| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-206677-10 |

| | | |

Free Writing Prospectus

Collateral Term Sheet

$858,177,959

(Approximate Aggregate Cut-off Date Balance of Mortgage Pool)

Wells Fargo Commercial Mortgage Trust 2016-C36

as Issuing Entity

Wells Fargo Commercial Mortgage Securities, Inc.

as Depositor

Barclays Bank PLC

Wells Fargo Bank, National Association

C-III Commercial Mortgage LLC

Rialto Mortgage Finance, LLC

National Cooperative Bank, N.A.

The Bancorp Bank

Basis Real Estate Capital II, LLC

as Sponsors and Mortgage Loan Sellers

Commercial Mortgage Pass-Through Certificates

Series 2016-C36

October 11, 2016

| WELLS FARGO SECURITIES | | BARCLAYS |

| | | |

Co-Lead Manager and Joint Bookrunner | | Co-Lead Manager and Joint Bookrunner |

| | | |

Academy Securities Co-Manager | | Citigroup Co-Manager |

| Wells Fargo Commercial Mortgage Trust 2016-C36 | Certain Terms and Conditions |

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (‘‘SEC’’) (SEC File No. 333-206677) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter, or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-800-745-2063 (8 a.m. – 5 p.m. EST) or by emailing wfs.cmbs@wellsfargo.com.

Nothing in this document constitutes an offer of securities for sale in any jurisdiction where the offer or sale is not permitted. The information contained herein is preliminary as of the date hereof, supersedes any such information previously delivered to you and will be superseded by any such information subsequently delivered and ultimately by the final prospectus relating to the securities. These materials are subject to change, completion, supplement or amendment from time to time.

STATEMENT REGARDING ASSUMPTIONS AS TO SECURITIES, PRICING ESTIMATES AND OTHER INFORMATION

This free writing prospectus contains certain forward-looking statements. If and when included in this free writing prospectus, the words “expects“, “intends“, “anticipates“, “estimates“ and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in customer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this free writing prospectus are made as of the date stated on the cover. We have no obligation to update or revise any forward-looking statement.

Wells Fargo Securities is the trade name for the capital markets and investment banking services of Wells Fargo & Company and its subsidiaries, including but not limited to Wells Fargo Securities, LLC, a member of NYSE, FINRA, NFA and SIPC, Wells Fargo Prime Services, LLC, a member of FINRA, NFA and SIPC, and Wells Fargo Bank, N.A. Wells Fargo Securities, LLC and Wells Fargo Prime Services, LLC are distinct entities from affiliated banks and thrifts.

IMPORTANT NOTICE REGARDING THE OFFERED CERTIFICATES

The information herein is preliminary and may be supplemented or amended prior to the time of sale. Prospective investors should understand that, when considering the purchase of the Offered Certificates, a contract of sale will come into being no sooner than the date on which the relevant class of certificates has been priced and the investor has otherwise taken all actions the investor must take to become committed to purchase the Offered Certificates, and the investor has therefore entered into a contract of sale. Any “indications of interest“ expressed by any prospective investor, and any “soft circles“ generated by the underwriters, prior to the time of sale, will not create binding contractual obligations for such prospective investors, on the one hand, or the underwriters, the depositor or any of their respective agents or affiliates, on the other hand.

In addition, the Offered Certificates referred to in these materials and the asset pool backing them are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued“ basis. As a result of the foregoing, a prospective investor may commit to purchase certificates that have characteristics that may change, and each prospective investor is advised that all or a portion of the certificates referred to in these materials may be issued without all or certain of the characteristics described in these materials. The underwriters’ obligation to sell certificates to any prospective investor is conditioned on the certificates and the transaction having the characteristics described in these materials. If the underwriters determine that a condition is not satisfied in any material respect, such prospective investor will be notified, and neither the depositor nor the underwriters will have any obligation to such prospective investor to deliver any portion of the Offered Certificates which such prospective investor has committed to purchase, and there will be no liability between the underwriters, the depositor or any of their respective agents or affiliates, on the one hand, and such prospective investor, on the other hand, as a consequence of the non-delivery.

The underwriters described in these materials may from time to time perform investment banking services for, or solicit investment banking business from, any company named in these materials. The underwriters and/or their affiliates or respective employees may from time to time have a long or short position in any security or contract discussed in these materials.

The information contained herein supersedes any previous such information delivered to any prospective investor and will be superseded by information delivered to such prospective investor prior to the time of sale.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) any representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

| No. 1 - Gurnee Mills |

| |

| Loan Information | | Property Information |

| Mortgage Loan Seller: | Wells Fargo Bank, National Association | | Single Asset/Portfolio: | Single Asset |

Credit Assessment

(Fitch/Moody’s/Morningstar): | NR/NR/NR | | Property Type: | Retail |

| Original Principal Balance(1): | $80,000,000 | | Specific Property Type: | Super Regional Mall |

| Cut-off Date Balance(1): | $79,893,396 | | Location: | Gurnee, IL |

| % of Initial Pool Balance: | 9.3% | | Size(3): | 1,683,915 SF |

| Loan Purpose: | Refinance | | Cut-off Date Balance Per SF(1): | $163.09 |

| Borrower Name: | Mall at Gurnee Mills, LLC | | Year Built/Renovated: | 1991/2014 |

| Sponsor: | Simon Property Group, L.P. | | Title Vesting: | Fee |

| Mortgage Rate: | 3.990% | | Property Manager: | Self-managed |

| Note Date: | September 27, 2016 | | 4thMost Recent Occupancy (As of): | 98.0% (12/31/2012) |

| Anticipated Repayment Date: | NAP | | 3rdMost Recent Occupancy (As of): | 95.2% (12/31/2013) |

| Maturity Date: | October 1, 2026 | | 2ndMost Recent Occupancy (As of): | 95.8% (12/31/2014) |

| IO Period: | 0 months | | Most Recent Occupancy (As of): | 95.1% (12/31/2015) |

| Loan Term (Original): | 120 months | | Current Occupancy (As of)(3): | 91.1% (9/22/2016) |

| Seasoning: | 1 month | | |

| Amortization Term (Original): | 360 months | | Underwriting and Financial Information: |

| Loan Amortization Type: | Amortizing Balloon | | | |

| Interest Accrual Method: | Actual/360 | | 4thMost Recent NOI (As of): | $25,964,013 (12/31/2013) |

| Call Protection: | L(25),D(88),O(7) | | 3rdMost Recent NOI (As of): | $27,475,772 (12/31/2014) |

| Lockbox Type: | Hard/Springing Cash Management | | 2ndMost Recent NOI (As of): | $27,801,962 (12/31/2015) |

| Additional Debt(1): | Yes | | Most Recent NOI (As of): | $28,050,715 (TTM 7/31/2016) |

| Additional Debt Type(1): | Pari Passu | | | |

| | | | U/W Revenues: | $40,778,955 |

| | | | U/W Expenses: | $14,098,029 |

| | | | U/W NOI: | $26,680,926 |

| | | | | | | U/W NCF: | $25,099,266 |

| | | | | | U/W NOI DSCR(1): | 1.70x |

| Escrows and Reserves(2): | | | | | U/W NCF DSCR(1): | 1.60x |

| | | | | | U/W NOI Debt Yield(1): | 9.7% |

| Type: | Initial | Monthly | Cap (If Any) | | U/W NCF Debt Yield(1): | 9.1% |

| Taxes | $0 | Springing | NAP | | As-Is Appraised Value: | $417,000,000 |

| Insurance | $0 | Springing | NAP | | As-Is Appraisal Valuation Date: | August 23, 2016 |

| Replacement Reserves | $0 | Springing | NAP | | Cut-off Date LTV Ratio(1): | 65.9% |

| TI/LC Reserve | $0 | Springing | NAP | | LTV Ratio at Maturity or ARD(1): | 52.4% |

| | | | | | | |

| (1) | See “The Mortgage Loan” section. All statistical financial information related to balance per square foot, loan-to-value ratios, debt service coverage ratios and debt yields are based on the funded outstanding principal balance of the Gurnee Mills Whole Loan (as defined below) as of the Cut-off Date. |

| (2) | See “Escrows” section. |

| (3) | See “Cash Flow Analysis” section. As of September 22, 2016, the Gurnee Mills Mortgaged Property (as defined below) was 91.1% leased and 81.9% occupied. The leased percentage includes the Simon Master Lease (as defined below) (2.8% of net rentable area), Floor & Décor and three other tenants who have not yet taken occupancy, all totaling 9.1% of net rentable area combined. Current occupancy and leased percentages do not include any temporary tenants. |

The Mortgage Loan. The mortgage loan (the “Gurnee Mills Mortgage Loan”) is part of a whole loan (the “Gurnee Mills Whole Loan”) that is evidenced by fivepari passu promissory notes (Notes A-1 through A-4) secured by a first mortgage encumbering an a super-regional mall located in Gurnee, Illinois (the “Gurnee Mills Property”). The Gurnee Mills Whole Loan was co-originated on September 27, 2016 by Wells Fargo Bank, National Association, Column Financial, Inc. and Regions Bank. The Gurnee Mills Whole Loan had an original principal balance of $275,000,000, has an outstanding principal balance as of the Cut-off Date of $274,633,547 and accrues interest at an interest rate of 3.990%per annum. The Gurnee Mills Whole Loan had an initial term of 120 months, has a remaining term of 119 months as of the Cut-off Date and requires payments of principal and interest based on a 30-year amortization schedule through the term of the Gurnee Mills Whole Loan. The Gurnee Mills Whole Loan matures on October 1, 2026.

Note A-2-A, which will be contributed to the WFCM 2016-C36 Trust, had an original principal balance of $80,000,000, has an outstanding principal balance as of the Cut-off Date of $79,893,396 and represents a non-controlling interest in the Gurnee Mills Whole Loan. The controlling Note A-1, which had an original principal balance of $110,000,000, is expected to be contributed to a future trust. The remaining non-controlling notes, which had an aggregate outstanding principal balance of $85,000,000, are expected to be contributed to future securitization trusts (referred to herein collectively as the (“Gurnee Mills Companion Loans”).

The lender provides no assurances that any non-securitizedpari passu note will not be split further. See “Description of the Mortgage Pool—The Whole Loans—The Serviced Whole Loans—The Gurnee Mills Whole Loan” in the Preliminary Prospectus.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

Note Summary

| Notes | Original Balance | | Note Holder | Controlling Interest |

| A-1 | $110,000,000 | | Column Financial, Inc. | Yes |

| A-2-A | $80,000,000 | | WFCM 2016-C36 | No |

| A-2-B | $25,000,000 | | Wells Fargo Bank, National Association | No |

| A-3 | $30,000,000 | | Regions Bank | No |

| A-4 | $30,000,000 | | Regions Bank | No |

| Total | $275,000,000 | | | |

Following the lockout period, the borrower has the right to defease the Gurnee Mills Mortgage Loan in whole, but not in part, on any date before April 1, 2026. In addition, the Gurnee Mills Mortgage Loan is prepayable without penalty on or after April 1, 2026. The lockout period will expire on the earlier to occur of (i) two years after the closing date of the securitization that includes the last note to be securitized and (ii) November 1, 2019.

Sources and Uses

| Sources | | | | | Uses | | | |

| Original whole loan amount | $275,000,000 | | 85.1% | | Loan payoff(1) | $322,543,428 | | 99.8% |

| Sponsor’s new cash contribution | 48,328,282 | | 14.9 | | Closing costs | 784,854 | | 0.2 |

| Total Sources | $323,328,282 | | 100.0% | | Total Uses | $323,328,282 | | 100.0% |

| (1) | The Gurnee Mills Property was previously securitized in the JPMCC 2007-CB20 and JPMCC 2007-C1 transactions. |

The Property.The Gurnee Mills Property is a single-story, super regional mall located at the intersection of Grand Avenue and Interstate-94 in Gurnee, Illinois, approximately 42.5 miles northwest of Chicago, Illinois. According to the appraisal, together with the adjacent Six Flag Great America (“Six Flags”) amusement park (located just across Interstate-94 approximately 2.8 miles southeast), the Gurnee Mills Property draws over 26 million visitors annually to the area. The Gurnee Mills Property contains 1,934,721 square feet of retail space, of which 1,683,915 square feet (the “Gurnee Mills Mortgaged Property”) serves as collateral for the Gurnee Mills Whole Loan. The Gurnee Mills Mortgaged Property is situated on a 233.5-acre parcel of land. Developed in 1991 by the Mills Corporation, the Gurnee Mills Property is anchored by Marcus Cinema (not part of the collateral), Burlington Coat Factory (not part of the collateral) and Value City Furniture (not part of the collateral), Bass Pro Shops Outdoor, Sears Grand, Floor & Décor, Kohl’s and Macy’s. Junior anchors at the Gurnee Mills Mortgaged Property include Forever 21, Marshalls Homegoods, Rink Side, Last Call Neiman Marcus, Bed Bath & Beyond / Buy Buy Baby, Off Broadway Shoes, Rainforest Café and Saks Fifth Avenue Off 5th, among others. In 2013, the Macy’s anchor space was constructed at a reported cost to the tenant of $20.0 million and the borrower simultaneously invested $2.7 million in renovations to the Macy’s wing of the Gurnee Mills Mortgaged Property. Further, the borrower negotiated a buyout of a prior tenant and executed a lease with Floor & Décor in 2016. Floor & Décor, which specializes in the hard surface flooring market, offering a broad in-stock selection of tile, wood, stone and flooring accessories straight from the manufacturers, began paying rent October 2016 and is expected to open in January 2017. Sports Authority previously occupied 46,892 square feet (2.8% of net rentable area) but declared bankruptcy, went out of business and vacated the Gurnee Mills Mortgaged Property in 2016. Simon Property Group, Inc. (“SPG”) (rated A2/A by Moody’s and S&P) has executed a 10-year master lease for this space at a rent of $700,000 ($14.93 per square foot), which will burn off once they have a signed lease and an acceptable tenant is in-place, open for business and paying full, unabated rent (“the Simon Master Lease”). See “Escrows” section.

As of July 31, 2016, tenants occupying 10,000 square feet or less had trailing 12-month in-line sales of $347 per square foot with an average occupancy cost of 15.3%, which is up 3.0% from 2014. Further, according to servicer-reported information, the Gurnee Mills Mortgaged Property has exhibited increasing cash flow, with net operating income increasing 27.6% from approximately $22.0 million in 2007 to $28.1 million as of the trailing-twelve months July 2016 operating statement. As of September 22, 2016, the Gurnee Mills Mortgaged Property was 91.1% leased and 81.9% occupied by 160 tenants. The leased percentage includes the Simon Master Lease (2.8% of net rentable area), Floor & Décor and three other tenants who have not yet taken occupancy, all totaling 9.2% of net rentable area combined.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

The following table presents certain information relating to the tenancy at the Gurnee Mills Property:

Major Tenants

| Tenant Name | Credit Rating

(Fitch/Moody’s/

S&P)(1) | Tenant

NRSF | % of

NRSF | Annual

U/W Base

Rent PSF(2) | Annual

U/W Base

Rent(2) | % of Total

Annual U/W

Base Rent | Sales

PSF(3) | Occupancy

Cost(3) | Lease

Expiration

Date |

| | | | | | | | | | |

| Anchor Tenant – Not Part of Collateral | | | | |

| Marcus Cinema | NR/NR/NR | 88,707 | ANCHOR OWNED – NOT PART OF THE COLLATERAL |

| Burlington Coat Factory | NR/NR/BB- | 82,320 | ANCHOR OWNED – NOT PART OF THE COLLATERAL |

| Value City Furniture | NR/NR/NR | 79,779 | ANCHOR OWNED – NOT PART OF THE COLLATERAL |

| | | | | | | | | | |

| Anchor Tenants | | | | | | | | | |

| Bass Pro Shops Outdoor | NR/NR/NR | 137,201 | 8.1% | $10.15 | $1,392,590 | 6.3% | $189 | 5.4% | 8/31/2018 |

| Sears Grand | CC/Caa1/CCC+ | 201,439 | 12.0% | $5.00 | $1,007,195 | 4.6% | $71 | 8.6% | 4/30/2019(4) |

| Floor & Décor(5) | NR/NR/NR | 105,248 | 6.3% | $9.25 | $974,000 | 4.4% | NAP | NAP | 9/30/2026(6) |

| Kohl’s | BBB/Baa2/BBB | 111,675 | 7.0% | $5.95 | $664,466 | 3.0% | $176(7) | 4.3%(7) | 9/2/2024(8) |

| Macy’s | BBB/Baa2/BBB | 130,000 | 7.7% | $0(9) | $0(9) | 0.0% | $134(7) | 0.4%(7) | 1/31/2039(10) |

| Total Anchor Tenants | | 685,563 | 40.7% | $7.27(11) | $4,038,251 | 18.3% | | | |

| | | | | | | | | | |

| Major Tenants | | | | | | | | | |

| Forever 21 | NR/NR/NR | 24,107 | 1.4% | $28.82 | $694,764 | 3.1% | $183 | 16.8% | 1/31/2024 |

| Marshalls Homegoods | NR/A2/A+ | 60,000 | 3.6% | $9.75 | $585,000 | 2.7% | $212 | 5.2% | 1/31/2022 |

| Rink Side | NR/NR/NR | 55,970 | 3.3% | $8.58 | $480,000 | 2.2% | NAP | NAP | 12/31/2016 |

| Last Call Neiman Marcus | NR/NR/NR | 30,462 | 1.8% | $15.00 | $456,930 | 2.1% | $166 | 9.1% | 1/31/2020 |

| Bed Bath & Beyond / Buy Buy Baby | NR/Baa1/BBB+ | 60,317 | 3.6% | $7.50 | $452,378 | 2.1% | $143 | 8.9% | 1/31/2023 |

| Off Broadway Shoes | NR/NR/NR | 21,000 | 1.2% | $17.00 | $357,000 | 1.6% | $110 | 20.8% | 4/30/2021 |

| Rainforest Cafe | NR/NR/NR | 20,003 | 1.2% | $14.90 | $298,000 | 1.4% | $174 | 11.6% | 12/31/2018(12) |

| Saks Fifth Avenue Off 5 | NR/B1/B+ | 28,108 | 1.7% | $9.10 | $255,783 | 1.2% | $105 | 11.0% | 6/30/2019 |

| Total Major Tenants | 299,967 | 17.8% | $11.93 | $3,579,854 | 16.2% | | | |

| | | | | | | | | | |

| Non-Major Tenants(13) | 548,621 | 32.6% | $26.32 | $14,438,249 | 65.4% | | | |

| | | | | | | | | |

| Occupied Collateral Total | 1,534,151 | 91.1%(14) | $14.38 | $22,056,354 | 100.0% | | | |

| | | | | | | | | | |

| Vacant Space | | 149,764 | 8.9% | | | | | | |

| | | | | | | | | | |

| Collateral Total | 1,683,915 | 100.0% | | | | | | |

| | | | | | | | | | |

| (1) | Certain ratings are those of the parent company whether or not the parent guarantees the lease. |

| (2) | Annual U/W Base Rent PSF and Annual U/W Base Rent include contractual rent steps through August 2017 totaling $315,690. |

| (3) | Sales PSF and occupancy costs are for the trailing 12-month period ending July 31, 2016. |

| (4) | Sears Grand has six, five-year lease extension options. |

| (5) | Floor & Décor is still completing its buildout and is not yet in occupancy but began paying rent on October 1, 2016. They are scheduled to open for business in January 2017. |

| (6) | Floor & Decor has three, five-year lease extension options. |

| (7) | Sales PSF and Occupancy cost are for the trailing-12-month period ending December 31, 2015. |

| (8) | Kohl’s has four, five-year lease extension options. |

| (9) | Macy’s pays solely reimbursements currently. They are also required to pay percentage rent, which is calculated based on a percentage of sales above $26.0 million. |

| (10) | Macy’s has ten, five-year lease extension options. |

| (11) | The Total Anchor Tenants Annual U/W Base Rent PSF excludes Macy’s square footage. Including Macy’s, the Annual U/W Base Rent PSF is $5.89. |

| (12) | Rainforest Café has the right to terminate its lease at any time with twelve months prior written notice and payment of a termination fee equal to the greater of one year of then current rent or $500,000. |

| (13) | Non-Major Tenants includes $700,000 attributed to the Simon Master Lease and $4,563 attributed to Marcus Cinema’s common area maintenance reimbursements. Marcus Cinema’s square footage is excluded from the calculation. |

| (14) | As of September 22, 2016, the Gurnee Mills Mortgaged Property was 81.9% occupied and 91.1% leased. The leased percentage includes the Simon Master Lease (2.8% of net rentable area), Floor & Décor and three other tenants who have not yet taken occupancy, all totaling 9.2% of net rentable area combined. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

The following table presents certain information relating to the historical sales and occupancy costs at the Gurnee Mills Mortgaged Property:

Historical Sales (PSF) and Occupancy Costs(1)

| Tenant Name | 2014 | 2015 | TTM 7/31/2016 | Current

Occupancy

Cost(2) |

| Bass Pro Shops Outdoor | $188 | $187 | $189 | 5.4% |

| Sears Grand | $86 | $76 | $71 | 8.6% |

| Kohl’s | $174 | $176 | NAV | 4.3% |

| Macy’s | $141 | $134 | NAV | 0.4%(3) |

| Forever 21 | $195 | $172 | $183 | 16.8% |

| Marshalls Homegoods | $192 | $211 | $212 | 5.2% |

| Last Call Neiman Marcus | $195 | $182 | $166 | 9.1% |

| Bed Bath & Beyond / Buy Buy Baby | $159 | $150 | $143 | 8.9% |

| Off Broadway Shoes | $115 | $114 | $110 | 20.8% |

| Rainforest Cafe | $175 | $186 | $174 | 11.6% |

| Saks Fifth Avenue Off 5 | NAV | $106 | $105 | 11.0% |

| | | | | |

| Total Comparable In-line Sales (< 10,000 square feet) | $337 | $353 | $347 | |

| Occupancy Costs | 15.0% | 14.5% | 15.3% | |

| (1) | Historical Sales (PSF) and Occupancy Costs were provided by the borrower. Current Occupancy Cost is based on the most recent available Historical Sales. |

| (2) | Occupancy Costs are based on the Annual U/W Base Rent and reimbursements and historical sales. |

| (3) | Macy’s pays solely reimbursements currently. They are also required to pay percentage rent, which is calculated based on a percentage of sales above $26.0 million. |

The following table presents certain information relating to the lease rollover schedule at the Gurnee Mills Mortgaged Property:

Lease Expiration Schedule(1)(2)

Year Ending

December 31, | No. of

Leases

Expiring | Expiring

NRSF | % of Total

NRSF | Cumulative

Expiring

NRSF | Cumulative %

of Total

NRSF | Annual

U/W

Base Rent | % of Total

Annual

U/W Base

Rent | Annual

U/W

Base Rent

PSF(3) |

| MTM | 3 | 11,475 | 0.7% | 11,475 | 0.7% | $311,601 | 1.4% | $27.15 |

| 2016 | 3 | 79,477 | 4.7% | 90,952 | 5.4% | $516,766 | 2.3% | $6.50 |

| 2017 | 26 | 69,784 | 4.1% | 160,736 | 9.5% | $2,515,793 | 11.4% | $36.05 |

| 2018 | 23 | 199,595 | 11.9% | 360,331 | 21.4% | $3,392,943 | 15.4% | $17.00 |

| 2019 | 16 | 278,979 | 16.6% | 639,310 | 38.0% | $2,716,434 | 12.3% | $9.74 |

| 2020 | 14 | 77,358 | 4.6% | 716,668 | 42.6% | $1,645,599 | 7.5% | $21.27 |

| 2021 | 15 | 73,185 | 4.3% | 789,853 | 46.9% | $1,957,735 | 8.9% | $26.75 |

| 2022 | 4 | 72,578 | 4.3% | 862,431 | 51.2% | $939,095 | 4.3% | $12.94 |

| 2023 | 15 | 107,168 | 6.4% | 969,599 | 57.6% | $1,853,045 | 8.4% | $17.29 |

| 2024 | 23 | 223,371 | 13.3% | 1,192,970 | 70.8% | $3,667,843 | 16.6% | $16.42 |

| 2025 | 8 | 20,126 | 1.2% | 1,213,096 | 72.0% | $522,412 | 2.4% | $25.96 |

| 2026 | 6 | 181,193 | 10.8% | 1,394,289 | 82.8% | $1,912,525 | 8.7% | $10.56 |

| Thereafter | 24 | 139,862 | 8.3% | 1,534,151 | 91.1% | $104,563 | 0.5% | $0.75 |

| Vacant | 0 | 149,764 | 8.9% | 1,683,915 | 100.0% | $0 | 0.0% | $0.00 |

| Total/Weighted Average | 160 | 1,683,915 | 100.0% | | | $22,056,354 | 100.0% | $14.38 |

| (1) | Information obtained from the underwritten rent roll. |

| (2) | Certain tenants may have lease termination options that are exercisable prior to the originally stated expiration date of the subject lease and that are not considered in the Lease Expiration Schedule. |

| (3) | Weighted Average Annual U/W Base Rent PSF excludes vacant space. |

The following table presents historical occupancy percentages at the Gurnee Mills Mortgaged Property:

Historical Occupancy

12/31/2012(1) | | 12/31/2013(1) | | 12/31/2014(1) | | 12/31/2015(1) | | 9/22/2016(2)(3) |

| 95.0% | | 95.2% | | 95.8% | | 95.1% | | 91.1% |

| (1) | Information obtained from the borrower. |

| (2) | Information obtained from the underwritten rent roll. |

| (3) | As of August 22, 2016, the Gurnee Mills Property was 81.9% occupied and 91.1% leased. The leased percentage includes the Simon Master Lease, Floor & Décor and three other tenants who have not yet taken occupancy, all totaling 9.2% of net rentable area combined. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

Operating History and Underwritten Net Cash Flow. The following table presents certain information relating to the historical operating performance and the underwritten net cash flow at the Gurnee Mills Mortgaged Property:

Cash Flow Analysis

| | | 2013 | | 2014 | | 2015 | | TTM

7/31/2016 | | U/W | | % of U/W

Effective

Gross

Income | | U/W $

per SF | |

| Base Rent | | $20,520,014 | | $22,641,489 | | $22,716,688 | | $22,207,409 | | $22,056,354(1) | | 54.1% | | $13.10 | |

| Grossed Up Vacant Space | | 0 | | 0 | | 0 | | 0 | | 6,159,895(2) | | 15.1 | | 3.66 | |

| Percentage Rent | | 542,881 | | 339,800 | | 599,424 | | 989,722 | | 979,159 | | 2.4 | | 0.58 | |

| Total Reimbursables | | 12,522,737 | | 13,642,927 | | 13,955,041 | | 14,065,465 | | 13,088,291 | | 32.1 | | 7.77 | |

| Specialty Leasing Income(3) | | 4,339,492 | | 3,638,788 | | 3,421,783 | | 3,392,678 | | 3,523,393 | | 8.6 | | 2.09 | |

| Other Income | | 1,200,144 | | 1,201,801 | | 1,068,511 | | 1,111,763 | | 1,131,757 | | 2.8 | | 0.67 | |

| Less Vacancy & Credit Loss | | 0 | | 0 | | 0 | | 0 | | (6,159,895)(4) | | (15.1) | | (3.66) | |

| Effective Gross Income | | $39,125,268 | | $41,464,805 | | $41,761,447 | | $41,767,037 | | $40,778,955 | | 100.0% | | $24.22 | |

| | | | | | | | | | | | | | | | |

| Total Operating Expenses | | $13,161,255 | | $13,989,033 | | $13,959,485 | | $13,716,322 | | $14,098,029 | | 34.6% | | $8.37 | |

| | | | | | | | | | | | | | | | |

| Net Operating Income | | $25,964,013 | | $27,475,772 | | $27,801,962 | | $28,050,715 | | $26,680,926 | | 65.4% | | $15.84 | |

| TI/LC | | 0 | | 0 | | 0 | | 0 | | 1,160,681 | | 2.8 | | 0.69 | |

| Capital Expenditures | | 0 | | 0 | | 0 | | 0 | | 420,979 | | 1.0 | | 0.25 | |

| Net Cash Flow | | $25,964,013 | | $27,475,772 | | $27,801,962 | | $28,050,715 | | $25,099,266 | | 61.5% | | $14.91 | |

| | | | | | | | | | | | | | | | |

| NOI DSCR(5) | | 1.65x | | 1.75x | | 1.77x | | 1.78x | | 1.70x | | | | | |

| NCF DSCR(5) | | 1.65x | | 1.75x | | 1.77x | | 1.78x | | 1.60x | | | | | |

| NOI DY(5) | | 9.5% | | 10.0% | | 10.1% | | 10.2% | | 9.7% | | | | | |

| NCF DY(5) | | 9.5% | | 10.0% | | 10.1% | | 10.2% | | 9.1% | | | | | |

| (1) | Annual U/W Base Rent PSF and Annual U/W Base Rent include contractual rent steps through August 2017 totaling $315,690. |

| (2) | Grossed up vacant space includes gross-up rent and recoveries. |

| (3) | Specialty leasing income includes income from temporary tenants, kiosks and signage at the Gurnee Mills Mortgaged Property. |

| (4) | The underwritten economic vacancy is 13.4%. The Gurnee Mills Property was 81.9% occupied and 91.1% leased as of September 22, 2016. The leased percentage includes the Simon Master Lease (2.8% of net rentable area), Floor & Décor and three other tenants who have not yet taken occupancy, all totaling 9.2% of net rentable area combined. Excluding the $700,000 in Simon Master Lease income results in a net cash flow debt service coverage ratio and debt yield of 1.53x and 8.7%, respectively. |

| (5) | The debt service coverage ratios and debt yields are based on the Gurnee Mills Whole Loan. |

Appraisal.As of the appraisal valuation date of August 23, 2016, the Gurnee Mills Property had an “as-is” appraised value of $417,000,000. The appraiser also concluded to an “as-stabilized” value of $430,000,000 as of September 1, 2017, which equates to an “as-stabilized” loan-to-value-ratio of 64.0%.

Environmental Matters. According to a Phase I environmental site assessment dated August 26, 2016, there was no evidence of any recognized environmental conditions at the Gurnee Mills Property.

Market Overview and Competition.The Gurnee Mills Property is located in Gurnee, Illinois, located at the intersection of Grand Avenue and Interstate-94 in Gurnee, Illinois, approximately 42.5 miles northwest of Chicago, Illinois and 48.2 miles south of Milwaukee. Located in Lake County, the Gurnee Mills Property has excellent visibility and direct access off of Interstate-94, the major north/south thoroughfare connecting Chicago and Milwaukee. Additional demand drivers in the area include Six Flags and KeyLime Cove Indoor Waterpark and Resort (“KeyLime Cove”), which are located directly southeast of the Gurnee Mills Property on the opposite side of Interestate-94. Six Flags is one of the Midwest’s largest theme and amusement/outdoor water parks, with over 100 rides and attractions that generate approximately 3.0 million visitors per year. KeyLime Cove includes a 65,000 square foot waterpark, seven restaurants, two spas and 414 resort style guestrooms and suites. KeyLime Cove was recently named among the top 10 water parks in the United States by two major news publications. The average daily traffic along Interestate-94 is 86,600 and 39,600 along Grand Avenue, which runs eight miles east to Lake Michigan and is the main access point for the Gurnee Mills Property. The area also benefits from the Naval Station Great Lakes, located eight miles southeast of the Gurnee Mills Property. The campus is home to the United States Navy’s only recruit training base, which graduates nearly 40,000 recruits annually.

According to the appraisal, the Gurnee Mills Property is located in the Lake/McHenry County submarket and has a primary trade area that encompasses a ten-mile radius. The 2015 population within a five- and 10-mile radius were reported at approximately 122,401 and 454,466, respectively, and average household income within the same radii were reported at approximately $102,298 and $94,579, respectively. The population is expected to grow 0.8% and 0.9% within the same five- and ten-mile radius from 2015 to 2020.

The appraiser estimated market rent for Gurnee Mills Property to be $15.95 per square foot on a triple net basis, compared to $14.38 per square foot at the Gurnee Mills Mortgaged Property. The appraiser concluded a vacancy rate of 5.0% and a third party market research report indicated a second quarter 2016 retail vacancy rate within a 3-mile radius of 1.7% and a competitive set vacancy of 5.4%.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

The following table presents certain information relating to comparable properties to the Gurnee Mills Property:

Competitive Set(1)

| | Gurnee Mills

(Subject) | Fashion

Outlets of

Chicago | Chicago

Premium

Outlets | Pleasant

Prairie

Premium

Outlets | Huntley

Outlet Center | Hawthorn

Center | Woodfield

Mall | Old Orchard |

| Location | Gurnee, IL | Rosemont, IL | Aurora, IL | Pleasant Prairie, WI | Huntley, IL | Vernon Hills, IL | Schaumburg, IL | Skokie, IL |

| Distance from Subject | -- | 29.0 miles | 44.0 miles | 8.7 miles | 30.3 miles | 10.0 miles | 24.0 miles | 25.0 miles |

| Property Type | Super-Regional Center/Outlet Mall | Super-Regional Center/Outlet Mall | Outlet Center | Outlet Center | Outlet Center | Super-Regional Center/Mall | Enclosed Regional Mall | Enclosed Regional Mall |

| Year Built/Renovated | 1991/2014 | 2013/NAP | 2004/2015 | 1988/2006 | 1994/2005 | 2014/2015 | 1999/2016 | 1956/1995 |

| Anchors | Sears Grand, Bass Pro Shops, Macy’s, Kohl’s, Floor & Décor | Bloomingdale’s Outlet, Forever 21, Last Call Neiman Marcus, Nike, Saks Fifth Avenue Off 5th | Nike, Polo, Ann Taylor, Adidas, Timberland, Eddie Bauer, Gap, Saks Fifth Avenue – Off 5th, J.Crew, Coach, Old Navy, Under Armour | Nike, Gap, Hilfiger, Under Armour, Coach Adidas, Timberland, Jockey, Bass, Polo, J. Crew, Banana | Eddie Bauer, Reebok, Carters, Gap, Bose, Banana, Aeropostale | Sears, Macy’s, JCPenney, Carson Pirie Scott | Nordstrom, Lord & Taylor, JCPenney, Sears, Macy’s | Nordstrom, Lord & Taylor, Macy’s, Bloomingdale’s, Cinema, Barnes & Noble |

| Total GLA | 1,934,721 SF | 528,112 SF | 690,000 SF | 776,000 SF | 279,387 SF | 1,329,555 SF | 2,208,000 SF | 1,740,000 SF |

| Total Occupancy | 95%(2) | 98% | 97% | 98% | 80% | 93% | 95% | 94% |

| (1) | Information obtained from the appraisal. |

| (2) | As of September 22, 2016, the Gurnee Mills Mortgaged Property was 91.1% leased and 81.9% occupied. See “Cash Flow Analysis” section. |

The Borrower.The borrower is Mall at Gurnee Mills, LLC, a Delaware limited liability company and single purpose entity with two independent directors. Legal counsel to the borrower delivered a non-consolidation opinion in connection with the origination of the Gurnee Mills Whole Loan. Simon Property Group, L.P. is the guarantor of certain nonrecourse carveouts under the Gurnee Mills Whole Loan. The liability of the guarantor under the non-recourse carveout provisions in the loan documents is capped at $55.0 million plus reasonable collection costs. See“Description of the Mortgage Pool-Certain Terms of the Mortgage Loans-Non-Recourse Obligations” in the Preliminary Prospectus.

The Sponsor.The sponsor is Simon Property Group, L.P. Simon Property Group, L.P. is an affiliate of SPG. SPG was founded in 1960 and is headquartered in Indianapolis, Indiana. SPG (NYSE: SPG, rated A2/A by Moody’s and S&P) is an S&P 100 company and the largest public real estate company in the world. SPG currently owns or has an interest in 231 retail real estate properties in North America, Europe and Asia comprising 191 million square feet. SPG has sponsored other real estate projects that have been the subject of mortgage loan defaults, foreclosure proceedings and deeds-in-lieu of foreclosure. See “Description of the Mortgage Pool—Default History, Bankruptcy Issues and Other Proceedings” in the Preliminary Prospectus.

Escrows.No upfront escrows were collected at origination.

Ongoing reserves for taxes are not required as long as (i) there is no event of default; (ii) no DSCR Reserve Trigger Event (as defined below) exists; and (iii) the borrower (a) pays all taxes prior to the assessment of any late payment penalty and the date that such taxes become delinquent or (b) upon request, provides the lender with satisfactory evidence of such payment of taxes. Ongoing reserves for insurance are not required as long as (i) no event of default exists and (ii) the borrower provides satisfactory evidence that the Gurnee Mills Mortgaged Property is insured under an acceptable blanket policy.

Ongoing replacement reserves are not required as long as no DSCR Reserve Trigger Event or event of default exists. Following the occurrence and during the continuance of a DSCR Reserve Trigger Event or an event of default, the borrower is required to deposit $29,926 per month for replacement reserves.

Ongoing reserves for tenant improvements and leasing commissions (“TI/LC”) are not required as long as no DSCR Reserve Trigger Event or event of default exists. Following the occurrence and during the continuance of a DSCR Reserve Trigger Event or an event of default, the borrower is required to deposit $94,204 per month for TI/LC reserves. The borrower shall have the right to provide a guaranty from the guarantors for all monthly deposits to the TI/LC reserve required by the loan documents so long as no DSCR Reserve Trigger Event or event of default exists.

A “DSCR Reserve Trigger Event” means the debt service coverage ratio for the Gurnee Mills Whole Loan based on the trailing four calendar quarter period immediately preceding the date of determination is less than 1.20x for two consecutive calendar quarters.

Lockbox and Cash Management.The Gurnee Mills Whole Loan requires a lender-controlled lockbox account, which is already in place, and that the borrower direct tenants to pay their rents directly into such lockbox account. The loan documents also require that all rents received by the borrower or the property manager be deposited into the lockbox account within two business days of receipt. Prior to the occurrence of a Cash Trap Event Period (as defined below), all cash flow is distributed to the borrower. During a Cash Trap Event Period, all cash flow is swept to a lender-controlled cash management account.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

A “Cash Trap Event Period” means the occurrence of: (i) an event of default; (ii) any bankruptcy or insolvency action of the borrower; (iii) any bankruptcy or insolvency action of the property manager if the property manager is affiliated with the borrower (provided that the property manager is not replaced within 60 days with a qualified manager); or (iv) a DSCR Reserve Trigger Event.

A Cash Trap Event Period may be cured (a) if the Cash Trap Event Period is caused solely by the occurrence of a DSCR Reserve Trigger Event, the achievement of a debt service coverage ratio of 1.20x or greater for two consecutive calendar quarters based upon the trailing four calendar quarter period immediately preceding the date of determination; (b) if the Cash Trap Event Period is caused solely by clause (i) above, by the acceptance of the lender of a cure of such event of default, provided that the lender has not accelerated the loan, moved for a receiver or commenced foreclosure proceedings; or (c) if the Cash Trap Event Period is caused solely by clause (iii) above, if the borrower replaces the property manager or such bankruptcy or insolvency action is discharged or dismissed without any adverse consequences to the property or the loan. The cures in this paragraph are also subject to the following conditions: (i) no event of default shall have occurred and be continuing; (ii) the borrower pays all of the lender’s reasonable out-of-pocket expenses incurred in connection with curing such Cash Trap Event Period including reasonable attorney’s fees and expenses; and (iii) the borrower may not cure a Cash Trap Event Period (x) more than a total of five times in the aggregate during the term of the loan or (y) triggered by a bankruptcy or insolvency action.

Property Management. The Gurnee Mills Property is managed by an affiliate of the borrower.

Assumption.The borrower has the right to transfer the Gurnee Mills Mortgaged Property provided that certain conditions are satisfied, including (i) no event of default has occurred and is continuing; (ii) in the event that in connection with such transfer, the manager will not thereafter continue to manage the Gurnee Mills Mortgaged Property, then a replacement management agreement with a qualified manager must be executed acceptable to lender; (iii) the transferee must not have been a party to any bankruptcy action within the previous seven years and there is no material litigation or regulatory action pending against the transferee unreasonable to lender; and (iv) the transferee is a qualified transferee meeting the requirements set forth in the loan documents or the lender receives rating agency confirmation that the sale and assumption will not result in a downgrade, withdrawal or qualification of the respective ratings assigned to the Series 2016-C36 certificates and similar confirmations from each rating agency rating any securities backed by any of the Gurnee Mills Companion Loans with respect to the ratings of such securities.

Partial Release. Not permitted.

Real Estate Substitution.Not permitted.

Subordinate and Mezzanine Indebtedness.Not permitted.

Ground Lease. None.

Terrorism Insurance.The loan documents require that the “all risk” insurance policy required to be maintained by the borrower provide coverage for terrorism in an amount equal to the full replacement cost of Gurnee Mills Mortgaged Property. The loan documents also require business interruption insurance covering no less than the 24-month period following the occurrence of a casualty event, together with a 365-day extended period of indemnity. Should the policy contain an exclusion for acts of terrorism, the loan documents require the borrower to obtain to the extent available a stand-alone policy providing the same coverage as previously in place prior to the exclusion, with a premium cap of two times the then current annual insurance premiums for the policy insuring the Gurnee Mills Mortgaged Property only (excluding the wind and flood components of the premiums) on a stand-alone basis, with a deductible no greater than $5,000,000.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| No. 2 – 101 Hudson Street |

| |

| Loan Information | | Property Information |

| Mortgage Loan Seller: | Wells Fargo Bank, National Association | | Single Asset/Portfolio: | Single Asset |

Credit Assessment (Fitch/Moody’s/Morningstar): | NR/NR/NR | | Property Type: | Office |

| Original Principal Balance(1): | $67,500,000 | | Specific Property Type: | CBD |

| Cut-off Date Balance(1): | $67,500,000 | | Location: | Jersey City, NJ |

| % of Initial Pool Balance: | 7.9% | | Size: | 1,341,649 SF |

| Loan Purpose: | Refinance | | Cut-off Date Balance Per SF(1): | $186.34 |

| Borrower Name: | 101 Hudson Realty L.L.C. | | Year Built/Renovated: | 1992/2015 |

| Sponsor: | Mack-Cali Realty, L.P. | | Title Vesting: | Fee |

| Mortgage Rate: | 3.117% | | Property Manager: | Self-managed |

| Note Date: | September 30, 2016 | | 4thMost Recent Occupancy (As of): | 89.0% (12/31/2012) |

| Anticipated Repayment Date: | NAP | | 3rdMost Recent Occupancy (As of): | 83.4% (12/31/2013) |

| Maturity Date: | October 11, 2026 | | 2ndMost Recent Occupancy (As of): | 87.0% (12/31/2014) |

| IO Period: | 120 months | | Most Recent Occupancy (As of): | 90.2% (12/31/2015) |

| Loan Term (Original): | 120 months | | Current Occupancy (As of): | 98.3% (9/21/2016) |

| Seasoning: | 1 month | | |

| Amortization Term (Original): | None | | Underwriting and Financial Information: |

| Loan Amortization Type: | Interest-only, Balloon | | | |

| Interest Accrual Method: | Actual/360 | | 4thMost Recent NOI (As of)(3): | $16,510,717 (12/31/2013) |

| Call Protection: | L(25),GRTR 1% or YM(88),O(7) | | 3rdMost Recent NOI (As of)(3): | $20,587,281 (12/31/2014) |

| Lockbox Type: | Hard/Springing Cash Management | | 2ndMost Recent NOI (As of)(3): | $21,296,669 (12/31/2015) |

| Additional Debt(1): | Yes | | Most Recent NOI (As of)(3): | $23,104,804 (TTM 7/31/2016) |

| Additional Debt Type(1): | Pari Passu | | |

| | | | U/W Revenues: | $50,810,573 |

| | | | U/W Expenses: | $18,681,652 |

| Escrows and Reserves(2): | | | | | U/W NOI: | $32,128,921 |

| | | | | | U/W NCF: | $29,075,403 |

| Type: | Initial | Monthly | Cap (If Any) | | U/W NOI DSCR(1): | 4.07x |

| Taxes | $0 | Springing | NAP | | U/W NCF DSCR(1): | 3.68x |

| Insurance | $0 | Springing | NAP | | U/W NOI Debt Yield(1): | 12.9% |

| Replacement Reserves | $0 | Springing | NAP | | U/W NCF Debt Yield(1): | 11.6% |

| TI/LC | $0 | Springing | NAP | | As-Is Appraised Value: | $482,500,000 |

| Deferred Maintenance | $104,000 | $0 | NAP | | As-Is Appraisal Valuation Date: | September 6, 2016 |

| Outstanding TI/LC Reserve | $16,270,684 | $0 | NAP | | Cut-off Date LTV Ratio(1): | 51.8% |

| Rent Concession Reserve | $2,779,153 | $0 | NAP | | LTV Ratio at Maturity or ARD(1): | 51.8% |

| (1) | See “The Mortgage Loan” section. All statistical financial information related to balances per square foot, loan-to-value ratios, debt service coverage ratios and debt yields are based on the 101 Hudson Street Whole Loan (as defined below). |

| (2) | See “Escrows” section. |

| (3) | See “Cash Flow Analysis” section. |

The Mortgage Loan. The mortgage loan (the “101 Hudson Street Mortgage Loan”) is part of a whole loan (the “101 Hudson Street Whole Loan”) that is evidenced by fivepari passu promissory notes (Notes A-1, A-2, A-3, A-4 and A-5) secured by a first mortgage encumbering an office building located in Jersey City, New Jersey (the “101 Hudson Street Property”). The 101 Hudson Street Whole Loan was co-originated on September 30, 2016 by Wells Fargo Bank, National Association, Bank of America, N.A. and Barclays Bank PLC. The 101 Hudson Street Whole Loan had an original principal balance of $250,000,000, has an outstanding principal balance as of the Cut-off Date of $250,000,000 and accrues interest at an interest rate of 3.117%per annum. The 101 Hudson Street Whole Loan had an initial term of 120 months, has a remaining term of 119 months as of the Cut-off Date and requires payments of interest only through the term of the 101 Hudson Street Mortgage Loan. The 101 Hudson Street Whole Loan matures on October 11, 2026.

The 101 Hudson Street Mortgage Loan, evidenced by the non-controlling Note A-2, which will be contributed to the WFCM 2016-C36 Trust, had an original principal balance of $67,500,000 and has an outstanding principal balance as of the Cut-off Date of $67,500,000. The controlling Note A-1, with an original principal balance of $70,000,000, is currently held by Wells Fargo Bank, National Association and is expected to be contributed to a future trust or trusts. The non-controlling Note A-3 and Note A-4, with an aggregate original principal balance of $56,250,000, are currently held by Bank of America, N.A. and are expected to be contributed to a future trust or trusts. The non-controlling Note A-5, with an original principal balance of $56,250,000, is currently held by Barclays Bank PLC and is expected to be contributed to a future trust or trusts. The lender provides no assurances that any non-securitizedpari passu note will not be split further. See “Description of the Mortgage Pool—The Whole Loans—The Servicing Shift Whole Loans—The 101 Hudson Street Whole Loan” and “Pooling and Servicing Agreement” in the Preliminary Prospectus.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

Note Summary

| Notes | Original Balance | | Note Holder | Controlling Interest |

| A-1 | $70,000,000 | | Wells Fargo Bank, National Association | Yes |

| A-2 | $67,500,000 | | WFCM 2016-C36 | No |

| A-3 | $30,000,000 | | Bank of America, N.A. | No |

| A-4 | $26,250,000 | | Bank of America, N.A. | No |

| A-5 | $56,250,000 | | Barclays Bank PLC | No |

| Total | $250,000,000 | | | |

Following the lockout period, the borrower has the right to prepay the 101 Hudson Street Mortgage Loan in whole, but not in part, on any date before April 11, 2026, provided that the borrower pay the greater of a yield maintenance premium or a prepayment premium equal to 1.0% of the principal amount being prepaid. In addition, the 101 Hudson Street Mortgage Loan is prepayable without penalty on or after April 11, 2026.

Sources and Uses

| Sources | | | | | Uses | | | |

| Original whole loan amount | $250,000,000 | | 100.0% | | Loan payoff(1) | $0 | | 0.0% |

| | | | | | Reserves | 19,153,837 | | 7.7 |

| | | | | | Closing costs | 1,733,229 | | 0.7 |

| | | | | | Return of equity | 229,112,934 | | 91.6 |

| Total Sources | $250,000,000 | | 100.0% | | Total Uses | $250,000,000 | | 100.0% |

| (1) | The 101 Hudson Street Property was previously unencumbered by debt. |

The Property. The 101 Hudson Street Property is a 42-story, class A office tower totaling approximately 1,341,649 square feet located in Jersey City, New Jersey within the center of Jersey City’s Waterfront district. The 101 Hudson Street Property is the second tallest office building in Jersey City and features views of the New York City Harbor and Manhattan skyline, 17-foot ceiling heights, ground floor retail, a landscaped courtyard area and an attached 900-space parking garage resulting in a parking ratio of 1.5 spaces per 1,000 feet of rentable area. Additionally, the 101 Hudson Street Property is Wired Certified Platinum, a certification awarded to buildings with the fastest, most reliable internet connections and telecom infrastructures. Built in 1992 and renovated in 2015, the 101 Hudson Street Property features investment-grade tenancy that accounts for approximately 58.1% of net rentable area and approximately 53.0% of in-place underwritten base rent. The 101 Hudson Street Property features a diverse tenant roster comprising 39 tenants with the largest tenant, Bank of America (rated A/Baa1/BBB+ by Fitch, Moody’s and S&P), representing 28.9% of the net rentable area and 21.8% of the underwritten base rent. Bank of America executed a 10-year lease renewal in March 2016, extending their lease through March 2027. In addition to the lease extension, Bank of America expanded into an additional 53,372 square feet (4.0% of net rentable area). The 101 Hudson Street Property has benefited from significant leasing momentum with approximately 359,225 square feet (26.8% of net rentable area) having signed a new lease or renewal since 2015. Over the past eleven years, the 101 Hudson Street Property has averaged 92.9% occupancy, and as of September 21, 2016, the 101 Hudson Street Property was 98.3% occupied by 39 tenants subject to 57 leases.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

The following table presents certain information relating to the tenancies at the 101 Hudson Street Property:

Major Tenants

| Tenant Name | Credit Rating (Fitch/Moody’s/

S&P)(1) | Tenant NRSF | % of

NRSF | Annual U/W Base Rent PSF(2) | Annual

U/W Base Rent(2) | % of Total Annual U/W Base Rent | Lease

Expiration

Date |

| | | | | | | |

| Major Tenants | | | | | |

| Bank of America | A/Baa1/BBB+ | 388,207 | 28.9% | $22.26 | $8,641,488 | 21.8% | 3/31/2027(3) |

| National Union Fire Insurance | NR/A2/A+ | 271,533(4) | 20.2% | $30.00 | $8,145,990 | 20.5% | 4/30/2018(5) |

| Tullett Prebon Holdings Corp. | BBB-/Ba1/NR | 100,909(6) | 7.5% | $31.05 | $3,132,809 | 7.9% | 11/30/2023(7) |

| Jeffries LLC | BBB-/Baa3/BBB- | 62,763 | 4.7% | $34.00 | $2,133,942 | 5.4% | 6/30/2023(8) |

| First Data Corporation | CCC+/B3/B+ | 54,669 | 4.1% | $35.14 | $1,921,135 | 4.8% | 5/31/2026(9)(10) |

| GBT US LLC | NR/NR/NR | 49,563 | 3.7% | $38.75 | $1,920,566 | 4.8% | 11/30/2026(11) |

| United States Fire Insurance | NR/Baa1/A- | 35,040 | 2.6% | $38.00 | $1,331,520 | 3.4% | 7/31/2032 |

| World Business Lenders LLC | NR/NR/NR | 35,040 | 2.6% | $37.00 | $1,296,480 | 3.3% | 1/31/2027(12) |

| Total Major Tenants | 997,724 | 74.4% | $28.59 | $28,523,930 | 71.8% | |

| | | | | | | | |

| Non-Major Tenants | | 321,566(13) | 24.0% | $34.82(13) | $11,197,678 | 28.2% | |

| | | | | | | | |

| Occupied Collateral Total | | 1,319,290(13) | 98.3% | $30.11(13) | $39,721,608 | 100.0% | |

| | | | | | | | |

| Vacant Space | | 22,359 | 1.7% | | | | |

| | | | | | | | |

| Collateral Total | | 1,341,649 | 100.0% | | | | |

| | | | | | | | |

| (1) | Certain ratings are those of the parent company whether or not the parent guarantees the lease. |

| (2) | Annual U/W Base Rent PSF and Annual U/W Base Rent include contractual rent steps through October 2017 totalling $1,648,952. |

| (3) | Bank of America has two, five-year extension options for 53,372 square feet. |

| (4) | National Union Fire Insurance is not currently in occupancy of 139,536 square feet (10.4% of net rentable area). See “Cash Flow Analysis” section. |

| (5) | National Union Fire Insurance has two, five-year extension options for 133,471 square feet. |

| (6) | Tullett Prebon Holdings Corp. is not currently in occupancy of 37,387 square feet (2.8% of net rentable area). See “Cash Flow Analysis” section. |

| (7) | Tullett Prebon Holdings Corp. has one, five-year extension option. |

| (8) | Jeffries LLC has two, five-year extension options. |

| (9) | First Data Corporation has the option to terminate its lease effective December 31, 2023 with required notice by June 30, 2022 and a termination fee of approximately $2,107,496. |

| (10) | First Data Corporation has one, five-year extension option. |

| (11) | GBT US LLC has one, five-year extension option. |

| (12) | World Business Lenders LLC has one, five-year extension option. |

| (13) | Includes two units occupied as a management office (2,778 square feet) and management storage (1,650 square feet), each with no attributed underwritten base rent. The Non-Major Tenants Annual U/W Base Rent PSF and Occupied Collateral Total Annual U/W Base Rent PSF excluding these spaces are $35.31 per square foot and $30.21 per square foot, respectively. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

The following table presents certain information relating to the lease rollover schedule at the 101 Hudson Street Property:

Lease Expiration Schedule(1)(2)

Year Ending

December 31, | No. of Leases Expiring | Expiring NRSF | % of Total NRSF | Cumulative Expiring NRSF | Cumulative % of Total NRSF | Annual

U/W

Base Rent | % of Total Annual U/W Base Rent | Annual

U/W

Base Rent

PSF(3) |

| MTM(4) | 3 | 5,271 | 0.4% | 5,271 | 0.4% | $38,778 | 0.1% | $7.36 |

| 2016 | 0 | 0 | 0.0% | 5,271 | 0.4% | $0 | 0.0% | $0.00 |

| 2017 | 6 | 71,589 | 5.3% | 76,860 | 5.7% | $2,649,476 | 6.7% | $37.01 |

| 2018 | 14 | 321,335 | 24.0% | 398,195 | 29.7% | $10,127,523 | 25.5% | $31.52 |

| 2019 | 4 | 29,846 | 2.2% | 428,041 | 31.9% | $1,074,568 | 2.7% | $36.00 |

| 2020 | 2 | 4,170 | 0.3% | 432,211 | 32.2% | $158,719 | 0.4% | $38.06 |

| 2021 | 2 | 15,257 | 1.1% | 447,468 | 33.4% | $551,665 | 1.4% | $36.16 |

| 2022 | 5 | 22,869 | 1.7% | 470,337 | 35.1% | $873,064 | 2.2% | $38.18 |

| 2023 | 6 | 184,370 | 13.7% | 654,707 | 48.8% | $5,997,183 | 15.1% | $32.53 |

| 2024 | 2 | 25,557 | 1.9% | 680,264 | 50.7% | $513,696 | 1.3% | $20.10 |

| 2025 | 2 | 25,528 | 1.9% | 705,792 | 52.6% | $867,952 | 2.2% | $34.00 |

| 2026 | 7 | 127,625 | 9.5% | 833,417 | 62.1% | $4,639,147 | 11.7% | $36.35 |

| Thereafter | 6 | 485,873 | 36.2% | 1,319,290 | 98.3% | $12,229,837 | 30.8% | $25.17 |

| Vacant | 0 | 22,359 | 1.7% | 1,341,649 | 100.0% | $0 | 0.0% | $0.00 |

| Total/Weighted Average(4) | 59(5) | 1,341,649 | 100.0% | | | $39,721,608 | 100.0% | $30.11(4) |

| (1) | Information obtained from the underwritten rent roll. |

| (2) | Certain tenants may have lease termination options that are exercisable prior to the stated expiration date of the subject lease and that are not considered in the Lease Expiration Schedule. |

| (3) | Weighted Average Annual U/W Base Rent PSF excludes vacant space. |

| (4) | Includes two units occupied as a management office (2,778 square feet) and management storage (1,650 square feet), each with no attributed underwritten base rent. The Total Annual U/W Base Rent PSF excluding these spaces is $30.21 per square foot. |

| (5) | The 101 Hudson Street Property is occupied by 39 tenants subject to 57 leases. |

The following table presents historical occupancy percentages at the 101 Hudson Street Property:

Historical Occupancy

12/31/2012(1) | | 12/31/2013(1) | | 12/31/2014(1) | | 12/31/2015(1) | | 9/21/2016(2) |

| 89.0% | | 83.4% | | 87.0% | | 90.2% | | 98.3% |

| (1) | Information obtained from the borrower. |

| (2) | Information obtained from the underwritten rent roll. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

Operating History and Underwritten Net Cash Flow.The following table presents certain information relating to the historical operating performance and the underwritten net cash flow at the 101 Hudson Street Property:

Cash Flow Analysis

| | | 2013(1) | |

2014(1) | | 2015(1) | | TTM

7/31/2016(1) | | U/W(1)(2) | | % of U/W Effective

Gross

Income | | U/W $

per SF | |

| Base Rent | | $28,311,298 | | $29,284,205 | | $30,453,201 | | $31,975,694 | | $38,568,810(3) | | 75.9% | | $28.75 | |

| Grossed Up Vacant Space | | 0 | | 0 | | 0 | | 0 | | 2,098,929 | | 4.1 | | 1.56 | |

| Straight Line Average Rent | | 0 | | 0 | | 0 | | 0 | | 1,106,341(4) | | 2.2 | | 0.82 | |

| Percentage Rent | | 381,069 | | 154,426 | | 209,962 | | 139,808 | | 204,500 | | 0.4 | | 0.15 | |

| Free Rent Adjustment | | (4,153,515) | | (319,825) | | (822,438) | | (1,383,837) | | 0 | | 0.0 | | 0.00 | |

| Total Reimbursables | | 7,856,996 | | 8,407,351 | | 7,696,085 | | 7,964,296 | | 9,584,061 | | 18.9 | | 7.14 | |

| Other Income | | 805,904 | | 702,221 | | 1,034,201 | | 1,264,812 | | 1,346,861 | | 2.7 | | 1.00 | |

| Less Vacancy & Credit Loss | | 0 | | 0 | | 0 | | 0 | | (2,098,929)(5) | | (4.1) | | (1.56) | |

| Effective Gross Income | | $33,201,752 | | $38,228,378 | | $38,571,011 | | $39,960,773 | | $50,810,573 | | 100.0% | | $37.87 | |

| | | | | | | | | | | | | | | | |

| Total Operating Expenses | | $16,691,035 | | $17,641,097 | | $17,274,342 | | $16,855,969 | | $18,681,652 | | 36.8% | | $13.92 | |

| | | | | | | | | | | | | | | | |

| Net Operating Income | | $16,510,717 | | $20,587,281 | | $21,296,669 | | $23,104,804 | | $32,128,921 | | 63.2% | | $23.95 | |

| TI/LC | | 0 | | 0 | | 0 | | 0 | | 2,771,771 | | 5.5 | | 2.07 | |

| Capital Expenditures | | 0 | | 0 | | 0 | | 0 | | 281,746 | | 0.6 | | 0.21 | |

| Net Cash Flow | | $16,510,717 | | $20,587,281 | | $21,296,669 | | $23,104,804 | | $29,075,403 | | 57.2% | | $21.67 | |

| | | | | | | | | | | | | | | | |

| NOI DSCR(6) | | 2.09x | | 2.61x | | 2.70x | | 2.92x | | 4.07x | | | | | |

| NCF DSCR(6) | | 2.09x | | 2.61x | | 2.70x | | 2.92x | | 3.68x | | | | | |

| NOI DY(6) | | 6.6% | | 8.2% | | 8.5% | | 9.2% | | 12.9% | | | | | |

| NCF DY(6) | | 6.6% | | 8.2% | | 8.5% | | 9.2% | | 11.6% | | | | | |

| (1) | The increase in Base Rent and Effective Gross Income from 2013 through U/W was due to continued increase in occupancy from 83.4% as of December 31, 2013 to 98.3% as of September 21, 2016. |

| (2) | National Union Fire Insurance is not currently in occupancy of 139,536 square feet (10.4% of net rentable area). Additionally, Tullett Prebon Holdings Corp. is not currently in occupancy of 37,387 square feet (2.8% of net rentable area). Current occupancy excluding these spaces is 85.1%, and the U/W NOI DSCR and U/W NCF DSCR are 3.52x and 3.17x, respectively, and the U/W NOI DY and U/W NCF DY are 11.1% and 10.0%, respectively. |

| (3) | U/W Base Rent includes contractual rent steps through October 2017 totaling $1,648,952. |

| (4) | U/W Straight Line Average Rent represents the average rent over the lease term in excess of the U/W Base Rent for the following tenants, all of which are rated investment grade by Fitch, Moody’s and/or S&P: Federal Farm Credit Bank, United States Fire Insurance, Berkeley Insurance Company, MCI Communications Services, Jeffries LLC and Bank of America. |

| (5) | The underwritten economic vacancy is 5.0%. The 101 Hudson Street Property was 98.3% physically occupied as of September 21, 2016. |

| (6) | The debt service coverage ratios and debt yields are based on the 101 Hudson Street Whole Loan. |

Appraisal.As of the appraisal valuation date of September 6, 2016, the 101 Hudson Street Property had an “as-is” appraised value of $482,500,000.

Environmental Matters.According to the Phase I environmental site assessment dated August 30, 2016, there was evidence of one recognized environmental condition at the 101 Hudson Street Property.

The Phase I environmental consultant identified two 10,000-gallon underground storage tanks (“USTs”) at the 101 Hudson Street Property, containing heating oil that is used to fuel the dual boilers for heating the building. The USTs are double-walled tanks constructed of fiberglass reinforced plastic and were installed at the 101 Hudson Street Property in 1991. Although there was no evidence of leaks or spills, the Phase I environmental consultant considered the USTs a recognized environmental condition due to their age. The USTs are registered and compliant through June 30, 2017. The Sponsor (as defined below) has obtained a $1.0 million Storage Tank Third-Party Liability, Corrective Action and Clean-Up Costs Insurance Policy from AIG. See “Description of the Mortgage Pool—Environmental Considerations” in the Preliminary Prospectus.

Market Overview and Competition. The 101 Hudson Street Property is located in Jersey City’s Waterfront District, situated on the west side of the Hudson River across from Manhattan. The Waterfront District is comprised of a number of high-rise office buildings as well as new residential developments. There are currently 18 major residential developments under construction in the Waterfront District that will bring more than 5,900 units to market by the end of 2018. The 101 Hudson Street Property is located in the ongoing development known as the Colgate Center, a 42-acre, mixed-use development. Currently, there is 3.5 million square feet of office space in the Colgate Center in four office towers, plus 1,733 residential units within four properties. The 2016 population and average household income within a one-mile radius of the 101 Hudson Street Property was 48,701 and $153,350, respectively.

The Port Authority Trans-Hudson (“PATH”) system provides subway and train lines to New York City, and maintains three of its seven New Jersey train stations within the Waterfront District including the Exchange Place Station, which is located one block from the 101 Hudson Street Property. PATH encompasses a total of 13.9 miles of rail lines and currently serves over 200,000 passengers daily. Additionally, the Hudson-Bergen Light Rail Transit System, Hudson County’s 34.1-mile light rail system, has a station directly adjacent to the 101 Hudson Street Property.

According to the appraisal, the 101 Hudson Street Property is located in the Waterfront submarket of the New Jersey office market, which is defined as the area along the Hudson River that extends from Jersey City to the George Washington Bridge. As of the second quarter of 2016, the Waterfront submarket contained approximately 19.3 million square feet (12.3% of the New Jersey office market) and reported a vacancy rate of 8.7%. For that same period, the Waterfront submarket reported positive net absorption of 121,013 square feet and an average asking rent of $35.33 per square foot, gross.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

The following table presents certain information relating to comparable office leases for the 101 Hudson Street Property:

Comparable Leases(1)

Property

Name/Location | Year Built/ Renovated | Stories | Total GLA (SF) | Total Occupancy | Distance from Subject | Tenant Name | Lease Date/Term | Lease Area (SF) | Annual Base Rent PSF | Lease Type |

| Waterfront Corporate Center III Hoboken, NJ | 2014/NAP | 14 | 507,781 | 100% | 2.0 miles | Jet.com | March 2016/ 12.0 Yrs | 39,900 | $51.50 | MG |

| Waterfront Corporate Center III Hoboken, NJ | 2014/NAP | 14 | 507,781 | 100% | 2.0 miles | Newell Rubbermaid | March 2016 / 10.5 Yrs | 99,960 | $51.00 | MG |

| Waterfront Corporate Center III Hoboken, NJ | 2014/NAP | 14 | 507,781 | 100% | 2.0 miles | NICE Systems | October 2015 / 11.0 Yrs | 59,990 | $44.00 | MG |

| Harborside Financial Center 5 Jersey City, NJ | 2002/NAP | 34 | 977,225 | 94% | 0.2 miles | Ishi Systems, Inc. | March 2013 / 10.6 Yrs | 12,365 | $37.00 | MG |

| Harborside Plaza Two Jersey City, NJ | 1930/1990 | 10 | 900,000 | 63% | 0.4 miles | Zurich Insurance | August 2016 / 15.0 Yrs | 64,414 | $41.00 | MG |

| Harborside Plaza Two Jersey City, NJ | 1930/1990 | 10 | 900,000 | 63% | 0.4 miles | Cardinia Real Estate | July 2016 / 15.0 Yrs | 79,771 | $37.50 | MG |

| Newport Office Tower Jersey City, NJ | 1990/NAP | 36 | 1,099,768 | 77% | 0.8 miles | FX Direct Dealer LLC | March 2016 / 10.7 Yrs | 15,912 | $35.00 | MG |

| Newport Office Tower Jersey City, NJ | 1990/NAP | 36 | 1,099,768 | 77% | 0.8 miles | Golden Pear Funding | April 2016 / 6.3 Yrs | 3,842 | $38.00 | MG |

| (1) | Information obtained from the appraisal and a third party market report. |

The Borrower.The borrower is 101 Hudson Realty L.L.C., a Delaware limited liability company and single purpose entity with two independent directors. Legal counsel to the borrower delivered a non-consolidation opinion in connection with the origination of the 101 Hudson Street Whole Loan. Mack-Cali Realty, L.P., is the guarantor of certain nonrecourse carveouts under the 101 Hudson Street Whole Loan.

The Sponsor.The sponsor is Mack-Cali Realty, L.P. (“Mack-Cali”). As of June 30, 2016, Mack-Cali (NYSE: CLI, rated BB+/Ba1/BB+ by Fitch, Moody’s and S&P) owned or had interests in 269 properties, including 142 office and 109 flex properties, totaling approximately 29.1 million square feet, leased to approximately 1,700 commercial tenants, and 18 multi-family rental properties containing 5,434 residential units. Mack-Cali has sponsored other real estate projects that have been the subject of mortgage loan defaults, foreclosure proceedings and deeds-in-lieu of foreclosure. See “Description of the Mortgage Pool—Default History, Bankruptcy Issues and Other Proceedings” in the Preliminary Prospectus.

Escrows.The loan documents provide for an upfront escrow at closing in the amount of $104,000 for deferred maintenance, $16,270,684 for tenant improvements and leasing commissions (“TI/LCs”) associated with eleven tenants, and $2,779,153 for rent concessions related to six tenants. The loan documents provide for the borrower to post a $19,049,837 upfront letter of credit, which encompasses the (i) TI/LCs associated with eleven tenants ($16,270,684) and (ii) rent concessions related to six tenants ($2,779,153). The loan documents do not require monthly deposits for real estate taxes, TI/LCs and replacement reserves as long as (i) no event of default has occurred or is continuing and (ii) the debt service coverage ratio is at least 1.25x. The loan documents do not require monthly deposits for insurance premiums as long as (i) no event of default has occurred or is continuing; (ii) the debt service coverage ratio is at least 1.25x; (iii) the 101 Hudson Street Property is insured via an acceptable blanket insurance policy; and (iv) the borrower provides the lender with timely proof of payment of insurance premiums.

Lockbox and Cash Management.The 101 Hudson Street Whole Loan requires a lender-controlled lockbox account, which is already in place, and that the borrower directs all tenants to pay their rents directly to such lockbox account. The loan documents also require that all rents received by the borrower or the property manager be deposited into the lockbox account within one business days of receipt. Prior to the occurrence of Cash Trap Event Period (as defined below), all funds are required to be distributed to the borrower. During a Cash Trap Event Period, all excess cash flow is required to be swept to a lender-controlled cash management account.

A “Cash Trap Event Period” will commence upon the earlier of (i) the occurrence and continuance of an event of default or (ii) the debt service coverage ratio being less than 1.25x. A Cash Trap Event Period will end, with respect to clause (i), upon the cure of such event of default; or, with respect to clause (ii), upon the debt service coverage ratio being at least 1.25x for two consecutive calendar quarters.

Property Management.The 101 Hudson Street Property is managed by an affiliate of the borrower.

Assumption.The borrower has the unlimited right to transfer the 101 Hudson Street Property, provided that certain other conditions are satisfied, including, but not limited to: (i) no event of default has occurred and is continuing; (ii) the lender’s reasonable determination that the proposed transferee and guarantor satisfy the lender’s credit review and underwriting standards, taking into consideration transferee experience, financial strength and general business standing; and (iii) if requested by the lender, rating agency confirmation from Fitch, Moody’s and Morningstar that the transfer will not result in a downgrade, withdrawal or qualification of the respective ratings assigned to the Series 2016-C36 Certificates and similar confirmations from each rating agency rating any securities backed by the 101 Hudson Street companion loans with respect to the ratings of such securities.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

Partial Release.Not permitted.

Real Estate Substitution.Not permitted.

Subordinate and Mezzanine Indebtedness.Not permitted.

Ground Lease.None.

Terrorism Insurance.The loan documents require that the “all risk” insurance policy required to be maintained by the borrower provide coverage for terrorism in an amount equal to the full replacement cost of the 101 Hudson Street Property, as well as business interruption insurance covering no less than the 18-month period following the occurrence of a casualty event, together with a six-month extended period of indemnity and subject to a cap equal to two times the premium for the casualty coverage on a stand-along basis.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| No. 3 – Plaza America I & II |

| |

| Loan Information | | Property Information |

| Mortgage Loan Seller: | Barclays Bank PLC | | Single Asset/Portfolio: | Single Asset |

| Credit Assessment (Fitch/Moody’s/Morningstar): | NR/NR/NR | | Property Type: | Office |

| Original Principal Balance(1): | $65,000,000 | | Specific Property Type: | Suburban |

| Cut-off Date Balance(1): | $65,000,000 | | Location: | Reston, VA |

| % of Initial Pool Balance: | 7.6% | | Size: | 514,615 SF |

| Loan Purpose: | Refinance | | Cut-off Date Balance Per SF(1): | $242.90 |

| Borrower Name: | Plaza Office Realty I, LLC | | Year Built/Renovated: | 1999/NAP |

| Sponsors: | Tamares Real Estate Holdings; Atlantic Realty Companies | | Title Vesting: | Fee |

| Mortgage Rate: | 4.19012% | | Property Manager: | Self-managed |

| Note Date: | July 20, 2016 | | 4thMost Recent Occupancy (As of)(4): | 75.1% (12/31/2012) |

| Anticipated Repayment Date: | NAP | | 3rdMost Recent Occupancy (As of)(4): | 82.2% (12/31/2013) |

| Maturity Date: | August 6, 2026 | | 2ndMost Recent Occupancy (As of)(4): | 83.7% (12/31/2014) |

| IO Period: | 120 months | | Most Recent Occupancy (As of)(4): | 91.9% (12/31/2015) |

| Loan Term (Original): | 120 months | | Current Occupancy (As of)(4): | 88.4% (7/1/2016) |

| Seasoning: | 3 months | | |

| Amortization Term (Original): | NAP | | Underwriting and Financial Information: |

| Loan Amortization Type: | Interest-only, Balloon | | | |

| Interest Accrual Method: | Actual/360 | | 4thMost Recent NOI: (As of)(5): | $8,380,359 (12/31/2013) |

| Call Protection: | L(27),D(86),O(7) | | 3rdMost Recent NOI (As of)(5): | $9,433,492 (12/31/2014) |

| Lockbox Type: | Hard/Upfront Cash Management | | 2ndMost Recent NOI (As of)(5): | $10,004,976 (12/31/2015) |

| Additional Debt(1)(2): | Yes | | Most Recent NOI (As of)(5): | $10,725,423 (TTM 7/31/2016) |

| Additional Debt Type(1)(2): | Pari Passu; Mezzanine | | |

| | | | U/W Revenues: | $17,034,804 |

| | | | U/W Expenses: | $5,460,995 |

| | | | U/W NOI: | $11,573,809 |

| Escrows and Reserves(3): | | | | | U/W NCF: | $10,382,024 |

| | | | | | U/W NOI DSCR(1): | 2.18x |

| Type: | Initial | Monthly | Cap (If Any) | | U/W NCF DSCR(1): | 1.96x |

| Taxes | $166,997 | $166,997 | NAP | | U/W NOI Debt Yield(1): | 9.3% |

| Insurance | $0 | Springing | NAP | | U/W NCF Debt Yield(1): | 8.3% |

| Replacement Reserves | $0 | $8,660 | $311,769 | | As-Is Appraised Value: | $195,000,000 |

| TI/LC Reserve | $4,118,237 | $64,327 | $2,315,770 | | As-Is Appraisal Valuation Date: | June 9, 2016 |

| CapTech/BB&T Reserve | $3,600,000 | $0 | NAP | | Cut-off Date LTV Ratio(1): | 64.1% |

| Free Rent/Gap Rent Reserve | $2,464,798 | $0 | NAP | | LTV Ratio at Maturity or ARD(1): | 64.1% |

| | | | | | | |

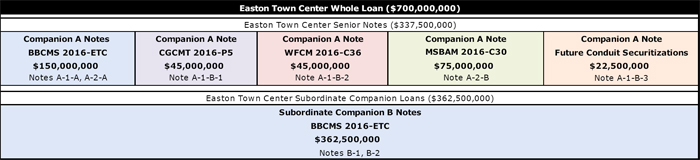

| | | | | | | | |