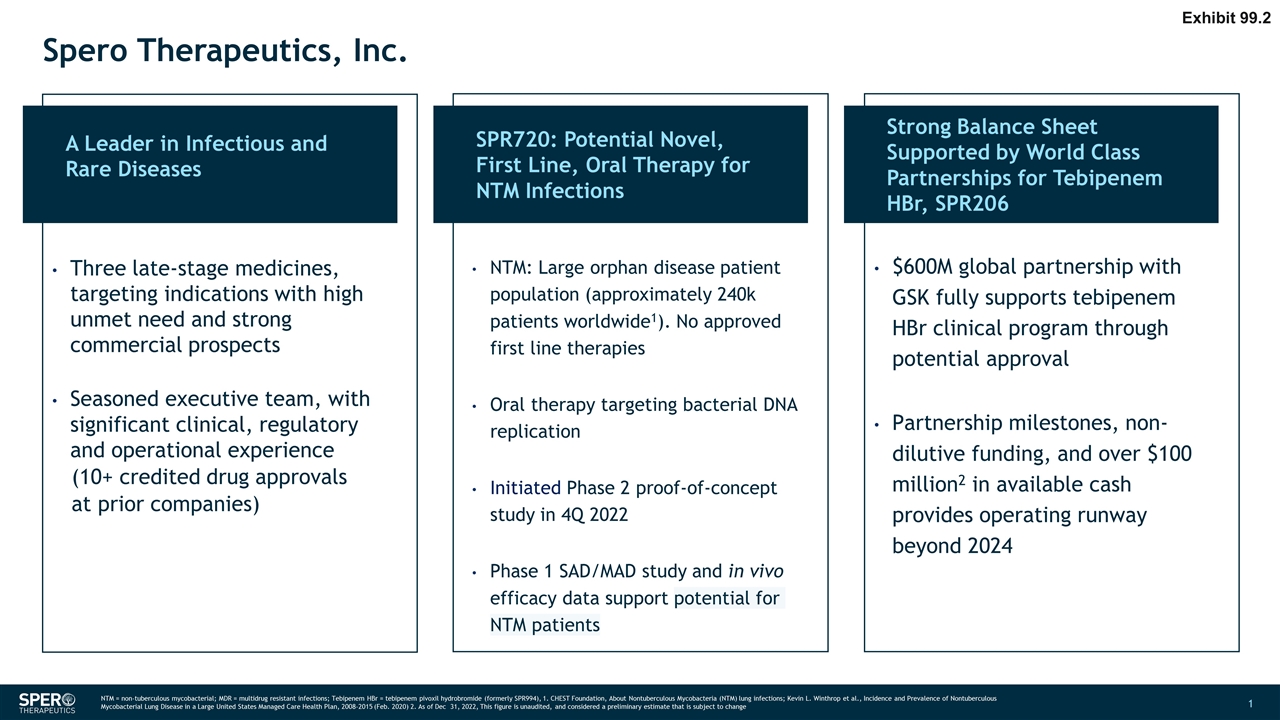

Spero Therapeutics, Inc. A Leader in Infectious and Rare Diseases SPR720: Potential Novel, First Line, Oral Therapy for NTM Infections Strong Balance Sheet Supported by World Class Partnerships for Tebipenem HBr, SPR206 NTM = non-tuberculous mycobacterial; MDR = multidrug resistant infections; Tebipenem HBr = tebipenem pivoxil hydrobromide (formerly SPR994), 1. CHEST Foundation, About Nontuberculous Mycobacteria (NTM) lung infections; Kevin L. Winthrop et al., Incidence and Prevalence of Nontuberculous Mycobacterial Lung Disease in a Large United States Managed Care Health Plan, 2008-2015 (Feb. 2020) 2. As of Dec 31, 2022, This figure is unaudited, and considered a preliminary estimate that is subject to change Three late-stage medicines, targeting indications with high unmet need and strong commercial prospects Seasoned executive team, with significant clinical, regulatory and operational experience (10+ credited drug approvals at prior companies) NTM: Large orphan disease patient population (approximately 240k patients worldwide1). No approved first line therapies Oral therapy targeting bacterial DNA replication Initiated Phase 2 proof-of-concept study in 4Q 2022 Phase 1 SAD/MAD study and in vivo efficacy data support potential for NTM patients $600M global partnership with GSK fully supports tebipenem HBr clinical program through potential approval Partnership milestones, non-dilutive funding, and over $100 million2 in available cash provides operating runway beyond 2024 Exhibit 99.2

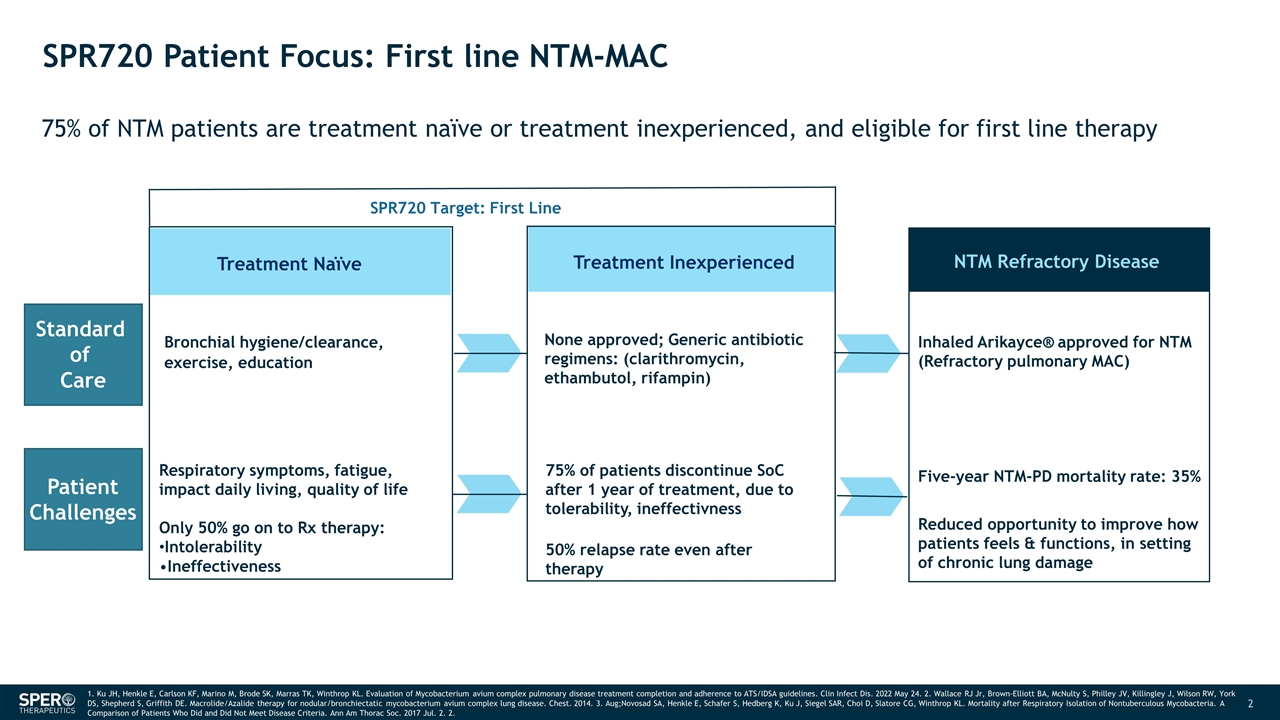

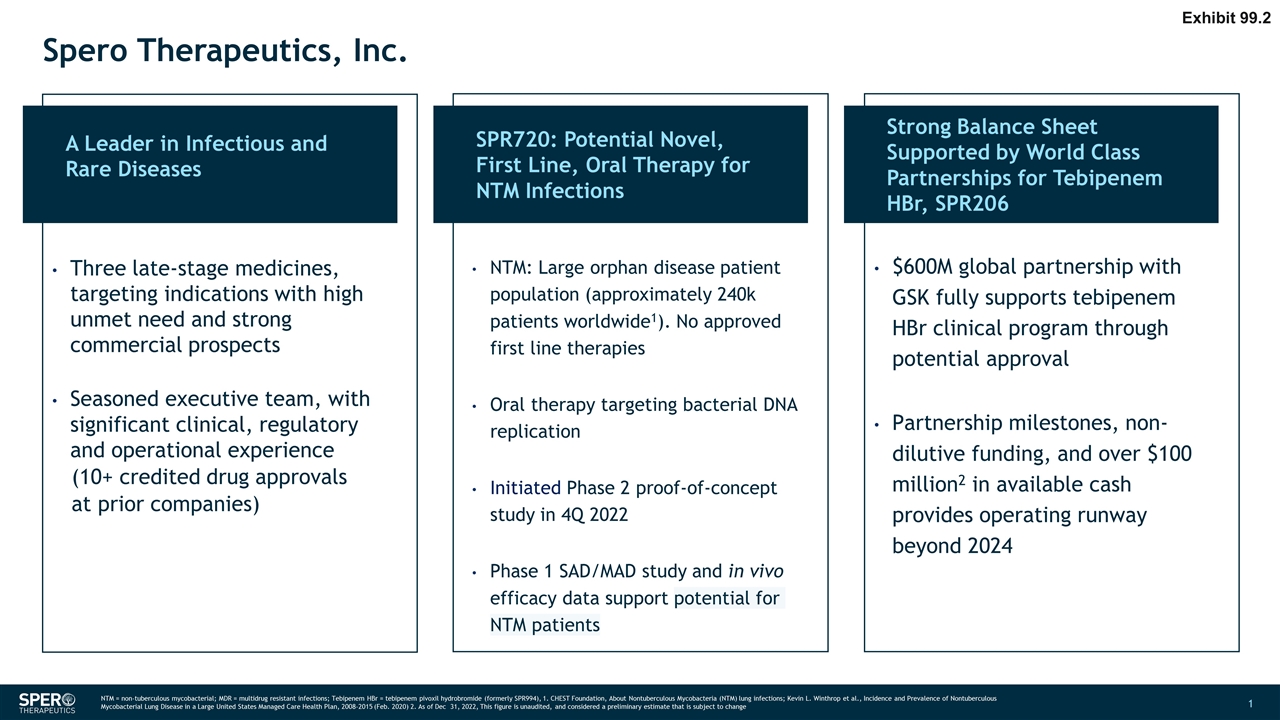

SPR720 Patient Focus: First line NTM-MAC 75% of NTM patients are treatment naïve or treatment inexperienced, and eligible for first line therapy Treatment Naïve Bronchial hygiene/clearance, exercise, education Treatment Inexperienced NTM Refractory Disease None approved; Generic antibiotic regimens: (clarithromycin, ethambutol, rifampin) Inhaled Arikayce® approved for NTM (Refractory pulmonary MAC) Five-year NTM-PD mortality rate: 35% SPR720 Target: First Line 1. Ku JH, Henkle E, Carlson KF, Marino M, Brode SK, Marras TK, Winthrop KL. Evaluation of Mycobacterium avium complex pulmonary disease treatment completion and adherence to ATS/IDSA guidelines. Clin Infect Dis. 2022 May 24. 2. Wallace RJ Jr, Brown-Elliott BA, McNulty S, Philley JV, Killingley J, Wilson RW, York DS, Shepherd S, Griffith DE. Macrolide/Azalide therapy for nodular/bronchiectatic mycobacterium avium complex lung disease. Chest. 2014. 3. Aug;Novosad SA, Henkle E, Schafer S, Hedberg K, Ku J, Siegel SAR, Choi D, Slatore CG, Winthrop KL. Mortality after Respiratory Isolation of Nontuberculous Mycobacteria. A Comparison of Patients Who Did and Did Not Meet Disease Criteria. Ann Am Thorac Soc. 2017 Jul. 2. 2. Standard of Care Patient Challenges Respiratory symptoms, fatigue, impact daily living, quality of life Only 50% go on to Rx therapy: Intolerability Ineffectiveness 75% of patients discontinue SoC after 1 year of treatment, due to tolerability, ineffectivness 50% relapse rate even after therapy Reduced opportunity to improve how patients feels & functions, in setting of chronic lung damage

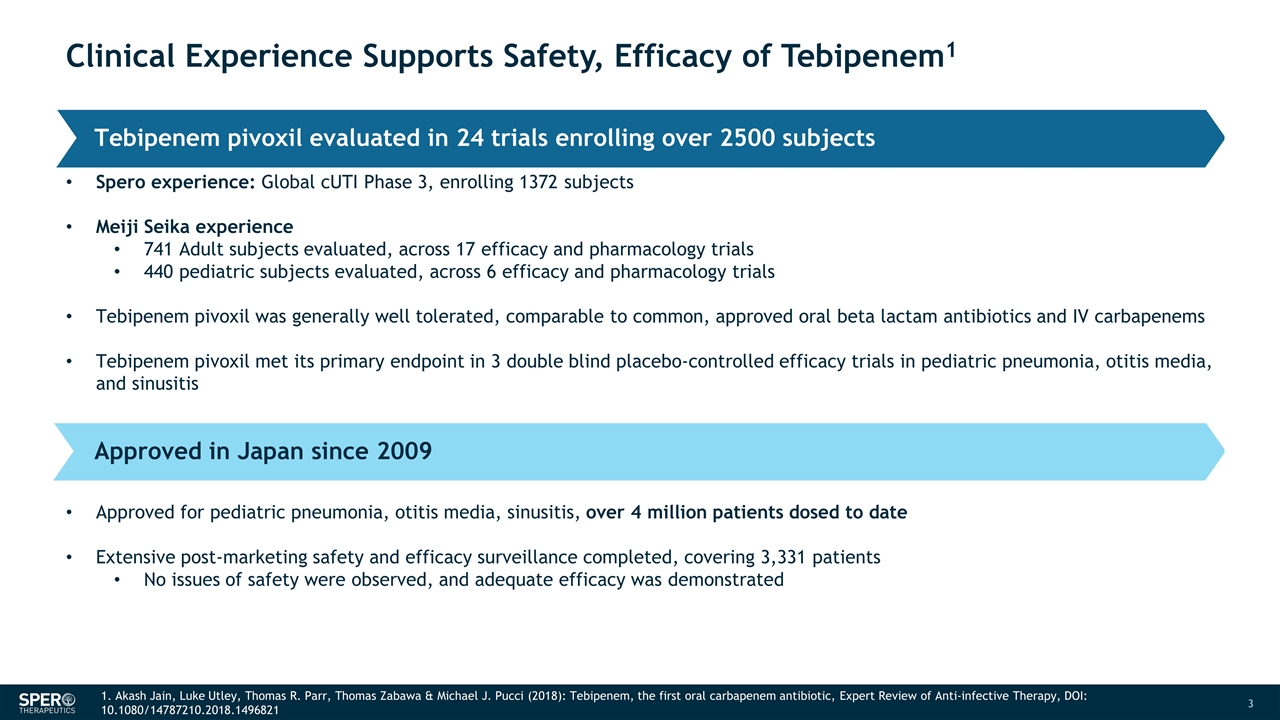

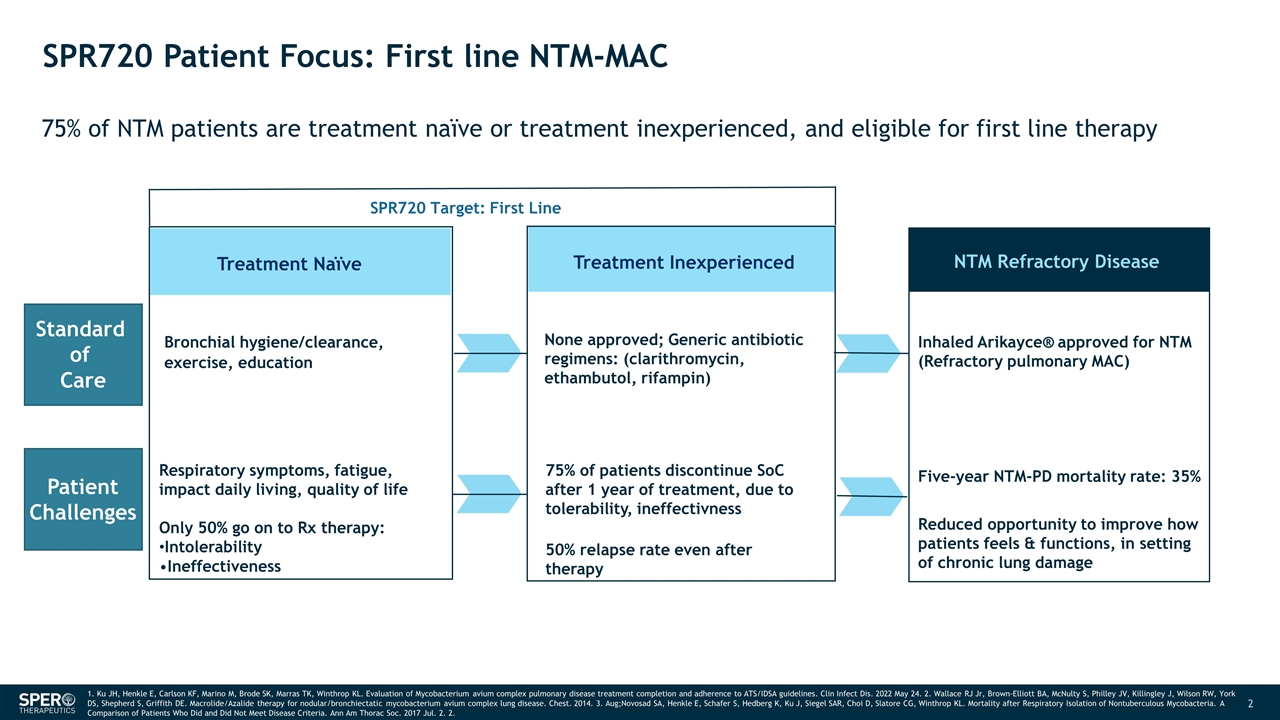

Clinical Experience Supports Safety, Efficacy of Tebipenem1 Tebipenem pivoxil evaluated in 24 trials enrolling over 2500 subjects Approved in Japan since 2009 Spero experience: Global cUTI Phase 3, enrolling 1372 subjects Meiji Seika experience 741 Adult subjects evaluated, across 17 efficacy and pharmacology trials 440 pediatric subjects evaluated, across 6 efficacy and pharmacology trials Tebipenem pivoxil was generally well tolerated, comparable to common, approved oral beta lactam antibiotics and IV carbapenems Tebipenem pivoxil met its primary endpoint in 3 double blind placebo-controlled efficacy trials in pediatric pneumonia, otitis media, and sinusitis Approved for pediatric pneumonia, otitis media, sinusitis, over 4 million patients dosed to date Extensive post-marketing safety and efficacy surveillance completed, covering 3,331 patients No issues of safety were observed, and adequate efficacy was demonstrated 1. Akash Jain, Luke Utley, Thomas R. Parr, Thomas Zabawa & Michael J. Pucci (2018): Tebipenem, the first oral carbapenem antibiotic, Expert Review of Anti-infective Therapy, DOI: 10.1080/14787210.2018.1496821

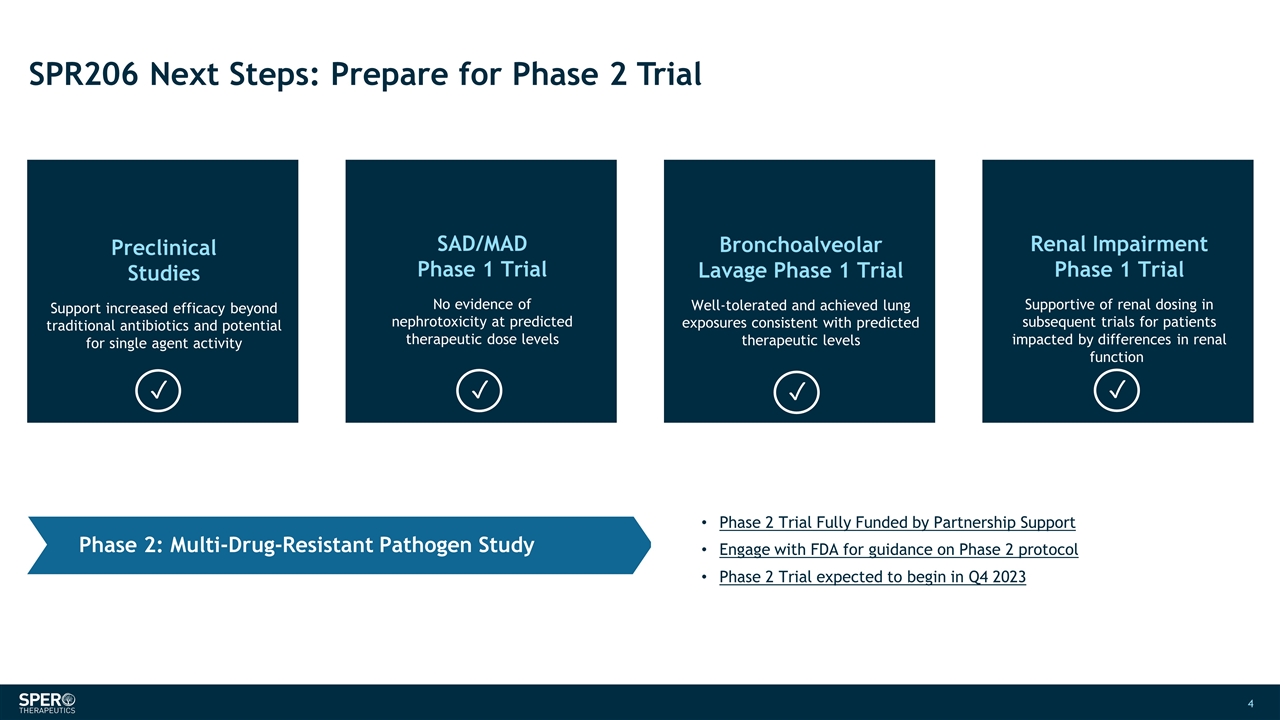

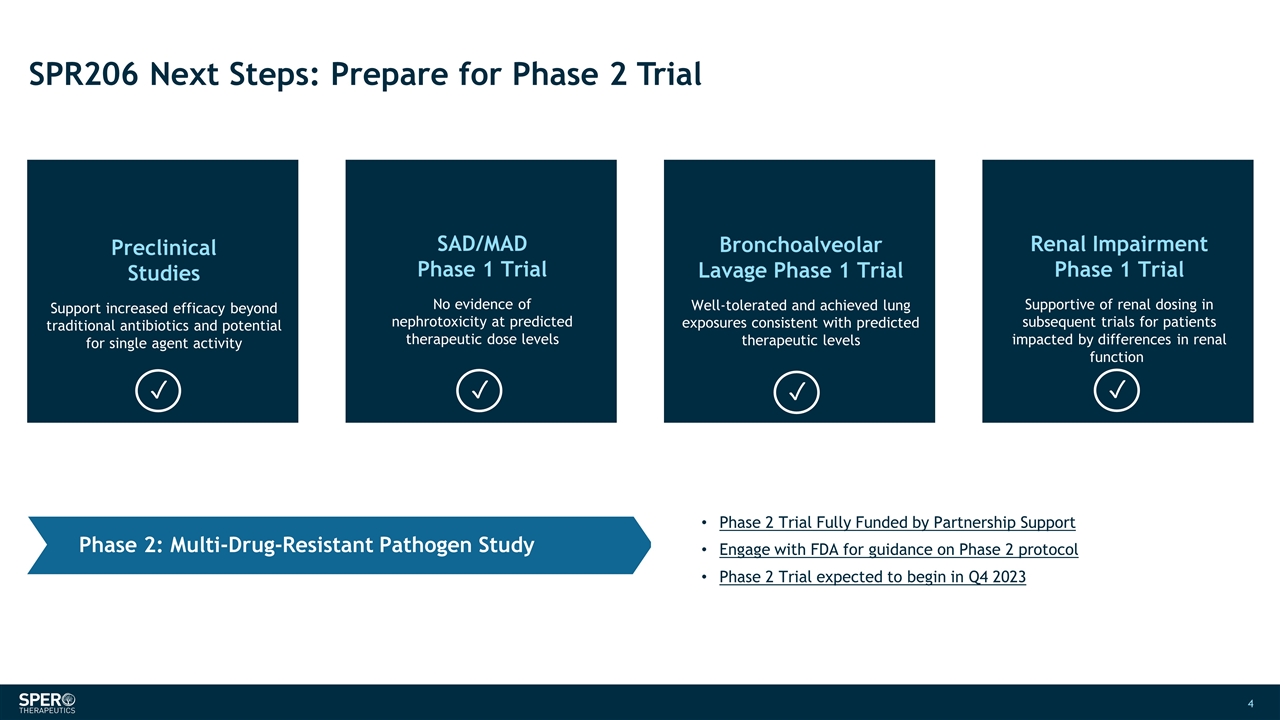

SPR206 Next Steps: Prepare for Phase 2 Trial SAD/MAD Phase 1 Trial No evidence of nephrotoxicity at predicted therapeutic dose levels Bronchoalveolar Lavage Phase 1 Trial Well-tolerated and achieved lung exposures consistent with predicted therapeutic levels Preclinical Studies Support increased efficacy beyond traditional antibiotics and potential for single agent activity Renal Impairment Phase 1 Trial Supportive of renal dosing in subsequent trials for patients impacted by differences in renal function Phase 2 Trial Fully Funded by Partnership Support Engage with FDA for guidance on Phase 2 protocol Phase 2 Trial expected to begin in Q4 2023 Phase 2: Multi-Drug-Resistant Pathogen Study ✓ ✓ ✓ ✓

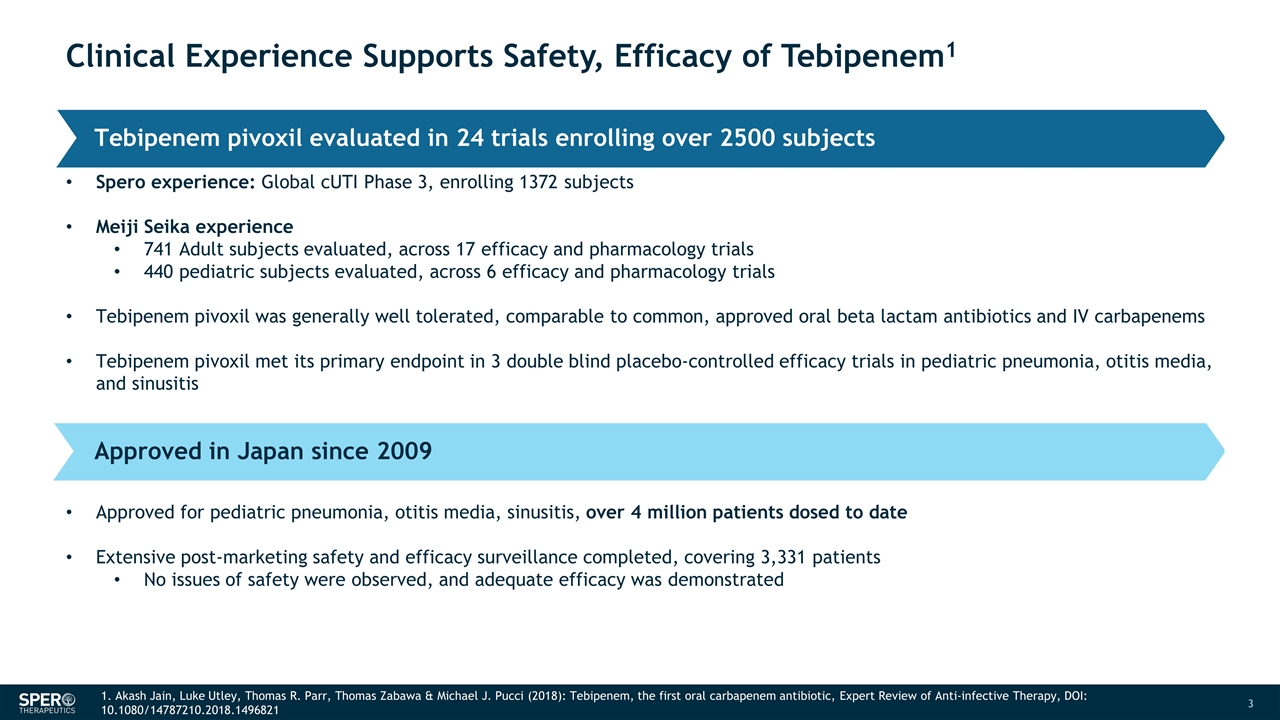

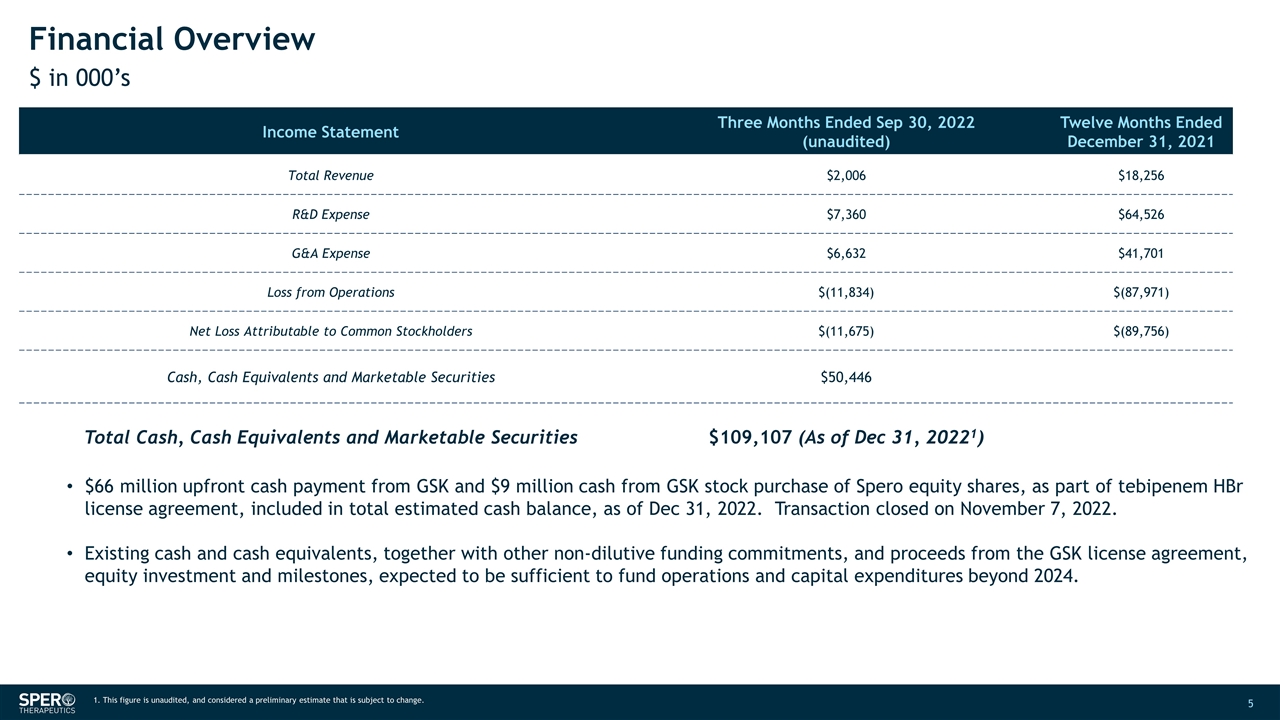

Financial Overview $ in 000’s Income Statement Three Months Ended Sep 30, 2022 (unaudited) Twelve Months Ended December 31, 2021 Total Revenue $2,006 $18,256 R&D Expense $7,360 $64,526 G&A Expense $6,632 $41,701 Loss from Operations $(11,834) $(87,971) Net Loss Attributable to Common Stockholders $(11,675) $(89,756) Cash, Cash Equivalents and Marketable Securities $50,446 Total Cash, Cash Equivalents and Marketable Securities $109,107 (As of Dec 31, 20221) $66 million upfront cash payment from GSK and $9 million cash from GSK stock purchase of Spero equity shares, as part of tebipenem HBr license agreement, included in total estimated cash balance, as of Dec 31, 2022. Transaction closed on November 7, 2022. Existing cash and cash equivalents, together with other non-dilutive funding commitments, and proceeds from the GSK license agreement, equity investment and milestones, expected to be sufficient to fund operations and capital expenditures beyond 2024. 1. This figure is unaudited, and considered a preliminary estimate that is subject to change.