Maximum Offering - $1,700,000,000 of Shares of Common Stock

Phillips Edison Grocery Center REIT III, Inc. is a recently formed Maryland corporation that intends to invest primarily in well-occupied grocery-anchored neighborhood and community shopping centers primarily leased to national and regional creditworthy tenants selling necessity-based goods and services in strong demographic markets throughout the United States. In addition, we may invest in other retail properties including power and lifestyle shopping centers, multi-tenant shopping centers, free-standing single-tenant retail properties and other real estate and real estate-related loans and securities depending on real estate market conditions and investment opportunities. We are an “emerging growth company” under federal securities laws.

We are offering up to an aggregate of $1,500,000,000 of shares of our Class T and Class I common stock in our primary offering. Class T shares are offered at $10.42 per share (subject to applicable discounts as discussed further in this prospectus) and Class I shares are offered at $10.00 per share. We are also offering up to an aggregate of $200,000,000 of shares of Class T, Class I and Class A common stock pursuant to our distribution reinvestment plan at a purchase price of $9.80 per share. This offering will terminate on or before May 8, 2020 (unless extended by our board of directors for an additional year or as otherwise permitted by applicable securities law).

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 19 to read about risks you should consider before buying shares of our common stock. These risks include the following:

| |

| • | No public market currently exists for our shares of common stock, and our charter does not require our board of directors to provide our stockholders a liquidity event by a specified date or at all. |

| |

| • | We set the offering prices of our shares arbitrarily. The offering prices are unrelated to the book or net value of our assets or to our expected operating income. |

| |

| • | We commenced investment operations on December 19, 2016 in connection with the acquisition of our first property, and as of the date of this prospectus we wholly own three shopping centers and have an ownership interest in a joint venture that owns three grocery anchored shopping centers. Except as disclosed in a supplement to this prospectus, we have not identified any additional investments to make with proceeds from this offering, and we are therefore a “blind pool.” |

| |

| • | Investors in this offering will experience immediate dilution in their investment primarily because, among other reasons, (i) we pay upfront fees in connection with the sale of our shares that reduce the proceeds to us, (ii) we sold approximately 5.8 million shares of our Class A common stock at an average purchase price of approximately $9.85 per share and received average net proceeds of approximately $9.00 per share in our private offering, and (iii) we paid certain organization and other offering expenses in connection with our private offering. |

| |

| • | We are dependent on our advisor and its affiliates to select investments and conduct our operations and this offering. |

| |

| • | We pay substantial fees and expenses to our advisor, its affiliates and broker-dealers, which payments increase the risk that you will not earn a profit on your investment. |

| |

| • | Our executive officers and our affiliated director face conflicts of interest. |

| |

| • | If we are unable to raise substantial funds during our offering stage, we may not be able to acquire a diverse portfolio of real estate investments and the value of our stockholders’ investment may vary more widely with the performance of specific assets. |

| |

| • | There are restrictions on the ownership and transferability of our shares of common stock. |

| |

| • | Our charter permits us to pay distributions from any source without limitation, including from offering proceeds, borrowings, sales of assets or waivers or deferrals of fees otherwise owed to our advisor. Distributions that exceed our net income or net capital gain will likely represent a return of capital as opposed to current income or gain, as applicable. During the early stages of our operations, we will likely fund distributions from sources that will be categorized as return of capital. As of December 31, 2018, all distributions have been funded by a combination of cash generated through borrowings and offering proceeds. |

| |

| • | We may change our targeted investments without stockholder consent. |

| |

| • | Some of the other programs sponsored by our sponsors have experienced adverse business developments or conditions. |

None of the Securities and Exchange Commission, the Attorney General of the State of New York or any other state securities regulator has approved or disapproved of our common stock, determined if this prospectus is truthful or complete or passed on or endorsed the merits of this offering. Any representation to the contrary is a criminal offense.

This investment involves a high degree of risk. You should purchase these securities only if you can afford a complete loss of your investment. The use of projections or forecasts in this offering is prohibited. Any representation to the contrary and any predictions, written or oral, as to the amount or certainty of any present or future cash benefit or tax consequence which may flow from an investment in this offering is not permitted.

|

| | | | | | | | | | | | | |

| | Price to Public(1) | Selling Commissions(2) | Dealer Manager Fee(2) | Net Proceeds (Before Expenses) (3) |

| Primary Offering | | | | | | | | | |

| Per T Share | $ | 10.42 |

| $ | 0.3126 | $ | 0.3126 |

| (4) | $ | 10.00 |

|

| Per I Share | $ | 10.00 |

| $ | 0.00 | $ | 0.15 |

| (4) | $ | 10.00 |

|

| Total Maximum | $ | 1,500,000,000 |

| $ | 40,500,000 |

| $ | 42,750,000 |

| (4) | $ | 1,446,000,000 |

|

| Distribution Reinvestment Plan | | | | | | | | | |

| Per A Share | $ | 9.80 |

| $ | 0.00 | $ | 0.00 | | $ | 9.80 |

|

| Per T Share | $ | 9.80 |

| $ | 0.00 | $ | 0.00 | | $ | 9.80 |

|

| Per I Share | $ | 9.80 |

| $ | 0.00 | $ | 0.00 | | $ | 9.80 |

|

| Total Maximum | $ | 200,000,000 |

| $ | 0.00 | $ | 0.00 | | $ | 200,000,000 |

|

(1) Volume and other discounts are available for some categories of investors. Reductions in commissions and fees will result in corresponding reductions in the purchase price.

(2) The maximum selling commissions and dealer manager fee assumes that 90% and 10% of the amount of common stock sold in the primary offering is Class T common stock and Class I common stock, respectively.

(3) In addition to selling commissions and the dealer manager fee, we pay additional underwriting compensation to our dealer manager in the form of a quarterly stockholder servicing fee on the shares of Class T common stock sold in the primary offering. This fee is subject to certain limits and accrues daily in an annual amount equal to 1.0% of the most recent purchase price per share of Class T common stock sold in the primary offering. See “Plan of Distribution.”

(4) Our dealer manager receives dealer manager fees in the amounts of (i) 3.0% of the gross offering proceeds for sales of Class T shares and (ii) 1.5% of the gross offering proceeds for sales of Class I shares. For sales of Class T shares, 2/3 of the dealer manager fee is funded by our advisor, and the remainder is funded by us. For sales of Class I shares, all of the dealer manager fee is funded by our advisor.

The dealer manager, Griffin Capital Securities, LLC, our affiliate, is not required to sell any specific number or dollar amount of shares but will use its best efforts to sell the shares offered. The minimum permitted purchase is $2,500.

The date of this prospectus is May 1, 2019.

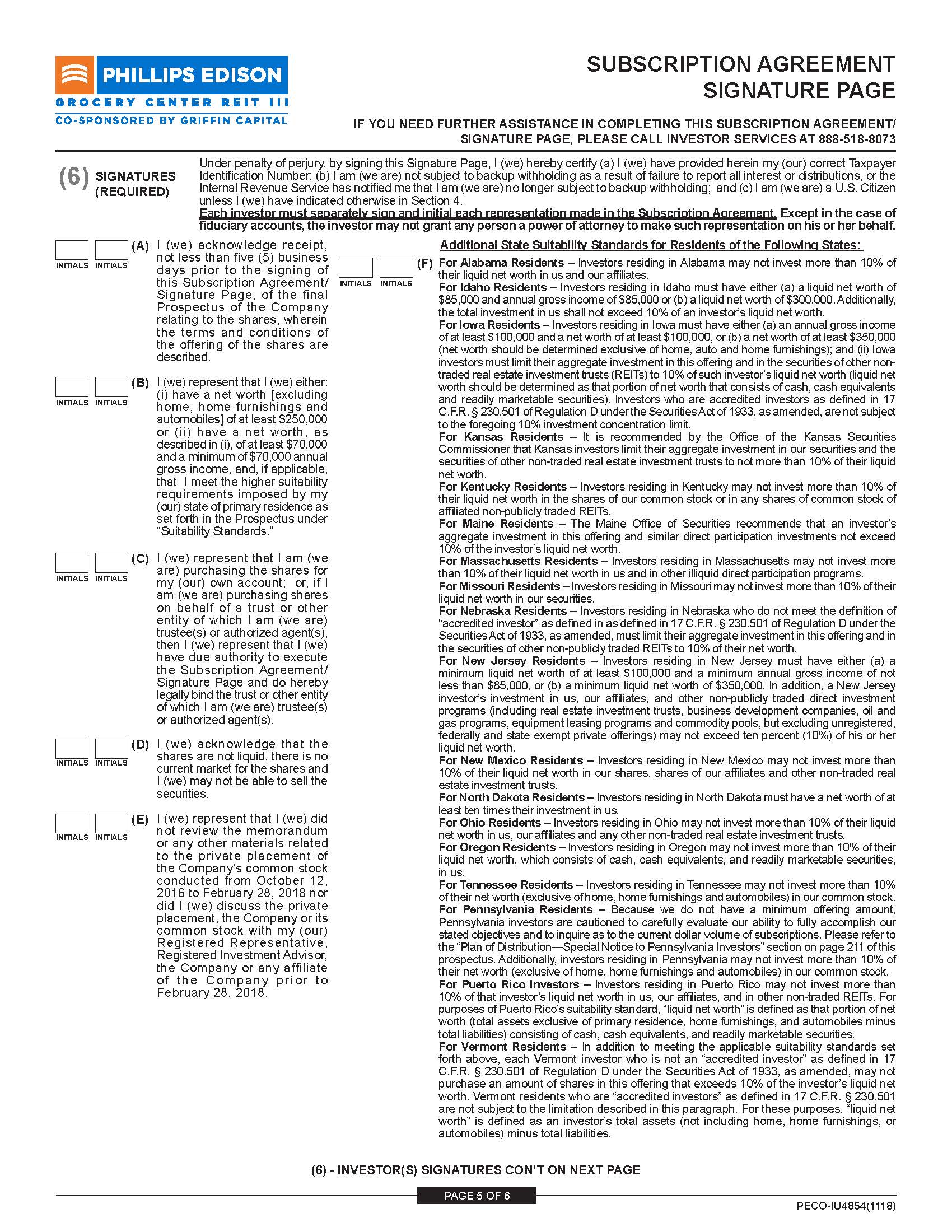

SUITABILITY STANDARDS

The shares we are offering through this prospectus are suitable only as a long-term investment for persons of adequate financial means and who have no need for liquidity in this investment. Because there is no public market for our shares, you will have difficulty selling your shares.

In consideration of these factors, we have established suitability standards for investors in this offering and subsequent purchasers of our shares. These suitability standards require that a purchaser of shares have either:

| |

| • | a net worth of at least $250,000; or |

| |

| • | gross annual income of at least $70,000 and a net worth of at least $70,000. |

In addition, the states listed below have established suitability requirements that are more stringent than ours and investors in these states are directed to the following special suitability standards:

| |

| • | Alabama - Investors residing in Alabama may not invest more than 10% of their liquid net worth in us and our affiliates. |

| |

| • | Idaho - Investors residing in Idaho must have either (a) a liquid net worth of $85,000 and annual gross income of $85,000 or (b) a liquid net worth of $300,000. Additionally, the total investment in us shall not exceed 10% of an investor’s liquid net worth. |

| |

| • | Iowa - Investors residing in Iowa must have (i) either (a) an annual gross income of at least $100,000 and a net worth of at least $100,000, or (b) a net worth of at least $350,000 (net worth should be determined exclusive of home, auto and home furnishings); and (ii) Iowa investors must limit their aggregate investment in this offering and in the securities of other non-traded real estate investment trusts (“REITs”) to 10% of such investor’s liquid net worth (liquid net worth should be determined as that portion of net worth that consists of cash, cash equivalents and readily marketable securities). Investors who are accredited investors as defined in 17 C.F.R. § 230.501 of Regulation D under the Securities Act of 1933, as amended, are not subject to the foregoing 10% investment concentration limit. |

| |

| • | Kansas - It is recommended by the Office of the Kansas Securities Commissioner that Kansas investors limit their aggregate investment in our securities and the securities of other non-traded REITs to not more than 10% of their liquid net worth. |

| |

| • | Kentucky - Investors residing in Kentucky may not invest more than 10% of their liquid net worth in the shares of our common stock or in any shares of common stock of affiliated non-publicly traded REITs. |

| |

| • | Maine - The Maine Office of Securities recommends that an investor’s aggregate investment in this offering and similar direct participation investments not exceed 10% of the investor’s liquid net worth. |

| |

| • | Massachusetts - Investors residing in Massachusetts may not invest more than 10% of their liquid net worth in us and in other illiquid direct participation programs. |

| |

| • | Missouri - Investors residing in Missouri may not invest more than 10% of their liquid net worth in our securities. |

| |

| • | Nebraska - Investors residing in Nebraska who do not meet the definition of “accredited investor” as defined in as defined in 17 C.F.R. § 230.501 of Regulation D under the Securities Act of 1933, as amended, must limit their aggregate investment in this offering and in the securities of other non-publicly traded REITs to 10% of their net worth. |

| |

| • | New Jersey - Investors residing in New Jersey must have either (a) a minimum liquid net worth of at least $100,000 and a minimum annual gross income of not less than $85,000, or (b) a minimum liquid net worth of $350,000. In addition, a New Jersey investor’s investment in us, our affiliates, and other non-publicly traded direct investment programs (including REITs, business development companies, oil and gas programs, equipment leasing programs and commodity pools, but excluding unregistered, federally and state exempt private offerings) may not exceed ten percent (10%) of his or her liquid net worth. |

| |

| • | New Mexico - Investors residing in New Mexico may not invest more than 10% of their liquid net worth in our shares, shares of our affiliates and other non-traded REITs. |

| |

| • | North Dakota - Investors residing in North Dakota must have a net worth of at least ten times their investment in us. |

| |

| • | Ohio - Investors residing in Ohio may not invest more than 10% of their liquid net worth in us, our affiliates and any other non-traded REITs. |

| |

| • | Oregon - Investors residing in Oregon may not invest more than 10% of their liquid net worth, which consists of cash, cash equivalents, and readily marketable securities, in us. |

| |

| • | Tennessee - Investors residing in Tennessee may not invest more than 10% of their net worth (exclusive of home, home furnishings and automobiles) in our common stock. |

| |

| • | Pennsylvania - Because we do not have a minimum offering amount, Pennsylvania investors are cautioned to carefully evaluate our ability to fully accomplish our stated objectives and to inquire as to the current dollar volume of subscriptions. Please refer to the “Plan of Distribution-Special Notice to Pennsylvania Investors” section on page 153 of this prospectus. Additionally, investors residing in Pennsylvania may not invest more than 10% of their net worth (exclusive of home, home furnishings and automobiles) in our common stock. |

| |

| • | Puerto Rico - Investors residing in Puerto Rico may not invest more than 10% of their liquid net worth in us, our affiliates, and in other non-traded REITs. For purposes of Puerto Rico’s suitability standard, “liquid net worth” is defined as that portion of net worth (total assets exclusive of primary residence, home furnishings, and automobiles minus total liabilities) consisting of cash, cash equivalents, and readily marketable securities. |

| |

| • | Vermont - In addition to meeting the applicable suitability standards set forth above, each Vermont investor who is not an “accredited investor” as defined in 17 C.F.R. § 230.501 of Regulation D under the Securities Act of 1933, as amended, may not purchase an amount of shares in this offering that exceeds 10% of the investor’s liquid net worth. Vermont residents who are “accredited investors” as defined in 17 C.F.R. § 230.501 are not subject to the limitation described in this paragraph. For these purposes, “liquid net worth” is defined as an investor’s total assets (not including home, home furnishings, or automobiles) minus total liabilities. |

For purposes of determining the suitability of an investor, net worth in all cases should be calculated excluding the value of an investor’s home, home furnishings and automobiles. Except as otherwise stated above, liquid net worth is defined as that portion of net worth that consists of cash, cash equivalents and readily marketable securities. In the case of sales to fiduciary accounts, these suitability standards must be met by the fiduciary account, by the person who directly or indirectly supplied the funds for the purchase of the shares if such person is the fiduciary or by the beneficiary of the account.

Our sponsors, those selling shares on our behalf, and participating broker-dealers and registered investment advisors recommending the purchase of shares in this offering must make every reasonable effort to determine that the purchase of shares in this offering is a suitable and appropriate investment for each stockholder based on information provided by the stockholder regarding the stockholder’s financial situation and investment objectives. See “Plan of Distribution-Determination of Suitability” for a detailed discussion of the determinations regarding suitability that we require.

TABLE OF CONTENTS

|

| |

| SUITABILITY STANDARDS | |

| PROSPECTUS SUMMARY | |

| RISK FACTORS | |

| Risks Related to an Investment in Us | |

| Risks Related to Conflicts of Interest | |

| Risks Related to This Offering and Our Corporate Structure | |

| Risks Related to Investments in Real Estate | |

| Risks Related to Real Estate-Related Investments | |

| Risks Associated with Debt Financing | |

| Federal Income Tax Risks | |

| Retirement Plan Risks | |

| SPECIAL NOTICE REGARDING FORWARD-LOOKING STATEMENTS | |

| ESTIMATED USE OF PROCEEDS | |

| POTENTIAL MARKET OPPORTUNITY | |

| MANAGEMENT | |

| Board of Directors | |

| Executive Officers and Directors | |

| Board Committees | |

| Compensation of Directors | |

| Board Participant | |

| Limited Liability and Indemnification of Directors, Officers, Employees and Other Agents | |

| Our Advisor | |

| Investment Committee | |

| The Advisory Agreement | |

| Initial Investment by Our Advisor | |

| Other Affiliates | |

| MANAGEMENT COMPENSATION | |

| STOCK OWNERSHIP | |

| CONFLICTS OF INTEREST | |

| Our Affiliates’ Interests in Other Real Estate Programs | |

| Receipt of Fees and Other Compensation by Our Advisor and its Affiliates | |

| Fiduciary Duties Owed by Some of Our Affiliates to Our Advisor and Our Advisor’s Affiliates | |

| Certain Conflict Resolution Measures | |

| INVESTMENT OBJECTIVES AND POLICIES | |

| General | |

| Grocery-Anchored Retail Properties Focus | |

| Other Real Estate and Real Estate-Related Loans and Securities | |

| Acquisition Policies | |

| Borrowing Policies | |

| Certain Risk Management Policies | |

| Equity Capital Policies | |

| Disposition Policies | |

| Liquidity Strategy | |

| Charter-Imposed Investment Limitations | |

|

| |

| Disclosure Policies with Respect to Future Probable Acquisitions | |

| Investment Limitations Under the Investment Company Act of 1940 | |

| Changes in Investment Objectives and Policies | |

| PRIOR PERFORMANCE SUMMARY | |

| Prior Investment Programs Sponsored by Our Phillips Edison Sponsor | |

| Prior Investment Programs Sponsored by Our Griffin Sponsor | |

| FEDERAL INCOME TAX CONSIDERATIONS | |

| Taxation of Phillips Edison Grocery Center REIT III, Inc. | |

| Taxation of Domestic Stockholders | |

| Taxation of Foreign Stockholders | |

| Taxation of Tax-Exempt Stockholders | |

| Backup Withholding and Information Reporting | |

| Other Tax Considerations | |

| ERISA CONSIDERATIONS | |

| Prohibited Transactions | |

| Plan Asset Considerations | |

| Other Prohibited Transactions | |

| Annual Valuation | |

| DESCRIPTION OF SHARES | |

| General | |

| Common Stock | |

| Preferred Stock | |

| Distributions | |

| Restriction on Ownership of Shares | |

| Transfer Agent and Registrar | |

| Meetings and Special Voting Requirements | |

| Advance Notice for Stockholder Nominations for Directors and Proposals of New Business | |

| Inspection of Books and Records | |

| Control Share Acquisitions | |

| Business Combinations | |

| Subtitle 8 | |

| Tender Offer by Stockholders | |

| Distribution Reinvestment Plan | |

| Share Repurchase Program | |

| Restrictions on Roll-Up Transactions | |

| THE OPERATING PARTNERSHIP AGREEMENT | |

| Description of Partnership Units | |

| Management of the Operating Partnership | |

| Indemnification | |

| Extraordinary Transactions | |

| Issuance of Additional Units | |

| Capital Contributions | |

| Distributions | |

| Liquidation | |

| Allocations | |

| Operations | |

|

| |

| Limited Partner Exchange Rights | |

| Special Limited Partner | |

| Tax Matters | |

| Term | |

| PLAN OF DISTRIBUTION | |

| General | |

| Compensation of Dealer Manager and Participating Broker-Dealers | |

| Underwriting Compensation and Organization and Offering Expenses | |

| Volume Discounts | |

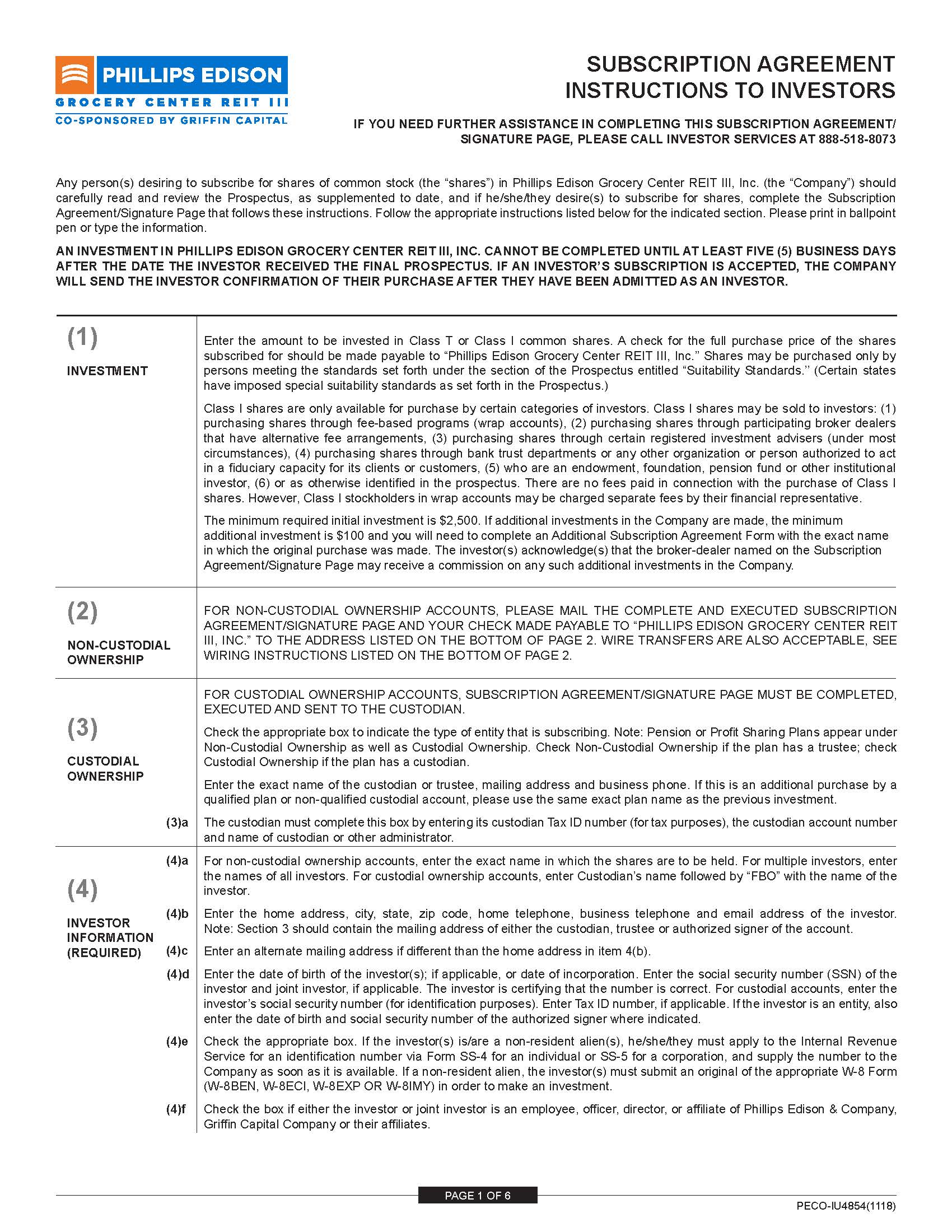

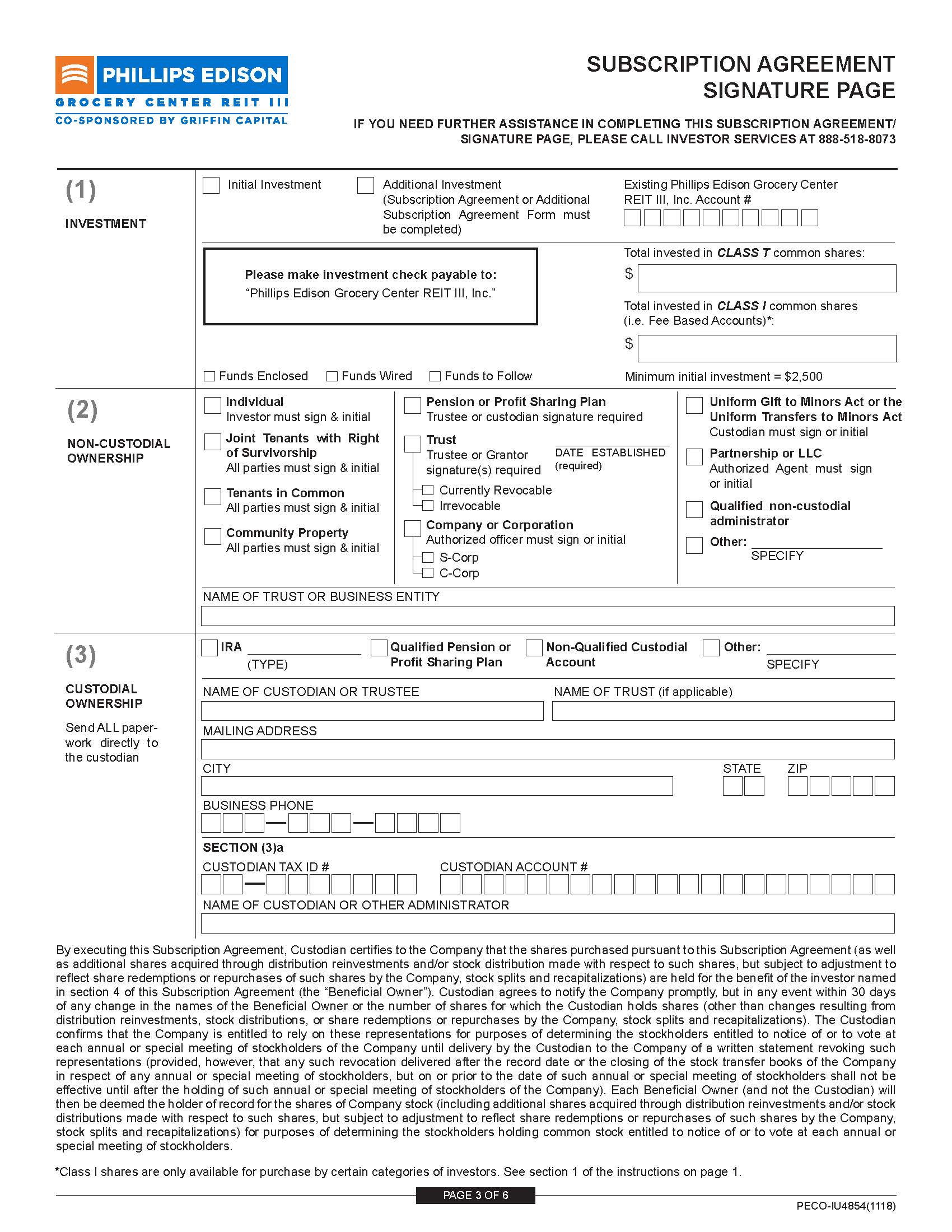

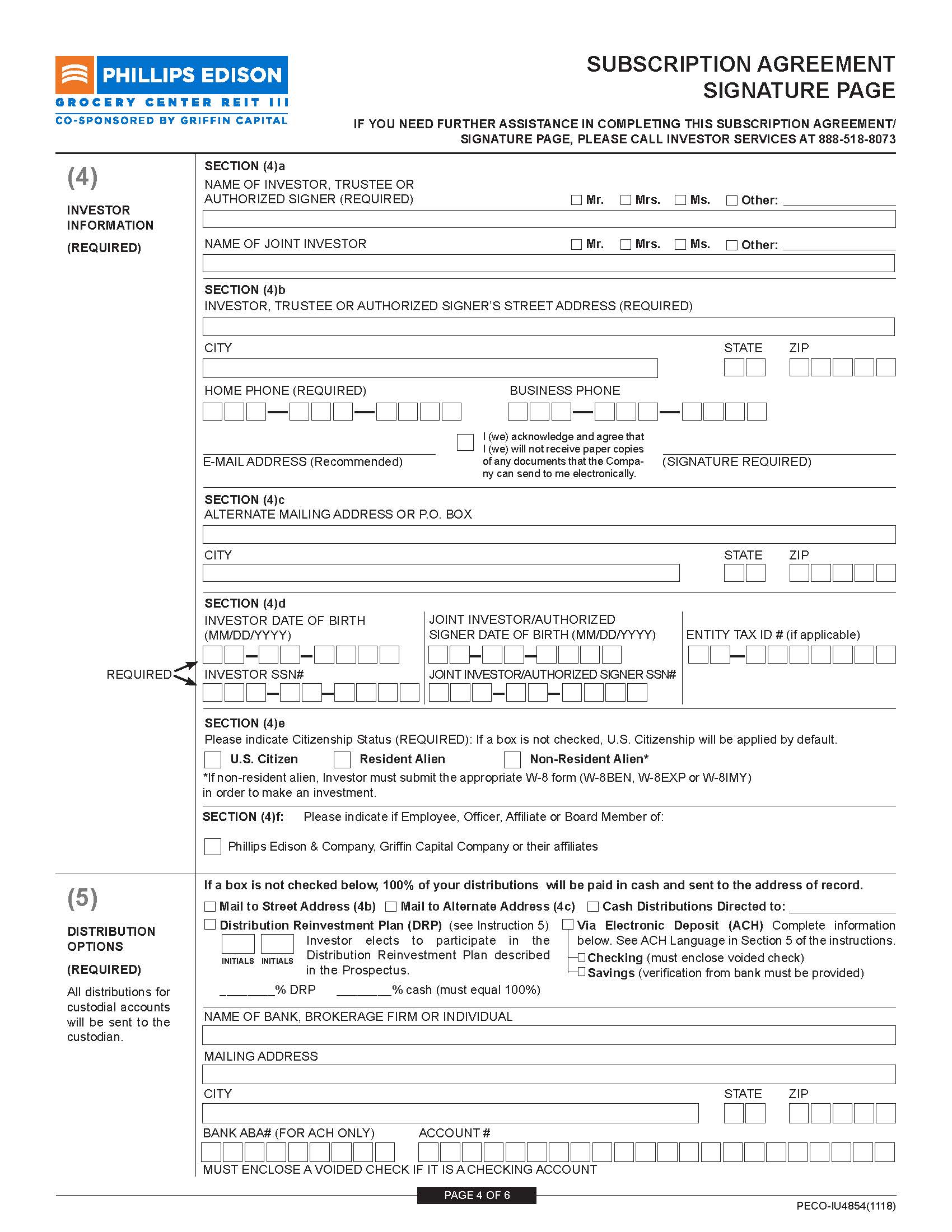

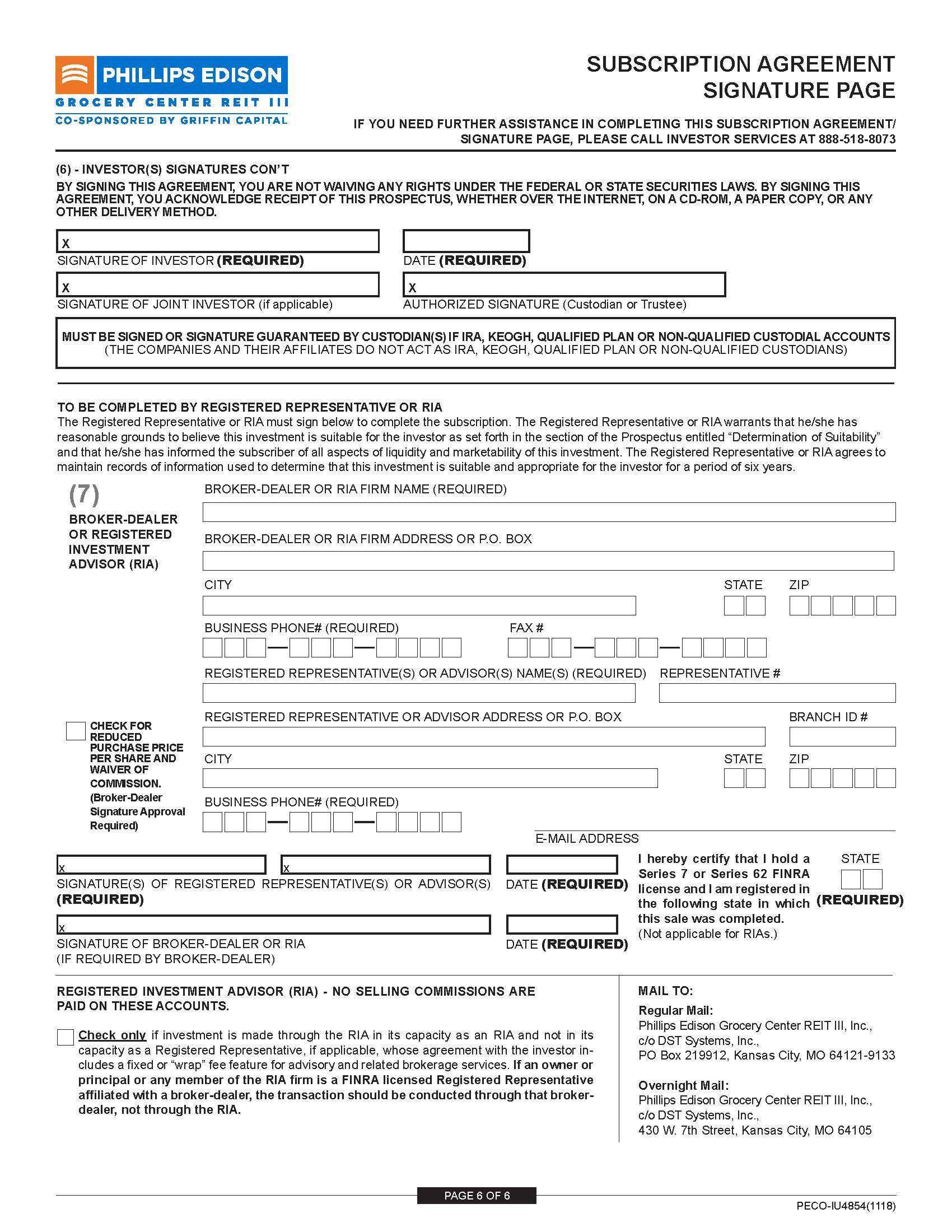

| Subscription Procedures | |

| Minimum Purchase Requirements | |

| Special Notice to Pennsylvania Investors | |

| HOW TO SUBSCRIBE | |

| ELECTRONIC DELIVERY OF DOCUMENTS | |

| SUPPLEMENTAL SALES MATERIAL | |

| LEGAL MATTERS | |

| WHERE YOU CAN FIND MORE INFORMATION | |

| Appendix A - Prior Performance Tables | |

| Appendix B - Form of Subscription Agreement | |

| Appendix C - Amended and Restated Distribution Reinvestment Plan | |

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. You should read the entire prospectus, including the information set forth in “Risk Factors,” and the information incorporated by reference herein, including the financial statements, for a more complete understanding of this offering. Except where the context suggests otherwise, the terms “we,” “us” and “our” refer to Phillips Edison Grocery Center REIT III, Inc. and its subsidiaries; “Operating Partnership” refers to our operating partnership, Phillips Edison Grocery Center Operating Partnership III, L.P.; “advisor” refers to PECO-Griffin REIT Advisor LLC; “property manager” collectively refers to Phillips Edison Grocery Center Operating Partnership I, L.P. and Phillips Edison & Company Ltd., which serve as our property manager and leasing services manager, respectively; “dealer manager” refers to Griffin Capital Securities, LLC; “Phillips Edison sponsor” refers to Phillips Edison Limited Partnership prior to October 4, 2017, and Phillips Edison & Company, Inc. on and after October 4, 2017; “Griffin sponsor” refers to Griffin Capital Company, LLC; and “sponsor” or “sponsors” refer to one or both of our Phillips Edison sponsor and our Griffin sponsor.

What is Phillips Edison Grocery Center REIT III, Inc.?

We are a Maryland corporation incorporated on April 15, 2016. We were formed to leverage the expertise of our sponsors and capitalize on the market opportunity to acquire and manage grocery-anchored neighborhood and community shopping centers located in strong demographic markets throughout the United States. We seek to acquire and manage grocery-anchored neighborhood and community shopping centers that are typically over 80% occupied, have a mix of national, regional and local tenants selling necessity-based goods and services, and are anchored by a leading grocery provider in the region, with the specific grocery store demonstrating solid sales performance. We intend to build a high-quality portfolio utilizing the following acquisition strategy:

| |

| • | Grocery-Anchored Retail - We are focused on primarily acquiring well-occupied grocery-anchored neighborhood and community shopping centers serving the day-to-day shopping needs of the community in the surrounding trade area. |

| |

| • | National and Regional Tenants - We intend to acquire shopping centers primarily leased to national and regional retail tenants selling necessity-based goods and services to customers living in the local trade area. |

| |

| • | Diversification - We intend to own and operate a diversified primarily grocery-anchored portfolio based on geography, industry, tenant mix, and lease expirations, thereby mitigating risk. |

| |

| • | Infill Locations/Solid Markets - We intend to target properties in established or growing markets based on trends in population density, population growth, employment, household income, employment diversification, and other key demographic factors having higher barriers to entry, which we believe limit additional competition. |

| |

| • | Triple-Net Leases - We intend to negotiate leases we enter into to provide for, or acquire properties with leases that provide for, tenant reimbursements of operating expenses, real estate taxes, and insurance, providing a level of protection against rising expenses. |

Our strategy is to acquire, own and manage a high-quality, diverse, grocery-anchored shopping center portfolio, while maintaining a property-focused approach to maximize total returns to stockholders. We believe these goals will be supported by the following attributes of our company:

| |

| • | Stable Income to Provide Consistent Distributions - We intend to acquire a portfolio with sustainable income, and expect that approximately 70% to 80% of such income will come from national and regional tenants. We expect that such sustainable income will fund monthly distributions to our stockholders at a rate consistent with our operating performance. |

| |

| • | Upside Potential - We seek to create value from a combination of the strategic leasing of portfolio vacancies, rental growth, creation of new revenue streams and strategic expense reduction, all leading to increased cash flow. |

| |

| • | Low Leverage - We intend to utilize a prudent leverage strategy with an approximate 45% to 50% targeted loan-to-value ratio on our portfolio once we have invested substantially all of the net proceeds of this offering. |

| |

| • | Tenured Management with a National Platform - Our Phillips Edison sponsor’s seasoned team of professional managers has extensive retail industry expertise and established tenant relationships. Accordingly, we expect that team to provide reliable execution of our acquisition and operating strategies through its national operating and leasing platform. |

| |

| • | Property Focus - We intend to utilize a property-specific operational focus that combines intensive leasing and merchandising plans with cost containment measures to deliver a more solid and stable income stream from each property. |

| |

| • | Liquidity Strategy - We anticipate listing our shares on a national securities exchange, merging, reorganizing or otherwise transferring our company or its assets to another entity, commencing the sale of our properties and |

liquidation of our company, conducting a “NAV” offering and providing increased capacity to repurchase shares through our share repurchase program or otherwise creating a liquidity event for our stockholders subject to then-existing market conditions and the sole discretion of our board of directors after the completion of our primary offering.

We commenced investment operations on December 19, 2016 in connection with the acquisition of our first property. As of the date of this prospectus, we wholly own three shopping centers located in North Fort Myers, Florida; Sudbury, Massachusetts; and Ashburn, Virginia and we have an ownership interest in a joint venture, Grocery Retail Partners II LLC (“Joint Venture”), with The Northwestern Mutual Life Insurance Company (“Northwestern Mutual”), which owns three grocery-anchored shopping centers located in St. Cloud, Florida; Rolling Meadows, Illinois; and Albertville, Minnesota. However, except as disclosed in a supplement to this prospectus, we have not yet identified any additional assets to acquire with the proceeds from this offering. Therefore, we are considered a “blind pool.” We are also considered an “emerging growth company” under federal securities laws.

Our external advisor, PECO-Griffin REIT Advisor LLC, conducts our operations and manages our portfolio of real estate investments, all subject to the supervision of our board of directors. We have no paid employees.

Our offices are located at 11501 Northlake Drive, Cincinnati, Ohio 45249. Our telephone number is (513) 554-1110, and our web site address is www.grocerycenterREIT3.com.

What is a REIT?

We have elected to be qualified as a real estate investment trust (“REIT”) beginning with the taxable year ended December 31, 2017. In general, a REIT is an entity that:

| |

| • | combines the capital of many investors to acquire or provide financing for real estate investments; |

| |

| • | allows individual investors to invest in a professionally managed, large-scale, diversified real estate portfolio through the purchase of interests, typically shares, in the REIT; |

| |

| • | is required to pay to investors distributions of at least 90% of its annual REIT taxable income (computed without regard to the dividends paid deduction and excluding net capital gain); and |

| |

| • | avoids the “double taxation” treatment of income that normally results from investments in a corporation because a REIT is not generally subject to federal corporate income taxes on that portion of its income distributed to its stockholders, provided certain income tax requirements are satisfied. |

However, under the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”), REITs are subject to numerous organizational and operational requirements. If we fail to qualify for taxation as a REIT in any year after electing REIT status, our income will be taxed at regular corporate rates, and we may be precluded from qualifying for treatment as a REIT for the four-year period following our failure to qualify. Even if we qualify as a REIT for federal income tax purposes, we may still be subject to state and local taxes on our income and property and to federal income and excise taxes on our undistributed income.

What are your investment objectives?

Our principal investment objectives are to:

| |

| • | preserve and protect your capital contribution; |

| |

| • | provide you with stable cash distributions; |

| |

| • | realize growth in the value of our assets upon the sale of such assets; and |

| |

| • | provide you with the potential for future liquidity through the sale of our assets, a sale or merger of our company, a listing of our common stock on a national securities exchange, increasing our capacity to repurchase shares in connection with a “NAV” offering or other similar transactions. See “-What are your potential liquidity strategies?” |

See the “Investment Objectives and Policies” section of this prospectus for a more complete description of our investment policies and charter-imposed investment restrictions.

How do you expect your assets to be allocated?

As of the date of this prospectus, we wholly own three shopping centers and we have an ownership interest in the Joint Venture, which owns three grocery-anchored shopping centers. We plan to diversify our real estate portfolio by geographic region, anchor tenants, tenant mix, investment size and investment risk with the goal of attaining an asset base of income-producing real estate properties and real estate-related assets that provide stable returns to our investors and the potential for growth in the value of our assets. We intend to allocate at least 90% of our asset base to investments in grocery-anchored

neighborhood and community shopping centers throughout the United States with a focus on well-located shopping centers that are well occupied at the time of purchase. We also may allocate up to 10% of our asset base to other real estate properties, real estate-related loans and securities and the equity securities of other REITs and real estate companies, assuming we sell the maximum offering amount.

How do you select potential properties for acquisition?

To find properties that best meet our criteria for investment, our Phillips Edison sponsor has developed a disciplined investment approach that combines the experience of its team of real estate professionals with a structure that emphasizes thorough market research, stringent underwriting standards and an extensive down-side analysis of the risks of each investment.

What types of real estate-related debt investments do you expect to make?

To the extent that we make any real estate-related debt investments, we intend to primarily focus on investments in first mortgages. The other real estate-related debt investments in which we may invest include mortgages (other than first mortgages); mezzanine, bridge and other loans; debt and derivative securities related to real estate assets, including mortgage-backed securities; collateralized debt obligations; debt securities issued by real estate companies; and credit default swaps.

What types of investments will you make in the equity securities of other companies?

We may make equity investments in REITs and other real estate companies. We may purchase the common or preferred stock of these entities or options to acquire their stock. We do not expect our non-controlling equity investments in other public companies to exceed 5% of the proceeds of this offering, assuming we sell the maximum offering amount, or to represent a substantial portion of our assets at any one time.

Are there any risks involved in an investment in your shares?

Investing in our common stock involves a high degree of risk. You should carefully review the “Risk Factors” section of this prospectus beginning on page 19, which contains a detailed discussion of the material risks that you should consider before you invest in our common stock. Some of the more significant risks relating to an investment in our shares include the following:

| |

| • | No public market currently exists for our shares of common stock, and our charter does not require our directors to seek stockholder approval to liquidate our assets, list our shares on an exchange, or create any other liquidity event for our stockholders by a specified date. In addition, our share repurchase program includes numerous restrictions that limit your ability to sell your shares to us. If you are able to sell your shares before a liquidity event or a listing, you will likely have to sell them at a substantial discount from their public offering price. |

| |

| • | We set the primary offering prices of our Class T and Class I shares arbitrarily. These prices may not be indicative of the prices at which our shares would trade if they were listed on an exchange or actively traded, and the prices bear no relationship to the book or net value of our assets or to our expected operating income. |

| |

| • | We commenced investment operations on December 19, 2016 in connection with the acquisition of our first property, and we have a limited operating history. Except as disclosed in a supplement to this prospectus, we have not identified any additional investments to make with proceeds from this offering, and we are therefore a “blind pool.” |

| |

| • | Investors in this offering will experience immediate dilution in their investment primarily because, among other reasons, (i) we pay upfront fees in connection with the sale of our shares that reduce the proceeds to us, (ii) we sold approximately 5.8 million shares of our Class A common stock at an average purchase price of approximately $9.85 per share and received average net proceeds of approximately $9.00 per share in our private offering, and (iii) we paid certain organization and other offering expenses in connection with our private offering. |

| |

| • | We are dependent on our advisor to select investments and conduct our operations. Loss of our advisor or the loss of key employees by our sponsors could cause a substantial disruption to our business. |

| |

| • | Our executive officers and our affiliated director are also officers, directors, managers, or key professionals of our sponsors. As a result, they will face conflicts of interest, including significant conflicts created by our advisor’s compensation arrangements with us and other programs sponsored by our sponsors and conflicts in allocating time among us and these other programs. These conflicts could result in action or inaction that is not in the best interests of our stockholders. |

| |

| • | We pay substantial fees to and expenses of our advisor, its affiliates, and participating broker-dealers, which payments increase the risk that you will not earn a profit on your investment. For a summary of these fees, see “-What are the fees that you pay to the advisor and its affiliates?” below in this section. |

| |

| • | Our advisor and its affiliates, including our property manager, receive fees in connection with transactions involving the acquisition and management of our investments. These fees are based on the cost of the investment, and not based on the quality of the investment or the quality of the services rendered to us. This may influence our advisor to recommend riskier transactions to us. |

| |

| • | There is no limit on the amount we can borrow to acquire a single real estate investment, but pursuant to our charter, we may not leverage our assets with debt financing such that our borrowings would be in excess of 300% of our net assets unless a majority of the members of our Conflicts Committee finds substantial justification for borrowing a greater amount. During the early stages of this offering and to the extent that financing in excess of this limit is available on attractive terms, our Conflicts Committee is more likely to approve debt in excess of this limit. High debt levels could limit the amount of cash we have available to distribute and could result in a decline in the value of your investment. |

| |

| • | Our charter prohibits the beneficial or constructive ownership of more than 9.8% of our common stock by any person, unless exempted by our board of directors, which may inhibit transfers of our common stock and large investors from purchasing your shares of common stock. |

| |

| • | This offering is being conducted on a “best efforts” basis, which means that our dealer manager is required to use only its best efforts to sell the shares in the offering and has no firm commitment or obligation to purchase any of the shares. Therefore, we may not sell all or many of the shares that we are offering. If we are unable to raise substantial funds during our offering stage, we may not be able to acquire a diverse portfolio of real estate investments, which may cause the value of an investment in us to vary more widely with the performance of specific assets and cause our general and administrative expenses to constitute a greater percentage of our revenue. Raising fewer proceeds during our offering stage, therefore, could increase the risk that our stockholders will lose money in their investment. |

| |

| • | Our charter permits us to pay distributions from any source without limitation, including from offering proceeds, borrowings, sales of assets or waivers or deferrals of fees otherwise owed to our advisor. To the extent these distributions exceed our net income or net capital gain, a greater proportion of your distributions will generally represent a return of capital as opposed to current income or gain, as applicable. Our organizational documents do not limit the amount of distributions we can fund from sources other than from cash flows from operations. If our cash flow from operations is insufficient to cover our distributions, we expect to use the proceeds from this offering, the proceeds from the issuance of securities in the future or proceeds from borrowings to pay distributions. During the early stages of our operations, we will likely fund distributions from sources that will be categorized as return of capital. As of December 31, 2018, all distributions have been funded by a combination of cash generated through borrowings and offering proceeds. |

| |

| • | We may experience adverse business developments or conditions similar to those affecting certain programs sponsored by our sponsors, which could limit our ability to make distributions and could decrease the value of your investment. |

| |

| • | Disruptions in the financial markets and poor economic conditions could adversely affect our ability to implement our business strategy and generate returns to you. |

| |

| • | Our failure to continue to qualify as a REIT for federal income tax purposes would reduce the amount of income we have available for distribution and limit our ability to make distributions to our stockholders. |

| |

| • | We may change our targeted investments without stockholder consent, which could adversely affect the value of our common stock and our ability to make distributions to you. |

| |

| • | Because the dealer manager is one of our affiliates, you will not have the benefit of an independent review of us or this prospectus customarily undertaken in underwritten offerings; the absence of an independent due diligence review increases the risks and uncertainty you face as a stockholder. |

Have you conducted prior offerings for your shares?

Yes. From October 12, 2016 through February 28, 2018, we conducted a best efforts private placement offering of our Class A shares of common stock to accredited investors only pursuant to a confidential private placement memorandum, which we refer to as the “private offering.” We raised $56.8 million in gross offering proceeds from the sale of approximately 5.8 million Class A shares in the private offering.

What is the role of the board of directors?

We operate under the direction of our board of directors, the members of which are accountable to us and our stockholders as fiduciaries. We have four members on our board of directors, three of whom are independent of our advisor and its affiliates. Our charter requires that a majority of our directors be independent of our advisor and creates a committee of our board

consisting solely of all of our independent directors. This committee, which we call the Conflicts Committee, is responsible for reviewing the performance of our advisor and must approve other matters set forth in our charter. See the “Conflicts of Interest-Certain Conflict Resolution Measures” section of this prospectus. Our directors are elected annually by the stockholders.

Subject to the investment objectives and limitations set forth in our charter and the investment policies approved by our board of directors, our advisor may not make any real property acquisitions, developments or dispositions on our behalf, including real property portfolio acquisitions, developments and dispositions, without the prior approval of the majority of our board of directors. The actual terms and conditions of transactions involving investments in real estate shall be determined by our advisor, subject to the oversight of our board of directors.

Who is your advisor?

Our advisor is PECO-Griffin REIT Advisor LLC. Our advisor is jointly owned by our Phillips Edison sponsor and our Griffin sponsor.

What does the advisor do?

Our advisor manages our day-to-day operations and our portfolio of real estate investments, and provides asset management, marketing, investor relations and other administrative services on our behalf, all subject to the supervision of our board of directors. We have entered into a management agreement with our property manager to provide property management services for most, if not all, of the properties or other real estate-related assets we acquire, provided our advisor is able to control the operational management of such acquisitions.

Our Phillips Edison sponsor and its team of real estate professionals, including Jeffrey S. Edison, Devin I. Murphy and R. Mark Addy, acting through our advisor, make most of the decisions regarding the selection, negotiation, financing and disposition of real estate investments. Currently, a majority of our board of directors approves all proposed investments. In the future, the board of directors may opt to delegate certain authority to our officers and advisor to make certain investments on our behalf without specific board approval of each investment.

What is the experience of your Phillips Edison sponsor?

Phillips Edison Limited Partnership, formed in 1991, was a privately owned fully integrated real estate operating company that acquired and operated neighborhood and community shopping centers throughout the United States. Phillips Edison Limited Partnership previously served as a sponsor for Phillips Edison & Company, Inc. (“PECO”) and Phillips Edison Grocery Center REIT II, Inc. (“PECO II”), both of which are (or was, in the case of PECO II) publicly registered, non-traded REITs. PECO seeks to acquire and manage well-occupied grocery-anchored neighborhood and community shopping centers having a mix of national and regional retailers selling necessity-based goods and services in strong demographic markets throughout the United States. On October 4, 2017, PECO acquired Phillips Edison Limited Partnership’s real estate and asset management business in an OP Unit-and-cash transaction valued at approximately $1.0 billion. As a result of this transaction, PECO became our Phillips Edison sponsor on October 4, 2017. On November 16, 2018, PECO acquired PECO II in a 100% stock-for-stock transaction valued at approximately $1.9 billion. The resulting company is an internally-managed, non-traded grocery-anchored shopping center REIT with a total enterprise value of approximately $6.0 billion.

Our Phillips Edison sponsor and its predecessor have operated with financial partners through both property-specific joint ventures and multi-asset discretionary private equity funds, as well as publicly registered, non-traded REITs. Led by senior executives with more than two decades of real estate experience and more than ten years together, our Phillips Edison sponsor and its predecessor and affiliates have owned, operated, managed and/or sponsored over 66 million square feet of space since 1991. Our Phillips Edison sponsor has built and refined its in-house, fully integrated real estate operating platform to manage multiple aspects of shopping center operations, including acquisitions, leasing, construction management, property management, finance, marketing and dispositions. As of December 31, 2018, our Phillips Edison sponsor and its affiliates owned, operated, managed and/or sponsored a portfolio consisting of approximately 38.1 million square feet, located in 32 states. Our Phillips Edison sponsor and its affiliates have over 5,800 tenants and long-standing relationships with national and regional companies with high credit ratings.

What is the experience of your Griffin sponsor?

Our Griffin sponsor, originally formed as a California corporation in 1995 and reorganized as a Delaware limited liability company in February 2017, is a privately owned real estate investment company specializing in the acquisition, financing and management of institutional-quality property in the United States. Led by senior executives with more than two decades of real estate experience collectively encompassing more than 650 transactions, our Griffin sponsor and its affiliates have acquired or constructed approximately 60 million square feet of space since 1995. As a principal, our Griffin sponsor has engaged in a full spectrum of transaction risk and complexity, ranging from ground-up development, opportunistic acquisitions requiring

significant re-tenanting or asset re-positioning to structured single-tenant acquisitions. Our Griffin sponsor currently serves as a co-sponsor for Griffin-American Healthcare REIT III, Inc. (“GAHR III”) and Griffin-American Healthcare REIT IV, Inc. (“GAHR IV”), each of which are publicly registered, non-traded REITs. Our Griffin sponsor is also the sponsor of Griffin Institutional Access Real Estate Fund (“GIA Real Estate Fund”) and Griffin Institutional Access Credit Fund (“GIA Credit Fund”), both of which are non-diversified, closed-end management investment companies that are operated as interval funds under the Investment Company Act of 1940, as amended (the “Investment Company Act”). Our Griffin sponsor also sponsors several private offerings. Prior to completing its merger transaction with NorthStar Realty Finance in December 2014, our Griffin sponsor was also a co-sponsor of Griffin-American Healthcare REIT II, Inc. (“GAHR II”), which was also a publicly registered, non-traded REIT. As of December 31, 2018, our Griffin sponsor and its affiliates have owned, managed, sponsored and/or co-sponsored approximately $16.8 billion in assets.

Will you use leverage?

Yes. We expect that upon full investment of the proceeds of this offering, assuming we sell the maximum amount, our aggregate borrowings will not exceed 50% of the total value of our assets (calculated after the close of the primary offering). Under our charter, the maximum amount of our total indebtedness shall not exceed 300% of our total “net assets” (as defined in our charter in accordance with the Statement of Policy Regarding Real Estate Investment Trusts revised and adopted by the North American Securities Administrators Association on May 7, 2007, or the NASAA REIT Guidelines) as of the date of any borrowing, which is generally expected to be approximately 75% of the cost of our investments; however, we may exceed that limit if such excess is approved by a majority of the members of the Conflicts Committee and disclosed to stockholders in our next quarterly report following that borrowing along with justification for exceeding such limit. This charter limitation, however, does not apply to individual real estate assets or investments. In any event, we expect that the amount of our aggregate borrowings will be reasonable in relation to the fair value of our assets and will be reviewed by our board of directors at least quarterly.

In addition, we do not intend to exceed the leverage limit in our charter, except in the early stages of our development when the costs of our investments are most likely to exceed our net offering proceeds. We believe that careful use of debt will help us to achieve our diversification goals because we will have more funds available for investment.

How will you structure the ownership and operation of your assets?

We plan to own substantially all of our assets and conduct our operations through Phillips Edison Grocery Center Operating Partnership III, L.P., which we refer to as our Operating Partnership in this prospectus. Our wholly owned subsidiary, Phillips Edison Grocery Center OP GP III LLC, is the sole general partner of our Operating Partnership and, as of the date of this prospectus, we are the sole limited partner of our Operating Partnership. We present our financial statements, operating partnership income, expenses and depreciation on a consolidated basis with Phillips Edison Grocery Center OP GP III LLC and our Operating Partnership. All items of income, gain, deduction (including depreciation), loss and credit flow through our Operating Partnership and Phillips Edison Grocery Center OP GP III LLC to us as each of these subsidiary entities are disregarded for federal tax purposes. These tax items do not generally flow through us to our investors; rather, our net income and net capital gain effectively flow through us to the stockholders as and when dividends are paid to our stockholders. Because we conduct substantially all of our operations through our Operating Partnership, we are considered an UPREIT.

What is an “UPREIT”?

UPREIT stands for “Umbrella Partnership Real Estate Investment Trust.” An UPREIT is a REIT that holds all or substantially all of its properties through a partnership in which the REIT holds a general partner or limited partner interest, approximately equal to the value of capital raised by the REIT through sales of its capital stock. Using an UPREIT structure may give us an advantage in acquiring properties from persons who may not otherwise sell their properties because of unfavorable tax results. Generally, a sale of property directly to a REIT is a taxable transaction to the selling property owner. In an UPREIT structure, a seller of a property who desires to defer taxable gain on the sale of his property may transfer the property to the UPREIT in exchange for limited partnership units in the partnership and defer taxation of gain until the seller later exchanges his limited partnership units for cash or, at our option, for shares of our common stock pursuant to the terms of the limited partnership agreement.

What is the impact of being an “emerging growth company”?

We do not believe that being an “emerging growth company,” as defined by the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”), will have a significant impact on our business or this offering. We have elected to opt out of the extended transition period for complying with new or revised accounting standards pursuant to Section 107(b) of the JOBS Act. This election is irrevocable. Also, because we are not a large accelerated filer or an accelerated filer under Section 12b-2 of the Securities Exchange Act of 1934 (the “Exchange Act”), and will not be for so long as our shares of common stock are not

traded on a securities exchange, we are not subject to auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act of 2002. In addition, so long as we are externally managed by our advisor, we do not expect to be required to seek stockholder approval of executive compensation and “golden parachute” compensation arrangements pursuant to Section 14A(a) and (b) of the Exchange Act. We will remain an “emerging growth company” for up to five years, although we will lose that status sooner if our revenues exceed $1 billion, if we issue more than $1 billion in non-convertible debt in a three-year period or if the market value of our common stock that is held by non-affiliates exceeds $700 million as of any June 30.

What conflicts of interest does your advisor face?

Each of our sponsors and their respective affiliates and personnel experience conflicts of interest in connection with the management of our business. Some of the material conflicts that our sponsors and their respective affiliates face include the following:

| |

| • | Our Phillips Edison sponsor must determine which investment opportunities to recommend to us and to other operating Phillips Edison-advised entities or Phillips Edison-sponsored programs, as well as our Phillips Edison sponsor itself; |

| |

| • | Our Phillips Edison sponsor primarily owns and acquires the same type of grocery-anchored shopping centers that we are seeking to acquire and our Phillips Edison sponsor has certain discretion in determining to which company opportunities to acquire such properties will be directed; |

| |

| • | Because our Griffin sponsor is a sponsor of four public offerings selling shares of capital stock concurrently with this offering, we may compete with these programs, as well as additional private programs that our Griffin sponsor also sponsors, for the same investors when raising capital; |

| |

| • | Our advisor and its affiliates may structure the terms of joint ventures between us and other Phillips Edison- or Griffin-sponsored programs or Phillips Edison- or Griffin-advised entities; |

| |

| • | Our sponsors and their respective affiliates have to allocate their time between us and other real estate programs and activities in which each is involved; |

| |

| • | Our advisor and its affiliates, including our property manager, receive fees in connection with transactions involving the purchase, management and sale of our assets regardless of the quality of the asset acquired or the services provided to us; |

| |

| • | Our dealer manager is an affiliate of our Griffin sponsor and receive fees in connection with this offering; |

| |

| • | The negotiations of the advisory agreement, the dealer manager agreement and the property management agreement (including the substantial fees our advisor and its affiliates receive thereunder) were not at arm’s length; and |

| |

| • | In the future, we may internalize our management by acquiring assets and the key professionals from our sponsors and their affiliates. We cannot be sure of the terms relating to any such acquisition. Additionally, in an internalization transaction, the professionals at our sponsors who become our employees may receive more compensation than they receive from our sponsors or its affiliates. These possibilities may provide incentives to our advisor or these individuals to pursue an internalization transaction rather than an alternative strategy, even if such alternative strategy might otherwise be in our stockholders’ best interests. |

See the “Conflicts of Interest” section of this prospectus for a detailed discussion of the various conflicts of interest relating to your investment, as well as the procedures that we have established to mitigate a number of these potential conflicts.

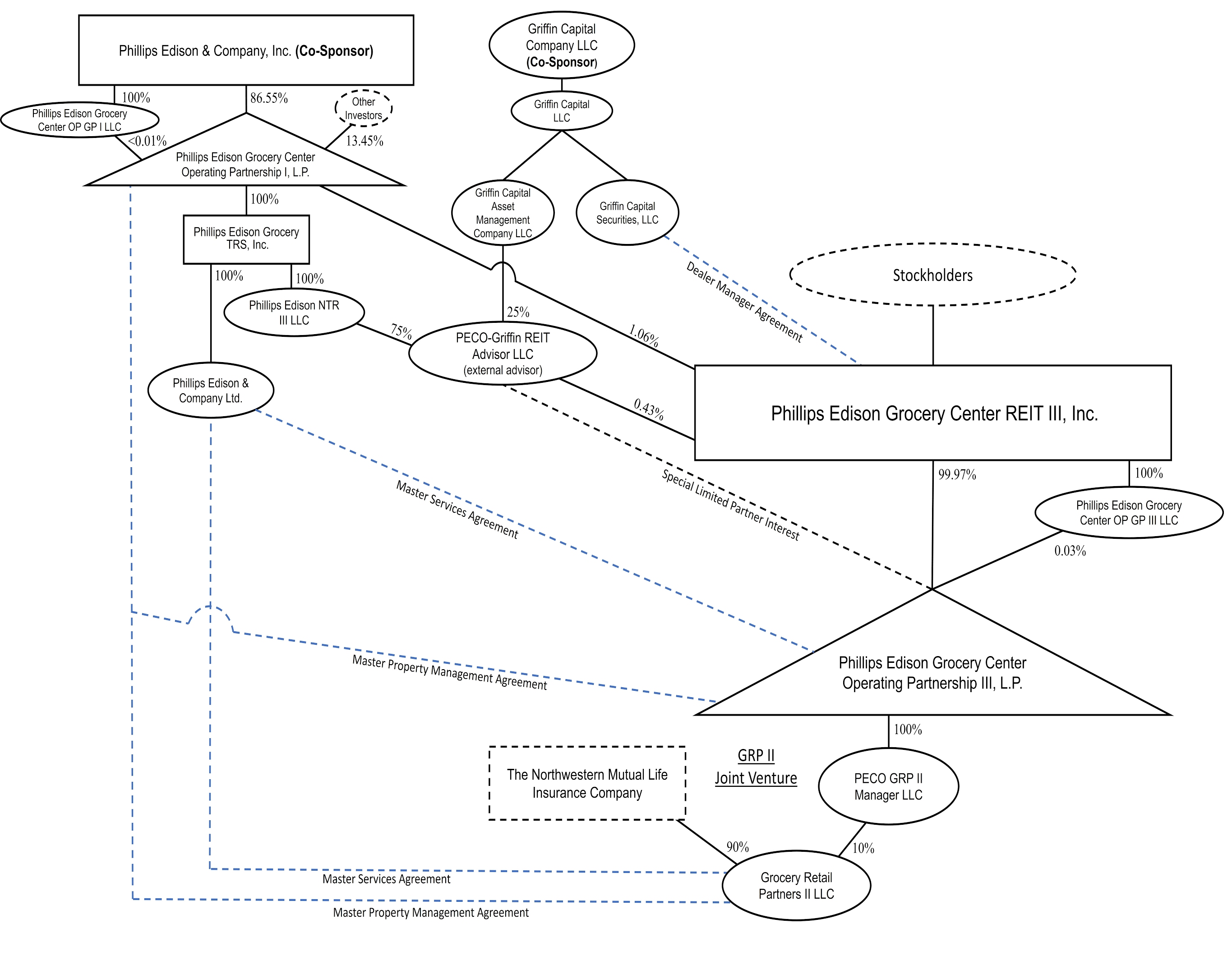

What is the ownership structure of the company and the affiliated entities that perform services for you?

The following chart shows the ownership structure of the various affiliated entities that perform or are likely to perform important services for us as of the date of this prospectus.

What are the fees that you pay to the advisor and its affiliates?

Our advisor and its affiliates receive compensation and reimbursement for services relating to this offering and the investment and management of our assets. The most significant items of compensation are included in the table below. Selling commissions and stockholder servicing fees vary for each class of shares offered and selling commissions and dealer manager fees may vary for different categories of purchasers. The table below assumes that (i) 90% of the amount of common stock sold in this primary offering is Class T common stock and 10% is Class I common stock, (ii) we do not reallocate shares being offered between our primary offering and distribution reinvestment plan, and (iii) based on this allocation, we sell all $1,500,000,000 of shares being offered at the highest possible selling commissions and dealer manager fees with respect to our primary offering (with no discounts to any categories of purchasers). The compensation set forth below may only be increased if approved by a majority of the members of our Conflicts Committee. The increase of such compensation does not require approval by stockholders.

|

| | | | | | | |

| Form of Compensation | | Recipient | | Determination of Amount | | Estimated Amount for Maximum Primary Offering |

| Organization and Offering Stage |

| Selling Commissions | | Griffin Capital Securities, LLC | | Generally, up to 3.0% of gross offering proceeds from the sale of shares of our Class T common stock pursuant to our primary offering (all or a portion of which may be reallowed by our dealer manager to participating broker-dealers). No selling commissions are payable on Class I shares or shares of our common stock sold pursuant to the distribution reinvestment plan. | | $40,500,000 |

|

| | | | | | | |

| Form of Compensation | | Recipient | | Determination of Amount | | Estimated Amount for Maximum Primary Offering |

| Dealer Manager Fee | | Griffin Capital Securities, LLC | | With respect to shares of our Class T common stock, generally, up to 3.0% of gross offering proceeds from the sale of shares of our Class T common stock pursuant to the primary offering (all or a portion of which may be reallowed by our dealer manager to participating broker-dealers), of which 1.0% of the gross offering proceeds is funded by us and up to 2.0% of the gross offering proceeds is funded by our advisor. With respect to shares of our Class I common stock, generally, up to an amount equal to 1.5% of gross offering proceeds from the sale of shares of our Class I common stock pursuant to the primary offering (all or a portion of which may be reallowed by our dealer manager to participating broker-dealers), all of which is funded by our advisor. However, our advisor intends to recoup the portion of the dealer manager fee it funds through the receipt of the Contingent Advisor Payment as part of our acquisition fees, as described below. To the extent that the dealer manager fee is less than 3.0% for any Class T shares sold and less than 1.5% for any Class I shares sold, such shares have a corresponding reduction in the applicable purchase price. No dealer manager fee is payable on shares of our common stock sold pursuant to the distribution reinvestment plan. | | $42,750,000 ($40,500,000 for Class T shares and $2,250,000 for Class I shares) |

| Other Organization and Offering Expenses | | PECO-Griffin REIT Advisor LLC | | Estimated to be 1.0% of gross offering proceeds from our primary offering in the event we raise the maximum offering. Our advisor pays organization and offering expenses up to 1.0% of gross offering proceeds from our primary offering, and we reimburse our advisor for any amounts in excess of 1.0% up to a maximum of 3.5%. Our advisor intends to recoup the portion of the organization and offering expenses it funds through the receipt of the Contingent Advisor Payment, as described below. | | $15,000,000 |

| Acquisition and Development Stage |

| Acquisition Fees and Contingent Advisor Payment | | PECO-Griffin REIT Advisor LLC | We pay our advisor a base acquisition fee of 2.0% of the contract purchase price of each property or other real estate investment we acquire. We also pay our advisor an additional contingent advisor payment of 2.15% of the contract purchase price of each property or other real estate investment we acquire (the “Contingent Advisor Payment”). The Contingent Advisor Payment allows our advisor to recoup the portion of the dealer manager fee and other organization and offering expenses funded by our advisor. Therefore, the amount of the Contingent Advisor Payment paid upon the closing of an acquisition shall not exceed the then outstanding amounts paid by our advisor for dealer manager fees and other organization and offering expenses at the time of such closing. For these purposes, the amounts paid by our advisor and considered as “outstanding” are reduced by the amount of the Contingent Advisor Payment previously paid. Notwithstanding the foregoing, the “Contingent Advisor Payment Holdback,” which is the initial $4.5 million of amounts to be paid by our advisor to fund the dealer manager fee and other organization and offering expenses, shall be retained by us until the later of the termination of our last public offering or May 8, 2021, at which time such amount shall be paid to our advisor or its affiliates. Our advisor may waive or defer all or a portion of the acquisition fee at any time and from time to time, in its sole discretion. | | $57,069,900 (maximum offering and no debt)/ $97,146,226 (maximum offering and leverage of 50% of the cost of our investments) |

| Acquisition Expenses | | PECO-Griffin REIT Advisor LLC | | Actual expenses incurred by our advisor and unaffiliated third parties in connection with an acquisition, which we estimate to be approximately 1.0% of the contract purchase price of each property. In no event will the total of all acquisition fees and acquisition expenses payable with respect to a particular investment exceed 6.0% of the contract purchase price, unless such excess fees and expenses are approved by a majority of our directors, including a majority of the Conflicts Committee, not otherwise interested in the transaction and they determine the transaction is commercially competitive, fair and reasonable to us. | | $13,751,784 (maximum offering and no debt)/ $26,448,113 (maximum offering and leverage of 50% of the cost of our investments) |

| Construction Management Fee | | Phillips Edison & Company Ltd. | | We expect to engage our property manager to provide construction management services for some of our properties. We will pay a construction management fee in an amount that is usual and customary for comparable services rendered to similar projects in the geographic market of the project. | | Not determinable at this time. |

| Development Fee | | Phillips Edison & Company Ltd. | | We may engage our property manager to provide development services for some of our properties. We will pay a development fee in an amount that is usual and customary for comparable services rendered to similar projects in the geographic market of the project. | | Not determinable at this time. |

|

| | | | | | | |

| Form of Compensation | | Recipient | | Determination of Amount | | Estimated Amount for Maximum Primary Offering |

| Operational Stage |

| Stockholder Servicing Fee | | Griffin Capital Securities, LLC | | A quarterly fee that accrues daily in an amount equal to 1/365th (1/366th during a leap year) of 1.0% of the most recent purchase price per share of Class T shares sold in our primary offering up to a maximum of 4.0% in the aggregate. The dealer manager generally reallows the entire stockholder servicing fee to participating broker-dealers. We will cease paying the stockholder servicing fee with respect to Class T shares held in any particular account on the earlier of: (i) a listing of the Class T shares on a national securities exchange; (ii) a merger or consolidation of the company with or into another entity, or the sale or other disposition of all or substantially all of our assets; (iii) after the termination of the primary offering in which the initial Class T shares in the account were sold, the end of the month in which total underwriting compensation paid in the primary offering is not less than 10.0% of the gross proceeds of the primary offering from the sale of Class T and Class I shares; and (iv) the end of the month in which the total stockholder servicing fees paid with respect to such Class T shares purchased in a primary offering is not less than 4.0% of the gross offering price of those Class T shares purchased in such primary offering (excluding shares purchased through our distribution reinvestment plan). If we redeem a portion, but not all of the Class T shares held in a stockholder’s account, the total stockholder servicing fee limit and amount of stockholder servicing fees previously paid will be prorated between the Class T shares that were redeemed and those Class T shares that were retained in the account. Likewise, if a portion of the Class T shares in a stockholder’s account is sold or otherwise transferred in a secondary transaction, the total stockholder servicing fee limit and amount of stockholder servicing fees previously paid will be prorated between the Class T shares that were transferred and the Class T shares that were retained in the account. | | $13,500,000 annually, and $54,000,000 in total (assuming the maximum stockholder servicing fee paid with respect to all Class T shares sold is 4.0% of the gross offering price of those Class T shares sold). |

| Property Management Fee | | Phillips Edison Grocery Center Operating Partnership I, L.P. | | Property management fees equal to 4.0% of the monthly gross receipts from the properties managed by our property manager, but no less than $3,000 per month for each property managed, will be payable monthly to our property manager. Our property manager may subcontract the performance of its property management and leasing duties to third parties, and our property manager may pay a portion of its property management or leasing fees to the third parties with whom it subcontracts for these services. We reimburse the costs and expenses incurred by our property manager on our behalf, including employee compensation, legal, travel and other out-of-pocket expenses that are directly related to the management of specific properties, as well as fees and expenses of third-party service providers. | | Actual amounts are dependent upon gross revenues of specific properties and actual property management fees or will be dependent upon the total equity and debt capital we raise and the results of our operations and therefore cannot be determined at the present time. |

| Asset Management Fee | | PECO-Griffin REIT Advisor LLC | | Monthly fee equal to one-twelfth of 1.0% of the cost of each asset. For purposes of this calculation, “cost” equals the purchase price, acquisition expenses, capital expenditures and other customarily capitalized costs, but will exclude acquisition fees associated with the property. The asset management fee is based only on the portion of the cost attributable to our investment in an asset if we do not own all or a majority of an asset and do not manage or control the asset. The asset management fee is not payable on assets held in the Joint Venture. | | The actual amounts are dependent upon the total equity and debt capital we raise and the results of our operations; we cannot determine these amounts at the present time. |

| Leasing Fee | | Phillips Edison & Company Ltd. | | We have engaged our property manager to provide leasing services with respect to our properties. We pay a leasing fee to our property manager in an amount that is usual and customary for comparable services rendered based on the geographic market of each property. | | Not determinable at this time. |

| Other Operating Expenses | | PECO-Griffin REIT Advisor LLC, Phillips Edison & Company Ltd.

and Phillips Edison Grocery Center Operating Partnership I, L.P. | | We reimburse the expenses incurred by our advisor and our property manager in connection with their provision of services to us, including the portion of the overhead of both the advisor and the property manager that is related to the provision of such services, including certain personnel costs of the advisor and the property manager. | | Actual amounts are dependent upon the results of our operations; we cannot determine these amounts at the present time. |

|

| | | | | | | |

| Form of Compensation | | Recipient | | Determination of Amount | | Estimated Amount for Maximum Primary Offering |

| Liquidation/Listing Stage |

| Disposition Fees | | PECO-Griffin REIT Advisor LLC | | For substantial assistance in connection with the sale of properties or other investments, we will pay our advisor or its affiliates 2.0% of the contract sales price of each property or other investment sold, including a sale or distribution of all of our assets; provided, however, that total real estate commissions paid (to our advisor and others) in connection with the sale may not exceed the lesser of 6% of the contract sales price and a competitive real estate commission. In the event such property or other investment sold was held by the Joint Venture at the time of sale, the disposition fee will be based on the portion of the contract sales price attributable to our investment in the Joint Venture. The Conflicts Committee will determine whether our advisor or its affiliates have provided substantial assistance to us in connection with the sale of an asset or a liquidity event. | | Actual amounts depend on the results of our operations; we cannot determine these amounts at the present time. |

| Subordinated Participation in Net Sale Proceeds (not payable if we are listed on an exchange) | | PECO-Griffin REIT Advisor LLC | | Our advisor will receive from time to time, when available, 15.0% of remaining “net sales proceeds” after return of capital contributions plus payment to investors of an annual 6.0% cumulative, pre-tax, non-compounded return on the capital contributed by investors. “Net sales proceeds” generally refers to the proceeds of sale transactions less selling expenses incurred by or on our behalf, including legal fees, closing costs or other applicable fees. | | Actual amounts depend on the results of our operations; we cannot determine these amounts at the present time. |

| Subordinated Incentive Listing Distribution (payable only if we are listed on an exchange) | | PECO-Griffin REIT Advisor LLC | | Upon the listing of our shares on a national securities exchange, our advisor will receive a distribution from our Operating Partnership equal to 15.0% of the amount by which the sum of our market value plus distributions paid prior to such listing exceeds the sum of the aggregate capital contributed by investors plus an amount equal to an annual 6.0% cumulative, pre-tax, non-compounded return to investors. | | Actual amounts depend on the results of our operations; we cannot determine these amounts at the present time. |

| Subordinated Distribution Due Upon Termination of Advisory Agreement | | PECO-Griffin REIT Advisor LLC | | Upon termination or non-renewal of the advisory agreement by the company with or without cause, our advisor will be entitled to receive distributions from our Operating Partnership payable in the form of a non-interest bearing promissory note equal to 15.0% of the amount by which the sum of our market value plus distributions paid through the termination date exceeds the sum of the aggregate capital contributed by investors plus an amount equal to an annual 6.0% cumulative, pre-tax, non-compounded return to investors. In addition, our advisor may elect to defer its right to receive a subordinated distribution upon termination until either a listing on a national securities exchange or other liquidity event occurs. Payment of the promissory note will be deferred until we receive net proceeds from the sale of properties after the termination date. If the promissory note has not been paid in full on the earlier of (a) the date our common stock is listed or (b) within three years from the termination date, then our advisor may elect to convert the balance of the fee into units of our Operating Partnership or shares of our common stock. In addition, if we merge or otherwise enter into a reorganization and the promissory note has not been paid in full, the note must be paid in full upon the closing date of such transaction. | | Actual amounts depend on the results of our operations; we cannot determine these amounts at the present time. |

How many real estate investments do you currently own?

As of the date of this prospectus, we owned fee simple interests in three shopping centers and we have an ownership interest in the Joint Venture, which owns three additional grocery-anchored shopping centers. Additional information about our real estate investments is included in a supplement to this prospectus. Except as disclosed in a supplement to this prospectus, we have not identified any additional real estate investments that it is reasonably probable we will acquire or originate with the proceeds from this offering. Because our stockholders will not have the opportunity to evaluate additional investments before we make them, we are considered a “blind pool.” As additional acquisitions become probable, we will supplement this prospectus to provide information regarding likely acquisitions to the extent material to an investment decision with respect to our common stock. We will also describe material changes to our portfolio, including the closing of property acquisitions, by means of a supplement to this prospectus.

Will you acquire properties or other assets in joint ventures?

Possibly. Among other reasons, joint venture investments permit us to own interests in large assets without unduly restricting the diversity of our portfolio. We may also want to acquire properties and other investments through joint ventures in order to diversify our portfolio by investment size or investment risk. In determining whether to invest in a particular joint

venture, our advisor will evaluate the real estate assets that such joint venture owns or is being formed to own under the same criteria as our other investments.

On November 9, 2018, we entered into the Joint Venture with Northwestern Mutual. We contributed our ownership interests in three grocery-anchored shopping centers to the Joint Venture in exchange for $41.3 million in cash and a 10% ownership interest in the Joint Venture, and Northwestern Mutual made an initial capital contribution to the Joint Venture of $42.6 million in cash in exchange for a 90% ownership interest in the Joint Venture.

If I buy shares, will I receive distributions and how often?

Our board of directors has declared cash distributions on the outstanding shares of our common stock based on daily record dates for the period from December 1, 2016 through June 30, 2019, which distributions we paid or expect to pay on a monthly basis. Distributions are calculated based on stockholders of record each day during these periods at a rate of $0.00164384 per share per day.

We expect our board of directors to continue to authorize distributions based on daily record dates and expect to pay distributions on a monthly basis. We intend to use daily record dates for the determination of who is entitled to a distribution so that investors may generally begin earning distributions immediately upon our acceptance of their subscription. We expect to pay distributions monthly and continue paying distributions monthly unless our results of operations, our general financial condition, general economic conditions or other factors make it imprudent to do so. The timing and amount of distributions will be determined by our board of directors in its sole discretion and may vary from time to time.

To maintain our qualification as a REIT, we will be required to make aggregate annual distributions to our common stockholders of at least 90% of our REIT taxable income (computed without regard to the dividends paid deduction and excluding net capital gain). Our board of directors may authorize distributions in excess of those required for us to maintain REIT status depending on our financial condition and such other factors as our board of directors deems relevant.