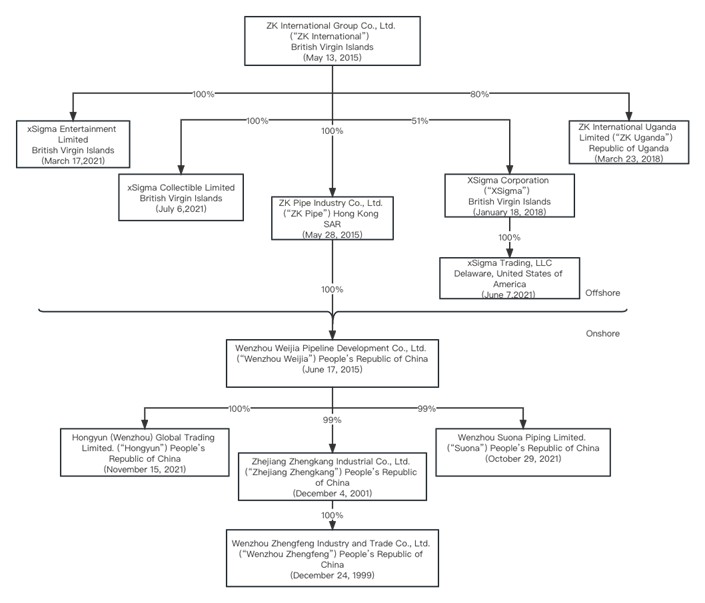

We incurred $5,772,710 in general and administrative expenses for the fiscal year ended September 30, 2021, compared to $2,482,972 for the fiscal year ended September 30, 2020. General and administrative expenses increase by $3,289,738, or 132.49%, for the fiscal year ended September 30, 2021 compared to the fiscal year ended September 30, 2020. The increase is primarily due to the stock-based compensation incurred during the fiscal year 2021 for the expenses related to our new business operations. During fiscal year 2021, we hired third-part individuals and consulting firms to facilitate our operations in xSigma Corporation which is principally engaged in decentralized finance (“DeFi”) and cryptocurrency market, and xSigma Collectibles which is principally engaged in operating NFT (Non-Fungible Token) marketplace.

Asset impairment costs

During the fiscal year ended September 30, 2021, the Company entered into a series of consulting agreements with third-party entity and individuals to develop and implement a defi exchange platform, which is a stablecoin DEX (decentralized exchange) and liquidity mining platform, available at https://xsigma.fi. During 2022 fiscal year, the Company evalutated the recoverability of the Defi platform pursuant to ASC 360-10-35-21 and concluded that the carrying value of the Defi Exchange may not be recoverable as it projects that the platform is likely to have continuing losses and it’s more likely than not this platform will be sold or otherwise disposed of significantly before the end of its previously estimated useful life. The Company wrote off the carrying value of the platform and recorded a loss of $2,771,019. There was no asset impairment cost during the fiscal year ended September 30, 2021

Research and Development Expenses

We incurred $987,186 in research and development expenses for the fiscal year ended September 30, 2022, compared to $1,234,161 for the fiscal year ended September 30, 2021. R&D expenses decreased by $246,975, or 20.01%, for the fiscal year ended September 30, 2022 compared to the fiscal year ended September 30, 2021. The decrease was primarily due to the decreased research and development activities during fiscal year 2022.

We incurred $1,234,161 in research and development expenses for the fiscal year ended September 30, 2021, compared to $1,123,555 for the fiscal year ended September 30, 2020. R&D expenses increased by $110,606, or 9.84%, for the fiscal year ended September 30, 2021 compared to the fiscal year ended September 30, 2020. The increase was primarily due to the increased research and development activities during fiscal year 2021. Management is committed to expanding our research and development activities to enhance competitive advantage.

Income from operations

As a result of the factors described above, operating loss was $3,964,610 for the fiscal year ended September 30, 2022, compared to operating loss of $3,653,589 for the fiscal year ended September 30, 2021, an increase of operating loss of $311,021 or approximately 8.51%.

As a result of the factors described above, operating loss was $3,653,589 for the fiscal year ended September 30, 2021, compared to operating loss of $1,879,376 for the fiscal year ended September 30, 2020, an increase of operating loss of $1,774,213 or approximately 94.40%.

Other income and expenses

Our interest income and expenses were $109,290 and $3,451,665, respectively, for the fiscal year ended September 30, 2022, compared to interest income and expenses of $13,733 and $1,196,648, respectively, for the fiscal year ended September 30, 2021. We also had government grant of $ 496,740 for financial support to the Company under local government’s innovation incentive programs which was recorded as other income in our Statement of Operations.

Our interest income and expenses were $13,733 and $1,196,648, respectively, for the fiscal year ended September 30, 2021, compared to interest income and expenses of $7,192 and $1,000,554, respectively, for the fiscal year ended September 30, 2020. We also had government grant of $446,480 for financial support to the Company under local government’s innovation incentive programs which was recorded as other income in our Statement of Operations.

Net Income

As a result of the factors described above, our net loss for the fiscal year ended September 30, 2022 was $6,054,266 compared to net loss of $3,802,271 for the fiscal year ended September 30, 2021, an increase in loss of $2,251,995 or approximately 59.23%.