Grant of LTIP Units

On March 25, 2020, we entered LTIP Unit Award Agreements with Enzio Cassinis, our Chief Executive Officer and President, and Adam Larson, our Chief Financial Officer, as well as certain other executive officers and registered persons associated with the dealer manager, with respect to the grant of LTIP Unit awards from the Operating Partnership as recommended by our compensation committee and approved by our board of directors. Annually, we expect to make additional grants of LTIP Unit awards to these individuals on the same terms and conditions.

The board of directors, upon the recommendation of the compensation committee, approved awards of time-based LTIP Units to Mr. Cassinis in the amount of $45,000 and to Mr. Larson in the amount of $33,750. Each award will vest approximatelyone-quarter of the awarded amount on January 1, 2021, 2022, 2023 and 2024.

The board of directors, upon the recommendation of the compensation committee, approved awards of performance-based LTIP Units to Mr. Cassinis in the target amount of $135,000 and to Mr. Larson in the target amount of $101,250. The actual amount of each award will be determined at the conclusion of the performance period and will depend on the internal rate of return as defined in the award agreement. The earned LTIP Units will become fully vested on the first anniversary of the last day of the performance period, subject to continued employment with the advisor or its affiliates.

Additional awards of $136,870 performance-based LTIP Units and $45,630 time-based LTIP Units were granted to certain other executive officers and registered persons associated with the dealer manager. The awards are granted effective March 25, 2020, and the number of units will be valued by reference to the estimated value per share of our common stock, currently $10.00.

The time-based and performance-based awards were designed to align the executive officers’ interests with those of our shareholders and to encourage the retention of our executive officers.

Prior Performance Summary

The following discussion supersedes and replaces the “Prior Performance Summary” section of the prospectus.

The information presented in this section represents the historical experience of real estate programs, which we refer to as “prior real estate programs,” sponsored by Cottonwood Residential Inc., Cottonwood Residential O.P., LP and their affiliates. The following summary is qualified in its entirety by reference to the Prior Performance Tables, which may be found in Appendix C of this supplement. Investors in our shares should not assume that they will experience returns, if any, comparable to those experienced by investors in the prior real estate programs. Investors who purchase our shares will not thereby acquire any ownership interest in any of the entities to which the following information relates. Unless specifically noted otherwise, all information in this supplement disclosure is as of December 31, 2019.

Experience and Background of Cottonwood Residential O.P., LP

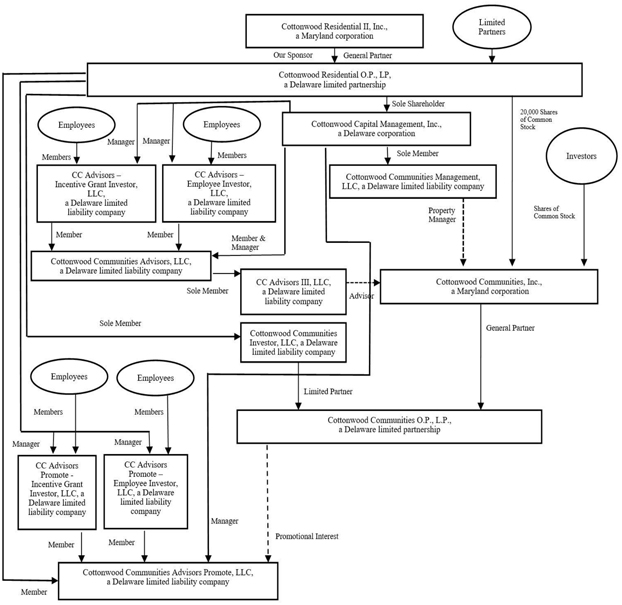

Our advisor, CC Advisors III, LLC, is a recently formed affiliate of Cottonwood Residential O.P., LP. Prior to September 2018, Cottonwood Residential, Inc., formed on September 24, 2009, was the sole general partner of Cottonwood Residential O.P., LP. Cottonwood Residential II, Inc. was added as a general partner of Cottonwood Residential O.P., LP following a decision by Cottonwood Residential, Inc. to commence a plan to liquidate and restructure its subsidiaries, including Cottonwood Residential O.P., LP.

Cottonwood Residential, Inc. did its investing through Cottonwood Residential O.P., LP, its operating partnership. After the implementation of Cottonwood Residential, Inc.’s liquidation and the admission of Cottonwood Residential II, Inc. as a general partner of Cottonwood Residential O.P., LP in September of 2018, Cottonwood Residential II, Inc. managed the investing activities of Cottonwood Residential O.P., LP. Since Cottonwood Residential O.P., LP’s formation in 2009, Cottonwood Residential O.P., LP, has grown into an industry-leading, fully integrated, national multifamily platform. As of December 31, 2019, Cottonwood Residential O.P., LP provides property and asset management services to a platform of multifamily assets representing approximately 14,000 multifamily apartment units across 13 states with over $2.0 billion in value.

S-15