PPDAI GROUP INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(All amounts in thousands, except share data, or otherwise noted)

13. Disposal of subsidiary

As a subsidiary of the Company, Shanghai Hepai Investment Management Co., Ltd. (“Hepai”) sourced funds from investors who were investing in alternative investment product and used these funds to originate loans on the PPDAI platform. The funds received from the investors were recorded as funds payable to investors within Accrued expenses and other liabilities. The interest due to investors or the alternative investment product was accrued based on the expected rate of return using the effective interest rate method.

Interest due to investors on the alternative investment product, interest earned or the loans receivable from borrowers and the loan provision losses are recorded in net interest income (expense) and loan provision losses in the consolidated statement of comprehensive income (loss).

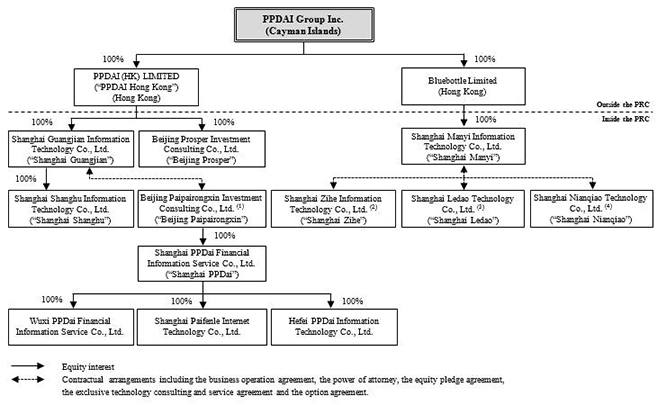

On September 30, 2016, the following transactions were completed pursuant to a share purchase agreement among Beijing Paipairongxin and third parties. Beijing Paipairongxin transferred 100% ownership interest in Hepai to the third parties in return for consideration of RMB20,000 in the form of a note. As a result of the Group’s loss of control over Hepai on September 30, 2016, the Group derecognized the assets and liabilities and recorded a gain of RMB20,611 on the disposal, which is the difference between the consideration of RMB20,000 and the carrying value of the subsidiary, net liability of RMB611. The Group has received the first instalment of RMB14,000 in December 2016 and the remaining RMB6,000 was received in February, 2017.

14. Ordinary shares and treasury stock

In June 2012, PPDAI Group Inc. was incorporated as Limited Liability Company with authorized share capital of US$50,000 divided into 5,000,000,000 shares, of which 4,266,159,600 shares are designated as ordinary shares at par value of US$0.00001 and 733,840,400 as preferred shares.

Immediately prior to the completion of the initial public offering, the Company adopted a dual class share structure. All classes of preferred shares of the Company were converted and designated as Class A ordinary shares on aone-for-one basis and all the ordinary shares of our company were redesignated as Class B ordinary shares on aone-for-one basis except for the 4,000,000 ordinary shares held by GF Sino Vest Fund SPC Star 6 SP, which will be redesignated as Class A ordinary shares on aone-for-one basis.

On November 10, 2017, the Company successfully completed its initial public offering on the New York Stock Exchange. The Company sold 85,000,000 Class A ordinary shares (equivalent to 17,000,000 ADS) at US$2.6 per share (equivalent to US$13.0 per ADS) for a total offering size of approximately RMB1,464.8 million (US$221.0 million). Concurrently with the initial public offering, the Company also closed a private placement with Sun Kung Kai & Co. (CP) Limited and sold 19,230,769 Class A ordinary shares at an aggregate investment amount of RMB331.4 million (US$50.0 million).

In May 2018, unanimously approved by the Board, the Company issued 30,000,000 Class A Ordinary Shares to Citi Limited which converted into 6,000,000 ADSs for exercise of share-based compensation plans. During the year ended December 31, 2018, the Company also had repurchased 12,061,272 ADS, or 60,306,360 shares, for US$67,622(RMB452,262) on the open market at a weighted average price of US$5.61 per ADS for exercise of share based compensation. These issued and repurchased shares are considered not outstanding and therefore were accounted for under the cost method and includes such treasury stock as a component of the shareholder’s equity. As of December 31, 2018, a total of 44,005,360 treasury stock were used for exercise of option with 46,301,000 shares not in use and not outstanding.

On December 17, 2018, Maggie & Tony Limited sold 2,000,000 Class B ordinary shares, or 400,000 ADS, on the open market which were automatically transferred into Class A ordinary shares upon completion of the transaction. As of December 31, 2018, 1,533,071,169 ordinary shares have been issued at par value of US$0.00001, including (i) 874,071,169 Class A ordinary shares and (ii) 659,000,000 Class B ordinary shares.

F-54