- DK Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Delek US (DK) DEF 14ADefinitive proxy

Filed: 24 Mar 23, 3:04pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 |

Delek US Holdings, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act rules 14a6(i)(1) and 0-11 |

NOTICE OF THE 2023 ANNUAL MEETING OF STOCKHOLDERS

To Our Stockholders:

Notice is hereby given that the 2023 Annual Meeting of Stockholders (the “Annual Meeting”) of Delek US Holdings, Inc. (the “Company,” “Delek,” “we,” “us,” or “our”) will be held on May 3, 2023 at 11:00 a.m., central time, for the following purposes:

| (1) | To elect nine directors of the Company to serve until the 2024 Annual Meeting of Stockholders or until their respective successors are appointed, elected and qualified; |

| (2) | To adopt the advisory resolution approving the Company’s executive compensation program for our named executive officers as described in the Proxy Statement; |

| (3) | To select, on an advisory basis, the frequency of advisory votes on the Company’s executive compensation program for named executive officers by our stockholders; |

| (4) | To approve an amendment to our 2016 Long-Term Incentive Plan to increase the number of shares available for issuance thereunder; |

| (5) | To ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the 2023 fiscal year; and |

| (6) | To transact any other business properly brought before the Annual Meeting. |

We will once again conduct a virtual annual meeting, which we believe provides expanded access, improved communications and cost and time savings for our stockholders and the Company. You may virtually attend the meeting, submit questions, and vote your shares by visiting www.virtualshareholdermeeting.com/DK2023 as described in the accompanying Proxy Statement.

Additional information concerning the matters to be voted upon at the Annual Meeting is set forth in the Company’s proxy materials. We have enclosed the 2022 Annual Report, Proxy Statement (together with this notice of Annual Meeting), and proxy card or voting instruction form. If you have any questions or need assistance, please contact our Investor Relations department at (615) 767-4344.

Only stockholders of record at the close of business on March 13, 2023 are entitled to receive notice of and vote at the Annual Meeting and at any postponement(s) or adjournment(s) thereof. A list of these stockholders will be open for examination by any stockholder for any purpose germane to the Annual Meeting for ten (10) days prior to the Annual Meeting at our corporate headquarters.

If you were a stockholder at the close of business on March 13, 2023, it is important that you vote your shares as soon as possible using one of the methods set forth on the proxy card or voting instruction form or by signing and returning your proxy card. Your vote is important and you are encouraged to vote your shares as soon as possible, even if you plan to participate in and vote at the Annual Meeting.

It is important that your shares be represented at the Annual Meeting. Even if you plan to attend the Annual Meeting virtually, it is important that you read the enclosed Proxy Statement and promptly vote by completing, signing, and dating the proxy card and mailing it in the enclosed, postage pre-paid envelope. You may also vote by telephone or by the Internet by following the instructions on the proxy card. Please note that if you hold your shares as a beneficial owner through a bank or broker and you do not provide voting instructions with respect to any given proposal, your bank or broker will not be permitted to vote on your behalf on such proposal.

By Order of the Board of Directors, Denise McWatters Executive Vice President, General Counsel and Corporate Secretary Delek US Holdings, Inc. March 24, 2023 | May 3, 2023 Online at |

ADDITIONAL INFORMATION

On or about March 24, 2023, we expect to mail our proxy materials to all stockholders of record as of the record date. Our proxy materials include the Notice of the 2023 Annual Meeting of Stockholders, this Proxy Statement, a proxy card and our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 (“2022 Annual Report”). Copies of these documents are also available on the Investor Relations page of our website at www.delekus.com. You may also obtain these materials at the SEC website at www.sec.gov. For additional questions, assistance in submitting proxies or voting shares, or to request additional copies of the Proxy Statement or the enclosed proxy card, please contact our Investor Relations department at (615) 767-4344.

The Company’s 2022 Annual Report is not proxy soliciting material. Except to the extent specifically referenced herein, information contained or referenced on our website is not incorporated by reference into, and does not form a part of, this Proxy Statement.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

STOCKHOLDER MEETING TO BE HELD ON MAY 3, 2023

Pursuant to rules adopted by the Securities and Exchange Commission (the “SEC”), the Company’s proxy materials are available over the Internet at ir.delekus.com/sec-filings.

This Notice of the 2023 Annual Meeting of Stockholders, the accompanying Proxy Statement, the Company’s 2022 Annual Report, and form of proxy card, and any amendments thereto, are available free of charge at https://ir.delekus.com/proxy-materials.

Stockholders may obtain a paper or email copy of these materials at no charge at https://ir.delekus.com/proxy-materials or by writing to the Corporate Secretary at the Company’s corporate headquarters located at 310 Seven Springs Way, Suite 500, Brentwood, Tennessee 37027. Upon payment of a reasonable fee, stockholders may also obtain a copy of the exhibits to our 2022 Annual Report.

For information on how to attend, vote and participate at the Annual Meeting, any control/identification numbers needed and instructions on how to access or request a proxy card, please contact our Investor Relations department at (615) 767-4344 requesting such information.

THE BOARD UNANIMOUSLY RECOMMENDS VOTING “FOR” THE ELECTION OF THE BOARD’S NINE NOMINEES UNDER PROPOSAL 1, “FOR” PROPOSAL 2 TO ADOPT THE ADVISORY RESOLUTION APPROVING THE COMPANY’S EXECUTIVE COMPENSATION PROGRAM FOR OUR NAMED EXECUTIVE OFFICERS AS DESCRIBED IN THE PROXY STATEMENT, “EVERY YEAR” FOR THE NON-BINDING ADVISORY VOTE ON THE FREQUENCY OF FUTURE EXECUTIVE COMPENSATION ADVISORY VOTES UNDER PROPOSAL 3, “FOR” PROPOSAL 4 TO APPROVE AN AMENDMENT TO OUR 2016 LONG-TERM INCENTIVE PLAN, AND “FOR” PROPOSAL 5 TO RATIFY THE APPOINTMENT OF ERNST & YOUNG LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE 2023 FISCAL YEAR, USING THE ENCLOSED PROXY CARD.

Additionally, if you have any questions or require assistance in authorizing a proxy or voting your shares of our Common Stock or in obtaining any of the above materials, please contact our Investor Relations department at (615) 767-4344. We are not aware of any other business, or any other nominees for election as directors, that may properly be brought before the Annual Meeting.

TABLE OF CONTENTS

PROXY STATEMENT

SUMMARY

This summary highlights information contained elsewhere in this Proxy Statement. This is only a summary and may not contain all of the information that is important to you. For more complete information, please review this Proxy Statement in its entirety, as well as our 2022 Annual Report. The Company’s 2022 Annual Report is not proxy soliciting material.

2023 Meeting Information

This Proxy Statement is first being furnished to stockholders on or about March 24, 2023 in connection with the solicitation by the Board of Directors (the “Board”) of Delek US Holdings, Inc. (“we,” “us,” “our” or the “Company”) of proxies to be voted at the 2023 Annual Meeting of Stockholders (the “Annual Meeting”), and at any adjournment or postponement of such meeting.

| Record Date | March 13, 2023 | |

| Meeting Date | May 3, 2023 | |

| Meeting Time | 11:00 a.m., central time | |

| Meeting Location | Online at www.virtualshareholdermeeting.com/DK2023 |

Matters to Be Voted Upon

| PROPOSALS | BOARD RECOMMENDATIONS | PAGE REFERENCES | ||

| PROPOSAL 1. ELECTION OF NINE DIRECTORS | FOR each Company | 26 | ||

| PROPOSAL 2. ADVISORY RESOLUTION ON EXECUTIVE COMPENSATION | FOR | 69 | ||

| PROPOSAL 3. ADVISORY VOTE ON THE FREQUENCY OF FUTURE ADVISORY VOTES TO APPROVE EXECUTIVE COMPENSATION | EVERY YEAR | 73 | ||

| PROPOSAL 4. APPROVE THE AMENDMENT TO OUR 2016 LONG-TERM INCENTIVE PLAN | FOR | 74 | ||

| PROPOSAL 5. RATIFY THE APPOINTMENT OF AUDITORS | FOR | 85 |

Stockholders will also transact any other business that may properly come before the meeting or any adjournment or postponement thereof.

A copy of this Notice of 2023 Annual Meeting of Stockholders and Proxy Statement is being sent to stockholders beginning on or about March 24, 2023.

How to Vote

Your vote is important. Even if you plan to attend the Annual Meeting, to ensure that your shares are represented and voted at the Annual Meeting, we encourage you to submit your proxy card or voting instructions form as soon as possible or to vote by Internet or phone prior to the Annual Meeting by following the instructions on your proxy card (though holders in “street name” should follow the instructions given to them by their bank, broker or other nominee to vote their shares). Internet and phone voting will close at 11:59 p.m. eastern time on May 2, 2023.

VOTING ELIGIBILITY

Only stockholders as of the close of business on March 13, 2023 (the “Record Date”) are eligible to vote at the Annual Meeting or by proxy and each such stockholder shall have one vote for each share of Common Stock held on the Record Date.

| VOTING METHODS | ||||||

| BEFORE THE MEETING | DURING THE MEETING | |||||

|  |  |  | |||

BY INTERNET Go to | BY TELEPHONE You may call | BY MAIL You may promptly mail your completed and executed proxy card in the postage-paid envelope, which must be received by the Company on or prior to May 2, 2023. | VIRTUAL MEETING Go to www.virtualshareholdermeeting. | |||

2

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Statements contained in this Proxy Statement which are not purely historical are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and are subject to risks and uncertainties such as those described in our Annual Report on Form 10-K for the year ended December 31, 2022 and subsequent filings with the SEC. Such risks and uncertainties include inherent risks and uncertainties relating to our internal models or the projections in this Proxy Statement; risks and uncertainties associated with the acquisition of 3 Bear Delaware Holding – NM, LLC (“3 Bear”) by Delek Logistics Partners, LP (the “3 Bear Acquisition”); the COVID-19 pandemic; negative changes in economic and industry conditions in the United States or other countries including those due to the ongoing conflict between Ukraine and Russia; disruptions to our refining operations; litigation and other judicial proceedings affecting the Company; restrictions on our liquidity or business operations resulting from our debt agreements; infringement of our technology or the assertion that our technology infringes the rights of other parties; risks and uncertainties associated with our information technology systems, including the potential for breaches of security and evolving regulations regarding privacy and data protection; increases in the prices of commodity components; potential for significant adverse changes in governing regulations; changes in tax laws and regulations in the United States; termination or interruption of relationships with our suppliers, or failure of such suppliers to perform; fluctuations in interest rates; concentration of a substantial portion of our revenues among four refining facilities; volatility in the market price of our common stock; failure to comply with applicable environmental laws; changes in key personnel; work stoppage or transportation risks; price and product competition; availability of labor and commodities; and other factors referenced in the 2022 Annual Report and other materials filed with the SEC. All subsequent forward-looking statements attributable to the Company or persons acting on our behalf are expressly qualified in their entirety by these cautionary statements. Actual results will likely differ, and may differ materially, from anticipated results. Financial estimates are subject to change and are not intended to be relied upon as predictions of future operating results, and the Company assumes no obligation to update or disclose revisions to those estimates.

DELEK US HOLDINGS, INC. | 2023 PROXY STATEMENT | 3 |

This Proxy Statement and our 2022 Annual Report are also available at ir.delekus.com/proxy-materials

QUESTIONS AND ANSWERS

Why am I receiving these proxy materials?

This Proxy Statement and enclosed form of proxy (first made available to stockholders on or about March 24, 2023) are furnished in connection with the solicitation by our Board of proxies for use at the Annual Meeting or at any postponement or adjournment thereof.

How do I attend the Annual Meeting?

The Annual Meeting will be a virtual meeting of stockholders, which we believe provides expanded access to the meeting, improves communications and provides cost and time savings for our stockholders and the Company. If you are a stockholder as of the Record Date, March 13, 2023, a proxy for a record stockholder or a beneficial owner of the Company’s common stock, $0.01 par value (“Common Stock”), with evidence of ownership, you will be able to attend the Annual Meeting and vote and submit questions during the Annual Meeting via a live webcast by visiting www.virtualshareholdermeeting.com/DK2023 and entering the 16-digit control number included in our notice of Internet availability of the proxy materials, on your proxy card, or in the instructions that accompanied your proxy materials. We intend to answer all questions submitted during the meeting which are pertinent to the Company and the meeting matters, as time permits. The Annual Meeting will convene at 11:00 a.m. on May 3, 2023.

How does the Board recommend that I vote?

The Board recommends that you vote: (1) “FOR” each of the nine nominees to the Board named in this Proxy Statement; (2) “FOR” the advisory resolution approving the executive compensation program for our named executive officers; (3) “EVERY YEAR” for the non-binding advisory vote on the frequency of future executive compensation advisory votes; (4) “FOR” the amendment to our 2016 Long-Term Incentive Plan; and (5) “FOR” the ratification of the appointment of Ernst & Young LLP (“Ernst & Young”) as our independent registered public accounting firm for the 2023 fiscal year.

Who is entitled to vote?

Holders of record of our Common Stock, at the close of business on the Record Date are entitled to vote at the Annual Meeting. On the Record Date, 66,993,576 shares of Common Stock were issued and outstanding. The Common Stock is our only outstanding class of voting securities. Each outstanding share of Common Stock is entitled to one vote for all matters before the Annual Meeting. If you virtually attend the Annual Meeting, which is the only way to attend the Annual Meeting, you may vote your shares online. Votes submitted and received as provided below on or before 11:59 p.m. eastern time on May 2, 2023 will be counted. Only votes submitted online at the virtual Annual Meeting will be counted after that time.

DELEK US HOLDINGS, INC. | 2023 PROXY STATEMENT | 4 |

How do I vote?

If you were a stockholder of record at the close of business on March 13, 2023, you can vote your shares by any one of the following methods:

| VOTING METHODS | ||||||

| BEFORE THE MEETING | DURING THE MEETING | |||||

|  |  |  | |||

BY INTERNET Go to | BY TELEPHONE You may call | BY MAIL You may promptly mail your completed and executed proxy card in the postage-paid envelope, which must be received by the Company on or prior to May 2, 2023. | VIRTUAL MEETING Go to www.virtualshareholdermeeting. | |||

Even if you currently plan to virtually attend the Annual Meeting, we recommend that you submit your proxy by one of the methods described above so that your shares will be represented and your vote will be counted if you later decide not to virtually attend and vote online at the Annual Meeting. If you hold your shares in street name, you may virtually attend and vote your shares online at the Annual Meeting only if you have obtained a legal proxy from your brokerage firm, bank, trustee or other nominee giving you the right to vote the shares at the Annual Meeting.

How do I vote my shares if they are held in street name?

If your shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company (“AmStock”), you are a “stockholder of record” (or “registered stockholder”) of those shares, and these proxy materials have been provided directly to you by the Company. If your shares are held in the name of a brokerage, bank, trust or other nominee as a custodian, you are a “beneficial owner” of shares held in “street name.” If your shares are held in street name, these proxy materials are being forwarded to you by your brokerage, bank, trust or other nominee as custodian (the “record holder”), along with voting instructions. As the beneficial owner, you have the right to direct your record holder how to vote your shares by using the voting instructions card, and the record holder is required to vote your shares in accordance with your instructions.

How will voting on any other business be conducted?

Although we do not know of any business to be considered at the Annual Meeting other than the proposals described in this Proxy Statement, if any other business is presented at the Annual Meeting, your signed proxy card gives authority to each of Avigal Soreq, our President and Chief Executive Officer, and Reuven Spiegel, our Executive Vice President and Chief Financial Officer, to vote your shares on such matters at their discretion.

DELEK US HOLDINGS, INC. | 2023 PROXY STATEMENT | 5 |

Can I revoke or change my vote?

Yes. You may revoke or change your proxy, including a proxy submitted via internet or telephone as described in this Proxy Statement by: (a) notifying our Corporate Secretary in writing on or before May 3, 2023; (b) submitting a later-dated but still timely proxy card by mail on or before May 3, 2023; or (c) virtually attending and voting online at the Annual Meeting. If you are a beneficial owner with your shares held in street name, you must follow the instructions of your broker, bank, trust or other nominee who is the registered stockholder of your shares to revoke a proxy. The latest-dated, timely, properly completed voting instructions that you submit will count as your vote. If a vote has been recorded for your shares and you submit a proxy card that is not properly signed and dated, the previously recorded vote will stand.

What if I submit my proxy but I do not specify how I want my shares voted?

If you submit a proxy but do not specify how you want your shares to be voted, the proxy holder will vote your shares in accordance with the recommendations of the Board of Directors for the five proposals described in this Proxy Statement. If other matters requiring the vote of stockholders properly come before the Annual Meeting, it is the intention of the persons named on the proxy card to vote proxies held by them in accordance with their best judgment.

What does it mean if I get more than one proxy card?

If your shares are registered in more than one name or in more than one account, you will receive more than one card. Please complete and return all of the proxy cards you receive to ensure that ALL of your shares are voted.

Who is soliciting my vote?

Your vote is being solicited by our Board. Certain of our officers, directors and employees, none of whom will receive additional compensation therefor, may solicit proxies by telephone or other personal communication. The Company may also engage a third party proxy solicitor. We will bear the cost of the solicitation of the proxies, including postage, printing and handling, and will reimburse the reasonable expenses of brokerage firms and others for forwarding material to beneficial owners of shares of Common Stock.

Who will count the vote?

Broadridge Financial Solutions, Inc. (“Broadridge”) will serve as master tabulator and a representative of Broadridge will act as the inspector of the elections.

What is a “quorum”?

A “quorum” is the presence of the holders of a majority of the outstanding shares entitled to vote either virtually attending or represented by proxy at the meeting. There must be a quorum for the Annual Meeting to be lawfully conducted. Proxies received but marked as abstentions, withheld votes and broker non-votes will be included in the calculation of the number of shares considered to be present at the meeting.

What are the voting requirements to approve each proposal?

Delek has implemented majority voting in uncontested elections of directors. Accordingly, Delek’s Fifth Amended and Restated Bylaws (the “Bylaws”) provide that in an uncontested election of directors, a nominee for director shall be elected if the number of votes cast “for” a nominee’s election exceeds the number of votes cast “against” that nominee’s election at a meeting at which a quorum is present in person or represented by proxy. To approve the advisory resolution approving the executive compensation program for our named executive officers, the proposal to approve the amendment of our 2016 Long-Term Incentive Plan, and the proposal to ratify the appointment of Ernst & Young as our independent registered public accounting firm for the fiscal year ending December 31, 2023, a majority of shares of Common Stock represented at the Annual Meeting and entitled to vote thereon must vote in favor of each proposal. A plurality of votes is required to approve the advisory resolution on how often the advisory vote on the Company’s executive compensation program for named executive officers should be presented to our stockholders.

What is the effect of abstentions, withheld votes and broker non-votes?

Abstentions and instructions to withhold authority to vote will be treated as shares that are present and entitled to vote for purposes of determining whether a quorum exists. Shares that are not voted in the election of directors, including broker non-votes, will have no direct effect in the election of directors. Those shares, however, are taken into account in determining whether a sufficient number of shares are present to establish a quorum. Abstentions have the same effect as a vote “against” Proposals 2, 4, and 5. Broker non-votes will have no effect on the outcome of Proposals 2, 4, and 5. Abstentions and broker non-votes will not count toward the outcome of the vote on Proposal 3.

DELEK US HOLDINGS, INC. | 2023 PROXY STATEMENT | 6 |

“Broker non-votes” are shares held by brokers or nominees which are present by virtually attending the Annual Meeting or represented by proxy, but which are not voted on a particular matter because instructions have not been received from the beneficial owner. Under New York Stock Exchange (“NYSE”) rules, NYSE-member brokers who hold shares of Common Stock in street name for their customers and have transmitted our proxy solicitation materials to their customers, but do not receive voting instructions from such customers, will be permitted to vote on discretionary items.

| • | Non-Discretionary Items. The election of directors, the approval of the advisory resolution approving the executive compensation program for our named executive officers, the selection, on an advisory basis, of the frequency of advisory votes on the Company’s executive compensation program for named executive officers by our stockholders, and the approval of the amendment of our 2016 Long-Term Incentive Plan are considered non-discretionary items and may not be voted on by brokers, banks or other nominees who have not received specific voting instructions from beneficial owners. |

| • | Discretionary Items. The ratification of the appointment of Ernst & Young LLP as independent auditors is a discretionary item. Generally, brokers, banks and other nominees that do not receive voting instructions from beneficial owners may be able vote on this Proposal in their discretion. |

Can I change the number of copies of the Annual Meeting materials that I receive?

Yes. The Company will generally deliver one copy of its proxy materials to each address where multiple record holders of our Common Stock reside, unless we have received instructions to the contrary, a process commonly referred to as “householding.” If you are a registered stockholder and would like to have separate copies of the proxy materials mailed to you in the future, or you would like to have a single copy of the proxy materials mailed to you in the future, please contact your bank, broker, or other nominee record holder, or you can notify the Company by sending a written request. Written requests for additional information or additional proxy materials should be directed to our Corporate Secretary, Delek US Holdings, Inc., 310 Seven Springs Way, Suite 500, Brentwood, Tennessee 37027, (615) 767-4344 or by sending an e-mail to Investor.Relations@delekus.com.

Who should I call if I have questions or need assistance voting my shares?

If you have any questions or need assistance in voting your shares, please call our Investor Relations department at (615) 767-4344.

Why is the Annual Meeting being held in virtual-only format this year?

We will once again conduct a virtual annual meeting, which we believe provides expanded access, improved communications and cost and time savings for our stockholders and the Company. The Annual Meeting is planned to be a completely virtual meeting of stockholders, and will be conducted exclusively by webcast at www.virtualshareholdermeeting.com/DK2023.

How can I participate in the Annual Meeting?

You may virtually attend, submit questions and vote your shares during the Annual Meeting by visiting our Annual Meeting website at www.virtualshareholdermeeting.com/DK2023.

Registered Stockholders

Stockholders of record as of the Record Date may attend the Annual Meeting online by visiting the website www.virtualshareholdermeeting.com/DK2023 and entering the 16-digit control number included in our notice of Internet availability of the proxy materials, on your proxy card, or in the instructions that accompanied your proxy materials. Please have your proxy card containing your control number available and follow the instructions to attend the virtual Annual Meeting.

Beneficial Stockholders

Stockholders whose shares are held through a broker, bank or other nominee as of the Record Date may attend the Annual Meeting online by visiting the website www.virtualshareholdermeeting.com/DK2023 and entering the 16-digit control number included in our notice of Internet availability of the proxy materials, on your proxy card, or in the instructions that accompanied your proxy materials. Please have your proxy card containing your control number available and follow the instructions to attend the virtual Annual Meeting. If you are a beneficial stockholder and you wish to vote your shares online during the virtual Annual Meeting, rather than submitting your voting instructions before the Annual Meeting, you will need to contact your bank, broker or other nominee to obtain a legal proxy form that you must submit in PDF or Image file format with your ballot when voting online during the Annual Meeting.

DELEK US HOLDINGS, INC. | 2023 PROXY STATEMENT | 7 |

Even if you plan to virtually attend the Annual Meeting, we recommend that you also vote by proxy as described above so that your vote will be counted if you later decide not to virtually attend the Annual Meeting. The Annual Meeting will begin promptly at 11:00 a.m., central time. Online check-in will begin at 10:45 a.m., central time, and you should allow ample time for the online check-in procedures.

In order to ensure that your shares are represented at the Annual Meeting, we strongly encourage you to vote your shares by proxy prior to the Annual Meeting, and further encourage you to submit your proxies electronically — by telephone or by Internet — by following the simple instructions on the enclosed proxy card. Your vote is important, and voting electronically should facilitate the timely receipt of your proxy despite any potential disruptions in mail service.

May stockholders ask questions at the Annual Meeting?

Yes. Stockholders who attend the Annual Meeting will have the ability to submit questions during the Annual Meeting by visiting our Annual Meeting website at www.virtualshareholdermeeting.com/DK2023. We intend to answer all questions submitted during the meeting which are pertinent to the Company and the meeting matters, as time permits. Detailed guidelines for submitting questions during the meeting are available on the Investor Relations page of our website at www.delekus.com.

What if I have technical difficulties or trouble accessing the Annual Meeting?

Beginning 15 minutes prior to the start of and during the meeting, we will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting. If you encounter any difficulties accessing the virtual meeting or during the meeting time, please call the technical support number that will be posted on the virtual meeting login page.

Is it possible that the meeting format will be changed so that it is no longer virtual only?

We believe a virtual-only format provides expanded access, improves communications and provides cost and time savings for our stockholders and the Company. However, if it becomes necessary or advisable to change the format of the meeting as circumstances evolve, we will notify stockholders as soon as practicable.

Do stockholders have any appraisal or dissenters’ rights on the matters to be voted on at the Annual Meeting?

No, stockholders of the Company will not have rights of appraisal or similar dissenters’ rights with respect to any of the matters identified in this Proxy Statement to be acted upon at the Annual Meeting.

How can I obtain additional information about the Company?

Copies of our Annual Report to Stockholders and Annual Report on Form 10-K for the year ended December 31, 2022, and our other annual, quarterly and current reports, and any amendments to those reports, are filed with the SEC, and are available free of charge on our website, which is located at www.delekus.com. These reports and other information are filed electronically with the SEC and are available at the SEC’s website, www.sec.gov. Copies of these reports will be sent without charge to any stockholder requesting it in writing to our Corporate Secretary, Delek US Holdings, Inc., 310 Seven Springs Way, Suite 500, Brentwood, Tennessee 37027. The investor relations page of our website contains our press releases, earnings releases, financial information and stock quotes, as well as links to our SEC filings. The information posted on our website is not incorporated into this Proxy Statement.

DELEK US HOLDINGS, INC. | 2023 PROXY STATEMENT | 8 |

CORPORATE GOVERNANCE

Composition of the Board

At the date of this Proxy Statement, the Board consists of seven independent directors (William J. Finnerty; Richard J. Marcogliese; Leonardo Moreno, Gary M. Sullivan, Jr.; Vasiliki (Vicky) Sutil; Laurie Z. Tolson; and Shlomo Zohar) and two employee directors (Ezra Uzi Yemin, the Executive Chairman of the Board, and Avigal Soreq, our President and Chief Executive Officer). Each of these individuals currently serves as a director of the Company and has been nominated for election at the Annual Meeting to serve for a one-year term expiring at our 2024 Annual Meeting of Stockholders or when his or her successor is duly appointed, elected and qualified.

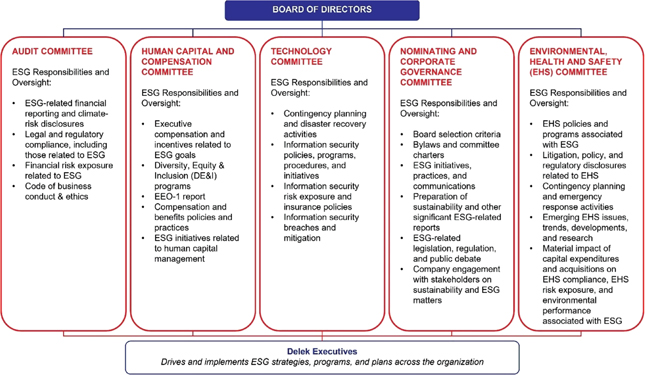

The Board has five standing committees: the Audit Committee, the Human Capital and Compensation Committee, the Nominating and Corporate Governance Committee (the “Governance Committee”), the Environmental Health & Safety Committee (the “EHS Committee”), and the Technology Committee. The role of each of these standing committees is further described under “Committees of the Board of Directors” beginning on page 13. The following table shows the current composition of our standing committees.

| Audit Committee | Governance Committee | Human Capital and Compensation Committee | EHS Committee | Technology Committee | ||||||

| William J. Finnerty | ● | « | ● | |||||||

| Richard J. Marcogliese | ● | ● | « | |||||||

| Leonardo Moreno | ● | ● | ||||||||

| Gary M. Sullivan, Jr. | « | ● | ● | ● | ||||||

| Vicky Sutil | ● | « | ● | |||||||

| Laurie Z. Tolson | ● | ● | « | |||||||

| Shlomo Zohar | ● | ● | ● |

« = Chair l = Member

Board Diversity

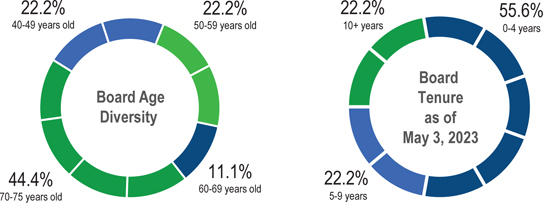

The following graphic presents information about the ages and tenures of the members of our Board.

|

DELEK US HOLDINGS, INC. | 2023 PROXY STATEMENT | 9 |

Executive Leadership Transition

Mr. Yemin served as our Chief Executive Officer for eighteen years, during which time the Company grew from a retail convenience store operator to a fully integrated downstream energy company with assets located along the Gulf Coast region, including four refineries, a strong midstream footprint, biodiesel plants and retail convenience store locations. The Board regularly conducts executive leadership succession planning and, in 2021 Mr. Yemin and the Board began to discuss the Company’s next generation of leadership in light of the Company’s strong foundation and positive momentum. Both Mr. Yemin and the Board believed that a change in the CEO position would only be desirable if an appropriate candidate to build on this foundation could be identified. To advance this process, the Board established a committee of independent directors (the “CEO Selection Committee”) to explore a potential transition of the CEO position.

The CEO Selection Committee met numerous times during 2021 and 2022 to consider the appropriate timing and structure of a potential CEO transition. The CEO Selection Committee consisted of William J. Finnerty as its Chair, Richard J. Marcogliese, Vicky Sutil, and Shlomo Zohar. In addition, Ron Haddock, the Lead Independent Director of Delek Logistics Partners, LP (“DKL” or “Delek Logistics”), participated as a non‑voting member of the CEO Selection Committee. During this process, Avigal Soreq, the then-current Chief Executive Officer of El Al Israel Airlines Ltd., the national airline of Israel, and formerly a senior executive of the Company from 2012 to 2021, was identified as the appropriate candidate. On March 27, 2022, the CEO Selection Committee recommended, and the Board approved, the transition of Mr. Yemin to the new role of Executive Chairman of the Company, and the appointment of Mr. Soreq as the new President and CEO of the Company, which was effective June 9, 2022. On March 27, 2022 the General Partner of Delek Logistics also approved the appointment of Mr. Soreq as the new President of Delek Logistics.

As Executive Chairman, Mr. Yemin helps oversee the Company’s strategic direction and innovation efforts in addition to his Board leadership duties.

As the new CEO of the Company, Mr. Soreq leads the Company, including overseeing other executives of the Company. Mr. Soreq has an extensive level of experience and knowledge about the Company from his previous service in senior leadership positions across our organization, including most recently as the Company’s Chief Operating Officer from March 2020 until January 2021. Mr. Soreq played an instrumental role in establishing our operational capabilities and growing our business during his tenure with us from 2012 until 2021. Prior to returning to the Company, Mr. Soreq served as the CEO of El Al Israel Airlines. His balanced combination of first‑hand insight into the Company as well as outside executive perspective makes him uniquely positioned lead the Company.

Board Leadership

The Board is led by the Board’s Executive Chairman, Mr. Yemin. In accordance with our Bylaws and Corporate Governance Guidelines (our “Governance Guidelines”), the Governance Committee and the Board periodically evaluate our leadership structure, including whether the roles of Chief Executive Officer and Chair of the Board should be held by the same or different individuals. Our Bylaws allow the Board flexibility to determine from time to time whether the two roles should be combined or separated based upon circumstances existing at such time. As discussed above, in March 2022 the Board approved the transition of Mr. Yemin to the role of Executive Chairman and the appointment of Avigal Soreq as the Company’s next CEO in June 2022. The Board believes Mr. Yemin’s appointment as Executive Chairman allows him to effectively identify strategic priorities and lead the Board’s oversight of the Company’s operations during the transition to Mr. Soreq as CEO. In light of these factors, combined with Mr. Yemin’s leadership skills, extensive history with the Company and industry expertise, the Board believes his holding the role of Executive Chairman is in the best interest of the Company and its stockholders at this time. The Governance Committee and the Board will continue to periodically evaluate our leadership structure, including these roles, in the future.

Because the Executive Chairman of the Board is not an independent director, the Board considers it to be useful and appropriate to designate an independent director to serve in a lead capacity (the “Lead Independent Director”) to coordinate the activities of the other independent directors and to perform such other duties and responsibilities as the Board may determine from time to time. Mr. Zohar has served as the Board’s Lead Independent Director since February 24, 2020. The Lead Independent Director is appointed annually by a majority of the independent directors on the Board and may be removed from or replaced in that position by a majority of the independent directors at any time. The Lead Independent Director will chair all meetings of the Board at which the Executive Chairman is not present, including executive sessions of the independent directors, call additional meetings of the independent directors as deemed appropriate, and perform such other functions as the Board may direct, including: (i) serving as principal liaison between the independent directors, on one hand, and the Executive Chairman and senior management, on the other hand; (ii) providing input from the Board and make recommendations to the Executive Chairman regarding Board meetings including with respect to meeting frequency, dates, locations, agendas, management participation and other matters; and (iii) consulting with the Executive Chairman regarding information submitted by our management that

DELEK US HOLDINGS, INC. | 2023 PROXY STATEMENT | 10 |

is necessary or appropriate for the Board’s deliberations. In addition, the Lead Independent Director has the authority to engage in direct communication, as appropriate, with our major stockholders, and engage outside counsel and consultants.

Director Independence

At the date of this Proxy Statement and at all times during 2022, the Board was composed of a majority of independent directors. The Board has affirmatively determined that Messrs. Finnerty, Marcogliese, Moreno, Sullivan, and Zohar and Mses. Sutil and Tolson are each independent under the rules and regulations of the NYSE, the SEC and Company guidelines, and meet the requirements for non-employee directors under the Securities and Exchange Act of 1934, as amended (the “Exchange Act”). In reaching its determinations, the Board affirmatively determined that these individuals have no material relationship with us or our management, either directly or as a partner, stockholder or officer of an organization that has a relationship or has engaged in transactions with us or with our management. The Board based this determination and its independence determinations on a review of all of the relevant facts and circumstances, including the responses of the directors to questions regarding their employment history, compensation, affiliations and other relationships including but not limited to familial, commercial, industrial, banking, consulting, legal, accounting, charitable and other relationships.

2022 Board Meetings

| Board Meetings. The Board held 18 meetings during 2022 and each director attended at least 75% of all Board and committee meetings on which he or she served during the year. While we do not have a policy with regard to Board member attendance at annual meetings of our stockholders, all directors serving at the time of our 2022 Annual Meeting of Stockholders attended the annual meeting on May 3, 2022. |

DELEK US HOLDINGS, INC. | 2023 PROXY STATEMENT | 11 |

Executive Sessions. Our independent directors also met in executive sessions without management present during each quarterly meeting of the Board in 2022. Our Lead Independent Director, Mr. Zohar, presided over these executive sessions of independent directors. The Board intends to continue to conduct such executive sessions of independent directors as necessary or desirable in 2023, including in connection with each regular quarterly meeting. The Lead Independent Director will continue to preside at executive sessions of independent directors.

| DIRECTORS’ EXPERIENCES AND SKILLS |  |  |  |  |  |  |  |  |  | ||

| PUBLIC COMPANY LEADERSHIP EXPERIENCE | ● | ● | ● | ● | ● | ● | ● | ● | ||

| PUBLIC COMPANY BOARD EXPERIENCE | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

| FINANCE | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

| ACCOUNTING AND AUDITING | ● | ● | ● | ● | ● | ● | ● | |||

| ENERGY INDUSTRY EXPERIENCE | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

| RETAIL EXPERIENCE | ● | ● | ● | ● | ● | ● | ● | |||

| OPERATIONS EXPERIENCE | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

| INTERNATIONAL BUSINESS EXPERIENCE | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

| RISK MANAGEMENT | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

| COMPENSATION | ● | ● | ● | ● | ● | ● | ● | ● | ||

| ENVIRONMENTAL/SUSTAINABILITY | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

| ESG/SOCIAL RESPONSIBILITY | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

| CYBERSECURITY/INFORMATION TECHNOLOGY | ● | ● | ● | ● | ● | |||||

| M&A / CAPITAL MARKETS | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

| STRATEGY | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

| GOVERNMENT/REGULATORY/PUBLIC POLICY | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

Stockholder Engagement

The Company is committed to active stockholder engagement through a combination of investor conferences, non-deal roadshows, quarterly conference calls and ongoing dialogue with the analyst and investment community. Our ambition is to provide transparency and clearly articulate the strategic direction of the Company, along with key drivers that underpin financial performance. We strive to deliver sustainable, long-term value to our stakeholders by maintaining active dialogue and ensuring that our objectives are aligned.

Both the Board and our management team are committed to being prudent stewards of capital with a strong commitment to good corporate citizenship. We engage in ongoing efforts to address environmental, social and governance (“ESG”) matters that are important to our stockholders. In 2021, we formalized the responsibilities of our Board committees for overseeing ESG matters. The Governance Committee has general oversight responsibility for the Company’s ESG efforts. Specific areas overseen by the Governance Committee include Board and committee diversity, stockholder rights, sustainability reporting, and ESG ratings. The EHS Committee and Human Capital and

DELEK US HOLDINGS, INC. | 2023 PROXY STATEMENT | 12 |

Compensation Committee also have areas of oversight responsibility, subject to the overall oversight of the Governance Committee. The EHS Committee reviews ESG matters relevant to the health and safety of employees, the Company’s climate impact, environmental risk assessments, and those portions of sustainability reports that relating to environmental, health and safety matters. The Human Capital and Compensation Committee reviews employee diversity and inclusion, executive succession planning, and those portions of sustainability reports related to employment and compensation matters. The Audit Committee has responsibility for oversight of the inclusion of ESG disclosures in the Company’s financial statements and SEC disclosures. Overall, this alignment of committee responsibilities is intended to organize a comprehensive approach to addressing the most important ESG issues the Company faces.

Committees of the Board of Directors

The Board has five standing committees: the Audit Committee, the Human Capital and Compensation Committee, the Governance Committee, the EHS Committee, and the Technology Committee. Although primary responsibilities may be assigned to one of these committees, the Board receives regular, detailed reports from each committee, engages in additional discussion and oversight regarding matters of particular concern or importance, and non-committee members regularly participate in meetings of each committee. At all times during 2022, all of the members of each of the Company’s standing committees were independent as defined by the rules and regulations of the NYSE, the SEC and Company guidelines. The Governance Committee regularly reviews the membership on each of the Board’s five standing committees, and periodically considers whether rotation of committee members or chairs is in the best interests of the Company and its stockholders.

Audit Committee

On January 1, 2022, the Audit Committee was comprised of Messrs. Sullivan (chair), Marcogliese, and Zohar and Ms. Sutil. Mr. Moreno was appointed to the Audit Committee in October 2022. The Board has determined that (i) Messrs. Sullivan, Marcogliese, Moreno, and Zohar and Ms. Sutil each qualify as independent and financially literate under applicable SEC rules and regulations and the rules of the NYSE; and (ii) Messrs. Sullivan, Marcogliese and Zohar all qualify as an “audit committee financial expert” within the meaning of Item 407(d)(5) of Regulation S-K.

| Audit Committee Members | Independent | Financially Literate | Qualifies as an Audit Committee Financial Expert |

| Gary M. Sullivan, Jr. (Chair) | ü | ü | ü |

| Richard J. Marcogliese | ü | ü | ü |

| Leonardo Moreno | ü | ü | |

| Vicky Sutil | ü | ü | |

| Shlomo Zohar | ü | ü | ü |

The Audit Committee met nine times during 2022. In performing its functions and to promote the independence of the audit, the Audit Committee consults separately and jointly with the independent auditors, our internal auditors, our Chief Executive Officer, our Chief Financial Officer, and other members of our management. Among other responsibilities, the Audit Committee is responsible for assisting Board oversight of:

| • | The quality and integrity of our financial statements, |

| • | The disclosure and financial reporting process carried out by management and the systems of internal accounting and financial controls developed and carried out by management; |

| • | The independent audit of our financial statements; |

| • | The independent registered public accounting firm’s appointment, qualifications, independence, performance and compensation; |

| • | The internal audit function; |

| • | Our compliance with legal and regulatory requirements including procedures for the internal and external reporting of financial accounting, internal control and other concerns as required by the Sarbanes Oxley Act (the “whistleblower hotline”); |

| • | The general administration of our related party transactions policy; and |

| • | ESG-related financial disclosures in our financial reports, including compliance with SEC required disclosures, and the related internal controls over financial reporting. |

Human Capital and Compensation Committee

On January 1, 2022, the Human Capital and Compensation Committee was comprised of Messrs. Finnerty (chair), Marcogliese, Sullivan, and Zohar and Ms. Tolson. In May 2022, on the recommendation of the Governance Committee, the Board approved a change of the Committee’s name from the Compensation Committee to the Human Capital and Compensation Committee. The Board has determined that Messrs. Finnerty, Marcogliese, Sullivan, and Zohar and Ms. Tolson each qualify as independent under applicable SEC rules and regulations

DELEK US HOLDINGS, INC. | 2023 PROXY STATEMENT | 13 |

and the rules of the NYSE and as a “non-employee director” for the purposes of Rule 16b-3 under the Exchange Act. The Human Capital and Compensation Committee met eight times in 2022. Under its charter, the Human Capital and Compensation Committee may delegate its authority to subcommittees, the chair of the committee, or to one or more officers of the Company to make grants of equity awards to non-named executive officers and non-Section 16 officers under our incentive or equity-based plans and only in accordance with the terms of such plans. The Human Capital and Compensation Committee is only permitted to delegate its authority when it deems such delegation to be appropriate and in the best interests of the Company.

As part of the governance and oversight process of the Company, the Human Capital and Compensation Committee supports the Board and works with management to ensure that compensation practices properly reflect management and Company philosophy, competitive practice and regulatory requirements. Among other responsibilities, the Human Capital and Compensation Committee is responsible for:

| • | Our compensation practices, including ensuring they reflect the Board’s and our philosophy, competitive practices and regulatory requirements and aligned with our strategic direction; |

| • | Evaluating the performance of our Chief Executive Officer and approving the compensation awarded to our executive officers; |

| • | Overseeing equity awards issued under our long-term incentive plans; |

| • | Periodically evaluating our compensation and benefits programs generally, including risks relating thereto; |

| • | ESG matters related to employees and compensation; and |

| • | Overseeing and reviewing the Company’s strategies, policies, and practices related to human capital management, including aspects of the Company’s ESG initiatives related to human capital management. |

Governance Committee

On January 1, 2022, the Governance Committee was comprised of Mses. Sutil (chair) and Tolson and Messrs. Finnerty and Sullivan. The Board has determined that Mses. Sutil and Tolson and Messrs. Finnerty and Sullivan each qualify as independent under applicable SEC rules and regulations and the rules of the NYSE. The Governance Committee met seven times in 2022. Among other responsibilities, the Governance Committee is responsible for:

| • | Assisting the Board in identifying and evaluating individuals qualified to become Board members and recommending to the Board the director nominees for each annual meeting of stockholders in accordance with the parameters set forth in our Governance Guidelines; |

| • | Overseeing our corporate governance policies and procedures applicable to the Governance Guidelines when required; |

| • | Reviewing the Governance Guidelines on an annual basis and recommending to the Board any changes deemed necessary or desirable; |

| • | Monitoring, overseeing and reviewing compliance with the Governance Guidelines and all other applicable policies of the Company as the Governance Committee or the Board deems necessary or desirable; |

| • | Leading the Board and each of its committees in an annual assessment of their performance; and |

| • | General oversight of ESG matters, Board diversity, stockholder rights, sustainability reporting and ESG ratings. |

EHS Committee

On January 1, 2022, the EHS Committee was comprised of Messrs. Marcogliese (chair) and Finnerty and Ms. Sutil. The EHS Committee met four times in 2022. Among other responsibilities, the EHS Committee is responsible for:

| • | Overseeing management’s establishment and administration of our environmental, health and safety policies, programs, procedures and initiatives; |

| • | Receiving periodic reports from management regarding environmental, health and safety laws, rules and regulations applicable to the Company; |

| • | Evaluating risks relating to such policies, programs, procedures and initiatives; and |

| • | ESG matters related to environment, health and safety. |

DELEK US HOLDINGS, INC. | 2023 PROXY STATEMENT | 14 |

Technology Committee

On January 1, 2022, the Technology Committee was comprised of Ms. Tolson (chair) and Messrs. Sullivan and Zohar. Mr. Moreno was appointed to the Technology Committee in October 2022. The Technology Committee met four times in 2022. Among other responsibilities, the Technology Committee is responsible for:

| • | Overseeing management’s establishment and administration of our policies, procedures, and initiatives with respect to digitalization, technology, cybersecurity, and information security; |

| • | Receiving periodic reports from management regarding our digitalization, technology, cybersecurity, and information security initiatives and related regulations and key legislation and regulatory developments; |

| • | Reviewing with management the adequacy of our information security and compliance program and any major security incidents that have occurred and steps that have been taken to mitigate against reoccurrence; and |

| • | Evaluating risks relating to such policies, programs, procedures and initiatives. |

Find more online Find more online |

| Each of the Board’s five standing committees has a written charter that may be found on the “Corporate Governance” page of our website at https://www.delekus.com/about/corporate-governance/. Each committee reviews the adequacy of its charter on an annual basis and recommends changes to the Board, as appropriate. Paper copies of the charters are available free of charge to all stockholders by calling (615) 767-4344 or by writing to our Corporate Secretary, Delek US Holdings, Inc., 310 Seven Springs Way, Suite 500, Brentwood, Tennessee 37027. |

DELEK US HOLDINGS, INC. | 2023 PROXY STATEMENT | 15 |

Risk Oversight

The Board considers oversight of risk management to be a responsibility of the entire Board as well as its committees. The Board’s role in risk oversight includes receiving regular reports from its committees and members of senior management on areas of material risk to the Company, including operational, compliance, financial, liquidity, credit, legal and regulatory, strategic, commercial, cybersecurity, enterprise and reputational risks. The Board further understands, evaluates and oversees risk identification, risk management and risk mitigation strategies, including cyber security risks. The Board delegates to certain of its standing committees oversight of certain categories of risk. Those committees regularly report to the Board on matters relating to the specific areas of risk such committees oversee, and directors are encouraged to attend and participate, ex officio, in committee meetings, to ensure all directors engage in oversight of risks overseen by each committee. The roles of the standing committees in assisting the Board in its oversight of risk management are as follows:

| Audit Committee | • Assists the Board in monitoring and assessing the Company’s financial, commercial, liquidity, credit, regulatory, and other risks and in developing guidelines and policies to govern processes for managing these risks. • Discusses the Company’s policies with respect to risk assessment, as well as with respect to the specific risks the Audit Committee oversees. • Regularly reports to the Board on its discussions and oversight. | |

| Human Capital and Compensation Committee | • Assists the Board in monitoring the risks associated with the Company’s compensation policies and practices. • Reviews the design and goals of the Company’s compensation programs and practices in the context of possible risks to the Company’s financial and reputational well-being. • Reviews risks to the continuity of the Company’s management, including the retention, quality and diversity of employees required to achieve the Company’s purpose and strategy. • Regularly reports to the Board on its discussions and oversight. | |

| Governance Committee | • Assists the Board in monitoring the Company’s risks incident to its board and committee structures and governance structures and processes, including ESG risks. • Discusses risk management in the context of general governance matters, Board succession planning and committee service by directors, among other topics. • Regularly reports to the Board on its discussions and oversight. | |

| EHS Committee | • Assists the Board in monitoring the risks associated with the Company’s compliance with environmental, health and safety regulations, including related ESG matters. • Reviews the Company’s policies and procedures relating to environmental, health and safety compliance. • Regularly reports to the Board on its discussions and oversight. | |

| Technology Committee | • Assists the Board in monitoring the Company’s risks related to cybersecurity, technological developments, digitalization, and information security. • Reviews the status and level of the Company’s contingency planning and disaster recovery activities. • Reviews with management any major security incidents that have occurred and steps that have been taken to mitigate against recurrence. • Reviews with management the adequacy of the Company’s information security training and compliance program. • Regularly reports to the Board on its discussions and oversight. | |

| The Board | • Oversees the enterprise risk management (“ERM”) program and cyber risk management, including both operational and information security risks resulting from operating critical infrastructure and retail operations. • Discusses findings of the ERM program, including cyber and ESG risks, and reviews the Company’s procedures related to the ERM program and risk management. • Receives regular updates on these matters from the Chief Financial Officer, Chief Information Officer, Chief Information Security Officer, and other senior management team members. • Review and assess industry risk through trade organizations. |

Board Oversight of Cyber Risk

Cyber risks are monitored through our ERM program, which is overseen by the Board with our Chief Technology Officer having overall responsibility for financial, information technology, and cybersecurity. In overseeing cyber risk, the Board follows the principles identified by the National Association of Corporate Directors in the oversight of cybersecurity risks. At each regular meeting of the Board, cybersecurity risks and Company programs are discussed with the Chief Technology Officer and others. Third parties are periodically engaged in the assessment of cybersecurity, including evaluating maturity under the National Institute for Security and Technology’s cybersecurity framework, testing informational and operational cyber defenses, and reviews of policies and procedures.

As discussed above, in 2021 the Board established the standing Technology Committee. One of the Technology Committee’s responsibilities is to review, assess, manage, and mitigate risks related to technological developments, digitalization and information security. The Technology

DELEK US HOLDINGS, INC. | 2023 PROXY STATEMENT | 16 |

Committee also reviews assessments of the effectiveness of the Company’s information security and technology programs, procedures and initiatives. The Technology Committee regularly receives reports from management regarding information security and cyber risk matters, including the Company’s contingency planning and information security training and compliance. The Technology Committee’s designated focus on these areas of the Company’s digitalization, information security and technology policies help ensure strategic alignment of the Company’s strategies with information security and risk management.

Additionally, in keeping with the Company’s commitment to provide the highest level of oversight of cybersecurity risks, we have a Chief Technology Officer who focuses all of their time to ensure the safety and security of our networks and systems. Our Chief Technology Officer oversees a team of security professionals within the Company and regularly updates the Board on any potential risks and threats to the Company. Our Chief Technology Officer, Chief Information Officer, and other senior leadership brief the Board on information security matters multiple times throughout the year.

Board Oversight of Sustainability

The Company is committed to operating in a sustainable and environmentally responsible manner. We are committed to our employees and the communities in which we operate. We have demonstrated this through strong markets and industry downturns. Our employees are our greatest asset, and we are committed to supporting them and the local economies of their communities. In 2019, we produced our first Corporate Social Responsibility Report, and in 2020 we produced our first Sustainability Report. In 2022 we produced our 2021-2022 Sustainability Report, which included goals and disclosures related to greenhouse gas (“GHG”) emissions, our first water consumption disclosures, our first diversity hiring target, and an expanded and more detailed response to the recommendations of the Taskforce on Climate-Related Disclosures (“TCFD”).

In October 2022 the Board revised the Company’s Governance Guidelines to specify that the Board retains overall responsibility for the oversight of the Company’s ESG activities, including oversight of climate-related risks and opportunities including broad emissions reduction targets and the Company’s sustainability reports. The Board has delegated oversight of certain ESG activities to its standing committees, as set forth in each committee’s respective charter, and from time to time the Board may refer specific issues to the committees at the Board’s discretion.

Commitment to Diversity Delek believes that a diverse workforce composed of individuals with a variety of personal and professional backgrounds and identities makes our company stronger. |

DELEK US HOLDINGS, INC. | 2023 PROXY STATEMENT | 17 |

The primary responsibility for assisting the Board in overseeing ESG-related matters has been assigned to the Governance Committee. The Governance Committee, which has been helping to guide these activities, is focused on elevating the Company’s ESG performance to that of a leader amongst its peers. The Human Capital and Compensation Committee also has responsibilities related to ESG-related matters, such as ensuring the consideration of executive compensation to the achievement of ESG-related goals, executing our Diversity, Equity and Inclusion (“DEI”) programs, and certifying the full and proper disclosure of our EEO-1 report. The EHS Committee exercises direct oversight over a number of ESG-related matters such as the implementation of our first GHG reductions goals, the continual improvement of our workforce health and safety performance and an examination of water conservation, waste minimization, and air emission reduction efforts. The Audit Committee oversees certain ESG-related matters, such as all financial reporting disclosures related to ESG, the Company’s legal and regulatory compliance, and any potential financial risk exposure related to ESG. Each committee reports its activities to our Board, which retains overall responsibility for incorporating ESG considerations into our strategic plans.

For example, our corporate governance and ERM programs are designed to help sustain our organization through a wide range of market and operating scenarios, and our community development efforts benefit the health and growth of the communities we serve. In addition, we are committed to supporting our employees through our health and safety policies and retention efforts. With the Board’s oversight, we have:

We believe these activities support our business and are integral to achieving the goals we have for the Company.

Find more online Find more online |

► Delek’s 2021-2022 Sustainability Report can be found on the “Social Commitment” page of our website at https://www.delekus.com/social-commitment/, as well as a more comprehensive look at our corporate responsibility and sustainability policies, practices and procedures. ► Our Diversity, Equity and Inclusion Policy can be found on the “Corporate Governance” page of our website at https://www.delekus.com/about/corporate-governance/. ► For more information about the Delek Fund for Hope, and information about our philanthropic programs, events, and donations, please visit the Delek Fund for Hope website at https://delekhope.com/. |

Nomination of Directors

In accordance with our Governance Guidelines and the charter of the Governance Committee, the Governance Committee seeks to identify individuals qualified to become directors and considers such factors as it deems appropriate, including the individual’s independence, education, experience, reputation, judgment, skill, integrity and industry knowledge. The Governance Committee considers the individual’s contribution to the Board’s overall diversity in the foregoing factors, the degree to which the individual’s qualities and attributes complement those of other directors, and the extent to which the candidate would be a desirable addition to the Board and committees thereof. Directors should have experience in positions with a high degree of responsibility; be leaders in the organizations with which they are affiliated; and have the time, energy, interest and willingness to serve as a member of the Board.

DELEK US HOLDINGS, INC. | 2023 PROXY STATEMENT | 18 |

Board Diversity In 2020, Delek pledged that by 2022 at least 30% of our Board would be female and/or racially diverse. With the appointment of Leonardo Moreno to our Board, we are proud to have met that goal. |

We recognize the importance of diversity of viewpoints, industry and professional experiences, ethnicity, age, race, backgrounds, education, skill sets and gender. With the appointment of Leonardo Moreno in March 2022, we met our pledge that in 2022 at least 30% of our Board will be female and/or racially diverse. This year, our Board formally committed that by the 2024 Annual Meeting at least 30% of our Board will be gender diverse.

Among other criteria, the Governance Committee seeks candidates who have business and/or professional knowledge and experience applicable to our industry and businesses and the goals and interests of our stockholders; are well regarded in their communities with a long-term, good reputation for the highest ethical standards; possess common sense and good judgment; have a positive record of accomplishment in present and prior positions; offer diverse viewpoints; have an excellent reputation for preparation, attendance, participation, interest and initiative on other boards on which they may serve; and have the time, energy, interest and willingness to become involved in our business and future.

The Governance Committee annually and periodically assesses whether the Board and its committees possess the right diversity of skills and backgrounds for the current issues we face. Annually, the Governance Committee will assess this composition in connection with the nomination of directors for re-election to the Board as well as during the annual Board and committee self-assessments. From time to time, the Governance Committee utilizes the services of third parties to assist in identifying or evaluating director nominees. The Governance Committee will also consider persons recommended by our stockholders and will evaluate each such person using the same criteria used to evaluate director candidates identified by the Governance Committee. Stockholders wishing to make such recommendations may write to the Board in care of our Corporate Secretary, Delek US Holdings, Inc., 310 Seven Springs Way, Suite 500, Brentwood, Tennessee 37027. Persons making submissions should include the full name and address of the recommended person, a description of the proposed person’s qualifications and other relevant biographical information.

Director Qualifications and Nomination Process

Annual Assessment of Size, Composition and Structure

The Board strives to maintain an appropriate balance of tenure, turnover, diversity, skills and experience. Our average director tenure is approximately seven years, representing an appropriate balance of tenures. The Board does not maintain term limits and in 2023 the Board amended the Company’s Governance Guidelines to remove the mandatory retirement age for directors, as the Board believes that continuity of service can provide stability and valuable insight.

The Board ensures refreshment and continued effectiveness through evaluation, nomination, and other policies, processes and practices. For example:

| • | The Governance Committee annually reviews with the Board the qualifications for Board members and the composition of the Board as a whole. |

| • | The Governance Committee annually reviews each director nominee’s continuation on the Board and makes recommendations to the full Board. |

| • | The Company’s Governance Guidelines provide that any director who changes the nature of the job he or she held when elected to the Board should volunteer to resign to give the Board the opportunity to review the appropriateness of continued Board membership under the circumstances. |

| Self-Assessment | |

| 1 Oversight of annual evaluation | Each committee of the Board performs an annual self-assessment, and the Governance Committee oversees an annual self-assessment of the full Board. |

| 2 Board effectiveness review | The self-assessment includes an evaluation survey concerning the functioning of the Board and its committees. |

| 3 Presentation of results | The Chair of the Governance Committee presents a summary of the results of the evaluation to the Board and makes any appropriate recommendations regarding changes for consideration by the Board. |

| 4 Incorporation of feedback | Any matters requiring further action are identified and action plans developed to address the matter. |

DELEK US HOLDINGS, INC. | 2023 PROXY STATEMENT | 19 |

Recent Board Refreshment

In 2022, the Board appointed Leonardo Moreno and Avigal Soreq to the Board. Mr. Moreno brings significant executive, renewables, technology, financial, global, and sustainability experience to the Board. Mr. Soreq brings significant financial, global, accounting, and industry experience, in addition to his valued perspective as Chief Executive Officer and President of the Company and President of Delek Logistics. These directors’ skills and perspectives further enhance our diversity and expertise in the boardroom. Their appointments were informed by the Board’s continued focus on its composition, as well as insights provided through the Board’s annual self-evaluation process. Our current Board composition provides a diversity of thought and a broad range of skills and perspectives aligned with our strategy.

In 2022, the Board appointed Leonardo Moreno and Avigal Soreq to the Board. Mr. Moreno brings significant executive, renewables, technology, financial, global, and sustainability experience to the Board. Mr. Soreq brings significant financial, global, accounting, and industry experience, in addition to his valued perspective as Chief Executive Officer and President of the Company and President of Delek Logistics. These directors’ skills and perspectives further enhance our diversity and expertise in the boardroom. Their appointments were informed by the Board’s continued focus on its composition, as well as insights provided through the Board’s annual self-evaluation process. Our current Board composition provides a diversity of thought and a broad range of skills and perspectives aligned with our strategy.

Identification and Consideration of New Nominees

The Board is responsible for nominating directors and filling vacancies that may occur between annual meetings, based upon the recommendation of the Governance Committee. The Governance Committee process for identifying and recommending candidates includes:

| 1 Review | The Governance Committee considers the Company’s current needs and long-term and strategic plans to determine the skills, experience and characteristics needed by our Board. |

| 2 Identify | The Governance Committee identifies candidates through the use of a search firm or the business and organizational contacts of directors and management. |

| 3 Evaluate | In evaluating potential candidates for nomination to the Board, the Governance Committee and the Board consider several factors: |

• all directors are expected to possess the highest personal and professional ethics, integrity and values and be committed to representing the long-term interests of the Company’s stockholders; • candidates should possess skills and experience complementary to those of existing directors; and • additionally, directors are expected to devote sufficient time and effort to their duties as a director. | |

| 4 Recommend | The Governance Committee recommends director candidates to the Board of Directors with the goal of creating a balance of knowledge, experience and diversity. |

Commitment to Board Diversity The Governance Committee believes that the Board should reflect a range of talents, ages, skills, experiences, diversity, and expertise sufficient to provide sound and prudent guidance with respect to the Company’s strategic and operational objectives. The Board has committed to seeking women and underrepresented groups, as well as candidates with diverse backgrounds, skills and experiences, as part of the search process for new directors. We have incorporated this commitment into our Governance Guidelines. To show our commitment to diversity, in 2023 Delek committed that by the 2024 Annual Meeting at least 30% of our Board will be gender diverse. |

Stockholder Recommendation of Candidates

The Governance Committee will consider director candidates recommended by stockholders. A stockholder wishing to recommend a candidate for nomination by the Governance Committee should follow the procedures described under “Stockholder Proposals for 2024 Annual Meeting.” Stockholders wishing to make such recommendations may write to the Board in care of our Corporate Secretary, Delek US Holdings, Inc., 310 Seven Springs Way, Suite 500, Brentwood, Tennessee 37027 no earlier than January 4, 2024, nor later than February 3, 2024. Persons making submissions should include the full name and address of the recommended person, a description of the proposed person’s qualifications and other relevant biographical information. In addition, the stockholder should provide such other information deemed relevant

DELEK US HOLDINGS, INC. | 2023 PROXY STATEMENT | 20 |

to the Governance Committee’s evaluation. Candidates recommended by the Company’s stockholders are evaluated on the same basis as candidates recommended by the Company’s directors, management, third-party search firms or other sources.

Human Capital and Compensation Committee Interlocks and Insider Participation

Each of Messrs. Finnerty, Marcogliese, Sullivan, and Zohar and Ms. Tolson served on the Human Capital and Compensation Committee during the 2022 fiscal year, and each of them qualified as independent under applicable SEC rules and regulations and the rules of the NYSE and as a “non-employee director” for the purposes of Rule 16b-3 under the Exchange Act during 2022. None of our executive officers currently serves (and did not serve during the 2022 fiscal year) as a member of the board of directors or compensation committee of another entity where an executive officer of such other entity serves as a member of our Board.

Governance Guidelines and Code of Business Conduct & Ethics

Our Governance Guidelines may be found on our website at www.delekus.com. The Governance Guidelines set out our and the Board’s guidelines on, among other things:

| • | The qualifications, independence and responsibilities of directors; |

| • | The process for selection of director candidates and qualifications thereof; |

| • | Board leadership and Board meetings; |

| • | Annual evaluation of the performance of the Board and its committees; |

| • | Director compensation and orientation; and |