| | OMB APPROVAL |

| | OMB Number: 3235-0570 Expires: July 31, 2022 Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-23244 | |

The Chartwell Funds

(Exact name of registrant as specified in charter)

| 1205 Westlakes Drive, Suite 100 Berwyn, Pennsylvania | 19312 |

| (Address of principal executive offices) | (Zip code) |

Timothy J. Riddle |

| The Chartwell Funds, 1205 Westlakes Drive, Suite 100 Berwyn, Pennsylvania 19312 |

| (Name and address of agent for service) |

With a copy to:

Alan R. Gedrich, Esq.

Stradley Ronon Stevens & Young, LLP

2005 Market Street, Suite 2600

Philadelphia, PA 19103-7018

| Registrant's telephone number, including area code: | (610) 296-1400 | |

| Date of fiscal year end: | December 31 | |

| | | |

| Date of reporting period: | December 31, 2021 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| |

| |

| |

| Chartwell Income Fund (BERIX) |

| Chartwell Mid Cap Value Fund (BERCX) |

| Chartwell Small Cap Value Fund (CWSIX) |

| Chartwell Short Duration High Yield Fund (CWFIX) |

| Chartwell Small Cap Growth Fund (CWSGX) |

| Chartwell Short Duration Bond Fund (CWSDX) |

| |

| |

| |

| ANNUAL REPORT |

| December 31, 2021 |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| THE CHARTWELL FUNDS |

| LETTER FROM THE PRESIDENT (Unaudited) |

Dear Fellow Shareholder,

As we close out our mutual funds’ 2021 fiscal year, I want to thank you for trusting The Chartwell Funds with your assets. At Chartwell, we are committed to enhancing our shareholders’ value every day through the quality of our research and portfolio implementation. As I write this letter, in late January, the markets have taken a step back and volatility is the order of the day. A year such as 2021 and the volatile start to 2022 underscores our belief that, in challenging market environments, active management and experience matter. At Chartwell, we feel that over time, our experience across various market cycles combined with our disciplined approach will reward our shareholders. And for that, we thank you for the trust you have placed in The Chartwell Funds.

Organizational Update:

On October 20, 2021, it was announced that the parent company of Chartwell Investment Partners, LLC (“Chartwell”), TriState Capital Holdings, Inc. (NASDAQ: TSC), had agreed to be acquired by Raymond James Financial, Inc. (NYSE: RJF), a leading diversified financial services company, headquartered in St. Petersburg, FL. Chartwell has operated as the asset management subsidiary of Tristate since March 2014. Under the ownership of Raymond James, Chartwell will continue to operate independently, as an affiliate of Carillon Tower Advisers (“Carillon”), the $70 billion asset management subsidiary of Raymond James. The essence of Carillon’s affiliate model is investment and client service team independence, which will allow our talented professionals to continue to focus on achieving the objectives of our shareholders and clients. While this acquisition will allow Chartwell to operate independently, it will also provide our firm with access to Carillon’s best of class distribution and shared services infrastructure. This transaction is subject to bank regulatory reviews and approval and is expected to close in the second quarter of 2022.

On December 15, 2021, The Chartwell Funds’ Board held a special meeting and voted unanimously to approve the proposed transaction and reorganization of The Chartwell Funds into the Carillon Funds. Over the next several weeks, our mutual funds’ shareholders will receive disclosure materials to review and a proxy card(s) to vote on the pending transaction. Please note that following the close of the proposed acquisition and the reorganization of The Chartwell Funds, the Chartwell team will continue to manage the assets of the funds. We encourage our shareholders to carefully review these materials and vote in favor of The Chartwell Funds’ reorganization.

Market Summary:

As we headed into 2021, Chartwell was bullish on the global economy as well as equities and high-grade corporate bonds (“risk assets”) for a handful of reasons that we detailed in our yearly outlook. The results did not disappoint. While the Delta variant and supply chain constraints created some headwinds, the U.S. economy could likely post its strongest annual growth numbers since 1984 and U.S. equity indices have produced robust returns. As we turn to our forecast for 2022, many of the strengths we recognized in the economy in late 2020 remain. For example, it appears that consumer balance sheets are strong, and savings are elevated. Furthermore, wage increases should continue to buoy the consumers’ spending ability, and with the reopening of the “experiential economy” (concerts, travel destinations,

| THE CHARTWELL FUNDS |

| LETTER FROM THE PRESIDENT (Unaudited) (Continued) |

etc.), individuals will have more outlets to spend this money outside of supply-constrained goods. For these reasons, and others, we believe economic growth in the first half of 2022 has the potential to remain strong. However, the second half of the year could lead to some consternation as growth starts to slow, inflation subsides, and the Federal Reserve continues to tighten policy.

While we fully support tighter monetary conditions and believe the economy can withstand significantly higher rates, the timing may cause some bumps along the way for risk assets. We believe inflation is likely to peak early in 2022 and start to moderate as the year progresses. Despite the anticipated volatility throughout 2022, I want to assure you that Chartwell’s investment teams will continue to work hard to find attractive investment opportunities across our six mutual funds.

You are a valued partner of Chartwell and we greatly appreciate our relationship. We hope that your families remain safe and healthy during this challenging time. Thank you for investing your trust and confidence in The Chartwell Funds. Stay safe and have a healthy 2022. Highlighted below are the performance summaries of each of our funds for the fiscal year ended December 31, 2021. We welcome any questions you may have on the fund(s) performance. Inquiries may be directed to Shareholder Services at 888.995.5505 or via our website at https://www.chartwellip.com/.

Thank you and we look forward to serving as your mutual funds’ manager in the coming year.

Best Regards,

Timothy Riddle

President of The Chartwell Funds

| THE CHARTWELL FUNDS |

| LETTER FROM THE PRESIDENT (Unaudited) (Continued) |

Mutual Funds Performance Summaries

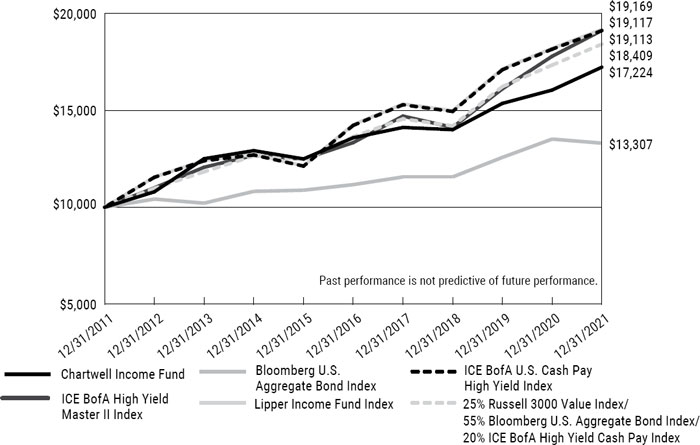

Chartwell Income Fund (BERIX):

The 1-year total return to shareholders of the Chartwell Income Fund (BERIX) for the fiscal year ended December 31, 2021, was +7.35 percent, while the Bloomberg U.S. Aggregate Index was down -1.54%. Net asset value increased from $13.53 on December 31, 2020, to $14.15 on December 31, 2021, and monthly dividends totaled $0.3650 per share for the twelve-month period. The negative returns produced by the Index were largely a product of higher interest rates in 2021, as the yield on the 10-year Treasury jumped nearly 60 basis points (bps)1. Due to the Fund’s shorter duration, corporate credit selection, and an allocation to equities, the portfolio was able to overcome the headwind of higher rates.

While we are biased towards the upside in risk assets, we do believe 2022 will be a year of volatility. We therefore remain neutral on equities for now, with our allocation around 20%. We still believe interest rates have another leg higher and remain short duration relative to the Index. Currently, the duration on the Fund resides at roughly 3.7 years against the Bloomberg U.S. Aggregate Bond Index’s duration of 6.8 years. We expect our duration to remain short of the Index throughout this cycle but will slowly move it higher as interest rates approach our targets. As previously stated, we are bullish on precious metals for a variety of reasons. We expressed our belief that precious metals are set for another leg higher by purchasing both the underlying commodity (currently a position in SLV) and equities that mine precious metals. We plan on capping the total purchases towards precious metals and their related equities around 5% and will keep investors apprised on the individual holdings as the positions are filled out.

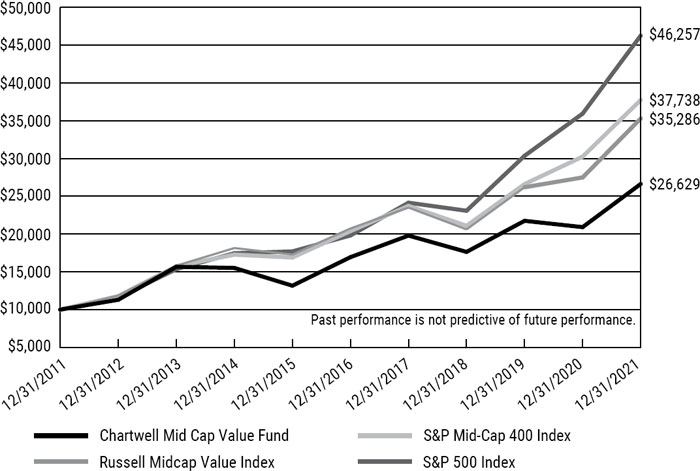

Chartwell Mid-Cap Value Fund (BERCX):

The 1-year total return to shareholders of the Chartwell Mid-Cap Value Fund (BERCX) for the fiscal year ended December 31, 2021, was +27.30 percent. Net asset value increased from $14.92 on December 31, 2020, to $18.88 on December 31, 2021. For the fiscal year, BERCX slightly underperformed its reference index, the Russell Midcap Value Index, with a return of +28.34%. After a second-half relative performance recovery, our Fund closed out the year lagging the Russell Midcap Value benchmark by 104 bps. We outperformed in just 5 of 12 sectors, but we were overweight where selection was best and underweight where we underperformed the most. This compensated for a meaningful drag from cash held in the portfolios during a period of strong market returns. Our biggest contributor was Consumer Services, where auto parts retailer AutoZone (2.9%)2 enjoyed a strong recovery in professional installer sales. In real estate investment trusts (REITs), self-storage facility operator Life Storage (2.3%) enjoyed strong occupancy and pricing growth. In Energy, E&P holdings including Diamondback (2.0%) were boosted by surging oil prices.

Our biggest detractor was Consumer Staples, where valued-added potato processor Lamb Weston (2.1%) encountered cost inflation that marred an impressive recovery in demand from foodservice customers. In Financial Services, P&C insurer Allstate (3.8%) was pressured by higher claims frequency and severity in its auto segment. In Basic Industry, we were underexposed to commodities and ag chemicals manufacturer FMC (3.9%) was challenged by raw material inflation.

| 1 | A basis point or bp represents a unit equal to 1/100th of 1%. |

| 2 | The numbers in parentheses following each company mentioned reflect the percentage of net assets comprised of such sectors or securities as of 12.31.2021. Holdings percentage is subject to change. |

| THE CHARTWELL FUNDS |

| LETTER FROM THE PRESIDENT (Unaudited) (Continued) |

We believe prioritizing business quality and financial strength when selecting value stocks is the key to potential outperformance over a full market cycle. This approach challenged our Fund in 2020 and in the first half of 2021 when weak, highly leveraged companies disproportionately benefited from an economic recovery fueled by fiscal and monetary stimulus. In the second half of 2021, we were encouraged to see investors begin to favor profitable, financially stable companies, and we’re cautiously optimistic that this market rotation will persist as stimulus is withdrawn and economic conditions normalize. Bottom-up selection decisions has continued to drive portfolio positioning, with our top-down economic outlook and view of industry prospects having a small influence on sector allocation. The Fund’s largest overweights are Consumer Services, Business Services, and Health Care, and their largest underweights are Capital Spending, Technology, and Basic Industry.

Chartwell Small Cap Value Fund (CWSIX):

The 1-year total return to shareholders of the Chartwell Small Cap Value Fund (CWSIX) for the fiscal year ended December 31, 2021, was +24.42 percent. Net asset value increased from $17.75 on December 31, 2020, to $19.90 on December 31, 2021. Our Fund trailed the Russell 2000 Value Index benchmark by 385 bps in 2021, which returned +28.27%. Sector allocation was a headwind, but selection was the primary driver of underperformance. Half of the sectors made positive contributions, but underperforming sectors were more impactful.

Our biggest detractor was Consumer Services, where selection was severely impacted in the first half by unowned “meme” stocks like AMC and GameStop, and pandemic winner Jack-in-the-Box (2.1%) lagged peers with more recovery potential. In Financial Services, non-standard auto insurer Kemper (1.4%) was pressured by increased claims frequency and severity. In Energy, an underweight was a headwind and selection was negatively impacted by higher exposure to service and equipment providers like ChampionX (1.2%) which trailed E&Ps.

Our biggest contributor was Business Services, where HR services provider Korn Ferry (1.7%) benefited from growing labor demand. In Consumer Cyclical, furniture manufacturer Knoll (0.5%) agreed to be acquired by a competitor for a substantial premium. In Consumer Staples, poultry producer Sanderson Farms (1.1%) also agreed to be acquired by a competitor for a substantial premium.

Chartwell Short Duration High Yield Fund (CWFIX):

The 1-year total return to shareholders of the Chartwell Short Duration High Yield Fund (CWFIX) for the fiscal year ended December 31, 2021, was +2.40 percent. For the fiscal year, CWFIX slightly outperformed its reference index, the Bloomberg Intermediate US Government/Credit Index, with a return of -1.44%. Net asset value decreased slightly from $9.79 on December 31, 2020, to $9.75 on December 31, 2021, and monthly dividends totaled $0.2725 per share for the twelve-month period.

The Fund closed out 2021 with Insurance (2.8%), Automotive (3.1%), and Transportation (4.5%) being the portfolio’s the best performing sectors, while Leisure (3.3%), Health Care (2.4%), and Capital Goods (2.3%) lagged. Top contributors closing out the Fund’s fiscal year included National Mortgage Insurance (2.8%)1, Rattler Midstream (2.5%), and Albertsons (2.5%). Offsetting these, iStar (2.5%), Sirius XM (2.5%), and SLM Corp. (1.5%) lagged. Trading

| THE CHARTWELL FUNDS |

| LETTER FROM THE PRESIDENT (Unaudited) (Continued) |

activity was modest in 2021 with turnover of approximately 52%. Several bonds were tendered or called at premiums to par including Ball Corp. (0.0%), Cheniere Energy (0.0%), Crown Americas (0.0%), Dell Technology (0.0%), SLM Corp. (1.5%), and Sunoco (0.0%). Proceeds were re-deployed by extending maturities in some of these same issuers, adding to existing positions, and initiating a couple new positions including Vici Properties (2.6%) and XPO Logistics (2.6%). At the close of 2021, the portfolio’s largest sector weights were in Basic Industry (12.7%), Financials (10.6%), and Energy (8.8%).

We would not be surprised to see interest rates grind higher during 2022. The circumstances that drove up inflation expectations in the second half of 2021 feel stubborn to us. While some of the components driving recent inflation higher are expected to roll over in 2022, increased government outlays, accommodative monetary policy (still, even after tapering and the initial rate hikes), a smaller labor force, disjointed supply chains, and pent-up consumer demand could conspire to support inflation readings that remain higher than recent historical averages. Of the companies we research for investment ideas, many believe they have pricing power sufficient to transmit higher costs through to consumers. In this environment, we believe high yield has the potential to outperform other areas of traditional fixed income. High yield bonds have relatively short durations and tend to benefit from a strong economy and some inflation. That said, we recognize the high yield’s 4.8% yield-to-maturity3 (30- Day SEC yield for subsidized and unsubsidized were 2.13% and 2.06%, respectively) is near an all-time low. We believe portfolios ought to be positioned with a quality bias today and look to capitalize on higher volatility when it comes. While absolute yield levels are relatively low, high yield corporates generate more income than most liquid fixed income alternatives.

The portfolio’s quality (BB)4 and maturity ‘guardrails’ remain the foundation around which we invest. We believe these structural inputs produce a relatively consistent and attractive income stream given the associated credit and interest rate risk.

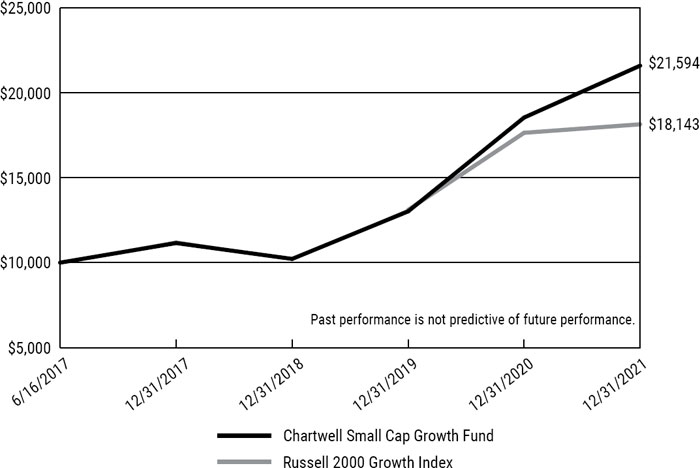

Chartwell Small Cap Growth Fund (CWSGX):

The 1-year total return to shareholders of the Chartwell Small Cap Growth Fund (CWSGX) for the fiscal year ended December 31, 2021, was +16.47 percent. Net asset value decreased from $17.29 on December 31, 2020, to $16.36 on December 31, 2021. The Fund significantly outperformed the Russell 2000 Growth Index for the year, which returned +2.83%. While the

| 3 | Yield to Maturity is the estimated rate of return based on the assumption that it will be held until its maturity date and not called. |

The 30-Day SEC Yield is computed under an SEC standardized formula based on net income earned over the past 30 days. It is a “subsidized” yield, which means it includes contractual expense reimbursements, and it would be lower without those reimbursements.

The Unsubsidized 30-Day SEC Yield is computed under an SEC standardized formula based on net income earned over the past 30 days. It excludes contractual expense reimbursements, resulting in a lower yield.

| 4 | Credit quality ratings are sourced from Standard & Poor’s (the “S&P”), Moody’s and Fitch’s. Ratings values are based on the higher of either S&P or Moody’s. If none of the rating agencies has assigned a rating, the Fund will assign a rating of NR (non-rated security). The ratings represent their (S&P, Moody’s) opinions as to the quality of the securities they rate. The ratings range from AAA (S&P) or Aaa (Moody’s) (extremely strong capacity to meet its financial commitment) to D (S&P, Fitch’s) or C (Moody’s) (in default). Credit ratings of BBB are good credit quality and the lowest category of investment grade. Ratings are relative and subjective and are not absolute standards of quality. The ratings provided relate to the underlying securities within the fund and not the fund itself. |

| THE CHARTWELL FUNDS |

| LETTER FROM THE PRESIDENT (Unaudited) (Continued) |

small cap growth style was broadly out of favor among investors this year when compared to other segments of the stock market, the strategy delivered strong performance through broad stock selection. While the Health Care sector had the best relative performance for the year, Consumer Discretionary, Industrials, and Technology sectors all had meaningful contributions to the outperformance as well.

For the year, the top overall contributor was At Home Group, (1.0%), which gained 134% for the year. At Home is a retailer focused on home furnishings whose sales and earnings benefited from the continued hybrid/Work From Home trends. Earlier this year, the company agreed to be acquired by a private equity firm at a 22% premium. The next largest contributor was Generac (1.2%), which returned 79% for the year. Generac is the largest automatic and stationary standby generator manufacturer in the U.S., serving both residential and commercial customers. The unstable electrical grid in numerous parts of the country have driven record high levels of orders for the company. Indeed, the company’s challenge now is trying to reduce the high level of backlog, as it navigates a challenging supply chain. Given its very strong returns over the past two years, the market capitalization moved out of the small cap range, leading to the sale of the position earlier this year.

The largest detractor in the Fund was Bandwidth (0.9%), which had a -53% return. Bandwidth is a cloud-based Communications Platform as a Service (CPaaS) company, reselling and utilizing their voice-based IP network for their enterprise customers. Bandwidth suffered through major disruptions in December as their network was interrupted by digital hackers. While the disruption was resolved within weeks, the traffic that was diverted has taken longer to return. Also, the company was seen as a Covid beneficiary, with many investors believing that the growth seen in 2020 was an aberration. While growth will slow going forward, we feel the stock over-corrected, and we are retaining our position in Bandwidth.

Another underperformer was our investment in Axsome Therapeutics (0.4%) which had a -70% return. Axsome Therapeutics suffered through several negative regulatory surprises; in early August, the FDA notified the company that there were deficiencies in the New Drug Application of AXS-05 for Major Depression Disorder. Later in the month, the FDA informed the company that the regulatory agency would not be able to review the NDA by the expected targeted date. At this point, it is still unclear if the company needs to submit additional data, or if the FDA just missed its internal deadlines due to other non-company issues. Given the significant uncertainties, we sold our position in Axsome.

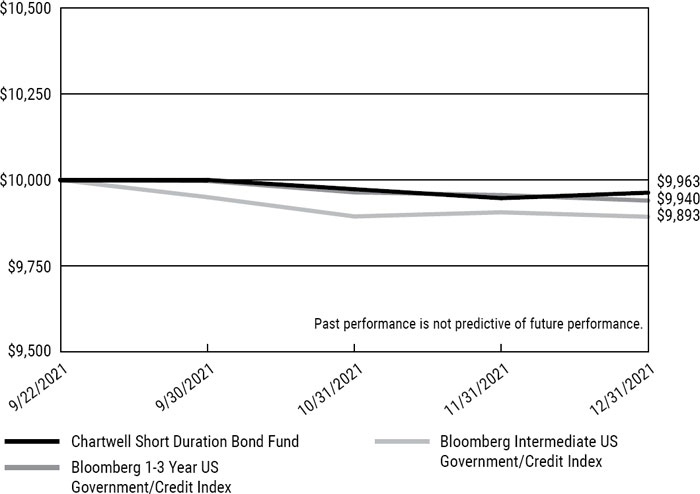

Chartwell Short Duration Bond Fund (CWSDX):

The fiscal year-to-date (YTD) 2021 total return to shareholders of the Chartwell Short Duration Bond Fund (CWSDX) for the period since inception through December 31, 2021, was -0.37%. This is our newest fund that incepted on September 22, 2021. Net asset value commenced at $10.00 and slightly decreased to $9.95 on December 31, 2021.

For the year ended December 31, 2021, CWSDX outperformed the Bloomberg Intermediate US Government/Credit Index at -1.07% and the Bloomberg 1-3 Year US Government /Credit Index at -0.60%. The performance data quoted represents past performance and is no guarantee of future results. Investment returns and principal value of an investment will fluctuate, so that

| THE CHARTWELL FUNDS |

| LETTER FROM THE PRESIDENT (Unaudited) (Continued) |

an investor’s shares, when redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance data cited. Current month end data is available at www.chartwellip.com. Returns for periods of less than a year are not annualized.

Closing out the fiscal year, the portfolio’s significant underweight to Treasuries (8%) and allocation to High Yield Securities (13%) were the biggest contributors to outperformance. The overweight in Financials (37.7%), particularly Banks (24.8%), was the biggest detractor to performance, although the selection benefit helped offset some of the total contribution to return. The current overweight in Banking is reflective of sound fundamentals within the sector and attractive relative value versus other corporate sectors given their ratings, likely due to banks being regular issuers in the front-end of the curve.

The Fund seeks to maximize current income by investing in high quality short maturity fixed income securities while also preserving capital. The portfolio’s short duration is more resistant to interest rate fluctuation than longer-term bonds. However, short-term bond funds do not seek to maintain stable values and offer no guarantees (i.e., not a money-market account). The portfolio’s total return approach means that it is designed to potentially avoid sacrificing principal by simply reaching for the highest yields available in the respective universe. In addition to employing sophisticated risk controls, the portfolio seeks to potentially benefit from the team’s efforts to identify major market risks early and position portfolios accordingly. The dollar-weighted average effective maturity5 will be more than one but less than three years during normal market conditions. The most distinct feature of the Fund is the ability to invest up to 25% in High Yield rated debt instruments. As of December 31, 2021, 13% of the portfolio is invested in below investment grade corporate securities and it is exclusively comprised of names that carry BB ratings. The enhanced income from this backet provides the potential cushion necessary to preserve capital, mitigating the underlying rate risk, and is the key differentiator towards generating alpha6.

Given the current backdrop, the Fund is primarily focused on income and capital preservation seeking to offer an attractive form of cash flow to navigate a potentially volatile year ahead. What was once viewed as a valuable alternative has become a necessary compliment to a broader fixed income allocation, particularly longer-duration strategies. As valuations have become rich on the front-end, we believe a pensive approach with a focus on being opportunistic and liquid, while potentially preserving optionality is a prudent balance. We also believe that maintaining the yield advantage in the form of high-quality income is paramount, so excess carry and active cash management has put us in a position not to make outsized duration bets. It could be expected for duration to approach a more neutral position as the curve prices in further terminal rate discovery. The digestion of the monetary and fiscal normalization process is not going to be smooth as defined by bouts of volatility and overshooting in rates. To help offset the rise in rates we have been buying investment grade corporate floating rate notes

| 5 | The average time it takes for securities in a portfolio to mature, weighted in proportion to the dollar amount that is invested in the portfolio. Weighted average maturity measures the sensitivity of fixed-income portfolios to interest rate changes. |

| 6 | A measure of performance on a risk-adjusted basis. Alpha takes the volatility (price risk) of a fund and compares its risk-adjusted performance to a benchmark index. The excess return of the fund relative to the return of the benchmark is a fund’s alpha. |

| THE CHARTWELL FUNDS |

| LETTER FROM THE PRESIDENT (Unaudited) (Continued) |

(5.3%) and selectively recycling capital from the high yield basket with the proceeds from calls, tenders and maturities. The guardrails in place have helped mitigate volatility and are aimed for the portfolio to potentially outperform the market on an absolute and risk-adjusted basis over a full-cycle.

Investing in mutual funds involves risk, including possible loss of principal.

| CHARTWELL INCOME FUND |

| PERFORMANCE INFORMATION |

| December 31, 2021 (Unaudited) |

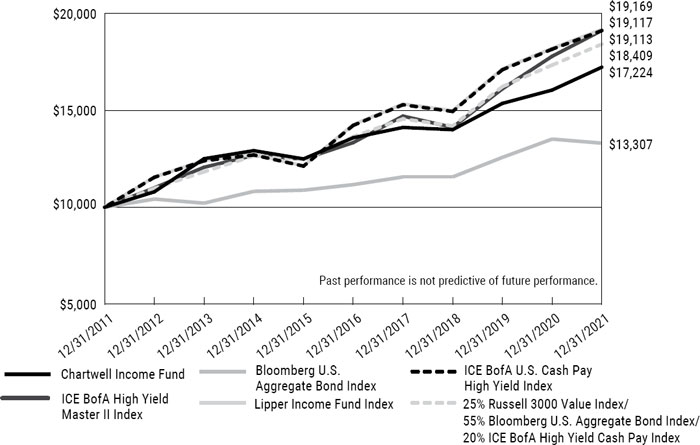

Comparison of the Change in Value of a $10,000 Investment

in Chartwell Income Fund versus the Bloomberg U.S. Aggregate Bond Index,

the ICE BofA U.S. Cash Pay High Yield Index*, the 25% Russell 3000 Value Index/55%

Bloomberg U.S. Aggregate Bond Index/20% ICE BofA High Yield Cash Pay Index**, the

ICE BofA High Yield Master II Index and the Lipper Income Fund Index.

This graph compares a hypothetical $10,000 investment in the Fund with a similar investment in the Bloomberg U.S. Aggregate Bond Index, the ICE BofA U.S. Cash Pay High Yield Index*, the 25% Russell 3000 Value Index/55% Bloomberg U.S. Aggregate Bond Index/20% ICE BofA High Yield Cash Pay Index**, the ICE BofA High Yield Master II Index, and the Lipper Income Fund Index for the periods shown.

The Bloomberg U.S. Aggregate Bond Index is an unmanaged index composed of the Bloomberg U.S. Government/Credit Index and the Bloomberg U.S. Mortgage-Backed Securities Index and includes Treasury issues, agency issues, corporate bond issues and mortgage-backed securities and is intended to be generally representative of the bond market as a whole. The ICE BofA U.S. Cash Pay High Yield Index is an index of all sectors of the non-investment grade bond market. The Russell 3000 Value Index measures the performance of the broad value segment of the U.S. equity value universe. The ICE BofA High Yield Master II Index is a broad-based index consisting of all US dollar denominated high-yield bonds with a minimum outstanding amount of $100 million and a maturity of over one year. The Lipper Income Fund Index consists of a small number of the largest mutual funds in a particular category as tracked by Lipper Inc. These indices do not reflect expenses, fees, or sales charge, which would lower performance. The indices are unmanaged, and they are not available for investment.

| * | The ICE BofA High Yield Master II Index is replaced with the ICE BofA U.S. Cash Pay High Yield Index which most closely reflects the allocation of the Fund’s portfolio investments. |

| ** | The Lipper Income Fund Index is replaced with the 25% Russell 3000 Value Index/55% Bloomberg U.S. Aggregate Bond Find/55% ICE BofA U.S. Cash Pay High Yield Index which most closely reflects the allocation of the Fund’s portfolio investments. |

| CHARTWELL INCOME FUND |

| PERFORMANCE INFORMATION (Continued) |

| December 31, 2021 (Unaudited) |

Average Annual Total Returns

(for periods ended December 31, 2021)

| | 1 Year | | 5 Years | | 10 Years |

| Chartwell Income Fund | 7.35% | | 4.86% | | 5.59% |

| Bloomberg U.S. Aggregate Bond Index | -1.54% | | 3.57% | | 2.90% |

| ICE BofA U.S. Cash Pay High Yield Index | 5.29% | | 6.09% | | 6.69% |

| 25% Russell 3000 Value Index/ | | | | | |

55% Bloomberg U.S. Aggregate Bond Index/

20% ICE BofA U.X. Cash Pay High Yield Index | 6.20% | | 6.18% | | 6.29% |

| ICE BofA HY Master II Index | 5.36% | | 6.10% | | 6.72% |

| Lipper Income Fund Index | 7.48% | | 7.47% | | 6.69% |

The Fund acquired the assets and liabilities of the Berwyn Income Fund (the “IMST Predecessor Fund”), a series of Investment Managers Series Trust, on July 17, 2017. The IMST Predecessor Fund acquired the assets and liabilities of the Berwyn Income Fund (the “Berwyn Funds Predecessor Fund,” and together with the IMST Predecessor Fund, the “Predecessor Funds”), a series of The Berwyn Funds, on April 29, 2016. As a result of the reorganizations, the Fund is the accounting successor of the Predecessor Funds. Performance results shown reflect the performance of the IMST Predecessor Fund for the period from April 29, 2016 through July 17, 2017, and the performance of the Berwyn Funds Predecessor Fund for the period prior to April 29, 2016.

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling (888) 995-5505.

Gross and net expense ratios for the Fund were 0.68% and 0.65%, respectively, as stated in the current prospectus dated May 1, 2021 and include Acquired Fund Fees and Expenses. For the Fund’s current expense ratios, please refer to the Financial Highlights section of this report. The Fund’s advisor has contractually agreed to reduce its fees and/or reimburse other operating expenses of the Fund to ensure that annual operating expenses do not exceed 0.64% of the Fund’s average daily net assets. This agreement is in effect until May 1, 2022, and it may be terminated prior to such date only by the Trust’s Board of Trustees. In the absence of such fee reductions and expense reimbursements, the Fund’s returns would have been lower.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| CHARTWELL MID CAP VALUE FUND |

| PERFORMANCE INFORMATION |

| December 31, 2021 (Unaudited) |

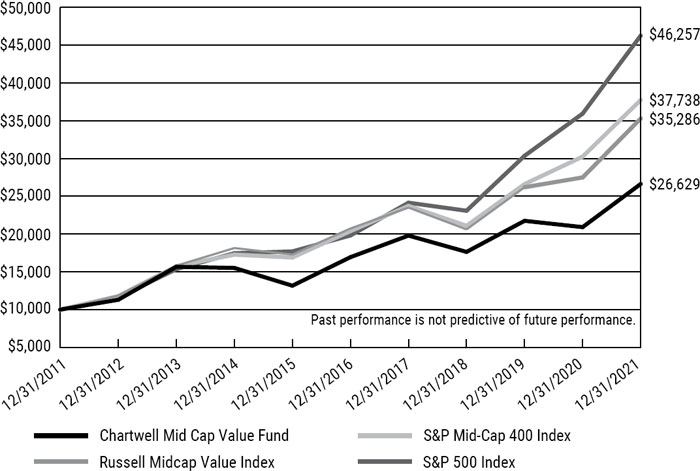

Comparison of the Change in Value of a $10,000 Investment

in Chartwell Mid Cap Value Fund versus the Russell Midcap Value Index,

the S&P Mid-Cap 400 Index and the S&P 500 Index.

This graph compares a hypothetical $10,000 investment in the Fund with a similar investment in the Russell Midcap Value Index, the S&P Mid-Cap 400 Index and the S&P 500 Index for the periods shown.

The Russell Midcap Value Index measures the performance of those Russell Midcap companies with lower price/book ratios and lower forecasted growth values. The S&P 500 Index tracks the stocks of 500 large US companies. The S&P Mid-Cap 400 Index measures the performance of 400 selected companies with a mid-sized market capitalization. These indices do not reflect expenses, fees, or sales charge, which would lower performance. The indices are unmanaged, and they are not available for investment.

| CHARTWELL MID CAP VALUE FUND |

| PERFORMANCE INFORMATION (Continued) |

| December 31, 2021 (Unaudited) |

Average Annual Total Returns

(for periods ended December 31, 2021)

| | 1 Year | | 5 Years | | 10 Years |

| Chartwell Mid Cap Value Fund | 27.30% | | 9.47% | | 10.29% |

| Russell Midcap Value Index | 28.34% | | 11.22% | | 13.44% |

| S&P Mid-Cap 400 Index | 24.76% | | 13.09% | | 14.20% |

| S&P 500 Index | 28.71% | | 18.47% | | 16.55% |

The Fund acquired the assets and liabilities of the Berwyn Cornerstone Fund (the “IMST Predecessor Fund”), a series of Investment Managers Series Trust, on July 17, 2017. The IMST Predecessor Fund acquired the assets and liabilities of the Berwyn Cornerstone Fund (the “Berwyn Funds Predecessor Fund,” and together with the IMST Predecessor Fund, the “Predecessor Funds”), a series of The Berwyn Funds, on April 29, 2016. As a result of the reorganizations, the Fund is the accounting successor of the Predecessor Funds. Performance results shown reflect the performance of the IMST Predecessor Fund for the period from April 29, 2016 through July 17, 2017, and the performance of the Berwyn Funds Predecessor Fund for the period prior to April 29, 2016. The Fund’s principal investment strategies differ from those of the Predecessor Funds; therefore, the performance and average annual total returns shown for periods prior to the reorganization may have differed had the Fund’s current investment strategy been in effect during those periods.

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling (888) 995-5505.

Gross and net expense ratios for the Fund were 1.47% and 0.90%, respectively, as stated in the current prospectus dated May 1, 2021. For the Fund’s current expense ratios, please refer to the Financial Highlights section of this report. The Fund’s advisor has contractually agreed to reduce its fees and/or reimburse other operating expenses of the Fund to ensure that annual operating expenses do not exceed 0.90% of the Fund’s average daily net assets. This agreement is in effect until May 1, 2022, and it may be terminated prior to such date only by the Trust’s Board of Trustees. In the absence of such fee reductions and expense reimbursements, the Fund’s returns would have been lower.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| CHARTWELL SMALL CAP VALUE FUND |

| PERFORMANCE INFORMATION |

| December 31, 2021 (Unaudited) |

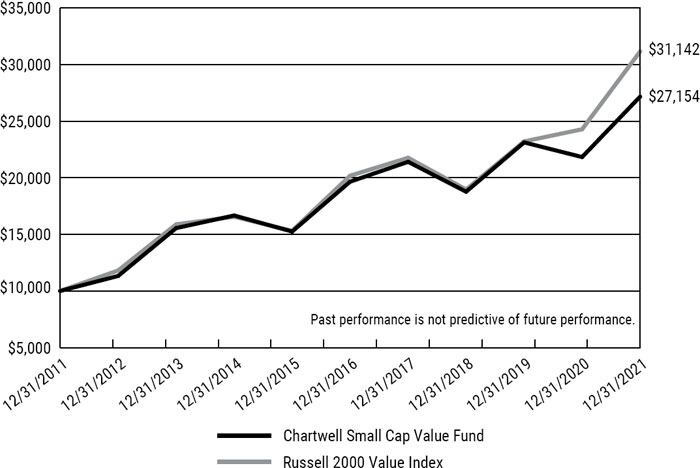

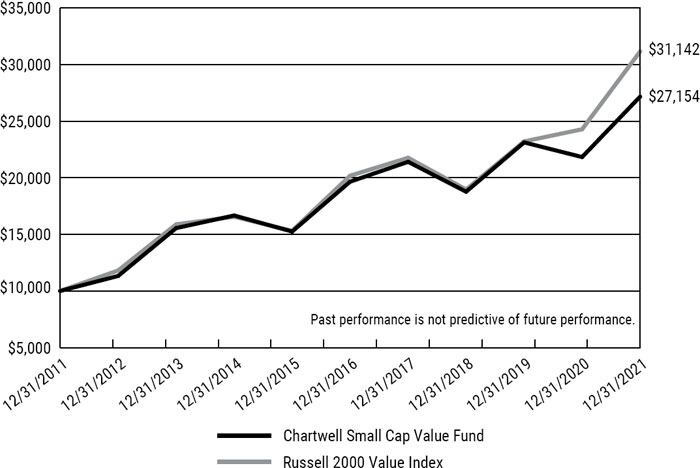

Comparison of the Change in Value of a $10,000 Investment

in Chartwell Small Cap Value Fund versus the Russell 2000 Value Index.

This graph compares a hypothetical $10,000 investment in the Fund’s shares, made at its inception, with a similar investment in the Russell 2000 Value Index. Results include the reinvestment of all dividends and capital gains. The performance figures include the performance for Class A shares for the periods prior to the start date of the current share class (March 16, 2012). Class A shares were liquidated on June 30, 2016.

The Russell 2000 Value Index measures the performance of the Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values. This index does not reflect expenses, fees or sales charges, which would lower performance. The index is unmanaged, and it is not available for investment.

| CHARTWELL SMALL CAP VALUE FUND |

| PERFORMANCE INFORMATION (Continued) |

| December 31, 2021 (Unaudited) |

Average Annual Total Returns

(for periods ended December 31, 2021)

| | 1 Year | | 5 Years | | 10 Years |

| Chartwell Small Cap Value Fund(a) | 24.42% | | 6.68% | | 10.51% |

| Russell 2000 Value Index | 28.27% | | 9.07% | | 12.03% |

| (a) | The performance figures include the performance for Class A for the periods prior to the start date of the current share class (March 16, 2012). Class A shares were liquidated on June 30, 2016. |

On July 17, 2017, the Chartwell Small Cap Value Fund acquired all the assets and liabilities of the Chartwell Small Cap Value Fund, a series of the Investment Managers Series Trust (the “Predecessor Fund”). As a result of the acquisition, the Fund is the accounting successor of the Predecessor Fund. Performance results shown in the graph and the performance table above for the periods prior to July 17, 2017 reflect the performance of the Predecessor Fund.

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling (888) 995-5505.

Gross and net expense ratios for the Fund were 1.18% and 1.05%, respectively, as stated in the current prospectus dated May 1, 2021. For the Fund’s current expense ratios, please refer to the Financial Highlights section of this report. The Fund’s advisor has contractually agreed to reduce its fees and/or reimburse other operating expenses of the Fund to ensure that annual operating expenses do not exceed 1.05% of the Fund’s average daily net assets. This agreement is in effect until May 1, 2022, and it may be terminated prior to such date only by the Trust’s Board of Trustees. In the absence of such fee reductions and expense reimbursements, the Fund’s returns would have been lower.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| CHARTWELL SHORT DURATION HIGH YIELD FUND |

| PERFORMANCE INFORMATION |

| December 31, 2021 (Unaudited) |

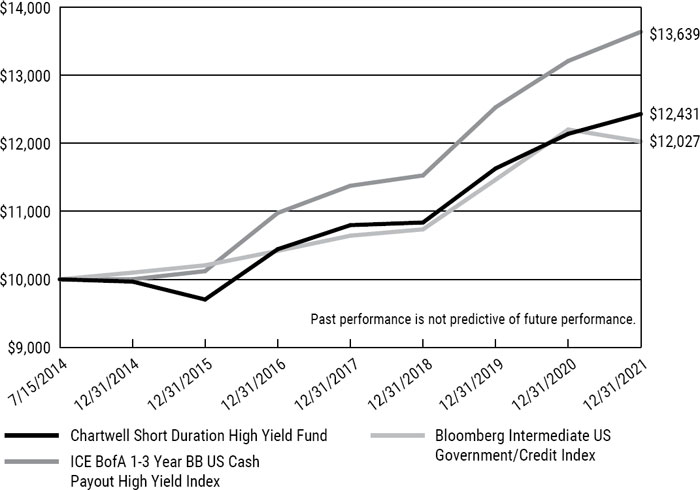

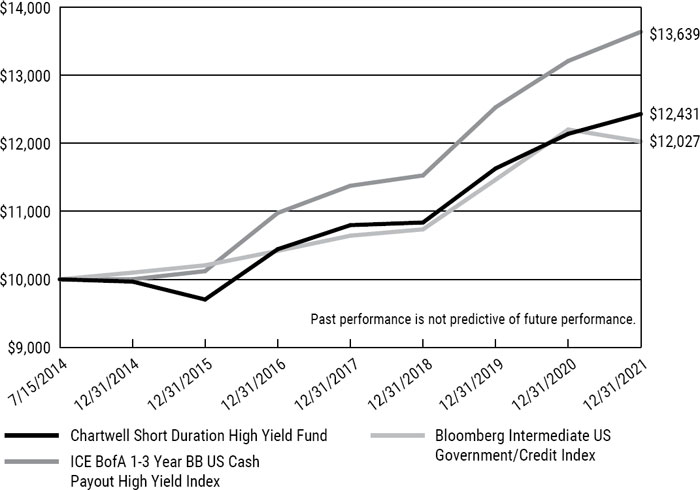

Comparison of the Change in Value of a $10,000 Investment

in Chartwell Short Duration High Yield Fund versus

the ICE BofA 1-3 Year BB US Cash Payout High Yield Index and

the Bloomberg Intermediate US Government/Credit Index.

This graph compares a hypothetical $10,000 investment in the Fund’s shares, made at its inception, with a similar investment in the ICE BofA 1-3 Year BB US Cash Payout High Yield Index and the Bloomberg Intermediate US Government/Credit Index. Results include the reinvestment of all dividends and capital gains.

The ICE BofA 1-3 Year BB US Cash Payout High Yield Index is a subset of the ICE BofA US Cash Payout High Yield Index including all securities with a remaining term to final maturity less than 3 years and rated BB1 through BB3, inclusive. The Bloomberg Intermediate US Government/ Credit Index is a broad-based flagship benchmark that measures the non-securitized component of the US Aggregate Index. It includes investment grade, US dollar-denominated, fixed-rate Treasuries, government-related and corporate securities. These indices do not reflect expenses, fees or sales charges, which would lower performance. These indices are unmanaged, and they are not available for investment.

| CHARTWELL SHORT DURATION HIGH YIELD FUND |

| PERFORMANCE INFORMATION (Continued) |

| December 31, 2021 (Unaudited) |

Average Annual Total Returns

(for periods ended December 31, 2021)

| | 1 Year | | 5 Years | | Since

Inception(a) |

| Chartwell Short Duration High Yield Fund | 2.40% | | 3.55% | | 2.96% |

| Bloomberg Intermediate US Government/Credit Index | -1.44% | | 2.91% | | 2.50% |

| ICE BofA 1-3 Year BB US Cash Payout High Yield Index | 3.24% | | 4.44% | | 4.25% |

| (a) | Commencement of operations was July 15, 2014. |

On July 17, 2017, the Chartwell Short Duration High Yield Fund acquired all the assets and liabilities of the Chartwell Short Duration High Yield Fund, a series of the Investment Managers Series Trust (the “Predecessor Fund”). As a result of the acquisition, the Fund is the accounting successor of the Predecessor Fund. Performance results shown in the graph and the performance table above for the periods prior to July 17, 2017 reflect the performance of the Predecessor Fund.

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling (888) 995-5505.

Gross and net expense ratios for the Fund were 0.61% and 0.49%, respectively, as stated in the current prospectus dated May 1, 2021. For the Fund’s current expense ratios, please refer to the Financial Highlights section of this report. The Fund’s advisor has contractually agreed to reduce its fees and/or reimburse other operating expenses of the Fund to ensure that annual operating expenses do not exceed 0.49% of the Fund’s average daily net assets. This agreement is in effect until May 1, 2022, and it may be terminated prior to such date only by the Trust’s Board of Trustees. In the absence of such fee reductions and expense reimbursements, the Fund’s returns would have been lower.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| CHARTWELL SMALL CAP GROWTH FUND |

| PERFORMANCE INFORMATION |

| December 31, 2021 (Unaudited) |

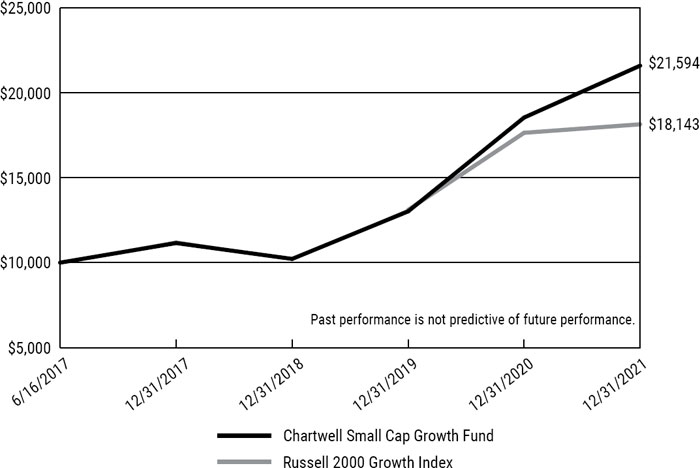

Comparison of the Change in Value of a $10,000 Investment

in Chartwell Small Cap Growth Fund versus the Russell 2000 Growth Index.

This graph compares a hypothetical $10,000 investment in the Fund, made at its inception, with a similar investment in the Russell 2000 Growth Index.

The Russell 2000 Growth Index measures the performance of the constituents that exhibit growth characteristics within the 2000 small-cap companies of the US stock market and is designed to represent the small-cap segment of the US equity universe. This index does not reflect expenses, fees or sales charge, which would lower performance. The index is unmanaged, and it is not available for investment.

| CHARTWELL SMALL CAP GROWTH FUND |

| PERFORMANCE INFORMATION (Continued |

| December 31, 2021 (Unaudited) |

Average Annual Total Returns

(for periods ended December 31, 2021)

| | 1 Year | | Since

Inception(a) |

| Chartwell Small Cap Growth Fund | 16.47% | | 18.47% |

| Russell 2000 Growth Index | 2.83% | | 14.01% |

| (a) | Commencement of operations was June 16, 2017. |

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling (888) 995-5505.

Gross and net expense ratios for the Fund were 1.73% and 1.05%, respectively, as stated in the current prospectus dated May 1, 2021. For the Fund’s current expense ratios, please refer to the Financial Highlights section of this report. The Fund’s advisor has contractually agreed to reduce its fees and/or reimburse other operating expenses of the Fund to ensure that annual operating expenses do not exceed 1.05% of the Fund’s average daily net assets. This agreement is in effect until May 1, 2022, and it may be terminated prior to such date only by the Trust’s Board of Trustees. In the absence of such fee reductions and expense reimbursements, the Fund’s returns would have been lower.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| CHARTWELL SHORT DURATION BOND FUND |

| PERFORMANCE INFORMATION |

| December 31, 2021 (Unaudited) |

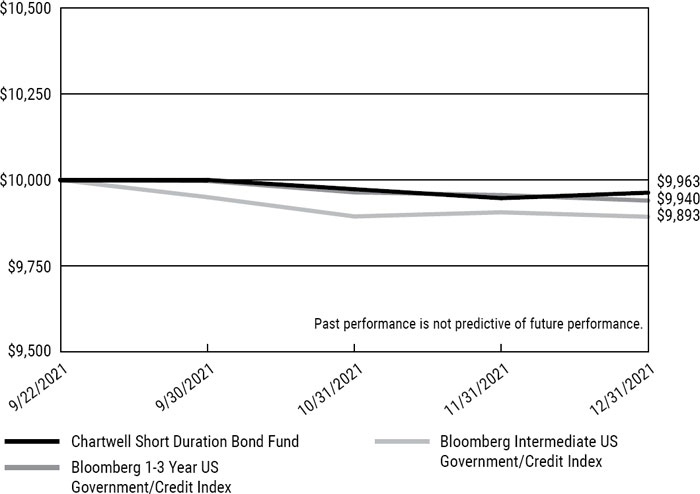

Comparison of the Change in Value of a $10,000 Investment

in Chartwell Short Duration Bond Fund versus

the Bloomberg 1-3 Year US Government/Credit Index and

the Bloomberg Intermediate US Government/Credit Index.

This graph compares a hypothetical $10,000 investment in the Fund’s shares, made at its inception, with a similar investment in the Bloomberg 1-3 Year US Government/Credit Index and the Bloomberg Intermediate US Government/Credit Index.

The Bloomberg 1-3 Year US Government/Credit Index is a broad-based flagship benchmark that measures the performance of US Treasury securities that have a maturity of 1-3 years. It includes investment grade, US dollar-denominated, fixed-rate Treasuries, government-related and corporate securities. The Bloomberg Intermediate US Government/Credit Index is a broad-based flagship benchmark that measures the non-securitized component of the US Aggregate Index. It includes investment grade, US dollar-denominated, fixed-rate Treasuries, government-related and corporate securities. These indices do not reflect expenses, fees or sales charges, which would lower performance. These indices are unmanaged, and they are not available for investment.

| CHARTWELL SHORT DURATION BOND FUND |

| PERFORMANCE INFORMATION (Continued) |

| December 31, 2021 (Unaudited) |

Total Returns

(for period ended December 31, 2021)

| | Since |

| | Inception(a) |

| Chartwell Short Duration Bond Fund | -0.37% |

| Bloomberg 1-3 Year US Government/Credit Index | -0.60% |

| Bloomberg Intermediate US Government/Credit Index | -1.07% |

| (a) | Commencement of operations was September 22, 2021. |

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling (888) 995-5505.

Gross and net expense ratios for the Fund were 2.31% and 0.39%, respectively, as stated in the current prospectus dated September 22, 2021. For the Fund’s current expense ratios, please refer to the Financial Highlights section of this report. The Fund’s advisor has contractually agreed to reduce its fees and/or reimburse other operating expenses of the Fund to ensure that annual operating expenses do not exceed 0.39% of the Fund’s average daily net assets. This agreement is in effect until at least September 22, 2022, and it may be terminated prior to such date only by the Trust’s Board of Trustees. In the absence of such fee reductions and expense reimbursements, the Fund’s returns would have been lower.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| CHARTWELL INCOME FUND |

| SCHEDULE OF INVESTMENTS |

| December 31, 2021 |

| COMMON STOCKS — 20.9% | | Shares | | | Value | |

| Communications — 1.8% | | | | | | | | |

| Advertising & Marketing — 0.1% | | | | | | | | |

| Omnicom Group, Inc. | | | 8,361 | | | $ | 612,610 | |

| | | | | | | | | |

| Entertainment Content — 0.2% | | | | | | | | |

| Activision Blizzard, Inc. | | | 10,409 | | | | 692,511 | |

| | | | | | | | | |

| Internet Media & Services — 0.2% | | | | | | | | |

| Expedia Group, Inc. (a) | | | 6,287 | | | | 1,136,187 | |

| | | | | | | | | |

| Telecommunications — 1.3% | | | | | | | | |

| AT&T, Inc. | | | 74,355 | | | | 1,829,133 | |

| Verizon Communications, Inc. | | | 95,527 | | | | 4,963,583 | |

| | | | | | | | 6,792,716 | |

| Consumer Discretionary — 1.8% | | | | | | | | |

| Apparel & Textile Products — 0.2% | | | | | | | | |

| Columbia Sportswear Company | | | 8,758 | | | | 853,379 | |

| | | | | | | | | |

| Automotive — 0.1% | | | | | | | | |

| General Motors Company (a) | | | 12,464 | | | | 730,764 | |

| | | | | | | | | |

| Consumer Services — 0.2% | | | | | | | | |

| Service Corporation International | | | 13,105 | | | | 930,324 | |

| | | | | | | | | |

| Leisure Facilities & Services — 0.1% | | | | | | | | |

| Las Vegas Sands Corporation (a) | | | 13,468 | | | | 506,936 | |

| | | | | | | | | |

| Retail - Discretionary — 1.2% | | | | | | | | |

| AutoZone, Inc. (a) | | | 689 | | | | 1,444,413 | |

| Foot Locker, Inc. | | | 73,731 | | | | 3,216,883 | |

| Genuine Parts Company | | | 5,796 | | | | 812,599 | |

| Home Depot, Inc. (The) | | | 1,874 | | | | 777,729 | |

| | | | | | | | 6,251,624 | |

| Consumer Staples — 1.3% | | | | | | | | |

| Beverages — 0.2% | | | | | | | | |

| Coca-Cola Company (The) | | | 16,744 | | | | 991,412 | |

| | | | | | | | | |

| Food — 0.3% | | | | | | | | |

| Conagra Brands, Inc. | | | 17,499 | | | | 597,591 | |

| Lamb Weston Holdings, Inc. | | | 10,690 | | | | 677,532 | |

| | | | | | | | 1,275,123 | |

See accompanying notes to financial statements.

| CHARTWELL INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| COMMON STOCKS — 20.9% (Continued) | | Shares | | | Value | |

| Consumer Staples — 1.3% (Continued) | | | | | | | | |

| Household Products — 0.2% | | | | | | | | |

| Procter & Gamble Company (The) | | | 7,604 | | | $ | 1,243,862 | |

| | | | | | | | | |

| Retail - Consumer Staples — 0.3% | | | | | | | | |

| Dollar Tree, Inc. (a) | | | 10,413 | | | | 1,463,235 | |

| | | | | | | | | |

| Tobacco & Cannabis — 0.3% | | | | | | | | |

| Philip Morris International, Inc. | | | 17,365 | | | | 1,649,675 | |

| | | | | | | | | |

| Energy — 1.1% | | | | | | | | |

| Oil & Gas Producers — 1.1% | | | | | | | | |

| Diamondback Energy, Inc. | | | 8,409 | | | | 906,911 | |

| Exxon Mobil Corporation | | | 26,001 | | | | 1,591,001 | |

| Hess Corporation | | | 8,404 | | | | 622,148 | |

| Pioneer Natural Resources Company | | | 11,437 | | | | 2,080,162 | |

| TotalEnergies SE - ADR | | | 13,727 | | | | 678,937 | |

| | | | | | | | 5,879,159 | |

| Financials — 3.2% | | | | | | | | |

| Asset Management — 0.2% | | | | | | | | |

| Ares Capital Corporation | | | 39,967 | | | | 846,901 | |

| | | | | | | | | |

| Banking — 1.5% | | | | | | | | |

| Citigroup, Inc. | | | 16,007 | | | | 966,663 | |

| JPMorgan Chase & Company | | | 13,691 | | | | 2,167,970 | |

| KeyCorp | | | 37,215 | | | | 860,783 | |

| M&T Bank Corporation | | | 2,772 | | | | 425,724 | |

| Pinnacle Financial Partners, Inc. | | | 13,857 | | | | 1,323,343 | |

| PNC Financial Services Group, Inc. (The) | | | 5,222 | | | | 1,047,115 | |

| Truist Financial Corporation | | | 18,929 | | | | 1,108,293 | |

| | | | | | | | 7,899,891 | |

| Institutional Financial Services — 0.5% | | | | | | | | |

| CME Group, Inc. | | | 2,999 | | | | 685,151 | |

| Morgan Stanley | | | 17,581 | | | | 1,725,751 | |

| | | | | | | | 2,410,902 | |

| Insurance — 0.8% | | | | | | | | |

| Allstate Corporation (The) | | | 11,284 | | | | 1,327,563 | |

| Arthur J. Gallagher & Company | | | 3,367 | | | | 571,279 | |

| Hanover Insurance Group, Inc. (The) | | | 6,731 | | | | 882,165 | |

| Lincoln National Corporation | | | 24,009 | | | | 1,638,854 | |

| | | | | | | | 4,419,861 | |

See accompanying notes to financial statements.

| CHARTWELL INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| COMMON STOCKS — 20.9% (Continued) | | Shares | | | Value | |

| Financials — 3.2% (Continued) | | | | | | | | |

| Specialty Finance — 0.2% | | | | | | | | |

| Blackstone Mortgage Trust, Inc. - Class A | | | 15,557 | | | $ | 476,355 | |

| Synchrony Financial | | | 15,441 | | | | 716,308 | |

| | | | | | | | 1,192,663 | |

| Health Care — 2.6% | | | | | | | | |

| Biotech & Pharma — 1.3% | | | | | | | | |

| AbbVie, Inc. | | | 4,090 | | | | 553,786 | |

| Bristol-Myers Squibb Company | | | 46,981 | | | | 2,929,265 | |

| Johnson & Johnson | | | 12,006 | | | | 2,053,867 | |

| Merck & Company, Inc. | | | 19,068 | | | | 1,461,372 | |

| | | | | | | | 6,998,290 | |

| Health Care Facilities & Services — 1.0% | | | | | | | | |

| CVS Health Corporation | | | 5,714 | | | | 589,456 | |

| Quest Diagnostics, Inc. | | | 10,223 | | | | 1,768,681 | |

| Syneos Health, Inc. (a) | | | 10,595 | | | | 1,087,895 | |

| UnitedHealth Group, Inc. | | | 1,229 | | | | 617,130 | |

| Universal Health Services, Inc. - Class B | | | 7,135 | | | | 925,124 | |

| | | | | | | | 4,988,286 | |

| Medical Equipment & Devices — 0.3% | | | | | | | | |

| Abbott Laboratories | | | 12,242 | | | | 1,722,939 | |

| | | | | | | | | |

| Industrials — 1.9% | | | | | | | | |

| Diversified Industrials — 0.3% | | | | | | | | |

| Emerson Electric Company | | | 15,058 | | | | 1,399,943 | |

| | | | | | | | | |

| Electrical Equipment — 0.2% | | | | | | | | |

| nVent Electric plc | | | 22,976 | | | | 873,088 | |

| | | | | | | | | |

| Machinery — 0.9% | | | | | | | | |

| Caterpillar, Inc. | | | 14,961 | | | | 3,093,037 | |

| Gates Industrial Corporation plc (a) | | | 56,123 | | | | 892,917 | |

| Snap-on, Inc. | | | 3,310 | | | | 712,908 | |

| | | | | | | | 4,698,862 | |

| Transportation & Logistics — 0.2% | | | | | | | | |

| United Parcel Service, Inc. - Class B | | | 4,924 | | | | 1,055,410 | |

| | | | | | | | | |

| Transportation Equipment — 0.3% | | | | | | | | |

| Allison Transmission Holdings, Inc. | | | 24,388 | | | | 886,504 | |

| PACCAR, Inc. | | | 8,794 | | | | 776,158 | |

| | | | | | | | 1,662,662 | |

See accompanying notes to financial statements.

| CHARTWELL INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| COMMON STOCKS — 20.9% (Continued) | | Shares | | | Value | |

| Materials — 2.3% | | | | | | | | |

| Chemicals — 0.7% | | | | | | | | |

| Air Products & Chemicals, Inc. | | | 2,750 | | | $ | 836,715 | |

| FMC Corporation | | | 13,113 | | | | 1,440,988 | |

| Univar Solutions, Inc. (a) | | | 44,064 | | | | 1,249,214 | |

| | | | | | | | 3,526,917 | |

| Construction Materials — 0.3% | | | | | | | | |

| Vulcan Materials Company | | | 8,116 | | | | 1,684,719 | |

| | | | | | | | | |

| Metals & Mining — 1.3% | | | | | | | | |

| Alamos Gold, Inc. - Class A | | | 310,000 | | | | 2,383,900 | |

| Southern Copper Corporation | | | 14,624 | | | | 902,447 | |

| SSR Mining, Inc. | | | 190,000 | | | | 3,363,000 | |

| | | | | | | | 6,649,347 | |

| Real Estate — 1.9% | | | | | | | | |

| REITs — 1.9% | | | | | | | | |

| Crown Castle International Corporation | | | 5,241 | | | | 1,094,006 | |

| Healthcare Trust of America, Inc. - Class A | | | 49,933 | | | | 1,667,263 | |

| Healthpeak Properties, Inc. | | | 83,200 | | | | 3,002,688 | |

| Life Storage, Inc. | | | 7,744 | | | | 1,186,226 | |

| Mid-America Apartment Communities, Inc. | | | 7,998 | | | | 1,835,061 | |

| Weyerhaeuser Company | | | 26,642 | | | | 1,097,118 | |

| | | | | | | | 9,882,362 | |

| Technology — 1.9% | | | | | | | | |

| Semiconductors — 0.5% | | | | | | | | |

| Intel Corporation | | | 26,493 | | | | 1,364,390 | |

| Lam Research Corporation | | | 928 | | | | 667,371 | |

| QUALCOMM, Inc. | | | 3,977 | | | | 727,274 | |

| | | | | | | | 2,759,035 | |

| Software — 0.2% | | | | | | | | |

| Microsoft Corporation | | | 3,131 | | | | 1,053,018 | |

| | | | | | | | | |

| Technology Hardware — 1.0% | | | | | | | | |

| Apple, Inc. | | | 3,733 | | | | 662,869 | |

| Ciena Corporation (a) | | | 22,654 | | | | 1,743,678 | |

| Dolby Laboratories, Inc. - Class A | | | 13,263 | | | | 1,262,903 | |

| Seagate Technology Holdings plc | | | 11,523 | | | | 1,301,868 | |

| | | | | | | | 4,971,318 | |

| Technology Services — 0.2% | | | | | | | | |

| DXC Technology Company (a) | | | 19,249 | | | | 619,625 | |

| International Business Machines Corporation | | | 4,163 | | | | 556,427 | |

| | | | | | | | 1,176,052 | |

See accompanying notes to financial statements.

| CHARTWELL INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| COMMON STOCKS — 20.9% (Continued) | | Shares | | | Value | |

| Utilities — 1.1% | | | | | | | | |

| Electric Utilities — 1.1% | | | | | | | | |

| Ameren Corporation | | | 12,155 | | | $ | 1,081,917 | |

| American Electric Power Company, Inc. | | | 16,196 | | | | 1,440,958 | |

| CMS Energy Corporation | | | 13,303 | | | | 865,360 | |

| Public Service Enterprise Group, Inc. | | | 21,339 | | | | 1,423,951 | |

| Southern Company (The) | | | 16,722 | | | | 1,146,795 | |

| | | | | | | | 5,958,981 | |

| Total Common Stocks (Cost $86,925,430) | | | | | | $ | 108,840,964 | |

| | | | | | | | | |

| EXCHANGE-TRADED FUNDS — 2.9% | | Shares | | | Value | |

| iShares Silver Trust (a) | | | 515,000 | | | $ | 11,077,650 | |

| VanEck Gold Miners ETF | | | 130,000 | | | | 4,163,900 | |

| Total Exchange-Traded Funds (Cost $16,600,702) | | | | | | $ | 15,241,550 | |

| | | | | | | | | |

| PREFERRED STOCKS — 3.3% | | Shares | | | Value | |

| Communications — 0.1% | | | | | | | | |

| Entertainment Content — 0.1% | | | | | | | | |

| ViacomCBS, Inc., Series A, 5.75% | | | 12,400 | | | $ | 622,728 | |

| | | | | | | | | |

| Financials — 1.1% | | | | | | | | |

| Specialty Finance — 1.1% | | | | | | | | |

| AGNC Investment Corporation, Series F, 6.12% | | | 29,603 | | | | 747,772 | |

| Annaly Capital Management, Inc., Series F, 6.95% | | | 201,929 | | | | 5,165,344 | |

| | | | | | | | 5,913,116 | |

| Real Estate — 2.1% | | | | | | | | |

| REITs — 2.1% | | | | | | | | |

| Chimera Investment Corporation, Series B, 8.00% | | | 181,980 | | | | 4,649,589 | |

| New Residential Investment Corporation, Series C, 6.375% | | | 260,000 | | | | 6,021,600 | |

| | | | | | | | 10,671,189 | |

| Total Preferred Stocks (Cost $14,253,202) | | | | | | $ | 17,207,033 | |

See accompanying notes to financial statements.

| CHARTWELL INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| CORPORATE BONDS — 26.8% | | Par Value | | | Value | |

| Communications — 0.8% | | | | | | | | |

| Consolidated Communications Holdings, Inc., 6.50%, due 10/1/2028 (c) | | $ | 975,000 | | | $ | 1,023,750 | |

| Gannett Holdings, LLC, 6.00%, due 11/1/2026 (c) | | | 1,745,000 | | | | 1,782,081 | |

| Liberty Interactive, LLC, 8.50%, due 7/15/2029 | | | 1,000,000 | | | | 1,090,000 | |

| | | | | | | | 3,895,831 | |

| Consumer Discretionary — 4.6% | | | | | | | | |

| AAG FH L.P./AAG FH Finco, Inc., 9.75%, due 7/15/2024 (c) | | | 2,523,000 | | | | 2,491,538 | |

| Affinity Gaming, 6.88%, due 12/15/2027 (c) | | | 1,200,000 | | | | 1,248,000 | |

| AutoNation, Inc., 3.80%, due 11/15/2027 | | | 3,532,000 | | | | 3,763,204 | |

| Bed Bath & Beyond, Inc., 3.75%, due 8/1/2024 | | | 1,820,000 | | | | 1,835,925 | |

| Ford Motor Credit Company, LLC, 4.54%, due 8/1/2026 | | | 1,375,000 | | | | 1,493,594 | |

| General Motors Financial Company, Inc., | | | | | | | | |

| 5.65%, due 1/17/2029 | | | 1,954,000 | | | | 2,319,023 | |

| Kohl’s Corporation, 5.55%, due 7/17/2045 | | | 2,969,000 | | | | 3,471,549 | |

| L Brands, Inc., 5.25%, due 2/1/2028 | | | 1,180,000 | | | | 1,303,900 | |

| QVC, Inc., 5.95%, due 3/15/2043 | | | 1,645,000 | | | | 1,638,831 | |

| StoneMor, Inc., 8.50%, due 5/15/2029 (c) | | | 1,520,000 | | | | 1,569,400 | |

| Tiffany & Company, 4.90%, due 10/1/2044 | | | 2,049,000 | | | | 2,760,309 | |

| | | | | | | | 23,895,273 | |

| Consumer Staples — 1.2% | | | | | | | | |

| Anheuser-Busch InBev Worldwide, Inc., 4.50%, due 6/1/2050 | | | 4,245,000 | | | | 5,251,720 | |

| KeHE Distributors, LLC, 8.63%, due 10/15/2026 (c) | | | 1,030,000 | | | | 1,102,100 | |

| | | | | | | | 6,353,820 | |

| Energy — 4.2% | | | | | | | | |

| Blue Racer Midstream, LLC/Blue Racer Finance Corporation, 6.63%, due 7/15/2026 (c) | | | 1,463,000 | | | | 1,506,890 | |

| Colgate Energy Partners III, LLC, 7.75%, due 2/15/2026 (c) | | | 2,465,000 | | | | 2,662,200 | |

| Energy Transfer Operating, L.P., 7.13%, (H15T5Y + 530.6) due 5/15/2030 (b) (d) | | | 5,653,000 | | | | 5,737,795 | |

| EnLink Midstream Partners, L.P., 4.85%, due 7/15/2026 | | | 1,475,000 | | | | 1,552,437 | |

| Genesis Energy, L.P./Genesis Energy Finance Corporation, 5.63%, due 6/15/2024 | | | 1,750,000 | | | | 1,732,500 | |

| Parkland Fuel Corporation, 5.88%, due 7/15/2027 (c) | | | 1,373,000 | | | | 1,448,515 | |

| Plains All American Pipeline, L.P., 3.80%, due 9/15/2030 | | | 3,365,000 | | | | 3,517,373 | |

| Summit Midstream Holdings, LLC/Summit Midstream Finance Corporation, 8.50%, due 10/15/2026 (c) | | | 1,870,000 | | | | 1,948,409 | |

| Teekay Corporation, 9.25%, due 11/15/2022 (c) | | | 1,075,000 | | | | 1,101,875 | |

| Western Midstream Operations, L.P., 4.35%, due 2/1/2025 | | | 845,000 | | | | 883,042 | |

| | | | | | | | 22,091,036 | |

See accompanying notes to financial statements.

| CHARTWELL INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| CORPORATE BONDS — 26.8% (Continued) | | Par Value | | | Value | |

| Financials — 7.0% | | | | | | | | |

| Ares Capital Corporation, 4.20%, due 6/10/2024 | | $ | 3,995,000 | | | $ | 4,216,304 | |

| Ares Capital Corporation, 3.25%, due 7/15/2025 | | | 4,240,000 | | | | 4,380,854 | |

| Bank of America Corporation, 0.88% (3MO LIBOR + 76), due 9/15/2026 (b) | | | 4,812,000 | | | | 4,791,471 | |

| Citizens Financial Group, Inc., Series B, 6.00% (3MO LIBOR + 300.3), due 12/31/2099 (b) (d) | | | 2,750,000 | | | | 2,815,312 | |

| Lincoln National Corporation, 3.05%, due 1/15/2030 | | | 2,845,000 | | | | 2,961,254 | |

| NMI Holdings, Inc., 7.38%, due 6/1/2025 (c) | | | 1,640,000 | | | | 1,862,220 | |

| Owl Rock Capital Corporation, 3.40%, due 7/15/2026 | | | 3,885,000 | | | | 3,949,546 | |

| PennyMac Corporation, 5.50%, due 3/15/2026 (c) | | | 7,000,000 | | | | 6,825,000 | |

| PRA Group, Inc., 5.00%, due 10/1/2029 (c) | | | 1,850,000 | | | | 1,854,625 | |

| Provident Funding Associates, L.P./PFG Finance Corporation, 6.38%, due 6/15/2025 (c) | | | 1,649,000 | | | | 1,677,858 | |

| StoneX Group, Inc., 8.63%, due 6/15/2025 (c) | | | 884,000 | | | | 937,040 | |

| | | | | | | | 36,271,484 | |

| Health Care — 0.5% | | | | | | | | |

| Horizon Pharma USA, Inc., 5.50%, due 8/1/2027 (c) | | | 1,275,000 | | | | 1,339,706 | |

| Prime Healthcare Services, Inc., 7.25%, due 11/1/2025 (c) | | | 1,065,000 | | | | 1,128,900 | |

| | | | | | | | 2,468,606 | |

| Industrials — 2.0% | | | | | | | | |

| American Airlines, Inc./AAdvantage Loyalty IP Ltd., 5.50%, due 4/20/2026 (c) | | | 1,680,000 | | | | 1,746,990 | |

| Boeing Company (The), 5.15%, due 5/1/2030 | | | 1,920,000 | | | | 2,239,069 | |

| Brundage-Bone Concrete Pumping Holdings, Inc., 6.00%, due 2/1/2026 (c) | | | 1,500,000 | | | | 1,560,000 | |

| Delta Air Lines, Inc., 7.38%, due 1/15/2026 | | | 533,000 | | | | 627,427 | |

| Harsco Corporation, 5.75%, due 7/31/2027 (c) | | | 980,000 | | | | 998,375 | |

| JPW Industries Holding Corporation, 9.00%, due 10/1/2024 (c) . | | | 1,195,000 | | | | 1,244,294 | |

| Railworks Holdings, L.P./Railworks Rally, Inc., 8.25%, due 11/15/2028 (c) | | | 2,000,000 | | | | 2,060,000 | |

| | | | | | | | 10,476,155 | |

| Materials — 2.0% | | | | | | | | |

| Compass Minerals International, Inc., 4.88%, due 7/15/2024 (c) | | | 1,410,000 | | | | 1,441,725 | |

| Fortress Transportation & Infrastructure Investors, LLC, | | | | | | | | |

| 9.75%, due 8/1/2027 (c) | | | 1,320,000 | | | | 1,478,400 | |

| IAMGOLD Corporation, 5.75%, due 10/15/2028 (c) | | | 2,400,000 | | | | 2,358,000 | |

| JW Aluminum Continuous Cast Company, 10.25%, due 6/1/2026 (c) | | | 1,365,000 | | | | 1,438,369 | |

| Neon Holdings, Inc., 10.13%, due 4/1/2026 (c) | | | 1,903,000 | | | | 2,027,285 | |

| Tacora Resources, Inc., 8.25%, due 5/15/2026 (c) | | | 1,870,000 | | | | 1,860,650 | |

| | | | | | | | 10,604,429 | |

See accompanying notes to financial statements.

| CHARTWELL INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| CORPORATE BONDS — 26.8% (Continued) | | Par Value | | | Value | |

| Real Estate — 1.0% | | | | | | | | |

| Greystar Real Estate Partners, LLC, 5.75%, due 12/1/2025 (c) | | $ | 1,500,000 | | | $ | 1,526,580 | |

| iStar, Inc., 5.50%, due 2/15/2026 | | | 1,160,000 | | | | 1,200,600 | |

| Safehold Operating Partnership, L.P., 2.85%, due 1/15/2032 | | | 2,490,000 | | | | 2,443,756 | |

| | | | | | | | 5,170,936 | |

| Technology — 3.0% | | | | | | | | |

| Apple, Inc., 3.85%, due 5/4/2043 | | | 1,990,000 | | | | 2,350,404 | |

| Brightstar Escrow Corporation, 9.75%, due 10/15/2025 (c) | | | 1,430,000 | | | | 1,533,675 | |

| CPI Card Group, Inc., 8.63%, due 3/15/2026 (c) | | | 495,000 | | | | 523,497 | |

| Dell International, LLC /EMC Corporation, 6.20%, due 7/15/2030 | | | 2,265,000 | | | | 2,860,782 | |

| Hewlett Packard Enterprise Company, 6.35%, due 10/15/2045 . | | | 3,209,000 | | | | 4,310,101 | |

| Oracle Corporation, 3.95%, due 3/25/2051 | | | 3,810,000 | | | | 3,969,878 | |

| | | | | | | | 15,548,337 | |

| Utilities — 0.5% | | | | | | | | |

| NSG Holdings, LLC, 7.75%, due 12/15/2025 (c) | | | 1,151,419 | | | | 1,230,579 | |

| Suburban Propane Partners, L.P., 5.88%, due 3/1/2027 | | | 1,100,000 | | | | 1,135,750 | |

| | | | | | | | 2,366,329 | |

| Total Corporate Bonds (Cost $129,205,021) | | | | | | $ | 139,142,236 | |

| | | | | | | |

| ASSET-BACKED SECURITIES — 2.6% | | Par Value | | | Value | |

| Colony American Finance Ltd., Series 2019-1, 3.32%, due 1/15/2029 (c) | | $ | 3,949,417 | | | $ | 4,135,294 | |

| Colony American Finance Ltd., Series 2019-3, 2.71%, due 10/15/2052 (c) | | | 1,999,078 | | | | 2,042,641 | |

| Latitude Management Real Estate Investors, Inc., Series 2019-CRE3, 1.486% (1MO LIBOR + 140), due 12/22/2035 (b) (c) | | | 3,615,000 | | | | 3,610,662 | |

| NRZ Excess Spread Collateralized Notes, Series 2021-FHT1, 3.10%, due 7/25/2026 (c) | | | 564,135 | | | | 562,282 | |

| NRZ Excess Spread Collateralized Notes, Series 2021-GNT1, 3.47%, due 11/25/2026 (c) | | | 2,982,125 | | | | 2,979,695 | |

| Total Asset-Backed Securities (Cost $13,109,501) | | | | | | $ | 13,330,574 | |

See accompanying notes to financial statements.

| CHARTWELL INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| MORTGAGE-BACKED SECURITIES — 25.0% | | Par Value | | | Value | |

| Agency Fixed Rate — 8.0% | | | | | | | | |

| Federal Home Loan Mortgage Corporation Pool #G6-1858, 3.50%, due 1/1/2048 | | $ | 2,949,051 | | | $ | 3,113,859 | |

| Federal Home Loan Mortgage Corporation Pool #ZA-5269, 3.00%, due 2/1/2048 | | | 1,060,692 | | | | 1,104,347 | |

| Federal Home Loan Mortgage Corporation Pool #ZN-6606, 3.00%, due 6/1/2049 | | | 1,339,321 | | | | 1,394,316 | |

| Federal Home Loan Mortgage Corporation Pool #SD-0144, 3.00%, due 11/1/2049 | | | 655,365 | | | | 680,153 | |

| Federal Home Loan Mortgage Corporation Pool #QA-7416, 3.00%, due 2/1/2050 | | | 3,781,482 | | | | 3,933,284 | |

| Federal National Mortgage Association Pool #BM6059, 3.00%, due 9/1/2029 | | | 966,566 | | | | 1,008,912 | |

| Federal National Mortgage Association Pool #BN0356, 3.00%, due 12/1/2033 | | | 1,487,376 | | | | 1,560,268 | |

| Federal National Mortgage Association Pool #BP6450, 2.50%, due 7/1/2040 | | | 3,116,210 | | | | 3,211,004 | |

| Federal National Mortgage Association Pool #BP6638, 2.50%, due 8/1/2040 | | | 2,403,383 | | | | 2,475,447 | |

| Federal National Mortgage Association Pool #BP6565, 2.50%, due 8/1/2040 | | | 2,428,931 | | | | 2,502,871 | |

| Federal National Mortgage Association Pool #FM1526, 3.00%, due 9/1/2049 | | | 2,350,037 | | | | 2,436,430 | |

| Federal National Mortgage Association Pool #CA4128, 3.00%, due 9/1/2049 | | | 1,647,502 | | | | 1,712,062 | |

| Federal National Mortgage Association Pool #B03192, 3.00%, due 10/1/2049 | | | 2,350,038 | | | | 2,442,401 | |

| Federal National Mortgage Association Pool #BO8653, 3.00%, due 2/1/2050 | | | 2,470,304 | | | | 2,573,600 | |

| Federal National Mortgage Association Pool #MA4392, 2.50%, due 7/1/2051 | | | 3,784,294 | | | | 3,843,664 | |

| Federal National Mortgage Association Pool #BT1862, 2.50%, due 7/1/2051 | | | 5,460,473 | | | | 5,583,598 | |

| Federal National Mortgage Association Pool #FM8793, 2.50%, due 10/1/2051 | | | 1,977,135 | | | | 2,022,105 | |

| | | | | | | | 41,598,321 | |

| Commercial — 17.0% | | | | | | | | |

| Agate Bay Mortgage Loan Trust, Series 2016-2 (c), 3.50%, due 3/25/2046 | | | 1,307,895 | | | | 1,315,780 | |

| BDS Ltd., Series 2019-FL4 (b) (c), 1.189% (1MO LIBOR + 110), due 8/15/2036 | | | 1,602,909 | | | | 1,600,985 | |

| Credit Suisse Mortgage Trust, Series 2018-J1 (c), 3.50%, due 2/25/2048 | | | 2,091,512 | | | | 2,123,666 | |

See accompanying notes to financial statements.

| CHARTWELL INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| MORTGAGE-BACKED SECURITIES — 25.0% (Continued) | | Par Value | | | Value | |

| Commercial — 17.0% (Continued) | | | | | | | | |

| Flagstar Mortgage Trust, Series 2020-2 (c), 3.00%, due 6/25/2048 | | $ | 1,125,359 | | | $ | 1,133,254 | |

| Flagstar Mortgage Trust, Series 2021-1 (c), 2.50%, due 2/1/2051 | | | 1,954,704 | | | | 1,956,891 | |

| Flagstar Mortgage Trust, Series 2021-1 (c), 2.50%, due 2/1/2051 | | | 2,693,687 | | | | 2,674,748 | |

| FMC GMSR Issuer Trust, Series 2020-GT1 (c), 4.45%, due 1/25/2026 | | | 2,265,000 | | | | 2,269,277 | |

| GS Mortgage Securities Trust, Series 2020-PJ5, 3.00%, due 3/27/2051 | | | 1,504,444 | | | | 1,530,558 | |

| GS Mortgage Securities Trust, Series 2021-PJ1 (c), 2.50%, due 6/25/2051 | | | 3,453,320 | | | | 3,424,723 | |

| GS Mortgage Securities Trust, Series 2021-PJ2 (c), 2.50%, due 7/25/2051 | | | 2,946,687 | | | | 2,914,919 | |

| GS Mortgage Securities Trust, Series 2021-PJ3 (c), 2.50%, due 8/25/2051 | | | 4,576,526 | | | | 4,538,628 | |

| GS Mortgage Securities Trust, Series 2021-PJ4 (c), 2.50%, due 9/25/2051 | | | 6,199,850 | | | | 6,148,509 | |

| GS Mortgage Securities Trust, Series 2021-P17 (c), 0.08%, due 1/25/2052 | | | 530,475,738 | | | | 1,450,108 | |

| GS Mortgage Securities Trust, Series 2021-PJ8 (c), 0.10%, due 1/25/2052 | | | 352,446,081 | | | | 1,259,431 | |

| GS Mortgage Securities Trust (c), 0.50%, due 2/26/2052 | | | 95,820,986 | | | | 1,858,927 | |

| HLSS Holdings, LLC, Series 2020-PLS1 (c), 3.84%, due 12/25/2025 | | | 1,173,723 | | | | 1,178,772 | |

| JPMorgan Mortgage Trust, Series 2020-LTV2 (c), 3.00%, due 11/25/2050 | | | 492,933 | | | | 494,890 | |

| JPMorgan Mortgage Trust, Series 2021-4 (c), 2.50%, due 8/25/2051 | | | 4,176,045 | | | | 4,138,853 | |

| JPMorgan Mortgage Trust, Series 2021-6 (c), 2.50%, due 10/25/2051 | | | 4,309,216 | | | | 4,273,531 | |

| JPMorgan Mortgage Trust, Series 2021-10 (c), 0.14%, due 12/25/2051 | | | 288,414,593 | | | | 1,515,388 | |

| JPMorgan Mortgage Trust, Series 2021-12 (c), 0.51%, due 2/25/2052 | | | 180,444,728 | | | | 3,025,409 | |

| JPMorgan Wealth Management Trust, Series 2020-ATR1 (c), 3.00%, due 2/25/2050 | | | 657,337 | | | | 667,054 | |

| Mello Mortgage Capital Acceptance Trust, Series 2021-MTG3 (c), 0.13%, due 7/1/2051 | | | 168,094,399 | | | | 524,001 | |

| Mello Mortgage Capital Acceptance Trust, Series 2021-MTG3 (c), 2.50%, due 7/1/2051 | | | 4,315,985 | | | | 4,305,277 | |

See accompanying notes to financial statements.

| CHARTWELL INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| MORTGAGE-BACKED SECURITIES — 25.0% (Continued) | | Par Value | | | Value | |

| Commercial — 17.0% (Continued) | | | | | | | | |

| Morgan Stanley Residential Mortgage Loan Trust, Series 2020-1 (c), 2.50%, due 12/25/2050 | | $ | 1,851,500 | | | $ | 1,853,571 | |

| Onslow Bay Financial, LLC, Series 2021-J1 (c), 2.50%, due 5/25/2051 | | | 4,581,687 | | | | 4,538,019 | |

| Onslow Bay Financial, LLC, Series 2019-EXP3 (c), 3.50%, due 10/25/2059 | | | 1,717,082 | | | | 1,747,593 | |

| Provident Funding Mortgage Trust, Series 2019-1 (c), 3.00%, due 12/25/2049 | | | 1,496,689 | | | | 1,496,169 | |

| Rate Mortgage Trust, Series 2021-J1 (c), 2.50%, due 7/1/2051 | | | 4,433,416 | | | | 4,396,703 | |

| RMF Buyout Issuance Trust, Series 2020-HB1 (c), 1.72%, due 10/25/2050 | | | 2,514,449 | | | | 2,520,472 | |

| Rocket Mortgage Trust, Series 2021-1 (c), 2.50%, due 3/25/2051 | | | 2,393,606 | | | | 2,367,801 | |

| Rocket Mortgage Trust, Series 2021-2 (c), 2.50%, due 6/25/2051 | | | 5,127,274 | | | | 5,094,428 | |

| Rocket Mortgage Trust, Series 2021-3 (c), 0.14%, due 7/25/2051 | | | 309,793,017 | | | | 1,517,986 | |

| Rocket Mortgage Trust, Series 2021-4 (c), 2.50%, due 9/25/2051 | | | 2,886,593 | | | | 2,851,720 | |

| Sequoia Mortgage Trust, Series 2019-5 (c), 3.50%, due 12/25/2049 | | | 1,088,634 | | | | 1,106,131 | |

| Sequoia Mortgage Trust, Series 2021-6 (c), 0.50%, due 10/25/2051 | | | 92,303,889 | | | | 1,772,235 | |

| United Wholesale Mortgage, LLC, Series 2021-1 (c), 0.14%, due 6/25/2051 | | | 194,574,410 | | | | 811,326 | |

| | | | | | | | 88,397,733 | |

| Total Mortgage-Backed Securities (Cost $130,394,798) | | | | | | $ | 129,996,054 | |

See accompanying notes to financial statements.

| CHARTWELL INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| U.S. GOVERNMENT & AGENCY OBLIGATIONS — 13.3% | | Par Value | | | Value | |

| Federal Home Loan Bank — 1.7% | | | | | | | | |

| Federal Home Loan Bank, 1.15%, due 2/26/2031 | | $ | 2,660,000 | | | $ | 2,603,290 | |

| Federal Home Loan Bank, 1.25%, due 7/7/2031 | | | 6,100,000 | | | | 6,018,979 | |

| | | | | | | | 8,622,269 | |

| Small Business Administration — 0.7% | | | | | | | | |

| Small Business Administration Participation Certificates, 3.20%, due 3/1/2039 | | | 3,648,462 | | | | 3,933,430 | |

| | | | | | | | | |

| U.S. Treasury Bonds — 1.5% | | | | | | | | |

| U.S. Treasury Bonds, 3.75%, due 8/15/2041 | | | 6,105,000 | | | | 7,996,835 | |

| | | | | | | | | |

| U.S. Treasury Inflation-Protected Notes — 1.1% | | | | | | | | |

| U.S. Treasury Inflation-Protected Notes, 0.63%, due 4/15/2023 | | | 5,566,100 | | | | 5,818,531 | |

| | | | | | | | | |

| U.S. Treasury Notes — 8.3% | | | | | | | | |

| U.S. Treasury Notes, 2.00%, due 2/15/2023 | | | 9,160,000 | | | | 9,318,153 | |

| U.S. Treasury Notes, 1.63%, due 9/30/2026 | | | 8,330,000 | | | | 8,476,751 | |

| U.S. Treasury Notes, 1.13%, due 2/15/2031 | | | 16,355,000 | | | | 15,890,544 | |