UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-23235

Morningstar Funds Trust

(Exact name of registrant as specified in charter)

Morningstar Funds Trust

22 W. Washington Street

Chicago, IL 60602

(Address of principal executive offices) (Zip code)

D. Scott Schilling

Morningstar Funds Trust

22 W. Washington Street

Chicago, IL 60602

With a copy to:

Eric S. Purple

Stradley Ronon Stevens & Young, LLP

1250 Connecticut Avenue, N.W., Suite 500

Washington, District of Columbia, 20036

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312)696-6000

Date of fiscal year end: April 30

Date of reporting period: April 30, 2019

Item 1. Reports to Stockholders.

2

April 30, 2019

A N N U A L R E P O R T

| | | | |

Morningstar Funds Trust | | Morningstar U.S. Equity Fund Morningstar International Equity Fund Morningstar Global Income Fund Morningstar Total Return Bond Fund Morningstar Municipal Bond Fund Morningstar Defensive Bond Fund Morningstar Multisector Bond Fund Morningstar Unconstrained Allocation Fund Morningstar Alternatives Fund | | |

| | |

| | Important Notice Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from your financial intermediary (e.g., custodian, financial adviser through which you invest or sponsor of the investment advisory program). Instead, the reports will be made available on a website (http://connect.rightprospectus.com/Morningstar), and you will be notified by mail or by such other manner as you have agreed upon with your financial intermediary each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund or your financial intermediary electronically by contacting your financial intermediary. You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary (including through an investment advisory program sponsored by Morningstar Investment Services LLC or another financial institution), you can contact your financial intermediary to inform it that you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Morningstar Funds held with your financial intermediary. | | |

| | | | |

Morningstar Funds Trust April 30, 2019

Introduction

Morningstar Investment Management, LLC launched anopen-end management investment company consisting of nine separate portfolios (each a fund) that span the investment opportunity set. Most of these Funds were designed to provide exposure to a broad asset class, such as U.S. equities, while our active management of each Fund’s asset allocation and active managers (known as “subadvisers”) will adjust exposures tosub-asset classes (such assmall-cap value) based on our valuation views and those of the subadvisers.

Concept and Structure

We created the Morningstar Funds Trust using an open architecture, multi-manager approach, hiring as active subadvisers both institutional managers and other managers whose mutual funds were previously used in Morningstar®Managed PortfoliosSM. Our analysts and portfolio managers continually use research, data, and analysis from Morningstar, Inc. and its affiliates to study the subadvisers and their investments closely and determine which fit best with our investment philosophy and the investment objectives of each Morningstar Fund1. We have selected managers we believed were independent, skilled investors in their respective asset classes.

Consistent with our investment approach, our asset allocation process for the Morningstar Funds is based on fundamentals and driven by valuations. We look for asset classes and sub-asset classes around the globe that, in our view, offer fundamental value relative to price. Allocations within each Fund are in line with what we believe to reflect the best risk-adjusted opportunities.

How to Read This Report

This report outlines the structure and performance of the assets comprised by the Morningstar Funds Trust from inception (November 2, 2018) through April 30, 2019 (our fiscal period end). Included are fund holdings, positioning, and performance summaries, including relevant commentary and examples that may aid understanding of returns for the period.

The commentary, views, and opinions in this report were current as of April 30, 2019. Our views reflect performance results net of fees and expenses as of the end of the reporting period.

Statements made within this report are not guarantees of future performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and we reserve the right to change views about individual holdings, sectors, and markets at any time. As a result, the views expressed should not be relied upon as a forecast of the Morningstar Funds’ future investment intent.

1Morningstar Funds Trust is an open-end management investment company registered under the Investment Company Act of 1940 (as amended). Use of the term “Morningstar Funds” hereafter refers to Morningstar Funds Trust, or its individual series, as applicable.

Morningstar Funds Trust April 30, 2019

Table of Contents

Morningstar Funds Trust April 30, 2019

Statement of Shareholder Rights

It is important to note that as a shareholder, you have certain rights and protections, chief among them an independent board of trustees, whose main role is to represent your interests.

The Trustees are responsible for the overall management of the Trust, including general supervision and review of the investment activities of each Fund. The Trustees, in turn, elect the officers of the Trust, who are responsible for administering theday-to-day operations of the Trust and its separate series, including the Funds.

The “Independent Trustees” are Trustees who are not “interested persons” of the Trust, as that term is defined in the Investment Company Act of 1940 (e.g. not a Morningstar employee).

More information about the Trustees is available athttps://www.morningstar.com/company/morningstar-funds-governance.

The Board of Trustees for the Morningstar Funds Trust is committed to representing your interests as well as implementing and maintaining sound fund governance principles. If you have comments or questions with respect to your investment in the Morningstar Funds, you may direct them to the Board of Trustees in the following ways:

By email:BoardofTrustees.MorningstarFundsTrust@morningstar.com

By mail: Chair of the Board of Trustees of Morningstar Funds Trust

c/o D. Scott Schilling, Chief Compliance Officer

22 West Washington Street

Chicago, IL 60602

1

Morningstar Funds Trust April 30, 2019

Letter to Shareholders

To Our Shareholders:

This won’t be your typical shareholder letter, with a standard operational overview, market synopsis, and performance highlights. When we launched the Morningstar Funds Trust, we set out to do things differently—the Morningstar way, which is independent, transparent, and long term. This letter continues that tradition, as we strive to raise transparency to a level that puts investors first.

Role of the Morningstar Funds

Morningstar®Managed PortfoliosSMprovides multi-asset portfolios to financial advisors in an effort to empower their clients and help achieve their financial goals. Our multi-asset mutual fund-based portfolios now use the Morningstar Funds in place of third-party funds. This has allowed us to simplify the product structure, improve our ability to implement the investment strategy, and, most importantly, to lower the aggregate fees and expenses for investors.

These funds serve two primary purposes: to achieve the investment objectives as outlined within the funds’ prospectus and to be the primary building blocks within some of our Managed Portfolios strategies. These are not funds that have been built with the sole focus of raising assets within a category or part of the market. They’ve been created to play a critical role in the portfolios of the clients of the numerous financial advisors that we serve across the United States.

That means we strive to manage these portfolios differently than your average mutual fund. For example, they won’t fit nicely into a Morningstar Category for at least two reasons. First, for the benefit of implementation efficiency and investment flexibility, we designed the funds to each be a large building block, like U.S. equity, rather than creating funds by style or market capitalization, as typically seen in the market. And second, we will also express investment views within the funds that deviate materially from indexes and categories, leading to wider short-term relative return variation—and this is an essential feature of our investment approach and our goal of long-term success. Again, these will differ from the characteristics of a typical mutual fund.

Through a detailed, comprehensive due diligence process, we selected what we believe werebest-in-class asset managers as subadvisers within the funds. Across the subadvisers, we’ve been able to select managers that we believe share many of the core investment principles that we adhere to when building and managing investment strategies. Our horizon is the long term, and our approach to selecting investment managers is to conduct significant amounts of work up front. Selecting subadvisers that we hope will outperform should be a very challenging, time-consuming, and expensive undertaking.

In our opinion, excessive subadviser turnover is one of the dangers and destroyers of value for investors. We are acutely aware of this risk, and to paraphrase legendary value investor Howard Marks,1well-researched is half-retained. If you don’t do the work up front, you can remove managers who appear to be underperforming and replace them with managers who appear to be outperforming. Unfortunately, the past isn’t predictive, and what matters to investors isn’t so much the performance of the past three years but that of the next 10—we always need to be looking forward. Finding long-term, well-resourced, like-minded fund managers and letting them manage assets for the long-term is critical to success.

1Howard Marks isco-chairman of Oaktree Capital Management.

2

Morningstar Funds Trust April 30, 2019

Letter to Shareholders(continued)

These funds are designed with a clear purpose in mind, and we expect them to form key parts of investors’ multi-asset strategies for decades to come. As long-term investors, we’ll continue to stay the course, take advantage of opportunities in markets, and share scale with investors as we grow, seeking to offer awin-win for end investors and their advisors.

Our Investment Views

The funds have existed for only a few months, so we will not devote any time discussing these short-term returns in this letter (although we discuss fund performance elsewhere in this report). We believe the long term is what matters for investment success, and we’ll avoid getting caught in a short-term relative performance derby in these annual letters. Instead, we’ll share some high-level views on the current conditions and how we’re responding.

To start, 2018 and 2019 are turning out to be much more volatile than the preceding few years. Despite the pickup in stock-market volatility in early 2018, markets reachedall-time highs in the third quarter in the U.S. before coming back to earth in the fourth quarter. Since then, we’ve seen a decent rally and then the resumption of volatility.

Stepping back from the short-term gyrations, asset prices are generally high relative to the underlying fundamentals they deliver, in our view. At the index level, price/earnings ratios are elevated, and bond yields and corporate spreads are low. While uncertainty remains high, markets appear to be reflecting lower levels of risk aversion from investors in what could be described as complacency. This is an environment where we believe more caution is warranted, balanced against generating long-term returns.

When looking below the surface, at the security and industry levels, the picture appears somewhat more encouraging. While credit markets are not appealing, thebottom-up picture for stocks is somewhat more appealing. Generally, high-growth, defensive, and “safe” stocks have been bid up to prices that limit the potential returns and add material downside risk. On the other hand, cyclicals, financials, and stocks facing disruption risks appear to be out of favor and discounted heavily, especially those businesses more exposed to a potential recession. The valuation spread betweenlow-returning and high-returning businesses is the widest since the early 2000s. We believe that this provides an interesting opportunity forbottom-up stock pickers and valuation-driven asset allocators.

Across our strategies, we seek to be positioned to take advantage of these opportunities at the industry and stock levels via our subadvisers and ETF allocations. At the same time, our risk levels are being managed at the multi-asset strategy level. This includes holding lower weightings in stocks than we would average over the cycle and owning less corporate debt in favor of U.S. government securities. Within each fund, positioning will vary based on its investment objectives, the relative valuations across asset classes, and the subadvisers’ positioning for the strategy-specific opportunity set.

As contrarian, valuation-driven investors, we see market volatility as an opportunity. Rather than focus on the noise in the market, we choose to tune into whether the current market behavior is creating opportunities that may pay off in the long term. After all, as Warren Buffett noted in his 2008 letter to shareholders, “price is what you pay, value is what you get,”2and we believe that a keen eye on the fundamentals will serve investors well.

2Chairman’s Letter—Berkshire-Hathaway 2008

3

Morningstar Funds Trust April 30, 2019

Letter to Shareholders(continued)

While market predictions aren’t worth the paper that they’re printed on, one thing we know for sure is that markets will fluctuate, and outcomes will differ from those priced into markets. Investing is as much a psychological endeavor as it is one of rational calculation. We believe our philosophy coupled with a studied understanding of behavioral finance helps keep us focused on what matters most—helping investors reach their financial goals.

Understanding Fees and Expenses in Morningstar Funds

To further help investors not only stay invested but also achieve better outcomes, we’re keenly focused on operational efficiency to create value by lowering investment costs. One of our seven investment principles is to Minimize Costs, and lower fees mean more money in investors’ pockets and less to the purveyors of investment services.

That’s one of the compelling reasons for creating the Morningstar Funds—lowering costs3on our mutual fund-based Managed Portfolios by using the multimanager Morningstar Funds to achieve fundamentally the same portfolio objectives, but at a savings.

Morningstar Investment ManagementInvestment Principles

Morningstar’s research has shown that fees have often been the best predictor of future relative performance, and lower-cost funds generally have greater odds of surviving and outperforming their more-expensive peers. We believe that we have set a competitive fee, based on our expectations that we will achieve scale and capitalize on efficiencies.

But mutual fund fees can be much more complex than a single figure. What investors really pay can be quite opaque. Regulators have required some transparency on fund costs, but we think fund managers can go further. And we are.

In fact, to aid understanding, we’re going to start by explaining the various fees that can be charged by mutual funds before answering the surprisingly complex question, “What is my mutual fund charging?”

It’s worth saying why we’re spending time on this explanation, which is simple: We’re keeping our word to investors in our funds. We aim to show that there’s a lot of complexity around how fees are charged in mutual funds and perhaps even more complexity in how they’re reported, but all in the effort to let our investors know that we’re honoring the level of fees we estimated in our original prospectuses for the funds. Our pledge came at a cost—we voluntarily waived about a third of the total fees incurred by the funds.

3For Morningstar®Managed PortfoliosSMthat contain Morningstar Funds, the total fee charged to investors does not include an investment management fee with respect to those Morningstar Funds where we act as a discretionary manager on our own platform. Where we act as a model provider on third-party platforms, we have eliminated the strategist fee for those Morningstar Managed Portfolios composed entirely of Morningstar Funds.

4

Morningstar Funds Trust April 30, 2019

Letter to Shareholders(continued)

Why did we have to waive the fees? That is, why were expenses higher than we expected? It was a matter of scale. When setting up the funds, we had a range of asset levels in mind and recognized there would be uncertainty around the assets under management (AUM) path. We set the pricing of the funds based on the levels that we reasonably expected to arrive at after completing the full transition of assets within our Managed Portfolios. Assets came in at the lower end of the range of our anticipated asset levels.

In our opinion, establishing the funds should not come at the expense of investors, nor should the impact of lower asset levels. On this front, we paid the startup costs outside of the funds and waived fees to stay in line with the estimated prospectus expenses, including expenses not required to be waived under the expense caps. More on this below.

One final note before we get into the details of these expenses and waivers: We want to be clear that this was part of the anticipated process of setting up the funds. At the time of writing, we had reached sufficient asset levels in the funds, such that the size of the waivers will likely be lower in future years.

How to Think About Fees

The Morningstar Funds, like any mutual fund family, incur expenses for a variety of reasons, including covering costs, like the custody of assets, and to pay investment managers—others and ourselves. Fees that are relevant are those that reduce net returns to deliver the outcomes for fund investors. Whether you’re paying fund managers via subadvisory services, mutual funds, or ETFs, we think it all counts. At the same time, things like dividends and interest rates on shorted securities are a part of the gross investment returns and are not the same as custody, management, or similar fund expenses, in our opinion. For most Morningstar Funds, the fees and expenses that represent our view come in four types as outlined by accounting rules:

1. Management fees (money paid to investment managers, including Morningstar Investment Management);

2.Sub-accounting fees (which covers shareholder recordkeeping services performed by brokerage platforms);

3. Other operating expenses like administration, legal, and audit costs; and

4. AFFE, or acquired fund fees and expenses, which are fees the Morningstar Funds pay indirectly to other fund providers by investing in mutual funds or ETFs they advise. These are effectively the management fees that every shareholder in those funds bear indirectly. They are embedded in the daily net asset value (NAV) of the underlying fund and are part of the returns of that particular holding.

We used more mutual funds than expected as we built scale to set up some of the subadviser mandates. Some Morningstar Funds needed to use mutual fund versions of the strategies for which we intended to hire subadvisers. Using other funds as investments incurs AFFE, which are separate from the other three fee types (that we refer to as gross fees) and are not direct expenses of the Morningstar Funds, although they do affect performance. Ultimately, when we use a fund, AFFE rises visibly in the Annual Fund Operating Expenses table within the fund’s prospectus, while the management fees, where subadvisory fees fall, stays constant.

Of course, we are able to bear AFFE through room made in the management fees area, as we don’t need to pay subadvisers on this portion of the funds’ assets. But we don’t treat this casually and intend to use third-party mutual funds sparingly in the future within the Morningstar Funds, primarily to take advantage of an investment opportunity or to build scale prior to establishing a subadviser. We do plan to regularly use ETFs in

5

Morningstar Funds Trust April 30, 2019

Letter to Shareholders(continued)

our funds to nimbly target exposure to certain country- or sector-specific equity investments. This use also incurs AFFE, but again, we plan to use ETFs only for targeted exposures.

AFFE falls outside of what’s known as the expense cap, or a fee level set in the prospectus of each fund as a cost ceiling for the investor. If a fund’s gross fees (management plussub-accounting plus other operating expenses) exceed the expense cap, we will waive all or a portion of our advisory fee and if necessary, assume certain other expenses (to the extent permitted by the Internal Revenue Code) such that the investor pays no more than the expense cap (plus any other fees outside the cap, like AFFE). Note that these rebates are, for fairness reasons, accrued on a daily basis and paid monthly.

AFFE is similar to “Dividend & Interest Expense on Shorts” in the prospectus in that if it is present, it needs to be presented as a separate line item in the Annual Fund Operating Expense table in the prospectus. While we’re required to report each type of cost for regulatory reasons, they are very different beasts. AFFE are the fees and expenses incurred indirectly by the Morningstar Fund as a result of investing in a mutual fund or ETF, and they can be avoided by engaging in direct investment in securities. Meanwhile, “Dividend & Interest Expense on Shorts” are normally part of one side of a short trade, and strategies that use this approach include equity long-short, merger arbitrage, and convertible arbitrage.

Without getting into the technical definitions of the strategies, shorting involves selling a stock that is borrowed, normally from a prime broker. As an example, a manager might like GM relative to Ford. They could buy some stock in GM, or “go long,” and then borrow an equivalent value of stocks in Ford. They take these borrowed stocks and sell them in the market, which is referred to as “selling short,” in the hope that the price will decline, providing them with a profit. For the Ford stock that they’ve sold, interest expense and any dividends that fall due on the borrowed stocks need to be paid to the stock lender. Given they’re also long GM, they will receive dividends on these stocks.

Ultimately the investment strategy will pay the difference between the returns of these two stocks (plus any other investments made in the period). And while the dividends on GM may be positive, offsetting some or all of the borrowing costs to be paid on Ford, the only part of the trade reported is the dividend and interest expense of the short side of the trade. This doesn’t seem right to us. Shorting costs are a critical part of the investment strategy and are not comparable to fund expenses. They should be excluded from the Total Annual Operating Expenses to make anapples-to-apples comparison between funds or within a fund across time.

Because we view these shorting costs as part of the investment strategy—which again is much different from AFFE—we exclude them from our estimates of the Total Annual Operating Expenses for a fund, such as the Morningstar Alternatives Fund, and do not plan to waive them when they are different than projected. Presumably a strategy that accrues considerable dividend & interest expense on shorts will aim to more than make up for these “costs” in its investment outcome.

Digging Into the Details

To help explain these various expenses, we’ve added a detailed table that illustrates their interplay in the context of one of the nine Morningstar Funds. Our goal is to use a concrete example to explain a frustratingly complicated attribute of mutual funds expenses.

6

Morningstar Funds Trust April 30, 2019

Letter to Shareholders(continued)

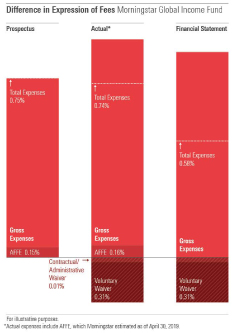

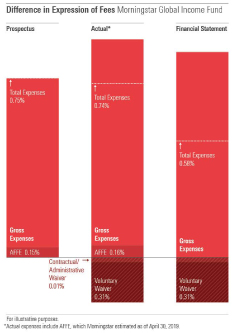

In order to better explain the fees, we discuss the expenses from three separate perspectives:

| ● | | The expenses disclosed in ourprospectus, which were forward looking and based on estimated expenses; |

| ● | | Theactual expensesand indirect costs to shareholders incurred during the period, which includes AFFE (which represent our estimate of the fees paid to third-party funds for the period); and |

| ● | | The expenses that we show in ourfinancial statements, and which do not include AFFE. (Because AFFE are not an actual expense of the Morningstar Funds, but are the indirect cost of investing in a third-party mutual fund or ETF, they are not reflected as an expense in the financial statements.) |

7

Morningstar Funds Trust April 30, 2019

Letter to Shareholders(continued)

The table below illustrates fees for one fund, the Morningstar Global Income Fund.

| | | | | | | | |

| | | |

Expense Detail | | Prospectus* | | Actual** | | Financial

Statements** |

| | |

| Fund Expenses Covered by the Expense Cap | | | | |

| | | | |

| 1 | | Management Fees | | 0.35 | | 0.35 | | 0.35 |

| | | | |

| 2 | | Sub-Accounting Fees | | 0.10 | | 0.10 | | 0.10 |

| | | | |

| 3 | | Other Operating Expenses | | 0.15 | | 0.45 | | 0.45 |

Gross Expense Ratio | | 0.60 | | 0.90 | | 0.90 |

| | |

Fund Expenses Not Covered by the Expense Cap | | | | |

| | | | |

| 4 | | AFFE (Estimated)*** | | 0.15 | | 0.16 | | 0 |

| | | |

Dividend & Interest Expense on Shorts | | 0 | | 0 | | 0 |

Total Expenses Not Subject to Cap | | 0.15 | | 0.16 | | 0 |

| | | |

Total Expenses Excluding the Voluntary Waiver | | 0.75 | | 1.06 | | 0.90 |

|

| | | |

| Total Fund Expenses Reported | | Prospectus | | Actual** | | Financial

Statements** |

| | | | |

| | Gross Expense Ratio | | 0.60 | | 0.90 | | 0.90 |

| | | | |

| 4 | | AFFE (Estimated)*** | | 0.15 | | 0.16 | | 0 |

| | | |

Contractual Waiver | | 0 | | 0 | | 0 |

| | | |

Voluntary Waiver | | 0 | | -0.31 | | -0.31 |

| | | |

Administrator Waiver**** | | 0 | | -0.01 | | -0.01 |

| Total Expenses | | 0.75 | | 0.74 | | 0.58 |

|

| ** | Actual expenses include AFFE, which Morningstar estimated as of the fiscal period ended April 30, 2019. |

| *** | AFFE is an estimate based on information from our custodian. |

| **** | The expense cap for the fund was 0.89, and the gross expense ratio was 0.90. This represents aone-time waiver from our administrator and accounting agent that is set to expire October 31, 2019. |

8

Morningstar Funds Trust April 30, 2019

Letter to Shareholders(continued)

In the first column, we show figures from the initialProspectusprior to the launch of the funds (which was based on reasonable estimates), and the second column (Actual) is what we estimate shareholders actually experienced in the first period of operation. The third column shows the figures presented in theFinancial Statementsaccompanying this letter, which differ from the second column in large part because AFFE are not direct expenses of the fund and are not included in the financial statements.

To navigate this section, we’ll use the numbers of the fee components from the previous section:

1. Management fees

2.Sub-accounting fees

3. Other operating expenses

4. AFFE (acquired fund fees and expenses)

Looking at items 1 through 3, our estimated expenses in theProspectusmatched the fund’s experience in most areas except for operating expenses, item 3. In that area, this fund experienced 30 basis points of additional expenses—these expenses weren’t higher per se, but thisper-shareholder figure was higher due to the fact that we were operating at lower asset levels than projected. Altogether, that meant the fund exceeded its expense cap by 0.01%. Waiving that overage is standard mutual fund practice when an expense limitation is in place. In the case of this fund, our shareholders benefited from aone-time fee waiver from our administrator/accounting agent. Therefore, we did not need to contractually waive the amount over the expense cap.

The number that matters for us is the totalActualexpenses, including AFFE. If you look at the table, in the last row of the first column (Prospectus), we estimated 0.75% for the fund. When we add the expenses up to the fee cap of 0.89%, in column 2, with the AFFE at 0.16%, we end up with 1.06% ofActualexpenses, including AFFE.

In considering the estimated expenses (Prospectus) versus theActualexpenses, we thought it appropriate to match the projected expenses of 0.75%. To do so, we needed to voluntarily waive a minimum of 0.31% of additional fees. Voluntary waivers at that level are not expected or required, but we felt it was the right thing to do.

Note that this is one example of the nine Morningstar Funds, each of which is different and, at times, more complex, especially when it comes to the Morningstar Alternatives Fund. The basics, however, remain the same: We made the principled, investors-first decision to waive fees back to our original estimates, above and beyond the expense cap and costs falling outside of the normal fee waiver process.

We would like to provide additional clarity to another confusing fact: If we waived fees back to our original estimates, why are the expense ratios for some of our funds in ourFinancial Statementslower than those estimates? Let’s continue to use the Morningstar Global Income Fund as an example. The total expenses reported in theFinancial Statementsis well below that in theProspectusand what we’ve outlined as our estimated costs experienced as of April 30, 2019—0.58% in theFinancial Statementsversus 0.74% for theActualexpenses. That difference, caused by AFFE not being reported in the financial statement, is 0.16%—the same size as our estimate of AFFE for the period.

Because there are different requirements and expectations for what’s reported in each document, it can be difficult to decipher the bottom line when it comes to fees. In our case, with these being new funds, the

9

Morningstar Funds Trust April 30, 2019

Letter to Shareholders(continued)

expenses noted in theProspectuswere based on projections whereas in ourFinancial Statementsappearing in this annual report, they reflect expenses actually incurred during the reporting period which in our case is the period ending April 30, 2019.

The apparent differences in these fees is also illustrated in the graph below, but one key element should emerge: TheActualtotal expenses are slightly below what we estimated it to be in theProspectus(however, technically there it is referred to as the Total Annual Operating Expense).

So, depending where you look, in either the prospectus or this report, you could have seen our fees as either over or under our estimates. The truth is, because of how we’ve chosen to implement the voluntary waiver, investors will realize fees that are consistent with what we intended from the start, but you won’t find that reported clearly in the financial statement or the prospectus because of different reporting conventions required by regulatory or accounting rules related to each document.

| | |

| | Most importantly, our decision to reimburse fees in this way is completely aligned with our principles. We have a fiduciary responsibility to our Managed Portfolios clients; this move primarily benefits the funds, which in turn helps us achieve the investment objectives of the strategies for shareholders. What to Expect Moving Forward Expense caps aren’t permanent—it’s up to our board to regularly reevaluate and approve them based on whether they benefit shareholders. We’re using voluntary waivers to ensure that expenses experienced are in line with the estimated expenses originally announced. Unfortunately, not every fund company follows this practice. Some use contractual waivers to entice investors with lower fees, only to raise them once they’ve reached scale. But for Morningstar Funds, when the Total Annual Operating Expenses, including AFFE but disregarding dividend & interest expense on shorts, are above the initial prospectus levels, we will waive the fees. |

It’s our commitment that over time we’ll work to share the operating efficiencies and benefits of scale with shareholders. In the meantime, we remain committed to waiving fees to the equivalent of Total Annual Operating Expenses listed in the initial prospectuses—but again, we don’t expect to include dividend & interest expense on shorts in the voluntary waiver.

10

Morningstar Funds Trust April 30, 2019

Letter to Shareholders(continued)

Summary

We’ve spent more time on the discussion of fees than we will devote in future annual letters. The goal was for this to be an owner’s manual, to help you navigate the complicated fee disclosures for mutual funds. Fees are very important, and we want to be transparentup-front. Rest assured, the investment and operational elements of the funds are also very important.

The nine funds are now the core of many of the multi-asset strategies that we manage on behalf of financial advisors. We have assembled what we believe to be some of the most talented investment firms to subadvise across the funds, and we will be managing the allocations within the funds to work toward achieving the Morningstar Funds’ investment objectives.

Our seven investment principles will guide us as we navigate the markets ahead. And we look forward to managing these funds for decades to come, empowering investors to help them reach their financial goals.

Best Regards,

Daniel Needham

President and CIO

Morningstar Investment Management

11

Morningstar Funds Trust April 30, 2019

Fund Information(unaudited)

|

|

Morningstar U.S. Equity Fund |

| | | | |

General Information | | | | |

Net Asset Value Per Share | | | $10.68 | |

Total Net Assets (millions) | | | $678 | |

Net Expense Ratio(a) | | | 0.82% | |

Gross Expense Ratio(a) | | | 1.08% | |

Portfolio Turnover Rate | | | 20% | |

Number of Issuers | | | 320 | |

Fund Inception | | | November 02, 2018 | |

No sales charges or distribution fees | |

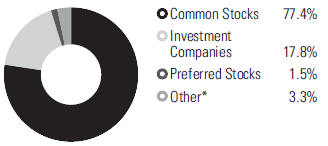

Asset Allocation

| | | | |

Portfolio Characteristics | | | | |

Weighted Average Market Capitalization (billions) | | $ | 33,055.65 | |

Price-to-Earnings Ratio(b) | | | 19.72x | |

| | | | |

Ten Largest Equities (%)(c) | | | | |

JPMorgan Chase & Co. | | | 1.8 | |

Pfizer, Inc. | | | 1.8 | |

Amazon.com, Inc. | | | 1.4 | |

Comcast Corp., Class A | | | 1.2 | |

Johnson & Johnson | | | 1.1 | |

Facebook, Inc., Class A | | | 1.1 | |

Apple, Inc. | | | 1.1 | |

Honeywell International, Inc. | | | 1.0 | |

Citigroup, Inc. | | | 1.0 | |

Microsoft Corp. | | | 1.0 | |

| | | | |

Sector Diversification (%) | | | | |

Consumer,Non-cyclical | | | 20.9 | |

Financial | | | 19.8 | |

Technology | | | 10.6 | |

Industrial | | | 10.5 | |

Communications | | | 9.9 | |

Consumer, Cyclical | | | 9.1 | |

Energy | | | 3.9 | |

Basic Materials | | | 3.5 | |

Utilities | | | 2.1 | |

*Includes cash, short-term investments, receivables and payables.

(a)Net expense ratios reflects fee waivers and/or expense reimbursements, if any, pursuant to an agreement that is in effect to cap the expenses whereas the gross expense ratio does not. On September 26, 2018, the Fund and Morningstar Investment Management, LLC (“MIM”) entered into an amended, written fee waiver/expense reimbursement agreement pursuant to which (“MIM”) is contractually obligated to waive its advisory fees and/or reimburse expenses so that the Fund’s ordinary total operating expenses through August 31, 2020 (excluding taxes, interest, brokerage commissions, trading costs, acquired fund fees and expenses, short sale dividend and interest expenses, litigation expenses, and extraordinary expenses) would not exceed 0.85%. The fee waiver/expense reimbursement agreement may be terminated by the Fund’s board at any time and also will terminate automatically upon the expiration or termination of the Fund’s advisory contract with MIM.

(b)Price-to-earnings (P/E) ratio is calculated using12-month forward earnings estimates from third-party sources deemed reliable.

(c) The Fund’s portfolio holdings are subject to change without notice. The mention of specific securities is not a recommendation to buy, sell, or hold any particular security and is not indicative of current or future trading activity.

12

Morningstar Funds Trust April 30, 2019

Performance Summary (unaudited)

|

|

Morningstar U.S. Equity Fund |

Investment Objective

Morningstar U.S. Equity Fund seeks long-term capital appreciation.

Investment Strategies

In seeking long-term capital appreciation, the Fund will normally invest at least 80% of its assets in equity securities of U.S.-based companies, and may invest up to 100% of its assets in such securities. The Fund seeks to provide broad U.S. equity exposure across market capitalizations and investment styles and has the flexibility to invest inlarge-cap,mid-cap, andsmall-cap common stocks across the growth and value style spectrum. The Fund may also invest in real estate investment trusts (REITs) andnon-U.S. companies. The Fund may invest in derivatives, including futures and forward foreign currency contracts, for risk management purposes or as part of its investment strategies. The Fund employs a multi-manager, subadvised structure. The Fund may also invest a portion of the Fund’s assets in shares of exchange-traded funds (ETFs), which use a passive management strategy.

Investment Commentary

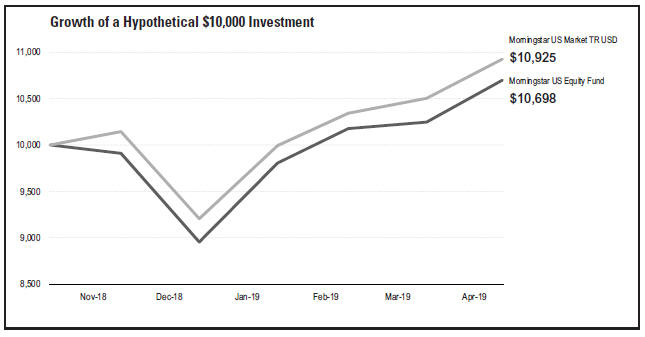

The Morningstar U.S. Equity Fund returned 6.98% from inception (November 2, 2018) through the Fund’s fiscal period end on April 30, 2019, trailing the Fund’s benchmark (the Morningstar U.S. Market Index), which returned 9.25% for the same period. All of the underperformance came during the first two weeks when the Fund held only seed capital and no public money, and was not yet fully allocated across the Fund’s six subadvisers. Subsequent to the seed period, the Fund modestly outpaced the benchmark gaining 9.50% from November 16, 2018 through April 30, 2019, compared to its benchmark return of 9.03%.

The U.S. equity market sold off sharply in December 2018 as investors fretted about the U.S./China tariff war, economic weakness abroad, and a ninth consecutive Federal Reserve rate hike. The Morningstar U.S. Market Index fell 9.24% in December 2018. The Fund recorded a slightly larger 9.64% decline, during the same period due in part to its diversification into smaller-cap stocks, which performed worse than large-cap stocks. The U.S. equity market rebounded strongly in January 2019, and continued to post gains through April 2019. The Fund moderately outperformed in that environment, returning 19.46% from January 1, 2019 through April 30, 2019, compared with the Index’s 18.67% return.

One positive return driver in early 2019 was the Fund’s position in energy infrastructure via the Global X MLP & Energy Infrastructure ETF, the only ETF position held in the Fund. The stocks of energy infrastructure assets (primarily comprising oil and gas pipelines and storage facilities) appeared unfairly depressed to us around the time of the Fund’s launch, so we included this position within the Fund’s ETF sleeve. After falling about as much as the overall market in December 2018, the ETF almost doubled the market’s returns in January’s 2019 rebound. The portfolio’s exposure tosmall-cap stocks also boosted returns from January 2019 through April 2019 as the market rose.

Our decision to weight the Fund more toward the value-style subadvisers (MFS Investment Management, Diamond Hill Capital Management, Inc. and Westwood Management Corp.) in late January 2019—owing to what we considered an overheated equity market—may have diluted the Fund’s participation in subsequent market gains as growth stocks continued to surge. It helped, however, that most of the six subadvisers

13

Morningstar Funds Trust April 30, 2019

Performance Summary (unaudited)(continued)

Morningstar U.S. Equity Fund

performed well relative to their style benchmarks. Although several beat their benchmarks meaningfully as the market climbed, ClearBridge deserves special mention, with its investment mandate having lost less than the market in December 2018 and then subsequently outperforming at the beginning of 2019.

Investment Subadvisers:

ClearBridge Investments, LLC

Diversifiedlarge-cap growth equity across stable, cyclical and select growth companies.

Diamond Hill Capital Management, Inc.

Targeted exposure to U.S.mid-cap value companies.

Levin Easterly Partners LLC

Provideslarge-cap blend U.S. equity exposure.

Massachusetts Financial Services Company, d/b/a MFS Investment Management

Provideslarge-cap value exposure, favoring higher-quality, value companies with stronger balance sheets and more consistent profitability.

Wasatch Advisors, Inc.

Small-/mid-cap growth companies with the potential to deliver more stable profits while avoiding earlier-stage companies that may lack a proven track record of revenues and earnings.

Westwood Management Corp.

Providessmall-cap equity with an emphasis on value.

14

Morningstar Funds Trust April 30, 2019

Performance Summary (unaudited)(continued)

Morningstar U.S. Equity Fund

Performance at a glance

| | | | | | | | |

| Average Total Returns as of 04/30/19 | | YTD2 | | | Since Inception3 | |

Morningstar U.S. Equity Fund | | | 19.46 | % | | | 6.98 | % |

Morningstar U.S. Market Index1 | | | 18.67 | % | | | 9.25 | % |

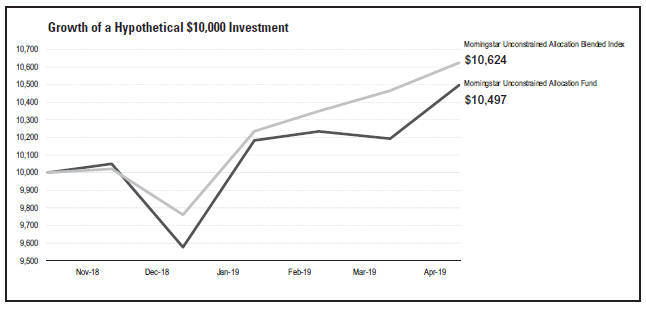

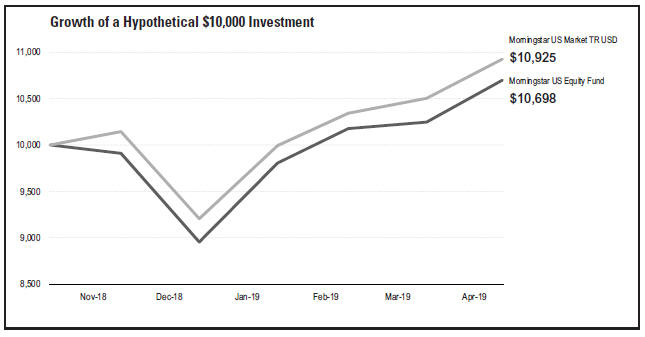

Illustration of an assumed investment of $10,000

The following graph depicts the performance of Morningstar U.S. Equity Fund shares versus the Morningstar U.S. Market Index from its inception (November 2, 2018) to April 30, 2019 (the Fund’s fiscal period end). Shares held through advisory programs may be subject to a program fee, which, if included, would have reduced performance. The performance provided does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results. Share price and returns will vary with market conditions; investors may realize a gain or loss upon redemption. It is important to note that Morningstar U.S. Equity Fund is a professionally managed portfolio while the Index is not available for direct investment, is unmanaged and does not include fees, expenses or taxes. The comparison is shown for illustration purposes only.

Morningstar U.S. Equity Fund

This chart does not imply future performance.

1The Morningstar U.S. Market Index is a diversified, broad-market index that targets 97% market capitalization coverage of the U.S. stock market. Investors should note that indices do not reflect the deduction of fees, expenses or taxes.

2Represents performance from January 1, 2019 to April 30, 2019.

3Inception Date is November 2, 2018.

Past performance does not predict future performance, and the performance information provided, does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Shares held through advisory programs are subject to a program fee, which, if included, would have reduced performance. The return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance results assume reinvestment of all dividends and capital gain distributions at net asset value on theex-dividend dates. Current performance may be higher or lower than the performance data quoted.

15

Morningstar Funds Trust April 30, 2019

Fund Information(unaudited)

|

|

Morningstar International Equity Fund |

| | | | |

General Information | | | | |

Net Asset Value Per Share | | | $10.79 | |

Total Net Assets (millions) | | | $469 | |

Net Expense Ratio(a) | | | 0.94% | |

Gross Expense Ratio(a) | | | 1.29% | |

Portfolio Turnover Rate | | | 19% | |

Number of Companies | | | 239 | |

Fund Inception | | | November 02, 2018 | |

No sales charges or distribution fees | | | | |

| | | | |

Portfolio Characteristics | | | | |

Weighted Average Market Capitalization (billions) | | | $38,593.27 | |

Price-to-Earnings Ratio(b) | | | 14.10x | |

Countries Represented | | | 42 | |

Emerging Markets | | | 28.9% | |

| | | | |

Ten Largest Equities (%)(c) | | | | |

Allianz S.E. | | | 1.7 | |

Samsung Electronics Co. Ltd. | | | 1.5 | |

BNP Paribas S.A. | | | 1.4 | |

Bayerische Motoren Werke A.G. | | | 1.3 | |

Taiwan Semiconductor Manufacturing Co. Ltd. | | | 1.3 | |

AIA Group Ltd. | | | 1.2 | |

Continental A.G. | | | 1.2 | |

Daimler A.G. | | | 1.2 | |

Credit Suisse Group A.G. | | | 1.2 | |

Intesa Sanpaolo S.p.A. | | | 1.2 | |

Asset Allocation

| | | | |

Sector Diversification (%) | | | | |

Financial | | | 19.9 | |

Consumer,Non-cyclical | | | 12.6 | |

Consumer, Cyclical | | | 11.4 | |

Technology | | | 9.4 | |

Industrial | | | 9.4 | |

Communications | | | 9.2 | |

Basic Materials | | | 4.0 | |

Energy | | | 2.7 | |

Utilities | | | 0.2 | |

Diversified | | | 0.2 | |

| | | | |

Region Diversification (%) | | | | |

Europe (excluding United Kingdom) | | | 32.5 | |

Pacific (excluding Japan) | | | 22.1 | |

United Kingdom | | | 8.7 | |

Japan | | | 4.9 | |

Latin America | | | 4.2 | |

Africa | | | 2.9 | |

Middle East | | | 1.3 | |

Canada | | | 1.3 | |

United States | | | 1.1 | |

*Includes cash, short-term investments, derivatives, receivables and payables.

(a)Net expense ratio reflects fee waivers and/or expense reimbursements, if any, pursuant to an agreement that is in effect to cap the expenses whereas the gross expense ratio does not. On September 26, 2018, the Fund and Morningstar Investment Management, LLC (“MIM”) entered into an amended, written fee waiver/expense reimbursement agreement pursuant to which (“MIM”) is contractually obligated to waive its advisory fees and/or reimburse expenses so that the Fund’s ordinary total operating expenses through August 31, 2020 (excluding taxes, interest, brokerage commissions, trading costs, acquired fund fees and expenses, short sale dividend and interest expenses, litigation expenses, and extraordinary expenses) would not exceed 1.00%. The fee waiver/expense reimbursement agreement may be terminated by the Fund’s board at any time and also will terminate automatically upon the expiration or termination of the Fund’s advisory contract with MIM.

(b)Price-to-earnings (P/E) ratio is calculated using12-month forward earnings estimates from third-party sources deemed reliable.

(c) The Fund’s portfolio holdings are subject to change without notice. The mention of specific securities is not a recommendation to buy, sell, or hold any particular security and is not indicative of current or future trading activity.

16

Morningstar Funds Trust April 30, 2019

Performance Summary (unaudited)

|

|

Morningstar International Equity Fund |

Investment Objective

Morningstar International Equity Fund seeks long-term capital appreciation.

Investment Strategies

In seeking long-term capital appreciation, the Fund will normally invest at least 80% of its assets in equity securities. Under normal circumstances, the Fund will invest approximately80-100% of its assets in securities of issuers domiciled outside of the United States. The Fund may invest in developed and emerging markets and will typically invest in a minimum of 10 countries. The Fund seeks to provide broad international equity exposure across market capitalizations and investment styles and has the flexibility to invest inlarge-cap,mid-cap, andsmall-cap common stocks across the growth and value style spectrum. The Fund may also invest in derivatives, including futures and forward foreign currency contracts, for risk management purposes or as part of its investment strategies. The Fund employs a multi-manager, subadvised structure. The Fund may also invest a portion of the Fund’s assets in shares of exchange-traded funds (ETFs), which use a passive management strategy.

Investment Commentary

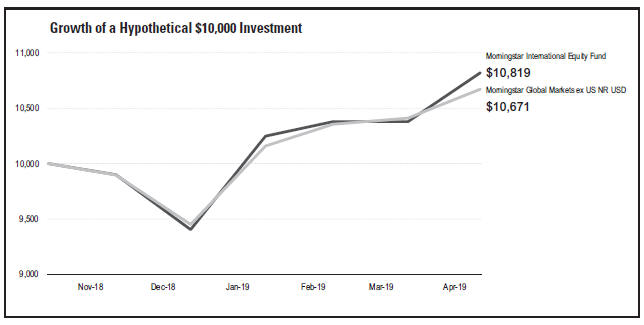

The Morningstar International Equity Fund returned 8.19% from inception (November 2, 2018) through the Fund’s fiscal period end on April 30, 2019, outperforming the Fund’s benchmark Morningstar Global Markets ex U.S. Index (net), which returned 6.71% for the same period.

Foreign stocks rebounded sharply in early 2019, but not before experiencing steep declines in late 2018 amid worries over slowing global growth and trade tensions. A move to a more dovish stance by the Federal Reserve and investor optimism for a U.S./China trade deal helped to bolster both developed and emerging-market stocks in the early months of 2019.

The Fund’s outperformance over the Index owed to an overweight in outperforming U.K. stocks and a simultaneous underweight in Japanese equities, which lagged broader developed markets during the period. The Fund’s overweight to the U.K. owes to the U.K.-focused ETF holding and, more indirectly, to our allocation to Harris Associates’ investment mandate.

Overall, our subadvisers contributed positively to the Fund’s results. T. Rowe Price and Harris Associates well outperformed their respective style benchmarks during the market rebound, making up for lost ground during the market decline. Lazard Asset Management, the Fund’s subadviser that focuses on value-oriented stocks within emerging-market equities, lagged its style benchmark for thesix-month period, however.

17

Morningstar Funds Trust April 30, 2019

Performance Summary (unaudited)(continued)

Morningstar International Equity Fund

Investment Subadvisers:

Harding Loevner L.P.

Provides growth-leaning exposure tonon-U.S. developed equity markets.

Harris Associates L.P.

Provides exposure to value-leaning,non-U.S. developed equity markets.

Lazard Asset Management LLC

Provides active equity exposure to emerging-markets value companies.

T. Rowe Price Associates, Inc.

Provides active exposure to emerging-markets growth companies.

18

Morningstar Funds Trust April 30, 2019

Performance Summary (unaudited)(continued)

Morningstar International Equity Fund

Performance at a glance

| | | | | | | | |

| Average Total Returns as of 04/30/19 | | YTD2 | | | Since Inception3 | |

Morningstar International Equity Fund | | | 15.03 | % | | | 8.19 | % |

Morningstar Global Markets ex U.S. Index (net)1 | | | 12.91 | % | | | 6.71 | % |

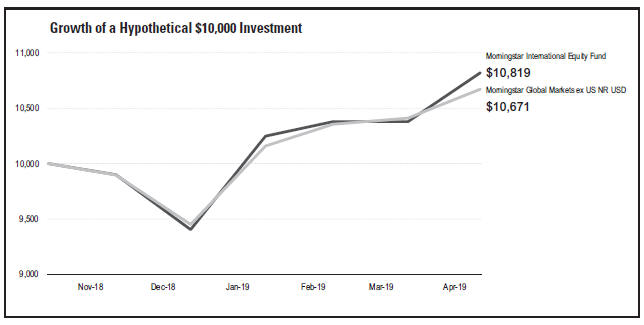

Illustration of an assumed investment of $10,000

The following graph depicts the performance of Morningstar International Equity Fund shares versus the Morningstar Global Markets ex U.S. Index (net) from its inception (November 2, 2018) to April 30, 2019 (the Fund’s fiscal period end). Shares held through advisory programs may be subject to a program fee, which, if included, would have reduced performance. The performance provided does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results. Share price and returns will vary with market conditions; investors may realize a gain or loss upon redemption. It is important to note that Morningstar International Equity Fund is a professionally managed portfolio while the Index is not available for direct investment, is unmanaged and does not include fees, expenses or certain taxes. The comparison is shown for illustration purposes only.

Morningstar International Equity Fund

This chart does not imply future performance.

1The Morningstar Global Markets ex U.S. Index (net) captures the performance of the stocks located in the developed and emerging countries across the world, excluding the United States. Stocks in the index are weighted by their float capital, which removes corporate cross-ownership, government holdings and otherlocked-in shares. Net total return indices reinvest dividends after the deduction of withholding taxes, using a tax rate applicable tonon-resident who do not benefit from double taxation. Investors should note that such indices do not reflect the deduction of fees, expenses or other taxes.

2Represents performance from January 1, 2019 to April 30, 2019.

3Inception Date is November 2, 2018.

Past performance does not predict future performance, and the performance information provided, does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Shares held through advisory programs are subject to a program fee, which, if included, would have reduced performance. The return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance results assume reinvestment of all dividends and capital gain distributions at net asset value on theex-dividend dates. Current performance may be higher or lower than the performance data quoted.

19

Morningstar Funds Trust April 30, 2019

Fund Information(unaudited)

|

|

Morningstar Global Income Fund |

| | | | |

| |

General Information | | | | |

Net Asset Value Per Share | | | $10.58 | |

Total Net Assets (millions) | | | $186 | |

Net Expense Ratio(a) | | | 0.58% | |

Gross Expense Ratio(a) | | | 0.90% | |

Portfolio Turnover Rate | | | 27% | |

Fund Inception | | | November 02, 2018 | |

No sales charges or distribution fees | |

| | | | |

Number of Common Stocks | | | 32 | |

| | | | |

| | |

Five Largest Sectors (%) | | | | |

Financial | | | 10.4 | |

Consumer,Non-cyclical | | | 9.2 | |

Industrial | | | 4.2 | |

Communications | | | 4.1 | |

Energy | | | 3.7 | |

| | | | |

| | |

Ten Largest Equities (%)(b) | | | | |

JPMorgan Chase & Co. | | | 1.7 | |

Unilever N.V. | | | 1.7 | |

NextEra Energy, Inc. | | | 1.7 | |

United Overseas Bank Ltd. | | | 1.6 | |

Cisco Systems, Inc. | | | 1.5 | |

Allianz S.E. | | | 1.5 | |

Sonic Healthcare Ltd. | | | 1.5 | |

Welltower, Inc. | | | 1.5 | |

Zurich Insurance Group A.G. | | | 1.5 | |

Novartis A.G. ADR | | | 1.5 | |

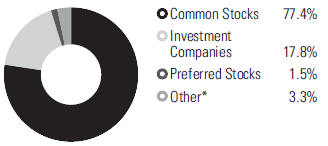

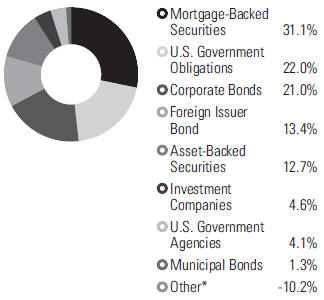

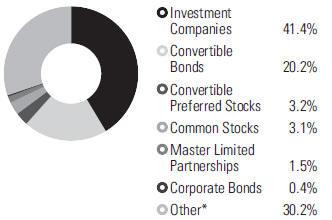

Asset Allocation

*Includes cash, short-term investments, receivables and payables.

(a)Net expense ratio reflects fee waivers and/or expense reimbursements, if any, pursuant to an agreement that is in effect to cap the expenses whereas the gross expense ratio does not. On September 26, 2018, the Fund and Morningstar Investment Management, LLC (“MIM”) entered into an amended, written fee waiver/expense reimbursement agreement pursuant to which (“MIM”) is contractually obligated to waive its advisory fees and/or reimburse expenses so that the Fund’s ordinary total operating expenses through August 31, 2020 (excluding taxes, interest, brokerage commissions, trading costs, acquired fund fees and expenses, short sale dividend and interest expenses, litigation expenses, and extraordinary expenses) would not exceed 0.89%. The fee waiver/expense reimbursement agreement may be terminated by the Fund’s board at any time and also will terminate automatically upon the expiration or termination of the Fund’s advisory contract with MIM.

(b)The Fund’s portfolio holdings are subject to change without notice. The mention of specific securities is not a recommendation to buy, sell, or hold any particular security and is not indicative of current or future trading activity.

20

Morningstar Funds Trust April 30, 2019

Performance Summary (unaudited)

|

|

Morningstar Global Income Fund |

Investment Objective

Morningstar Global Income Fund seeks current income and long-term capital appreciation.

Investment Strategies

In seeking current income and long-term capital appreciation, the Fund has significant flexibility and invests across asset classes and geographies, according to the portfolio management team’s assessment of their valuations, fundamental health, and income levels. Under normal circumstances, the Fund will invest at least 20% (or, if market conditions are unfavorable, at least 10%) of assets in securities of issuers domiciled outside of the United States and may invest up to 100% assets in such securities.

The Fund invests in income-generating equity securities, which may include common stocks, convertible securities, preferred stocks, real estate investment trusts (REITs), and master limited partnerships (MLPs). The Fund may invest in companies of any size from any country, including emerging markets.

The Fund also invests in fixed-income securities of varying maturity, duration, and quality. These may include U.S. andnon-U.S. corporate debt securities, U.S. andnon-U.S. government debt securities, emerging-market debt securities, mortgage-backed and asset-backed securities, and floating-rate notes. The Fund may invest without limit in fixed-income securities that are rated below investment grade (commonly known as junk bonds) or, if unrated, are determined by the Fund’s subadviser(s) to be of comparable quality.

To meet its objective, the Fund may invest in exchange traded funds (ETFs), which could represent a significant percentage of assets. The Fund may also invest in derivatives, including options, futures, swaps, and forward foreign currency contracts, for risk management purposes or as part of its investment strategies. The Fund employs a multi-manager, subadvised structure. The Fund may also invest a portion of the Fund’s assets in shares of exchange-traded funds (ETFs), which use a passive management strategy.

Investment Commentary

The Morningstar Global Income Fund returned 6.85% from inception (November 2, 2018) through the Fund’s fiscal period end on April 30, 2019, underperforming the Fund’s blended benchmark (75% Global Markets Index (net), 25% Bloomberg Barclays Multiverse Total Return Index), which returned 7.10% for the same period.

The Fund’s holdings generally gained ground during the period from November 2, 2018 to April 30, 2019, with the largest gains coming from income-producing asset classes such as REITs, MLPs, convertible bonds and long-term, investment grade debt. Other portions of the Fund, including telecommunications stocks, generated positive, albeit more modest, returns.

The Fund’s modest underweight to equities detracted from relative performance since inception through the end of April 2019, as equities outperformed global bonds. Particular Fund exposures, including exposure to U.K. equities, further dragged on returns. However, strong performance from convertibles and long-term debt helped close the gap.

The Fund’s sole subadviser Schaffer Cullen trailed the Index during the period in question.

21

Morningstar Funds Trust April 30, 2019

Performance Summary (unaudited)(continued)

Morningstar Global Income Fund

Investment Subadviser:

Schafer Cullen Capital Management, Inc.

Global income that seeks exposure to attractively priced, high-quality, dividend-paying companies in the U.S. and international markets, including emerging markets.

22

Morningstar Funds Trust April 30, 2019

Performance Summary (unaudited)(continued)

Morningstar Global Income Fund

Performance at a glance

| | | | | | | | |

| Average Total Returns as of 04/30/19 | | YTD2 | | | Since Inception3 | |

Morningstar Global Income Fund | | | 10.80 | % | | | 6.85 | % |

Morningstar Global Income Blended Index1 | | | 12.30 | % | | | 7.10 | % |

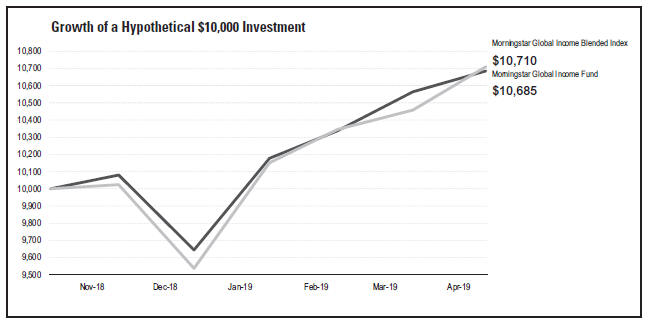

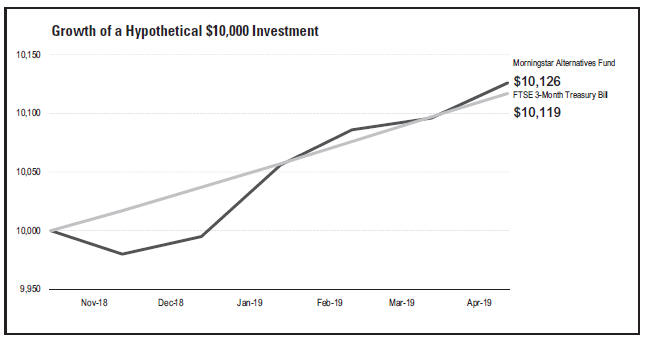

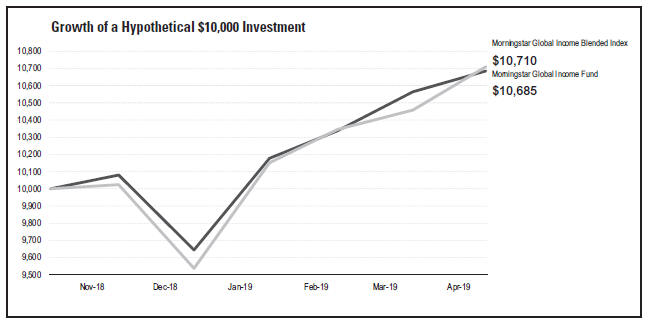

Illustration of an assumed investment of $10,000

The following graph depicts the performance of Morningstar Global Income Fund shares versus the Morningstar Global Income Blended Index from its inception (November 2, 2018) to April 30, 2019 (the Fund’s fiscal period end). Shares held through advisory programs may be subject to a program fee, which, if included, would have reduced performance. The performance provided does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results. Share price and returns will vary with market conditions; investors may realize a gain or loss upon redemption. It is important to note that Morningstar Global Income Fund is a professionally managed portfolio while the Index is not available for direct investment, is unmanaged and does not include fees, expenses or certain taxes. The comparison is shown for illustration purposes only.

Morningstar Global Income Fund

This chart does not imply future performance.

1The Morningstar Global Income Blended Index is composed of 75% Morningstar Global Ex U.S. Index (net) and 25% Bloomberg Barclays Multiverse Total Return Index. The Morningstar Global Ex U.S. Index (net) captures the performance of the stocks located in the developed and emerging countries across the world, excluding the United States. The Bloomberg Barclays Multiverse Total Return Index provides a broad-based measure of the global fixed-income bond market. Net total return indices reinvest dividends after the deduction of withholding taxes, using a tax rate applicable tonon-resident individuals who do not benefit from double taxation treaties. Investors should note that such indices do not reflect the deduction of fees, expenses or other taxes.

2Represents performance from January 1, 2019 to April 30, 2019.

3Inception Date is November 2, 2018.

Past performance does not predict future performance, and the performance information provided, does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Shares held through advisory programs are subject to a program fee, which, if included, would have reduced performance. The return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance results assume reinvestment of all dividends and capital gain distributions at net asset value on theex-dividend dates. Current performance may be higher or lower than the performance data quoted.

23

Morningstar Funds Trust April 30, 2019

Fund Information(unaudited)

|

|

Morningstar Total Return Bond Fund |

| | | | |

| | |

General Information | | | | |

Net Asset Value Per Share | | | $10.48 | |

Total Net Assets (millions) | | | $415 | |

Net Expense Ratio(a) | | | 0.53% | |

Gross Expense Ratio(a) | | | 0.88% | |

Portfolio Turnover Rate | | | 318% | |

30-Day SEC Yield (using net

expenses)(b) | | | 2.56% | |

30-Day SEC Yield (using gross

expenses)(b) | | | 2.91% | |

Number of Issuers | | | 490 | |

Fund Inception | | | November 02, 2018 | |

No sales charges or distribution fees | |

| | | | |

| | |

Portfolio Characteristics | | | | |

Effective Duration (years)(c) | | | 15.5 | |

Non-USD Exposure(d) | | | 0.6% | |

| | | | |

| | |

Five Largest Issuers (%) | | | | |

U.S. Treasury | | | 21.3 | |

Federal National Mortgage Association | | | 14.3 | |

Government National Mortgage Association | | | 9.3 | |

Federal Home Loan Mortgage Association | | | 6.4 | |

Federal Home Loan Banks | | | 4.1 | |

| | | | |

Credit Quality (%)(e)(f) | | | | |

US Treasury | | | 22.0 | |

US Agency | | | 35.2 | |

AAA | | | 6.7 | |

AA | | | 3.4 | |

A | | | 12.4 | |

BBB | | | 21.2 | |

BB | | | 0.8 | |

B | | | 0.6 | |

CCC | | | 0.2 | |

CC | | | 0.1 | |

Not Rated | | | 3.0 | |

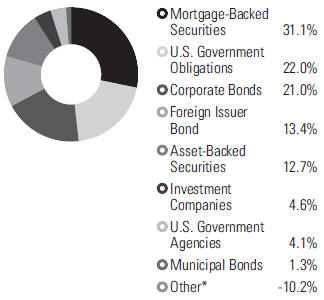

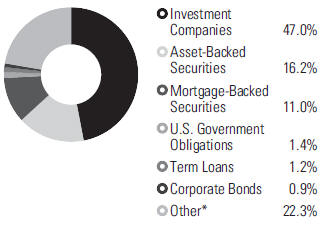

Asset Allocation

| | | | |

| | |

Sector Diversification (%) | | | | |

Mortgage Securities | | | 37.0 | |

Government | | | 31.3 | |

Financial | | | 10.9 | |

Asset Backed Securities | | | 6.8 | |

Energy | | | 4.5 | |

Consumer,Non-cyclical | | | 4.5 | |

Communications | | | 3.0 | |

Technology | | | 1.7 | |

Industrial | | | 1.7 | |

Consumer, Cyclical | | | 1.4 | |

Basic Materials | | | 1.4 | |

Utilities | | | 1.4 | |

| | |

Region Diversification (%) | | | | |

United States | | | 87.9 | |

Latin America | | | 7.7 | |

Europe (excluding United Kingdom) | | | 4.6 | |

United Kingdom | | | 2.0 | |

Pacific (excluding Japan) | | | 1.5 | |

Middle East | | | 0.8 | |

Africa | | | 0.4 | |

Japan | | | 0.4 | |

Canada | | | 0.3 | |

*Includes cash, short-term investments, derivatives, receivables and payables.

(a)Net expense ratio reflects fee waivers and/or expense reimbursements, if any, pursuant to an agreement that is in effect to cap the expenses whereas the gross expense ratio does not. On September 26, 2018, the Fund and Morningstar Investment Management, LLC (“MIM”) entered into an amended, written fee waiver/expense reimbursement agreement pursuant to which (“MIM”) is contractually obligated to waive its advisory fees and/or reimburse expenses so that the Fund’s ordinary total operating expenses through August 31, 2020 (excluding taxes, interest, brokerage commissions, trading costs, acquired fund fees and expenses, short sale dividend and interest expenses, litigation expenses, and extraordinary expenses) would not exceed 0.53%.

24

Morningstar Funds Trust April 30, 2019

Fund Information (unaudited)(continued)

Morningstar Total Return Bond Fund

The fee waiver/expense reimbursement agreement may be terminated by the Fund’s board at any time and also will terminate automatically upon the expiration or termination of the Fund’s advisory contract with MIM.

(b)SEC Yield is an annualization of the Fund’s net investment income for the trailing30-day period. Dividends paid by the Fund may be higher or lower than implied by the SEC Yield.

(c) Effective duration is measure of a Fund’s interest-rate sensitivity—the longer a Fund’s duration, the more sensitive the Fund is to shifts in interest rates. Duration is determined by a formula that includes coupon rates and bond maturities. Small coupons tend to increase duration, while shorter maturities and higher coupons shorten duration.

(d)Non-USD currency exposure for the Fund reflects the value of the portfolio’snon-U.S. dollar denominated investments, as well as the impact of currency derivatives.

(e)Credit quality ratings are based on the conservative average of Moody’s, S&P Global and Fitch ratings. If ratings from all three rating agencies disagree, the model assigns the middle rating to the security. If two of the three agree, the model assigns the rating from those two to the security. If none of these three rating agencies has assigned a rating, the Fund will assign a rating of not rated. The ratings, expressed in S&P Global’s nomenclature, range from AAA (extremely strong capacity to meet its financial commitment) to D (in default). Short-term ratings, expressed in S&P Global’s nomenclature, range from A1 to D (in default). The ratings represent the rating agencies’ opinions of the quality of the securities they rate. Ratings are relative and subjective and are not absolute standards of quality.

(f)Excludes the Fund’s derivative contracts.

25

Morningstar Funds Trust April 30, 2019

Performance Summary (unaudited)

|

|

Morningstar Total Return Bond Fund |

Investment Objective

Morningstar Total Return Bond Fund seeks to maximize total return while also generating income and preserving capital.

Investment Strategies

In seeking to maximize total return while also generating income and preserving capital, the Fund will normally invest at least 80% of its assets in debt securities (commonly referred to as “bonds”) of varying maturity, duration, and quality.

The Fund invests primarily in investment-grade fixed-income securities. These may include U.S. andnon-U.S. investment-grade corporate debt securities, U.S. government debt securities including Treasury Inflation Protected Bond Securities andzero-coupon securities,non-U.S. government debt securities, emerging-market debt securities, and mortgage-backed and asset-backed securities. The Fund may also invest up to 20% of its assets in fixed-income securities that are rated below investment grade (commonly known as junk bonds), or if unrated, are determined by the Fund’s subadviser(s) to be of comparable quality.

In addition, the Fund may invest up to 15% of its assets in collateralized debt obligations (CDOs), of which 10% (as a percentage of the Fund’s assets) may be in collateralized loan obligations (CLOs). CDOs are types of asset-backed securities. CLOs are ordinarily issued by a trust or other special purpose entity and are typically collateralized by a pool of loans, which may include, among others, domestic andnon-U.S. senior secured loans, senior unsecured loans, and subordinate corporate loans, including loans that may be rated below investment grade or equivalent unrated loans, held by such issuer.

The Fund may invest up to 20% of its assets in securities denominated in foreign currencies. The Fund may also invest in securities acquired in a private placement, such as Rule 144A securities, as well as derivatives, including options, futures, swaps, and forward foreign currency contracts, for risk management purposes or as part of its investment strategies. The Fund may also enter into reverse repurchase agreements and dollar rolls. The Fund employs a multi-manager, subadvised structure. The Fund may also invest a portion of the Fund’s assets in shares of exchange-traded funds (ETFs), which use a passive management strategy.

Investment Commentary

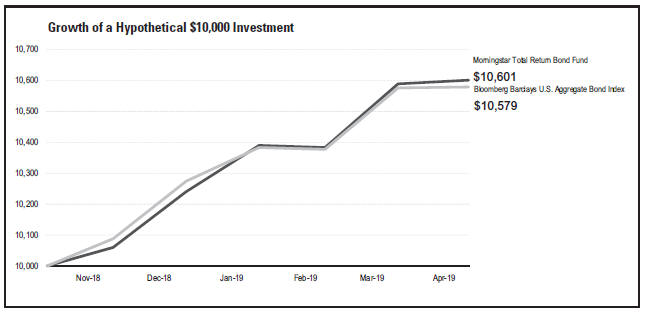

The Morningstar Total Return Bond Fund returned 6.01% from inception (November 2, 2018) through the Fund’s fiscal period end on April 30, 2019, outperforming the Bloomberg Barclays U.S. Aggregate Bond Index, which returned 5.79% for the same period.

Strong relative performance from the Fund’s subadvisers BlackRock Financial Management, Inc. and Western Asset Management Company was the primary driver of relative outperformance. The Fund’s overweight to duration relative to the benchmark, driven by the subadvisers’ positioning, aided relative results as yields declined meaningfully from the Fund’s inception through April 30, 2019. Western Asset’sout-of-benchmark allocation to hard-currency emerging-markets debt also contributed to the Fund’s relative outperformance.

26

Morningstar Funds Trust April 30, 2019

Performance Summary (unaudited)(continued)

Morningstar Total Return Bond Fund

Investment Subadvisers:

BlackRock Financial Management, Inc.

Core-plus total return objective; aims to primarily invest in investment-grade, domestic fixed-income securities with opportunistic,out-of-benchmark allocations and derivatives.

Western Asset Management Company

Provides core-bond exposure seeking exposure to investment-grade, domestic fixed-income securities.

27

Morningstar Funds Trust April 30, 2019

��

Performance Summary (unaudited)(continued)

Morningstar Total Return Bond Fund

Performance at a glance

| | | | | | | | |

| Average Total Returns as of 04/30/19 | | YTD2 | | | Since Inception3 | |

Morningstar Total Return Bond Fund | | | 3.53 | % | | | 6.01 | % |

Bloomberg Barclays U.S. Aggregate Bond Index1 | | | 2.97 | % | | | 5.79 | % |

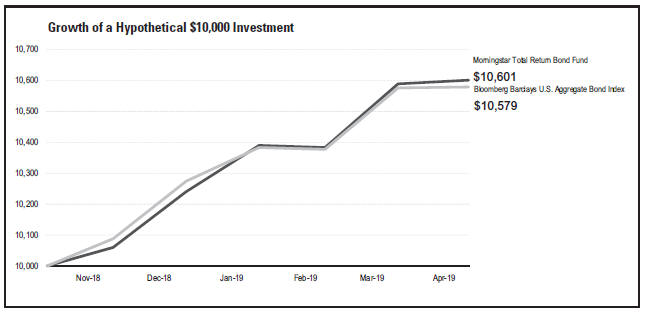

Illustration of an assumed investment of $10,000

The following graph depicts the performance of Morningstar Total Return Bond Fund shares versus the Bloomberg Barclays U.S. Aggregate Bond Index from its inception (November 2, 2018) to April 30, 2019 (the Fund’s fiscal period end). Shares held through advisory programs may be subject to a program fee, which, if included, would have reduced performance. The performance provided does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results. Share price and returns will vary with market conditions; investors may realize a gain or loss upon redemption. It is important to note that Morningstar Total Return Bond Fund is a professionally managed portfolio while the Index is not available for direct investment, is unmanaged and does not include fees, expenses or taxes. The comparison is shown for illustration purposes only.

Morningstar Total Return Bond Fund

This chart does not imply future performance.

1The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based, flagship benchmark that measures the investment grade, U.S.-dollar-denominated, fixed-rate, taxable bond market. Investors should note that indices do not reflect the deduction of fees, expenses or taxes.

2Represents performance from January 1, 2019 to April 30, 2019.

3Inception Date is November 2, 2018.

Past performance does not predict future performance, and the performance information provided, does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Shares held through advisory programs are subject to a program fee, which, if included, would have reduced performance. The return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance results assume reinvestment of all dividends and capital gain distributions at net asset value on theex-dividend dates. Current performance may be higher or lower than the performance data quoted.

28

Morningstar Funds Trust April 30, 2019

Fund Information (unaudited)

|

|

Morningstar Municipal Bond Fund |

| | | | |

| | |

General Information | | | | |

Net Asset Value Per Share | | | $10.38 | |

Total Net Assets (millions) | | | $105 | |

Net Expense Ratio(a) | | | 0.58% | |

Gross Expense Ratio(a) | | | 1.05% | |

Portfolio Turnover Rate | | | 115% | |

30-Day SEC Yield (using net

expenses)(b) | | | 1.98% | |

30-Day SEC Yield (using gross

expenses)(b) | | | 2.45% | |

Number of Issuers | | | 177 | |

Fund Inception | | | November 02, 2018 | |

No sales charges or distribution fees | |

| | | | |

| | |

Portfolio Characteristics | | | | |

Effective Duration (years)(c) | | | 15.5 | |

| | | | |

| | |

Five Largest Issuers (%) | | | | |

Pennsylvania Housing Finance Agency | | | 2.3 | |

Public Finance Authority | | | 2.2 | |

District of Columbia Water & Sewer Authority | | | 2.1 | |

Metropolitan Transportation Authority | | | 2.0 | |

New York State Dormitory Authority | | | 2.0 | |

| | | | |

| | |

Credit Quality (%)(d) | | | | |

AAA | | | 9.5 | |

AA | | | 31.9 | |

A | | | 29.6 | |

BBB | | | 14.6 | |

BB | | | 2.6 | |

B | | | 0.5 | |

A1+ (Short Term) | | | 1.0 | |

A1 (Short Term) | | | 1.9 | |

A2 (Short Term) | | | 0.5 | |

Not Rated | | | 2.6 | |

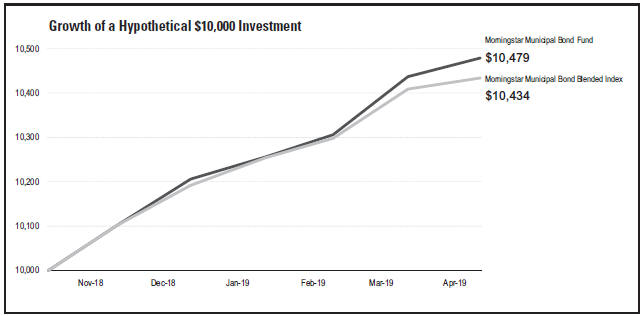

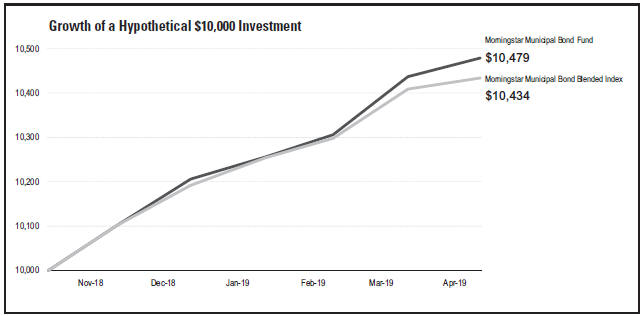

Asset Allocation

| | | | |

| | |

Sector Diversification (%) | | | | |

Medical | | | 14.2 | |

General | | | 14.1 | |

Transportation | | | 13.3 | |

School District | | | 7.6 | |

General Obligation | | | 7.5 | |

Airport | | | 6.2 | |

Development | | | 5.8 | |

Multifamily Housing | | | 5.7 | |

Water | | | 3.9 | |

Power | | | 3.3 | |

Higher Education | | | 2.9 | |

Utilities | | | 2.5 | |

Single Family Housing | | | 1.9 | |

Nursing Home | | | 1.6 | |

Education | | | 1.4 | |

Pollution | | | 0.9 | |

Housing | | | 0.8 | |

Student Loan | | | 0.5 | |

Facilities | | | 0.4 | |

Government | | | 0.2 | |

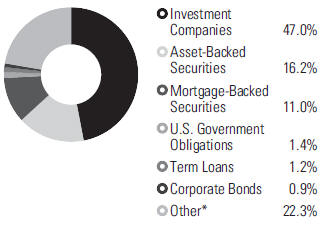

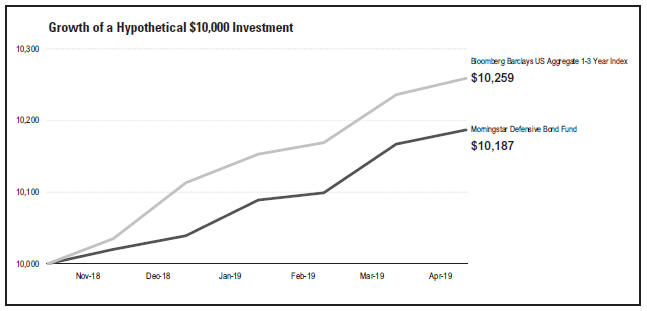

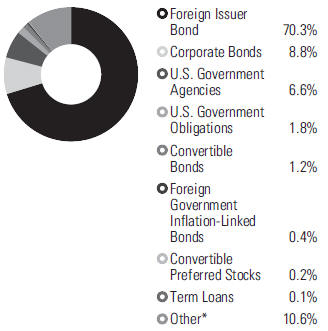

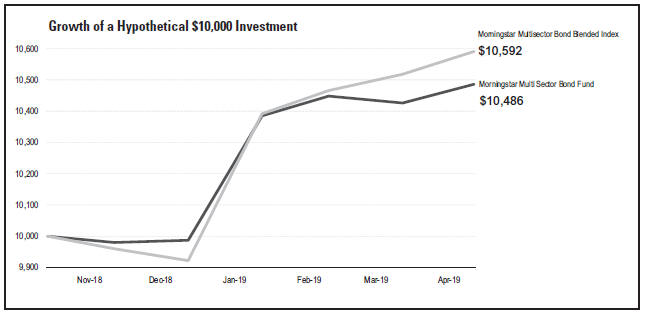

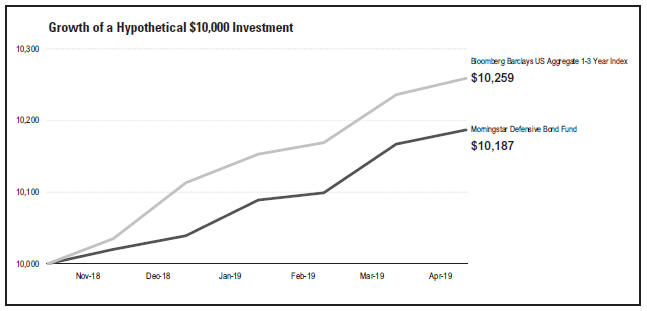

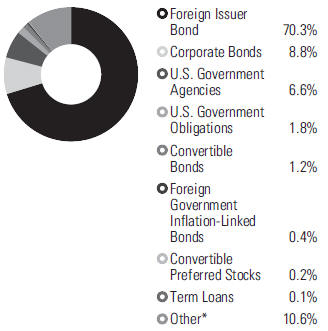

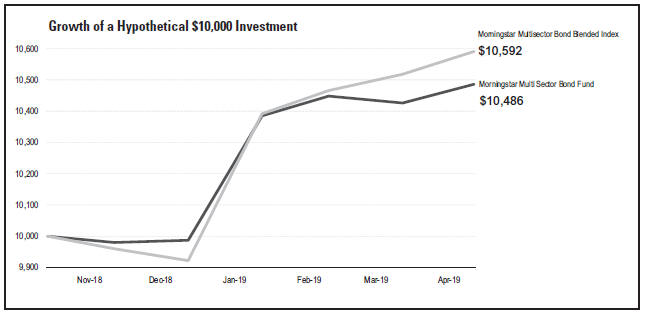

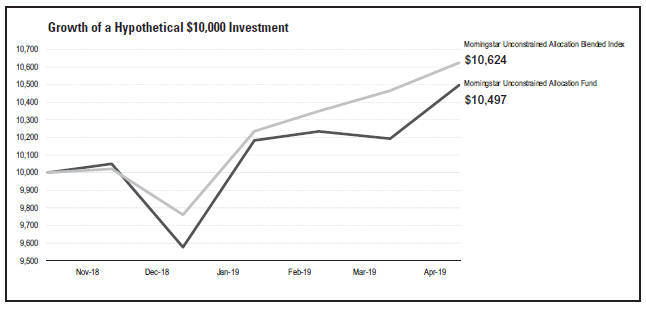

*Includes cash, short-term investments, receivables and payables.