UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-SA

SEMIANNUAL REPORT PURSUANT TO REGULATION A

For the fiscal semiannual period ended June 30, 2021

MOGULREIT II, Inc.

(Exact name of issuer as specified in its charter)

| Maryland | | 81-5263630 |

| (State or other jurisdiction | | (I.R.S. Employer |

| of incorporation or organization) | | Identification No.) |

| | | |

| 10573 W Pico Blvd., PMB #603 | | |

| Los Angeles, CA | | 90064 |

| (Full mailing address of | | (Zip code) |

| principal executive offices) | | |

(877) 781-7153

(Issuer’s telephone number, including area code)

Item 1. Management’s Discussion and Analysis of Financial Condition and Results of Operations

An investment in our common stock involves substantial risks. You should carefully consider the risk factors in addition to the other information contained in our offering circular before purchasing shares. The occurrence of the stated risks might cause you to lose a significant part, or all, of your investment. The risks and uncertainties discussed in the offering circular are not the only ones we face, but do represent those risks and uncertainties that we believe are most significant to our business, operating results, prospects and financial condition. Some statements in this semiannual report constitute forward-looking statements. These forward-looking statements involve known and unknown risks, uncertainties and other important factors that could cause our actual results, performance or achievements, or industry results, to differ materially from those expressed or implied by these forward-looking statements, and you are cautioned not to place undue reliance on any forward-looking statements included in this semiannual report. Except as otherwise required by federal securities laws, we do not undertake to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Operating Results

Overview

MogulREIT II, Inc. is a Maryland corporation formed on January 13, 2017 to own and manage a diversified portfolio of preferred equity, marketable securities and joint venture equity investments in multifamily properties located in target markets throughout the United States. The use of the terms “MogulREIT II,” the “Company,” “we,” “us” or “our” in this semiannual refer to MogulREIT II, Inc., unless the context indicates otherwise. We operate under the direction of the board of directors, the members of which are accountable to us and our stockholders as fiduciaries. The current board members are Jilliene Helman, Flynann Janisse and Louis S. Weeks III. Ms. Janisse and Mr. Weeks are independent directors. We are externally managed by RM Adviser, LLC (“Manager”), which is an affiliate of the Company’s sponsor, RM Sponsor, LLC (“Sponsor”). Our Manager and our Sponsor are each wholly-owned subsidiaries of Realty Mogul, Co. Our Manager manages our day-to-day operations and also provides asset management and other services with the goal of maximizing our operating cash flow and preserving our capital. Our affiliate, RM Technologies, LLC, which is a wholly-owned subsidiary of Realty Mogul, Co. and an affiliate of our Sponsor and our Manager, operates an online investment platform, www.realtymogul.com (the “Realty Mogul Platform”), through which shares of common stock are being offered exclusively.

On August 23, 2017, we commenced our initial public offering of $50,000,000 in shares of common stock (the “Initial Offering”). On December 23, 2020, our follow-on offering (the “Follow-on Offering,” and together with the Initial Offering, the “Offerings”) was qualified by the Securities and Exchange Commission (the “SEC”), and we terminated our Initial Offering.

Pursuant to the Follow-on Offering, we are offering up to $43,522,230 in shares of our common stock, including any shares that may be sold pursuant to our distribution reinvestment plan, which represents the value of the shares of our common stock available to be offered as of October 31, 2020 out of the rolling 12-month maximum offering amount of $50,000,000 in shares of our common stock. The SEC adopted an amendment to increase the maximum offering amount under Tier 2 of Regulation A from $50,000,000 to $75,000,000. This amendment is effective March 15, 2021, and the Company intends to utilize this increased offering amount in the future. As of June 30, 2021, we had issued 3,510,289 shares of our common stock in the Offerings for gross offering proceeds of approximately $35.3 million. We expect to offer shares of our common stock in the Follow-on Offering until the earlier of (i) December 23, 2023, which is three years from the qualification date of the Follow-on Offering, or (ii) the date on which the maximum offering amount has been raised, unless the Follow-on Offering is terminated by our board of directors at an earlier time.

As of June 30, 2021, our portfolio was comprised of approximately $192,807,000 in real estate investments at original cost that, in the opinion of our Manager, meets our investment objectives. We have used, and intend to continue to use, substantially all of the net proceeds from the Offerings to make preferred equity and joint venture equity investments in apartment communities that have demonstrated consistently high occupancy and income levels across market cycles as well as multifamily properties that offer value added opportunities with appropriate risk-adjusted returns and opportunity for value appreciation.

Results of Operations

We commenced our Initial Offering upon receiving qualification of the Initial Offering from the SEC, and our Follow-On Offering was qualified on December 23, 2020. Our financial statements are presented for the six months ended June 30, 2021, resulting in operating income of approximately $630,000 including net operating income from rental operations and a consolidated loss of $1,444,000 of which $1,024,000 was attributable to MogulREIT II, Inc. Generally accepted accounting principles in the United States of America (“GAAP”) require any subsidiaries or affiliates under common control to be consolidated. The financial statements include the financial statements of the Company and its controlled joint ventures, Travertine North Park Investors, LLC and Vinegar Hill Asset, LLC, which were acquired during 2017, Avon 46, LLC, which was acquired during 2018, RM Terrace Hill, LLC, which was acquired during 2019, NinetyNine44 Owner, LLC, which was acquired in 2020, RM Orion LLC and OREI Lotus Village Property Owner, LLC, which were acquired in 2021.

Sources of Operating Revenue and Cash Flows

Our revenue is mainly generated from rental income, tenant fee income and tenant reimbursements.

Revenue

For the six months ended June 30, 2021, we earned rental income, net of $7,346,000 as compared to the same period in 2020 in which we earned net rental income of $4,932,000.

Expenses

For the six months ended June 30, 2021, we incurred depreciation and amortization expenses of $2,699,000 as compared to the same period in 2020 in which we incurred depreciation and amortization expenses of $1,596,000. For the six months ended June 30, 2021, we incurred general and administrative expenses of $678,000, which includes professional fees, insurance expenses and other costs associated with running our business as well as operating expenses for our consolidated investments, as compared to the same period in 2020 in which we incurred general and administrative expenses of $785,000. For the six months ended June 30, 2021, we incurred real estate operating expenses of $3,704,000 as compared to the same period in 2020 in which we incurred real estate expenses of $2,293,000. For the six months ended June 30, 2021, we incurred interest expense of $2,092,000 as compared to the same period in 2020 in which we incurred interest expenses of $1,695,000.

Distributions

Our board of directors has declared and paid, and we expect that our board of directors will continue to declare and pay, distributions quarterly in arrears. Stockholders who are record holders with respect to declared distributions will be entitled to such distributions until such time as the stockholders have had their shares repurchased by us. Although our goal is to fund the payment of distributions from cash flow from operations, we have paid, and may continue to pay distributions from other sources, including the net proceeds of the Offerings, cash advances by our Manager, cash resulting from a waiver of fees or reimbursements due to our Manager, borrowings in anticipation of future operating cash flow and the issuance of additional securities, and we have no limit on the amounts we may pay from such other sources.

On December 15, 2017, our board of directors declared our first distribution to stockholders of record as of the close of business on each day of the period commencing on December 17, 2017 and ending on December 31, 2017. Our board of directors has declared quarterly distributions for stockholders of record as of the close of business on the last day of each quarter, as shown in the table below:

Distribution Period for Daily Record Dates | | Date of Authorization | | Payment Date(1) | | Cash Distribution Amount per Share of Common Stock | | | Annualized Yield | |

| 12/17/2017 – 12/31/2017 | | 12/15/2017 | | 1/15/2018 | | $ | 0.0057682365 | | | | 2.1 | %(2) |

| 1/1/2018 – 3/31/2018 | | 12/22/2017 | | 4/13/2018 | | $ | 0.0012328767 | | | | 4.5 | %(3) |

| 4/1/2018 – 6/30/2018 | | 3/21/2018 | | 7/16/2018 | | $ | 0.0012328767 | | | | 4.5 | %(3) |

| 7/1/2018 – 9/30/2018 | | 6/20/2018 | | 10/15/2018 | | $ | 0.0012328767 | | | | 4.5 | %(3) |

| 10/1/2018 – 12/31/2018 | | 9/18/2018 | | 1/15/2019 | | $ | 0.0012328767 | | | | 4.5 | %(3) |

| 1/1/2019 – 3/31/2019 | | 12/20/2018 | | 4/15/2019 | | $ | 0.0012328767 | | | | 4.5 | %(3) |

| 4/1/2019 – 6/30/2019 | | 3/30/2019 | | 7/15/2019 | | $ | 0.0012328767 | | | | 4.5 | %(3) |

| 7/1/2019 – 9/30/2019 | | 6/25/2019 | | 10/15/2019 | | $ | 0.0012328767 | | | | 4.5 | %(3) |

| 10/1/2019 – 12/31/2019 | | 9/26/2019 | | 1/15/2020 | | $ | 0.0012328767 | | | | 4.5 | %(4) |

| 1/30/2020 – 3/31/2020 | | 12/27/2019 | | 4/15/2020 | | $ | 0.0012811475 | | | | 4.5 | %(5) |

| 4/1/2020 – 6/30/2020 | | 3/30/2020 | | 7/15/2020 | | $ | 0.0012811475 (4/1 – 4/30) | | | | | |

| | | | | | | $ | 0.0012012295 (5/1 – 6/30) | | | | 4.5 | %(6) |

| 7/1/2020 – 9/30/2020 | | 6/30/2020 | | 10/15/2020 | | $ | 0.0012098361 | | | | 4.5 | %(7) |

| 10/1/2020 – 12/31/2020 | | 9/30/2020 | | 1/15/2021 | | $ | 0.0012184426 | | | | 4.5 | %(8) |

| 1/1/2021 – 3/31/2021 | | 12/31/2020 | | 4/15/2021 | | $ | 0.0012217808 (1/1 – 1/31) | | | | 4.5 | %(9) |

| | | | | | | $ | 0.0012526027 (2/1 – 3/31) | | | | | |

| 4/1/2021 – 6/30/2021 | | 3/30/2021 | | 7/15/2021 | | $ | 0.0012526027 (4/1 – 4/21) | | | | 4.5 | %(10) |

| | | | | | | $ | 0.0013130137 (4/22 – 4/30) | | | | | |

| | | | | | | $ | 0.0013130137 (5/1 – 6/30) | | | | | |

| | (1) | Dates presented are the dates on which the distributions were scheduled to be distributed; actual distribution dates may vary. |

| | (2) | Annualized yield represents the annualized yield amount of each distribution calculated on an annualized basis at the then-current rate, assuming a $10.00 per share purchase price. Special distribution occurred, was a not a full distribution period. |

| | (3) | Annualized yield represents the annualized yield amount of each distribution calculated on an annualized basis at the then-current rate, assuming a $10.00 per share purchase price. |

| | (4) | Annualized yield represents the annualized yield amount of each distribution calculated on an annualized basis at the then-current rate, assuming a $10.28 per share purchase price. |

| | (5) | Annualized yield represents the annualized yield amount of each distribution calculated on an annualized basis at the then-current rate, assuming a $10.28 per share purchase price for the distribution period from January 1, 2020 through January 31, 2020, and assuming a $10.42 per share purchase price for the distribution period from February 1, 2020 through March 31, 2020. |

| | (6) | Annualized yield represents the annualized yield amount of each distribution calculated on an annualized basis at the then-current rate, assuming a $10.42 per share purchase price (the then-current purchase price for the period from April 1, 2020 to April 29, 2020) and calculated for April 1, 2020 through April 30, 2020 and a $9.77 per share purchase price (the current purchase price effective April 30, 2020) for the distribution period from May 1, 2020 through June 30, 2020. |

| | (7) | Annualized yield represents the annualized yield amount of each distribution calculated on an annualized basis at the then-current rate, assuming a $9.77 per share net asset value (the then-current purchase price for the period from July 1, 2020 to July 30, 2020) and calculated for the distribution period beginning July 1, 2020 and ending July 31, 2020 and a $9.84 per share net asset value (the then-current purchase price effective July 31, 2020) calculated for the distribution periods beginning August 1, 2020 and ending August 31, 2020 and beginning September 1, 2020 and ending September 30, 2020. |

| | (8) | Annualized yield represents the annualized yield amount of each distribution calculated on an annualized basis at the then-current rate, assuming a $9.84 per share net asset value (the then-current purchase price for the period from October 1, 2020 to October 29, 2020) and calculated for distribution period beginning October 1, 2020 and ending October 31, 2020 and a $9.91 per share net asset value (the then-current purchase price effective October 30, 2020) calculated for the distribution periods beginning November 1, 2020 and ending November 30, 2020 and beginning December 1, 2020 and ending December 31, 2020. |

| | (9) | Annualized yield represents the annualized yield amount of each distribution calculated on an annualized basis at the then-current rate assuming a $9.91 per share net asset value (the then-current purchase price for the period from January 1, 2021 to January 31, 2021) and calculated for the distribution period beginning January 1, 2021 and ending January 31, 2021 and a $10.16 per share net asset value (the then-current purchase price effective February 1, 2021) calculated for the distribution periods beginning February 1, 2021 and ending February 28, 2021 and beginning March 1, 2021 and ending March 31, 2021. |

| | (10) | Annualized yield represents the annualized yield amount of each distribution calculated on an annualized basis at the then-current rate assuming a $10.16 per share net asset value (the then-current purchase price for the period from April 1, 2021 to April 21, 2021) and calculated for the distribution period beginning April 1, 2021 and ending April 30, 2021 and a $10.65 per share net asset value (the then-current purchase price effective April 22, 2021) calculated for the distribution periods beginning May 1, 2021 and ending May 31, 2021 and beginning June 1, 2021 and ending June 30, 2021. |

For the six months ended June 30, 2021, we have paid distributions to our stockholders of approximately $732,000, including approximately $460,000 through the issuance of shares pursuant to our distribution reinvestment plan.

Liquidity and Capital Resources

We require capital to fund our investment activities and operating expenses. Our capital sources may include net proceeds from the Offerings, cash flow from operations and borrowings under credit facilities.

We are dependent upon the net proceeds from the Offerings to conduct our operations. We currently obtain the capital required to purchase real estate-related investments and conduct our operations from the proceeds of the Offerings and any future offerings we may conduct, from secured or unsecured financings from banks and other lenders and from any undistributed funds from our operations. As of June 30, 2021, we had cash and cash equivalents of approximately $9,848,000 and approximately $1,674,000 invested in marketable securities at fair value that are available to provide capital for operations and investments. We anticipate that proceeds from the Offerings, cash flow from operations and available cash will provide sufficient liquidity to meet future funding commitments for at least one year from the date the financial statements are available to be issued.

We expect to selectively employ leverage to enhance total returns to our stockholders. Our targeted portfolio-wide leverage after we have acquired an initial substantial portfolio of diversified investments is up to 75% of the fair market value or expected fair market value (for a value-add acquisition) of our assets; provided, however, we may exceed this limit for certain temporary bridge financings. During the period when we are acquiring our initial portfolio, we may employ greater leverage on individual assets (that will also result in greater leverage of the initial portfolio) in order to quickly build a diversified portfolio of assets. As of June 30, 2021, we had outstanding borrowings of approximately $150,093,000, net of deferred financing costs and discounts.

On August 28, 2020, we acquired shares of iShares Preferred and Income Securities ETF (NASDAQ: PFF) (“PFF”) and Invesco Variable Rate Preferred ETF (NASDAQ: VRP) (“VRP”) for approximately $2,397,000 and $1,596,000, respectively (collectively, the “Preferred Stock Investments”). PFF is an exchange-traded fund, which tracks the investment results of the ICE Exchange-Listed Preferred & Hybrid Securities Index, which measures the performance of a select group of exchange-listed, U.S. dollar-denominated preferred securities, hybrid securities and convertible preferred securities listed on the NYSE or NASDAQ. VRP is also an exchange-traded fund, which tracks the investment results of the Wells Fargo Hybrid and Preferred Securities Floating and Variable Rate Index, which measures the performance of preferred stocks and hybrid securities of U.S. and foreign issuers that pay a floating or variable rate dividend or coupon. We acquired the Preferred Stock Investments through JPMorgan Chase. We acquired the Preferred Stock Investments because they have demonstrated historic positive returns on investments. In addition, the Preferred Stock Investments are liquid in nature so that they can provide us flexibility while we consider future possible investments and acquisitions. On February 19, 2021, the Company completed the sale of certain exchange-traded funds reported as marketable securities for net proceeds of $2,458,000 and resulting in a realized gain of $58,000.

In addition to making investments in accordance with our investment objectives, we expect to use our capital resources to make certain payments and reimbursements to our Manager. During our organization and offering stage, the Manager will be reimbursed for certain organization and offering expenses. We expect aggregate organization and offering expenses to be approximately $1,306,000 or, if we raise the maximum offering amount, approximately 3% of gross offering proceeds. If the Follow-on Offering is not successfully completed, we will not be obligated to pay the remaining offering and organizational costs owed to our Manager. In addition, we reimburse our Manager for out-of-pocket expenses incurred on our behalf, including license fees, auditing fees, fees associated with SEC reporting requirements, acquisition expenses, interest expenses, property management fees, insurance costs, tax return preparation fees, marketing costs, taxes and filing fees, administration fees, fees for the services of independent directors, and third-party costs associated with the aforementioned expenses.

Cash Flow

The following presents our cash flows for six months ended June 30, 2021 (in thousands):

| | | For the six months ended June 30, 2021 | |

| Operating activities: | | $ | 1,274 | |

| Investing activities: | | | (68,197 | ) |

| Financing activities: | | | 70,119 | |

| Net increase in cash and cash equivalents | | | 3,196 | |

| Cash and cash equivalents, beginning of period | | | 13,143 | |

| Cash and cash equivalents, end of period | | $ | 16,339 | |

Net cash provided by operating activities was $1,274,000 and after adjustments related to non-cash charges for depreciation, amortization, and equity in loss of unconsolidated joint ventures of 3,036,000.

Net cash used in investing activities was $68,197,000 including purchases of real estate of $69,200,000, capital improvements of $1,463,000, offset by cash distributions from equity investments of $30,000 and proceeds from sales of marketable securities of $2,458,000.

Net cash provided by financing activities was $70,119,000 and related to $3,416,000 in new proceeds from the issuance of shares of our common stock pursuant to the Offerings and approximately $55,218,000 in debt proceeds, net of debt repayments and distributions to noncontrolling interests in consolidated real estate investments.

Outlook and Recent Trends

Since the inception of MogulREIT II, we have focused on two key objectives: realize capital appreciation in the value of our investments over the long term and pay attractive and stable cash distributions to stockholders. This strategy is not changing. To date, the majority of our investments have been in value-add multifamily apartment buildings and our business plan is to continue to invest in this asset class pursuant to our investment guidelines as shared in the formal offering circular.

We remain excited about value-add multifamily investing and believe that it may provide a good risk adjusted return in today’s market. We seek to mitigate risk by keeping cash flow at the properties while we are engaged in renovations. We are concerned about capitalization rates, as they are near historical lows in certain markets for multifamily investments; thus, we are particularly interested in investing in markets where occupancy levels remained high during the 2008 recession.

MACRO OVERVIEW

We believe that the stimulus provided by the federal government accomplished its goal of facilitating economic growth as the U.S. continues to recover from the novel coronavirus pandemic (COVID-19). During Q2 2021, the U.S. Bureau of Economic Analysis estimated that U.S. real GDP grew 6.5% quarter over quarter, and total GDP now exceeds pre-pandemic levels by 4.7%. The Federal Reserve continues to increase its GDP prediction and now forecasts a 7.0% increase in real GDP for 2021, compared to its 6.5% prediction last quarter, as well as a 4.5% unemployment rate by year-end. Strong employment may put upward pressure on wages, which could benefit the multifamily asset class by increasing personal savings. In addition, the Consumer Price Index rose year over year 4.2% in April, 5.0% in May, and 5.4% in June, according to the U.S. Bureau of Labor Statistics (“BLS”). We believe that real estate is positively correlated with inflation as property prices and rental income tend to rise as inflation rises. We like multifamily investments in an inflationary environment as the typical one-year lease term allows an owner to mark rents to market on an annual basis. As cities across the country continue to reopen since the outbreak of the COVID-19 pandemic, we believe that the economy will continue to improve and create an accretive environment for real estate investment. We believe that MogulREIT II is well positioned as it continues to seek a diversified portfolio of multifamily real estate, which we believe has a low or negative correlation to other major asset classes and over time has exhibited less volatility than other asset classes.

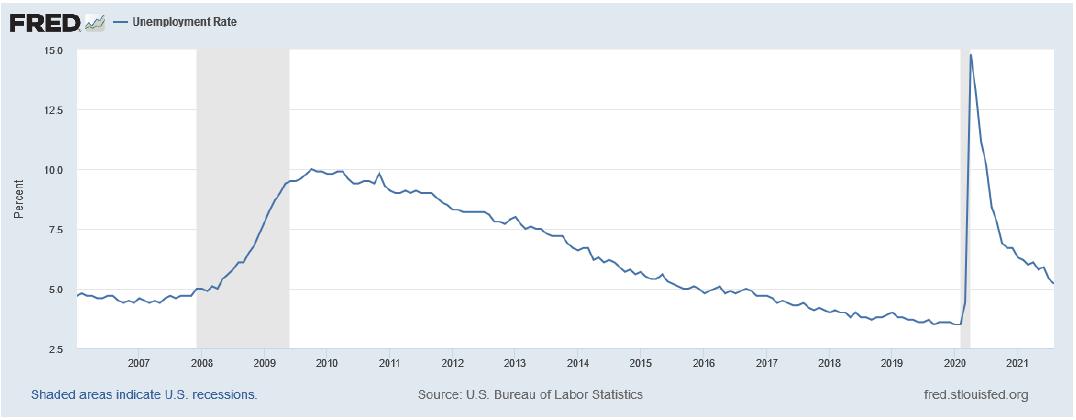

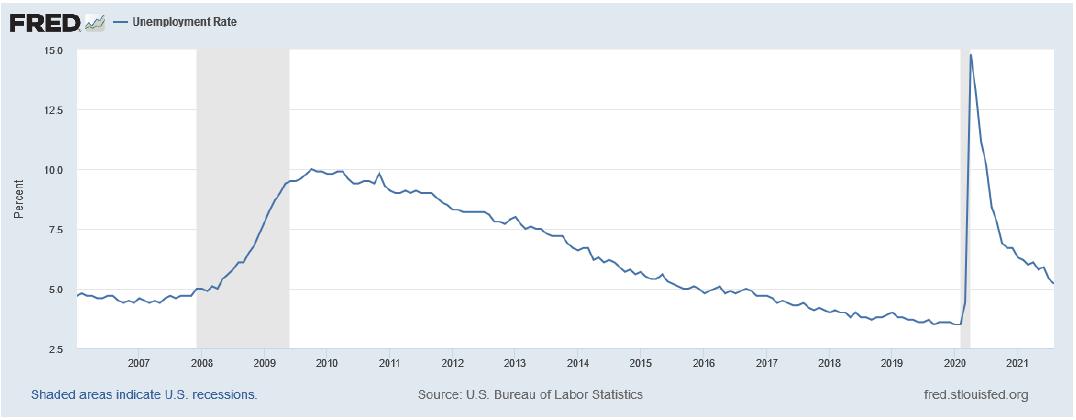

EMPLOYMENT AND WAGE GROWTH

Unemployment has fluctuated as a result of COVID-19, reaching a peak in April 2020 at 14.9% as reported by the BLS. The unemployment rate has dropped or remained static each month since April 2020, ending August 2021 at 5.2%. The Fed forecasts that the unemployment rate will decrease to 4.8% for 2021.

IMPACT OF MONETARY POLICY

In an effort to relieve downward economic pressure caused by COVID-19, the federal government has intervened with multiple stimulus bills. In 2020, Congress passed the $484 billion Paycheck Protection Program and Health Care Enhancement Act, the $2.3 trillion Coronavirus Aid, Relief, and Economic Security Act (the “CARES Act”), the $8.3 billion Coronavirus Preparedness and Response Supplemental Appropriations Act and the $192 billion Families First Coronavirus Response Act, totaling almost $3 trillion of coronavirus-related aid to both businesses and individuals.

In March 2021, Congress finalized the American Rescue Plan, a $1.9 trillion relief bill, which includes an additional $1,400 stimulus payment, $25 billion in rental assistance for low and moderate-income households who have lost jobs during the pandemic, and $5 billion to help struggling renters pay their utility bills. The plan will also continue to protect tenants from eviction through September 30, 2021.

The Wharton School at the University of Pennsylvania estimates that the American Rescue Plan will increase GDP by approximately 0.6% in 2021 while lowering GDP by 0.2% in 2022. We expect this federal stimulus to further benefit the economic recovery, but such aggressive stimulus over the past year, may lead to inflation in the intermediate term. We believe that real estate acts as a hedge against inflation as property prices and rental income tend to rise as inflation rises.

MULTIFAMILY FUNDAMENTALS AND OUTLOOK

Our long-term view of multifamily product has not changed, and we continue to believe in the macroeconomic fundamentals of multifamily investing. According to Freddie Mac’s Midyear Outlook, $4 trillion in stimulus funds have helped buoy the economy and workers impacted by the pandemic. Freddie Mac’s report states “We project the vacancy rate for 2021 to decrease 40 bps to 5.0%. Rental rates are expected to increase 2.5% and gross income is projected to grow 2.9%. In 2021 we expect over 90% of markets to achieve positive rent growth. Generally speaking, in 2021, smaller less expensive markets – particularly those that are a lower-cost alternative to a gateway market – as well as the Sun Belt markets are expected to perform well this year. While we anticipate that the larger gateway markets will continue being among the worst performers, the conditions in those markets are still expected to be much better in 2021 than in 2020.”

Freddie Mac’s positive outlook is shared by Yardi Matrix and its July Multifamily Rent Forecast Update. According to the report, “Rent increases have broadly accelerated more quickly than anticipated, and as such our forecasts have largely been adjusted upwards during the short term. Record breaking rent increases will be the norm across metros by the end of the year, but our longer-term outlook remains largely unchanged. In short, market fundamentals are good, and the strengthening jobs market should support continued longer term rent growth.”

Pairing market research from firms such as Freddie Mac & Yardi with the recent performance of the Company’s existing assets, we believe that the long-term market for investment in multifamily communities is compelling from a risk-return perspective. We fundamentally believe in the strategy to acquire multifamily properties due to the asset class’s resiliency during downturns and potential long-term appreciation. We have acquired, and will continue to acquire, cash-producing investments that meet our investment criteria, and we will continue to employ an acquisition strategy that supports this goal. The combination of our team’s vast experience in underwriting potential acquisitions and executing business plans positions the Company to take advantage of strong market conditions.

INVESTMENT STRATEGY

Since inception in MogulREIT II, we have focused on two key objectives: realize capital appreciation in the value of our investments over the long term and pay attractive and stable cash distributions to shareholders.

We have made, and intend to continue to make, preferred equity and joint venture equity investments in multifamily properties located in target markets throughout the United States. We have invested, and intend to continue to invest, in apartment communities that have demonstrated consistently high occupancy and income levels across market cycles as well as multifamily properties that offer value added opportunities with appropriate risk-adjusted returns and opportunity for value appreciation. We will invest in the following types of assets: equity or preferred equity interests in companies whose primary business is to own and operate one or more specified multifamily projects.

For our value-add multifamily investments, our investment strategy involves acquiring apartment communities that can benefit from a value-add plan in which the real estate operator is making both exterior improvements, such as adding amenities like playgrounds, clubhouses and outdoor living areas, as well as interior improvements such as upgraded appliances, air conditioning and finishes. We believe that these investments have a high value from an investment standpoint and also a local community standpoint by enhancing previously underserviced apartment buildings. We also believe that these properties offer downside protection on one’s investment due to the large number of tenants at each property and the adaptability of individual property business plans.

Our Manager, through its affiliates, intends to structure, underwrite and originate many of the products in which we will invest as we believe that this provides for the best opportunity to control our borrower and partner relationships and optimize the terms of our investments. Our affiliates’ underwriting process, which our management team has successfully developed over their extensive real estate careers in a variety of market conditions and implemented at Realty Mogul, Co., will involve comprehensive financial, structural, operational and legal due diligence of our borrowers and partners in order to optimize pricing and structuring and mitigate risk. We believe the current and future market environment provides a wide range of opportunities to generate compelling investments with strong risk-return profiles for our stockholders.

Critical Accounting Policies

The preparation of financial statements in accordance with GAAP requires management to use judgment in the application of accounting policies, including making estimates and assumptions. Such judgments are based on our management’s experience, our historical experience, the experience of our Manager’s affiliates, and the industry. We consider these policies critical because we believe that understanding these policies is critical to understanding and evaluating our reported financial results. Additionally, these policies may involve significant management judgments and assumptions, or require estimates about matters that are inherently uncertain. These judgments will affect the reported amounts of assets and liabilities and our disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting periods. With different estimates or assumptions, materially different amounts could be reported in our financial statements. Additionally, other companies may utilize different estimates that may impact the comparability of our results of operations to those of companies in similar businesses.

Please refer to “Note 2 — Summary of Significant Accounting Policies,” in Item 3. “Financial Statements” contained in this report, for a more thorough discussion of our accounting policies and procedures.

Off-Balance Sheet Arrangements

As of June 30, 2021, we had no off-balance sheet arrangements.

Related Party Arrangements

For further details, please see “Note 8 — Related Party Arrangements” in Item 3. “Financial Statements” below.

Non-GAAP Financial Measures

Our Manager believes that funds from operations (“FFO”) and adjusted funds from operations (“AFFO”), each of which are non-GAAP measures, are additional appropriate measures of the operating performance of a REIT and the Company. We compute FFO in accordance with the standards established by the National Association of Real Estate Investment Trusts (“NAREIT”), as net income or loss (computed in accordance with GAAP), excluding gains or losses from sales of depreciable properties, the cumulative effect of changes in accounting principles, real estate-related depreciation and amortization, and after adjustments for unconsolidated/uncombined partnerships and joint ventures. FFO, as defined by NAREIT, is a computation made by analysts and investors to measure a real estate company’s cash flow generated by operations.

We calculate AFFO by subtracting from (or adding to) FFO:

| | ● | the amortization or accrual of various deferred costs; and |

| | ● | an adjustment to reverse the effects of unrealized gains/(losses) |

Our calculation of AFFO differs from the methodology used for calculating AFFO by certain other REITs and, accordingly, our AFFO may not be comparable to AFFO reported by other REITs. Our management utilizes FFO and AFFO as measures of our operating performance, and believes they are also useful to investors, because they facilitate an understanding of our operating performance after adjustment for certain non-cash expenses. Additionally, FFO and AFFO serve as measures of our operating performance because they facilitate evaluation of the Company without the effects of selected items required in accordance with GAAP that may not necessarily be indicative of current operating performance and that may not accurately compare our operating performance between periods. Furthermore, although FFO, AFFO and other supplemental performance measures are defined in various ways throughout the REIT industry, we also believe that FFO and AFFO may provide us and our investors with an additional useful measure to compare our financial performance to certain other REITs.

Neither FFO nor AFFO is equivalent to net income or cash generated from operating activities determined in accordance with GAAP. Furthermore, FFO and AFFO do not represent amounts available for management’s discretionary use because of needed capital replacement or expansion, debt service obligations or other commitments or uncertainties. Neither FFO nor AFFO should be considered as an alternative to net income as an indicator of our operating performance or as an alternative to cash flow from operating activities as a measure of our liquidity.

Our unaudited FFO and AFFO calculations for the six months ended June 30, 2021, are as follows:

| | | For the Period Ended June 30, 2021 (in thousands) | |

| GAAP net loss attributable to MogulREIT II, Inc. | | $ | (1,024 | ) |

| Add: depreciation of properties | | | 2,325 | |

| Adjustments for noncontrolling interests | | | (1,259 | ) |

| Adjustments for Unrealized gain on marketable securities | | | 91 | |

| Adjustments for realized gain on marketable securities | | | (58 | ) |

| Adjustments for Gain from equity method investee | | | (30 | ) |

| Adjustments for equity method investments | | | 166 | |

| Funds from operations (“FFO”) applicable to common stock | | | 211 | |

| Add: amortization of lease intangibles | | | 374 | |

| Add: amortization of deferred financing costs, discount and premium | | | 101 | |

| Adjustments for noncontrolling interests | | | (246 | ) |

| Adjusted funds from operations (“AFFO”) applicable to common stock | | $ | 440 | |

Item 2. Other Information

None.

Item 3. Financial Statements

MogulREIT II, Inc.

Index

MogulREIT II, Inc.

Consolidated Balance Sheets

As of June 30, 2021 (unaudited) and December 31, 2020 (audited)

(Amounts in thousands, except share and per share data)

| | | As of June 30, 2021 | | | As of December 31, 2020 | |

| ASSETS | | | | | | | | |

| Real estate investments, at cost | | | | | | | | |

| Land | | $ | 42,045 | | | $ | 32,711 | |

| Buildings and improvements | | | 129,174 | | | | 90,322 | |

| Total real estate investments, at cost | | | 171,219 | | | | 123,033 | |

| Less accumulated depreciation | | | (8,244 | ) | | | (7,641 | ) |

| Real estate investments, net | | | 162,975 | | | | 115,392 | |

| Real estate held for sale | | | 19,866 | | | | - | |

| Investments in real estate, equity method | | | 421 | | | | 657 | |

| Marketable securities, at fair value | | | 1,674 | | | | 4,164 | |

| Cash and cash equivalents | | | 9,848 | | | | 8,679 | |

| Escrows and deposits | | | 6,491 | | | | 4,464 | |

| Rent receivable, net | | | 708 | | | | 485 | |

| Intangible lease assets, net | | | 538 | | | | - | |

| Stock subscription receivable | | | 170 | | | | 52 | |

| Deferred offering costs, net | | | 218 | | | | 183 | |

| Prepaid expenses | | | 334 | | | | 243 | |

| Other receivable | | | 36 | | | | 35 | |

| Total Assets | | $ | 203,279 | | | $ | 134,354 | |

| | | | | | | | | |

| LIABILITIES AND EQUITY | | | | | | | | |

| Liabilities: | | | | | | | | |

| Mortgages payable, net of $2,469 and $853 of deferred financing costs and $1,084 and $0 premium | | $ | 150,093 | | | $ | 94,534 | |

| Accounts payable and accrued expenses | | | 2,176 | | | | 2,483 | |

| Settling subscription payable | | | 365 | | | | 229 | |

| Deferred offering costs payable | | | 6 | | | | 36 | |

| Dividends payable | | | 389 | | | | 333 | |

| Other liabilities | | | 850 | | | | 609 | |

| Asset management fee payable | | | 45 | | | | 31 | |

| Total Liabilities | | | 153,924 | | | | 98,255 | |

| | | | | | | | | |

| Equity: | | | | | | | | |

| Common stock, $0.01 par value; 9,000,000 shares authorized; 3,316,621 and 2,994,468 shares issued and outstanding, as of June 30, 2021 and December 31, 2020, respectively | | | 33 | | | | 30 | |

| Additional paid-in capital | | | 28,705 | | | | 26,266 | |

| Accumulated deficit | | | (7,895 | ) | | | (6,871 | ) |

| Total MogulREIT II, Inc. equity | | | 20,843 | | | | 19,425 | |

| Noncontrolling interests in consolidated joint ventures | | | 28,512 | | | | 16,674 | |

| Total Equity | | | 49,355 | | | | 36,099 | |

| | | | | | | | | |

| Total Liabilities and Equity | | $ | 203,279 | | | $ | 134,354 | |

The accompanying notes are an integral part of these consolidated financial statements.

MogulREIT II, Inc.

Consolidated Statements of Operations

For the Six Months ended June 30, 2021 (unaudited) and June 30, 2020 (unaudited)

(Amounts in thousands)

| | | For the Six Months Ended June 30, 2021 | | | For the Six Months Ended June 30, 2020 | |

| Revenues | | | | | | | | |

| Rental income, net | | $ | 7,346 | | | $ | 4,932 | |

| Tenant reimbursements and other revenue | | | 866 | | | | 496 | |

| Interest income on debt investment | | | - | | | | 14 | |

| Equity in losses of investees | | | (236 | ) | | | (181 | ) |

| Gain from equity method investee | | | 30 | | | | - | |

| Total revenues | | | 8,006 | | | | 5,261 | |

| | | | | | | | | |

| Operating expenses | | | | | | | | |

| Depreciation and amortization | | | 2,699 | | | | 1,596 | |

| General and administrative expenses | | | 678 | | | | 785 | |

| Real estate operating expenses | | | 3,704 | | | | 2,293 | |

| Asset management fees | | | 295 | | | | 343 | |

| Total operating expenses | | | 7,376 | | | | 5,017 | |

| Operating income | | | 630 | | | | 244 | |

| Other (income) and expenses | | | | | | | | |

| Interest expense | | | 2,092 | | | | 1,695 | |

| Other (income) expenses | | | (51 | ) | | | 24 | |

| Unrealized loss on marketable securities | | | 91 | | | | - | |

| Realized gain on marketable securities | | | (58 | ) | | | - | |

| Consolidated net loss | | | (1,444 | ) | | | (1,475 | ) |

| Net loss attributable to noncontrolling interests | | | (420 | ) | | | (468 | ) |

| Net loss attributable to MogulREIT II, Inc. | | $ | (1,024 | ) | | $ | (1,007 | ) |

The accompanying notes are an integral part of these consolidated financial statements.

MogulREIT II, Inc.

Consolidated Statements of Equity

For the Six Months ended June 30, 2021 (unaudited) and June 30, 2020 (unaudited)

(Amounts in thousands, except share data)

| | | Common Stock | | | Additional Paid-in | | | Accumulated | | | Total MogulREIT II Inc. | | | Noncontrolling interests in Consolidated Joint | | | Total | |

| | | Shares | | | Amount | | | Capital | | | Deficit | | | Equity | | | Ventures | | | Equity | |

| Balance as of December 31, 2019 | | | 2,460,817 | | | $ | 25 | | | $ | 22,299 | | | $ | (4,913 | ) | | $ | 17,411 | | | $ | 12,808 | | | $ | 30,219 | |

| Proceeds from issuance of common stock, net of syndication costs | | | 320,946 | | | | 3 | | | | 3,289 | | | | - | | | | 3,292 | | | | - | | | | 3,292 | |

| Stock award | | | 3,500 | | | | - | | | | 34 | | | | - | | | | 34 | | | | - | | | | 34 | |

| Amortization of deferred offering costs | | | - | | | | - | | | | (88 | ) | | | - | | | | (88 | ) | | | - | | | | (88 | ) |

| Dividends declared on common stock | | | - | | | | - | | | | (609 | ) | | | - | | | | (609 | ) | | | - | | | | (609 | ) |

| Repurchase of common stock | | | (41,855 | ) | | | - | | | | (405 | ) | | | - | | | | (405 | ) | | | - | | | | (405 | ) |

| Contributions from noncontrolling interests, net of syndication costs | | | - | | | | - | | | | - | | | | - | | | | - | | | | (49 | ) | | | (49 | ) |

Distributions to

noncontrolling interests | | | - | | | | - | | | | - | | | | - | | | | - | | | | (1,252 | ) | | | (1,252 | ) |

| Net loss | | | - | | | | - | | | | - | | | | (1,007 | ) | | | (1,007 | ) | | | (468 | ) | | | (1,475 | ) |

| Balance as of June 30, 2020 | | | 2,743,408 | | | $ | 28 | | | $ | 24,520 | | | $ | (5,920 | ) | | $ | 18,628 | | | $ | 11,039 | | | $ | 29,667 | |

| | | Common Stock | | | Additional Paid-in | | | Accumulated | | | Total MogulREIT II Inc. | | | Noncontrolling interests in Consolidated Joint | | | Total | |

| | | Shares | | | Amount | | | Capital | | | Deficit | | | Equity | | | Ventures | | | Equity | |

| Balance as of December 31, 2020 | | | 2,994,468 | | | $ | 30 | | | $ | 26,266 | | | $ | (6,871 | ) | | $ | 19,425 | | | $ | 16,674 | | | $ | 36,099 | |

| Proceeds from issuance of common stock, net of syndication costs | | | 386,233 | | | | 4 | | | | 3,951 | | | | - | | | | 3,955 | | | | - | | | | 3,955 | |

| Stock award | | | 4,500 | | | | - | | | | 46 | | | | - | | | | 46 | | | | - | | | | 46 | |

| Amortization of deferred offering costs | | | - | | | | - | | | | (99 | ) | | | - | | | | (99 | ) | | | - | | | | (99 | ) |

| Dividends declared on common stock | | | - | | | | - | | | | (732 | ) | | | - | | | | (732 | ) | | | - | | | | (732 | ) |

| Repurchase of common stock | | | (68,580 | ) | | | (1 | ) | | | (727 | ) | | | - | | | | (728 | ) | | | - | | | | (728 | ) |

| Contributions from noncontrolling interests, net of syndication costs | | | - | | | | - | | | | - | | | | - | | | | - | | | | 14,244 | | | | 14,244 | |

| Distributions to noncontrolling interests | | | - | | | | - | | | | - | | | | - | | | | - | | | | (1,986 | ) | | | (1,986 | ) |

| Net loss | | | - | | | | - | | | | - | | | | (1,024 | ) | | | (1,024 | ) | | | (420 | ) | | | (1,444 | ) |

| Balance as of June 30, 2021 | | | 3,316,621 | | | $ | 33 | | | $ | 28,705 | | | $ | (7,895 | ) | | $ | 20,843 | | | $ | 28,512 | | | $ | 49,355 | |

The accompanying notes are an integral part of these consolidated financial statements.

MogulREIT II, Inc.

Consolidated Statements of Cash Flows

For the Six Months ended June 30, 2021 (unaudited) and June 30, 2020 (unaudited)

(Amounts in thousands)

| | | For the Six Months Ended June 30, 2021 | | | For the Six Months Ended June 30, 2020 | |

| OPERATING ACTIVITIES: | | | | | | | | |

| Consolidated net loss | | $ | (1,444 | ) | | $ | (1,475 | ) |

| Adjustments to reconcile consolidated net loss to net cash provided by operating activities: | | | | | | | | |

| Depreciation | | | 2,325 | | | | 1,596 | |

| Equity in loss of investees | | | 236 | | | | 181 | |

| Unrealized loss on marketable securities | | | 91 | | | | - | |

| Realized gain on marketable securities | | | (58 | ) | | | - | |

| Gain from equity method investee | | | (30 | ) | | | - | |

| Non-cash adjustment for stock award | | | 46 | | | | 34 | |

| Amortization of intangibles relating to leases | | | 374 | | | | - | |

| Amortization of deferred financing costs and premium | | | 101 | | | | 198 | |

| Distributions from equity method investee | | | - | | | | 532 | |

| Changes in assets and liabilities: | | | | | | | | |

| Net change in rent receivable | | | (223 | ) | | | (59 | ) |

| Net change in other receivable | | | (1 | ) | | | (79 | ) |

| Net change in prepaid expenses | | | (91 | ) | | | 63 | |

| Net change in accounts payable and accrued expenses | | | (307 | ) | | | 8 | |

| Net change in asset management fees payable | | | 14 | | | | 3 | |

| Net change in other liabilities | | | 241 | | | | 57 | |

| Net cash provided by operating activities | | | 1,274 | | | | 1,059 | |

| INVESTING ACTIVITIES: | | | | | | | | |

| Purchase of real estate | | | (69,222 | ) | | | - | |

| Improvements to real estate | | | (1,463 | ) | | | (965 | ) |

| Return of investment in equity method investee | | | 30 | | | | - | |

| Proceeds from sales of marketable securities | | | 2,458 | | | | - | |

| Net cash used in investing activities | | | (68,197 | ) | | | (965 | ) |

| FINANCING ACTIVITIES: | | | | | | | | |

| Proceeds from the issuance of common stock, net of syndication costs | | | 3,416 | | | | 3,001 | |

| Repurchase of common stock | | | (592 | ) | | | (354 | ) |

| Proceeds from the issuance of debt | | | 75,180 | | | | 4,810 | |

| Deferred offering costs paid | | | (164 | ) | | | (21 | ) |

| Repayment of debt | | | (17,976 | ) | | | (114 | ) |

| Payment of finance costs | | | (1,747 | ) | | | (247 | ) |

| Payment of cash dividends | | | (256 | ) | | | (209 | ) |

| Capital contributions from noncontrolling interests, net of syndication costs | | | 14,244 | | | | (49 | ) |

| Distributions to noncontrolling interests | | | (1,986 | ) | | | (1,252 | ) |

| Net cash provided by financing activities | | | 70,119 | | | | 5,565 | |

| | | | | | | | | |

| Net increase in cash, restricted cash and cash equivalents | | | 3,196 | | | | 5,659 | |

| Cash and restricted cash and equivalents, beginning of period | | | 13,143 | | | | 9,254 | |

| Cash and restricted cash and equivalents, end of period | | $ | 16,339 | | | $ | 14,913 | |

| | | | | | | | | |

| Cash paid for interest | | $ | 1,924 | | | $ | 1,167 | |

| | | | | | | | | |

| SUPPLEMENTAL DISCLOSURE OF NON-CASH INVESTING AND FINANCING ACTIVITY: | | | | | | | | |

| Change in deferred offering costs payable | | $ | (30 | ) | | $ | 15 | |

| Dividends declared but not paid | | $ | 56 | | | $ | 27 | |

| Distributions reinvested | | $ | 420 | | | $ | 374 | |

| Stock subscription receivable | | $ | (118 | ) | | $ | - | |

| Settling subscriptions payable | | $ | 136 | | | $ | 51 | |

| Investment distribution receivable | | $ | - | | | $ | (80 | ) |

The accompanying notes are an integral part of these consolidated financial statements.

MogulREIT II, Inc.

Notes to the Consolidated Financial Statements

June 30, 2021 (unaudited)

(Amounts in thousands, except share and per share data)

Note 1 - Formation and Organization

MogulREIT II, Inc. (the “Company”) was formed as a Maryland corporation on January 13, 2017 to own and manage a diversified portfolio of preferred equity, marketable securities, and joint venture equity investments in multifamily properties located in target markets throughout the United States. The use of the terms “MogulREIT II”, the “Company,” “we,” “us,” or “our” in this semiannual report refer to MogulREIT II, Inc., unless the context indicates otherwise.

The Company is externally managed by RM Adviser, LLC (“Manager”), which is an affiliate of the Company’s sponsor, RM Sponsor, LLC (“Sponsor”). Our Manager and our Sponsor are each wholly-owned subsidiaries of Realty Mogul, Co. (“RM”). Our Manager is an investment adviser registered with the Securities and Exchange Commission (“SEC”). Although our Manager manages our day-to-day operations, we operate under the direction of our board of directors, a majority of whom are independent directors.

The Company’s investing and management activities related to multifamily real estate are all considered a single reportable business segment for financial reporting purposes. All of the investments the Company has made to date have been in domestic multifamily real estate assets with similar economic characteristics, and the Company evaluates the performance of all of its investments using similar criterion.

We believe we have operated in such a manner as to qualify as a real estate investment trust (“REIT”) for federal income tax purposes. We hold substantially all of our assets directly, and as of the date of these consolidated financial statements, have not established an operating partnership or any taxable REIT subsidiary or qualified REIT subsidiary.

On August 23, 2017, we commenced our initial public offering (the “Initial Offering”) of up to $50,000 in shares of common stock. On December 23, 2020, we commenced our follow-on offering (the “Follow-on Offering”) and together with the Initial Offering, (the “Offerings”) of up to $43,522 in shares of common stock. Pursuant to the Follow-on Offering, we are offering up to $43,522 in shares of our common stock, including any shares that may be sold pursuant to our distribution reinvestment plan, which represents the value of the shares of our common stock available to be offered as of October 31, 2020 out of the rolling 12-month maximum offering amount of $50,000 in shares of our common stock. The SEC adopted an amendment to increase the maximum offering amount under Tier 2 of Regulation A from $50,000 to $75,000. This amendment is effective March 15, 2021, and the Company intends to utilize this increased offering amount in the future. As of June 30, 2021, we had issued 3,510,289 shares of our common stock in the Offerings for gross offering proceeds of approximately $35.3 million.

Note 2 - Summary of Significant Accounting Policies

Basis of Presentation and Principles of Consolidation

The accompanying consolidated balance sheets, statements of operations, statements of equity, statements of cash flows and related notes to the consolidated financial statements of the Company are prepared in accordance with generally accepted accounting principles in the United States of America (“GAAP”). The Company has adopted a calendar year-end for financial of reporting.

GAAP requires any subsidiaries, investments, or affiliates under the Company’s control to be consolidated. The consolidated financial statements of the Company include its controlled joint ventures, Travertine North Park Investors, LLC and Vinegar Hill Asset, LLC, which were acquired during 2017, Avon 46, LLC, which was acquired during 2018, RM Terrace Hill, LLC, which was acquired during 2019, NinetyNine44 Owner, LLC, which was acquired during 2020 and RM Orion, LLC and Lotus Village Holdco, LLC, which were acquired during 2021.

MogulREIT II, Inc.

Notes to the Consolidated Financial Statements

June 30, 2021 (unaudited)

(Amounts in thousands)

All significant intercompany balances and transactions are eliminated in consolidation.

In the opinion of management, all adjustments considered necessary for a fair presentation of the Company’s financial position, results of operations and cash flows have been included and are of a normal and recurring nature. Interim results are not necessarily indicative of operating results for any other interim period or for the entire year and certain disclosures may be condensed for interim reporting. These financial statements should be read in conjunction with the Company’s consolidated financial statements and notes thereto included in the Company’s annual report on Form 1-K for the fiscal year ended December 31, 2020, which was filed with the SEC on April 29, 2021.

Reclassification of Prior Year Presentation

Certain amounts in the prior period have been reclassified to conform to the current year presentation in connection with the classification of “General and administrative expenses”, “Real estate operating expenses” and “Asset management fees” on the consolidated statements of operations. The reclassification had no effect on the previously reported totals (e.g. operating income (loss) and consolidated net loss).

Use of Estimates

The preparation of the consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements. Actual events and results could differ from those assumptions and estimates.

Cash and Cash Equivalents

Cash and cash equivalents consist of demand deposits. Cash and cash equivalents are carried at cost which approximates fair value.

Concentration of Credit Risk

At times, our cash may exceed the Federal Deposit Insurance Corporation deposit insurance limit of $250 per institution. The Company mitigates credit risk by placing cash with major financial institutions. To date, the Company has not experienced any losses on cash.

Geographic concentration

As of June 30, 2021, the Company’s investments in real estate operate in Texas, Connecticut, New York and Michigan. Future operations could be affected by changes in economic or other conditions in those geographical areas or the demand for such housing in those geographical areas.

For the six months ended June 30, 2021, the Company’s annualized rental income in real estate equity investments by state is approximately 53%, 17%, 17% and 12%, for Texas, Connecticut, Michigan and New York, respectively.

MogulREIT II, Inc.

Notes to the Consolidated Financial Statements

June 30, 2021 (unaudited)

(Amounts in thousands)

Organizational, Offering and Related Costs

Organizational and offering costs of the Company are initially being paid by the Manager on behalf of the Company. These organizational and offering costs include all expenses to be paid by the Company in connection with the formation of the Company and the qualification of the Offerings, and the marketing and distribution of shares, including, without limitation, expenses for printing, and amending offering statements or supplementing offering circulars, mailing and distributing costs, advertising and marketing expenses, charges of experts and fees, expenses and taxes related to the filing, registration and qualification of the sale of shares under federal and state laws, including taxes and fees and accountants’ and attorneys’ fees.

The Company expenses organization costs as incurred and offering costs, when incurred, will be deferred and charged to additional paid-in capital. The deferred offering costs will be charged against the gross proceeds of the Offerings when received or written off in the event that the Follow-on Offering is not successfully completed.

As of June 30, 2021 and December 31, 2020, the Manager has incurred offering costs of $1,217 and $1,083, respectively, on behalf of the Company. As of June 30, 2021 and December 31, 2020, $999 and $901 of offering costs, respectively, had been amortized and were included in the consolidated statements of equity.

Variable Interest Entities and Voting Interest Entities

A variable interest entity (“VIE”) is an entity that lacks one or more of the characteristics of a voting interest entity. A VIE is defined as an entity in which equity investors do not have the characteristics of a controlling financial interest or do not have sufficient equity at risk for the entity to finance its activities without additional subordinated financial support from other parties. The determination of whether an entity is a VIE includes consideration of various factors. These factors include review of the formation and design of the entity, its organizational structure including decision-making ability and relevant financial agreements, and analysis of the forecasted cash flows of the entity. We make an initial determination upon acquisition of a VIE, and reassess the initial evaluation of an entity as a VIE upon the occurrence of certain events.

A VIE must be consolidated only by its primary beneficiary, which is defined as the party who, along with its affiliates and agents has both the: (i) power to direct the activities that most significantly impact the VIE’s performance; and (ii) obligation to absorb the losses of the VIE or the right to receive the benefits from the VIE, which could be significant to the VIE. We determine whether we are the primary beneficiary of a VIE by considering various factors, including, but not limited to: which activities most significantly impact the VIE’s economic performance and which party controls such activities; the amount and characteristics of its investment; the obligation or likelihood for us or other interests to provide financial support; consideration of the VIE’s purpose and design, including the risks the VIE was designed to create and pass through to its variable interest holders and the similarity with and significance to the business activities of our interest and the other interests. We reassess our determination of whether we are the primary beneficiary of a VIE each reporting period. Significant judgments related to these determinations include estimates about the future performance of investments held by VIEs and general market conditions. The maximum risk of loss related to our investments is limited to our recorded investment in such entities, if any.

A voting interest entity (“VOE”) is an entity in which equity investors have the characteristics of a controlling financial interest and has sufficient equity at risk to finance its activities. A controlling financial interest exists if limited partners with equity at risk are able to exercise substantive kick-out rights or are able to exercise substantive participation rights. Under the VOE model, generally, only a single limited partner that is able to exercise substantial kick-out rights will consolidate the entity.

MogulREIT II, Inc.

Notes to the Consolidated Financial Statements

June 30, 2021 (unaudited)

(Amounts in thousands)

As of both June 30, 2021 and December 31, 2020, the Company held investments in three entities, which were evaluated under the VOE model and were not consolidated because the Company does not have substantive kick-out rights or a controlling financial interest. These investments are carried on the equity method because of the Company’s significant influence.

As of June 30, 2021 and December 31, 2020, the Company held investments in seven and five entities, respectively, which were evaluated under the VOE model and are consolidated because the Company is able to exercise substantial kick-out rights and substantive participating rights.

Income Taxes

The Company operates and is taxed as a REIT for federal income tax purposes beginning the year ended December 31, 2017. To qualify as a REIT, the Company must meet certain organizational and operational requirements, including a requirement to distribute at least 90% of its taxable income to its stockholders. As a REIT, the Company generally is not subject to federal corporate income tax on that portion of its taxable income that is currently distributed to stockholders. Even if the Company qualifies for taxation as a REIT, it may be subject to certain state and local taxes on its income and property, and federal income and excise taxes on its undistributed income. No material provisions have been made for federal income taxes in the accompanying consolidated financial statements, and no gross deferred tax assets or liabilities have been recorded as of June 30, 2021 and December 31, 2020.

For the six months ended June 30, 2021 and the year ended December 31, 2020, $732 and $1,255, respectively, in distributions have been made to stockholders. The Company expects its distributions to be characterized for federal income tax purposes as (i) ordinary income, (ii) non-taxable return of capital, or (iii) long-term capital gain. Distributions that exceed current or accumulated taxable earnings and profits constitute a return of capital for tax purposes and reduce the stockholders’ basis in the shares of common stock. To the extent that distributions exceed both current and accumulated earnings and profits and the stockholders’ basis in shares of common stock, they will generally be treated as a gain or loss upon the sale or exchange of our stockholders’ shares of common stock. We will report the taxability of such distributions in information returns that will be provided to our stockholders and filed with the Internal Revenue Service in the year following such distributions.

All tax periods since inception remain open to examination by the major taxing authorities in all jurisdictions where we are subject to taxation.

Stock Subscription Receivable

Stock subscription receivable consists of shares that have been issued with subscriptions that have not yet settled. As of June 30, 2021 and December 31, 2020, there was $170 and $52, respectively, in subscriptions that had not settled. All of these funds settled subsequent to June 30, 2021 and December 31, 2020, respectively. Stock subscription receivable are carried at cost which approximates fair value.

Settling Subscription Payable

Share repurchases initiated in June 2021 and December 2020 were settled in August 2021 and in February 2021, respectively. The settling subscription payable are recorded on the consolidated balance sheet as Settling Subscription Payable as of June 30, 2021 and December 31, 2020, respectively. These liabilities were reversed subsequent to June 30, 2021 when the share repurchases settled in August 2021 and February 2021, respectively.

MogulREIT II, Inc.

Notes to the Consolidated Financial Statements

June 30, 2021 (unaudited)

(Amounts in thousands)

Revenue Recognition

Rental income is recognized as rentals become due. Rental payments received in advance are deferred until earned. All leases between the Company and tenants of the property are operating leases and are one year or less.

For certain properties, in addition to contractual base rent, the tenants pay their share of utilities to the Company. The income and expenses associated with these properties are generally recorded on a gross basis when the Company is the primary obligor.

Tenant fees, such as application fees, administrative fees, late fees, and other revenues from tenants are recorded when amounts become due.

As a result of the adoption of ASC 606, Revenue from Contracts with Customers (“ASC 606”), the Company has updated its policies as it relates to revenue recognition. Revenue is measured based on consideration specified in a contract with a customer. The Company recognizes revenue when it satisfies a performance obligation by transferring control over a product or service to a customer. The adoption of ASC 606 in 2019 did not materially change our revenue recognition patterns.

Purchase Accounting for Acquisitions of Real Estate

Prior to January 1, 2018, the Company recorded acquired real estate investments that are consolidated as business combinations when the real estate is occupied, at least in part, at acquisition. Costs directly related to the acquisition of such investments have been expensed as incurred. The purchase consideration included cash paid, the fair value of equity or other assets issued, and the fair value of any assumed debt. The Company assessed the fair value of assumed debt based on estimated cash flow projections that utilize appropriate discount rates and available market information. Such inputs are categorized as Level 3 in the fair value hierarchy. The difference between the fair value and the stated principal of assumed debt is amortized using the effective interest method basis over the terms of the respective debt obligation.

The Company allocated the fair value of the purchase consideration to the fair value of land, buildings, site improvements and intangible assets including in-place leases at the acquisition date. The Company estimated the fair value of the assets using market-based, cost-based, and income-based valuation techniques.

Effective January 1, 2018, the Company adopted the provisions of Accounting Standards Update 2017-01, Business Combinations (Topic 805): Clarifying the Definition of a Business, which provides that if substantially all the fair value of the gross assets is concentrated in any individual asset, the acquisition is treated as an asset acquisition as opposed to a business combination. Under an asset acquisition, costs directly related to the acquisition are capitalized as part of the purchase consideration. The fair value of the purchase consideration is then allocated based on the relative fair value of the assets. The estimates of the fair value of the purchase consideration and the fair value of the assets acquired is consistent with the techniques used in a business combination.

MogulREIT II, Inc.

Notes to the Consolidated Financial Statements

June 30, 2021 (unaudited)

(Amounts in thousands)

Investments in Equity Method Investees

If it is determined that we do not have a controlling interest in a joint venture through our financial interest in a VIE or through our voting interest in a VOE and we have the ability to provide significant influence, the equity method of accounting is used. Under this method, the investment, originally recorded at cost, is adjusted to recognize our share of net earnings or losses of the affiliate as they occur, with losses limited to the extent of our investment in, advances to, and commitments to the investee. For the six months ended June 30, 2021 and June 30, 2020, we recorded a loss of $236 and $181, respectively, related to investments in equity method investees.

Distributions received from an equity method investee are recognized as a reduction in the carrying amount of the investment. If distributions are received from an equity method investee that would reduce the carrying amount of an equity method investment below zero, the Company evaluates the facts and circumstances of the distributions to determine the appropriate accounting for the excess distribution, including an evaluation of the source of the proceeds and implicit or explicit commitments to fund the equity method investee. The excess distribution is either recorded as a gain from equity method investee, or in instances where the source of proceeds is from financing activities or the Company has a significant commitment to fund the investee, the excess distribution would result in an equity method liability and the Company would continue to record its share of the equity method investee’s earnings and losses. When the Company does not have a significant requirement to contribute additional capital over and above the original capital commitment and the carrying value of the investment in the unconsolidated venture is reduced to zero, the Company discontinues applying the equity method of accounting unless the venture has an expectation of an imminent return to profitability. If the venture subsequently reports net income, the equity method of accounting is resumed only after the Company’s share of that net income equals the share of net losses or distributions not recognized during the period the equity method was suspended. The Company has elected to classify distributions from equity method investees under the cumulative-earnings approach. For the six months ended June 30, 2021 and June 30, 2020, the Company recorded a gain from equity method investee of $30 and $0, respectively, related to a distribution that would have reduced the carrying value of the investment below zero.

The Company evaluates its investments in equity method investees for impairment annually or whenever events or changes in circumstances indicate that there may be an other-than-temporary decline in value. To do so, the Company would calculate the estimated fair value of the investment using various valuation techniques, including, but not limited to, discounted cash flow models, the Company’s intent and ability to retain its investment in the entity, the financial condition and long-term prospects of the entity, and the expected term of the investment. If the Company determined any decline in value is other-than-temporary, the Company would recognize an impairment charge to reduce the carrying value of its investment to fair value. As of both June 30, 2021 and December 31, 2020, the Company determined that there was no impairment of its investments in equity method investees.

MogulREIT II, Inc.

Notes to the Consolidated Financial Statements

June 30, 2021 (unaudited)

(Amounts in thousands)

Accounting for Long-Lived Assets and Impairment of Real Estate Owned

The Company reviews its real estate portfolio on a quarterly basis to ascertain if there are any indicators of impairment to the value of any of its real estate assets, including deferred costs and intangibles, to determine if there is any need for an impairment charge. In reviewing the portfolio, the Company examines one or more of the following: the type of asset, the current financial statements or other available financial information of the asset, and the economic situation in the area in which the asset is located. For each real estate asset owned for which indicators of impairment exist, management performs a recoverability test by comparing the sum of the estimated undiscounted future cash flows attributable to the asset to its carrying amount. If the aggregate undiscounted cash flows are less than the asset’s carrying amount, an impairment loss is recorded to the extent that the estimated fair value is less than the asset’s carrying amount. The estimated fair value is determined using a discounted cash flow model of the expected future cash flows through the useful life of the property. The analysis includes an estimate of the future cash flows that are expected to result from the real estate investment’s use and eventual disposition. These cash flows consider factors such as expected future operating income, trends and prospects, the effects of leasing demand, competition and other factors.

As of both June 30, 2021 and December 31, 2020, the Company determined that there was no impairment of long-lived assets.

Real Estate Held for Sale

The Company classifies real estate investment as being held for sale when management commits to a plan to sell the asset, the asset is available for immediate sale, an active program to locate a buyer has been initiated, the sale is highly probable to occur within one year, and it is unlikely that significant changes to the plan will be made. When a real estate investment is classified as held for sale, depreciation of the asset is discontinued and the asset is carried at the lower its carrying amount and the fair value less costs to sell. As of June 30, 2021, the Company determined that Terrace Hill Apartments should be classified as held for sale at its carrying value in the amount of $19,865.

Restricted Cash and Escrows

In November 2016, the FASB issued Accounting Standards Updated 2016-18 (“ASU 2016-18”) Statement of Cash Flows: Restricted Cash, which clarifies the presentation requirements of restricted cash within the statement of cash flows. The standard requires that changes in restricted cash and restricted cash equivalents during the period be included in the beginning and ending cash and cash equivalents balance reconciliation on the statement of cash flows. The adoption of this standard during 2019 results in amounts previously recorded in cash provided by (used in) operating activities on the statement of cash flows to be included in the beginning and ending balances of Cash and Restricted Cash and Equivalents on the statements of cash flows.

The adoption of this standard results in amounts detailed below that are reported as restricted cash and escrows and deposits on the balance sheet to be included in Cash and Restricted Cash and Equivalents on the statements of cash flows.

MogulREIT II, Inc.

Notes to the Consolidated Financial Statements

June 30, 2021 (unaudited)

(Amounts in thousands)

The following are the amounts reported on the consolidated balance sheets that are included in Cash and Restricted Cash and Equivalents on the consolidated statements of cash flows:

| | | June 30, 2021 | | | June 30, 2020 | |

| | | | | | | |

| Cash and cash equivalents | | $ | 9,848 | | | $ | 13,379 | |

| | | | | | | | |

| Restricted cash, escrows and deposit | | | 6,491 | | | | 1,534 | |

| | | | | | | | | |

| Total cash and restricted cash and equivalents | | $ | 16,339 | | | $ | 14,913 | |

Allowance for Doubtful Accounts

The Company maintains an allowance for doubtful accounts for estimated losses resulting from the inability of a tenant to make required rent payments. As of June 30, 2021 and December 31, 2020, there was $236 and $258, respectively, in the allowance for doubtful accounts. The Company records bad debt expense in real estate operating expenses in the consolidated statements of operations.

Depreciation

Depreciation of assets is computed on the straight-line method over the estimated useful life of the asset. Depreciation of buildings is computed on the straight-line method over an estimated useful life ranging from 30 to 45 years. Site improvements and certain building improvements are depreciated on the straight-line method over an estimated useful life of 10 to 15 years, and depreciation of furniture, fixtures and equipment is computed on the straight-line method over an estimated useful life of 5 to 7 years. Improvements are capitalized, while expenditures for maintenance and repairs are charged to expense as incurred. Depreciation expense amounted to $2,325 and $1,596 for the six months ended June 30, 2021 and June 30, 2020, respectively.

Advertising costs

The Company’s policy is to expense advertising costs when incurred. Such costs incurred during the six months ended June 30, 2021 and June 30, 2020 were $92 and $73, respectively.

Deferred Financing Costs

Mortgage costs are deferred and amortized using the straight-line method which management does not believe is materially different than the effective interest rate method, over the terms of the respective debt obligations. At June 30, 2021, deferred financing costs amounted to $2,469, net of accumulated amortization of $687. At December 31, 2020, deferred financing costs amounted to $853, net of accumulated amortization of $557. The Company presents unamortized deferred financing costs as a direct deduction from the carrying amount of the related debt liability.

Fair Value

Fair value is the exchange price that would be received for an asset or paid to transfer a liability (exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. There are three levels of inputs that may be used to measure fair values:

Level 1 — Quoted prices (unadjusted) for identical assets or liabilities in active markets that the entity has the ability to access as of the measurement date.

MogulREIT II, Inc.

Notes to the Consolidated Financial Statements

June 30, 2021 (unaudited)

(Amounts in thousands)

Level 2 — Significant other observable inputs other than Level 1 prices such as quoted prices for similar assets or liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data.

Level 3 — Significant unobservable inputs that reflect a company’s own assumptions about the assumptions that market participants would use in pricing an asset or liability.

On a recurring basis, the Company measures its investment in marketable securities at fair value consisting of its investment in exchange traded funds. The exchange traded funds are freely tradeable in active markets and fair value is based on the quoted market price for identical securities, which represents a Level 1 input and Level 1 measurement. The marketable securities are treated as trading securities with unrealized gains and losses from the change in fair value reported in the consolidated statements of operations.