UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811-23214

GraniteShares ETF Trust

(Exact name of registrant as specified in charter)

205 Hudson Street, 7th floor

New York, New York 10013

(Address of principal executive offices) (Zip code)

William Rhind

GraniteShares ETF Trust

205 Hudson Street, 7th floor

New York, New York 10013

(Name and address of agent for service)

Copy to:

W. Thomas Conner, Esq.

Vedder Price

1633 Broadway, 31st Floor

New York, NY 10019

Registrant’s telephone number, including area code:1-800-422-3554

Date of fiscal year end:June 30

Date of reporting period:June 30, 2019

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

GraniteShares ETF Trust

Annual Report

June 30, 2019

GraniteShares Bloomberg Commodity Broad Strategy No K-1 ETF

GraniteShares S&P GSCI Commodity Broad Strategy No K-1 ETF

GraniteShares HIPS US High Income ETF

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. Please contact your financial intermediary to elect to receive shareholder reports and other communications electronically. You may elect to receive all future reports in paper free of charge. Please contact your financial intermediary to continue receiving paper copies of your shareholder reports and for information about whether your election to receive reports in paper will apply to all funds held with your financial intermediary.

GraniteShares ETF Trust

Table of Contents

GraniteShares ETF Trust

Management Discussion of Fund Performance (Unaudited)

THE MARKET ENVIRONMENT

Commodity Market

For the period July 1, 2018 to June 30, 2019 commodity returns, as measured by the performance of broad-based indexes were negative. For example, The Bloomberg Commodity Total Return Index decreased 6.75% over this period and the S&P Goldman Sachs Commodity Total Return Index decreased 11.49%. Poor performance in the energy and base metal sectors were primarily responsible for the negative returns.

The energy sector was the worst performing sector over the period. Natural gas prices dropped 22% while WTI and Brent crude oil prices fell 20% and 16%, respectively. Gasoline prices decreased 14% and heating oil and gasoil prices fell 12%. Energy prices moved sharply lower through the end of the calendar year over concerns of weaker global economic growth, record U.S. oil production and the U.S. Federal Reserve Bank’s continued rate increases despite the implementation of U.S. sanctions on Iran and OPEC+ production cutbacks. Though oil prices moved off their calendar year-end lows, continued concerns of weaker global growth combined with record U.S. oil production left prices significantly lower at the end of the period.

The base metals sector was the next worst performing sector. Aluminum prices fell 18%, nickel prices fell 17%, copper prices fell 10% and zinc prices fell 3%. Like energy prices, base metal prices moved lower through the end of the calendar year, falling on concerns of weaker global and Chinese growth, U.S.- China trade frictions and over concerns of restrictive U.S Federal Reserve Bank policy. Though base metal prices moved significantly off their calendar year-end lows as concerns of lower global economic growth receded, prices moved lower again, ending the period significantly lower, on renewed concerns of slower economic growth as well as continued concerns over U.S. Federal Reserve Bank monetary policy.

Grain prices, except for corn prices, were all lower for the period. Kansas wheat prices decreased 18%, Chicago wheat prices fell 3% and soybean prices declined 4%. Corn prices increased 4%. Stable throughout most of the period, grain prices fell on forecasts of global oversupply in the first quarter of 2019. Prices then increased, moving off their lows, due to unfavorable weather in the U.S. affecting harvests and plantings though ending the period lower. Corn prices ended the period higher, supported by forecasts of lower plantings and harvest than wheat and soybeans.

Precious metal prices were mixed over the period with gold prices increasing just 10% and silver prices decreasing 8%. Gold prices which were initially lower on a strong U.S. dollar and restrictive U.S. Federal Reserve Bank monetary policy, moved higher on greatly increased expectations of U.S. Federal Reserve Bank rate decreases and on the back of increased geopolitical tensions in the Middle East.

Fixed Income

Over the period July 1, 2018 to June 30, 2019, the U.S Federal Reserve Bank increased the federal funds target range 2 times, once in the September FOMC meeting and once in the December FOMC meeting. As a result, the interest rate paid on required and excess reserves increased from 1.95% to 2.20% and the target range for the federal funds rate increased from 1.75% - 2.00% to 2.00% - 2.50%. Following the December FOMC meeting, U.S. stock markets experienced increased volatility while significantly declining, precipitating the U.S. Federal Reserve Bank to implement less restrictive monetary policy. In the March meeting, the FOMC slowed its balance sheet reduction and adopted a “patient and flexible” monetary policy while maintaining the Fed Funds target rate. In the June meeting, the FOMC stated it would take appropriate actions to sustain the expansion while maintaining the current Fed Funds target range.

Over the period, 3-month Treasury Bill rates fell 18 bps from 2.09% to 1.91%. Over this same period, the 10-year U.S Treasury rate fell 85bps from approximately 2.86% to 2.01%.

Pass-Through Securities

For the period July 1, 2018 to June 30, 2019 pass-through security returns, as measured by the performance of TFMS HIPS 300 Total Return Index (a broad-based index), were positive. The TFMS HIPS 300 Total Return Index increased 5.82% over this period. The Index return was affected by positive performance in all sectors with the closed-end fund and BDC and REIT sectors contributing the most. For example, FT Taxable CEF Total Return Index increased 7.93%, the S&P BDC Total Return Index increased 8.63% and the Dow Jones Equity REIT Total Return Index increased 13.08%.

Pass-through securities prices generally moved lower in the first half of the period, pressured by the U.S. Federal Reserve Banks rate increase in December 2018 and continued restrictive monetary policy. Following the adoption by the U.S. Federal Reserve Banks of a more accommodative monetary policy, pass through securities prices generally moved higher.

GraniteShares ETF Trust

Management Discussion of Fund Performance (Unaudited) (continued)

MANAGER’S ANALYSIS

GraniteShares Bloomberg Commodity Broad Strategy No K-1 ETF (COMB)

The GraniteShares Bloomberg Commodity Broad Strategy No K-1 ETF (the “Fund”) is an actively managed exchange-traded fund (“ETF”) that seeks to provide long-term capital appreciation, primarily through exposure to commodity futures markets. The Fund’s investment strategy is based in part on the Bloomberg Commodity Index (the “BCOM Benchmark”), which is designed to be a highly liquid and broad benchmark for commodities futures investments. The BCOM Benchmark provides broad-based exposure to commodities as an asset class, since no single commodity or commodity sector dominates the BCOM Benchmark. The weightings of the components of the BCOM Benchmark are based on (1) liquidity data, which is the relative amount of trading activity of a particular commodity; (2) production data, which measures the importance of a commodity to the world economy; and (3) diversification rules that attempt to reduce disproportionate weightings of any single commodity. Rather than being driven by micro-economic events affecting one commodity market or sector, the BCOM Benchmark is comprised of futures contracts on a broad basket of underlying commodities, which potentially reduces volatility in comparison with narrower commodity baskets.

Currently, the BCOM Benchmark consists of 23 commodities futures contracts with respect to 21 commodities: aluminum, coffee, copper, corn, cotton, crude oil (WTI and Brent), gold, ULS Diesel, lean hogs, live cattle, low sulfur gasoil, natural gas, nickel, silver, soybean meal, soybean oil, soybeans, sugar, unleaded gas, wheat (Chicago and KC HRW), and zinc. The BCOM Benchmark reflects the return from these commodity futures contracts.

While the Fund generally seeks exposure to the commodity futures markets included in the BCOM Benchmark, the Fund is not an index tracking ETF and will seek to improve its performance, in part through a cash management strategy consisting of investments in investment grade fixed income securities issued by various U.S. public-sector or corporate entities (“Fixed Income Securities”). The Adviser will use such instruments to generate a total return for investors and exercise its discretion in the use of such instruments to seek to optimize the investment performance of the Fund. In addition, the Fund at times may actively select investments with differing maturities from the underlying components of the BCOM Benchmark, may not invest in all of the BCOM Benchmark’s components or in the same proportion as the BCOM Benchmark, may invest in commodity-linked derivative instruments and other commodity-linked instruments outside the BCOM Benchmark, and may emphasize some commodity sectors more than others.

The Fund is called “No K1” because it is designed to operate differently than commodity-based exchange traded funds that distribute a “Schedule K-1” to shareholders. Schedule K-1 is a tax document that contains information regarding a fund’s income and expenses. Schedule K-1 is a complex form and shareholders may find that preparing tax returns requires additional time or the assistance of a professional tax adviser, at additional expense to the shareholder. In contrast, the Fund is designed to be taxed like a conventional mutual fund and therefore will deliver a “Form 1099” to investors, from which income, gains, and losses can be entered onto the investor’s tax return. To deliver 1099s consistent with applicable tax law, the Fund currently expects to invest in an underlying subsidiary, as discussed below.

The Fund gains exposure to the commodity futures markets by investing in commodity futures contracts (“Commodity Futures”). Because the Fund may not invest directly in commodity futures, the Fund gains exposure to these investments by investing a portion of its assets in the GraniteShares BCOM Cayman Limited, a wholly-owned subsidiary of the Fund organized under the laws of the Cayman Islands (the “Subsidiary”). The Subsidiary is advised by the Adviser, and the Adviser complies with the provisions of the Investment Company Act of 1940 relating to advisory contracts. Unlike the Fund, the Subsidiary is not an investment company registered under the Investment Company Act of 1940 (the “1940 Act”). The Fund’s investment in the Subsidiary is intended to provide the Fund with exposure to commodity futures markets in accordance with applicable rules and regulations. The Subsidiary has the same investment objective and will follow the same general investment policies and restrictions as the Fund. The Fund will invest up to 25% of its total assets in the Subsidiary. The Fund complies with the provisions of the 1940 Act governing capital structure and leverage (Section 18) on an aggregate basis with the Subsidiary. Except as otherwise noted, references to the Fund’s investment strategies and risks include the investment strategies and risks of the Subsidiary.

For the period July 1, 2018 through June 30, 2019 (the fiscal year end of the Fund), on a market price basis, the Fund returned -7.40%. On a net asset value (“NAV”) basis, the Fund returned -7.16%. During the same time period, the BCOM Benchmark returned –8.87%. Additionally, the BCOM Total Return Index returned -6.75%. The BCOM Total Return Index is similar to the BCOM Benchmark except that the BCOM Total Return Index performance includes the return that would be generated in a fully collateralized investment in the BCOM Benchmark. This combines the returns of the BCOM Benchmark with the returns on cash collateral invested in Treasury Bills. The majority of the Fund’s outperformance on a NAV basis relative to the BCOM Benchmark is due to slight position differences between the BCOM Benchmark and the Fund as well as returns on collateral invested in Treasury Bills. The majority of the Fund’s underperformance on a NAV basis relative to the BCOM Total Return Index is a result of fees and operating expenses incurred by the fund.

GraniteShares ETF Trust

Management Discussion of Fund Performance (Unaudited) (continued)

Positions that contributed most significantly to the Fund’s return were Gold (CME) and Corn (CME) futures contracts (portfolio weight of 19.1%). Positions that detracted most significantly from the Fund’s return included Natural Gas (CME), WTI Crude Oil (CME), Brent Crude Oil (ICE), Gasoil (ICE) and Heating Oil (CME) futures contracts (combined portfolio weight of 31.3%), the Aluminum (ICE), Copper (CME) and Nickel (ICE) futures contracts (combined portfolio weight 14.2%) and the Cotton (CME) and Coffee (CME) futures contracts (combined portfolio weight of 3.8%)

| Percentage Weight* (% of Fund’s Net Assets as of June 30, 2019) |

| Asset Class | | Fund Percentage Weight By Sector** | | | |

| Commodities | | | | | | |

| | | Agriculture | | | 35.0 | % |

| | | Energy | | | 31.2 | % |

| | | Base Metals | | | 17.3 | % |

| | | Precious Metals | | | 16.5 | % |

*Based on notional value of futures contracts.

**Allocations are subject to change.

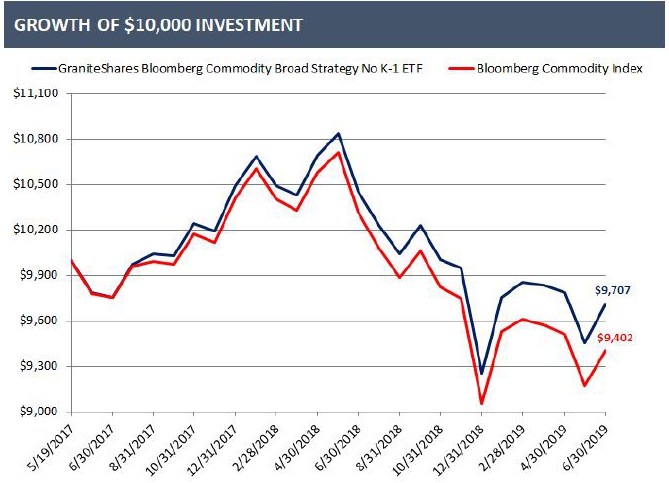

GROWTH OF $10,000 INVESTMENT

For the period May 19, 2017* to June 30, 2019

HISTORICAL PERFORMANCE

Total Return as of June 30, 2019

| | | 1 Year | | | Since

Inception

5/19/2017* | |

| GraniteShares Bloomberg Commodity Broad Strategy No K-1 ETF NAV | | | (7.16 | )% | | | (1.40 | )% |

| GraniteShares Bloomberg Commodity Broad Strategy No K-1 ETF Market Price** | | | (7.40 | )% | | | (1.51 | )% |

| Bloomberg Commodity Index | | | (8.87 | )% | | | (2.88 | )% |

GraniteShares ETF Trust

Management Discussion of Fund Performance (Unaudited) (continued)

Total Annual Fund Operating Expenses were 0.25%.Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the fund’s most recent month end performance, please call 1(844) 476-8747 or visit www.graniteshares.com.

| | * | Commencement of operations. |

| | ** | The price used to calculate market return (‘‘Market Price’’) is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00 pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV and are not individually redeemed from the Fund. |

| | | |

| | - | Bloomberg Commodity Index - is a broad-based index providing exposure to commodities as an asset class, with no single commodity or commodity sector dominating the index. Currently, the BCOM Benchmark consists of 22 commodities futures contracts with respect to 20 commodities: aluminum, coffee, copper, corn, cotton, crude oil (WTI and Brent), gold, ULS Diesel, lean hogs, live cattle, natural gas, nickel, silver, soybean meal, soybean oil, soybeans, sugar, unleaded gas, wheat (Chicago and KC HRW), and zinc. The BCOM Benchmark reflects the return from these commodity futures contracts. |

| | - | An investor cannot invest directly in an unmanaged index. Indexes do not reflect fees and/or expenses. |

| | - | Investing involves market risk, including the potential loss of principal. Investing in commodities is speculative, can be extremely volatile and may not be suitable for all investors. There are no assurances that the investment objective and strategies of the funds will be achieved. You could lose money by investing in the exchange-traded funds. Past performance does not guarantee future performance results. |

GraniteShares ETF Trust

Management Discussion of Fund Performance (Unaudited) (continued)

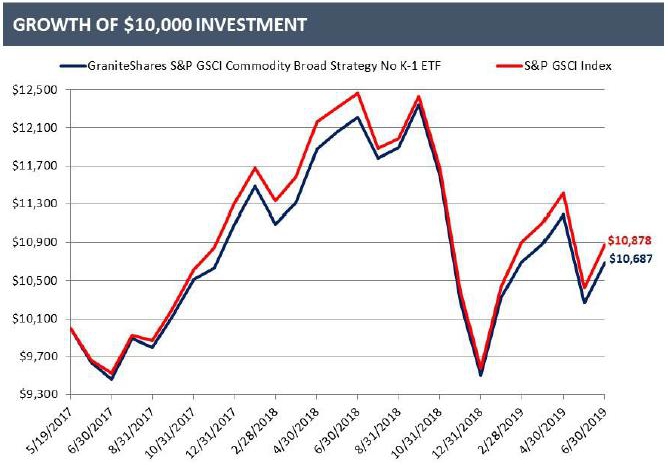

GraniteShares S&P GSCI Commodity Broad Strategy No K-1 ETF (COMG)

The GraniteShares S&P GSCI Commodity Broad Strategy No K-1 ETF (the “Fund”) is an actively managed exchange traded fund (“ETF”) that seeks to provide long-term capital appreciation, primarily through exposure to commodity futures markets. The Fund’s investment strategy is based in part on the S&P GSCI Index (the “GSCI Benchmark”), which is designed to be a measure of commodity market performance over time.

The commodity futures contracts represented in the GSCI Benchmark are weighted based on global production values to reflect the relative significance of the physical commodities underlying such commodity futures contracts to the world economy.

Currently, the GSCI Benchmark consists of 24 commodities futures contracts with respect to 22 commodities: crude oil (WTI and Brent), corn, live cattle, wheat (Chicago and Kansas), heating oil, gasoil, gold, copper, RBOB gasoline, soybeans, natural gas, aluminum, lean hogs, sugar, cotton, feeder cattle, coffee, zinc, lead, nickel, cocoa and silver. The GSCI Benchmark reflects the return from these commodity futures contracts.

While the Fund generally seeks exposure to the commodity futures markets included in the GSCI Benchmark, the Fund is not an index tracking ETF and seeks to improve its performance, in part through a cash management strategy consisting of investments in investment grade fixed income securities issued by various U.S. public-sector or corporate entities (“Fixed Income Securities”). The Adviser will use such instruments to generate a total return for investors and exercise its discretion in the use of such instruments to seek to optimize the investment performance of the Fund. In addition, the Fund at times may actively select investments with differing maturities from the underlying components of the GSCI Benchmark, may not invest in all of the GSCI Benchmark’s components or in the same proportion as the GSCI Benchmark, may invest in commodity-linked derivative instruments and other commodity-linked instruments outside the GSCI Benchmark, and may emphasize some commodity sectors more than others.

The Fund is called “No K1” because it is designed to operate differently than commodity-based exchange traded funds that distribute a “Schedule K-1” to shareholders. Schedule K-1 is a tax document that contains information regarding a fund’s income and expenses. Schedule K-1 is a complex form and shareholders may find that preparing tax returns requires additional time or the assistance of a professional tax adviser, at additional expense to the shareholder. In contrast, the Fund is designed to be taxed like a conventional mutual fund and therefore will deliver a “Form 1099” to investors, from which income, gains, and losses can be entered onto the investor’s tax return. To deliver 1099s consistent with applicable tax law, the Fund currently expects to invest in an underlying subsidiary, as discussed below.

The Fund gains exposure to the commodity futures markets by investing initially in commodity futures contracts (“Commodity Futures”). The Fund does will not invest directly in Commodity Futures. The Fund expects to gain exposure to these investments by investing a portion of its assets in the GraniteShares GSCI Cayman Limited, a wholly-owned subsidiary of the Fund organized under the laws of the Cayman Islands (the “Subsidiary”). The Subsidiary is advised by the Adviser, and the Adviser complies with the provisions of the Investment Company Act of 1940 relating to advisory contracts. Unlike the Fund, the Subsidiary is not an investment company registered under the Investment Company Act of 1940 (the “1940 Act”). The Fund’s investment in the Subsidiary is intended to provide the Fund with exposure to commodity futures markets in accordance with applicable rules and regulations. The Subsidiary has the same investment objective and will follow the same general investment policies and restrictions as the Fund. The Fund will invest up to 25% of its total assets in the Subsidiary. The Fund complies with the provisions of the 1940 Act governing capital structure and leverage (Section 18) on an aggregate basis with the Subsidiary. Except as otherwise noted, references to the Fund’s investment strategies and risks include the investment strategies and risks of the Subsidiary.

For the period July 1, 2018 through June 30, 2019 (the fiscal year end of the Fund), on a market price basis, the Fund returned -12.65%. On a net asset value (“NAV”) basis, the Fund returned -12.51%. During the same period, the GSCI Benchmark returned -12.74%. Additionally, the S&P GSCI Total Return Index returned -11.49%. The S&P GSCI Total Return Index is similar to the GSCI Benchmark except that the S&P GSCI Total Return Index performance includes the return that would be generated in a fully collateralized investment in the GSCI Benchmark as well as reflecting the positive or negative returns that would be generated over time by rolling each underlying futures contract forward as it approaches expiration to the next expiring contract month. The majority of the Fund’s outperformance on a NAV basis relative to the GSCI Benchmark is due to tracking error incurred from the Fund’s investing in GSCI Index Futures and not the individual commodity futures comprising the GSCI Benchmark as well as returns on collateral invested in Treasury Bills. The majority of the Fund’s underperformance on a NAV basis relative to the GSCI Total Return Index is a result of fees and operating expenses incurred by the fund and to tracking error incurred from the Fund’s investing in GSCI Index Futures and not the individual commodity futures comprising the GSCI Benchmark.

For the period July 1, 2018 through June 30, 2019, the fund invested in the GSCI Index futures instead of the individual futures contracts comprising the GSCI Benchmark. The GSCI Index futures track the underlying futures contracts comprising the S&P GSCI Spot Index. The weightings of the futures contracts in the S&P GSCI Spot Index are the same as those in the GSCI Benchmark.

GraniteShares ETF Trust

Management Discussion of Fund Performance (Unaudited) (continued)

Positions that contributed most significantly to the Fund’s return were Gold (CME) and Corn (CME) futures contracts (portfolio weight of 9.6%). Positions that detracted most significantly from the Fund’s return included Natural Gas (CME), WTI Crude Oil (CME), Brent Crude Oil (ICE), Gasoil (ICE) and Heating Oil (CME) futures contracts (combined portfolio weight of 61.5%) and the Aluminum (ICE) and Copper (ICE) futures contracts (combined portfolio weight 7.6%)

| Percentage Weight* (% of Fund’s Net Assets as of June 30, 2019) | |

| Asset Class | | Fund Percentage Weight By Sector** | | | |

| Commodities | | | | | |

| | Energy | | | 61.5 | % |

| | Agriculture | | | 23.6 | % |

| | | Base Metals | | | 10.2 | % |

| | | Precious Metals | | | 4.7 | % |

*Based on notional value of futures contracts.

**Allocations are subject to change.

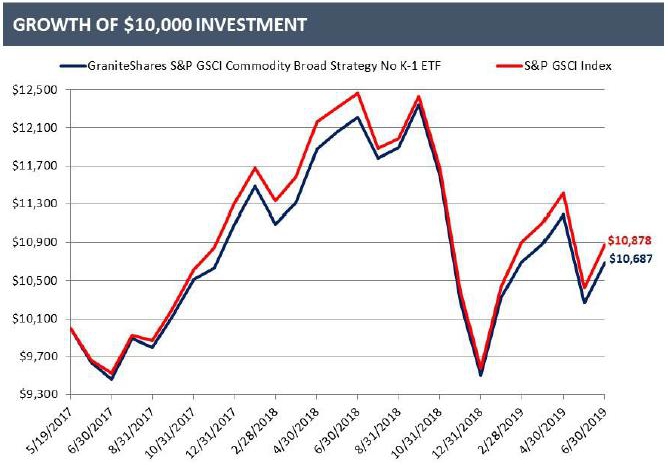

GROWTH OF $10,000 INVESTMENT

For the period May 19, 2017* to June 30, 2019

HISTORICAL PERFORMANCE

Total Return as of June 30, 2019

| | | 1 Year | | | Since

Inception

5/19/2017* | |

| GraniteShares S&P GSCI Commodity Broad Strategy No K-1 ETF NAV | | | (12.51 | )% | | | 3.19 | % |

| GraniteShares S&P GSCI Commodity Broad Strategy No K-1 ETF Market Price** | | | (12.65 | )% | | | 3.15 | % |

| S&P GSCI Index | | | (12.74 | )% | | | 4.07 | % |

GraniteShares ETF Trust

Management Discussion of Fund Performance (Unaudited) (continued)

Total Annual Fund Operating Expenses were 0.35%. Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the fund’s most recent month end performance, please call 1(844) 476-8747 or visit www.graniteshares.com.

| | * | Commencement of operations. |

| | ** | The price used to calculate market return (‘‘Market Price’’) is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00 pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV and are not individually redeemed from the Fund. |

| | | |

| | - | S&P Goldman Sachs Commodity Index - is a broad-based index designed to be a measure of commodity market performance over time. The commodity futures contracts represented in the GSCI Benchmark are weighted based on global production values to reflect the relative significance of the physical commodities underlying such commodity futures contracts to the world economy. Currently, the GSCI Benchmark consists of 24 commodities futures contracts with respect to 22 commodities: crude oil, corn, live cattle, wheat, heating oil, gasoil, gold, copper, RBOB gasoline, soybeans, natural gas, aluminum, lean hogs, sugar, cotton, feeder cattle, coffee, zinc, lead, nickel, cocoa and silver. |

| | - | An investor cannot invest directly in an unmanaged index. Indexes do not reflect fees and/or expenses. |

| | - | Investing involves market risk, including the potential loss of principal. Investing in commodities is speculative, can be extremely volatile and may not be suitable for all investors. There are no assurances that the investment objective and strategies of the funds will be achieved. You could lose money by investing in the exchange-traded funds. Past performance does not guarantee future performance results. |

GraniteShares ETF Trust

Management Discussion of Fund Performance (Unaudited) (continued)

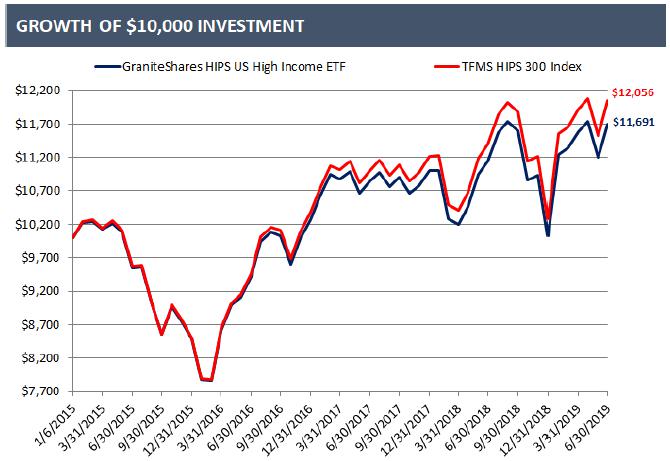

GraniteShares HIPS US High Income ETF (HIPS)

The GraniteShares HIPS US High Income ETF (the “Fund”) seeks to track the performance, before fees and expenses, of the TFMS HIPS Index (the “Index”).

The Fund employs a “passive management”—or indexing—investment approach designed to track the performance of the Index. The rules-based Index measures the performance of up to 60 high income U.S.-listed securities that typically have “pass-through” structures that require them to distribute substantially all of their earnings to shareholders as cash distributions. This “high income, pass-through” strategy is known as HIPS.

The Index

The Index is constructed to capture up to 60 high income securities, typically with pass-through structures, across the following sectors: (i) closed-end funds (“CEFs”), (ii) real estate investment trusts (“REITS”), (iii) asset management and business development companies (“BDCs”), and (iv) energy production and energy transportation and processing companies. Energy-related companies included in the Index are expected to primarily be structured as master limited partnerships (“MLPs”). CEFs included in the Index are option income funds and taxable, debt-based funds and may include CEFs that invest primarily in bank loans, high-yield securities (also known as “junk bonds”), foreign securities (including those in emerging markets), and mortgage- or asset-backed securities.

The Index applies a quantitative screen to the securities in such sectors for minimum sector-specific yields relative to the yield of the S&P 500® Index, minimum market capitalizations and minimum liquidity thresholds. The Index may include small-, mid-, and large-capitalization companies meeting the screening criteria.

The Index applies a quantitative screen to the securities in such sectors for minimum market capitalizations and minimum liquidity thresholds. The Index then selects up to 15 securities with the highest yield and lowest volatility over a prescribed time period for each sector with all securities equally weighted. Finally, the Index adjusts the weights of each sector to minimize the Index volatility and maximize the Index return, as measured over a prescribed time period, subject to a minimum sector weight of 15% and a maximum MLP sector weight of 25%.The Index may include small-, mid-, and large-capitalization companies meeting the screening criteria.

The Index is reconstituted annually and rebalanced only if the MLP sector weight exceeds 25% at the end of a quarter.

The Fund’s Investment Strategy attempts to invest all, or substantially all, of its assets in the securities that make up the Index. The Fund will generally use a “replication” strategy to achieve its investment objective, meaning it generally will invest in all of the component securities of the Index, but may, when the adviser believes it is in the best interests of the Fund, use a “representative sampling” strategy, meaning it may invest in a sample of the securities in the Index whose risk, return and other characteristics are expected to closely resemble the risk, return and other characteristics of the Index as a whole.

Under normal circumstances, at least 80% of the Fund’s total assets (exclusive of collateral held from securities lending) will be invested in the component securities of the Index and investments that have economic characteristics that are substantially identical to the economic characteristics of such component securities. GraniteShares Advisors LLC (“GraniteShares” or the “Adviser”), the Fund’s investment adviser, expects that, over time, the correlation between the Fund’s performance and that of the Index, before fees and expenses, will be 95% or better

For the period July 1, 2018 through June 30, 2019 (the fiscal year end of the Fund), on a market price basis, the Fund returned 6.24%, on a total return basis. On a net asset value (“NAV”) basis, the Fund returned 4.95%, on a total return basis. During the same time period, the TFMS HIPS Total Return Index returned 5.82%. The TFMS HIPS Total Return Index is similar to the TFMS HIPS Index except that the TFMS HIPS Total Return Index performance includes the return that would be generated if all distributions from securities comprising the TFMS HIPS Index were reinvested in the TFMS HIPS Index. The majority of the Fund’s underperformance on a NAV basis relative to the TFMS HIPS Index Total Return Index is a result of fees and operating expenses incurred by the fund and the Fund’s cash position.

GraniteShares ETF Trust

Management Discussion of Fund Performance (Unaudited) (continued)

Positions that contributed most significantly to the Fund’s return included REITs (portfolio weight of 32%), CEFs (portfolio weight of 25%) and Asset Managers and BDCs (portfolio weight 25%).

| Percentage Weight (% of Fund’s Net Assets as of June 30, 2019) | |

| Sector | | Fund Percentage Weight By Sector* | |

| Asset Mgmt Cos and BDCs | | | 24.8 | % |

| Closed End Funds | | | 25.0 | % |

| REITs | | | 32.0 | % |

| MLPS | | | 17.6 | % |

| Cash | | | 0.6 | % |

*Allocations are subject to change.

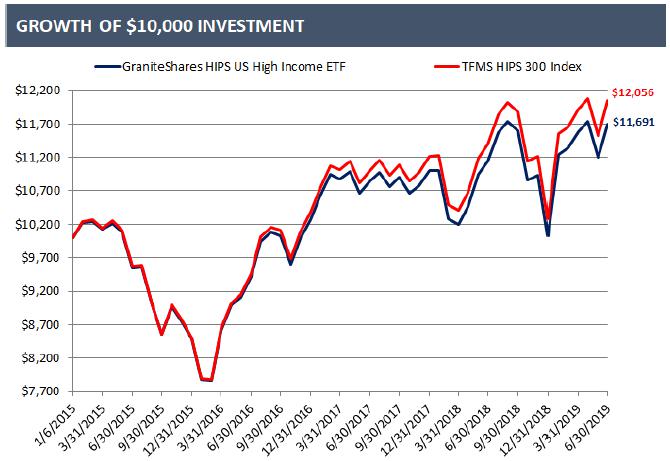

GROWTH OF $10,000 INVESTMENT

For the period January 6, 2015* to June 30, 2019

HISTORICAL PERFORMANCE

Total Return as of June 30, 2019

| | | 1 Year | | | 3 Year | | | Since

Inception

1/6/2015* | |

| GraniteShares HIPS US High Income ETF NAV | | | 4.95 | % | | | 7.48 | % | | | 3.55 | % |

| GraniteShares HIPS US High Income ETF Market Price** | | | 6.24 | % | | | 7.88 | % | | | 3.64 | % |

| TFMS HIPS 300 Index | | | 5.82 | % | | | 8.40 | % | | | 4.26 | % |

GraniteShares ETF Trust

Management Discussion of Fund Performance (Unaudited) (continued)

Total Annual Fund Operating Expenses were 1.42%.Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the fund’s most recent month end performance, please call 1(844) 476-8747 or visit www.graniteshares.com.

| | * | Commencement of operations. |

| | ** | The price used to calculate market return (‘‘Market Price’’) is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00 pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV and are not individually redeemed from the Fund. |

| | | |

| | - | Dow Jones REIT Total Return Index - is an index comprised of REITs that directly own all or part of the properties in their portfolios. |

| | - | S&P BDC Total Return Index - is an index designed to track leading business development companies that trade on major U.S. exchanges. |

| | - | Alerian MLP Total Return Index - is a cap-weighted index, whose constituents represent approximately 85% the total market capitalization of energy MLPs. |

| | - | FT TaxCEFT Index - the First Trust Taxable Fixed Income Closed Fund Total Return Index is a cap weighted index designed to provide a broad representation of the taxable fixed income closed-end fund universe. |

| | - | An investor cannot invest directly in an unmanaged index. Indexes do not reflect fees and/or expenses. |

| | - | Investing involves market risk, including the potential loss of principal. There are no assurances that the investment objective and strategies of the fund will be achieved. You could lose money by investing in the exchange-traded fund. Diversification does not assure a profit or protect against loss in a declining market. Past performance does not guarantee future performance results. |

Shareholder Expense Example (Unaudited)

June 30, 2019

As a shareholder of the Fund you incur two types of costs: (1) transaction costs, including brokerage commissions paid on purchases and sales of Fund shares; and (2) ongoing costs, including management fees and other fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars and cents) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds.

The expense examples are based on an investment of $1,000 invested at January 1, 2019 and held for the entire period ended June 30, 2019.

ACTUAL EXPENSES

The first line under the Fund in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line for the Fund under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line under the Fund in the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of Fund shares. Therefore, the second line under the Fund in the table is useful in comparing ongoing Fund costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account Value

1/1/2019 | | | Ending

Account Value 6/30/2019 | | | Annualized

Net Expense Ratio for the Period | | | Expenses Paid During the Period(1) | |

GraniteShares Bloomberg Commodity Broad StrategyNo K-1 ETF | | | | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,048.80 | | | | 0.25 | % | | $ | 1.27 | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.55 | | | | 0.25 | % | | $ | 1.25 | |

| | | | | | | | | | | | | | | | | |

GraniteShares S&P GSCI Commodity Broad StrategyNo K-1 ETF | | | | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,124.30 | | | | 0.35 | % | | $ | 1.84 | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.06 | | | | 0.35 | % | | $ | 1.76 | |

| | | | | | | | | | | | | | | | | |

| GraniteShares HIPS US High Income ETF | | | | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,166.20 | | | | 0.70 | % | | $ | 3.76 | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.32 | | | | 0.70 | % | | $ | 3.51 | |

(1)Expenses are calculated using the Fund’s annualized net expense ratio, multiplied by the average account value for the period, multiplied by 181/365 (to reflect the six month period).

See accompanying notes to consolidated financial statements.

GraniteShares ETF Trust

| Consolidated Schedule of Investments |

GraniteShares Bloomberg Commodity Broad Strategy No K-1 ETF

June 30, 2019

| Investments | | Principal | | | Value | |

| U.S. TREASURY OBLIGATIONS – 99.3%(a) | | | | | | | | |

| U.S. Treasury Bill, 2.43%, 07/05/19(b) | | $ | 4,200,000 | | | $ | 4,199,092 | |

| U.S. Treasury Bill, 2.41%, 07/11/19(b) | | | 4,595,000 | | | | 4,592,546 | |

| U.S. Treasury Bill, 2.39%, 07/18/19(b) | | | 4,235,000 | | | | 4,230,908 | |

| U.S. Treasury Bill, 2.40%, 07/25/19(b) | | | 4,420,000 | | | | 4,414,269 | |

| U.S. Treasury Bill, 2.41%, 08/01/19(b) | | | 4,460,000 | | | | 4,452,300 | |

| U.S. Treasury Bill, 2.41%, 08/08/19(b) | | | 4,280,000 | | | | 4,270,710 | |

| U.S. Treasury Bill, 2.40%, 08/15/19(b) | | | 4,250,000 | | | | 4,238,910 | |

| U.S. Treasury Bill, 2.39%, 08/22/19(b) | | | 4,605,000 | | | | 4,591,071 | |

| U.S. Treasury Bill, 2.33%, 08/29/19(b) | | | 3,895,000 | | | | 3,881,627 | |

| U.S. Treasury Bill, 2.34%, 09/05/19 | | | 4,765,000 | | | | 4,746,764 | |

| U.S. Treasury Bill, 2.19%, 09/12/19(b) | | | 4,145,000 | | | | 4,127,706 | |

| U.S. Treasury Bill, 2.14%, 09/19/19(b) | | | 4,530,000 | | | | 4,509,135 | |

| U.S. Treasury Bill, 2.13%, 09/26/19(b) | | | 1,000,000 | | | | 994,998 | |

| U.S. Treasury Bill, 2.21%, 10/03/19 | | | 5,000,000 | | | | 4,972,747 | |

| U.S. Treasury Bill, 2.08%, 10/10/19(b) | | | 3,705,000 | | | | 3,683,275 | |

| U.S. Treasury Bill, 2.17%, 10/24/19(b) | | | 4,890,000 | | | | 4,859,012 | |

Total United States Treasury Obligations (Cost $66,749,428) | | | | | | | 66,765,070 | |

| Total Investments – 99.3% | | | | | | | | |

| (Cost $66,749,428) | | | | | | | 66,765,070 | |

| Other Assets in Excess of Liabilities – 0.7% | | | | | | | 451,044 | |

| Net Assets – 100.0% | | | | | | $ | 67,216,114 | |

| (a) | Represents zero coupon bonds. Rates shown reflects the effective yield. |

| (b) | A portion or all of the security is owned by GraniteShares BCOM Cayman Limited, a wholly-owned subsidiary of the Fund. See Note 2. |

At June 30, 2019, open futures contracts were as follows:

| Description | | Number of Contracts | | | Expiration

Date | | Contract Type | | Notional Amount | | | Value/Unrealized Appreciation | | | Value/Unrealized Depreciation | |

| Brent Crude(a) | | | 83 | | | 7/31/2019 | | Long | | $ | 5,373,420 | | | $ | – | | | $ | (227,390 | ) |

| Coffee ‘C’(a) | | | 42 | | | 9/18/2019 | | Long | | | 1,723,837 | | | | 131,588 | | | | – | |

| Copper(a) | | | 72 | | | 9/26/2019 | | Long | | | 4,884,300 | | | | 104,363 | | | | – | |

| Corn(a) | | | 199 | | | 9/13/2019 | | Long | | | 4,226,263 | | | | – | | | | (102,587 | ) |

| Cotton No. 2(a) | | | 25 | | | 12/06/2019 | | Long | | | 826,000 | | | | 4,045 | | | | – | |

| Crude Oil(a) | | | 101 | | | 8/20/2019 | | Long | | | 5,910,520 | | | | 562,700 | | | | – | |

| Gasoline RBOB(a) | | | 26 | | | 8/30/2019 | | Long | | | 2,024,677 | | | | 207,262 | | | | – | |

| Gold 100 OZ(a) | | | 61 | | | 8/28/2019 | | Long | | | 8,623,570 | | | | 694,130 | | | | – | |

| KC Hard Red Winter Wheat(a) | | | 33 | | | 9/13/2019 | | Long | | | 761,475 | | | | – | | | | (17,575 | ) |

| Lean Hogs(a) | | | 48 | | | 8/14/2019 | | Long | | | 1,459,200 | | | | – | | | | (142,960 | ) |

| Live Cattle(a) | | | 54 | | | 8/30/2019 | | Long | | | 2,253,960 | | | | – | | | | (69,400 | ) |

| LME Nickel(a) | | | 23 | | | 7/15/2019 | | Long | | | 1,744,320 | | | | – | | | | (67,464 | ) |

See accompanying notes to consolidated financial statements.

GraniteShares ETF Trust

| Consolidated Schedule of Investments |

GraniteShares Bloomberg Commodity Broad Strategy No K-1 ETF (continued)

June 30, 2019

| Description | | Number of Contracts | | | Expiration Date | | | Contract

Type | | Notional

Amount | | | Value/Unrealized

Appreciation | | | Value/Unrealized Depreciation | |

| LME Nickel(a) | | | (23) | | | | 7/15/2019 | | | Short | | $ | (1,744,320 | ) | | $ | – | | | $ | (127,920 | ) |

| LME Nickel(a) | | | 26 | | | | 9/16/2019 | | | Long | | | 1,981,980 | | | | 144,216 | | | | – | |

| LME Primary Aluminum(a) | | | 54 | | | | 7/15/2019 | | | Long | | | 2,406,038 | | | | – | | | | (124,557 | ) |

| LME Primary Aluminum(a) | | | (54) | | | | 7/15/2019 | | | Short | | | (2,406,038 | ) | | | – | | | | (27,181 | ) |

| LME Primary Aluminum(a) | | | 62 | | | | 9/16/2019 | | | Long | | | 2,790,388 | | | | 27,687 | | | | – | |

| LME Primary Aluminum(a) | | | (2) | | | | 9/16/2019 | | | Short | | | (90,013 | ) | | | 738 | | | | – | |

| LME Zinc(a) | | | (30) | | | | 7/15/2019 | | | Short | | | (1,908,750 | ) | | | – | | | | (6,325 | ) |

| LME Zinc(a) | | | 30 | | | | 7/15/2019 | | | Long | | | 1,908,750 | | | | – | | | | (248,850 | ) |

| LME Zinc(a) | | | (1) | | | | 9/16/2019 | | | Short | | | (62,525 | ) | | | 1,356 | | | | – | |

| LME Zinc(a) | | | 34 | | | | 9/16/2019 | | | Long | | | 2,125,850 | | | | 12,800 | | | | – | |

| Low Sulphur Gasoil(a) | | | 31 | | | | 9/12/2019 | | | Long | | | 1,861,550 | | | | 117,985 | | | | – | |

| Natural Gas(a) | | | 187 | | | | 8/28/2019 | | | Long | | | 4,267,340 | | | | – | | | | (115,090 | ) |

| NY Harbour ULSD(a) | | | 19 | | | | 8/30/2019 | | | Long | | | 1,553,866 | | | | 100,913 | | | | – | |

| Silver(a) | | | 32 | | | | 9/26/2019 | | | Long | | | 2,454,560 | | | | 73,655 | | | | – | |

| Soybean(a) | | | 84 | | | | 11/14/2019 | | | Long | | | 3,876,600 | | | | 107,600 | | | | – | |

| Soybean Meal(a) | | | 69 | | | | 12/13/2019 | | | Long | | | 2,228,010 | | | | – | | | | (15,940 | ) |

| Soybean Oil(a) | | | 117 | | | | 12/13/2019 | | | Long | | | 2,023,866 | | | | 44,988 | | | | – | |

| Sugar #11(a) | | | 143 | | | | 9/30/2019 | | | Long | | | 2,021,219 | | | | – | | | | (32,738 | ) |

| Wheat (CBT)(a) | | | 79 | | | | 9/13/2019 | | | Long | | | 2,082,638 | | | | 12,575 | | | | – | |

| Total Futures Contracts | | | | | | | | | | | | $ | 67,182,551 | | | $ | 2,348,601 | | | $ | (1,325,977 | ) |

| Net Unrealized Appreciation (Depreciation) | | | | | | | | | | | | | | | | $ | 1,022,624 | | | | | |

| (a) | A portion or all of the security is owned by GraniteShares BCOM Cayman Limited, a wholly-owned subsidiary of the Fund. See Note 2. |

The following table summarizes valuation of the Fund’s investments under the fair value hierarchy levels as of June 30, 2019:

| | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Asset Valuation Inputs | | | | | | | | | | | | | | | | |

| Investments in Securities | | | | | | | | | | | | | | | | |

| U.S. Treasury Obligations | | $ | 66,765,070 | | | $ | – | | | $ | – | | | $ | 66,765,070 | |

| Other Investments | | | | | | | | | | | | | | | | |

| Futures | | | 2,348,601 | | | | – | | | | – | | | | 2,348,601 | |

| Total | | $ | 69,113,671 | | | $ | – | | | $ | – | | | $ | 69,113,671 | |

| Liability Valuation Inputs | | | | | | | | | | | | | | | | |

| Other Investments | | | | | | | | | | | | | | | | |

| Futures | | $ | 1,325,977 | | | $ | – | | | $ | – | | | $ | 1,325,977 | |

| Total | | $ | 1,325,977 | | | $ | – | | | $ | – | | | $ | 1,325,977 | |

As of June 30, 2019, there were no Level 3 investments held in the Fund.

See accompanying notes to consolidated financial statements.

GraniteShares ETF Trust

| Consolidated Schedule of Investments |

GraniteShares S&P GSCI Commodity Broad Strategy No K-1 ETF

June 30, 2019

| Investments | | Principal | | | Value | |

| U.S. TREASURY OBLIGATIONS – 99.3%(a) | | | | | | | | |

| U.S. Treasury Bill, 2.45%, 07/05/19(b) | | $ | 500,000 | | | $ | 499,892 | |

| U.S. Treasury Bill, 2.41%, 07/11/19(b) | | | 470,000 | | | | 469,749 | |

| U.S. Treasury Bill, 2.39%, 07/18/19(b) | | | 595,000 | | | | 594,425 | |

| U.S. Treasury Bill, 2.38%, 07/25/19 | | | 500,000 | | | | 499,352 | |

| U.S. Treasury Bill, 2.40%, 08/01/19(b) | | | 440,000 | | | | 439,240 | |

| U.S. Treasury Bill, 2.41%, 08/08/19 | | | 500,000 | | | | 498,915 | |

| U.S. Treasury Bill, 2.39%, 08/15/19(b) | | | 370,000 | | | | 369,034 | |

| U.S. Treasury Bill, 2.38%, 08/22/19(b) | | | 520,000 | | | | 518,427 | |

| U.S. Treasury Bill, 2.33%, 08/29/19 | | | 210,000 | | | | 209,279 | |

| U.S. Treasury Bill, 2.35%, 09/05/19 | | | 445,000 | | | | 443,297 | |

| U.S. Treasury Bill, 2.22%, 09/12/19(b) | | | 705,000 | | | | 702,059 | |

| U.S. Treasury Bill, 2.14%, 09/19/19 | | | 480,000 | | | | 477,789 | |

| U.S. Treasury Bill, 2.14%, 09/26/19(b) | | | 100,000 | | | | 99,500 | |

| U.S. Treasury Bill, 2.08%, 10/10/19 | | | 600,000 | | | | 596,482 | |

| U.S. Treasury Bill, 2.17%, 10/24/19(b) | | | 125,000 | | | | 124,208 | |

Total United States Treasury Obligations (Cost $6,540,300) | | | | | | | 6,541,648 | |

| Total Investments – 99.3% | | | | | | | | |

| (Cost $6,540,300) | | | | | | | 6,541,648 | |

| Other Assets in Excess of Liabilities – 0.7% | | | | | | | 49,041 | |

| Net Assets – 100.0% | | | | | | $ | 6,590,689 | |

| (a) | Represents zero coupon bonds. Rates shown reflects the effective yield. |

| (b) | A portion or all of the security is owned by GraniteShares GSCI Cayman Limited, a wholly-owned subsidiary of the Fund. See Note 2. |

At June 30, 2019, open futures contracts were as follows:

| Description | | Number of Contracts | | | Expiration Date | | Contract

Type | | Notional Amount | | | Value/Unrealized

Appreciation | | | Value/Unrealized Depreciation | |

| S&P-Goldman Sachs Commodity Index(a) | | | 62 | | | 7/16/2019 | | Long | | $ | 6,569,675 | | | $ | 306,937 | | | $ | – | |

| (a) | A portion or all of the security is owned by GraniteShares GSCI Cayman Limited, a wholly-owned subsidiary of the Fund. See Note 2. |

The following table summarizes valuation of the Fund's investments under the fair value hierarchy levels as of June 30, 2019:

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Asset Valuation Inputs | | | | | | | | | | | | | | | | |

| Investments in Securities | | | | | | | | | | | | | | | | |

| U.S. Treasury Obligations | | $ | 6,541,648 | | | $ | – | | | $ | – | | | $ | 6,541,648 | |

| Other Investments | | | | | | | | | | | | | | | | |

| Futures | | | 306,937 | | | | – | | | | – | | | | 306,937 | |

| Total | | $ | 6,848,585 | | | $ | – | | | $ | – | | | $ | 6,848,585 | |

As of June 30, 2019, there were no Level 3 investments held in the Fund.

See accompanying notes to consolidated financial statements.

GraniteShares ETF Trust

| Consolidated Statements of Assets and Liabilities |

June 30, 2019

| | | GraniteShares Bloomberg Commodity Broad Strategy No

K-1 ETF | | | GraniteShares

S&P GSCI

Commodity Broad

Strategy No

K-1 ETF | |

| Assets: | | | | | | | | |

| Investments at cost | | $ | 66,749,428 | | | $ | 6,540,300 | |

| Investments at value | | $ | 66,765,070 | | | $ | 6,541,648 | |

| Cash | | | 6,833 | | | | 10,796 | |

| Unrealized appreciation on open futures contracts | | | 2,348,601 | | | | 306,937 | |

| Total Assets | | | 69,120,504 | | | | 6,859,381 | |

| Liabilities: | | | | | | | | |

| Advisory fees payable | | | 13,013 | | | | 1,846 | |

| Due to broker | | | 565,400 | | | | 266,846 | |

| Unrealized depreciation on open future contracts | | | 1,325,977 | | | | — | |

| Total Liabilities | | | 1,904,390 | | | | 268,692 | |

| Net Assets | | $ | 67,216,114 | | | $ | 6,590,689 | |

| | | | | | | | | |

| Net Assets Consist of: | | | | | | | | |

| Paid-in capital | | $ | 65,678,251 | | | $ | 6,236,087 | |

| Distributable earnings/accumulated (loss) | | | 1,537,863 | | | | 354,602 | |

| Net Assets | | $ | 67,216,114 | | | $ | 6,590,689 | |

| | | | | | | | | |

| Shares Outstanding | | | 2,802,000 | | | | 302,000 | |

| Net Asset Value per share: | | $ | 23.99 | | | $ | 21.82 | |

See accompanying notes to consolidated financial statements.

GraniteShares ETF Trust

| Consolidated Statementsof Operations |

June 30, 2019

| | | GraniteShares Bloomberg Commodity Broad Strategy No

K-1 ETF | | | GraniteShares

S&P GSCI

Commodity Broad

Strategy No

K-1 ETF | |

| | | Year Ended

June 30, 2019 | | | Year Ended

June 30, 2019 | |

| Investment Income: | | | | | | | | |

| Interest | | $ | 1,163,393 | | | $ | 147,713 | |

| Total Investment Income | | | 1,163,393 | | | | 147,713 | |

| Expenses: | | | | | | | | |

| Advisory fees | | | 130,106 | | | | 23,944 | |

| Tax fees | | | 57 | | | | 57 | |

| Trustees' fees(a) | | | 1,502 | | | | 1,502 | |

| CCO fees(a) | | | 4,468 | | | | 1,571 | |

| Total Expenses | | | 136,133 | | | | 27,074 | |

| Expense Reimbursement | | | (5,970 | ) | | | (3,073 | ) |

| Net Expenses | | | 130,163 | | | | 24,001 | |

| Net Investment Income | | | 1,033,230 | | | | 123,712 | |

| Net Realized and Unrealized Gain (Loss) on: | | | | | | | | |

| Net realized gain (loss) on: | | | | | | | | |

| Investments | | | (43 | ) | | | (51 | ) |

| Futures contracts | | | (5,845,310 | ) | | | (1,688,291 | ) |

| Net realized loss | | | (5,845,353 | ) | | | (1,688,342 | ) |

| Net change in unrealized appreciation (depreciation) on: | | | | | | | | |

| Investments | | | 15,079 | | | | 1,335 | |

| Futures contracts | | | 1,742,435 | | | | 135,787 | |

| Net change in unrealized appreciation (depreciation) | | | 1,757,514 | | | | 137,122 | |

| Net Realized and Unrealized Loss | | | (4,087,839 | ) | | | (1,551,220 | ) |

| Net Decrease in Net Assets Resulting from Operations | | $ | (3,054,609 | ) | | $ | (1,427,508 | ) |

| (a) | From the period July 1, 2018 through August 17, 2018, the Funds paid Trustees’ fees and CCO fees, but was reimbursed through a fee waiver agreement by the Adviser. Starting August 18, 2018, the Board of Directors of the GraniteShares ETF Trust adopted a unitary fee model for the Funds. |

See accompanying notes to consolidated financial statements.

GraniteShares ETF Trust

| Consolidated Statements of Changes in Net Assets |

June 30, 2019

| | | GraniteShares Bloomberg Commodity Broad Strategy No

K-1 ETF | | | GraniteShares S&P GSCI Commodity Broad Strategy No

K-1 ETF | |

| | | Year Ended

June 30, 2019 | | | Year Ended

June 30, 2018 | | | Year Ended

June 30, 2019 | | | Year Ended

June 30, 2018 | |

| Operations: | | | | | | | | | | | | | | | | |

| Net investment income | | $ | 1,033,230 | | | $ | 184,940 | | | $ | 123,712 | | | $ | 47,678 | |

| Net realized gain (loss) | | | (5,845,353 | ) | | | 643,990 | | | | (1,688,342 | ) | | | 838,635 | |

| Net change in unrealized gain (loss) | | | 1,757,514 | | | | (714,209 | ) | | | 137,122 | | | | 153,369 | |

| Net Increase (Decrease) in Net Assets Resulting from Operations | | | (3,054,609 | ) | | | 114,721 | | | | (1,427,508 | ) | | | 1,039,682 | |

| | | | | | | | | | | | | | | | | |

| Distributions to shareholders | | | (499,719 | ) | | | (20,807 | )(a) | | | (1,088,275 | ) | | | (6,519 | )(a) |

| | | | | | | | | | | | | | | | | |

| From share transactions: | | | | | | | | | | | | | | | | |

| Proceeds from sales of shares | | | 43,080,362 | | | | 28,816,954 | | | | 2,727,705 | | | | 8,175,050 | |

| Cost of shares redeemed | | | (2,361,563 | ) | | | (1,346,661 | ) | | | (1,304,358 | ) | | | (3,938,162 | ) |

| Net increase in net assets resulting from share transactions | | | 40,718,799 | | | | 27,470,293 | | | | 1,423,347 | | | | 4,236,888 | |

| Total Increase (Decrease) in net assets | | | 37,164,471 | | | | 27,564,207 | | | | (1,092,436 | ) | | | 5,270,051 | |

| | | | | | | | | | | | | | | | | |

| Net Assets: | | | | | | | | | | | | | | | | |

| Beginning of year | | | 30,051,643 | | | | 2,487,436 | | | | 7,683,125 | | | | 2,413,074 | |

| End of year | | $ | 67,216,114 | | | $ | 30,051,643 | (b) | | $ | 6,590,689 | | | $ | 7,683,125 | (b) |

| | | | | | | | | | | | | | | | | |

| Changes in Shares Outstanding: | | | | | | | | | | | | | | | | |

| Shares outstanding, beginning of year | | | 1,152,000 | | | | 102,000 | | | | 252,000 | | | | 102,000 | |

| Shares sold | | | 1,750,000 | | | | 1,100,000 | | | | 100,000 | | | | 300,000 | |

| Shares redeemed | | | (100,000 | ) | | | (50,000 | ) | | | (50,000 | ) | | | (150,000 | ) |

| Shares outstanding, end of year | | | 2,802,000 | | | | 1,152,000 | | | | 302,000 | | | | 252,000 | |

| (a) | Includes distributions from net investment income of $(20,807) and $(6,519), respectively. |

| (b) | Includes undistributed net investment income of $145,591 and $1,034,492, respectively. |

See accompanying notes to consolidated financial statements.

GraniteShares ETF Trust

| Consolidated Financial Highlights |

| | | Year Ended

June 30, | | | For the Period May 19, 2017(a) to | |

| GraniteShares Bloomberg Commodity Broad Strategy No K-1 ETF | | 2019 | | | 2018 | | | June 30, 2017 | |

| Operating Performance: | | | | | | | | | | | | |

| Net asset value, beginning of year/period | | $ | 26.09 | | | $ | 24.39 | | | $ | 25.00 | |

| Net investment income(b) | | | 0.48 | ) | | | 0.32 | | | | 0.01 | |

| Net realized and unrealized gain (loss)(c) | | | (2.36 | ) | | | 1.43 | | | | (0.62 | ) |

| Total gain (loss) from investment operations | | | (1.88 | ) | | | 1.75 | | | | (0.61 | ) |

| Less distributions from: | | | | | | | | | | | | |

| Net investment income | | | (0.22 | ) | | | (0.05 | ) | | | — | |

| Net asset value, end of year/period | | $ | 23.99 | | | $ | 26.09 | | | $ | 24.39 | |

| Total Return(d) | | | (7.16 | )% | | | 7.19 | % | | | (2.46 | )%(e) |

| Ratios to Average Net Assets and Supplemental Data: | | | | | | | | | | | | |

| Net assets, end of year/period (in 000's) | | $ | 67,216 | | | $ | 30,052 | | | $ | 2,487 | |

| Ratio of net investment income to average net assets | | | 1.99 | % | | | 1.21 | % | | | 0.49 | %(f) |

| Ratio of operating expenses before waivers/reimbursements | | | 0.26 | % | | | 0.52 | % | | | 1.85 | %(f) |

| Ratio of net operating expenses net of waivers/reimbursements | | | 0.25 | % | | | 0.27 | % | | | 0.30 | %(f) |

| Portfolio turnover rate | | | — | % | | | — | % | | | — | % |

| (a) | Commencement of operations. |

| (b) | Per share data is calculated using the average daily shares outstanding method. |

| (c) | Calculation of the net gain (loss) per share (both realized and unrealized) may not correlate to the aggregate realized and unrealized gains (losses) presented in the Consolidated Statements of Operations due to the timing of sales and repurchases of Fund shares in relation to fluctuating market values of the investments of the Fund. |

| (d) | Total return would have been lower if certain fund expenses had not been reimbursed by the Advisor. |

| (e) | Not annualized. |

| (f) | Annualized. |

See accompanying notes to consolidated financial statements.

GraniteShares ETF Trust

| Consolidated Financial Highlights |

| | | Year Ended June 30, | | | For the Period May 19, 2017(a) to

| |

| GraniteShares S&P GSCI Commodity Broad Strategy No K-1 ETF | | 2019 | | | 2018 | | | June 30, 2017 | |

| Operating Performance: | | | | | | | | | | | | |

| Net asset value, beginning of year/period | | $ | 30.49 | | | $ | 23.66 | | | $ | 25.00 | |

| Net investment income(b) | | | 0.45 | | | | 0.28 | | | | 0.01 | |

| Net realized and unrealized gain (loss)(c) | | | (4.80 | ) | | | 6.59 | | | | (1.35 | ) |

| Total gain (loss) from investment operations | | | (4.35 | ) | | | 6.87 | | | | (1.34 | ) |

| Less distributions from: | | | | | | | | | | | | |

| Net investment income | | | (4.32 | ) | | | (0.04 | ) | | | — | |

| Net asset value, end of year/period | | $ | 21.82 | | | $ | 30.49 | | | $ | 23.66 | |

| Total Return(d) | | | (12.51 | )% | | | 29.08 | % | | | (5.37 | )%(e) |

| Ratios to Average Net Assets and Supplemental Data: | | | | | | | | | | | | |

| Net assets, end of year/period (in 000's) | | $ | 6,591 | | | $ | 7,683 | | | $ | 2,413 | |

| Ratio of net investment income to average net assets | | | 1.81 | % | | | 1.03 | % | | | 0.45 | %(f) |

| Ratio of operating expenses before waivers/reimbursements | | | 0.40 | % | | | 0.88 | % | | | 2.12 | %(f) |

| Ratio of net operating expenses net of waivers/reimbursements | | | 0.35 | % | | | 0.37 | % | | | 0.40 | %(f) |

| Portfolio turnover rate | | | — | % | | | — | % | | | — | % |

| (a) | Commencement of operations. |

| (b) | Per share data is calculated using the average daily shares outstanding method. |

| (c) | Calculation of the net gain (loss) per share (both realized and unrealized) may not correlate to the aggregate realized and unrealized gains (losses) presented in the Consolidated Statements of Operations due to the timing of sales and repurchases of Fund shares in relation to fluctuating market values of the investments of the Fund. |

| (d) | Total return would have been lower if certain fund expenses had not been reimbursed by the Advisor. |

| (e) | Not annualized. |

| (f) | Annualized. |

See accompanying notes to consolidated financial statements.

Notes to Consolidated Financial Statements

June 30, 2019

1. ORGANIZATION

The GraniteShares ETF Trust (the “Trust”) was organized as a Delaware statutory trust on November 7, 2016. The Trust is registered with the Securities and Exchange Commission (the “SEC”) under the Investment Company Act of 1940, as amended (the “1940 Act”), and the offering of each Fund’s shares (“Shares”) is registered under the Securities Act of 1933, as amended (the “Securities Act”). GraniteShares Advisors LLC (the “Adviser”) serves as investment adviser to the Funds. Each Fund is a non-diversified series of a management investment company under the 1940 Act. The Trust is an open-end management investment company currently consisting of three investment series, of which two are presented below (each, a “Fund,” and collectively, the “Funds”) and presented herein. The remaining Fund in the Trust is presented separately.

| Fund | | Commencement of Operations |

| GraniteShares Bloomberg Commodity Broad Strategy No K-1 ETF | | May 19, 2017 |

| GraniteShares S&P GSCI Commodity Broad Strategy No K-1 ETF | | May 19, 2017 |

2. CONSOLIDATED SUBSIDIARY

GraniteShares Bloomberg Commodity Broad Strategy No K-1 ETF and GraniteShares S&P GSCI Commodity Broad Strategy No K-1 ETF invest in certain commodity-related investments through GraniteShares BCOM Cayman Limited and GraniteShares GSCI Cayman Limited respectively, wholly-owned subsidiaries (each, a “Subsidiary”, collectively, the “Subsidiaries”).

The following table reflects the net assets of each Subsidiary as a percentage of each Fund’s net assets at June 30, 2019:

| Fund | | Wholly Owned Subsidiary | | Value | | | Percentage of

Fund’s Net Assets | |

| GraniteShares Bloomberg Commodity Broad Strategy No K-1 ETF | | GraniteShares BCOM

Cayman Limited | | $ | 12,574,594 | | | | 18.7 | % |

| GraniteShares S&P GSCI Commodity Broad Strategy No K-1 ETF | | GraniteShares GSCI

Cayman Limited | | $ | 1,024,560 | | | | 15.5 | % |

3. SIGNIFICANT ACCOUNTING POLICIES

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (U.S. GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. The Fund follows the accounting and reporting guidance in the Accounting Standards Codifications 946, “Financial Services—Investment Companies” issued by the U.S. Financial Accounting Standards Board.

The following is a summary of significant accounting policies followed by the Funds in the preparation of its financial statements.

Investment Transactions and Investment Income:Investment transactions are recorded on the trade date. Gains and losses on securities sold are determined on the basis of identified cost. Dividend income, if any, is recorded on the ex-dividend date or, in the case of foreign securities, as soon as each Fund is informed of the ex-dividend dates. Interest income, including accretion of discounts and amortization of premiums, is recorded on the accrual basis.

Dividend Distributions: Distributions to shareholders are recorded on the ex-dividend date and are determined in accordance with federal income tax regulations, which may differ from U.S. GAAP. The Funds distribute all or substantially all of their net investment income to shareholders in the form of dividends.

Futures contracts: The GraniteShares Bloomberg Commodity Broad Strategy No K-1 ETF and The GraniteShares S&P GSCI Commodity Broad Strategy No K-1 ETF, through their Subsidiaries, invest in a combination of exchange-listed commodity futures contracts in the normal course of pursuing their investment objectives. A futures contract is a financial instrument in which a party agrees to pay a fixed price for securities or commodities at a specified future date. Futures contracts are traded at market prices on exchanges pursuant to terms common to all market participants. Upon entering into such contracts, the Funds are required to deposit with the broker, either in cash or in securities, an initial margin in an amount equal to a certain percentage of the contract amount. Subsequent fluctuations in the value of the contract are recorded for financial statement purposes as unrealized appreciation or depreciation on open futures contracts. Payments received or paid by the Funds adjust the variation margin accounts. When a contract is closed, the Funds record a realized gain or loss.

Notes to Consolidated Financial Statements (continued)

June 30, 2019

Futures contracts may be highly volatile. Price movements may be sudden and extreme, and are influenced by a variety of factors including, among other things, changing supply and demand relationships; climate; government agricultural, trade, fiscal, monetary and exchange control programs and policies; national and international political and economic events; crop diseases; the purchasing and marketing programs of different nations; and changes in interest rates.

Open futures contracts at June 30, 2019 are listed in the Consolidated Schedules of Investments. As of June 30, 2019, the balance of margin deposited with the broker by the GraniteShares Bloomberg Commodity Broad Strategy No K-1 ETF, and the GraniteShares S&P GSCI Commodity Broad Strategy No K-1 ETF, was $565,400, and $266,846, respectively, as presented on the Consolidated Statements of Assets and Liabilities as due to broker. At June 30, 2019 the GraniteShares Bloomberg Commodity Broad Strategy No K-1 ETF had variation margin receivable from broker of $457,224, and the GraniteShares S&P GSCI Commodity Broad Strategy No K-1 ETF had variation margin receivable from broker in the amount of $40,091. The variation margin payable/receivable is represented by the difference between the balance of margin on deposit with the broker and the unrealized appreciation/depreciation on open futures contracts as of June 30, 2019.

4. SECURITIES VALUATION

Investment Valuation: Each Fund calculates its net asset value (“NAV”) each day the New York Stock Exchange (the “NYSE”) is open for trading as of the close of regular trading on the NYSE, normally 4:00 p.m. Eastern time (the “NAV Calculation Time”).

If a market quotation is not readily available or is deemed not to reflect market value, GraniteShares Advisors LLC, (the “Adviser”) determines the price of the security held by each Fund based on a determination of the security’s fair value pursuant to policies and procedures approved by the Board of Trustees (the “Board”). In addition, each Fund may use fair valuation to price securities that trade on a foreign exchange when a significant event has occurred after the foreign exchange closes but before the time at which the Fund’s NAV is calculated. Such valuations would typically be categorized as Level 2 or Level 3 in the fair value hierarchy described below.

Exchange-traded futures contracts are valued at the closing price in the market where such contracts are principally traded. If no closing price is available, exchange-traded futures contracts are fair valued at the mean of the last bid and asked prices, if available, and otherwise at the closing bid price. Such valuations are typically categorized as Level 1 in the fair value hierarchy described below.

Certain securities may not be able to be priced by pre-established pricing methods. Such securities may be valued by the Board or its delegate at fair value. These securities generally include but are not limited to, restricted securities (securities which may not be publicly sold without registration under the 1933 Act) for which a pricing service is unable to provide a market price; securities whose trading has been formally suspended; a security whose market price is not available from a pre- established pricing source; a security with respect to which an event has occurred that is likely to materially affect the value of the security after the market has closed but before the calculation of each Fund net asset value (as may be the case in foreign markets on which the security is primarily traded) or make it difficult or impossible to obtain a reliable market quotation; and a security whose price, as provided by the pricing service, does not reflect the security’s “fair value.” A variety of factors may be considered in determining the fair value of such securities.

Valuing the Funds’ investments using fair value pricing will result in using prices for those investments that may differ from current market valuations.

5. FAIR VALUE MEASUREMENT

The Financial Accounting Standards Board (FASB) established a framework for measuring fair value in accordance with U.S. GAAP. Under Fair Value Measurements and Disclosures, various inputs are used in determining the value of the exchange traded fund’s investments. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The three Levels of inputs of the fair value hierarchy are defined as follows:

Level 1 — Unadjusted quoted prices in active markets for identical assets or liabilities.

Level 2 — Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar securities, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 — Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available; representing the Funds’ own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The hierarchy classification of inputs used to value each Fund’s investments at June 30, 2019, is disclosed at the end of each Fund’s Consolidated Schedule of Investments.

Notes to Consolidated Financial Statements (continued)

June 30, 2019

6. ADVISORY, OTHER AGREEMENTS, AND TRANSACTIONS WITH RELATED PARTIES

GraniteShares Advisors LLC, the investment adviser to the Fund, is a Delaware limited Liability Company located at 205 Hudson Street, 7th Floor, New York, NY 10013. The Adviser provides investment advisory services to exchange-traded funds. The Adviser serves as investment adviser to the Fund with overall responsibility for the portfolio management of the Fund, subject to the supervision of the Board of Trustees (the “Board”) of the Trust.

For its services, the Adviser receives a fee that is equal to 0.25% per annum of the average daily net assets of the COMB Fund and 0.35% per annum of the average daily net assets of the COMG Fund, in each case calculated daily and paid monthly. Pursuant to the Advisory Agreement, the Adviser is responsible for substantially all expenses of each Fund (excluding interest, taxes, brokerage commissions, expenses related to short sales, other expenditures which are capitalized in accordance with generally accepted accounting principles, other extraordinary expenses not incurred in the ordinary course of each Fund’s business, and amounts, if any, payable pursuant to a plan adopted in accordance with Rule 12b-1 under the 1940 Act).

Pursuant to the Advisory Agreement, the Adviser has agreed to pay all expenses of the Funds, except for: (i) brokerage expenses and other fees, charges, taxes, levies or expenses (such as stamp taxes) incurred in connection with the execution of portfolio transactions or in connection with creation and redemption transactions; (ii) legal fees or expenses in connection with any arbitration, litigation or pending or threatened arbitration or litigation, including any settlements in connection therewith; (iii) compensation and expenses of the Independent Trustees; (iv) compensation and expenses of counsel to the Independent Trustees; (v) compensation and expenses of the Trust’s Chief Compliance Officer; (vi) extraordinary expenses; (vii) distribution fees and expenses paid by the Trust under any distribution plan adopted pursuant to Rule 12b-1 under the 1940 Act; (viii) interest and taxes of any kind or nature; (ix) any fees and expenses related to the provision of securities lending services; and (x) the advisory fee payable to the Adviser under the Advisory Agreement.

This contractual arrangement may only be changed or eliminated by or with the consent of the Funds’ Board of Trustees.

During the year ended June 30, 2019, the COMB Fund and the COMG Fund received cash payments of $15,287 and $7,048, respectively, from the Adviser in connection with the expense reimbursement arrangement to the advisory agreement.

GraniteShares Advisors LLC is the only related party involved with the operations of the Funds.

Administrator, Custodian, Accounting Agent and Transfer Agent Services: The Bank of New York Mellon (in each capacity, the “Administrator”, “Custodian,” “Accounting Agent” or “Transfer Agent”) serves as the Funds’ Administrator, Custodian, Accounting Agent and Transfer Agent pursuant to the Funds Administration and Accounting Agreement. The Bank of New York Mellon is a subsidiary of The Bank of New York Mellon Corporation, a financial holding company.

Distribution and Service Fees: Foreside Fund Services, LLC. (“Distributor”) serves as the Funds’ distributor. The Trust has adopted a distribution and service plan (“Rule 12b-1 Plan”) pursuant to Rule 12b-1 under the 1940 Act. Under the Rule 12b-1 Plan, the Funds are authorized to pay an amount up to a maximum annual rate of 0.25% of its average net assets in connection with the sale and distribution of its shares and pay service fees in connection with the provision of ongoing services to shareholders. No distribution fees are currently charged to the Funds; there are no plans to impose these fees.

Notes to Consolidated Financial Statements (continued)

June 30, 2019

Share Transactions

The Funds issue and redeem shares at NAV only with certain authorized participants in large increments known as Creation Units. A Creation Unit consists of 50,000 shares. Creation Units are issued and redeemed principally in exchange for the deposit or delivery of cash. A fund's shares are available in smaller increments to investors in the secondary market at market prices and may be subject to commissions. Authorized participants pay a transaction fee to the shareholder servicing agent when purchasing and redeeming Creation Units of a fund. The transaction fee is used to defray the costs associated with the issuance and redemption of Creation Units.

7. INVESTMENT TRANSACTIONS

There were no cost of purchases and proceeds from sales of investment securities (excluding short-term investments) for the year ended June 30, 2019.

8. VALUATION OF DERIVATIVE INSTRUMENTS