UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1‑SA

SPECIAL FINANCIAL REPORT PURSUANT TO REGULATION A

For the fiscal semiannual period ended June 30, 2019

MOGULREIT II, Inc.

(Exact name of issue as specified in its charter)

Maryland | | 81-5263630 |

(State or other jurisdiction | | (I.R.S. Employer |

of incorporation or organization) | | Identification No.) |

| | |

10780 Santa Monica Blvd, Suite 140 | | |

Los Angeles, CA | | 90025 |

(Full mailing address of | | (Zip code) |

principal executive offices) | | |

(877) 781‑7153

(Issuer’s telephone number, including area code)

Item 1. Management’s Discussion and Analysis of Financial Condition and Results of Operations

An investment in our common stock involves substantial risks. You should carefully consider the risk factors in addition to the other information contained in our offering circular before purchasing shares. The occurrence of the stated risks might cause you to lose a significant part, or all, of your investment. The risks and uncertainties discussed in the offering circular are not the only ones we face, but do represent those risks and uncertainties that we believe are most significant to our business, operating results, prospects and financial condition. Some statements in this semiannual report constitute forward-looking statements. These forward-looking statements involve known and unknown risks, uncertainties and other important factors that could cause our actual results, performance or achievements, or industry results, to differ materially from those expressed or implied by these forward-looking statements, and you are cautioned not to place undue reliance on any forward-looking statements included in this semiannual report. Except as otherwise required by federal securities laws, we do not undertake to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Operating Results

Overview

MogulREIT II, Inc. is a Maryland corporation formed on January 13, 2017 to own and manage a diversified portfolio of preferred equity and joint venture equity investments in multifamily properties located in target markets throughout the United States. The use of the terms “MogulREIT II”, the “Company,” “we,” “us” or “our” in this semiannual report refer to MogulREIT II, Inc., unless the context indicates otherwise. We are externally managed by RM Adviser, LLC, (our “Manager”), which is an investment adviser registered with the Securities and Exchange Commission (“SEC”) and a wholly-owned subsidiary of RM Sponsor, LLC (our “Sponsor”). Both our Manager and our Sponsor are wholly-owned subsidiaries of Realty Mogul, Co. Although our Manager manages our day-to-day operations, we operate under the direction of our board of directors, majority of whom are independent directors. Our affiliate, RM Technologies, LLC operates an online investment platform, www.realtymogul.com. We currently are offering, pursuant to Regulation A of the Securities Act of 1933, as amended (the “Securities Act”), up to $50,000,000 in shares of our common stock, including any shares that may be sold pursuant to our distribution reinvestment plan (the “Offering”) and such shares are being offered in the Offering exclusively through the aforementioned platform. The Offering was qualified by the SEC on August 23, 2017, and we commenced operations on September 18, 2017.

As of June 30, 2019, we had raised total gross offering proceeds of approximately $18,374,444 from settled subscriptions and issued an aggregate of 1,837,444 shares of our common stock. Assuming the settlement for all subscriptions received, as of June 30, 2019, approximately 3,162,556 in shares of our common stock remained available for sale to the public pursuant to the Offering. We intend to use substantially all of the net proceeds from the Offering (after paying or reimbursing organization and offering expenses) to invest in and manage a diverse portfolio of preferred equity and joint venture equity investments in multifamily properties located in target markets throughout the United States.

Results of Operations

Our consolidated financial statements are presented for the six months ended June 30, 2019, resulting in a consolidated loss of $1,164,479 of which $799,454 was attributable to MogulREIT II, Inc. Generally Accepted Accounting Principles (“GAAP”) requires any subsidiaries or affiliates under common control to be consolidated. The consolidated financial statements include the financial statements of the Company and its controlled joint ventures, Travertine North Park Investors, LLC, and Vinegar Hill Asset, LLC, which were acquired during 2017, Avon 46, LLC, which was acquired during 2018 and RM Terrace Hill, LLC, which was acquired during 2019.

Sources of Operating Revenue and Cash Flows

Our revenue is mainly generated from rental income and tenant reimbursements of our consolidated investments, equity in earnings of our unconsolidated joint ventures and accrued interest in our preferred equity investments.

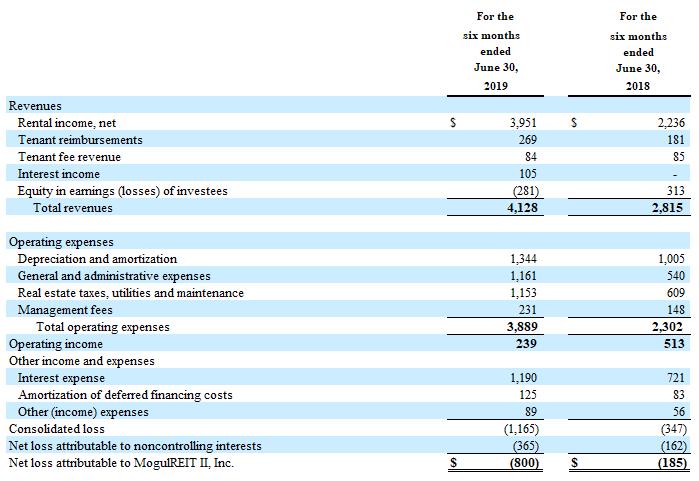

Revenue

For the six months ended June 30, 2019, we earned net rental income of $4.0 million as compared to the same period in 2018 in which we earned net rental income of $2.8 million. This increase was primarily due to the addition of Avon and Terrace Hill. For the six months ended June 30, 2019 we recorded operating income of $97,493 and a net loss of $280,571 in equity from our unconsolidated joint ventures as compared to the same period in 2018 in which we recorded operating income of $312, 634 and net income of $28,738. These decreases were primarily due to higher real estate taxes and higher depreciation and amortization expense.

Expenses

For the six months ended June 30, 2019, we incurred depreciation and amortization expenses of $1,344,115 as compared to the same period in 2018 in which we incurred depreciation and amortization expenses of $1,005,291. For the six months ended June 30, 2019, we incurred general and administrative expenses of $1,161,000, which includes professional fees, insurance expenses and other costs associated with running our business as well as operating expenses for our consolidated investments, as compared to the same period in 2018 in which we incurred general and administrative expenses of $539,825. For the six months ended June 30, 2019, we incurred real estate expenses of $1,153,487 as compared to the same period in 2018 in which we incurred real estate expenses of $608,355. For the six months ended June 30, 2019, we incurred interest expense of $1,190,523 as compared to the same period in 2018 in which we incurred interest expenses of $720, 561. These increases were primarily due to the addition of Avon and Terrace Hill.

Distributions

Our board of directors has declared and paid, and we expect that our board of directors will continue to declare and pay, distributions quarterly in arrears. Stockholders who are record holders with respect to declared distributions will be entitled to such distributions until such time as the stockholders have had their shares repurchased by us.

On December 15, 2017, our board of directors authorized a special daily cash distribution of $0.0057682365 per share of the Company’s common stock to stockholders of record as of the close of business on each day of the period commencing on December 17, 2017 and ending on December 31, 2017 (the “Special Distribution Period”), which was payable to stockholders of record as of the close of business on each day of the Special Distribution Period. On December 22, 2017, our board of directors authorized a daily cash distribution of $0.0012328767 per share of the Company’s common stock to stockholders of record as of the close of business on each day of the period commencing on January 1, 2019 and ending on March 31, 2018 (the “Q1 Distribution Period”), which was payable to stockholders of record as of the close of each business day of the Q1 Distribution Period. On March 21, 2018, our board of directors authorized a daily cash distribution of $0.0012328767 per share of the Company’s common stock to stockholders of record as of the close of business each day of the period commencing on April 1, 2018 (the “Q2 Distribution Period”) and ending on June 30, 2019, which was payable to stockholders of record as of the close of business on each day of the Q2 Distribution Period. Our board of directors has declared quarterly distributions for stockholders of record as of the close of business on the last day of each quarter, as shown in the table below.

Distribution Period for Daily Record Dates | Date of Authorization | Payment Date(1) | Cash Distribution Amount per Share of Common Stock | Annualized Yield |

12/17/2017 - 12/31/2017 | 12/15/2017 | 1/15/2018 | $0.0057682365 | 2.1%(2) |

1/30/2018 - 03/31/2018 | 12/22/2017 | 4/13/2018 | $0.0012328767 | 4.5%(2) |

4/1/2018 - 06/30/2018 | 3/21/2018 | 7/16/2018 | $0.0012328767 | 4.5%(2) |

7/1/2018 – 9/30/2018 | 6/20/2018 | 10/15/2018 | $0.0012328767 | 4.5%(2) |

10/1/2018 – 12/31/2018 | 9/18/2018 | 1/15/2019 | $0.0012328767 | 4.5%(2) |

1/1/2019 – 3/31/2019 | 12/20/2018 | 4/15/2029 | $0.0012328767 | 4.5%(2) |

4/1/2019 – 6/30/2019 | 3/30/2019 | 7/15/2019 | $0.0012328767 | 4.5%(2) |

(1) Dates presented are the dates on which the distributions were scheduled to be distributed; actual distribution dates may vary.

(2) Annualized yield represents the annualized yield amount of each distribution calculated on an annualized basis at the then current rate, assuming a $10.00 per share purchase price.

For the six months ended June 30, 2019, we have paid $292,995 in distributions, of which $90,701 was paid in cash and $202,294 was reinvested in our shares pursuant to the distribution reinvestment plan.

Liquidity and Capital Resources

We require capital to fund our investment activities and operating expenses. Our capital sources may include net proceeds from the Offering, cash flow from operations and borrowings under credit facilities.

We are dependent upon the net proceeds from the Offering to conduct our proposed operations. We currently obtain the capital required to purchase real estate-related investments and conduct our operations from the proceeds of the Offering and any future offerings we may conduct, from secured or unsecured financings from banks and other lenders and from any undistributed funds from our operations. As of June 30, 2019, we had made seven investments with a net investment value of approximately $15.6 million and had cash of approximately $4.3 million, of which $2.3 million was attributed to our consolidated investments. We anticipate that proceeds from the Offering will provide sufficient liquidity to meet future funding commitments as of June 30, 2019 as well as our operational cost.

If we raise substantially less than $50,000,000 in gross offering proceeds, we will make fewer investments resulting in less diversification in terms of the type, number and size of investments we make and the value of an investment in us will fluctuate more with the performance of the specific assets we acquire. Further, we will have certain fixed operating expenses, including certain expenses as a publicly offered REIT, regardless of whether we are able to raise substantial funds in this Offering. Our inability to raise substantial funds would increase our fixed operating expenses as a percentage of gross income, reducing our net income and limiting our ability to make distributions.

We expect to selectively employ leverage to enhance total returns to our stockholders. Our targeted portfolio-wide leverage after we have acquired an initial substantial portfolio of diversified investments is up to 75% of the fair market value or expected fair market value (for a value-add acquisition) of our assets; provided, however, we may exceed this limit for certain temporary bridge financings. During the period when we are acquiring our initial portfolio, we may employ greater leverage on individual assets (that will also result in greater leverage of the initial portfolio) in order to quickly build a diversified portfolio of assets. As of June 30, 2019, we had no outstanding borrowings other than those owed to related parties and mortgages outstanding on our consolidated investments.

In addition to making investments in accordance with our investment objectives, we expect to use our capital resources to make certain payments to our Manager. During our organization and offering stage, these payments will include payments for reimbursement of certain organization and offering expenses. We expect aggregate organization and offering expenses to be approximately $1,500,000 or, if we raise the maximum offering amount, approximately 3% of gross offering proceeds. If the Offering is not successfully completed, we will not be obligated to pay the remaining offering and organizational costs owed to our Manager. Real estate sponsors may make payments to our Sponsor or its affiliates in connection with the selection or purchase of investments. We will pay the Manager a monthly asset management fee of one-twelfth of 1.25%, which, until September 30, 2018, was based on our net offering proceeds as of the end of each quarter, and thereafter was based on the average investment value of our assets. During our acquisition stage, we also expect to make payments to our Manager affiliate of our Manager in connection with the purchase of investments of up to 3% of the contract purchase price of each asset and for costs incurred by our Manager in providing services to us. When assets are disposed of, we expect to make payments to our Manager or an affiliate of our Manager of up to 2% of the contract sales prices of each property sold.

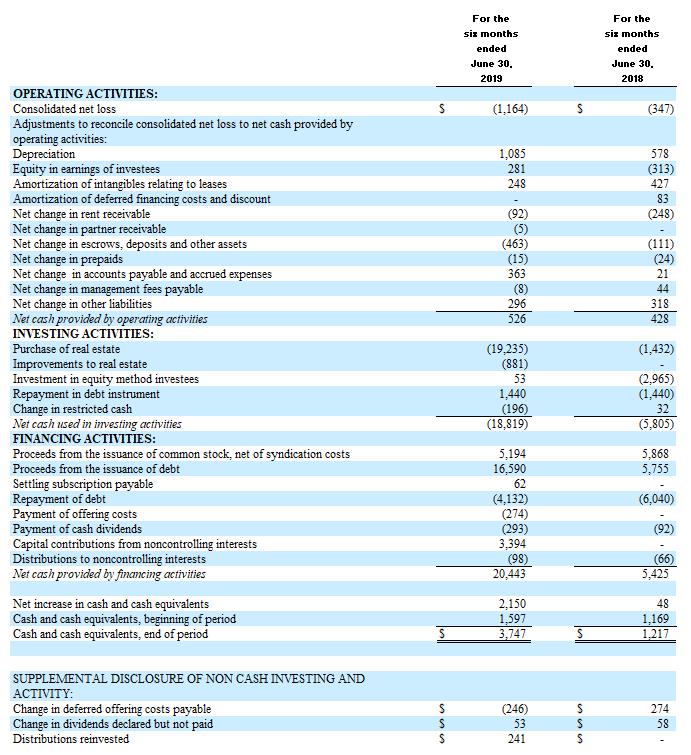

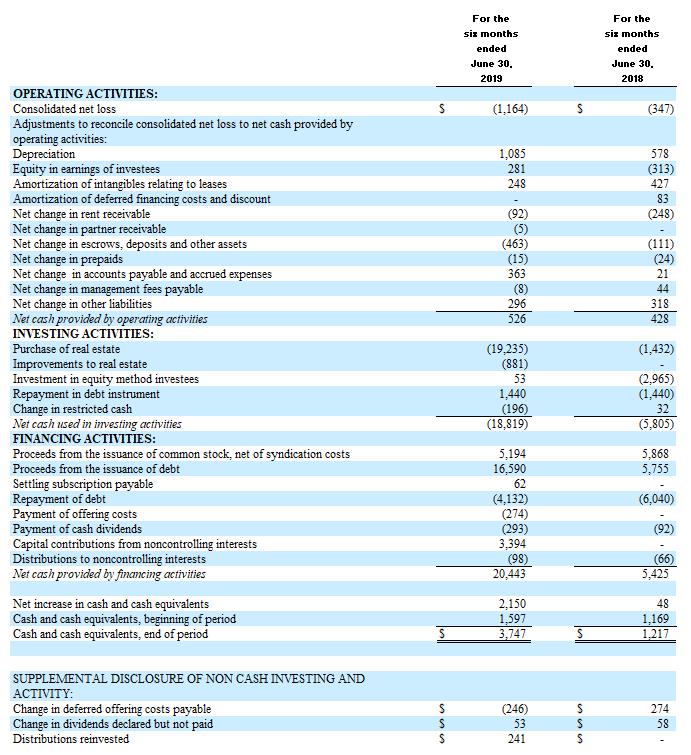

Cash Flow

The following presents our cash flows for the period January 1, 2019 through June 30, 2019 (in thousands):

| | | |

| | For the six months ended

June 30,

2019 |

Operating activities: | | $ | 526 |

Investing activities: | | | (18,819) |

Financing activities: | | | 20,443 |

Net increase in cash and cash equivalents | | | 2,150 |

Cash and cash equivalents, beginning of period | | | 1,597 |

Cash and cash equivalents, end of period | | $ | 3,747 |

Net cash provided by operating activities was $525,552 and related to net income after adjustments related to depreciation, amortization, and equity in earnings of unconsolidated joint ventures of $428,530.

Net cash used in investing activities was $18,819,907 and related to the acquisition of unconsolidated investments in real estate joint ventures of $26,414 and capital improvements of $880,716.

Net cash provided by financing activities was $20,443,358 million and related to $5,193,828 in new proceeds from the issuance of shares of our common stock pursuant to the Offering and approximately $16,589,902 in debt proceeds, net of $4,131,694 in debt repayments.

Outlook and Recent Trends

Since inception in MogulREIT II, we have focused on two key objectives: realize capital appreciation in the value of our investments over the long term and pay attractive and stable cash distributions to shareholders. This strategy is not changing. To date, the majority of our investments have been in value-add multifamily apartment buildings and our business plan is to continue to invest in this asset class pursuant to our investment guidelines as shared in the formal offering circular.

We remain excited about value-add multifamily investing and believe that it may provide a good risk adjusted return in today’s market. We seek to mitigate risk by keeping cash flow at the properties while we are engaged in renovations, and we are proud of the work completed to date. We are concerned about cap rates, as they are near historical lows in certain markets for multifamily; thus, we are particularly interested in investing in markets where occupancy levels remained high during the 2008 recession.

MACRO OVERVIEW

In Q2, economic indicators remain positive, and the consensus appears to suggest that there is more economic expansion in the US. We are, however, aware that there are multiple global risks that may disrupt growth, including a potential trade war, increasing domestic political tension and civil unrest abroad, among others. We are watching these risks closely and including a potential event in our strategic thinking.

GDP GROWTH

We believe the U.S. economy is in the late stages of recovery, we continue to believe that there will be moderated economic expansion. According to the ULI real estate economic forecast, a survey of leading real estate economists, GDP growth is forecast at 2.3% in 2019 and 1.8% in 2020. The second quarter of 2019 is in line with this forecast with a 2.1% increase in GDP. As a point of reference, 2018 ended with real GDP growth of 2.2%.

EMPLOYMENT AND WAGE GROWTH

In April 2019, unemployment rates were at their lowest levels in over two decades, at 3.6%, and they have increased minimally to 3.7% as of June 2019. We believe this is one of the most important macroeconomic factors for real estate and one of the foundations of our cautiously optimistic near-term outlook. In addition to continued reduction in unemployment, real average hourly earnings increased 1.5%, seasonally adjusted from June 2018 to June 2019, an indicator that consumers are starting to capture the benefit of the growing economy.

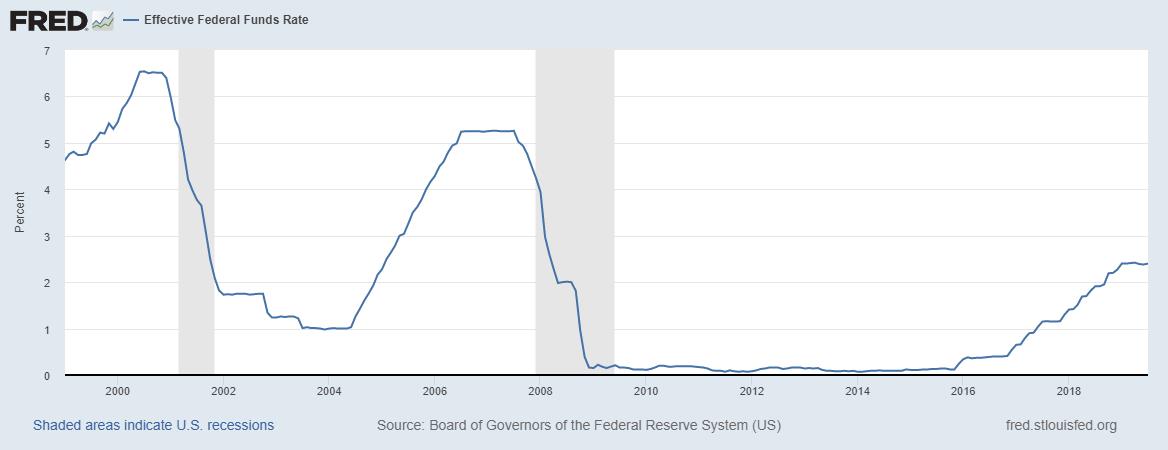

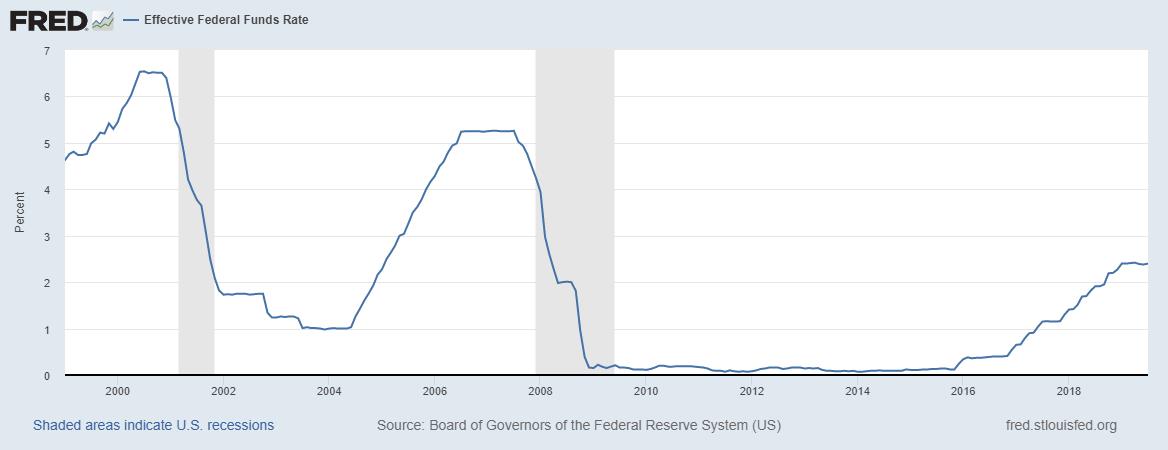

IMPACT OF MONETARY POLICY

While GDP growth, a decline in unemployment and wage growth are all indicators of a strong and thriving economy, the monetary policy from the Federal Reserve has been tempering even further economic success. The Fed raised rates once in 2016, three times in 2017, and four times in 2018, by 0.25 percentage points each time, leading to a Federal Funds Rate of 2.4% as of June 30, 2019. In July 2019, however, the Fed, citing “weak global growth, trade policy uncertainty, and muted inflation”, issued a rate cut of 0.25 percentage points, bringing the Federal Funds Rate down to 2.25%.

While interest rates have risen since its low point in 2015 when they were effectively zero, interest rates remain at relatively low rates compared to the last 40 years. As it relates to MogulREIT II, because we use leverage to acquire and fund renovations, we believe these historically low interest rates remain a driver for continuing to invest in multifamily real estate and building a portfolio for the long term.

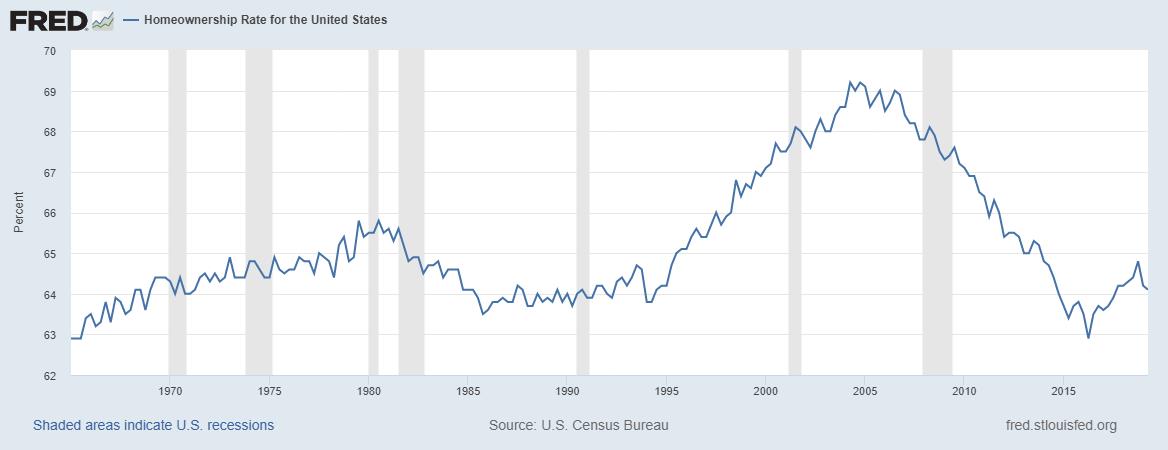

MULTIFAMILY FUNDAMENTALS

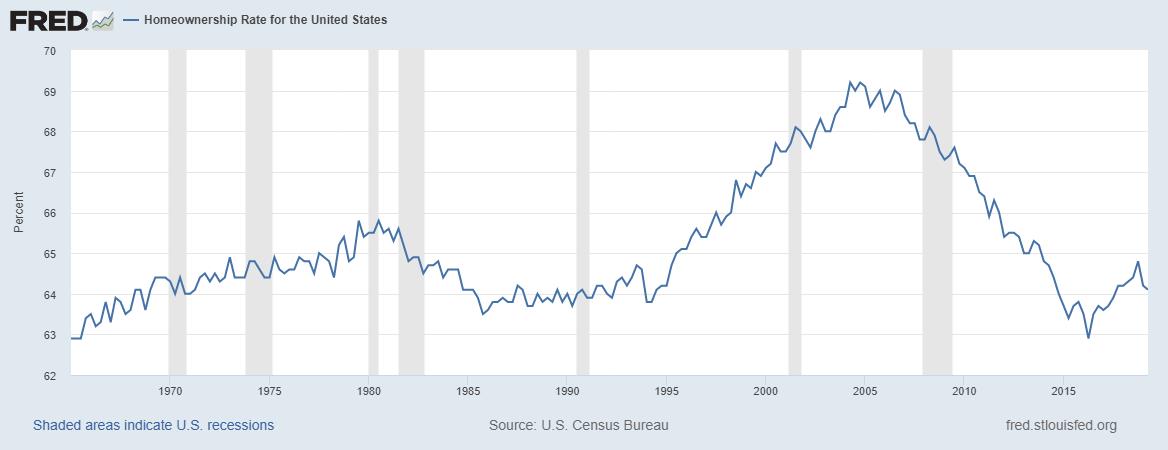

We continue to believe in the macroeconomic fundamentals that highlight the benefits of multifamily investing. Since reaching its peak in 2005, home ownership has dropped to near historic lows ending April 2019 at 64.1%. This trend has continued despite a low interest rate environment (which lowers the cost of a mortgage) and the longest economic expansion in American history, which factors should encourage home ownership.

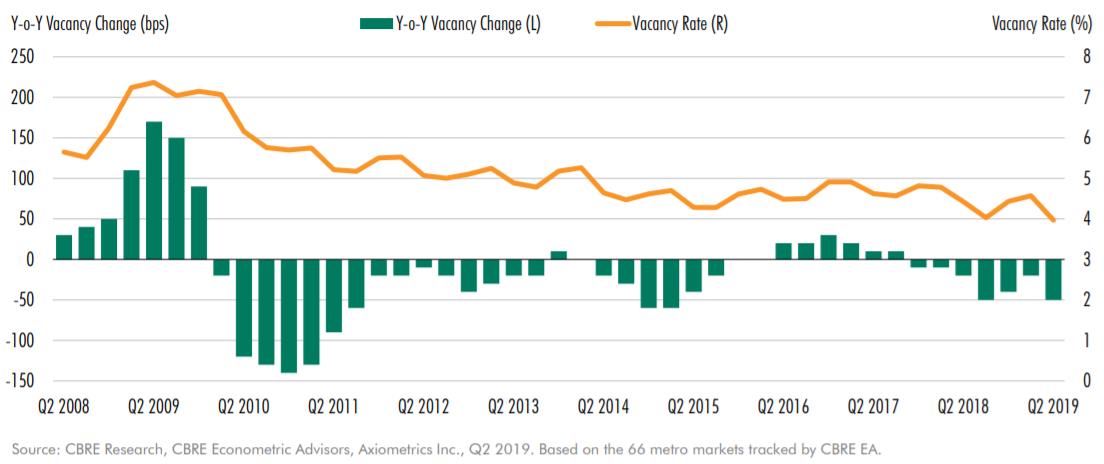

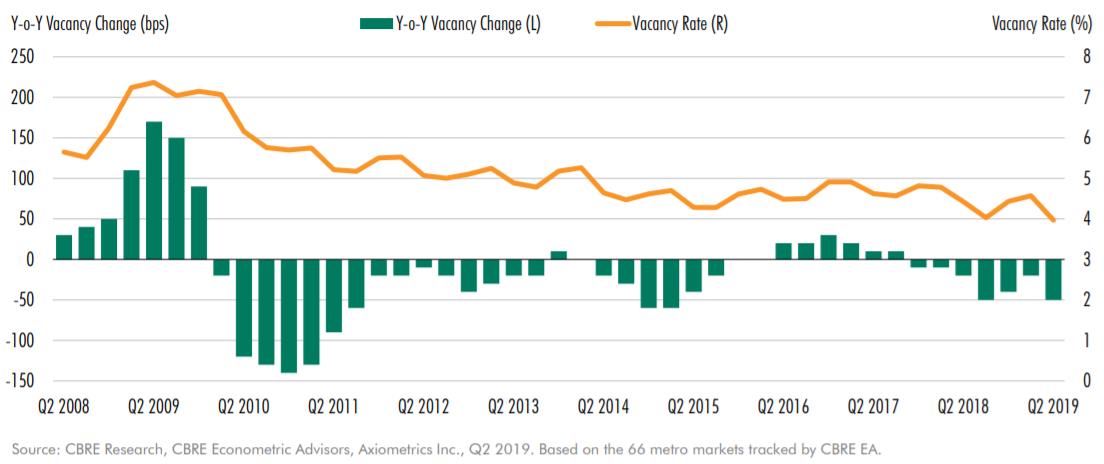

According to CBRE, Q2 net absorption was 160,900 units. While the second quarter of the year is typically a higher demand quarter due to seasonal leasing trends, the absorption for Q2 2019 represented the highest quarterly demand in at least 15 years.

Even with continued construction activity over the past decade, the apartment sector has continued to perform very well, with vacancy rates decreasing steadily from 7.0% in 2009 to 4.5% in 2018 and down to 4.0% in Q2 2019.

As mentioned above, we are particularly interested in investing in markets where occupancy levels remained high during the 2008 recession. In Q2 2019, we further implemented this strategy by closing Terrace Hill Apartments in El Paso, Texas.

We chose El Paso as it is a growing, opportunity city with good downside protection. Per Greysteel’s Q2 2019 report, El Paso is the 18th most populous city in the United States, with a strong demographic due to Fort Bliss, one of the nation’s largest Army bases, and University of Texas – El Paso, which has over 25,000 students. For multifamily properties, while rent growth is 60% below the national average, rent gains have averaged 3.3% in 2018 and 2.5% in 2019, and average vacancy has dropped from 10% in 2016 to 7.0% in 2019. Notably, El Paso held up well through the previous recession, with cumulative job losses of less than 3%. Many back-office jobs, specifically call centers, have recently been added in El Paso due to the large bilingual population, and annual job growth has ranged between 2.5% and 3.0% since 2016. As we look to the future of MogulREIT II, we believe that Terrace Hill meets the long-term strategy of the REIT by offering strong risk mitigants for any market correction along with income and solid growth potential.

On the topic of risk mitigation, especially given the Fed’s interest rate pullback, which is often seen as an indication that the Fed believes the economy requires a boost, we are constantly assessing market conditions to dictate REIT strategy. Even though many fundamentals are strong, we continue to have an inverted yield curve with a widening spread, which has historically been a predictor of an impending market correction, and the current length of this recovery is longer than historical recoveries. We want to be prepared and we want to be able to hold onto real estate assets through the cycle. We believe Terrace Hill to be one of these assets, and we will seek to acquire similar, market resilient assets going forward.

Critical Accounting Policies

The preparation of financial statements in accordance with GAAP requires management to use judgment in the application of accounting policies, including making estimates and assumptions. Such judgments are based on our management’s experience, our historical experience, the experience of our Manager’s affiliates, and the industry. We consider these policies critical because we believe that understanding these policies is critical to understanding and evaluating our reported financial results. Additionally, these policies may involve significant management judgments and assumptions, or require estimates about matters that are inherently uncertain. These judgments will affect the reported amounts of assets and liabilities and our disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting periods. With different estimates or assumptions, materially different amounts could be reported in our financial statements. Additionally, other companies may utilize different estimates that may impact the comparability of our results of operations to those of companies in similar businesses.

Please refer to “Note 2 — Summary of Significant Accounting Policies,” in Item 3. “Financial Statements” contained in this report, for a more thorough discussion of our accounting policies and procedures.

Off-Balance Sheet Arrangements

As of June 30, 2019, we had no off-balance sheet arrangements.

Related Party Arrangements

For further details, please see “Note 6 ─ Related Party Arrangements” in Item 3 “Financial Statements” below.

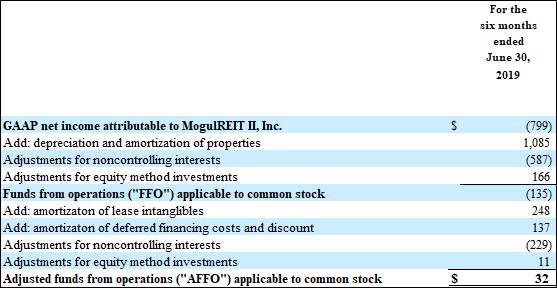

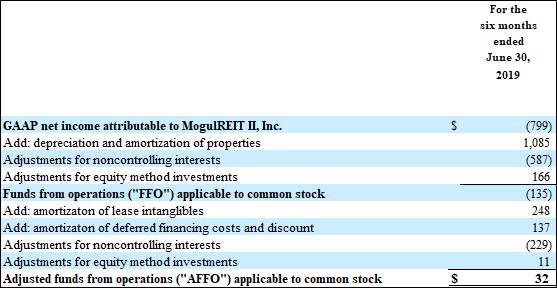

Non-GAAP Financial Measures

Our Manager believes that funds from operations (“FFO”) and modified funds from operations (“MFFO”) each of which are non-GAAP measures, are additional appropriate measures of the operating performance of a REIT and of our company in particular. We compute FFO in accordance with the standards established by the National Association of Real Estate Investment Trusts (“NAREIT”) as net income or loss (computed in accordance with GAAP), excluding gains or losses from sales of depreciable properties, the cumulative effect of changes in accounting principles, real estate-related depreciation and amortization, and after adjustments for unconsolidated/uncombined partnerships and joint ventures. FFO, as defined by NAREIT, is a computation made by analysts and investors to measure a real estate company’s cash flow generated by operations.

This presentation contains MFFO, which the Investment Program Association (“IPA”) has recommended as a supplemental measure for publicly registered, non-listed REITs. We believe MFFO is reflective of the ongoing operating performance of publicly registered, non-listed REITs by adjusting for those costs that are more reflective of acquisitions and investment activity, along with other items the IPA believes are not indicative of the ongoing operating performance of a publicly registered, non-listed REIT, such as straight-lining of rents as required by GAAP. We believe that MFFO can provide, on a going-forward basis, an indication of the sustainability (that is, the capacity to continue to be maintained) of our operating performance after the period in which we are acquiring properties and once our portfolio is stabilized. MFFO is not equivalent to our net income or loss as determined under GAAP.

Not all publicly registered, non-listed REITs calculate MFFO the same way. Accordingly, comparisons with other non-listed REITs may not be meaningful. Furthermore, MFFO is not indicative of cash flow available to fund cash needs and should not be considered as an alternative to net income (loss) or income (loss) from continuing operations as determined under GAAP as an indication of our performance, as an alternative to cash flows from operations, as an indication of our liquidity, or indicative of funds available to fund our cash needs including our ability to make distributions to our stockholders. MFFO should be reviewed in conjunction with other GAAP measurements and should not be construed to be more relevant or accurate than the current GAAP methodology

Our unaudited MFFO calculation for the six months ended June 30, 2019, is as follows:

Item 2.Other Information

None.

Item 3. Financial Statements

MogulREIT II, Inc.

Index

MogulREIT II, Inc.

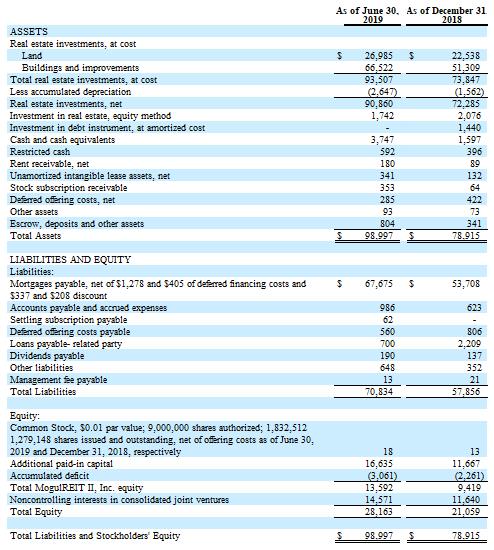

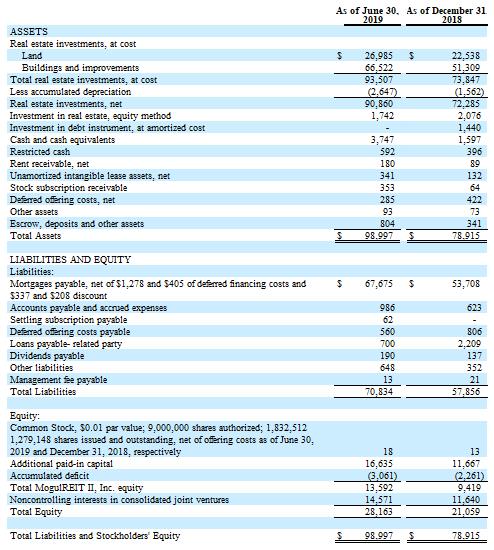

Consolidated Balance Sheets

As of June 30, 2019 (unaudited) and December 31, 2018 (audited)

(Amounts in thousands, except share and per share data)

The accompanying notes are an integral part of these consolidated financial statements.

MogulREIT II, Inc.

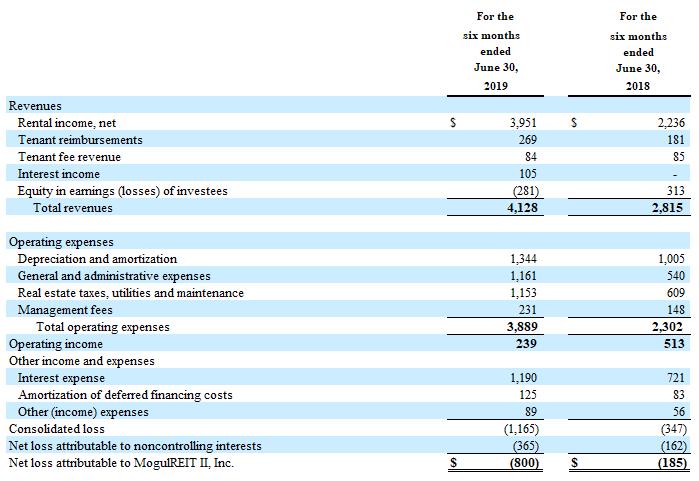

Consolidated Statements of Operations

For the Six Months Ended June 30, 2019 (unaudited) and June 30, 2018 (unaudited)

(Amounts in thousands)

The accompanying notes are an integral part of these consolidated financial statements.

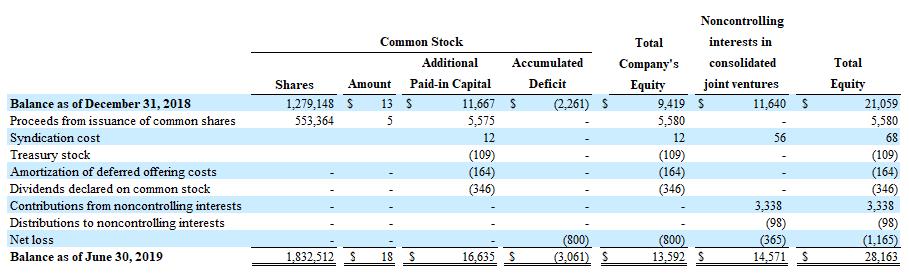

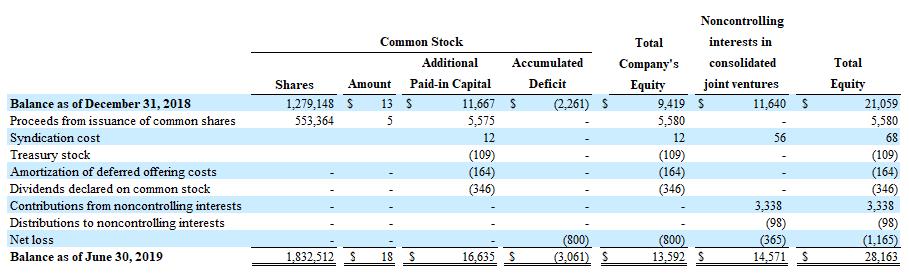

MogulREIT II, Inc.

Consolidated Statement of Stockholders' Equity

For the six Months Ended June 30, 2019 (unaudited)

(Amounts in thousands, except share data)

The accompanying notes are an integral part of these consolidated financial statements.

MogulREIT II, Inc.

Consolidated Statements of Cash Flows

For the Six Months Ended June 30, 2019 (unaudited) and June 30, 2018 (unaudited)

(Amounts in thousands)

The accompanying notes are an integral part of these consolidated financial statements.

MogulREIT II, Inc.

Notes to Consolidated Financial Statements (unaudited)

June 30, 2019

Note 1 - Organization and Nature of Operation

MogulREIT II, Inc. (the "Company") was formed as a Maryland corporation on January 13, 2017 to own and manage a diversified portfolio of preferred equity and joint venture equity investments in multifamily properties located in target markets throughout the United States. The use of the terms “MogulREIT II”, the “Company”, “we”, “us”, or “our” in this report refer to MogulREIT II, Inc., unless the context indicates otherwise.

The Company is externally managed by RM Adviser, LLC (“Manager”), which is an affiliate of the Company’s sponsor, RM Sponsor, LLC (“Sponsor”). Our Manager and our Sponsor are each wholly-owned subsidiaries of Realty Mogul, Co. (“RM”). Our Manager is an investment adviser registered with the Securities and Exchange Commission (“SEC”). Although our Manager manages our day-to-day operations, we operate under the direction of our board of directors, a majority of whom are independent directors.

The Company’s investing and management activities related to commercial real estate are all considered a single reportable business segment for financial reporting purposes. All of the investments the Company has made to date have been in domestic commercial real estate assets with similar economic characteristics, and the Company evaluates the performance of all of its investments using similar criterion.

We believe we have operated in such a manner as to qualify as a real estate investment trust (“REIT”) for federal income tax purposes as of and for the year ending December 31, 2019. We hold substantially all of our assets directly, and as of the date of these financial statements have not established an operating partnership or any taxable REIT subsidiary or qualified REIT subsidiary.

Pursuant to the Form 1-A filed with the SEC with respect to the Offering of up to $50,000,000 in shares of common stock, the purchase price for all shares was $10.00 per share as of June 30, 2019. The Offering was qualified by the SEC on August 23, 2017, and we commenced operations as of September 18, 2017. As of June 30, 2019, the Company has issued 1,837,444 shares, including 10,000 shares issued to our Sponsor, for an aggregate purchase price of $100,000. The Company has the authority to issue 9,000,000 shares of common stock.

Note 2 - Summary of Significant Accounting Policies

Basis of Presentation and Principles of Consolidation

The accompanying consolidated balance sheet, statement of operations, statement of stockholders’ equity, statement of cash flows and related notes to the financial statements of the Company are prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”). The Company has adopted a calendar year basis of reporting.

GAAP requires any subsidiaries or affiliates under common control to be consolidated. The consolidated financial statements include the financial statements of the Company and its controlled joint ventures, Travertine North Park Investors, LLC, and Vinegar Hill Asset, LLC, which were acquired during 2017, Avon 46, LLC, which was acquired during 2018 and RM Terrace Hill, LLC, which was acquired during 2019. See Note 3 – Consolidated Investments in Real Estate.

All significant intercompany balances and transactions are eliminated in consolidation.

In the opinion of management, all adjustments considered necessary for a fair presentation of the Company’s financial position, results of operations and cash flows have been included and are of a normal and recurring nature. Interim results are not necessarily indicative of operating results for any other interim period or for the entire year and certain disclosures may be condensed for interim reporting. These financial statements should be read in conjunction with the Company’s consolidated financial statements and notes thereto included in the Company’s Form 1-K for the fiscal year ended December 31, 2018, which was filed with the SEC on April 30, 2019.

Reclassification of Prior Year Presentation

Certain prior year amounts have been reclassified for consistency with the current period presentation. These reclassifications had no effect on the reported consolidated statements of operations.

Use of Estimates

The preparation of the financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements. Actual events and results could differ from those assumptions and estimates.

Cash and Cash Equivalents

Cash and cash equivalents consist of demand deposits. Cash and cash equivalents are carried at cost which approximates fair value.

Concentration of Credit Risk

At times, our cash may exceed the Federal Deposit Insurance Corporation deposit insurance limit of $250,000 per institution. The Company mitigates credit risk by placing cash with major financial institutions. To date, the Company has not experienced any losses on cash.

Geographic concentration

As of June 30, 2019, the Company's investments in real estate operate in New York, Texas and Connecticut. Future operations could be affected by changes in economic or other conditions in those geographical areas or the demand for such housing.

Organizational, Offering and Related Costs

Organizational and offering costs of the Company are initially being paid by the Manager on behalf of the Company. These organizational and offering costs include all expenses to be paid by the Company in connection with the formation of the Company and the qualification of the Offering, and the marketing and distribution of shares, including, without limitation, expenses for printing, and amending offering statements or supplementing offering circulars, mailing and distributing costs, advertising and marketing expenses, charges of experts and fees, expenses and taxes related to the filing, registration and qualification of the sale of shares under federal and state laws, including taxes and fees and accountants’ and attorneys’ fees.

The Company expenses organization costs as incurred and offering costs, when incurred, will be deferred and charged to additional paid-in capital. The deferred offering costs will be charged against the gross proceeds of the Offering when received or written off in the event that the Offering is not successfully completed. The Manager and/or affiliates will be reimbursed for organizational and offering expenses incurred in conjunction with the Offering subject to achieving a minimum capital raise of $1,000,000. The Company was not required to reimburse any organizational and offering costs before June 30, 2019.

As of June 30, 2019 and December 31, 2018, the Manager had incurred offering costs of $833,000 and $806,000, respectively, on behalf of the Company, including the full amount of legal fees of $261,000. As of June 30, 2019 and December 31, 2018, $548,000 and $384,000, respectively, of offering costs had been amortized and were included in the consolidated statement of equity.

Variable Interest Entities and Voting Interest Entities

A variable interest entity (“VIE”) is an entity that lacks one or more of the characteristics of a voting interest entity. A VIE is defined as an entity in which equity investors do not have the characteristics of a controlling financial interest or do not have sufficient equity at risk for the entity to finance its activities without additional subordinated financial support from other parties. The determination of whether an entity is a VIE includes consideration of various

factors. These factors include review of the formation and design of the entity, its organizational structure including decision-making ability and relevant financial agreements, and analysis of the forecasted cash flows of the entity. We make an initial determination upon acquisition of a VIE, and reassesses the initial evaluation of an entity as a VIE upon the occurrence of certain events.

A VIE must be consolidated only by its primary beneficiary, which is defined as the party who, along with its affiliates and agents has both the: (i) power to direct the activities that most significantly impact the VIE’s performance; and (ii) obligation to absorb the losses of the VIE or the right to receive the benefits from the VIE, which could be significant to the VIE. We determine whether we are the primary beneficiary of a VIE by considering various factors, including, but not limited to: which activities most significantly impact the VIE’s economic performance and which party controls such activities; the amount and characteristics of its investment; the obligation or likelihood for us or other interests to provide financial support; consideration of the VIE’s purpose and design, including the risks the VIE was designed to create and pass through to its variable interest holders and the similarity with and significance to the business activities of our interest and the other interests. We reassess our determination of whether we are the primary beneficiary of a VIE each reporting period. Significant judgments related to these determinations include estimates about the future performance of investments held by VIEs and general market conditions. The maximum risk of loss related to our investments is limited to our recorded investment in such entities, if any.

A voting interest entity (“VOE”) is an entity in which equity investors have the characteristics of a controlling financial interest and has sufficient equity at risk to finance its activities. A controlling financial interest exists if limited partners with equity at risk are able to exercise substantive kick-out rights or are able to exercise substantive participation

rights. Under the VOE model, generally, only a single limited partner that is able to exercise substantial kick-out rights will consolidate the entity.

As of June 30, 2019, the Company held investments in three entities, which were evaluated under the VOE model and were not consolidated because the Company does not have substantive kick out rights or a controlling financial interest. These investments are carried on the equity method because of the Company’s significant influence.

As of June 30, 2019 the Company held investments in four entities which were evaluated under the VOE model and are consolidated because the Company is able to exercise substantial kick-out rights and substantive participation rights.

Income Taxes

The Company elected to be taxed, and currently qualifies, as a REIT for federal income tax purposes beginning the taxable year ended December 31, 2017. To qualify as a REIT, the Company must meet certain organizational and operational requirements, including a requirement to distribute at least 90% of its taxable income to its stockholders. As a REIT, the Company generally is not subject to federal corporate income tax on that portion of its taxable income that is currently distributed to stockholders. Even if the Company qualifies for taxation as a REIT, it may be subject to certain state and local taxes on its income and property, and federal income and excise taxes on its undistributed income. No material provisions have been made for federal income taxes in the accompanying consolidated financial statements, and no gross deferred tax assets or liabilities have been recorded as of June 30, 2019.

For the six months ended June 30, 2019, and for the year ended December 31, 2018, $346,000 and $406,000, respectively, in distributions have been made to stockholders, which were classified for tax purposes as ordinary income. The Company expects its distributions to be characterized for federal income tax purposes as (i) ordinary income, (ii) non-taxable return of capital, or (iii) long-term capital gain. Distributions that exceed current or accumulated taxable earnings and profits constitute a return of capital for tax purposes and reduce the stockholders’ basis in the shares of common stock. To the extent that distributions exceed both current and accumulated earnings and profits and the shareholders’ basis in shares of common stock, they will generally be treated as a gain or loss upon the sale or exchange of our stockholders’ shares of common stock. When we begin to make distributions to our stockholders, we will report the taxability of such distributions in information returns that will be provided to our stockholders and filed with the Internal Revenue Service in the year following such distributions. This information will be provided annually beginning in the first year that distributions occur.

All tax periods since inception remain open to examination by the major taxing authorities in all jurisdictions where we are subject to taxation.

Stockholder Funds Receivable

Stockholder funds receivable consists of shares that have been issued with subscriptions that have not yet settled. As of June 30, 2019 there was approximately $353,000 in subscriptions that had not settled. Stockholder funds receivable are carried at cost which approximates fair value.

Revenue Recognition

Rental income is recognized as rentals become due. Rental payments received in advance are deferred until earned. All leases between the Company and tenants of the property are operating leases and are one year or less.

For certain properties, in addition to contractual base rent, the tenants pay their share of utilities to the Company. The income and expenses associated with these properties are generally recorded on a gross basis when the Company is the primary obligor. For the six months ended June 30, 2019, the Company recorded reimbursements of expenses of $269,000, which are reported as Tenant reimbursements in the accompanying consolidated statements of operations.

Tenant fees, such as application fees, administrative fees, late fees, and other revenues from tenants are recorded when earned.

Purchase Accounting for Acquisition of Real Estate

Prior to January 1, 2018, the Company recorded acquired real estate investments that are consolidated as business combinations when the real estate is occupied, at least in part, at acquisition. Costs directly related to the acquisition of such investments have been expensed as incurred. The purchase consideration includes cash paid, the fair value of equity or other assets issued, and the fair value of any assumed debt. The Company assesses the fair value of assumed debt based on estimated cash flow projections that utilize appropriate discount rates and available market information. Such inputs are categorized as Level 3 in the fair value hierarchy. The difference between the fair value and the stated principal of assumed debt is amortized using the effective interest method basis over the terms of the respective debt obligation.

The Company allocates the fair value of the purchase consideration to the fair value of land, buildings, site improvements and intangible assets including in-place leases at the acquisition date. The Company estimates the fair value of the assets using market-based, cost-based, and income-based valuation techniques.

Effective January 1, 2018, the Company adopted the provisions of Accounting Standard Update 2017-01, which

provides that if substantially all the fair value of the gross assets is concentrated in any individual asset, the acquisition is treated as an asset acquisition as opposed to a business combination. Under an asset acquisition, costs directly related to the acquisition are capitalized as part of the purchase consideration. The fair value of the purchase consideration is then allocated based on the relative fair value of the assets. The estimates of the fair value of the purchase consideration and the fair value of the assets acquired is consistent with the techniques used in a business combination.

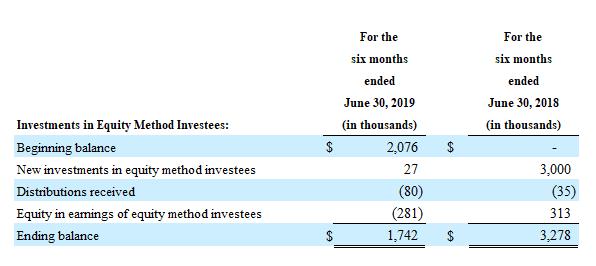

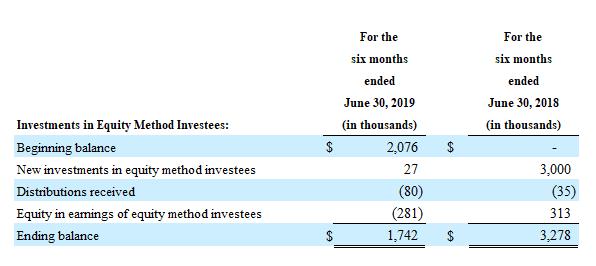

Investments in Equity Method Investees

If it is determined that we do not have a controlling interest in a joint venture through our financial interest in a VIE or through our voting interest in a VOE, and we have the ability to provide significant influence, the equity method of accounting is used. Under this method, the investment, originally recorded at cost, is adjusted to recognize our share of net earnings or losses of the affiliate as they occur, with losses limited to the extent of our investment in, advances to, and commitments to the investee. The Company evaluates its investment in equity method investees for impairment annually or whenever events or changes in circumstances indicate that there may be an other-than-temporary decline in value. To do so, the Company would calculate the estimated fair value of the investment using various valuation techniques, including, but not limited to, discounted cash flow models, the Company’s intent and ability to retain its investment in the entity, the financial condition and long-term prospects of the entity, and the expected term of the investment. If the Company determined any decline in value is other-than-temporary, the Company would recognize an impairment charge

to reduce the carrying value of its investment to fair value. We recorded a loss of $281,000 related to equity method investees for the six month ended June 30, 2019.

Accounting for Long-Lived Assets and Impairment of Real Estate Owned

The Company reviews its real estate portfolio on a quarterly basis to ascertain if there are any indicators of impairment to the value of any of its real estate assets, including deferred costs and intangibles, to determine if there is any need for an impairment charge. In reviewing the portfolio, the Company examines one or more of the following: the type of asset, the current financial statements or other available financial information of the asset, and the economic situation in the area in which the asset is located. For each real estate asset owned for which indicators of impairment exist, management performs a recoverability test by comparing the sum of the estimated undiscounted future cash flows attributable to the asset to its carrying amount. If the aggregate undiscounted cash flows are less than the asset's carrying amount, an impairment loss is recorded to the extent that the estimated fair value is less than the asset's carrying amount. The estimated fair value is determined using a discounted cash flow model of the expected future cash flows through the useful life of the property. The analysis includes an estimate of the future cash flows that are expected to result from the real estate investment's use and eventual disposition. These cash flows consider factors such as expected future operating income, trends and prospects, the effects of leasing demand, competition and other factors.

As of June 30, 2019, the Company determined that there was no impairment of long-lived assets.

Escrows

Real estate taxes, insurance and other escrows aggregating $804,000 and $321,000, respectively, at June 30, 2019 and December 31, 2018, are included in Escrow, deposits and other assets.

Allowance for Doubtful Accounts

The Company maintains an allowance for doubtful accounts for estimated losses resulting from the inability of a tenant to make required rent payments. At June 30, 2019 and December 31, 2018, respectively, there was $53,000 and $53,000 balance in the allowance for doubtful accounts. The Company records bad debt expense as a reduction of rental income and/or tenant reimbursements.

Depreciation and Amortization

Depreciation of assets is computed on the straight-line method over the estimated useful life of the asset. Depreciation of buildings is computed on the straight-line method over an estimated useful life of 30 years. Site improvements and certain building improvements are depreciated on the straight-line method over an estimated useful life of 10 years and depreciation of furniture, fixtures and equipment is computed on the straight-line method over an estimated useful life of 5 years. Improvements are capitalized, while expenditures for maintenance and repairs are charged to expense as incurred. Depreciation expense amounted to approximately $1,085,000 and $1,328,000 for the period ended June 30, 2019 and year ended December 31, 2018 respectively.

As of June 30, 2019 and December 31, 2018, respectively, accumulated amortization of intangible lease assets was $1,225,000 and $977,000. For the six month ended June 30, 2019 and year ended December 31, 2018, the Company recognized amortization expense of $248,000 and $749,064 respectively relating to the amortization of intangible lease assets, which is included in depreciation and amortization expense. The unamortized balance of intangible lease assets as of June 30, 2019 and December 31, 2018 respectively, was $341,041 and $132,420.

Advertising costs

The Company's policy is to expense advertising costs when incurred. Such costs incurred for the six month ended June 30, 2019 and year ended December 31, 2018 were $50,000 and $69,000 respectively.

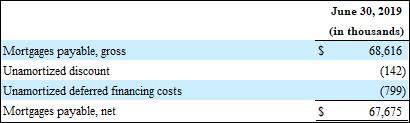

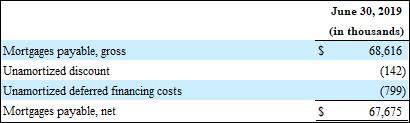

Deferred Financing Costs

Mortgage costs are deferred and amortized using the effective interest method over the terms of the respective debt obligations. At June 30, 2019, deferred financing costs amounted to $941,000 net of accumulated amortization of $337,000. The Company presents unamortized deferred financing costs as a direct deduction from the carrying amount of the related debt liability.

Minimum Future Rents

The rental properties owned at June 30, 2019 are principally leased under 12-month operating leases with certain tenant renewal rights.

Note 3 – Consolidated Investments in Real Estate

With respect to the four consolidated joint ventures in which the Company holds a 31%, 34%, 53% and 64% interest, respectively, the Company has determined that such ventures are VOEs because we hold substantive kick-out or participating rights.

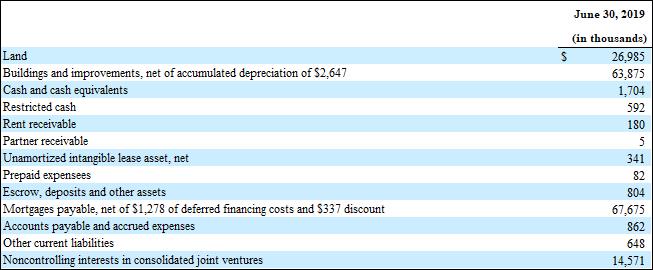

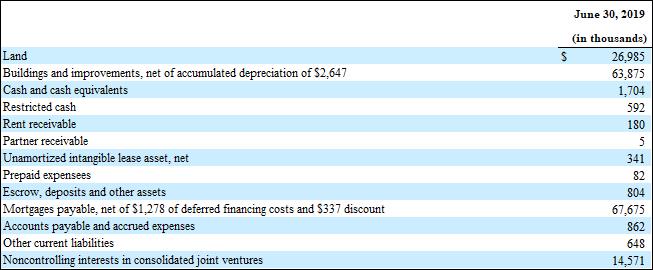

The following is a summary of the consolidated VOEs' carrying amounts and classification in the Company's consolidated balance sheet:

On May 31, 2019, the Company acquired a 53% equity interest in RM Terrace Hill, LLC (“Terrace Hill”). Terrace Hill is a joint venture formed to acquire, renovate, own and operate Terrace Hill Apartments, a 310-unit, Class B, garden-style apartment community in El Paso, TX.

GAAP defines the acquirer in an asset acquisition as the entity that obtains control of the assets and establishes the acquisition date as the date that the acquirer achieves control. Terrace Hill is considered a VOE, and the Company is deemed to have control rights, and therefore, the joint venture’s controlling member.

GAAP requires an acquirer to recognize the assets acquired, the liabilities assumed, and any noncontrolling interest in the acquiree at the acquisition date, measured by allocating the consideration to the relative fair values of the assets as of that date. The following table summarizes the consideration paid for Terrace Hill and the relative fair value of the assets acquired and liabilities assumed recognized at the acquisition date:

Note 4 – Investments in Unconsolidated Joint Ventures

The table below presents the activity of the Company's investments in unconsolidated joint ventures as of and for the periods presented (amounts in thousands):

As of June 30, 2019 and December 31, 2018, the Company's investments in unconsolidated joint ventures that are accounted for under the equity method of accounting consist of the following

| 1) | | Acquired in 2018, a 30% non-controlling joint venture limited partnership interest in Plano CRP Portfolio, LLC, for the acquisition and renovation of two garden-style apartment communities in Plano, Texas. |

| 2) | | Acquired in 2018, a 26% non-controlling joint venture limited partnership interest in Tuscany CRP 29, LLC, for the acquisition of a Class B apartment complex in San Antonio, Texas. |

| 3) | | Acquired in 2018, a 27% non-controlling joint venture limited partnership interest in Villas del Mar Partners 29, LLC, for the acquisition of an apartment complex in Fort Worth, Texas. |

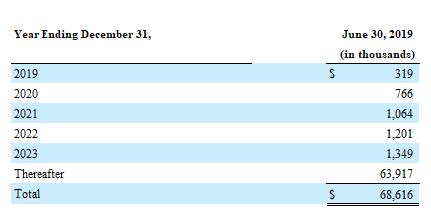

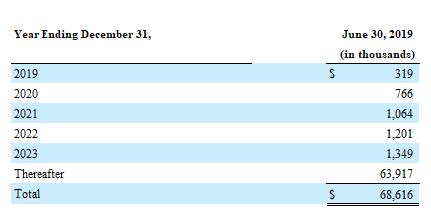

Note 5 – Borrowings

Mortgages Payable

The following table details the Mortgages payable, net, balances per the consolidated balance sheet:

Scheduled principal repayments during the next five years and thereafter are as follows:

Related Party Loans

On August 31, 2017, the Company entered into an unsecured promissory note for approximately $4 million with RMCC. The proceeds from the loan were used to purchase the Company’s first asset, a 63% equity interest in Travertine North Park Investors, LLC. During 2017, the Company used proceeds from the issuance of common stock to repay approximately $3.7 million to RMCC. The note was fully repaid as of June 30, 2019. The promissory note accrued interest at an annual rate of LIBOR plus 2%

On November 30, 2017, the Company entered into an unsecured promissory note for approximately $3 million with RMCC. The proceeds from the loan were used to purchase the Company’s second asset, a 34% equity interest in Vinegar Hill Asset, LLC. The note was fully repaid as of June 30, 2019. The promissory note accrued interest at an annual rate of LIBOR plus 2%.

As of December 31, 2017, an aggregate amount of approximately $3.3 million was outstanding on these related party loans. From January 13, 2017 (inception) to December 31, 2017, approximately $40,000 was incurred in interest expense to RMCC pursuant to these loans, which was fully repaid as of June 30, 2019.

On January 8, 2018, the Company entered into an unsecured promissory note for $1,000,000 with Realty Mogul

Commercial Capital, Co. (“RMCC”), an affiliate of the Manager. The proceeds from the loan were used to purchase a 30% non-controlling joint venture limited partnership interest in Plano CRP Portfolio, LLC for the Company. During 2018, the Company used proceeds from the issuance of common stock to repay the entire loan to RMCC and therefore the loan was fully repaid as of June 30, 2019. The promissory note accrued interest at an annual rate of LIBOR plus 2%.

On January 30, 2018, the Company entered into an unsecured promissory note for $1,000,000 with RMCC. The

proceeds from the loan were used to purchase a 26% non-controlling joint venture limited partnership interest in Tuscany CRP 29, LLC for the Company. During 2018, the Company used proceeds from the issuance of common stock to repay the entire loan to RMCC and therefore the loan was fully repaid as of June 30, 2019. The promissory note accrued interest at an annual rate of LIBOR plus 2%.

On February 27, 2018, the Company entered into an unsecured promissory note for $1,000,000 with RMCC. The proceeds from the loan were used to purchase a 27% non-controlling joint venture limited partnership interest in Villas del Mar Partners 29, LLC for the Company. During 2018, the Company used proceeds from the issuance of common stock to repay the entire loan to RMCC and therefore the loan was fully repaid as of June 30, 2019. The promissory note accrued interest at an annual rate of LIBOR plus 2%.

On June 29, 2018, the Company entered into an unsecured promissory note for $1,440,000 with RMCC. The proceeds from the loan were used to purchase a $1,440,000 preferred equity investment in 5009 Ashland LLC for the Company. During 2018, the Company used proceeds from the issuance of common stock to repay the entire loan to RMCC and therefore the loan was fully repaid as of June 30, 2019. The promissory note accrued interest at an annual rate of LIBOR plus 2%.

On October 30, 2018, the Company entered into an unsecured promissory note for $2,634,000 with RMCC. The

proceeds from the loan were used to purchase a 35% equity interest in Avon 46, LLC for the Company. During 2018, the

Company used proceeds from the issuance of common stock to repay $590,000 to RMCC. The loan was fully repaid as of June 30, 2019. The promissory note accrued interest at an annual rate of LIBOR plus 2%.

On December 26, 2018, the Company entered into an unsecured promissory note for $165,040 with RMCC. The proceeds from the loan were used for the refinancing and improvements of Avon Place as part of MogulREIT II’s future funding obligation related to its investment in Avon 46, LLC. The loan was fully repaid as of June 30, 2019. The promissory note accrued interest at an annual rate of LIBOR plus 2%.

On May 29, 2019, the Company entered into an unsecured promissory note for $2.4 million with RMCC. The proceeds from the loan were used to purchase preferred equity investment in Terrace Hill. As of June 30, 2019, $1,700,000 has been repaid on the loan to RMCC. The promissory note matures on May 29, 2024 and accrues interest at an annual rate of LIBOR plus 2%.

As of June 30, 2019, an aggregate amount of approximately $700,000 was outstanding on these related party loans. The outstanding related party loan was repaid in full on July 19, 2019. For the six month ended June 30, 2019, approximately $13,000 was incurred in interest expense to RMCC pursuant to these loans, of which approximately $4,157 remains outstanding as of June 30, 2019.

Note 6 – Related Party Arrangements

RM Adviser, LLC, Manager

Subject to certain restrictions and limitations, the Manager is responsible for managing the Company’s affairs on a day-to-day basis and for identifying and making investments on behalf of the Company.

The Manager and certain affiliates of the Manager receive fees and compensation in connection with the Company’s public offering, and the acquisition and management of the Company’s real estate investments.

The Manager will be reimbursed for organizational and offering expenses incurred in conjunction with the Offering. The Company will reimburse the Manager for actual expenses incurred on behalf of the Company in connection with the selection or acquisition of an investment, to the extent not reimbursed by the borrower, whether or not the Company ultimately acquires the investment. The Company will reimburse the Manager for out-of-pocket expenses paid to third parties in connection with providing services to the Company. This does not include the Manager’s overhead, employee costs borne by the Manager, utilities or technology costs. Expense reimbursements payable to the Manager also may include expenses incurred by the Sponsor in the performance of services pursuant to a shared services agreement between the Manager and the Sponsor, including any increases in insurance attributable to the management or operation of the Company. See Note 2 – Summary of Significant Accounting Policies – Organizational, Offering and Related Costs.

As of June 30, 2019 and December 31, 2018, the Company owed its Manager $560,000 and $806,000, respectively, in deferred offering costs. As of June 30, 2019 and December 31, 2018, $548,000 and $384,000, respectively, of offering costs were amortized against stockholders’ equity, which represents the ratable portion of proceeds raised to date to the total amount of proceeds expected to be raised from the Offering. As of June 30, 2019, the Company did not owe its Manager any additional funds outside of offering costs.

The Company will pay the Manager a monthly asset management fee of one- twelfth of 1.25%, which, will be based on the average investment value of our assets. During the six month ended June 30, 2019, approximately $92,000 was charged by our Manager, of which approximately $13,000 is outstanding as of June 30, 2019.

Realty Mogul, Co. and affiliates

If the Company has insufficient funds to acquire all or a portion of an investment, then it may obtain a related party loan from an RM Originator or one of its affiliates on commercially reasonable terms. Our charter authorizes us to enter into related party loans. Related party loans would require prior approval from the Board. However, neither Realty Mogul, Co. nor its affiliates are obligated to make a related party loan to the Company at any time. See Note 5 ─ Borrowings.

In 2017, an entity managed by an affiliate of Realty Mogul, Co. acquired a 27% noncontrolling interest in Travertine North Park Investors, LLC., The entity’s equity investment in Travertine was approximately $1,670,000 as of June 30, 2019.

In 2018, an entity managed by an affiliate of Realty Mogul, Co. acquired an approximate 39% noncontrolling interest in Avon Place Apartments. The entity’s equity investment in Avon Place Apartments was approximately $3,500,000 as of June 30, 2019, which represents a 44% noncontrolling interest.

In 2018, an entity managed by an affiliate of Realty Mogul, Co. acquired an approximate 50% interest in Villas del Mar. The entity’s equity investment in Villas del Mar was approximately $1,860,000 as of June 30, 2019.

In 2018, an entity managed by an affiliate of Realty Mogul, Co. acquired an approximate 61% interest in Tuscany at Westover Hills. The entity’s equity investment in Tuscany at Westover Hills was approximately $2,360,000 as of June 30, 2019

In 2018, an entity managed by an affiliate of Realty Mogul, Co. acquired an approximate 54% interest in Plano Multifamily Portfolio. The entity’s equity investment in Plano Multifamily Portfolio was approximately $1,750,000 as of

June 30, 2019.

In 2018, an entity managed by an affiliate of Realty Mogul, Co. acquired an approximate 24% interest in Vinegar Hill. The entity’s equity investment in Vinegar Hill was approximately $2,070,000 as of June 30, 2019.

In 2019, an entity managed by an affiliate of Realty Mogul, Co. acquired an approximate 47% interest in Terrace Hill. The entity’s equity investment in Terrace Hill was approximately $2,950,000 as of June 30, 2019.

RM Sponsor, LLC, Stockholder and Sponsor

RM Sponsor, LLC is a stockholder of the Company and holds 10,000 shares of our common stock as of June 30, 2019.

Joint Venture Partners and Affiliates

For the six month ended June 30, 2019, the Company paid an aggregate of $1,153,487 to its joint venture partners or other affiliates of its consolidated joint ventures for property management fees, which are included in Real estate expenses and Real estate acquisition costs on the consolidated statements of income.

Executive Officers of our Manager

As of the date of these financial statements, the executive officers of the Company’s Manager and their positions and offices are as follows:

| | | | |

Name | | Age | | Position |

Jilliene Helman | | 32 | | Chief Executive Officer, Chief Financial Officer and Secretary |

Eric Levy | | 32 | | Portfolio Manager |

William Wenke | | 36 | | General Counsel |

.

Note 7 – Economic Dependency

Under various agreements, the Company has engaged or will engage RM Adviser, LLC and its affiliates to provide certain services to the Company, including asset management services, asset acquisition and disposition decisions, the sale of the Company’s shares of our common stock available for issue, as well as other administrative responsibilities for the Company including accounting services and investor relations. As a result of these relationships, the Company is dependent upon RM Adviser, LLC and its affiliates. In the event that these companies were unable to provide the Company with the respective services, the Company would be required to find alternative providers of these services.

Note 8 – Commitments and Contingencies

Legal Proceedings

As of June 30, 2019, we were not named as a defendant in any active or pending litigation. However, it is possible that the Company could become involved in various litigation matters arising in the ordinary course of our business. Although we are unable to predict with certainty the eventual outcome of any litigation, management is not aware of any litigation likely to occur that we currently assess as being significant to us.

Note 9 – Subsequent Events

Events that occur after the balance sheet date, but before the consolidated financial statements were available to be issued, must be evaluated for recognition or disclosure. The effects of subsequent events that provide evidence about conditions that existed at the consolidated balance sheet date are recognized in the accompanying consolidated financial statements. Subsequent events which provide evidence about conditions that existed after the consolidated balance sheet date require disclosure in the accompanying notes. Management has evaluated the activity of the Company through September 26, 2019, the date the consolidated financial statements were available to be issued.

Distributions Declared

From July 1, 2019 through September 26, 2019, we declared and paid distributions of $56,290

From July 1, 2019 through September 26, 2019, a total offering cost of $556,127 was reimbursed to the Manager.

Item 4. Exhibits

INDEX TO EXHIBITS

Exhibit No. | Description |

2.1 | Articles of Amendment and Restatement of MogulREIT II, Inc. (Incorporated by reference to Exhibit 2.1 to the Company’s Offering Statement on Form 1-A/A, filed on August 4, 2017) |

2.2 | Amended and Restated Bylaws of MogulREIT II, Inc. (Incorporated by reference to Exhibit 2.3 to the Company’s Offering Statement on Form 1-A, filed on June 28, 2017) |

4.1 | Form of Subscription Package (Incorporated by reference to Exhibit 4.1 to the Company’s Offering Statement on Form 1-A/A, filed on June 28, 2017) |

4.2 | Distribution Reinvestment Plan (Incorporated by reference to Exhibit 4.2 to the Company’s Offering Statement on Form 1-A/A, filed on June 28, 2017) |

6.1 | Form of Management Agreement between MogulREIT II, Inc. and RM Adviser, LLC (Incorporated by reference to Exhibit 6.1 to the Company’s Offering Statement on Form 1-A/A, filed on June 28, 2017) |

6.2 | Agreement of Limited Partnership of MogulREIT II Operating Partnership, L.P. (Incorporated by reference to Exhibit 6.2 to the Company’s Offering Statement on Form 1-A/A, filed on June 28, 2017) |

6.3 | Form of License Agreement between MogulREIT II, Inc. and Realty Mogul, Co. (Incorporated by reference to Exhibit 6.3 to the Company’s Offering Statement on Form 1-A/A, filed on June 28, 2017) |

6.4 | Form of Master Technology and Services Agreement among RM Technologies, LLC, RM Sponsor, LLC and MogulREIT II, Inc. (Incorporated by reference to Exhibit 6.4 to the Company’s Offering Statement on Form 1-A/A, filed on June 28, 2017) |

15.1 | Draft offering statement previously submitted by or on behalf of the issuer pursuant to Rule 252(d) (incorporated by reference to the copy thereof previously made public pursuant to Rule 301 of Regulation S-T) |

15.2 | Non-public correspondence submitted by or on behalf of the issuer pursuant to Rule 252(d) |

15.3 | Draft amended offering statement previously submitted by or on behalf of the issuer pursuant to Rule 252(d) (incorporated by reference to the copy thereof previously made public pursuant to Rule 301 of Regulation S-T) |

15.4 | Non-public correspondence submitted by or on behalf of the issuer pursuant to Rule 252(d) |

15.5 | Non-public correspondence submitted by or on behalf of the issuer pursuant to Rule 252(d) |

SIGNATURES

Pursuant to the requirements of Regulation A, the issuer has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized in Los Angeles, California on September 30, 2019.

| |

MOGULREIT II, INC. |

|

By: | /s/ Jilliene Helman |

Name: | Jilliene Helman |

Title: | Chief Executive Officer, Chief Financial Officer and Secretary |

Pursuant to the requirements of Regulation A, this report has been signed below by the following persons on behalf of the issuer and in the capacities and on the dates indicated.

Signature | | Title | | Date |

| | | | |

| | Chief Executive Officer, Chief Financial Officer and Secretary of MogulREIT II, Inc. | | |

/s/ Jilliene Helman | | | September 30, 2019 |

Jilliene Helman | | (Principal Executive Officer, Principal Financial Officer and Principal Accounting Officer) | | |