“CMRII Merger”). On July 15, 2021, the CMRI Merger and the CMRII Merger were completed. We refer to the CRII Merger, the CMRI Merger and the CMRII Merger as, the “Mergers.”

At the effective time of the CMRI Merger, each issued and outstanding share of CMRI’s common stock received the merger consideration of 1.175 shares of our Class A common stock in exchange for their CMRI common stock. At the effective time of the CMRII Merger, each issued and outstanding share of CMRII’s common stock received the merger consideration of 1.072 shares of our Class A common stock in exchange for their CMRII common stock. In addition, each partnership unit in CMRI OP and CMRII OP, which equaled the total number of common stock in CMRI and CMRII, respectively, issued and outstanding immediately prior to the respective merger, converted into common limited partner units in CROP at the same exchange ratio.

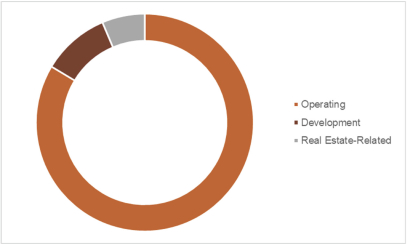

With the completion of the Mergers, we acquired interests in 22 stabilized multifamily apartment communities, four multifamily development projects, one structured investment, and land held for development. We also acquired CRII’s property management business and its employees, which currently manage over 13,000 units, including approximately 8,600 for Cottonwood affiliates (including us).

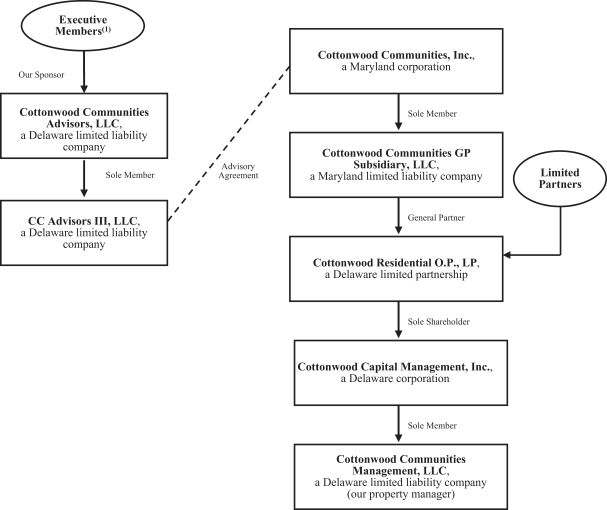

In addition, in connection with the CRII Merger, on May 7, 2021, we, CROP and our advisor entered into an amended and restated advisory agreement, the fees of which are disclosed in this prospectus, as well as the CROP Partnership Agreement, the terms of which are described in this prospectus. In addition, we acquired personnel who historically performed certain operational services for us on behalf of our advisor, including property management, legal, accounting, property development oversight and certain services relating to construction management, stockholders, human resources, renter insurance and information technology. Following the CRII Merger, we generally intend to property manage our real estate investments directly; however, in some circumstances, we may be required to hire local property managers to oversee the day-to-day operations at some of our properties.

Our advisor will continue to manage our business through its employees, and, with the exception of our Chief Legal Officer, Chief Operating Officer, Chief Accounting Officer and Executive Vice President, we will not employ our executive officers.

What policies will you follow in implementing your investment strategy?

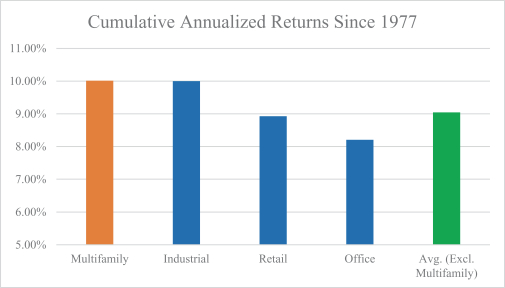

Our advisor operates pursuant to a philosophy that location, investment time horizon, asset-specific attributes and appropriate leverage are fundamental drivers of long-term value creation in real estate. These principles drive the material aspects of our advisor’s investment decision-making process. See “Investment Objectives – Investment Philosophy and Life Cycle” for a discussion of these principles.

Once a potential investment has been identified, our advisor will engage in a rigorous due diligence process. Although due diligence procedures are customized for specific elements of each deal, our advisor will follow traditional due diligence processes (physical, market, financial, environmental, zoning, insurance, tax, legal, etc.) in considering investments for us. Our advisor may outsource certain due diligence items to specialized consultants or third-party service providers, as needed, to support the diligence effort. Our advisor’s diligence focuses on three customary areas: financial, physical, and legal and tax. Additional information about these focuses is available at “Investment Objectives - Investment Philosophy and Life Cycle.”

We finance the purchase of multifamily apartment communities with proceeds of this offering and loans obtained from third-party lenders. We anticipate the use of moderate leverage to enhance total cash flow to our stockholders. We will target an aggregate loan-to-cost or loan-to-value ratio of 45% to 65% at the REIT level; provided, however, that we may obtain financing that is less than or exceeds such ratio in the discretion of our board of directors if the board of directors deems it to be in our best interest to obtain such financing. Although there is no limit on the amount we can borrow to acquire a single real estate investment, we may not leverage our

4