UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) of

THE SECURITIES EXCHANGE ACT OF 1934

For the year ended December 31, 2007

Commission File Number 1-6702

NEXEN INC.

Incorporated under the Laws of Canada

98-6000202

(I.R.S. Employer Identification No.)

801 – 7th Avenue S.W.

Calgary, Alberta, Canada T2P 3P7

Telephone - (403) 699-4000

Web site - www.nexeninc.com

Securities registered pursuant to Section 12(b) of the Act:

Title |

| Exchange Registered On |

|

|

|

Common shares, no par value |

| The New York Stock Exchange |

|

| The Toronto Stock Exchange |

|

|

|

Subordinated Securities, due 2043 |

| The New York Stock Exchange |

|

| The Toronto Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

Yes o Nox

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days.

Yes x Noo

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer.

Large accelerated filer x Accelerated filer o Non-accelerated filer o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

On June 30, 2007, the aggregate market value of the voting shares held by non-affiliates of the registrant was approximately Cdn $17 billion based on the Toronto Stock Exchange closing price on that date. On January 31, 2008, there were 528,502,991 common shares issued and outstanding.

TABLE OF CONTENTS

Unless we indicate otherwise, all dollar amounts ($) are in Canadian dollars, and oil and gas volumes, reserves and related performance measures are presented on a working interest before-royalties basis. Where appropriate, information on an after-royalties basis is provided in tabular format. Volumes and reserves include Syncrude operations unless otherwise stated.

Below is a list of terms specific to the oil and gas industry. They are used throughout the Form 10-K.

/d |

| = |

| per day |

| mboe |

| = |

| thousand barrels of oil equivalent |

|

|

|

|

|

|

|

|

|

|

|

bbl |

| = |

| barrel |

| mmboe |

| = |

| million barrels of oil equivalent |

|

|

|

|

|

|

|

|

|

|

|

mbbls |

| = |

| thousand barrels |

| mcf |

| = |

| thousand cubic feet |

|

|

|

|

|

|

|

|

|

|

|

mmbbls |

| = |

| million barrels |

| mmcf |

| = |

| million cubic feet |

|

|

|

|

|

|

|

|

|

|

|

mmbtu |

| = |

| million British thermal units |

| bcf |

| = |

| billion cubic feet |

|

|

|

|

|

|

|

|

|

|

|

km |

| = |

| kilometre |

| WTI |

| = |

| West Texas Intermediate |

|

|

|

|

|

|

|

|

|

|

|

MW |

| = |

| megawatt |

| NGL |

| = |

| natural gas liquid |

In this 10-K, we refer to oil and gas in common units called barrel of oil equivalent (boe). A boe is derived by converting six thousand cubic feet of gas to one barrel of oil (6mcf/1bbl). This conversion may be misleading, particularly if used in isolation, as the 6mcf/1bbl ratio is based on an energy equivalency at the burner tip and does not represent the value equivalency at the well head.

The noon-day Canadian to US dollar exchange rates for Cdn $1.00, as reported by the Bank of Canada, were:

(US$ ) |

| December 31 |

| Average |

| High |

| Low |

|

2003 |

| 0.7738 |

| 0.7135 |

| 0.7738 |

| 0.6350 |

|

2004 |

| 0.8308 |

| 0.7683 |

| 0.8493 |

| 0.7159 |

|

2005 |

| 0.8577 |

| 0.8253 |

| 0.8690 |

| 0.7872 |

|

2006 |

| 0.8581 |

| 0.8818 |

| 0.9099 |

| 0.8528 |

|

2007 |

| 1.0120 |

| 0.9304 |

| 1.0905 |

| 0.8437 |

|

On January 31, 2008, the noon-day exchange rate was US $0.9978 for Cdn $1.00.

Electronic copies of our filings with the Securities Exchange Commission (SEC) and the Ontario Securities Commission (OSC) (from November 8, 2002 onward) are available, free of charge, on our website (www.nexeninc.com). Filings prior to November 8, 2002 are available free of charge, on request, by contacting our investor relations department at 403.699.5931. As soon as reasonably practicable, our filings are made available on our website once they are electronically filed with the SEC and/or the OSC. Alternatively, the SEC and the OSC each maintain a website (www.sec.gov and www.sedar.com) that contains our reports, proxy and information statements and other published information that have been filed or furnished with the SEC and the OSC

global

operations

In 2007, we added value by

bringing Buzzard on stream.

Our Long Lake oil sands

project is next, expected

on stream mid 2008.

1

Items 1 and 2 Business and Properties About Us

Nexen Inc. (Nexen, we or our) is an independent, Canadian-based, global energy company. We were formed in Canada in 1971 when Occidental Petroleum Corporation (Occidental) combined their Canadian crude oil, natural gas, sulphur and chemical operations into one company. We’ve grown from producing 10,700 boe/d before royalties with revenues of $26 million in 1971, to producing 253,600 boe/d before royalties (including Syncrude production) and revenues of $5.6 billion in 2007. We achieved this growth through exploration success and strategic acquisitions. Operating for more than 35 years, we have been profitable every year, except one, and have been paying quarterly dividends consecutively since 1975.

In the 1970s, we expanded our western Canadian assets and entered the US Gulf of Mexico. We finished this decade with production of approximately 11,000 boe/d before royalties and revenues of $126 million.

Buzzard produced first oil early in the year and we made significant construction and commissioning progress at Long Lake.

In the 1980s, we continued to expand in western Canada and the Gulf of Mexico through acquisitions. Acquiring Canada-Cities Services in 1983 doubled our size and included an interest in the Syncrude Joint Venture, our entry into the Athabasca oil sands. We finished this decade with production of approximately 68,600 boe/d before royalties and revenues of $591 million.

In the 1990s, we had two defining events: discovering oil on the Masila block in Yemen and acquiring Wascana Energy Inc. The first of 17 fields at Masila was discovered in 1991. Since start up in 1993, Masila has produced almost a billion barrels of crude oil. Our 1997 purchase of Wascana Energy Inc. almost tripled our Canadian production. In 1998, we entered Australia with an interest in the offshore Buffalo field and Nigeria as the operator of the Ejulebe field. Also in 1998, we discovered Ukot on Block OPL-222, offshore Nigeria. We finished this decade with production of approximately 239,200 boe/d before royalties and revenues of $1.7 billion.

So far in the 21st century, we have made a number of discoveries, two strategic acquisitions and completed non-core asset divestiture programs. In 2000, we discovered Gunnison in the deep-water Gulf of Mexico and Guando in Colombia. We joined with Ontario Teachers’ Pension Plan Board (Teachers) to acquire Occidental’s remaining 29% interest in us. Teachers purchased 20.2 million common shares. We repurchased the remaining 20 million common shares for $605 million, which would have had a value of almost $2.6 billion at the end of 2007. We also exchanged our oil and gas operations in Ecuador for Occidental’s 15% interest in our chemical operations and we changed our name from Canadian Occidental Petroleum Ltd. to Nexen Inc. In 2001, we discovered Aspen in the deep-water Gulf of Mexico and signed a joint venture agreement with OPTI Canada Inc. to develop, produce and upgrade bitumen at Long Lake in the Athabasca oil sands. In 2002, we discovered Usan, the second discovery on OPL-222, offshore Nigeria. In late 2003, we discovered two fields on Block 51 in Yemen.

In 2004 , we acquired properties in the UK North Sea , providing us with operatorship of the Buzzard discovery, the producing Scott and Telford fields and 700,000 exploration acres. In 2005, we completed non-core asset divestiture programs by selling Canadian conventional oil and gas properties producing approximately 18,300 boe/d before royalties and by monetizing 39% of our chemical business through the initial public offering of the Canexus Income Fund. We also made a potentially significant discovery in the Gulf of Mexico at Knotty Head and commenced commercial development of our first coalbed methane (CBM) project in the Fort Assiniboine area in western Canada. In 2006, we completed major development projects at Buzzard in the North Sea and the Syncrude Stage 3 expansion in the Athabasca oil sands. In 2007, Buzzard produced first oil early in the year and we made significant construction and commissioning progress at our Long Lake Project. At Long Lake, SAGD steam injection began in the second half of 2007 and the upgrader is scheduled to start up in mid 2008. We also significantly added to our inventory of exploration prospects during the year by securing new Gulf of Mexico deepwater leases, obtaining exploration licences offshore Norway and acquiring additional shale gas opportunities in Canada. Our portfolio of assets, combined with talented people and an active exploration program, are expected to provide future growth for our company.

For financial reporting purposes, we report on four main segments:

· oil and gas;

· Syncrude;

· energy marketing; and

· chemicals.

Our oil and gas operations are broken down geographically into the UK North Sea, US Gulf of Mexico, Canada, Yemen and Other International (currently Colombia, offshore West Africa and Norway). Results from our Long Lake Project are included in Canada. Syncrude is our 7.23% interest in the Syncrude Joint Venture. Energy marketing includes our growing crude oil, natural gas, natural gas liquids, ethanol and power marketing business in North America, Europe and Asia.

3

Items 1 and 2 Business and Properties Strategy

Chemicals includes operations in North America and Brazil that manufacture, market and distribute sodium chlorate, caustic soda and chlorine through the Canexus Limited Partnership.

Production, revenues, net income, capital expenditures and identifiable assets for these segments appear in Note 20 to the Consolidated Financial Statements and in Management’s Discussion and Analysis of Financial Condition and Results of Operations (MD&A) in this report.

Our goal is to grow long-term value for our shareholders responsibly. Key drivers to growing value include increasing reserves, production, cash flow and net income on a cost-effective basis over the long term. We believe in developing a competitive advantage where possible, to assist in generating opportunities for long-term success in our ever-evolving industry. As conventional basins in North America mature, we have developed specific capabilities in oil sands, CBM, deep-water technology and international experience. These skills enable us to focus on specific types of projects, as we transition toward major projects in established basins, exploration in less mature basins and exploitation of unconventional resources.

Today, we are building new sustainable businesses in western Canada, the North Sea, Gulf of Mexico, and offshore West Africa, capitalizing on the following corporate strengths:

· We have access to resource in our key areas that creates future opportunities. Our Long Lake Project is developing only 10% of our oil sands leases in the Athabasca oil sands and we hold unexplored acreage in the Gulf of Mexico, the North Sea, western Canada and elsewhere;

· We are successful explorers with significant discoveries at Knotty Head and Vicksburg in the Gulf of Mexico, Golden Eagle in the UK North Sea and at Usan, offshore Nigeria;

· We are skilled project managers with major development projects, proven by bringing Buzzard on stream in early 2007;

· We are innovative in our application of technology. Long Lake is expected to be the first oil sands project to use gasification technology to significantly reduce the cost of producing bitumen and we are advancing new techniques for unconventional production of CBM and enhanced heavy oil recovery in western Canada;

· We are an international operator with a proven track record of successful business ventures in Yemen, the United Kingdom, Nigeria, Colombia and Australia; and

· From time to time, we supplement our growth with acquisitions, such as our strategic entry into the UK North Sea in 2004.

The location and scale of our operations often result in: 1) an extended period of time from the capture of opportunities to first production and 2) non-linear, year-over-year growth in reserves and production. Significant up-front capital investment is often required prior to realizing production and free cash flows. We fund this investment by maximizing cash flow from our producing assets, issuing long-term debt and/or equity and selling non-core assets into attractive markets.

Our long-term strategy is to build capacity by ensuring we have a sufficient inventory of opportunities for future growth. We have a number of opportunities expected to provide production growth and create shareholder value well into the next decade. They include undeveloped discoveries at Knotty Head and Vicksburg in the Gulf of Mexico, Usan and Ukot offshore Nigeria, various discoveries in the UK North Sea, together with development of CBM, shale gas and additional oil sands leases in Canada.

Our goal is to grow long-term value responsibly for our shareholders by building sustainable businesses in western Canada, the North Sea, Gulf of Mexico, and offshore West Africa.

In creating sustainable businesses, we are committed to good corporate governance practices and social responsibility. We believe that over the long term, companies that follow sustainable business practices outperform those with narrower priorities. We foster dialogue with stakeholders about our operational opportunities and challenges, from exploration to production to reclamation. Our goal is to help stakeholders become engaged participants in a continuing consultation process, while balancing multiple, and sometimes conflicting goals.

UNDERSTANDING THE OIL AND GAS BUSINESS

The oil and gas industry is highly competitive. With strong global demand for energy, there is intense competition to find and develop new sources of supply. Yet, barrels from different reservoirs around the world do not have equal value. Their value depends on the costs to find, develop and produce the oil or gas, the fiscal terms of the host regime and the price products command in the market based on quality and marketing efforts. Our goal is to extract the maximum value from each barrel of oil equivalent, so every dollar of capital we invest generates an attractive return.

Numerous factors can affect this. Changes in crude oil and natural gas prices can significantly affect our net income and cash generated from operating activities. Consequently, these prices may also affect the carrying value of our oil and gas properties and how much we invest in oil and gas exploration and development. We attempt to reduce these impacts by investing in projects we believe will generate positive returns at relatively low commodity prices.

4

Items 1 and 2 Business and Properties Oil and Gas Operations

The prices we receive for our oil and gas products are mainly determined by volatile global crude oil and natural gas markets. With many alternative customers, the loss of any one customer is not expected to have a significantly adverse effect on the price of our products or revenues. Oil and gas producing operations are generally not seasonal. However, demand for some of our products can fluctuate season to season, which impacts price. In particular, heavy oil is generally in higher demand in the summer for its use in road construction, and natural gas is generally in higher demand in the winter for heating. We manage our operations on a country-by-country basis, reflecting differences in the regulatory and competitive environments and risk factors associated with each country.

We have oil and gas operations in the UK North Sea, US Gulf of Mexico, western Canada, Yemen, Colombia, offshore West Africa and Norway. We also have operations in Canada’s Athabasca oil sands which produce synthetic crude oil. We operate most of our production and continue to develop new growth opportunities in each area by actively exploring and applying technology.

In this Form 10-K, we provide estimates of remaining quantities of proved oil and gas reserves for our various properties. Such estimates are internally prepared. We had 98% of our oil and gas reserves before royalties (98% after royalties) and 100% of our Syncrude reserves before royalties (100% after royalties) assessed (either evaluated or audited as described on page 21) by independent reserves consultants. Their assessments are performed at varying levels of property aggregation, and we work with them to reconcile the differences on the portfolio of properties to within 10% in the aggregate. Estimates pertaining to individual properties within the portfolio may differ by more than 10%, either positively or negatively; however, we believe such differences are not material relative to our total proved reserves. Refer to the section on Critical Accounting Estimates—Oil and Gas Accounting—Reserves Determination on page 68 for a description of our reserves process, and to the section on Reserves, Production and Related Information on page 16 for a description of the nature and scope of the independent assessments performed and the results thereof.

The UK North Sea is a key producing area. In 2004, we acquired a 43.2% operated interest in the Buzzard development, a 41% operated interest in the Scott field, a 54.3% operated interest in the Telford field, the Scott production platform, interests in several satellite discoveries and more than 700,000 net undeveloped exploration acres for US$2.1 billion. This acquisition established us as a significant regional player with concentrated assets, infrastructure and exploration and development potential for future growth. It added high-margin reserves and production, diversified our worldwide portfolio by adding strong assets in a stable jurisdiction, and complemented our other longer cycle-time projects.

Our UK strategy is to grow and sustain our existing North Sea production and capture new production hubs with exploration and exploitation opportunities near existing infrastructure. We

5

Items 1 and 2 Business and Properties North Sea

have a number of exploitation opportunities in our existing fields and smaller undeveloped discoveries near infrastructure. Most of our unexplored acreage is near Scott/Telford, Buzzard or Ettrick. As a result, new discoveries can be tied-in quickly.

During the year, we produced 84,000 boe/d before royalties (84,000 after royalties) in the UK, which was approximately one-third of our total production. At year end, our UK proved oil and gas reserves of 207 mmboe before royalties (207 after royalties) represented about 20% of our total proved oil and gas and Syncrude reserves.

Buzzard

Buzzard is the largest discovery in the UK North Sea in the past ten years. It was discovered in 2001 and began producing January 7, 2007. Development of this discovery was on time and on budget.

The Buzzard field is located about 60 miles northeast of Aberdeen in the Outer Moray Firth, central North Sea, in 317 feet of water. The facilities can process at least 200,000 bbls/d of oil and 60 mmcf/d of gas. Development drilling has resulted in more well-to-well variability in the concentration of hydrogen sulphide than originally expected. To address this, we plan to construct a fourth platform with production sweetening facilities to handle higher levels of hydrogen sulphide. We believe existing equipment and processes can manage current hydrogen sulphide levels and maintain current production deliverability until the additional equipment is commissioned in 2010.

During the year, we produced 84,000 boe/d in the UK, which was approximately one-third of our total production.

Oil from Buzzard is exported via the Forties pipeline to the Grangemouth refinery in Scotland. Gas is exported via the Frigg system to the St. Fergus Gas Terminal in northeast Scotland.

We expect to produce Buzzard through 27 production wells and maintain reservoir pressure through an active water-flood program. In 2008, we plan to invest $255 million to drill five production wells, two sidetracks, one water injector and progress work on the fourth platform.

Scott/Telford

Scott and Telford are producing fields with additional exploitation opportunities and both tie back to the Scott platform. Scott was discovered in 1987 and began producing in September 1993, while Telford was discovered in 1991 and came on stream in 1996. In 2007, we increased our interests in these fields and at the end of the year, we have a 41.9% working interest in the Scott platform and field, and a 71.75% working interest in Telford. In 2007, our share of production from these fields was approximately 16,500 boe/d. The production is royalty-free, around 90% oil and produced through numerous subsea wells. Oil is delivered to the Grangemouth refinery in Scotland via the Forties pipeline, while gas is exported via the SAGE pipeline to the St. Fergus Gas Terminal in northeast Scotland. In recent years, the Scott platform underwent a significant maintenance turnaround and facilities upgrade to improve reliability and extend facility life.

Ettrick

We are progressing development of the Ettrick field and we expect it on stream mid 2008. Our share of production is expected to average approximately 20,000 boe/d at peak rates. Development includes three subsea production wells and one water injector tied back to a leased floating production, storage and off-loading vessel (FPSO). The FPSO is designed to handle 30,000 bbls/d of oil, 35 mmcf/d of gas and to re-inject 55,000 bbls/d of water. Our share of full-cycle development costs is estimated at $460 million. In 2008, we expect our share of Ettrick production to average approximately 9,000 boe/d. We operate Ettrick with an 80% working interest.

Other

Our 2004 UK acquisition included a non-operated interest in Farragon, a small satellite discovery, which was brought on stream in late 2005. In 2007, the non-operated Duart field was brought on stream and began producing oil from a single well tied back to the Tartan platform. Our share of production from these non-operated properties was 3,300 boe/d before royalties (3,300 after royalties) in 2007.

6

Exploration and Undeveloped Assets

In 2007, we discovered hydrocarbons at Golden Eagle and then drilled a successful sidetrack to appraise the accumulation. We are currently evaluating development options and expect to sanction development in 2008. In 2007, we also drilled a successful exploration well at Kildare, and plan to follow up the discovery with an appraisal well. We also completed appraisal of the Selkirk prospect with favourable results. We have a number of discoveries on operated blocks near Scott, Buzzard and third-party facilities as follows:

Field |

| Interest (%) |

| Operator Status |

| Comments |

|

Black Horse |

| 60 |

| operated |

| discovery near Scott; evaluating development alternatives |

|

Bugle |

| 41 |

| operated |

| discovery near Scott; appraisal well underway |

|

Dolphin |

| 42 |

| operated |

| discovery near Scott; evaluating development alternatives |

|

Golden Eagle |

| 34 |

| operated |

| discovery near Ettrick; evaluating development alternatives |

|

Kildare |

| 50 |

| operated |

| discovery near Scott; appraisal well planned for 2008 |

|

Perth |

| 42 |

| operated |

| discovery near Scott; evaluating development alternatives |

|

Polecat |

| 40 |

| operated |

| discovery near Buzzard; evaluating appraisal options |

|

Selkirk |

| 38 |

| operated |

| discovery near Buzzard; evaluating development alternatives |

|

Yeoman |

| 50 |

| operated |

| discovery near Scott; evaluating development alternatives |

|

In 2007, we drilled unsuccessful exploration wells at Guinea, Dee and Stag. The three wells encountered non-commercial quantities of hydrocarbons and were abandoned. In 2008, we expect to drill six exploration and two appraisal wells. We have secured drilling rigs for all of our 2008 North Sea exploration and development program.

We have also begun assessing emerging CBM opportunities in the UK. In 2006, we acquired an 80% working interest in one opportunity and have drilled two successful exploration wells so far. Both encountered coal seams as expected and are being monitored through ongoing production testing. In another CBM opportunity, we drilled two unsuccessful exploration wells in 2007. We plan to continue assessing CBM potential in the UK with additional exploratory wells in 2008.

Fiscal Terms

UK fiscal terms are favourable. New discoveries pay no royalties and result in cash netbacks that are higher than our company average. Scott is subject to Petroleum Revenue Tax (PRT), although no PRT is payable until available oil allowances have been fully utilized, which isn’t expected before 2010. Once payable, PRT is levied at 50% of cash flow after capital expenditures, operating costs and an oil allowance. PRT is applicable to fields receiving development consent prior to March 1993. Buzzard, Ettrick, Farragon, Duart and Telford are not subject to PRT. PRT is deductible for corporate income tax purposes. The UK corporate income tax rate on oil and gas activities is 30% of taxable income and is also subject to a 20% supplemental charge. The amount and timing of income taxes payable depends on many factors including price, production, capital investment levels and available tax losses.

Gulf of Mexico—United States (US)

The Gulf of Mexico is an integral part of our growth strategy. Large discoveries, relatively high success rates, expanding production infrastructure and attractive fiscal terms make the deep-water Gulf of Mexico one of the world’s most prospective sources for oil and gas. While costs of deep-water exploration are high relative to other basins, deep-water prospects generally have multiple sands and high production rates—factors which reduce risk and improve economics. Technology to find, drill, and develop discoveries is rapidly progressing and becoming more cost effective. The deep-water Gulf is near infrastructure and continental US markets, so discoveries can be brought on stream in reasonable time.

We are evaluating development options for Vicksburg, South Marsh Island 257 and Mississippi Canyon 72 and look forward to developing Longhorn in 2008.

Our strategy in the Gulf is to explore for new reserves, exploit our existing asset base and acquire assets with upside potential. We focus our exploration program on three strategic play types:

· | deep-water prospects near existing infrastructure; |

· | deep-water, Miocene and Lower Tertiary sub-salt plays with the potential to become new core areas; and |

· | deep-water, Norphlet targets in the eastern Gulf of Mexico. |

These plays are relatively under-explored, hold potential for large discoveries and have attractive fiscal terms. The relatively shorter cycle-times for deep-water prospects near

7

Items 1 and 2 Business and Properties Gulf of Mexico

infrastructure complement the longer cycle-times for deep-water sub-salt and Norphlet plays. Although competition in the Gulf is strong, we have built a large inventory of deep-water acreage and are now the eighth largest leaseholder in the deep-water.

In 2007, we invested $793 million on exploration, development and acquisitions in the Gulf. This resulted in three discoveries at Desoto Canyon Block 353 (Vicksburg), South Marsh Island 257 and Mississippi Canyon 72 as well as a successful appraisal well at Longhorn. Additionally, we acquired three producing deep-water fields and enhanced our deep-water acreage position. However, some of our development drilling in 2007 did not meet expectations. In 2008, we plan to invest approximately $390 million in the Gulf to further our growth strategies. This includes development of our Longhorn discovery, drilling of proved undeveloped reserves, exploration drilling and land acquisition.

Exploration and Undeveloped Assets

Given our drilling success in 2007, we are evaluating development options for our discoveries at Vicksburg, South Marsh Island 257 and Mississippi Canyon 72 and look forward to developing the Longhorn discovery in 2008. Our undeveloped deep-water discoveries include:

Well |

| Interest (%) |

| Operator Status |

| Comments |

|

Longhorn |

| 25 |

| non-operated |

| sanctioned; production expected 2009 |

|

Tobago |

| 10 |

| non-operated |

| sanctioned; production expected 2009 |

|

Knotty Head |

| 25 |

| operated |

| discovery; further appraisal required |

|

Vicksburg |

| 25 |

| non-operated |

| discovery; further appraisal required |

|

South Marsh Island 257 |

| 35 |

| non-operated |

| discovery; production expected 2008 |

|

Mississippi Canyon 72 |

| 33 |

| non-operated |

| discovery; production expected 2008 |

|

During the year, we drilled ten exploratory dry holes on the shelf. We also converted our interests in Anduin and Great White West to overriding royalty interests to accelerate monetization of the reserves with no further capital investment. We acquired deep-water acreage during the year and hold approximately 200 blocks and expect this acreage and future exploration opportunities to position us well for continued growth. In 2008, we plan to drill seven exploration and appraisal wells and have secured drilling rigs for more than half of the wells. Access to deep-water rigs remains limited. To explore our inventory and evaluate existing discoveries, we have secured two new-build dynamically-positioned fifth-generation semi-submersible drilling rigs. We will have access to each rig for at least two years. We expect the first rig to be available mid 2009, followed by the second rig in 2010.

US Production

|

| 2007 |

| 2006 |

| 2005 |

| ||||||

|

| Before |

| After |

| Before |

| After |

| Before |

| After |

|

(mboe/d) |

| Royalties |

| Royalties |

| Royalties |

| Royalties |

| Royalties |

| Royalties |

|

Deep-water |

| 19.4 |

| 17.4 |

| 19.6 |

| 17.5 |

| 24.0 |

| 21.5 |

|

Shelf |

| 13.8 |

| 11.5 |

| 15.9 |

| 13.2 |

| 17.6 |

| 14.6 |

|

Total |

| 33.2 |

| 28.9 |

| 35.5 |

| 30.7 |

| 41.6 |

| 36.1 |

|

At year end, proved reserves of 62 mmboe before royalties (53 after royalties) in the Gulf of Mexico represented about 6% of our total proved oil and gas and Syncrude reserves. Our Gulf production and reserves are primarily concentrated in four deep-water and five shallow-water (shelf) areas. We operate most of this production.

8

Item 1 and 2 Business and Properties Canada

Deep-water

Most of our deep-water production comes from our 100%-operated Aspen field and our 30% non-operated Gunnison field. The remaining comes from our 50% non-operated Wrigley field and three 100%-operated properties purchased in 2007.

Aspen is on Green Canyon Block 243 in 3,150 feet of water. The project was developed using subsea wells tied back to the Shell-operated Bullwinkle platform 16 miles away and began producing in December 2002. Our share of 2007 production before royalties was approximately 10,400 boe/d (9,500 after royalties).

Gunnison is in 3,100 feet of water and includes Garden Banks Blocks 667, 668 and 669. Gunnison began production in December 2003 through our truss SPAR platform that can handle 40,000 bbls/d of oil and 200 mmcf/d of gas. Our Gunnison SPAR facility has excess capacity, leaving room for growth from regional exploration and processing of third-party volumes. We achieved payout on Gunnison in December 2005, just two years after first production. In 2007, our share of production before royalties was approximately 7,000 boe/d (6,200 after royalties).

Wrigley is on Mississippi Canyon Block 506 in 3,300 feet of water. The project consists of a single subsea well tied back to the Shell-operated Cognac platform 17 miles away. Wrigley began gas production in July 2007 and our share before royalties in 2007 was approximately 1,100 boe/d (1,000 after royalties).

The three new deep-water fields acquired in 2007 are on Garden Banks Block 205, Green Canyon 137 and Green Canyon 6/50—all in water depths between 700 and 1,100 feet. In 2008, we plan to drill a development well at Green Canyon 6/50.

Shelf

Our shelf producing assets are offshore Louisiana, primarily in five 100%-owned field areas: Eugene Island 18, Eugene Island 255/257/258/259, Eugene Island 295, Vermilion 302/321/339/340, and Vermilion 76 (consisting of Blocks 65, 66 and 67). We continue to exploit these assets and look for other shelf opportunities. Most of our 2007 shelf activities focused on development drilling at Eugene Island 258/259, Eugene Island 295 and Vermillion 340.

Fiscal Terms

In 2007, royalty rates on our US production averaged 16.5% for shelf volumes and 10.6% for deep-water volumes. The US government has increased royalty rates from 12.5% to 16.7% for new deep-water leases awarded after July 2007. We qualify for royalty relief at our deep-water Aspen and Gunnison fields on the first 87.5 mmboe of production. However, we may be subject to royalties at Gunnison if annual commodity prices are higher than threshold prices set by the US Department of the Interior’s Minerals Management Service (MMS). The oil and gas industry is currently litigating the enforceability of these price thresholds. In October 2007, a US District Court ruled that the price thresholds were unenforceable. The MMS has since appealed this ruling and a decision is expected by the end of 2008. In 2007, commodity prices exceeded these thresholds and we were assessed a royalty at Gunnison of 12.5% by the MMS. If the litigation is not successful, royalties that we have accrued on our Gunnison production will be payable. Our Aspen field is not subject to the minimum price threshold. Although several bills were recently proposed burdening leases awarded in 1998 and 1999 with royalties or severance taxes, no such legislation was passed by US Congress.

US taxable income is subject to federal income tax of 35% and state taxes ranging from 0% to 12%.

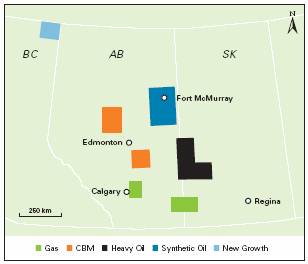

Our strategy in Canada is two fold: 1) develop unconventional resource opportunities (oil sands, CBM and shale gas) and 2) maximize value from our established operations through continued conventional development and enhanced recovery methods. In 2007, we produced 36,800 boe/d before royalties (29,700 after royalties) in Canada, which was approximately 14% of our total production including Syncrude. At year end 2007, Canadian proved reserves (including bitumen and excluding Syncrude) of 386 mmboe before royalties (334 after royalties) were approximately 36% of our total proved oil and gas and Syncrude reserves.

Our Canadian conventional assets include heavy oil production in east-central Alberta and west-central Saskatchewan,

9

and natural gas near Calgary and in southern Alberta and Saskatchewan. We operate most of our producing properties and hold almost one million net acres of undeveloped land across western Canada. These assets provide predictable production volumes and earnings while we advance the following initiatives for future growth:

· Athabasca oil sands—to produce and upgrade bitumen into synthetic crude;

· enhanced oil recovery (EOR)—to increase recovery in our heavy oil fields;

· coalbed methane (CBM)—to extract natural gas primarily from Upper Mannville and Horseshoe Canyon coals; and

· shale gas—to evaluate natural gas from organic shales.

In 2007, we invested $1,505 million in Canada; $1,380 million into these growth initiatives. With the expected completion of Long Lake Phase 1 in the Athabasca oil sands, we plan to reduce our capital investment in 2008 to approximately $770 million. Our 2008 capital programs will focus on completing Phase 1 and work towards sanctioning Phase 2 at Long Lake, advance our CBM strategies and evaluate the potential of shale gas.

Athabasca Oil Sands

The Athabasca oil sands in northeast Alberta is a key growth area for Nexen. Our strategy is to economically develop our bitumen resource in phases to provide low-risk, stable, future growth. Our Long Lake Project involves integrating steam-assisted-gravity-drainage (SAGD) bitumen production with field upgrading technology to produce a premium synthetic crude and synthetic gas, which significantly reduces our need

to purchase natural gas for operations. We also have a 7.23% investment in the Syncrude oil sands mining operation.

Long Lake Project

In 2001, we formed a 50/50 joint venture with OPTI Canada Inc. (OPTI) to develop the Long Lake lease using SAGD for bitumen production and proprietary OrCrude™ technology for our first stage of upgrading. OPTI has the exclusive Canadian license for the OrCrude™ technology. We acquired the exclusive right to use this technology with OPTI within approximately 100 miles of Long Lake, and the right to use the technology independently elsewhere in the world.

We operate the Long Lake bitumen extraction process and are responsible for constructing, developing and operating the SAGD project. OPTI is responsible for designing, constructing and operating the upgrader. We share equally in all project reserves, production, operating and capital costs.

SAGD and Upgrader Integration

SAGD involves drilling two parallel horizontal wells, generally between 2,300 and 3,300 feet long, with about 16 feet of vertical separation. Steam is injected into the shallower well, where it heats the bitumen that then flows by gravity to the deeper producing well. The OrCrude™ technology, using conventional distillation, solvent de-asphalting and thermal cracking, separates the produced bitumen into partially upgraded sour crude oil and liquid asphaltenes. By coupling the OrCrude™ process with commercially available hydrocracking and gasification technologies, sour crude is upgraded to light (39° API) premium synthetic sweet crude oil, and the asphaltenes are converted to a low-energy, synthetic fuel gas. This gas is available as a low-cost fuel for generating steam and as a source of hydrogen for the hydrocracking process. The gas will also be burned in a cogeneration plant to produce electricity to be used on-site and sold to the provincial electricity grid. The energy conversion efficiency for our Long Lake upgrader is about 90% compared to 75% for a typical bitumen-fed coker, which we expect will provide us with an approximate $10/bbl operating cost advantage.

Our Strategic Advantage

Our integrated SAGD and upgrading process addresses three main economic hurdles of SAGD bitumen production: 1) the high cost of natural gas; 2) the cost and availability of diluent; and 3) the realized price of bitumen. With synthetic gas from the asphaltenes as fuel, we need to purchase very little additional natural gas. With the upgrading facilities on site, expensive diluent is not required to transport the bitumen to market. And, by upgrading the bitumen into a highly desirable refinery feedstock or diluent supply, the end product commands light-sweet crude oil premium pricing.

10

Project Milestones and Costs

The Long Lake Project received regulatory approval in 2003 and Nexen board approval in 2004. Field construction of the SAGD and upgrader facilities began in 2004. In 2006, we substantially completed module and site construction of the SAGD facilities. In 2007, we began injecting steam in all 10 well pads. The first six months of steam injection largely involves heating the reservoir, followed up by a ramp-up of bitumen production to peak rates over 12 to 24 months. At the start of production, steam-to-oil ratios will be high but will decline as bitumen production ramps up to our target rates. Depending on start up issues and any related facility down time, we expect bitumen production before royalties to reach between 35,000 and 45,000 bbls/d (between 17,500 and 22,500 bbls/d net to our share) by the end of 2008, with a steam-to-oil ratio of between 3.5 and 4.0. We expect the steam-to-oil ratio to average approximately 3.0 over the long-term.

Upgrader module fabrication is complete and all modules are on site. Construction of the upgrader is approximately 97% complete and start up is scheduled for mid 2008. Peak output of premium synthetic crude oil is expected within 12 to 18 months of upgrader start up and we expect to exit 2008 with synthetic production rates between 30,000 and 40,000 bbls/d (between 15,000 and 20,000 bbls/d net to our share). Production capacity for the first phase of Long Lake is approximately 60,000 bbls/d (30,000 bbls/d net to our share) of premium synthetic crude, which we expect to reach in 2009. We expect to maintain production over the project’s life, estimated at 40 years, by periodically drilling additional SAGD well pairs.

In 2008, we will bring on Long Lake and expect bitumen production to reach between 35,000 and 45,000 bbls/d (17,500 and 22,500 bbls/d net to us).

In 2007, we invested $1,025 million at Long Lake Phase 1. Long Lake’s total capital costs have increased since project sanctioning due to design enhancements and industry cost pressures. When our board sanctioned the project in February 2004, capital costs were estimated at $3.4 billion ($1.7 billion net). In December 2004, we accelerated the drilling of an additional well pad consisting of 13 well-pairs to ensure reliability of bitumen production at the commencement of upgrader operations at a cost of $98 million ($49 million net). In early 2006, we further modified the project design by adding steam generation capacity and soot handling equipment at a cost of $360 million ($180 million net). These scope changes increased the estimated project cost to $3.8 billion ($1.9 billion net). Since then, high activity in the oil sands has placed ongoing cost pressures on labour and services. As well, lower than anticipated labour productivity has required a larger workforce to maintain progress. As a result, the projected costs of Long Lake have increased from $3.8 billion to between $5.8 billion and $6.1 billion (between $2.9 billion and $3.05 billion net to us). Despite capital cost increases, we still expect to achieve good economic returns which benefit from a significant operating cost advantage. Combined SAGD, cogeneration and upgrading operating costs are expected to average about $17/bbl,

11

substantially lower than coking or other upgrading processes. We expect ongoing capital to average between $3/bbl and $4/bbl. The full-cycle capital costs of producing and upgrading bitumen using this technology are comparable to those for surface mining and coking upgrading on a barrel-of-daily production basis.

Future Phases

We have approximately 249,000 net acres of bitumen-prone lands in the Athabasca region, with plans to acquire more. We plan to continue developing our bitumen lands in phases using our integrated upgrading strategy. In 2005, we announced our plan to duplicate Long Lake by developing Phase 2. In 2007, we invested $114 million on land acquisition, additional drilling, seismic and engineering to develop our leases and advance regulatory applications for these phases.

During 2007, the Alberta government proposed increases to oil sands royalty rates and implemented climate change legislation. The federal government also announced climate change proposals; however, legislation has not been drafted. Due to this regulatory uncertainty, we are delaying certain planned expenditures on Phase 2. Phase 2 will be followed by additional phases every three or four years. Each phase will leverage the knowledge and experience gained from successfully developing Long Lake and subsequent projects will be similar in size and design. By keeping the core team in place and repeating and improving on existing designs and implementation plans, we expect to gain efficiencies in engineering, modular fabrication and on-site construction. We also anticipate enhanced operating efficiencies as we can train and move people easily between the various plants.

Reserves Recognition

Under SEC rules and regulations, we are required to recognize bitumen reserves rather than the upgraded premium synthetic crude oil that we expect to produce and sell. The economic recoverability of bitumen reserves is sensitive to natural gas prices, diluent costs and light/heavy differentials, risks that our integrated project has been designed to virtually eliminate. At December 31, 2007, we recognized proved bitumen reserves of 268 mmboe before royalties (234 after royalties) for our Long Lake Project, representing about 25% of our total proved oil and gas and Syncrude reserves before royalties.

Heavy Oil

Approximately 45% of our Canadian conventional production is heavy oil. Heavy oil is characterized by high specific gravity or weight and high viscosity or resistance to flow. Therefore, heavy oil is more difficult and expensive to extract, transport and refine than other types of oil. Heavy oil also receives a lower price than light oil, as more expensive and complex refineries are required to refine heavy crude into higher-value petroleum products.

To maximize heavy oil returns, it is important to manage capital and operating costs. Our large production base and existing infrastructure are advantageous in managing these costs. In 2008, we plan to continue exploiting our existing fields through drilling and optimizing operations.

Heavy oil reservoirs typically have lower recovery factors than conventional oil reservoirs, leaving substantial amounts of oil in the ground. This creates an opportunity to increase recovery factors by applying new technology. We are continuing to research various technologies to increase our heavy oil recoveries with several ongoing pilot projects in west-central Saskatchewan.

Natural Gas

Approximately 40% of our Canadian production is natural gas extracted primarily from shallow sweet reservoirs in southern Alberta and Saskatchewan and from sour gas reservoirs near Calgary. In general, shallower gas targets are cheaper to drill and develop, but have relatively smaller reserves and lower productivity per well. Sour gas is natural gas that contains hydrogen sulfide. Our Balzac field, northeast of Calgary, has been producing sour natural gas since 1961. This sour gas is processed through our operated Balzac plant.

At the end of 2007, we held more than 725 net sections of land in Alberta with CBM potential.

Coalbed Methane (CBM)

Approximately 15% of our Canadian production is from our commercial CBM developments at Corbett, Doris and Thunder in the Fort Assiniboine area of central Alberta. We began commercial development in the Upper Mannville coals in 2005 by applying horizontal well technology to increase gas production rates and reduce de-watering time from water-saturated coal. Upper Mannville coals are generally deeper than the Horseshoe Canyon “dry coal” play, which is also being commercially developed in Alberta.

We have a long-term view of this business and plan to increase our CBM production by progressively developing opportunities on our extensive land base. At the end of 2007, we held more than 725 net sections of land in Alberta with CBM potential, some of which overlay existing conventional producing lands. In 2007, we invested approximately $170 million in exploration and development activities. For 2008, we have slowed our pace of program spending until we gain clarity on the impact of Alberta royalty changes. In 2008, we plan to tie-in Upper Mannville development wells drilled in 2007 for production and commence development of our Horseshoe Canyon lands.

12

Item 1 and 2 Business and Properties Yemen

Shale Gas

As part of our growth strategy in unconventional Canadian resource plays, we acquired approximately 190 net sections of land in an emerging Devonian shale gas play in north eastern British Columbia. Shale gas is natural gas produced from reservoirs composed of organic shale. The gas is stored in pore spaces, fractures or absorbed into organic matter. Currently, the United States is the largest producer of shale gas. In 2008, we plan to continue our evaluation program to demonstrate the feasibility of this resource.

Fiscal Terms

In Canada, we pay two types of royalties to federal and provincial governments on production from lands where they own the petroleum and natural gas rights. The first type is a gross royalty (Gross Royalty) system whereby we pay royalties ranging from 5% to 40% depending upon drilling date, production rate and product sales price. The second type of royalty (NPI) applies to our oil sands projects, which includes a 1% royalty on gross revenue prior to the recovery of capital costs. After achieving payout on these costs, the royalty converts to the greater of 1% of gross revenues or 25% of net profits.

During 2007, the Alberta government announced a new royalty framework effective January 1, 2009 that includes proposed increases to Alberta’s royalty rates, although it has yet to be passed into legislation. Under the new framework, the upper limit of the Gross Royalty system is expected to increase to 50%, depending on production rate and product sales price. The new framework will also increase the royalty rates for the NPI royalty system that applies to oil sands projects. The new royalty rates for oil sands projects will range from 1% to 9% of gross revenue for projects that are pre-payout of capital costs, and from 25% to 40% of net profit for projects that are post-payout. These royalty rates will vary depending on WTI (US$55/bbl to US$120/bbl).

In addition to royalties, some provinces impose taxes on production from lands where they do not own the mineral rights. The Saskatchewan government assesses a resource surcharge on gross Saskatchewan resource sales that are subject to crown royalties, ranging from 1.75% to 3.3%. In 2008, the rates will reduce slightly to 1.7% and 3.0%. In Alberta, we are subject to a freehold mineral tax of approximately 4%.

Profits earned in Canada from resource properties are subject to federal and provincial income taxes. In late 2007, the federal government reduced the federal corporate income tax rate from 22% in 2007 to 15% by 2012. Provincial income tax rates vary from approximately 10% to 16%.

Yemen has been a significant international region since we first began production at Masila in 1993. We operate the country’s largest oil project and have developed excellent relationships with the government and local communities.

Our strategy in Yemen is to maximize the value from our existing blocks, while we continue to search for new reservoirs in deeper horizons. We have two producing blocks: Masila (Block 14) and East Al Hajr (Block 51). In 2007, we produced 71,600 bbls/d of oil before royalties (39,800 after royalties), representing approximately 28% of Nexen’s total production. Proved reserves of 41 mmboe before royalties (23 after royalties) comprise approximately 4% of Nexen’s total proved oil and gas and Syncrude reserves before royalties (3% after royalties).

Masila Block (Block 14)

We operate the Masila Project with a 52% working interest. Our share of 2007 production was 57,000 bbls/d before royalties (29,900 after royalties). After more than 10 years of growth, our Masila fields have matured, but significant value still remains. As a result of the Production Sharing Agreement (PSA) terms that govern Masila production, we still expect to generate approximately 22% of total project free cash flow from the remaining proved reserves recoverable before the PSA expires in 2011.

13

Item 1 and 2 Business and Properties Middle East

The first successful Masila exploratory well was drilled at Sunah in 1990, with additional discoveries quickly following at Heijah and Camaal. Initial production began in July 1993, with the first lifting of oil in August 1993. Masila Blend oil averages 32° API at very low gas-oil ratios. Most of the oil is produced from the Upper Qishn formation, but we also produce from deeper formations including the Lower Qishn, Upper Saar, Saar, Madbi, Basal Sand and Basement formations. Production is collected at our Central Processing Facility (CPF) where water is separated for reinjection and oil is pumped to the Ash Shihr export terminal on the Indian Ocean and shipped to customers, primarily in Asia.

We are managing the pace of our drilling program to ensure we recover the remaining reserves in the most efficient, cost-effective manner. In 2008, we plan to drill ten development wells and sidetracks.

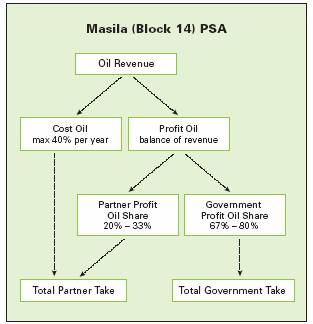

The Masila PSA was signed in 1987 between the Government of Yemen and the Masila joint venture partners (Masila Partners), including Nexen. Under the PSA, we have the right to produce oil from Masila into 2011 and to negotiate a five-year extension. Production is divided into cost recovery oil and profit oil. Cost recovery oil provides for the recovery of all exploration, development, and operating costs that are funded by the Masila Partners. Costs are recovered from a maximum of 40% of production each year, as follows:

Costs |

| Recovery |

Operating |

| 100% in year incurred |

Exploration |

| 25% per year for 4 years |

Development |

| 16.7% per year for 6 years |

The remaining production is profit oil that is shared between the Masila Partners and the Government and is calculated on a sliding scale based on production. The Masila Partners’ share of

profit oil ranges from 20% to 33%. The structure of the agreement moderates the impact on the Masila Partners’ cash flows during periods of low prices, as we recover our costs first and then share any remaining profit oil with the Government. The Government’s share of profit oil includes a component for Yemen income taxes payable by the Masila Partners at a rate of 35%. In 2007, the Masila Partners’ share of production, including recovery of past costs, was approximately 39%.

East Al Hajr Block (Block 51)

We operate Block 51, which is also governed by a PSA between the Government of Yemen and the East Al Hajr partners (EAH Partners): The Yemen Company (TYCO) (12.5% carried working interest) and Nexen (87.5% working interest). Under the PSA, TYCO has no obligation to fund capital or operating expenditures. Our effective interest is 100% and for purposes of accounting and reserves recognition, we treat TYCO’s 12.5% participating interest as a royalty interest. We recognize both the Government’s share and TYCO’s share of profit oil under the PSA as royalties and taxes consistent with our treatment of our Masila operations. The PSA expires in 2023, and we have the right to negotiate a five-year extension. Under the PSA, the EAH Partners pay a royalty ranging from 3% to 10% to the Government depending on production volumes. The remaining production is divided into cost recovery oil and profit oil. Cost recovery oil provides for the recovery of all of the project’s exploration, development and operating costs, funded solely by Nexen. Costs are recovered from a maximum of 50% of production each year after royalties, as follows:

Costs |

| Recovery |

Operating |

| 100% in year incurred |

Exploration |

| 75% per year, declining balance |

Development |

| 75% per year, declining balance |

14

Items 1 and 2 Business and Properties Offshore West Africa

The remaining production is profit oil that is shared between the EAH Partners and the Government on a sliding scale based on production rates. The EAH Partners’ share of profit oil ranges from 20% to 30%. The Government’s share of profit oil includes a component for Yemen income taxes payable by the EAH Partners at a rate of 35%. In 2007, the EAH Partners’ share of Block 51 production, including recovery of past costs, was approximately 54%.

The first successful exploratory well was drilled at BAK-A in 2003, with BAK-B discovered shortly after. Block 51 development began in 2004 and includes a CPF, gathering system and a 22-km tieback to our Masila export pipeline. Production began in November 2004. During 2007, production averaged 14,600 bbls/d before royalties (9,900 after royalties).

Offshore West Africa is a core area where we already have discoveries. It offers prolific reservoirs and multiple opportunities to invest in this oil-rich region. Our strategy here is to explore and develop our portfolio for medium- to long-term growth.

Nigeria

In 1998, we acquired a 20% non-operated interest in Block OPL-222 which covers 448,000 acres approximately 50 miles offshore in water depths ranging from 600 to 3,500 feet. Based on the drilling results outlined below, significant hydrocarbons exist on these blocks.

Year |

| Well |

| Location |

| Results |

1998 |

| Ukot-1 |

| Ukot field discovery well |

| encountered three oil-bearing intervals and flowed at restricted rate of 13,900 bbls/d from two intervals |

2002 |

| Usan-1 |

| Usan field discovery well |

| encountered several oil-bearing intervals and flowed at restricted rate of 5,000 bbls/d from one interval |

2003 |

| Usan-2 |

| 3 km west of discovery |

| appraised up-dip portion of the fault block |

2003 |

| Usan-3 |

| 2 km northwest of discovery |

| appraised separate fault block and flowed at restricted rate of 5,600 bbls/d from one interval |

2003 |

| Ukot-2 |

| 3.5 km south of discovery |

| encountered three oil-bearing intervals |

2003 |

| Usan-4 |

| 5 km south of discovery |

| flowed at restricted rate of 4,400 bbls/d from first interval and |

|

|

|

|

|

| 6,300 bbls/d from second interval |

2004 |

| Usan-5 |

| 6 km west of discovery |

| sampled oil in several intervals |

2004 |

| Usan-6 |

| 4 km south of Usan-5 |

| flowed at restricted rate of 5,800 bbls/d from one interval |

2005 |

| Usan-7 |

| 9 km southwest of discovery |

| confirmed an eastern extension of the field |

2005 |

| Usan-8 |

| 3 km southwest of discovery |

| confirmed an eastern extension of the field |

Appraisal of the Usan field is complete and the field development continues to move forward. We expect the project to advance to the execution phase shortly and this will facilitate the award of the major deep-water facilities contracts. The project will have the ability to process an average of 180,000 bbls/d of oil during the initial production plateau period through a new FPSO with a two million barrel storage capacity. We have a 20% interest in exploration and development on this block. In 2008, we plan to invest approximately $165 million to progress development and award the major deep-water facilities contracts. At year-end 2007, proved reserves of 30 mmboe before royalties (25 after royalties) comprise approximately 3% of our total proved oil and gas and Syncrude reserves.

15

Item 1 and 2 Business and Properties Other International

Colombia

Boqueron Block – Guando

In 2000, we made our first discovery at Guando on our 20% non-operated Boqueron Block. Boqueron is in the Upper Magdalena Basin of central Colombia, approximately 45 km southwest of Bogota. Our working interest in Guando will decrease to 10% once the field has produced 60 million barrels of oil, which is expected to occur in early 2009. Our share of 2007 production averaged 6,200 bbls/d before royalties (5,700 after royalties), about 2% of Nexen’s total production including Syncrude.

Production from Guando is subject to a royalty between 5% and 25% depending on daily production, and in 2007 averaged 8%. Colombian taxable income is subject to federal income tax of 34% in 2007 and 33% in 2008 and future years.

Exploration

We have interests in three exploration blocks in the Upper Magdalena Basin: EI Queso acquired in 2003, Villarrica Norte Block in 2005 and EI Guadual in 2007. In 2007, we drilled two unsuccessful wells; Guaini-1 and Atalea-1. We hold five technical evaluation agreements that each provide approximately one year to evaluate potential prospects. We are also identifying other growth opportunities in Colombia.

Norway

As part of our growth strategy in the North Sea, we participated in the 2006 bid round for exploration rights offshore Norway and were awarded interests in six licences covering nine blocks in early 2007. In 2008, we expect to invest approximately $40 million in additional seismic and geologic studies. In early 2008, we were awarded interests in three additional licences.

Norwegian oil and gas activities are subject to a general corporate income tax rate of 28% plus an additional 50% special petroleum tax. A tax refund of 78% is received on tax losses arising from qualifying exploration expenses in Norway.

ReserVes, produCtIon and reLated InformatIon

In addition to the tables below, we refer you to the Supplementary Data in Item 8 of this Form 10-K for information on our oil and gas producing activities. Nexen has not filed with nor included in reports to any other United States federal authority or agency, any estimates of total proved crude oil or natural gas reserves since the beginning of the last fiscal year.

Net Sales by Product from Continuing Oil and Gas Operations (including Syncrude)

(Cdn$ millions) |

| 2007 |

| 2006 |

| 2005 |

|

Conventional Crude Oil and Natural Gas Liquids (NGLs) |

| 4,077 |

| 2,479 |

| 2,438 |

|

Synthetic Crude Oil |

| 545 |

| 446 |

| 397 |

|

Natural Gas |

| 499 |

| 553 |

| 671 |

|

Total |

| 5,121 |

| 3,478 |

| 3,506 |

|

Crude oil (including synthetic crude oil) and natural gas liquids represent approximately 90% of our oil and gas net sales, while natural gas represents the remaining 10%.

16

Item 1 and 2 Business and Properties Operations Statistics

Sales Prices and Production Costs (excluding Syncrude)

|

| Average Sales Price (1) |

| Average Production Cost (1) |

| ||||||||

|

| 2007 |

| 2006 |

| 2005 |

| 2007 |

| 2006 |

| 2005 |

|

Crude Oil and NGLs (Cdn$/bbl) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Yemen |

| 76.29 |

| 71.57 |

| 62.07 |

| 12.00 |

| 8.11 |

| 6.75 |

|

Canada (2) |

| 44.07 |

| 42.79 |

| 40.51 |

| 18.67 |

| 15.50 |

| 14.01 |

|

United States |

| 69.83 |

| 65.80 |

| 57.63 |

| 9.69 |

| 9.45 |

| 7.33 |

|

United Kingdom |

| 76.30 |

| 71.19 |

| 60.55 |

| 6.94 |

| 11.28 |

| 14.90 |

|

Other Countries |

| 71.29 |

| 66.09 |

| 59.96 |

| 3.76 |

| 3.13 |

| 6.08 |

|

Natural Gas (Cdn$/mcf) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Canada (2) |

| 6.32 |

| 6.49 |

| 7.51 |

| 2.28 |

| 1.65 |

| 0.95 |

|

United States |

| 7.80 |

| 7.86 |

| 10.56 |

| 1.61 |

| 1.58 |

| 1.22 |

|

United Kingdom |

| 4.71 |

| 7.43 |

| 7.86 |

| 1.16 |

| 1.88 |

| 2.48 |

|

Notes:

(1) | Sales prices and unit production costs are calculated using our working interest production after royalties. |

(2) | Includes results of discontinued operations for 2005 (See Note 14 to our Consolidated Financial Statements). |

Oil and Gas Acreage

|

| Developed |

| Undeveloped 1 |

| Total |

| ||||||

(thousands of acres) |

| Gross |

| Net |

| Gross |

| Net |

| Gross |

| Net |

|

Yemen (2) |

| 50 |

| 29 |

| 756 |

| 628 |

| 806 |

| 657 |

|

Canada |

| 797 |

| 610 |

| 1,871 |

| 980 |

| 2,668 |

| 1,590 |

|

United States |

| 206 |

| 122 |

| 1,123 |

| 562 |

| 1,329 |

| 684 |

|

United Kingdom |

| 202 |

| 83 |

| 1,290 |

| 846 |

| 1,492 |

| 929 |

|

Colombia (4) |

| 1 |

| — |

| 607 |

| 372 |

| 608 |

| 372 |

|

Nigeria (2), (3) |

| — |

| — |

| 448 |

| 90 |

| 448 |

| 90 |

|

Norway |

| — |

| — |

| 280 |

| 134 |

| 280 |

| 134 |

|

Total |

| 1,256 |

| 844 |

| 6,375 |

| 3,612 |

| 7,631 |

| 4,456 (5 | ) |

Notes:

(1) | Undeveloped acreage is considered to be those acres on which wells have not been drilled or completed to a point that would permit production of commercial quantities of crude oil and natural gas regardless of whether or not such acreage contains proved reserves. |

(2) | The acreage is covered by production sharing contracts. |

(3) | The acreage is covered by a joint venture agreement. |

(4) | The acreage is covered by an association contract. |

(5) | Approximately 20% of our net oil and gas acreage is scheduled to expire within three years if production is not established or we take no other action to extend the terms. We plan to continue the terms of many of these licences. |

Producing Oil and Gas Wells

|

| Oil |

| Gas |

| Total |

| ||||||

(number of wells) |

| Gross (1) |

| Net (2) |

| Gross (1) |

| Net (2) |

| Gross (1) |

| Net (2) |

|

Yemen |

| 463 |

| 274 |

| — |

| — |

| 463 |

| 274 |

|

Canada |

| 2,231 |

| 1,550 |

| 2,884 |

| 2,522 |

| 5,115 |

| 4,072 |

|

United States |

| 193 |

| 94 |

| 202 |

| 141 |

| 395 |

| 235 |

|

United Kingdom |

| 48 |

| 21 |

| — |

| — |

| 48 |

| 21 |

|

Colombia |

| 121 |

| 25 |

| — |

| — |

| 121 |

| 25 |

|

Total |

| 3,056 |

| 1,964 |

| 3,086 |

| 2,663 |

| 6,142 |

| 4,627 |

|

Notes:

(1) | Gross wells are the total number of wells in which we own an interest. |

(2) | Net wells are the sum of fractional interests owned in gross wells. |

17

Item 1 and 2 Business and Properties Drilling Activity

Drilling Activity

|

| 2007 |

| |||||||||||||||||||||||

|

| Net Exploratory |

| Net Development |

|

|

| |||||||||||||||||||

(number of net wells) |

| Productive |

| Dry Holes |

| Total |

| Productive |

| Dry Holes |

| Total |

| Total |

| |||||||||||

Yemen |

| 1.0 |

| 1.0 |

| 2.0 |

| 28.0 |

| — |

| 28.0 |

| 30.0 |

| |||||||||||

Canada |

| 23.2 |

| 0.6 |

| 23.8 |

| 295.6 |

| 3.2 |

| 298.8 |

| 322.6 |

| |||||||||||

United States |

| 0.8 |

| 2.9 |

| 3.7 |

| 8.6 |

| 1.0 |

| 9.6 |

| 13.3 |

| |||||||||||

United Kingdom |

| 2.0 |

| 3.2 |

| 5.2 |

| 4.2 |

| — |

| 4.2 |

| 9.4 |

| |||||||||||

Colombia |

| — |

| 0.9 |

| 0.9 |

| 7.0 |

| — |

| 7.0 |

| 7.9 |

| |||||||||||

Total |

| 27.0 |

| 8.6 |

| 35.6 |

| 343.4 |

| 4.2 |

| 347.6 |

| 383.2 |

| |||||||||||

|

| 2006 |

| ||||||||||||

|

| Net Exploratory |

| Net Development |

|

|

| ||||||||

(number of net wells) |

| Productive |

| Dry Holes |

| Total |

| Productive |

| Dry Holes |

| Total |

| Total |

|

Yemen |

| 3.0 |

| 5.5 |

| 8.5 |

| 36.0 |

| 1.0 |

| 37.0 |

| 45.5 |

|

Canada |

| 35.4 |

| 2.2 |

| 37.6 |

| 214.3 |

| 0.7 |

| 215.0 |

| 252.6 |

|

United States |

| 1.6 |

| 2.1 |

| 3.7 |

| 8.3 |

| 2.0 |

| 10.3 |

| 14.0 |

|

United Kingdom |

| 0.8 |

| 1.7 |

| 2.5 |

| 5.5 |

| — |

| 5.5 |

| 8.0 |

|

Colombia |

| — |

| — |

| — |

| 2.0 |

| — |

| 2.0 |

| 2.0 |

|

Nigeria |

| — |

| 0.2 |

| 0.2 |

| — |

| — |

| — |

| 0.2 |

|

Total |

| 40.8 |

| 11.7 |

| 52.5 |

| 266.1 |

| 3.7 |

| 269.8 |

| 322.3 |

|

|

| 2005 | |||||||||||||

|

| Net Exploratory |

| Net Development |

|

|

| ||||||||

(number of net wells) |

| Productive |

| Dry Holes |

| Total |

| Productive |

| Dry Holes |

| Total |

| Total |

|

Yemen |

| 0.5 |

| 4.6 |

| 5.1 |

| 33.0 |

| 1.6 |

| 34.6 |

| 39.7 |

|

Canada |

| 32.2 |

| 8.0 |

| 40.2 |

| 198.9 |

| 0.5 |

| 199.4 |

| 239.6 |

|

United States |

| — |

| 0.6 |

| 0.6 |

| 7.2 |

| 1.0 |

| 8.2 |

| 8.8 |

|

United Kingdom |

| 0.5 |

| 2.1 |

| 2.6 |

| 1.5 |

| — |

| 1.5 |

| 4.1 |

|

Colombia |

| — |

| — |

| — |

| 1.8 |

| — |

| 1.8 |

| 1.8 |

|

Nigeria |

| 0.4 |

| 0.2 |

| 0.6 |

| — |

| — |

| — |

| 0.6 |

|

Equatorial Guinea |

| — |

| 0.5 |

| 0.5 |

| — |

| — |

| — |

| 0.5 |

|

Total |

| 33.6 |

| 16.0 |

| 49.6 |

| 242.4 |

| 3.1 |

| 245.5 |

| 295.1 |

|

Wells in Progress

At December 31, 2007, we were drilling 3 wells in Yemen (2 net), 2 wells in Canada (2 net), 4 wells in the United States (1.9 net), 3 wells in the United Kingdom (1.4 net), and 1 well in Colombia (0.2 net).

18

Items 1 and 2 Business and Properties Reserves

Proved Reserves including Proved Undeveloped Reserves

At December 31, 2007, we had 734 mmboe of proved oil and gas reserves before royalties (650 after royalties). This is a 1% increase over the prior year (2% after royalties). Including Syncrude, our total proved oil and gas and Syncrude reserves increased 1% to 1,058 mmboe (1% to 917 after royalties).

The following table provides a summary of the changes in our proved oil and gas reserves (before royalties) excluding our Syncrude reserves during 2007. Refer to page 120 for proved reserves information on an after-royalties basis.

|

|

|

| United |

| United |

|

|

| Other |

|

|

|

(mmboe) |

| Canada |

| Kingdom |

| States |

| Yemen |

| Countries |

| Total |

|

December 31, 2006 |

| 364 |

| 182 |

| 73 |

| 66 |

| 40 |

| 725 |

|

Extension and Discoveries |

| 7 |

| 10 |

| 4 |

| 2 |

| — |

| 23 |

|

Revisions |

| 28 |

| 44 |

| (12 | ) | 1 |

| — |

| 61 |

|

Acquisitions |

| — |

| 1 |

| 11 |

| — |

| — |

| 12 |

|

Divestments |

| — |

| — |

| (2 | ) | — |

| — |

| (2 | ) |

Production |

| (13 | ) | (30 | ) | (12 | ) | (28 | ) | (2 | ) | (85 | ) |

December 31, 2007 |

| 386 |

| 207 |

| 62 |

| 41 |

| 38 |

| 734 |

|

Extensions and discoveries contributed 23 mmboe. The majority of the increase results from updip drilling at Buzzard in the North Sea, appraisal drilling at Longhorn in the Gulf of Mexico, and ongoing development of coalbed methane in Canada. Other increases relate to ongoing exploitation activities in the North Sea, Yemen, the Gulf of Mexico and Canada.

More than half of the 61 mmboe of positive revisions occurred at Buzzard where drilling results and production performance supported higher reserve estimates. About a third of the revisions are from our Long Lake Project where performance of analogous commercial SAGD projects support increased expected recoveries. The remaining positive revisions are primarily from price revisions in Canadian heavy oil properties and the Ettrick field, recovery factor improvements on our Canadian CBM lands and other areas. In the United States, the negative revision mainly relates to our deep-water Gulf of Mexico Aspen property where unsuccessful development drilling and production declines resulted in a reassessment of the property. In addition, four Gulf of Mexico shelf properties recognized negative reserve revisions from unsuccessful recompletions, production declines and increasing operating costs on older platforms reduced their economic life.

Acquisitions and divestments accounted for a net 10 mmboe addition (8 after royalties), primarily in the Gulf of Mexico where we acquired Shelf properties, pooled our deep-water Ringo well within the Longhorn development, and swapped our interest in Great White West for an overriding royalty interest in the entire Great White reservoir. In addition, we acquired additional interests in our operated Scott and Telford properties in the North Sea.

The following provides a summary of the changes in our proved oil and gas reserves (before royalties) excluding Syncrude, during the past three years. Refer to page 120 for proved reserves information on an after royalty basis for the past three years.

|

|

|

| United |

| United |

|

|

| Other |

|

|

|

(mmboe) |

| Canada |

| Kingdom |

| States |

| Yemen |

| Countries |

| Total |

|

December 31, 2004 |

| 164 |

| 130 |

| 103 |

| 133 |

| 12 |

| 542 |

|

Extension and Discoveries |

| 30 |

| 41 |

| 24 |

| 17 |

| 31 |

| 143 |

|

Revisions |

| 283 |

| 79 |

| (33 | ) | (4 | ) | 1 |

| 326 |

|

Acquisitions |

| 2 |

| 1 |

| 11 |

| — |

| — |

| 14 |

|

Divestments |

| (49 | ) | — |

| (2 | ) | — |

| — |

| (51 | ) |

Production |

| (44 | ) | (44 | ) | (41 | ) | (105 | ) | (6 | ) | (240 | ) |

December 31, 2007 |

| 386 |

| 207 |

| 62 |

| 41 |

| 38 |

| 734 |

|

19