FILED PURSUANT TO RULE 424(B)(3)

REGISTRATION NO. 333-217924

PHILLIPS EDISON GROCERY CENTER REIT III, INC.

SUPPLEMENT NO. 1 DATED MAY 18, 2018

TO THE PROSPECTUS DATED MAY 8, 2018

This prospectus supplement, or this Supplement No. 1, is part of the prospectus of Phillips Edison Grocery Center REIT III, Inc., or the Company, dated May 8, 2018, or the Prospectus. Unless the context suggests otherwise, the terms “we” “us” and “our” used herein refer to the Company, together with its consolidated subsidiaries. The purposes of this Supplement No. 1 are to provide:

| |

| • | an additional group of investors eligible to purchase Class I shares of common stock; |

| |

| • | “Management’s Discussion and Analysis of Financial Condition and Results of Operations” similar to that filed in our quarterly Report on Form 10-Q for the period ended March 31, 2018, filed May 16, 2018; and |

| |

| • | our unaudited consolidated financial statements and the notes thereto as of March 31, 2018 and December 31, 2017 and for the three months ended March 31, 2018 and 2017. |

Investors Eligible to Purchase Class I Shares

In addition to the categories of investors already listed in this prospectus, Class I shares are available for purchase by our executive officers or directors, or an officer or employee of our advisor, our sponsors or their affiliates or their respective family members (including spouses, parents, grandparents, children and siblings), our consultants, participating broker-dealers, their retirement plans, their representatives and their respective family members, and IRAs and qualified plans of their representatives.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

All references to “Notes” throughout the document refer to the footnotes to the consolidated financial statements. Dollars and shares are presented in thousands.

Overview

Organization—We were formed as a Maryland corporation on April 15, 2016, and intend to elect to be taxed as a REIT for U.S. federal income tax purposes commencing with the taxable year ended December 31, 2017.

We completed a private placement offering of Class A shares of common stock on a “reasonable best efforts” basis to accredited investors. We ceased offering Class A shares in the private offering during the first quarter of 2018. Pursuant to our Registration Statement, declared effective on May 8, 2018, we are offering $1,500,000 in shares of common stock in the primary portion of this offering, consisting of two classes of shares: Class T and Class I, at purchase prices of $10.42 per share and $10.00 per share, respectively, with discounts available to some categories of investors with respect to Class T shares. In addition, we are also offering $200,000 in Class A, Class T, and Class I shares of our common stock pursuant to our distribution reinvestment plan at a price of $9.80 per share. Our dealer manager is responsible for marketing our shares in this offering.

We intend to invest primarily in well-occupied, grocery-anchored neighborhood and community shopping centers leased to a mix of national and regional creditworthy retailers selling necessity-based goods and services in strong demographic markets throughout the United States. In addition, we may invest in other retail properties including power and lifestyle shopping centers, multi-tenant shopping centers, free-standing single-tenant retail properties, and other real estate and real estate-related loans and securities depending on real estate market conditions and investment opportunities that we determine are in the best interests of our stockholders. As of March 31, 2018, we owned four real estate properties acquired from third parties unaffiliated with us or our advisor.

Equity Raise Activity—As of March 31, 2018, we had issued 5,831 shares of Class A common stock, including 64 shares issued through the distribution reinvestment plan, generating gross cash proceeds of $57,414 since our inception.

Portfolio—Below are statistical highlights of our portfolio: |

| | | | | |

| | Total Portfolio as of March 31, 2018 | | Property Acquisitions During the Period Ended March 31, 2018 |

| Number of properties | 4 |

| | 1 |

|

| Number of states | 3 |

| | 1 |

|

| Total square feet (in thousands) | 381 |

| | 99 |

|

| Leased % of rentable square feet | 93.4 | % | | 89.7 | % |

Average remaining lease term (in years)(1) | 5.0 |

| | 8.6 |

|

| |

(1) | The average remaining lease term in years excludes future options to extend the term of the lease. |

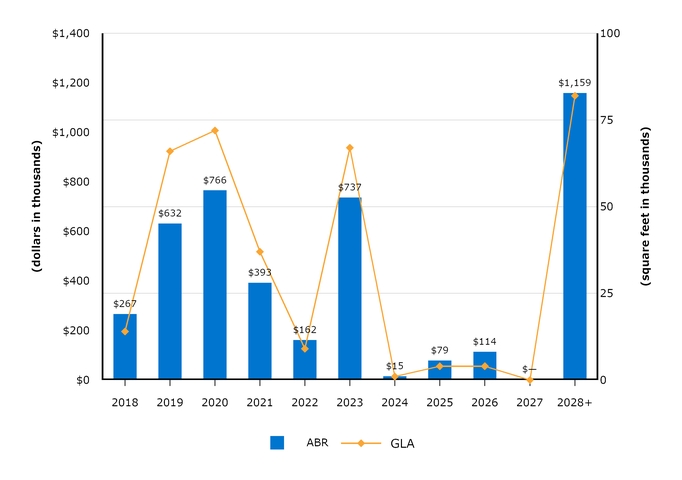

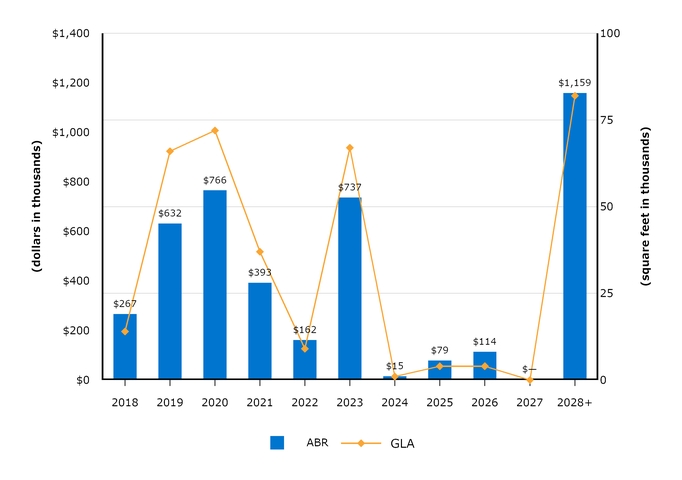

Lease Expirations—The following table lists, on an aggregate basis, all of the scheduled lease expirations after March 31, 2018, for each of the next ten years and thereafter for our four shopping centers. The chart shows the leased square feet and annual base rent (“ABR”) represented by the applicable lease expiration year:

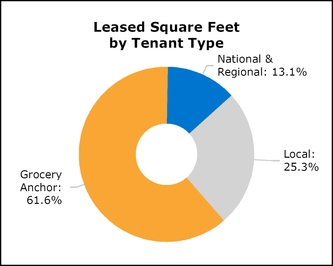

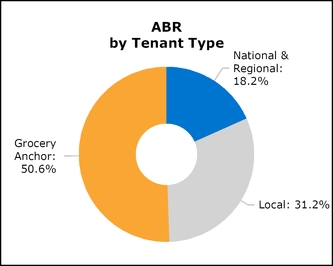

Portfolio Tenancy—Prior to the acquisition of each property, we assess the suitability of the grocery-anchor tenant and other tenants in light of our investment objectives, namely, preserving capital and providing stable cash flows for distributions. Generally, we assess the strength of the tenant by consideration of company factors, such as its financial strength and market share in the geographic area of the shopping center, as well as location-specific factors, such as the store’s sales, local competition, and demographics. When assessing the tenancy of the non-anchor space at the shopping center, we consider the tenant mix at each shopping center in light of our portfolio, the proportion of national and national franchise tenants, the creditworthiness of specific tenants, and the timing of lease expirations. When evaluating non-national tenancy, we attempt to obtain credit enhancements to leases, which typically come in the form of deposits and/or guarantees from one or more individuals.

We define national tenants as those tenants that operate in at least three states. Regional tenants are defined as those

tenants that have at least three locations. The following charts present the composition of our portfolio by tenant type as of

March 31, 2018:

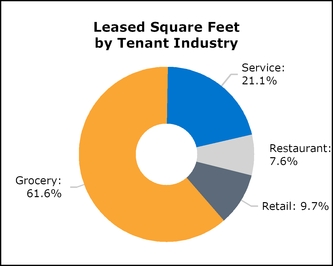

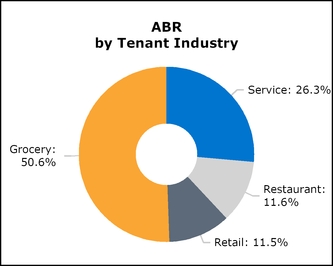

The following charts present the composition of our portfolio by tenant industry as of March 31, 2018:

The following table presents our grocery-anchor tenants, grouped according to parent company, by ABR as of March 31, 2018 (dollars and square feet in thousands): |

| | | | | | | | | | | | | | | |

| Tenant | | ABR | | % of ABR | | Leased Square Feet | | % of Leased Square Feet | | Number of Locations(1) |

| Publix Super Markets | | $ | 932 |

| | 21.5 | % | | 99 |

| | 27.7 | % | | 2 |

| Coborn's | | 639 |

| | 14.8 | % | | 58 |

| | 16.4 | % | | 1 |

| Albertsons Companies | | 617 |

| | 14.3 | % | | 62 |

| | 17.5 | % | | 1 |

| | | $ | 2,188 |

| | 50.6 | % | | 219 |

| | 61.6 | % | | 4 |

| |

(1) | Number of locations excludes auxiliary leases with grocery anchors such as fuel stations and liquor stores. |

Results of Operations

Summary of Operating Activities for the Three Months Ended March 31, 2018 and 2017 |

| | | | | | | | | | | |

| | 2018 | | 2017 | | Favorable (Unfavorable) Change |

| Operating Data: | | | | | |

| Total revenues | $ | 1,373 |

| | $ | 365 |

| | $ | 1,008 |

|

| Property operating expenses | (228 | ) | | (62 | ) | | (166 | ) |

| Real estate tax expenses | (323 | ) | | (48 | ) | | (275 | ) |

| General and administrative expenses | (323 | ) | | (221 | ) | | (102 | ) |

| Depreciation and amortization | (606 | ) | | (148 | ) | | (458 | ) |

| Interest expense | (344 | ) | | (131 | ) | | (213 | ) |

| Other expense, net | (6 | ) | | — |

| | (6 | ) |

| Net loss | $ | (457 | ) | | $ | (245 | ) | | $ | (212 | ) |

| | | | | | |

| Net loss per share—basic and diluted | $ | (0.08 | ) | | $ | (0.45 | ) | | $ | 0.37 |

|

We owned four properties as of March 31, 2018, and one property as of March 31, 2017. Unless otherwise discussed below, year-over-year comparative differences for the three months ended March 31, 2018 and 2017, are almost entirely attributable to the number of properties owned and the length of ownership of these properties.

Total revenues—Of the $1.0 million increase in total revenues, $998 was related to the properties acquired in 2017 and 2018. The remaining variance was the result of an increase in revenue at the property acquired prior to January 1, 2017, which was primarily driven by a $0.78 increase in minimum rent per square foot since March 31, 2017. During the three months ended March 31, 2018, we executed one new lease with $33 in annual rent for a term of five years. We also renewed one lease for a term of five years with $34 in annual rent, which was a 25.0% increase in rent per square foot over the previous lease. Our portfolio retention rate during the three months ended March 31, 2018 was 100.0%.

General and administrative expenses—The $102 increase in general and administrative expenses was primarily attributable to the $86 increase in the cash asset management fees as a result of the additional properties acquired in 2017 and 2018.

Interest expense—Of the $213 increase in interest expense, $298 is related to the amortization of loan closing costs and interest and fees incurred on borrowings on the revolving credit facility that we entered into in March 2017. The increase was partially offset by a reduction of $85 related to a mortgage held on one property that was refinanced with proceeds from the revolving credit facility in August 2017.

We generally expect our revenues and expenses to increase in future years as a result of owning the properties acquired in 2017 and 2018 for a full year and the acquisition of additional properties. Although we expect our general and administrative expenses to increase, we expect such expenses to decrease as a percentage of our revenues.

Non-GAAP Measures

Net Operating Income—We present Net Operating Income (“NOI”) as a supplemental measure of our performance. We define NOI as total operating revenues less property operating expenses, real estate taxes, and non-cash revenue items. We believe that NOI provides useful information to our investors about our financial and operating performance because it provides a performance measure of the revenues and expenses directly involved in owning and operating real estate assets and provides a perspective not immediately apparent from net income.

NOI should not be viewed as an alternative measure of our financial performance since it only highlights the operating income and costs on properties. NOI does not reflect the impact of general and administrative expenses, acquisition expenses, interest expense, depreciation and amortization, other income, or the level of capital expenditures and leasing costs necessary to maintain the operating performance of our properties that could materially impact our results from operations.

The table below is a comparison of NOI for the three months ended March 31, 2018 and 2017 (in thousands): |

| | | | | | | | | | | | |

| | | Three Months Ended March 31, | | Favorable (Unfavorable) Changes |

| | | 2018 | | 2017 | |

| Revenues: | | | | | | |

Rental income(1) | | $ | 898 |

| | $ | 257 |

| | $ | 641 |

|

| Tenant recovery income | | 410 |

| | 92 |

| | 318 |

|

| Other property income | | 7 |

| | 2 |

| | 5 |

|

| Total revenues | | 1,315 |

| | 351 |

| | 964 |

|

| Operating Expenses: | | | | | | |

| Property operating expenses | | 228 |

| | 62 |

| | (166 | ) |

| Real estate taxes | | 323 |

| | 48 |

| | (275 | ) |

| Total operating expenses | | 551 |

| | 110 |

| | (441 | ) |

| Total NOI | | $ | 764 |

| | $ | 241 |

| | $ | 523 |

|

| |

(1) | Excludes straight-line rental income, net amortization of above- and below-market leases, and lease buy-out income. |

Below is a reconciliation of Net Loss to NOI for the three months ended March 31, 2018 and 2017 (in thousands): |

| | | | | | | |

| | 2018 | | 2017 |

| Net loss: | $ | (457 | ) | | $ | (245 | ) |

| Adjusted to exclude: | | | |

| Straight-line rental income | (60 | ) | | (5 | ) |

| Net amortization of above- and below-market leases | 2 |

| | (9 | ) |

| General and administrative expenses | 323 |

| | 221 |

|

| Depreciation and amortization | 606 |

| | 148 |

|

| Interest expense, net | 344 |

| | 131 |

|

| Other income, net | 6 |

| | — |

|

| NOI | $ | 764 |

| | $ | 241 |

|

Funds from Operations and Modified Funds from Operations—Funds from Operations (“FFO”) is a non-GAAP performance financial measure that is widely recognized as a measure of REIT operating performance. We use FFO as defined by the National Association of Real Estate Investment Trusts (“NAREIT”) to be net income (loss) attributable to common shareholders computed in accordance with GAAP, excluding gains (or losses) from sales of property, plus depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures. Adjustments for unconsolidated partnerships and joint ventures are calculated to reflect funds from operations on the same basis.

Modified Funds from Operations (“MFFO”) is an additional performance financial measure used by us as FFO includes certain non-comparable items that affect our performance over time. MFFO excludes the following items:

| |

| • | acquisition fees and expenses; |

| |

| • | straight-line rent amounts, both income and expense; |

| |

| • | amortization of above- or below-market intangible lease assets and liabilities; |

| |

| • | amortization of discounts and premiums on debt investments; |

| |

| • | gains or losses from the early extinguishment of debt; |

| |

| • | gains or losses on the extinguishment of derivatives, except where the trading of such instruments is a fundamental attribute of our operations; |

| |

| • | gains or losses related to fair value adjustments for derivatives not qualifying for hedge accounting; |

| |

| • | gains or losses related to consolidation from, or deconsolidation to, equity accounting; and |

| |

| • | adjustments related to the above items for unconsolidated entities in the application of equity accounting. |

We believe that MFFO is helpful in assisting management and investors with the assessment of the sustainability of operating performance in future periods. Neither FFO nor MFFO should be considered as an alternative to net income (loss) or income (loss) from continuing operations under GAAP, nor as an indication of our liquidity, nor is either of these measures indicative of funds available to fund our cash needs, including our ability to fund distributions. MFFO may not be a useful measure of the impact of long-term operating performance on value if we do not continue to operate our business plan in the manner currently contemplated.

Accordingly, FFO and MFFO should be reviewed in connection with other GAAP measurements. FFO and MFFO should not be viewed as more prominent measures of performance than our net income or cash flows from operations prepared in accordance with GAAP. Our FFO and MFFO as presented may not be comparable to amounts calculated by other REITs.

The following section presents our calculation of FFO and MFFO and provides additional information related to our operations. As a result of the timing of the commencement of our initial public offering and our active real estate acquisitions, FFO and MFFO are not relevant to a discussion comparing operations for the periods presented. We expect revenues and expenses to increase in future periods as we acquire additional investments.

As a result of the timing of the commencement of this offering and our active real estate acquisitions, FFO and MFFO are not relevant to a discussion comparing operations for the periods presented. We expect revenues and expenses to increase in future periods as we acquire additional investments.

The following table presents our calculation of FFO and MFFO and provides additional information related to our operations (in thousands): |

| | | | | | | |

| | Three Months Ended March 31, |

| | 2018 | | 2017 |

| Calculation of FFO | | | |

| Net loss | $ | (457 | ) | | $ | (245 | ) |

| Adjustments: | |

| | |

|

| Depreciation and amortization of real estate assets | 606 |

| | 148 |

|

| FFO | $ | 149 |

| | $ | (97 | ) |

| Calculation of MFFO | | | |

| FFO | $ | 149 |

| | $ | (97 | ) |

| Adjustments: | | | |

| Acquisition expenses | 6 |

| | — |

|

| Net amortization of above- and below-market leases | 2 |

| | (9 | ) |

| Straight-line rental income | (60 | ) | | (5 | ) |

| MFFO | $ | 97 |

| | $ | (111 | ) |

| | | | |

| Earnings per common share: | | | |

| Weighted-average common shares outstanding - basic and diluted | 5,552 |

| | 544 |

|

| Net loss per share - basic and diluted | $ | (0.08 | ) | | $ | (0.45 | ) |

| FFO per share - basic and diluted | $ | 0.03 |

| | $ | (0.18 | ) |

| MFFO per share - basic and diluted | $ | 0.02 |

| | $ | (0.20 | ) |

Liquidity and Capital Resources

General—Our principal cash demands are for real estate and real estate-related investments, operating expenses, and distributions to stockholders. Our primary source of cash flow is proceeds from our private offering, and we expect our primary source of cash flow going forward to be proceeds from our Public Offering. We intend to use these proceeds, as well as proceeds from our unsecured debt facility, to acquire additional properties. Generally, we expect cash needed for items other than acquisitions to be generated from operations. The proceeds from this offering, operating cash flows, proceeds from our distribution reinvestment plan, cash on hand, and borrowings under our unsecured credit facility are our primary sources of immediate and long-term liquidity.

As of March 31, 2018, we had cash, cash equivalents, and restricted cash of $1,449, a net decrease of $1,210 as discussed below.

Operating Activities—Our net cash provided by operating activities consists primarily of cash inflows from tenant rental and recovery payments and cash outflows for property operating expenses, real estate taxes, general and administrative expenses, acquisition expenses, and interest payments.

Our cash flows provided by operating activities were $458 for the three months ended March 31, 2018, compared to cash flows provided by operating activities of $30 for the same period in 2017. The change was primarily due to operating a larger portfolio, as well as variances in the timing of working capital payments. Operating cash flows are expected to increase as we continue to acquire new properties.

Investing Activities—Net cash used in investing activities is impacted by the nature, timing, and extent of improvements to and acquisitions of real estate and real estate-related assets.

During the three months ended March 31, 2018, we acquired one grocery-anchored shopping center for a total cash outlay of $12,340. During the same period in 2017, we had no acquisitions.

Financing Activities—Net cash flows from financing activities are affected by proceeds from the issuance of common stock, payments of distributions and offering costs, principal and other payments associated with our outstanding debt, and borrowings during the period. Our cash flows provided by financing activities were $10,676 for the three months ended March 31, 2018, compared to cash flows provided by financing activities of $655 for the same period in 2017.

Debt—We have access to a revolving credit facility with availability of $32,052 as of March 31, 2018. During the three months ended March 31, 2018, we repaid $3,000 on our revolving credit facility. During the three months ended March 31, 2017, we paid $2,173 for deferred financing costs related to our revolving credit facility.

Equity—Through our private offering, we raised $15,570 in proceeds from the issuance of common stock during the three months ended March 31, 2018, compared to $3,156 during the same period in 2017. In connection with our private offering, we paid $1,478 in offering costs related to selling commissions and dealer manager fees during the three months ended March 31, 2018, compared to $279 during the same period in 2017.

We offer an SRP that provides a limited opportunity for stockholders to have shares of common stock repurchased, subject to certain restrictions and limitations. For a more detailed discussion of our SRP, see Note 8. During the three months ended March 31, 2018 and 2017, we did not repurchase any common stock.

Activity related to distributions to our stockholders for the periods ended March 31, 2018 and 2017, was as follows: |

| | | | | | | |

| | 2018 | | 2017 |

| Gross distributions paid | $ | 719 |

| | $ | 65 |

|

| Distributions reinvested through DRIP | 303 |

| | 16 |

|

| Net cash distributions | $ | 416 |

| | $ | 49 |

|

| Net loss | $ | (457 | ) | | $ | (245 | ) |

| Net cash provided by operating activities | $ | 458 |

| | $ | 30 |

|

FFO(1) | $ | 149 |

| | $ | (97 | ) |

(1) See Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations - Non-GAAP Measures - Funds from Operations and Modified Funds from Operations for the definition of FFO, information regarding why we present FFO, as well as for a reconciliation of this non-GAAP financial measure to Net Loss.

We expect to pay distributions monthly unless our results of operations, our general financial condition, general economic conditions or other factors, as determined by the board, make it imprudent to do so. The timing and amount of distributions is determined by our board and is influenced in part by our intention to comply with REIT requirements of the Internal Revenue Code.

In order to qualify as a REIT, we must make aggregate annual distributions to our stockholders of at least 90% of our REIT taxable income (which is computed without regard to the dividends paid deduction or net capital gain and which does not necessarily equal net income as calculated in accordance with GAAP). If we meet the REIT qualification requirements, we generally will not be subject to U.S. federal income tax on the income that we distribute to our stockholders each year. However, we may be subject to certain state and local taxes on our income, property, or net worth, respectively, and to federal income and excise taxes on our undistributed income.

We have not established a minimum distribution level, and our charter does not require that our board of directors approves distributions to our stockholders.

Critical Accounting Policies and Estimates

Below is a discussion of our critical accounting policies and estimates. Our accounting policies have been established to conform with GAAP. We consider these policies critical because they involve significant management judgments and assumptions, require estimates about matters that are inherently uncertain and are important for understanding and evaluating our reported financial results. These judgments affect the reported amounts of assets and liabilities and our disclosure of contingent assets and liabilities at the dates of the consolidated financial statements, as well as the reported amounts of revenue and expenses during the reporting periods. With different estimates or assumptions, materially different amounts could be reported in our consolidated financial statements. Additionally, other companies may utilize different estimates that may impact the comparability of our results of operations to those of companies in similar businesses.

Real Estate Assets—We assess the acquisition-date fair values of all tangible assets, identifiable intangibles, and assumed liabilities using methods similar to those used by independent appraisers (e.g., discounted cash flow analysis and replacement cost) and that utilize appropriate discount and/or capitalization rates and available market information. Estimates of future cash flows are based on a number of factors including historical operating results, known and anticipated trends, and market and economic conditions. The fair value of tangible assets of an acquired property considers the value of the property as if it were vacant.

We generally determine the value of construction in progress based upon the replacement cost. However, for certain acquired properties that are part of a ground-up development, we determine fair value by using the same valuation approach as for all other properties and deducting the estimated cost to complete the development. During the remaining construction period, we capitalize interest expense until the development has reached substantial completion. Construction in progress, including capitalized interest, is not depreciated until the development has reached substantial completion.

We record above-market and below-market lease values for acquired properties based on the present value (using a discount rate that reflects the risks associated with the leases acquired) of the difference between (i) the contractual amounts to be

paid pursuant to the in-place leases and (ii) management’s estimate of market lease rates for the corresponding in-place leases, measured over a period equal to the remaining non-cancelable term of the lease. We amortize any recorded above-market or below-market lease values as a reduction or increase, respectively, to rental income over the remaining non-cancelable terms of the respective lease. We also include fixed-rate renewal options in our calculation of the fair value of below-market leases and the periods over which such leases are amortized. If a tenant has a unilateral option to renew a below-market lease, we include such an option in the calculation of the fair value of such lease and the period over which the lease is amortized if we determine that the tenant has a financial incentive and wherewithal to exercise such option.

Intangible assets also include the value of in-place leases, which represents the estimated value of the net cash flows of the in-place leases to be realized, as compared to the net cash flows that would have occurred had the property been vacant at the time of acquisition and subject to lease-up. Acquired in-place lease value is amortized to depreciation and amortization expense over the average remaining non-cancelable terms of the respective in-place leases.

We estimate the value of tenant origination and absorption costs by considering the estimated carrying costs during hypothetical expected lease-up periods, considering current market conditions. In estimating carrying costs, management includes real estate taxes, insurance and other operating expenses, and estimates of lost rentals at market rates during the expected lease-up periods.

Estimates of the fair values of the tangible assets, identifiable intangibles, and assumed liabilities require us to estimate market lease rates, property operating expenses, carrying costs during lease-up periods, discount rates, market absorption periods, and the number of years the property will be held for investment. The use of inappropriate estimates would result in an incorrect valuation of our acquired tangible assets, identifiable intangibles and assumed liabilities, which would impact the amount of our net income.

We calculate the fair value of assumed long-term debt by discounting the remaining contractual cash flows on each instrument at the current market rate for those borrowings, which we approximate based on the rate at which we would expect to incur a replacement instrument on the date of acquisition, and recognize any fair value adjustments related to long-term debt as effective yield adjustments over the remaining term of the instrument.

Generally, our real estate acquisition activity is classified as asset acquisitions. As a result, most acquisition-related costs have been capitalized and will be amortized over the life of the related assets.

Impairment of Real Estate and Related Intangible Assets—We monitor events and changes in circumstances that could indicate that the carrying amounts of our real estate and related intangible assets may be impaired. When indicators of potential impairment suggest that the carrying value of real estate and related intangible assets may be greater than fair value, we will assess the recoverability, considering recent operating results, expected net operating cash flow, and plans for future operations. If, based on this analysis of undiscounted cash flows, we do not believe that we will be able to recover the carrying value of the real estate and related intangible assets, we would record an impairment loss to the extent that the carrying value exceeds the estimated fair value of the real estate and related intangible assets as defined by ASC 360, Property, Plant, and Equipment. Particular examples of events and changes in circumstances that could indicate potential impairments are significant decreases in occupancy, rental income, operating income, and market values.

Revenue Recognition—We recognize minimum rent, including rental abatements and contractual fixed increases attributable to operating leases, on a straight-line basis over the terms of the related leases, and we include amounts expected to be received in later years in deferred rents receivable. Our policy for percentage rental income is to defer recognition of contingent rental income until the specified target (i.e., breakpoint) that triggers the contingent rental income is achieved.

We record property operating expense reimbursements due from tenants for common area maintenance, real estate taxes, and other recoverable costs in the period the related expenses are incurred. We make certain assumptions and judgments in estimating the reimbursements at the end of each reporting period. We do not expect the actual results to differ materially from the estimated reimbursement.

We make estimates of the collectability of our tenant receivables related to base rents, expense reimbursements, and other revenue or income. We specifically analyze accounts receivable and historical bad debts, customer creditworthiness, current economic trends, and changes in customer payment terms when evaluating the adequacy of the allowance for doubtful accounts. In addition, with respect to tenants in bankruptcy, we will make estimates of the expected recovery of pre-petition and post-petition claims in assessing the estimated collectability of the related receivable. In some cases, the ultimate resolution of these claims can exceed one year. These estimates have a direct impact on our net income because a higher bad debt reserve results in less net income.

We record lease termination income if there is a signed termination letter agreement, all of the conditions of the agreement have been met, collectability is reasonably assured and the tenant is no longer occupying the property. Upon early lease termination, we provide for losses related to unrecovered intangibles and other assets.

Effective January 1, 2018, we adopted the guidance of ASC 610-20, which applies to sales or transfers to non-customers of non-financial assets, or in substance, nonfinancial assets that do not meet the definition of a business. Generally, our sales of real estate would be considered a sale of a non-financial asset as defined by ASC 610-20.

ASC 610-20 refers to the revenue recognition principles under ASU 2014-09. Under ASC 610-20, if we determines we do not have a controlling financial interest in the entity that holds the asset and the arrangement meets the criteria to be accounted for as a contract, we would de-recognize the asset and recognize a gain or loss on the sale of the real estate when control of the underlying asset transfers to the buyer.

Impact of Recently Issued Accounting Pronouncements—Refer to Note 2 for discussion of the impact of recently issued accounting pronouncements.

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

PHILLIPS EDISON GROCERY CENTER REIT III, INC.

CONSOLIDATED BALANCE SHEETS

AS OF MARCH 31, 2018 AND DECEMBER 31, 2017

(Unaudited)

(In thousands, except per share amounts)

|

| | | | | | | |

| | March 31, 2018 | | December 31, 2017 |

| ASSETS | | | |

| Investment in real estate: | | | |

| Land and improvements | $ | 17,085 |

| | $ | 12,122 |

|

| Building and improvements | 32,082 |

| | 25,439 |

|

| Acquired in-place lease assets | 6,318 |

| | 4,686 |

|

| Acquired above-market lease assets | 1,860 |

| | 1,779 |

|

| Total investment in real estate assets | 57,345 |

| | 44,026 |

|

| Accumulated depreciation and amortization | (1,324 | ) | | (684 | ) |

| Total investment in real estate assets, net | 56,021 |

| | 43,342 |

|

| Cash and cash equivalents | 1,449 |

| | 2,659 |

|

| Deferred financing expense, net of accumulated amortization of $582 and $448, respectively | 1,568 |

| | 1,702 |

|

| Other assets, net | 642 |

| | 973 |

|

| Total assets | $ | 59,680 |

| | $ | 48,676 |

|

| LIABILITIES AND EQUITY | |

| | |

| Liabilities: | |

| | |

| Debt obligation | $ | 6,000 |

| | $ | 9,000 |

|

| Acquired below-market lease liabilities, net | 2,375 |

| | 2,314 |

|

| Accounts payable – affiliates | 2,148 |

| | 2,157 |

|

| Accounts payable and other liabilities | 2,993 |

| | 2,157 |

|

| Total liabilities | 13,516 |

| | 15,628 |

|

| Commitments and contingencies (Note 7) | — |

| | — |

|

| Equity: | |

| | |

| Preferred stock, $0.01 par value per share, 10,000 shares authorized, zero shares issued | | | |

| and outstanding at March 31, 2018 and December 31, 2017, respectively | — |

| | — |

|

| Common stock, $0.01 par value per share, 1,000,000 shares authorized, 6,315 and 4,502 | | | |

| shares issued and outstanding at March 31, 2018 and December 31, 2017, respectively | 63 |

| | 45 |

|

| Stock dividends to be distributed | — |

| | 644 |

|

| Additional paid-in capital | 55,359 |

| | 38,836 |

|

| Accumulated deficit | (9,258 | ) | | (6,477 | ) |

| Total equity | 46,164 |

| | 33,048 |

|

| Total liabilities and equity | $ | 59,680 |

| | $ | 48,676 |

|

See notes to consolidated financial statements.

PHILLIPS EDISON GROCERY CENTER REIT III, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

FOR THE THREE MONTHS ENDED MARCH 31, 2018 AND 2017

(Unaudited)

(In thousands, except per share amounts)

|

| | | | | | | |

| | Three Months Ended March 31, |

| | 2018 | | 2017 |

| Revenues: | | | |

| Rental income | $ | 956 |

| | $ | 271 |

|

| Tenant recovery income | 410 |

| | 92 |

|

| Other property income | 7 |

| | 2 |

|

| Total revenues | 1,373 |

| | 365 |

|

| Expenses: | |

| | |

| Property operating | 228 |

| | 62 |

|

| Real estate taxes | 323 |

| | 48 |

|

| General and administrative | 323 |

| | 221 |

|

| Depreciation and amortization | 606 |

| | 148 |

|

| Total expenses | 1,480 |

| | 479 |

|

| Other: | | | |

| Interest expense | (344 | ) | | (131 | ) |

| Other expense, net | (6 | ) | | — |

|

| Net loss | $ | (457 | ) | | $ | (245 | ) |

| Earnings per common share: | |

| | |

| Loss per share - basic and diluted | $ | (0.08 | ) | | $ | (0.45 | ) |

| Weighted-average common shares outstanding: | | | |

| Basic and diluted | 5,552 |

| | 544 |

|

See notes to consolidated financial statements.

PHILLIPS EDISON GROCERY CENTER REIT III, INC.

CONSOLIDATED STATEMENTS OF EQUITY

FOR THE THREE MONTHS ENDED MARCH 31, 2018 and 2017

(Unaudited)

(In thousands, except per share amounts)

|

| | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock | | Additional Paid-in Capital | | Stock Dividend to be Distributed | | Accumulated Deficit | | Total Equity |

| | Shares | | Amount | | | | |

| Balance at January 1, 2017 | 435 |

|

| $ | 4 |

| | $ | 3,911 |

|

| $ | 56 |

|

| $ | (226 | ) |

| $ | 3,745 |

|

| Issuance of common stock | 319 |

| | 3 |

| | 3,209 |

| | (56 | ) | | — |

| | 3,156 |

|

| Distribution Reinvestment Plan (“DRIP”) | 2 |

| | — |

| | 16 |

| | — |

| | — |

| | 16 |

|

| Common distributions declared, $0.15 per share | — |

| | — |

| | — |

| | — |

| | (79 | ) | | (79 | ) |

| Stock dividends declared, 0.0441 shares per share | 20 |

| | 1 |

| | 132 |

| | 101 |

| | (234 | ) | | — |

|

| Offering costs | — |

| | — |

| | (279 | ) | | — |

| | — |

| | (279 | ) |

| Net loss | — |

| | — |

| | — |

| | — |

| | (245 | ) | | (245 | ) |

| Balance at March 31, 2017 | 776 |

|

| $ | 8 |

|

| $ | 6,989 |

|

| $ | 101 |

|

| $ | (784 | ) |

| $ | 6,314 |

|

| | | | | | | | | | | | |

| Balance at January 1, 2018 | 4,502 |

|

| $ | 45 |

| | $ | 38,836 |

|

| $ | 644 |

|

| $ | (6,477 | ) |

| $ | 33,048 |

|

| Issuance of common stock | 1,566 |

| | 16 |

| | 16,199 |

| | (644 | ) | | — |

| | 15,571 |

|

| DRIP | 32 |

| | — |

| | 303 |

| | — |

| | — |

| | 303 |

|

| Common distributions declared, $0.15 per share | — |

| | — |

| | — |

| | — |

| | (823 | ) | | (823 | ) |

| Stock dividends declared, 0.0289 shares per share | 215 |

| | 2 |

| | 1,499 |

| | — |

| | (1,501 | ) | | — |

|

| Offering costs | — |

| | — |

| | (1,478 | ) | | — |

| | — |

| | (1,478 | ) |

| Net loss | — |

| | — |

| | — |

| | — |

| | (457 | ) | | (457 | ) |

| Balance at March 31, 2018 | 6,315 |

| | $ | 63 |

| | $ | 55,359 |

| | $ | — |

| | $ | (9,258 | ) | | $ | 46,164 |

|

See notes to consolidated financial statements.

PHILLIPS EDISON GROCERY CENTER REIT III, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE THREE MONTHS ENDED MARCH 31, 2018 AND 2017

(Unaudited)

(In thousands)

|

| | | | | | | |

| | 2018 | | 2017 |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net loss | $ | (457 | ) | | $ | (245 | ) |

| Adjustments to reconcile net loss to net cash provided by operating activities: | |

| | |

| Depreciation and amortization | 607 |

| | 148 |

|

| Net amortization of above- and below-market leases | 2 |

| | (9 | ) |

| Amortization of deferred financing expense | 134 |

| | 45 |

|

| Straight-line rental income | (60 | ) | | (5 | ) |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable, net | 315 |

| | (139 | ) |

| Other assets, net | (25 | ) | | (47 | ) |

| Accounts payable - affiliates | (9 | ) | | 186 |

|

| Accounts payable and other liabilities | (49 | ) | | 96 |

|

| Net cash provided by operating activities | 458 |

| | 30 |

|

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | |

| Real estate acquisitions | (12,340 | ) | | — |

|

| Capital expenditures | (4 | ) | | — |

|

| Net cash used in investing activities | (12,344 | ) | | — |

|

| CASH FLOWS FROM FINANCING ACTIVITIES: | |

| | |

| Net change in credit facility | (3,000 | ) | | — |

|

| Payments of deferred financing expenses | — |

| | (2,173 | ) |

| Distributions paid, net of DRIP | (416 | ) | | (49 | ) |

| Payment of offering costs | (1,478 | ) | | (279 | ) |

| Proceeds from issuance of common stock | 15,570 |

| | 3,156 |

|

| Net cash provided by financing activities | 10,676 |

|

| 655 |

|

| NET (DECREASE) INCREASE IN CASH, CASH EQUIVALENTS, AND RESTRICTED CASH: | (1,210 | ) | | 685 |

|

| CASH, CASH EQUIVALENTS, AND RESTRICTED CASH: | |

| | |

| Beginning of period | 2,659 |

| | 790 |

|

| End of period | $ | 1,449 |

| | $ | 1,475 |

|

| | | | |

| SUPPLEMENTAL CASH FLOW DISCLOSURE, INCLUDING NON-CASH INVESTING AND FINANCING ACTIVITIES: |

| Cash paid for interest | $ | 202 |

| | $ | — |

|

| Accrued capital expenditures and acquisition costs | 1,104 |

| | 147 |

|

| Change in distributions payable | 104 |

| | 14 |

|

| Distributions reinvested | 303 |

| | 16 |

|

See notes to consolidated financial statements.

Phillips Edison Grocery Center REIT III, Inc.

Notes to Consolidated Financial Statements

(Dollars and shares in thousands)

Phillips Edison Grocery Center REIT III, Inc. (“we,” the “Company,” “our,” or “us”) was formed as a Maryland corporation on April 15, 2016. Substantially all of our business is conducted through Phillips Edison Grocery Center Operating Partnership III, L.P. (“Operating Partnership”), a Delaware limited partnership formed on July 29, 2016. We are a limited partner of the Operating Partnership, and our wholly owned subsidiary, Phillips Edison Grocery Center OP GP III LLC, is the sole general partner of the Operating Partnership.

We completed a private placement offering of shares of common stock (“Class A”) on a “reasonable best efforts” basis to accredited investors. We ceased offering Class A shares in the private offering during the first quarter of 2018. As of March 31, 2018, we had raised $57,414 in gross offering proceeds from the issuance of 5,831 Class A shares, inclusive of the DRIP.

Pursuant to the Registration Statement on Form S-11 (SEC Registration No. 333-217924), as amended (“Registration Statement”), declared effective on May 8, 2018, we are offering to the public (“Public Offering”) $1,500,000 in shares of common stock in the primary offering, consisting of two classes of shares: Class T and Class I, at purchase prices of $10.42 per share and $10.00 per share, respectively, with discounts available to some categories of investors with respect to Class T shares (“Primary Offering”). In addition, we are also offering $200,000 in Class A, Class T, and Class I shares of our common stock pursuant to the DRIP at a price of $9.80 per share. For more detail on the DRIP, see Note 8. We are offering any combination of Class T and Class I shares in the Primary Offering and any combination of Class A, Class T, and Class I shares through the DRIP. We reserve the right to reallocate shares between the Primary Offering and the DRIP. We have retained Griffin Capital Securities, LLC (“Dealer Manager”) to serve as the dealer manager of the Public Offering, which commenced May 8, 2018. The Dealer Manager is responsible for marketing our shares in the Public Offering.

Our property managers are owned by Phillips Edison & Company, Inc. and its subsidiaries (“PECO” or “Manager”). Our advisor is PECO-Griffin REIT Advisor, LLC (“Advisor”), a limited liability company that was formed in the state of Delaware on May 23, 2016, and is jointly owned by PECO and Griffin Capital Corporation (“Griffin sponsor”). We have entered into an advisory agreement, which makes the Advisor ultimately responsible for the management of our day-to-day activities and the implementation of our investment strategy.

We intend to invest primarily in well-occupied, grocery-anchored neighborhood and community shopping centers leased to a mix of national and regional creditworthy retailers selling necessity-based goods and services in strong demographic markets throughout the United States. In addition, we may invest in other retail properties including power and lifestyle shopping centers, multi-tenant shopping centers, free-standing single-tenant retail properties, and other real estate and real estate-related loans and securities depending on real estate market conditions and investment opportunities that we determine are in the best interests of our stockholders.

As of March 31, 2018, we owned fee simple interests in four grocery-anchored shopping centers acquired from third parties unaffiliated with us or our Advisor.

|

|

| 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

Basis of Presentation and Principles of Consolidation—The accompanying consolidated financial statements have been prepared pursuant to accounting principles generally accepted in the United States of America (“GAAP”). The consolidated financial statements include our accounts and the accounts of our consolidated subsidiaries (over which we exercise financial and operating control). All intercompany balances and transactions are eliminated upon consolidation.

Partially-Owned Entities—If we determine that we are an owner in a variable-interest entity (“VIE”), and we hold a controlling financial interest, then we will consolidate the entity as the primary beneficiary. For a partially-owned entity determined not to be a VIE, we analyze rights held by each partner to determine which would be the consolidating party. We will generally consolidate entities (in the absence of other factors when determining control) when we have over a 50% ownership interest in the entity. We will assess our interests in VIEs on an ongoing basis to determine whether or not we are the primary beneficiary. However, we will also evaluate who controls the entity even in circumstances in which we have greater than a 50% ownership interest. If we do not control the entity due to the lack of decision-making abilities, we will not consolidate the entity. We have determined that the Operating Partnership is considered a VIE. We are the primary beneficiary of the VIE, and our partnership interest is considered a majority voting interest. As such, we have consolidated the Operating Partnership and its subsidiaries.

Use of Estimates—The preparation of the consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the consolidated financial statements, and the reported amounts of revenues and expenses during the reporting periods. For example, significant estimates and assumptions have been made with respect to the useful lives of assets; recoverable amounts of receivables; initial valuations of tangible and intangible assets and liabilities and related amortization periods of deferred costs and intangibles, particularly with respect to property acquisitions; and other fair value measurement assessments required for the preparation of the consolidated financial statements. Actual results could differ from those estimates.

Cash and Cash Equivalents—We consider all highly liquid investments purchased with an original maturity of three months or less to be cash equivalents. Cash equivalents may include cash and short-term investments. Short-term investments are stated at cost, which approximates fair value and may consist of investments in money market accounts. The cash and cash equivalent balances at one or more of our financial institutions exceeds the Federal Depository Insurance Corporation insurance coverage.

Investment in Property and Lease Intangibles—Real estate assets are stated at cost less accumulated depreciation. Depreciation is computed using the straight-line method. The estimated useful lives for computing depreciation are generally not to exceed 5-7 years for furniture, fixtures and equipment, 15 years for land improvements, and 30 years for buildings and building improvements. Tenant improvements are amortized over the shorter of the respective lease term or the expected useful life of the asset. Major replacements that extend the useful lives of the assets are capitalized, and maintenance and repair costs are expensed as incurred.

Real estate assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of the individual property may not be recoverable. In such an event, a comparison will be made of the projected operating cash flows of each property on an undiscounted basis to the carrying amount of such property. If deemed unrecoverable on an undiscounted basis, such carrying amount would be adjusted, if necessary, to estimated fair values to reflect impairment in the value of the asset. We recorded no impairments as of March 31, 2018 and December 31, 2017.

The results of operations of acquired properties are included in our results of operations from their respective dates of acquisition. The acquisition-date fair values of all tangible assets, identifiable intangibles, and assumed liabilities are assessed using methods (e.g., discounted cash flow analysis and replacement cost) that utilize appropriate discount and/or capitalization rates and available market information. Estimates of future cash flows are based on a number of factors including historical operating results, known and anticipated trends, and market and economic conditions. The fair value of tangible assets of an acquired property considers the value of the property as if it were vacant. Most acquisition-related costs are capitalized and allocated to the tangible and identifiable intangible assets based on their respective acquisition-date fair values, and amortized over the same useful lives of the respective tangible and identifiable intangible assets.

The fair values of buildings and improvements are determined on an as-if-vacant basis. The estimated fair value of acquired in-place leases is the cost we would have incurred to lease the properties to the occupancy level of the properties at the date of acquisition. Such estimates include leasing commissions, legal costs, and other direct costs that would be incurred to lease the properties to such occupancy levels. Additionally, we evaluate the time period over which such occupancy levels would be achieved. Such evaluation includes an estimate of the net market-based rental revenues and net operating costs (primarily consisting of real estate taxes, insurance and utilities) that would be incurred during the lease-up period. Acquired in-place leases as of the date of acquisition are amortized over the weighted-average remaining lease terms.

Acquired above- and below-market lease values are recorded based on the present value (using discount rates that reflect the risks associated with the leases acquired) of the difference between the contractual amounts to be paid pursuant to the in-place leases and management’s estimate of the market lease rates for the corresponding in-place leases. The capitalized above- and below-market lease values are amortized as adjustments to rental income over the remaining terms of the respective leases. We also consider fixed rate renewal options in our calculation of the fair value of below-market leases and the periods over which such leases are amortized. If a tenant has a unilateral option to renew a below-market lease and we determine that the tenant has a financial incentive to exercise such option, we include such an option in the calculation of the fair value of such lease and the period over which the lease is amortized.

We estimate the value of tenant origination and absorption costs by considering the estimated carrying costs during hypothetical expected lease-up periods, considering current market conditions. In estimating carrying costs, management includes real estate taxes, insurance and other operating expenses and estimates of lost rentals at market rates during the expected lease-up periods.

We estimate the fair value of assumed mortgage notes payable based upon indications of then-current market pricing for similar types of debt with similar maturities. Assumed mortgage notes payable are initially recorded at their estimated fair value as of the assumption date, and the difference between such estimated fair value and the note’s outstanding principal balance is amortized over the life of the mortgage note payable as an adjustment to interest expense.

Deferred Financing Expenses—Deferred financing expenses are capitalized and amortized on a straight-line basis over the term of the related financing arrangement, which approximates the effective interest method. Deferred financing costs related to term loan facilities and mortgages will be recorded in Debt Obligation, while deferred financing costs related to our revolving credit facility are recorded in Deferred Financing Expense, Net, on our consolidated balance sheets.

Other Assets, Net—Other Assets, Net on our consolidated balance sheets consists primarily of accounts receivable, prepaid expenses, and deferred rent receivable. Prepaid expenses and deferred rent receivable are amortized using the straight-line method over the terms of the respective agreements.

Fair Value Measurement—Accounting Standards Codification (“ASC”) 820, Fair Value Measurement (“ASC 820”) defines fair value, establishes a framework for measuring fair value in accordance with GAAP and expands disclosures about fair value measurements. ASC 820 emphasizes that fair value is intended to be a market-based measurement, as opposed to a transaction-specific measurement. Fair value is defined by ASC 820 as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Depending on the nature of the asset or liability, various techniques and assumptions can be used to estimate the fair value. Assets and liabilities are measured using inputs from three levels of the fair value hierarchy, as follows:

Level 1—Inputs are quoted prices (unadjusted) in active markets for identical assets or liabilities that we have the ability to access at the measurement date. An active market is defined as a market in which transactions for the assets or liabilities occur with sufficient frequency and volume to provide pricing information on an ongoing basis.

Level 2—Inputs include quoted prices for similar assets and liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are not active (markets with few transactions), inputs other than quoted

prices that are observable for the asset or liability (i.e., interest rates, yield curves, etc.), and inputs that are derived principally from or corroborated by observable market data correlation or other means (market corroborated inputs).

Level 3—Unobservable inputs, only used to the extent that observable inputs are not available, reflect our assumptions about the pricing of an asset or liability.

Considerable judgment is necessary to develop estimated fair values of financial and non-financial assets and liabilities. Accordingly, the estimates presented herein are not necessarily indicative of the amounts we did or could actually realize upon disposition of the financial assets and liabilities previously sold or currently held.

Repurchase of Common Stock—We offer a share repurchase program (“SRP”) which may provide a limited opportunity for stockholders to have their shares repurchased subject to approval and certain limitations and restrictions (see Note 8). We account for approved requests to repurchase shares as liabilities to be reported at settlement value.

The maximum amount of common stock that we may redeem, at the stockholder’s election, during any calendar year is limited, among other things, to 5% of the weighted-average number of shares outstanding during the prior calendar year. The maximum amount is reduced each reporting period by the current year share redemptions to date. In addition, the cash available for repurchases on any particular date is generally limited to the proceeds from the DRIP during the preceding four fiscal quarters, less amounts already used for repurchases since the beginning of that period. The board of directors may, in its sole discretion, amend, suspend, or terminate the share repurchase program at any time upon 30 days’ written notice. In addition, the board of directors reserves the right, in its sole discretion, to reject any request for repurchase.

There were no shares repurchased under the SRP for the periods ended March 31, 2018 and December 31, 2017.

Revenue Recognition—The majority of our revenue is lease revenue from our wholly-owned properties, which is accounted for under ASC 840, Leases. We commence revenue recognition on our leases based on a number of factors. In most cases, revenue recognition under a lease begins when the lessee takes possession of or controls the physical use of the leased asset. The determination of who is the owner, for accounting purposes, of the tenant improvements determines the nature of the leased asset and when revenue recognition under a lease begins. If we are the owner, for accounting purposes, of the tenant improvements, then the leased asset is the finished space, and revenue recognition begins when the lessee takes possession of the finished space, typically when the improvements are substantially complete.

If we conclude that we are not the owner, for accounting purposes, of the tenant improvements (the lessee is the owner), then the leased asset is the unimproved space and any tenant allowances funded under the lease are treated as lease incentives, which reduce revenue recognized over the term of the lease. In these circumstances, we begin revenue recognition when the lessee takes possession of the unimproved space to construct their own improvements. We consider a number of different factors in evaluating whether we or the lessee is the owner of the tenant improvements for accounting purposes. These factors include:

| |

| • | whether the lease stipulates how and on what a tenant improvement allowance may be spent; |

| |

| • | whether the tenant or landlord retains legal title to the improvements; |

| |

| • | the uniqueness of the improvements; |

| |

| • | the expected economic life of the tenant improvements relative to the length of the lease; and |

| |

| • | who constructs or directs the construction of the improvements. |

We recognize rental income on a straight-line basis over the term of each lease that includes periodic and determinable adjustments to rent. The difference between rental income earned on a straight-line basis and the cash rent due under the provisions of the lease agreements is recorded as deferred rent receivable and is included as a component of other assets. Due to the impact of the straight-line adjustments, rental income generally will be greater than the cash collected in the early years and will be less than the cash collected in the later years of a lease. For percentage rental income, we defer recognition of contingent rental income until the specified target (i.e. breakpoint) that triggers the contingent rental income is achieved.

Reimbursements from tenants for recoverable real estate tax and operating expenses are accrued as revenue in the period in which the applicable expenses are incurred. We make certain assumptions and judgments in estimating the reimbursements at the end of each reporting period. We do not expect the actual results to materially differ from the estimated reimbursements.

We periodically review the collectability of outstanding receivables. Allowances will be taken for those balances that we deem to be uncollectible, including any amounts relating to straight-line rent receivables and/or receivables for recoverable expenses.

We record lease termination income if there is a signed termination agreement, all of the conditions of the agreement have been met, collectability is reasonably assured and the tenant is no longer occupying the property. Upon early lease termination, we provide for losses related to unrecovered tenant-specific intangibles and other assets.

Effective January 1, 2018, we adopted the guidance of ASC 610-20, Other Income - Gains and Losses from the Derecognition of Nonfinancial Assets (“ASC 610-20”), which applies to sales or transfers to non-customers of non-financial assets, or in substance, nonfinancial assets that do not meet the definition of a business. Generally, our sales of real estate would be considered a sale of a non-financial asset as defined by ASC 610-20.

ASC 610-20 refers to the revenue recognition principles under Accounting Standards Update (“ASU”) 2014-09, Revenue from Contracts with Customers (Topic 606) (“ASU 2014-09”). Under ASC 610-20, if we determines we do not have a controlling financial interest in the entity that holds the asset and the arrangement meets the criteria to be accounted for as a contract, we would de-recognize the asset and recognize a gain or loss on the sale of the real estate when control of the underlying asset transfers to the buyer.

Income Taxes—We intend to make an election to be taxed as a real estate investment trust (“REIT”) under the Internal Revenue Code of 1986, as amended (the “Code”), beginning with the taxable year ended December 31, 2017. Our qualification and taxation as a REIT depends on our ability, on a continuing basis, to meet certain organizational and operational qualification requirements imposed upon REITs by the Code. If we fail to qualify as a REIT for any reason in a taxable year, we will be subject to tax on our taxable income at regular corporate rates. We would not be able to deduct distributions paid to stockholders in any year in which we fail to qualify as a REIT. We will also be disqualified for the four taxable years following the year during which qualification was lost unless we are entitled to relief under specific statutory provisions. Additionally, GAAP prescribes a recognition threshold and measurement attribute for the financial statement recognition of a tax position taken, or expected to be taken, in a tax return. A tax position may only be recognized in the consolidated financial statements if it is more likely than not that the tax position will be sustained upon examination. We believe it is more likely than not that our tax positions will be sustained in any tax examinations.

Notwithstanding our qualification as a REIT, we may be subject to certain state and local taxes on our income or properties. In addition, our consolidated financial statements include the operations of one wholly owned subsidiary that has jointly elected to be treated as a Taxable REIT Subsidiary (“TRS”) and is subject to U.S. federal, state and local income taxes at regular corporate tax rates.

We are continuing to evaluate the impact of the 2017 Tax Cuts and Jobs Act on the organization as a whole. We do not expect the impact of the Act to have a material impact on the financial statements.

Organizational and Offering Costs—The Advisor has paid and will pay organizational and offering expenses on our behalf. Pursuant to the terms of our current advisory agreement with the Advisor, we will generally reimburse the Advisor for these costs and future offering costs it or any of its affiliates may incur on our behalf in connection with the private placement of our Class A shares. Organizational and offering expenses consist of all expenses (other than selling commissions and dealer manager fees) to be paid by us in connection with the offering, including our legal, accounting, printing, mailing, filing and registration fees, and other accountable offering expenses including (a) legal, tax, accounting and escrow fees, (b) expenses for printing, engraving, amending, supplementing and mailing, (c) distribution costs, (d) compensation to employees of the Advisor while engaged in registering, marketing and wholesaling our common stock or providing administrative services relating thereto, (e) telegraph and telephone costs, (f) all advertising and marketing expenses (including the costs related to investor and broker-dealer sales meetings), (g) charges of transfer agents, registrars, trustees, escrow holders, depositories, and experts, (h) fees, expenses and taxes related to the filing, registration and qualification of the sale of our common stock under federal and state laws, including accountants’ and attorneys’ fees and other accountable offering expenses, (i) amounts to reimburse the Advisor for all marketing related costs and expenses such as compensation to and direct expenses of the Advisor’s employees or employees of the Advisor’s affiliates in connection with registering and marketing our common stock, (j) travel and entertainment expenses related to the offering and marketing of our common stock, (k) facilities and technology costs and other costs and expenses associated with the offering and ownership of our common stock and to facilitate the marketing of our common stock, including web site design and management, (l) costs and expenses of conducting training and educational conferences and seminars, (m) costs and expenses of attending broker-dealer sponsored retail seminars or conferences, and (n) payment or reimbursement of bona fide due diligence expenses, including compensation to employees while engaged in the provision or support of bona fide due diligence services.

There is no limit on the amount of organizational and other offering expenses we may incur in the private placement of our Class A shares. In connection with the Public Offering, the Advisor will pay organizational and offering expenses up to 1% of gross offering proceeds from the Primary Offering, which the Advisor intends to recoup through the receipt of a contingent advisor payment (see Note 9). We will reimburse the Advisor for any amounts in excess of 1% up to a maximum of 3.5% of gross offering proceeds from the Primary Offering.

As the Public Offering had not yet commenced as of March 31, 2018, only the organizational and offering costs incurred in connection with the private placement had been billed to us by the Advisor as of March 31, 2018 and December 31, 2017, which are recorded in Accounts Payable - Affiliates on the consolidated balance sheets. Whether additional organizational and offering costs associated with the private placement, or any organizational and offering costs associated with the Public Offering, will be billed to us and become a liability of ours in the future is at the discretion of the Advisor and will likely depend on the success of both our private placement and the Public Offering.

When recognized by us, organizational expenses will be expensed as incurred, and offering costs will be recorded as a reduction to stockholders’ equity as such amounts will be reimbursed to the Advisor or its affiliates from the gross proceeds of the Public Offering.

Earnings Per Share—Earnings per share is calculated based on the weighted-average number of common shares outstanding during each period. Diluted earnings per share considers the effect of any potentially dilutive share equivalents, of which we had none for the three months ended March 31, 2018 and 2017.

Segment Reporting—We internally evaluate the operating performance of our portfolio of properties and currently do not differentiate properties by geography, size, or type. As operating performance is reviewed at a portfolio level rather than at a property level, our entire portfolio of properties is considered one operating segment. Accordingly, we did not report any other segment disclosures for the three months ended March 31, 2018.

Impact of Recently Issued Accounting Pronouncements—The following table provides a brief description of recent accounting pronouncements that could have a material effect on our consolidated financial statements: |

| | | | | | |

| Standard | | Description | | Date of Adoption | | Effect on the Consolidated Financial Statements or Other Significant Matters |

ASU 2016-02, Leases (Topic 842), ASU 2018-01, Leases (Topic 842): Land Easement Practical Expedient for

Transition to Topic 842 | | This update amends existing guidance by recognizing lease assets and lease liabilities on the balance sheet and disclosing key information about leasing arrangements.

In January 2018, the Financial Accounting Standards Board (“FASB”) issued ASU 2018-01, which includes amendments to clarify land easements are within the scope of the new leases standard (Topic 842). Early adoption is permitted as of the original effective date. | | January 1, 2019 | | We are currently evaluating the impact the adoption of these standards will have on our consolidated financial statements. We have identified areas within our accounting policies we believe could be impacted by the new standard. This standard impacts the lessor’s ability to capitalize certain costs related to leasing, which will result in a reduction in the amount of execution costs currently being capitalized in connection with leasing activities and an increase to our General and Administrative expenses.

In January 2018, the FASB issued a proposed ASU related to ASC 842. The update would allow lessors to use a practical expedient to account for non-lease components and related lease components as a single lease component instead of accounting for them separately, if certain conditions are met. This proposal is currently under consideration by regulators.

We will continue to evaluate the effect the adoption of these ASUs will have on our consolidated financial statements. However, we currently believe that the adoption will not have a material impact for operating leases where we are a lessor and will continue to record revenues from rental properties for our operating leases on a straight-line basis. We are still evaluating the impact for leases where we are the lessee. |

The following table provides a brief description of newly adopted accounting pronouncements and their effect on our consolidated financial statements: |

| | | | | | |

| Standard | | Description | | Date of Adoption | | Effect on the Financial Statements or Other Significant Matters |

| ASU 2017-05, Other Income - Gains and Losses from the Derecognition of Nonfinancial Assets (Sub-topic 610-20) | | This update amends existing guidance in order to provide consistency in accounting for the derecognition of a business or non-profit activity. | | January 1, 2018 | | We did not record any cumulative adjustment in connection with the adoption of the new pronouncement as we determined that these changes did not have any impact on our consolidated financial statements. |

ASU 2016-15, Statement of Cash Flows (Topic 230);

ASU 2016-18, Statement of Cash Flows (Topic 230) | | These updates address the presentation of eight specific cash receipts and cash payments on the statement of cash flows as well as clarify the classification and presentation of restricted cash on the statement of cash flows. | | January 1, 2018 | | As we have no restricted cash, there was no impact on our consolidated statement of cash flows for all periods presented. |

| ASU 2014-09, Revenue from Contracts with Customers (Topic 606) | | This update outlines a comprehensive model for entities to use in accounting for revenue arising from contracts with customers. ASU 2014-09 states that “an entity recognizes revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services.” While ASU 2014-09 specifically references contracts with customers, it also applies to certain other transactions such as the sale of real estate or equipment. Expanded quantitative and qualitative disclosures are also required for contracts subject to ASU 2014-09. | | January 1, 2018 | | The majority of our revenue is lease revenue from our wholly-owned properties. We record these amounts as Rental Income and Tenant Recovery Income on the consolidated statements of operations. These revenue amounts are excluded from the scope of ASU 2014-09. As a result, the adoption of ASU 2014-09 did not result in any adjusting entries to prior periods as our revenue recognition related to these revenues aligned with the updated guidance. |

|

|

| 3. FAIR VALUE MEASUREMENTS |

The following describes the methods we use to estimate the fair value of our financial and non-financial assets and liabilities:

Cash and Cash Equivalents, Accounts Receivable, and Accounts Payable—We consider the carrying values of these financial instruments to approximate fair value because of the short period of time between origination of the instruments and their expected realization.

Real Estate Investments—The purchase prices of the investment properties, including related lease intangible assets and liabilities, were allocated at estimated fair value based on Level 3 inputs, such as discount rates, capitalization rates, comparable sales, replacement costs, income and expense growth rates, and current market rents and allowances as determined by management.

Debt Obligation—We estimate the fair value of our debt by discounting the future cash flows of each instrument at rates currently offered for similar debt instruments of comparable maturities by our lenders using Level 3 inputs. The discount rate used approximates current lending rates for loans or groups of loans with similar maturities and credit quality, assuming the debt is outstanding through maturity and considering the debt’s collateral (if applicable). We have utilized market information, as available, or present value techniques to estimate the amounts required to be disclosed.

The interest rate on our debt approximated the market interest rate, and as such, the fair value and recorded value of our debt were both $6,000 on March 31, 2018 and $9,000 on December 31, 2017.

|

|

| 4. REAL ESTATE ACQUISITIONS |

During the three months ended March 31, 2018, we acquired one grocery-anchored shopping center. During the three months ended March 31, 2017, we did not acquire any properties. The acquisition was not considered a business combination, but rather was classified as an asset acquisition. As such, most acquisition-related costs were capitalized and are included in the total purchase price shown below. Our real estate asset acquired during the three months ended March 31, 2018, was as follows: |

| | | | | | | | | | | | | | | |

| Property Name | | Location | | Anchor Tenant | | Acquisition Date | | Purchase Price | | Square Footage | | Leased % of Rentable Square Feet at Acquisition |

| Albertville Crossing | | Albertville, MN | | Coborn’s | | 2/21/2018 | | $ | 13,156 |

| | 99,013 |

| | 89.7% |

The fair value and weighted-average useful life for in-place, above-market, and below-market lease intangibles acquired during the three months ended March 31, 2018, are as follows (useful life in years): |

| | | | | | |

| | | 2018 |

| | | Fair Value | | Weighted-Average Useful Life |

| Acquired in-place leases | | $ | 1,632 |

| | 9 |

| Acquired above-market leases | | 82 |

| | 7 |

| Acquired below-market leases | | (93 | ) | | 8 |

|

|

| 5. ACQUIRED INTANGIBLE LEASES |

Acquired intangible lease assets and liabilities consisted of the following amounts as of March 31, 2018 and December 31, 2017: |

| | | | | | | |

| | March 31, 2018 | | December 31, 2017 |

| Acquired in-place leases | $ | 6,318 |

| | $ | 4,686 |

|

| Acquired above-market leases | 1,860 |

| | 1,779 |

|

| Total acquired intangible lease assets | 8,178 |

| | 6,465 |

|

| Accumulated amortization | (305 | ) | | (124 | ) |

| Net acquired intangible lease assets | $ | 7,873 |

| | $ | 6,341 |

|

| | | | |

| Acquired below-market liabilities | $ | 2,455 |

| | $ | 2,362 |

|

| Accumulated amortization | (80 | ) | | (48 | ) |

| Net below-market lease liabilities | $ | 2,375 |

| | $ | 2,314 |

|

Summarized below is the amortization recorded on the intangible assets and liabilities for the periods ended March 31, 2018 and 2017: |

| | | | | | | |

| | March 31, 2018 | | March 31, 2017 |

| In-place leases | $ | 147 |

| | $ | 25 |

|

| Above-market leases | 34 |

| | 1 |

|

| Below-market leases | (32 | ) | | (10 | ) |

| Total | $ | 149 |

| | $ | 16 |

|

Estimated future amortization of the respective acquired intangible lease assets and liabilities as of March 31, 2018, for each of the next five years is as follows: |

| | | | | | | | | | | |

| Year | In-Place Leases | | Above-Market Leases | | Below-Market Leases |

| Remaining 2018 | $ | 515 |

| | $ | 109 |

| | $ | (104 | ) |

| 2019 | 662 |

| | 143 |

| | (136 | ) |

| 2020 | 662 |

| | 143 |

| | (136 | ) |

| 2021 | 662 |

| | 143 |

| | (136 | ) |

| 2022 | 662 |

| | 143 |

| | (136 | ) |