Income from operations

As a result of the factors described above, operating loss was $60,443,588 for the fiscal year ended September 30, 2023, compared to operating loss of $3,964,610 for the fiscal year ended September 30, 2022, an increase of operating loss of $56,478,979 or approximately 1424.58%.

As a result of the factors described above, operating loss was $3,964,610 for the fiscal year ended September 30, 2022, compared to operating loss of $3,653,589 for the fiscal year ended September 30, 2021, an increase of operating loss of $311,021 or approximately 8.51%.

Other income and expenses

Our interest income and expenses were $36,699 and $1,583,734, respectively, for the fiscal year ended September 30, 2023, compared to interest income and expenses of $109,290 and $3,451,665, respectively, for the fiscal year ended September 30, 2022. We also had government grant of $337,216 for financial support to the Company under local government’s innovation incentive programs which was recorded as other income in our Statement of Operations.

Our interest income and expenses were $109,290 and $3,451,665, respectively, for the fiscal year ended September 30, 2022, compared to interest income and expenses of $13,733 and $1,196,648, respectively, for the fiscal year ended September 30, 2021. We also had government grant of $ 496,740 for financial support to the Company under local government’s innovation incentive programs which was recorded as other income in our Statement of Operations.

Net Income

As a result of the factors described above, our net loss for the fiscal year ended September 30, 2023 was $61,290,390 compared to net loss of $6,054,266 for the fiscal year ended September 30, 2022, an increase in loss of $55,236,125 or approximately 912.35%.

As a result of the factors described above, our net loss for the fiscal year ended September 30, 2022 was $6,054,266 compared to net loss of $3,802,271 for the fiscal year ended September 30, 2021, an increase in loss of $2,251,995 or approximately 59.23%.

Foreign currency translation

Our consolidated financial statements are expressed in U.S. dollars but the functional currency of our operating subsidiaries is RMB. Results of operations and cash flows are translated at average exchange rates during the period, assets and liabilities are translated at the unified exchange rate at the end of the period and equity is translated at historical exchange rates. Translation adjustments resulting from the process of translating the financial statements denominated in RMB into U.S. dollars are included in determining comprehensive income. Our foreign currency translation loss for the fiscal year ended September 30, 2023 was $549,332, compared to a currency translation loss of $5,504,385 for the fiscal year ended September 30, 2022, a decrease of $4,955,053. The decreased loss is primarily due to the depreciation of RMB against the U.S. dollars. Our foreign currency translation loss for the fiscal year ended September 30, 2022 was $5,504,385, compared to a currency translation gain of $2,423,439 for the fiscal year ended September 30, 2021, a decrease of $7,927,824. The increased loss is primarily due to the depreciation of RMB against the U.S. dollars.

B. | Liquidity and Capital Resources |

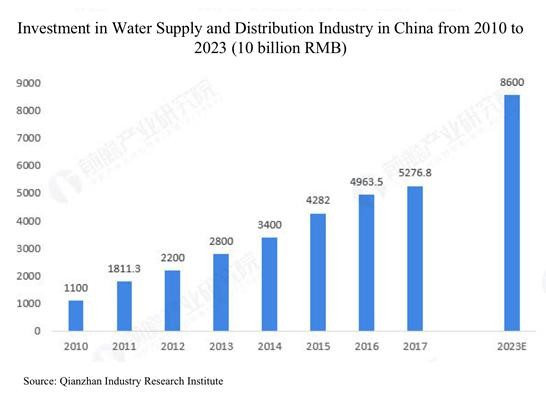

As of September 30, 2023, 2022 and 2021, we had cash and cash equivalents of $5,045,406, $7,515,147, and $13,525,298 respectively. We believe that our current cash, cash to be generated from our operations and access to capital market will be sufficient to meet our working capital needs for at least the next twelve months. However, we do not have any amounts committed to be provided by our related party. We are also not dependent upon future financing to meet our liquidity needs for the next twelve months. However, we plan to expand our business to implement our growth strategies in the water supply market and strengthen our position in the marketplace. To do so, we may need more capital through equity financing to increase our production and meet market demands. Substantially all of our operations are conducted in China and all of our revenues, expense, cash and cash equivalents are denominated in Renminbi (RMB). RMB is subject to the exchange control regulation in China, and, as a result, we may have difficulty distributing any dividends outside of China due to PRC exchange control regulations that restrict its ability to convert RMB into U.S. Dollars.