Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23216

FS Series Trust

(Exact name of registrant as specified in charter)

201 Rouse Boulevard

Philadelphia, Pennsylvania 19112

(Address of principal executive officers)

Michael C. Forman

FS Series Trust

201 Rouse Boulevard

Philadelphia, Pennsylvania 19112

(Name and address of agent for service)

Registrant’s telephone number, including area code: (215) 495-1185

Date of fiscal year end: December 31

Date of reporting period: December 31, 2021

Table of Contents

| Item 1. | Reports to Shareholders. |

| (a) | The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”): |

Table of Contents

| Annual report | |

| 2021 |

FS Series Trust

FS Multi-Strategy Alternatives Fund

FS Managed Futures Fund

FS Chiron Real Asset Fund |

Table of Contents

Annual Report for the Year Ended December 31, 2021

| Page | ||||

Management’s Discussion of Fund Performance (unaudited) | ||||

| 1 | ||||

| 3 | ||||

| 5 | ||||

| 7 | ||||

| 9 | ||||

Schedule of Investments | ||||

| 10 | ||||

| 44 | ||||

| 50 | ||||

| 54 | ||||

| 56 | ||||

| 57 | ||||

Financial Highlights | ||||

| 59 | ||||

| 63 | ||||

| 67 | ||||

| 71 | ||||

Table of Contents

FS MULTI-STRATEGY ALTERNATIVES FUND

Dear Shareholder:

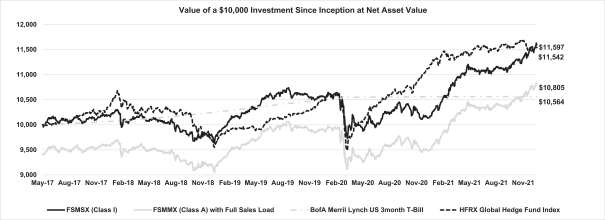

For the fiscal year ended December 31, 2021, FS Multi-Strategy Alternatives Fund (the “Fund”) returned 13.96% (Class I shares) with a realized 3.8% annualized monthly volatility and a 0.49 correlation to equities. The BofA Merrill Lynch 3-Month U.S. Treasury Bill Index (which tracks the performance of the U.S. dollar-denominated U.S. Treasury Bills publicly issued in the U.S. domestic market with remaining term to final maturity of less than 3 months), the primary benchmark for the Fund, had a positive return of 0.05% over this time period.

The Fund follows a “hybrid” investment approach — allocating to both skilled hedge fund managers for alpha and rules-based alternative beta strategies for long/short sources of return that can be captured systematically. These strategies trade long and short across different asset groups: stocks of major developed markets, country indices, bond futures, interest rate futures, currencies, bonds and credit securities.

The fund allocates to three hedge fund managers:

| • | Chilton Investment Company, LLC (“Chilton”) pursues a long/short equity strategy focused on high-quality companies with strong business models and growth potential at reasonable valuations. |

| • | Crabel Capital Management, LLC (“Crabel”): specializes in the systematic, automated trading of worldwide futures and foreign exchange designed to capture market anomalies implemented through a technologically advanced, low latency infrastructure to deliver uncorrelated return. |

| • | MidOcean Credit Fund Management, L.P. (“MidOcean”) implements an event driven long/short credit strategy which seeks to capture current income and growth from three primary pockets of inefficiencies in the credit market: callable bonds, short-dated credit and crossover credit. |

The Fund invests across four main alternative beta strategy categories:

| • | Equity: Investing in stocks seeking to generate returns less sensitive to market direction based on specific factors (e.g. size, quality) |

| • | Macro: Investing in bonds, currencies and commodities seeking to generate risk-adjusted returns through specific factors (e.g., value, carry) |

| • | Technical trading: Investing across asset classes seeking to generate uncorrelated returns-based on price trends and trading patterns (e.g., momentum, mean reversion) |

| • | Volatility: Investing in volatility markets seeking to profit from price inefficiencies and relative value opportunities (e.g., realized volatility vs implied volatility) |

The Fund uses derivatives to execute investment objectives for a variety of purposes, such as to seek economic exposure to one or more alternative strategies, enhance returns, increase investment flexibility, speculate on a targeted investment opportunity, or for hedging purposes. In attempting to achieve its investment objectives, the Fund primarily use total return basket swaps that seek both long and short exposure on variety of strategies, in a notional amount, that the Funds could not otherwise have exposure to on a name by name basis. The total return basket swaps include exposure to equity, foreign currency, commodity and interest rate risk.

Performance this year was driven primarily by positive contributions from the rules-based alternative beta strategies. The Fund’s best performing alternative beta strategies were Equity risk premia strategies, particularly those strategies seeking to capture the value, size, and volatility factors. The Fund’s hedge fund managers, Chilton, MidOcean, and Crabel all positively contributed to fund performance in 2021. Though 2021 ended on a

1

Table of Contents

positive note for traditional assets, 2022 is likely to be more volatile and less constructive for markets. This type of environment creates a great opportunity set for the fund’s alpha managers and alternative beta strategies to deliver differentiated return. The fund’s low reliance on beta, broad return contribution and uncorrelated return streams allow the fund to navigate ever changing market dynamics. By focusing on balanced, macro aware return the fund is looking to generate quality of return with diversification benefits such as low correlation to equities and bonds as well as capital preservation.

Sincerely,

| • | Michael Kelly |

| • | Scott Burr |

Cumulative Total Return

| Period from May 16, 2017 (Commencement of Operations) through December 31, 2021 | 2021 | |||||||

FSMSX (Class I) | 15.97 | % | 13.96 | % | ||||

FSMMX (Class A) with Full Sales Load | 8.06 | % | 7.04 | % | ||||

BofA Merril Lynch US 3month T-Bill | 5.64 | % | 0.05 | % | ||||

HFRX Global Hedge Fund Index | 15.42 | % | 3.04 | % | ||||

Performance quoted represents past performance, which may be higher or lower than current performance. Past performance is not indicative of future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original costs. The returns shown do not reflect taxes that an investor would pay on Fund distributions or on the sale of Fund shares. To obtain the most recent month-end performance, visit www.fsinvestments.com.

2

Table of Contents

Dear Shareholder:

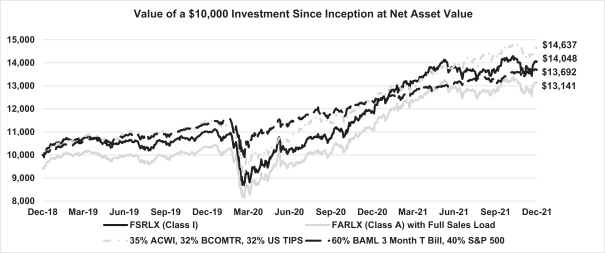

For the fiscal year ended December 31, 2021, FS Chiron Real Asset Fund (the “Fund”) returned 18.0% (Class I shares) with a realized 8.1% annualized monthly volatility and a 0.49 correlation to equities. The primary benchmarks for the Fund are a blended index consisting of 60% the BofA Merrill Lynch 3-Month U.S. Treasury Bill Index (which tracks the performance of the U.S. dollar-denominated U.S. Treasury Bills publicly issued in the U.S. domestic market with remaining term to final maturity of less than 3 months) and 40% the S&P 500 Index (which tracks the performance of large capitalization US equities), as well as a blended index consisting of 35% the MSCI ACWI Net Total Return USD Index (which is a free-float weighted equity index including both emerging and developed world markets), 32.5% the Bloomberg Commodity Total Return Index (which is composed of commodity futures contracts weighted 2/3 by trading volume and 1/3 by world production) and 32.5% the Bloomberg US Treasury Inflation-Linked Bond Index (which measures the performance of the US Treasury Inflation Protected Securities (TIPS) market). These benchmarks had positive returns of 10.9% and 17.3.0% over this period, respectively.

The Fund seeks to achieve its investment objective by actively allocating its assets across a broad spectrum of real asset investments, which may include i) instruments or companies that derive their value from physical properties (such as energy and natural resources, real estate, basic materials, equipment, utilities and infrastructure, and commodities), ii) companies that are directly involved in real asset activities (such as logistics, data centers, communication towers, life sciences office and lab space, cold storage and renewable power among, among others,, and iii) inflation-indexed securities that can generate returns in inflationary environments.

The Fund utilizes a “quantamental” approach, which combines quantitative and fundamental research. The quantitative process identifies opportunities for growth with the fundamental approach identifying changes not captured by the quantitative research, such as regulatory environment and industry dynamics. As markets are not static and go through various stages, the Fund seeks to identify the current stage in each market in which it invests and makes investment decisions accordingly, in order to capitalize on the underlying factors driving that particular market stage. The Fund aims to reduce volatility and risk through diversifying its investment choices across a range of industries.

The Fund uses derivatives to execute investment objectives for a variety of purposes, such as to seek economic exposure to one or more alternative strategies, enhance returns, increase investment flexibility, speculate on a targeted investment opportunity, or for hedging purposes.

Performance this year was driven primarily by long exposure to equities across the energy, real estate, materials, and industrials sectors. Commodity exposure also delivered positive returns for the fund.

Looking forward, as markets become increasingly focused on monetary policy and inflation, the opportunity set for the fund is quite robust. The fund will continue to dynamically invest in global markets across a broad range of traditional (real estate, commodities, infrastructure and energy) and next generation real assets to generate differentiated total returns through economic and inflationary cycles. This approach allows the fund to capitalize on cyclical and growth-oriented opportunities vs. traditional real asset funds which tend to be highly biased to value/cyclical assets. Finally, the fund’s focus on next generation real assets provides investors exposure to growth-oriented areas of the economy which may offer attractive returns regardless of the level or direction of inflation.

Sincerely,

| • | Peter Bianco |

| • | Scott Burr |

| • | Brian Cho |

3

Table of Contents

Cumulative Total Return

| Period from Dec 31, 2018 (Commencement of Operations) through December 31, 2021 | 2021 | |||||||

FSRLX (Class I) | 40.48 | % | 18.02 | % | ||||

FARLX (Class A) with Full Sales Load | 31.41 | % | 11.19 | % | ||||

60% BAML 3 Month T Bill, 40% S&P 500 | 36.92 | % | 10.88 | % | ||||

35% ACWI, 32% BCOMTR, 32% US TIPS | 46.37 | % | 17.88 | % | ||||

Performance quoted represents past performance, which may be higher or lower than current performance. Past performance is not indicative of future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original costs. The returns shown do not reflect taxes that an investor would pay on Fund distributions or on the sale of Fund shares. To obtain the most recent month-end performance, visit www.fsinvestments.com.

4

Table of Contents

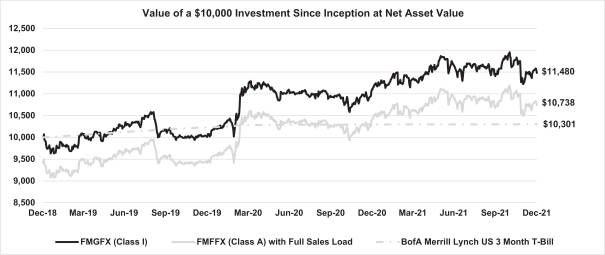

Dear Shareholder:

For the fiscal year ended December 31, 2021, FS Managed Futures Fund (the “Fund”) returned 3.5% (Class I shares) with a realized 8.7% annualized monthly volatility and a 0.64 correlation to equities. The BofA Merrill Lynch 3-Month U.S. Treasury Bill Index (which tracks the performance of the U.S. dollar-denominated U.S. Treasury Bills publicly issued in the U.S. domestic market with remaining term to final maturity of less than 3 months), the primary benchmark for the Fund, had a positive return of 0.05% over this time period.

The Fund seeks to achieve its investment objective by allocating its assets across a broad spectrum of alternative investment strategies. The Fund may provide exposure to alternative strategies across the five major asset classes (commodities, currencies, fixed income, equities and credit). The strategy will normally be implemented through rules-based strategies that typically use historical price data to determine whether to take a long, short, or cash position in a given instrument. A rules-based strategy is a methodology based on a systematic approach. Principal strategies include “momentum/trend” based strategies that buy and sell securities in the same direction as the historical price movement and “counter-trend/mean reversion” based strategies that buy and sell securities in the opposite direction as the historical price movement. Other alternative strategies that do not rely on historical prices may also be utilized to enhance return.

The Fund uses derivatives to execute investment objectives for a variety of purposes, such as to seek economic exposure to one or more alternative strategies, enhance returns, increase investment flexibility, speculate on a targeted investment opportunity, or for hedging purposes. In attempting to achieve its investment objectives, the Fund primarily use total return basket swaps that seek both long and short exposure on variety of strategies, in a notional amount, that the Funds could not otherwise have exposure to on a name by name basis. The total return basket swaps include exposure to equity, foreign currency, and interest rate risk.

In 2021, the top performing strategies for the Fund were equity risk premia strategies, particularly those looking to capture the low volatility and momentum factors, as well as commodity exposure. The bottom performing strategy for the Fund was a cross asset trend following strategy.

Rising market fragility, driven by the policy, illiquidity and positioning feedback loop creates a favorable backdrop for the Fund. With the market going from calm to stressed in record level frequency and intensity, the Fund’s strategies can monetize the market across time frames — intra-day, weekly and monthly. The fund has delivered its best returns during periods of market turbulence such as March 2020 and improves the overall risk adjusted return of traditional asset allocations.

Sincerely,

| • | Michael Kelly |

| • | Scott Burr |

5

Table of Contents

Cumulative Total Return

| Period from Dec 31, 2018 (Commencement of Operations) through December 31, 2021 | 2021 | |||||||

FMGFX (Class I) | 14.80 | % | 3.48 | % | ||||

FMFFX (Class A) with Full Sales Load | 7.38 | % | -2.71 | % | ||||

BofA Merrill Lynch US 3 Month T-Bill | 3.01 | % | 0.05 | % | ||||

Performance quoted represents past performance, which may be higher or lower than current performance. Past performance is not indicative of future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original costs. The returns shown do not reflect taxes that an investor would pay on Fund distributions or on the sale of Fund shares. To obtain the most recent month-end performance, visit www.fsinvestments.com.

6

Table of Contents

Shareholder Fee Example (Unaudited)

Fund Expenses — for the period from July 01, 2021 through December 31, 2021 (Unaudited)

Example: As a Fund shareholder, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase (if any); and (2) ongoing costs, including management fees; distribution and/or service fees (12b-1 fees); and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The actual and hypothetical expense examples are based on an investment of $1,000 invested at the beginning of a six month period and held through the six months ended December 31, 2021.

Actual Expenses: The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes: The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year (before expenses), which is not the actual Fund return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

7

Table of Contents

FS Multi-Strategy Alternatives Fund

| Beginning Account Value (7/1/21) | Ending Account Value (12/31/21) | Expenses Paid During the Period(*) | Annualized Net Expense Ratio(**) | |||||||||||||

Actual |

| |||||||||||||||

Class A Shares | $ | 1,000.00 | $ | 1,044.20 | $ | 12.02 | 2.33 | % | ||||||||

Class I Shares | $ | 1,000.00 | $ | 1,046.70 | $ | 10.96 | 2.12 | % | ||||||||

| Beginning Account Value (7/1/21) | Ending Account Value (12/31/21) | Expenses Paid During the Period(*) | Annualized Expense Ratio(**) | |||||||||||||

Hypothetical (5% annual return before expenses) |

| |||||||||||||||

Class A Shares | $ | 1,000.00 | $ | 1,013.45 | $ | 11.84 | 2.33 | % | ||||||||

Class I Shares | $ | 1,000.00 | $ | 1,014.50 | $ | 10.78 | 2.12 | % | ||||||||

FS Managed Futures Fund

| Beginning Account Value (7/1/21) | Ending Account Value (12/31/21) | Expenses Paid During the Period(*) | Annualized Net Expense Ratio(**) | |||||||||||||

Actual |

| |||||||||||||||

Class A Shares | $ | 1,000.00 | $ | 985.50 | $ | 3.69 | 0.74 | % | ||||||||

Class I Shares | $ | 1,000.00 | $ | 986.10 | $ | 2.46 | 0.49 | % | ||||||||

| Beginning Account Value (7/1/21) | Ending Account Value (12/31/21) | Expenses Paid During the Period(*) | Annualized Expense Ratio(**) | |||||||||||||

Hypothetical (5% annual return before expenses) |

| |||||||||||||||

Class A Shares | $ | 1,000.00 | $ | 1,021.49 | $ | 3.76 | 0.74 | % | ||||||||

Class I Shares | $ | 1,000.00 | $ | 1,022.72 | $ | 2.51 | 0.49 | % | ||||||||

FS Chiron Real Asset Fund

| Beginning Account Value (7/1/21) | Ending Account Value (12/31/21) | Expenses Paid During the Period(*) | Annualized Net Expense Ratio(**) | |||||||||||||

Actual |

| |||||||||||||||

Class A Shares | $ | 1,000.00 | $ | 1,018.20 | $ | 5.07 | 1.00 | % | ||||||||

Class I Shares | $ | 1,000.00 | $ | 1,019.30 | $ | 5.53 | 1.09 | % | ||||||||

| Beginning Account Value (7/1/21) | Ending Account Value (12/31/21) | Expenses Paid During the Period(*) | Annualized Expense Ratio(**) | |||||||||||||

Hypothetical (5% annual return before expenses) |

| |||||||||||||||

Class A Shares | $ | 1,000.00 | $ | 1,020.18 | $ | 5.07 | 1.00 | % | ||||||||

Class I Shares | $ | 1,000.00 | $ | 1,019.72 | $ | 5.53 | 1.09 | % | ||||||||

| * | Hypothetical expenses are equal to the Fund’s annualized expense ratio for the indicated Class, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the opening of business on July 1, 2021. |

| ** | Annualized ratio of expenses to average net assets for the period from July 1, 2021 through December 31, 2021. The expense ratio includes the effect of expenses waived or reimbursed by FS Fund Advisor, LLC, each Fund’s investment adviser. |

8

Table of Contents

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Trustees of FS Series Trust

Opinion on the Financial Statements

We have audited the accompanying consolidated statements of assets and liabilities of FS Multi-Strategy Alternatives Fund, FS Managed Futures Fund and FS Chiron Real Asset Fund (collectively referred to as the “Funds”), three of the funds constituting FS Series Trust (the “Trust”)) , including the consolidated schedules of investments, as of December 31, 2021, and the related consolidated statements of operations and changes in net assets, and the consolidated financial highlights for each of the periods indicated in the table below and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the consolidated financial position of each of the Funds (three of the funds constituting FS Series Trust) at December 31, 2021, the consolidated results of their operations, changes in net assets and financial highlights for each of the periods indicated in the table below, in conformity with U.S. generally accepted accounting principles.

Individual Funds | Consolidated Statements of Operations | Consolidated Statements of Changes in Net Assets | Consolidated Financial | |||

FS Multi-Strategy Alternatives Fund | For the year ended December 31, 2021 | For each of the two years in the period ended December 31, 2021 | For each of the four years in the period ended December 31, 2021 and the period from May 16, 2017 (Commencement of Operations) to December 31, 2017 | |||

FS Managed Futures Fund FS Chiron Real Asset Fund | For the year ended December 31, 2021 | For each of the two years in the period ended December 31, 2021 | For each of the three years in the period ended December 31, 2021 | |||

Basis for Opinion

These financial statements are the responsibility of the Trust’s management. Our responsibility is to express an opinion on each of the Funds’ financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Trust in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Trust is not required to have, nor were we engaged to perform, an audit of the Trust’s internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Trust’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2021, by correspondence with the custodian and others or by other appropriate auditing procedures where replies from others were not received. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as auditor of one or more FS Investments investment companies since 2013.

Philadelphia, Pennsylvania

March 2, 2022

9

Table of Contents

FS Multi-Strategy Alternatives Fund

Consolidated Schedule of Investments

As of December 31, 2021

(dollar values in thousands, except share and per share amounts)

| Portfolio Company(a) | Footnotes | Industry | Principal Amount(b) | Amortized Cost | Fair Value(c) | |||||||||||

|

|

|

|

|

| |||||||||||

Corporate Bonds—24.1% |

| |||||||||||||||

ACI Worldwide, Inc., 5.8%, 8/15/26 | (d) | Software | $ | 154 | $ | 161 | $ | 161 | ||||||||

Acrisure LLC / Acrisure Finance, Inc., 6.0%, 8/1/29 | (d) | Insurance | 399 | 399 | 395 | |||||||||||

Alliance Data Systems Corp., 4.8%, 12/15/24 | (d) | Diversified Financial Services | 948 | 913 | 968 | |||||||||||

Altice France Holding SA, 10.5%, 5/15/27 | (d) | Telecommunications | 500 | 446 | 538 | |||||||||||

American Greetings Corp., 8.8%, 4/15/25 | (d) | Housewares | 392 | 409 | 403 | |||||||||||

Apollo Commercial Real Estate Finance, Inc., 4.6%, 6/15/29 | (d) | Real Estate Investment Trusts | 376 | 376 | 364 | |||||||||||

APX Group, Inc., 5.8%, 7/15/29 | (d) | Commercial Services | 239 | 239 | 236 | |||||||||||

Aretec Escrow Issuer, Inc., 7.5%, 4/1/29 | (d) | Diversified Financial Services | 120 | 122 | 123 | |||||||||||

At Home Group, Inc., 4.9%, 7/15/28 | (d) | Retail | 138 | 138 | 136 | |||||||||||

B&G Foods, Inc., 5.3%, 4/1/25 | Food | 123 | 126 | 126 | ||||||||||||

Bausch Health Companies, Inc., 9.0%, 12/15/25 | (d) | Pharmaceuticals | 225 | 237 | 237 | |||||||||||

Bausch Health Companies, Inc., 6.1%, 4/15/25 | (d) | Pharmaceuticals | 806 | 822 | 822 | |||||||||||

Blackstone Mortgage Trust, Inc., 3.8%, 1/15/27 | (d) | Real Estate Investment Trusts | 144 | 144 | 144 | |||||||||||

Bombardier, Inc., 6.0%, 2/15/28 | (d) | Aerospace/Defense | 226 | 228 | 227 | |||||||||||

BroadStreet Partners, Inc., 5.9%, 4/15/29 | (d) | Insurance | 140 | 138 | 138 | |||||||||||

Callon Petroleum Co., 9.0%, 4/1/25 | (d) | Oil & Gas | 203 | 220 | 220 | |||||||||||

CITGO Petroleum Corp., 6.4%, 6/15/26 | (d) | Oil & Gas | 93 | 93 | 95 | |||||||||||

CITGO Petroleum Corp., 7.0%, 6/15/25 | (d) | Oil & Gas | 624 | 624 | 643 | |||||||||||

CommScope Finance LLC, 6.0%, 3/1/26 | (d) | Telecommunications | 264 | 274 | 272 | |||||||||||

CommScope, Inc., 4.8%, 9/1/29 | (d) | Telecommunications | 337 | 340 | 336 | |||||||||||

Connect Finco SARL / Connect US Finco LLC, 6.8%, 10/1/26 | (d) | Telecommunications | 135 | 143 | 142 | |||||||||||

CoreCivic, Inc., 4.8%, 10/15/27 | Commercial Services | 236 | 211 | 214 | ||||||||||||

CoreCivic, Inc., 8.3%, 4/15/26 | Commercial Services | 133 | 134 | 139 | ||||||||||||

CP Atlas Buyer, Inc., 7.0%, 12/1/28 | (d) | Building Materials | 268 | 277 | 267 | |||||||||||

CSC Holdings LLC, 4.5%, 11/15/31 | (d) | Media Entertainment | 433 | 426 | 428 | |||||||||||

Dave & Buster’s, Inc., 7.6%, 11/1/25 | (d) | Retail | 665 | 711 | 710 | |||||||||||

Dealer Tire LLC / DT Issuer LLC, 8.0%, 2/1/28 | (d) | Auto Parts & Equipment | 665 | 586 | 693 | |||||||||||

eG Global Finance Plc, 8.5%, 10/30/25 | (d) | Retail | 196 | 204 | 203 | |||||||||||

eG Global Finance Plc, 6.8%, 2/7/25 | (d) | Retail | 986 | 978 | 999 | |||||||||||

Empire Resorts, Inc., 7.8%, 11/1/26 | (d) | Entertainment | 207 | 208 | 208 | |||||||||||

Five Point Operating Co. LP / Five Point Capital Corp., 7.9%, 11/15/25 | (d) | Real Estate | 1,134 | 1,127 | 1,184 | |||||||||||

Flex Acquisition Co., Inc., 7.9%, 7/15/26 | (d) | Packaging & Containers | 458 | 479 | 476 | |||||||||||

Fortress Transportation and Infrastructure Investors LLC, 9.8%, 8/1/27 | (d) | Trucking & Leasing | 561 | 642 | 629 | |||||||||||

Gates Global LLC / Gates Corp., 6.3%, 1/15/26 | (d) | Miscellaneous Manufacturing | 317 | 327 | 328 | |||||||||||

Genesis Energy LP / Genesis Energy Finance Corp., 7.8%, 2/1/28 | Pipelines | 49 | 48 | 49 | ||||||||||||

GEO Group, Inc., 5.1%, 4/1/23 | Real Estate Investment Trusts | 210 | 201 | 200 | ||||||||||||

GEO Group, Inc., 6.0%, 4/15/26 | Real Estate Investment Trusts | 203 | 178 | 164 | ||||||||||||

Golden Nugget, Inc., 6.8%, 10/15/24 | (d) | Retail | 456 | 458 | 457 | |||||||||||

H-Food Holdings LLC / Hearthside Finance Co., Inc., 8.5%, 6/1/26 | (d) | Food | 246 | 252 | 246 | |||||||||||

See notes to consolidated financial statements.

10

Table of Contents

FS Multi-Strategy Alternatives Fund

Consolidated Schedule of Investments (continued)

As of December 31, 2021

(dollar values in thousands, except share and per share amounts)

Portfolio Company(a) | Footnotes | Industry | Principal Amount(b) | Amortized Cost | Fair Value(c) | |||||||||||

Hadrian Merger Sub, Inc., 8.5%, 5/1/26 | (d) | Healthcare-Services | $ | 283 | $ | 295 | $ | 292 | ||||||||

Herbalife Nutrition Ltd. / HLF Financing, Inc., 7.9%, 9/1/25 | (d) | Pharmaceuticals | 174 | 174 | 185 | |||||||||||

Ingevity Corp., 4.5%, 2/1/26 | (d) | Chemicals | 276 | 278 | 277 | |||||||||||

iStar, Inc., 5.5%, 2/15/26 | Real Estate Investment Trusts | 535 | 554 | 554 | ||||||||||||

Jacobs Entertainment, Inc., 7.9%, 2/1/24 | (d) | Entertainment | 93 | 96 | 95 | |||||||||||

JELD-WEN, Inc., 4.6%, 12/15/25 | (d) | Building Materials | 285 | 289 | 287 | |||||||||||

KAR Auction Services, Inc., 5.1%, 6/1/25 | (d) | Distribution/Wholesale | 942 | 956 | 957 | |||||||||||

Kronos Acquisition Holdings, Inc., 5.0%, 12/31/26 | (d) | Household Products/Wares | 110 | 112 | 109 | |||||||||||

Kronos Acquisition Holdings, Inc., 7.0%, 12/31/27 | (d) | Household Products/Wares | 261 | 266 | 246 | |||||||||||

Ladder Capital Finance Holdings LLLP / Ladder Capital Finance Corp., 4.3%, 2/1/27 | (d) | Real Estate Investment Trusts | 87 | 78 | 88 | |||||||||||

Ladder Capital Finance Holdings LLLP / Ladder Capital Finance Corp., 5.3%, 10/1/25 | (d) | Real Estate Investment Trusts | 444 | 450 | 450 | |||||||||||

Level 3 Financing, Inc., 5.4%, 5/1/25 | Telecommunications | 245 | 250 | 251 | ||||||||||||

LifePoint Health, Inc., 5.4%, 1/15/29 | (d) | Healthcare-Services | 141 | 140 | 141 | |||||||||||

Live Nation Entertainment, Inc., 4.9%, 11/1/24 | (d) | Entertainment | 276 | 279 | 279 | |||||||||||

Lumen Technologies, Inc., 4.0%, 2/15/27 | (d) | Telecommunications | 276 | 282 | 280 | |||||||||||

Maxim Crane Works Holdings Capital LLC, 10.1%, 8/1/24 | (d) | Machinery-Diversified | 688 | 692 | 705 | |||||||||||

Metis Merger Sub LLC, 6.5%, 5/15/29 | (d) | Commercial Services | 224 | 224 | 220 | |||||||||||

Midcap Financial Issuer Trust, 5.6%, 1/15/30 | (d) | Diversified Financial Services | 209 | 207 | 210 | |||||||||||

Mohegan Gaming & Entertainment, 8.0%, 2/1/26 | (d) | Entertainment | 820 | 820 | 862 | |||||||||||

New Home Co., Inc., 7.3%, 10/15/25 | (d) | Home Builders | 566 | 568 | 579 | |||||||||||

Nuance Communications, Inc., 5.6%, 12/15/26 | Software | 138 | 143 | 143 | ||||||||||||

Outfront Media Capital LLC / Outfront Media Capital Corp., 6.3%, 6/15/25 | (d) | Advertising | 164 | 173 | 171 | |||||||||||

Pactiv LLC , 8.0%, 12/15/25 | Packaging & Containers | 217 | 219 | 241 | ||||||||||||

Pactiv LLC, 8.4%, 4/15/27 | Packaging & Containers | 861 | 911 | 960 | ||||||||||||

Panther BF Aggregator 2 LP / Panther Finance Co., Inc., 8.5%, 5/15/27 | (d) | Auto Parts & Equipment | 263 | 283 | 279 | |||||||||||

Powdr Corp., 6.0%, 8/1/25 | (d) | Entertainment | 207 | 218 | 216 | |||||||||||

Prime Healthcare Services, Inc., 7.3%, 11/1/25 | (d) | Healthcare-Services | 264 | 272 | 280 | |||||||||||

Raptor Acquisition Corp. / Raptor Co-Issuer LLC, 4.9%, 11/1/26 | (d) | Entertainment | 382 | 387 | 386 | |||||||||||

RegionalCare Hospital Partners Holdings, Inc. / LifePoint Health, Inc., 9.8%, 12/1/26 | (d) | Healthcare-Services | 77 | 81 | 81 | |||||||||||

Rite Aid Corp., 7.5%, 7/1/25 | (d) | Retail | 36 | 36 | 37 | |||||||||||

Rite Aid Corp., 8.0%, 11/15/26 | (d) | Retail | 93 | 95 | 95 | |||||||||||

RLJ Lodging Trust LP, 3.8%, 7/1/26 | (d) | Real Estate Investment Trusts | 294 | 294 | 296 | |||||||||||

Rockies Express Pipeline LLC, 5.0%, 7/15/29 | (d) | Pipelines | 141 | 144 | 150 | |||||||||||

Royal Caribbean Cruises Ltd., 10.9%, 6/1/23 | (d) | Leisure Time | 451 | 499 | 493 | |||||||||||

RP Escrow Issuer LLC, 5.3%, 12/15/25 | (d) | Healthcare-Services | 239 | 247 | 241 | |||||||||||

Scientific Games International, Inc., 5.0%, 10/15/25 | (d) | Entertainment | 230 | 237 | 237 | |||||||||||

SeaWorld Parks & Entertainment, Inc., 8.8%, 5/1/25 | (d) | Entertainment | 402 | 432 | 427 | |||||||||||

SeaWorld Parks & Entertainment, Inc., 5.3%, 8/15/29 | (d) | Entertainment | 40 | 40 | 41 | |||||||||||

See notes to consolidated financial statements.

11

Table of Contents

FS Multi-Strategy Alternatives Fund

Consolidated Schedule of Investments (continued)

As of December 31, 2021

(dollar values in thousands, except share and per share amounts)

Portfolio Company(a) | Footnotes | Industry | Principal Amount(b) | Amortized Cost | Fair Value(c) | |||||||||||

Service Properties Trust, 7.5%, 9/15/25 | Real Estate Investment Trusts | $ | 814 | $ | 909 | $ | 883 | |||||||||

Sonic Automotive, Inc., 4.9%, 11/15/31 | (d) | Retail | 209 | 209 | 211 | |||||||||||

Sonic Automotive, Inc., 4.6%, 11/15/29 | (d) | Retail | 97 | 97 | 98 | |||||||||||

Spirit Loyalty Cayman Ltd. / Spirit IP Cayman Ltd., 8.0%, 9/20/25 | (d) | Airlines | 805 | 885 | 889 | |||||||||||

SRS Distribution, Inc., 6.0%, 12/1/29 | (d) | Retail | 287 | 288 | 289 | |||||||||||

Starwood Property Trust, Inc., 3.8%, 12/31/24 | (d) | Real Estate Investment Trusts | 460 | 460 | 466 | |||||||||||

Starwood Property Trust, Inc., 3.6%, 7/15/26 | (d) | Real Estate Investment Trusts | 492 | 493 | 490 | |||||||||||

Stericycle, Inc., 5.4%, 7/15/24 | (d) | Environmental Control | 325 | 331 | 332 | |||||||||||

Sunoco LP / Sunoco Finance Corp., 6.0%, 4/15/27 | Oil & Gas | 96 | 86 | 100 | ||||||||||||

Surgery Center Holdings, Inc., 6.8%, 7/1/25 | (d) | Healthcare-Services | 451 | 459 | 455 | |||||||||||

TKC Holdings, Inc., 6.9%, 5/15/28 | (d) | Food Service | 537 | 546 | 550 | |||||||||||

TransDigm UK Holdings Plc, 6.9%, 5/15/26 | Aerospace/Defense | 472 | 496 | 494 | ||||||||||||

TransDigm, Inc., 6.4%, 6/15/26 | Aerospace/Defense | 563 | 581 | 579 | ||||||||||||

TransDigm, Inc., 6.3%, 3/15/26 | (d) | Aerospace/Defense | 244 | 253 | 254 | |||||||||||

Triumph Group, Inc., 8.9%, 6/1/24 | (d) | Aerospace/Defense | 721 | 788 | 787 | |||||||||||

Trivium Packaging Finance B.V., 8.5%, 8/15/27 | (d) | Packaging & Containers | 221 | 237 | 234 | |||||||||||

Uber Technologies, Inc., 8.0%, 11/1/26 | (d) | Internet | 756 | 805 | 806 | |||||||||||

US Acute Care Solutions LLC, 6.4%, 3/1/26 | (d) | Healthcare-Services | 722 | 747 | 757 | |||||||||||

Vector Group Ltd., 5.8%, 2/1/29 | (d) | Agriculture | 728 | 728 | 710 | |||||||||||

Vector Group Ltd., 10.5%, 11/1/26 | (d) | Agriculture | 622 | 656 | 645 | |||||||||||

Verscend Escrow Corp., 9.8%, 8/15/26 | (d) | Commercial Services | 396 | 418 | 421 | |||||||||||

Viasat, Inc., 5.6%, 9/15/25 | (d) | Telecommunications | 521 | 529 | 524 | |||||||||||

WASH Multifamily Acquisition, Inc., 5.8%, 4/15/26 | (d) | Commercial Services | 778 | 799 | 819 | |||||||||||

Waste Pro USA, Inc., 5.5%, 2/15/26 | (d) | Environmental Control | 648 | 664 | 645 | |||||||||||

|

|

|

| |||||||||||||

Total Corporate Bonds |

| $ | 38,224 | $ | 38,599 | |||||||||||

|

|

|

| |||||||||||||

Convertible Bonds—0.6% |

| |||||||||||||||

Apollo Commercial Real Estate Finance, Inc., 5.4%, 10/15/23 | Real Estate Investment Trusts | 434 | 430 | 444 | ||||||||||||

RWT Holdings, Inc., 5.8%, 10/1/25 | Holding Companies-Diversified | 273 | 272 | 281 | ||||||||||||

|

|

|

| |||||||||||||

Total Convertible Bonds | $ | 702 | $ | 725 | ||||||||||||

|

|

|

| |||||||||||||

| Portfolio Company(a) | Footnotes | Industry | Number of Shares | Cost(b) | Fair Value(c) | |||||||||||

|

|

|

|

|

| |||||||||||

Common Stocks—11.8% |

| |||||||||||||||

Adobe, Inc. | (e) | Software | 712 | $ | 428 | $ | 404 | |||||||||

Ardagh Metal Packaging SA | (e) | Packaging & Containers | 16,373 | 164 | 148 | |||||||||||

Ball Corp. | (f) | Packaging & Containers | 14,676 | 1,157 | 1,413 | |||||||||||

Canadian Pacific Railway Ltd. | Transportation | 14,317 | 952 | 1,030 | ||||||||||||

Chipotle Mexican Grill, Inc. | (e) | Retail | 250 | 408 | 437 | |||||||||||

Cintas Corp. | (f) | Commercial Services | 1,494 | 475 | 662 | |||||||||||

Costco Wholesale Corp. | (f) | Retail | 1,753 | 668 | 995 | |||||||||||

CSX Corp. | Transportation | 4,618 | 145 | 174 | ||||||||||||

CVS Health Corp. | Pharmaceuticals | 5,349 | 443 | 552 | ||||||||||||

Danaher Corp. | Healthcare-Products | 2,121 | 556 | 698 | ||||||||||||

Davide Campari-Milano N.V. | Beverages | 35,734 | 401 | 523 | ||||||||||||

See notes to consolidated financial statements.

12

Table of Contents

FS Multi-Strategy Alternatives Fund

Consolidated Schedule of Investments (continued)

As of December 31, 2021

(dollar values in thousands, except share and per share amounts)

Portfolio Company(a) | Footnotes | Industry | Number of Shares | Cost(b) | Fair Value(c) | |||||||||||

Deere & Co. | Machinery-Diversified | 854 | $ | 292 | $ | 293 | ||||||||||

Domino’s Pizza, Inc. | Retail | 547 | 245 | 309 | ||||||||||||

Five Below, Inc. | (e) | Retail | 1,563 | 258 | 323 | |||||||||||

Floor & Decor Holdings, Inc. | (e) | Retail | 2,844 | 358 | 370 | |||||||||||

Home Depot, Inc. | (f) | Retail | 2,333 | 647 | 968 | |||||||||||

II-VI, Inc. | (e) | Electronics | 2,101 | 133 | 144 | |||||||||||

Intuit, Inc. | Software | 636 | 282 | 409 | ||||||||||||

Mastercard, Inc. | (f) | Diversified Financial Services | 1,425 | 435 | 512 | |||||||||||

Mettler-Toledo International, Inc. | (e) (f) | Electronics | 634 | 646 | 1,076 | |||||||||||

Microsoft Corp. | (f) | Software | 2,976 | 679 | 1,001 | |||||||||||

Mister Car Wash, Inc. | (e) | Commercial Services | 9,950 | 178 | 181 | |||||||||||

Moody’s Corp. | Commercial Services | 1,223 | 360 | 478 | ||||||||||||

Pool Corp. | Distribution/Wholesale | 966 | 339 | 547 | ||||||||||||

Republic Services, Inc. | (f) | Environmental Control | 5,165 | 539 | 720 | |||||||||||

Sherwin-Williams Co. | (f) | Chemicals | 3,755 | 889 | 1,322 | |||||||||||

Skyline Champion Corp. | (e) | Home Builders | 2,132 | 143 | 168 | |||||||||||

Target Corp. | Retail | 1,993 | 461 | 461 | ||||||||||||

Texas Instruments, Inc. | Semiconductors | 1,815 | 333 | 342 | ||||||||||||

Thermo Fisher Scientific, Inc. | Healthcare-Products | 567 | 257 | 378 | ||||||||||||

Tractor Supply Co. | Retail | 1,635 | 291 | 390 | ||||||||||||

Treatt Plc | Chemicals | 129 | 2 | 2 | ||||||||||||

Union Pacific Corp. | (f) | Transportation | 3,725 | 714 | 938 | |||||||||||

UnitedHealth Group, Inc. | Healthcare-Services | 659 | 274 | 331 | ||||||||||||

VPC Impact Acquisition Holdings III, Inc. | (e) | Holding Companies-Diversified | 10,029 | 99 | 103 | |||||||||||

Watches of Switzerland Group Plc | (d) (e) | Retail | 21,483 | 278 | 413 | |||||||||||

|

|

|

| |||||||||||||

Total Common Stocks |

| $ | 14,929 | $ | 19,215 | |||||||||||

|

|

|

| |||||||||||||

| Portfolio Company(a) | Footnotes | Yield | Number of Shares | Cost | Fair Value(c) | |||||||||||

|

|

|

|

|

| |||||||||||

Short-Term Investments—52.7% |

| |||||||||||||||

State Street Institutional Liquid Reserves Fund - Premier Class | (g) | 0.04% | 85,942,284 | $ | 85,960 | $ | 85,951 | |||||||||

|

|

|

| |||||||||||||

Total Short-Term Investments |

| 85,960 | 85,951 | |||||||||||||

TOTAL INVESTMENTS—88.6% |

| $ | 139,815 | 144,490 | ||||||||||||

|

|

|

| |||||||||||||

Other Assets in Excess of Liabilities—11.4% |

| 18,592 | ||||||||||||||

|

| |||||||||||||||

Net Assets—100.0% |

| $ | 163,082 | |||||||||||||

|

| |||||||||||||||

Investments Sold Short—(6.80)% |

| |||||||||||||||

| Portfolio Company(a) | Footnotes | Number of Shares | Proceeds | Fair Value(c) | ||||||||||||

|

|

|

|

| ||||||||||||

Mutual Funds Sold Short—(2.5)% |

| |||||||||||||||

iPath Series B Bloomberg Coffee Subindex Total Return ETN | (2,432 | ) | $ | (133 | ) | $ | (149 | ) | ||||||||

iShares Russell 1000 ETF | (14,039 | ) | (3,616 | ) | (3,712 | ) | ||||||||||

ProShares Short VIX Short-Term Futures ETF | (3,509 | ) | (212 | ) | (216 | ) | ||||||||||

|

|

|

| |||||||||||||

Total Mutual Funds Sold Short |

| $ | (3,961 | ) | $ | (4,077 | ) | |||||||||

|

|

|

| |||||||||||||

See notes to consolidated financial statements.

13

Table of Contents

FS Multi-Strategy Alternatives Fund

Consolidated Schedule of Investments (continued)

As of December 31, 2021

(dollar values in thousands, except share and per share amounts)

| Portfolio Company(a) | Footnotes | Industry | Par(b) | Proceeds | Fair Value(c) | |||||||||||

|

|

|

|

|

| |||||||||||

Corporate Bonds Sold Short—(1.1)% |

| |||||||||||||||

99 Escrow Issuer, Inc., 7.5%, 1/15/26 | Retail | (90 | ) | $ | (82 | ) | $ | (71 | ) | |||||||

At Home Group, Inc., 7.1%, 7/15/29 | Retail | (138 | ) | (135 | ) | (136 | ) | |||||||||

Beazer Homes USA, Inc., 7.3%, 10/15/29 | Home Builders | (276 | ) | (308 | ) | (308 | ) | |||||||||

Carrols Restaurant Group, Inc., 5.9%, 7/1/29 | Retail | (280 | ) | (261 | ) | (253 | ) | |||||||||

DIRECTV Holdings LLC / DIRECTV Financing Co., Inc., 5.9%, 8/15/27 | Media Entertainment | (286 | ) | (296 | ) | (293 | ) | |||||||||

Lumen Technologies, Inc., 5.4%, 6/15/29 | Telecommunications | (138 | ) | (140 | ) | (138 | ) | |||||||||

Polar US Borrower LLC / Schenectady International Group, Inc., 6.8%, 5/15/26 | Chemicals | (111 | ) | (111 | ) | (109 | ) | |||||||||

Tallgrass Energy Partners LP / Tallgrass Energy Finance Corp., 6.0%, 12/31/30 | Pipelines | (141 | ) | (147 | ) | (141 | ) | |||||||||

United Rentals North America, Inc., 3.9%, 2/15/31 | Commercial Services | (412 | ) | (422 | ) | (419 | ) | |||||||||

|

|

|

| |||||||||||||

Total Corporate Bonds Sold Short |

| $ | (1,902 | ) | $ | (1,868 | ) | |||||||||

|

|

|

| |||||||||||||

Portfolio Company(a) | Footnotes | Industry | Number of Shares | Proceeds | Fair Value(c) | |||||||||||

Common Stocks Sold Short—(3.2)% | ||||||||||||||||

3M Co. | Miscellaneous Manufacturing | (263 | ) | $ | (47 | ) | $ | (47 | ) | |||||||

Activision Blizzard, Inc. | Software | (132 | ) | (9 | ) | (9 | ) | |||||||||

Aflac, Inc. | Insurance | (2,889 | ) | (158 | ) | (169 | ) | |||||||||

Air Products and Chemicals, Inc. | Chemicals | (18 | ) | (5 | ) | (5 | ) | |||||||||

Albertsons Companies, Inc. | Food | (1,751 | ) | (57 | ) | (53 | ) | |||||||||

Amazon.com, Inc. | Internet | (9 | ) | (30 | ) | (30 | ) | |||||||||

AMC Entertainment Holdings, Inc. | Entertainment | (433 | ) | (24 | ) | (12 | ) | |||||||||

American Airlines Group, Inc. | Airlines | (2,596 | ) | (58 | ) | (47 | ) | |||||||||

Automatic Data Processing, Inc. | Commercial Services | (967 | ) | (222 | ) | (238 | ) | |||||||||

Beyond Meat, Inc. | Food | (524 | ) | (41 | ) | (34 | ) | |||||||||

Black Knight, Inc. | Software | (1,140 | ) | (92 | ) | (94 | ) | |||||||||

Boise Cascade Co. | Building Materials | (2,958 | ) | (171 | ) | (211 | ) | |||||||||

Callaway Golf Co. | Leisure Time | (1,747 | ) | (54 | ) | (48 | ) | |||||||||

Cargurus, Inc. | Internet | (3,067 | ) | (113 | ) | (103 | ) | |||||||||

Church & Dwight Co., Inc. | Household Products/Wares | (2,544 | ) | (227 | ) | (261 | ) | |||||||||

Citrix Systems, Inc. | Software | (44 | ) | (4 | ) | (4 | ) | |||||||||

Clean Harbors, Inc. | Environmental Control | (263 | ) | (26 | ) | (26 | ) | |||||||||

Clorox Co./The | Household Products/Wares | (966 | ) | (162 | ) | (168 | ) | |||||||||

CME Group, Inc. | Diversified Financial Services | (438 | ) | (99 | ) | (100 | ) | |||||||||

Conagra Brands, Inc. | Food | (2,019 | ) | (67 | ) | (69 | ) | |||||||||

Datadog, Inc. | Software | (149 | ) | (27 | ) | (27 | ) | |||||||||

Denny’s Corp. | Retail | (864 | ) | (14 | ) | (14 | ) | |||||||||

Diageo Plc | Beverages | (1,777 | ) | (93 | ) | (97 | ) | |||||||||

Dollar Tree, Inc. | Retail | (1,491 | ) | (205 | ) | (210 | ) | |||||||||

Ecolab, Inc. | Chemicals | (44 | ) | (10 | ) | (10 | ) | |||||||||

Fox Factory Holding Corp. | Auto Parts & Equipment | (438 | ) | (69 | ) | (75 | ) | |||||||||

General Electric Co. | Miscellaneous Manufacturing | (352 | ) | (34 | ) | (33 | ) | |||||||||

General Mills, Inc. | Food | (3,064 | ) | (186 | ) | (206 | ) | |||||||||

See notes to consolidated financial statements.

14

Table of Contents

FS Multi-Strategy Alternatives Fund

Consolidated Schedule of Investments (continued)

As of December 31, 2021

(dollar values in thousands, except share and per share amounts)

Portfolio Company(a) | Footnotes | Industry | Number of Shares | Proceeds | Fair Value(c) | |||||||||||

Genuine Parts Co. | Retail | (2,146 | ) | $ | (276 | ) | $ | (301 | ) | |||||||

HB Fuller Co. | Chemicals | (2,358 | ) | (167 | ) | (191 | ) | |||||||||

Hilton Worldwide Holdings, Inc. | Lodging | (132 | ) | (21 | ) | (21 | ) | |||||||||

Hormel Foods Corp. | Food | (1,492 | ) | (71 | ) | (73 | ) | |||||||||

Lockheed Martin Corp. | Aerospace/Defense | (26 | ) | (9 | ) | (9 | ) | |||||||||

Louisiana-Pacific Corp. | Building Materials | (3,132 | ) | (197 | ) | (245 | ) | |||||||||

Minerals Technologies, Inc. | Chemicals | (55 | ) | (4 | ) | (4 | ) | |||||||||

Nektar Therapeutics | Biotechnology | (351 | ) | (5 | ) | (5 | ) | |||||||||

Nestle SA | Food | (789 | ) | (104 | ) | (111 | ) | |||||||||

New York Times Co. | Media Entertainment | (88 | ) | (4 | ) | (4 | ) | |||||||||

Planet Fitness, Inc. | Leisure Time | (1,585 | ) | (129 | ) | (144 | ) | |||||||||

PotlatchDeltic Corp. | Real Estate Investment Trusts | (255 | ) | (14 | ) | (15 | ) | |||||||||

Principal Financial Group, Inc. | Insurance | (2,107 | ) | (146 | ) | (152 | ) | |||||||||

Prudential Financial, Inc. | Insurance | (350 | ) | (37 | ) | (38 | ) | |||||||||

Rivian Automotive, Inc. | Auto Manufacturers | (263 | ) | (26 | ) | (27 | ) | |||||||||

Shake Shack, Inc. | Retail | (175 | ) | (13 | ) | (13 | ) | |||||||||

Snap, Inc. | Internet | (175 | ) | (8 | ) | (8 | ) | |||||||||

Snowflake, Inc. | Software | (88 | ) | (31 | ) | (30 | ) | |||||||||

Sonoco Products Co. | Packaging & Containers | (694 | ) | (43 | ) | (40 | ) | |||||||||

Starbucks Corp. | Retail | (2,191 | ) | (253 | ) | (256 | ) | |||||||||

Tesla, Inc. | Auto Manufacturers | (18 | ) | (19 | ) | (19 | ) | |||||||||

Thor Industries, Inc. | Home Builders | (172 | ) | (20 | ) | (18 | ) | |||||||||

Trupanion, Inc. | Insurance | (886 | ) | (94 | ) | (117 | ) | |||||||||

Uber Technologies, Inc. | Internet | (2,185 | ) | (92 | ) | (92 | ) | |||||||||

Verisk Analytics, Inc. | Commercial Services | (24 | ) | (4 | ) | (5 | ) | |||||||||

Visa, Inc. | Diversified Financial Services | (44 | ) | (10 | ) | (10 | ) | |||||||||

Walgreens Boots Alliance, Inc. | Retail | (3,936 | ) | (190 | ) | (205 | ) | |||||||||

Walt Disney Co. | Media Entertainment | (88 | ) | (14 | ) | (14 | ) | |||||||||

Warby Parker, Inc. | Retail | (175 | ) | (8 | ) | (8 | ) | |||||||||

Wayfair, Inc. | Internet | (44 | ) | (9 | ) | (8 | ) | |||||||||

West Fraser Timber Co. Ltd. | Forest Products & Paper | (1,396 | ) | (115 | ) | (133 | ) | |||||||||

Weyerhaeuser Co. | Real Estate Investment Trusts | (3,710 | ) | (142 | ) | (153 | ) | |||||||||

Yum! Brands, Inc. | Retail | (2,002 | ) | (250 | ) | (278 | ) | |||||||||

|

|

|

| |||||||||||||

Total Common Stocks Sold Short | $ | (4,829 | ) | $ | (5,147 | ) | ||||||||||

|

|

|

| |||||||||||||

Total Investments Sold Short | $ | (10,693 | ) | $ | (11,092 | ) | ||||||||||

|

|

|

| |||||||||||||

Forward Foreign Currency Exchange Contracts—0.1%

Counterparty | Contract | Currency and Amount to be Received | Currency and Amount to be Delivered | Unrealized Appreciation | Unrealized Depreciation | |||||||||||||||||

Deutsche Bank AG | 1/12/22 | AUD | 200 | JPY | 16,294 | $ | 4 | $ | — | |||||||||||||

Deutsche Bank AG | 1/12/22 | AUD | 465 | GBP | 250 | — | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | AUD | 198 | EUR | 125 | 1 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | AUD | 200 | JPY | 16,112 | 5 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | AUD | 200 | CAD | 184 | — | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | AUD | 200 | JPY | 16,542 | 2 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | AUD | 100 | USD | 72 | 1 | — | |||||||||||||||

See notes to consolidated financial statements.

15

Table of Contents

FS Multi-Strategy Alternatives Fund

Consolidated Schedule of Investments (continued)

As of December 31, 2021

(dollar values in thousands, except share and per share amounts)

Counterparty | Contract | Currency and Amount to be Received | Currency and Amount to be Delivered | Unrealized Appreciation | Unrealized Depreciation | |||||||||||||||||

Deutsche Bank AG | 1/12/22 | AUD | 100 | USD | 71 | $ | 2 | $ | — | |||||||||||||

Deutsche Bank AG | 1/12/22 | AUD | 500 | USD | 357 | 7 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | AUD | 200 | USD | 145 | — | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | CAD | 200 | USD | 155 | 6 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | CAD | 200 | USD | 156 | 2 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | CAD | 100 | USD | 78 | 1 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | CHF | 125 | USD | 135 | 2 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | CHF | 125 | USD | 136 | 2 | — | |||||||||||||||

Deutsche Bank AG | 1/18/22 | CLP | 84,585 | USD | 100 | — | 1 | |||||||||||||||

Deutsche Bank AG | 1/24/22 | CLP | 87,140 | USD | 100 | 2 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | CNH | 3,831 | USD | 600 | 2 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | CNH | 2,554 | USD | 400 | 2 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | CNH | 1,919 | USD | 300 | 2 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | CNH | 639 | USD | 100 | 1 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | CNH | 3,193 | USD | 500 | 2 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | CNH | 637 | USD | 100 | — | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | EUR | 1,125 | USD | 1,276 | 5 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | EUR | 750 | USD | 848 | 6 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | EUR | 125 | USD | 142 | — | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | EUR | 1,125 | USD | 1,272 | 9 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | GBP | 250 | USD | 330 | 8 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | GBP | 188 | USD | 249 | 5 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | GBP | 313 | USD | 421 | 2 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | GBP | 63 | USD | 84 | — | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | ILS | 621 | USD | 200 | — | — | |||||||||||||||

Deutsche Bank AG | 1/6/22 | INR | 13,949 | USD | 185 | 2 | — | |||||||||||||||

Deutsche Bank AG | 1/6/22 | INR | 1,101 | USD | 15 | — | — | |||||||||||||||

Deutsche Bank AG | 1/3/22 | INR | 22,681 | USD | 300 | 5 | — | |||||||||||||||

Deutsche Bank AG | 1/3/22 | INR | 15,122 | USD | 200 | 3 | — | |||||||||||||||

Deutsche Bank AG | 1/10/22 | INR | 4,909 | USD | 65 | 1 | — | |||||||||||||||

Deutsche Bank AG | 1/10/22 | INR | 2,650 | USD | 35 | — | — | |||||||||||||||

Deutsche Bank AG | 1/18/22 | INR | 7,612 | USD | 100 | 2 | — | |||||||||||||||

Deutsche Bank AG | 1/10/22 | INR | 22,808 | USD | 300 | 6 | — | |||||||||||||||

Deutsche Bank AG | 1/18/22 | INR | 22,721 | USD | 300 | 5 | — | |||||||||||||||

Deutsche Bank AG | 1/21/22 | INR | 7,576 | USD | 100 | 2 | — | |||||||||||||||

Deutsche Bank AG | 1/24/22 | INR | 7,581 | USD | 100 | 2 | — | |||||||||||||||

Deutsche Bank AG | 1/24/22 | INR | 22,500 | USD | 300 | 1 | — | |||||||||||||||

Deutsche Bank AG | 1/31/22 | INR | 7,503 | USD | 100 | — | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | JPY | 12,500 | USD | 110 | — | 1 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | JPY | 87,500 | USD | 766 | — | 5 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | JPY | 50,000 | USD | 434 | 1 | — | |||||||||||||||

Deutsche Bank AG | 1/3/22 | KRW | 40,862 | USD | 35 | — | — | |||||||||||||||

Deutsche Bank AG | 1/3/22 | KRW | 86,197 | USD | 73 | — | — | |||||||||||||||

Deutsche Bank AG | 1/3/22 | KRW | 31,953 | USD | 27 | — | — | |||||||||||||||

Deutsche Bank AG | 1/3/22 | KRW | 40,840 | USD | 35 | — | — | |||||||||||||||

Deutsche Bank AG | 1/3/22 | KRW | 34,608 | USD | 29 | — | — | |||||||||||||||

Deutsche Bank AG | 1/3/22 | KRW | 45,112 | USD | 38 | — | — | |||||||||||||||

Deutsche Bank AG | 1/3/22 | KRW | 3,364 | USD | 3 | — | — | |||||||||||||||

Deutsche Bank AG | 1/3/22 | KRW | 36,207 | USD | 31 | — | — | |||||||||||||||

Deutsche Bank AG | 1/3/22 | KRW | 34,554 | USD | 29 | — | — | |||||||||||||||

Deutsche Bank AG | 1/7/22 | KRW | 118,027 | USD | 100 | — | 1 | |||||||||||||||

See notes to consolidated financial statements.

16

Table of Contents

FS Multi-Strategy Alternatives Fund

Consolidated Schedule of Investments (continued)

As of December 31, 2021

(dollar values in thousands, except share and per share amounts)

Counterparty | Contract | Currency and Amount to be Received | Currency and Amount to be Delivered | Unrealized Appreciation | Unrealized Depreciation | |||||||||||||||||

Deutsche Bank AG | 1/6/22 | KRW | 354,135 | USD | 300 | $ | — | $ | 2 | |||||||||||||

Deutsche Bank AG | 1/18/22 | KRW | 117,833 | USD | 100 | — | 1 | |||||||||||||||

Deutsche Bank AG | 1/10/22 | KRW | 354,960 | USD | 300 | — | 2 | |||||||||||||||

Deutsche Bank AG | 1/18/22 | KRW | 357,570 | USD | 300 | 1 | — | |||||||||||||||

Deutsche Bank AG | 1/24/22 | KRW | 107,345 | USD | 90 | — | — | |||||||||||||||

Deutsche Bank AG | 1/24/22 | KRW | 11,808 | USD | 10 | — | — | |||||||||||||||

Deutsche Bank AG | 1/27/22 | KRW | 118,661 | USD | 100 | — | — | |||||||||||||||

Deutsche Bank AG | 1/24/22 | KRW | 118,779 | USD | 100 | — | — | |||||||||||||||

Deutsche Bank AG | 1/24/22 | KRW | 237,558 | USD | 200 | — | — | |||||||||||||||

Deutsche Bank AG | 1/24/22 | KRW | 118,805 | USD | 100 | — | — | |||||||||||||||

Deutsche Bank AG | 1/3/22 | KRW | 2,326 | USD | 2 | — | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | MXN | 2,000 | USD | 96 | 1 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | MXN | 500 | USD | 24 | 1 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | MXN | 500 | USD | 25 | — | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | NOK | 882 | USD | 100 | — | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | NZD | 100 | USD | 68 | 1 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | NZD | 300 | USD | 205 | — | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | PLN | 409 | USD | 100 | 1 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | RUB | 7,479 | USD | 100 | — | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | SGD | 137 | USD | 100 | 1 | — | |||||||||||||||

Deutsche Bank AG | 2/10/22 | TRY | 1,380 | USD | 100 | 1 | — | |||||||||||||||

Deutsche Bank AG | 2/10/22 | TRY | 1,427 | USD | 100 | 9 | — | |||||||||||||||

Deutsche Bank AG | 2/10/22 | TRY | 1,298 | USD | 100 | — | 5 | |||||||||||||||

Deutsche Bank AG | 2/9/22 | TRY | 1,306 | USD | 100 | — | 5 | |||||||||||||||

Deutsche Bank AG | 2/9/22 | TRY | 1,331 | USD | 100 | — | 3 | |||||||||||||||

Deutsche Bank AG | 2/9/22 | TRY | 1,164 | USD | 100 | — | 30 | |||||||||||||||

Deutsche Bank AG | 2/9/22 | TRY | 1,151 | USD | 100 | — | 16 | |||||||||||||||

Deutsche Bank AG | 2/9/22 | TRY | 1,097 | USD | 100 | — | 20 | |||||||||||||||

Deutsche Bank AG | 2/9/22 | TRY | 998 | USD | 100 | — | 27 | |||||||||||||||

Deutsche Bank AG | 2/9/22 | TRY | 4,053 | USD | 400 | — | 103 | |||||||||||||||

Deutsche Bank AG | 2/9/22 | TRY | 956 | USD | 100 | — | 30 | |||||||||||||||

Deutsche Bank AG | 3/10/22 | TRY | 1,565 | USD | 100 | 12 | — | |||||||||||||||

Deutsche Bank AG | 3/10/22 | TRY | 1,745 | USD | 100 | 25 | — | |||||||||||||||

Deutsche Bank AG | 3/10/22 | TRY | 1,401 | USD | 100 | — | — | |||||||||||||||

Deutsche Bank AG | 1/5/22 | TRY | 1,357 | USD | 100 | 2 | — | |||||||||||||||

Deutsche Bank AG | 1/10/22 | TWD | 5,532 | USD | 200 | — | — | |||||||||||||||

Deutsche Bank AG | 1/10/22 | TWD | 5,557 | USD | 200 | 1 | — | |||||||||||||||

Deutsche Bank AG | 1/18/22 | TWD | 5,550 | USD | 200 | — | — | |||||||||||||||

Deutsche Bank AG | 1/3/22 | TWD | 5,535 | USD | 200 | — | — | |||||||||||||||

Deutsche Bank AG | 1/24/22 | TWD | 5,552 | USD | 200 | 1 | — | |||||||||||||||

Deutsche Bank AG | 1/18/22 | TWD | 5,555 | USD | 200 | 1 | — | |||||||||||||||

Deutsche Bank AG | 1/28/22 | TWD | 2,765 | USD | 100 | — | — | |||||||||||||||

Deutsche Bank AG | 1/24/22 | TWD | 5,513 | USD | 200 | — | 1 | |||||||||||||||

Deutsche Bank AG | 1/28/22 | TWD | 5,508 | USD | 200 | — | 1 | |||||||||||||||

Deutsche Bank AG | 1/3/22 | TWD | 7 | USD | — | — | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 71 | AUD | 100 | — | 3 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 213 | AUD | 300 | — | 5 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 72 | AUD | 100 | — | 1 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 215 | AUD | 300 | — | 3 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 72 | AUD | 100 | — | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 155 | CAD | 200 | — | 7 | |||||||||||||||

See notes to consolidated financial statements.

17

Table of Contents

FS Multi-Strategy Alternatives Fund

Consolidated Schedule of Investments (continued)

As of December 31, 2021

(dollar values in thousands, except share and per share amounts)

Counterparty | Contract | Currency and Amount to be Received | Currency and Amount to be Delivered | Unrealized Appreciation | Unrealized Depreciation | |||||||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 79 | CAD | 100 | $ | — | $ | 1 | |||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 156 | CAD | 200 | — | 2 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 136 | CHF | 125 | — | 2 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 135 | CHF | 125 | — | 2 | |||||||||||||||

Deutsche Bank AG | 1/24/22 | USD | 100 | CLP | 88,073 | — | 3 | |||||||||||||||

Deutsche Bank AG | 1/18/22 | USD | 100 | CLP | 87,116 | — | 2 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 200 | CNH | 1,276 | — | 1 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 700 | CNH | 4,465 | — | 2 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 500 | CNH | 3,189 | — | 2 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 283 | EUR | 250 | — | 1 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 1,551 | EUR | 1,375 | — | 15 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 1,133 | EUR | 1,000 | — | 6 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 1,273 | EUR | 1,125 | — | 8 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 845 | EUR | 750 | — | 9 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 282 | EUR | 250 | — | 3 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 141 | EUR | 125 | — | 1 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 83 | GBP | 63 | — | 1 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 417 | GBP | 313 | — | 6 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 248 | GBP | 188 | — | 6 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 84 | GBP | 63 | — | 1 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 300 | HUF | 97,718 | — | 1 | |||||||||||||||

Deutsche Bank AG | 1/3/22 | USD | 500 | INR | 37,708 | — | 7 | |||||||||||||||

Deutsche Bank AG | 1/10/22 | USD | 300 | INR | 22,708 | — | 5 | |||||||||||||||

Deutsche Bank AG | 1/6/22 | USD | 200 | INR | 15,132 | — | 3 | |||||||||||||||

Deutsche Bank AG | 1/18/22 | USD | 300 | INR | 22,835 | — | 6 | |||||||||||||||

Deutsche Bank AG | 1/10/22 | USD | 100 | INR | 7,603 | — | 2 | |||||||||||||||

Deutsche Bank AG | 1/21/22 | USD | 100 | INR | 7,635 | — | 2 | |||||||||||||||

Deutsche Bank AG | 1/24/22 | USD | 300 | INR | 22,744 | — | 5 | |||||||||||||||

Deutsche Bank AG | 1/18/22 | USD | 100 | INR | 7,573 | — | 2 | |||||||||||||||

Deutsche Bank AG | 1/31/22 | USD | 300 | INR | 22,524 | — | 2 | |||||||||||||||

Deutsche Bank AG | 1/24/22 | USD | 100 | INR | 7,499 | — | — | |||||||||||||||

Deutsche Bank AG | 1/3/22 | USD | 1 | INR | 95 | — | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 110 | JPY | 12,500 | 2 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 1,321 | JPY | 150,000 | 17 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 219 | JPY | 25,000 | 1 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 327 | JPY | 37,500 | 1 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 110 | JPY | 12,500 | 2 | — | |||||||||||||||

Deutsche Bank AG | 1/4/22 | USD | 434 | JPY | 50,000 | — | 1 | |||||||||||||||

Deutsche Bank AG | 1/3/22 | USD | 200 | KRW | 237,874 | — | — | |||||||||||||||

Deutsche Bank AG | 1/6/22 | USD | 147 | KRW | 172,788 | 1 | — | |||||||||||||||

Deutsche Bank AG | 1/6/22 | USD | 57 | KRW | 67,150 | 1 | — | |||||||||||||||

Deutsche Bank AG | 1/6/22 | USD | 67 | KRW | 79,282 | 1 | — | |||||||||||||||

Deutsche Bank AG | 1/6/22 | USD | 29 | KRW | 34,095 | — | — | |||||||||||||||

Deutsche Bank AG | 1/7/22 | USD | 100 | KRW | 117,729 | 1 | — | |||||||||||||||

Deutsche Bank AG | 1/10/22 | USD | 300 | KRW | 354,225 | 2 | — | |||||||||||||||

Deutsche Bank AG | 1/3/22 | USD | 100 | KRW | 118,056 | 1 | — | |||||||||||||||

Deutsche Bank AG | 1/18/22 | USD | 300 | KRW | 355,110 | 1 | — | |||||||||||||||

Deutsche Bank AG | 1/18/22 | USD | 100 | KRW | 118,546 | — | — | |||||||||||||||

Deutsche Bank AG | 1/24/22 | USD | 100 | KRW | 119,025 | — | — | |||||||||||||||

Deutsche Bank AG | 1/24/22 | USD | 100 | KRW | 119,242 | — | — | |||||||||||||||

Deutsche Bank AG | 1/24/22 | USD | 300 | KRW | 357,630 | — | — | |||||||||||||||

See notes to consolidated financial statements.

18

Table of Contents

FS Multi-Strategy Alternatives Fund

Consolidated Schedule of Investments (continued)

As of December 31, 2021

(dollar values in thousands, except share and per share amounts)

Counterparty | Contract | Currency and Amount to be Received | Currency and Amount to be Delivered | Unrealized Appreciation | Unrealized Depreciation | |||||||||||||||||

Deutsche Bank AG | 1/28/22 | USD | 200 | KRW | 237,598 | $ | — | $ | — | |||||||||||||

Deutsche Bank AG | 1/27/22 | USD | 100 | KRW | 118,822 | — | — | |||||||||||||||

Deutsche Bank AG | 1/28/22 | USD | 100 | KRW | 118,799 | — | — | |||||||||||||||

Deutsche Bank AG | 1/3/22 | USD | — | KRW | 94 | — | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 120 | MXN | 2,500 | — | 2 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 24 | MXN | 500 | — | 2 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 200 | NOK | 1,797 | — | 4 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 136 | NZD | 200 | — | 1 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 68 | NZD | 100 | — | 2 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 67 | NZD | 100 | — | 1 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 201 | NZD | 300 | — | 4 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 300 | PLN | 1,227 | — | 4 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 200 | RUB | 14,894 | 2 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 100 | RUB | 7,402 | 1 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 100 | RUB | 7,439 | 1 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 200 | SEK | 1,807 | — | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 600 | SGD | 819 | — | 8 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 100 | SGD | 136 | — | 1 | |||||||||||||||

Deutsche Bank AG | 2/10/22 | USD | 100 | TRY | 1,246 | 9 | — | |||||||||||||||

Deutsche Bank AG | 2/10/22 | USD | 100 | TRY | 1,440 | — | 5 | |||||||||||||||

Deutsche Bank AG | 2/10/22 | USD | 100 | TRY | 1,423 | — | 4 | |||||||||||||||

Deutsche Bank AG | 3/10/22 | USD | 100 | TRY | 1,453 | — | 8 | |||||||||||||||

Deutsche Bank AG | 3/10/22 | USD | 100 | TRY | 1,465 | — | 5 | |||||||||||||||

Deutsche Bank AG | 2/10/22 | USD | 100 | TRY | 1,307 | 4 | — | |||||||||||||||

Deutsche Bank AG | 2/9/22 | USD | 100 | TRY | 1,043 | 24 | — | |||||||||||||||

Deutsche Bank AG | 2/9/22 | USD | 200 | TRY | 2,022 | 52 | — | |||||||||||||||

Deutsche Bank AG | 2/9/22 | USD | 100 | TRY | 1,000 | 27 | — | |||||||||||||||

Deutsche Bank AG | 2/9/22 | USD | 100 | TRY | 984 | 28 | — | |||||||||||||||

Deutsche Bank AG | 2/9/22 | USD | 100 | TRY | 993 | 27 | — | |||||||||||||||

Deutsche Bank AG | 2/9/22 | USD | 100 | TRY | 978 | 28 | — | |||||||||||||||

Deutsche Bank AG | 2/9/22 | USD | 100 | TRY | 962 | 30 | — | |||||||||||||||

Deutsche Bank AG | 2/9/22 | USD | 100 | TRY | 948 | 31 | — | |||||||||||||||

Deutsche Bank AG | 2/9/22 | USD | 300 | TRY | 2,845 | 92 | — | |||||||||||||||

Deutsche Bank AG | 3/10/22 | USD | 100 | TRY | 1,377 | 2 | — | |||||||||||||||

Deutsche Bank AG | 1/3/22 | USD | 200 | TWD | 5,542 | — | — | |||||||||||||||

Deutsche Bank AG | 1/10/22 | USD | 99 | TWD | 2,745 | — | — | |||||||||||||||

Deutsche Bank AG | 1/10/22 | USD | 101 | TWD | 2,784 | — | — | |||||||||||||||

Deutsche Bank AG | 1/18/22 | USD | 200 | TWD | 5,555 | — | 1 | |||||||||||||||

Deutsche Bank AG | 1/10/22 | USD | 200 | TWD | 5,556 | — | 1 | |||||||||||||||

Deutsche Bank AG | 1/24/22 | USD | 200 | TWD | 5,556 | — | 1 | |||||||||||||||

Deutsche Bank AG | 1/28/22 | USD | 200 | TWD | 5,513 | 1 | — | |||||||||||||||

Deutsche Bank AG | 1/24/22 | USD | 200 | TWD | 5,513 | 1 | — | |||||||||||||||

Deutsche Bank AG | 2/7/22 | USD | 100 | TWD | 2,765 | — | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | USD | 100 | ZAR | 1,595 | — | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | ZAR | 1,590 | USD | 100 | — | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | CAD | 733 | AUD | 800 | — | 2 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | CAD | 181 | EUR | 125 | 1 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | CAD | 200 | JPY | 17,776 | 4 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | CAD | 200 | JPY | 17,547 | 6 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | EUR | 100 | JPY | 12,873 | 1 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | EUR | 200 | GBP | 170 | — | 3 | |||||||||||||||

See notes to consolidated financial statements.

19

Table of Contents

FS Multi-Strategy Alternatives Fund

Consolidated Schedule of Investments (continued)

As of December 31, 2021

(dollar values in thousands, except share and per share amounts)

Counterparty | Contract | Currency and Amount to be Received | Currency and Amount to be Delivered | Unrealized Appreciation | Unrealized Depreciation | |||||||||||||||||

Deutsche Bank AG | 1/12/22 | EUR | 100 | HUF | 36,932 | $ | — | $ | — | |||||||||||||

Deutsche Bank AG | 1/12/22 | EUR | 100 | GBP | 85 | — | 4 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | EUR | 125 | SEK | 1,291 | — | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | EUR | 100 | JPY | 12,837 | 2 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | EUR | 300 | JPY | 38,666 | 5 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | EUR | 200 | GBP | 169 | — | 1 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | EUR | 100 | JPY | 12,970 | 1 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | EUR | 125 | SEK | 1,284 | — | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | EUR | 100 | JPY | 13,024 | 1 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | EUR | 200 | JPY | 26,048 | 2 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | EUR | 125 | NOK | 1,248 | 1 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | EUR | 100 | GBP | 84 | 1 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | HUF | 36,723 | EUR | 100 | — | 1 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | JPY | 16,294 | AUD | 200 | — | 4 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | JPY | 25,746 | EUR | 200 | — | 4 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | JPY | 15,393 | NZD | 200 | — | 3 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | JPY | 37,846 | GBP | 250 | — | 9 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | JPY | 12,781 | EUR | 100 | — | 3 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | JPY | 25,674 | EUR | 200 | — | 5 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | JPY | 16,540 | AUD | 200 | — | 2 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | JPY | 19,165 | GBP | 125 | — | 3 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | JPY | 13,011 | EUR | 100 | — | 1 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | JPY | 38,934 | EUR | 300 | — | 3 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | JPY | 15,624 | NZD | 200 | — | 1 | |||||||||||||||

Deutsche Bank AG | 1/4/22 | JPY | 13,022 | EUR | 100 | — | 1 | |||||||||||||||

Deutsche Bank AG | 1/4/22 | JPY | 19,388 | GBP | 125 | — | 1 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | JPY | 19,388 | GBP | 125 | — | 1 | |||||||||||||||

Deutsche Bank AG | 1/4/22 | JPY | 26,044 | EUR | 200 | — | 1 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | NZD | 423 | AUD | 400 | — | 1 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | NZD | 200 | JPY | 15,393 | 3 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | NZD | 200 | JPY | 15,448 | 3 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | NZD | 200 | JPY | 15,619 | 1 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | NOK | 1,273 | EUR | 125 | 2 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | NOK | 1,000 | SEK | 1,006 | 2 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | NOK | 2,550 | EUR | 250 | 5 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | GBP | 125 | AUD | 232 | — | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | GBP | 170 | EUR | 200 | 2 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | GBP | 250 | JPY | 37,846 | 9 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | GBP | 125 | JPY | 18,965 | 4 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | GBP | 425 | EUR | 500 | 6 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | GBP | 125 | JPY | 19,124 | 3 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | GBP | 125 | JPY | 19,287 | 2 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | GBP | 336 | EUR | 400 | — | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | GBP | 125 | JPY | 19,388 | 1 | — | |||||||||||||||

Deutsche Bank AG | 1/4/22 | GBP | 125 | JPY | 19,388 | 1 | — | |||||||||||||||

Deutsche Bank AG | 1/12/22 | SEK | 1,281 | EUR | 125 | — | 1 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | SEK | 1,280 | EUR | 125 | — | 1 | |||||||||||||||

Deutsche Bank AG | 1/12/22 | CHF | 390 | EUR | 375 | 1 | — | |||||||||||||||

Morgan Stanley & Co. International PLC | 3/16/22 | USD | 541 | EUR | 477 | — | 3 | |||||||||||||||

See notes to consolidated financial statements.

20

Table of Contents

FS Multi-Strategy Alternatives Fund

Consolidated Schedule of Investments (continued)

As of December 31, 2021

(dollar values in thousands, except share and per share amounts)

Counterparty | Contract | Currency and Amount to be Received | Currency and Amount to be Delivered | Unrealized Appreciation | Unrealized Depreciation | |||||||||||||||||

Morgan Stanley & Co. International PLC | 3/16/22 | USD | 405 | GBP | 305 | $ | — | $ | 9 | |||||||||||||

State Street Bank and Trust Company | 1/4/22 | GBP | 2 | USD | 2 | — | — | |||||||||||||||

| ||||||||||||||||||||||

|

|

|

| |||||||||||||||||||

Total Forward Foreign Currency Exchange Contracts |

| $ | 630 | $ | 505 | |||||||||||||||||

|

|

|

| |||||||||||||||||||

| Description | Number of Contracts | Position | Expiration Date | Notional Amount | Unrealized Appreciation | Unrealized Depreciation | ||||||||||||

|

|

|

|

|

|

| ||||||||||||

Long Futures—0.3% |

| |||||||||||||||||

Commodity Futures Contracts—0.2% |

| |||||||||||||||||

Aluminum | 1 | Long | 1/4/22 | 72 | $ | — | $ | 2 | ||||||||||

Aluminum | 1 | Long | 1/6/22 | 77 | — | 7 | ||||||||||||

Aluminum | 3 | Long | 1/7/22 | 227 | — | 16 | ||||||||||||

Aluminum | 1 | Long | 2/11/22 | 66 | 4 | — | ||||||||||||

Aluminum | 1 | Long | 2/22/22 | 65 | 5 | — | ||||||||||||

Aluminum | 1 | Long | 2/25/22 | 68 | 2 | — | ||||||||||||

Aluminum | 1 | Long | 3/1/22 | 66 | 4 | — | ||||||||||||

Aluminum | 1 | Long | 3/2/22 | 67 | 3 | — | ||||||||||||

Aluminum | 1 | Long | 3/8/22 | 66 | 4 | — | ||||||||||||

Aluminum | 1 | Long | 3/15/22 | 67 | 4 | — | ||||||||||||

Aluminum | 1 | Long | 3/22/22 | 70 | — | — | ||||||||||||

Brent Crude | 1 | Long | 1/31/22 | 78 | — | 1 | ||||||||||||

Canola | 1 | Long | 3/14/22 | 16 | — | — | ||||||||||||

Coffee | 1 | Long | 3/21/22 | 88 | — | 3 | ||||||||||||

Copper | 1 | Long | 3/29/22 | 112 | — | 1 | ||||||||||||

Copper | 1 | Long | 1/5/22 | 229 | 14 | — | ||||||||||||

Copper | 2 | Long | 1/12/22 | 474 | 14 | — | ||||||||||||

Copper | 1 | Long | 1/28/22 | 242 | 2 | — | ||||||||||||

Copper | 1 | Long | 2/3/22 | 238 | 6 | — | ||||||||||||

Copper | 2 | Long | 2/4/22 | 478 | 9 | — | ||||||||||||

Copper | 1 | Long | 2/9/22 | 236 | 7 | — | ||||||||||||

Copper | 1 | Long | 2/10/22 | 236 | 7 | — | ||||||||||||

Copper | 1 | Long | 2/11/22 | 243 | — | — | ||||||||||||

Copper | 2 | Long | 2/18/22 | 482 | 4 | — | ||||||||||||

Copper | 1 | Long | 3/3/22 | 238 | 5 | — | ||||||||||||

Copper | 1 | Long | 3/7/22 | 237 | 7 | — | ||||||||||||

Copper | 1 | Long | 3/9/22 | 239 | 4 | — | ||||||||||||

Copper | 1 | Long | 3/14/22 | 238 | 5 | — | ||||||||||||

Copper | 2 | Long | 3/22/22 | 479 | 7 | — | ||||||||||||

Corn | 2 | Long | 12/14/22 | 56 | — | 1 | ||||||||||||

Corn | 2 | Long | 3/14/22 | 58 | 2 | — | ||||||||||||

Cotton | 1 | Long | 3/9/22 | 56 | — | — | ||||||||||||

Crude Palm Oil Future | 1 | Long | 3/15/22 | 28 | — | — | ||||||||||||

Gasoline | 1 | Long | 1/31/22 | 90 | 4 | — | ||||||||||||

Lead | 1 | Long | 1/6/22 | 54 | 5 | — | ||||||||||||

Lead | 1 | Long | 1/14/22 | 58 | — | — | ||||||||||||

Lead | 1 | Long | 1/28/22 | 60 | — | 2 | ||||||||||||

Lead | 1 | Long | 2/2/22 | 59 | — | — | ||||||||||||

Lead | 1 | Long | 2/3/22 | 59 | — | — | ||||||||||||

Lead | 1 | Long | 2/17/22 | 55 | 3 | — | ||||||||||||

Lead | 1 | Long | 2/18/22 | 56 | 2 | — | ||||||||||||

See notes to consolidated financial statements.

21

Table of Contents