Purpose of Report – W.D. Von Gonten & Co. was engaged by Harvest to develop the appropriate reserve projections and estimate the remaining reserves associated with the developed and undeveloped properties included in this report. The properties evaluated by W.D. Von Gonten & Co. represent 100% of the total net proved and undeveloped gas reserves, 100% of the probable reserves, and 100% of the possible reserves owned by Harvest as of January 1, 2021. All of Harvest’s probable and possible reserves are undeveloped. Once the reserves were estimated, future revenues were determined in accordance with SEC pricing effective January 1, 2021.

Scope of Work – W.D. Von Gonten & Co. was engaged by Harvest to estimate remaining reserves and associated revenues with the proved developed and undeveloped properties included in this report. The properties evaluated by W.D. Von Gonten & Co. represent 100% royalty interest of the total net proved gas reserves owned by Harvest as of January 1, 2021. Once reserves were estimated, future revenues were determined in accordance with SEC pricing effective January 1, 2021.

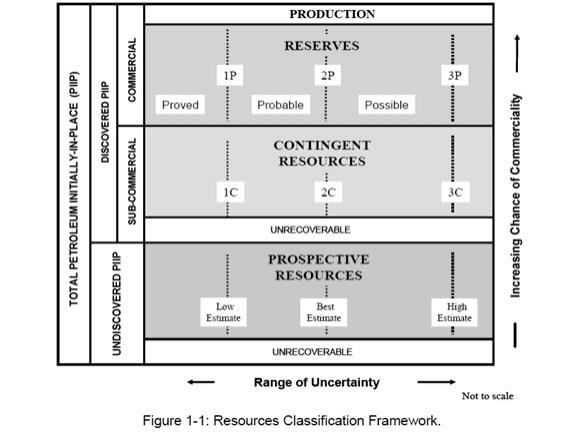

Reporting Requirements – Securities and Exchange Commission (SEC) Regulation S-X 210, Rule 4-10 and Regulation S-K 229, Item 1200 (as revised in December 2008, effective 1-1-10), and Accounting Standards Codification Topic 932 require oil and gas reserve information to be reported by publicly held companies as supplemental financial data. These regulations and standards provide for estimates of Proved reserves and revenues discounted at 10% and based on un-escalated prices. Revenues based on alternate product price scenarios may be reported in addition to the current pricing case.

Estimates of proved, probable and possible reserves presented in the report were prepared in conformance with the Securities and Exchange Commission (SEC) definitions and requirements as set-forth in Rule 4-10(a) of Regulation S-X as required by Item 1202(a)(8)(iv) of Regulation S-K.

Projections – The attached reserves and revenue projections are on a calendar year basis with the first time period being January 1, 2021 through December 31, 2021.

Property Discussion

Harvest currently owns an approximate 1.0% royalty interest in 13 Proved Developed Producing (“PDP”) wells and an approximate 0.7% royalty interest in 3 Proved Undeveloped (“PUD”) wells that Vine Oil & Gas LP. operates. Harvest also owns an approximate 2.5% royalty interest in 2 PUD wells operated by GeoSouthern and an approximate 0.2% royalty interest in 9 PUD wells operated by Brix Oil & Gas LP. All wells are located in Red River and De Soto Parishes, Louisiana. All existing PDP production and future developmental drilling will originate from the Haynesville and Mid-Bossier shale formations.

Reserve Estimates

Proved Producing Reserves – Reserve estimates for the PDP properties were based on volumetric calculations, log analysis, decline curve analysis, rate transient analysis, and/or analogy to nearby production, including from other operators.

Proved Undeveloped Reserves – The undeveloped reserves were necessarily estimated using volumetric calculations, log analysis, core analysis, geophysical interpretation and/or analogy to nearby recently drilled wells with comparative completion practices. In addition, W.D. Von Gonten & Co. has performed a field study of the Haynesville and Mid-Bossier shale plays independent of this report. Our conclusion from that field study has fortified our confidence in the producing and undeveloped reserves included herein.

Based on SEC reserves reporting requirements, only those undeveloped volumes scheduled to be drilled within five years of their initial recognition have been included within the Proved Undeveloped category of reserves. That volume, as reflected in the results table of page 1 of this report, is approximately 1,138 MMcf of natural gas.

Harvest Royalties Holdings LP – 01.01.21 3P Reserves Report, SEC Pricing, January 8, 2021 – Page 2