| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-206677-10 |

| | | |

Free Writing Prospectus

Structural and Collateral Term Sheet

$858,177,959

(Approximate Initial Pool Balance)

$757,342,000

(Approximate Aggregate Certificate Balance of Offered Certificates)

Wells Fargo Commercial Mortgage Trust 2016-C36

as Issuing Entity

Wells Fargo Commercial Mortgage Securities, Inc.

as Depositor

Barclays Bank PLC

Wells Fargo Bank, National Association

C-III Commercial Mortgage LLC

Rialto Mortgage Finance, LLC

National Cooperative Bank, N.A.

The Bancorp Bank

Basis Real Estate Capital II, LLC

as Sponsors and Mortgage Loan Sellers

Commercial Mortgage Pass-Through Certificates

Series 2016-C36

October 18, 2016

WELLS FARGO SECURITIES | | BARCLAYS |

Co-Lead Manager and Joint

Bookrunner | | Co-Lead Manager and Joint

Bookrunner |

| | | |

Academy Securities Co-Manager | | Citigroup Co-Manager |

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (‘‘SEC’’) (SEC File No. 333-206677) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter, or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-800-745-2063 (8 a.m. – 5 p.m. EST) or by emailing wfs.cmbs@wellsfargo.com.

Nothing in this document constitutes an offer of securities for sale in any jurisdiction where the offer or sale is not permitted. The information contained herein is preliminary as of the date hereof, supersedes any such information previously delivered to you and will be superseded by any such information subsequently delivered and ultimately by the final prospectus relating to the securities. These materials are subject to change, completion, supplement or amendment from time to time.

This free writing prospectus has been prepared by the underwriters for information purposes only and does not constitute, in whole or in part, a prospectus for the purposes of Directive 2003/71/EC (as amended) and/or Part VI of the Financial Services and Markets Act 2000, as amended, or other offering document.

STATEMENT REGARDING ASSUMPTIONS AS TO SECURITIES, PRICING ESTIMATES AND OTHER INFORMATION

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these securities. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the securities may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of Wells Fargo Securities, LLC, Barclays Capital Inc., Academy Securities, Inc., Citigroup Global Markets Inc., or any of their respective affiliates, make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the securities. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

This free writing prospectus contains certain forward-looking statements. If and when included in this free writing prospectus, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in customer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this free writing prospectus are made as of the date stated on the cover. We have no obligation to update or revise any forward-looking statement.

Wells Fargo Securities is the trade name for the capital markets and investment banking services of Wells Fargo & Company and its subsidiaries, including but not limited to Wells Fargo Securities, LLC, a member of NYSE, FINRA, NFA and SIPC, Wells Fargo Prime Services, LLC, a member of FINRA, NFA and SIPC, and Wells Fargo Bank, N.A. Wells Fargo Securities, LLC and Wells Fargo Prime Services, LLC are distinct entities from affiliated banks and thrifts.

IMPORTANT NOTICE REGARDING THE OFFERED CERTIFICATES

The information herein is preliminary and may be supplemented or amended prior to the time of sale. In addition, the Offered Certificates referred to in these materials and the asset pool backing them are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis.

The underwriters described in these materials may from time to time perform investment banking services for, or solicit investment banking business from, any company named in these materials. The underwriters and/or their affiliates or respective employees may from time to time have a long or short position in any security or contract discussed in these materials.

The information contained herein supersedes any previous such information delivered to any prospective investor and will be superseded by information delivered to such prospective investor prior to the time of sale.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) any representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

2

| Wells Fargo Commercial Mortgage Trust 2016-C36 | Certificate Structure |

I. Certificate Structure

| | | | | | | | | | | | | | | | | | |

| | Class | | Expected Ratings

(Fitch/Moody’s/Morningstar)(1) | | Approximate Initial Certificate Balance or Notional

Amount(2) | | Approx. Initial Credit

Support(3) | | Pass-Through Rate Description | | Weighted Average Life (Years)(4) | | Expected Principal Window(4) | | Certificate Principal to Value

Ratio(5) | | Certificate Principal U/W NOI Debt Yield(6) |

| | Offered Certificates | | | | | | | | | | | | | | |

| | A-1 | | AAAsf/Aaa(sf)/AAA | | $41,947,000 | | 30.000% | | (7) | | 2.44 | | 12/16 – 05/21 | | 41.2% | | 17.6% |

| | A-2 | | AAAsf/Aaa(sf)/AAA | | $39,657,000 | | 30.000% | | (7) | | 4.79 | | 05/21 – 10/21 | | 41.2% | | 17.6% |

| | A-3 | | AAAsf/Aaa(sf)/AAA | | $220,000,000 | | 30.000% | | (7) | | 9.70 | | 11/25 – 09/26 | | 41.2% | | 17.6% |

| | A-4 | | AAAsf/Aaa(sf)/AAA | | $250,203,000 | | 30.000% | | (7) | | 9.91 | | 09/26 – 10/26 | | 41.2% | | 17.6% |

| | A-SB | | AAAsf/Aaa(sf)/AAA | | $48,917,000 | | 30.000% | | (7) | | 7.05 | | 10/21 – 11/25 | | 41.2% | | 17.6% |

| | A-S | | AAAsf/Aa3(sf)/AAA | | $77,236,000 | | 21.000% | | (7) | | 9.95 | | 10/26 – 10/26 | | 46.5% | | 15.6% |

| | X-A | | AAAsf/Aaa(sf)/AAA | | $600,724,000(8) | | N/A | | Variable(9) | | N/A | | N/A | | N/A | | N/A |

| | X-B | | AA-sf/NR/AAA | | $120,145,000(10) | | N/A | | Variable(11) | | N/A | | N/A | | N/A | | N/A |

| | B | | AA-sf/NR/AA | | $42,909,000 | | 16.000% | | (7) | | 9.95 | | 10/26 – 10/26 | | 49.5% | | 14.7% |

| | C | | A-sf/NR/A | | $36,473,000 | | 11.750% | | (7) | | 9.95 | | 10/26 – 10/26 | | 52.0% | | 14.0% |

| | Non-Offered Certificates | | | | | | | | | | | | | | |

| | X-D | | BBB-sf/NR/AAA | | $41,836,000(12) | | N/A | | Variable(13) | | N/A | | N/A | | N/A | | N/A |

| | D | | BBB-sf/NR/BBB | | $41,836,000 | | 6.875% | | (7) | | 9.95 | | 10/26 – 10/26 | | 54.8% | | 13.2% |

| | E-1(14)(20)(26) | | BB+sf/NR/BBB | | $9,118,000(15)(21)(27) | | 5.813% | | (7) | | 9.95 | | 10/26 – 10/26 | | 55.5% | | 13.1% |

| | E-2(14)(20)(26) | | BB-sf/NR/BB+ | | $9,118,000(15)(21)(27) | | 4.750% | | (7) | | 9.95 | | 10/26 – 10/26 | | 56.1% | | 12.9% |

| | E(14) | | BB-sf/NR/BB+ | | $18,236,000(15) | | 4.750% | | N/A(16) | | 9.95 | | 10/26 – 10/26 | | 56.1% | | 12.9% |

| | F-1(17)(20)(26) | | NR/NR/BB | | $4,291,000(18)(21)(27) | | 4.250% | | (7) | | 9.95 | | 10/26 – 10/26 | | 56.4% | | 12.9% |

| | F-2(17)(20)(26) | | NR/NR/BB- | | $4,291,000(18)(21)(27) | | 3.750% | | (7) | | 9.95 | | 10/26 – 10/26 | | 56.7% | | 12.8% |

| | F(17) | | B-sf/NR/BB- | | $8,582,000(18) | | 3.750% | | N/A(19) | | 9.95 | | 10/26 – 10/26 | | 56.7% | | 12.8% |

| | EF(20) | | B-sf/NR/BB- | | $26,818,000(21) | | 3.750% | | N/A(22) | | 9.95 | | 10/26 – 10/26 | | 56.7% | | 12.8% |

| | G-1(23)(26) | | NR/NR/B | | $6,098,000(24)(27) | | 3.039% | | (7) | | 9.95 | | 10/26 – 10/26 | | 57.1% | | 12.7% |

| | G-2(23)(26) | | NR/NR/B- | | $6,098,000(24)(27) | | 2.329% | | (7) | | 9.95 | | 10/26 – 10/26 | | 57.5% | | 12.6% |

| | G(23) | | NR/NR/B- | | $12,196,000(24) | | 2.329% | | N/A(25) | | 9.95 | | 10/26 – 10/26 | | 57.5% | | 12.6% |

| | EFG(26) | | NR/NR/B- | | $39,014,000(27) | | 2.329% | | N/A(28) | | 9.95 | | 10/26 – 10/26 | | 57.5% | | 12.6% |

| | H-1(29) | | NR/NR/NR | | $9,992,979(30) | | 1.164% | | (7) | | 9.95 | | 10/26 – 10/26 | | 58.2% | | 12.5% |

| | H-2(29) | | NR/NR/NR | | $9,992,979(30) | | 0.000% | | (7) | | 9.97 | | 10/26 – 11/26 | | 58.9% | | 12.3% |

| | H(29) | | NR/NR/NR | | $19,985,958(30) | | 0.000% | | N/A(31) | | 9.96 | | 10/26 – 11/26 | | 58.9% | | 12.3% |

| | | | | | | | | | | | | | | | | | |

Notes:

| (1) | The expected ratings presented are those of Fitch Ratings, Inc. (“Fitch”), Moody’s Investors Service, Inc. (“Moody’s”) and Morningstar Credit Ratings, LLC (“Morningstar”) which the depositor hired to rate the offered certificates. One or more other nationally recognized statistical rating organizations that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise, to rate or provide market reports and/or published commentary related to the offered certificates. We cannot assure you as to what ratings a non-hired nationally recognized statistical rating organization would assign or that its reports will not express differing, possibly negative, views of the mortgage loans and/or the offered certificates. The ratings of each class of offered certificates address the likelihood of the timely distribution of interest and, except in the case of the Class X-A and X-B Certificates, the ultimate distribution of principal due on those classes on or before the Rated Final Distribution Date. See “Risk Factors—Other Risks Relating to the Certificates—Nationally Recognized Statistical Rating Organizations May Assign Different Ratings to the Certificates; Ratings of the Certificates Reflect Only the Views of the Applicable Rating Agencies as of the Dates Such Ratings Were Issued; Ratings May Affect ERISA Eligibility; Ratings May Be Downgraded” and “Ratings” in the Preliminary Prospectus, expected to be dated October 18, 2016 (the “Preliminary Prospectus”). Fitch and Moody’s have informed us that the “sf” designation in their ratings represents an identifier for structured finance product ratings. |

| (2) | The certificate balances and notional amounts set forth in the table are approximate. The actual initial certificate balances and notional amounts may be larger or smaller depending on the initial pool balance of the mortgage loans definitively included in the pool of mortgage loans, which aggregate cut-off date balance may be as much as 5% larger or smaller than the amount presented in the Preliminary Prospectus. |

| (3) | The approximate initial credit support with respect to the Class A-1, A-2, A-3, A-4 and A-SB Certificates represents the approximate credit enhancement for the Class A-1, A-2, A-3, A-4 and A-SB Certificates in the aggregate. |

| (4) | Weighted Average Lives and Expected Principal Windows are calculated based on an assumed prepayment rate of 0% CPR and the “Structuring Assumptions” described under “Yield and Maturity Considerations—Weighted Average Life” in the Preliminary Prospectus. |

| (5) | The Certificate Principal to Value Ratio for each Class of Certificates (other than the Class A-1, A-2, A-3, A-4 and A-SB Certificates) is calculated as the product of (a) the weighted average Cut-off Date LTV Ratio for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of such Class of Certificates and all Classes of Principal Balance Certificates senior to such Class of Certificates and the denominator of which is the total initial Certificate Balance of all of the Principal Balance Certificates. The Certificate Principal to Value Ratio for each of the Class A-1, A-2, A-3, A-4 and A-SB Certificates is calculated in the aggregate for those Classes as if they were a single Class and is calculated as the product of (a) the weighted average Cut-off Date LTV Ratio for the mortgage loans and (b) a fraction, the numerator of which is the total initial aggregate Certificate Balances of such Classes of Certificates and the denominator of which is the total initial Certificate Balance of all of the Principal Balance Certificates. In any event, however, excess mortgaged property value associated with a mortgage loan will not be available to offset losses on any other mortgage loan. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

3

| Wells Fargo Commercial Mortgage Trust 2016-C36 | Certificate Structure |

| (6) | The Certificate Principal U/W NOI Debt Yield for each Class of Certificates (other than the Class A-1, A-2, A-3, A-4 and A-SB Certificates) is calculated as the product of (a) the weighted average U/W NOI Debt Yield for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of all of the Classes of Principal Balance Certificates and the denominator of which is the total initial Certificate Balance for such Class of Certificates and all Classes of Principal Balance Certificates senior to such Class of Certificates. The Certificate Principal U/W NOI Debt Yield for each of the Class A-1, A-2, A-3, A-4 and A-SB Certificates is calculated in the aggregate for those Classes as if they were a single Class and is calculated as the product of (a) the weighted average U/W NOI Debt Yield for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of all of the Classes of Principal Balance Certificates and the denominator of which is the total aggregate initial Certificate Balances for the Class A-1, A-2, A-3, A-4 and A-SB Certificates. In any event, however, cash flow from each mortgaged property supports only the related mortgage loan and will not be available to support any other mortgage loan. |

| (7) | The pass-through rates for the Class A-1, A-2, A-3, A-4, A-SB, A-S, B, C, D, E-1, E-2, F-1, F-2, G-1, G-2, H-1 and H-2 Certificates in each case will be one of the following: (i) a fixed rateper annum, (ii) a variable rate per annum equal to the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, (iii) a variable rateper annum equal to the lesser of (a) a fixed rate and (b) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date or (iv) a variable rateper annum equal to the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date minus a specified percentage. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (8) | The Class X-A Certificates are notional amount certificates. The Notional Amount of the Class X-A Certificates will be equal to the aggregate Certificate Balance of the Class A-1, A-2, A-3, A-4 and A-SB Certificates outstanding from time to time. The Class X-A Certificates will not be entitled to distributions of principal. |

| (9) | The pass-through rate for the Class X-A Certificates for any distribution date will be aper annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class A-1, A-2, A-3, A-4 and A-SB Certificates for the related distribution date, weighted on the basis of their respective aggregate Certificate Balances outstanding immediately prior to that distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (10) | The Class X-B Certificates are notional amount certificates. The Notional Amount of the Class X-B Certificates will be equal to the aggregate Certificate Balance of the Class A-S and B Certificates outstanding from time to time. The Class X-B Certificates will not be entitled to distributions of principal. |

| (11) | The pass-through rate for the Class X-B Certificates for any distribution date will be aper annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class A-S and B Certificates for the related distribution date, weighted on the basis of their respective aggregate Certificate Balances outstanding immediately prior to that distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (12) | The Class X-D Certificates are notional amount certificates. The Notional Amount of the Class X-D Certificates will be equal to the Certificate Balance of the Class D Certificates outstanding from time to time. The Class X-D Certificates will not be entitled to distributions of principal. |

| (13) | The pass-through rate for the Class X-D Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the pass-through rate on the Class D Certificates for the related distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (14) | A holder of Class E-1 and E-2 Certificates may exchange such classes of certificates in the required proportion for a related amount of Class E Certificates, and a holder of Class E Certificates may exchange that class for a ratable portion of each class of the Class E-1 and E-2 Certificates. |

| (15) | On the closing date, the issuing entity will issue the Class E-1 and E-2 trust components (collectively, the “Class E Trust Components”), which will have outstanding certificate balances on the closing date of $9,118,000 and $9,118,000, respectively. The Class E-1 and E-2 Certificates and the Class E Certificates will, at all times, represent undivided beneficial ownership interests in a grantor trust that will hold such trust components. Each class of the Class E-1, E-2 and E Certificates will, at all times, represent a beneficial interest in a percentage of the outstanding certificate balance of the Class E-1 and E-2 trust components. Following any exchange of Class E-1 and E-2 Certificates for Class E Certificates or any exchange of Class E Certificates for Class E-1 and E-2 Certificates, the portion of the outstanding certificate balances of the Class E-1 and E-2 trust components that is represented by the Class E-1 and E-2 Certificates and the Class E Certificates will be increased or decreased accordingly. The initial balance of each class of the Class E-1 and E-2 Certificates shown in the table above represents the maximum principal balance of such class without giving effect to any issuance of Class E Certificates (and assuming no Class EF or EFG Certificates are issued). The initial certificate balance of the Class E Certificates shown in the table above is equal to the aggregate of the maximum initial certificate balances of the Class E-1 and E-2 Certificates, representing the maximum certificate balance of the Class E Certificates that could be issued in an exchange. The principal balance of the Class E-1 and E-2 Certificates to be issued on the closing date will be reduced, in required proportions, by an amount equal to the principal balance of the Class E Certificates issued on the closing date. |

| (16) | The Class E Certificates will not have a pass-through rate, but will be entitled to receive the sum of the interest distributable on its allocable share in the Class E-1 and Class E-2 trust components. The pass-through rates on the Class E-1 and E-2 trust components will at all times be the same as the pass-through rates of the Class E-1 and E-2 Certificates, respectively. Any distribution of interest to the Class E Certificates on the first distribution date is expected to be in an amount that would produce an effective pass-through rate equal to the weighted average of the pass-through rates of the Class E-1 and E-2 trust components for the first distribution date, weighted on the basis of their respective aggregate certificate balances outstanding immediately prior to that distribution date. |

| (17) | A holder of Class F-1 and F-2 Certificates may exchange such classes of certificates in the required proportion for a related amount of Class F Certificates, and a holder of Class F Certificates may exchange that class for a ratable portion of each class of the Class F-1 and F-2 Certificates. |

| (18) | On the closing date, the issuing entity will issue the Class F-1 and F-2 trust components (collectively, the “Class F Trust Components”), which will have outstanding certificate balances on the closing date of $4,291,000 and $4,291,000, respectively. The Class F-1 and F-2 Certificates and the Class F Certificates will, at all times, represent undivided beneficial ownership interests in a grantor trust that will hold such trust components. Each class of the Class F-1, F-2 and F Certificates will, at all times, represent a beneficial interest in a percentage of the outstanding certificate balance of the Class F-1 and F-2 trust components. Following any exchange of Class F-1 and F-2 Certificates for Class F Certificates or any exchange of Class F Certificates for Class F-1 and F-2 Certificates, the portion of the outstanding certificate balances of the Class F-1 and F-2 trust components that is represented by the Class F-1 and F-2 Certificates and the Class F Certificates will be increased or decreased accordingly. The initial balance of each class of the Class F-1 and F-2 Certificates shown in the table above represents the maximum principal balance of such class without giving effect to any issuance of Class F Certificates (and assuming no Class EF or EFG Certificates are issued). The initial certificate balance of the Class F Certificates shown in the table above is equal to the aggregate of the maximum initial certificate balances of the Class F-1 and F-2 Certificates, representing the maximum certificate balance of the Class F Certificates that could be issued in an exchange. The principal balance of the Class F-1 and F-2 Certificates to be issued on the closing date will be reduced, in required proportions, by an amount equal to the principal balance of the Class F Certificates issued on the closing date. |

| (19) | The Class F Certificates will not have a pass-through rate, but will be entitled to receive the sum of the interest distributable on its allocable share in the Class F-1 and F-2 trust components. The pass-through rates on the Class F-1 and F-2 trust components will at all times be the same as the pass-through rates of the Class F-1 and F-2 Certificates, respectively. Any distribution of interest to the Class F Certificates on the first distribution date is expected to be in an amount that would produce an effective pass-through rate equal to the weighted average of the pass-through rates of the Class F-1 and F-2 trust components for the first distribution date, weighted on the basis of their respective aggregate certificate balances outstanding immediately prior to that distribution date. |

| (20) | A holder of Class E-1, E-2, F-1 and F-2 Certificates may exchange such classes of certificates in the required proportion for a related amount of Class EF Certificates, and a holder of Class EF Certificates may exchange that class for a ratable portion of each class of the Class E-1, E-2, F-1 and F-2 Certificates. |

| (21) | Each class of the Class E-1, E-2, F-1, F-2 and EF Certificates will, at all times, represent a beneficial interest in a percentage of the outstanding certificate balance of the Class E-1, Class E-2, Class F-1 and Class F-2 trust components. Following any exchange of Class E-1, E-2, F-1 and F-2 Certificates for Class EF Certificates or any exchange of Class EF Certificates for Class E-1, E-2, F-1 and F-2 Certificates, the portion of the outstanding certificate balances of the Class E-1, Class E-2, Class F-1 and Class F-2 trust components that is represented by the Class E-1, E-2, F-1 and F-2 Certificates and the Class EF Certificates will be increased or decreased accordingly. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

4

| Wells Fargo Commercial Mortgage Trust 2016-C36 | Certificate Structure |

The initial balance of each class of the Class E-1, E-2, F-1 and F-2 Certificates shown in the table above represents the maximum principal balance of such class without giving effect to any issuance of Class EF Certificates (and assuming no Class E, F or EFG Certificates are issued). The initial certificate balance of the Class EF Certificates shown in the table above is equal to the aggregate of the maximum initial certificate balances of the Class E-1, E-2, F-1 and F-2 Certificates, representing the maximum certificate balance of the Class EF Certificates that could be issued in an exchange. The principal balance of the Class E-1, E-2, F-1 and F-2 Certificates to be issued on the closing date will be reduced, in required proportions, by an amount equal to the principal balance of the Class EF Certificates issued on the closing date.

| (22) | The Class EF Certificates will not have a pass-through rate, but will be entitled to receive the sum of the interest distributable on its allocable share in the Class E-1, Class E-2, Class F-1 and Class F-2 trust components. Any distribution of interest to the Class EF Certificates on the first distribution date is expected to be in an amount that would produce an effective pass-through rate equal to the weighted average of the pass-through rates of the Class E-1, Class E-2, Class F-1 and Class F-2 trust components for the first distribution date, weighted on the basis of their respective aggregate certificate balances outstanding immediately prior to that distribution date. |

| (23) | A holder of Class G-1 and Class G-2 Certificates may exchange such classes of certificates in the required proportion for a related amount of Class G Certificates, and a holder of Class G Certificates may exchange that class for a ratable portion of each class of the Class G-1 and G-2 Certificates. |

| (24) | On the closing date, the issuing entity will issue the Class G-1 and Class G-2 trust components (collectively, the “Class G Trust Components”), which will have outstanding certificate balances on the closing date of $6,098,000 and $6,098,000, respectively. The Class G-1 and G-2 Certificates and the Class G Certificates will, at all times, represent undivided beneficial ownership interests in a grantor trust that will hold such trust components. Each class of the Class G-1, G-2 and G Certificates will, at all times, represent a beneficial interest in a percentage of the outstanding certificate balance of the Class G-1 and Class G-2 trust components. Following any exchange of Class G-1 and G-2 Certificates for Class G Certificates or any exchange of Class G Certificates for G-1 and G-2 Certificates, the portion of the outstanding certificate balances of the Class G-1 and Class G-2 trust components that is represented by the Class G-1 and G-2 Certificates and the Class G Certificates will be increased or decreased accordingly. The initial balance of each class of the Class G-1 and G-2 Certificates shown in the table above represents the maximum principal balance of such class without giving effect to any issuance of Class G Certificates (and assuming no Class EFG Certificates are issued). The initial certificate balance of the Class G Certificates shown in the table above is equal to the aggregate of the maximum initial certificate balances of the Class G-1 and G-2 Certificates, representing the maximum certificate balance of the Class G Certificates that could be issued in an exchange. The principal balance of the Class G-1 and G-2 Certificates to be issued on the closing date will be reduced, in required proportions, by an amount equal to the principal balance of the Class G Certificates issued on the closing date. |

| (25) | The Class G Certificates will not have a pass-through rate, but will be entitled to receive the sum of the interest distributable on its allocable share in the Class G-1 and Class G-2 trust components. The pass-through rates on the Class G-1 and Class G-2 trust components will at all times be the same as the pass-through rates of the Class G-1 and G-2 Certificates, respectively. Any distribution of interest to the Class G Certificates on the first distribution date is expected to be in an amount that would produce an effective pass-through rate equal to the weighted average of the pass-through rates of the Class G-1 and Class G-2 trust components for the first distribution date, weighted on the basis of their respective aggregate certificate balances outstanding immediately prior to that distribution date. |

| (26) | A holder of Class E-1, E-2, F-1, F-2, G-1 and G-2 Certificates may exchange such classes of certificates in the required proportion for a related amount of Class EFG Certificates, and a holder of Class EFG Certificates may exchange that Class EFG for a ratable portion of each class of the Class E-1, E-2, F-1, F-2, G-1 and G-2 Certificates. |

| (27) | Each class of the Class E-1, E-2, F-1, F-2, G-1, G-2 and EFG Certificates will, at all times, represent a beneficial interest in a percentage of the outstanding certificate balance of the Class E-1, Class E-2, Class F-1, Class F-2, Class G-1 and Class G-2 trust components. Following any exchange of Class E-1, E-2, F-1, F-2, G-1 and G-2 Certificates for Class EFG Certificates or any exchange of Class EFG Certificates for Class E-1, E-2, F-1, F-2, G-1 and G-2 Certificates, the portion of the outstanding certificate balances of the Class E-1, Class E-2, Class F-1, Class F-2, Class G-1 and Class G-2 trust components that is represented by the Class E-1, E-2, F-1, F-2, G-1 and G-2 Certificates and the EFG Certificates will be increased or decreased accordingly. The initial balance of each class of the Class E-1, E-2, F-1, F-2, G-1 and G-2 Certificates shown in the table above represents the maximum principal balance of such class without giving effect to any issuance of Class EFG Certificates (and assuming no Class E, F, EF or G Certificates are issued). The initial certificate balance of the Class EFG Certificates shown in the table above is equal to the aggregate of the maximum initial certificate balances of the Class E-1, E-2, F-1, F-2, G-1 and G-2 Certificates, representing the maximum certificate balance of the Class EFG Certificates that could be issued in an exchange. The principal balance of the Class E-1, E-2, F-1, F-2, G-1 and G-2 Certificates to be issued on the closing date will be reduced, in required proportions, by an amount equal to the principal balance of the Class EFG Certificates issued on the closing date. |

| (28) | The Class EFG Certificates will not have a pass-through rate, but will be entitled to receive the sum of the interest distributable on its allocable share in the Class E-1, Class E-2, Class F-1, Class F-2, Class G-1 and Class G-2 trust components. Any distribution of interest to the Class EFG Certificates on the first distribution date is expected to be in an amount that would produce an effective pass-through rate equal to the weighted average of the pass-through rates of the Class E-1, Class E-2, Class F-1, Class F-2, Class G-1 and Class G-2 trust components for the first distribution date, weighted on the basis of their respective aggregate certificate balances outstanding immediately prior to that distribution date. |

| (29) | A holder of Class H-1 and H-2 Certificates may exchange such classes of certificates in the required proportion for a related amount of Class H Certificates, and a holder of Class H Certificates may exchange that class for a ratable portion of each class of the Class H-1 and H-2 Certificates. |

| (30) | On the closing date, the issuing entity will issue the Class H-1 and Class H-2 trust components (collectively, the “Class H Trust Components”), which will have outstanding certificate balances on the closing date of $9,992,979 and $9,992,979, respectively. The Class H-1 and H-2 Certificates and the Class H Certificates will, at all times, represent undivided beneficial ownership interests in a grantor trust that will hold such trust components. Each class of the Class H-1, H-2 and H Certificates will, at all times, represent a beneficial interest in a percentage of the outstanding certificate balance of the Class H-1 and Class H-2 trust components. Following any exchange of Class H-1 and H-2 Certificates for Class H Certificates or any exchange of Class H Certificates for Class H-1 and H-2 Certificates, the portion of the outstanding certificate balances of the Class H-1 and Class H-2 trust components that is represented by the Class H-1 and H-2 Certificates and the Class H Certificates will be increased or decreased accordingly. The initial balance of each class of the Class H-1 and H-2 Certificates shown in the table above represents the maximum principal balance of such class without giving effect to any issuance of Class H Certificates. The initial certificate balance of the Class H Certificates shown in the table above is equal to the aggregate of the maximum initial certificate balances of the Class H-1 and H-2 Certificates, representing the maximum certificate balance of the Class H Certificates that could be issued in an exchange. The principal balance of the Class H-1 and H-2 Certificates to be issued on the closing date will be reduced, in required proportions, by an amount equal to the principal balance of the Class H Certificates issued on the closing date. |

| (31) | The Class H Certificates will not have a pass-through rate, but will be entitled to receive the sum of the interest distributable on its allocable share in the Class H-1 and Class H-2 trust components. The pass-through rates on the Class H-1 and Class H-2 trust components will at all times be the same as the pass-through rates of the Class H-1 and H-2 Certificates, respectively. Any distribution of interest to the Class H Certificates on the first distribution date is expected to be in an amount that would produce an effective pass-through rate equal to the weighted average of the pass-through rates of the Class H-1 and H-2 trust components for the first distribution date, weighted on the basis of their respective aggregate certificate balances outstanding immediately prior to that distribution date. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

5

| Wells Fargo Commercial Mortgage Trust 2016-C36 | Transaction Highlights |

II. Transaction Highlights

Mortgage Loan Sellers:

Mortgage Loan Seller | | Number of

Mortgage Loans | | Number of

Mortgaged

Properties | | Aggregate Cut-off Date Balance | | % of Initial Pool

Balance |

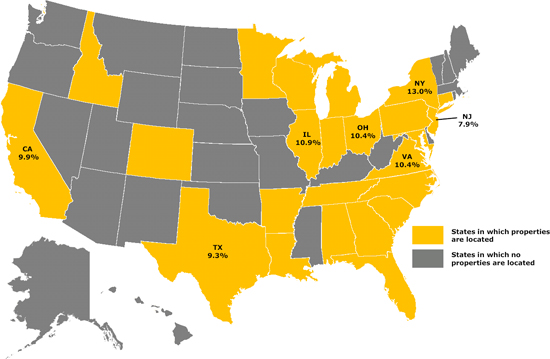

| Barclays Bank PLC(1) | | 11 | | 35 | | $266,192,284 | | 31.0% |

| Wells Fargo Bank, National Association(2) | | 9 | | 9 | | 241,981,505 | | 28.2 |

| C-III Commercial Mortgage LLC | | 19 | | 20 | | 102,618,218 | | 12.0 |

| Rialto Mortgage Finance, LLC | | 15 | | 15 | | 97,829,277 | | 11.4 |

| National Cooperative Bank, N.A. | | 10 | | 10 | | 72,468,927 | | 8.4 |

| The Bancorp Bank | | 7 | | 7 | | 46,590,624 | | 5.4 |

| Basis Real Estate Capital II, LLC | | 2 | | 2 | | 30,497,124 | | 3.6 |

Total | | 73 | | 98 | | $858,177,959 | | 100.0% |

|

| (1) | One mortgage loan secured by the mortgaged property identified on Annex A-1 to the Preliminary Prospectus as Easton Town Center, representing approximately 5.2% of the aggregate principal balance of the pool of mortgage loans as of the cut-off date, is part of a whole loan that was co-originated by Barclays and Morgan Stanley Mortgage Capital Bank, N.A (“MS”). One mortgage loan secured by the mortgaged property identified on Annex A-1 to the Preliminary Prospectus as Gas Company Tower & World Trade Center Parking Garage, representing approximately 1.7% of the aggregate principal balance of the pool of mortgage loans as of the cut-off date, is part of a whole loan that was co-originated by Barclays and Deutsche Bank AG, New York Branch (“DB”). |

| (2) | One mortgage loan secured by the mortgaged property identified on Annex A-1 to the Preliminary Prospectus as Gurnee Mills, representing approximately 9.3% of the aggregate principal balance of the pool of mortgage loans as of the cut-off date, is part of a whole loan that was co-originated by WFB, Column Financials, Inc. (“Column”) and Regions Bank (“Regions”). In addition, one mortgage loan secured by the mortgaged property identified on Annex A-1 to the Preliminary Prospectus as 101 Hudson Street, representing approximately 7.9% of the aggregate principal balance of the pool of mortgage loans as of the cut-off date, is part of a whole loan that was co-originated by WFB, Bank of America, N.A. (“BANA”) and Barclays. |

Loan Pool:

| Initial Pool Balance: | $858,177,959 |

| Number of Mortgage Loans: | 73 |

| Average Cut-off Date Balance per Mortgage Loan: | $11,755,862 |

| Number of Mortgaged Properties: | 98 |

| Average Cut-off Date Balance per Mortgaged Property(1): | $8,756,918 |

| Weighted Average Mortgage Interest Rate: | 4.218% |

| Ten Largest Mortgage Loans as % of Initial Pool Balance: | 50.8% |

| Weighted Average Original Term to Maturity (months): | 118 |

| Weighted Average Remaining Term to Maturity (months): | 116 |

| Weighted Average Original Amortization Term (months)(2): | 357 |

| Weighted Average Remaining Amortization Term (months)(2): | 355 |

| Weighted Average Seasoning (months): | 2 |

|

| (1) | Information regarding mortgage loans secured by multiple properties is based on an allocation according to relative appraised values or the allocated loan amounts or property-specific release prices set forth in the related loan documents or such other allocation as the related mortgage loan seller deemed appropriate. |

| (2) | Excludes any mortgage loan that does not amortize. |

Credit Statistics:

| Weighted Average U/W Net Cash Flow DSCR(1): | 2.30x |

| Weighted Average U/W Net Operating Income Debt Yield(1): | 12.3% |

| Weighted Average Cut-off Date Loan-to-Value Ratio(1): | 58.9% |

| Weighted Average Balloon Loan-to-Value Ratio(1): | 50.9% |

| % of Mortgage Loans with Additional Subordinate Debt(2): | 19.3% |

| % of Mortgage Loans with Single Tenants(3): | 1.2% |

|

| (1) | With respect to any mortgage loan that is part of a whole loan, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the relatedpari passu companion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). For mortgaged properties securing residential cooperative mortgage loans, the debt service coverage ratio and debt yield for each such mortgaged property is calculated using U/W Net Operating Income or U/W Net Cash Flow, as applicable, for the related residential cooperative property which is the projected net operating income or net cash flow, as applicable, reflected in the most recent appraisal obtained by or otherwise in the possession of the related mortgage loan seller as of the cut-off date, and the loan-to-value ratio is calculated based upon the appraised value of the residential cooperative property determined as if such residential cooperative property is operated as a residential cooperative. The debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property), that currently exists or is allowed under the terms of any mortgage loan. |

| (2) | Five (5) of the mortgage loans, each of which is secured by a residential cooperative property, currently have in place subordinate secured lines of credit to the related mortgage borrowers that permit future advances (such loans, collectively, the “Subordinate Coop LOCs”). The percentage figure expressed as “% of Mortgage Loans with Additional Subordinate Debt” is determined as a percentage of the initial pool balance and does not take into account any future subordinate debt (whether or not secured by the mortgaged property), if any, that may be permitted under the terms of any mortgage loan or the pooling and servicing agreement. See “Description of the Mortgage Pool—Additional Indebtedness—Other Unsecured Indebtedness” and “Description of the Mortgage Pool—Additional Debt Financing for Mortgage Loans Secured by Residential Cooperatives” in the Preliminary Prospectus. |

| (3) | Excludes mortgage loans that are secured by multiple single tenant properties. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

6

| Wells Fargo Commercial Mortgage Trust 2016-C36 | Transaction Highlights |

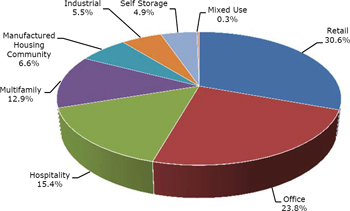

Loan Structural Features:

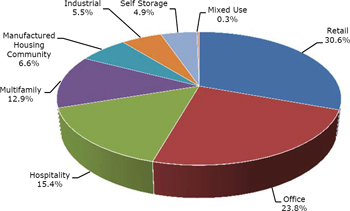

Amortization:Based on the Initial Pool Balance, 69.4% of the mortgage pool (61 mortgage loans) has scheduled amortization, as follows:

56.8% (49 mortgage loans) requires amortization during the entire loan term; and

12.5% (12 mortgage loans) provides for an interest-only period followed by an amortization period.

Interest-Only:Based on the Initial Pool Balance, 30.6% of the mortgage pool (12 mortgage loans) provides for interest-only payments during the entire loan term. The Weighted Average Cut-off Date Loan-to-Value Ratio and Weighted Average U/W Net Cash Flow DSCR for those mortgage loans are 48.8% and 3.20x, respectively.

Hard Lockboxes: Based on the Initial Pool Balance, 48.9% of the mortgage pool (14 mortgage loans) have hard lockboxes in place.

Reserves: The mortgage loans require amounts to be escrowed monthly as follows (excluding any mortgage loans with springing provisions):

| | Real Estate Taxes: | 74.8% of the pool |

| | Insurance: | 34.9% of the pool |

| | Capital Replacements: | 61.8% of the pool |

| | TI/LC: | 51.0% of the pool(1) |

| | (1) The percentage of Initial Pool Balance for mortgage loans with TI/LC reserves is based on the aggregate principal balance allocable to loans that include retail, office, mixed use and industrial properties. |

Call Protection/Defeasance: Based on the Initial Pool Balance, the mortgage pool has the following call protection and defeasance features:

73.3% of the mortgage pool (57 mortgage loans) features a lockout period, then defeasance only until an open period;

11.0% of the mortgage pool (four mortgage loans) features a lockout period, then the greater of a prepayment premium or yield maintenance until an open period;

8.4% of the mortgage pool (10 mortgage loans) features no lockout period, but requires the greater of a prepayment premium or yield maintenance, then a prepayment premium until an open period;

5.2% of the mortgage pool (one mortgage loan) features no lockout period, but requires the greater of a prepayment premium or yield maintenance, then defeasance or the greater of a prepayment premium or yield maintenance until an open period; and

2.0% of the mortgage pool (one mortgage loan) features a lockout period, then defeasance or the greater of a prepayment premium or yield maintenance until an open period.

Please refer to Annex A-1 and the footnotes related thereto to the Preliminary Prospectus for further information regarding individual loan call protection.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

7

| Wells Fargo Commercial Mortgage Trust 2016-C36 | Issue Characteristics |

| III. | Issue Characteristics | | |

| | | | |

| | Securities Offered: | | $757,342,000 approximate monthly pay, multi-class, commercial mortgage REMIC pass-through certificates consisting of ten classes (Classes A-1, A-2, A-3, A-4, A-SB, A-S, B, C, X-A and X-B), which are offered pursuant to a registration statement filed with the SEC (such classes of certificates, the “Offered Certificates”). |

| | | | |

| | Mortgage Loan Sellers: | | Barclays Bank PLC (“Barclays”), Wells Fargo Bank, National Association (“WFB”), C-III Commercial Mortgage LLC (“CIIICM”), Rialto Mortgage Finance, LLC (“RMF”), National Cooperative Bank, N.A. (“NCB”), The Bancorp Bank (“Bancorp”) and Basis Real Estate Capital II, LLC (“Basis”). |

| | | | |

| | Joint Bookrunners and Co-Lead Managers: | | Wells Fargo Securities, LLC and Barclays Capital Inc. |

| | | | |

| | Co-Managers: | | Academy Securities, Inc. and Citigroup Global Markets Inc. |

| | | | |

| | Rating Agencies: | | Fitch Ratings, Inc., Moody’s Investors Service, Inc. and Morningstar Credit Ratings, LLC |

| | | | |

| | Master Servicers: | | Wells Fargo Bank, National Association and National Cooperative Bank, N.A. |

| | | | |

| | Special Servicers: | | C-III Asset Management LLC and National Cooperative Bank, N.A. |

| | | | |

| | Certificate Administrator: | | Wells Fargo Bank, National Association |

| | | | |

| | Trustee: | | Wilmington Trust, National Association |

| | | | |

| | Operating Advisor: | | Park Bridge Lender Services LLC |

| | | | |

| | Asset Representations Reviewer: | | Park Bridge Lender Services LLC |

| | | | |

| | Initial Majority Controlling Class Certificateholder: | | C-III Investment Management LLC or an affiliate |

| | | | |

| | Cut-off Date: | | The Cut-off Date with respect to each mortgage loan is the due date for the monthly debt service payment that is due in November 2016 (or, in the case of any mortgage loan that has its first due date in December 2016, the date that would have been its due date in November 2016 under the terms of that mortgage loan if a monthly debt service payment were scheduled to be due in that month). |

| | | | |

| | Expected Closing Date: | | On or about November 3, 2016. |

| | | | |

| | Determination Dates: | | The 11th day of each month (or if that day is not a business day, the next succeeding business day), commencing in December 2016. |

| | | | |

| | Distribution Dates: | | The fourth business day following the Determination Date in each month, commencing in December 2016. |

| | | | |

| | Rated Final Distribution Date: | | The Distribution Date in November 2059. |

| | | | |

| | Interest Accrual Period: | | With respect to any Distribution Date, the calendar month immediately preceding the month in which such Distribution Date occurs. |

| | | | |

| | Day Count: | | The Offered Certificates will accrue interest on a 30/360 basis. |

| | | | |

| | Minimum Denominations: | | $10,000 for each Class of Offered Certificates (other than the Class X-A and X-B Certificates) and $1,000,000 for the Class X-A and X-B Certificates. Investments may also be made in any whole dollar denomination in excess of the applicable minimum denomination. |

| | | | |

| | Clean-up Call: | | 1.0% |

| | | | |

| | Delivery: | | DTC, Euroclear and Clearstream Banking |

| | | | |

| | ERISA/SMMEA Status: | | Each Class of Offered Certificates is expected to be eligible for exemptive relief under ERISA. No Class of Offered Certificates will be SMMEA eligible. |

| | | | |

| | Risk Factors: | | THE CERTIFICATES INVOLVE CERTAIN RISKS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. SEE THE “RISK FACTORS” SECTION OF THE PRELIMINARY PROSPECTUS. |

| | | | |

| | Bond Analytics Information: | | The Certificate Administrator will be authorized to make distribution date statements, CREFC® reports and certain supplemental reports (other than confidential information) available to certain financial modeling and data provision services, including Bloomberg, L.P., Trepp, LLC, Intex Solutions, Inc., Moody’s Analytics, Markit Group Limited, Interactive Data Corp., BlackRock Financial Management, Inc., CMBS.com, Inc. and Thomson Reuters Corporation. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

8

| Wells Fargo Commercial Mortgage Trust 2016-C36 | Characteristics of the Mortgage Pool |

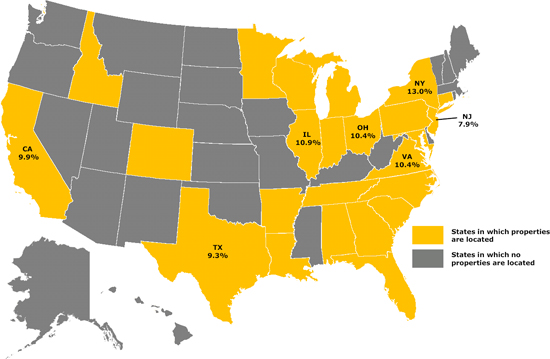

| IV. | Characteristics of the Mortgage Pool(1) |

| A. | Ten Largest Mortgage Loans |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Mortgage

Loan

Seller | | Mortgage Loan Name | | City | | State | | Number of Mortgage Loans / Mortgaged Properties | | Mortgage Loan

Cut-off Date

Balance ($) | | % of

Initial

Pool

Balance

(%) | | Property

Type | | Number of

SF / Rooms /

Units | | Cut-off Date Balance

Per

SF /Room/

Unit | | Cut-off

Date LTV

Ratio (%) | | Balloon

LTV

Ratio (%) | | U/W

NCF

DSCR (x) | | U/W NOI

Debt

Yield (%) |

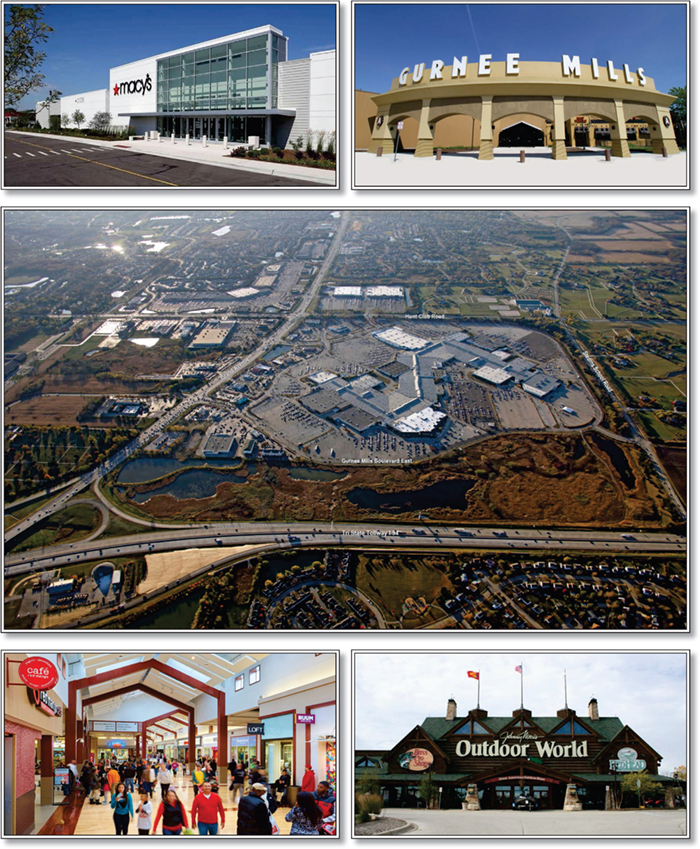

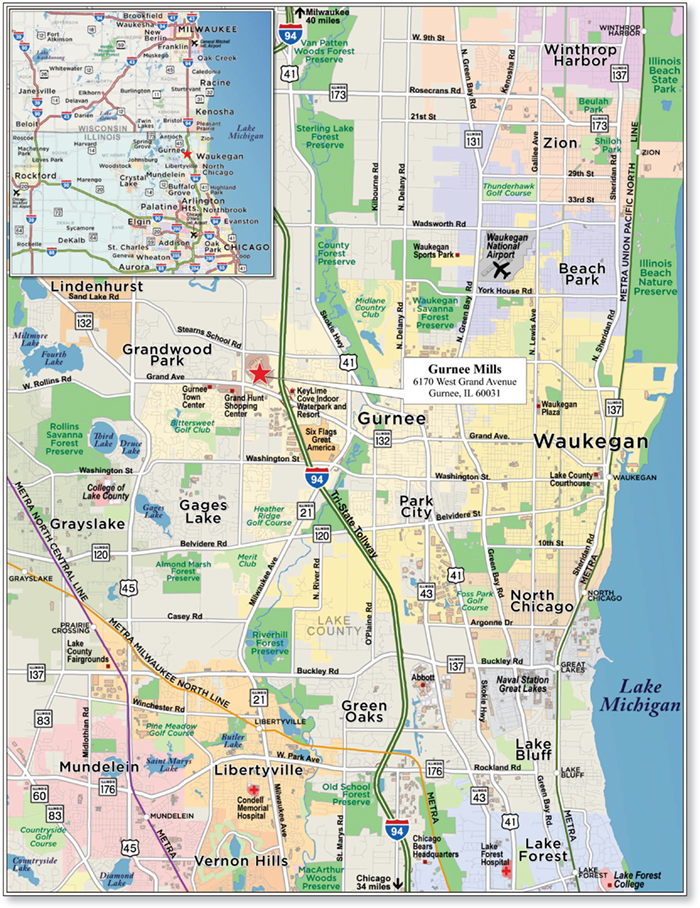

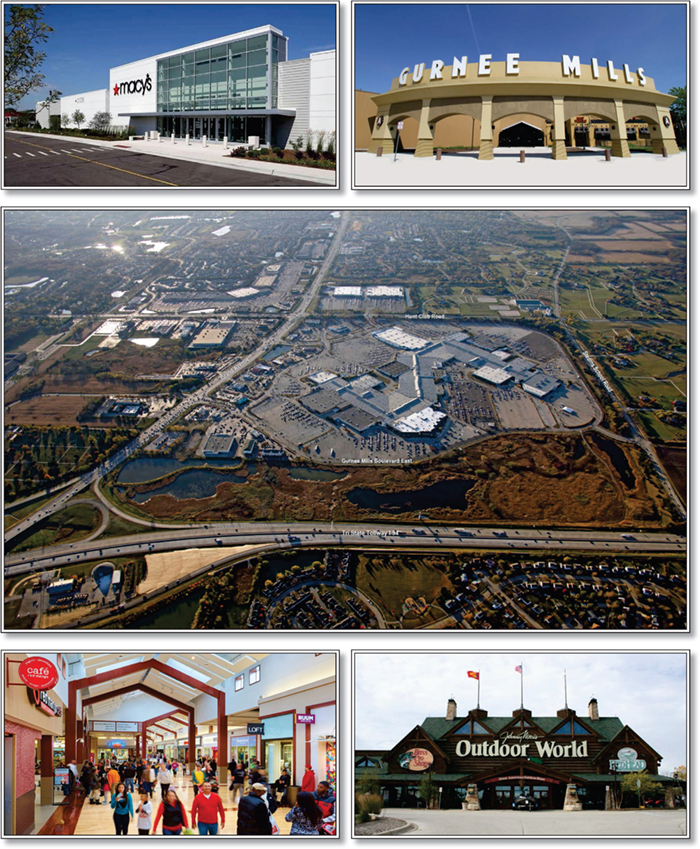

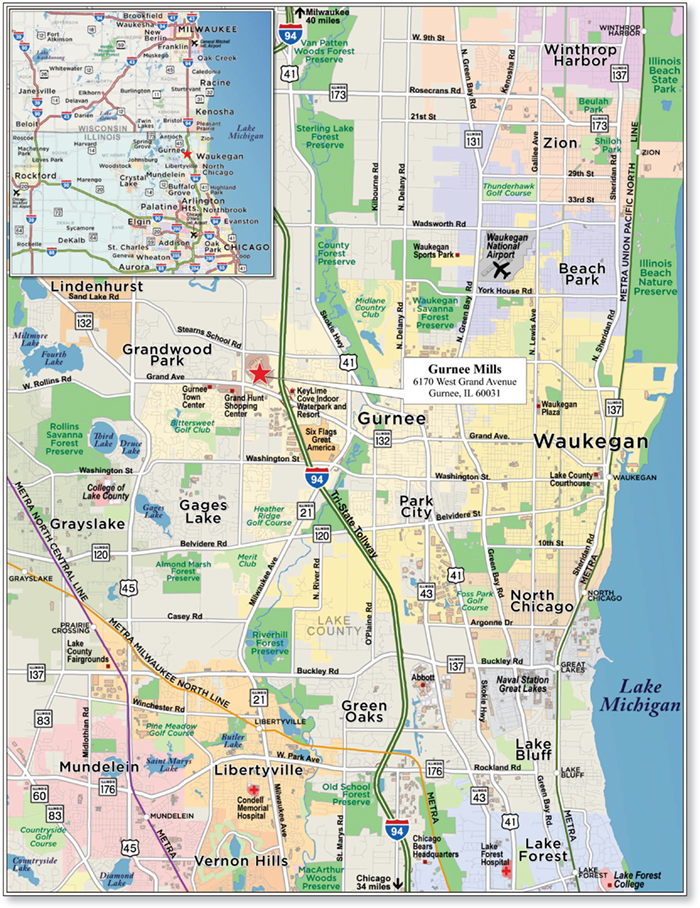

| WFB | | Gurnee Mills | | Gurnee | | IL | | 1 / 1 | | $79,893,396 | | | 9.3 | % | | Retail | | 1,683,915 | | $163 | | 65.9 | % | | 52.4 | % | | 1.60 | x | | 9.7 | % |

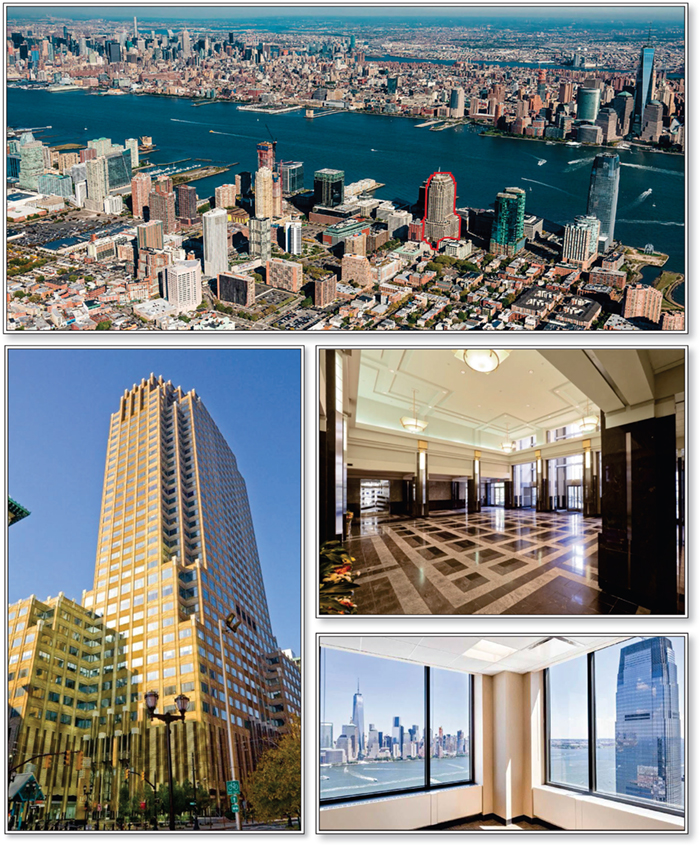

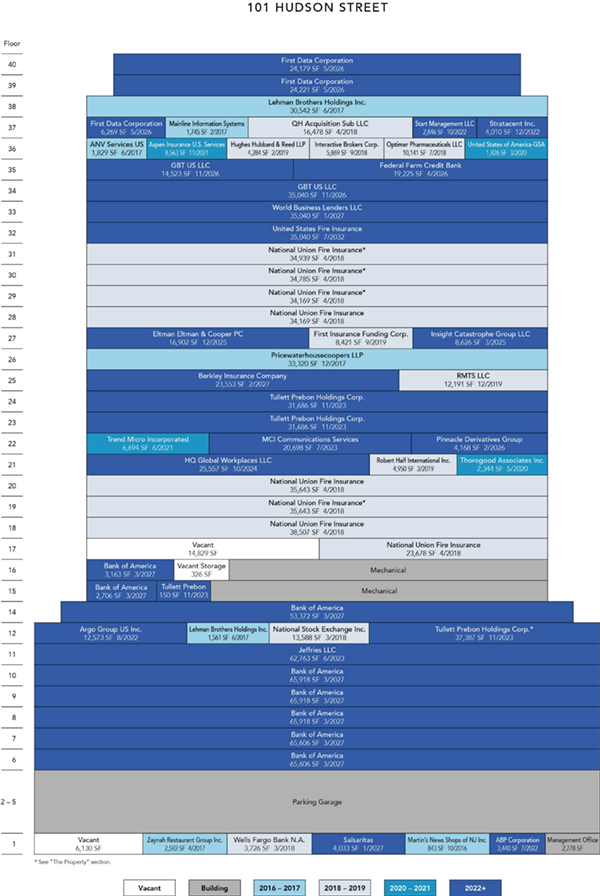

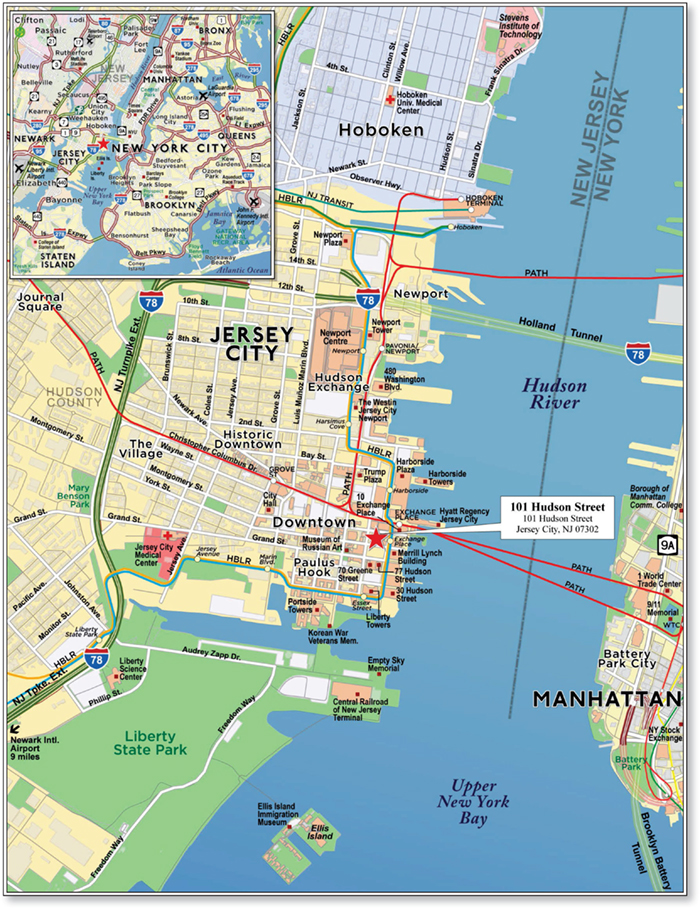

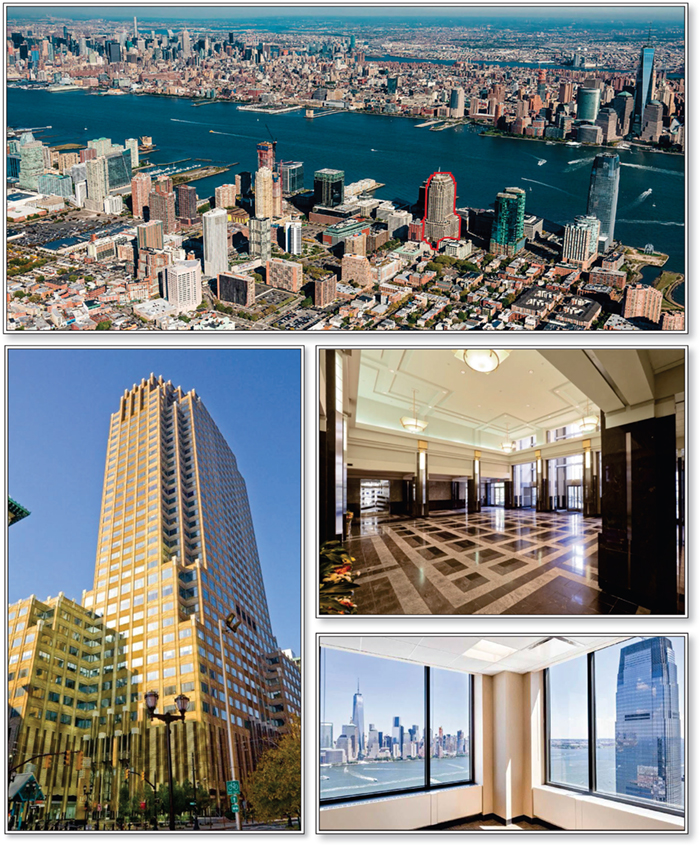

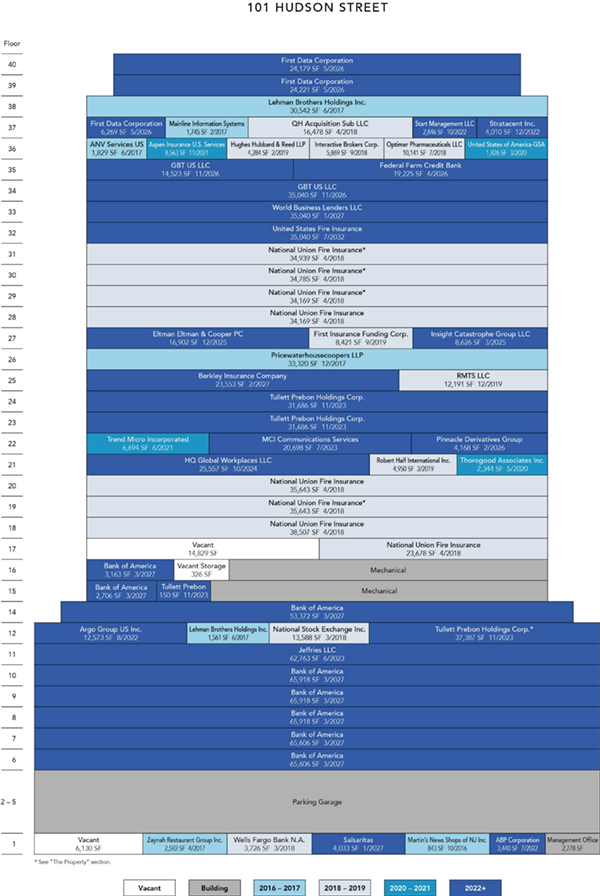

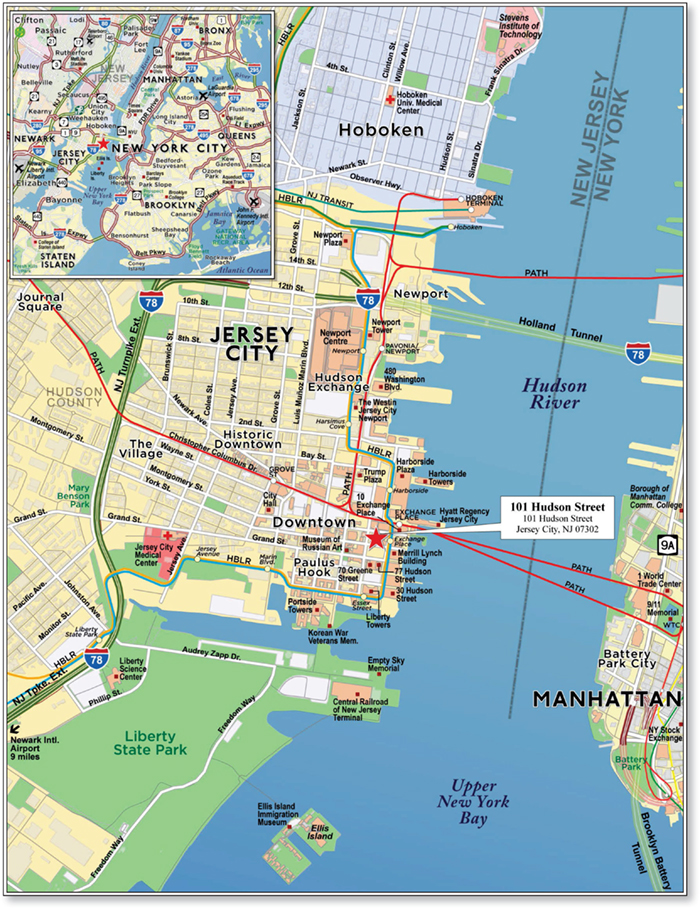

| WFB | | 101 Hudson Street | | Jersey City | | NJ | | 1 / 1 | | 67,500,000 | | | 7.9 | | | Office | | 1,341,649 | | 186 | | 51.8 | | | 51.8 | | | 3.68 | | | 12.9 | |

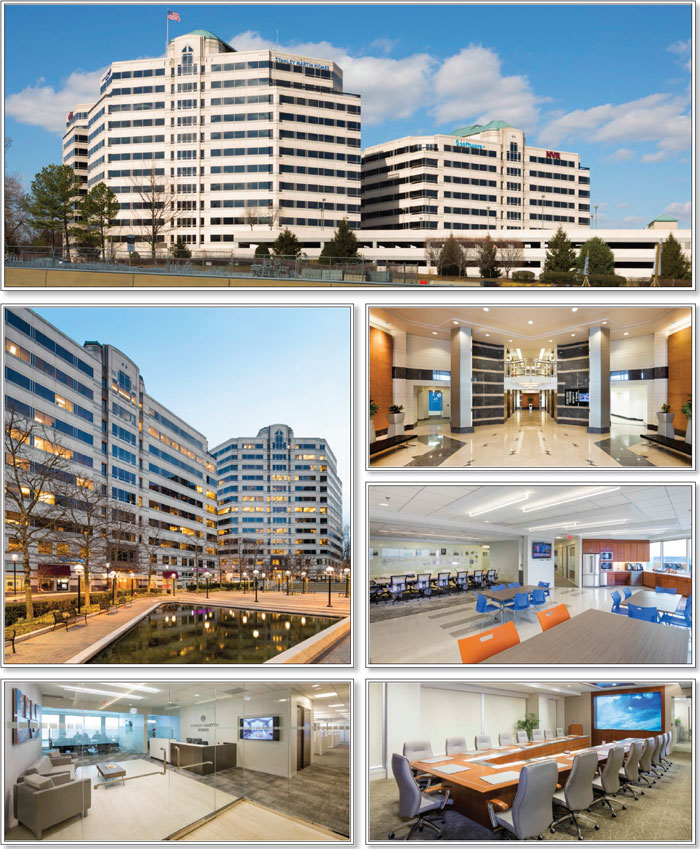

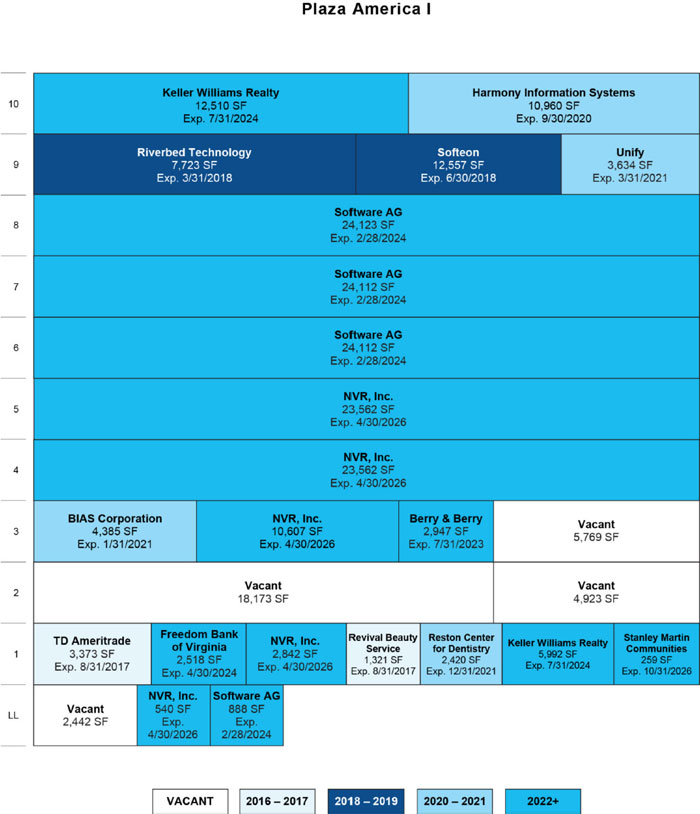

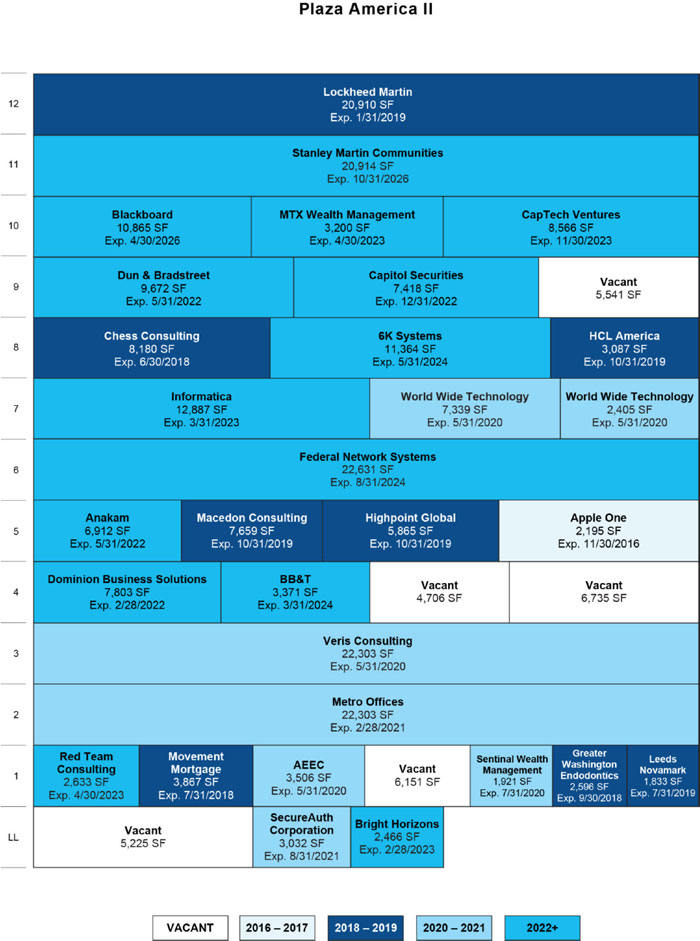

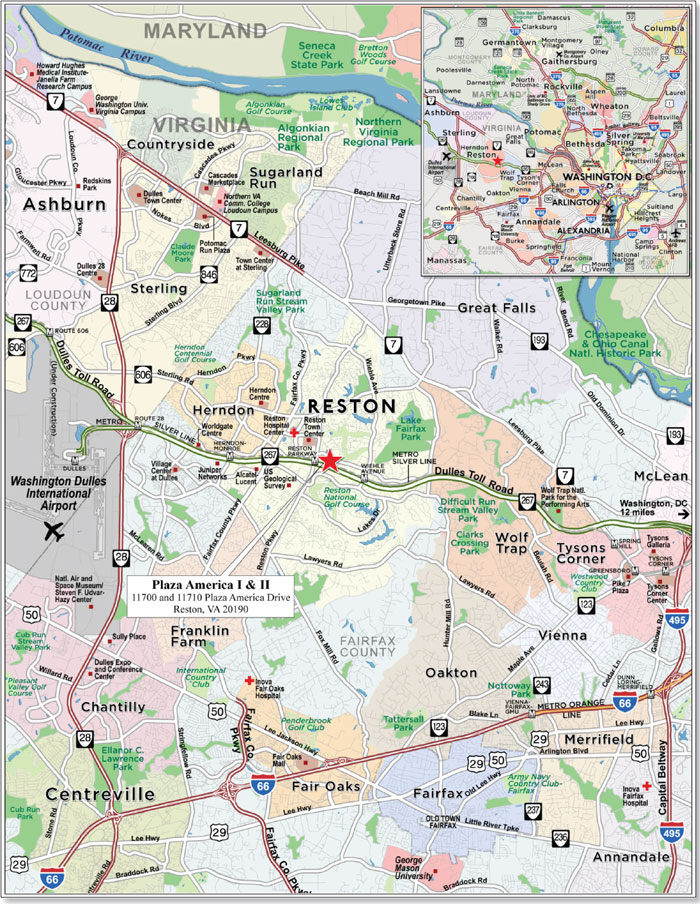

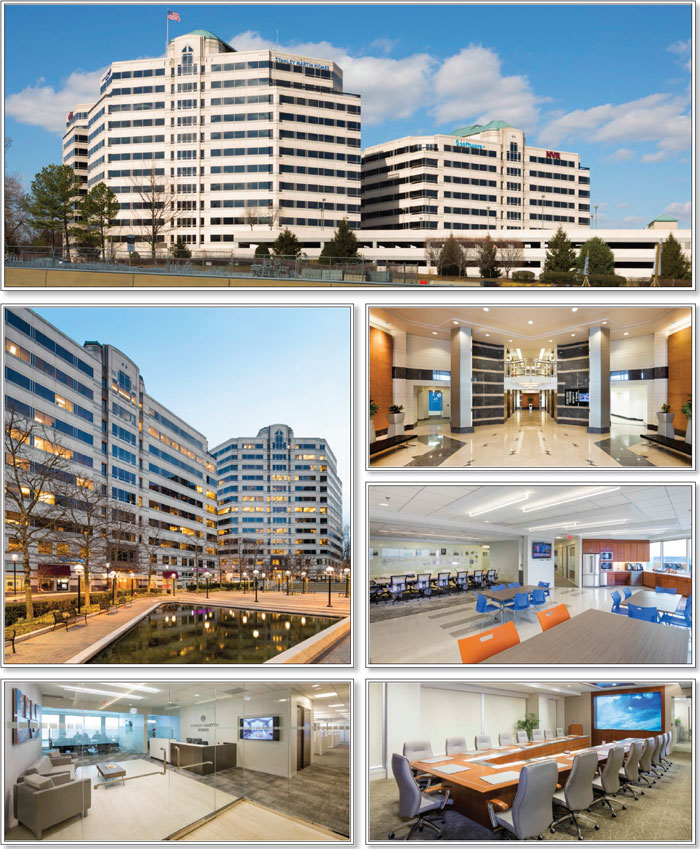

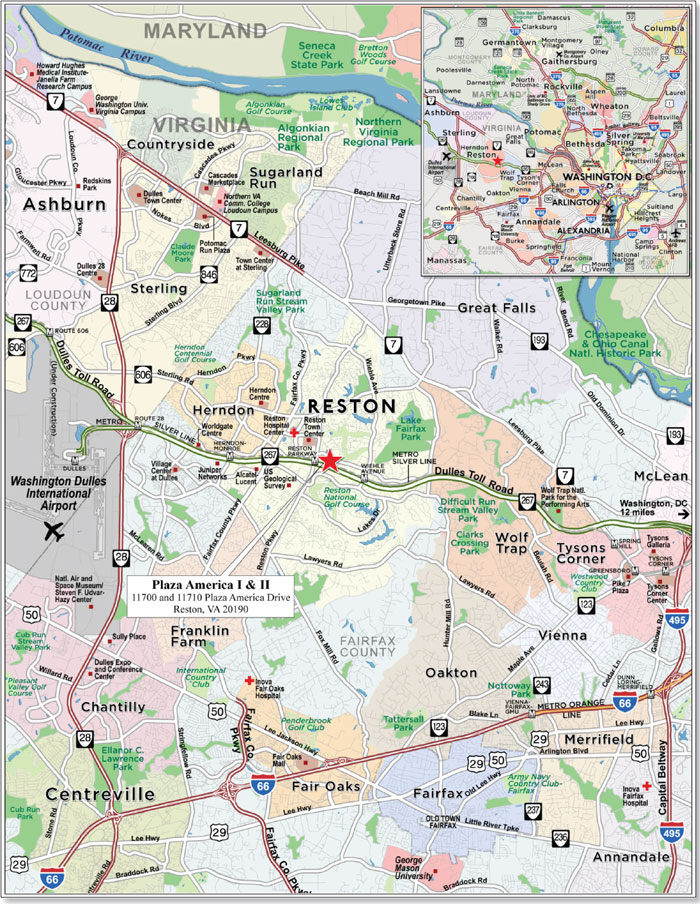

| Barclays | | Plaza America I & II | | Reston | | VA | | 1 / 1 | | 65,000,000 | | | 7.6 | | | Office | | 514,615 | | 243 | | 64.1 | | | 64.1 | | | 1.96 | | | 9.3 | |

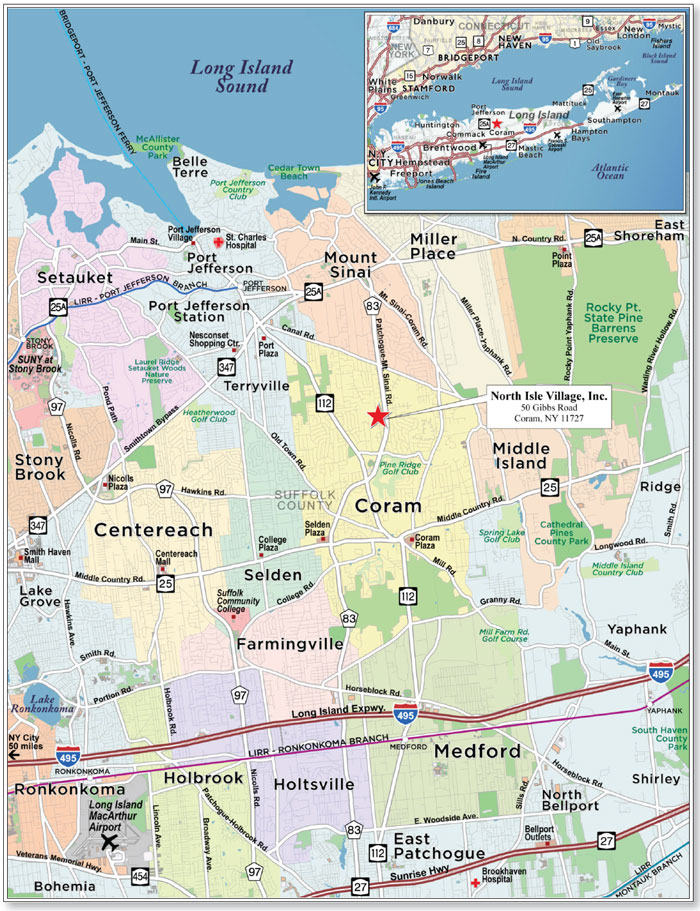

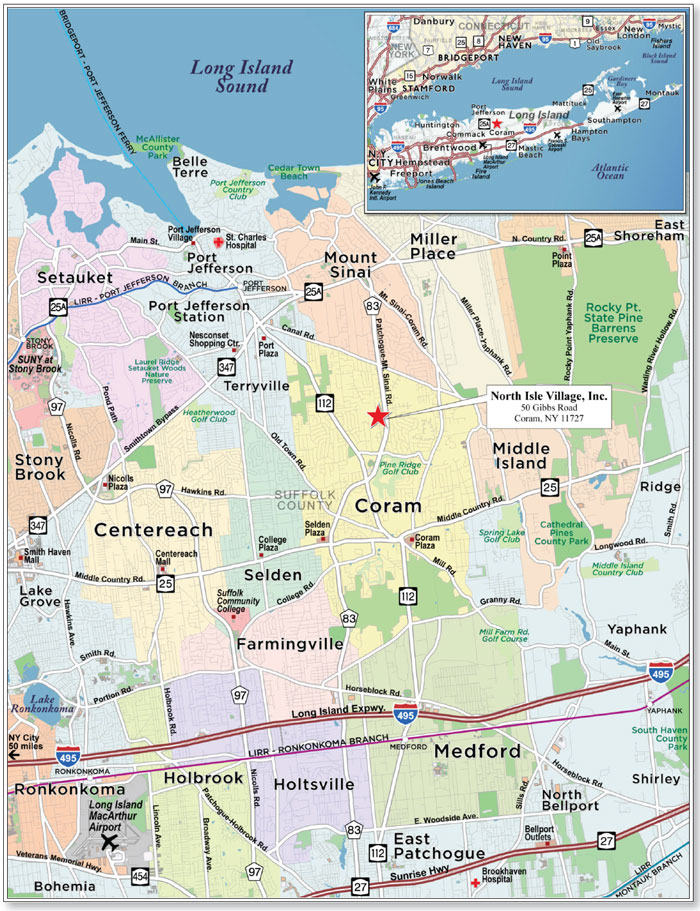

| NCB | | North Isle Village, Inc. | | Coram | | NY | | 1 / 1 | | 45,933,875 | | | 5.4 | | | Multifamily | | 763 | | 60,202 | | 52.8 | | | 41.5 | | | 2.65 | | | 14.8 | |

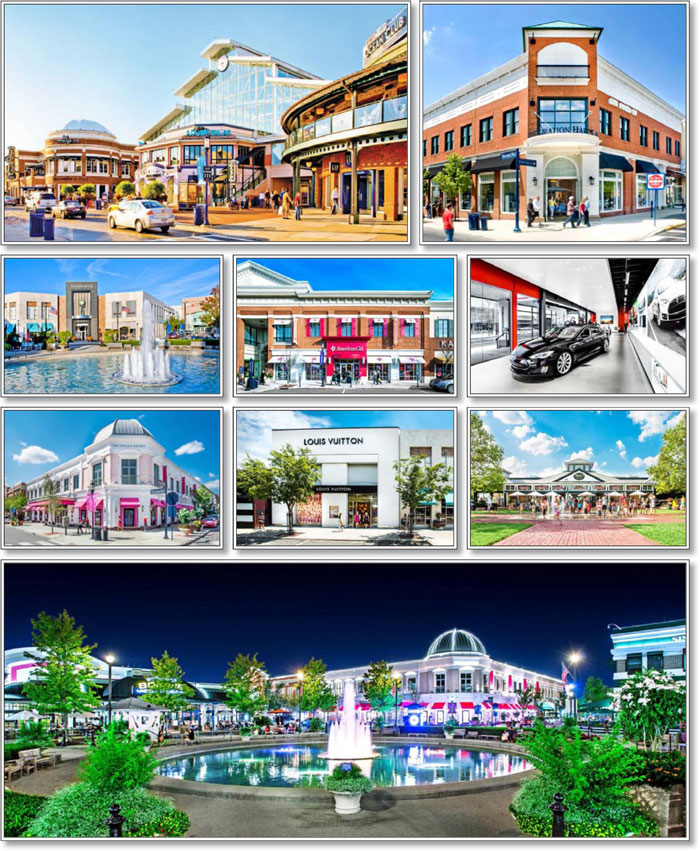

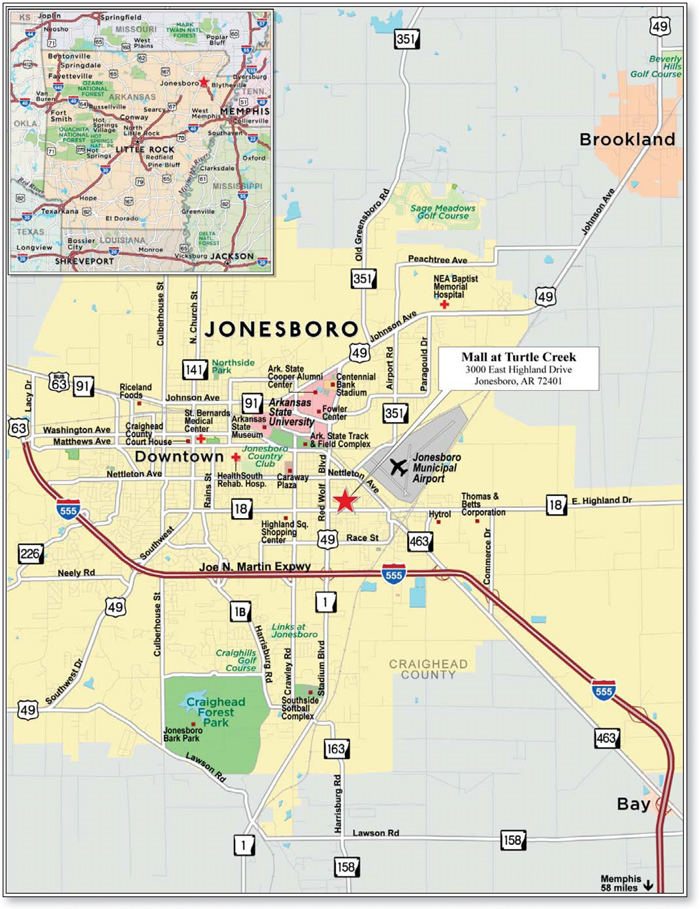

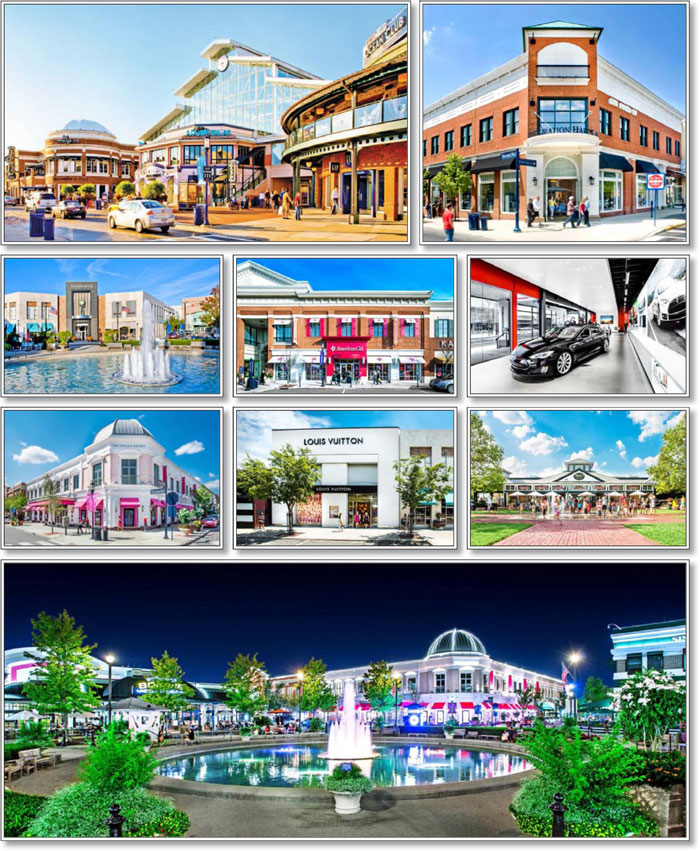

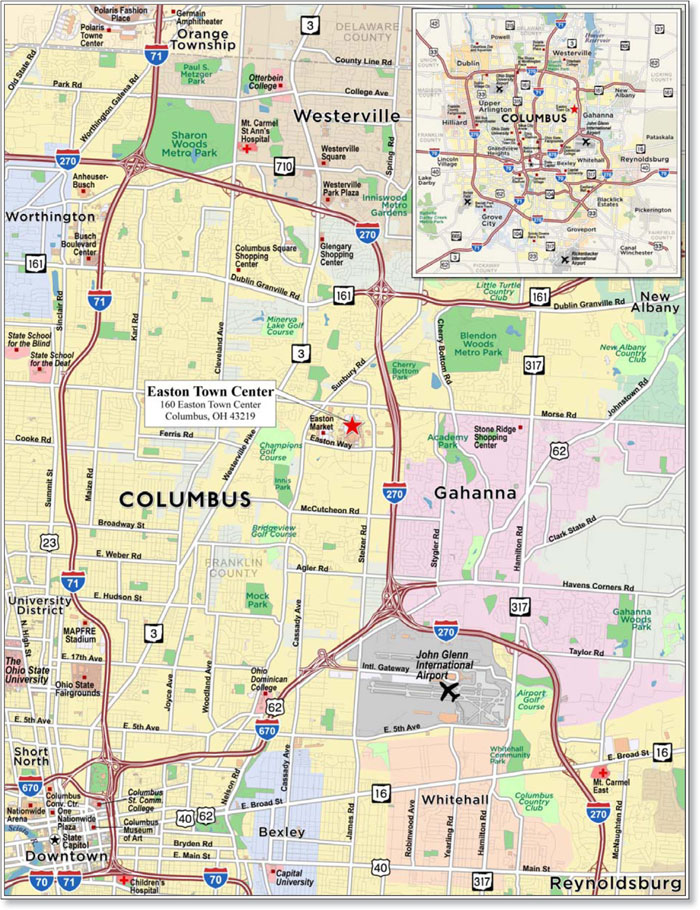

| Barclays | | Easton Town Center | | Columbus | | OH | | 1 / 1 | | 45,000,000 | | | 5.2 | | | Retail | | 1,303,073 | | 259 | | 28.5 | | | 28.5 | | | 4.02 | | | 15.4 | |

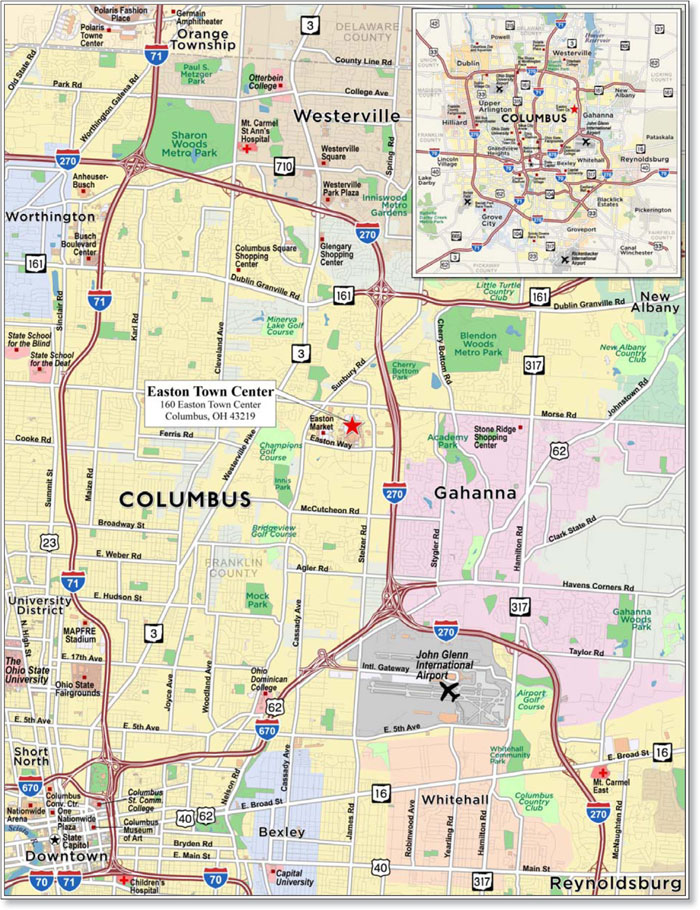

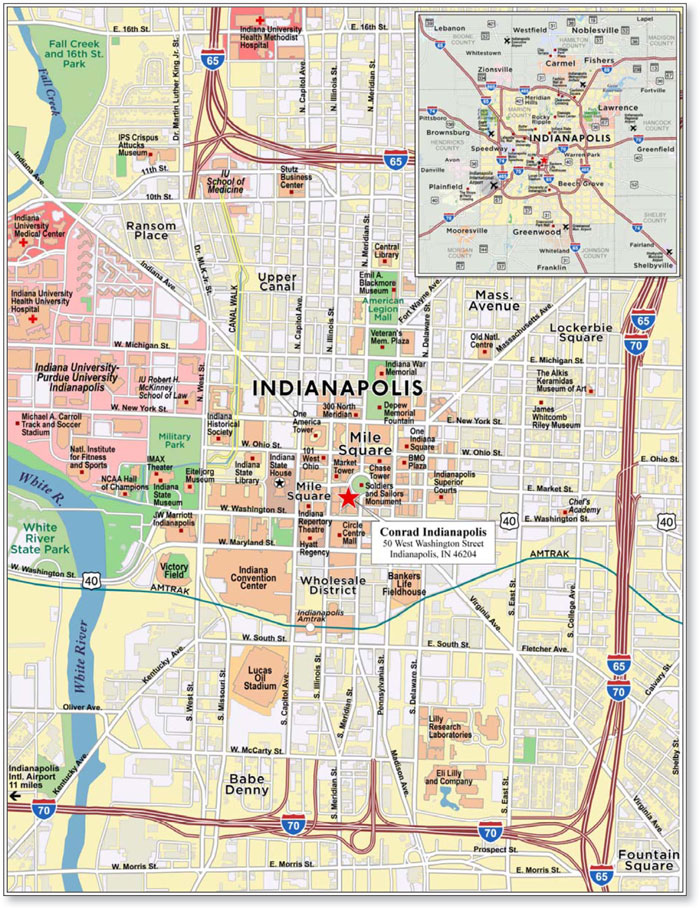

| WFB | | Conrad Indianapolis | | Indianapolis | | IN | | 1 / 1 | | 31,962,031 | | | 3.7 | | | Hospitality | | 247 | | 225,239 | | 64.8 | | | 52.5 | | | 1.71 | | | 12.6 | |

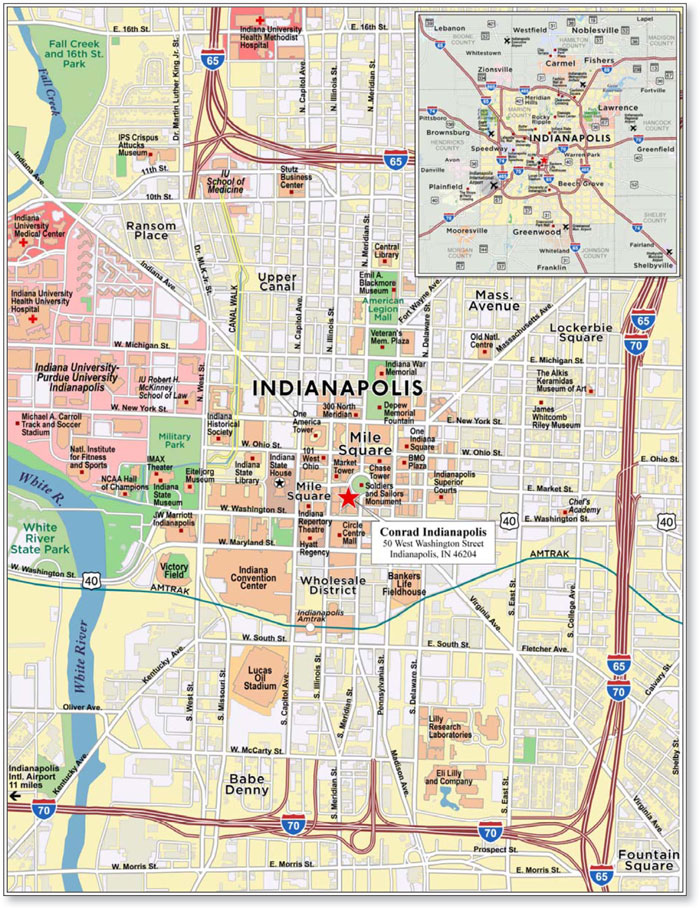

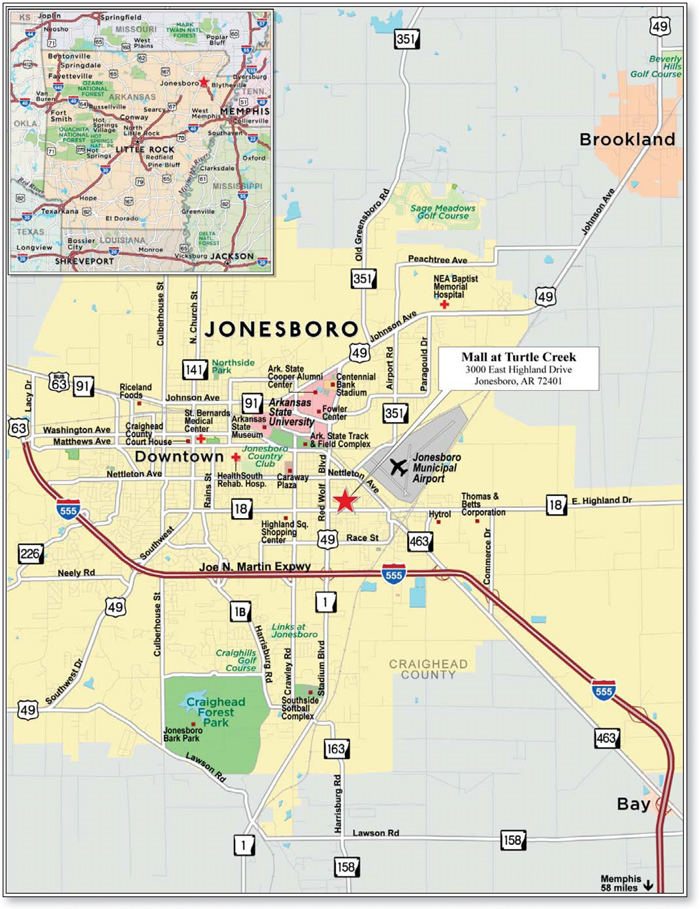

| Barclays | | Mall at Turtle Creek | | Jonesboro | | AR | | 1 / 1 | | 29,683,636 | | | 3.5 | | | Retail | | 329,398 | | 217 | | 55.0 | | | 45.1 | | | 1.57 | | | 10.7 | |

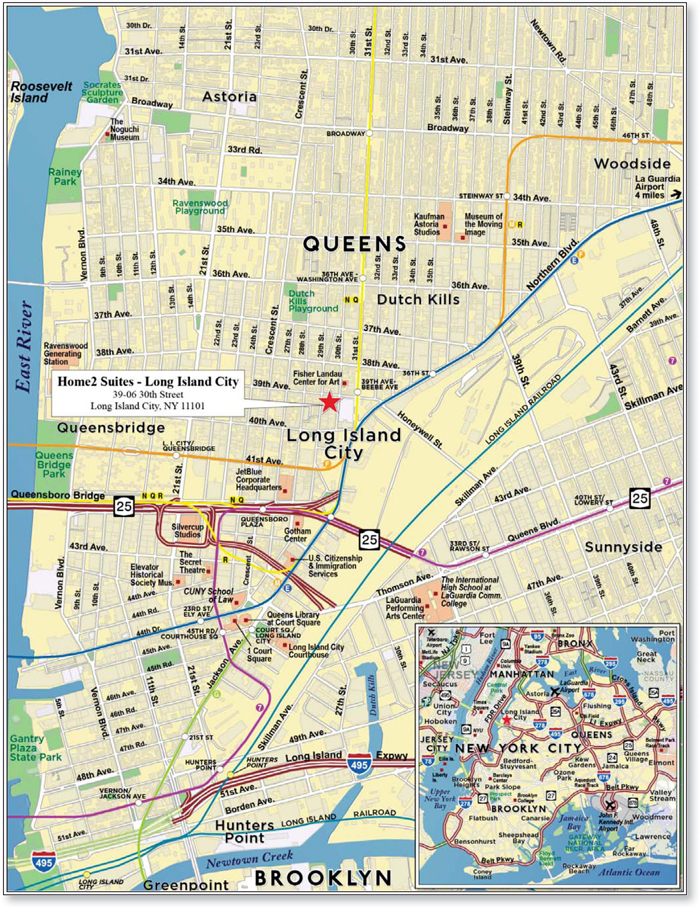

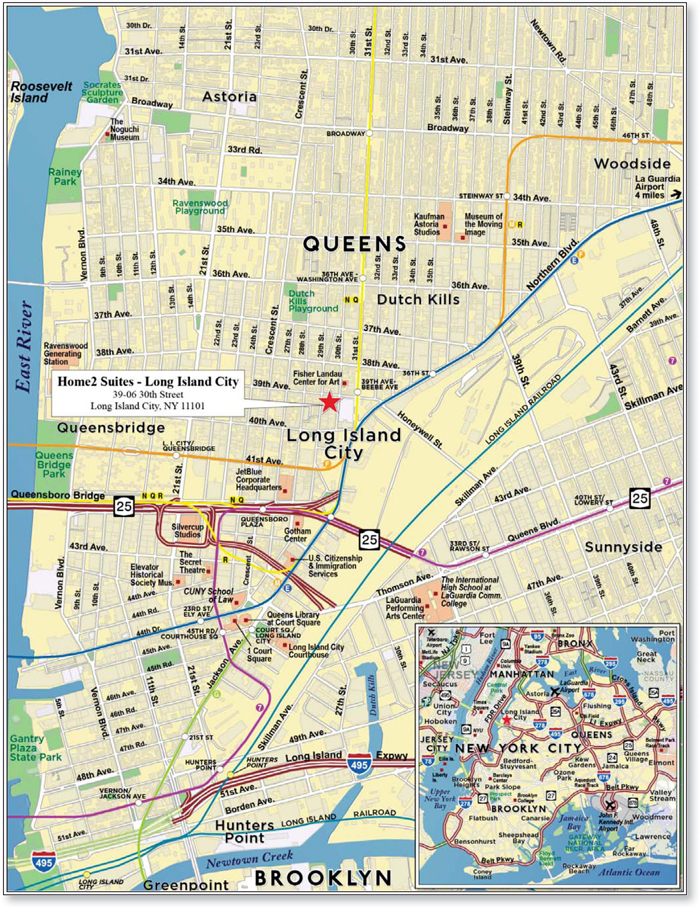

| Basis | | Home2 Suites - Long Island City | | Long Island City | | NY | | 1 / 1 | | 24,973,745 | | | 2.9 | | | Hospitality | | 115 | | 217,163 | | 61.2 | | | 50.5 | | | 1.53 | | | 11.0 | |

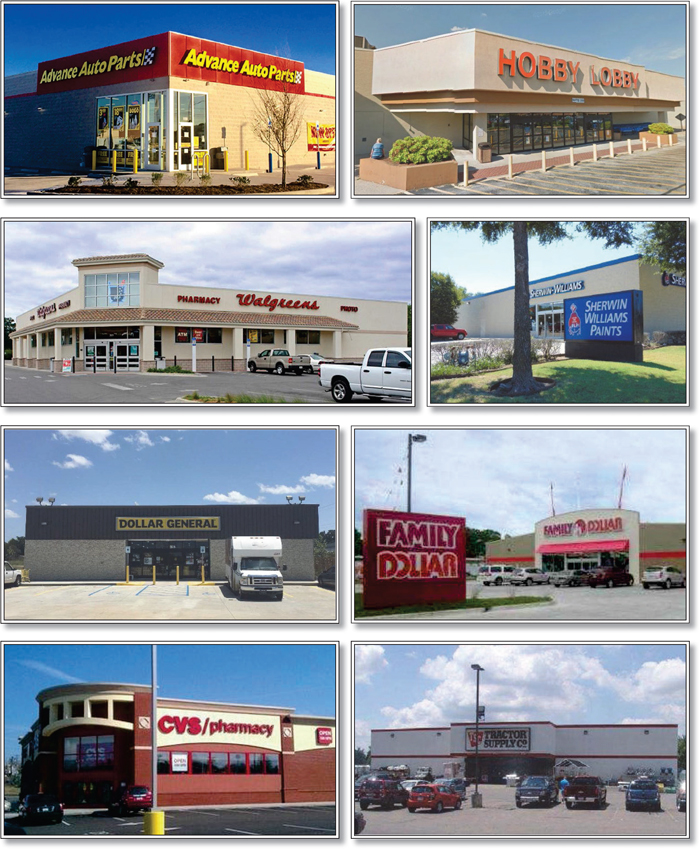

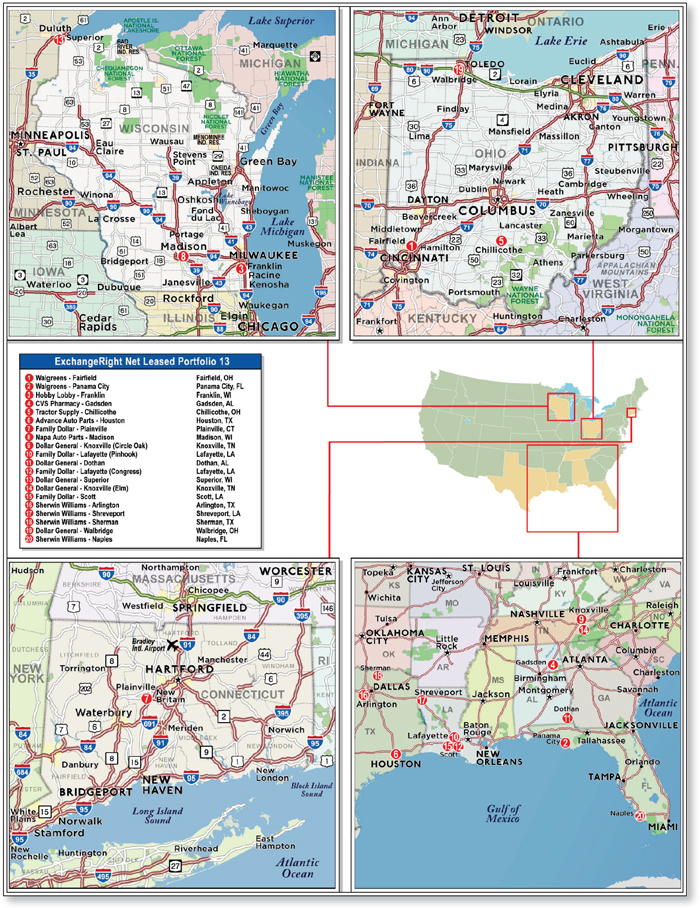

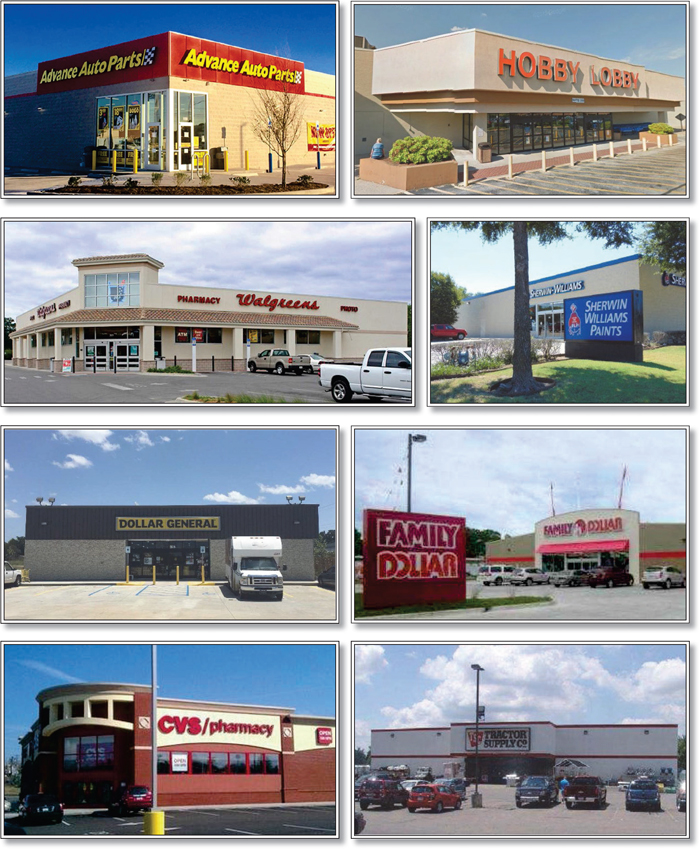

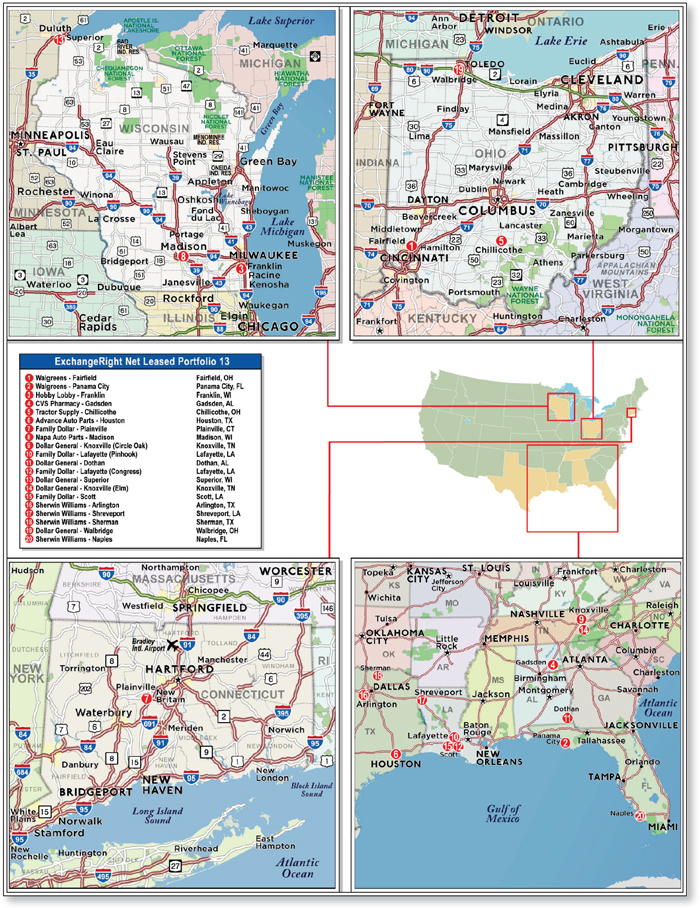

| Barclays | | ExchangeRight Net Leased Portfolio 13 | | Various | | Various | | 1 / 20 | | 24,485,000 | | | 2.9 | | | Retail | | 233,055 | | 105 | | 54.1 | | | 54.1 | | | 2.74 | | | 11.1 | |

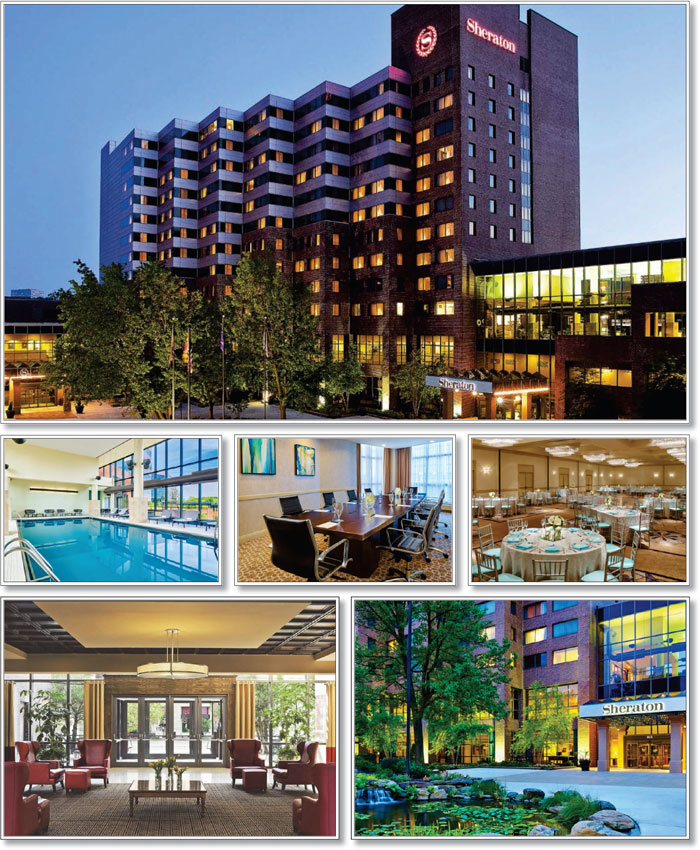

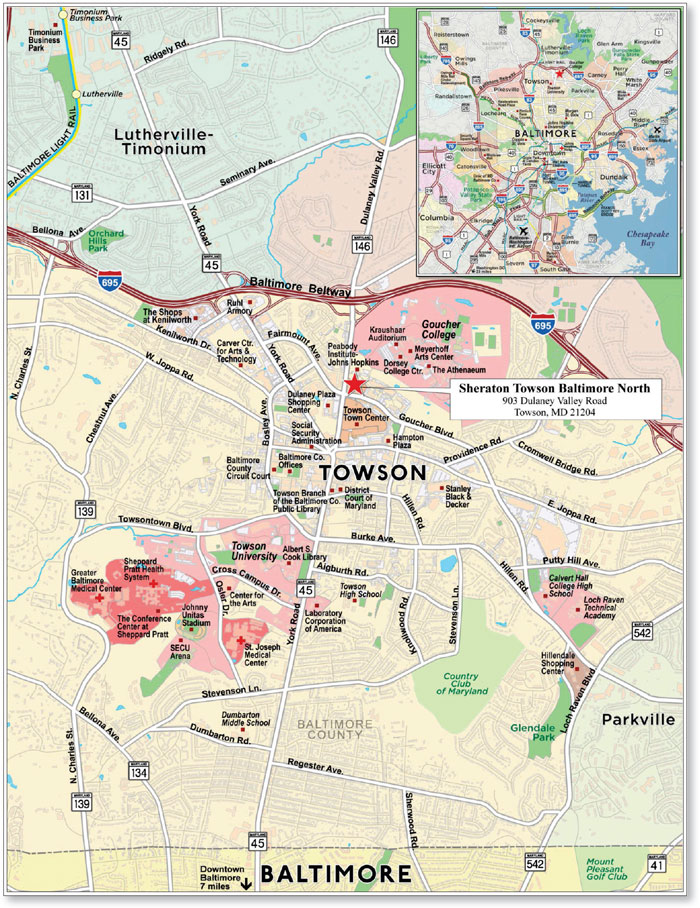

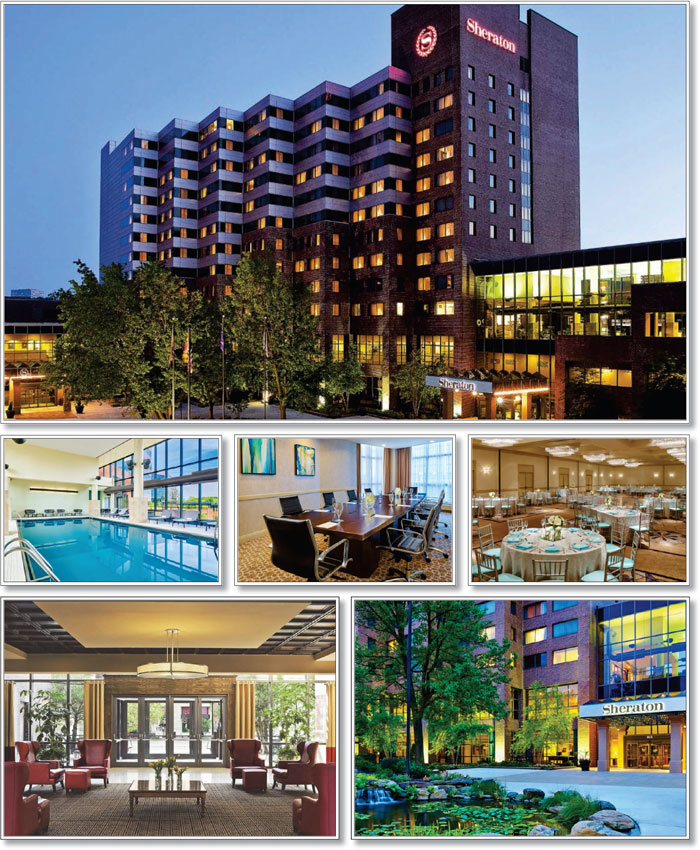

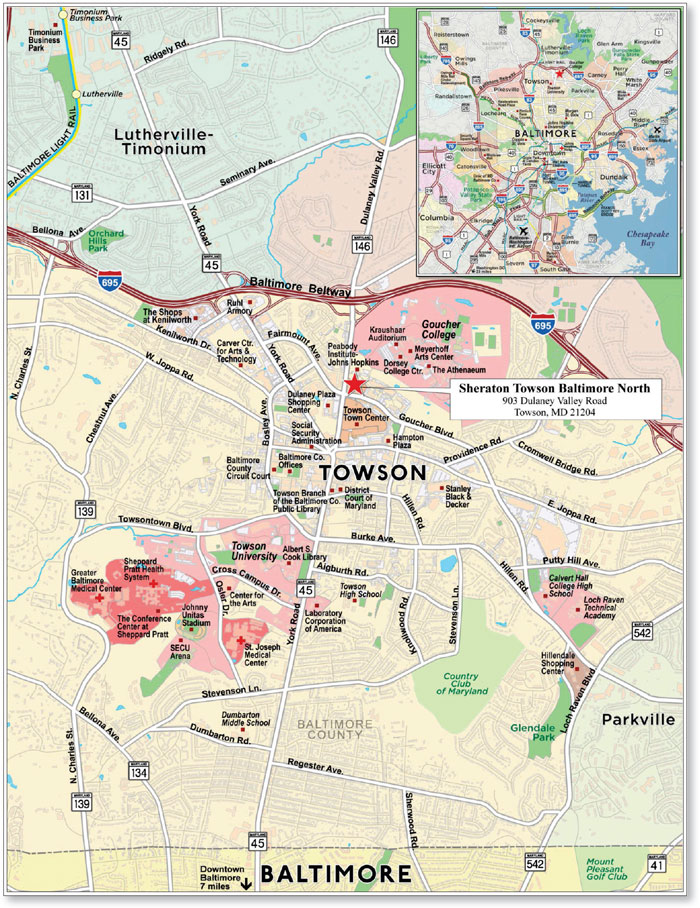

| Barclays | | Sheraton Towson Baltimore North | | Towson | | MD | | 1 / 1 | | 21,949,866 | | | 2.6 | | | Hospitality | | 283 | | 77,561 | | 62.7 | | | 51.6 | | | 1.57 | | | 12.4 | |

| Top Three Total/Weighted Average | | | | 3 / 3 | | $212,393,396 | | | 24.7 | % | | | | | | | | 60.9 | % | | 55.8 | % | | 2.37 | x | | 10.6 | % |

| Top Five Total/Weighted Average | | | | 5 / 5 | | $303,327,271 | | | 35.3 | % | | | | | | | | 54.8 | % | | 49.6 | % | | 2.66 | x | | 11.9 | % |

| Top Ten Total/Weighted Average | | | | 10 / 29 | | $436,381,549 | | | 50.8 | % | | | | | | | | 56.3 | % | | 49.9 | % | | 2.40 | x | | 11.8 | % |

| Non-Top Ten Total/Weighted Average | | | | 63 / 69 | | $421,796,410 | | | 49.2 | % | | | | | | | | 61.6 | % | | 51.9 | % | | 2.19 | x | | 12.8 | % |

| (1) | With respect to any mortgage loan that is part of a whole loan, Cut-off Date Balance Per SF/Room/Unit, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the relatedpari passu companion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). For mortgaged properties securing residential cooperative mortgage loans, the debt service coverage ratio and debt yield for each such mortgaged property is calculated using U/W Net Operating Income or U/W Net Cash Flow, as applicable, for the related residential cooperative property, which is the projected net operating income or net cash flow, as applicable, reflected in the most recent appraisal obtained by or otherwise in the possession of the related mortgage loan seller as of the cut-off date, and the loan-to-value ratio, is calculated based upon the appraised value of the residential cooperative property determined as if such residential cooperative property is operated as a residential cooperative. With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account subordinate debt (whether or not secured by the related mortgaged property), if any, that currently exists or is allowed under the terms of such mortgage loan. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

9

| Wells Fargo Commercial Mortgage Trust 2016-C36 | Characteristics of the Mortgage Pool |

| B. | Summary of thePari PassuWhole Loans |

| Property Name | Mortgage Loan Originator | Note(s) | Related Notes in

Loan Group

(Original Balance) | Holder of Note | Lead Servicer for

the Entire Whole loan | Current Master Servicer Under Related

Securitization Servicing Agreement | Current Special Servicer Under Related

Securitization Servicing Agreement |

| Gurnee Mills | Column | A-1A & A-1B | $110,000,000 | (1) | Yes(2) | TBD | TBD |

| WFB | A-2A | $80,000,000 | WFCM 2016-C36 | No(2) | Wells Fargo Bank, National Association | C-III Asset Management LLC |

| WFB | A-2B | $25,000,000 | (3) | No | TBD | TBD |

| Regions | A-3 & A-4 | $60,000,000 | (4) | No | TBD | TBD |

| 101 Hudson Street | WFB | A-1 | $70,000,000 | (5) | Yes(6) | TBD | TBD |

| WFB | A-2 | $67,500,000 | WFCM 2016-C36 | No(6) | Wells Fargo Bank, National Association | C-III Asset Management LLC |

| BANA | A-3 & A-4 | $56,250,000 | (7) | No | TBD | TBD |

| Barclays | A-5 | $56,250,000 | (8) | No | TBD | TBD |

| Plaza America I & II | Barclays | A-1 | $65,000,000 | WFCM 2016-C36 | Yes | Wells Fargo Bank, National Association | C-III Asset Management LLC |

| Barclays | A-2 | $60,000,000 | CGCMT 2016-P5 | No | Midland Loan Services, a Division of PNC Bank, National Association | LNR Partners, LLC |

| Easton Town Center(9) | Barclays/MS | A-1-A & A-2-A | $150,000,000 | BBCMS 2016-ETC | Yes | Wells Fargo Bank, National Association | AEGON USA Realty Advisors, LLC |

| Barclays | A-1-B-1 | $45,000,000 | CGCMT 2016-P5 | No | Wells Fargo Bank, National Association | LNR Partners, LLC |

| Barclays | A-1-B-2 | $45,000,000 | WFCM 2016-C36 | No | Wells Fargo Bank, National Association | C-III Asset Management LLC |

| Barclays | A-1-B-3 | $22,500,000 | (10) | No | TBD | TBD |

| MS | A-2-B | $75,000,000 | MSBAM 2016-C30 | No | Wells Fargo Bank, National Association | LNR Partners, LLC |

| Conrad Indianapolis | WFB | A-1 | $32,000,000 | WFCM 2016-C36 | Yes | Wells Fargo Bank, National Association | C-III Asset Management LLC |

| WFB | A-2 | $23,700,000 | (11) | No | TBD | TBD |

| Mall At Turtle Creek | Barclays | A-1 | $42,000,000 | WFCM 2016-C35 | Yes | Wells Fargo Bank, National Association | CWCapital Asset Management LLC |

| Barclays | A-2 | $29,860,000 | WFCM 2016-C36 | No | Wells Fargo Bank, National Association | C-III Asset Management LLC |

| Central Park Retail | WFB | A-1 | $70,000,000 | WFCM 2016-LC24 | Yes | Wells Fargo Bank, National Association | Midland Loan Services, a Division of PNC Bank, National Association |

| WFB | A-2 | $20,000,000 | WFCM 2016-C36 | No | Wells Fargo Bank, National Association | C-III Asset Management LLC |

| Gas Company Tower & World Trade Center Parking Garage(12) | DB / Barclays | A-1-S1, A-1-S2, A-1-S3 & A-2-S | $89,000,000 | COMM 2016-GCT | Yes | Wells Fargo Bank, National Association | Strategic Asset Services LLC |

| DB | A-1-C | $40,000,000 | CD 2016-CD1 | No | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC |

| Barclays | A-2-C | $15,000,000 | WFCM 2016-C36 | No | Wells Fargo Bank, National Association | C-III Asset Management LLC |

| One & Two Corporate Plaza | RMF | A-1 | $20,000,000 | WFCM 2016-LC24 | Yes | Wells Fargo Bank, National Association | Midland Loan Services, a Division of PNC Bank, National Association |

| RMF | A-2 | $7,000,000 | WFCM 2016-C36 | No | Wells Fargo Bank, National Association | C-III Asset Management LLC |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

10

| Wells Fargo Commercial Mortgage Trust 2016-C36 | Characteristics of the Mortgage Pool |

| (1) | The relatedpari passu Notes A-1A & A-1B are currently held by Column and is expected to be contributed to a future securitization. No assurance can be provided that the Note A-1A or A-1B will not be split further. |

| (2) | The Gurnee Mills whole loan is expected to initially be serviced under the WFCM 2016-C36 pooling and servicing agreement until the securitization of the related controllingpari passu Note A-1A (the “Gurnee Mills Servicing Shift Securitization Date”), after which the Gurnee Mills whole loan will be serviced under the pooling and servicing agreement related to the securitization of the related controllingpari passu Note A-1A (the “Gurnee Mills Servicing Shift PSA”). The master servicer and special servicer under the Gurnee Mills Servicing Shift PSA will be identified in a notice, report or statement to holders of the WFCM 2016-C36 certificates after the securitization of the related controllingpari passu Note A-1A. |

| (3) | The relatedpari passu Note A-2B is currently held by WFB and is expected to be contributed to a future securitization. No assurance can be provided that the Note A-2B will not be split further. |

| (4) | The relatedpari passu Notes A-3 and A-4 are currently held by Regions and are expected to be contributed to one or more future securitizations. No assurance can be provided that the Note A-3 or A-4 will not be split further. |

| (5) | The relatedpari passu Note A-1 is currently held by WFB and is expected to be contributed to a future securitization. No assurance can be provided that the Note A-1 will not be split further. |

| (6) | The 101 Hudson Street whole loan is expected to initially be serviced under the WFCM 2016-C36 pooling and servicing agreement until the securitization of the related controllingpari passu Note A-1 (the “101 Hudson Street Servicing Shift Securitization Date”), after which the 101 Hudson Street whole loan will be serviced under the pooling and servicing agreement related to the securitization of the related controllingpari passu Note A-1 (the “101 Hudson Street Servicing Shift PSA”). The master servicer and special servicer under the 101 Hudson Street Servicing Shift PSA will be identified in a notice, report or statement to holders of the WFCM 2016-C36 certificates after the securitization of the related controllingpari passu Note A-1. |

| (7) | The relatedpari passu Notes A-3 and A-4 are currently held by BANA and are expected to be contributed to one or more future securitizations. No assurance can be provided that the Note A-3 or A-4 will not be split further. |

| (8) | The relatedpari passu Note A-5 is currently held by Barclays and is expected to be contributed to a future securitization. No assurance can be provided that the Note A-5 will not be split further. |

| (9) | The Easton Town Center whole loan includes two junior companion loans with an aggregate original principal balance of $362,500,000. Such junior companion loans are not reflected in, and are subordinate to all of the notes listed in the “Related Notes in Loan Group (Original Balance)” column. The junior companion loans were securitized in the BBCMS 2016-ETC transaction. |

| (10) | The relatedpari passu Note A-1-B-3 is currently held by Barclays and is expected to be contributed to a future securitization. No assurance can be provided that the Note A-1-B-3 will not be split further. |

| (11) | The relatedpari passu Note A-2 is currently held by WFB and is expected to be contributed to a future securitization. No assurance can be provided that Note A-2 will not be split further. |

| (12) | The Gas Company Tower & World Trade Center Parking Garage whole loan includes two junior companion loans with an aggregate original principal balance of $175,000,000. Such junior companion loans are not reflected in, and are subordinate to all of the notes listed in the “Related Notes in Loan Group (Original Balance)” column. |

C. Mortgage Loans with Additional Secured and Mezzanine Financing(1)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Loan

No. | | Mortgage

Loan Seller | | Mortgage Loan Name | | Mortgage

Loan

Cut-off Date Balance ($) | | % of Initial

Pool

Balance

(%) | | Subordinate

Debt

Cut-off Date

Balance ($) | | Mezzanine

Debt Cut-off

Date

Balance ($) | | Total Debt

Interest

Rate (%)(2) | | Mortgage

Loan U/W

NCF DSCR

(x)(3) | | Total Debt

U/W

NCF DSCR (x) | | Mortgage

Loan Cut-off Date U/W

NOI Debt

Yield (%)(3) | | Total Debt Cut-off Date U/W NOI

Debt Yield

(%) | | Mortgage

Loan Cut-off Date LTV

Ratio (%)(3) | | Total Debt Cut-off

Date LTV

Ratio (%) |

| 3 | | Barclays | | Plaza America I & II | | $65,000,000 | | 7.6 | % | | NAP | | $20,000,000 | | 4.557 | % | | 1.96 | x | | 1.55 | x | | 9.3 | % | | 8.0 | % | | 64.1 | % | | 74.4 | % |

| 5 | | Barclays | | Easton Town Center | | 45,000,000 | | 5.2 | | | 362,500,000 | | NAP | | 3.616 | | | 4.02 | | | 1.94 | | | 15.4 | | | 7.4 | | | 28.5 | | | 59.0 | |

| 18 | | Barclays | | Gas Company Tower & World Trade Center Parking Garage | | 15,000,000 | | 1.7 | | | 175,000,000 | | 131,000,000 | | 4.354 | | | 5.23 | | | 1.34 | | | 19.9 | | | 6.4 | | | 23.6 | | | 73.6 | |

| | | Total/Weighted Average | | $125,000,000 | | 14.6 | % | | $537,500,000 | | $151,000,000 | | 4.194 | % | | 3.09 | x | | 1.67 | x | | 12.8 | % | | 7.6 | % | | 46.4 | % | | 68.8 | % |

| (1) | In addition, five (5) of the mortgage loans, each of which is secured by a residential cooperative property, currently have in place Subordinate Coop LOCs, that permit future advances. See “Description of the Mortgage Pool—Additional Indebtedness—Other Unsecured Indebtedness” and “Description of the Mortgage Pool—Additional Debt Financing for Mortgage Loans Secured by Residential Cooperatives” in the Preliminary Prospectus. |

| (2) | Total Debt Interest Rate for any specified mortgage loan reflects the weighted average of the interest rates on the respective components of the total debt. |

| (3) | With respect to Plaza America I & II mortgage loan, the Easton Town Center mortgage loan and the Gas Company Tower & World Trade Center Parking Garage mortgage loan, each of which is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the relatedpari passu companion loan(s), but does not take into account subordinate debt, if any. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

11

| Wells Fargo Commercial Mortgage Trust 2016-C36 | Characteristics of the Mortgage Pool |

D. Previous Securitization History(1)

Loan

No. | Mortgage

Loan

Seller | Mortgage

Loan or Mortgaged

Property Name | City | State | Property

Type |

Mortgage Loan

or Mortgaged

Property Cut-off

Date Balance ($) | % of

Initial Pool

Balance

(%) | Previous

Securitization |

| 1 | WFB | Gurnee Mills | Gurnee | IL | Retail | $79,893,396 | | 9.3 | % | JPMCC 2007-C1; JPMCC 2007-CB20 |

| 3 | Barclays | Plaza America I & II | Reston | VA | Office | $65,000,000 | | 7.6 | % | GCCFC 2007-GG9 |

| 5 | Barclays | Easton Town Center | Columbus | OH | Retail | 45,000,000 | | 5.2 | | MSC 2007-IQ16; BSCMS 2007-T28 |

| 6 | WFB | Conrad Indianapolis | Indianapolis | IN | Hospitality | 31,962,031 | | 3.7 | | CSMC 2007-C1 |

| 9.02 | Barclays | Walgreens - Panama City | Panama City | FL | Retail | 3,165,000 | | 0.4 | | MLCFC 2007-5 |

| 10 | Barclays | Sheraton Towson

Baltimore North | Towson | MD | Hospitality | 21,949,866 | | 2.6 | | WBCMT 2006-C27 |

| 11.01 | Barclays | Emmott Business Center | Houston | TX | Industrial | 7,188,439 | | 0.8 | | MSC 1997-HF1 |

| 11.05 | Barclays | Aldine Westfield | Houston | TX | Industrial | 1,497,591 | | 0.2 | | SBM7 1999-C1 |

| 12 | WFB | Central Park Retail(2) | Fredericksburg | VA | Retail | 19,948,500 | | 2.3 | | MLCFC 2006-4 |

| 16 | CIIICM | Spanish Fort Town Center Apartments | Spanish Fort | AL | Multifamily | 15,750,000 | | 1.8 | | COMM 2014-UBS4 |

| 18 | Barclays | Gas Company Tower & World Trade Center Parking Garage | Los Angeles | CA | Office | 15,000,000 | | 1.7 | | JPMCC 2006-LDP8 |

| 20 | RMF | Consumer Square West | Columbus | OH | Retail | 13,584,151 | | 1.6 | | GSMS 2011-GC5 |

| 21 | RMF | Northtowne Meadows | Erie | MI | Manufactured Housing Community | 12,717,625 | | 1.5 | | MLCFC 2006-4 |

| 22 | WFB | Central Self Storage -

Daly City, CA | Daly City | CA | Self Storage | 11,850,000 | | 1.4 | | BACM 2006-4 |

| 25 | RMF | Holiday Inn Express & Suites Cooperstown | Cooperstown | NY | Hospitality | 8,678,812 | | 1.0 | | UBSC 2011-C1 |

| 28 | RMF | One & Two Corporate Plaza | Houston | TX | Office | 6,984,312 | | 0.8 | | CD 2006-CD3; CD 2007-CD4 |

| 31 | Barclays | Pacific Rancho Business Park | Spring Valley | CA | Industrial | 6,350,000 | | 0.7 | | SBM7 2001-C1 |

| 35 | NCB | Fillmore Gardens Co-operative, Inc. a/k/a The Fillmore Gardens Co-operative, Inc. | Brooklyn | NY | Multifamily | 5,991,303 | | 0.7 | | WFCM 2015-LC22 |

| 37 | RMF | Hampton Inn Richmond Hill | Richmond Hill | GA | Hospitality | 5,543,649 | | 0.6 | | CSMC 2007-C2 |

| 38 | Basis | 4119 Syracuse Holding

(Camillus Plaza) | Camillus | NY | Retail | 5,523,379 | | 0.6 | | MSC 2006-1Q12 |

| 40 | CIIICM | Lock Ur Own Self Storage | Aurora | CO | Self Storage | 5,281,080 | | 0.6 | | LBUBS 2007-C6 |

| 44 | RMF | Comfort Inn & Suites Market Center Dallas | Dallas | TX | Hospitality | 4,495,229 | | 0.5 | | BACM 2006-5 |

| 46 | CIIICM | Sun Lake Estates MHP | San Angelo | TX | Manufactured Housing Community | 4,229,889 | | 0.5 | | BACM 2006-5 |

| 48 | The Bancorp Bank | Best Western - Westgate | York | PA | Hospitality | 4,118,381 | | 0.5 | | CSMC 2007-C5 |

| 49 | RMF | Courthouse Square | Stafford | VA | Office | 4,075,846 | | 0.5 | | WBCMT 2006-C29 |

| 50 | The Bancorp Bank | Pokegama Mobile Home

& R.V. Park | Pine City | MN | Manufactured Housing Community | 3,979,396 | | 0.5 | | LBUBS 2006-C3 |

| 55 | CIIICM | Guardian Self Storage San Antonio | San Antonio | TX | Self Storage | 3,491,272 | | 0.4 | | LBUBS 2006-C6 |

| 58 | CIIICM | Pleasant Ridge | Evansville | IN | Manufactured Housing Community | 3,242,234 | | 0.4 | | BSCMS 2006-PW13 |

| 59 | NCB | Bayview Owners Corp. | Brooklyn | NY | Multifamily | 2,997,388 | | 0.3 | | MSC 2003-IQ6 |

| 63 | CIIICM | Belle Grove MHP | Bradenton | FL | Manufactured Housing Community | 2,697,022 | | 0.3 | | CD 2007-CD4 |

| 67 | CIIICM | Newtown Self Storage | Newtown | CT | Self Storage | 2,097,452 | | 0.2 | | MSC 2006-IQ12 |

| 71 | NCB | 1122 Yonkers Avenue Ltd. a/k/a 1122 Yonkers Avenue, Ltd. | Yonkers | NY | Multifamily | 1,248,196 | | 0.1 | | MSC 2007-IQ13 |

| | Total | | | | | $425,531,440 | | 49.6 | % | |

| (1) | The table above represents the most recent securitization with respect to the mortgaged property securing the related mortgage loan, based on information provided by the related borrower or obtained through searches of a third-party database. While loans secured by the above mortgaged properties may have been securitized multiple times in prior transactions, mortgage loans in this securitization are only listed in the above chart if the mortgage loan paid off a loan in another securitization. The information has not otherwise been confirmed by the mortgage loan sellers. |

| (2) | The Central Park Retail whole loan was used to pay off a portion of the previous $125,000,000 mortgage loan, which also included debt secured by a 229,611 square foot office complex that was refinanced separately. Approximately $90,451,770 of the previous $125,000,000 loan is allocated to the Central Park Retail property. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

12

| Wells Fargo Commercial Mortgage Trust 2016-C36 | Characteristics of the Mortgage Pool |

E. Mortgage Loans with Scheduled Balloon Payments and Related Classes

| Class A-2(1) |

Loan

No. | Mortgage Loan

Seller | Mortgage Loan Name | State | Property Type | Mortgage Loan

Cut-off Date

Balance ($) | % of Initial

Pool Balance

(%) | Balloon Balance

($) | % of Class

A-2

Certificate

Balance

(%)(2) | SF/ Pads / Units | Loan per SF/ Pad / Unit($)(3) | U/W NCF

DSCR (x)(3) | U/W NOI

Debt Yield

(%)(3) | Cut-off Date LTV Ratio (%)(3) | Balloon LTV Ratio (%)(3) | Rem. IO Period (mos.) | Rem.

Term to

Maturity

(mos.) |

| 18 | Barclays | Gas Company Tower & World Trade Center Parking Garage | CA | Office | $15,000,000 | 1.7% | $15,000,000 | 37.8% | 1,372,329 | $105 | 5.23x | 19.9% | 23.6% | 23.6% | 57 | 57 |

| 30 | The Bancorp Bank | Paradise Ranch MHP | CA | Manufactured Housing Community | 6,492,847 | 0.8 | 5,980,764 | 15.1 | 94 | 69,073 | 1.53 | 9.8 | 57.6 | 53.0 | 0 | 59 |

| 36 | CIIICM | Village at Fairplain | MI | Multifamily | 5,615,689 | 0.7 | 5,047,960 | 12.7 | 178 | 31,549 | 1.41 | 11.1 | 59.7 | 53.7 | 0 | 56 |

| 42 | CIIICM | Country Aire MHP | LA | Manufactured Housing Community | 4,595,112 | 0.5 | 4,242,238 | 10.7 | 192 | 23,933 | 1.54 | 10.2 | 74.2 | 68.5 | 0 | 59 |

| 50 | The Bancorp Bank | Pokegama Mobile Home & R.V. Park | MN | Manufactured Housing Community | 3,979,396 | 0.5 | 3,750,821 | 9.5 | 337 | 11,808 | 1.66 | 12.7 | 53.3 | 50.3 | 0 | 54 |

| | Total/Weighted Average | | | $35,683,044 | 4.2% | $34,021,783 | 85.8% | | | 3.08x | 14.6% | 45.3% | 42.4% | 24 | 57 |

| (1) | The table above presents the mortgage loan(s) whose balloon payments would be applied to pay down the principal balance of the Class A-2 Certificates, assuming a 0% CPR and applying the “Structuring Assumptions” described in the Preliminary Prospectus, including the assumptions that (i) none of the mortgage loans in the pool experience prepayments prior to maturity, defaults or losses; (ii) there are no extensions of maturity dates of any mortgage loans in the pool; and (iii) each mortgage loan in the pool is paid in full on its stated maturity date. Each Class of Certificates evidences undivided ownership interests in the entire pool of mortgage loans. Debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account subordinate debt (whether or not secured by the related mortgaged property), if any, that currently exists or is allowed under the terms of any mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

| (2) | Reflects the percentage equal to the Balloon Balance divided by the initial Class A-2 Certificate Balance. |