UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

| | | | | | |

| Filed by the Registrant | ý | |

| Filed by a Party other than the Registrant | ☐ | |

Check the appropriate box:

| | | | | | |

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ý | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 | |

COTTONWOOD COMMUNITIES, INC.

(Name of Registrant as Specified in its Charter)

Payment of Filing Fee (Check the appropriate box):

| | | | | | |

| ý | No fee required. | |

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and | |

Proxy Statement and

Notice of Annual Meeting of Stockholders

To Be Held November 12, 2024

Dear Stockholder:

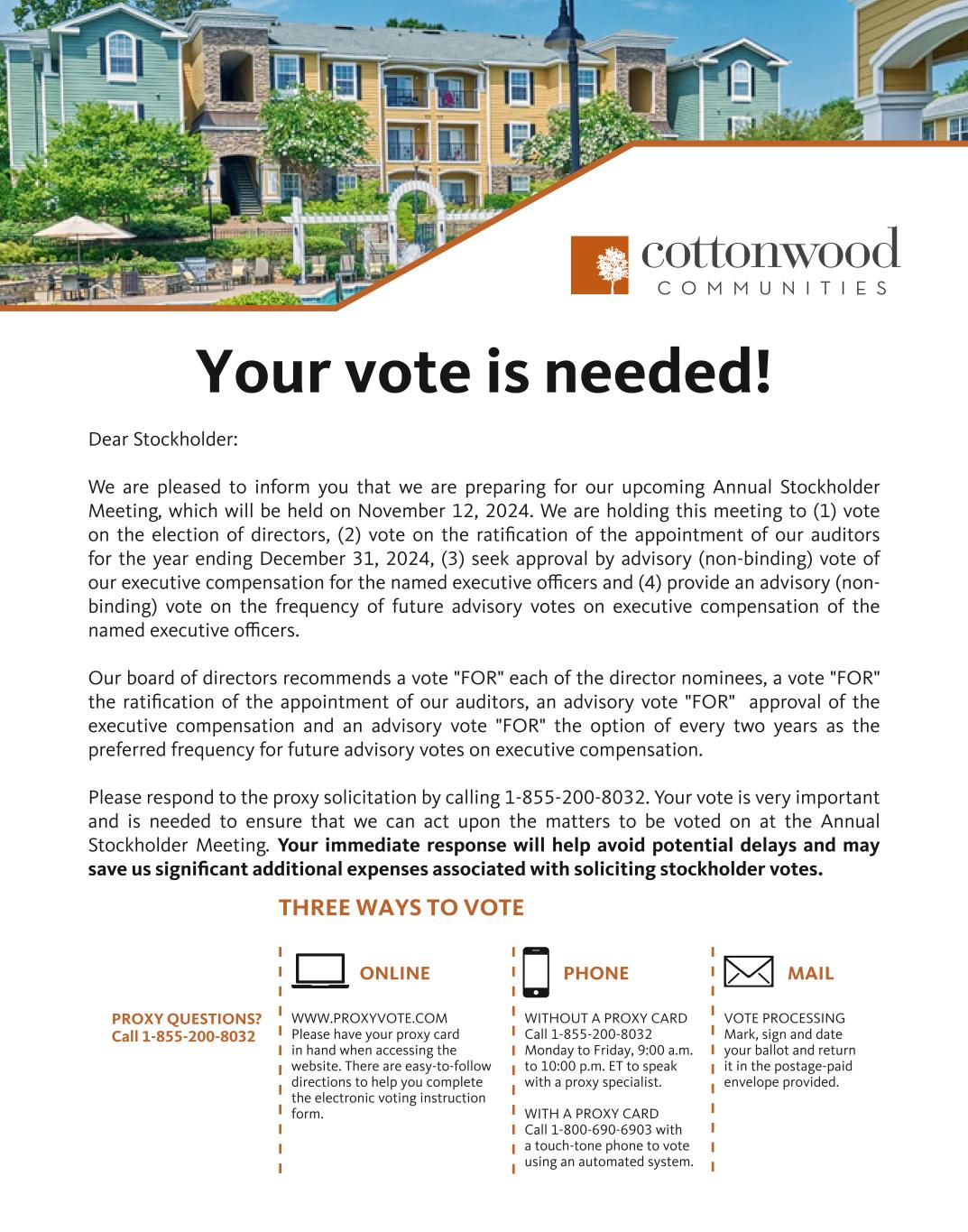

On Tuesday, November 12, 2024, we will hold our 2024 annual meeting of stockholders at 1245 Brickyard Road, Suite 250, Salt Lake City, Utah 84106. The meeting will begin at 10:00 a.m. Mountain Standard Time. Directions to the meeting can be obtained by calling 801-278-0700.

We are holding this meeting for the following purposes:

| | |

1.Elect five directors to hold office for one-year terms expiring in 2025. The Board of Directors recommends a vote FOR each nominee. 2.To ratify the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2024. The Board of Directors recommends a vote FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2024. 3.To approve, by advisory (non-binding) vote, our executive compensation for the named executive officers; The Board of Directors recommends a vote FOR the approval of our executive compensation. 4.To recommend, by, advisory (non-binding) vote, the frequency of future executive compensation advisory votes; The Board of Directors recommends a vote of TWO YEARS for the frequency of future executive compensation advisory votes 5.Attend to such other business as may properly come before the meeting and any adjournment or postponement thereof. |

The board of directors has selected August 14, 2024, as the record date for determining stockholders entitled to vote at the meeting.

The proxy statement, proxy card and our 2023 annual report to stockholders (all included herewith) are being mailed to you on or about August 16, 2024.

Whether or not you plan to attend the meeting and vote in person, we urge you to have your vote recorded as early as possible. Stockholders have the following three options for submitting their votes by proxy: (1) via the Internet; (2) by telephone; or (3) by mail, using the enclosed proxy card.

Your vote is very important! Your immediate response will help avoid potential delays and may save us significant additional expenses associated with soliciting stockholder votes.

| | |

IMPORTANT NOTICE REGARDING AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON NOVEMBER 12, 2024:

Our proxy statement, form of proxy card and 2023 annual report to stockholders are also available at www.proxyvote.com. |

By Order of the Board of Directors

/s/ Gregg Christensen

Gregg Christensen

Secretary

Salt Lake City, Utah

August 16, 2024

QUESTIONS AND ANSWERS ABOUT THE MEETING AND VOTING

Q: Why did you send me this proxy statement?

A: We sent you this proxy statement and the enclosed proxy card because our board of directors is soliciting your proxy to vote your shares at the 2024 annual stockholders meeting. This proxy statement is designed to assist you in voting. You do not need to attend the annual meeting in person to vote.

Q: What is a proxy?

A: A proxy is a person who votes the shares of stock of another person who could not attend a meeting. The term “proxy” also refers to the proxy card or other method of appointing a proxy. When you submit your proxy, you are appointing Enzio Cassinis, Adam Larson and Gregg Christensen, and each of them, as your proxies, and you are giving them permission to vote your shares of common stock at the annual meeting. Each of Messrs. Cassinis, Larson and Christensen is one of our officers. The appointed proxies will vote your shares of common stock as you instruct unless you submit your proxy without instructions. If you submit your signed proxy without instructions, they will vote:

(1) FOR all of the director nominees;

(2) FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2024;

(3) FOR the approval, by advisory (non-binding) vote, of our executive compensation for the named executive officers; and

(4) FOR the recommendation, by advisory (non-binding) vote, of future executive compensation advisory votes on a frequency of every two years.

With respect to any other proposals to be voted upon, they will vote in accordance with the recommendation of the board of directors or, in the absence of such a recommendation, in their discretion. If you do not submit your proxy, they will not vote your shares of common stock. This is why it is important for you to return the proxy card to us (or submit your proxy via the Internet or by telephone) as soon as possible whether or not you plan on attending the meeting.

Q: When is the annual meeting and where will it be held?

A: The annual meeting will be held on Tuesday, November 12, 2024, at 10:00 a.m. Mountain Standard Time at our executive offices at 1245 Brickyard Road, Suite 250, Salt Lake City, Utah 84106.

Q: Who is entitled to vote?

A: Anyone who is a stockholder of record at the close of business on August 14, 2024, the record date, or holds a valid proxy for the annual meeting, is entitled to vote at the annual meeting.

Q: How many shares of common stock are outstanding?

A: As of August 14, 2024, there were 31,765,289 shares of our common stock outstanding and entitled to vote.

Q: What constitutes a quorum?

A: A quorum consists of the presence in person or by proxy of stockholders entitled to cast 50% of all the votes entitled to be cast at the annual meeting. There must be a quorum present in order for the annual meeting to be a duly held meeting at which business can be conducted. If you submit your proxy, even if you abstain from voting, then you will at least be considered part of the quorum. Broker non-votes (discussed below) will also be considered present for the purpose of determining whether we have a quorum.

If a quorum is not present at the annual meeting, the chairman of the meeting may adjourn the annual meeting to another date, time or place, not later than 120 days after the original record date of August 14, 2024. Notice need not be given of the new date, time or place if announced at the annual meeting before an adjournment is taken.

Q: How many votes do I have?

A: You are entitled to one vote for each share of common stock you held as of the record date.

Q: What may I vote on?

A: You may vote on:

(1)the election of the nominees to serve on the board of directors;

(2)the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2024;

(3)the approval, by advisory (non-binding) vote, of our executive compensation for the named executive officers; and

(4)the recommendation, by advisory (non-binding) vote, on the frequency of future executive compensation advisory votes.

In addition, you may vote on such other business as may properly come before the annual meeting and any adjournment or postponement thereof.

Q: How does the board of directors recommend I vote on the proposals?

A: The board of directors recommends that you vote:

(1)FOR each of the nominees for election as a director who is named in this proxy statement;

(2)FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2024;

(3)FOR approving the compensation of the named executive officers; and

(4)FOR a two-year frequency for future advisory votes on executive compensation.

Q: How can I vote?

A: Stockholders can vote in person at the meeting or by proxy. Stockholders have the following three options for submitting their votes by proxy:

•via the Internet at www.proxyvote.com;

•by automated telephone, using your touch-tone phone by calling 1-800-690-6903;

•by speaking to a live agent, by calling 1-855-200-8032; or

•by mail, by completing, signing, dating and returning the enclosed proxy card.

For those stockholders with Internet access, we encourage you to vote by proxy via the Internet, since it is quick, convenient and provides a cost savings to us. When you vote by proxy via the Internet or by telephone prior to the meeting date, your vote is recorded immediately and there is no risk that postal delays will cause your vote to arrive late and, therefore, not be counted. For further instructions on voting, see the enclosed proxy card.

If you elect to attend the meeting, you can submit your vote in person, and any previous votes that you submitted, whether by Internet, telephone or mail, will be superseded.

Q: What if I submit my proxy and then change my mind?

A: You have the right to revoke your proxy at any time before the meeting by:

(1) notifying Gregg Christensen, our Secretary;

(2) attending the meeting and voting in person;

(3) recasting your proxy vote via the Internet or by telephone; or

(4) returning another proxy card dated after your first proxy card if we receive it before the annual meeting date.

Only the most recent proxy vote will be counted and all others will be discarded regardless of the method of voting.

Q: Will my vote make a difference?

A: Yes. Your vote could affect the proposals described in this proxy statement. Moreover, your vote is needed to ensure that the proposals described herein can be acted upon. YOUR VOTE IS VERY IMPORTANT! Your immediate response will help avoid potential delays and may save us significant additional expenses associated with soliciting stockholder votes.

Q: What are the voting requirements to elect the board of directors?

A: The vote of a majority of the total of votes cast for and against a nominee at a meeting at which a quorum is present is required for the election of a director. This means that, of the votes cast at an annual meeting, a director nominee needs to receive affirmative votes from a majority of such votes cast in order to be elected to the board of directors. For purposes of the election of directors, abstentions and broker non-votes, if any, will not be counted as votes cast and will have no effect on the result of the vote. If an incumbent director nominee fails to receive the required number of votes for re-election, then under Maryland law, he will continue to serve as a “holdover” director until their successor is duly elected and qualified. If you submit a proxy card with no further instructions, your shares will be voted FOR each of the director nominees.

Q: What are the voting requirements for the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2024?

A: The affirmative vote of a majority of the votes cast at an annual meeting at which a quorum is present is required for the ratification of the appointment of KPMG LLP as our independent registered public accounting

firm for the year ending December 31, 2024. For purposes of the ratification of our auditor, abstentions will not count as votes cast and will have no effect on the result of the vote. If you submit a proxy card with no further instructions, your shares will be voted FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2024.

Q: What are the voting requirements for the stockholders’ advisory (non-binding) vote on executive compensation of the named executive officers?

A: The affirmative vote of a majority of the votes cast at an annual meeting at which a quorum is present is required to approve, by non-binding vote, the executive compensation of the named executive officers. For purposes of this advisory vote on executive compensation, abstentions and broker non-votes will not count as votes cast and will have no effect on the result of the vote. If you submit a proxy card with no further instructions, your shares will be voted FOR the executive compensation of the named executive officers.

Q: What are the voting requirements for the stockholders’ advisory (non-binding) vote on the frequency of future executive compensation advisory votes?

A: The frequency of the advisory vote on executive compensation receiving the greatest number of votes (every one, two or three years) will be considered the frequency recommended by the stockholders. For purposes of this advisory vote on the frequency of future advisory votes on executive compensation, abstentions and broker non-votes will not be counted as votes cast and will have no effect on the result of the vote. If you submit a proxy card with no further instructions, your shares will be voted FOR a frequency of every two years.

Q: What is a “broker non-vote”?

A: A “broker non-vote” occurs when a broker holding stock on behalf of a beneficial owner submits a proxy but does not vote on a particular proposal because the broker does not have discretionary voting power with respect to that particular proposal and has not received instructions from the beneficial owner.

Brokers are precluded from exercising their voting discretion with respect to the approval of non-routine matters, and, as a result, absent specific instructions from the beneficial owner of such shares, brokers will not vote those shares. Broker non-votes will have no effect on the election of our directors, the advisory vote on executive compensation of the named executive officers, or the advisory vote on the frequency of future executive compensation advisory votes. Because brokers have discretionary authority to vote for the ratification of the appointment of KPMG LLP as our independent registered public accounting firm, in the event they do not receive voting instructions from the beneficial owner of the shares, there will not be any broker non-votes with respect to that proposal.

Your broker will send you information to instruct it on how to vote on your behalf. If you do not receive a voting instruction card from your broker, please contact your broker promptly to obtain a voting instruction card. Your vote is important to the success of the proposals. We encourage all of our stockholders whose shares are held by a broker to provide their brokers with instructions on how to vote.

Q: How will voting on any other business be conducted?

A: Although we do not know of any business to be considered at the annual meeting other than the election of directors, the ratification of the appointment of KPMG LLP as our independent registered public accounting firm, the stockholders’ advisory (non-binding) vote on executive compensation of the named executive officers and the stockholders’ advisory (non-binding) vote on the frequency of future executive compensation advisory votes, if any other business is properly presented at the annual meeting, your submitted proxy gives authority

to Enzio Cassinis, our President, Adam Larson, our Chief Financial Officer, and Gregg Christensen, our Chief Legal Officer and Secretary, and each of them, to vote on such matters in accordance with the recommendation of the board of directors or, in the absence of such a recommendation, in their discretion.

Q: When are the stockholder proposals for the next annual meeting of stockholders due?

A: Any proposals by stockholders for inclusion in our proxy solicitation material for the next annual meeting of stockholders must be received by Mr. Christensen, our Secretary, at our executive offices no later than April 18, 2025. However, if we hold our next annual meeting before October 13, 2025 or after December 12, 2025 stockholders must submit proposals for inclusion in our proxy statement within a reasonable time before we begin to print our proxy materials.

Stockholders interested in nominating a person as a director or presenting any other business for consideration at our annual meeting of stockholders in 2025 may do so by following the procedures prescribed in Section 2.12 of our bylaws. To be eligible for presentation to and action by the stockholders at the 2025 annual meeting, director nominations and other stockholder proposals must be received by Mr. Christensen, our Secretary, no earlier than March 19, 2025 nor later than 5:00 p.m., Eastern Time, on April 18, 2025.

Q: Is this proxy statement the only way that proxies are being solicited?

A: No. In addition to mailing proxy solicitation material, our directors and employees of our advisor or its affiliates, as well as third-party proxy service companies we retain, may also solicit proxies in person, via the Internet, by telephone or by any other electronic means of communication we deem appropriate. Additionally, we have retained Broadridge Financial Solutions, Inc. (“Broadridge”), a proxy solicitation firm, to assist us in the proxy solicitation process.

Q: Who pays the cost of this proxy solicitation?

A: We will pay all of the costs of soliciting these proxies, including the cost of Broadridge’s services. We anticipate that for Broadridge’s solicitation services we will pay approximately $120,000, plus reimbursement of Broadridge’s out-of-pocket expenses. We will also reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to our stockholders. Our directors and employees of our advisor or its affiliates will not be paid any additional compensation for soliciting proxies.

Q: What should I do if I receive more than one set of voting materials for the annual meeting?

A: You may receive more than one set of voting materials for the annual meeting, including multiple copies of this proxy statement and multiple proxy cards or voting instruction forms. For example, if you hold your shares in more than one brokerage account, you will receive a separate voting instruction form for each brokerage account in which you hold shares. If you are a holder of record and your shares are registered in more than one name, you will receive more than one proxy card and voting instruction form. For each and every proxy card and voting instruction form that you receive, please authorize a proxy as soon as possible using one of the following methods:

(1)via the Internet, by accessing the website and following the instructions indicated on the enclosed proxy card;

(2)by telephone, by calling the telephone number and following the instructions indicated on the enclosed proxy card; or

(3)by mail, by completing, signing, dating and returning the enclosed proxy card.

Q: What should I do if only one set of voting materials for the annual meeting is sent and there are multiple stockholders in my household?

A: Some banks, brokers and other nominee record holders may be participating in the practice of “householding” proxy statements and annual reports. This means that only one copy of this proxy statement may have been sent to multiple stockholders in your household. We will promptly deliver a separate copy of this proxy statement to you if you contact Broadridge at 1-866-540-7095.

Q: Where can I find more information?

A: We file annual, quarterly and current reports and other information with the SEC. You may read and copy any reports, statements or other information we file with the SEC on the web site maintained by the SEC at http://www.sec.gov.

FORWARD-LOOKING STATEMENTS

Certain statements contained in this proxy statement other than historical facts may be considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We intend for all such forward-looking statements to be covered by the applicable safe harbor provisions for forward-looking statements contained in those acts. Such statements include, in particular, statements about our plans, strategies, and prospects and are subject to certain risks and uncertainties, including known and unknown risks, which could cause actual results to differ materially from those projected or anticipated. Therefore, such statements are not intended to be a guarantee of our performance in future periods. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue,” or other similar words. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date they are made. We make no representations or warranties (expressed or implied) about the accuracy of any such forward-looking statements contained in this proxy statement, and we do not intend to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, unless required by law.

Any such forward-looking statements are subject to risks, uncertainties, and other factors and are based on a number of assumptions involving judgments with respect to, among other things, future economic, competitive, and market conditions, all of which are difficult or impossible to predict accurately. To the extent that our assumptions differ from actual conditions, our ability to accurately anticipate results expressed in such forward-looking statements, including our ability to generate positive cash flows from operations, make distributions to stockholders, maintain the value of our real estate properties and provide liquidity to stockholders, may be significantly hindered. See Part I, Item 1A in our Annual Report on Form 10-K filed with the SEC on March 28, 2024 for a discussion of some of the risks and uncertainties, although not all risks and uncertainties, that could cause actual results to differ materially from those presented in our forward-looking statements.

CERTAIN INFORMATION ABOUT MANAGEMENT

Board of Directors

Cottonwood Communities, Inc. (“we” or the “Company”) operates under the direction of our board of directors, the members of which are accountable to us and our stockholders as fiduciaries. The board of directors is responsible for the management and control of our affairs and oversight of service providers at all times. The board of directors has retained our advisor, CC Advisors III, LLC (“CC Advisors III”), to manage our business and the acquisition and disposition of our real estate investments, subject to the board of director’s supervision. Because of the numerous conflicts of interest created by the relationships among us, our advisor and various affiliates, many of the responsibilities of the board of directors have been delegated to a committee that consists solely of independent directors. This committee is the conflicts committee and is discussed below. During 2023, the board of directors held nine meetings.

Board Leadership Structure

Our board of directors consists of five directors, two of whom are affiliated with our advisor, and three of whom are independent, meeting the independence criteria as specified in our charter. Unless otherwise specified, all references to independent directors in this proxy statement refer to compliance with the independent director criteria as specified in our charter, as set forth under “ – Director Independence” below. Our charter provides that a majority of the seats on the board of directors will be for independent directors. The board composition and the corporate governance provisions in our charter ensure strong oversight by independent directors. The board of directors’ three standing committees, the audit committee, the compensation committee and the conflicts committee, are composed entirely of independent directors. We do not currently have a policy requiring the appointment of a lead independent director as all of our independent directors are actively involved in board meetings.

Since October 2018, we have operated under a board leadership structure with separate roles for our Chairman of the Board and our Principal Executive Officer. Our Chairman of the Board is responsible for setting the agenda for each of the meetings of the board of directors and the annual meetings of stockholders. As our Chairman also serves as one of our executive officers, his direct involvement in our operations makes him well positioned to lead strategic planning sessions and determine the time allocated to each agenda item in discussions of our short- and long-term objectives. Our Principal Executive Officer is responsible for the general management of the business, financial affairs and day-to-day operations of the Company. We believe it is beneficial to have separate roles for our Principal Executive Officer and the Chairman of the Board as this permits the Chairman to focus on leading the board and facilitating communication among directors and management. Accordingly, we believe this structure has been the best governance model for the Company and our stockholders to date.

The Role of the Board of Directors in our Risk Oversight Process

Our executive officers and our advisor are responsible for the day-to-day management of risks we face, while the board of directors, as a whole and through its committees, has responsibility for the oversight of risk management. No less than quarterly, the entire board of directors reviews information regarding our liquidity, credit, operations, regulatory compliance and compliance with covenants in our material agreements, as well as the risks associated with each. In addition, each year the board of directors reviews significant variances between our current portfolio business plan and our original underwriting analysis and each quarter the directors review significant variances between our current results and our projections from the prior quarter, review all significant changes to our projections for future periods and discuss risks related to our portfolio. The board of directors also is responsible for reviewing our advisor’s cybersecurity policies with management and evaluating the adequacy of the program, compliance and controls with management. Our Executive Security Council reports to our board of directors and to our audit committee as appropriate. Material cybersecurity events, if any, are escalated to our full board of directors on an ongoing basis as necessary. The audit committee oversees risk management in the areas of financial reporting, internal controls and compliance with legal and regulatory requirements. The compensation committee manages risks related to our compensation policies and programs, including whether any compensation program has the potential to encourage excessive risk taking. The conflicts committee manages risks associated with the

independence of the independent directors and potential conflicts of interest involving our advisor and its affiliates. Although each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire board of directors is regularly informed through committee reports about such risks as well as through regular reports directly from the executive officers responsible for oversight of particular risks to us.

Director Independence

Our charter provides that a majority of our directors must be independent. We currently have three independent directors on our five-member board of directors. A majority of the directors on any committees established by the board must also be independent. Our board of directors has three standing committees: the audit committee, the conflicts committee and the compensation committee.

Under our charter, an independent director is a person who is not associated and has not been associated within the last two years, directly or indirectly, with our sponsor or advisor. A director is deemed to be associated with our sponsor or our advisor if he or she owns an interest in, is employed by, is an officer or director of, or has any material business or professional relationship with our sponsor, advisor or any of their affiliates, performs services (other than as a director) for us, is a director for more than three REITs organized by our sponsor or advised by our advisor. A business or professional relationship will be deemed material if the gross income derived by the director from our sponsor, our advisor and any of their affiliates exceeds 5% of (1) the director’s annual gross revenue derived from all sources, during either of the last two years or (2) the director’s net worth on a fair market value basis. An indirect relationship will include circumstances in which a director’s spouse, parent, child, sibling, mother- or father-in-law, son- or daughter-in-law, or brother- or sister-in-law is or has been associated with our sponsor, advisor or any of their affiliates or the Company.

In addition, although our shares are not listed for trading on any national securities exchange, a majority of our directors, and all of the members of the audit committee, the conflicts committee, and the compensation committee are “independent” as defined by the New York Stock Exchange. The New York Stock Exchange standards provide that to qualify as an independent director, in addition to satisfying certain bright-line criteria, our board of directors must affirmatively determine that a director has no material relationship with us (either directly or as a partner, stockholder or officer of an organization that has a relationship with us). Our board of directors has affirmatively determined that each of our independent directors, Jonathan Gardner, John Lunt and Philip White, satisfies the New York Stock Exchange independence standards.

Advisory Board Members

Our board of directors has established advisory board members to provide advice and recommendations to our board with respect to matters as our board may from time to time request concerning our operations (the “Advisory Board Members”). Gregg Christensen, Glenn Rand and Susan Hallenberg, all of whom are our officers, have been appointed to serve as Advisory Board Members. The Advisory Board Members may attend board meetings at the invitation of our board, but will not be permitted to vote on any matter presented to our board or to bind us on any matter in their role as Advisory Board Members. Advisory Board Members will not be compensated for their service to the board.

Code of Ethics

We have adopted a Code of Conduct and Ethics that applies to all of our executive officers and directors including but not limited to our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of our Code of Conduct and Ethics is available on our website at cottonwoodcommunities.com/corporate-governance/. Any amendment to, or a waiver from, a provision of the Code of Conduct and Ethics that would require disclosure under Item 5.05 of Form 8-K will be posted on our website at cottonwoodcommunities.com/corporate-governance/.

The Audit Committee

General

Our board of directors has established an audit committee composed entirely of independent directors. Audit Committee members are “independent”, consistent with the qualifications set forth in Rule 10A-3 under the Exchange Act, applicable to boards of directors in general and audit committees in particular. Mr. Lunt is qualified as an audit committee financial expert within the meaning of Item 407(d)(5) of Regulation S-K under the Exchange Act.

Among other things, the audit committee will assist the board in overseeing:

| | | | | | | | | | | |

| • | | our accounting and financial reporting processes; |

| | | | | | | | | | | |

| • | | the integrity and audits of our financial statements; |

| | | | | | | | | | | |

| • | | our compliance with legal and regulatory requirements; |

| | | | | | | | | | | |

| • | | the qualifications and independence of our independent registered public accounting firm; and |

| | | | | | | | | | | |

| • | | the performance of our internal auditors and our independent registered public accounting firm. |

The audit committee is also responsible for engaging our independent registered public accounting firm, reviewing with the independent registered public accounting firm the plans and results of the audit engagement, and considering and approving the audit and non-audit services and fees provided by the independent registered public accounting firm. The members of the audit committee are Messrs. Gardner, Lunt and White

During 2023, the audit committee held five meetings. The audit committee charter is available on our website at cottonwoodcommunities.com

Independent Registered Public Accounting Firm

During the year ended December 31, 2023, KPMG LLP served as our independent registered public accounting firm and provided certain tax and other services. KPMG LLP has served as our independent registered public accounting firm since our formation. We expect that KPMG LLP representatives will be present at the annual meeting and they will have the opportunity to make a statement if they desire to do so. In addition, we expect that the KPMG LLP representatives will be available to respond to appropriate questions posed by stockholders. The audit committee has appointed KPMG LLP as our independent registered public accounting firm to audit our financial statements for the year ending December 31, 2024. The audit committee may, however, select a new independent registered public accounting firm at any time in the future in its discretion if it deems such decision to be in our best interest. Any such decision would be disclosed to our stockholders in accordance with applicable securities laws.

Pre-Approval Policies

In order to ensure that the provision of such services does not impair the independent registered public accounting firm’s independence, the audit committee charter imposes a duty on the audit committee to pre-approve all auditing services performed for us by our independent registered public accounting firm, as well as all permitted non-audit services. In determining whether or not to pre-approve services, the audit committee considers whether the service is a permissible service under the rules and regulations promulgated by the SEC. The audit committee may, in its discretion, delegate to one or more of its members the authority to pre-approve any audit or non-audit services to be performed by our independent registered public accounting firm, provided any such approval is presented to and approved by the full audit committee at its next scheduled meeting.

All services rendered by KPMG LLP for the years ended December 31, 2023 and 2022 were pre-approved in accordance with the policies and procedures described above.

Principal Independent Registered Public Accounting Firm Fees

The audit committee reviewed the audit and non-audit services performed by KPMG LLP, as well as the fees charged by KPMG LLP for such services. In its review of the non-audit service fees, the audit committee considered whether the provision of such services is compatible with maintaining the independence of KPMG LLP. The aggregate fees billed to us for professional accounting services, including the audit of our annual financial statements by KPMG LLP for the years ended December 31, 2023 and 2022, are set forth in the table below (in thousands).

| | | | | | | | | | | |

| 2023 | | 2022 |

| Audit fees | $ | 1,226 | | $ | 843 |

| Audit-related fees | — | | — |

| Tax fees | — | | — |

| All other fees | — | | — |

| Total | $ | 1,226 | | $ | 843 |

For purposes of the preceding table, KPMG LLP’s professional fees are classified as follows:

•Audit fees – These are fees for professional services performed for the audit of our annual financial statements and the required review of quarterly financial statements and other procedures performed by KPMG LLP in order for them to be able to form an opinion on our consolidated financial statements. These fees also cover services that are normally provided by independent registered public accounting firms in connection with statutory and regulatory filings or engagements.

•Audit-related fees – These are fees for assurance and related services that traditionally are performed by independent registered public accounting firms that are reasonably related to the performance of the audit or review of our financial statements, such as due diligence related to acquisitions and dispositions, attestation services that are not required by statute or regulation, internal control reviews and consultation concerning financial accounting and reporting standards.

•Tax fees – These are fees for all professional services performed by professional staff in our independent registered public accounting firm’s tax division, except those services related to the audit of our financial statements. These include fees for tax compliance, tax planning and tax advice, including federal, state and local issues. Services may also include assistance with tax audits and appeals before the U.S. Internal Revenue Service (the “IRS”) and similar state and local agencies, as well as federal, state and local tax issues related to due diligence.

•All other fees – These are fees for any services not included in the above-described categories.

Report of the Audit Committee

The function of the audit committee is oversight of the financial reporting process on behalf of the board of directors. Management has responsibility for the financial reporting process, including the system of internal control over financial reporting, and for the preparation, presentation, and integrity of our financial statements. In addition, our independent registered public accounting firm devotes more time and has access to more information than does the audit committee. Membership on the audit committee does not call for the professional training and technical skills generally associated with career professionals in the field of accounting and auditing. Accordingly, in fulfilling their responsibilities, it is recognized that members of the audit committee are not, and do not represent themselves to be, performing the functions of auditors or accountants.

In this context, the audit committee reviewed and discussed the 2023 audited financial statements with management, including a discussion of the quality and acceptability of our financial reporting, the reasonableness of significant judgments and the clarity of disclosures in the financial statements. The audit committee discussed with KPMG LLP, which is responsible for expressing an opinion on the conformity of those audited financial statements

with U.S. generally accepted accounting principles (“GAAP”), the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board and the SEC. The audit committee received from KPMG LLP the written disclosures and the letter required by applicable requirements of the Public Company Accounting Oversight Board regarding KPMG LLP’s communications with the audit committee concerning independence and discussed with KPMG LLP their independence from us. In addition, the audit committee considered whether KPMG LLP’s provision of non-audit services is compatible with KPMG LLP’s independence.

Based on these reviews and discussions, the audit committee recommended to the board of directors that the audited financial statements be included in our Annual Report on Form 10-K for the year ended December 31, 2023 for filing with the SEC.

| | | | | |

| August 6, 2024 | The Audit Committee of the Board of Directors: |

| |

| John Lunt (Chairman), Jonathan Gardner and Philip White |

The foregoing Report of the Audit Committee shall not be deemed to be “soliciting material” or incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), except to the extent that we specifically incorporate this information by reference, and shall not otherwise be deemed filed under the Exchange Act.

The Compensation Committee

The primary purpose of the compensation committee, which is composed of all of our independent directors, is to oversee our compensation programs. The committee discharges the board of directors' responsibilities relating to compensation practices for directors and executive officers to the extent they are compensated directly. The compensation committee may, in its discretion, delegate all or a portion of its duties and responsibilities to a subcommittee of the committee. The members of the compensation committee are Messrs. Gardner, Lunt and White.

During 2023, the compensation committee held two meetings. The compensation committee charter is available on our website at www.cottonwoodcommunities.com.

Compensation Committee Interlocks and Insider Participation

During 2023, the Compensation Committee was composed of Messrs. Gardner, Lunt and White, none of whom were officers or employees of the Company during the fiscal year ended December 31, 2023, and none of whom had any relationship requiring disclosure by the Company under Item 404 of Regulation S-K under the Exchange Act.

The Conflicts Committee

General

The members of the conflicts committee are Messrs. Gardner, Lunt and White, all of whom are independent directors. Our charter empowers the conflicts committee to act on any matter permitted under Maryland law if the matter at issue is such that the exercise of independent judgment by directors who are affiliates of our advisor could reasonably be compromised. Among the duties of the conflicts committee are the following:

•reviewing and reporting on our policies;

•approving transactions with affiliates and reporting on their fairness to us;

•supervising and evaluating the performance and compensation of our advisor;

•reviewing our expenses and determining that they are reasonable and within the limits prescribed by our charter; and

•approving borrowings in excess of the total liabilities limit set forth in our charter.

The primary responsibilities of the conflicts committee are enumerated in our charter. The conflicts committee does not have a separate committee charter. During 2023, the conflicts committee held five meetings.

Our Policy Regarding Transactions with Related Persons

Our charter requires the conflicts committee to review and approve all transactions between us and our advisor, and any of our officers or directors or any of their affiliates. Prior to entering into a transaction with a related party, a majority of the board of directors (including a majority of the conflicts committee) not otherwise interested in the transaction must conclude that the transaction is fair and reasonable to us and on terms and conditions not less favorable to us than those available from unaffiliated third parties. In addition, our Code of Conduct and Ethics lists examples of types of transactions with related parties that would create prohibited conflicts of interest and requires our officers and directors to be conscientious of actual and potential conflicts of interest with respect to our interests and to seek to avoid such conflicts or handle such conflicts in an ethical manner at all times consistent with applicable law. Our executive officers and directors are required to report potential and actual conflicts to the Compliance Officer, currently our Chief Legal Officer, or directly to the audit committee chair, as appropriate.

Certain Transactions with Related Persons

The conflicts committee has reviewed the transactions between our affiliates and us since the beginning of 2022 as well as any such currently proposed transactions and determined them to be fair and reasonable to the Company. The following describes all transactions from January 1, 2022, through June 30, 2024, and all currently proposed transactions involving us, our directors and officers, our sponsor or advisor or any of their affiliates.

As further described below, we have entered into agreements with certain affiliates pursuant to which they provide services to us. In May 2021, Cottonwood Communities Advisors, LLC (“CCA”) became our sponsor when Cottonwood Residential II, Inc. (“CRII”) undertook a series of transactions that resulted in CRII and Cottonwood Residential O.P., LP (“CROP” or the “Operating Partnership”) divesting their complete interest in CCA to an entity beneficially and majority owned and controlled by Messrs. Shaeffer, C. Christensen and G. Christensen. As of June 30, 2024, Messrs. Shaeffer, C. Christensen and G. Christensen beneficially owned approximately 73.5% of CCA. CCA wholly owns CC Advisors III. All of our executive officers are also executive officers of CCA and CC Advisors III. In addition, all of our executive officers own an interest in CCA.

Advisory Agreement

Our advisor manages our business subject to the supervision of our board of directors and only has such authority as we may delegate to it as our agent. Under the terms of the advisory agreement in effect from January 1, 2022, we paid the fees and expense reimbursements described below to our advisor from January 1, 2022, through June 30, 2024.

Organization and Offering Expenses. We reimburse our advisor for any organization and offering expenses that it incurs on our behalf as and when incurred. After termination of our primary offering, our advisor will reimburse us to the extent that the organization and offering expenses that we incur exceed 15% of the gross proceeds from any public offering. From January 1, 2022, through June 30, 2024, there were no organizational and offering costs incurred by our advisor on our behalf.

Contingent Acquisition Fee and Contingent Financing Fee. If the advisory agreement is terminated other than for cause (or non-renewal or termination by our advisor), the contingent acquisition fees and contingent financing fees provided for in our prior advisory agreement will be due and payable in an amount equal to approximately $17.6 million ($22.0 million if the termination occurred in year one reduced by 10% each year thereafter).

Acquisition Expense Reimbursement. Subject to limitations in our charter, our advisor will be reimbursed for all out-of-pocket expenses incurred in connection with the selection and acquisition of real estate assets, whether or not the acquisition is consummated. There were no acquisition expenses reimbursed to our advisor from January 1, 2022, through June 30, 2024, as we have incurred and paid such expenses directly.

Management Fee. Our advisor receives a monthly management fee equal to 0.0625% of the gross asset value or GAV of CROP (subject to a cap as described herein), before giving effect to any accruals (related to the month for which the management fee is being calculated) for the management fee, distribution fees in connection with a securities offering, the Performance Allocation (as defined in the CROP Partnership Agreement and discussed below under “Operating Partnership Agreement”) or any distributions. The GAV and NAV of CROP are determined in accordance with the valuation guidelines adopted by our board of directors and reflective of the ownership interest held by CROP in such gross assets. If we own assets other than through CROP, we will pay a corresponding fee to our advisor. Through September 19, 2023, the cap on the management fee was equal to 0.125% of net asset value of CROP. Effective September 19, 2023, the cap was amended to be based on “adjusted net asset value”, which is defined to include the value attributable to preferred stock that is convertible into common equity in the calculation of net asset value of CROP. For the years ended December 31, 2022 and 2023, and the six months ended June 30, 2024, we incurred management fees of $17.8 million, $17.3 million and $6.2 million, respectively.

Other Fees and Reimbursable Expenses. Subject to the limitations on total operating expenses described below, our advisor is entitled to reimbursement of all costs and expenses incurred by it or its affiliates on our behalf, provided that our advisor is responsible for the expenses related to any and all of our advisor’s personnel who provide investment advisory services pursuant to the advisory agreement (including, without limitation, each of our executive officers and any directors who are also directors, officers or employees of our advisor or any of its affiliates), including, without limitation, salaries, bonuses and other wages, payroll taxes and the cost of employee benefit plans of such personnel, and costs of insurance with respect to such personnel; provided that we will be responsible for the personnel costs of our employees even if they are also directors or officers of our advisor or any of its affiliates except as provided for in the Reimbursement and Cost Sharing Agreement described below. We had no reimbursable company operating expenses to our advisor or its affiliates under the advisory agreement for the years ended December 31, 2022 and 2023, and the six months ended June 30, 2024.

Our advisor is required to reimburse us the amount by which our aggregate total operating expenses for the four consecutive fiscal quarters then ended exceed the greater of 2% of our average invested assets or 25% of our net income, unless our conflicts committee has determined that such excess expenses were justified based on unusual and non-recurring factors. “Average invested assets” means the average monthly book value of our assets during the 12-month period before deducting depreciation, bad debts or other non-cash reserves. “Total operating expenses” means all expenses paid or incurred by us that are in any way related to our operation, including advisory fees, but excluding (i) the expenses of raising capital to the extent paid by us such as organization and offering expenses, legal, audit, accounting, underwriting, brokerage, listing, registration and other fees, printing and other such expenses and taxes incurred in connection with the issuance, distribution, transfer, registration and stock exchange listing of our stock, (ii) interest payments, (iii) taxes, (iv) non-cash expenditures such as depreciation, amortization and bad debt reserves; (v) reasonable incentive fees based on the gain from the sale of our assets and (vi) acquisition fees, acquisition expenses (including expenses relating to potential investments that we do not close), disposition fees on the resale of property and other expenses connected with the acquisition, disposition and ownership of real estate interests, loans or other property (other than disposition fees on the sale of assets other than real property), including the costs of foreclosure, insurance premiums, legal services, maintenance, repair and improvement of property. Our conflicts committee determined that the relationship of our total operating expenses and our net assets was justified for each of the four consecutive fiscal quarters ending March 31, June 30, September 30, and December 31, 2022, and approved total operating expenses in excess of the operating expense reimbursement obligation in each of these periods. For all periods in 2023 and 2024, our total operating expenses did not exceed the operating expense limit.

Operating Partnership Agreement

Performance Allocation. In addition to the compensation payable and expenses reimbursed to our advisor pursuant to the advisory agreement, an affiliate of our advisor, as the “Special Limited Partner” is entitled to receive a 12.5% promotional interest, subject to a 5% hurdle and certain limitations, under the terms of the amended and restated limited partnership agreement of CROP dated May 7, 2021, as further amended and restated, as described below. As of December 31, 2022, we had accrued $20.3 million for the Performance Allocation, which was paid in cash on March 2, 2023. No Performance Allocation was earned for the year ended December 31, 2023, or the six months ended June 30, 2024.

So long as the advisory agreement has not been terminated (including by means of non-renewal), the Special Limited Partner will be entitled to an annual distribution (the “Performance Allocation”), promptly following the end of each year (which will accrue on a monthly basis) in an amount equal to:

1.First, if the Total Return for the applicable period exceeds the sum of (i) the Hurdle Amount for that period and (ii) the Loss Carryforward Amount (any such excess, “Excess Profits”), 100% of such Excess Profits until the total amount allocated to the Special Limited Partner equals 12.5% of the sum of (A) the Hurdle Amount for that period and (B) any amount allocated to the Special Limited Partner pursuant to this clause; and

2.Second, to the extent there are remaining Excess Profits, 12.5% of such remaining Excess Profits.

For purposes of this section:

“Hurdle Amount” refers to, for any period during a calendar year, an amount that results in a 5% annualized internal rate of return on the net asset value of the Participating Partnership Units outstanding at the beginning of the then-current calendar year and all Participating Partnership Units issued since the beginning of the applicable calendar year, taking into account the timing and amount of all distributions accrued or paid (without duplication) on all such Participating Partnership Units and all issuances of Participating Partnership Units over the period and calculated in accordance with recognized industry practices. The ending net asset value of the Participating Partnership Units used in calculating the internal rate of return will be calculated before giving effect to any allocation or accrual to the Participating Performance Allocation and any applicable distribution fee expenses, provided that the calculation of the Hurdle Amount for any period will exclude any Participating Partnership Units repurchased during such period, which Participating Partnership Units will be subject to the Performance Allocation upon such repurchase as described below.

“Loss Carryforward Amount” refers to an amount initially equal to zero and which will cumulatively increase by the absolute value of any negative annual Total Return and decrease by any positive annual Total Return, provided that the Loss Carryforward Amount will at no time be less than zero, and provided further, that the calculation of the Loss Carryforward Amount will exclude the Total Return related to any Participating Partnership Units repurchased during such year, which Participating Partnership Units will be subject to the Performance Allocation upon such repurchase as described below.

“Participating Partnership Units” refers to the CROP Common Units, the CROP LTIP Units, the CROP Special LTIP Units or the CROP general partner units, and excludes any CROP preferred units.

“Total Return” refers to for any period since the end of the prior calendar year, the sum of: (i) all distributions accrued or paid (without duplication) on the Participating Partnership Units outstanding at the end of such period since the beginning of the then-current calendar year plus (ii) the change in aggregate net asset value of such Participating Partnership Units since the beginning of such year , before giving effect to (A) changes resulting solely from the proceeds of issuances of the Participating Partnership Units, (B) any allocation or accrual to the Performance Allocation and (C) any applicable distribution fee expenses (including any payments made to the general partner for payment of such expenses). For the avoidance of doubt, the calculation of Total Return will (i) include any appreciation or depreciation in the net asset value of the Participating Partnership Units issued during

the then-current calendar year but (ii) exclude the proceeds from the initial issuance of such Participating Partnership Units.

The following special provisions will be applicable to the Performance Allocation:

•Any amount by which Total Return falls below the Hurdle Amount and that does not constitute Loss Carryforward Amount will not be carried forward to subsequent periods.

•With respect to all CROP partnership units that are repurchased at the end of any month in connection with repurchases of shares of our common stock pursuant to our share repurchase plan, the Special Limited Partner will be entitled to such Performance Allocation in an amount calculated as described above calculated in respect of the portion of the year for which such CROP partnership units were outstanding, and proceeds for any such CROP partnership unit repurchase will be reduced by the amount of any such Performance Allocation.

•The Performance Allocation may be payable in cash or CROP Common Units at the election of the Special Limited Partner. If the Special Limited Partner elects to receive such distributions in CROP Common Units, the Special Limited Partner will receive the number of CROP Common Units that results from dividing the Performance Allocation by the net asset value per CROP Common Unit at the time of such distribution. If the Special Limited Partner elects to receive such distributions in CROP Common Units, the Special Limited Partner may request CROP to redeem such CROP Common Units from the Special Limited Partner at any time thereafter pursuant to the Operating Partnership Agreement. Any CROP Common Units received by the Special Limited Partner will not be subject to the one-year holding requirement with respect to the exchange right in the Operating Partnership Agreement.

•The measurement of the change in net asset value for the purpose of calculating the Total Return is subject to adjustment by our board of directors to account for any dividend, split, recapitalization or any other similar change in CROP’s capital structure or any distributions that our board of directors deems to be a return of capital if such changes are not already reflected in CROP’s net assets.

•The Special Limited Partner will not be obligated to return any portion of the Performance Allocation paid due to the subsequent performance of CROP.

•In the event that the advisory agreement is terminated (including by means of non-renewal), the Special Limited Partner will be allocated any accrued Performance Allocation with respect to all CROP partnership units as of the date of such termination.

Dealer Manager and Managing Broker Dealer Agreements

We have engaged an unaffiliated third party dealer manager (the “Dealer Manager”) to act as the dealer manager for our follow-on public offering of our common stock and the managing broker-dealer for our private offerings of preferred stock. In this capacity we pay (or paid) the Dealer Manager certain underwriting compensation from the proceeds of the offerings as described below, all or a portion of which the Dealer Manager reallows (or reallowed) to wholesalers internal to our advisor and its affiliates.

Specifically, in connection with the follow-on public offering, we pay the Dealer Manager the following upfront selling commissions, dealer manager fees and wholesaling fee in connection with the sale of shares in the primary portion of the follow-on public offering. The upfront selling commission, dealer manager fee and wholesaling fee are a percentage of the transaction price for the shares available in the primary offering, which will generally be the prior month’s NAV per share for such class. No upfront selling commissions or dealer manager fees are paid with respect to any shares sold under the distribution reinvestment plan offering.

| | | | | | | | | | | | | | | | | |

| Maximum Upfront Selling Commissions as a % of Transaction Price | | Maximum Upfront Dealer Manager Fees as a % of Transaction Price | | Maximum Upfront Wholesaling Fee as a % of Transaction Price |

| Class T shares | Up to 3.0% | | 0.5% | | Up to 1.85% |

| Class D shares | None | | None | | Up to 1.85% |

| Class I shares | None | | None | | Up to 1.85% |

For the years ended December 31, 2022 and 2023, and the six months ended June 30, 2024, we paid $5.6 million, $0.9 million and $0.5 million, respectively, for the follow-on public offering in selling commissions, dealer manager fees and wholesaling fees, a portion of which was reallowed to wholesalers internal to our advisor and its affiliates.

In connection with our private offerings of the Series 2019, Series 2023 and Series A Convertible preferred stock, we paid or will pay, the third party a placement fee in an amount up to 3.0% of the gross proceeds from the sale of preferred shares in the offerings. In connection with our private offering of the Series 2023-A preferred stock we pay a wholesaler fee in an amount up to 2.0% of the gross proceeds from the sale of the preferred shares. For the years ended December 31, 2022 and 2023, and the six months ended June 30, 2024, we paid $0.4 million, $2.6 million and $1.1 million, respectively, in fees in connection with the Private Offerings, all or a portion of which were reallowed to wholesalers internal to our advisor and its affiliates.

We expect to pay this third party additional underwriting compensation in the future in connection with future private offerings, which compensation may be reallowed to wholesalers internal to our advisor and its affiliates.

Equity Compensation to Advisor Employees

In January of 2022, 2023, and 2024, our compensation committee approved grants of LTIP Units to our executive officers and certain of our employees as equity compensation. The January 2022 grants included $1,113,807 time-based awards and $2,068,499 in targeted performance-based awards to employees of our advisor or its affiliates. The January 2023 awards included $1,113,807 time-based awards and $2,068,499 targeted performance-based awards granted to employees of our advisor or its affiliates. The January 2024 awards included $1,117,375 time-based awards and $2,075,125 targeted performance-based awards granted to employees of our advisor or its affiliates. Each time-based award will vest approximately one-quarter of the awarded amount on January 1 in each of the four years following the grant date. The actual amount of each performance-based LTIP award will be determined at the conclusion of a three-year performance period and will depend on the internal rate of return as defined in the award agreement. The earned LTIP Units will become full vested on the first anniversary of the last day of the performance period, subject to continued employment with our advisor or its affiliates.

In April 2022, and January 2023 and 2024, our compensation committee approved grants of restricted stock units with a four-year vesting schedule to our employees and employees of our advisor or its affiliates for services provided to us. Included in the amount of awards granted were $80,000, $90,000 and $221,500 in restricted stock units in 2022, 2023, and 2024, respectively for employees of our advisor and its affiliates.

Trademark License Agreement. We entered into a Trademark License Agreement with CROP and our advisor as of May 7, 2021. Pursuant to the Trademark License Agreement, we granted to our advisor a non-exclusive license under our rights in certain trademarks related to the Cottonwood name to use and display the

trademarks solely for the purpose of our advisor performing services identified in the agreement. The Trademark License Agreement provides for the payment of compensation by our advisor to us for the use of the trademarks. The Trademark License Agreement is co-terminus with the advisory agreement. No amounts were paid or payable under this agreement as of June 30, 2024.

Reimbursement and Cost Sharing Agreement. On May 7, 2021, Cottonwood Capital Management, Inc. (“Cottonwood Capital Management”), a wholly owned subsidiary of CROP, entered into a Reimbursement and Cost Sharing Agreement with CCA, which owns our advisor, whereby Cottonwood Capital Management will make available to CCA on an as-needed basis certain employees of Cottonwood Capital Management to the extent the employees are not otherwise occupied in providing services for us or our subsidiaries. The employees will remain employees of Cottonwood Capital Management, and Cottonwood Capital Management will be responsible for all wages, salaries and other employee benefits provided to such employees. In performing work for CCA, the employees may use office space and office supplies and equipment of Cottonwood Capital Management. CCA will reimburse Cottonwood Capital Management for CCA’s allocable share of all direct and indirect costs related to the employees, including wages, salaries and other employee benefits and allocable overhead expenses. CCA will reimburse Cottonwood Capital Management for CCA’s allocable costs on a quarterly basis. The Reimbursement and Cost Sharing Agreement will terminate on the earlier of (i) the one-year anniversary of the effective date of the agreement and (ii) the termination of the advisory agreement. Thereafter, the Reimbursement and Cost Sharing Agreement may be renewed for an unlimited number of successive one-year terms upon mutual consent of the parties. The Reimbursement and Cost Sharing Agreement has been renewed through May 7, 2025. Cottonwood Capital Management may, at any time and upon 60 days’ prior written notice to CCA, cease to make its employees available to CCA. For the years ended December 31, 2022 and 2023, and the six months ended June 30, 2024, we had received $262,649, $190,266 and $102,554, respectively, of reimbursable costs under this agreement.

CROP Tax Protection Agreement. CROP and HT Holdings, an entity owned and controlled by Messrs. Shaeffer, C. Christensen, G. Christensen and Marlin, are parties to the CROP Tax Protection Agreement, which became effective as of May 7, 2021. Pursuant to the CROP Tax Protection Agreement, CROP agrees to indemnify the Protected Partners against certain tax consequences of a taxable transfer of all or any portion of the Protected Properties or any interest therein, subject to certain conditions and limitations. CROP’s tax obligations under the CROP Tax Protection Agreement will expire one day after the 10th anniversary of the effective date of the CROP Tax Protection Agreement, subject to certain limitations. We estimate the maximum potential liability associated with the CROP Tax Protection Agreement to be approximately $16.5 million. Although this estimate has been made based on the best judgment of our management assuming current tax rates as well as the current state of residence of indemnified parties, both of which may change in the future, no assurances can be provided that the actual amount of any indemnification obligation would not exceed this estimate.

If CROP is required to indemnify a Protected Partner under the terms of the CROP Tax Protection Agreement, the sole right of such Protected Partner is to receive from CROP a payment in an amount equal to such Protected Partner’s tax liability using the highest U.S. federal income tax rate applicable to the character of the gain and state income tax rate in the state where the Protected Partner resides, such payment to be grossed up so that the net amount received after such gross up is equal to the required payment. CROP will permit the Protected Partners to guarantee up to $50.0 million in the aggregate of CROP’s liabilities to avoid certain adverse tax consequences. Either CROP or the Protected Partners may elect to transfer assets or receive a distribution of assets equal to the net fair market value of the CROP Units held by the Protected Partners in full liquidation and redemption of the CROP Units held by the Protected Partners. The Protected Partners will have the right to select the assets of CROP necessary to effectuate the in-kind redemption transaction, subject to certain limitations.

For purposes of the CROP Tax Protection Agreement:

“HT Holdings Units” refers to the limited partner interests in HT Holdings which were outstanding at the effective time of the merger with and into CROP.

“Permitted Transferee” refers to any person who holds HT Holdings Units and who acquired such HT Holdings Units from HT Holdings or another Permitted Transferee in a permitted disposition (generally includes

transfers to family members, family trusts, beneficiaries of trusts and partners or members of entities), in which such person’s adjusted basis in such HT Holdings Units, as determined for U.S. federal income tax purposes, is determined, in whole or in part, by reference to the adjusted basis of HT Holdings (or such other Permitted Transferee) in such HT Holdings Units and who has notified CROP of its status as a Permitted Transferee, subject to certain conditions and limitations.

“Protected Partners” refers to HT Holdings and each Permitted Transferee.

“Protected Properties” refers to the properties owned by CROP on the effective date of the Tax Protection Agreement, including any and all replacement property received in exchange for all or any portion of the Protected Properties pursuant to Section 1031 of the Internal Revenue Code of 1986, as amended (the “Code”), Code Section 1033, any other Code provision that provides for the non-recognition of income or gain or any transaction pursuant to which the tax basis of such property is determined in whole or in part by reference to the tax basis of all or any portion of the Protected Properties.

No amounts were paid or payable under this agreement as of June 30, 2024.

Amended and Restated Promissory Note of CCA and CROP. CCA issued a $13.0 million promissory note payable to CROP dated January 1, 2021 (the “CCA Note”). The CCA Note has a 10-year term with an interest rate of 7%. The CCA Note required monthly payments of interest only through June 30, 2021 and thereafter, monthly payments of principal and interest in the amount of $150,941. CCA may prepay the principal balance under the CCA Note, in whole or in part, with all interest then accrued, at any time, without premium or penalty.

The CCA Note will accelerate upon termination of the advisory agreement to the extent of amounts then owed by CROP to our advisor thereunder. If such acceleration occurs and CROP holds the CCA Note at such time, then we may offset any termination payments payable to our advisor under the advisory agreement by the accelerated portion of the CCA Note.

Prior to the consummation of the merger with and into CROP, the CCA Note distribution was effected whereby the CCA Note was distributed by CROP to the holders of CROP’s participating partnership units of record immediately prior to the merger with and into CROP, including CRII. CRII subsequently distributed its share in the CCA Note to its common stockholders of record immediately prior to the CRII Merger.

Allonge to CCA. At the time of the CCA Note distribution described above, CROP and CCA entered into an agreement (the “Allonge”) with the CROP unitholders and the CRII stockholders of record who received an in-kind distribution of the CCA Note in connection with the CCA Note distribution. The Allonge provides for an offset arrangement whereby we have the right to offset payments due to our advisor under the advisory agreement by assigning all or a portion of the CCA Note to our advisor as payment for amounts due as modified to account for the fact that the CCA Note is held by the CROP unitholders and the CRII stockholders of record immediately prior to the mergers with CROP and CRII.

Cottonwood Multifamily Opportunity Fund, Inc.

Background. Cottonwood Multifamily Opportunity Fund, Inc. (“CMOF”) was a Maryland corporation that was sponsored by CROP and formed to invest in multifamily development projects and/or make mezzanine loans or preferred equity investments in multifamily construction and development projects. CMOF owned investments in two development projects and one investment in a land parcel held for development, all through separate joint ventures with CROP as follows: Park Avenue (development project), Cottonwood Broadway (development project) and Block C, a joint venture owning land held for development for two projects called Westerly and Millcreek North, with a percentage ownership interest held by CMOF as of September 27, 2022, of 76.4%, 81.2%, and 63.0%, respectively, and the balance of a majority of the remaining interest held by CROP. In addition, Daniel Shaeffer, Chad Christensen and Gregg Christensen were each officers and directors of CMOF.

Property Management. Cottonwood Capital Property Management II, LLC (“CCPMII”), a wholly owned subsidiary of CROP, acted as the sponsor, property manager and asset manager for CMOF. As the property manager and asset manager for CMOF, CCPMII received compensation for the acquisition, management and disposition of CMOF’s assets. Total compensation paid to CCPMII as the asset manager of CMOF was $601,493 for the period from January 1, 2022 through September 27, 2022 (the closing date of the CMOF Merger, as defined below).

Merger. On July 8, 2022, we, CROP, a wholly owned subsidiary of ours (“Merger Sub”), CMOF, and the operating partnership for CMOF (“CMOF OP”) entered into an Agreement and Plan of Merger (the “CMOF Merger Agreement”).

Subject to the terms and conditions of the CMOF Merger Agreement (i) CMOF merged with and into Merger Sub, with Merger Sub surviving as our direct, wholly owned subsidiary (the “CMOF Company Merger”) and (ii) CMOF OP merged with and into CROP, with CROP surviving (the “CMOF OP Merger” and, together with the CMOF Company Merger, the “CMOF Merger”). On September 27, 2022, the CMOF Merger was completed. At such time, the separate existence of CMOF and CMOF OP ceased.

At the effective time of the CMOF Company Merger, each issued and outstanding share of CMOF’s common stock converted into 0.8669 shares of our Class A common stock.

At the effective time of the CMOF OP Merger, each partnership unit of CMOF OP issued and outstanding immediately prior to the CMOF OP Merger converted into 0.8669 CROP Common Units, including CMOF OP units held by certain of our officers and directors as described below. Each partnership unit of CROP issued and outstanding immediately prior to the effective time of the CMOF OP Merger remained outstanding.

At the time of the CMOF Merger, certain outstanding promissory notes from CMOF held directly, or indirectly through affiliate entities, by Enzio Cassinis, Adam Larson and Eric Marlin, our executive officers, each in the amount of $425,000, were repaid with cash from us.

In addition, immediately prior to the effective time of the CMOF OP Merger, CMOF OP acquired the outstanding residual interests in a joint venture referred to as Park Avenue and a joint venture referred to as Broadway held by certain of our executive officers and directors in exchange for an aggregate 461,023 CMOF OP partnership units. As a result of CMOF OP’s acquisition of the residual interests in the joint ventures, Daniel Shaeffer, Chad Christensen, Gregg Christensen, Susan Hallenberg, Glenn Rand and Stan Hanks directly or indirectly owned 164,585, 164,585, 82,062, 6,597, 6,597 and 6,597 CMOF OP partnership units, respectively, at the time of the CMOF OP Merger, which were converted into CROP Common Units at the time of the CMOF OP Merger as described above.

Richmond Guaranty

We assumed a 50% payment guarantee provided by CRII and CROP in connection with the mergers with CRII and CROP, for certain obligations of Villas at Millcreek, LLC (“Richmond Borrower”) with respect to a construction loan in the amount of $53.6 million obtained in connection with the development of Richmond at Millcreek, a development project sponsored by High Traverse Development, LLC. Certain of our officers and directors own an aggregate 13.91% of Richmond Borrower as of June 30, 2024. A wholly owned subsidiary of CROP receives fees from High Traverse Development, LLC related to the development of Richmond at Millcreek. Richmond Borrower increased the loan amount outstanding to $60.1 million in the second quarter of 2023.

Alpha Mill Transactions

On November 2, 2021, we sold tenant-in-common interests in Alpha Mill (the “Alpha Mill TIC Interests”) totaling 43% to certain unaffiliated third parties through a private offering for $34.8 million. On April 7, 2022, we sold an additional 29% in Alpha Mill (while we retain a 28% interest) to certain third parties for a total purchase price of $23.3 million. One of the purchasers of the Alpha Mill TIC Interests in the April 7, 2022 sale was the Christensen Marital Trust, a trust established by the father of Chad Christensen, one of our directors and Executive Chairman, and Gregg Christensen, our Chief Legal Officer and Secretary (the “Christensen Trust”). Messrs. C. Christensen and G. Christensen are two of the five beneficiaries of the Christensen Trust. Decisions regarding the assets of the Christensen Trust require approval of all five beneficiaries. The Christensen Trust purchased its interest net of selling commissions in the amount of $244,444. The Christensen Trust’s interest is 10.3%, acquired at a purchase price of $8.2 million. The net proceeds received by us for the sale of the shares to the Christensen Trust were the same as what we received from unaffiliated third parties.