UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23214

GraniteShares ETF Trust

(Exact name of registrant as specified in charter)

205 Hudson Street, 7th floor

New York, New York 10013

(Address of principal executive offices) (Zip code)

William Rhind

GraniteShares ETF Trust

205 Hudson Street, 7th floor

New York, New York 10013

(Name and address of agent for service)

Copy to:

W. Thomas Conner, Esq.

Vedder Price

1633 Broadway, 31st Floor

New York, NY 10019

Registrant’s telephone number, including area code: 1-800-422-3554

Date of fiscal year end: June 30

Date of reporting period: June 30, 2020

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

GraniteShares ETF Trust

Annual Report

June 30, 2020

GraniteShares Bloomberg Commodity Broad Strategy No K-1 ETF

GraniteShares HIPS US High Income ETF

GraniteShares XOUT U.S. Large Cap ETF

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. Please contact your financial intermediary to elect to receive shareholder reports and other communications electronically. You may elect to receive all future reports in paper free of charge. Please contact your financial intermediary to continue receiving paper copies of your shareholder reports and for information about whether your election to receive reports in paper will apply to all funds held with your financial intermediary.

GraniteShares ETF Trust

Table of Contents

GraniteShares ETF Trust

Management Discussion of Fund Performance (Unaudited)

THE MARKET ENVIRONMENT

Commodity Market

For the period June 30, 2019 to June 30, 2020 commodity returns, as measured by the performance of broad-based indexes were negative. For example, The Bloomberg Commodity Total Return Index decreased 17.38%. All sectors of the Bloomberg Commodity Total Return Index had negative returns with the exception of the precious metals sector. The energy sector (the largest percentage weight sector in the index at the beginning of the period) performed exceedingly poorly.

The energy sector was the worst performing sector over the period. All components of this sector experienced severe price drops. WTI and Brent crude oil prices plummeted 57% and 38%, respectively. Gasoil, gasoline and heating oil prices plunged 46%, 42% and 44%, respectively. Natural gas prices plunged 50%. WTI crude oil prices, up approximately 5% through the end of the calendar year on reduced U.S. – China trade frictions, the passage of the USMCA and expectations of stronger global growth, plunged with the onset of coronavirus-related demand destruction combined with continued high OPEC+ and U.S. oil production. WTI oil crude prices were down nearly 80% in late April with the front month futures contract price settling below zero on April 20 for the first time ever. Derivative oil products followed the same performance trajectory. Natural gas prices, already suffering from oversupply, also fell sharply as a result of coronavirus demand destruction.

Despite a negative performance over the period, the base metals sector was the second best performing sector. Aluminum and zinc prices fell the most, declining 15% and 18%, respectively. Nickel prices edged lower, falling under 1% and copper prices fell 2%. Aluminum prices, almost unchanged at calendar’s year end, dropped significantly due to coronavirus related demand destruction and already existing oversupply conditions. Copper prices, up around 2% at the end of the calendar year due to reduced U.S. – China trade frictions, fell over 20% with the onset of coronavirus restrictions and lockdowns and then retraced most of their losses as restrictions began to be lifted. Nickel prices behaved similarly.

Grain prices were all lower over the period as well. Kansas wheat prices decreased 14%, Chicago wheat prices fell 9% and soybean prices declined 11%. Corn prices plunged 27%. Initially hurt by oversupply and decreased exports resulting from U.S. – China trade frictions, wheat and soybean prices moved higher with the completion of the phase 1 U.S. – China trade agreement, with wheat prices up near 4% and soybean prices practically unchanged at the end of the calendar year. The onset of the coronavirus, while initially positive for wheat demand, pushed all grain prices lower as a result of reduced demand. Corn prices, already suffering from global oversupply, were pushed even lower with greatly reduced demand for ethanol and as a result of coronavirus meat processing shutdowns reducing feedstock demand.

The precious metal sector was the best performing sector over the period. Gold prices increased 24% and silver prices climbed 17%. Global growth concerns, trade frictions between the U.S. and China and the U.S. and the EU and expectations the U.S. Federal Reserve Bank would reduce rates more quickly pushed gold prices approximately 8% higher through the first half of this period. The onset of the coronavirus pandemic and its concomitant demand destruction, resulting in unprecedented fiscal and monetary stimulus, helped moved gold prices 16% higher in the second half of the period.

Fixed Income

The Federal Open Market Committee (FOMC) met 9 times during the period, instead of its usual 8 meetings, canceling its scheduled meeting in March in lieu of 2 unscheduled meetings convened to handle the extraordinary conditions resulting from the onset of the coronavirus pandemic.

Meeting in late July and mid-September 2019, the FOMC voted in each meeting to reduce the Fed Funds rate target range by 25 bps, lowering the Fed Funds rate target range from 2.25% – 2.50% to 1.75% – 2.00%. The FOMC maintained its stated goal of working to sustain economic expansion.

Meeting in late October and mid December 2019, the FOMC voted in the October meeting to reduce the Fed Funds rate target range by 25 bps to 1.50% – 1.75% citing continued uncertainties despite a strong economy and labor market. In the December meeting, the FOMC voted to maintain the Fed Funds rate target range, stating that current monetary policy was sufficient to support sustained economic activity and a strong labor market.

Meeting in late January 2020 as scheduled, the FOMC left the Fed Funds rate target range unchanged at 1.50% – 1.75%, stating no change was needed to sustain the economic expansion. Just over a month later on March 3, the FOMC announced it would lower the target range by 50bps to 1.00% – 1.25%, citing coronavirus related risks to the economy. Twelve days later on March 15, in another unscheduled meeting, the FOMC announced it would lower the Fed Funds rate target range 100bps, dropping it to 0.00% – 0.25%, stating that though the current state of the economy was strong, it was acting on the basis of future deleterious effects on the U.S. economy from the coronavirus. The FOMC also announced the resumption of quantitative easing saying would purchase up to $700 billion of Treasury and mortgage backed securities. The scheduled meeting for March 17-18 was canceled.

GraniteShares ETF Trust

Management Discussion of Fund Performance (Unaudited) (continued)

Following its last (unscheduled) meeting, the FOMC made three additional announcements. On March 19, the FOMC announced the establishment of swap lines with 9 additional central banks. Each swap line was for $60 billion and they were established to provide U.S. dollar liquidity to these additional central banks. On March 23, the FOMC announced it would continue its buyback of Treasury and mortgage back securities but would not limit the amount. Finally on March 31, the FOMC announced the establishment of a repurchase agreement facility for central banks and international monetary authorities to ensure the liquidity of the U.S. Treasury market

The FOMC met in late April and mid-June, voting to leave the Fed Funds rate target range unchanged at 0.00% - 0.25%.

Over the period, 3-month Treasury Bill rates fell 135 bps from 2.09% to 0.13%. Over this same period, the 10-year U.S Treasury rate fell 135bps from approximately 2.01% to 0.66%.

Pass-Through Securities

For the period June 30, 2019 to June 30, 2020 pass-through security returns, as measured by the performance of TFMS HIPS Total Return Index (a broad-based index), were negative. The TFMS HIPS Total Return Index decreased 22.79% over this period. The Index return was affected by negative performance in all sectors with the MLP, REIT and BDC sectors detracting the most. For example, the Alerian MLP Total Return Index fell 41.43%, the S&P BDC Total Return Index fell 20.82% and the Dow Jones US Mortgage REIT Total Return Index fell 32.31%.

Pass-through securities prices generally moved higher in the first half of the period, supported by accommodative monetary policy and expectations of stronger economic growth resulting from reduced trade frictions between the U.S. and China. With the onset of the coronavirus pandemic in late February, pass-through security prices dropped significantly, with the TFMS HIPS Total Return index decreasing almost 49% from calendar year end to its low in early April 2020. Following unprecedented monetary and fiscal stimulus by the U.S. Federal Reserve Bank and the U.S. government, pass-through securities generally moved higher with TMFS HIPS Index increasing approximately 42% from early April to June 30, the end of the period.

Large-Cap Security Market

For the period June 30, 2019 to June 30, 2020 large-cap security returns, as measured by the performance of S&P 500 Total Return Index, were positive. The S&P 500 Total Return Index increased 7.5% over the period. The best performing sectors of the S&P 500 Index were the information technology sector (+30.7%), the health care sector (+12.4%) and the communication services sector (+9.5%). The worst performing sectors were the energy sector (-31.0%), the financial sector (-15.0%), the real estate sector (-11.1%) and the utilities sector (-10.2%).

Up over 16% through mid-February on accommodative monetary policy and expectations of stronger economic growth resulting from reduced trade frictions between the U.S. and China, the S&P 500 Total Return Index fell nearly 34% to its low over the period on March 23, 2020 as a result of the coronavirus pandemic. Following unprecedented monetary and fiscal stimulus by the U.S. Federal Reserve Bank and the U.S. government, the S&P 500 Total Return Index increased just over 39% from its low to the end of the period.

GraniteShares ETF Trust

Management Discussion of Fund Performance (Unaudited) (continued)

MANAGER’S ANALYSIS

GraniteShares Bloomberg Commodity Broad Strategy No K-1 ETF (COMB)

The GraniteShares Bloomberg Commodity Broad Strategy No K-1 ETF (the “Fund”) is an actively managed exchange-traded fund (“ETF”) that seeks to provide long-term capital appreciation, primarily through exposure to commodity futures markets. The Fund’s investment strategy is based in part on the Bloomberg Commodity Index (the “BCOM Benchmark”), which is designed to be a highly liquid and broad benchmark for commodities futures investments. The BCOM Benchmark provides broad-based exposure to commodities as an asset class, since no single commodity or commodity sector dominates the BCOM Benchmark. The weightings of the components of the BCOM Benchmark are based on (1) liquidity data, which is the relative amount of trading activity of a particular commodity; (2) production data, which measures the importance of a commodity to the world economy; and (3) diversification rules that attempt to reduce disproportionate weightings of any single commodity. Rather than being driven by micro-economic events affecting one commodity market or sector, the BCOM Benchmark is comprised of futures contracts on a broad basket of underlying commodities, which potentially reduces volatility in comparison with narrower commodity baskets.

Currently, the BCOM Benchmark consists of 23 commodities futures contracts with respect to 21 commodities: aluminum, coffee, copper, corn, cotton, crude oil (WTI and Brent), gold, ULS Diesel, lean hogs, live cattle, low sulfur gasoil, natural gas, nickel, silver, soybean meal, soybean oil, soybeans, sugar, unleaded gas, wheat (Chicago and KC HRW), and zinc. The BCOM Benchmark reflects the return from these commodity futures contracts.

While the Fund generally seeks exposure to the commodity futures markets included in the BCOM Benchmark, the Fund is not an index tracking ETF and will seek to improve its performance, in part through a cash management strategy consisting of investments in investment grade fixed income securities issued by various U.S. public-sector or corporate entities (“Fixed Income Securities”). The Adviser will use such instruments to generate a total return for investors and exercise its discretion in the use of such instruments to seek to optimize the investment performance of the Fund. In addition, the Fund at times may actively select investments with differing maturities from the underlying components of the BCOM Benchmark, may not invest in all of the BCOM Benchmark’s components or in the same proportion as the BCOM Benchmark, may invest in commodity-linked derivative instruments and other commodity-linked instruments outside the BCOM Benchmark, and may emphasize some commodity sectors more than others.

The Fund is called “No K1” because it is designed to operate differently than commodity-based exchange traded funds that distribute a “Schedule K-1” to shareholders. Schedule K-1 is a tax document that contains information regarding a fund’s income and expenses. Schedule K-1 is a complex form and shareholders may find that preparing tax returns requires additional time or the assistance of a professional tax adviser, at additional expense to the shareholder. In contrast, the Fund is designed to be taxed like a conventional mutual fund and therefore will deliver a “Form 1099” to investors, from which income, gains, and losses can be entered onto the investor’s tax return. To deliver 1099s consistent with applicable tax law, the Fund currently expects to invest in an underlying subsidiary, as discussed below.

The Fund gains exposure to the commodity futures markets by investing in commodity futures contracts (“Commodity Futures”). Because the Fund may not invest directly in commodity futures, the Fund gains exposure to these investments by investing a portion of its assets in the GraniteShares BCOM Cayman Limited, a wholly-owned subsidiary of the Fund organized under the laws of the Cayman Islands (the “Subsidiary”). The Subsidiary is advised by the Adviser, and the Adviser complies with the provisions of the Investment Company Act of 1940 relating to advisory contracts. Unlike the Fund, the Subsidiary is not an investment company registered under the Investment Company Act of 1940 (the “1940 Act”). The Fund’s investment in the Subsidiary is intended to provide the Fund with exposure to commodity futures markets in accordance with applicable rules and regulations. The Subsidiary has the same investment objective and will follow the same general investment policies and restrictions as the Fund. The Fund will invest up to 25% of its total assets in the Subsidiary. The Fund complies with the provisions of the 1940 Act governing capital structure and leverage (Section 18) on an aggregate basis with the Subsidiary. Except as otherwise noted, references to the Fund’s investment strategies and risks include the investment strategies and risks of the Subsidiary.

For the period June 30, 2019 through June 30, 2020 (the fiscal year end of the Fund), on a market price basis, the Fund returned -17.37%. On a net asset value (“NAV”) basis, the Fund returned -17.55%. During the same time period, the BCOM Benchmark returned –18.43%. Additionally, the BCOM Total Return Index returned -17.38%. The BCOM Total Return Index is similar to the BCOM Benchmark except that the BCOM Total Return Index performance includes the return that would be generated in a fully collateralized investment in the BCOM Benchmark. This combines the returns of the BCOM Benchmark with the returns on cash collateral invested in Treasury Bills. The majority of the Fund’s outperformance on a NAV basis relative to the BCOM Benchmark is due to slight position differences between the BCOM Benchmark and the Fund as well as returns on collateral invested in Treasury Bills. The majority of the Fund’s underperformance on a NAV basis relative to the BCOM Total Return Index is a result of fees and operating expenses incurred by the fund.

GraniteShares ETF Trust

Management Discussion of Fund Performance (Unaudited) (continued)

Positions that contributed most significantly to the Fund’s return were Gold (CME) and Silver (CME) futures contracts (combined portfolio weight of 17%). Positions that detracted most significantly from the Fund’s return included WTI Crude oil (CME), Brent Crude Oil (ICE), Natural Gas (CME), Gasoil (ICE), Gasoline (CME) and Heating Oil (CME) futures contracts (combined portfolio weight of 31%) and Corn (CME) and Lean Hogs (CME) futures contracts (combined portfolio weight 9%)

| Percentage Weight* (% of Fund’s Net Assets as of June 30, 2020) |

| Asset Class | | Fund Percentage Weight By Sector | | | | |

| Commodities | | | | | | |

| | Agriculture | | | 35.5 | % |

| | | Energy | | | 23.4 | % |

| | | Base Metals | | | 22.5 | % |

| | | Precious Metals | | | 18.6 | % |

*Based on notional value of futures contracts.

**Allocations are subject to change.

GROWTH OF $10,000 INVESTMENT

For the period May 19, 2017* to June 30, 2020

HISTORICAL PERFORMANCE

Total Return as of June 30, 2020

| | | 1 Year | | | 3 Year | | | Since

Inception

5/19/2017* | |

| GraniteShares Bloomberg Commodity Broad Strategy No K-1 ETF NAV | | | -17.55 | % | | | -6.39 | % | | | -6.90 | % |

| GraniteShares Bloomberg Commodity Broad Strategy No K-1 ETF Market Price** | | | -17.37 | % | | | -6.56 | % | | | -6.92 | % |

| Bloomberg Commodity Total Return Index | | | -17.38 | % | | | -6.13 | % | | | -6.85 | % |

Total Annual Fund Operating Expenses were 0.25%. Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the fund’s most recent month end performance, please call 1(844) 476-8747 or visit www.graniteshares.com.

| * | Commencement of operations. |

| ** | The price used to calculate market return (‘‘Market Price’’) is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00 pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV and are not individually redeemed from the Fund. |

| - | Bloomberg Commodity Index - is a broad-based index providing exposure to commodities as an asset class, with no single commodity or commodity sector dominating the index. Currently, the BCOM Benchmark consists of 23 commodities futures contracts with respect to 21 commodities: aluminum, coffee, copper, corn, cotton, crude oil (WTI and Brent), gold, ULS Diesel, lean hogs, live cattle, low sulfur gasoil, natural gas, nickel, silver, soybean meal, soybean oil, soybeans, sugar, unleaded gas, wheat (Chicago and KC HRW), and zinc. The BCOM Benchmark reflects the return from these commodity futures contracts. |

| - | An investor cannot invest directly in an unmanaged index. Indexes do not reflect fees and/or expenses. |

| - | Investing involves market risk, including the potential loss of principal. Investing in commodities is speculative, can be extremely volatile and may not be suitable for all investors. Derivatives may be more sensitive to changes in market conditions and may amplify risks. There are no assurances that the investment objective and strategies of the funds will be achieved. You could lose money by investing in the exchange-traded funds. Past performance does not guarantee future performance results. |

GraniteShares ETF Trust

Management Discussion of Fund Performance (Unaudited) (continued)

GraniteShares HIPS US High Income ETF (HIPS)

The GraniteShares HIPS US High Income ETF (the “Fund”) seeks to track the performance, before fees and expenses, of the TFMS HIPS Index (the “Index”).

The Fund employs a “passive management”—or indexing—investment approach designed to track the performance of the Index. The rules-based Index measures the performance of up to 60 high income U.S.-listed securities that typically have “pass-through” structures that require them to distribute substantially all of their earnings to shareholders as cash distributions. This “high income, pass-through” strategy is known as HIPS.

The Index

The Index is constructed to capture up to 60 high income securities, typically with pass-through structures, across the following sectors: (i) closed-end funds (“CEFs”), (ii) real estate investment trusts (“REITS”), (iii) asset management and business development companies (“BDCs”), and (iv) energy production and energy transportation and processing companies. Energy-related companies included in the Index are expected to primarily be structured as master limited partnerships (“MLPs”).

The Index applies a quantitative screen to the securities in such sectors for minimum market capitalizations and minimum liquidity thresholds. The Index then selects up to 15 securities with the highest yield and lowest volatility over a prescribed time period for each sector with all securities equally weighted. Finally, the Index adjusts the weights of each sector to minimize the Index volatility and maximize the Index return, as measured over a prescribed time period, subject to a minimum sector weight of 15% and a maximum MLP sector weight of 25%. The Index may include small-, mid-, and large-capitalization companies meeting the screening criteria. The Index is reconstituted annually and rebalanced only if the MLP sector weight exceeds 25% at the end of a quarter.

The Fund’s Investment Strategy

The Fund attempts to invest all, or substantially all, of its assets in the securities that make up the Index. The Fund will generally use a “replication” strategy to achieve its investment objective, meaning it generally will invest in all of the component securities of the Index, but may, when the adviser believes it is in the best interests of the Fund, use a “representative sampling” strategy, meaning it may invest in a sample of the securities in the Index whose risk, return and other characteristics are expected to closely resemble the risk, return and other characteristics of the Index as a whole.

Under normal circumstances, at least 80% of the Fund’s total assets (exclusive of collateral held from securities lending) will be invested in the component securities of the Index and investments that have economic characteristics that are substantially identical to the economic characteristics of such component securities. GraniteShares Advisors LLC (“GraniteShares” or the “Adviser”), the Fund’s investment adviser, expects that, over time, the correlation between the Fund’s performance and that of the Index, before fees and expenses, will be 95% or better.

For the period June 30, 2019 through June 30, 2020 (the fiscal year end of the Fund), on a market price basis, the Fund returned -23.69%, on a total return basis. On a net asset value (“NAV”) basis, the Fund returned -23.20%, on a total return basis. During the same time period, the TFMS HIPS Total Return Index returned -22.79%. The TFMS HIPS Total Return Index is similar to the TFMS HIPS Index except that the TFMS HIPS Total Return Index performance includes the return that would be generated if all distributions from securities comprising the TFMS HIPS Index were reinvested in the TFMS HIPS Index. The majority of the Fund’s underperformance on a NAV basis relative to the TFMS HIPS Index Total Return Index is a result of fees and operating expenses incurred by the Fund and the Fund’s cash position.

Positions that detracted most significantly from the Fund’s return included MLPs (portfolio weight 18%), REITs (portfolio weight of 32%), and Asset Managers and BDCs (portfolio weight 25%).

| Percentage Weight (% of Fund’s Net Assets as of June 30, 2020) |

| Sector | | Fund Percentage Weight By Sector* | |

| Asset Mgmt Cos and BDCs | | | 28.8 | % |

| Closed End Funds | | | 39.6 | % |

| REITs | | | 17.8 | % |

| MLPS | | | 12.6 | % |

| Cash | | | 1.2 | % |

*Allocations are subject to change.

GraniteShares ETF Trust

Management Discussion of Fund Performance (Unaudited) (continued)

GROWTH OF $10,000 INVESTMENT

For the period January 6, 2015* to June 30, 2020

HISTORICAL PERFORMANCE

Total Return as of June 30, 2020

| | | 1 Year | | | 3 Year | | | 5 Year | | | Since Inception 1/6/2015* | |

| GraniteShares HIPS US High Income ETF NAV | | | -23.20 | % | | | -5.99 | % | | | -1.15 | % | | | -1.88 | % |

| GraniteShares HIPS US High Income ETF Market Price** | | | -23.69 | % | | | -6.27 | % | | | -1.27 | % | | | -1.95 | % |

| TFMS HIPS Total Return Index | | | -22.79 | % | | | -5.43 | % | | | -0.55 | % | | | -1.42 | % |

Total Annual Fund Operating Expenses were 1.27%. Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the fund’s most recent month end performance, please call 1(844) 476-8747 or visit www.graniteshares.com.

| | * | Commencement of operations. |

| | ** | The price used to calculate market return (‘‘Market Price’’) is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00 pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV and are not individually redeemed from the Fund. |

| | - | Dow Jones U.S. Mortgage REIT Total Return Index - is an index comprised of REITs that hold real estate mortgages. |

| | - | S&P BDC Total Return Index - is an index designed to track leading business development companies that trade on major U.S. exchanges. |

| | - | Alerian MLP Total Return Index - is a cap-weighted index, whose constituents represent approximately 85% the total market capitalization of energy MLPs. |

| | - | FT TaxCEFT Index - the First Trust Taxable Fixed Income Closed Fund Total Return Index is a cap weighted index designed to provide a broad representation of the taxable fixed income closed-end fund universe. |

| | - | An investor cannot invest directly in an unmanaged index. Indexes do not reflect fees and/or expenses. |

| | - | Investing involves market risk, including the potential loss of principal. There are no assurances that the investment objective and strategies of the fund will be achieved. You could lose money by investing in the exchange-traded fund. Investments in debt securities typically decrease when interest rates rise. This risk is usually greater for longer-term debt securities. Investments in lower rated and non-rated securities present a greater risk of loss to principal and interest than higher-rated securities. Investments in foreign securities involve greater volatility and political, economic, and currency risks and differences in accounting methods. Investments in smaller companies involve additional risks, such as limited liquidity and greater volatility. An investment in the Fund does not receive the same tax advantages as a direct investment in a Pass-Thru Security.. The potential tax benefits from investing in Pass-Thru Securities depend on them being treated as partnerships for federal income tax purposes. |

| | - | The Fund is not a diversified investment, it may be more volatile than other investments. |

GraniteShares XOUT U.S. Large Cap ETF (XOUT)

The GraniteShares XOUT U.S. Large Cap ETF (the “Fund”) seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of the XOUT U.S. Large Cap Index (the “Index”)

Given the Fund’s investment objective of attempting to track the Index, the Fund does not follow traditional methods of active management, which may involve buying and selling securities based upon analysis of economic and market factors. Rather, the Adviser employs a “passive management” – or indexing – investment approach to seek to achieve the Fund’s investment objective.

GraniteShares ETF Trust

Management Discussion of Fund Performance (Unaudited) (continued)

The Index

The Index utilizes a proprietary, quantitative methodology developed by XOUT Capital, LLC (the “Index Provider”), designed to identify companies that have a risk of being disrupted and as a result could underperform their relevant sector. The companies identified are then excluded from the Index selection. In order to identify the companies to be excluded, each eligible company receives a score, the XOUT Score, based on the following 7 quantitative factors:

- Revenue growth

- Hiring growth

- Capital deployment

- Share repurchases

- Profitability and deposit growth (for banks)

- Earning sentiment

- Management performance

Each quantitative factor receives a quintile score from 1 to 5, 5 being the best. The quintile scores are weighted to achieve an aggregate quintile score for each company. Companies scoring below the median quintile are excluded from the index selection.

The Index is market capitalization weighted and reconstituted on a quarterly basis.

The index universe is composed of the 500 largest (by market capitalization) publicly traded companies listed on a US national securities exchange and headquartered in the United States with:

- a free-float percentage equal to or exceeding 50% of total shares outstanding,

- a share price less than $10,000 per share (USD),

- positive earnings per share for each quarter over the last trailing 12-month period for companies below median in market capitalization.

- minimum market capitalization of $5 billion at time of index reconstitution, and

- minimum liquidity of a quarter million shares average volume traded over the last six-month period.

Initial public offerings become eligible for inclusion in the Index six months after trading.

The Fund’s Investment Strategy

The Fund generally will use a “replication” strategy to seek to achieve its investment objective, meaning it generally will invest in the Index components in approximately the same weighting that such components have within the Index at the applicable time. However, under various circumstances, it may not be possible or practicable to purchase all of the securities in the Index in the approximate Index weight. Some examples include if and when a stock becomes illiquid and is therefore difficult to trade, the price of a stock becomes extremely high or a stock is subject to a market disruption event. In these circumstances, the Fund may use a “representative sampling” strategy, meaning it may purchase a subset of the securities in the Index in an effort to hold a portfolio of securities with generally the same risk and return characteristics as the Index. The Adviser expects that, over time, the correlation between the Fund’s performance and that of the Index, before fees and expenses, will be 95% or better. A correlation percentage of 100% would indicate perfect correlation. If the Fund uses a replication strategy, it can be expected to have greater correlation to the Index than if it uses a representative sampling strategy.

GraniteShares ETF Trust

Management Discussion of Fund Performance (Unaudited) (continued)

For the period October 4, 2019 through June 30, 2020 (the fiscal year end of the Fund), on a market price basis, the Fund returned 15.10%, on a total return basis. On a net asset value (“NAV”) basis, the Fund returned 15.78%, on a total return basis. During the same time period, the XOUT U.S. Large Cap Total Return Index returned 16.35%. The XOUT U.S. Large Cap Index is similar to the XOUT U.S. Large Cap Index except that the XOUT U.S Large Cap Total Return Index performance includes the return that would be generated if all distributions from securities comprising the XOUT U.S. Large Cap Index were reinvested in the XOUT U.S. Large Cap Index. The majority of the Fund’s underperformance on a NAV basis relative to the XOUT U.S. Large Cap Index Total Return Index is a result of fees and operating expenses incurred by the fund.

Sectors that contributed most significantly to the Fund’s return included the information technology, health care, communication services and consumer discretionary sectors (combined portfolio weight of 84%). Sectors that detracted most significantly from the Fund’s return included the energy, financial, real estate and utilities sectors (combined portfolio weight of 5%)

| Percentage Weight (% of Fund’s Net Assets as of June 30, 2020) |

| Sector | | Fund Percentage Weight By Sector* | |

| Information Technology | | | 37.0 | % |

| Health Care | | | 20.6 | % |

| Consumer Discretionary | | | 13.4 | % |

| Communication Services | | | 13.3 | % |

| Consumer Staples | | | 5.4 | % |

| Industrials | | | 4.6 | % |

| Financials | | | 3.1 | % |

| Real Estate | | | 1.2 | % |

| Materials | | | 0.7 | % |

| Energy | | | 0.3 | % |

| Utilities | | | 0.2 | % |

| S&P 500 | | | 0.1 | % |

| Cash | | | 0.1 | % |

*Allocations are subject to change.

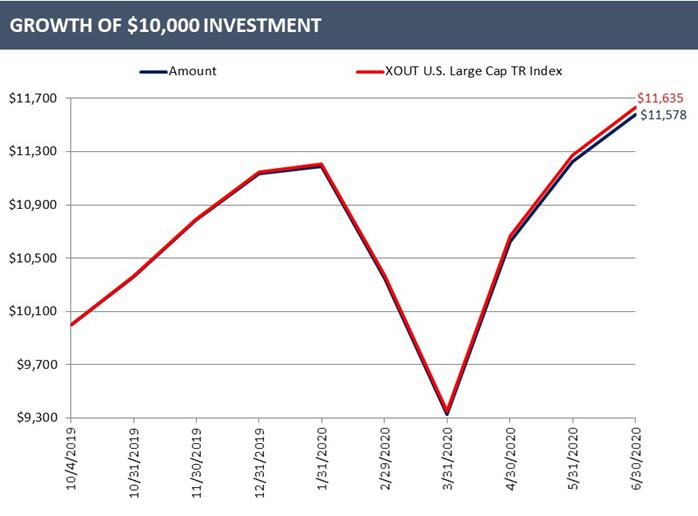

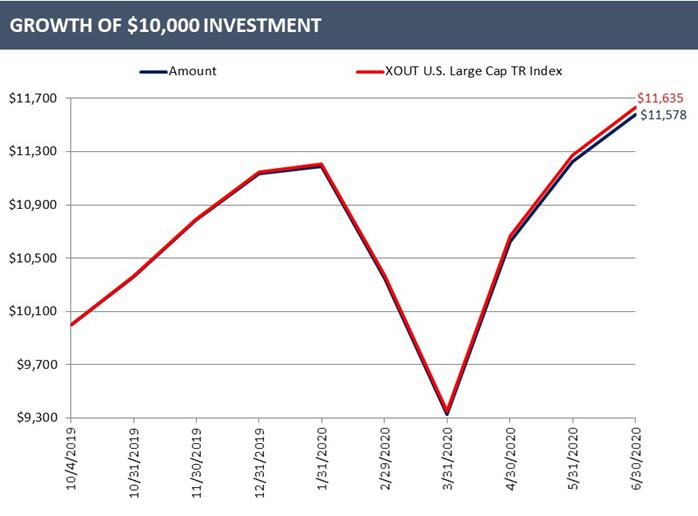

GROWTH OF $10,000 INVESTMENT

For the period October 4, 2019* to June 30, 2020

Insert Plot points from 3.1 “XOUT” tab

HISTORICAL PERFORMANCE

Total Return as of June 30, 2020

| | | Since

Inception

10/4/2019* | |

| GraniteShares XOUT U.S. Large Cap ETF NAV | | | 15.78 | % |

| GraniteShares XOUT U.S. Large Cap ETF Market Price** | | | 15.10 | % |

| XOUT U.S. Large Cap Total Return Index | | | 16.35 | % |

Total Annual Fund Operating Expenses were 0.60%. Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the fund’s most recent month end performance, please call 1(844) 476-8747.

| | * | Commencement of operations. |

| | ** | The price used to calculate market return (‘‘Market Price’’) is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00 pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV and are not individually redeemed from the Fund. |

| | - | The Fund is passively-managed and attempts to mirror the composition and performance of the Index. The Fund’s returns may diverge from that of the Index due to costs and expenses incurred by the Fund or its holdings may deviate from a precise correlation with the Index. The Index uses proprietary methodology to exclude certain securities and there can be no assurance this will result in positive performance. The Fund may concentrate its investments to the same extent as the index and it may be exposed to the risk of loss from adverse developments facing those industries. |

Shareholder Expense Example (Unaudited)

June 30, 2020

As a shareholder of the Fund you incur two types of costs: (1) transaction costs, including brokerage commissions paid on purchases and sales of Fund shares; and (2) ongoing costs, including management fees and other fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars and cents) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds.

The expense examples are based on an investment of $1,000 invested at January 1, 2020 and held for the entire period ended June 30, 2020.

ACTUAL EXPENSES

The first line under the Fund in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line for the Fund under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line under the Fund in the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of Fund shares. Therefore, the second line under the Fund in the table is useful in comparing ongoing Fund costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning Account Value 1/1/2020 | | | Ending Account Value 6/30/2020 | | | Annualized Expense Ratio for the Period | | | Expenses Paid During the Period(1) | |

| GraniteShares Bloomberg Commodity Broad Strategy No K-1 ETF | | | | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 805.30 | | | | 0.25 | % | | $ | 1.12 | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.62 | | | | 0.25 | % | | $ | 1.26 | |

| | | | | | | | | | | | | | | | | |

| GraniteShares HIPS US High Income ETF | | | | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 735.90 | | | | 0.70 | % | | $ | 3.02 | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.38 | | | | 0.70 | % | | $ | 3.52 | |

| | | | | | | | | | | | | | | | | |

| GraniteShares XOUT U.S. Large Cap ETF | | | | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,040.00 | | | | 0.60 | % | | $ | 3.04 | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.88 | | | | 0.60 | % | | $ | 3.02 | |

(1)Expenses are calculated using the Fund’s annualized expense ratio, multiplied by the average account value for the period, multiplied by 182/366 (to reflect the six month period).

See accompanying notes to consolidated financial statements.

GraniteShares ETF Trust

| Consolidated Schedule of Investments |

GraniteShares Bloomberg Commodity Broad Strategy No K-1 ETF

June 30, 2020

| Investments | | Principal | | | Value | |

| UNITED STATES TREASURY OBLIGATIONS – 91.8%(a) | | | | | | | | |

| U.S. Treasury Bill, 0.07%, 07/02/20 | | $ | 2,000,000 | | | $ | 1,999,995 | |

| U.S. Treasury Bill, 0.10%, 07/07/20 | | | 2,500,000 | | | | 2,499,955 | |

| U.S. Treasury Bill, 0.17%, 07/14/20(b) | | | 2,500,000 | | | | 2,499,910 | |

| U.S. Treasury Bill, 0.75%, 07/16/20(b) | | | 700,000 | | | | 699,966 | |

| U.S. Treasury Bill, 0.13%, 07/21/20 | | | 2,000,000 | | | | 1,999,880 | |

| U.S. Treasury Bill, 0.17%, 07/23/20(b) | | | 1,000,000 | | | | 999,931 | |

| U.S. Treasury Bill, 0.17%, 07/28/20 | | | 2,500,000 | | | | 2,499,770 | |

| U.S. Treasury Bill, 1.52%, 07/30/20 | | | 20,000 | | | | 19,998 | |

| U.S. Treasury Bill, 0.10%, 08/04/20 | | | 1,000,000 | | | | 999,882 | |

| U.S. Treasury Bill, 0.54%, 08/06/20(b) | | | 1,530,000 | | | | 1,529,832 | |

| U.S. Treasury Bill, 0.09%, 08/11/20 | | | 1,970,000 | | | | 1,969,731 | |

| U.S. Treasury Bill, 0.10%, 08/13/20 | | | 1,000,000 | | | | 999,851 | |

| U.S. Treasury Bill, 0.12%, 08/20/20 | | | 2,000,000 | | | | 1,999,667 | |

| U.S. Treasury Bill, 0.11%, 08/25/20 | | | 1,000,000 | | | | 999,801 | |

| U.S. Treasury Bill, 0.15%, 09/03/20 | | | 2,200,000 | | | | 2,199,482 | |

| U.S. Treasury Bill, 0.17%, 09/15/20(b) | | | 1,600,000 | | | | 1,599,561 | |

| U.S. Treasury Bill, 0.17%, 09/24/20 | | | 3,000,000 | | | | 2,999,044 | |

| U.S. Treasury Bill, 0.15%, 10/27/20 | | | 1,300,000 | | | | 1,299,446 | |

| U.S. Treasury Bill, 0.16%, 11/05/20 | | | 1,500,000 | | | | 1,499,206 | |

| U.S. Treasury Bill, 0.17%, 11/17/20(b) | | | 500,000 | | | | 499,681 | |

| U.S. Treasury Bill, 0.17%, 12/03/20 | | | 4,900,000 | | | | 4,896,941 | |

Total United States Treasury Obligations (Cost $36,709,683) | | | | | | | 36,711,530 | |

| | | | | | | | | |

Total Investments – 91.8% (Cost $36,709,683) | | | | | | | 36,711,530 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities – 8.2% | | | | | | | 3,281,794 | |

| Net Assets – 100.0% | | | | | | $ | 39,993,324 | |

| (a) | Represents zero coupon bonds. Rates shown reflects the effective yield. |

| (b) | A portion or all of the security is owned by GraniteShares BCOM Cayman Limited, a wholly-owned subsidiary of the Fund. See Note 2. |

See accompanying notes to consolidated financial statements.

GraniteShares ETF Trust

| Consolidated Schedule of Investments |

GraniteShares Bloomberg Commodity Broad Strategy No K-1 ETF (continued)

June 30, 2020

At June 30, 2020, open futures contracts were as follows:

| Description | | Number of Contracts | | Expiration Date | | Contract Type | | Notional Amount | | | Value/Unrealized Appreciation | | | Value/Unrealized Depreciation | |

| Brent Crude(a) | | 48 | | 7/31/2020 | | Long | | $ | 1,980,960 | | | $ | 291,290 | | | $ | – | |

| Coffee ‘C’(a) | | 27 | | 9/18/2020 | | Long | | | 1,022,625 | | | | 19,106 | | | | – | |

| Copper(a) | | 46 | | 9/28/2020 | | Long | | | 3,137,775 | | | | 126,950 | | | | – | |

| Corn(a) | | 140 | | 9/14/2020 | | Long | | | 2,390,500 | | | | 50,200 | | | | – | |

| Cotton No. 2(a) | | 20 | | 12/08/2020 | | Long | | | 608,800 | | | | 8,150 | | | | – | |

| Crude Oil(a) | | 59 | | 8/20/2020 | | Long | | | 2,321,060 | | | | 387,050 | | | | – | |

| Gasoline RBOB(a) | | 14 | | 8/31/2020 | | Long | | | 698,191 | | | | – | | | | (3,973 | ) |

| Gold 100 OZ(a) | | 40 | | 8/27/2020 | | Long | | | 7,202,000 | | | | 296,730 | | | | – | |

| KC Hard Red Winter Wheat(a) | | 29 | | 9/14/2020 | | Long | | | 637,637 | | | | – | | | | (34,830 | ) |

| Lean Hogs(a) | | 30 | | 8/14/2020 | | Long | | | 588,300 | | | | – | | | | (86,420 | ) |

| Live Cattle(a) | | 37 | | 8/31/2020 | | Long | | | 1,424,870 | | | | – | | | | (22,635 | ) |

| LME Nickel(a) | | 20 | | 7/13/2020 | | Long | | | 1,531,440 | | | | 109,033 | | | | – | |

| LME Nickel(a) | | (20) | | 7/13/2020 | | Short | | | (1,531,440 | ) | | | – | | | | (7,837 | ) |

| LME Nickel(a) | | 21 | | 9/14/2020 | | Long | | | 1,612,926 | | | | – | | | | (17,838 | ) |

| LME Nickel(a) | | (6) | | 9/14/2020 | | Short | | | (460,836 | ) | | | – | | | | (491 | ) |

| LME Primary Aluminum(a) | | 60 | | 7/13/2020 | | Long | | | 2,390,625 | | | | 163,906 | | | | – | |

| LME Primary Aluminum(a) | | (60) | | 7/13/2020 | | Short | | | (2,390,625 | ) | | | – | | | | (42,319 | ) |

| LME Primary Aluminum(a) | | 60 | | 9/14/2020 | | Long | | | 2,424,000 | | | | 11,594 | | | | – | |

| LME Primary Aluminum(a) | | (16) | | 9/14/2020 | | Short | | | (646,400 | ) | | | – | | | | (14,692 | ) |

| LME Zinc(a) | | 37 | | 7/13/2020 | | Long | | | 1,885,381 | | | | 85,031 | | | | – | |

| LME Zinc(a) | | (37) | | 7/13/2020 | | Short | | | (1,885,381 | ) | | | – | | | | (28,556 | ) |

| LME Zinc(a) | | (10) | | 9/14/2020 | | Short | | | (511,500 | ) | | | – | | | | (15,725 | ) |

| LME Zinc(a) | | 37 | | 9/14/2020 | | Long | | | 1,892,550 | | | | 15,856 | | | | – | |

| Low Sulphur Gasoil(a) | | 20 | | 9/10/2020 | | Long | | | 718,000 | | | | 16,625 | | | | – | |

| Natural Gas(a) | | 171 | | 8/27/2020 | | Long | | | 3,059,190 | | | | – | | | | (251,170 | ) |

| NY Harbour ULSD(a) | | 11 | | 8/31/2020 | | Long | | | 556,063 | | | | 6,926 | | | | – | |

| Silver(a) | | 19 | | 9/28/2020 | | Long | | | 1,770,515 | | | | 58,055 | | | | – | |

| Soybean(a) | | 55 | | 11/13/2020 | | Long | | | 2,426,188 | | | | 14,363 | | | | – | |

| Soybean Meal(a) | | 51 | | 12/14/2020 | | Long | | | 1,509,090 | | | | – | | | | (12,380 | ) |

| Soybean Oil(a) | | 64 | | 12/14/2020 | | Long | | | 1,106,304 | | | | – | | | | (1,932 | ) |

| Sugar #11(a) | | 92 | | 9/30/2020 | | Long | | | 1,232,358 | | | | – | | | | (21,930 | ) |

| Wheat (CBD)(a) | | 51 | | 9/14/2020 | | Long | | | 1,253,963 | | | | – | | | | (49,050 | ) |

| Total Futures Contracts | | | | | | | | | | | | $ | 1,660,865 | | | $ | (611,778 | ) |

| Net Unrealized Appreciation (Depreciation) | | | | | | | | | | | | $ | 1,049,087 | | | | | |

| (a) | A portion or all of the security is owned by GraniteShares BCOM Cayman Limited, a wholly-owned subsidiary of the Fund. See Note 2. |

The following table summarizes valuation of the Fund’s investments under the fair value hierarchy levels as of June 30, 2020:

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Asset Valuation Inputs | | | | | | | | | | | | | | | | |

| Investments in Securities | | | | | | | | | | | | | | | | |

| United States Treasury Obligations | | $ | 36,711,530 | | | $ | – | | | $ | – | | | $ | 36,711,530 | |

| Other Investments | | | | | | | | | | | | | | | | |

| Futures | | | 1,660,865 | | | | – | | | | – | | | | 1,660,865 | |

| Total | | $ | 38,372,395 | | | $ | – | | | $ | – | | | $ | 38,372,395 | |

| Liability Valuation Inputs | | | | | | | | | | | | | | | | |

| Other Investments | | | | | | | | | | | | | | | | |

| Futures | | $ | 611,778 | | | $ | – | | | $ | – | | | $ | 611,778 | |

As of June 30, 2020, there were no Level 3 investments held in the Fund.

See accompanying notes to consolidated financial statements.

GraniteShares ETF Trust

| Consolidated Statement of Assets and Liabilities |

June 30, 2020

| | | GraniteShares Bloomberg Commodity Broad Strategy No K-1 ETF | |

| Assets: | | | | |

| Investments at cost | | $ | 36,709,683 | |

| Investments at value | | $ | 36,711,530 | |

| Cash | | | 697,092 | |

| Unrealized appreciation on open futures contracts | | | 1,660,865 | |

| Due from broker | | | 1,544,718 | |

| Total Assets | | | 40,614,205 | |

| Liabilities: | | | | |

| Advisory fees payable | | | 9,103 | |

| Unrealized depreciation on open future contracts | | | 611,778 | |

| Total Liabilities | | | 620,881 | |

| Net Assets | | $ | 39,993,324 | |

| | | | | |

| Net Assets Consist of: | | | | |

| Paid-in capital | | $ | 38,725,012 | |

| Distributable earnings/accumulated (loss) | | | 1,268,312 | |

| Net Assets | | $ | 39,993,324 | |

| | | | | |

| Shares Outstanding | | | 2,052,000 | |

| Net Asset Value per share: | | $ | 19.49 | |

See accompanying notes to consolidated financial statements.

GraniteShares ETF Trust

| Consolidated Statement of Operations |

June 30, 2020

| | | GraniteShares Bloomberg Commodity Broad Strategy No K-1 ETF | |

| | | Year Ended

June 30, 2020 | |

| Investment Income: | | | | |

| Interest | | $ | 980,831 | |

| Total Investment Income | | | 980,831 | |

| Expenses: | | | | |

| Advisory fees | | | 152,480 | |

| Tax fees | | | 57 | |

| Total Expenses | | | 152,537 | |

| Net Investment Income | | | 828,294 | |

| Net Realized and Unrealized Gain (Loss) on: | | | | |

| Net realized gain (loss) on: | | | | |

| Investments | | | 20,671 | |

| Futures contracts | | | (16,639,005 | ) |

| Net realized loss | | | (16,618,334 | ) |

| Net change in unrealized appreciation (depreciation) on: | | | | |

| Investments | | | (13,795 | ) |

| Future contracts | | | 26,463 | |

| Net change in unrealized appreciation | | | 12,668 | |

| Net Realized and Unrealized Loss | | | (16,605,666 | ) |

| Net Decrease in Net Assets Resulting from Operations | | $ | (15,777,372 | ) |

See accompanying notes to consolidated financial statements.

GraniteShares ETF Trust

| Consolidated Statements of Changes in Net Assets |

June 30, 2020

| | | GraniteShares Bloomberg

Commodity Broad Strategy No K-1 ETF | |

| | | Year Ended

June 30, | |

| | | 2020 | | | 2019 | |

| Operations: | | | | | | | | |

| Net investment income | | $ | 828,294 | | | $ | 1,033,230 | |

| Net realized loss | | | (16,618,334 | ) | | | (5,845,353 | ) |

| Net change in unrealized gain | | | 12,668 | | | | 1,757,514 | |

| Net Decrease in Net Assets Resulting from Operations | | | (15,777,372 | ) | | | (3,054,609 | ) |

| | | | | | | | | |

| Distributions to shareholders | | | (968,910 | ) | | | (499,719 | ) |

| | | | | | | | | |

| From share transactions: | | | | | | | | |

| Proceeds from sales of shares | | | 63,573,411 | | | | 43,080,362 | |

| Cost of shares redeemed | | | (74,049,919 | ) | | | (2,361,563 | ) |

| Net increase (decrease) in net assets resulting from share transactions | | | (10,476,508 | ) | | | 40,718,799 | |

| Total Increase (Decrease) in net assets | | | (27,222,790 | ) | | | 37,164,471 | |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of year | | | 67,216,114 | | | | 30,051,643 | |

| End of year | | $ | 39,993,324 | | | $ | 67,216,114 | |

| | | | | | | | | |

| Changes in Shares Outstanding: | | | | | | | | |

| Shares outstanding, beginning of year | | | 2,802,000 | | | | 1,152,000 | |

| Shares sold | | | 3,050,000 | | | | 1,750,000 | |

| Shares redeemed | | | (3,800,000 | ) | | | (100,000 | ) |

| Shares outstanding, end of year | | | 2,052,000 | | | | 2,802,000 | |

See accompanying notes to consolidated financial statements.

GraniteShares ETF Trust

| Consolidated Financial Highlights |

| | | Year Ended June 30, | | | For the Period May 19, 2017(a) to | |

| GraniteShares Bloomberg Commodity Broad Strategy No K-1 ETF | | 2020 | | | 2019 | | | 2018 | | | June 30,

2017 | |

| Operating Performance: | | | | | | | | | | | | | | | | |

| Net asset value, beginning of year/period | | $ | 23.99 | | | $ | 26.09 | | | $ | 24.39 | | | $ | 25.00 | |

| Net investment income(b) | | | 0.30 | | | | 0.48 | | | | 0.32 | | | | 0.01 | |

| Net realized and unrealized gain (loss)(c) | | | (4.44 | ) | | | (2.36 | ) | | | 1.43 | | | | (0.62 | ) |

| Total gain (loss) from investment operations | | | (4.14 | ) | | | (1.88 | ) | | | 1.75 | | | | (0.61 | ) |

| Less distributions from: | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.36 | ) | | | (0.22 | ) | | | (0.05 | ) | | | — | |

| Net asset value, end of year/period | | $ | 19.49 | | | $ | 23.99 | | | $ | 26.09 | | | $ | 24.39 | |

| Total Return | | | (17.55 | )% | | | (7.16 | )%(d) | | | 7.19 | %(d) | | | (2.46 | )%(d)(e) |

| Ratios to Average Net Assets and Supplemental Data: | | | | | | | | | | | | | | | | |

| Net assets, end of year/period (in 000’s) | | $ | 39,993 | | | $ | 67,216 | | | $ | 30,052 | | | $ | 2,487 | |

| Ratio of net investment income to average net assets | | | 1.36 | % | | | 1.99 | % | | | 1.21 | % | | | 0.49 | %(f) |

| Ratio of operating expenses before waivers/reimbursements | | | 0.25 | % | | | 0.26 | % | | | 0.52 | % | | | 1.85 | %(f) |

| Ratio of net operating expenses net of waivers/reimbursements | | | 0.25 | % | | | 0.25 | % | | | 0.27 | % | | | 0.30 | %(f) |

| Portfolio turnover rate | | | — | % | | | — | % | | | — | % | | | — | % |

| (a) | Commencement of operations. |

| (b) | Per share data is calculated using the average daily shares outstanding method. |

| (c) | Calculation of the net gain (loss) per share (both realized and unrealized) may not correlate to the aggregate realized and unrealized gains (losses) presented in the Consolidated Statement of Operations due to the timing of sales and repurchases of Fund shares in relation to fluctuating market values of the investments of the Fund. |

| (d) | Total return would have been lower if certain fund expenses had not been reimbursed by the Advisor. |

| (e) | Not annualized |

| (f) | Annualized. |

See accompanying notes to consolidated financial statements.

Notes to Consolidated Financial Statements

June 30, 2020

1. ORGANIZATION

The GraniteShares ETF Trust (the “Trust”) was organized as a Delaware statutory trust on November 7, 2016. The Trust is registered with the Securities and Exchange Commission (the “SEC”) under the Investment Company Act of 1940, as amended (the “1940 Act”), and the offering of each Fund’s shares (“Shares”) is registered under the Securities Act of 1933, as amended (the “Securities Act”). The Trust is an open-end management investment company currently consisting of three investment series. GraniteShares Bloomberg Commodity Broad Strategy No K-1 ETF (the “Fund”) commenced operations on May 19, 2017 and is a non-diversified series. The remaining Funds in the Trust are presented separately.

2. CONSOLIDATED SUBSIDIARY

The Fund invests in certain commodity-related investments through GraniteShares BCOM Cayman Limited, a wholly-owned subsidiary (the “Subsidiary”).

The following table reflects the net assets of the Subsidiary as a percentage of the Fund’s net assets at June 30, 2020:

| Fund | | Wholly Owned Subsidiary | | Value | | | Percentage of Fund’s Net Assets | |

| GraniteShares Bloomberg Commodity Broad Strategy No K-1 ETF | | GraniteShares BCOM Cayman Limited | | $ | 8,774,957 | | | | 21.9 | % |

3. SIGNIFICANT ACCOUNTING POLICIES

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (U.S. GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. The Fund follows the accounting and reporting guidance in the Accounting Standards Codifications 946, “Financial Services—Investment Companies” issued by the U.S. Financial Accounting Standards Board.

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements.

Investment Transactions and Investment Income: Investment transactions are recorded on the trade date. Gains and losses on securities sold are determined on the basis of identified cost. Dividend income, if any, is recorded on the ex-dividend date or, in the case of foreign securities, as soon as each Fund is informed of the ex-dividend dates. Interest income, including accretion of discounts and amortization of premiums, is recorded on the accrual basis.

Dividend Distributions: Distributions to shareholders are recorded on the ex-dividend date and are determined in accordance with federal income tax regulations, which may differ from U.S. GAAP. The Fund distribute all or substantially all of their net investment income to shareholders in the form of dividends.

Futures contracts: The Fund, through its Subsidiary, invests in a combination of exchange-listed commodity futures contracts in the normal course of pursuing its investment objectives. A futures contract is a financial instrument in which a party agrees to pay a fixed price for securities or commodities at a specified future date. Futures contracts are traded at market prices on exchanges pursuant to terms common to all market participants. Upon entering into such contracts, the Fund is required to deposit with the broker, either in cash or in securities, an initial margin in an amount equal to a certain percentage of the contract amount. Subsequent fluctuations in the value of the contract are recorded for financial statement purposes as unrealized gains or losses by the Fund and variation margin receivable or payable. Payments received or paid by the Fund adjusts the variation margin account. When a contract is closed, the Fund records a realized gain or loss.

Futures contracts may be highly volatile. Price movements may be sudden and extreme, and are influenced by a variety of factors including, among other things, changing supply and demand relationships; climate; government agricultural, trade, fiscal, monetary and exchange control programs and policies; national and international political and economic events; crop diseases; the purchasing and marketing programs of different nations; and changes in interest rates.

Open futures contracts at June 30, 2020 are listed in the Consolidated Schedule of Investments. As of June 30, 2020, the balance of margin receivable from the broker to the Fund was $1,544,718 as presented on the Consolidated Statement of Assets and Liabilities as due from broker. At June 30, 2020 the Fund had a variation margin receivable from broker of $2,593,805. The variation margin payable/receivable is represented by the difference between the balance of margin receivable from the broker and the unrealized appreciation/depreciation on open futures contracts as of June 30, 2020.

4. SECURITIES VALUATION

Investment Valuation: The Fund calculates its net asset value (“NAV”) each day the New York Stock Exchange (the “NYSE”) is open for trading as of the close of regular trading on the NYSE, normally 4:00 p.m. Eastern time (the “NAV Calculation Time”).

Notes to Consolidated Financial Statements (continued)

June 30, 2020

If a market quotation is not readily available or is deemed not to reflect market value, the Adviser determines the price of the security held by the Fund based on a determination of the security’s fair value pursuant to policies and procedures approved by the Board of Trustees (the “Board”). In addition, the Fund may use fair valuation to price securities that trade on a foreign exchange when a significant event has occurred after the foreign exchange closes but before the time at which the Fund’s NAV is calculated. Such valuations would typically be categorized as Level 2 or Level 3 in the fair value hierarchy described below.

Fixed income instruments are valued based on prices received from pricing services. The pricing services use multiple valuation techniques to determine the valuation of fixed income instruments. In instances where sufficient market activity exists, the pricing services may utilize a market based approach through which trades or quotes from market makers are used to determine the valuation of these instruments.

Exchange-traded futures contracts are valued at the closing price in the market where such contracts are principally traded. If no closing price is available, exchange-traded futures contracts are fair valued at the mean of the last bid and asked prices, if available, and otherwise at the closing bid price. Such valuations are typically categorized as Level 1 in the fair value hierarchy described below.

Certain securities may not be able to be priced by pre-established pricing methods. Such securities may be valued by the Board or its delegate at fair value. These securities generally include but are not limited to, restricted securities (securities which may not be publicly sold without registration under the 1933 Act) for which a pricing service is unable to provide a market price; securities whose trading has been formally suspended; a security whose market price is not available from a pre- established pricing source; a security with respect to which an event has occurred that is likely to materially affect the value of the security after the market has closed but before the calculation of each Fund net asset value (as may be the case in foreign markets on which the security is primarily traded) or make it difficult or impossible to obtain a reliable market quotation; and a security whose price, as provided by the pricing service, does not reflect the security’s “fair value.” A variety of factors may be considered in determining the fair value of such securities.

Valuing the Fund’s investments using fair value pricing will result in using prices for those investments that may differ from current market valuations.

5. FAIR VALUE MEASUREMENT

The Financial Accounting Standards Board (FASB) established a framework for measuring fair value in accordance with U.S. GAAP. Under Fair Value Measurements and Disclosures, various inputs are used in determining the value of the exchange traded fund’s investments. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The three Levels of inputs of the fair value hierarchy are defined as follows:

| | Level 1 — Unadjusted quoted prices in active markets for identical assets or liabilities. |

| | |

| | Level 2 — Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar securities, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| | |

| | Level 3 — Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available; representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The hierarchy classification of inputs used to value the Fund’s investments at June 30, 2020, is disclosed at the end of the Fund’s Consolidated Schedule of Investments.

6. ADVISORY AND OTHER AGREEMENTS

GraniteShares Advisors LLC (the “Adviser”), the investment adviser to the Fund, is a Delaware limited Liability Company located at 205 Hudson Street, 7th Floor, New York, NY 10013. The Adviser provides investment advisory services to exchange-traded funds. The Adviser serves as investment adviser to the Fund with overall responsibility for the portfolio management of the Fund, subject to the supervision of the Board of Trustees (the “Board”) of the Trust.

For its services, the Adviser receives a fee that is equal to 0.25% per annum of the average daily net assets of the Fund calculated daily and paid monthly. Pursuant to the Advisory Agreement, the Adviser is responsible for substantially all expenses of the Fund (excluding interest, taxes, brokerage commissions, expenses related to short sales, other expenditures which are capitalized in accordance with generally accepted accounting principles, other extraordinary expenses not incurred in the ordinary course of the Fund’s business, and amounts, if any, payable pursuant to a plan adopted in accordance with Rule 12b-1 under the 1940 Act).

Notes to Consolidated Financial Statements (continued)

June 30, 2020

Pursuant to the Advisory Agreement, the Adviser has agreed to pay all expenses of the Fund, except for: (i) brokerage expenses and other fees, charges, taxes, levies or expenses (such as stamp taxes) incurred in connection with the execution of portfolio transactions or in connection with creation and redemption transactions; (ii) legal fees or expenses in connection with any arbitration, litigation or pending or threatened arbitration or litigation, including any settlements in connection therewith; (iii) compensation and expenses of counsel to the Independent Trustees; (iv) extraordinary expenses; (v) distribution fees and expenses paid by the Trust under any distribution plan adopted pursuant to Rule 12b-1 under the 1940 Act; (vi) interest and taxes of any kind or nature; (vii) any fees and expenses related to the provision of securities lending services; and (viii) the advisory fee payable to the Adviser under the Advisory Agreement.

This contractual arrangement may only be changed or eliminated by or with the consent of the Fund’s Board of Trustees.

During the year ended June 30, 2020, the Fund received no reimbursement payments from the Adviser.

The Adviser is the only related party involved with the operations of the Fund.

Administrator, Custodian, Accounting Agent and Transfer Agent Services: The Bank of New York Mellon serves as the Fund’s Administrator, Custodian, Accounting Agent and Transfer Agent (in each capacity, the “Administrator”, “Custodian,” “Accounting Agent” or “Transfer Agent”) pursuant to the Fund’s Administration and Accounting Agreement. The Bank of New York Mellon is a subsidiary of The Bank of New York Mellon Corporation, a financial holding company.

Distribution and Service Fees: Foreside Fund Services, LLC. (“Distributor”) serves as the Fund’s distributor. The Trust has adopted a distribution and service plan (“Rule 12b-1 Plan”) pursuant to Rule 12b-1 under the 1940 Act. Under the Rule 12b-1 Plan, the Fund is authorized to pay an amount up to a maximum annual rate of 0.25% of its average net assets in connection with the sale and distribution of its shares and pay service fees in connection with the provision of ongoing services to shareholders. No distribution fees are currently charged to the Fund; there are no plans to impose these fees.

Share Transactions

The Fund issues and redeems shares at NAV only with certain authorized participants in large increments known as Creation Units. A Creation Unit consists of 50,000 shares. Creation Units are issued and redeemed principally in exchange for the deposit or delivery of cash. The Fund’s shares are available in smaller increments to investors in the secondary market at market prices and may be subject to commissions. Authorized participants pay a transaction fee to the shareholder servicing agent when purchasing and redeeming Creation Units of the Fund. The transaction fee is used to defray the costs associated with the issuance and redemption of Creation Units.

7. INVESTMENT TRANSACTIONS

There were no cost of purchases and proceeds from sales of investment securities (excluding short-term investments) for the year ended June 30, 2020.

8. VALUATION OF DERIVATIVE INSTRUMENTS

The Fund has adopted authoritative standards of accounting for derivative instruments which establish disclosure requirements for derivative instruments. These standards improve financial reporting for derivative instruments by requiring enhanced disclosures that enables investors to understand how and why a fund uses derivatives instruments, how derivatives instruments are accounted for and how derivative instruments affect a fund’s financial position and results of operations. The Fund uses derivative instruments as part of its principal investment strategy to achieve its investment objective.

The following is the location and fair values of the Fund’s derivative investments disclosed, if any, in the Consolidated Statement of Assets and Liabilities, categorized by primary market risk exposure as of June 30, 2020:

| Fund | | Asset Derivatives: | | Commodity Risk | |

| GraniteShares Bloomberg Commodity Broad Strategy No K-1 ETF | | Unrealized appreciation on futures contracts | | $ | 1,660,865 | |

| Fund | | Liability Derivatives: | | Commodity Risk | |

| GraniteShares Bloomberg Commodity Broad Strategy No K-1 ETF | | Unrealized depreciation on futures contracts | | $ | 611,778 | |

Notes to Consolidated Financial Statements (continued)

June 30, 2020

The following is the location and the effect of derivative investments, if any, on the Fund’s Consolidated Statement of Operations, categorized by primary market risk exposure during the year ended June 30, 2020:

| Fund | | Realized Gain (Loss) | | Commodity Risk | |

| GraniteShares Bloomberg Commodity Broad Strategy No K-1 ETF | | Futures contracts | | $ | (16,639,005 | ) |

| Fund | | Change in Unrealized Gain (Loss): | | Commodity Risk | |

| GraniteShares Bloomberg Commodity Broad Strategy No K-1 ETF | | Futures contracts | | $ | 26,463 | |

The following is a summary of the average volume derivative activity for the year ended June 30, 2020:

| | | GraniteShares Bloomberg Commodity Broad Strategy No K-1 ETF | |

| Futures contracts: | | | | |

| Average notional value of contracts | | $ | 65,468,988 | |

For the purpose of this calculation, the absolute value of quarterly outstanding notional amounts were used.

9. FEDERAL INCOME TAX MATTERS

The Fund intends to qualify as a ‘‘regulated investment company’’ under Subchapter M of the Internal Revenue Code of 1986, as amended. If so qualified, the Fund will not be subject to Federal income tax to the extent it distributes substantially all of its net investment income and net capital gains to its shareholders. Accounting for Uncertainty in Income Taxes provides guidance for how uncertain tax positions should be recognized, measured, presented and disclosed in the consolidated financial statements, and requires the evaluation of tax positions taken or expected to be taken in the course of preparing the Fund’s tax return to determine whether the tax positions are ‘‘more-likely-than-not’’ of being sustained by the applicable tax authority. Tax positions not deemed to meet the more-likely-than-not threshold would be recorded as a tax benefit or expense in the current year. Interest and penalty related to income taxes would be recorded as income tax expense. Management of the Fund is required to analyze all open tax years, as defined by IRS statute of limitations, for all major jurisdictions, including federal tax authorities and certain state tax authorities. As of June 30, 2020, the Fund did not have a liability for any unrecognized tax benefits. The Fund has no examination in progress and is not aware of any tax positions for which it is reasonably possible that the amounts of unrecognized tax benefits will significantly change in the next twelve months.

At June 30, 2020, the cost of investments and net unrealized appreciation (depreciation) for federal income tax purposes were as follows:

| Fund | | Federal Tax Cost of Investments | | | Gross Unrealized Appreciation | | | Gross Unrealized Depreciation | | | Net Unrealized Appreciation (Depreciation) | |

GraniteShares Bloomberg Commodity Broad

Strategy No K-1 ETF | | $ | 36,709,837 | | | $ | 1,855 | | | $ | (162 | ) | | $ | 1,693 | |

The differences between book and tax basis cost of investments and net unrealized appreciation (depreciation) are primarily attributable to investments in pass through entities.

At June 30, 2020, the components of undistributed or accumulated earnings (loss) on a tax-basis were as follows:

| Fund | | Undistributed Net Investment Income (Loss) | | | Accumulated Capital and Other Gains (Losses) | | | Net Unrealized Appreciation (Depreciation) | | | Total Accumulated Earnings (Losses) | |

| GraniteShares Bloomberg Commodity Broad Strategy No K-1 ETF | | $ | 217,532 | | | $ | - | | | $ | 1,050,780 | | | $ | 1,268,312 | |

Notes to Consolidated Financial Statements (continued)

June 30, 2020

At June 30, 2020, the effect of permanent book/tax reclassifications resulted in increase (decrease) to the components of net assets were as follows:

| Fund | | Total distributable earnings/ (accumulated Loss) | | | Paid-In Capital | |

GraniteShares Bloomberg Commodity Broad

Strategy No K-1 ETF | | $ | 16,476,731 | | | $ | (16,476,731 | ) |

10. INDEMNIFICATION

In the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties which provide general indemnities. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. Management expects this risk of loss to be remote.

11. PRINCIPAL RISKS

The Fund is “non-diversified,” meaning that a relatively high percentage of their assets may be invested in a limited number of issuers of securities.

In the normal course of business, the Fund makes investments in financial instruments where the risk of potential loss exists due to changes in the market. The following is a description of select risks of investing in the Fund.

Commodity Futures: The Fund expects to gain exposure to the commodity futures markets initially by investing in Commodity Futures through the Subsidiary. A Commodity Futures contract is a standardized contract traded on, or subject to the rules of, an exchange that calls for the future delivery of a specified quantity and type of underlying commodity at a specified time and place or, alternatively, may call for cash settlement.

Commodity-linked derivative instruments: Commodities are assets that have tangible properties, such as oil, metals, and agricultural products. A commodity-linked instrument is a financial instrument whose value is linked to the movement of a commodity, commodity index, or commodity futures contract. The value of commodity-linked instruments may be affected by overall market movements and other factors affecting the value of a particular industry or commodity, such as weather, disease, embargoes, or political and regulatory developments.