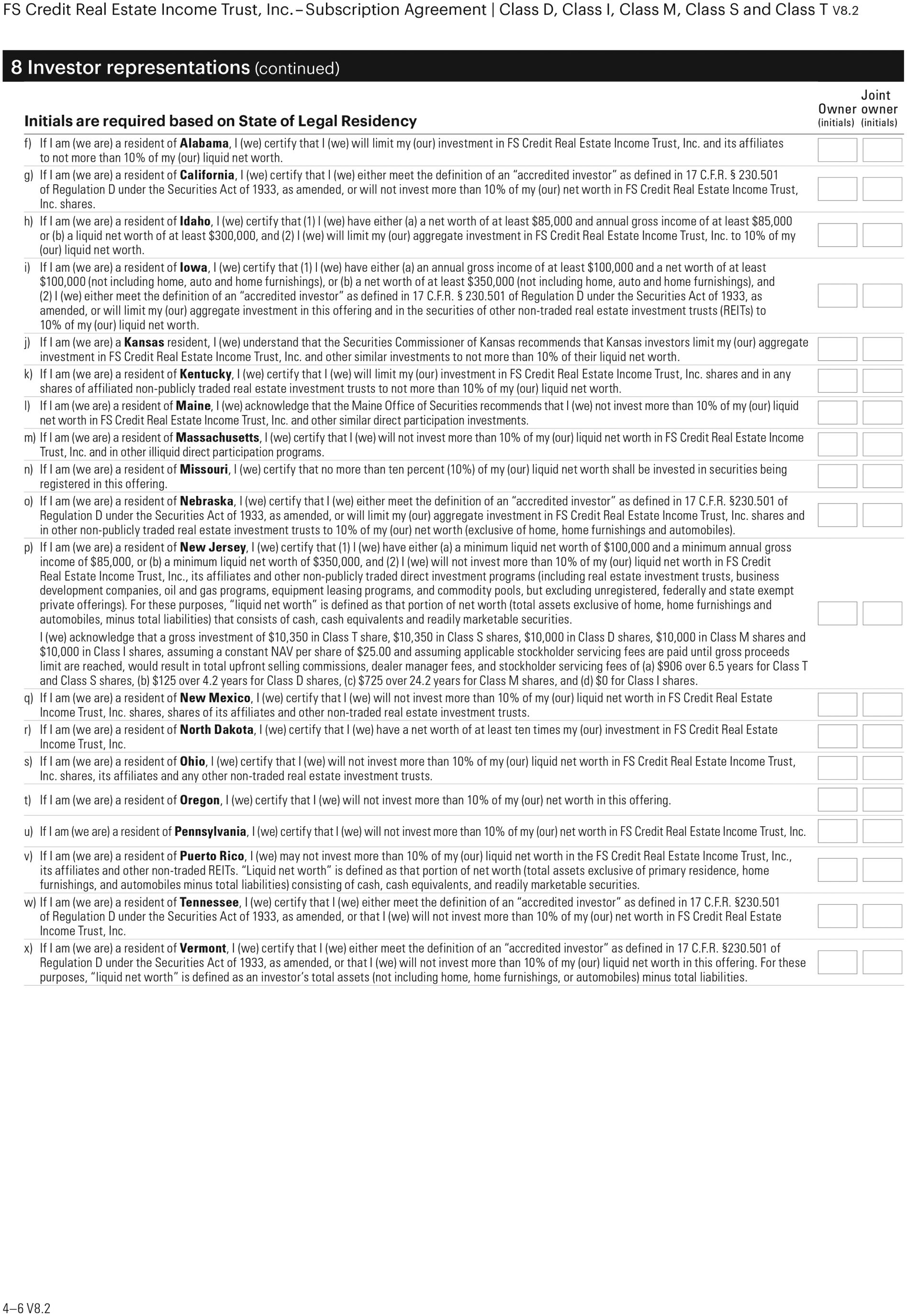

FS Credit Real Estate Income Trust, Inc.Subscription Agreement | Class D, Class I, Class M, Class S and Class T V8.28 Investor representations (continued)JointOwner ownerInitials are required based on State of Legal Residency(initials) (initials)f)If I am (we are) a resident of Alabama, I (we) certify that I (we) will limit my (our) investment in FS Credit Real Estate Income Trust, Inc. and its affiliatesto not more than 10% of my (our) liquid net worth.g)If I am (we are) a resident of California, I (we) certify that I (we) either meet the definition of an accredited investor as defined in 17 C.F.R. (S) 230.501of Regulation D under the Securities Act of 1933, as amended, or will not invest more than 10% of my (our) net worth in FS Credit Real Estate Income Trust,Inc. shares.h)If I am (we are) a resident of Idaho, I (we) certify that (1) I (we) have either (a) a net worth of at least $85,000 and annual gross income of at least $85,000or (b) a liquid net worth of at least $300,000, and (2) I (we) will limit my (our) aggregate investment in FS Credit Real Estate Income Trust, Inc. to 10% of my(our) liquid net worth.i)If I am (we are) a resident of Iowa, I (we) certify that (1) I (we) have either (a) an annual gross income of at least $100,000 and a net worth of at least$100,000 (not including home, auto and home furnishings), or (b) a net worth of at least $350,000 (not including home, auto and home furnishings), and(2) I (we) either meet the definition of an accredited investor as defined in 17 C.F.R. (S) 230.501 of Regulation D under the Securities Act of 1933, asamended, or will limit my (our) aggregate investment in this offering and in the securities of other non-traded real estate investment trusts (REITs) to10% of my (our) liquid net worth.j)If I am (we are) a Kansas resident, I (we) understand that the Securities Commissioner of Kansas recommends that Kansas investors limit my (our) aggregateinvestment in FS Credit Real Estate Income Trust, Inc. and other similar investments to not more than 10% of their liquid net worth.k)If I am (we are) a resident of Kentucky, I (we) certify that I (we) will limit my (our) investment in FS Credit Real Estate Income Trust, Inc. shares and in anyshares of affiliated nonpublicly traded real estate investment trusts to not more than 10% of my (our) liquid net worth.l)If I am (we are) a resident of Maine, I (we) acknowledge that the Maine Office of Securities recommends that I (we) not invest more than 10% of my (our) liquidnet worth in FS Credit Real Estate Income Trust, Inc. and other similar direct participation investments.m)If I am (we are) a resident of Massachusetts, I (we) certify that I (we) will not invest more than 10% of my (our) liquid net worth in FS Credit Real Estate IncomeTrust, Inc. and in other illiquid direct participation programs.n)If I am (we are) a resident of Missouri, I (we) certify that no more than ten percent (10%) of my (our) liquid net worth shall be invested in securities beingregistered in this offering.o)If I am (we are) a resident of Nebraska, I (we) certify that I (we) either meet the definition of an accredited investor as defined in 17 C.F.R. (S)230.501 ofRegulation D under the Securities Act of 1933, as amended, or will limit my (our) aggregate investment in FS Credit Real Estate Income Trust, Inc. shares andin other nonpublicly traded real estate investment trusts to 10% of my (our) net worth (exclusive of home, home furnishings and automobiles).p)If I am (we are) a resident of New Jersey, I (we) certify that (1) I (we) have either (a) a minimum liquid net worth of $100,000 and a minimum annual grossincome of $85,000, or (b) a minimum liquid net worth of $350,000, and (2) I (we) will not invest more than 10% of my (our) liquid net worth in FS CreditReal Estate Income Trust, Inc., its affiliates and other non-publicly traded direct investment programs (including real estate investment trusts, businessdevelopment companies, oil and gas programs, equipment leasing programs, and commodity pools, but excluding unregistered, federally and state exemptprivate offerings). For these purposes, liquid net worth is defined as that portion of net worth (total assets exclusive of home, home furnishings andautomobiles, minus total liabilities) that consists of cash, cash equivalents and readily marketable securities.I (we) acknowledge that a gross investment of $10,350 in Class T share, $10,350 in Class S shares, $10,000 in Class D shares, $10,000 in Class M shares and$10,000 in Class I shares, assuming a constant NAV per share of $25.00 and assuming applicable stockholder servicing fees are paid until gross proceedslimit are reached, would result in total upfront selling commissions, dealer manager fees, and stockholder servicing fees of (a) $906 over 6.5 years for Class Tand Class S shares, (b) $125 over 4.2 years for Class D shares, (c) $725 over 24.2 years for Class M shares, and (d) $0 for Class I shares.q)If I am (we are) a resident of New Mexico, I (we) certify that I (we) will not invest more than 10% of my (our) liquid net worth in FS Credit Real EstateIncome Trust, Inc. shares, shares of its affiliates and other non-traded real estate investment trusts.r)If I am (we are) a resident of North Dakota, I (we) certify that I (we) have a net worth of at least ten times my (our) investment in FS Credit Real EstateIncome Trust, Inc.s)If I am (we are) a resident of Ohio, I (we) certify that I (we) will not invest more than 10% of my (our) liquid net worth in FS Credit Real Estate Income Trust,Inc. shares, its affiliates and any other non-traded real estate investment trusts.t)If I am (we are) a resident of Oregon, I (we) certify that I (we) will not invest more than 10% of my (our) net worth in this offering.u)If I am (we are) a resident of Pennsylvania, I (we) certify that I (we) will not invest more than 10% of my (our) net worth in FS Credit Real Estate Income Trust, Inc.v)If I am (we are) a resident of Puerto Rico, I (we) may not invest more than 10% of my (our) liquid net worth in the FS Credit Real Estate Income Trust, Inc.,its affiliates and other non-traded REITs. Liquid net worth is defined as that portion of net worth (total assets exclusive of primary residence, homefurnishings, and automobiles minus total liabilities) consisting of cash, cash equivalents, and readily marketable securities.w)If I am (we are) a resident of Tennessee, I (we) certify that I (we) either meet the definition of an accredited investor as defined in 17 C.F.R. (S)230.501of Regulation D under the Securities Act of 1933, as amended, or that I (we) will not invest more than 10% of my (our) net worth in FS Credit Real EstateIncome Trust, Inc.x)If I am (we are) a resident of Vermont, I (we) certify that I (we) either meet the definition of an accredited investor as defined in 17 C.F.R. (S)230.501 ofRegulation D under the Securities Act of 1933, as amended, or that I (we) will not invest more than 10% of my (our) liquid net worth in this offering. For thesepurposes, liquid net worth is defined as an investors total assets (not including home, home furnishings, or automobiles) minus total liabilities.