting with the IRS respecting its tax claims scheduled for November 2013 was delayed. The MFC Board believes that shareholders need to be wary of the Kellogg Group's intentions, as it appears that it wants to raid MFC's substantial assets for its own purposes. See "Reasons to Support MFC and Its Nominees" beginning on page 5 below.

For assistance, please call MacKenzie Partners North America toll free at 1-800-322-2885 or collect at (212) 929-5500

PROTECT YOUR INVESTMENT – VOTE ONLY YOURWHITE PROXY OR VIF TODAY

3

- The Kellogg Group could have worked with the existing Board to discuss any ostensible concerns it had regarding MFC's "strategic direction". Representatives of MFC have, on several occasions, requested the Kellogg Group to detail any such concerns. Instead, the Kellogg Group unnecessarily, and without notice, launched a proxy contest which hasalready disrupted MFC's operations. For example, since the announcement of the Kellogg Proposals, MFC's lenders have expressed concerns regarding a change of control of MFC's Board and the resulting uncertainty regarding the strategic direction of MFC. Shareholders should be concerned that a Kellogg Group board may raid or deplete MFC's assets, adversely affecting MFC's business, which is capital intensive and requires high liquidity levels. The Kellogg Group's proxy contest has also jeopardized advanced negotiations regarding two possible separate accretive acquisitions by MFC scheduled to be completed in the fourth quarter of 2013. These transactions could provide MFC with significant enhanced potential for near- and long-term growth.

- The Kellogg Group nominees have little or no relevant operational expertise running a commodities business. For the most part, the nominees also lack the international experience necessary to successfully run MFC's operations. Additionally, the Kellogg Group nominees appear to have no significant recent experience as independent directors of a Canadian public company.

- If the Kellogg Proposals are successful, MFC believes the Kellogg Group nominees would likely try to dismiss MFC's existing legal actions against Mr. Kellogg for his blatant breaches of securities laws and the resulting damage it has caused MFC and its shareholders.

- The Kellogg Group has no strategic plan for MFC and has not been transparent in its intentions for MFC's future.

- Changes in the Board as a result of the Kellogg Proposals could be a change of control and could trigger events of default under certain of MFC's existing credit agreements or cause lenders not to renew them on maturation.The Kellogg Group has provided no plan or assurance that it could fund or arrange replacement financing. The Kellogg Proposals could also trigger change of control provisions in one or more of MFC's other contracts with third parties and in its employment agreements with MFC's management.

- The remaining directors whom the Kellogg Group is not seeking to replace are considering their positions in light of the proxy contest and, in the event that the Kellogg Group is successful, they may not wish to remain in their positions as directors of MFC. Should those directors decide to depart, MFC would have no continuity of directors going forward.

- If the Kellogg Group nominees go in a direction incompatible with MFC's current strategy, senior management and other key employees may not wish to remain in their current positions and may instead wish to explore alternative opportunities, which could have a material adverse impact on MFC's business and operations.

Your Board needs your support to prevent the Kellogg Group from completing its takeover. All votes matter, regardless of how many shares you hold. We urge you to vote yourWHITE proxy or VIF today.

For assistance, please call MacKenzie Partners North America toll free at 1-800-322-2885 or collect at (212) 929-5500

PROTECT YOUR INVESTMENT – VOTE ONLY YOURWHITE PROXY OR VIF TODAY

4

REASONS TO SUPPORT MFC AND ITS NOMINEES

The existing Board and management of MFC are implementing a long-term growth strategy.

MFC is a global commodities supply chain company, which sources and delivers commodities and materials to clients, with an expertise on the financing and risk management aspects of the businesses. MFC's strategic vision is to expand its commodities platform through strategic acquisitions and investments, including the acquisition of commodities sources for integration into its existing commodities trading platform.

MFC considers investment opportunities where: (i) its existing participation in the marketing and production of commodities provides expert insight; (ii) it can obtain a satisfactory return of future capital investment; and (iii) such investment integrates with its business. MFC's philosophy is to utilize its financial strength to realize the commercial potential of assets in markets where it has a comprehensive understanding of the drivers of value.

In executing MFC's growth strategy, MFC is committed to maintaining a financially disciplined approach to new investments and acquisitions in order to maintain a strong balance sheet and financial ratios.

The existing Board and management of MFC have a demonstrated record of identifying and executing accretive transactions to build shareholder value.

In implementing MFC's long-term growth strategy, its existing Board and management have identified and completed transactions that have enhanced shareholder value. In 2012, MFC completed the following strategic acquisitions:

- Expansion into NaturalGas – In September 2012, MFC expanded its commodities platform into natural gas by successfully completing the acquisition of Compton Petroleum Corporation, a company active in the production and processing of natural gas, natural gas liquids and, to a much lesser degree, crude oil.

- Increased our Global Reach – In November 2012, MFC acquired a controlling interest in each of ACC Resources Inc. and Possehl Mexico S.A. de C.V., which are global commodities supply chain businesses with a presence in the North American and Latin American markets and a focus on refractory and ceramic materials and other products that were new to MFC's commodities platform.

These and other opportunities have allowed MFC to enlarge its commodities footprint, enter new markets and expand its supply chain platform, offering growth and the potential for significant contributions to the economics of the company in a recovering economy.

Going forward, MFC continues to evaluate additional opportunities to further enhance shareholder value and grow its integrated commodities business. However, MFC is also focused on streamlining and enhancing its existing operations.

As previously disclosed, additional time and work will be needed in order to extract the full value of these assets. MFC has made significant efforts to realize on the value of these recent acquisitions and integrate such businesses into its global commodities operations. Most recently, for example, in November 2013, MFC announced that it entered into an agreement with an established oil and gas company in Alberta, Canada, whereby such company committed to spending a minimum of C$50 million to drill a total of 12 net wells over an initial three-year term primarily on MFC's undeveloped lands. The transaction provided MFC the opportunity to develop these properties without taking an investment risk and, at the same time, provided possible future sources of revenue expansion through royalty and processing arrangements.

For assistance, please call MacKenzie Partners North America toll free at 1-800-322-2885 or collect at (212) 929-5500

PROTECT YOUR INVESTMENT – VOTE ONLY YOURWHITE PROXY OR VIF TODAY

5

The existing Board and management of MFC have a demonstrated record of generating strong returns for shareholders.

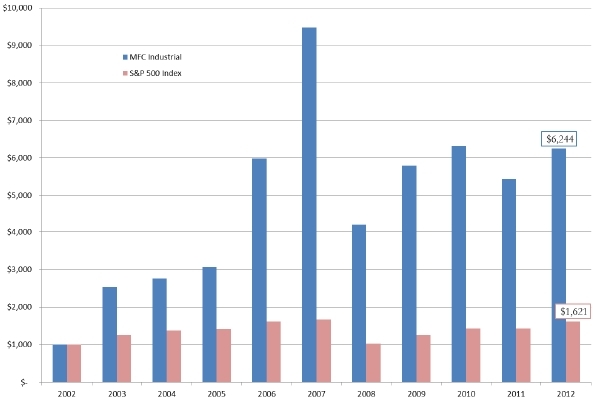

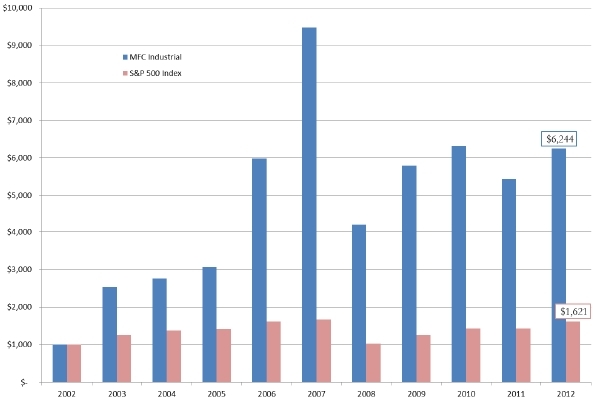

The following table sets out the compound annual growth rate of MFC's common shares between December 31, 2002 and 2012. A $1,000 investment in our common shares on December 31, 2002 would have increased to over $6,200 as at December 31, 2012. The compound annual growth rate of MFC's shares was 20.1% over the 10-year period, compared to 4.9% for the S&P 500 Index over the same period.

$1,000 Invested in MFC in December 2002 Would Have Grown to More Than $6,200 by December 2012 –

A Compound Annual Growth Rate of 20.1% Versus Just 4.9% for the S&P Index Over the Same Period |

|

____________________

Note:

Based on year end closing prices and the assumptions that: (i) $1,000 was invested in MFC shares on December 31, 2002; (ii) all in-kind distributions were held until the end of the period; (iii) all cash distributions were held and not re-invested; and (iv) the cash balance was utilized to fully exercise rights under our 2010 rights offering.

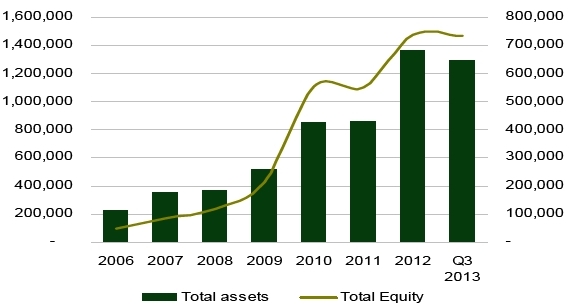

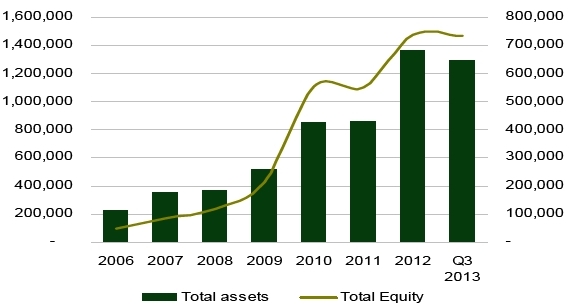

We view our net book value per share as a key indicator of our overall financial performance and growth. Between December 31, 2002 and September 30, 2013, our net book value increased by 307% from $180.6 million to $735.3 million. During the same period, our total assets increased by approximately 356% from $282.7 million to $1.3 billion. Such increases were computed after the share and cash distributions during the periods from December 31, 2002 to September 30, 2013.

For assistance, please call MacKenzie Partners North America toll free at 1-800-322-2885 or collect at (212) 929-5500

PROTECT YOUR INVESTMENT – VOTE ONLY YOURWHITEPROXY OR VIF TODAY

6

The following graph sets forth the historical growth of MFC's total assets and total equity from 2006 until September 30, 2013.

| HISTORICAL GROWTH OF TOTAL ASSETS AND TOTAL EQUITY |

| All amounts in United States dollars |

| TOTAL ASSETS | | TOTAL EQUITY |

|

The record of performance of the existing Board and management includes:

- Generating Superior Returns through Spinouts –The existing Board and management of MFC have a strong record of generating superior returns for our shareholders by distributing operating businesses to shareholders. Most recently, MFC distributed shares of KHD Humboldt Wedag International AG ("KHD") to its shareholders in 2010. On October 11, 2013, AVIC International Engineering Holdings Pte. Ltd. and certain other parties announced an offer to acquire all of the shares of KHD for cash consideration of €6.45 per share.

- Cash Dividend Policy – In 2011, our existing Board adopted an annual cash dividend policy. Since then, as a result of our strong financial position, we have been able to pay increasingly attractive dividends to our shareholders. In 2011, 2012 and 2013, our existing Board declared and paid annual cash dividends to our shareholders of $0.20, $0.22 and $0.24 per share, respectively. Our annual cash dividend for 2013 represents a yield of approximately 2.8% (based on MFC's share price at the end of 2012), as compared to an annual dividend yield of approximately 2.5% for the NYSE Composite Index in 2012.

- Maintaining a Strong Balance Sheet – As a result of the fiscal discipline of MFC's existing Board and management, MFC has maintained a strong balance sheet. As at September 30, 2013, MFC had cash, cash equivalents and securities of $293.5 million, working capital of $398.8 million and total debt of $186.5 million. MFC's long term debt-to-equity ratio was 0.2 as at September 30, 2013.

- Financial Discipline – The existing Board and management of MFC are focused on maintaining fiscal discipline. This has resulted in our strong financial position and allowed MFC to avoid dilutive transactions to finance its growth.

- Below Market Compensation Arrangements – MFC's existing Board has maintained responsible executive compensation practices. MFC's executive compensation levels are generally lower than compensation paid by its peer group.

For assistance, please call MacKenzie Partners North America toll free at 1-800-322-2885 or collect at (212) 929-5500

PROTECT YOUR INVESTMENT – VOTE ONLY YOURWHITE PROXY OR VIF TODAY

7

REASONS TO OPPOSE THE KELLOGG GROUP NOMINEES

Kellogg unlawfully acquired a control position in MFC and now wants to seize control of the MFC Board without paying youany control premium.

On October 1, 2013, the Kellogg Group made, for the first time, a public filing in Canada regarding its holdings in MFC. The Kellogg Group acknowledged that it had been an insider of MFC since December 31, 1999, although no explanation for the14 year delay in making this disclosure was provided. It is now clear that the Kellogg Group had been waiting in the weeds to ambush this year's annual general meeting of MFC in an attempt to seize control of MFC's Board.

It is not a coincidence that the Kellogg Group disclosed its shareholdings in MFC through an "early warning report" only weeks before it first disclosed its intention to nominate its own slate of nominees to MFC's Board and shortly after Mr. Kellogg had said his investment was "passive". Mr. Kellogg is a very senior and experienced market participant. There is no doubt that, given his experience, the Kellogg Group was fully aware of the strict regulatory regime in the North American capital markets. MFC believes the Kellogg Group's failure to properly inform the public of its share ownership position in MFC was a calculated and deliberate attempt to take control of MFC's Board, while keeping other MFC shareholders and markets uninformed of their true intentions in order to avoid having to pay shareholders a "control premium". MFC believes the Kellogg Group's conduct has caused and will continue to cause significant harm and damage to MFC and its shareholders.

MFC shareholders should be under no illusion that the Kellogg Group's efforts are anything other than an attempt to acquire control of MFC's Board. The Kellogg Proposals would let the Kellogg Group complete its takeover of MFC without any compensation being paid to other MFC shareholders. In most acquisitions of control, shareholders receive a significant premium to the current share price in exchange for handing over control of their company. The Kellogg Group is offeringno compensation to shareholders whatsoever. If the Kellogg Group is interested in controlling MFC, they should make a premium offer on the open market, instead of attempting to gain control through back channels. Shareholders should be skeptical of the Kellogg Group which has operated, and continues to operate, in a deceptive manner.

We urge shareholders not to cede control of MFC's Board without receiving a change of control premium.

The Kellogg Group's unlawful takeover violated applicable Canadian and United States securities laws and deprived shareholders of possible financial gain.

On November 27, 2013, MFC announced that due to the Kellogg Group's many egregious and ongoing violations of Canadian and United States securities laws, it had commenced legal actions against the Kellogg Group in British Columbia and New York seeking, among other things, orders prohibiting the Kellogg Group from voting its MFC shares or acquiring further MFC shares and requiring the Kellogg Group to dispose of MFC shares. MFC is amending its court filings in the British Columbia Supreme Court seeking additional orders, including, among others, orders prohibiting the Kellogg Group from nominating directors to MFC's Board, soliciting proxies in connection with the Meeting and voting its shares at the Meeting.

Additionally, MFC has applied to a Canadian securities regulator to investigate the actions of the Kellogg Group and make appropriate orders.

MFC undertook the foregoing actions to prevent the Kellogg Group from improperly and unlawfully seizing control of MFC's Board by continually and blatantly disregarding applicable securities laws and the rights of other shareholders.

MFC believes that the Kellogg Group's actions, including the process of acquiring its current significant ownership of MFC shares, have flagrantly and repeatedly violated applicable securities laws, including as follows:

- Since at least1999, the Kellogg Group has been an "insider" by acquiring over 10% of MFC shares, but left MFC shareholders and the markets in the dark regarding its subsequent acquisitions of MFC shares and its intentions in violation of "insider", "early warning" and "takeover bid" laws.

For assistance, please call MacKenzie Partners North America toll free at 1-800-322-2885 or collect at (212) 929-5500

PROTECT YOUR INVESTMENT – VOTE ONLY YOURWHITE PROXY OR VIF TODAY

8

- Canadian securities laws require a person (or group of persons), such as the Kellogg Group, who acquires 10% or more of MFC's outstanding voting shares to publicly file and issue an "insider report", "press release" and "early warning report" (collectively, the "Early Warning Regime") in order to alert shareholders and the market to the acquisition and intentions of a person acquiring a significant ownership interest. The Early Warning Regime also requires further such public reports and disclosure for subsequent purchases in excess of 2% of the MFC shares. The Kellogg Group broke the 10% threshold in 1999, but failed to comply with the Early Warning Regime for almost14 years until October 1, 2013, when it disclosed ownership of 33% of the outstanding MFC shares.

- The Early Warning Regime also provides that, during the time the Kellogg Group was required to file an early warning report or further report (acquisition of 10% and subsequent acquisitions of 2%) and ending one business day after such report or further report is filed, the Kellogg Group must not acquire any additional MFC shares. Despite acquiring 10% of the MFC Shares in 1999, the Kellogg Group continually and repeatedly violated these requirements by acquiring MFC shares without complying with the Early Warning Regime and, in particular, in violation of the prohibition on acquisitions of further MFC shares until after filing the requisite early warning report or further report.

- Today, the Kellogg Group continues to violate securities laws as its filed reports are misleading and fail to disclose the actual date and amount of acquisitions and/or dispositions, the prices paid and received for MFC shares and other required disclosure.

- United States securities laws require that a shareholder holding more than 5% of a company's shares file a Schedule 13D and amendments thereto and disclose, among other things, the purpose of its investment to other shareholders as well as any arrangements, understandings or agreements with other shareholders with respect to a company's shares. The Kellogg Group failed to file Schedule 13D ownership reports under United States securities laws between February 2001 and January 2013 (approximately 12 years) when it disclosed it had increased its ownership to approximately 30.9% of the outstanding MFC shares.

The Kellogg Group's egregious violations of securities laws have also unfairly deprived MFC's minority shareholders of possible economic gain with respect to their investment in MFC. Under Canadian takeover bid rules, unless an applicable exemption applies, a person acquiring 20% or more of an issuer's outstanding securities must make a formal takeover bid to all shareholders and comply with timing, disclosure, pricing and other requirements designed to foster fair and efficient capital markets and the fair treatment of shareholders. It now appears that the Kellogg Group surpassed this 20% threshold in 2000 and has thereafter made numerous acquisitions to increase its ownership to 33% without making a formal takeover bid to all shareholders. In most cases, shareholders receive a significant premium to the current share price in exchange for handing over control of their company, but the Kellogg Group has failed to pay shareholders anything for its control position.

Between May 2003 and August 2006, MFC had a shareholders rights plan (the "2003 Rights Plan") in place. The 2003 Rights Plan would have been triggered and a "flip-in" would have occurred if the Kellogg Group had acquired an additional 0.5% of MFC's shares after the 2003 Rights Plan was established. The occurrence of such a "flip-in event" would have entitled all other shareholders to acquire additional MFC shares at one-half the then market price. MFC believes that the Kellogg Group may likely have triggered the 2003 Rights Plan between 2003 and 2006, but due to the Kellogg Group's failure to disclose the details of their acquisitions, MFC shareholders did not know and could not have known that the 2003 Rights Plan might have been triggered, and as a result, were effectively deprived of their rights under the plan. The resulting economic deprivation to shareholders may have been substantial. On December 31, 2003, MFC's share price was $18.42 per share, and there were 9,577,882 shares outstanding (not including shares assumed to be held at that time by the Kellogg Group). If the 2003 Rights Plan was triggered on that date, under the terms of the plan, shareholders would have been entitled to purchase a total of approximately 77,995,556 shares at a 50% discount to the market price. By failing to make appropriate public disclosures, the Kellogg Group may have unfairly deprived MFC shareholders the right to purchase MFC shares at a discounted price of approximately $9.21 per share, representing an economic loss to other shareholders potentially in excess ofhundreds of millions of dollars. At the same time, the Kellogg Group unfairly maintained its share position in MFC, which would have been significantly diluted by triggering the 2003 Rights Plan. Assuming shareholders exercised their rights in full, the Kellogg Group's shareholdings would have been diluted to about only3% of the outstanding MFC shares.

For assistance, please call MacKenzie Partners North America toll free at 1-800-322-2885 or collect at (212) 929-5500

PROTECT YOUR INVESTMENT – VOTE ONLY YOURWHITE PROXY OR VIF TODAY

9

Why has the Kellogg Group chosennow to launch this proxy contest?

In its November 25, 2013 news release, the Kellogg Group made abstract, specious and self-serving references to its ostensible concerns regarding the "strategic direction" of MFC. These concerns are specious and self-serving and only came about after MFC adopted a shareholder rights plan and took other steps to protect itself against the Kellogg Group's unlawful accumulation of shares. If the Kellogg Group's concerns were legitimate, why has Mr. Kellogg recently been acquiring substantial amounts of MFC shares, including purchases of 1,606,241 MFC shares between April 2013 and October 2013 for approximately $13.1 million? Interestingly, these purchases increased the Kellogg Group's holdings to 33% of the MFC shares, which is coincidentally the threshold necessary to defeat any transaction requiring special majority approval.The Kellogg Group never previously raised any such concerns with MFC, nor has it ever offered any tangible strategic plans to the Board concerning MFC's future.

So why the sudden public campaign against MFC's Board and strategies? Why would an opportunistic investor such as Mr. Kellogg now spend several hundred thousand dollars to change MFC's "strategic direction" when he has never previously raised any such concerns before? The reason is clear on closer scrutiny – the Kellogg Group may need access to MFC's significant assets, and now wishes to take control of MFC's Board for such purpose.

As outlined in an article in Forbes Magazine dated March 5, 2001 titled "Are You a Chump" and another article dated June 17, 2013 titled "Billionaire Seeks $186 Million Tax Refund, Claims IRS Biased by 'Politically Charged Atmosphere'", Kellogg and IAT have been embroiled in significant ongoing lawsuits with the IRS after the IRS rejected various tax exemptions claimed by IAT and/or its affiliates which permitted the Kellogg Group to avoid very significant tax obligations.

In and around June to November 2011, the Kellogg Group made payments in excess of $186 million to the IRS to settle the reassessment.

Subsequently, IAT's chief financial officer, David Pirrung, wrote a letter dated October 3, 2011 to the IRS seeking a waiver with respect to certain penalties and interest. This letter, which MFC has been able to locate, is reflective of the financial burden the tax reassessment imposed on IAT. A portion of the letter is reproduced below:

In response to these and subsequent bills, including the ones which I am paying today, as Chief Financial Officer of the taxpayer, I have made substantial and strenuous efforts to promptly pay amounts totaling approximately $170 million which is approximately20% of the [Kellogg] Group's capital base.This is a particularly difficult economic time to liquidate holdings of such a significant percentage of the taxpayer's entire holdings and I have to take great pains to determine how best to liquidate assets without jeopardizing the company's continuing operations (emphasis added).

Shortly following this, in or about the third quarter of 2011, the Kellogg Group approached MFC for a loan of $50 million dollars, which MFC believes was related to IAT's lack of liquidity caused by the IRS ruling. After careful consideration of all factors, including the Kellogg Group's status as a shareholder, MFC decided that it was not in the best interests of MFC or its shareholders to grant a loan to IAT. However, MFC did assist IAT in attempting to arrange third-party bank financing through its strong banking connections. Ultimately, MFC did not arrange any financing for IAT and discussions terminated.

In June of this year, only months before the Kellogg Group announced its decision to nominate its own directors, Mr. Kellogg and IAT commenced a lawsuit against the IRS to reclaim in excess of $186 million in taxes and interest they had to pay. The action was supposed to go to an alternative dispute resolution onNovember 13, 2013, but all proceedings in the action were stayed by court order because of the recent U.S. Government shutdown and lack of appropriations for the Department of Justice. About two weeks later, on November 25, 2013, the Kellogg Group launched its proxy contest.

For assistance, please call MacKenzie Partners North America toll free at 1-800-322-2885 or collect at (212) 929-5500

PROTECT YOUR INVESTMENT – VOTE ONLY YOURWHITE PROXY OR VIF TODAY

10

The following is a timeline of significant events that illustrate the Kellogg Group's true intentions:

____________________

| Date | | Event |

| 2008 | | The IRS finds that the Kellogg Group unlawfully avoided taxes and orders the Kellogg Group to pay in excess of $186 million in unpaid taxes and interest. |

| | |

| June – November 2011 | | The Kellogg Group pays the IRS in excess of $186 million in unpaid taxes and interest. |

| | |

| October 2011 | | IAT complains to the IRS about its liquidity crunch. |

| | |

| Q3 2011 | | The Kellogg Group approaches MFC for a $50 million loan, which MFC does not grant. |

| | |

| November 2011 | | MFC did not arrange any financing for IAT and discussions terminated. |

| | |

| January 2013 | | The Kellogg Group announces the acquisition of an additional 7.1% of the MFC shares, increasing its ownership to 30.9% of the outstanding MFC shares. The pricing and timing of these acquisitions were not provided. |

| | |

| April 2013 | | The Kellogg Group sues the IRS in relation to over $186 million in taxes and interest it paid the IRS in June 2011. |

| | |

| April 2013 | | The Kellogg Group acquires an additional 542,503 MFC shares, increasing its ownership to 31.8% of the outstanding MFC shares. |

| | |

| May 2013 | | The Kellogg Group acquires an additional 101,338 MFC shares, increasing its ownership to 32.0% of the outstanding MFC shares. |

| | |

| July 2013 | | The Kellogg Group acquires an additional 403,000 MFC shares, increasing its ownership to 32.8% of the outstanding MFC shares. |

| | |

| August 2013 | | The Kellogg Group acquires an additional 302,200 MFC shares, increasing its ownership to 33.3% of the outstanding MFC shares. |

| | |

| September 2013 | | The Kellogg Group acquires an additional 257,400 MFC shares, increasing its ownership to 33.7% of the outstanding MFC shares. |

| | |

| October 2013 | | The Kellogg Group files an amended Schedule 13D disclosing that Mr. Kellogg has approached MFC concerning the appointment ofoneadditional director and ownership of 33.0% of the MFC shares. |

| | |

| October 2013 | | Alternative dispute resolution proceedings between the Kellogg Group and the IRS are stayed. |

| | |

| November 11, 2013 | | MFC adopts a shareholder rights plan. |

| | |

| November 25, 2013 | | The Kellogg Group launches its proxy contest for control of MFC. |

____________________

Against this backdrop, it is apparent to MFC why the Kellogg Group chose now to launch its proxy contest. As Mr. Kellogg stated in his November 25, 2013, news release, "we are not shareholder activists." The Kellogg Group chose to begin its proxy campaign now because it appears to be under short-term financial pressure. The Kellogg Group's abstract justification of "strategic direction" for launching its proxy contest is simply a smokescreen designed to distract shareholders from its hidden agenda – to complete its takeover of MFC and gain control of its significant treasury.

Don't be fooled by sudden overtures of "camaraderie" by the Kellogg Group to its "fellow shareholders". The Kellogg Group spends its money only to advance its own interests. This is not an altruistic crusade for the benefit of MFC's minority shareholders, but rather a self-interested mission bya former Wall Street tycoon.

For assistance, please call MacKenzie Partners North America toll free at 1-800-322-2885 or collect at (212) 929-5500

PROTECT YOUR INVESTMENT – VOTE ONLY YOURWHITE PROXY OR VIF TODAY

11

The interests of the Kellogg Group nominees are not aligned with the interests of minority shareholders.

The interests of the Kellogg Group nominees are not aligned with shareholders.

The Kellogg Group appears to be under short-term financial pressure. The MFC Board has serious concerns about the motives of the Kellogg Group's nominees, which has offered no plans to guide MFC or enhance shareholder value, and their true agenda remains hidden. The MFC Board believes that shareholders need to be wary of the Kellogg Group's intentions, as it appears that it wants to raid MFC's substantial assets for its own purposes.

The current proxy contest itself is evidence of the Kellogg Group's selfish motives.There is no valid reason for a costly and disruptive proxy contest. The Kellogg Group could have worked with the existing Board to discuss any ostensible concerns it had regarding MFC's "strategic direction". Instead, the Kellogg Group unnecessarily, and without notice, launched a proxy contest which hasalready been disruptive to MFC. Since November 2013, when the Kellogg Group announced its intention to nominate its own slate of directors, for example, MFC's lenders have expressed concerns regarding a change of control of MFC's Board and the resulting uncertainty regarding the strategic direction of MFC. Shareholders should be concerned that a Kellogg Group board may raid MFC's assets, adversely affecting MFC's business, which is capital intensive and requires high liquidity levels. This includes, if the Kellogg Proposals are successful, a possible change of control triggering an event of default under MFC's existing arrangements with its lenders. Although MFC is working with its lenders to help ensure that the banking lines and existing lending arrangements are unaffected by the proxy contest, there is no assurance that MFC will be successful.

The Kellogg Group's proxy contest has also jeopardized advanced negotiations regarding two separate accretive acquisitions by MFC scheduled to be completed in the fourth quarter of 2013. These transactions would have provided MFC with significant enhanced potential for near- and long-term growth.

The Kellogg Group lacks knowledge of MFC, its business and international strategies.

The Kellogg Group nominees lack working knowledge of MFC, its business and international strategies. The Kellogg Group has no strategic plan for MFC and has not been transparent in its strategy or intentions for MFC's future. It is not in shareholders' best interests to install a board and management that have not disclosed their plans to MFC shareholders.

The existing Board has demonstrated a clear strategy to build long-term value for your investment in MFC, and has created tremendous shareholder value in the past, including achieving a compound annual growth rate on the MFC shares of 20.1% between December 31, 2002 and December 31, 2012.

The Kellogg Group nominees have little or no relevant operational expertise or experience running a commodities business. The Kellogg Group nominees also, for the most part, lack the international experience necessary to successfully run MFC's operations, including in MFC's key markets of Europe, Latin America and Asia. If successful, the Kellogg Group will remove Dr. Shuming Zhao and Ravin Prakash, members of MFC's Board who have extensive international experience running commodities companies, and have a proven record of delivering value on an international stage. The Board believes that the Kellogg Group nominees' lack of international experience could seriously impact MFC's business and operations, and could negatively impact the strategic plans designed by the current MFC Board which have created substantial value for shareholders.

Your Board has demonstrated a clear strategy to build long-term value for your investment in MFC. MFC's current directors have extensive experience in the global commodities trading industry. They are committed to high standards of corporate governance and to creating long-term value for all of MFC's shareholders. In today's uncertain economic environment, MFC needs a strong Board that is experienced and focused on long-term success, not short-term, selfish goals.

For assistance, please call MacKenzie Partners North America toll free at 1-800-322-2885 or collect at (212) 929-5500

PROTECT YOUR INVESTMENT – VOTE ONLY YOURWHITE PROXY OR VIF TODAY

12

Mr. Kellogg, the Kellogg Group and several of the Kellogg Group nominees have a significant prior record of run-ins with legal regulators.

The significant ongoing disputes between the Kellogg Group and the IRS after the IRS rejected various tax exemptions claimed by IAT and/or its affiliates which permitted the Kellogg Group to avoid very significant tax obligations and resulted in the IRS seeking and collecting in excess of $186 million in taxes, interests and other charges are described in detail above. This is not the only significant instance where Mr. Kellogg, or one of the Kellogg Group nominees, has had a run-in with a legal regulator:

KELLOGG

NOMINEE | LEGAL/REGULATORY RUN-IN |

PETER

KELLOGG | In 2003, the National Association of Securities Dealers filed a disciplinary action against Mr. Kellogg alleging that Mr. Kellogg directed fraudulent wash trades and matched trades between four accounts he controlled. As a result of the trades, companies owned by Mr. Kellogg's children recognized a greater profit than they would have received in the open market, and the trading public was deceived about the volume of trading in the underlying stocks. In this instance, Mr. Kellogg was able to successfully argue that the transactions were conducted for legitimate business and tax purposes and the charges were dropped. |

In 1999, the adjudicatory council of the American Stock Exchange (the "Amex") ordered that a former managing director of Spear, Leeds & Kellogg, pay a $100,000 fine and be permanently barred from association with the exchange. He had violated anti-fraud provisions of federal securities laws by creating fraudulent trades. According to an April 26, 1999 Businessweek cover story titled "The American Stock Exchange: Scandal on Wall Street", the Amex was later criticized for not following up on testimony which indicated knowledge and approval of his activities by, among others, Mr. Kellogg. Mr. Kellogg was never charged by the Amex. |

WILLIAM

HORN | In 2008, Mr. Horn became a director of LMS Medical Systems, Inc. ("LMS"). The next year, LMS was cease traded by the securities commissions in Alberta, British Columbia, Ontario and Quebec for failing to properly file its annual filings. As a result, trading in the common shares of LMS was halted on the Toronto Stock Exchange. On January 26, 2010, Mr. Horn resigned as a director, chief executive officer and chief financial officer of LMS. However, in his last year as chief executive officer and chief financial officer of LMS, Mr. Horn saw fit to pay himself over $300,000. His successor was paid less than a third of that amount in the following year. It ultimately took over two years for LMS to effect the revocation of the cease trade orders issued while Mr. Horn was LMS's chief executive officer and chief financial officer. |

LOGAN

KRUGER | Mr. Kruger was the chief executive officer of Hudson Bay Mining and Smelting when, on August 8, 2000, an explosion occurred at its smelter in Flin Flon, Manitoba, killing one man and severely injuring thirteen others. According to a paper published in June 2009 by the Canadian Centre for Policy Alternatives titled "Invitation to an inquest: Death and dissatisfaction in Flin Flon", the resulting government inquiry revealed that Hudson Bay Mining and Smelting had engaged in unsafe work practices to speed up a maintenance shutdown. On November 29, 2001, the company pleaded guilty to contravention ofThe Workplace Safety and Health Act (Manitoba), which creates an obligation to provide and maintain a safe workplace. |

As reported by MiningWatch Canada, in 2006, Mr. Kruger was a director of a parent company which owned the Goro Nickel mine in New Caledonia, when the company's mining permit was revoked for violating the rights of the indigenous people and for providing an inadequate and flawed environmental impact assessment. |

In 2009, Mr. Kruger was the chief executive officer of Century Aluminum Co. when it closed its Ravenswood, West Virginia aluminum smelter plant, putting 651 people out of work. According to a July 1, 2011 article in the Charleston Daily Mail titled "Century Aluminum retirees picket for health care benefits", despite guaranteeing retired employees health care coverage under a contract negotiated with the United Steelworkers Union, Mr. Kruger terminated those benefits, leaving many uninsurable. The Senator for West Virginia, Mr. John D. Rockefeller IV, wrote a letter dated June 16, 2011 addressed to Mr. Kruger commenting on the "unimaginable hardship" that his decision had brought and that he had "been less than forthcoming" in relation to retirees' health care. According to a Reuters report dated November 18, 2011, upon being ousted as Century Aluminum Co.'s chief executive officer in November 2011, Mr. Kruger commenced a lawsuit against his former employer in an attempt to get a $26 million golden parachute. |

For assistance, please call MacKenzie Partners North America toll free at 1-800-322-2885 or collect at (212) 929-5500

PROTECT YOUR INVESTMENT – VOTE ONLY YOURWHITE PROXY OR VIF TODAY

13

KELLOGG

NOMINEE | LEGAL/REGULATORY RUN-IN |

PATRICE

MERRIN | While an executive vice-president and chief operating officer at Sherritt International Corporation, Ms. Merrin was banned for a time from entering the United States for violating the 1998Helms-Burton Act. TheHelms-Burton Act denies entry to the United States for people who "traffic" in American goods seized by Fidel Castro during the 1959 Cuban revolution. Sherritt International jointly owns a zinc mine with the Cuban government, which had been seized from Freeport McMoRan, a U.S. company, after Fidel Castro came to power. |

TREVOR

SCHULTZ | As reported in an October 30, 2012 article in the Financial Post, recent litigation in Egypt has called into question the legality of Centamin Plc's mining license, which had been issued during the Mubarek regime. The matter has yet to be resolved. Mr. Schultz has been a director of Centamin Plc since 2008. |

The dangers of the Kellogg Proposals

The Kellogg Proposals pose a number of serious concerns which shareholders need to consider:

- The Kellogg Proposals would let the Kellogg Group complete ade facto change of control of MFC's Board without payment of any change of control premium and without giving other shareholders a chance to sell their shares into a bid. As compared to the Kellogg Group's 33% ownership interest in MFC, the Kellogg Proposals seeks the appointment of approximately 75% of the Board.

- The Kellogg Group may be intending to raid MFC's substantial assets for their own purposes. The Kellogg Group's undisclosed business plan could include granting a significant loan to the Kellogg Group in light of its liquidity crunch. In the midst of the current difficult global economic reality and commodity price environment and in order to execute its long-term strategy, MFC's cash balance is a precious asset that needs to be protected.

- If elected, MFC believes the Kellogg Group nominees would try to dismiss MFC's existing legal actions against Mr. Kellogg for his blatant breaches of securities laws and the resulting damage it has caused MFC and its shareholders.

- The Kellogg Proposals could trigger a change of control under MFC's existing bank lines and arrangements with lenders. MFC's lenders have already expressed serious concerns as a result of the uncertainty regarding the strategic direction of MFC.

- The Kellogg Proposals could also trigger change of control provisions in MFC's other contracts, including employment agreements with management.

- The Kellogg Group has made no commitment to a long-term strategy for MFC, nor has it proposed any strategies for MFC's future.

- The Kellogg Group's nominees lack working knowledge of MFC, its business or strategies. The Kellogg Group nominees fail to provide the international experience or expertise needed to face the challenges and pursue the opportunities presented by MFC's international businesses.